FCPA Spring Review 2017

International Alert

Introduction

The first three weeks of 2017 served as a capstone to the flurry of U.S. Foreign Corrupt Practices Act (FCPA) enforcement activity that marked the end of 2016, while the remainder of the quarter saw little in the way of additional enforcement actions by the U.S. authorities. Notwithstanding the drop in FCPA resolutions following the inauguration of President Trump, there are no significant indications to date that FCPA enforcement efforts by the Securities and Exchange Commission (SEC or Commission) and the U.S. Department of Justice (DOJ or Department) under the Trump administration represent any drastic shift from previous trends. Indeed, other recent developments suggest that the agencies will continue to pursue both corporate and individual cases under the statute.

Most FCPA-related dispositions resolved during the first quarter of 2017 were finalized under the Obama administration, including all eight corporate dispositions and two guilty pleas by individuals. Thereafter, the SEC entered into three negotiated resolutions with individual defendants, further contributing to a steady pace of FCPA enforcement against individuals. In addition to these enforcement actions, the SEC and DOJ issued 10 known declinations during the first quarter, a notable uptick from the pace of agency declinations in 2016.

Following the surge in enforcement activity at the end of the Obama presidency, and with important SEC and DOJ appointments still pending, the Trump administration has not sent a strong signal regarding its policy approach to, or enforcement priorities under, the FCPA. Most indicators, however, suggest that major changes to the government's current approach to FCPA enforcement are not imminent. The DOJ's issuance of new guidance regarding corporate compliance programs, the Department's decision to endorse the Obama administration's broad reading of the FCPA in the ongoing case against Lawrence Hoskins, and its recent announcement that the DOJ's FCPA Pilot Program will be extended represent a continuation of the Department's direction over the past few years. Also of note are remarks by Deputy Assistant Attorney General Trevor McFadden at a compliance conference on April 18, 2017, which provide a window into current DOJ FCPA enforcement policy. After reiterating the DOJ's commitment to enforcing the FCPA, McFadden asserted that, among other things, the Department intends to: (a) continue to "prioritize the prosecutions of individuals who have willfully and corruptly violated the FCPA"; (b) continue to consider "voluntary self-disclosures, cooperation and remedial efforts" when making charging decisions involving companies; (c) make a "concerted effort to move corporate investigations expeditiously," with the expectation that cooperating companies will do so as well; and (d) focus on wrapping up old investigations. He also stated that the DOJ's "aims are not to prosecute every company we can, nor to break our own records for the largest fines or longest prison sentences. Our goal is for companies and individuals to voluntarily comply with the law."

Continued litigation relating to the constitutionality of SEC administrative proceedings may affect the SEC's use of administrative actions as an enforcement tool under the FCPA, though that would be a change directed by the courts rather than the new administration. As we have noted previously, even if the agencies' enforcement practices do change over time, developments involving non-U.S. regulators highlight the expanding focus on anti-corruption enforcement by other countries, with recent foreign enforcement actions reflecting the continuing impact of the Organisation for Economic Co-operation and Development (OECD) Anti-Bribery Convention.

Resolved Enforcement Actions

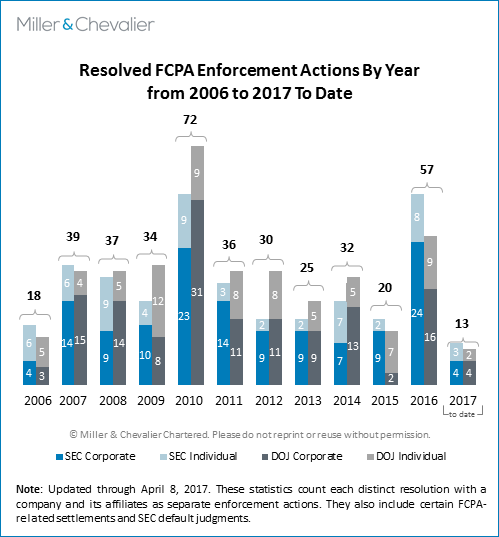

The SEC and DOJ resolved 13 FCPA-related enforcement actions during the first quarter of 2017, including eight corporate dispositions (four by each agency), two individual guilty pleas, and three individual civil resolutions.

The corporate enforcement actions concluded this past quarter include two combined settlements with the DOJ and SEC (one of which also involved a guilty plea by a foreign subsidiary to FCPA charges), two SEC-only settlements, and one DOJ-only disposition. All of the dispositions involved allegations under the FCPA's accounting provisions; only the SEC's settlement with Zimmer Biomet also included charges under the anti-bribery provisions.

The first enforcement action of 2017 was the SEC's January 6, 2017, administrative settlement with Illinois-based food and beverage company Mondelēz International, Inc., formerly known as Kraft Foods, Inc. (Mondelēz), and its U.K. subsidiary, Cadbury Limited, acquired by Mondelēz in February 2010. The SEC's allegations centered on an agent that Cadbury's then-subsidiary, Cadbury India Limited, retained shortly after the Mondelēz acquisition to interact with Indian officials to obtain certain licenses. The company agreed to pay a $13 million civil penalty to settle charges that its alleged failure to conduct due diligence on and monitor the agent constituted internal-accounting-controls and books-and-records violations, with the terms of the settlement reflecting Mondelēz's cooperation and remedial actions.

The DOJ's January 17, 2017, non-prosecution agreement (NPA) with Las Vegas-based gaming and resort company Las Vegas Sands Corp. (Sands) also involved insufficient internal controls relating to an agent. The DOJ charged the company with violating the FCPA's internal-accounting-controls and books-and-records provisions in connection with Sands' transfer of roughly $60 million over three years to a consultant involved in a series of high-risk transactions in China and Macao. In settling with the Department, Sands agreed to pay a criminal penalty of nearly $7 million. This resolution came approximately nine months after Sands settled related civil charges with the SEC, agreeing to pay a $9 million civil penalty and to retain an independent consultant to review and evaluate the company's FCPA controls for two years, as described in our FCPA Summer Review 2016.

In another enforcement action relating to the use of third parties, on January 18, 2017, the SEC entered into an administrative settlement with Orthofix International N.V. (Orthofix), a medical device manufacturer headquartered in Texas. The SEC alleged that the company's Brazilian subsidiary sought to increase sales by engaging third-party agents to make improper payments to doctors at government-owned hospitals. To settle the SEC's charges of violating the FCPA's books-and-records and internal-accounting-controls provisions, the company agreed to pay $6.1 million in civil penalties and disgorgement and to retain an independent compliance monitor for one year. On the same day, Orthofix announced that the DOJ "decided to take no further action with respect to this matter."

In the first of the two combined SEC and DOJ settlements this past quarter, Indiana-based Zimmer Biomet Holdings, Inc. (Zimmer Biomet), a manufacturer of medical implant devices, settled with the DOJ and SEC on January 12, 2017, related to its operations in Mexico and Brazil. In March 2012, the company's corporate predecessor, Biomet Inc., settled with the SEC and entered into a three-year deferred prosecution agreement (DPA) with the DOJ over alleged bribery of healthcare professionals at state-run hospitals throughout Latin America (as reported in our FCPA Spring Review 2012). The 2017 settlement documents alleged that Biomet continued to use a Brazilian distributor implicated in the company's 2012 settlement. In addition, the company allegedly engaged customs brokers without conducting adequate due diligence, who, in turn, imported goods into Mexico using illicit methods and indirectly made improper payments to Mexican customs officials. To settle these allegations, the company entered into a new three-year DPA with the DOJ, which alleged internal-accounting-controls violations, while consenting to the entry of an SEC cease-and-desist order, which included anti-bribery, books-and-records, and internal-accounting-controls charges. The company agreed to pay more than $30 million in penalties, disgorgement, and prejudgment interest, and to retain an independent compliance monitor for three years. In addition, Zimmer Biomet's Luxembourg subsidiary pled guilty to causing violations of the FCPA's books-and-records provisions in connection with the company's Mexico operations.

Finally, in another combined settlement, Chilean chemicals and mining company Sociedad Química y Minera de Chile (SQM) settled with the DOJ and SEC on January 13, 2017, over allegations that it made unauthorized payments to Chilean politicians, political candidates, and others from an account controlled by a now-former senior manager. The agencies alleged that SQM's actions violated the FCPA's books-and-records and internal-accounting-controls provisions. To settle the charges, the company agreed to pay $30.5 million in criminal and civil penalties, to retain an independent compliance monitor for two years, and to self-report to the agencies for an additional year.

Continuing a trend dating back to 2014, all of the SEC's corporate dispositions during the first quarter of 2017 were resolved via administrative proceedings. As noted in past Reviews, the SEC has continued to rely on its expanded authority under the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) to prosecute a significant portion of FCPA-related misconduct via administrative proceedings rather than through traditional court-filed civil complaints. According to our research, since January 2014, 35 of the SEC's 44 corporate FCPA enforcement actions were resolved via administrative settlement, with the other nine settled in federal district court actions.

The SEC has faced criticism for its increasingly heavy reliance on in-house administrative tribunals. (See, for example, our discussion in the FCPA Summer Review 2015.) The SEC has vigorously defended its use of these administrative proceedings in the face of constitutional challenges by defendants. However, recent judicial developments cast doubt on the future of the SEC's use of such proceedings without some administrative or legislative action addressing the potential constitutional deficiencies in the appointment process for SEC administrative law judges (ALJs). While the U.S. Court of Appeals for the D.C. Circuit upheld the constitutionality of the ALJ appointment process in an August 2016 opinion (see our discussion of Lucia v. SEC in the FCPA Autumn Review 2016), the U.S. Court of Appeals for the 10th Circuit subsequently found that the process violated the Appointments Clause in Article II of the U.S. Constitution, creating a circuit split on the issue. (See our discussion of Bandimere v. SEC in our FCPA Winter Review 2017.) In March 2017, as discussed in greater detail below, the D.C. Circuit vacated its earlier opinion in Lucia and scheduled an en banc rehearing for May 24, 2017, specifically highlighting the split created by Bandimere. This development is not a promising one for the SEC; the best-case scenario is that the circuit split will remain and the issue will end up before the Supreme Court. If the D.C. Circuit overturns its ruling, both federal Courts of Appeals to have considered this issue will have ruled against the SEC.

Aside from the recently concluded corporate enforcement actions, the DOJ has completed an "ability-to-pay" analysis to determine the criminal fine Brazilian construction conglomerate Odebrecht S.A. (Odebrecht) must pay as part of its December 2016 settlement with the DOJ, Brazil's Ministério Público Federal (MPF), and the Office of the Attorney General of Switzerland. Based on Odebrecht's representations that it could not afford a penalty exceeding $2.6 billion, the company's plea agreement stipulated that the overall fine amount would be determined by an "an independent analysis to verify the accuracy of [Odebrecht's] representations" regarding the company's ability to pay the fine, to be conducted by U.S. prosecutors and the Brazilian authorities. (See our coverage of the settlement in our FCPA Winter Review 2017.) On April 11, 2017, the DOJ disclosed the results of this analysis ahead of Odebrecht's sentencing hearing on April 17, 2017. In a memorandum filed with the U.S. District Court for the Eastern District of New York, the Department discussed the various considerations and calculations underlying its determination of the fine amount, concluding that a $2.6 billion criminal fine, together with a guilty plea, "the imposition of an independent compliance monitor for a three-year term[,] ongoing reporting obligations[,] and Odebrecht's continued obligations to enhance its compliance program and cooperate fully with authorities, among others," constituted an appropriate sentence for the company. During the April 17, 2017, sentencing hearing, Judge Raymond Dearie imposed a $2.6 billion criminal penalty, confirming that Odebrecht will pay approximately $2.4 billion to Brazil, $116 million to Switzerland, and $93 million to the United States.

In addition to these recently concluded corporate enforcement actions, the DOJ and SEC resolved FCPA-related charges against five individuals during the past quarter, including two guilty pleas and three civil settlements. Both of the guilty pleas relate to the DOJ's ongoing investigation into energy contracts with Venezuelan state-owned energy company Petroleos de Venezuela S.A. (PDVSA), which we previously covered in our FCPA Summer Review 2016. As part of their pleas, Charles Quintard Beech III, an owner of multiple Texas energy companies, and Juan Jose Hernandez Comerma, a former general manager and owner of a Florida energy company, admitted to offering or paying bribes to multiple PDVSA officials to win business or secure favorable treatment. The defendants have yet to be sentenced.

In line with the DOJ's stated goal of holding more individuals personally accountable for FCPA-related misconduct, on March 30, 2017, a court sentenced Douglas Ray to 18 months in prison and three years of supervised release and ordered him to pay $590,000 in restitution. As described in our FCPA Winter Review 2017, Ray was one of six defendants who pled guilty before the U.S. District Court for the Southern District of Texas in connection with conspiring to bribe Mexican officials to secure aviation-related contracts.

The SEC's three individual settlements during the first quarter of 2017 serve to close the Commission's long-running civil case against three executives of Magyar Telekom, including the company's CEO, for alleged bribery of Macedonian officials. (See our FCPA Autumn Review 2016 for additional background.) Over the last two months, all three executives settled charges with the SEC. In settling, one of the defendants agreed to pay a $60,000 civil fine, while the settlement terms for the remaining two defendants have not yet been made public.

Further reflecting the SEC's FCPA enforcement efforts against individuals, in January 2017, the Commission filed a civil suit in the U.S. District Court for the Eastern District of New York against two former executives of New York-based hedge fund Och-Ziff Capital Management Group LLC (Och-Ziff), Michael L. Cohen and Vanja Baros. The complaint includes claims that Cohen and Baros "executed a sprawling scheme involving serial corrupt transactions and bribes paid to high-ranking government officials in African countries," directly and indirectly violating the anti-bribery and internal-accounting-controls provisions of the FCPA, along with several provisions of the Investment Advisers Act of 1940. The allegations relate to Och-Ziff's 2016 FCPA settlement with the SEC and DOJ. As we reported in our FCPA Autumn Review 2016, Och-Ziff agreed to pay approximately $412 million in fines, disgorgement, and interest to settle allegations that third parties associated with the company bribed foreign officials in connection with Och-Ziff projects in several African countries. The company's CEO and CFO agreed to pay more than $2 million to settle related SEC charges against them personally.

Declinations

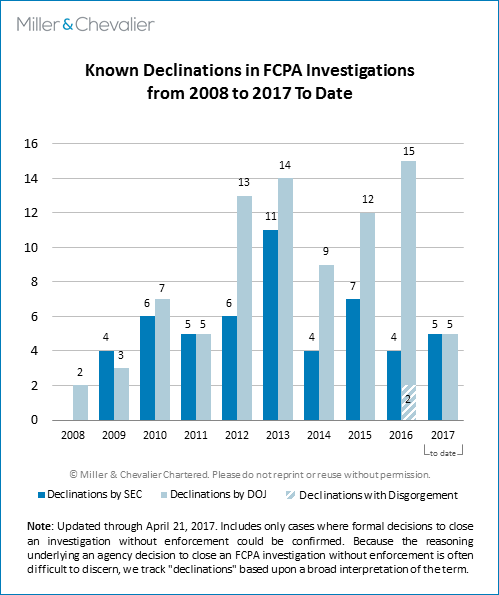

In addition to the FCPA dispositions resolved in the first quarter of 2017, the SEC and DOJ have issued 10 declinations – or decisions to close an active FCPA investigation without enforcement – during the same period. As noted in the chart below, we track "declinations" based upon a broad interpretation of the term, since the reasoning underlying an agency decision to close an FCPA investigation without enforcement is often difficult to discern.

The 10 declinations issued over the past quarter – five by the DOJ and five by the SEC – reflect a noteworthy level of activity, as this number constitutes more than half of the sum total of declinations we have identified to date from 2016. For its part, the SEC issued more declinations in the first three months of 2017 than it did in all of 2016. As we have noted in years past, our declination totals are subject to revision, since companies often wait to announce the closure of investigations in their quarterly securities filings or annual reports, if they choose to disclose them at all. This practice generally means that there is a lag in identifying new declination decisions, and the number of known SEC or DOJ declinations – whether from the first quarter of 2017 or years past – is likely to rise as we learn of additional declinations from those time periods.

The declinations we have identified that took place in the first quarter of 2017 are:

- Orthofix: In a January 18, 2017, press release announcing its FCPA settlement with the SEC, the Curaçao-incorporated medical device company disclosed that "after careful review by the DOJ, the Company was informed that the DOJ has decided to take no further action with respect to this matter."

- Cobalt International Energy, Inc.: In a February 9, 2017, press release, the company stated that it had "received a letter from the [DOJ] advising Cobalt that the DOJ has closed its FCPA investigation into Cobalt's operations in Angola." Cobalt had previously received a declination from the SEC in January 2015 in connection with the Commission's related investigation. (See our FCPA Spring Review 2015.) The company's February 9, 2017, statement asserted that the DOJ's declination "formally concludes the DOJ investigation, which was the last remaining FCPA investigation by any U.S. regulatory agency into Cobalt's Angolan operations. No regulatory action has been taken against Cobalt as a result of these investigations." However, in the company's Form 10-K filed on March 14, 2017, Cobalt disclosed that the SEC had informed the company on March 13, 2017, "that it had initiated an informal inquiry regarding Cobalt related to the Sonangol Research and Technology Center (the 'Technology Center')," and that the company received a voluntary request for information on the same day. The disclosure implied that the SEC's inquiry is related to "certain social contributions to Sonangol, including for the Technology Center," which the company is purportedly required to make under a Production Sharing Contract executed in December 2011. The company stated that it intends to cooperate with the SEC and that it believes its "activities in Angola have complied with all applicable laws, including the FCPA."

- Crawford & Co.: In a Form 10-K filed on February 27, 2017, the Georgia-based independent claims-management company announced that, in 2015, it had "voluntarily self-reported to the SEC and the Department of Justice certain potential violations of the [FCPA] discovered by the Company during the course of its regular internal audit process." The company stated that "with the oversight of the Audit Committee and the Board of Directors, [it had] proactively initiated an investigation into this matter with the assistance of external legal counsel and external forensic accountants." According to the February 27, 2017, 10-K, "the Company received notice from the SEC [earlier in 2017] that the SEC has concluded its investigation and did not intend to recommend an enforcement action against the Company with respect to this matter." We have not identified any public information as to whether the DOJ has conducted or is still conducting its investigation into the matter.

- Varian Medical Systems, Inc.: In a Form 10-Q filed on February 7, 2017, the California-based company, which specializes in radiation oncology systems and software, disclosed that Portuguese authorities had charged its foreign subsidiary in June 2015 "with alleged improper activities relating to three tenders of medical equipment in Portugal during the period of 2003 to 2009." According to the 10-Q, the company "undertook an internal investigation of this matter and voluntarily disclosed the results of this investigation to the U.S. Department of Justice and the U.S. Securities and Exchange Commission," and Portuguese authorities subsequently resolved and dismissed the matter in December 2016 "with no adverse findings or charges against the Company or its foreign subsidiary." According to a March 7, 2017, press report, the company separately disclosed that the SEC and DOJ "declined to take any action and there is no ongoing investigation at either US agency that [the company] knows of."

- Merck & Co., Inc.: In a Form 10-K filed on February 28, 2017, the New Jersey-headquartered pharmaceutical company disclosed the end of the SEC's investigation into the company's practices under the FCPA. The company noted that it had "received letters from the DOJ and the SEC that seek information about activities in a number of countries and reference the [FCPA,] " and stated that it "has cooperated with the agencies in their requests and believes that this inquiry is part of a broader review of pharmaceutical industry practices in foreign countries." The 10-K referred to the DOJ's 2014 declination in connection with this investigation and stated that "[t]he Company has also recently been advised by the SEC that it has closed its inquiry into this matter as it relates to the Company."

- Innodata, Inc.: In a Form 10-K dated March 15, 2017, the New Jersey-based provider of digital content services provided an update regarding an internal investigation concerning "potentially improper payments and related transactions" related to an "inspection of [a foreign] subsidiary's compliance with local employment-related tax requirements," which it had initially disclosed in a Form 10-Q filed on May 10, 2016. The company noted that it had disclosed its internal investigation to both the DOJ and SEC, and, in the latest filing, the company advised that "[t]he DOJ and the SEC have advised the Company that they have closed their inquiry into the matter."

In addition to the above, we are also aware of two other declinations issued during the first quarter of 2017 – one by the SEC and one by the DOJ. We cannot report any other details for these declinations, including the names of the target companies, because the declinations have not been publicly reported. As is our standard practice, we do not report the details of non-public declinations.

Known Investigations

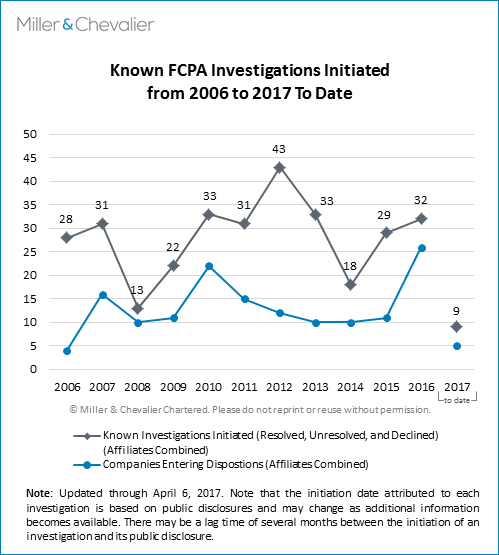

So far in 2017, we have identified nine FCPA-related investigations opened by U.S. enforcement agencies. Although it is not clear in every case, several of these investigations appear to have been initiated following the change in administrations on January 20, 2017. We will continue to monitor and analyze all new FCPA investigations that come to light in an effort to identify any changes in investigation activity or investigation-initiation practices under the Trump administration and new SEC and DOJ leadership.

As we have noted in the past, the numbers in this chart are likely to rise, even for past years, since public companies sometimes wait months, or even years, to disclose the existence of an investigation in their securities filings – with some choosing never to do so – and non-issuer companies often never disclose the existence of an investigation.

DOJ Pilot Program

The DOJ has provided some guidance, albeit limited, about the future of its FCPA Pilot Program, which it initially announced as a one-year initiative on April 5, 2016. As we previously discussed, the Pilot Program provides certain incentives to companies that self-report FCPA violations and cooperate with the DOJ, including a reduction of up to 50 percent off the bottom of the Sentencing Guidelines fine range, a reduced chance of having an independent compliance monitor imposed, and the possibility that the DOJ may altogether decline to prosecute an FCPA violation. Per the Pilot Program's guidance, a company must meet four main requirements to qualify for the Program's benefits: (1) voluntary self-disclosure, (2) full cooperation with the DOJ, (3) appropriate remediation measures, and (4) disgorgement of all profits resulting from the FCPA violation. By its terms, the Program applies "to all FCPA matters handled by the Fraud Section," and as we noted in our FCPA Winter Review 2017, the Department appears, at times, to have applied the Program's terms retroactively – that is, to investigations already initiated at the time of the Program's introduction.

On March 20, 2017, Acting Assistant Attorney General Kenneth Blanco announced in public remarks that the Pilot Program will continue in force while the Department evaluates its utility and efficacy after the end of the pilot period. According to Blanco, the Department's evaluation, which is to begin after April 5, 2017, will include "whether to extend it, and what revisions, if any, [the DOJ] should make to it."

On April 18, 2017, Deputy Assistant Attorney General McFadden stated that the DOJ is currently conducting a "full assessment" of the Pilot Program. He explained that in its review, the Department is "examining whether there is more that we can do to promote voluntary compliance with the law and what more we can be doing to provide appropriate transparency regarding our expectations and prosecutorial priorities." He noted that in the interim, "the Program will continue in full force."

Focus on Compliance Program Effectiveness and Increase in the Imposition of Compliance Monitors

As noted above, one potential benefit for companies under the Pilot Program is a DOJ determination that the appointment of a compliance monitor is not required as part of a company's resolution with the Department. The Pilot Program's guidance clarifies that even when the DOJ decides that a criminal resolution is otherwise warranted, the Department "generally should not require the appointment of a monitor if a company has, at the time of resolution, implemented an effective compliance program."

The effectiveness of compliance programs was itself the subject of a separate guidance document issued on February 8, 2017, by the DOJ Fraud Section: "Evaluation of Corporate Compliance Programs." This guidance was designed by the DOJ to help companies evaluate the robustness of their compliance programs by reciting a series of questions focusing on various aspects of such programs – presumably, the same questions the DOJ would ask when reviewing whether a company's compliance program is effective under the Sentencing Guidelines or when considering whether a monitor is required. As discussed below, the guidance provides only questions and no benchmarks, but these questions should nonetheless prove useful in evaluating new compliance programs or considering enhancements to existing ones.

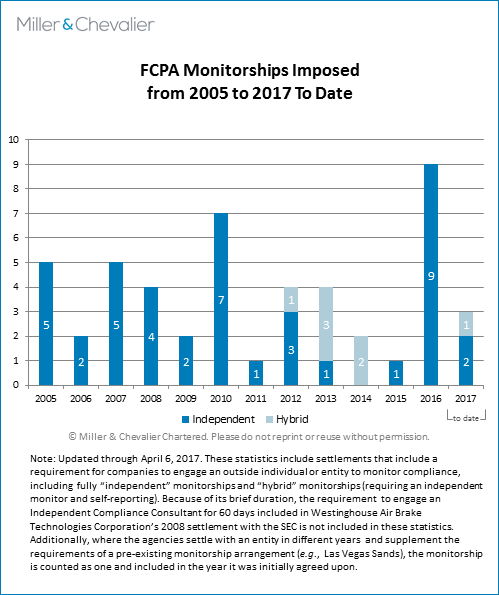

In connection with the extension of the Pilot Program and the continued focus on compliance programs, we have conducted an analysis of the DOJ's and SEC's practices concerning the requirement of compliance monitors as part of FCPA enforcement resolutions. The chart below depicts the 49 monitorships we have identified from 2005 to date.

We analyzed all settlements from this period, with this chart reflecting all settlements that required the appointment of an independent monitor for FCPA compliance. The titles used in settlement documents vary and include "independent corporate monitor," "outside compliance monitor," and "independent compliance consultant," among others. As noted in the explanatory statement under the chart, we use the term "hybrid" monitorship to refer to a requirement of an independent monitor and a period of time during which the company must self-report its compliance to the agency or agencies overseeing the monitorship.

Of the monitorships included in the chart, 63 percent included a monitorship requirement by both agencies, 29 percent by the DOJ only, six percent by the SEC only, and the remaining two percent reflect the only non-DOJ or SEC monitorship we considered – Alstom's monitorship arrangement with the World Bank, which we covered in our FCPA Winter Review 2015. Industry-wise, we found that at least 20 percent (10 of the monitorships) were imposed on companies in the oil-and-gas industry and a similar number on companies in the healthcare industry.

Overall, there has been a sharp increase in the number of monitorships in recent years. In 2015, only one company was required to engage a monitor (Louis Berger International, covered in our FCPA Autumn Review 2015). In 2016, nine companies were required to engage a monitor. In the first quarter of 2017, four of the five resolved corporate FCPA investigations included a monitorship requirement as a part of the settlement. (We counted Sands under 2016 because the company's April 2016 settlement with the SEC included a monitorship requirement and its January 2017 NPA with the DOJ "piggy-backed" on the SEC's order by requiring the company to submit the existing monitor's reports to the DOJ.) The 2017 resolutions with a monitorship requirement were Zimmer Biomet, Sands, Orthofix, and SQM. Mondelēz was the only corporate settlement in the last quarter in which the enforcement agencies did not require the company to engage a monitor.

Although it is impossible to state with certainty why the use of monitors has increased in the last year, one possibility is that the DOJ may be testing companies' compliance programs more rigorously than in the past with the aid of its new compliance expert, Hui Chen, and the February 2017 compliance program guidelines referenced above. When measured against the standards in the compliance program guidelines, the DOJ may consider fewer programs to be truly effective. It is also possible that the DOJ's Pilot Program has played some role by "resetting" the bar in terms of what incentives the DOJ provides to companies seeking to negotiate settlements for potential FCPA violations. One stated purpose of the Pilot Program is to "promote greater accountability" for companies that engage in corporate crime by motivating them to voluntarily disclose potential misconduct, fully cooperate in any DOJ investigation, and fully remediate flaws in their compliance programs—and an increase in the imposition of monitors could serve as significant motivation. Other factors, such as the time period taken to reach a disposition, could play a role – cases that are resolved quickly may be more likely to involve a monitorship requirement because a program may not have had time to be fully upgraded.

Enforcement Agency Appointments

The new administration continues to work to fill positions at both the SEC and DOJ involved in shaping FCPA enforcement and related policy. While key positions remain to be appointed or confirmed, evidence from the appointments to date does not suggest potentially significant breaks with recent years' enforcement practices.

Senator Jeff Sessions was confirmed as U.S. Attorney General on February 8, 2017, and sworn into his new role the next day. As noted in our FCPA Winter Review 2017, Sessions' statements prior to his confirmation did not provide much insight into what approach he might take to enforcing the FCPA, with the exception of an apparent emphasis on individual prosecutions over corporate penalties, which largely reflects current DOJ practice.

On April 4, 2017, Jay Clayton, President Trump's choice to head the SEC, saw his nomination approved by the Senate Committee on Banking, Housing and Urban Affairs. Clayton is now awaiting a vote by the full Senate, which is likely to confirm his nomination. In our FCPA Winter Review 2017, we noted Clayton's reservations about FCPA enforcement expressed in a 2011 publication. On March 23, 2017, in a written response to questions posed by Senator Sherrod Brown of Ohio, Clayton made his first on-the-record remarks about the FCPA in the context of his nomination. Clayton expressed his support for the role of the FCPA in combating corruption, which he described as an "important government mission," highlighting his expected focus on coordination of enforcement with the DOJ and international anti-corruption enforcement efforts.

Also on April 4, 2017, the SEC announced that Kara Brockmeyer, who has served at the SEC since 2000 and has been Chief of the FCPA Unit since 2011, will leave the Commission before the end of the month. Charles Cain, the Deputy Chief of the FCPA Unit, who has been with the SEC since 1999, will replace Brockmeyer as Acting Chief of the FCPA Unit.

International Developments

The December 21, 2016, global settlement between Brazilian, U.S., and Swiss authorities on the one hand, and Odebrecht and its petrochemical subsidiary, Braskem, S.A. (Braskem) on the other (see our FCPA Winter Review 2017), requires the companies to pay more than $3.5 billion in combined penalties, reflecting Odebrecht's $2.6 billion criminal fine described above. Aside from the extensive international cooperation and extraordinary size of the financial penalties levied against the companies, the settlement is notable because of the number of related investigations that have arisen as a result. To improve the efficiency of these investigations, on February 17, 2017, Vladimir Aras, the Head of International Cooperation at the Prosecutor General's office in Brazil, announced the formation of an international task force to investigate corruption allegations related to Odebrecht throughout Latin America. The agreement—signed by prosecutors in Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Panama, Peru, Portugal, the Dominican Republic, and Venezuela—will allow for greater cooperation through evidence sharing.

Other recent international developments further reflect the evolving interconnected nature of international anti-corruption enforcement. Foreign bribery convictions in Israel and Spain over the past several months reflect the rising importance of the OECD Anti-Bribery Convention. In Israel, IT company Nikuv International Projects Ltd. pled guilty to charges of bribery of a Lesotho official. The conviction is the first under Israel's foreign bribery statute, enacted in 2008 as part of the country's obligations under the OECD Convention. In Spain, two executives pled guilty to bribing an official in Equatorial Guinea to win contracts for their employer. These convictions are the first under provisions in Spain's penal code that criminalize corrupt payments to foreign officials. Similar to Israel, these provisions were incorporated in local law to comply with Spain's obligations under the OECD Convention.

In the United Kingdom, the first quarter of 2017 saw the Serious Fraud Office (SFO) enter into its third- and fourth-ever DPAs. While only the first of these DPAs involved charges of foreign official corruption – the January 17, 2017, settlement with Rolls-Royce over allegations that the company paid bribes to win government contracts in several countries – both DPAs reflect the SFO's increased use of DPAs as an enforcement tool.

Meanwhile, Operation Car Wash – the corruption investigation related to Brazil's national oil company Petroleo Brasileiro S.A. (Petrobras) – has entered its fourth year, with no conclusion in sight. In January 2017, the Brazilian authorities' investigation of Odebrecht, which initially arose as part of Operation Car Wash, resulted in 77 more bribery-related plea bargains, which provided testimony implicating dozens of high-ranking public officials. In March 2017, a Brazilian court sentenced former President of the Brazilian Chamber of Deputies Eduardo Cunha – the highest-ranked official to be convicted as part of Operation Car Wash – to more than 15 years of incarceration on charges involving corruption, money laundering, and tax evasion.

Actions Against Corporations

Mondelēz International, Inc. and Cadbury Limited Settle with SEC Over Relationship with an Agent in India

On January 6, 2017, Mondelēz International Inc. (Mondelēz), a food, beverage, and snack manufacturer with its principal executive offices in Illinois, agreed to cease and desist from committing or causing any violations and any future FCPA accounting provision violations and to pay a $13 million civil penalty to the SEC to settle charges that it violated the books-and-records and internal-accounting-controls provisions of the FCPA.

On February 2, 2010, Mondelēz (which at the time was doing business as Kraft Foods Inc., before a reorganization and rebranding) acquired U.K.-based Cadbury Limited and its subsidiaries. Before the acquisition, Cadbury's American Depository Shares (ADSs) had been registered and traded on the New York Stock Exchange. As a result of the acquisition, Cadbury terminated its ADSs, a step that took effect on September 6, 2010. Mondelēz is a Virginia company and U.S. "issuer." According to the Cease-and-Desist Order (SEC Order), Cadbury violated the books-and-records and internal-accounting-controls provisions of the FCPA, and "[a]s a result of Mondelēz's subsequent acquisition of Cadbury's stock, Mondelēz is also responsible for Cadbury's violations."

One of the entities that Mondelēz acquired was Cadbury India Limited (Cadbury India), with headquarters in Mumbai and six manufacturing plants and four sales offices across India. The SEC Order stated that in early 2010, Cadbury India retained an agent (Agent) to interact with Indian government officials to obtain licenses to increase production capacity for a chocolate factory in Baddi, Himachal Pradesh, India. As part of these efforts, on February 23, 2010, Cadbury India executed a letter of authorization, allowing the Agent to represent Cadbury India before the Indian government. According to the SEC Order, the company performed no due diligence on the Agent before executing the letter of authorization.

According to Cadbury India's estimation at that time, the company was required to obtain approximately 30 licenses for the project. From February 2010 to July 2010, Cadbury India paid the Agent a total of $90,666 for "providing consultation, arrang[ing] statutory/government prescribed formats of applications to be filed for the various statutory clearances, documentation, [and] preparation of files and the submission of the same with [government] authorities" for specific licenses, whereas, according to the SEC Order, Cadbury India's employees prepared these license applications themselves. The SEC Order indicates that, during this period, the company received some of the licenses necessary for its project.

The SEC Order noted that Cadbury India did not have any additional meetings with the Agent besides the initial meeting where the parties negotiated the cost of the services. The company neither obtained any additional information regarding the details of the services rendered nor received any supporting documents from the Agent in addition to its invoices. Moreover, the SEC Order stated that Cadbury India did not have a written contract with the Agent for the provision of its services.

According to the SEC, the company's failure to conduct due diligence and monitor the Agent "created the risk" that funds paid to the Agent could be used for improper or unauthorized purposes. The SEC also concluded that Cadbury India's books and records did not accurately and fairly reflect the nature of the services rendered by the Agent.

Noteworthy Aspects

- Agent was Retained Just After Closing of Acquisition, and Post-Acquisition Compliance Review Did Not Identify the Relationship: According to the SEC Order, Mondelēz was unable to conduct complete due diligence before its acquisition of Cadbury, including in the area of anti-corruption. The SEC Order suggests that Cadbury India retained the Agent only three weeks after the acquisition was completed. The SEC Order stated that Mondelēz did conduct "substantial, risk-based, post-acquisition compliance-related due diligence reviews" between April 2010 and December 2010, which covered India, among a total of 24 countries. However, according to the SEC Order, that review did not identify the Agent's relationship with the company. The SEC Order does not contain details as to why a review described in a manner that suggests it followed good practice did not detect this issue.

- Internal Investigation and Remediation: The SEC Order stated that in October 2010, Mondelēz launched an internal investigation related to the Agent and "required" that Cadbury India terminate its relationship with the Agent. The SEC Order further stated that no additional payments to the Agent were made and that Mondelēz conducted an internal investigation with the help of external counsel and forensic accountants, and cooperated with the SEC in the course of the SEC's probe. Finally, Mondelēz implemented its global compliance program at Cadbury and conducted a review of all third parties related to Cadbury India's business. The SEC Order does not make clear the relationship between the post-acquisition compliance review noted above and the October 2010 investigation, even though they appear to overlap. Some press accounts (e.g., here) suggest that the investigation was triggered by a whistleblower. It is clear, however, that the SEC considered both specific actions related to Cadbury India's third-party processes and overall remediation activity focused on the post-acquisition roll-out of Mondelēz's compliance program to be relevant mitigation, and the agency accounted for it in the settlement.

Zimmer Biomet Settles with the DOJ and SEC and its Luxembourg Subsidiary Pleads Guilty over Alleged Violations in Latin America

On January 12, 2017, Zimmer Biomet Holdings, Inc. (Zimmer Biomet), a U.S.-based medical device company, and its affiliates settled FCPA charges with the DOJ and the SEC for $30.46 million. The DOJ issued a DPA and a Superseding Information that charged Zimmer Biomet with violating the internal-accounting-controls provisions of the FCPA. The DOJ also charged a Zimmer Biomet indirect subsidiary, JERDS Luxembourg Holding S.àr.L. (JERDS), with violating the statute's books-and-records provision. On the same day, the SEC issued a Cease-and-Desist Order against Biomet, Inc., to which Zimmer Biomet is the successor-in-interest, for violating the anti-bribery, books-and-records, and internal-accounting-controls provisions of the FCPA. Biomet had previously entered into FCPA resolutions with the DOJ and SEC in 2012, paying approximately $23 million in fines and penalties, based on similar allegations.

All of the conduct at issue in the resolutions predates June 2015, when Zimmer Holdings, Inc. acquired Biomet, Inc. for $14 billion. The resulting new entity, Zimmer Biomet, assumed all of Biomet's legal obligations as Biomet's successor-in-interest.

2012 Settlements and Monitorship

On March 26, 2012, Biomet entered into a DPA with the DOJ and a settlement with the SEC totaling roughly $23 million in fines and penalties relating to allegations that Biomet and its subsidiaries had bribed doctors and hospital administrators at state-run hospitals in China, Argentina, and Brazil to generate business between 2000 and 2008 (see our FCPA Review Spring 2012). The DOJ charged Biomet with conspiracy to violate and violating the anti-corruption and books-and-records provisions of the FCPA, while the SEC charged the company with violating the anti-bribery, internal-accounting-controls, and books-and-records provisions of the FCPA.

As part of the 2012 DPA, Biomet agreed to engage an independent compliance monitor for an initial period of 18 months, which was later extended to three years. During the monitorship, in 2013, Biomet identified and, in 2014, reported to the monitor, DOJ, and SEC the activities in Brazil and Mexico that led to the 2017 resolution. At the end of his three-year term, the monitor found that he "could not certify that Biomet's compliance program met the standards set forth in the 2012 DPA," according to the 2017 DPA. In March 2015 (less than three months before the merger), the DOJ extended the Biomet DPA and monitorship for an additional year. In March 2016, the monitor, again, did not certify the program. The monitorship ended, and the 2012 DPA was allowed to expire, presumably in anticipation of the second DPA.

2017 Settlements: Brazil

The DPA and SEC Order note that the 2012 resolutions covered payments by Biomet's subsidiary, Biomet International, to healthcare professionals (HCPs) at publicly-owned and operated hospitals to incentivize the purchase of Biomet's medical devices through a Brazilian distributor (Prohibited Distributor). The 2012 resolutions alleged the Prohibited Distributor paid the HCPs a form of "commission" ranging from 10 to 20 percent of the value of the Biomet products they purchased. As part of the 2012 resolution, Biomet committed to terminating the Prohibited Distributor.

According to the 2017 resolutions, however, Biomet continued to use the Prohibited Distributor until 2013 through the involvement of a Brazilian company that served as Biomet's authorized distributor (Authorized Distributor). Biomet International recorded the transactions with the Prohibited Distributor in its accounts as if they were with the Authorized Distributor. The SEC Order also alleges that internal auditors identified the relationship between the Authorized Distributor and the Prohibited Distributor as early as 2009 and recommended separating the Authorized Distributor from the Prohibited Distributor in a draft audit report. However, the Order alleges that a member of Biomet's legal team removed the reference to the Prohibited Distributor from the final version of the report, "and the issue was not tracked or followed up by anyone from Biomet's legal, compliance, or internal audit departments, thereby allowing the relationship to continue for several more years." Moreover, according to the 2017 DPA and the SEC Order, in 2010, a Biomet executive learned that the Prohibited Distributor was not only affiliated with the Authorized Distributor, but also had gained control of the latter. Although this executive made some initial effort to investigate the relationship between the two Brazilian distributors, the agencies alleged that he ultimately did not engage in adequate due diligence after that first inquiry.

In all, between July 2012 and September 2013, the Authorized Distributor paid the Prohibited Distributor or his company roughly $3 million for product purchases. According to the SEC Order, Biomet "could not determine the purpose" of $2 million of the $3 million amount, in addition to paying $30,000 for an apartment for the Prohibited Distributor. The SEC and DOJ alleged that Biomet obtained more than $3,168,000 in profits from its relationship with the Prohibited Distributor from 2009 to 2013. The SEC determined that these actions resulted in internal-accounting-controls and books-and-records violations, whereas the DOJ only asserted internal-accounting-controls violations.

2017 Settlements: Mexico

With respect to Mexico, the DOJ and SEC identified concerns with Biomet's subsidiaries' use of customs brokers to import products from the United States to Mexico. The DPA and the SEC Order allege that the company's subsidiaries in Mexico, Biomet Mexico and Biomet 3i Mexico S.A. de C.V. (3i Mexico), a Mexican business operation of Biomet 3i, LLC (Biomet 3i), imported their products into Mexico using an unlicensed Texas customs broker, with whom the entities did not have a written contract or fee schedule. In 2009, Biomet 3i employees received emails, including from the head of 3i Mexico, indicating that 3i Mexico wanted to import unregistered products to Mexico through Laredo, Texas, which reportedly had more lax border controls. Biomet subsequently retained counsel to investigate the Texas customs broker. The investigation uncovered that Biomet Mexico was still using the Texas customs broker to move high-risk goods to Mexico. Additionally, the report found that Biomet lacked sufficient due diligence measures around the use of distributors and customs agents/consultants, who were "causing internal controls risks." According to the SEC Order, some Biomet Mexico executives knew that the Texas customs broker would drive goods across the border in a car "essentially smuggling the goods over the border."

When 3i Mexico hired a Mexican customs broker to replace the Texas customs broker in April 2010, the company failed to enter into a written contract or a fee schedule with the new broker, according to the SEC Order. To address 3i Mexico's problems with importing products through the Mexico City International Airport due to missing registrations and incorrect labeling, 3i Mexico management approved a plan in 2010 to ship the goods via Laredo, through the Mexican customs broker and his subagents. A 3i Mexico manager wrote to a senior manager in charge of Biomet 3i's regulatory affairs department for Latin America that customs agents advised "that we use the border and in this case [Texas] because at this entry point the authorities are not as strict since from the US to Mexico there is no problem with prohibited substances." Moreover, although Biomet 3i confirmed in July 2012 that it was illegal to import and sell unregistered products into Mexico, the company continued to do so.

The SEC Order also alleges that the Mexican customs broker hired subagents to smuggle the unregistered products through Laredo and paid bribes to Mexican customs officials through these subagents. Additionally, Biomet 3i's Mexico employees recorded payments to the subagents as payments to the Mexican customs broker in Biomet's accounting system. Moreover, the payments to the subagents were sometimes unusually large and lacked specific documentation of the services, using descriptions such as "professional services." Between April 2010 and September 2013, Biomet paid the Mexican customs broker roughly $549,000 and its subagents roughly $981,000. As a result of these transactions, between 2008 and 2013, Biomet allegedly made a profit of $2,652,100.

The SEC determined that Biomet improperly recorded payments to the Texan and Mexican customs brokers in violation of the FCPA's books-and-records provisions. The DOJ similarly found that JERDS, Biomet's indirect subsidiary which owned Biomet 3i and 3i Mexico, violated the books-and-records provisions. Both the DOJ and SEC asserted that Biomet failed to devise and maintain internal accounting controls to prevent and detect payments to the customs brokers for improper activities. In addition, the SEC determined that Biomet violated the anti-bribery provisions. In support of the anti-bribery violation, the SEC stated that 3i Mexico engaged the Mexican customs broker and its subagents to pay bribes to Mexican customs officials and that Biomet employees "across multiple levels and departments" were aware of numerous red flags and failed to take steps to prevent the bribery.

2017 Settlement Terms

Under the DPA and plea agreement, the company agreed to pay the DOJ a fine of $17.4 million and engage an independent compliance monitor for up to three years. According to the DOJ, Zimmer Biomet received credit for full cooperation and remediation, including the termination of multiple employees. The company, however, did not receive voluntary disclosure credit because the 2012 DPA obligated Biomet to disclose the conduct at issue. In addition, the DPA notes that some of the conduct described in the Statement of Facts predated the 2012 DPA.

As part of the SEC settlement, Zimmer Biomet agreed to pay $5,820,100 in disgorgement, $702,705 in prejudgment interest, and $6,500,000 in penalties for a total of just over $13 million to the SEC. The terms of the SEC Order also includes the engagement of an independent monitor, which was not a part of the 2012 SEC settlement.

Noteworthy Aspects

- Different Charges in Each Agency's Resolutions: The DOJ charged Zimmer Biomet with violating only the internal-accounting-controls provisions, while the SEC Order charged Biomet with anti-bribery, books-and-records, and internal-accounting-controls violations. The SEC Order stated that the parent company was aware of "significant red flags" that were sufficient to establish the anti-bribery violations. However, the DOJ did not arrive at the same conclusion even though the DOJ Superseding Information also stated that subsidiaries and third parties paid bribes.

- Repeat Offense is Taken into Account: According to now-former Assistant Attorney General Leslie Caldwell in the 2017 DOJ press release, "Zimmer Biomet is now paying the price for disregarding its obligations under the earlier DPA. In appropriate circumstances the department will resolve serious criminal conduct through alternative means, but there will be consequences for those companies that refuse to take these agreements seriously." Caldwell's statement highlights that the DOJ took Biomet's violation of the 2012 DPA into account in determining the terms of the 2017 resolution with Zimmer Biomet.

- Management's Knowledge of the Lack of Internal Controls: This is a rare case where the DOJ determined that the alleged misconduct met the "knowingly" and "willfully" elements of a criminal violation of the FCPA's internal-accounting-controls provisions. The government's allegations point to a series of decisions by management of Biomet's subsidiaries to continue engaging in high-risk practices despite multiple red flags over a period of years. In both Brazil and Mexico, the management of Biomet's subsidiaries failed to engage in adequate monitoring of payments, due diligence processes, and accounting controls. Although these schemes did not seem to come from the top, some executives and managers had knowledge of them.

SQM Settles with the DOJ and SEC in Connection with Improper Payments Made in Chile

On January 13, 2017, Sociedad Química y Minera de Chile (SQM) entered into a DPA with the DOJ and consented to a Cease-and-Desist Order from the SEC, agreeing to pay more than $30 million in penalties to resolve violations of the FCPA's books-and-records and internal-accounting-controls provisions. SQM is a mining and chemicals company headquartered in Santiago, Chile and is an "issuer" within the meaning of the FCPA.

According to the DOJ Information and the SEC Order, from at least 2008 to 2015, a now-former SQM executive made "improper payments" from a discretionary fund created for the office of the CEO, totaling approximately $14.75 million to "Chilean politicians, political candidates, and individuals connected to them (collectively, 'politically exposed persons' or 'PEPs')." The DPA also indicates that an SQM executive "sought and received assistance from SQM employees to disguise some of the payments by directing them to create fictitious invoices and contracts for services that were not rendered, pay invoices for which there was no evidence of services being performed to justify the payments, and falsely record some of the payments in SQM's books and ledgers."

The settlement documents state that many of the payments from the CEO's fund violated Chilean tax laws or campaign finance rules. The DOJ and SEC noted a number of accounting controls issues that prevented SQM from detecting and preventing the payments including: (1) that SQM "failed to exercise any oversight over the CEO account;" (2) that SQM "failed to conduct adequate due diligence on third party entities;" (3) that SQM failed to ensure that services had been received in exchange for the payments; and (4) that SQM made payments to foundations affiliated with Chilean PEPs without ensuring that the payments were legitimate charitable donations.

In addition, the agency documents note that SQM included the payments at issue on SQM's books and records, and the SQM executive who authorized the payments signed financial certifications knowing they were not accurate. In 2014, SQM's internal audit function identified payments to vendors with "high risk" connections to PEPs. Nevertheless, the executive continued to make payments from the account for about six months. The DOJ Information states that, even after SQM's board of directors was advised of internal audit's findings, SQM did not adequately improve its accounting controls.

According to the agencies, SQM conducted an internal investigation after receiving inquiries from Chilean tax authorities in 2015. To remediate the findings of its investigation, the company terminated the SQM executive at issue and undertook measures to strengthen its compliance program and accounting controls. According to the SEC Order, SQM reported the potential FCPA violations to the SEC.

SQM's resolutions with the DOJ and SEC require the company to, among other things, cease and desist from any ongoing or future violations of the FCPA's books-and-records and internal-accounting-controls provisions, pay a $15 million civil penalty to the SEC and a $15,487,500 criminal penalty to the DOJ, enter into a DPA with the DOJ that requires the company to engage an independent compliance monitor for two years, self-report on the company's compliance for an additional year after that, continue to improve its compliance program, and continue to cooperate with the DOJ, SEC, and others.

Noteworthy Aspects

- No Anti-Bribery Violation Alleged: As in other recent cases, such as the Orthofix and Zimmer Biomet settlements, the case documents state that some of the payments made were "improper," but did not allege an FCPA anti-bribery violation. In this case, there could be varying reasons for the absence of charges under the anti-bribery provisions. One possibility is that there was no nexus between the "improper payments" and the United States. Additionally, the term "improper payments" could be a reference to the allegations that these payments violated certain Chilean laws.

- Impact of Senior Level Involvement: This case highlights the risks to companies of having insufficient oversight over senior executives' use of funds. In this case, the senior executive's participation in the alleged misconduct increased the culpability score used to determine SQM's criminal penalty by four points. By comparison, had the company engaged in obstruction of justice, the score would have increased by only three points, and a previous violation of the FCPA by SQM would have increased the culpability score by only one or two points, depending on when the prior violation occurred. To ensure oversight of senior executives, companies have undertaken various types of safeguards, including establishing direct or indirect reporting lines from individuals in gatekeeper functions (such as internal audit and compliance) to the company's board of directors or audit committee, a safeguard the SEC says SQM adopted during remediation.

Las Vegas Sands Enters into NPA with DOJ over Conduct in China and Macao Subject to Earlier SEC Settlement

On January 17, 2017, Las Vegas Sands Corp. (Sands), a Nevada-based casino and resort company, entered into an NPA with the DOJ in connection with transactions in the People's Republic of China (PRC) and Macao. Sands agreed to pay a criminal penalty of $6.96 million to the DOJ to resolve the investigation. The underlying facts of this disposition are similar to those addressed in Sands' April 2016 settlement with the SEC, pursuant to which Sands agreed to pay a civil penalty of approximately $9 million (see our coverage of Sands' settlement with the SEC).

According to the NPA's Statement of Facts, between approximately 2006 and 2009, Sands, through its subsidiaries in Macao and the PRC, transferred roughly $60 million to a consultant who represented that he was a former PRC government official. The DOJ noted that, "in particular, Sands failed to carry out enhanced due diligence on all of Consultant's myriad companies, and did not insist on the appropriate documentation, approvals, or justifications for the payments to Consultant, even after Sands had become aware of Consultant's failure to account for sums of over $700,000 paid by Sands and Consultant's business practices." The case documents note that many of the payments had no discernible legitimate business purpose and both an employee in the finance function, as well as outside counsel, warned senior executives at the company about the high risk of the transactions. When the company hired outside accountants, the DOJ stated that the consultant and a certain executive prevented them from accessing key information.

According to the NPA, notable payments Sands made to the consultant include, among others:

- Sponsorship of a Chinese Basketball Team: In 2007, Sands sought to acquire a basketball team in the Chinese Basketball Association to increase interest in Sands' casino operations in Macao. Upon learning that it was prohibited by local law from doing so, Sands paid companies affiliated with the consultant approximately $7.5 million so that the consultant could purchase the team and Sands would appear as a "sponsor." According to the NPA, the contracts, pursuant to which this payment occurred, did not accurately reflect the parties to the transaction.

- Acquisition of Several Floors of a Building in Beijing: The NPA stated that, as part of its efforts to partner with a Chinese state-owned travel agency, Sands acquired a controlling interest in companies set up by the consultant to purchase several floors of a building in Beijing from that agency. Approximately $42 million in payments were made, although none were done with the approval of a Sands employee with sufficient authority. Sands subsequently paid approximately $3.6 million to a company of the consultant for a five-year lease of the basement of the building.

- Significant Additional Payments to the Consultant's Companies: The NPA noted that Sands' subsidiaries made additional payments reflecting "the failure of effective internal accounting controls . . . that were ultimately misrepresented in Sands' books and records." These payments included approximately $1.4 million in April 2008 for "arts and craft procurement," approximately $1.4 million in September 2008 for "advertisement," approximately $1.4 million in October 2008 for marketing and promotional services, and approximately $900,000 in installments between November 2008 and July 2009 to a company of the consultant for property management fees associated with the Beijing building (even though the building was managed by an unaffiliated company).

Noteworthy Aspects

- Penalty Considerations: Although Sands received full credit for its cooperation with the DOJ (including by conducting an internal investigation, sharing facts with the DOJ, facilitating interviews of foreign witnesses, organizing evidence, and translating documents), disclosed all relevant facts known to Sands, engaged in extensive remediation, and no longer employs or is affiliated with culpable individuals, it received only a 25 percent reduction off of the bottom of the U.S. Sentencing Guidelines because the company did not self-disclose, consistent with the DOJ's practice under the Pilot Program.

- High-Level Internal Controls Failures: This settlement discusses significant books-and-records and internal-accounting-controls failures, though it does not state that Sands violated the anti-bribery provisions of the FCPA. In explaining the penalty, the DOJ noted, "in particular a willful failure by then executives of the Company to implement adequate internal accounting controls in connection with significant payments to companies associated with a consultant in a region known to be high risk for corruption, without appropriate due diligence of certain entities, consistent monitoring of or justifications for payments, and proper approvals and documentation, even after certain then-senior executives of the Company had been notified about the consultant's business practices and failure to account for over $700,000."

- Related Lawsuit Prompted Government Investigation: In 2010, Steven Jacobs, the former head of Sands' China operations, sued Sands for wrongful termination. The case, which was covered extensively in the media, settled in 2016 in a confidential settlement. According to press reports, the lawsuit, in which Jacobs claimed that he was terminated "for blowing the whistle on improprieties and placing the interests of shareholders above those of Adelson," led to the DOJ and SEC investigations of Sands.

Orthofix International Charged with FCPA Violations for Second Time

On January 18, 2017, Orthofix International N.V. (Orthofix), a Curaçao-incorporated medical device company that is headquartered in Texas and has shares traded on U.S. exchanges, entered into its second FCPA settlement in less than five years, consenting to the entry of an SEC Cease-and-Desist Order to resolve accounting violations related to improper payments the company's Brazilian subsidiary allegedly made to doctors at government-owned hospitals in Brazil. As part of this settlement, Orthofix agreed to pay $6.1 million in civil penalties, disgorgement, and prejudgment interest and to retain an independent compliance consultant for one year to review and test its FCPA compliance program. In a parallel proceeding, Orthofix consented to the entry of a separate SEC Cease-and-Desist Order focused on other non-bribery-related securities violations in Brazil that carried an additional $8.25 million civil penalty.

According to the SEC Order, from at least 2011 to 2013, Orthofix's Brazilian subsidiary, Orthofix do Brasil LTDA (Orthofix Brazil), colluded with third-party commercial representatives and distributors to make illicit payments to doctors at state-owned hospitals to induce them to use Orthofix's products, thereby increasing sales. Specifically:

- Commercial representatives for Orthofix Brazil paid kickbacks to doctors using Orthofix products valued at between 20 and 25 percent of the sales price. Orthofix Brazil then billed the hospitals directly for the products and channeled the kickbacks by inflating the commissions of its commercial representatives to between 33 and 43 percent of the sales price, a portion of which the commercial representatives passed on to the doctors.

- A company associated with an Orthofix Brazil commercial representative or distributor submitted false invoices for marketing and/or other services never rendered. Orthofix Brazil then approved payment of these invoices, inaccurately characterizing them as "administrative expenses" or "consulting for sales" payments even though the funds were meant to facilitate improper payments to doctors.

- Orthofix Brazil provided substantial discounts of up to 70 percent to distributors, who then used a portion of the profits to make improper payments to certain doctors.

The SEC stated that Orthofix Brazil generated nearly $3 million in illicit profits as a result of the improper payments made using these schemes. The Commission also claimed the subsidiary's senior management, including its general manager and finance director, knew of the schemes and were involved in improperly recording the payments and discounts as legitimate business expenses in the subsidiary's books and records, which were subsequently consolidated into Orthofix's books and records, rendering them inaccurate.

Orthofix had previously resolved FCPA charges with the DOJ and SEC in July 2012 related to allegations of corruption by the company's wholly-owned Mexican subsidiary, Promeca S.A. de C.V. (see our FCPA Autumn Review 2012). In light of this prior settlement, the SEC asserted that Orthofix was aware of the deficiencies in its internal accounting controls and the FCPA risks facing its subsidiaries in higher-risk countries, yet it failed to adequately enhance its controls or the supervision it exercised over these higher-risk subsidiaries.

Per the terms of its 2012 SEC Order and DOJ DPA, Orthofix self-disclosed the misconduct at Orthofix Brazil after receiving internal reports in August 2013. The DOJ and the SEC followed up by initiating new investigations, with the DOJ twice extending the term of Orthofix's DPA while its investigation was pending. The DOJ ultimately decided to take no further action and filed a motion to dismiss the DPA on July 28, 2016.

For its part, the SEC charged Orthofix with violating the FCPA for failing to: (1) accurately record the improper payments in its books and records; and (2) devise and maintain a system of internal accounting controls that could have detected and prevented such payments. The more than $6.1 million that Orthofix agreed to pay to settle the charges include $2.928 million in civil penalties, $2.928 million in disgorgement, and $263,375 in prejudgment interest.

Noteworthy Aspects

- Slow Pace of Orthofix's 2012 Remediation: In resolving FCPA charges with the agencies in 2012, Orthofix avoided the imposition of an independent compliance monitor, but agreed to, among other things, maintain a corporate compliance program with rigorous internal controls and provide periodic reports to the DOJ and SEC over a two-year period detailing the company's remediation efforts and the maintenance of its compliance program. Without the oversight of a monitor, however, Orthofix's remedial efforts lagged in the SEC's view. While the SEC Order acknowledges the preliminary remediation Orthofix undertook following its 2012 resolution, it also states the company did not start "fully implementing sufficient remedial steps" until after the discovery of the Brazil conduct in late 2013, nearly a year and a half after the settlement. The slow pace of Orthofix's 2012 remediation may have driven the SEC's decision to require the company to retain an independent compliance consultant for one year as part of the 2017 resolution.

- Decentralization as a Cause of Inadequate Internal Accounting Controls: The SEC Order characterized Orthofix's reporting structure and relationship with its subsidiaries as "decentralized" during the relevant time period, complicating parent oversight, compliance monitoring, and communication with U.S. executives. These deficiencies included a lack of policies or processes to standardize or centrally approve and monitor the commissions and discounts that Orthofix Brazil was providing to third parties. Such gaps allowed Orthofix Brazil to push through high commissions and discounts used to facilitate improper payments. According to the SEC, this decentralized structure provided Orthofix Brazil with the opportunity to orchestrate and execute its bribery schemes without detection because it allowed the subsidiary to: (1) easily evade Orthofix's existing policies and controls by exploiting gaps in supervision created by the company's indirect reporting structure; and (2) record the improper payments as legitimate business expenses. In discussing the settlement, Kara Brockmeyer, Chief of the SEC's FCPA Unit, indicated that these gaps were not limited to Orthofix Brazil, noting that "Orthofix did not have adequate internal controls across all its subsidiaries."

- Orthofix's Cooperation and "Significant" Remedial Efforts: The SEC Order highlighted Orthofix's self-report, a requirement under the company's 2012 SEC Order and DOJ DPA, as well as its cooperation throughout the course of the SEC's most recent investigation. The Commission also characterized Orthofix's remedial efforts, albeit delayed, as "significant," noting that the company had "terminated problematic representatives and distributors; developed and implemented new global accounting policies to provide further structure and guidance to foreign subsidiaries; established an internal audit function and expanded [its] compliance department; conducted extensive audits of third-party vendors used by subsidiaries; and revised existing trainings and implemented additional compliance training for employees."

- Risks Posed by the Agencies' Continued Focus on the Life Sciences Industry: Orthofix is the 10th company in the pharmaceutical or medical device sector to enter into an FCPA enforcement action since January 2016. In addition, we are currently tracking ongoing FCPA investigations against more than 10 other such companies, underscoring the continued compliance and corruption risks facing the life sciences industry. And, as evidenced by the SEC's prosecution of Orthofix and Zimmer Biomet this past quarter, even companies that have presumably remediated past misconduct and enhanced their compliance programs in connection with past FCPA settlements are not immune from future scrutiny, and need to continually adapt and enhance their programs to address evolving risk.

Actions Against Individuals

Two Individuals Plead Guilty to FCPA-Related Charges in Connection with PDVSA Energy Contracts

Two more defendants have pled guilty in the DOJ's ongoing investigation into contracts with Venezuelan state-owned energy company PDVSA, which we last discussed in our FCPA Spring Review 2016. On January 10, 2017, the DOJ announced that Juan Jose Hernandez Comerma (Hernandez) and Charles Quintard Beech III (Beech) each pled guilty in the U.S. District Court for the Southern District of Texas to one count of conspiracy to violate the anti-bribery provisions of the FCPA.

As described in our FCPA Spring Review 2016, the DOJ alleged a conspiracy involving the owners of multiple U.S.-based energy companies, who sought to obtain contracts from PDVSA for the provision of equipment and services to the state-owned company by paying bribes to PDVSA purchasing managers. Beech owned one of the companies involved in the scheme and Hernandez worked as the general manager of another company, eventually acquiring a minority stake in it. The Information charging Beech alleges that he and his co-conspirators orchestrated a scheme to secure these contracts by providing payments and other things of value to PDVSA officials. The Information states that Beech, in furtherance of the scheme, caused funds to be sent to a bank account associated with a purchasing manager of a PDVSA subsidiary and to a company under the control of another PDVSA official. The Information charging Hernandez alleges similar conduct, highlighting Hernandez's role in transferring funds to a bank account controlled by a purchasing manager of a PDVSA subsidiary and covering hotel stays for PDVSA officials in New York City and Miami Beach.

Hernandez and Beech are scheduled to be sentenced on July 14, 2017, and face a maximum of five years of imprisonment, a fine of the greater of $250,000 or twice the gross gain to the conspirators or loss to its victims, full restitution, a special assessment, and three years of supervised release. Six other individuals have pled guilty as part of this investigation, as we have reported here and here.

Magyar Telekom Executives Settle with the SEC over Bribery Allegations

As discussed in our previous FCPA Reviews (see our FCPA Winter Review 2013 and FCPA Spring Review 2013), the SEC filed charges in the Southern District of New York on December 29, 2011, alleging that three former Magyar Telekom executives – Elek Straub, Tamás Morvai, and András Balogh – participated in a scheme to bribe government officials in Macedonia from December 2004 to June 2006 in exchange for favorable treatment for Magyar Telekom's Macedonian subsidiary. Through a series of sham contracts with a consultant, the company allegedly paid approximately €4.9 million in bribes to Macedonian officials. The SEC claimed that the defendants concealed these payments in Magyar Telekom's books and records by submitting false management representation letters to the company's external auditor, false Sarbanes-Oxley Act certifications in connection with Magyar Telekom's SEC filings, and false representations to the accounting department. The SEC charged all three individuals with multiple FCPA-related violations, including aiding and abetting and violating the anti-bribery provisions; aiding and abetting Magyar's failure to maintain accurate books and records and internal accounting controls; falsifying Magyar's books and records; and making false or misleading statements to an auditor.

Mere months before their scheduled May 8, 2017, trial date, all three former Magyar Telekom executives have now settled the SEC's charges against them. According to a February 8, 2017, filing by the SEC, Morvai has accepted a settlement agreement with the agency imposing a civil penalty and enjoining him from future securities law violations. Under the terms of the settlement, Morvai will neither admit nor deny the bribery allegations and will pay a $60,000 fine. The Court entered final judgment against Morvai on February 15, 2017.

Similarly, in a March 10, 2017, filing, the SEC stated that Straub, Magyar Telekom's former CEO, had reached an "agreement in principle" to settle his charges, which the Commission approved on March 21, 2017. The court initially denied the SEC's request to stay the proceedings until the SEC vote and ruled that the parties must comply with the trial schedule until the settlement agreement is formally executed. While it typically takes about six weeks for the SEC to finalize a settlement agreement, the Commission voted to approve the final agreement, the terms of which have not yet been made public, less than two weeks later, on March 21, 2017.