FCPA Autumn Review 2023

International Alert

Introduction

The Department of Justice (DOJ) re-entered the U.S. Foreign Corrupt Practices Act (FCPA) enforcement stage in the third quarter of 2023, publicly resolving two corporate investigations after none in the second quarter. The Securities and Exchange Commission (SEC) kept up its active pace for 2023, joining in the two DOJ resolutions and completing two additional corporate settlements during the quarter. The third quarter also produced several developments in cases involving individuals, including matters involving former foreign officials accused of receiving bribes – a focus of the current administration as set out in the U.S. Strategy on Countering Corruption (SCC). In addition, there were several relevant U.S. court decisions, as well as court rulings in Brazil and Australia addressing key aspects of those countries' anti-corruption enforcement efforts.

On October 4, 2023, Deputy Attorney General (DAG) Lisa Monaco announced a new Mergers & Acquisitions (M&A) Safe Harbor Policy designed to promote voluntary self-disclosures to the DOJ of misconduct discovered during pre- and post-acquisition due diligence. We discussed that new policy and other aspects of DAG Monaco's speech in a separate alert. The new policy has generated concern among some groups who have questioned whether the policy (as well as the revised Corporate Enforcement Policy (CEP)) is too lenient on corporate wrongdoers. Senator Elizabeth Warren (D-MA) also raised questions and concerns about the M&A Safe Harbor Policy's effects.

The DOJ also continued to discuss all of its recent policy updates, often focusing on company and bar questions related to the operation of the DOJ's clawback pilot program and related guidance on compliance-based incentives and on updates to voluntary disclosure policies. At a speech on October 10, 2023, Acting Assistant Attorney General (AAG) Nicole Argentieri discussed several themes, including: expanding cooperation with other countries (as indicated by the ABB disposition involving South African authorities in December 2022 and the Corficolombiana case involving Colombian authorities, discussed below); the roll-out (in recent resolutions) of new requirements derived from the DOJ's Clawbacks Pilot Program (which we discussed previously in this alert and in discussions of the Corficolombiana and Albemarle resolutions below); and further commentary on the new M&A Safe Harbor Policy. On this last point, AAG Argentieri described briefly "how we envision the Safe Harbor Policy will interact with our CEP" – noting in part aspects of the Safran declination from December 2022. AAG Argentieri stated, "[u]nder the new [Safe Harbor] policy… to the extent that companies were not already motivated to rapidly come forward to report misconduct uncovered in the M&A context and remediate, the message is clear: companies will best position themselves for a declination if they move swiftly – within six months, if not sooner." In addition, she stated, "And if [companies] fall short, keep in mind [that] while early reporting is best, self-reporting late is always better than never, whether in the M&A context or otherwise, [as] [th]ere are significant benefits available under our policies, in terms of both penalty reductions and the form of the resolution."

Finally, on the agency staffing front, in early October 2023, David Fuhr was named Chief of the DOJ's FCPA Unit, having spent the past several months as Acting Chief.

Corporate Enforcement Actions

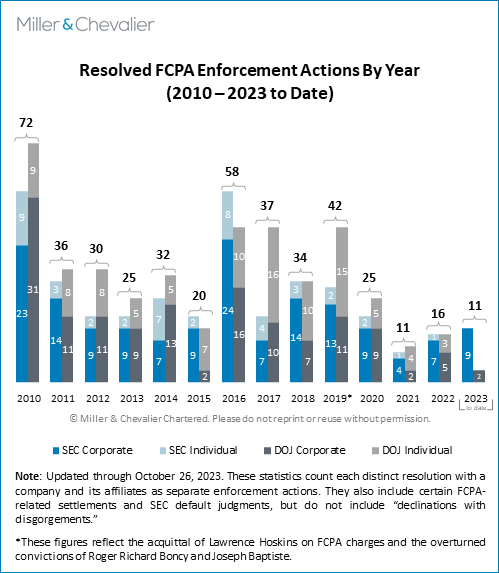

During the first half of 2023, the only new corporate resolution announced by the DOJ was the Corsa Coal declination issued in March. The DOJ announced two dispositions with companies in Q3 2023; the SEC issued four dispositions.

Overall, the pace of announced resolutions for the first nine months of 2023 shows different trends between the two agencies. The nine dispositions thus far by the SEC place the agency within range of pre-COVID-19 activity levels and exceeds the number of settlements in the past couple of years. On the other hand, the two corporate dispositions to date by DOJ represent a historically slow rate for resolutions. Even in years in which the DOJ matched that number (2021 – at the height of COVID – and 2015), there were several actions concluded against individuals. It is still possible, of course, that the announcements will accelerate in the fourth quarter, as there are several publicly disclosed investigations that could be resolved in 2023. For example, on July 19, 2023, German software company SAP SE disclosed a provision of €170 million related to "potential regulatory compliance matters" that have been the subject of past disclosures dating from 2017 covering multiple countries, including South Africa.

On August 10, 2023, the DOJ entered a three-year deferred prosecution agreement (DPA) with Colombia-based Corporación Financiera Colombiana S.A. (Corficolombiana) for one count of conspiracy to violate the anti-bribery provisions of the FCPA related to payments by third parties to government officials in Colombia through joint ventures (JVs) majority-owned by Odebrecht, the Brazilian construction conglomerate, in return for benefits from highway infrastructure contracts. The same day, the SEC settled its investigation of Corficolombiana and Grupo Aval Acciones y Valores S.A. (Grupo Aval), the Colombian parent of Corficolombiana and a U.S. "issuer." The SEC Order states that Corficolombiana violated the FCPA's anti-bribery provisions and caused Grupo Aval to violate the FCPA's accounting provisions. Under the combined dispositions, the two companies agreed to pay just over $60 million in penalties, disgorgement, and prejudgment interest in the U.S.

On August 25, 2023, the SEC announced a resolution with 3M Company (3M) that imposed penalties and disgorgement of more than $6.5 million over alleged violations of the books and records and internal controls provisions of the FCPA related to the provision of overseas travel, sightseeing, and entertainment by personnel from 3M's China affiliate to employees at state-owned hospitals designed to induce the purchase of 3M products. The SEC Order notes that 3M China personnel worked with local travel agencies to illicitly fund and disguise the true nature of such travel, which violated existing company policy.

On September 28 and 29, 2023, specialty chemicals company Albemarle Corporation (Albemarle) entered into a three-year non-prosecution agreement (NPA) with the DOJ and a cease-and-desist order with the SEC related to alleged violations of the FCPA's anti-bribery and accounting provisions in several different countries. The allegations centered on the management of sales agents by one company business line. Under the terms of the resolutions, Albemarle paid a combined total of approximately $218.5 million in penalties, disgorgement, and prejudgment interest. The NPA resolution is the first to publicly cite the DOJ's clawback pilot program, under which the DOJ credited the amount withheld by Albemarle from employees suspected of misconduct (over $750,000) against the company's monetary penalty.

Finally, on September 28, 2023, outdoor advertiser Clear Channel Outdoor Holdings, Inc. (Clear Channel) and the SEC announced a settlement under which the company agreed to pay disgorgement and prejudgment interest of approximately $20.1 million and a $6 million civil penalty related to allegations that the company's Chinese subsidiary provided local Chinese government officials with expensive gifts, entertainment, and travel using on-book third parties, off-books "consultants," and executive control over cash funds. The SEC Order describes significant efforts by the management of the China affiliate to block access by Clear Channel auditors to records and personnel, among other issues.

While we will cover this in more detail in our next Review, we note that on November 16, 2023, the DOJ issued a declination with disgorgement to biotech company Lifecore Biomedical related to alleged "bribery committed by employees and agents of the Company and its former U.S. subsidiary." The DOJ's declination letter stated that certain of the subsidiary's officers and personnel, including personnel at a maquiladora in Mexico, paid bribes to Mexican officials to secure permits and other benefits. The alleged bribery occurred before and after Lifecore acquired the subsidiary in 2018. The DOJ stated that it declined to prosecute Lifecore as the company had met the standards of the DOJ's Corporate Enforcement and Voluntary Self Disclosure Policy, including agreeing to pay $406,505.

Enforcement Actions Against Individuals

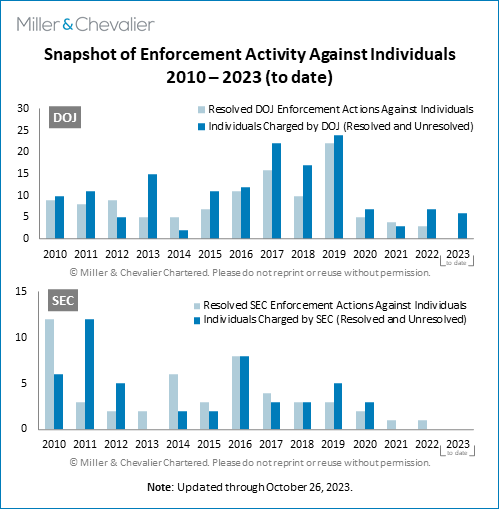

There were developments in several announced DOJ cases involving individuals this quarter, including sentencing decisions and new indictments. The SEC did not announce any FCPA-related actions against individuals this quarter.

Two individuals were sentenced to prison for their roles in bribery schemes – former Petróleos de Venezuela, S.A. (PDVSA) director Luis Carlos de León Pérez (August 7) and Canadian businessman Naeem Riaz Tyab (September 6) – while another individual, Juan Ribas Domenech, former chairman of Ecuador's state-owned company Seguros Sucre S.A., received a reduction in his sentence on July 20 based on his cooperation with U.S. authorities in their ongoing investigations.

Former Vitol trader Javier Aguilar faces FCPA and related charges for activities tied to Mexico and Ecuador, and now potentially faces two trials after having the FCPA charges regarding Mexico dismissed in New York based on lack of venue in June 2023. Specifically, Aguilar now faces a new FCPA-related indictment by the DOJ in Texas, filed on August 3, 2023, for the Mexico-related charges, while he is still scheduled to go on trial in New York in January 2024 for the Ecuador-related charges that were not dismissed. Elsewhere, on August 28, 2023, a federal grand jury in Connecticut returned a superseding indictment against Glenn Oztemel, Gary Oztemel, and Eduardo Innecco for multiple FCPA-related and money laundering charges related to bribery allegations involving Petrobras. Glenn Oztemel and Innecco had been previously charged; the superseding indictment brought new charges against Gary Oztemel for his alleged involvement.

On July 12, 2023, Manuel Chang, the former Finance Minister of Mozambique, was extradited to the U.S. from South Africa, where he had been held since being arrested in December 2018, to face criminal charges related to alleged fraudulent transactions in connection with loans for government-led projects that were intended to benefit Mozambique's tuna fishing industry. Other Mozambican defendants remain at large, though the scandal has resulted in other charges and a corporate disposition in 2021 involving Credit Suisse.

Finally, on September 11, 2023, federal prosecutors in Miami charged Venezuelan businessman Orlando Alfonso Contreras Saab with conspiring to bribe Venezuelan officials to obtain multi-million-dollar contracts in food and medicine distribution in Venezuela.

There were new developments this quarter related to the 1MDB scandal. Former 1MDB legal officer Jasmine Loo Ai Swan was arrested in Malaysia in July 2023, according to media reports; Loo has been wanted since fleeing the country in 2018 and is alleged to have been close to financier Jho Low. Media reports note that her Malaysian lawyers have indicated her desire to cooperate in the ongoing investigation. And on October 5, 2023, convicted former Goldman Sachs banker Roger Ng was ordered to be returned to the custody of Malaysian authorities just before his U.S. sentence was to begin. The Malaysian government had requested the return so that Ng could stand trial there. Ng previously asked for a reduced sentence in the U.S., in part based on the conditions of the prisons in Malaysia (where he previously was detained before his extradition to the U.S.).

Declinations and Other Indicia of Enforcement Trends

The DOJ did not announce any public declinations in the third quarter of 2023.

In announcing its September 28, 2023 settlement with the SEC, Clear Channel stated in its press release that "[i]In connection with the settlement, the U.S. Department of Justice has declined to pursue any charges against the Company."

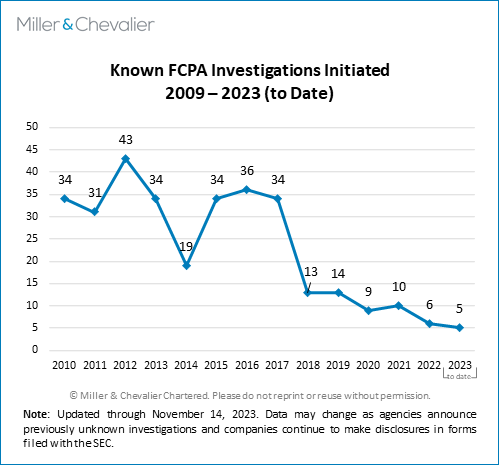

There were two corporate FCPA-related investigations announced during the quarter. On August 11, 2023, clinical research company Inotiv, Inc. disclosed in its 10-Q filing that it was cooperating in a new FCPA-related investigation by the SEC. Inotiv provides animals for medical research to companies in the pharmaceutical and medical device industries, as well as for academia and government. According to the filing, Inotiv received a voluntary request from the SEC on May 23, 2023, seeking documents and information regarding the company and two of its subsidiaries' importation of non-human primates (NHPs) from Asia, including information relating to whether their importation practices complied with the FCPA. Inotiv also disclosed that in November 2022, the U.S. Attorney's Office for the Southern District of Florida had charged employees of Inotiv's principal supplier of NHPs, along with two Cambodian government officials, for conspiring to illegally import NHPs into the U.S. from Cambodia. Two of Inotiv's subsidiaries also received grand jury subpoenas to produce documents and information related to their imports of NHPs. Although the company did not characterize it as an FCPA action, Charles River Laboratories International, Inc. also announced a federal investigation regarding "shipments of non-human primates from Cambodia," with the company noting that any concerns "are without merit."

On October 31, 2023, GE Healthcare (a NASDAQ-listed company spun off from GE that began separate operations in 2023) disclosed in a 10-Q filing that the company is under investigation by the DOJ and SEC "regarding tender irregularities and other potential violations of the FCPA relating to our activities in certain provinces in China." The disclosure noted that the issues were originally disclosed to the agencies in 2018, that the company has "been engaged in ongoing discussions with each of the SEC and the DOJ regarding these matters," and is "fully cooperating with the reviews by these agencies and [has] implemented, and continue to implement, enhancements to our compliance policies and practices." We have updated our statistics and the chart of known investigations, below, to show the initiation of the GE Healthcare investigation in 2018.

We note, as always, that the numbers in this chart are subject to limitations on available public information, and because neither the DOJ nor the SEC disclose official investigations statistics in anything close to real-time and only some companies are likely to disclose such information through SEC filings or other means, our investigation statistics are necessarily incomplete.

U.S. Court Decisions

On July 20, 2023, a federal district court in New Jersey denied motions to suppress evidence brought by the defendants under two Supreme Court precedents (Garrity v. State of N.J. and Brady v. Maryland) in the ongoing prosecution of two former senior executives of Cognizant Technology Solutions Corporation. At issue were the defendants' claims that Cognizant's internal investigation and cooperation with the DOJ and SEC (which ultimately led to February 2019 dispositions, including a declination with disgorgement from the DOJ) were controlled by the U.S. government; such a finding would have led to exclusion of evidence under the relevant precedents. Due to the retirement of the federal judge who had been handling the case, the relevant trial is now scheduled to begin on May 6, 2024.

On August 3, 2023, a federal court in the Southern District of New York (SDNY) denied a motion to dismiss by a former senior executive of Allianz Global Investors U.S. LLC (AGI), finding that the defendant (who is being prosecuted for defrauding investors) had waived any claim of attorney-client privilege when he signed an engagement letter in the context of a joint representation that expressly permitted AGI's parent Allianz SE (Allianz) to waive privilege and produce confidential information to the U.S. government if Allianz "deem[ed] it appropriate." While not an FCPA case, the decision informs how companies conduct investigations and make decisions regarding disclosures of information to the U.S. government and a time when "full cooperation" is a critical mitigating factor in enforcement outcomes.

On August 4, 2023, a panel of the U.S. Court of Appeals for the Fifth Circuit issued an opinion responding to an appeal by a group of press organizations requesting the release of sealed records related to the U.S. government's prosecution of the Ahsani brothers, including the sentencing of Saman Ahsani in January 2023. The federal district court in Houston had denied a motion to unseal the records in February 2023, on the grounds that the release of information under seal could "jeopardize the defendants' safety, the safety of their families and the integrity of the Government's ongoing investigation." The court had found that media First Amendment rights "cannot trump the rights of the Defendant to be safe from harm and the Government to have its investigations free from impairment." The Fifth Circuit panel affirmed the district court's decision, stating in an order that the "compelling interests" of protecting the integrity of the ongoing investigations related to the Ahsanis and Unaoil and "protecting cooperating individuals and their families from harm" "defeat[ed] the presumption of access to judicial records" under the First Amendment and common law. The court noted that redactions in information in the records were "narrowly tailored to furthering those [compelling] interests." Thus, the relevant records remain under seal, although the court stated that the media companies could "renew their motion to unseal as information becomes public or the interests involved attenuate."

On September 2, 2023, a federal district court judge in the Eastern District of New York (EDNY) threw out convictions for a former Fox executive and a South American sports media and marketing company related to a bribery scandal involving the Fédération Internationale de Football Association (FIFA), the international governing body for soccer. The judge cited recent decisions by the U.S. Supreme Court (in Percoco v. United States and Ciminelli v. United States) that narrowed the scope of federal wire fraud prosecutions and admonished prosecutors against extending their reach in mail and wire fraud cases without express statutory authorization. Wire fraud charges have been a tool used by prosecutors in certain other corruption prosecutions, though the ruling should not directly impact FCPA prosecutions. The DOJ is appealing.

In other matters, on August 10, 2023, following the DOJ's motion, a court confirmed the dismissal of the January 2020 DPA involving Airbus. In its motion, the DOJ noted that "the Chief Executive Officer and Chief Financial Officer of Airbus certified to the Government that Airbus had met its disclosure obligations pursuant to paragraph 6 of the DPA" and that the company had met its obligations to cooperate with the DOJ related to other investigations and to implement "an enhanced compliance program and procedures." The dismissal of the DPA ends the corruption side of a multinational disposition involving Airbus and various governments, as, according to an Airbus registration document, "[o]n 13 February 2023, the [U.K. Serious Fraud Office] gave notice to the Company discontinuing the prosecution [and] [o]n 17 March 2023, the [French Parquet national financier] gave notice of the same."

Policy and Legislative Developments

On August 14, 2023, the DOJ published a new FCPA Opinion Procedure Release (OPR) – FCPA OPR 23-1 -- following a request by a U.S.-based child welfare and adoption services agency regarding the payment of expenses for two public officials from a foreign country. The discussion of various types of travel expenses and relevant limitations presented by the requesting agency, along with the DOJ's conclusion that it would not pursue an enforcement action under the stated facts, provide a reminder of DOJ expectations for hosting travel by government officials.

The DOJ published another OPR (FCPA OPR 23-2) on October 25, 2023. The requesting entity was "a provider of training events and logistical support" with a U.S. government contract, under which they provide "logistical support for foreign government personnel" including "stipend payments to foreign officials who attend… training events." The OPR noted that the stipends are paid first to a U.S. official, who then distributes them; the stipends are also authorized under the Foreign Assistance Act of 1961. The OPR also sets out other limitations and protections noted by the requesting company. Based on the information contained in the OPR, the DOJ stated that it "does not presently intend to take any enforcement action under the anti-bribery provisions of the FCPA," noting that the key elements of corrupt intent and obtaining or retaining business were not present. The DOJ issued the OPR just over a month after the initial request.

On July 18, 2023, a bipartisan group of U.S. lawmakers re-introduced the Foreign Extortion Prevention Act (FEPA) "to combat kleptocracy and corruption by criminalizing bribery demands by foreign officials." On July 28, 2023, the Senate passed the FEPA bill as part of the Senate's National Defense Authorization Act (NDAA) 2024 legislation. However, to date, the parallel House of Representatives bill, also passed in July, does not contain a similar set of provisions. If passed, FEPA would amend 18 U.S.C. §201, the primary statute covering domestic bribery in the U.S. Criminalization of the demand side of bribery (as opposed to the prohibitions on the supply side represented by the FCPA) is a key goal in the Biden administration's SCC – specifically "pillar 3" on holding corrupt actors accountable. FEPA was introduced in 2021 with similar bipartisan support but failed to clear various legislative hurdles. Earlier versions date back several years, as well. The fate of the current version remains unclear.

The U.S. government continues to designate foreign officials and others as subject to economic sanctions and visa/immigration restrictions under the Global Magnitsky Human Rights Accountability Act and other statutory and regulatory authorities for acts of corruption. For example, on July 19, 2023, the U.S. Department of the Treasury (Treasury) sanctioned North Macedonian businessman Jordan "Orce" Kamcev. The Treasury public release states that Kamcev "has engaged extensively in corruption, including abuse of office, money laundering, and other offenses for more than a decade starting in the early 2000s." The release notes further that "[i]n 2020, the head prosecutor of [North Macedonia's] Special Prosecutor's Office (SPO) was charged for accepting a bribe from Kamcev and testified that Kamcev paid money in exchange for favorable arrest conditions and case outcomes." Per the release, "[i]n the aftermath of the scandal, the SPO collapsed [and] many high-level corruption cases that the SPO had been considering remain stagnant and undecided, delaying accountability for numerous individuals who have engaged in corruption similar to Kamcev."

On August 10, 2023, Treasury sanctioned the "former governor of Lebanon's central bank, Riad Salameh, whose corrupt and unlawful actions have contributed to the breakdown of the rule of law in Lebanon." The public release asserts that "Salameh abused his position of power, likely in violation of Lebanese law, to enrich himself and his associates by funneling hundreds of millions of dollars through layered shell companies to invest in European real estate." The release notes that the U.K. and Canada are implementing coordinating sanctions and that the activities of Salameh and his "co-conspirators" are being investigated in Lebanon and Europe.

On October 20, 2023, Treasury announced sanctions against "Republika Srpska (RS) President Milorad Dodik's… patronage network." The release states that "[m]embers of this network, which include Dodik's adult children, facilitate Dodik's ongoing corruption in Bosnia and Herzegovina's (BiH) RS entity, allowing him to siphon public funds from the RS and enrich himself and his family at the expense of BiH citizens and functional governance in the country." This announcement followed direct sanctions against Dodik announced on July 31, 2023, for his role "in undermining the rule of law" in BiH and RS and "obstructing and threatening the implementation of the Dayton Peace Agreement."

International Developments

Related to investigations against corruption and the operation of anti-compliance programs, on July 10, 2023, the EU Commission adopted a long-awaited "adequacy decision" for the newest version of the EU-U.S. Data Privacy Agreement, which was announced in March 2022 and implemented on the U.S. side by an executive order issued on October 7, 2022. According to the Commission, "[o]n the basis of the new adequacy decision, personal data can flow safely from the EU to U.S. companies participating in the Framework, without having to put in place additional data protection safeguards." The recent adequacy decision (and the March 2022 Privacy Agreement framework overall) was a response to the July 2020 Schrems II decision by the European Court of Justice (ECJ) that struck down the EU-U.S. Privacy Shield, an agreement on which many companies had relied to facilitate transfers of data to the U.S. while complying with EU General Data Privacy Regulation (GDPR) requirements. The ECJ's decision stated, in part, that U.S. laws allowing for national security-based surveillance and acquisition of personal data did not adequately protect EU citizens' rights. The July 2023 adequacy determination occurred in the face of concerns raised by some EU Members of Parliament and the European Data Protection Board about the EU-U.S. Data Privacy Agreement. It is almost certain that this new framework will be challenged in court in the EU, potentially prolonging the uncertainty for companies trying to manage requirements in this area.

On July 27, 2023, the Brazilian Controladoria-Geral da União (CGU) announced that it had sanctioned seven companies, including a Brazilian subsidiary of German company Helm AG, for various illicit acts (including alleged trading of confidential state information to obtain advantages in public contracting) under the Brazilian Clean Company Act. Helm Brazil entered into an "early judgment" – an administrative sanction that went into effect in August 2022. This instrument is different from a leniency agreement and is aimed at promoting rapid accountability for companies that request it, take responsibility for the actions under investigation, and "comply with the imposed obligations and affirm their commitment to collaboration with the State [as to compliance and cooperation]." The process also allows for the CGU to reduce fine levels subject to certain considerations; in Helm Brazil's case, the company paid a fine of R$696.712 (approximately $143,000).

On September 6, 2023, in another development, a judge on the Brazilian Federal Supreme Court issued a ruling holding that any evidence obtained by Brazilian prosecutors as a result of the leniency agreement signed by Odebrecht (now Novonor) in December 2016 is inadmissible in other cases. This decision has potentially far-reaching implications for other cases arising from Brazil's Lava Jato investigation that will bear monitoring in the coming months, further raising questions about the long-term impact of the investigation. Two groups of Brazilian prosecutors appealed the ruling later in September.

In one other notable development in Brazil, Braskem announced on August 15, 2023, that the CGU had notified the company "about the end of the monitoring period of the Company's integrity program as provided for in the [2019] Leniency Agreement." The May 2019 agreement was a follow-on to the 2016 disposition that Braskem entered with several authorities, including in the U.S. The recent Braskem announcement noted, in part, that one of "the initiatives implemented by the Company that allowed for such closure" was "obtaining ISO 37001 certification" on anti-bribery management systems for the company's integrity program.

In Australia, on August 2, 2023, the High Court ruled in a case involving construction engineering company Jacobs Group (Australia) Pty Ltd. (Jacobs Group) that a lower court should have imposed a maximum fine of AUS$30.4 million (approximately $19.9 million) after the company had pled guilty in September 2020 to paying bribes to win tenders for public infrastructure projects between 2003 and 2012. At issue in the court proceedings was the definition of "benefit," which the Australian anti-corruption statute uses as a basis for the calculation of penalties. After lower courts had ruled that this definition should be defined as the net benefit, or profit, related to the transactions under scrutiny, the High Court (agreeing with arguments by Australia's Commonwealth Director of Public Prosecutions) held that the "benefit" is the amount a company received and should amount to "no more and no less than the sum of the money in fact received […]" under a contract – effectively, the gross income. The High Court's ruling likely will increase penalty levels for corruption cases in the future. Our article on this case also notes several other recent steps that the Australian government is undertaking to bolster its anti-corruption enforcement abilities, the effectiveness of which have been questioned in the past by, for example, the Organisation for Economic Cooperation and Development (OECD) Working Group that monitors party compliance with the OECD Anti-Bribery Convention. Australian law firm Allens published a newsletter that discusses these and other recent developments in detail.

On July 31, 2023, the Chinese government announced a sweeping initiative to combat corruption in the public health system, focusing on the pharmaceutical industry and government-run hospitals. According to public statements and press reports, more than 150 state officials were already under investigation as of July 2023.

In the U.K., new leaders took the helm at the primary agencies involved in anti-corruption enforcement. On July 5, 2023, the Attorney General announced that former police commissioner (and non-lawyer) Nick Ephgrave would take over as Director of the Serious Fraud Office (SFO), replacing Lisa Osofsky. Director Ephgrave began his tenure at the end of September. On September 14, 2023, the Attorney General announced that attorney Stephen Parkinson (most recently a partner at a U.K. law firm) would be the new Director of Public Prosecutions and would also lead the Crown Prosecution Service (CPS). Director Parkinson begins his five-year term on November 1, 2023.

In August 2023, the SFO announced that it was closing two long-running investigations into Eurasian Natural Resources Company (ENRC) and Rio Tinto. Rio Tinto had concluded a civil resolution with the SEC earlier this year, as reported in our FCPA Spring Review 2023. According to Global Investigations Review, the Parquet national financier (PNF) in France announced it was not pursuing an investigation of Rio Tinto after prosecuting the third party individual at the center of the facts summarized in the SEC resolution (the "Consultant" identified as François Polge de Combret in press reports).

On August 10, 2023, U.K.-based gaming company Entain announced that the company had "taken a £585 million provision in respect of its ongoing [DPA] negotiations with" the CPS. The company further stated that it "anticipates judicial approval [for a DPA] will be sought during Q4 2023." Interestingly, the press release noted that the potential DPA would be "in relation to alleged offences under Section 7 of the Bribery Act 2010," which, per the release, "relates to the failure of a relevant commercial organisation to have adequate procedures in place designed to prevent persons associated with it from undertaking bribery for the benefit of the commercial organisation." Further details as to this posture and underlying issues likely will be forthcoming when the DPA is approved and formally announced.

In other U.K. news, the National Crime Agency (NCA) announced charges on August 14, 2023, against the now former Chief of Staff of the President of Madagascar, Andry Rajoelina, as well as a third party consultant from France, after they attended a meeting that same month in London and allegedly solicited bribes from Gemfields Group Ltd., a U.K.-based mining company. The NCA reportedly used an undercover officer to attend the meeting, in which the government official and third party requested a cash sum and an equity stake in an entity as a condition for a license in Madagascar. President Rajoelina fired the Chief of Staff and reiterated a commitment to anti-corruption.

The NCA and the CPS also received a confiscation order from courts in the U.K. against a former Nigerian governor for over 102 million pounds ($124 million) based on earlier conviction for money laundering and related charges, following an investigation into corruption. The NCA also announced charges against another former Nigerian minister in a corruption case, noting cooperation with the DOJ to seize assets.

Finally, on September 28, 2023, the Swiss Office of the Attorney General (OAG) announced an "indictment in the [Swiss] Federal Criminal Court (FCC) against Gulnara Karimova, daughter of the former president of the Republic of Uzbekistan, Islam Karimov, and the former general director of the Uzbek subsidiary of a Russian telecommunications company." The two defendants are charged with "participation in a criminal organization," "money laundering," "acceptance of bribes as foreign public officials," and "forgery of documents." The long-running investigation covered, in part, activities in Switzerland in support of various alleged criminal actions, including in Uzbekistan. The indictment announcement noted, for example, that "foreign companies that wished to enter and operate in this sector were required to pay bribes to Gulnara Karimova…[so] that she would intervene decisively in their favour" and that "Karimova thus exploited her dual status as the daughter of the President and as an Uzbek public official, which allowed her to exercise unlimited influence over state officials when it came to allowing companies to enter and operate in the telecommunications sector." This indictment follows a ruling from a Swiss court in 2022 that Karimova was not a public official under Swiss law, which undermined the allegations of bribery and money laundering, as noted in our FCPA Autumn Review 2022. Three FCPA prosecutions that involved substantial penalties – related to VimpelCom (in February 2016), Telia (in September 2017) and MTS (in March 2019) – have ties to this alleged scheme.

Actions Against Corporations

Colombian Company Corficolombiana and Parent Grupo Aval Conclude FCPA Resolution with SEC; Corficolombiana Concludes Parallel Resolution with DOJ

On August 10, 2023, Corficolombiana announced that it had entered into a three-year DPA with the DOJ based on allegations that a former executive of Corficolombiana was involved in the payment of bribes to high-ranking government officials in Colombia through a JV in which Corficolombiana held a minority stake. Corficolombiana is majority owned by Grupo Aval Grupo Aval, a Colombian conglomerate that is a U.S. issuer. Grupo Aval and Corficolombiana (as Grupo Aval's agent) also agreed to an SEC settlement (the SEC Order) arising from the same underlying conduct as the DPA in connection with alleged violations of the FCPA's anti-bribery provisions by Corficolombiana. The SEC Order also alleged that Corficolombiana caused Grupo Aval to violate the accounting provisions for Corficolombiana of the FCPA.

These resolutions follow various proceedings relating to the construction of a road extension to Ruta de Sol II (RDS2), a major highway project in Colombia. In 2020, the Industry and Commerce Superintendency (SIC), an antitrust authority in Colombia, issued $84.4 million in fines to Odebrecht, Corficolombiana, and related entities and individuals, including several Odebrecht executives and Corficolombiana's former President José Elías Melo, "for devising and executing a system restricting free competition during the award and execution" of the contract for RDS2, including through "irregular payments." Specifically, Corficolombiana was fined approximately $15.9 million, and its subsidiary Estudios y Proyectos del Sol S.A.S. (Episol) fined $9.7 million. Melo was assessed a fine by the SIC of $112,769 and was separately found guilty of corruption and sentenced to prison time in 2019.

Odebrecht's involvement in this scheme was covered in its resolution with the DOJ as part of the 2017 global resolutions involving Odebrecht and Braskem, in which the companies agreed to fines and payments of $3.5 billion (later reduced based on inability to pay) to resolve charges with authorities in the U.S., Switzerland, and Brazil for paying hundreds of millions of dollars to bribe government officials in different jurisdictions, including related to public works contracts in Colombia.

Under the DPA with the DOJ, Corficolombiana agreed to a fine of $40,600,000 (reflecting a 30 percent discount off the bottom of the applicable U.S. Sentencing Guidelines range), and the DOJ agreed to credit half of that fine against the fine that Corficolombiana paid to the SIC related to Melo's conduct, provided that Corficolombiana drops its appeal of the SIC fine. The DPA also includes forfeiture in the amount of $28,630,000, but the DOJ credited against that forfeiture amount the full disgorgement amount tied to the SEC Order, under which Grupo Aval agreed to disgorge $32,139,731 and pay prejudgment interest of $8,129,558 to the SEC. Thus, the net payment to the U.S. authorities is $60,569,289 (disgorgement and interest of approximately $40 million, plus a net fine payment of $20.3 million). Corficolombiana's DPA with the DOJ did not include charges against Grupo Aval.

The allegations underlying the resolutions related to Concesionaria Ruta del Sol S.A.S., a JV majority owned by Odebrecht, the Brazilian construction conglomerate now operating under the name Novonor. According to the SEC Order, the DPA, and other materials, in 2009, the Colombian government started a bidding process for the RDS2 construction project. Corficolombiana's former president (Melo) negotiated a joint proposal with Odebrecht. To submit the bid and subsequently to build the highway, Corficolombiana entered into the JV through one of its subsidiaries, Episol, with Odebrecht and a third company (Solarte Group, according to SEC filings by Group Aval). In this structure, Odebrecht held a 62 percent equity interest and Corficolombiana's subsidiary owned approximately 33 percent of the equity in the JV.

According to the DPA and the SEC Order, between 2012 and 2015, Melo, Odebrecht, and certain intermediaries "conspired and agreed with others to corruptly offer and pay more than $23 million in bribes, to and for the benefit of, Colombian government officials" through the JV in connection with an extension of the RDS2 project. According to the SEC Order and DPA, the JV engaged in "no-work contracts" with and received "sham invoices" from two Colombian "intermediaries," and the intermediaries used part of the funds to make improper payments to Colombian government officials, including through "illicit campaign contributions." The SEC Order states that those expenses were improperly recorded as legitimate business expenses in the books and records of the JV and of Corficolombiana, thereby causing Grupo Aval to violate the FCPA's books and records provisions. In discussing how Corficolombiana caused Grupo Aval's accounting provisions violations, the SEC noted, for example, that Melo "signed various sub-certifications in connection with Grupo Aval's financial reporting that falsely stated he was unaware of illegal acts."

The DOJ noted several considerations that supported entering into the DPA and providing the 30 percent penalty discount from the bottom of the applicable Sentencing Guidelines range, including Corficolombiana's full cooperation with the investigation, assisting in preserving and obtaining evidence, "producing documents… from Colombia that the [DOJ] may not otherwise have had access to in ways that did not implicate foreign data privacy laws and providing translations for those documents," and "providing sworn testimony from the Colombian criminal and administrative proceedings of relevant witnesses whom the [DOJ] were not able to independently interview."

Neither the DOJ nor the SEC imposed a monitorship, with the DOJ stating that "based on the Company's remediation and the state of its compliance program and the Company's agreement to report to [the DOJ during the DPA's three-year term]… [the DOJ] determined that an independent compliance monitor was unnecessary." The DOJ noted that Corficolombiana had engaged in various remedial measures, including "conducting a root cause analysis of conduct identified during [its] internal investigations and promptly taking action to enhance corporate governance and controls at joint venture entities and improve oversight of non-controlled joint ventures and investments," "overhauling its compliance program, including strengthening its corporate governance and risk management structures, enhancing the independence and stature of its compliance function and hiring additional experienced compliance personnel," "enhancing [Corficolombiana's] third-party intermediary risk management process," "implementing a robust process for reporting and investigating allegations of misconduct," and other actions. The DOJ also did not require Grupo Aval to sign on to the compliance provisions of the DPA.

Key Takeaways

- FCPA Liability Arising from Minority JV Positions: In general, it is rare for a company to face FCPA liability for the actions of a JV in which it does not have a majority interest and that it does not control. Here, U.S. authorities alleged that Corficolombiana was responsible for illegal payments "caused" by its former president. For the accounting provisions, the SEC standard in minority-ownership situations is that companies must use "good faith" efforts to cause the JV to implement appropriate internal accounting controls. But company liability can arise when there are indicia of control or actions by the investor with respect to alleged improper activities involving the joint venture. In this instance, the U.S. authorities alleged that Melo caused certain payments to be made through the JV and, per the SEC Order, he "maintained influence over accounting and financial operations" of the JV.

- Revisions to Attachment C – DOJ's "Minimal Elements" for Compliance Program: In DPAs and other non-trial resolutions, the DOJ typically includes an attachment that specifies the minimal elements for a company's compliance program as part of the agreement, usually "Attachment C" to a DPA. For the Corficolombiana DPA, the DOJ revised Attachment C compared to prior versions used in 2022. These revisions to DOJ compliance expectations are important to understand for all compliance professionals and they are summarized in our recent alert, Guidance from Attachment C: Recent Resolutions Include DOJ Updates to the Requirements for an Effective Compliance Program.

- Formal Cooperation with Colombian Authorities: As noted by the DOJ's press release, this is "the first-ever… foreign bribery case… coordinated with Colombian authorities" – another illustration of the expanding efforts by U.S. authorities to pursue multinational cooperation, which can, for example, allow for access to evidence that would be otherwise unavailable. In this case, the DOJ press release noted coordination with and "substantial assistance by" Colombia's SIC and the Colombian National General Prosecutor Office (Fiscalía General de la Nación), and the SEC's press release also acknowledged assistance from the SIC.

3M Settles with SEC for FCPA Accounting Violations Related to China Operations

On August 25, 2023, the SEC announced a resolution with 3M that imposed penalties and disgorgement of more than $6.5 million over alleged violations of the books and records and internal controls provisions of the FCPA. Specifically, 3M agreed to cease and desist from future FCPA violations and to disgorge $3,538,897, pay prejudgment interest of $1,042,721, and pay a civil money penalty of $2,000,000. 3M neither admitted to nor denied the allegations in the SEC Order.

According to the SEC Order, from at least 2014 to 2018, employees of 3M's China-based subsidiary 3M-China Ltd. (3M-China) provided Chinese government officials employed by state-owned healthcare facilities with overseas travel, sightseeing, and entertainment to induce them to purchase 3M-China products. The Order states that 3M-China personnel sent Chinese government officials on at least 24 trips that included tourism activities, including trips to Los Angeles, Chicago, and Sydney. The SEC alleged that 3M-China employees, led by the former "Marketing Manager" and in collusion with two Chinese travel agencies, created travel itineraries showing legitimate overseas "educational events and health care facility visits" for "Chinese health care officials" for review and approval by 3M-China's compliance function. The employees then delivered the real itineraries, which reflected tourism activities and which "violated company policy," by hand or WeChat, and asked the government officials to keep them hidden.

The SEC alleged that the primary purpose of several of the 24 overseas trips was tourism "designed to improperly induce the Officials to purchase 3M products." As evidence, the Order notes that tourist activities were scheduled at the same time as the ostensible "educational events," the educational events were in English even though participants did not speak English (and there were inadequate translation services), and government officials did not attend the educational events. In one case, 11 Chinese government officials went on a nine-day trip to St. Paul, Nashville, and Los Angeles, during which only one day included educational events. In another case, during an eight-day trip to Chicago in 2016, two of the five government official participants were accompanied by their spouses, and one official and his spouse left Chicago during an educational event and returned later to participate in tourism activities. 3M organized a dinner for the officials, but none of the Chinese officials attended.

The SEC noted that 3M-China employees targeted "influential" employees of 3M-China's state-owned customers for the trips and tracked the impact of the trips on 3M-China's sales to state-owned entity (SOE) customers. 3M-China management also asked for the "return on investment" from an "educational event." The Order cited an example of 3M-China employees "track[ing] post-trip sales to the SOE Customer to ensure they were consistent with 3M-China's sales goals."

According to the Order, certain 3M-China employees accompanied the government officials on the trips and, in order to cover their own expenses, the employees inflated their billing invoices for "ostensibly legitimate line-item expenses (e.g., travel costs)." 3M-China also arranged for the transfer of company funds to one of the travel agencies involved to improperly offset the costs of the tourism-related activities. 3M's records indicate that between February 2016 and September 2018, 3M made 15 transfers with vague descriptions such as "marketing," to the travel agency, totaling $254,000. The Order also states that the travel agencies "with the support of the 3M-China [e]mployees, at times directed that 3M-China's distributors pay for portions of the non-reimbursable expenses."

During the relevant time period, 3M-China paid nearly $1 million for the at least 24 trips and benefited "by at least $3.5 million from increased sales" as a result of the improper conduct. The SEC alleged that "[t]he costs of these trips were improperly recorded in 3M's books and records as legitimate business expenses, without any indication that they included" the various tourism activities. The SEC also asserted that "3M had insufficient controls over" certain payments to the travel agencies that "did not adequately describe the purpose or uses of the funds."

In determining the appropriate penalty, the SEC listed "3M's self-reporting, cooperation, and remedial efforts" as mitigating factors. Specifically, the Order states that 3M "promptly self-reported the misconduct after learning of it" and cooperated with the investigation by "making witnesses available for interviews, voluntarily producing translations of relevant documents, sharing facts uncovered during its internal investigation – including notes of witness interviews – and providing comprehensive, periodic updates on its internal investigation." The Order also detailed 3M's "significant remedial measures," including "disciplining and/or terminating involved employees," terminating the relationships with the travel agencies, and enhancing its internal controls and compliance program, "including additional controls over [its] cross-border fund transfers."

Key Takeaways

- No FCPA Bribery Charges: Despite the allegation that 3M-China paid for the cost of improper non-work travel by Chinese government officials designed to induce them to buy 3M products, the SEC did not charge 3M with violating the FCPA's anti-bribery provisions. There are many factors that may have led to the SEC's decision to include only the accounting provisions violations, but one significant factor here may have been that based on the resolution, it does appear that 3M did in fact have educational events planned and executed for these trips, but the relevant public officials simply did not attend.

- 3M-China Circumvention of Compliance Processes Using Travel Agencies and Others: 3M-China utilized third parties – including travel agencies and distributors – to deliberately circumvent internal compliance processes and evade the policies and controls in place. The case thus reiterates the risks that these types of third parties present, as well as the need to monitor them, particularly in high-risk jurisdictions like China, where travel-related risks are high. Travel agencies have a long history of enforcement actions in China, including – for example – the domestic enforcement action against GlaxoSmithKline in 2016 and the SEC resolution involving IBM Corporation in 2011.

- Administrative Proceeding: The SEC brought the case as an administrative proceeding rather than a civil injunctive action, avoiding the possibility of a District Court judge questioning the payment for disgorgement for accounting provisions. In its 2020 Liu v. SEC decision (covered here), the U.S. Supreme Court upheld the SEC's statutory authority to seek disgorgement but limited the scope of such relief to net profits. Congress subsequently amended the Exchange Act to provide that the SEC may seek "disgorgement . . . of any unjust enrichment by the person who received such unjust enrichment as a result of" securities law violations. The SEC appears to have only gotten disgorgement for accounting violations through administrative proceedings, which may suggest that SEC questions regarding the applicability of disgorgement for accounting violations is creating an SEC preference for administrative proceedings in such cases, and it is certainly the current norm for corporate FCPA resolutions.

Albemarle Settles with DOJ and SEC Over FCPA Allegations in Vietnam, India, and Elsewhere

On September 28 and 29, 2023, Charlotte, North Carolina-based Albemarle Corporation — a global specialty chemicals company and a U.S. issuer — entered into respective resolutions with the DOJ and SEC that resolved claims against the company for alleged violations of the FCPA's anti-bribery and accounting provisions in several different countries. Albemarle entered into a three-year NPA with the DOJ and agreed to a Cease-and-Desist Order with the SEC related to the FCPA's anti-bribery and accounting provisions, both for conduct that occurred between 2009 and 2017 that, per the DOJ, enabled the company to "obtain[] profits of approximately $98.5 million." According to the public documents, Albemarle first learned of the misconduct during an internal investigation and voluntarily self-reported it to the DOJ and SEC in 2018. Under the terms of the resolutions, Albemarle paid a combined total of approximately $218.5 million in penalties, disgorgement, and prejudgment interest.

The NPA and Order state that personnel in Albemarle's Refining Solutions business line (in the company's former Catalyst business unit) made improper payments via sales agents to employees of SOEs and JVs in Vietnam, Indonesia, and India. With respect to Vietnam, the public documents note that Albemarle won business from two different state-owned refineries by hiring a sales agent that used a portion of its commission to pay bribes to refinery employees from 2013 to 2017. In Indonesia, Albemarle won business and received non-public information from a state-owned oil and gas company after the company replaced its existing sales agent with a new sales agent that then used a portion of its commission to pay bribes in 2012 and 2013 to various SOE employees and to a close relative of an SOE employee. Finally, in India, in 2009 Albemarle avoided being blacklisted by a state-owned oil company and grew its business with that company by hiring an agent that paid bribes to employees associated with the SOE.

The SEC Order also details allegations of misconduct with respect to a private company in India, and in China and the United Arab Emirates. In India, the Order describes a commercial bribery scheme that involved the same agent from the FCPA scheme making improper payments to employees of a private company along with their family members in violation of the FCPA's accounting provisions. In addition to Vietnam, Indonesia, and India, the SEC also asserted that Albemarle had "insufficient internal accounting controls" in place when the company decided to engage and continue to pay agents in connection with Albemarle's business with SOEs in China and the United Arab Emirates "despite elevated risks of bribery and without reasonable assurance that its payments compensated legitimate services." The SEC cited emails discussing potential familial connections between a Chinese agent and SOE customer officials, "high" commissions, and "close and well-publicized" connections between the United Arab Emirates agent and the United Arab Emirates customer and royal family as examples of red flags.

The Albemarle NPA marks one of the first major resolutions under DOJ's updated Corporate Enforcement Policy (CEP). Under the terms of the CEP, companies that voluntarily self-report potential misconduct "at the earliest possible time," fully cooperate with the government, and timely and appropriately remediate any issues can receive "at least 50% and up to a 75% reduction off of the low end of the U.S. Sentencing Guidelines fine range, except in the case of a criminal recidivist." In Albemarle's case, both the DOJ and SEC recognized Albemarle for voluntarily self-disclosing, cooperating with the government, and "engag[ing] in extensive and timely remedial measures," including employee discipline and "transforming its business model and risk management process to reduce corruption risk in its operation and to embed compliance in the business, including implementing a go-to-market strategy that resulted in eliminating the use of sales agents throughout the Company." The DOJ did determine that Albemarle's self-disclosure was not "reasonably prompt." However, the DOJ "gave significant weight" to the company's ultimate disclosure and other actions and thus awarded Albemarle with a 45 percent reduction of the available 50 percent off of the bottom of the U.S. Sentencing Guidelines fine range. In subsequent public statements, DOJ recognized that Albemarle's 45 percent reduction is the "highest percentage reduction under the revised CEP to date."

DOJ also praised Albemarle for withholding bonuses from employees suspected of misconduct, and per the recent clawback pilot program, credited the amount withheld ($763,453) against Albemarle's monetary penalty. As part of the NPA, the company agreed to compliance reporting obligations for a period of three years, but it was not required to retain a Monitor.

Miller & Chevalier acted as co-counsel for Albemarle in this matter.

Key Takeaways

- Third Parties Continue to Drive Risk for Companies: The Albemarle resolution makes clear that third parties involved in interacting with foreign officials on behalf of companies continue to create significant risk under the FCPA. As noted, in Albemarle's case, the company terminated relationships with all sales agents as part of its remediation – a significant step noted by the DOJ, though one that is not necessarily achievable by all companies. That said, the facts in the matter note various issues and potential red flags that compliance personnel can look for and guard against in monitoring third party relationships.

- Updated CEP Offers Significant Benefits if Companies Qualify: Not only did Albemarle earn a substantial reduction in its fine range, DOJ has since acknowledged that Albemarle would have been eligible for a declination had the company reported sooner. Under the old CEP, Albemarle would have only been entitled to a maximum reduction of 25 percent.

Clear Channel Outdoor Agrees to More Than $26 Million in Penalties Following FCPA Charges

On September 28, 2023, the SEC issued a Cease-and-Desist Order against Clear Channel, "a Texas-headquartered company in the out-of-home advertising industry" and issuer, for alleged violations of the FCPA's anti-bribery and accounting provisions. Without admitting or denying the SEC's findings, Clear Channel agreed to cease and desist from violating future FCPA provisions, pay disgorgement and prejudgment interest of approximately $20.1 million, and pay a $6 million civil penalty.

The SEC Order alleges that from at least 2012 to 2017, Clear Channel's "indirect, majority-owned Chinese subsidiary, Clear Media Limited" (Clear Media) "bribed Chinese government officials… to obtain concession contracts" needed to sell a variety of advertising services. Clear Media provided local Chinese government officials with "cash-equivalent gift cards, golf clubs, vases, and other expensive and unidentified gifts and entertainment" – some of which were identified as tied to "the negotiation process with clients for a renewal" of contracts. The Order also states that "Clear Media's principal executive officer" "spent hundreds of thousands of dollars, subject to no advance review or approval, on government officials for first-class travel, hotel rooms, meals, and entertainment." The Order includes that "Clear Media also maintained an annual reserve of $525,000 to $600,000 for "special funding" or "special request funding" for "ad hoc requests" and notes that such funds largely went to hospitality for officials.

The Order alleges that Clear Media also paid "improper benefits to government officials through vendors known as 'cleaning and maintenance entities'" – third party Chinese vendors that often were related to the JV partner with whom Clear Channel owned and controlled Clear Media and were administered by a "close family member" of Clear Media's principal executive officer. Clear Media allegedly paid these entities "based solely on oral agreements, often disguising payments for the benefit of government officials as various 'subsidies' or 'special request' expenses"; such payments often occurred without detailed descriptions of services or backup as required by Clear Media policies. The Order cites a statement from a general manager of one such entity to a Clear Channel auditor in 2017 in which the manager asserted that his primary job "was to maintain a 'close relationship' with Shanghai government officials, including through entertainment, in order to avoid having the Shanghai concession put out for public tender." The manager also stated that Clear Media would likely lose any such tender because "it was unable to compete based on price."

The SEC also alleges that Clear Media "developed an off-book cash fund for payments made to undisclosed consultants to win, grow, or retain advertising business from approximately 70 private and government customers." Clear Media senior managers "considered the identities of the [at least 19] consultants to be sensitive and confidential information and did not properly diligence or document them," nor did they enter written contracts. To fund these payments, Clear Media personnel sometimes withdrew cash from corporate accounts and sometimes "created false invoices and tax records to justify cash payments to three shell company intermediaries that provided no actual services."

The SEC Order cited many issues related to the internal accounting and compliance controls related to Clear Media, often through active steps taken by Clear Media senior management. For example, in September 2015, Clear Media managers cautioned employees to not "describe the purposes of the Hospitality Costs too specifically, e.g., for the purpose of winning the contract." The SEC noted that "Clear Media's documentation often failed to identify the officials who received the benefits or to specify the amount spent on each official's behalf."

The SEC Order focuses on issues with Clear Channel's internal audits of Clear Media and related remediation attempts – some of which were actively blocked and undermined by Clear Media senior managers. The Order states that "[f]rom 2012 through 2017, [Clear Channel] internal auditors repeatedly reported elevated bribery risks at Clear Media and concerns regarding Clear Media's compliance program and internal accounting controls, including in relation to cleaning and maintenance vendors; travel, gifts, and entertainment; compliance training; and whistleblower hotline implementation." The Order also lists various instances in which the auditors' efforts "failed," including by not sufficiently testing "high-risk transactions" and accepting Clear Media managers' statements at face value without sufficient efforts to corroborate such statements. The Order states that Clear Channel "failed to ensure that Clear Media took adequate steps to sufficiently address these repeated concerns" even though in multiple instances the auditors found that "some gifts and entertainment Clear Media provided to government officials may violate relevant anti-corruption laws" or were "high-risk" or "problematic" under such laws.

In addition, the Order describes occasions in which Clear Media senior management actively inhibited auditor efforts. In 2017, for example, Clear Media's principal executive officer "blocked" access to requested records from auditors and other executives. When an investigation into other issues, including a "misappropriation scheme" called out by a Clear Media whistleblower and "suspicious commission payments," was launched in 2018, the Clear Media principal executive officer "prevented investigators from interviewing" certain third-party personnel or accessing relevant records. The order asserts that the principal executive officer "continued to deny [Clear Channel's] internal auditors access to financial records related to the cleaning and maintenance entities' expenses in 2019." In light of these and other developments, an external auditor found that the payments to cleaning and maintenance entities "created a 'critical risk; to Clear Media's operational performance, financial statements, and reputation or could result in legal fines and penalties."

According to the Order, by 2018, Clear Media faced a suspension from the Hong Kong Stock Exchange and a finding by Clear Channel's U.S.-based auditors of "material weaknesses" in its internal control over financial reporting. In November 2019, facing findings that it "still could not assure itself that Clear Media's payments to cleaning and maintenance entities were being spent appropriately," Clear Channel "announced a strategic review of" its ownership of Clear Media, and in March 2020, "disposed of its interest in Clear Media."

The SEC Order states that, because of Clear Media's improper payments, Clear Channel received $16.4 million "in benefits." The Order notes several mitigating factors related to the disposition, including a voluntary disclosure and cooperation, including facilitation of documents retrieval from and interviews of personnel from certain third parties. Clear Channel's remediation efforts are also cited favorably – these include the "disposing of its interest in Clear Media," various enhancements of compliance policies and financial controls, and the "increasing human and financial resources for compliance, including the hiring of a dedicated Compliance Director."

Key Takeaways

- Issues with Audits and Audit Responses: A key theme emphasized by the SEC Order is the fact that Clear Channel (via its internal audits and through other signs) had identified clear risks and gaps in internal accounting controls, but repeatedly failed to address the identified issues. Indeed, the SEC asserts that the company initially determined that the issues had been addressed, but without proof of actual remediation and in the face of contrary information. In the resolution, the SEC notes that Clear Channel remediated the issues in part by retaining a dedicated compliance officer, which indicates that part of the reason for the failure to address internal audit concerns that Clear Channel did not previously have a dedicated compliance function. This dynamic may also have contributed to the ability of Clear Media senior management to block access to information for years without apparent consequence (though the corporate structure of Clear Media may also have been a factor). The resolution is a reminder for compliance teams to be aware of and assist with oversight of remedial actions from internal audits.

- Role of Cleaning and Maintenance Entities as Conduits for Payments: Many of the payments at issue in the SEC Order were made to cleaning and maintenance entities. Normally, these vendors are not considered high-risk, although there were at least two factors here that indicated heightened risk. One, they were owned by or closely related to the local JV partner and controlled by a close family member of Clear Media's principal executive, and two, there were indications that the cleaning and maintenance entities were involved in interactions with government officials (which normally is not the case for such vendors and should have raised additional questions). Nonetheless, businesses operating in China and elsewhere may want to use this resolution as a predicate for updating their risk assessments of lower-risk vendors to ensure that there are not similar indicators present.

- The Role of the Local Partner: The Clear Media operations in China were founded by Clear Media's principal executive officer, who maintained an ownership stake and the ability to continue to run the China business after Clear Channel acquired its stake. The Clear Media principal executive maintained a network of affiliated companies that were involved in the improper payments, as detailed above, and it does not appear that Clear Channel conducted detailed reviews on the potential conflicts of interests or general business rationales for such engagements. According to press reports, a co-founder and co-owner of Clear Media was Han Zi Jing, and he remained a significant owner of Clear Media after its divestment from Clear Channel, without any clear evidence of any enforcement actions in China or elsewhere (although one article indicates that two Clear Media employees have been prosecuted for misappropriation). This resolution reinforces another clear theme about the importance of selecting joint venture partners or local stakeholders.

Enforcement Actions Against Individuals

Former PDVSA Director Sentenced to Jail Time and $18 Million Forfeiture

On February 12, 2018, the DOJ unsealed indictments, filed in 2017, against five former government officials who were referred to as the "management team" of PDVSA. All five members of the management team are Venezuelan citizens who allegedly used their significant influence with PDVSA to solicit bribes and kickbacks from vendors in the U.S., with two of them arranging for some of the bribes and kickbacks to be directed to other PDVSA officials. One of those two was Luis Carlos De Leon-Perez (De Leon), a dual U.S.-Venezuelan citizen, who was arrested in Spain in October 2017 and subsequently extradited to the U.S. We have reported on various aspects of this case in our Winter 2018, Autumn 2018, and Spring 2018 FCPA Reviews.

The DOJ has also previously indicted and convicted several U.S.-based individuals who allegedly paid the bribes and kickbacks to the PDVSA management team and other officials in exchange for having their energy companies put on PDVSA's vendor list, as reported in our Spring 2016, Summer 2016, Spring 2017, and Winter 2018 FCPA Reviews.

On July 16, 2018, the DOJ announced that De Leon pled guilty to one count of conspiracy to violate the FCPA's anti-bribery provisions and one count of conspiracy to commit money laundering. According to the DOJ, De Leon admitted to entering into a conspiracy with former executives at PDVSA and its subsidiaries, as well as other former Venezuelan government officials, to solicit bribes and kickbacks from vendors seeking to do business with the Venezuelan national oil company. De Leon's role in the scheme included attempting to solicit the bribes from vendors based in the U.S. and elsewhere and then directing a portion of those bribes to PDVSA executives. De Leon's efforts to conceal the proceeds from these bribes gave rise to a separate charge of conspiracy to commit money laundering. All the conduct giving rise to De Leon's charges occurred from 2011 to 2013.

On August 7, 2023, the U.S. District Court of the Southern District of Texas sentenced De Leon to a year and a day in prison, to be followed by two years of supervised release, and ordered him to pay a fine of $472,064 and a mandatory assessment of $200. The court also issued an Order of Forfeiture of Substitute Asset. In the Order, the court states that on October 2, 2020, the court imposed and De Leon agreed to a money judgement in the amount of over $18 million against De Leon. De Leon "tendered" the relevant amount "from a financial account in Switzerland" and the Order confirmed forfeiture of that amount as part of the penalty.

Canadian Businessman Sentenced for Bribery Scheme Involving Former Chadian Diplomats

On September 6, 2023, Judge Richard Leon of the U.S. District Court for the District of Columbia sentenced Canadian businessman Naeem Riaz Tyab to three years in prison, including time served (over two months), followed by three years of supervised release.

As previously reported, Tyab pleaded guilty to one count of conspiracy to violate the FCPA in 2019 for his role in a bribery scheme involving two former Chadian diplomats to the U.S., Mahamoud A. Bechir and Youssouf H. Takane. According to federal prosecutors, Tyab, the co-founder and director of Griffith Energy, a start-up Canadian energy company, paid $2 million in bribes to Bechir and Takane as part of an arrangement that lasted from 2009 to 2014 in exchange for securing Chadian oil contracts for his company. Bechir's wife, Nourachem Bechir Niam, allegedly acted as an intermediary for the payments through her consulting company. Bechir, Takane, and Niam, who were also indicted in 2019, remain at large.

The DOJ filed a Motion for Downward Departure a week prior to Tyab's sentencing recommending a one-and-a-half- to two-year sentence in light of his "substantial assistance in the investigation and prosecution of others." The DOJ specified that Tyab accepted responsibility for his own conduct and "proactive[ly]" cooperated with the government by sharing information on his co-conspirators, the bribery operation, and other potential corrupt ventures to justify its recommended shortened sentence. Furthermore, Tyab forfeited around $27.6 million of criminal proceeds as part of his guilty plea. Global Investigations Review reported that Judge Leon was concerned that the prosecutors' recommended sentence was too lenient given the scale of bribery, so he opted for a longer three-year sentence with the stated goal of deterring similar crimes. In the judgment, the court also recommended that Tyab serve time at a minimum-security prison in Washington state, "as close as possible to the country of Canada, to facilitate family visits."

Former Chairman of Ecuador's Seguros Sucre's Sentence Reduced for Cooperation in Investigation

On September 16, 2020, Juan Ribas Domenech (Ribas), the former chairman of the board of directors of the Ecuadorian state-owned surety company Seguros Sucre, pleaded guilty to a single count of conspiracy to commit money laundering. The DOJ charges alleged that Ribas participated in a scheme to launder over $5 million in bribes paid to him by three reinsurance brokers in exchange for helping reinsurance companies "to obtain and retain contracts with Seguros Sucre." On March 23, 2021, Ribas was sentenced to 51 months in prison.

On July 20, 2023, the U.S. District Court for the Southern District of Florida amended the judgment against Ribas and reduced his sentence to 37 months under the Federal Rule of Criminal Procedure 35(b). Under this rule, if the U.S. government believes that a sentenced defendant has provided substantial assistance in investigating or prosecuting another person, it may move the court to reduce the original sentence. The amended judgment did not describe the extent or details of Ribas's cooperation with the government.

Several other cases have arisen from the conduct surrounding Seguros Sucre. In January 2021, a U.S. court sentenced Felipe Moncaleano Botero, the former CEO of the Colombian subsidiary of a U.K.-based insurance brokerage, to six years in prison and directed him to pay a $50,000 fine in relation to one count of conspiracy to commit money laundering in connection with the scheme. Jose Vicente Gomez Aviles, the co-owner of an "introducer company," pleaded guilty to charges in September 2020 and was sentenced to close to four years in prison. Another intermediary, Robert Heinert, also pleaded guilty and was sentenced to three years in prison and three years of supervised release. Finally, on March 18, 2022, the DOJ announced it had declined to prosecute U.K.-based Jardine Lloyd Thompson Group Holding Ltd. (JLT), for violations of the anti-bribery provisions of the FCPA. The DOJ stated that it had declined to prosecute the company despite evidence that a JLT employee and JLT agents paid approximately $3.157 million in bribes to Ecuadorian government officials through a Florida-based third-party intermediary between 2014-2016 to obtain and retain contracts with Seguros Sucre. The declination indicated a likely action in the U.K., and later that year in June, the U.K. Financial Conduct Authority (FCA) fined the related entity JLT Speciality Limited more than £7 million for financial crime control failings that contributed to bribery in Colombia.

On November 20, 2023, the DOJ announced DPAs with two additional re-insurance companies, Tysers Insurance Brokers Limited and H.W. Wood Limited. We will cover these two new DPAs in our next Review.

Former Vitol Trader Faces New FCPA Charges in Texas

On August 3, 2023, the DOJ filed an indictment in Texas against Javier Aguilar, a former oil and commodities trader at Vitol, charging one count of conspiracy to violate the FCPA and a separate count for violating the FCPA anti-bribery provisions.

The charges stem from Aguilar's alleged role in a bribery scheme involving Pemex, the Mexican state-owned oil company. According to the indictment, between August 2017 and July 2020, Aguilar engaged in a scheme to pay bribes to two procurement managers at PPI, a wholly owned and controlled subsidiary of Pemex, in exchange for inside information to obtain business for Vitol. Aguilar's trial is scheduled to begin on April 15, 2024.

Aguilar was first charged with violating the FCPA in a New York case originating in 2020, which charged him with a similar bribery scheme involving Petroecuador, a state-owned oil company in Ecuador. In 2022, the DOJ attempted to add charges regarding transactions with Pemex through a superseding indictment. The New York indictment also charged Aguilar with conspiracy to commit money laundering to launder the proceeds of both the Mexico- and Ecuador-related schemes. On May 31, 2023, the U.S. District Court for the EDNY dismissed the FCPA charges regarding Pemex and Mexico without prejudice for lack of venue. However, the court found venue to be proper as to the original FCPA charges related to Ecuador and the money laundering charge based on the government's allegation that the conspiracy included financial transactions conducted in the EDNY. The trial on the remaining charges is scheduled for January 2024.

In December 2020, Vitol entered a three-year DPA with the DOJ and an Order with the U.S. Commodity Futures Trading Commission (CFTC) related to FCPA and other allegations for activities by its traders in Mexico, Ecuador, and Brazil. Vitol also entered into a leniency agreement with the Brazilian authorities.

Former Oil and Gas Trader, Brazilian-Italian Intermediary, and Executive Indicted for Petrobras-Related Bribes