FCPA Spring Review 2021

International Alert

Introduction

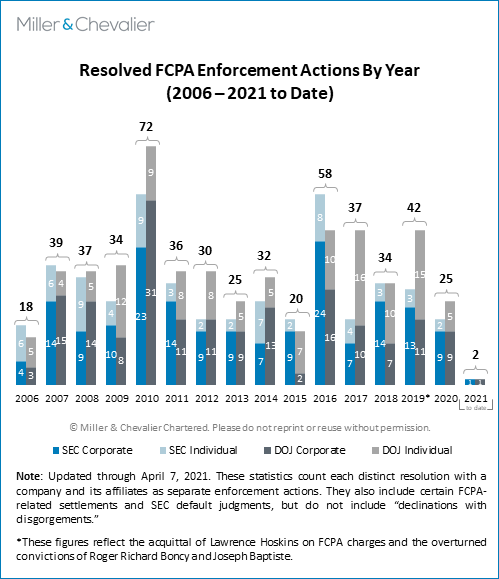

In the first quarter of 2021, the U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) each announced one corporate Foreign Corrupt Practices Act (FCPA) enforcement action – related dispositions involving German financial services company Deutsche Bank AG. The first quarter of 2021 saw no individual FCPA enforcement actions, although the DOJ announced bribery-related money laundering charges against two individuals, and multiple individuals received sentences or fines for FCPA charges that had been previously resolved. Two individuals—both employees of foreign state-owned entities—also pleaded guilty to money laundering charges in connection with international bribery schemes during the first quarter, and the DOJ unsealed a similar money laundering plea agreement in March.

The relatively slow start to enforcement action announcements in 2021 is likely due, in part, to the continued effects of the COVID-19 pandemic. The DOJ and SEC have reported that they quickly adjusted to the disruptions to their normal operations caused by the pandemic, relying on technology to conduct document reviews and interviews, process disclosures and whistleblower reports, and otherwise investigate possible FCPA violations. However, the agencies have publicly noted that the pandemic has nonetheless presented difficulties with respect to some aspects of traditional enforcement activities. During remarks at a February 2021 International Bar Association (IBA) webinar (moderated by Miller & Chevalier Member Ann Sultan), Daniel Kahn, Acting Chief of the DOJ's Fraud Section, noted that remote interviews in particular have presented challenges that may impact the "effectiveness" of the interview, and that COVID-19 conditions have in some cases impacted the ability to coordinate with authorities in other jurisdictions.

During the IBA webinar, Kahn and Charles Cain, Chief of the FCPA Unit of the SEC's Enforcement Division, emphasized that any perceived slowdown in announcements of enforcement resolutions or investigations is not the result of decreased resources or willingness of the agencies to pursue FCPA-related offenses. Kahn asserted that the pipeline for corporate self-disclosures remains "very healthy" and that the FCPA case pipeline, generally, "has never been this strong." Kahn also noted the DOJ's view that the "Corporate Enforcement Policy is working," as evidenced by increased voluntary disclosures involving "significant high-level involvement" and "significant bribery schemes." Kahn and Cain also predicted a continuing increase in multi-jurisdictional investigations and coordinated resolutions – with Cain noting that these coordinated resolutions may involve jurisdictions with which U.S. authorities have not coordinated in the past.

In their remarks, Kahn and Cain both noted that the agencies are focused on what they termed "corruption detection," with Cain explaining that the SEC is focused on detecting corruption in industries not traditionally perceived as high-risk, but which have governmental touchpoints or other risks that "may result in violations." Cain also explained that the SEC is reviewing the "evolving methods by which funds are extracted [from companies] to pay bribes, and the conduits for bribes."

It is too early for the first-quarter statistics to reflect any shift in priorities following the change in administrations in January 2021. However, the Biden administration has publicly stated that white-collar enforcement activity will be a priority in several legal arenas, including the FCPA. For example, while running for office, then-candidate Biden stated that during his first year in office, he would "issue a presidential policy directive that establishes combating corruption as a core national security interest and democratic responsibility," and would "lead efforts internationally to bring transparency to the global financial system . . .". The nominations of Attorney General Merrick Garland and SEC Chairman Gary Gensler suggest that enforcement efforts in the white-collar area will be a core focus of DOJ and SEC policy. The Senate confirmed Attorney General Garland on March 10, 2021, and during the confirmation process, Garland stated that he was committed to "vigorous enforcement of the Foreign Corrupt Practices Act and other federal anti-corruption laws." Attorney General Garland will inherit an FCPA Unit that has increased in size over the past several years, now numbering a total of 39 prosecutors.

The Senate confirmed Gensler as SEC Chairman on April 14, 2021. Chairman Gensler is expected to enhance the SEC's focus on misconduct by corporations, including violations of the FCPA (though the confirmation process did not produce any specific discussion of the FCPA by Gensler). Unlike his predecessor, who prior to his assuming the SEC chairmanship had questioned the impact of the FCPA on the competitiveness of U.S. companies, Chairman Gensler has not expressed any such qualms. During his tenure as Chairman of the Commodity Futures Trading Commission (CFTC), the CFTC was at the forefront of cases against systemic abuses by large financial institutions, such as for the manipulation of LIBOR. Further, Chairman Gensler can be expected to seek to exact large penalties in the cases the SEC brings, likely with less concern about the impact of corporate fines on public companies than under the previous administration. A Gensler-led SEC likely will focus on environmental, social, and governance (ESG) issues; how this might affect FCPA-related investigations or disclosures is unclear at present, but bears watching.

Notably for corporate compliance teams, COVID-19 and the related remote work arrangements appear to have contributed to an increase in whistleblowing. Fiscal year 2020 was a record-breaking year for the SEC's whistleblower program, both in terms of monetary awards issued and tips received. In 2020, the SEC received more than 6,900 whistleblower reports – a 31 percent increase over the second-highest year in 2018. According to the SEC Office of the Whistleblower's Annual Report to Congress, it received a "particularly high" number of tips in Q3 of the SEC’s fiscal year 2020 (April-June), when work-from-home arrangements were initiated. With 2021 already a record-breaking year in terms of total monetary amount of awards issued for raising allegations and submitting evidence, whistleblowers remain incentivized to report to the SEC. Notably, the SEC reported that 81 percent of insiders who received awards in FY 2020 raised their concerns internally before reporting to the Commission – signaling that corporate compliance teams may have room to adapt to better address these complaints and prevent reporting to the SEC. However, as discussed further below, recent amendments to the SEC's whistleblower rules, as well as legislative developments to revamp the anti-money laundering whistleblower program overseen by the Treasury Department, will likely further incentivize employee whistleblower reports to U.S. enforcement authorities.

Corporate Enforcement Actions

The Deutsche Bank resolutions were the only corporate enforcement actions resolved during the first calendar quarter of 2021, though they were in some ways noteworthy, as will be discussed below.

In coordinated resolutions with the agencies on January 8, 2021, Deutsche Bank—now a repeat FCPA offender following its August 2019 FCPA resolution with the SEC—agreed to pay approximately $123 million in penalties and disgorgement to resolve alleged violations of the FCPA's accounting provisions. According to the settlement papers, Deutsche Bank's violations resulted from improper payments made to "Business Development Consultants" (BDCs) — third parties hired to assist the bank with obtaining business in various jurisdictions — from 2009 to 2016. As discussed in detail below, Deutsche Bank entered into a three-year Deferred Prosecution Agreement (DPA) with the DOJ, agreeing to pay a criminal penalty of approximately $79.6 million. The bank additionally agreed to pay the SEC approximately $35.1 million in disgorgement and $8.2 million in prejudgment interest (for a total of approximately $43.3 million).

Corporate Investigations Closed without Enforcement Actions

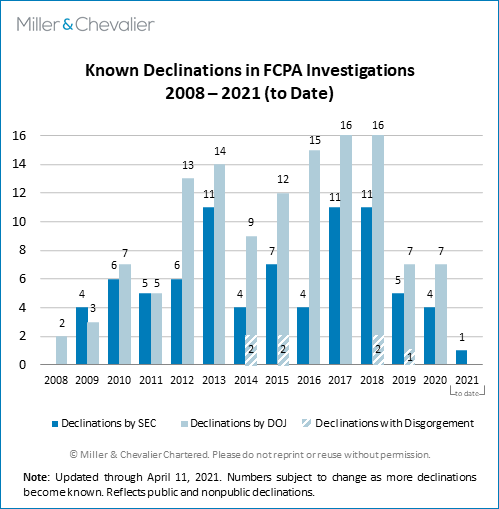

Following our practice from past years, throughout the first quarter of 2021, Miller & Chevalier has tracked investigations closed without an enforcement action, i.e., known investigations that the DOJ and the SEC have initiated but closed without a DPA, Non-Prosecution Agreement (NPA), Cease-and-Desist Order, guilty plea, jury conviction, or other final enforcement procedure.1 During the first three months of 2021, we tracked only one such investigation announced publicly as closed without enforcement action: in a 6-K filed on February 26, 2021, Brazilian food company BRF S.A. (BRF) announced that it had received a letter from the SEC's Enforcement Division stating that the SEC had concluded its investigation into the company for potential FCPA violations and did not intend to recommend an enforcement action against the company. In 2017, BRF disclosed in U.S. securities filings that the DOJ and SEC had requested information from the company following a probe by Brazilian authorities into alleged bribery of food sanitation inspectors in Brazil (Brazilian Federal Police's Operations Carne Fraca and Trapaça). In the February announcement, the company reiterated "its commitment to collaborate with the Brazilian authorities" and the DOJ.

The chart below reflects the BRF investigation closure as the only closure or declination announced by companies or the DOJ of 2021 thus far. Of the eleven declinations we tracked in 2020, only one was (publicly) announced by the DOJ under its Corporate Enforcement Policy: World Acceptance Corporation (WAC). We previously reported on the DOJ declination to prosecute WAC in our FCPA Autumn Review 2020. Information on the remaining closures — involving CHS Inc., Uber Technologies Inc., Alexion Pharmaceuticals Inc. (all DOJ only), United Technologies Corporation (SEC only, though note that DOJ closed a parallel investigation in 2019), GlaxoSmithKline, Usana Health Sciences Inc., and KBR (both DOJ and SEC)— comes from the respective companies' U.S. securities filings.

Known FCPA Investigations Initiated

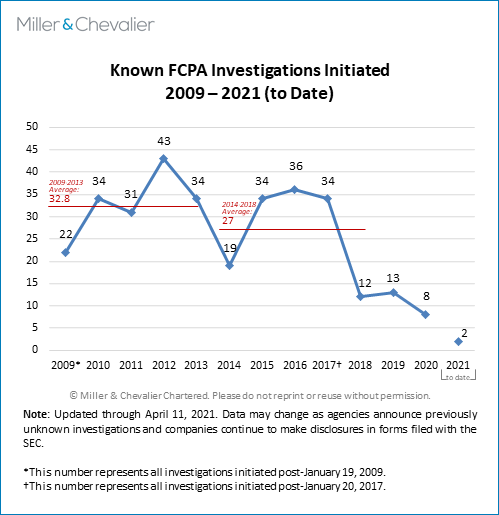

Two companies disclosed new FCPA-related investigations during the first quarter of 2021. In a February 16, 2021 U.S. securities filing, Cisco Systems Inc. (Cisco) reported that the company was investigating allegations of a self-enrichment scheme involving former employees in China and allegations that certain of those employees had "directed payments from the funds they received to third parties, including employees of state-owned enterprises." Cisco stated that it had voluntarily disclosed its investigation to the DOJ and SEC and would report the results of the investigation to the agencies. In a March 18, 2021 U.S. securities filing, Toyota Motor Corporation (Toyota) said that in April 2020, the company reported "possible anti-bribery violations related to a Thai subsidiary" to the DOJ and SEC. In addition to these DOJ and SEC investigations, in a Form 6-K filed on March 12, 2021, Brazilian petrochemical producer Braskem S.A. (Braskem) disclosed that it had hired a U.S. law firm to conduct an internal investigation to carry out an internal investigation into "alleged improper payments related to the Ethylene XXI project." Braskem's filing did not indicate whether the SEC or DOJ have opened investigations into the alleged misconduct.

The Cisco and Toyota investigations are reflected in the below chart of known FCPA investigations initiated from 2009 to date. The chart depicts a decline in publicly announced new FCPA investigations since 2016-2017. As we have noted in the past, this lower number is almost certainly created by incomplete information. We are likely to learn of more investigations launched in late 2020 and 2021 in the coming weeks and months, as companies disclose such information in their public disclosure filings. Because neither the DOJ nor the SEC disclose official investigations statistics in anything close to real time and only some companies are likely to disclose such information through SEC filings or other means, our investigation statistics are necessarily incomplete.

Individual Enforcement Actions

No individual FCPA enforcement actions were resolved in the first quarter of 2021 – the DOJ and the SEC announced no new FCPA resolutions related to individuals, nor did any individuals plead guilty to existing FCPA charges. We note, however, that on April 15, 2021, José Carlos Grubisich, the former CEO of Braskem (discussed above), pleaded guilty to conspiracy to violate the anti-bribery provisions of the FCPA and conspiracy to violate the books and records provisions of the FCPA for his role in the bribery scheme involving Braskem and its parent company, Odebrecht S.A. As we previously reported, in 2016, Braskem resolved corporate enforcement actions arising out of "Operation Car Wash," the Brazilian corruption investigation into state oil company Petrobras. The DOJ unsealed an indictment against Grubisich in November 2019, charging him one count of conspiracy to violate the anti-bribery provisions of the FCPA, one count of conspiracy to violate the books and records provision of the FCPA, and one count of conspiracy to commit money laundering. Grubisich admitted that he "agreed to pay bribes to Brazilian government officials to ensure Braskem's retention of a contract for a significant petrochemical project from [Petrobras]" and that he agreed to "falsify Braskem's books and records by causing Braskem to falsely record the payments to offshore shell companies controlled by Braskem as payments for legitimate services." (We will cover this plea agreement in more detail in our Summer Review covering Q2 2021 developments.)

Foreign officials are not directly subject to the FCPA, which targets "supply-side" bribery; however, in recent years the DOJ has charged multiple bribe recipients with violations of U.S. anti-money laundering laws, in connection with the Department's broader FCPA investigations. Two individuals pleaded guilty this quarter to money laundering charges in connection with bribery schemes that formed the basis of previous corporate FCPA enforcement actions. Both individuals were employees of foreign state-owned entities and alleged bribe recipients:

- In January, Daniel Comoretto Gomez (Comoretto), a former manager at state-owned oil company Petróleos de Venezuela SA (PDVSA), pleaded guilty to a single count of conspiracy to commit money laundering. The charges against Comoretto stem from the DOJ's investigation into Florida-based asphalt company Sargeant Marine Inc. (SMI), which resolved corporate FCPA charges in September 2020; Comoretto allegedly accepted bribes from Sargeant Marine, through an intermediary, in exchange for assisting the company with winning contracts to purchase asphalt from PDVSA.

- In March, Jose Luis De Jongh Atencio (De Jongh), a former procurement officer with PDVSA subsidiary Citgo Petroleum Corporation (Citgo), pleaded guilty to conspiracy to commit money laundering, also for allegedly assisting companies with obtaining business with Citgo and PDVSA. (As discussed below, the DOJ also unsealed a related plea agreement from 2019 involving Laymar Giosse Peña Torrealba (Pena) for one count of conspiracy to commit money laundering.)

Additionally, in March, the DOJ announced new money laundering charges against another foreign official: John Luzuriaga Aguinaga (Luzuriaga). The complaint alleges that Luzuriaga, an employee at Ecuador's police pension fund (ISSPOL), accepted bribes from U.S. investment companies in exchange for assisting them with obtaining ISSPOL business. U.S. investment fund manager Jorge Cherrez Miño (Cherrez) was also charged for his role in the scheme.

In addition to these bribery-related money laundering enforcement developments, several individuals recently were sentenced and/or received monetary penalties for previously resolved FCPA violations:

- In January, Armengol Alfonso Cevallos Diaz (Cevallos) was sentenced to 35 months in prison and ordered to pay a criminal fine of $35,000 for his role a scheme to bribe to officials at Ecuador's state-owned oil company, Empresa Pública de Hidrocarburos del Ecuador (PetroEcuador). Cevallos pleaded guilty in January 2020 to one count of conspiracy to violate the FCPA and one count of conspiracy to commit money laundering.

- In March, former CFO of Och-Ziff Capital Management Group LLC (Och-Ziff) Joel Frank agreed to pay the SEC a civil penalty of $35,000 to settle charges that he "caused" Och-Ziff's violations of the FCPA's accounting provisions. Och-Ziff settled its corporate FCPA charges via a Cease-and-Desist Order with the SEC, to which Frank also consented. Frank agreed to cooperate with the SEC's ongoing investigation, and his $35,000 penalty reportedly reflects his years-long cooperation.

- Also in March, Heidi Hong Piao was sentenced to time served and two years of supervised release for her role in the scheme to bribe former U.N. General Assembly President John Ashe. Piao pleaded guilty to bribery and money laundering charges in 2016 and is the last in the case to be sentenced. In a related development, Piao's co-defendant Ng Lap Seng—convicted in 2017 of bribing Ashe and other U.N. officials—was granted compassionate release in March, after serving 34 months of his four-year sentence.

Finally, this quarter saw the sentencing of one individual for bribery-related money laundering charges: in January, Felipe Moncaleano Botero (Botero) was handed a six-year prison term and ordered to pay a $50,000 fine for his role in a scheme to bribe officials at Ecuador's state-owned insurance company, Seguros Sucre. Botero had pleaded guilty to one count of conspiracy to commit money laundering in August 2020.

Policy and Legislative Developments

Several recent policy and legislative developments may result in increased employee whistleblowing of potential corruption-related offenses to U.S. authorities. Late last year, the SEC amended the rules governing its whistleblower program. As discussed further below, the amendments contain several provisions which are likely to further incentivize whistleblowing by employees. In addition to the SEC rule amendments, the National Defense Authorization Act (NDAA), passed in January, included two provisions geared towards incentivizing whistleblowing of anti-money laundering violations. First, the Anti-Money Laundering Act of 2020 (AMLA) amended the Bank Secrecy Act (BSA) to both expand the Treasury Department's BSA whistleblower program and enhance anti-retaliation protections for whistleblowers who report potential anti-money laundering violations. Second, NDAA's Kleptocracy Asset Recovery Rewards Act (KARRA) establishes a new Treasury Department whistleblower program specifically designed to reward whistleblowers who provide information leading to recovery of assets derived from foreign government corruption. We discuss these developments in detail below.

International Developments

In January 2020, Transparency International (TI) released its annual Corruption Perceptions Index (CPI) that ranks perceived levels of governmental corruption in 180 countries and territories. This year, TI also examined the impact of corruption on efficiency of emergency response in the context of COVID-2019 pandemic and found that funds appropriated for healthcare and emergency response relief are impacted by corruption-related diversions and that the lack of transparency in allocating the funds linked to corruption weakens crisis response.

Additionally, a number of key international developments emerged from the United Kingdom, Brazil, China, and South Korea in the first quarter of 2021. In the United Kingdom, the Supreme Court issued a decision limiting the extra-territorial reach of the Serious Fraud Office (SFO) in the case involving U.S. company KBR Inc., which received a request from the SFO to produce documents in its investigation into alleged bribery payments involving Unaoil. The U.K. Supreme Court ruled in favor of KBR Inc. and found that the U.K. law presumption against extra-territorial effect applied to KBR Inc., which did not have an office in the U.K. nor had it conducted business in the U.K. Shortly thereafter, the SFO announced on March 18, 2021 that it had ceased investigating KBR, Inc.'s U.K. subsidiaries in relation to Unaoil and the alleged bribes.

There are two additional developments from the U.K. related to the Unaoil investigation. First, the SFO announced on February 24, 2021 that a U.K. jury convicted Paul Bond, a former sales manager at SBM Inc., of two counts of conspiracy to give corrupt payments in connection with an alleged scheme to bribe Iraqi officials in order to secure oil contracts in the years following the overthrow of Saddam Hussein. Bond, now the fourth executive convicted of bribery in the Unaoil investigation, was subsequently sentenced to three and a half years in prison. Second, the Scottish Crown Office and Procurator Fiscal Service reached a resolution with WGPSN Holdings Ltd. (WGPSN) on March 16, 2021 to settle the allegations that a subsidiary of WGPSN improperly benefited from its payments of more than USD 8.7 million to Unaoil from 2012 through 2015 to secure contracts in Kazakhstan. Under the settlement, WGPSN agreed to pay Scotland's Civil Recovery Unit approximately USD 8.8 million, which represents the profits from the improperly acquired contracts.

In Brazil, three enforcement authorities jointly entered into a leniency agreement with Samsung Heavy Industries (SHI), a South Korean-based engineering company, to resolve allegations of misconduct related to contracts between SHI and Brazil's state-owned oil company—Petróleo Brasileiro S.A. (Petrobras). SHI agreed to pay approximately USD 125 million to Petrobras and USD 19.5 million in fines to the Brazilian government. SHI is also required to improve its governance and compliance policies, as well as control and inspection mechanisms, if it plans to sign future contracts in Brazil.

In Italy, a Milan trial court in March acquitted oil and gas companies Royal Dutch Shell Plc (Shell) and ENI SpA (ENI) of criminal corruption charges, ending a three-year criminal trial. The court also acquitted several current and former executives of both companies, including ENI’s current and former CEOs, as well as former Nigerian Oil Minister Dan Etete. Prosecutors had alleged that Shell and ENI had involvement in and knowledge of corrupt payments—including benefits to Etete—funneled through an escrow account held by the Nigerian government in connection with an oil and gas concession. Further detail on the judge’s legal analysis in the decision, which may still be appealed, will be forthcoming in a future FCPA Review once the court has issued a final written order.

In China, the Central Commission for Discipline Inspection (CCDI) announced its anti-corruption enforcement priorities for 2021 in January, which include combatting corruption in the financial sector, state-owned enterprises, and law enforcement and focusing on investigating corruption in state-backed initiatives under the country's new five-year plan. The CCDI is responsible for policing China's Communist Party ranks; however, CCDI investigations can have spillover effects into private-sector corporate enforcement. For example, the Chinese authorities announced in February that an executive at Tencent had been detained in connection with the corruption investigation into a former vice-minister at China's Ministry of Public Security. We discuss the CCDI enforcement priorities and related private-sector effects in detail below.

Finally, in South Korea, the parliament passed an act in late 2019 on the establishment and operation of a new agency, the Corruption Investigation Office for High-Ranking Officials (CIO). As its name indicates, the CIO will be primarily responsible for investigating and prosecuting criminal allegations involving high-ranking officials in South Korea and their direct family members, such as active and passive bribery, abuse of authority, alteration of official documents, and embezzlement, among others. The establishment of the CIO was challenged by South Korea's main opposition political party, but the country's Constitutional Court ruled in January 2021 that the establishment of the CIO is constitutional. As the Constitutional Court's decision was pending, South Korea's President Moon Jae-in confirmed the appointment of Kim Jin-wook, a former judge, as CIO's first chief.

Corporate Enforcement Actions

Deutsche Bank Settles FCPA Charges and Agrees to Pay DOJ and SEC More Than $122 Million in Penalties

On January 8, 2021, the DOJ and SEC announced (here and here, respectively) that Deutsche Bank AG (Deutsche Bank or the Bank), a German financial services company headquartered in Frankfurt, Germany and an "issuer" listed on the New York Stock Exchange, had agreed to pay approximately $123 million in penalties and disgorgement in coordinated resolutions to resolve alleged violations of the FCPA's accounting provisions.

In a criminal information, the DOJ charged Deutsche Bank with one count of conspiracy to violate the books and records and internal accounting controls of the FCPA. To resolve the charge, Deutsche Bank entered into a three-year DPA and agreed to pay a criminal penalty of approximately $79.6 million. The DPA states, in part, that the Bank made improper payments to third parties – called Business Development Consultants (BDCs) by the Bank – in the United Arab Emirates (Abu Dhabi), Italy, and Saudi Arabia.

The SEC charged the Bank with violating the FCPA's books and records and internal accounting controls provisions. Deutsche Bank agreed to pay approximately $35.1 million in disgorgement and $8.2 million in prejudgment interest (for a total of $43.3 million) to resolve the SEC's allegations related to payments to BDCs in Abu Dhabi, China, Italy, and an unnamed country in the Middle East. The SEC's Cease-and-Desist Order concerns the same allegations as the DOJ enforcement action regarding Abu Dhabi, Saudi Arabia, and Italy; the SEC papers include additional findings related to one BDC in China.

Deutsche Bank's DPA with the DOJ also resolved a non-FCPA charge brought by the DOJ: conspiracy to commit wire fraud related to commodities trading violations between 2008 and 2013. According to the criminal information, the charge arose from a commodities scheme to engage in fraudulent and manipulative commodities trading practices involving publicly-traded futures contracts on precious metals, for which the Bank agreed to pay approximately $7.5 million, including $5.6 million criminal penalty, $681,000 disgorgement, and $1.2 million compensation of victims of the commodities trading offenses. The Bank's criminal penalty for the wire fraud charge was credited against a $30 million civil penalty imposed by the CFTC in 2018 for regulatory violations involving the same misconduct.

The FCPA-related misconduct allegedly took place between 2009 and 2016, during which time, according to the case documents, Deutsche Bank improperly engaged and used many third-party intermediaries — BDCs — to obtain and retain business for the Bank in various jurisdictions. Senior management and various committees allegedly approved the Bank's use of the BDCs, often without appropriate due diligence, assessment of corruption risks, or mitigation of other risks posed by the engagements. The DOJ and SEC found that Deutsche Bank made payments to certain BDCs without contractual arrangements or without invoices or adequate documentation of the services that the BDCs purportedly provided. In practice, according to the DOJ and SEC, certain BDCs served as conduits for bribes to foreign officials so that they could obtain and retain business for Deutsche Bank.

Specifically, the disposition documents state that Deutsche Bank engaged in a scheme where it "knowingly and willfully conspired to maintain false books, records, and accounts" so the Bank could conceal approximately $7.2 million in improper payments to four BDCs. One of the BDCs allegedly received millions of dollars from the Bank, payments which were recorded as legitimate consultancy payments; however, the BDC was in fact a merely a proxy for a foreign official. Another BDC received bribes that were passed on to a decision-maker for a state-owned client in order to obtain the client's business for the Bank. Deutsche Bank concealed these bribes by recording them as "referral fees" paid to the BDC. In addition, Deutsche Bank made payments to other BDCs that were not supported by invoices or evidence of any services provided. In other cases, Deutsche Bank employees created, or helped BDCs create, false justifications and documentation for approval of the payments.

The January 2021 resolution with the DOJ and SEC is the second FCPA settlement for Deutsche Bank in less than 18 months. As we reported in our FCPA Autumn Review 2019, in August 2019, Deutsche Bank had settled with the SEC allegations of improper hiring practices. Specifically, Deutsche Bank agreed to pay the SEC $16 million to resolve FCPA charges stemming from the bank's hiring of relatives of foreign government officials in China and Russia at the request of executives at state-owned enterprises to assist with obtaining business.

Payments to BDC in the United Arab Emirates/Abu Dhabi

According to the case documents, between 2010 and 2011, the Bank retained a BDC in Abu Dhabi to secure a deal dubbed "Project X" with an Abu Dhabi sovereign wealth fund, a state-owned enterprise (SOE). Before it engaged the BDC, Deutsche Bank employees — including Managing Directors with high-level positions at the Bank — knew that the BDC was a relative of a high-ranking Abu Dhabi official who was a key decision-maker for the SOE. The DPA details that at least four Managing Directors knew that the BDC was a "proxy" for the Abu Dhabi official and that paying fees to the BDC "was a requirement for" the Bank to win the Project X business from the SOE.

Deutsche Bank's Global Markets Risk Assessment Committee (GMRAC), which included senior-level employees in the Bank's legal and compliance and other functions, allegedly approved the BDC's engagement despite numerous red flags and — in contravention of the Bank's BDC policy — the lack of due diligence on the BDC. According to the DPA, Deutsche Bank "even failed to document the [] BDC's full name and biographical information." GMRAC reportedly approved the engagement without assessing or mitigating the potential corruption risks and conflicts of interest, including the fact that the BDC was a relative of a key decision-maker at the SOE; the BDC had no known qualifications for the role; and the Abu Dhabi official had made multiple requests to the Bank "to finance a mega-yacht as a means to help position the Bank to obtain [the project]."

According to SEC's Order, Deutsche Bank was awarded the Project X business shortly after retaining the BDC. Within a week of BDC's retention, the Bank paid him more than $2 million for his "purported legitimate services." Overall, the BDC was paid approximately $3.5 million without invoices or other documentation to support the payments. In addition, the Order found that the agreement with the BDC obligated the BDC to provide only "generic advice and introductions" and the payments the Bank made to him "were not proportionate to any legitimately rendered services." Regardless, a senior Bank executive had approved the payments, and Deutsche Bank was unjustly enriched by approximately $30 million as a result, according to the Order.

Payments to BDC in Italy

The case disposition documents state that, from February 2007 to February 2016, Deutsche Bank maintained a BDC relationship with a regional tax judge in Italy to refer potential high net worth clients to the Bank. According to the documents, prior to the BDC's engagement, Deutsche Bank failed to conduct reasonable due diligence on the BDC. At the time of onboarding and throughout his engagement, the BDC was an acting tax judge and thus clearly a government official – although it is unclear whether or how his government position played a role in his selection as a BDC.

Throughout the engagement period, the Bank allegedly paid the BDC approximately $864,450, with "numerous payments" made at a higher commission rate than his contract allowed or outside the terms of the contract altogether. For example, the BDC/judge generally was supposed to be paid twice a year, but records showed that he was paid more often and received multiple payments for the same services, and sometimes was paid for no services at all. The disposition documents note that certain Managing Directors at the Bank knew that the invoices submitted by the BDC/judge were false, and employees additionally assisted in falsifying documents to support the payments. When a 2010 invoice was challenged for lack of proof that the BDC had provided any services, the BDC's business sponsor at the Bank falsely linked the introduction of three client accounts for the Bank to the BDC. The case documents state that, on other occasions in 2012 and 2013, the BDC demanded more money than he was entitled to under his contract. The Bank made the additional payments even though the services the BDC provided in the form of research reports and advisory information were deemed to be "of no value" to the Bank. According to the DPA, many of the payments were falsely recorded in Deutsche Bank's books and records.

Payments to BDC in Saudi Arabia

The DOJ and SEC found that from approximately 2011 to the end of 2012, Deutsche Bank made corrupt payments to a general manager of the family office of a senior member of a Middle Eastern royal family in order to obtain and retain the family office's banking business. The Bank signed a contract with and made the payments to a shell company owned by the wife of the family office's general manager. According to the disposition documents, prior to entering into the contract, certain Bank employees, including at least four Managing Directors and several high-level employees and officers of the Bank and the Bank's European subsidiary allegedly knew that the BDC was the wife of the family office's general manager and that the purpose of the engagement was to bribe the general manager in order to retain the family office's business. Although there was no evidence that the shell company or the BDC's wife provided any services to the Bank, the case documents state that the Bank made four payments totaling approximately $1.1 million to the shell company in order to induce the BDC to invest and maintain the family office's substantial assets with the Bank. The payments were inaccurately recorded in the Bank's books and records as legitimate payments, and the Bank was unjustly enriched by approximately $3 million as a result.

Payments to BDC in China

According to the SEC's Order, Deutsche Bank retained a BDC to help it establish a clean energy investment fund with a Chinese government entity. The Bank allegedly knew that the BDC was potentially a government official or was acting in an official capacity, and that the BDC was a close friend of a second person who was a government official and whose approval was needed to establish the fund. The SEC Order also notes that the government official required the Bank to work with the BDC to establish the fund. Despite these circumstances, the Bank retained the BDC without conducting due diligence. The Bank subsequently paid the BDC approximately $1.6 million from April 2011 to May 2013. The invoices submitted by the BDC for payment included expenses for gifts and entertainment provided to government officials and were reimbursed, in the SEC's view, without adequate review by the Bank. The SEC noted that the Bank also gave the BDC a partnership interest in the clean energy investment fund which "entitled him to a large potential profit share" — in exchange for little to no upfront capital — in addition to the $1.6 million that the Bank paid the BDC.

Noteworthy Aspects

- Significant Criminal Penalty Increase Based on Prior Resolutions: Deutsche Bank received full credit for its cooperation with the FCPA investigations by the DOJ and SEC, but in other ways the DOJ significantly increased the criminal penalty based on the lack of voluntary disclosure credit and Deutsche Bank's prior resolutions. In particular, as a result of Deutsche Bank's prior resolutions, the DOJ criminal fine was nearly double what it could have been under typical criminal fine calculations in FCPA resolutions for first-time offenders.

As noted, Deutsche Bank did receive the full cooperation credit. Both agencies specifically mentioned, among others, the Bank's detailed factual presentations; regular updates on its internal investigation; highlights of key facts and documents; making foreign-based employees available for interviews in the United States; and production of extensive documentation, including documents located in foreign jurisdictions. Deutsche Bank did not receive voluntary disclosure credit pursuant to the FCPA Corporate Enforcement Policy because the Bank did not voluntarily and timely self-disclose the FCPA-related conduct to the DOJ. Voluntary disclosure credit could have reduced the criminal fine another 25 percent under the DOJ policy.

Perhaps most noteworthy, the DOJ significantly increased the criminal penalty based on prior resolutions, although the documents do not explicitly explain whether the DOJ is relying on the 2019 resolution with the SEC on prior FCPA issues or the DOJ LIBOR resolution to support that action. Under the U.S. Sentencing Guidelines (USSG), one of the factors for determining the culpability score and calculating the penalty in FCPA cases is whether a company "committed any part of the instant offense less than five years after (A) a criminal adjudication based on similar misconduct; or (B) civil or administrative adjudication(s) based on two or more separate instances of similar misconduct," where "similar misconduct" is defined as "prior conduct that is similar in nature to the conduct underlying the instant offense, without regard to whether or not such conduct violated the same statutory provision." Thus, in calculating the penalty for Deutsche Bank's FCPA resolution under the Sentencing Guidelines, the DOJ added two points to the culpability score, the maximum under §8C2.5(c)(2) in the USSG, stating in the DPA that Deutsche Bank had "committed part of the instant offense less than five years after a criminal adjudication based on similar conduct." This determination increased the multiplier range from 1.6/3.2 to 2/4 under the Sentencing Guidelines, meaning that the base fine increased from approximately $56 million to $71 million, with the overall fine range set at $71 million to $141 million. Moreover, without explanation, the DOJ also applied the 25 percent cooperation credit not to the low end of the fine range (as is the usual practice for first-time offenders), but instead against the "middle of the applicable Sentencing Guidelines fine range" (i.e., $106 million). These two decisions increased the final criminal penalty for the FCPA violations, after the cooperation credit, from approximately $42.3 million to $79.6 million, an increase of 88 percent. - No Monitor Despite Findings of Significant Controls and Compliance Issues and Prior Resolution: Despite the multiple and serious issues over a "seven-year course of conduct" as described in the disposition documents, the DOJ "determined that an independent compliance monitor was unnecessary." According to the DPA, the DOJ based its decision not to impose a monitor on a number of factors. The first factor was Deutsche Bank's specific remediation actions and the improvements that the Bank had already made to its anticorruption compliance program. The DOJ also pointed to the Bank's detailed reporting requirements during the DPA set forth in the DPA's Attachment D (Corporate Compliance Reporting), including an initial review and report describing the Bank's remediation efforts to date, its proposals designed to improve the Bank's internal controls, and procedures for ensuring compliance with the FCPA and other applicable laws, and at least two follow-up reviews and reports. Finally, the DOJ specifically noted Deutsche Bank's "ongoing" independent compliance monitor obligations in connection with the April 23, 2015 DPA with the DOJ for criminal violations in connection with the Bank's manipulation of the London Interbank Offered Rate.

The DOJ's decision is consistent with the presumption against the imposition of a monitor established by the DOJ's October 2018 internal policy on the standards and policies for selection and retention of corporate compliance monitors. The policy directs DOJ attorneys to consider, among other factors, the state of the company's corporate compliance program at the time of a resolution, the financial burden potentially imposed by a monitor on the company, and any unnecessary disruptions and other burdens to the company's operations that a monitor might entail. The ongoing LIBOR-related monitor obligations likely weighed significantly on the DOJ's decision.

On the SEC side, there is no discussion in the Order of the possibility of a monitor or reference to the SEC's August 2019 resolution with Deutsche Bank. - Repeated Instances of High Level Management Involvement/Knowledge: Some of the violations discussed in the disposition papers implicated now-former members of the Bank's senior management, including Managing Directors and members of its Management Board, several of whom are cited as ignoring or failing to remediate serious red flags related to the use of BDCs. For example, at least four Managing Directors knew that the purpose of engaging the BDC in Saudi Arabia was to provide bribe payments to the BDC's husband who managed the family office and personal investments of a government official. The case documents note other instances in which Managing Directors knew that invoices and records of payments to BDCs were false and made outside the terms of the contracts with the BDC. Despite the existence at Deutsche Bank of an Anti-Corruption Policy and a global "Use of Business Development Consultants Policy," actions by senior managers resulted in multiple improper payments and the failure of the Bank's internal accounting controls. The case is another reminder that no set of compliance policies or processes can succeed if management is not committed to supporting them.

- Failure by Senior Management to Remediate Known Internal Accounting Controls Inadequacies Related to BDCs: Even without active involvement by senior managers in risky transactions, Deutsche Bank's settlement also illustrates the importance of reviewing closely and addressing appropriately compliance-related red flags, including those identified in internal audit reports. The case documents cite two reports, in which red flags were raised related to the use of consultants engaged with the specific purpose of developing business in risky jurisdictions, that were escalated to senior management and the company's Management Board.

- Specifically, in 2009, an internal audit identified certain concerns with Deutsche Bank's use of one BDC, including insufficient oversight over its engagement and a lack of documentation regarding its services. The report recommended a revision of the Bank's BDC Policy; maintenance of detailed records of BDCs' work; and a requirement that BDC engagement include books and records provisions "giving Deutsche Bank inspection rights," among others.

- Similarly, in 2011, a second internal audit of BDC relationships identified what the disposition documents state were numerous internal accounting control failures, including lack of due diligence on BDCs; lack of training and awareness of Deutsche Bank's BDC Policy and due diligence requirements; failure to appropriately assess, document and mitigate corruption risks and conflicts of interest related to BDCs; and failure to document the proportionality and justification for certain payments to BDCs.

Although Deutsche Bank's senior management, including members of the Management Board, received the results of the audits on both occasions, the case documents state that Deutsche Bank took only limited steps in response to the audit reports and their recommendations.

Individual Enforcement Actions

Felipe Moncaleano Botero Sentencing

On January 27, 2021, a judge in the Southern District of Florida sentenced Felipe Moncaleano Botero (Botero) to six years in prison and directed him to pay a $50,000 fine in relation to one count of conspiracy to commit money laundering in connection with a scheme to bribe Ecuadorian government officials. Botero, the former CEO of the Colombian subsidiary of a U.K.-based insurance brokerage, pleaded guilty to the charge in August 2020. His two co-defendants, Juan Ribas Domenech (Ribas) and Jose Vicente Gomez Aviles (Gomez), pleaded guilty in June and September 2020, respectively.

In the proffer entered with his guilty plea, Botero admitted to participating in an illegal bribery scheme to secure the 2014 renewal of the insurance brokerage's contract with Ecuador's state-owned insurance company, Seguros Sucre. Botero and Gomez, a co-owner of an "'Introducer Company'" that assisted companies with securing business with Seguros Sucre, conspired with Ribas, then-CEO of Seguros Sucre, to execute the scheme. According to Botero's proffer, he and Gomez "used . . . U.S.-based companies and U.S. bank accounts, to corruptly promise to pay, to authorize payment of, and to pay" at least $3,157,000 in bribe payments to Ribas and others in order to secure business with Seguros Sucre.

Botero's proffer noted that he and his co-conspirators transferred the illicit funds through "multiple intermediary companies" and "provided false justifications for transactions" to the banks and to the parent insurance company's compliance personnel. Although the insurance brokerage had contracted to pay Gomez's company a commission for acting as a "third party introducer" with Seguros Sucre, Botero instead directed payments far in excess of the agreed-upon commission to several other intermediary companies not named in the contract. Portions of those payments were then remitted to U.S.-based bank accounts held by Ribas and his relatives.

In Botero's plea agreement, prosecutors agreed to recommend a reduced sentence as long as Botero continued to assist with the ongoing investigation. Ribas initially pleaded not guilty to his charge in July 2020 but reversed his plea after Botero pleaded guilty. Neither Ribas nor Gomez have been sentenced.

Former PDVSA Official Pleads Guilty to Single Count of Money Laundering in Asphalt Contractor Bribery Scheme

On January 27, 2021, Daniel Comoretto Gomez (Comoretto) — a former manager at Petróleos de Venezuela SA (PDVSA) — pleaded guilty to a single count of conspiracy to commit money laundering for his role in a bribery scheme involving U.S. asphalt companies seeking to buy asphalt from the Venezuelan state-owned oil company. According to the DOJ, from 2011 through 2015, Comoretto and his subordinate, Hector Nunez Troyano, received approximately $518,000 in bribes funded by "commissions" that two PDVSA customers paid to a third-party agent, David Diaz, on each barrel of asphalt purchased. Diaz then wired the money from U.S. and Panamanian bank accounts to offshore accounts held by a shell company controlled by Troyano, who in turn wired a portion of the payments to Comoretto's U.S. bank account. The payments were purportedly made to assist the asphalt companies in obtaining purchasing contracts with PDVSA.

Comoretto's is the latest of several guilty pleas stemming from the broader investigation of Florida-based asphalt company Sargeant Marine Inc (SMI). As reported in our FCPA Autumn Review 2020, SMI pleaded guilty in September 2020 to conspiracy to violate the anti-bribery provisions of the FCPA and agreed to pay $16.6 million in connection with numerous multiyear bribery schemes throughout Latin America. Troyano and Diaz pleaded guilty for their roles in the PDVSA scheme in March 2018 and March 2019, respectively. Under federal sentencing guidelines, Comoretto potentially faces roughly five to six years of imprisonment.

Businessman Sentenced for Role in Foreign Bribery Scheme Involving PetroEcuador Officials

On January 28, 2021, a federal judge in the U.S. District Court for the Southern District of Florida sentenced an Ecuadorian businessman, Armengol Alfonso Cevallos Diaz (Cevallos), to 35 months in prison for his role in funneling bribes to public officials of Empresa Pública de Hidrocarburos del Ecuador (PetroEcuador), the state-owned and state-controlled oil company of Ecuador. Cevallos was also ordered to pay a fine of $35,000. As reported in our FCPA Spring Review 2020, Cevallos pleaded guilty in January 2020 to one count of conspiracy to violate the FCPA and one count of conspiracy to commit money laundering in connection with a scheme to pay PetroEcuador officials bribes worth $4.4 million to obtain and retain business. At his plea hearing, Cevallos admitted to acting as an intermediary for bribe payments from an oilfield services company to PetroEcuador officials and to helping launder the bribes through shell companies and bank accounts based in Miami. Cevallos also admitted to conspiring with others to purchase Miami properties for the benefit of PetroEcuador officials.

Cevallos's 35-month sentence reflects a significant downward variance from the calculated sentencing guideline range for his offenses: 135 to 168 months. As we have previously reported, numerous other individuals have been prosecuted in connection with the DOJ's ongoing investigation into the PetroEcuador bribery scandal. In his motion for a downward variance, Cevallos argued that a variance "would avoid an unreasonable disparity in sentencing" given the sentences imposed on several of his co-conspirators. According to media accounts, the court granted Cevallos's motion for a downward variance in recognition of what the court termed his "minor role" in the bribery and to avoid significant disparities in sentencing outcomes when compared to other participants in the scheme.

Charges Unsealed Against Ecuadorian Investment Advisor and Ecuadorian Official for Conspiracy to Commit Money Laundering in Connection with FCPA Violations

On March 2, 2021, the DOJ announced that it had charged two Ecuadorian citizens, Jorge Cherrez Miño (Cherrez) and John Luzuriaga Aguinaga (Luzuriaga), with a single count each of conspiracy to commit money laundering in connection with a scheme to defraud Ecuador's public police pension fund (ISSPOL). The complaints allege that from 2014 to 2020, Cherrez – the manager, president, and director of a group of U.S. investment fund companies – and his entities paid bribes of more than approximately $2.6 million to Luzariaga and other ISSPOL officials in order to obtain and retain investment business from the pension fund. Luzuriaga, a Risk Director at ISSPOL and member of the fund's Investment Committee, allegedly received approximately $1.4 million of the bribe payments. Interestingly, the complaints allege that the underlying conduct violated the FCPA and Ecuador's anti-bribery law, but Cherrez (the bribe-giver) has not been charged under the FCPA.

According to the complaints, ISSPOL and one of Cherrez's companies entered into a swap transaction agreement in "or around December 2015 and January 2016." Luzuriaga approved the agreement on behalf of ISSPOL. Cherrez's companies subsequently earned a profit of approximately $65 million at ISSPOL's expense by receiving "more money earlier and more money overall" than provided for in the agreement. The complaints additionally allege that one of Cherrez's companies defaulted on bond repurchase transactions with ISSPOL, resulting in a total of $111 million in overdue purchase agreements.

Cherrez allegedly used a U.S. bank account to conduct business related to ISSPOL, used Florida-based companies and banks to pay the bribes, and took acts in furtherance of these bribes in Florida. For example, the complaint notes that Luzuriaga held a debit card through a U.S. bank account in the name of one of Cherrez's companies that he used for approximately $313,840 in purchases and cash withdrawals. Cherrez and Luzuriaga also allegedly laundered the profits from the scheme through Florida companies and bank accounts, including investment funds where Cherrez served as an officer or director.

U.N. Bribery Case Updates: Heidi Hong Piao Sentenced, Ng Lap Seng Granted Compassionate Release

On March 5, 2021, the U.S. District Court for the Southern District of New York sentenced Heidi Hong Piao to time served and two years of supervised release for her role in a scheme to bribe a former president of the U.N. General Assembly, John Ashe. As we previously reported, Piao, the former finance director of the Global Sustainability Foundation (GSF), pleaded guilty in 2016 to bribery-related and money laundering charges and admitted to providing bribes to Ashe.

Piao was the first to plead guilty in the case, which has since seen the successful conviction of several of her co-defendants, including Macao billionaire Ng Lap Seng (the update on Ng's case is below). Ng, Piao, and others were all charged in October 2015 with crimes related to bribery of U.N. officials. In particular, Piao and her co-conspirator Shiwei Yan were alleged to have paid bribes of more than $800,000 to Ashe in order to obtain his advocacy with Antiguan government officials on behalf of several Chinese businessmen. Charges against Ashe were dropped following his death in 2016.

Yan, who pleaded guilty shortly after Piao, was sentenced to 20 months in prison in July 2016. Piao is the last defendant to be sentenced in the case. Prosecutors refrained from making a specific sentencing recommendation for Piao but asked the court for leniency given her cooperation with the investigation. In deciding not to impose a prison sentence, U.S. District Judge Vernon S. Broderick cited Piao's early guilty plea and cooperation with the government's prosecution of others involved.

On March 15, 2021, Judge Broderick granted Ng's motion for compassionate release from prison based on COVID-19 concerns. As we reported in our FCPA Review Autumn 2017, a federal jury found Ng guilty in 2017 of paying approximately $1.3 million in bribes to two former U.N. officials, including Ashe, in exchange for U.N. support for a multi-billion-dollar conference center he planned to construct in Macau. Ng had served 34 months of his four-year sentence. The court denied a similar motion by Ng in May 2020 but found that COVID-19 concerns at the prison where Ng was housed, coupled with his underlying health conditions, now warranted his release. According to the court's order dated March 23, 2021, upon his release from imprisonment, Ng will be placed in the custody of the U.S. Immigration and Customs Enforcement and removed from the United States.

Former CFO of Och-Ziff Capital Management Reaches Settlement Agreement with SEC

On March 16, 2021 Joel Frank, the former CFO of hedge fund Och-Ziff Capital Management Group LLC (Och-Ziff), entered into a settlement agreement with the SEC in connection with Frank's alleged violations of the internal controls books and records provisions of the FCPA. Under the settlement agreement, Frank agreed to pay a civil monetary fine of $35,000. Frank's settlement is the latest enforcement action related to Och-Ziff and its subsidiary investment adviser OZ Management's complex bribery scheme involving government officials in several African countries.

In 2016, Och-Ziff and OZ Management agreed under a separate SEC settlement agreement to pay a total of $199,045,167 for alleged violations of the anti-bribery, books and records, and internal controls provisions of the FCPA as well as anti-fraud provisions of the Investment Advisers Act of 1940. The 2016 SEC settlement agreement also, among other things, required the companies to retain a compliance monitor to evaluate, assess, and provide reports to the SEC on the company's compliance efforts. Under the settlement agreement Och-Ziff's CEO Daniel S. Och agreed to pay nearly $2.2 million to settle SEC charges that he caused certain FCPA violations along with CFO Frank. That same year, the company agreed to pay a criminal penalty of $213 million under a DPA it entered into with the DOJ.

According to this most recent SEC settlement agreement, beginning in 2007 and continuing through 2011 Och-Ziff and OZ Management entered into seven relationships and investments in which bribes were paid through intermediaries and business partners who funneled funds to high ranking government officials in African countries, including Libya, Chad, Niger, and the Democratic Republic of the Congo, in order to win or retain business for Och-Ziff. In each instance, company executives undertook these payments and investments fully aware of or willfully ignoring the red flags and risks that the various investments or payments would be used to bribe foreign officials. The Och-Ziff's deal team in London promoted and supported the corrupt arrangements, which were approved by the company's legal and compliance team, who had to obtain final approval from Frank. Och-Ziff would inaccurately record the corrupt payments in the company's books and records as loans, "deal fees," "subscription amounts," payments to business partners, payments to agents, or "professional services fees."

Frank, who had final signing authority for every expense paid by Och-Ziff and final approval and funding authority for every private side investment transaction that took place using OZ Management's investor fund, approved each improperly recorded payment. The SEC settlement notes that Frank, who had primary authority over the company's books and records, failed to ensure that required information regarding transactions was documented, that appropriate business partner information was obtained, and that ongoing due diligence and audits were performed properly. These acts, according to the settlement, caused Och Ziff and OZ Management's violations of the internal controls and books and records provisions of the FCPA.

Former Citgo Officials Plead Guilty in Connection with International Money Laundering and Bribery Scheme

Two former procurement officers with Citgo Petroleum Corporation's (Citgo) Special Projects Group have pleaded guilty in connection with multi-year international money laundering and bribery schemes. Citgo is a Houston-based subsidiary of Venezuelan state-owned oil company PDVSA. Citgo's Special Projects Group bore responsibility for procuring equipment and supplies needed by PDVSA in Venezuela, for which PDVSA would pay Citgo in crude oil.

On March 21, 2021, federal prosecutors unsealed a 2019 plea agreement with Laymar Giosse Peña Torrealba (Peña), a Venezuelan citizen and resident of Texas, who served as a buyer and, later, a supervisor in Citgo's Special Projects Group. The DOJ alleged during her time in the Special Projects Group, Peña accepted over $340,000 in monetary bribes and reimbursed travel from Jose Manuel Gonzalez Testino (Gonzalez), and his associates, in exchange for inside information and other acts intended to help Gonzalez's logistics company obtain and retain business with Citgo. Peña, and the other individuals involved in the bribery scheme, also allegedly concealed the bribes by directing payments to be made into overseas accounts in the name of one of Peña's associates.

Peña pleaded guilty to one count of conspiracy to launder money. As part of her plea agreement, Peña agreed to forfeit at least $332,308.47 in laundered funds. Peña also agreed to fully cooperate with the federal government's investigation into Venezuelan corruption. Peña is scheduled to be sentenced on August 19, 2021.

According to reporting by Global Investigations Review, Peña's case was unsealed because she was due to testify at the trial of her former colleague Jose Luis De Jongh Atencio (De Jongh). De Jongh was the manager of Citgo's Special Projects Group. The DOJ alleged that between 2013 and 2019, De Jongh accepted more than $7 million in monetary payments and gifts in exchange for assisting companies in obtaining and retaining business with Citgo and PDVSA. The gifts included tickets to a 2014 World Series game, the Super Bowl in 2015, and a U2 concert. De Jongh admitted to directing his co-conspirators, Gonzalez and Tulio Anibal Farias Perez (Farias), to send bribe payments to accounts in the names of overseas shell companies that De Jongh controlled. According to the indictment, De Jongh also directed Gonzalez and Farias to send payments to U.S. bank accounts in the names of his relatives and associates, in some instances creating fake invoices to disguise the illicit funds. De Jongh allegedly laundered the funds through U.S. bank accounts and used the proceeds to purchase real estate in the Houston area and to make other investments.

In June 2020, the DOJ charged De Jongh with one count of conspiracy to launder money and five counts of money laundering. De Jongh's attorney filed a letter stating the "defense [did] not intend to dispute the conduct alleged in this Indictment: De Jongh worked for Citgo; he received payments from vendors; and he conducted financial transactions." However, De Jongh was planning to contest whether Citgo was an "instrumentality" of Venezuela. However, in December 2020, a grand jury issued a ten-count superseding indictment, which included one new count of conspiracy to violate the Travel Act and three new counts of violating the Travel Act (in addition to the six existing counts). Specifically, the superseding indictment alleged that De Jongh, Gonzalez, and Faris traveled in and used the mail and facilities of interstate commerce to further their violation of Texas' commercial bribery statute. De Jongh indicated he also planned to contest the new Travel Act charges on the grounds that Citgo "consented to his bribe-taking and that De Jongh believed that he had Citgo's consent at the time he took the bribes." But, on March 19, 2021, three days before the trial was set to begin, the DOJ submitted a Notice of Potential Evidence indicating that it planned to introduce portions of De Jongh's federal income tax record into evidence at trial. According to the DOJ, De Jongh's taxes failed to declare the bribe proceeds as income and, in its Notice of Potential Evidence, the DOJ argued that failure constituted an overt act of the charged conspiracy, and undermined De Jongh's claim that he received the bribes with the consent of Citgo. According to reporting from Global Investigations Review, De Jongh's counsel subsequently requested a 60-day delay to prepare for the trial and argued the potential introduction of De Jongh's tax returns "fundamentally change[d] the nature of the case."

On the eve of his trial, March 22, 2021, De Jongh ultimately pleaded guilty to a single count of conspiracy to launder money. As part of his plea agreement, De Jongh also agreed to forfeit over $3 million seized from his bank accounts and 15 properties he allegedly purchased with the illicit proceeds. De Jongh is also scheduled to be sentenced on August 19, 2021.

The charges filed against De Jongh and Peña are one part of a larger ongoing U.S. government investigation into bribery and related criminal activity at PDVSA; to date, the DOJ has announced charges against 28 individuals, 22 of whom — including Farias and Gonzalez — have pleaded guilty.

Policy & Legislative Developments

SEC Rule Amendments

In December 2020, amendments to the rules governing the SEC's whistleblower program went into effect. The rule amendments contain significant reforms to the Commission's administration of the program that are likely to result in increased employee whistleblowing.

First, the SEC expanded the definition of "action" in Rule 21F-4(d) to include DPAs and NPAs entered into with the DOJ and settlement agreements entered into with the SEC. As such, whistleblowers who report information that results in an NPA, DPA, or SEC settlement agreement are now eligible for awards under the program. In February, the SEC issued its first award based on an NPA or DPA with DOJ.

Second, the SEC has changed the way that awards are calculated. Under the previous rules, whistleblowers were entitled to awards ranging from 10 percent to 30 percent of monetary sanctions over $1 million collected by the SEC. The Commission retained discretion to determine the percentage awarded — which could vary based on several positive and negative factors. Following the amendments, whistleblowers will automatically receive the statutory maximum for awards (i.e., 30 percent of the monetary sanctions collected) for awards of $5 million or less, absent the existence of negative factors or an "unreasonable delay in reporting." This amendment to the rules incentivizes potential whistleblowers by providing greater certainty regarding the size of eventual awards – which could now be up to three times higher than under the previous rules.

Finally, the recent amendments bring the SEC's whistleblower rules in line with the Supreme Court's 2018 decision in Digital Realty Trust, Inc. v. Somers, 183 S. Ct. 767 (2018). In Digital Realty, the Supreme Court resolved a circuit split on whether whistleblowers are eligible for the anti-retaliation protections under the Dodd-Frank Act if they report their concerns only internally, but not to the SEC. The Supreme Court held that to be eligible for the anti-retaliation protections, whistleblowers must first report to the Commission. The recent amendments make the SEC's rules consistent with the decision: to be eligible for anti-retaliation protections under Dodd-Frank, whistleblowers must first report information to the Commission. (To be eligible for whistleblower awards, however, the SEC still permits whistleblowers to report internally first, as long as they subsequently report to the SEC within 120 days.) This rule change may result not only in increased reporting to the SEC by employees who may otherwise have raised their concerns only internally, but it also may incentivize employees to report to the Commission before raising concerns internally, if they fear that reporting internally may result in retaliation. Given that 81 percent of internal whistleblowers in 2020 reported concerns internally before reporting to the Commission, the impact of this rule change could be significant.

NDAA: Anti-Money Laundering Act of 2020 (AMLA) and Kleptocracy Asset Recovery Rewards Act (KARRA)

Two sections of the NDAA, which was passed on January 1, 2021, are relevant to FCPA and related compliance issues – the Anti-Money Laundering Act of 2020 (AMLA) and the Kleptocracy Recovery Rewards Act (KARRA).

AMLA

The AMLA includes significant reforms to the Treasury Department's whistleblower program under the BSA, bringing the anti-money laundering whistleblower program and anti-retaliation protections more in line with that of the SEC.

Under the previous regime, whistleblower awards were discretionary and capped in most cases at 25 percent or $150,000, whichever was lower. The AMLA increases the maximum award to 30 percent of all monetary sanctions collected and provides that the Secretary of Treasury "shall" pay an award for actions that result in monetary sanctions over $1 million. Both the increase in award caps and the mandate that Treasury will pay awards for sanctions over $1 million are aimed at incentivizing more whistleblowers to come forward. In addition, the AMLA contains provisions that increase penalties for BSA violations, meaning that more whistleblowers may be eligible for the non-discretionary awards. The AMLA also protects whistleblowers from retaliation, including discharge, demotion, and other direct and indirect forms of retaliation. Unlike Dodd-Frank, however, the AMLA's anti-retaliation provisions apply to protect whistleblowers who raise their concerns internally, as well as to Treasury or to DOJ.

Another notable difference between the AMLA whistleblower program and that of the SEC is the award eligibility of compliance personnel. Whereas under Dodd-Frank compliance and internal audit personnel are generally not eligible for awards except in special circumstances, the AMLA does not limit award eligibility for compliance personnel or internal or external auditors. The AMLA defines a "whistleblower" as "any individual who provides . . . information relating to a violation . . . including as part of the job duties of the individual or individuals."

Despite the expanded incentives and protections provided for in the AMLA, ambiguity remains as to how the program will be administered. Unlike the SEC's program, which has a demonstrated record of offering the sizeable awards to whistleblowers, the AMLA's nascent changes have not yet resulted in publicized awards on the same scale. This ambiguity may factor into risk/reward analysis of potential whistleblowers, and much of the program's effectiveness will depend on its implementation. However, if the success of SEC's program — which in ten years has led to more than 26,000 whistleblower tips and over $700 million in awards to individuals — the AMLA whistleblower program could lead to a significant increase in reports of anti-money laundering violations.

KARRA

The NDAA also establishes a new Treasury Department whistleblower pilot program specifically designed to reward whistleblowers who provide information leading to recovery of assets derived from foreign government corruption. Under the three-year pilot program, Treasury may award up to $5 million to whistleblowers who provide information leading to the restraint, seizure, forfeiture, or repatriation of "stolen assets" – i.e., funds traceable to foreign government corruption. The assets must be held in an account of a U.S. financial institution (including U.S. branches of foreign financial institutions), have come within the U.S., or have come within the possession or control of any U.S. person. The Act defines "stolen assets" as "financial assets within the jurisdiction of the United States, constituting, derived from, or traceable to, any proceeded obtained directly or indirectly from foreign government corruption." Financial assets are in turn defined as "any funds, investments, or ownership interests, as defined by the Secretary." Notably, a whistleblower tip need not lead to a successful prosecution, in order to make the whistleblower eligible for award; it need only lead to the successful restraint or seizure of stolen assets.

The KARRA whistleblower program is limited in nature, with awards capped at $5 million per individual award and $25 million total awards per calendar year. Ambiguity regarding its implementation may also diminish its effectiveness; the Act does not clearly define "foreign corruption," and awards are furthermore discretionary. Given the remaining uncertainty in Act's deployment and its limited nature, it remains to be seen whether KARRA will accomplish its goals of increased reporting on assets linked to foreign government corruption.

If successful, however, KARRA and the AMLA may lead to increased reporting of conduct that implicates both U.S. anti-money laundering laws and the FCPA—the natural crossover of which is evidenced by numerous SEC and DOJ enforcement actions involving FCPA and anti-money laundering.

For a discussion of other important changes to AML laws under the NDAA, see Miller & Chevalier Counsel Ian Herbert's comments at a recent round-table hosted by Corporate LiveWire.

International Developments

Transparency International's Corruption Perceptions Index 2020

On January 28, 2021, Transparency International (TI) released its 2020 Corruption Perceptions Index (CPI), a ranking list that compares the perceived levels of governmental corruption in 180 countries and territories based on a combination of surveys and assessments of businesses and experts in each country. The CPI is a composite index that looks at multiple factors, including government accountability, existence and enforcement of anti-corruption laws, access to government information, and abuse of government ethics and conflict of interest rules. International companies often use TI CPI scores to assess country-specific risks in the context of their anti-corruption compliance efforts.

TI has published this index for 25 years. Currently, the CPI scores countries on the level of perceived corruption on a scale of zero to 100, with zero representing the highest level of perceived corruption and 100 representing a hypothetical corruption-free country. The top scoring country (with the lowest perceived corruption) in 2020 is New Zealand, with a score of 88; the countries perceived as most corrupt are Somalia and South Sudan, both of which have scores of 12.

In its CPI report, TI identified countries for which the CPI score has significantly decreased over recent years – meaning that perceptions of corruption issues have worsened. In the Americas, a region "characterized by weak government institutions," such countries include Guatemala, Chile, Nicaragua, and Venezuela. In Eastern Europe and Central Asia, a region where governments "are failing to preserve the checks and balances," the countries with deteriorating corruption climates include Azerbaijan and Russia, among others. TI points to limited progress in the area of anti-corruption across the Asia Pacific region and lists Australia and Mongolia as significant regional decliners. The Middle East and North Africa region, based on the CPI report, continues to be perceived as highly corrupt, with significant decliners being Lebanon, Syria, and Yemen. Sub-Saharan Africa, according to TI, is the lowest performing region, with Zambia and Mozambique declining in their CPI score. Finally, even the highest performing region on the CPI, Western Europe and European Union, also experienced a strain due to COVID-19, with Hungary, Malta, and Poland significantly dropping in their CPI score.

In its report, TI also separately focuses on the impact of corruption on the efficiency of emergency responses, specifically, in the context of the COVID-19 pandemic. According to TI's analysis, (i) countries with higher corruption levels are more prone to violations of human rights in the scope of their pandemic management; (ii) a lack of transparency in resource allocation linked to corruption weakens crisis response; and (iii) funding of healthcare and other essential services is impacted by corruption-related diversions of funds appropriated for emergency response relief. Based on its analysis, TI emphasizes that combating corruption is critical for efficient response to crises, including the current pandemic.

TI, which has traditionally focused on the "demand" side of corruption in its CPI analysis, emphasizes that countries with the lowest scores "play a major role in both fueling corruption through foreign bribery and enabling corruption by allowing opaque company [and asset] ownership," as well as by allowing limited enforcement measures by gatekeepers, such as lawyers and bankers. The CPI further refers to TI’s 2020 Exporting Corruption report published on October 13, 2020, which focuses on the "supply" side of corruption – specifically exporter countries’ effectiveness in combating bribery of foreign officials by those countries’ companies operating abroad.

U.K. Supreme Court Strikes Down Serious Fraud Office Request for Documents

On February 5, 2021, the U.K. Supreme Court (the Court) issued an important decision limiting the extra-territorial reach of the U.K.’s Serious Fraud Office (SFO). The case arose from an SFO request for documents issued in 2017. Specifically, on April 4, 2017, the SFO issued a notice to produce documents to KBR Inc. (KBR U.S.), a company incorporated in the United States, under section 2(3) of the UK's 1987 Criminal Justice Act; these requests are known as "section 2 notices." Pursuant to the notice, KBR U.S. would have been mandated to provide the documents or face criminal penalty. KBR U.S. did not have an office in the U.K. nor had it conducted business in the U.K. While KBR U.S. has a U.K. subsidiary, Kellogg Brown and Root Ltd. (KBR U.K.), the notice in question was issued to KBR US. Ultimately, the Court held that "the presumption against extra-territorial effect clearly does apply here" and found in favor of KBR U.S., as discussed below.

This case involved an investigation by the SFO into alleged bribery payments involving Unaoil. The SFO first issued a section 2 notice to KBR U.K., which responded to the request and noted that some of the requested documents were under the possession of KBR U.S. Subsequently, the SFO requested officers from KBR U.S. to travel to London to meet with the SFO. Pursuant to the request, two KBR U.S. officers flew to London for the meeting, when they were served with the section 2 notice by the SFO, which was issued to KBR U.S.

KBR U.S. challenged the section 2 notice and sought judicial review, arguing that (1) the notice was "ultra vires as it requested material held outside the jurisdiction from a company incorporated in the United States of America;" (2) there was "an error of law on the part of [the SFO's Director] to exercise his powers under section 2" when the SFO had the ability to seek mutual legal assistance with the US government instead; and (3) the notice was improperly served because the KBR U.S. officer was only in London temporarily. The Divisional Court ruled that KBR U.S. failed on all three grounds and dismissed its application for judicial review. The Court reviewed the case on appeal under the first grounds only.

The Court noted that the presumption against extra-territorial effect was applicable. In its reasoning, the Court explained that KBR U.S. "has never carried on business in the United Kingdom or had a registered office or any other presence here." As the evidence that the SFO was seeking was located outside of the U.K., the Court stated that the SFO could have sought to obtain the requested documents from U.S. authorities under the mutual legal assistance framework.

Subsequently – presumably in response to the decision – the SFO announced on March 18, 2021, that it had ceased investigating KBR U.S.'s U.K. subsidiaries in relation to Unaoil and alleged bribes. In its announcement, the SFO stated that the case failed to satisfy the "evidential test" under the "Code for Crown Prosecutors."