FCPA Winter Review 2020

International Alert

Introduction

2019 – Year in Review

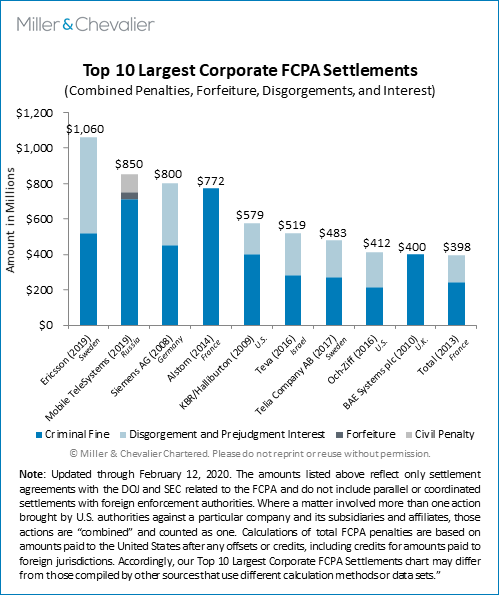

Calendar year 2019 continued the long-established track record of significant U.S. Foreign Corrupt Practices Act (FCPA) enforcement activity. The U.S. enforcement agencies – the Department of Justice (DOJ) and Securities and Exchange Commission (SEC) – completed enforcement actions that resulted in a combined total of more than $2.6 billion in corporate fines, penalties, disgorgement, and prejudgment interest – a new record. Two enforcement actions contributed almost 70 percent to this record total – namely, the corporate resolutions with two telecommunications companies, the Swedish company Telefonaktiebolaget LM Ericsson (Ericsson) and the Russian company PJSC Mobile TeleSystems (MTS). When calculating the rankings based on criminal fines and disgorgement and prejudgment interest actually collected by the U.S. federal government, these two enforcement actions are the two largest corporate resolutions in the history of the FCPA statute. This trend of record-setting resolutions continued into early 2020, as the DOJ collaborated with prosecutors in the U.K. and France to bring coordinated enforcement actions against Airbus in January 2020 that resulted in large fines shared among the participating agencies. (While the Airbus resolutions are groundbreaking, the DOJ portion of the resolution covers both FCPA and export controls violations, and the criminal fines related to the FCPA violations do not place Airbus into the Top 10 list included here. We will address the Airbus resolutions and their place among historical global anti-corruption resolutions in our forthcoming Spring Review.)

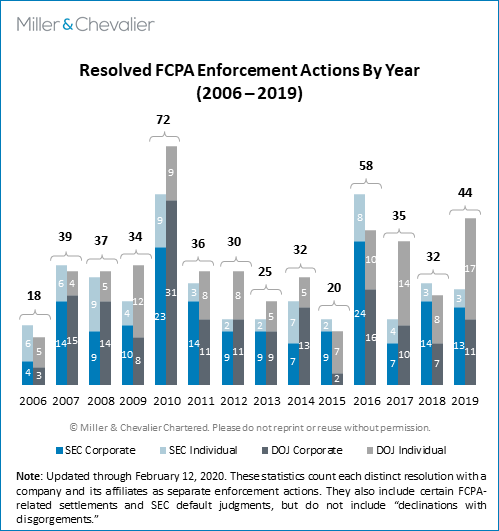

The year was also notable with regard to the number of FCPA enforcement actions that reached a conclusion. In 2019, the DOJ resolved 17 actions against individuals (either through convictions or guilty pleas) and 11 actions against companies (all through negotiated resolutions), while the SEC concluded three actions against individuals and 13 against companies (all through consent agreements). As usual, the DOJ and SEC enforcement activity overlapped to some extent, with a net total of 13 companies (including subsidiaries or affiliates as one company) concluding FCPA resolutions. With the overall total of 44 resolved FCPA enforcement actions by the DOJ and SEC, last year was one of the most prolific in FCPA enforcement, ranking third only to 2010 and 2016, which respectively saw 72 and 58 resolved FCPA enforcement actions. The total number of 44 resolved actions last year was more than 15 percent higher than the DOJ's and SEC's combined overall average of approximately 38 such enforcement actions per year over the past 10 years (i.e., 2009-2019), and it marked a significant jump of almost 40 percent over the 2018 total of a combined 32 resolved FCPA enforcement actions.

Four corporate resolutions in 2019 each included combined financial penalties paid to the DOJ and SEC in excess of $200 million. However, the 2019 average amounts were driven significantly higher by the $850 million corporate FCPA resolutions by the DOJ and the SEC with MTS in March 2019 (discussed in our FCPA Spring Review 2019) and the $1.06 billion combined DOJ and SEC resolutions with Ericsson in December 2019.

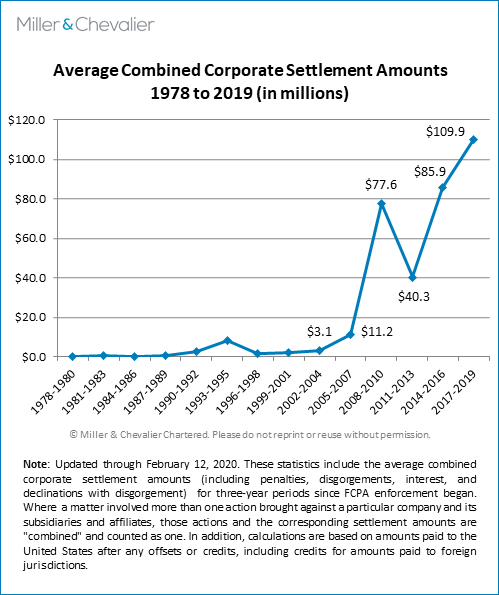

As can be seen from the chart above, the average corporate settlement amount has increased from almost $86 million for the 2014-2016 period to almost $110 million for the last three years, a rise of more than 27 percent. This rise has been driven not only by the large 2019 penalties just noted but also by other large penalty levels in dispositions within the current three-year period, including Telia in 2017 and Société Générale in 2018. As we have noted when presenting and commenting on these numbers in the past, penalty averages can be affected by a number of factors, including the timing of disposition, that are not necessarily indicative of long-term trends.

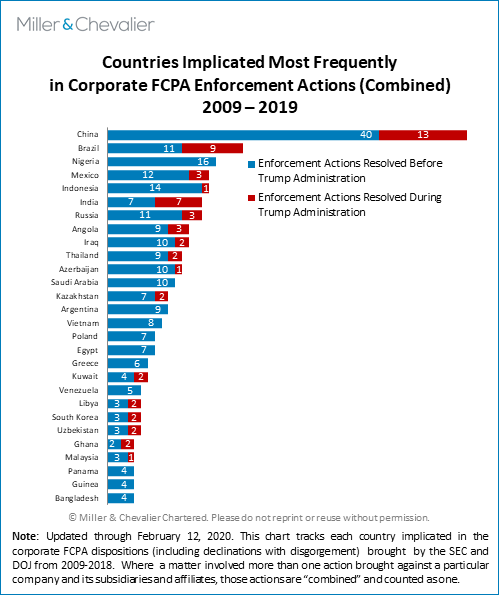

Regarding countries implicated most frequently in corporate FCPA enforcement actions, China, Brazil, Mexico, and India have remained in the spotlight recently. China's business culture continues to challenge companies that count on the country as a key area of growth, while the cases centered in Brazil derive both from continuing fall-out of the "Car Wash" investigation and from other actions by enforcement authorities there.

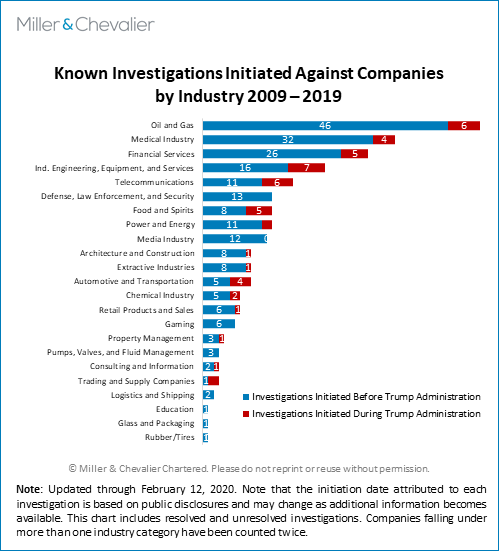

The chart below provides an update on the known investigations by industry over the past 10 years. As we have noted previously, industries that have historically attracted FCPA enforcement attention have continued to do so in past several years. This is partly attributable to the inherent risks in the sectors with heavy government regulation or nature of the transactions (e.g., involvement of state actors in the transaction), and partly to the nature of the investigations, which often focus on multiple companies implicated in the same or similar conduct.

2019 continued the U.S. agencies' focus on individuals in corporate corruption investigations (initially discussed in our FCPA Autumn Review 2015), particularly in enforcement actions brought by the DOJ. Notably, there were four FCPA-related trials in 2019, including the high-profile Hoskins trial, discussed in detail below. Overall, the DOJ and SEC resolved 20 FCPA enforcement actions against individuals (17 by the DOJ and three by the SEC). Additionally, in 2019 the DOJ continued the trend of bringing non-FCPA charges, including wire fraud and money laundering charges, against individuals in cases stemming from FCPA investigations. These cases are not reflected in our statistics, but they are noteworthy because the DOJ has been targeting foreign government officials who cannot otherwise be charged under the FCPA by charging them with other offenses (e.g., money laundering) to target the officials' roles as recipients and/or facilitators of bribes. While significant, the increase of enforcement activity against individuals should not be surprising, however. It follows multiple announcements by the DOJ and SEC in the past several years that the government agencies are prioritizing individual prosecutions. For example, in December 2019, Assistant Attorney General Brian Benczkowski said during the 36th International Conference on the FCPA in Washington, DC that, "The number of individual prosecutions in 2019 is not an outlier or a statistical anomaly. Rather, it is part of the Department's continued dedication to holding individual wrongdoers accountable across the board."

The year, and particularly its last quarter, also had several important policy and international developments, including, among others, the revised FCPA enforcement policy guidance from DOJ (which related to ephemeral messaging apps, deconfliction of interviews and other investigative steps, M&A due diligence, significance of aggravating factors, and companies' disclosure obligations); the DOJ's updated guidance for evaluating corporate compliance programs; the updated corporate cooperation guidance from the U.K.'s Serious Fraud Office (SFO); and the rapidly evolving enforcement environments in France, Brazil, Canada, and elsewhere. Taken together with the enforcement actions against companies and individuals, these developments demonstrate the significance and robustness of international anti-corruption enforcement.

The past year was also characterized by the continued and growing trend of internationalization of anti-bribery enforcement. For example, in their announcements of the resolution with MTS, the DOJ and SEC acknowledged the cooperation from 16 countries around the world. Overall, both U.S. agencies acknowledged the cooperation from 25 countries in resolved FCPA enforcement actions throughout the year. International cooperation between the U.S. and foreign authorities has been bolstered in part by the May 2018 DOJ policy that establishes principles for coordination by DOJ attorneys with their foreign counterparts. The policy and resulting uptick in international cooperation efforts have already contributed to the resolution of several significant FCPA cases just in the past year and a half alone, including Ericsson, Vantage, Petrobras, and Société Générale, among others.

Q4 2019

The fourth quarter of 2019 included two major enforcement actions against companies (Ericsson and Samsung Heavy Industries), both of which are headquartered outside the United States. The first was the biggest corporate resolution of 2019 and involved the highest penalties paid to the U.S. agencies in the history of FCPA enforcement. In addition, the DOJ announced enforcement actions against six individuals in the last quarter of 2019 – three of which already have concluded with guilty pleas – and there were three FCPA-related trials. Meanwhile, the SEC brought one corporate enforcement action (against Ericsson) in the fourth quarter of 2019. In addition, in a civil complaint, the SEC also charged one individual (who was also subject to charges by the DOJ) with violating the FCPA's anti-bribery provisions and aiding and abetting books and records and internal accounting controls violations.

Lastly, capping an already dynamic year in FCPA enforcement and policy developments, Larry Kudlow, White House economic advisor and Director of the National Economic Council, announced on January 17, 2020 that the Trump administration was "looking at" making changes to the FCPA in response to "some complaints from [U.S.] companies." Given the political dynamics of an election year in the United States, it is unlikely that any statutory changes would move forward if proposed. However, we will continue to monitor the enforcement trends at the DOJ and SEC to discern any potential changes to FCPA enforcement policy or the pace of investigations.

We summarize this quarter's corporate enforcement actions, individual enforcement actions, and other policy, litigation, and international developments below.

Corporate Enforcement Actions

As we report in greater detail below, Ericsson agreed in December 2019 to pay $1.06 billion to the DOJ and SEC to resolve the agencies' investigations into alleged FCPA violations across different regions. A month earlier, Samsung Heavy Industries had agreed to settle corruption-related charges and to pay a criminal penalty to the DOJ of more than $75 million. We summarize the corporate enforcement actions from the fourth quarter below.

- Samsung Heavy Industries Company Limited. On November 22, 2019, Samsung Heavy Industries Company Limited (SHI), a South Korean engineering company with a branch office in the United States, entered into a deferred prosecution agreement (DPA) with the DOJ. Under the terms of the DPA, SHI agreed to pay a total criminal penalty of more than $75 million to resolve charges that it had violated the FCPA arising out of a scheme to pay millions of dollars in bribes to Brazilian officials. SHI admitted that from 2007 to 2013, the company conspired—and took actions in furtherance of the bribery conspiracy—to violate the FCPA by paying approximately $20 million in commissions to a Brazilian intermediary, knowing that a portion of the money would be paid as bribes to officials at Petrobras, the Brazilian state-owned oil and state-controlled energy company, in exchange for assistance in securing improper business advantages. In addition to the criminal penalty, as part of the DPA, SHI also agreed to continue to cooperate with the DOJ in any ongoing investigations and prosecutions related to the conduct; to enhance its compliance program, and to report to the DOJ on the implementation of its enhanced compliance program. We discuss the SHI enforcement action in greater detail below.

- Telefonaktiebolaget LM Ericsson. On December 6, 2019, Ericsson, a Stockholm, Sweden-headquartered multinational telecommunications company, agreed to pay total penalties, disgorgement, and interest of more than $1 billion to resolve the DOJ's and SEC's investigations into violations of the FCPA arising out of the company's activities in several countries from the period of 2000-2016, including China, Djibouti, Indonesia, Kuwait, Saudi Arabia, and Vietnam; falsification of its books and records; and failure to implement reasonable internal accounting controls. The penalty amount includes a criminal penalty of more than $520 million and approximately $540 million in disgorgement and prejudgment interest to be paid to the SEC. An Ericsson subsidiary in Egypt also pleaded guilty to its role in the scheme. Under the terms of the agreements with both the DOJ and the SEC, Ericsson agreed to retain an independent compliance monitor for three years. We discuss the Ericsson settlement in greater detail below.

Individual Enforcement Actions

The last quarter of 2019 saw several important enforcement actions resolved against individuals, including three significant trials. We summarize each of the individual enforcement actions below.

- On October 30, 2019, the DOJ announced that Cyrus Ahsani and his brother Saman Ahsani, respectively the former Chief Executive Officer and Chief Operations Officer of Unaoil, a Monaco-based intermediary company, pleaded guilty for their roles in a corrupt scheme to facilitate millions of dollars in bribes to officials in multiple countries in order to secure oil and gas contracts. The DOJ also announced that Steven Hunter, a U.K. resident and former business development director for Unaoil, also had pleaded guilty in August 2018 to one count of conspiracy to violate the FCPA's anti-bribery provisions. Court documents show that the Ahsani brothers conspired with others from 1996 to 2016 to make millions of dollars in bribe payments to government officials in Algeria, Angola, Azerbaijan, the Democratic Republic of the Congo, Iran, Iraq, Kazakhstan, Libya, and Syria. Court documents also show that the Ahsanis laundered the proceeds of the bribery scheme to promote and conceal the scheme and caused destruction of evidence to obstruct the investigation. Hunter, on the other hand, participated in the conspiracy to violate the FCPA by facilitating bribe payments to Libyan officials between 2009 and 2015. The sentencing of the Ahsani brothers is scheduled for April 20, 2020, while that of Hunter is scheduled for March 13, 2020. Several multinational companies have announced related resolutions and/or investigations related to their dealings with Unaoil.

- On November 4, 2019, District Court Judge Dale Fischer entered the consent judgment of forfeiture against Low Taek Jho, members of his family, and a group of entities. As reported in our FCPA Autumn Review 2019, Low, a businessman-turned-fugitive, is the accused mastermind of a multibillion-dollar fraud involving Malaysia's sovereign-wealth fund 1MDB. Low has agreed to forfeit more than $700 million in assets, including real estate, a luxury yacht, and a private jet, that U.S. authorities sought to seize. The settlement does not resolve the criminal charges against Low, including conspiracy to launder billions of dollars in proceeds from the fraud, bribing Malaysian government officials, and committing U.S. campaign-finance violations. Nor does it include any admission of wrongdoing by him. Low, who remains a fugitive from the U.S. criminal justice system, is believed to be in China or under Chinese protection.

- On November 8, 2019, after a two-week trial, a jury in Connecticut convicted Lawrence Hoskins, a U.K. citizen and a former senior vice president at Alstom S.A. (Alstom), a French electricity generation and rail transport company. Specifically, the jury convicted Hoskins on 11 of the 12 FCPA and money laundering charges brought against him by the DOJ, including six counts of violating the FCPA, three counts of money laundering, two counts of conspiracy, and found him not guilty on one count of money laundering. Evidence presented at trial showed that Hoskins had engaged in a conspiracy to pay bribes to Indonesian officials, including a high-ranking member of the Indonesian Parliament and the president of the state-owned electricity company in Indonesia, in exchange for securing a $118 million contract for Alstom Power, Inc. (Alstom Power), a Connecticut-based company, and Marubeni Corporation of Japan. In connection with the contract and to conceal the bribes, Hoskins and his co-conspirators retained two consultants purportedly to provide consulting services on behalf of Alstom Power. One key issue for the jury was whether Hoskins was an agent of Alstom Power and therefore subject to the FCPA's jurisdiction. Hoskins's sentencing is scheduled for March 6, 2020.

- On November 14, 2019, the DOJ announced that it had filed a three-count indictment against Yanliang Li and Hongwei Yang, two former executives of the China subsidiary of Herbalife, for their alleged role in a conspiracy to violate the anti-bribery and internal accounting controls provisions of the FCPA, perjury, and destruction of records in a federal investigation. In a related proceeding, the SEC announced that same day that it had filed a civil complaint against Li alleging violations of the anti-bribery, books and records, and internal controls provisions of the FCPA.

- On November 19, 2019, Michael Leslie Cohen, a former Executive Managing Director of Och-Ziff Capital Management's (Och-Ziff) European office, was sentenced to three months in prison and ordered to pay a $250,000 fine. Pursuant to a plea agreement, dated July 16, 2019, Cohen pleaded guilty to making a false statement to the FBI during a 2013 investigation into the hedge fund. The case against Cohen stemmed from a foreign bribery investigation into Och-Ziff, with the DOJ originally filing a 10-count indictment against Cohen in October 2017 accusing him of participating, beginning in about 2008, in a scheme to defraud one of Och-Ziff's clients, a large U.K. charitable foundation. The U.K. charitable foundation was considering whether to invest in an Och-Ziff JV that had been created for the purpose of investing in African mining, oil, and mineral concessions. The indictment alleged that Cohen failed to disclose that one of the sellers of shares in the JV owed Cohen millions of dollars on a delinquent personal loan and that Cohen himself had a personal interest in the JV. The indictment further alleged that once the SEC began an investigation into Och-Ziff in 2011, Cohen produced fake documents to obstruct the investigation. The SEC, and later DOJ, investigation eventually led to the related FCPA charges brought against Och-Ziff.

- On November 22, 2019, a federal jury in Maryland convicted Mark Lambert, former President of Transport Logistics International, Inc. (TLI), for conspiring to violate and violating the FCPA and conspiring to commit and committing wire fraud. The jury also acquitted Lambert of three counts of violating the FCPA and of money laundering. Evidence presented at his three-week trial showed that Lambert had engaged in a scheme to bribe Vadim Mikerin, a Russian official at JSC Techsnabexport, a subsidiary of Russia's State Atomic Energy Corporation, to secure contracts with it. Evidence also showed that Lambert conspired with others at TLI over the course of several years to make, at Mikerin's direction, the bribery and kickback payments to Mikerin through offshore bank accounts of shell companies. To conceal the bribe payments, Lambert and his co-conspirators used fake invoices that described fictitious services, and then Lambert and others caused TLI to wire the corrupt payments for those purported services to shell companies in Latvia, Cyprus and Switzerland. Lambert faces a maximum of five years in federal prison for the conspiracy to violate the FCPA and commit wire fraud, a maximum of 20 years for each of two counts of wire fraud, and a maximum of five years for each of four counts of violating the FCPA. Sentencing for Lambert is scheduled on March 9, 2020.

- On December 2, 2019, after a six-week trial, a jury in the Eastern District of New York acquitted Jean Boustani, a Lebanese executive from the Abu Dhabi-based international shipbuilding company Privinvest Group, of wire fraud conspiracy, money laundering conspiracy, and securities fraud conspiracy charges related to allegations that he had defrauded U.S. investors in a multi-billion dollar scheme. The DOJ had alleged that between 2013 and 2016, Boustani, a lead salesperson for Privinvest, had played an integral role in defrauding U.S. investors in a complex scheme involving $2 billion in loans to state-owned companies in Mozambique. Boustani and his co-conspirators allegedly had arranged for investment banks to finance government-sponsored development projects in Mozambique and formed three state-owned entities to borrow the funds for those projects. Privinvest had secured from the Mozambican government the contract to perform the work on the projects, while Boustani and his co-conspirators had secured the loans, which, once securitized, were sold to various investors, including investors in the U.S. More than $200 million of the loans was purportedly diverted for bribes and kickbacks to Boustani, his co-conspirators, and Mozambican officials, among others. While prosecutors argued that Boustani had helped negotiate the loans, made material misrepresentations to investors, and took approximately $15 million in improper payments from the proceeds of the fraudulent scheme, Boustani's defense emphasized the lack of nexus between Boustani's alleged misconduct and the Eastern District of New York. In contrast to the Hoskins conviction, the Boustani acquittal and judgment, which we discuss in greater detail below, highlight jurisdictional issues that may limit the DOJ's ability to prosecute non-U.S. citizens involved in overseas corruption.

- On December 16, 2019, the DOJ responded to the requests of Gordon Coburn and Steven Schwartz, two former executives of information technology company Cognizant Technology Solutions, that a federal court remove certain counts in the FCPA indictment against them because of purported inconsistencies and deficiencies, including prosecutors' failure to produce potentially incriminating documents. As we reported in more detail in our FCPA Spring Review 2019, both Coburn and Schwartz, Cognizant's former president and Chief Legal Officer, respectively, had been charged in February 2019 for their alleged role in paying a $2 million bribe to Indian government officials to secure a permit to build a facility in India. In November 2019, both Coburn and Schwartz, who had pleaded not guilty, launched separate attempts to dismiss counts from their FCPA indictment. In response to the executives' arguments, the DOJ argued in its December 2019 brief that Coburn's request to dismiss counts against him used arguments that were "meritless" because they were "based on an incorrect and overly narrow view of the unit of prosecution under the FCPA." In addition, the DOJ addressed Coburn's and Schwartz's request for more information about their case by arguing that the former executives were seeking "wide-ranging, all-encompassing particulars" which were "an effort to gain an unwarranted tactical advantage for trial."

- On December 18, 2019, Frank Roberto Chatburn Ripalda (Chatburn) was sentenced to 42 months in prison after pleading guilty in October 2019 to one count of conspiracy to commit money laundering in connection with the PetroEcuador bribery scandal. Chatburn, a former Miami financial advisor, was indicted in April 2018 with conspiracy to violate the FCPA, violation of the FCPA, money laundering, and conspiracy to commit money laundering arising from bribe payments in exchange for contracts from PetroEcuador. He will spend three and a half years in prison for facilitating and helping to conceal the bribery scheme that funneled millions of dollars to Ecuadorian oil officials in exchange for contracts for a private company. The sentence was below the sentencing guidelines of seven to nine years that the parties had agreed to in the plea agreement and within the range of sentences previously issued to other co-conspirators.

Each of these developments is discussed in more detail below.

Policy & Litigation Developments

The last quarter of 2019 witnessed several important FCPA-related policy and litigation developments.

In November 2019, the DOJ refined the cooperation requirements of the FCPA Corporate Enforcement Policy (the Policy). The largely practical changes to the Policy relate to companies' voluntary disclosures of potential FCPA violations to the DOJ.

Also in November 2019, the Supreme Court announced that it would hear the case of Charles C. Liu et al. v. SEC (Liu v. SEC), which challenges the authority of the SEC to seek disgorgement when bringing charges in federal court (as opposed to administrative proceedings, where disgorgement is a statutorily authorized remedy) and whose outcome could, in the FCPA context, affect the SEC's ability in federal court actions to recover profits resulting from the payment of bribes.

In the fall, the press reported that the SEC was exploring the use of the FCPA's accounting provisions to pursue charges for money laundering, but Charles Cain, the Chief of the FCPA Unit of the SEC's Division of Enforcement, downplayed these reports in December during a public appearance, but without ruling out the possibility altogether. Additionally, there were various press reports suggesting that the Trump Administration has been and is still considering revisions to the FCPA.

We discuss these policy developments in more detail below.

International Developments

There were several noteworthy international developments during the fourth quarter of 2019.

In the United Kingdom, the SFO updated the Corporate Cooperation Guidance (CCG) used in assessing a company's cooperation with the SFO in an investigation. As we discuss in more detail below, while the CCG confirms the SFO's intention to seek privileged documents during investigations, it also attempts to provide more transparency in connection with SFO's expectations of cooperation if a company under investigation seeks leniency from the SFO.

In Canada, the construction division of the engineering, procurement, and construction services company SNC-Lavalin, SNC-Lavalin Construction, agreed to settle charges of fraud and corruption for bribing several Libyan officials, including the son of Muammar el-Qaddafi, in exchange for procuring construction contracts. Pursuant to the settlement, the company agreed to pay C$280 million in fines over five years and became subject to a three-year probation order, under the terms of which the company agreed to retain an independent monitor.

In August 2019, Mexico's Congress enacted the National Asset Forfeiture Law (the Forfeiture Law), which represents an overhaul of the country's prior forfeiture law. Importantly, the new law includes provisions for the forfeiture of tangible and intangible assets that are reasonably linked to criminal conduct or whose lawful origin cannot be established. To implement the new legislation, Mexico's Federal Attorney General created a Special Forfeiture Unit in November 2019.

We discuss these and other international developments below.

Corporate Enforcement Actions

South Korean Engineering Company Samsung Heavy Industries Settles FCPA Charges with DOJ

On November 22, 2019, the DOJ announced a DPA with Samsung Heavy Industries Company Limited (SHI), an international engineering company that builds ships and offshore oil platforms, among other items. Under the DPA, SHI agreed to pay a penalty of $75,481,600 to settle corruption-related charges. Up to half of the penalty may be paid to Brazilian officials under a separate Memorandum of Understanding with three Brazil enforcement agencies – the Controladoria-Geral da União, the Advogado-Geral da União, and the Ministério Público Federal. The remainder must be paid to the United States with regards to one count of conspiracy to violate the anti-bribery provisions of the FCPA.

SHI is organized under the laws of South Korea, with headquarters in Seoul, South Korea, and shipyards in Geoje, South Korea. The SHI DPA is the latest in a series of FCPA enforcement actions connected to Petróleo Brasileiro S.A. (Petrobras), a Brazilian state-owned oil company, and much of the alleged misconduct took place in Brazil. However, the DOJ alleged that one SHI senior manager involved in the misconduct was based in the company's branch office in Houston, Texas—a U.S. connection sufficient for the DOJ to assert jurisdiction over the conduct subject to the DPA under 15 U.S.C. § 78dd-3 provision of the FCPA.

Specifically, in June 2007, SHI executed an option agreement for the purchase of a not-yet-constructed drillship with an offshore drilling company, also based in Houston, Texas. At the time, SHI allegedly understood that the option would be exercised only if the offshore drilling company secured a chartering agreement with Petrobras for the same drillship.

Following the execution of the options agreement with the offshore drilling company, two SHI senior managers allegedly arranged for the engagement of a Brazilian national as an "agent" to represent SHI's interest in the drillship deal. One of these senior managers was a South Korean national based in the company's branch office in Houston, Texas. This Houston-based manager allegedly travelled to Rio de Janeiro, Brazil to meet with the Brazilian agent and two Petrobras officials. The DOJ documents state that a second SHI senior manager—a South Korean national based in Seoul, South Korea—conferred with the Houston-based manager and agreed that SHI would engage the Brazilian agent.

SHI then agreed to pay a "commission" of $20 million to the Brazilian agent, contingent on consummation of the option agreement with the offshore drilling company. The commission was to be paid in installments to two intermediary companies organized in the British Virgin Islands (BVI) and controlled by the agent. According to the DOJ, SHI then increased the price of the drillship offered to the offshore drilling company by $20 million, apparently to cover the cost of the additional $20 million commission payment.

The DOJ alleges that SHI knew that at least a portion of the $20 million commission payment would be passed on to the same two Petrobras officials that the SHI manager had met with in Brazil. Most notably, in a December 2007 phone call, SHI's Brazilian agent allegedly told the Houston-based SHI manager that a portion of the $20 million commission would be paid to the two Petrobras officials. The manager also wrote in an e-mail that the two officials would "consult and divide among themselves within the amounts promised by SHI."

On December 18, 2007, Petrobras and the offshore drilling company executed a non-binding "Heads of Agreement" document for the chartering of the soon-to-be-built drillship. A few days later, on December 21, 2007, the offshore drilling company and SHI executed a purchase agreement for the drillship for $636,040,000. In January 2008, the two Petrobras officials signed the formal chartering agreement between Petrobras and the offshore drilling company, which specifically referred to the drillship to be built by SHI. SHI began work on the drillship at its shipyards in Geoje, South Korea.

The DOJ documents state that from February 2008 to April 2011, the Brazilian agent's two BVI intermediary companies issued commission invoices to SHI, which SHI paid as it received milestone payments from the offshore drilling company. The Brazilian agent and another Brazilian national then allegedly arranged for the BVI intermediary companies to pass at least $4 million to accounts controlled by the two Petrobras officials, including as "repayment" under what the DOJ alleged was a sham loan agreement with a Swiss shell company controlled by a French businessperson.

SHI's criminal penalty of $75,481,600 represents an aggregate discount of 20 percent off of the bottom of the otherwise-applicable U.S. Sentencing Guidelines fine range—which is less than the discount that corporate defendants may receive under the FCPA Corporate Enforcement Policy. In the DPA, the DOJ noted that SHI had not voluntarily disclosed the alleged misconduct and that SHI had failed to receive full credit for cooperation "due to its failure to meet reasonable deadlines imposed by the Fraud Section and [U.S. Attorney's] Office and delays it caused in reaching a resolution." Nevertheless, the DPA notes that SHI did provide all relevant facts to the DOJ, including information about individuals involved in the alleged misconduct.

The DPA also noted SHI's "significant" remedial measures, including program enhancements, hiring of additional compliance staff, implementing updated anti-corruption and whistleblower policies, instituting mandatory anti-corruption training for all employees, and enacting additional controls, including heightened due diligence over third-party vendors.

The DPA does not provide for the appointment of a compliance monitor, although it does require further cooperation with and reporting to the DOJ.

Noteworthy Aspects:

- Presence of Senior Manager in United States Agreed as Sufficient for 15 USC § 78dd-3 Jurisdiction. SHI is organized under the laws of South Korea and based in Seoul, South Korea. The drillship itself was built at SHI's shipyard in Geoje, South Korea. Petrobras is based in Brazil. Nevertheless, the DOJ was able to assert—and SHI agreed in the negotiated disposition to accept —DOJ jurisdiction over the alleged misconduct, primarily based on one SHI senior manager's presence in Houston, Texas, the location of the company's branch office. Accordingly, the SHI enforcement action represents a rare corporate enforcement action based on 15 USC § 78dd-3, the provision of the FCPA that applies to any person "while in the territory of the United States," other than an "issuer" (i.e., a U.S. or non-U.S. person that issues securities in the United States under 15 USC § 78dd-1) or a "domestic concern" (i.e., a U.S. citizen, national, or resident and any entity based in or organized under the laws of the United States under 15 USC § 78dd-2). Though rarely used when other bases of jurisdiction are available, 15 USC § 78dd-3 remains an important tool for the DOJ, especially given the agency's long-standing focus on bringing enforcement actions against both U.S. and non-U.S. companies to "level the playing field" in international business.

- Cooperation Credit Reduced Due to Failure to Meet "Reasonable Deadlines." In the DPA with SHI, the DOJ noted SHI's internal investigation, factual presentations to the DOJ, making foreign-based employees available for interviews, and producing relevant documents and translation. The DOJ also provided SHI with the benefit of a two-point reduction to its "Culpability Score" under the Sentencing Guidelines, which is available only when an organization has "fully cooperated in the investigation." Nevertheless, the DOJ declined to provide full cooperation credit to SHI, explicitly noting that the company "did not receive full credit for its cooperation due to its failure to meet reasonable deadlines" set by the DOJ. Combined with the lack of voluntary self-disclosure, these delays appear to have made SHI ineligible for an additional 30 percent discount from the bottom of the applicable U.S. Sentencing Guidelines fine range—i.e., a discount of approximately $28 million, based on a guideline range of $94 million to $188 million. Neither the DPA nor SHI's press release describe either the length or reason for the delays or how the DOJ measured the "reasonableness" of the relevant deadlines.

- Additional Commercial Ramifications from Related Arbitration. In its press release announcing the resolution with the DOJ, SHI identified the offshore drilling company as Pride International (Pride). In 2011, Pride was acquired by the U.K.-based offshore drilling contractor Ensco plc, which was renamed Valaris plc in 2019. In December 2019, Valaris announced that it received a $200 million payment from SHI following an arbitral award earlier that year. Valaris (then Ensco) had initiated the arbitration in 2016, claiming "losses incurred in connection with the DS-5 drilling services agreement with Petrobras," after Petrobras purported to void the agreement.

Telefonaktiebolaget LM Ericsson Agrees to Pay More Than $1 Billion to SEC and DOJ to Resolve FCPA Violations in Six Countries While Egyptian Subsidiary Pleads Guilty

On December 6, 2019, the SEC and DOJ announced that Telefonaktiebolaget LM Ericsson (Ericsson) a multinational telecommunications company headquartered in Sweden, agreed to pay more than $1 billion to resolve allegations that it had violated the anti-bribery, recordkeeping, and internal-accounting-controls provisions of the FCPA. At the time of the conduct at issue, Ericsson was a U.S. issuer (and Ericsson is still listed on NASDAQ). More specifically, Ericsson agreed to pay a criminal penalty of $520,650,432 in a DPA with the DOJ plus $458,380,000 in disgorgement and $81,540,000 in prejudgment interest to the SEC, for a combined total of $1,055,990,432. Further, Ericsson's subsidiary Ericsson Egypt Ltd. (Ericsson Egypt) pleaded guilty to conspiracy to violate the anti-bribery provisions of the FCPA and agreed to a penalty of $9,520,000, but this amount will be paid as part of Ericsson's total criminal penalty of $521 million. Ericsson's DPA and Ericsson Egypt's plea agreement were concluded on November 26-27, 2019, but the SEC filed its Complaint on December 6, 2019, when both agencies announced the resolutions. These resolutions arise out of investigations that originated in the SEC in early 2013 and in the DOJ in 2015.

According to the SEC's filed complaint, from 2011 through 2017, Ericsson engaged in conduct that violated the FCPA in Djibouti, Saudi Arabia, China, Vietnam, Indonesia, and Kuwait. The SEC categorized the conduct in Djibouti, Saudi Arabia, and China as violations of both the anti-bribery provisions and the accounting provisions, while the conduct in Vietnam, Indonesia, and Kuwait was categorized as violations of only the accounting provisions. According to the DOJ's DPA, from 2000 to 2016, Ericsson engaged in conduct that violated the FCPA in Djibouti, China, Vietnam, Indonesia, and Kuwait, but only the conduct regarding Djibouti was a violation of both the anti-bribery and accounting provisions. The DOJ categorized the facts in the other countries as violations of the accounting provisions. The conduct involved subsidiaries of Ericsson entering false consulting and services contracts to funnel payments to government officials and purchase gifts such as leisure travel and entertainment for government officials and others.

Djibouti

According to the DOJ and SEC, between 2010 and 2014, employees of Ericsson's subsidiaries (including Ericsson Egypt) engaged in a plan to provide approximately $2.1 million in payments to foreign government officials in Djibouti. The purpose of the payments was to secure a contract worth approximately €20.3 million with a state-owned telecommunications company. The DOJ and SEC state that, in 2010, prior to offering a tender for the contract, the employees were in communication with two high-ranking Djiboutian government officials and the CEO of the Djiboutian state-owned telecommunications company. During their communications, a foreign official told the employees that Ericsson would be awarded the contract if they agreed to make a payment to two other officials. The employees discussed the official's offer and decided that the payments to the officials should be tied to costs associated with the contract.

On June 16, 2011, after Ericsson AB was awarded the contract, the Ericsson AB branch in Ethiopia entered into a consulting agreement with a firm owned by the wife of the relevant government official. On June 26, 2011, the Ethiopia branch received the first invoice from the consulting company for €1,000,000. On August 22, 2011, after the consulting contract was signed but before the invoice was paid, an Ericsson VP of New Business Development circulated a draft due diligence report on the consulting company that failed to disclose the spousal relationship between the owner of the consulting company and the relevant official. On August 24, 2011, Ericsson AB's Dubai branch transferred $1,441,050 to the consulting company (the U.S. dollar equivalent amount of €1 million at that time). Two subsequent invoices were submitted by the consulting company and paid by Ericsson AB, bringing the total paid to approximately $2.1 million. All three invoices falsely claimed that the consulting company was providing services for a set number of hours. According to the DOJ and SEC, these payments were improperly recorded in Ericsson's books and records.

China

According to the Complaint and DPA, Ericsson engaged in two patterns of conduct in China in violation of the FCPA. The first originated in the early 1990s and was designed to provide travel, gifts, and entertainment for third-party agents and customers (including state-owned customers) in China. The second arose in 2013 when some employees of Ericsson and Ericsson AB, including a high-level Ericsson executive, coordinated to circumvent new controls that Ericsson implemented that year on third-party agents. The DOJ's DPA considered the two sets of conduct to be violations of the FCPA's accounting provisions, while the SEC's complaint considered them to be a violation of both the anti-bribery provisions and the accounting provisions.

For the first issue, the DOJ and SEC state that, since the early 1990s, Ericsson and its agents operated an expense account that was used to cover non-business-related expenses, including purchasing gifts, travel, and entertainment for state-owned enterprise customers. According to the DOJ, in and around 2008, to conceal the continued existence of the expense account from Ericsson's headquarters, a high-level executive of Ericsson and a high-level executive of Ericsson AB caused a subsidiary in China to come "to an arrangement" with a third party. The purpose of the arrangement was to have the third party cover the cost of the expense account but then receive reimbursement from other Ericsson subsidiaries in China. The arrangement with the third party also included an Ericsson subsidiary in China providing Letters of Guarantee to certain vendors, such as a luxury hotel and a travel agent, to guarantee that the Ericsson subsidiary would be responsible for any payments that the third party could not pay. In 2013, after Ericsson prohibited the use of third-party sales agents, the high-level Ericsson executive directed another high-level Ericsson executive and a high-level Ericsson AB executive to continue reimbursing the third-party through payments under false service agreements. In total, the DPA and Complaint found that Ericsson paid approximately $19.5 million to cover the expenses associated with the expense account, most of which related to travel for foreign officials in China. Those payments were then mischaracterized in Ericsson's consolidated books and records.

The second scheme, between 2013 and 2016, utilized sham contracts and payments to third-party service providers to allow Ericsson AB and Ericsson subsidiaries in China to continue making payments to third-party agents with strong connections to state-owned customers, in contravention of Ericsson policies and procedures. After Ericsson placed restrictions on third-party agents in 2013, Ericsson and Ericsson AB executives caused Ericsson's subsidiaries in China to enter into false contracts with pre-existing approved service providers, for purposes of passing along funds to the unapproved third-party agents. To avoid detection, the payments were processed manually using paper rather than through the electronic accounting system. The total amount paid under the scheme, according to the SEC and DOJ, was $31.5 million. Those payments were then improperly recorded in Ericsson's books and records.

Vietnam

According to the SEC and DOJ, from approximately 2011 to 2015, Ericsson entities maintained "off-the-books slush funds" with a consulting company in Vietnam, in violation of the FCPA's accounting provisions. The DOJ states that Ericsson, its agents, and its subsidiaries paid the company a total of $4.8 million, while the SEC states that the consultant was paid approximately $11.4 million. The scheme provided that the consulting company, with oversight from Ericsson subsidiaries Ericsson Malaysia, Ericsson Vietnam, and a high-level Ericsson AB executive, submitted invoices to Ericsson Malaysia and Ericsson Vietnam for services that were never performed. Ericsson Malaysia and Ericsson Vietnam paid those invoices and the funds were then transferred to third parties, including individuals identified as sub-agents for state-owned customers as well as third parties that would not pass due diligence requirements. The funds were also used to give customers cash gifts. Some of these payments were then recorded in Ericsson's consolidated books and records.

Indonesia

According to the DOJ and SEC, from 2012 to 2015, Ericsson's subsidiaries and agents violated the accounting provisions of the FCPA by making approximately $45 million in payments to a consulting company to create a series of slush funds that the consulting company used to make payments to third parties. The slush fund was managed by the consulting company with oversight from Ericsson Indonesia, a high-level Ericsson executive, and a high-level Ericsson AB executive. The payments to the consulting company were made pursuant to sham contracts between Ericsson Malaysia, Ericsson Indonesia, and the consulting company. Ericsson Indonesia employees were aware of the slush funds, used code names to conceal them, and mischaracterized them in Ericsson Indonesia's books. Ericsson Indonesia's books were consolidated into Ericsson's consolidated books and records.

Kuwait

According to the DOJ and SEC, Ericsson's agents violated the FCPA's accounting provisions while seeking a contract with a state-owned enterprise in Kuwait. In 2011, Ericsson and its agents were seeking a contract with a state-owned telecom company in Kuwait worth more than $182 million. While seeking that contract, an Ericsson AB employee was given inside information about the client's contract tender by an Ericsson AB consultant. In 2012, Ericsson AB was awarded the contract. Then, in 2013, the Ericsson AB consultant began requesting payment of $400,000 from the Ericsson AB employee and a high-level executive of an Ericsson subsidiary in the Middle East so that he could give payments to his "friends." After continued pressure from the consultant, an Ericsson employee provided the Ericsson AB branch in Qatar a draft consultancy contract between the Qatar branch and the consultant's company, stating, "I do not want anyone to think that I had anything to do with this just because I am now cleaning it up!" Shortly thereafter, the Ericsson AB office in Qatar entered into the consulting agreement with the consulting company. The consulting company then issued an invoice for $450,000 for services that were never performed, and the Ericsson AB branch in Qatar paid the invoice. The payment was later improperly recorded in Ericsson's books and records.

Saudi Arabia

The SEC detailed two sets of payments in Saudi Arabia (the DOJ did not address any conduct relating to Saudi Arabia) and categorized the conduct as violations of both the anti-bribery provisions and the accounting provisions of the FCPA. The first set of payments, according to the SEC, took place between 2012 and 2013, when Ericsson AB's branch in Saudi Arabia sought to secure contracts with a state-owned enterprise through false consulting agreements with two private individuals who were believed to have influence over the state-owned enterprise. The SEC alleges that employees of Ericsson and Ericsson AB ignored multiple red flags that should have indicated that the payments were going to foreign officials, including: (1) that the contracts for both consultants were identical; (2) that the first consultant had only one employee; (3) that the first consultant's only client was Ericsson AB; (4) that the first consultant's entity was formed a year after the consulting agreement with Ericsson AB was signed; and (5) that one of the second consultant's references was a senior official at a Saudi state-owned enterprise. Further, Ericsson AB conducted their due diligence a year after the agreements were signed and only did so because the due diligence was required before payments could be made. The SEC found that Ericsson AB's Saudi branch paid approximately $40 million to the two consultants and received nine contracts from the state-owned enterprise worth more than $700 million.

According to the SEC, the second set of payments took place between 2015 and 2017, when Ericsson AB's Saudi Arabia branch paid for the leisure travel of two Saudi state-owned enterprise employees to secure orders from a state-owned enterprise and then improperly recorded the amounts in their books and records. The leisure travel included tickets to the United States and France for the state-owned customer's employees and their families (with one trip to Los Angeles including seven members of an official's family). The SEC states that the Ericsson AB's Saudi branch generated at least $40.54 million of gross revenue from the customer.

Willful Failure to Implement and Maintain Sufficient Internal Accounting Controls

According to the DOJ and SEC, Ericsson, through its employees and agents, knowingly and willfully failed to implement and maintain sufficient internal accounting controls. In particular, the SEC and DOJ draw attention to high-level Ericsson officials who were in a position to oversee and implement the controls, knew that the internal accounting controls were insufficient to prevent corruption, and did not take any action. The SEC explained that Ericsson failed to implement controls, such as: (1) requiring employees to properly document and account for payments to agents and consultants; (2) requiring adequate due diligence on third-party agents and consultants; (3) requiring that a contract and due diligence be completed with a third party before services could be provided; (4) requiring that payments be commensurate with the services performed; (5) prohibiting certain compensation arrangement with third parties such as advance payments; and (6) establishing oversight procedures by personnel at Ericsson's headquarters to ensure that third parties were retained with appropriate controls.

DOJ gave Ericsson no voluntary disclosure credit. Ericsson received partial credit (15 percent) for its cooperation with the Fraud Section, which included conducting a thorough internal investigation and making regular factual presentations to the DOJ. According to the DOJ, Ericsson did not receive full 25 percent credit for cooperation and remediation because it did not disclose allegations of corruption with respect to two relevant matters and did not take adequate disciplinary actions against certain executives and employees. The DOJ notes that while Ericsson had inadequate controls and compliance program during the period of illicit conduct, Ericsson had committed to enhancing their controls and compliance program. However, because Ericsson had not fully implemented or tested its compliance program, Ericsson agreed to the imposition of an independent compliance monitor.

Noteworthy Aspects:

- Penalty Amount: Ericsson agreed to pay a total amount of $1.06 billion into the U.S. Treasury to resolve the issues with the DOJ and SEC. At the time of the announcement, the combined resolution was the third largest FCPA amount, behind the original $3.56 billion Odebrecht/Braskem resolutions in 2016 and the $1.78 billion in penalties, disgorgement, and prejudgment interest imposed on Petrobras as part of a 2018 global settlement. However, it is the largest overall when it is compared on the basis of the amount actually collected by the U.S. federal government (given that the majority of the Odebrecht, Braskem, and Petrobras penalty and disgorgement amounts were paid to the Brazilian government, a fund in the U.S. related to shareholder litigation for Petrobras, or other governments). Further, Ericsson's disgorgement (including prejudgment interest) of $540 million to the SEC is the FCPA's second largest disgorgement amount, behind only the disgorgement amount set forth in the 2018 Petrobras resolution. Again, however, the Ericsson disgorgement amount is the largest actually collected by the SEC in an FCPA resolution (because the SEC allowed Petrobras to offset amounts paid to a fund for Petrobras investors).

- Investigation in Sweden: In their December 6, 2019 press release, the DOJ thanked law enforcement authorities in Sweden for their cooperation with the DOJ's investigation. Then, on December 13, 2019, Swedish authorities announced that there was an open preliminary investigation of Ericsson at the National Anti-Corruption Unit in Sweden. It is reported that the spokesperson for Sweden's prosecution authority said that the investigation was opened in April in response to information that became public during the DOJ and SEC's investigations. Although this further emphasizes that anti-corruption enforcement is not limited to the U.S. agencies, it is noteworthy that the Swedish authorities appear to have opened their investigation years after the start of the U.S. investigations.

Individual Enforcement Actions

U.S. Reaches Settlement in 1MDB Forfeiture Case

As previously reported in our FCPA Autumn Review 2019, the DOJ announced a civil forfeiture settlement with Low Taek Jho (aka Jho Low), members of his family, and a group of entities on October 30, 2019. District Court Judge Dale Fischer entered the consent judgment of forfeiture on November 4.

The DOJ filed the initial forfeiture complaint in this matter on July 20, 2016 and the First Amended Complaint approximately one year later, on August 4, 2017. The government alleged that the assets were involved in a money laundering conspiracy spanning from 2009 through at least 2014. Low and his family allegedly misappropriated funds from 1Malaysia Development Berhad (1MDB), Malaysia's investment and development fund. The government further alleged that the misappropriated funds were used for extravagant purchases, including artwork, jewelry, luxury real estate, and the payment of gambling expenses.

The assets at issue allegedly account for a portion of the proceeds of the approximately $4.5 billion misappropriated from 1MDB. According to the government, the assets are worth approximately $700 million and, when combined with the disposition of related forfeiture cases, the settlement with Low and his family brings the total recovery of funds related to the 1MDB conspiracy to a total of more than $1 billion.

Three Former Unaoil Executives Pleaded Guilty for their Roles in Bribe Payments

On October 30, 2019, the DOJ announced that the Ahsani brothers Cyrus and Saman, respectively the former CEO and former Chief Operations Officer (COO) of a Monaco-based intermediary company, had earlier in 2019 pleaded guilty in connection with their roles in facilitating bribe payments to officials from countries including Algeria, Angola, Azerbaijan, the Democratic Republic of Congo, Iran, Iraq, Kazakhstan, Libya, and Syria. The press quickly identified the "Intermediary Company" as Unaoil, a company which is reported to have been involved in numerous ongoing or closed U.S. government investigations, including into Rolls-Royce, SBM Offshore, and TechnipFMC plc. The DOJ also announced that Steven Hugh Hunter, a former Business Development Director for Unaoil, had in 2018 pleaded guilty for his role in bribe payments in Libya. The announcement marked a dramatic turn for Unaoil and its executives. When allegations first rose against Unaoil, the company had denied wrongdoing and threatened legal action against the newspapers that first published the allegations of corruption.

Cyrus Allen Ahsani, the former CEO of Unaoil, and his brother, Saman Ahsani, the former COO, pleaded guilty on March 25, 2019 to conspiracy to violate the FCPA, according to the DOJ. An Information filed on March 4, 2019 in the United States District Court for the Southern District of Texas states that both former executives were non-U.S. citizens but acted as "agents" of an "issuer." Specifically, according to the Information, between 1999 and 2016, Cyrus Ahsani and Saman Ahsani acted on behalf of 25 companies, including Rolls Royce and SBM Offshore (as well as other companies whose names are not disclosed), conspired with others to pay bribes, laundered the proceeds of bribe payments, and caused false statements or destroyed or concealed evidence from U.S. authorities. In addition, the Information states that Cyrus Ahsani and Saman Ahsani conspired to rig bids and pay kickbacks to employees at certain of Unaoil's clients. For example, in Iraq, according to the Information, Cyrus Ahsani and Saman Ahsani beginning in or around January 2008, conspired to pay bribes to an Iraqi official "to help steer contract awards to" at least six of Unaoil's clients. The following year, Cyrus Ahsani and Saman Ahsani, with others, agreed to pay a monthly bribe to another Iraq government official in exchange for his agreement to provide confidential documents and steer contracts to certain of Unaoil's client companies. Cyrus Ahsani and Saman Ahsani are scheduled to be sentenced on April 20, 2020.

According to the unsealed Information from the United States District Court for the Southern Division of Texas, U.K. citizen Steven Hunter, a former Unaoil Business Development Director, joined a conspiracy in 2009 to pay bribes to government officials of certain state-owned and state-controlled oil and gas companies. The Information states that Hunter took a number of steps in furtherance of the conspiracy, including setting up a "secret, personal email account to use when transmitting confidential bidding and other information" when he understood that there was "a high probability that [Unaoil] paid bribes in order to receive such confidential bidding and other information." According to the Information, in May 2010, Hunter "agreed to bribe" a Libyan official in exchange for that official providing confidential bidding information and shortly thereafter used the secret email address he had provided to instruct a bribe payment. Hunter pleaded guilty on August 2, 2018 and is scheduled to be sentenced on March 13, 2020.

Long-Running Hoskins Trial Ends in Guilty Verdict

On November 7, 2019, a jury convicted Lawrence Hoskins of six substantive FCPA violations, three substantive money laundering violations, two conspiracy violations, and found him not guilty on one count of substantive money laundering for his role in a scheme to secure a $118 million contract in Indonesia for a Connecticut-based company and its consortium partner. The main question at trial was whether Hoskins, a former Senior Vice President at Alstom, S.A. (Alstom), a French electricity generation and rail transport company, was acting as an "agent" of Alstom's Connecticut, U.S.-based subsidiary, Alstom Power, Inc. (Alstom Power). The jury found that Hoskins acted as an agent of Alstom Power in furtherance of the scheme to bribe Indonesian officials and convicted him of 11 of the 12 FCPA and money laundering counts. The jury's verdict closes a chapter of the long-running case which began when the United States charged Hoskins on July 30, 2013.

In December 2014, Alstom and three of its subsidiaries, including Alstom Power, resolved the DOJ's investigation of millions of dollars in bribes that the entities allegedly paid to government officials in Indonesia and other countries. We discussed the Alstom-related cases, including aspects of Hoskins, in our FCPA Reviews in Autumn 2013, Winter 2015, Summer 2015, Autumn 2015, Spring 2016, Spring 2017, Autumn 2018, and Spring 2019. In the more than six years between the first charges being levied and the jury's verdict, Hoskins challenged whether the DOJ could charge him for conspiracy to violate the FCPA if he had not taken any actions in the United States or was otherwise not directly subject to the FCPA as an officer or employee of an issuer or a domestic concern. The Second Circuit Court of Appeals agreed with Hoskins, thereby limiting the DOJ's available avenues for prosecution.

Consequently, the United States' second amended third superseding indictment charged Hoskins as an agent of Alstom Power, a U.S. company and, therefore, a "domestic concern" for the purposes of the FCPA. In respect to the "agent" concept, the FCPA specifically identifies "any officer, director, employee, or agent" of domestic concerns as being within the statute's jurisdiction. While agency is a well-established criminal law concept, its application is heavily fact-specific. Hoskins challenged the government to prove that he was an agent of a domestic concern, arguing that he was not a U.S. citizen or national, was not employed by Alstom's U.S. subsidiary, Alstom Power, had no formal agreement with the U.S. company, had not traveled to the U.S. during the relevant period, and had only supported, but was not directed by, Frédéric Pierucci, an Alstom Power executive whom the government alleged was a U.S. resident and whose responsibilities included "oversight of Alstom Power U.S.'s efforts to obtain contracts … around the world, including obtaining and retaining the contract … in Indonesia." The government reportedly argued that witness testimony and discussions in emails and phone calls were sufficient to show the existence of an agency relationship between Alstom Power and Hoskins.

After briefings and oral arguments, the trial judge instructed the jury that the government had to prove that Alstom Power controlled Hoskins's conduct and had authorized him to act on its behalf. Specifically, Judge Arterton instructed the jury that agency requires a "manifestation by [Alstom Power] that [Hoskins] will act for it," Hoskins agreed to act for Alstom Power, and "an understanding that [Alstom Power] is in control of [Hoskins'] acts or services." In respect to the element of control, Judge Arterton noted Alstom Power need not control Hoskins "at every moment," its control might be "ineffective," and agency agreement needn't be memorialized in a "formal agreement;" an agreement "may be inferred circumstantially from the words and actions of the parties involved." The jury's guilty verdict on each FCPA count indicates that it deemed Hoskins an agent of Alstom Power in relation to the bribery scheme.

As the concept of agency is well-established and the application heavily dependent on the specific facts of the case, the impact of the Hoskins jury instruction may be of limited use to the FCPA bar or business community. In addition, during the trial Judge Arterton reportedly suggested that complicated questions of agency would be best argued on appeal. At the end of the trial, Hoskins moved for acquittal or a new trial and he may yet appeal. As such, the case has not yet concluded, and the agency question may be addressed by the appellate courts.

Shortly after the jury's verdict Assistant Attorney General Brian A. Benczkowski made comments at a conference that may be more relevant for the business community. Benczkowski said, "I want to be clear today that the Department is not looking to stretch the bounds of agency principles beyond recognition, or even push the FCPA statute towards its outer edges."

Former Och-Ziff Executive Sentenced to Three Months in Prison

On November 19, 2019, a federal judge in the Eastern District of New York sentenced Michael Leslie Cohen to three months in prison and issued a $250,000 fine. Cohen, a former executive at Och-Ziff, pleaded guilty to making a false statement to the FBI during a 2013 investigation into the hedge fund.

During sentencing, U.S. District Judge Nicholas G. Garaufis rejected Cohen's request for probation and stated that prison time was necessary to send a broader message discouraging dishonesty during investigations. Cohen was investigated after recommending an investment for an African mining company without disclosing that one of the sellers owed him millions of dollars on a delinquent $18 million personal loan. The loan was made to finance the acquisition of a yacht. After the SEC began investigating Och-Ziff in 2011, Cohen tried to conceal the conflict of interest by conspiring with others to cover up facts surrounding the transaction.

In 2017, the DOJ filed a 10-count indictment against Mr. Cohen accusing him of participating in a scheme to defraud a large charitable foundation that was an Och-Ziff client. The SEC also filed civil charges against Cohen related to the bribery scheme, but Judge Garaufis dismissed them in July 2018, saying that the government failed to bring them soon enough.

Former President of Transport Logistics International, Inc. Found Guilty of Violating the Foreign Corrupt Practices Act

On November 22, 2019, a federal jury in the District of Maryland convicted Mark Lambert, former president of Transport Logistics International, Inc. (TLI), for conspiring to violate and violating the FCPA and conspiring to commit and committing wire fraud. The jury acquitted Lambert of three counts of violating the FCPA and of money laundering. TLI is a Maryland-based transportation company that provides services for transportation of nuclear materials to consumers within the United States and abroad.

According to the DOJ press release, throughout a three-week trial, evidence indicated that Lambert engaged in a scheme to bribe Vadim Mikerin, a Russian official at JSC Techsnabexport (TENEX), a subsidiary of Russia's State Atomic Energy Corporation. TENEX is "the sole supplier and exporter of uranium and uranium enrichment services from Russia to nuclear power companies worldwide." Lambert conspired with others at TLI to make bribes and kickback payments to Mikerin in exchange for securing contracts with TENEX. At Mikerin's direction, the payments were made using offshore bank accounts and shell companies in Latvia, Cyprus, and Switzerland. To conceal the payments, Lambert and his co-conspirators "caused" the generation and use of fake invoices purportedly from TENEX to TLI. Lambert faces a maximum of five years in prison for the conspiracy charges, a maximum of 20 years in prison for each of two counts of wire fraud, and a maximum of five years in prison for each of four counts of violating the FCPA.

As we previously reported, in March 2018, TLI agreed to pay a $2 million criminal penalty to settle charges related to this scheme. Earlier, in August 2015, Mikerin pleaded guilty to conspiracy to commit money laundering involving violations of the FCPA; he was sentenced to four years in prison. Similarly, in June 2015, TLI co-president Daren Condrey pleaded guilty to conspiracy to violate the FCPA and commit wire fraud. Condrey testified at Lambert's trial and awaits sentencing.

American/Ecuadorian Businessman Sentenced to 42 Months for Role in PetroEcuador Bribery Scandal

In December 2019, businessman Frank Roberto Chatburn Ripalda (Chatburn) was sentenced to 42 months in prison after pleading guilty to conspiracy to commit money laundering in connection with the PetroEcuador bribery scandal. Chatburn's sentence was less than half of the low end of the Guideline range of 87-108 months, and less than Chatburn's lawyers had argued for in his sentencing memo.

Chatburn was indicted along with Jose Larrea in April 2018 with conspiracy to violate the FCPA, violation of the FCPA, conspiracy to commit money laundering, and money laundering, stemming from bribe payments caused by Chatburn in order to obtain or retain contracts from PetroEcuador. Chatburn pleaded guilty in October 2019 to one count of conspiracy to commit money laundering. In his guilty plea, Chatburn admitted that between 2013 and 2015, he conspired to make bribe payments of at least $2,970,080 for the benefit of PetroEcuador officials to obtain and retain contracts for a company owned by Argentina businessman Ramiro Andres Luque Flores, who was also charged and pleaded guilty in October 2019.

The government argued for a sentence within the guideline range of 87-108 months, arguing that Chatburn was "central in two separate and sophisticated conspiracies to launder nearly $3.5 million dollars in bribes on behalf of both bribe-paying contractors and corrupt government officials." Chatburn requested a variant sentence below 53 months, which is the sentencing imposed on PetroEcuador official Marcolo Reyes. Chatburn's lawyers argued that Chatburn should not receive a sentence longer than the longest sentence imposed in the PetroEcuador scandal to date.

Thus far, the government has publicly charged six individuals for paying bribes, two individuals for receiving bribes, and two individuals for facilitating payments. Chatburn was the ninth to plead guilty. He received a sentence in the middle of what others involved in the scandal have previously received, but his sentence was longer than all of the other bribe payors sentenced to date. Facilitator Jose Larrea was sentenced to 27 months and bribe payor Jose Luis de la Paz was sentenced to 36 months, but bribe recipients Arturo Escobar Dominguez and Marcelo Reyes Lopez were sentenced to 48 months and 53 months respectively. The U.S. government has not yet publicly sought to bring an enforcement action against any corporation involved in the scandal.

Boustani Acquitted by Jury in Mozambique "Tuna Bond" Scandal

On December 2, 2019, a jury in the Eastern District of New York acquitted Jean Boustani, an executive from the Abu Dhabi-based maritime conglomerate Privinvest Group, of wire fraud conspiracy, money laundering conspiracy, and securities fraud conspiracy charges related to allegations that he defrauded U.S. investors involving US$2 billion in loans backed by the Mozambican government. As part of the alleged scheme, Boustani and others allegedly diverted approximately US$200 million in loan proceeds to pay kickbacks and bribes to Privinvest executives, bankers, and Mozambican officials and their agents to guarantee various shipyard, tuna fishing, and coastline surveillance projects.

In addition to Boustani, the individuals charged in connection with the scheme include: Privinvest's CFO (Najib Allam), three former Credit Suisse bankers (Andrew Pearse, Surjan Singh, and Detelina Subeva), and three individuals allegedly working for or on behalf of the Mozambican government (Manuel Chang, Mozambique's former finance minister; Antonio do Rosario, a former State Information and Security Service official; and Teofilo Nhangumele, a purported agent of the Office of the President of Mozambique). According to an indictment filed in the United States Eastern District of New York on December 19, 2018, only the three former Credit Suisse employees faced charges of conspiracy to violate the FCPA as "employees" and "agents" of a U.S. issuer (i.e., Credit Suisse). All three have since pleaded guilty to non-FCPA charges (Pearse pleaded guilty to one count of wire fraud conspiracy and Singh and Subeva each pleaded guilty to one count of money laundering conspiracy). The remaining four defendants are not in U.S. custody, including former Minister Chang, who has been fighting extradition from South Africa to the United States since he was arrested at Tambo International Airport in Johannesburg in December 2018.

The Alleged Scheme

According to the indictment, from approximately 2013 to 2016, three Mozambican state-owned enterprises (SOEs)—a coastal surveillance company Proindicus S.A. (Proindicus), a tuna fishing company Empresa Moçambicana de Atum, S.A. (EMATUM), and shipyard builder and maintenance company Mozambique Asset Management (MAM)—borrowed more than US$2 billion through loans guaranteed by the Mozambican government. Two investment banks identified as "Investment Bank 1" (thought to be Credit Suisse, based on news reports) and "Investment Bank 2" (thought to be VTB, based on news reports) arranged the loans and sold them to investors worldwide, including in the United States. According to the indictment, throughout the course of the transactions, the defendants, and others, conspired to defraud investors and potential investors regarding "(i) the use of loan proceeds, (ii) bribe and kickback payments to Mozambican government officials and bankers, (iii) the amount and maturity dates of debt owed by Mozambique, and (iv) Mozambique's ability and intention to pay back investors."

According to the indictment, Abu Dhabi-based Privinvest signed contracts with Proindicus, EMATUM, and MAM to provide equipment and services to complete the respective maritime projects and received nearly all US$2 billion of the borrowed money directly from Investment Banks 1 and 2. Instead of financing maritime projects in Mozambique, it is alleged that only a portion of the loan proceeds were applied to the maritime projects and that the defendants and others "created the maritime projects as fronts to raise money to enrich themselves and intentionally diverted portions of the loan proceeds to pay at least [US$] 200 million in bribes and kickbacks to themselves, Mozambican government officials, and others."

Proindicus, EMATUM, and MAM ultimately defaulted on the loans. In addition, the Mozambican government allegedly failed to inform the International Monetary Fund (IMF) at the time of the transactions and afterwards. Moreover, in the case of EMATUM, the government took steps to hide the loans from the IMF. This ultimately contributed to the IMF's 2016 decision to halt financial assistance to Mozambique, which, according to the indictment, "caused a severe financial crisis in Mozambique."

Boustani's Defense Strategy

District Court Judge William F. Kuntz II denied pre-trial attempts by defense counsel to dismiss the indictment based largely on jurisdictional grounds. However, trial transcripts show that Boustani's counsel repeatedly emphasized the lack of connections between Boustani's conduct and the Eastern District of New York. For example, in closing arguments, defense counsel summarized witness testimony from a JP Morgan employee who testified that 98 percent of wire transfers are processed electronically with no human interaction and that even where human interaction is needed, the relevant employees do not sit in New York, but instead in Florida, India, and the Philippines. In addition, defense counsel recalled witness testimony that although JPMorgan and Privinvest's bank in Abu Dhabi did have a correspondent banking relationship, the servers involved in processing the wire transfers were not located in the state of New York. Counsel for Boustani also underscored Boustani's lack of interaction with U.S. investors.

Notably, Boustani, who took the stand on his own behalf, testified that he arranged to pay an agent and Pearse millions of dollars in "success fees" for access to Mozambican officials to win business for Privinvest, but insisted that such payments were not bribes or kickbacks.

Defense counsel's efforts apparently resonated with the jury, which acquitted Boustani of all charges. According to post-verdict reporting by Bloomberg, "[t]he verdict came down to the venue, three jurors, including the foreman, said in interviews afterward. All three, who declined to give their names, said the panel didn't see how federal prosecutors in Brooklyn had the authority to prosecute crimes that hadn't occurred in their jurisdiction."

Policy and Litigation Developments

DOJ Refines FCPA Corporate Enforcement Policy Cooperation Requirements

In November 2019, the DOJ refined the cooperation requirements of the FCPA Corporate Enforcement Policy (the Policy). The changes to the Policy relate to companies' voluntary disclosures of potential FCPA violations to the DOJ. The first change relates to one of the three requirements a company must meet to receive credit for voluntary self-disclosure of wrongdoing. The revision clarifies that a company must disclose the relevant facts known to it at the time of disclosure and changes the standard "violation of law" to "misconduct." The second revision simplifies a prior requirement by stating that to receive full cooperation credit, a company that is aware of relevant evidence not in the company's possession must identify that evidence to the DOJ. The third change clarifies that the "presumption of declination" applies where a company discovers misconduct "by the merged or acquired entity," thereby encouraging companies to disclose conduct discovered after a merger and to assure that the acquirer will not face successor liability. Apart from acknowledging practical realities of investigating and bringing enforcement actions against companies, the changes aim at providing more transparency and greater consistency and flexibility related to DOJ's exercise of prosecutorial discretion.

Supreme Court Agrees to Hear SEC Disgorgement Case

In another important development, the Supreme Court announced on November 1, 2019 that it would hear the case of Liu v. SEC, which challenges the authority of the SEC to seek disgorgement in civil injunctive actions in federal court under the federal securities laws. The case involves a couple, Charles Liu and his wife Xin Wang, who were accused of defrauding Chinese investors seeking U.S. visas. The Supreme Court's decision to grant a writ of certiorari to Liu v. SEC represents another serious challenge to the SEC's disgorgement authority, following the 2017 case of Kokesh v. SEC, in which the Court ruled that SEC's disgorgement remedy constitutes a "penalty" and as such is subject to the five-year statute of limitations in 28 U.S.C. § 2462. While the ruling in Kokesh made it clear that the SEC cannot seek disgorgement of ill-gotten gains older than five years, the case left unanswered the broader question of whether the SEC had the authority to seek disgorgement in the first place when in federal court. (Disgorgement is a statutorily authorized remedy for administrative enforcement actions.) Depending on how the Supreme Court answers this question in Liu v. SEC will have a significant impact on SEC's enforcement powers and ability to seek equitable relief that may amount to billions of dollars per year.

Possible SEC Use of FCPA Accounting Provisions to Investigate Potential Money Laundering Violations