FCPA Spring Review 2022

International Alert

Introduction

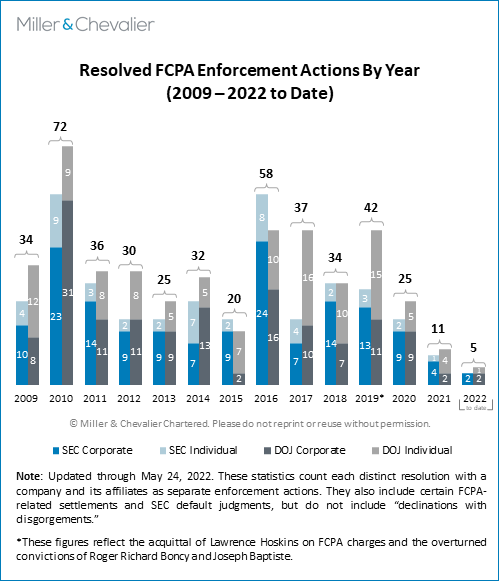

The pace of corporate Foreign Corrupt Practices Act (FCPA) resolutions continues to be slow, but the first quarter of 2022 included other notable anti-corruption developments, including actions against individuals, a new U.S. Department of Justice (DOJ) Opinion Procedure Release (OPR), and new decisions in the courts on questions of fora and privilege.

Corporate Enforcement Actions

While the DOJ and Securities and Exchange Commission (SEC) continued to assert an active enforcement agenda (for example, in late January stating that a "very robust pipeline" of cases exists), the agencies announced only one FCPA-related corporate enforcement action during first quarter of 2022: an SEC disposition involving South Korean telecommunications company KT Corporation (KT). The larger combined dispositions involving medical waste management company Stericycle previewed in Q1 and formally finalized and announced in April 2022, as well as the just-announced major dispositions with Glencore, bring the year-to-date count to only three corporate actions, which is well below the average public enforcement pace in the medium-to-long term.

Regarding ongoing enforcement matters, MTS announced this March a voluntary one-year extension of its three-year monitorship to September 2023. This announcement follows a November 2021 public disclosure by MTS of potential issues in Armenia. At the time, MTS stated: "certain transactions were identified relating to the company's subsidiary in Armenia, and such transactions were disclosed to the DOJ and SEC."

Enforcement Actions Against Individuals

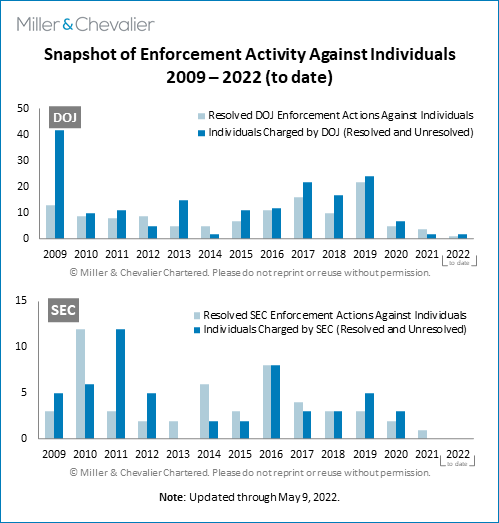

The DOJ announced two bribery-related guilty pleas in the first quarter of 2022 and two FCPA-related indictments. The SEC did not make any public announcements related to individual actions. This pace is consistent with the slower pace of such cases in 2021 and is well behind the pace that marked recent higher volume years such as from 2017 to2019. The range of cases in this quarter does illustrate that the DOJ is continuing to use all the legal tools at its disposal to bring criminal charges against different types of corrupt actors, from company executives to foreign officials who allegedly received bribes. This focus on both the supply and demand side of the bribery equation is consistent with the current administration's anti-corruption National Security Strategy, which in part promised more effort to act against bribe recipients, who are not covered by the FCPA.

On April 8, 2022, the DOJ obtained a significant conviction in a jury trial – former Goldman Sachs managing director Roger Ng was convicted of conspiring to commit bribery, to circumvent internal accounting controls, and to commit money laundering in relation to the long-running investigation of Malaysia's government-owned investment fund, 1Malaysia Development Berhad (1MDB). Goldman Sachs entered into a deferred prosecution agreement (DPA) with the DOJ and related dispositions with other authorities in connection with the firm's 1MDB activities in October 2020. We will cover the verdict and a related judicial memorandum that provides a gloss on the FCPA's accounting provisions in our next issue.

Declinations and Other Indicia of Enforcement Trends

Further evidence of continuing enforcement efforts came with DOJ's formal declination issued on March 18, 2022, related to its investigation of Jardine Lloyd Thompson Group Holding Ltd. (JLT), a British-based multinational insurance corporation. The JLT declination is the first under the FCPA Corporate Enforcement Policy in almost two years, since the DOJ announced its decision to decline prosecution of World Acceptance Corporation in August 2020. JLT is now owned by Marsh & McLennan, which entered into a related settlement in Colombia for another former JLT entity. The U.K. Serious Fraud Office (SFO) is expected to finalize a resolution for the same conduct in the future, and the DOJ's declination letter explicitly states that the $29 million disgorgement required by the DOJ's declination can be credited to the future SFO resolution.

In February, Cisco announced the DOJ and SEC were not taking action against the company following an investigation of allegations of a "self-enrichment scheme" in China that also appeared to involve payments to officials by third parties.

Regulatory/Policy Actions

As noted, in January, the DOJ issued a rare FCPA OPR, the first since 2020 and only the second since 2014. The OPR reconfirmed that companies making potentially unlawful payments to foreign officials to avoid imminent threats to the safety of company personnel do not violate key elements of the FCPA's anti-bribery provisions – an enforcement position that is reflected in many companies' existing compliance policies.

In March, Assistant Attorney General Kenneth A. Polite Jr. stated that "in order to further empower Chief Compliance Officers," he is asking his policy team to review different proposals for Chief Compliance Officer Certifications, whether at the end of the term of a DPA (to certify the compliance program meets the design and effectiveness standards set in the agreement) or on a regular basis during an agreement (for example, if the company is expected to report annually to the DOJ in lieu of a monitorship). Polite has continued to discuss the initiative more recently. These proposals could significantly alter the role of the Chief Compliance Officer in such instances, though some commentators have raised concerns about potential unintended consequences.

In late February, the DOJ announced that it was ending its China Initiative, which had been in place since 2018 and had an FCPA-related component. The initiative had raised questions regarding effectiveness, potential bias, and a chilling effect on free speech for academics who were one of the key focuses of the initiative. A new, broader "Strategy for Countering Nation-State Threats" will replace the initiative.

U.S. Court Decisions

The first quarter of 2022 saw the issuance of several court rulings of potential interest to companies. First, in January, a federal court in New York dismissed a suit brought against Misonex by a Chinese distributor that Misonex had terminated over corruption concerns. While there remain questions regarding the quantum of evidence needed by companies of potential improper behavior to support such a basis for termination, the holding is useful precedent supporting corporate efforts to protect companies from liability for the actions of third parties.

In other U.S. court actions, two federal appellate courts affirmed judgments against a Mexican state agency dismissing the agency's separate civil suits against two U.S. companies (Zimmer Biomet and Stryker) for alleged harm caused by corrupt payments to Mexican officials by those companies. Both rulings affirmed that the doctrine of forum non conveniens can apply to such suits, even though the UN Convention Against Corruption (UNCAC) – to which the United States is a signatory – contains a requirement (in Article 53) that state parties allow other state party actors to bring civil actions in domestic courts for monetary damages or similar compensation resulting from activities that violate UNCAC standards. In both cases, the courts note that the corporate defendants had agreed to submit themselves to the jurisdiction of Mexican authorities and courts. Thus, while the rulings limit the ability of foreign state agencies to sue in U.S. federal courts, they do not necessarily preclude success by plaintiffs in different factual circumstances.

On February 1, 2022 (and in a follow-up "clarification" Order on April 27, 2022), a federal district court in New Jersey ruled that Cognizant Technology, which entered into FCPA-related dispositions (including a declination with the DOJ under the FCPA Corporate Enforcement Policy) in February 2019, had created a significant subject matter waiver of attorney-client privilege and work product protection when the company shared information from an internal investigation with the DOJ. The ruling had the effect of allowing former Cognizant executives to access this information in their own trials. This decision is the most recent reminder that companies' actions to qualify for a DOJ determination of full cooperation under the Corporate Enforcement Policy can trigger claims by other parties towards otherwise privileged and protected information given to the DOJ.

Also, at the end of the quarter, the U.S. Court of Appeals for the DC Circuit rejected an appeal by two whistleblowers for awards related to the 2016 resolution with Novartis. The whistleblowers had worked at competitors of Novartis and had reported information about violations at their own company, both to the SEC and to journalists. They claimed that this information led Novartis to open its own investigation and ultimately the resolution with the SEC. The SEC had denied the awards, asserting that the information provided to the SEC did not relate to Novartis because it related to other investigations. Ultimately, the appeals court deferred to the SEC.

International Developments

In early March 2022, the French Anti-Corruption Agency (AFA) and National Financial Prosecutor's Office (PNF) published draft guidance for certain companies subject to Sapin II regarding the conduct of internal corruption investigations. The draft guidance is designed to provide official guideposts as to the implementation of internal corruption investigations at various stages, including underlying triggers, post-investigative remediation, and regulatory cooperation. Unsurprisingly, the guidance emphasizes disclosure to and cooperation with French judicial authorities throughout the process.

In the United Kingdom, the SFO has suffered two recent setbacks in attempts to prosecute individuals for corruption-related defenses. In March, a London appellate court overturned the February 2021 conviction of a former SBM Offshore executive, Paul Bond, when the court determined that the SFO failed to provide key relevant evidence to the defendant. In December 2021, an appellate court quashed the conviction of a former Unaoil manager for the same reason. These results have led to questions about the SFO's capabilities and have been the subject of parliamentary inquiry.

The SFO and the government of Nigeria signed a Memorandum of Understanding (MOU) in February under which £200,000 would be transferred to the Nigerian government for use in three different infrastructure projects. The MOU was concluded in connection with the SFO's 2021 DPA involving Amec Foster Wheeler. According to the SFO press release, the Nigerian government had suffered direct losses in tax revenue through the corrupt schemes detailed in the DPA.

Our New Format

After 15 years of publishing the FCPA Review, we are slightly adjusting our format to make the Review more accessible. Our aim is to continue to provide summaries of and insights into the most relevant FCPA and international anti-corruption happenings each quarter, however, we understand that not everyone reads through all 40+ pages of information we usually publish. Therefore, while we will continue to have the same introduction and charts surveying the developments from the prior quarter, we will now provide the detailed case-specific information more concisely. In addition, we have created slides to highlight the key takeaways that our in-house friends can use for training purposes. We will also hold a one-hour webinar each quarter for compliance professionals who would prefer to receive the FCPA Review contents that way. If you would like to receive a copy of the slides or join the webinar, please email us.

We welcome feedback on the new format and approach – both positive and negative. Our goal is to help compliance professionals understand and disseminate information on key new developments in the anti-corruption space efficiently.

Corporate Enforcement Actions

South Korean Telecom Giant KT Corporation Settles FCPA Charges with SEC

South Korean-based telecommunications company KT Corporation agreed to pay $6.3 million (including $2.8 million in disgorgement and pre-judgment interest) to settle civil charges that the company violated FCPA books and records and internal controls provisions by providing improper payments to Vietnamese and South Korean government officials. The SEC alleged that KT had violated the books and records and internal accounting controls provisions of the Securities Exchange Act of 1934 to allow certain KT executives to accumulate "slush funds" through various schemes. In turn, KT executives used the funds for gifts and illegal political contributions to South Korean officials who had influence over the telecommunications sector. KT also agreed to report to the SEC for two years regarding the ongoing state of the company's remediation and compliance upgrade efforts and to report during that two-year period to the SEC "credible evidence…that questionable or corrupt payments" may have been offered or given by the company.

There is no parallel DOJ resolution, but the SEC press release noted that, "[i]In November 2021, South Korean authorities indicted KT Corp. and 14 executives for criminal violations related to illegal political contributions from the slush funds."

According to the SEC documents, beginning in 2009, KT executives approved inflated bonuses for members of the executive team, portions of which were then returned to a then-KT executive officer, who allegedly used the $1 million as a slush fund, some of which was stored in his personal bank account. The KT executive officer used these funds for gifts to government officials with responsibility for overseeing sectors of industry in which KT was a participant. The documents state that KT did not maintain records of these gifts and booked the costs as executive bonuses, even though the ultimate recipients of the cash were government officials.

In 2013, South Korean media reports about the inflated bonuses led to the resignation of the involved executive officer, against whom criminal charges were filed by Korean authorities in 2014. The SEC documents also state, however, from 2014 through 2017, KT employees "devised a new method to continue generating a slush fund" by purchasing gift cards, which were then converted to cash that was distributed to various KT employees with the understanding that the cash was to be passed along to various government officials, mostly to lawmakers on telecommunications committees. The payments, which the SEC states were made in amounts up to $12,500, were internally recorded as "research and analysis" or "entertainment" – and totaled around $1.3 million.

Separately, the SEC documents state that in 2015 and 2016, KT made payments of over $1.6 million to three organizations at the request of high-level South Korean government officials. The SEC alleges that the relevant organizations had been established by "close associates" of the government officials and had not yet been officially registered at the time that the donations were requested. The documents note that KT made no effort to vet either of the organizations or to determine whether the payments were being used for legitimate charitable purposes, which the SEC asserts violated the internal controls requirements.

In addition, the SEC documents also assert that KT entered into agreements with a construction company to make payments to a Vietnamese official who selected KT for a government contract. KT officials also directed payments to be made to Vietnamese public officials to "speed up the performance of their duties" and process an advance payment on a government contract that had stalled.

KT's misconduct in Vietnam also included the hiring of a local agent, who received a portion of the contract bid, which was later passed along to a government official who selected the contract winner. KT purposefully hired the agent with knowledge of the arrangement. KT also hired a subcontractor, whose sole responsibility was to interface with and make payments to the agent in an attempt to distance KT from the illegality and conceal the agent payments from KT's compliance program. KT ultimately paid nearly $1 million to the agent for the purposes of bribing a public official.

Key Takeaways:

- Long-Term, Adaptive Payment Scheme Managed by Senior Executives: KT's misconduct stretched over an extended period (2009-2017) and involved senior executives in a wide array of schemes, which makes it a great case for training discussions. The schemes included a senior executive officer from 2009-2013, whom the SEC states personally operated a slush fund. The SEC Order notes that, after criminal charges against the ex-senior executive related to the funds were filed in South Korea in 2014, KT personnel found new methods to fund illicit payments (via gift cards) rather than remediating the underlying conduct.

- No Self-Disclosure, But Cooperation with SEC: KT did not disclose its misconduct to the SEC when South Korean media first published reports of KT corrupt acts in 2013. The SEC noted that lack of self-reporting in its discussion of the matter but did not specify any impact on the settlement terms. The SEC Order did note KT's cooperation and remediation efforts.

- Criminal Charges Brought by South Korean Authorities against Company and Individual Executives: While there is no public evidence of DOJ action against KT related to these issues, the company and 14 executives were indicted by South Korean authorities in November 2021 for the same conduct. The action by the South Korean authorities, as well as potential issues related to jurisdiction and relevant limitations periods, could explain the lack of DOJ action.

Individual Enforcement Actions

Two Individuals Plead Guilty and Three Others Charged in Bribery-Related Schemes

In the first quarter of 2022, two individuals pleaded guilty and three individuals were charged in connection with four separate bribery-related schemes. The charges target both the recipients and payers of bribes, and, of note, only one individual – Charles Hunter Hobson – faces actual FCPA charges. In a trend continuing from last year, the DOJ has taken the lead over the SEC in charging individuals, and the SEC has not announced any actions related to the cases discussed.

Charges

On March 8, 2022, the DOJ announced that Daniel D'Andrea Golindano (D'Andrea) and Luis Javier Sanchez Rangel (Sanchez), two former Venezuelan prosecutors, had been charged with conspiracy to commit money laundering and engaging in monetary transactions involving criminally derived property. In or around 2017, according to the indictment, D'Andrea and Sanchez received over $1 million in bribes in exchange for not pursuing criminal charges against individuals identified as Contractor 1 and Venezuelan Official 1, among others. At the time, D'Andrea and Sanchez were investigating Contractor 1, Venezuelan Official 1, and others for corruption involving the award of contracts with subsidiaries of Petróleos de Venezuela, S.A. (PDVSA), the Venezuelan state-owned and state-controlled oil company. The bribes were paid after D'Andrea and a co-conspirator allegedly created false invoices that sought payment from Contractor 1, allegedly for approximately $1 million worth of equipment. Contractor 1 then paid approximately $1 million to an account in Florida for the benefit of D'Andrea and Sanchez, and as a result, the Venezuelan Attorney General's Office did not pursue charges against Contractor 1 and others in connection with the PDVSA corruption scheme. According to the DOJ's press release, D'Andrea and Sanchez both remain at large (likely in Venezuela).

Most recently, on March 31, 2022, the DOJ announced that Charles Hunter Hobson, a former Corsa Coal Corporation executive, was arrested and charged for his alleged involvement in a bribery scheme between 2016 and 2020. According to the indictment, Hobson was involved in a scheme to pay bribes to officials connected with Al Nasr Company for Coke and Chemicals, an Egyptian state-owned and state-controlled company, in order to secure approximately $143 million in coal contracts and information about competing bids. To execute the scheme, Corsa Coal executives paid over $4.8 million in commissions to a third-party sales agent with the intent that the commission payments be used to pay bribes to Egyptian officials. It is also alleged that Hobson conspired to receive a portion of the commission payments as kickbacks. The seven-count indictment includes charges for conspiracy to violate the FCPA, violating the FCPA's anti-bribery provisions, conspiracy to launder money, money laundering, and conspiracy to commit wire fraud. Previously on November 17, 2021, Frederick Cushmore, Jr., another Corsa Coal executive, pleaded guilty to one count of conspiracy to violate the FCPA's anti-bribery provisions in connection with this same scheme (see FCPA Winter Review 2022).

Pleas

On February 2, 2022, John Robert Luzuriaga Aguinaga (Luzuriaga) pleaded guilty to one count of conspiracy to commit money laundering in connection with the bribery of officials from Ecuador's public police pension fund, Instituto de Seguridad Social de la Policía Nacional (ISSPOL). The DOJ previously announced the charge against Luzuriaga, along with an identical charge against Jorge Cherrez Miño (Cherrez), as discussed in the FCPA Spring Review 2021. Luzuriaga, the ISSPOL Risk Director and a member of ISSPOL's Investment Committee, admitted to receiving approximately $1.4 million in bribe payments from Cherrez, the manager, president, and director of multiple investment fund companies, and from Cherrez's entities. Some payments were made by check directly payable to Luzuriaga, others were paid to Luzuriaga's relatives, and some funds were deposited into the U.S. bank account of one of Cherrez's companies for which Luzuriaga held a debit card. According to the public documents, in exchange for the bribes, Luzuriaga and other ISSPOL officials approved investment contracts for Cherrez's companies. These contracts included a swap transaction where ISSPOL provided one of Cherrez's companies with approximately $327 million in Ecuadorian bonds. Cherrez invested some of the funds for his own benefit and ultimately obtained $65 million on the transaction. ISSPOL also entered into bond repurchase transactions with another of Cherrez's companies, on which Cherrez later defaulted. Luzuriaga is currently scheduled to be sentenced on June 16, 2022.

On February 4, 2022, the DOJ announced that Margaret Cole pleaded guilty to conspiracy to defraud the U.S. and making a false statement to a Polish authority in connection with an adoption scheme. Cole admitted to conspiring to deceive U.S. and Polish authorities to conceal the transfer of a Polish child to relatives of her co-conspirator, Debra Parris, who were not eligible to adopt the child, after the intended adoptive parents determined they did not wish to proceed with the adoption. Cole was sentenced on May 19, 2022 to three months in prison and 12 months of home confinement; she was also fined $7,500. Debra Parris previously pleaded guilty to charges related to her role in the transfer as well as her participation in a related scheme that involved paying bribes to Ugandan officials to secure adoptions, as discussed in our FCPA Winter Review 2022. Parris is scheduled to be sentenced on July 7, 2022. Two other individuals, Robin Longoria and Dorah Mirembe, were also charged in connection with the Uganda scheme. Longoria pleaded guilty in 2019 and Mirembe is still at large.

Declinations and Other Indicia of Enforcement Trends

DOJ Issues Declination to Jardine Lloyd Thompson Group Holdings Ltd.

On March 18, 2022, the DOJ announced it had declined to prosecute Jardine Lloyd Thompson Group Holding Ltd. (JLT, formerly Jardine Lloyd Thompson Group plc), a British multinational insurance corporation headquartered in London for violations of the anti-bribery provisions of the FCPA. Marsh & McLennan Companies, Inc. (Marsh & McLennan) acquired JLT on April 1, 2019, and as a successor in interest to JLT, agreed to the facts and conditions stipulated in the declination letter, as well as to paying the disgorgement and continuing to cooperate with the DOJ. The DOJ refers to 15 USC §§ 78dd-1 et seq., pointing to how JLT was acquired by Marsh & McLennan (a U.S. publicly listed company) in 2019, but provides no further explicit analysis on jurisdiction.

According to the declination letter, the DOJ declined to prosecute despite evidence that a JLT employee and JLT agents paid approximately $3.157 million in bribes to Ecuadorian government officials through a Florida-based third party intermediary between 2014-2016. The letter states that approximately $1.2 million of the payments were laundered through bank accounts in the U.S. The bribes were paid to obtain and retain contracts with surety company Seguros Sucre, an Ecuadorian state-owned and controlled entity.

The DOJ declined to prosecute JLT on the basis of:

- JLT's "voluntary self-disclosure"

- JLT's "full and proactive cooperation" and agreement to continue to cooperate in ongoing investigations and any resulting prosecutions

- "The nature and seriousness of the offence"

- "JLT's timely and full remediation, including separation from" the employee and "intermediary company involved in the misconduct" and JLT's efforts to enhance its compliance program

- JLT's agreement to "disgorge the full amount of its ill-gotten gains."

In April 2020, the DOJ brought money laundering charges against the former Chairman of Seguros Sucros (Juan Ribas Domenech), an employee of JLT's Colombia operations (Felipe Moncaleano Botero), and businessmen serving as intermediaries (Jose Vicente Gomez Aviles and Robert Heinert). By early 2021, the defendants were sentenced to prison after each had pleaded guilty in 2020 – Ribas to 51 months, Moncaleano to 72 months, Gomez to 46 months, and Heinert to three years in prison and three years supervised release, plus forfeiting more than $3 million.

The DOJ required JLT to disgorge approximately $29 million but noted that the DOJ would credit all amounts that JLT will disgorge to the SFO due to "the Company's separate resolution with the SFO that addresses the same underlying conduct," Although that resolution has not yet been announced. If JLT does not pay the SFO any part of the disgorgement amount by March 18, 2023, the declination letter requires JLT to pay any remaining amount to the U.S. Treasury. Notably, according to press reports, the SFO and U.S. authorities are currently looking into JLT in connection with the related misconduct in Ecuador (as well as other insurance firms, also for transactions related to Ecuador).

In a related case in Colombia, Carpenter Marsh Fac Colombia (a subsidiary of Marsh & McLennan and the apparent successor-in-interest to JLT Re Colombia), agreed in March 2022 to pay $2.1 million to resolve allegations that it paid bribes to retain business with two Ecuadorian insurance companies, Seguros Sucre and Seguros Rocafuerte. A Carpenter Marsh Fac spokesperson said the alleged bribery took place in 2014-2016, before the company acquired JLT in 2019, and that the company had fully cooperated with the Colombian regulator's investigation.

Key Takeaways:

- First Declination Crediting Potential Future Payments to Other Authorities: This is the first published declination that specifically credits a disgorgement amount that might be paid to a foreign enforcement agency in the future.

- Potential Discovery of Misconduct Via M&A Due Diligence: Considering the timing of JLT's disclosure to the authorities and the relevant acquisition activities by Marsh & McLennan, it is possible that the alleged misconduct was discovered during pre-acquisition due diligence and that the government disclosure took place as part of risk mitigation by the acquiring company. Marsh & McLennan announced that it would acquire JLT on September 18, 2018. In its 2021 SEC filing, Marsh & McLennan noted that "[i]n 2017, JLT identified payments to a third-party introducer that had been directed to unapproved bank accounts. These payments related to reinsurance placements made on behalf of an Ecuadorian state-owned insurer between 2014 and 2017." The company explained in its filing that "in early 2018, JLT voluntarily reported this matter to law enforcement authorities."

- Use of Monaco Memorandum Standards for Cooperation: In describing JLT's cooperation, the DOJ specifically credited JLT's "provision of all known relevant facts about the misconduct, including information about the individuals involved in the conduct." This language is consistent with guidance in the Monaco Memorandum (discussed here), emphasizing the DOJ's requirement that companies provide "all" relevant facts "relating to the individuals responsible for the misconduct" in order to gain full credit for cooperation. As noted above, the DOJ did have several successful prosecutions of individuals.

- Declinations Update: This is the first public declination letter since the DOJ's publicly released decision not to prosecute World Acceptance Corporation in August 2020. In total, DOJ has thus far published 15 declination letters since the DOJ announced the FCPA Pilot Program in April 2016, which started the "declination with disgorgement" practice. The DOJ also continues its long-standing practice of closing investigations without action (sometimes also referred to as declinations) without public announcement.

Regulatory/Policy Actions

DOJ Again Revives FCPA Opinion Procedure with Release on Extortion Payment

On January 21, 2022, the DOJ issued a rare FCPA OPR, the first since 2020 and only the second since 2014. The new OPR concluded that a U.S.-based company (the Requestor) would not be subject to an enforcement action under the FCPA's anti-bribery provisions for making a cash payment of $175,000 through an agent and intermediary to obtain the release of its vessel, captain, and crew that had been detained by naval forces of a country where it was not doing business. The OPR analysis centered on the fact that the company would not be making the payment with corrupt intent or, relatedly, an intent to obtain or retain business, and instead would be doing so "to avoid imminent and potentially serious harm to the captain and the crew of the Requestor vessel."

The situation arose when, according to the OPR, the Requestor's vessel sought to anchor in international waters while waiting to enter Country B's port for maintenance and renewal of technical maritime certificates, but it inadvertently anchored in Country A's waters after a shipping agent in Country B gave incorrect anchoring coordinates to the captain. Country A's navy confiscated the vessel's logbooks and other documents, ordered the crew to remain onboard, and detained the captain in jail onshore without providing any documentation showing authorization of his arrest or detention. The DOJ did not provide detail on the specific timeline. The OPR noted that the captain was held in detention and was "suffering from serious medical conditions that would be significantly exacerbated by the circumstances and conditions of his detention and created a significant risk to his life and well-being."

A third party purporting to act on behalf of the Country A's navy (the Intermediary) then demanded an "imminent" payment of $175,000 in cash from the Requestor to release the captain, crew, and vessel, "otherwise the captain and crew members would be detained for a longer period of time and the vessel would be seized." Despite multiple appeals from the Requestor, the Intermediary refused to provide any formal basis or documentation for the payment. The OPR states that the Requestor sought assistance from U.S. government agencies to no avail for the release of its captain, crew, and vessel.

The DOJ opined that the proposed payment would not trigger an enforcement action under the FCPA's anti-bribery provisions because the Requestor would not be making the payment "corruptly" or to "obtain or retain business." It determined that "the primary reason for the payment was to avoid imminent and potentially serious harm to the captain and the crew," so the Requestor would not be acting "voluntarily and intentionally, with an improper motive of accomplishing either an unlawful result or a lawful result by some unlawful method or means." The DOJ also found that "the payment is not motivated by an intent to obtain or retain business." The OPR listed a few reasons for reaching this conclusion: (1) the Requestor has no ongoing or anticipated business with Country A and the situation, including the request for payment, arose out of an error; (2) the Requestor did not seek to conceal the demand for payment and engaged with various U.S. government agency personnel to resolve the matter without success prior to considering making the payment; (3) the Requestor repeatedly asked for but was denied "proper documentation" from Intermediary to support the payment; and (4) the Requestor was told that "the only way to secure the safe and prompt release of the captain and crew was through a payment of $175,000 in cash."

Key Takeaways:

- DOJ Re-Confirmation that Extortion/Duress Payments Tied to Threats to Personal Safety Do Not Violate FCPA Anti-Bribery Provisions: The OPR reconfirms that making potentially unlawful payments to officials to avoid imminent threats to personal safety, extortion, or duress payments does not violate key elements of the FCPA's anti-bribery provisions, an enforcement position that is reflected in many companies' compliance policies. The OPR also emphasizes that such payments are still a narrow exception and require exigent and extraordinary circumstances and an intent to avoid "imminent threat of physical harm." The OPR notes that the Requestor's situation is "readily distinguishable from other situations in which a company is threatened with severe economic or financial consequences in the absence of a payment," which could give rise to liability under the FCPA. The DOJ did not directly address the fact that this single payment would serve to release personnel as well as a vessel (a major revenue-generating asset), the seizure of which would have led to several financial consequences.

- Prompt Response from DOJ: The DOJ issued a short preliminary opinion to the Requestor only one day after the Requestor submitted their request. Historically, the opinion procedure process has been underutilized in part because of perceptions that the DOJ's response times are inconsistent with business needs. In this OPR, the DOJ is attempting to counter that perception, at least related to "unusual and exigent circumstances" involving a "risk of imminent harm to the health and well-being" of individuals.

- No Ongoing Business Activity: A key element in this case is the fact that the Requestor was not operating in Country A and had no plans to operate there in the future. The DOJ states: "In contrast, payments under circumstances that companies may perceive as economically coercive, especially in countries in which they are in historical, pending, ongoing, anticipated, or sought-after business relationships with government actors may well give rise to liability under the FCPA" (emphasis added). Thus, the OPR may have limited utility for determining what may be permissible for other companies in assessing their most common situations in high-risk countries where they do in fact conduct business.

- Accurate Recording in Books and Records: Finally, it is important to note that all extortion or duress payments should be accurately recorded in the company's internal books and records to comply with the FCPA's accounting provisions.

U.S. Court Decisions

EDNY Upholds Termination of Distribution Contract Tied to Potential FCPA Violations

On January 20, 2022, a federal court in the Eastern District of New York (EDNY) granted the summary judgment motion of Misonix, Inc. (Misonix), finding the company lawfully terminated its distribution agreement with Cicel Beijing Science & Technology Co., Ltd. (Cicel) due to concerns regarding Cicel's potential FCPA violations. The decision provides insight for companies managing the balance between addressing FCPA-related risks related to third parties and defending against the potential repercussions of terminating the contractual relationship.

According to the court decision, in 2016, after a Misonix employee voiced concerns about possible illegal conduct by Cicel, Misonix's Chinese distributor, Misonix launched an internal investigation that uncovered what the court characterized as "incontrovertible proof" that Cicel had engaged in misconduct. Specifically, several emails penned by Cicel management spoke to "under the table deals" in which sub-dealers brokered deals with Chinese doctors and hospitals and discussed areas of China receptive to such deals. In addition, Misonix learned that Chinese authorities had fined Cicel in 2014 for committing bribery. As the court noted, "given the existential threat…posed by potential FCPA violations," Misonix swiftly terminated the contract. After Cicel sued for breach of contract, Misonix moved for summary judgment on the claim.

The court held that Misonix had a "right and an obligation to act promptly to protect themselves from FCPA liability." According to the court, the emails uncovered by Misonix established Cicel's unlawful methods in distributing Misonix products and such illegal conduct rendered the contract unenforceable under New York law, without regard to any contract clauses. The court relied on McConnell v. Commonwealth Pictures, 7 N.Y.2d 465 (1960), where the New York Court of Appeals held that a party engaging in "gravely immoral and illegal conduct," such as the methods used by Cicel, cannot enforce the contract.

Notably, the court found Cicel's argument that Misonix terminated the agreement for financial benefit and not because of the alleged illegal conduct "fundamentally ridiculous" and "absurd." To the contrary, the court held that the record demonstrated that Misonix was forced by Cicel to bear millions in legal and investigative costs, resolve a derivative lawsuit, and defend the instant case (which had a previous privilege dispute we discussed in our FCPA Summer Review 2019). Misonix reported that the SEC notified the company that it did not intend to recommend an enforcement action against Misonix and DOJ had closed its inquiry into Misonix without any action in June and August 2019, respectively.

Key Takeaways:

- Helpful Precedent but Questions Remain as to Requisite Factual Support for Illegal Action by Third Parties: The decision provides a precedent supporting companies that decide to terminate a contract when their contracting partner may potentially be violating the FCPA, even if the relevant contract does not have specific anti-corruption clauses. However, the decision did not definitively define the quantum of evidence of possible FCPA violations required for a lawful contract termination. In this case, Misonix had significant findings from due diligence and an investigation.

- Nexus with Contract: The court did not weigh in on any specific standard or test for determining a sufficient nexus between the illegal conduct and the scope of the contract such that termination is appropriate, though the court did caution that minor wrongdoings do not excuse contract performance and that there must be a direct connection between the misconduct and the contract.

- Importance of Contract Terms: While the decision provides some guidance to companies, the unresolved questions reiterate that it is still a best practice to negotiate upfront the right to terminate the contract when there is evidence of FCPA violations, or if there are merely allegations of misconduct that could lead to a violation, to avoid unnecessary litigation over breach claims.

U.S. Appellate Courts Reject Mexican Government Agency's Cases against Zimmer Biomet and Stryker

Instituto Mexicano del Seguro Social v. Zimmer Biomet Holdings

On March 21, 2022, the U.S. Court of Appeals for the Seventh Circuit affirmed the U.S. District Court for the Northern District of Indiana's January 5, 2021 judgment dismissing the law suit of Instituto Mexico del Seguro Social (IMSS) against Zimmer Biomet Holdings, Inc. (Zimmer Biomet) on the basis of forum non conveniens. IMSS had claimed that between 2008 and 2013, Zimmer Biomet bribed Mexican government officials to facilitate the sale of its unregistered medical products in Mexico to and through IMSS. Zimmer Biomet filed for dismissal on the grounds of forum non conveniens, arguing Mexico was the appropriate venue for the case and that the U.S. case created an unreasonable burden.

IMSS is a Mexican government agency in charge of purchasing medical products to distribute them in Mexico; the agency also operates several hospitals around the country. Zimmer Biomet distributes its products in Mexico through an indirect wholly owned subsidiary called Biomet 3i Mexico. IMSS's complaint described an alleged international bribery scheme coordinated from Zimmer Biomet's headquarters in Indiana and included allegations of Zimmer Biomet personnel traveling to Mexico to support the scheme as well as Mexican agents passing the bribes to local governmental officials. IMSS alleged that as a result of said scheme, Zimmer Biomet entered into FCPA-related resolutions with the DOJ and the SEC.

The district court mentioned that the first requirement for a finding of forum non conveniens – that there be an appropriate alternative – may be satisfied by a party consenting to jurisdiction, adding that Zimmer Biomet did consent to jurisdiction in Mexico "through its vice president and associated general counsel." Regarding the second requirement, the District Court highlighted that Mexico has easier access to witnesses and evidence related to the complaint. The court also noted that, from the public interest perspective, transportation limitations due to COVID 19 and the Mexican government's interest in the case also were key arguments for the dismissal. The court stated that IMSS's claims are rooted in Mexican law, the relevant contract was entered between Mexican parties, and the claimed injury took place in Mexico. Lastly, the court said that UNCAC Article 53 does not preclude the operation of forum non conveniens for such actions and that dismissing the case under the applicable facts was not inconsistent with protecting a general right to initiate civil actions.

The Seventh Circuit confirmed the district court's decision, affirming many of the same points. In response to IMSS's claims that the relevant evidence was in Indiana, based on Zimmer Biomet's cooperation with the DOJ and SEC investigations, the court noted that IMSS's pleading was unclear to what extent the focus of the DOJ and SEC investigations overlapped with the topics of IMSS's complaint, that there was no indication that the individuals relevant to the IMSS suit were in Indiana, and that the district court had already concluded that the documents in Indiana were "fewer in number and secondary in relevance" (internal quotations omitted) to the evidence in Mexico.

The Seventh Circuit also mentioned that for this case, the administrative burdens are comparatively less significant in Mexico, given the touchpoints with the alleged scheme. Lastly, on the UNCAC issue, the court said that this international treaty is not self-executing and therefore not binding federal law.

Instituto Mexicano del Seguro Social v. Stryker Corp.

Similarly, on March 17, 2022, the U.S. Court of Appeals for the Sixth Circuit affirmed the U.S. District Court for the Western District of Michigan's January 4, 2021 judgment dismissing IMSS's suit against Stryker Corp. (Stryker) on the basis of forum non conveniens. The case has similarities with the Zimmer Biomet matter and the court rulings undertake similar analyses to reach similar conclusions. In the Stryker case, IMSS alleged that between at least 2003 and 2015, Stryker bribed Mexican governmental officials through its wholly owned Mexican subsidiary and a Mexican law firm to obtain contracts and generate significant illicit profits. IMSS argued that Stryker used U.S.-based personnel traveling to Mexico to support the scheme, that enforcement actions by the SEC and DOJ had established the alleged pattern of corrupt activities, that Stryker had breached contracts, and that Stryker had committed other violations based on Mexican law.

In explaining its dismissal of the action, the district court stated that little deference is owed to the forum choice of a foreign party and explained that choosing the defendant's home forum does not compel a different conclusion; that there were counts based on Mexican law and that Stryker consented to submit to the jurisdiction of Mexican courts; and that there were numerous efficiencies for having the case heard in Mexico because the identified witnesses and documentation are located in Mexico.

The Sixth Circuit affirmed the lower court decision. First, the court stated that the UNCAC does not supersede the general doctrine of forum non conveniens. The court also explained that the district court did not abuse its discretion by according to IMSS's choice of forum little deference, noting in part that Stryker had committed to submitting to Mexican jurisdiction and would not contest services of the process in Mexico. The court also confirmed that the district court had thoroughly considered various public interest factors, including administrative difficulties, local interests, and unfairness burdening citizens in an unrelated forum with jury duty.

These cases illustrate a key obstacle for foreign plaintiffs filing actions in U.S. courts claiming damages related to transnational corruption and bribery practices. Both appellate court decisions affirm that U.S. commitments regarding the application of Article 53 of the UNCAC (which requires treaty parties to permit a foreign state to initiate civil actions before a party's courts to obtain compensation or damages caused by corrupt practices) are still subject to federal court doctrines and principles. Defendant companies can use these decisions as potential roadmaps to achieve similar results, assuming the relevant facts are present and such companies can show that they are amenable to alternate forums.

According to press reports, IMSS filed similar claims in 2020 against three other companies of the healthcare sector: Olympus Latin America Inc. (Olympus), Fresenius Medical Care AG & Co. KGaA (Fresenius), and Teva Pharmaceuticals, Inc. (Teva). Olympus's case does not appear to have made any substantial progress since November 24, 2021, when Olympus filed a response in support of their motion to dismiss the case before the District Court for the Southern District of Florida. On June 23, 2021 Fresenius' case was voluntarily dismissed by IMSS and therefore appears closed before the Massachusetts District Court. Finally, regarding Teva, on April 25, 2022 IMSS filed a Notice of Waiver of Reply Brief and Concession.

In Cases Against Former Executives, District Court Finds Broad Privilege Waiver by Cognizant Due to Disclosures to Government

On February 1, 2022, Judge Kevin McNulty of the Federal District Court of New Jersey held that Cognizant Technology Solutions Corporation (Cognizant) effectuated a "significant" waiver of privilege when it disclosed to the DOJ information from its internal investigation into potential FCPA violations. As reported in our 2019 Spring and Autumn Reviews, in February 2019, Cognizant settled with the SEC and received a declination with disgorgement from the DOJ after voluntarily disclosing potential FCPA violations related to an alleged bribery scheme in India.

Specifically, Judge McNulty ruled that Cognizant's disclosures to the DOJ of "detailed accounts" of interviews entailed a sweeping subject matter waiver that extended to:

- "Memoranda, notes, summaries, or other records of the interviews themselves"

- "To the extent the summaries directly conveyed the contents of documents or communications, those underlying documents or communications themselves"

- "Documents and communications that were reviewed and formed any part of the basis of any presentation, oral or written, to the DOJ in connection with this investigation"

In addition, Judge McNulty granted a motion to quash for personal jurisdiction a subpoena against Larsen & Toubro Construction (L&T Construction), holding that the first of the Third Circuit's three-prong test for specific jurisdiction (purposeful availment) over a company was not met. Thus, the defendants could not pursue discovery against the agent that allegedly paid a bribe at the direction of the defendants, even though the agent had cooperated with the U.S. authorities.

The ruling came in the trial of former Cognizant executives Gordon J. Coburn and Steven Schwartz, who currently face 12 counts relating to violating and conspiring to violate the anti-bribery, books and records, and internal controls provisions of the FCPA in connection with Cognizant's operations in India. According to Cognizant's resolutions – namely, the DOJ Letter Agreement and the SEC Cease-and-Desist Order – Cognizant authorized and reimbursed a third-party construction company, L&T Construction, to make approximately $2 million in bribe payments to Indian government officials to secure a planning permit to construct an office park in Tamil Nadu, India. According to the Order, Coburn and Schwartz approved the bribe payment and reimbursement while on a conference call from the U.S. After the corporate resolutions, the DOJ brought charges against Coburn and Schwartz in February 2019. In October 2020, Coburn and Schwartz served subpoenas to Cognizant relating to obtaining documents from the company's investigation, which led to the recent ruling.

Judge McNulty ruled that Cognizant had waived its attorney-client privilege as to the materials furnished to the government, including detailed accounts of 42 interviews of 19 Cognizant employees (including those of Coburn and Schwartz). Judge McNulty reasoned that Cognizant's disclosure to the government, a potential adversary, "under threat of prosecution," undermined the purposes of both attorney-client privilege and work-product protection. Judge McNulty further held that that in turning over internal investigation materials to the government, Cognizant had effectuated a subject-matter waiver of privilege as to communications that "concern the same subject matter" and "ought in fairness be considered together" with the disclosures to DOJ. As such, the judge found Cognizant also waived privilege as to any memoranda, notes, summaries, or others records of interviews that had been summarized to the government; underlying documents or communications summarized to the government; and documents and communications that were reviewed and formed part of the basis of any presentation to the DOJ in connection with the investigation.

In related evidentiary disputes, regarding subpoenas submitted by the defendants on L&T Construction, Judge McNulty granted a motion to quash for lack of personal jurisdiction over the company. Applying the Third Circuit's three-prong test for specific jurisdiction over a company, Judge McNulty held that L&T Construction's cooperation with U.S. investigators did not show that it "purposefully availed" itself of New Jersey law or purposefully directed its activities at New Jersey, and thus that the first prong of the test was not met.

The opinion included several other rulings, including granting discovery requests to assess potential Garrity issues (whether there was "government direction" of "coerced interviews" by Cognizant to the extent that it would render the admissions of the Cognizant employees inadmissible in a criminal trial), and referring certain disputes to the relevant Magistrate Judge for further evaluation.

In a further Memorandum and Order from on April 27, 2022 (unsealed on May 4, 2022), Judge McNulty issued a clarification of his original ruling, after Cognizant sought "clarification," having produced "extensively redacted" portions of interview notes and entirely withheld attorney notes used in preparation of the DOJ disclosures. Judge McNulty ordered Cognizant to disclose the unredacted interview memoranda and attorney notes within 14 days and reiterated his original finding that privilege as to these documents had been waived.

The case is the most recent example of the potential ramifications of a company's decision to disclose potentially privileged material to the government. While companies and outside counsel have long known that outright disclosure waives privilege as to the disclosed materials themselves, this opinion highlights the risks that companies must consider when deciding whether to disclose summaries or findings from specific internal investigation interviews - including whether they are risking waiving privilege as to the broader universe of undisclosed documents related to the subject matter of the disclosures. We note that Cognizant already settled shareholder litigation in August 2021, which removes one collateral litigation risk for Cognizant.

Key Takeaways:

- Consequences of Voluntary Disclosure: In the course of cooperation with government agencies, including in the voluntary disclosure process, companies may choose to share with investigative agencies summaries of interviews or privileged documents, on the assumption that the government will not seek to assert a privilege waiver (or on the basis that the summaries do not constitute a waiver). This case highlights one set of potential consequences from such disclosure practices.

- Privilege Waiver Limited in Some Respects: The court upheld Cognizant's assertions of privilege for certain other categories of documents related to the investigation, such as communications on document retention and collection policies, as well communications with the accounting firm EY (which appears to have been retained to assist the investigation) and related updates to the Board.

- Cooperation Does Not Necessarily Create Personal Jurisdiction: In its discussion of L&T Construction, the case highlights that voluntary cooperation by foreign companies with federal law enforcement will not, on its own, subject them to personal jurisdiction.

International Developments

France's PNF and AFA Publish Draft Guidance for Corruption Investigations and Seek Comments from the Public

On March 7, 2022, France's Anti-Corruption Agency (AFA) and National Financial Prosecutor's Office (PNF) published draft guidance for companies conducting internal corruption investigations (Draft Guide) on which it also solicited comments from the public for a 30-day period. Building upon the AFA and PNF's 2019 Guidelines on the Implementation of Judicial Public Interest Agreements, the Draft Guide aims to provide guideposts as to the implementation of internal corruption investigations at various stages, including underlying triggers, post-investigative remediation, and regulatory cooperation. The Draft Guide applies to companies subject to France's national anti-corruption legislation (known as Sapin II) with more than 500 employees and whose annual turnover exceeds 100 million euros.

Underlying Triggers for Investigation

According to the Draft Guide, an internal investigation may be warranted "when facts that may constitute violations of the anti-corruption code of conduct or qualify as influence peddling are brought to the attention of the company and its leadership." The Draft Guide outlines various channels through which a company may become aware of potential misconduct, such as through internal and external hotlines, routine internal audits or other control mechanisms, and existing reporting channels established by the PNF, external audits, and controls or requests for information from a foreign authority.

The Draft Guide includes discussions of issues normally not covered by guidance from government authorities, including company strategies for managing external communications in the face of media reports and related disclosure controls. Less surprisingly, the Draft Guide also highlights the importance of early and transparent communication with the PNF and Prosecutor of the Financial Republic (PRF) about potential criminal acts, cautioning against waiting for the completion of an internal investigation to prompt communication.

Implementation of Investigations

The bulk of the Draft Guide focuses on conducting investigations, taking into account French and European Union privacy and labor considerations. At the outset, the Draft Guide recommends that companies formalize an investigation procedure that addresses data retention, document collection, timing considerations, employee rights, confidentiality, investigative techniques, composition of the investigative team, post-investigative remediation processes, and guiding principles to help preserve fairness and consistency.

The Draft Guide states that the company can implement the internal investigation itself, or, depending on resources, can retain a third party to do so. In either case, the Draft Guide emphasizes the importance of ensuring that the investigative team has the requisite training, expertise, and independence to implement the investigation. Moreover, to the extent that a company retains a third party lawyer, the Draft Guide recommends that the third party lawyer be different from the third-party external counsel ultimately retained to represent the Company or its employees.

The Draft Guide also highlights the need to balance the company's interests against its employees' rights under French and EU law. For example, the Draft Guide addresses:

- Adherence to principles of proportionality, loyalty, innocence, impartiality, and privacy (particularly with respect to data collection and General Data Protection Regulation (GDPR) requirements)

- Compliance with notice requirements and the obligation to provide adequate information concerning the investigation to employees

- Ensuring appropriate etiquette at the interview stage

The Draft Guide also provides guidance as to memorializing findings from an investigation, first by strongly recommending that companies document their findings in an investigation report. The guide notes that an investigation report should contain information regarding the investigative methodology, facts established, and "elements likely to confirm or eliminate suspicion." With respect to the former, the Draft Guide highlights the importance of retaining minutes from interviews and describing the document collection process. It also encourages communication to a "limited number of authorized persons" should the report corroborate allegations of corruption, though the language does not suggest that all relevant employees be given a report.

The Draft Guide recommends that an investigation report be shared with judicial authorities should the internal investigation occur in parallel with a preliminary judicial investigation and cautions against the internal investigation's interference with an envisaged convention judiciaire d'intérêt public (CJIP).

Post-Investigative Follow-up and Remediation

Finally, the Draft Guide outlines steps that companies can take to follow up on investigation findings and remediation. The Guide states that a company's governing body is responsible for determining the appropriate follow-up and remediation, but recommends that actions should generally include appropriate communication of results, proportionate disciplinary actions, and enhancements to a company's anti-corruption compliance program. With respect to enhancements to a company's anti-corruption compliance program, it highlights several components, many of which are similar to the DOJ's Hallmarks of an Effective Compliance Program, including:

- Corruption risk mapping

- Revisions to a company's code of conduct

- Enhancements to training materials and risk-based training (based on employees' exposure to corruption risks)

- Assessment of third parties, accounting controls, and disciplinary procedures

Miller & Chevalier Upcoming Speaking Events, Recent Publications, and Podcasts

Podcasts

EMBARGOED! is intelligent talk about sanctions, export controls, and all things international trade for trade nerds and normal human beings alike, hosted by Miller & Chevalier Members Brian Fleming and Tim O'Toole. Each episode will feature deep thoughts and hot takes about the latest headline-grabbing developments in this area of the law, as well as some below-the-radar items to keep an eye on. Subscribe for new bi-monthly episodes so you don't miss out: Apple Podcasts | Spotify | Amazon Music | Google Podcasts | Stitcher | YouTube

Upcoming Speaking Engagements

| 06.10.22 | SCCE: Higher Education Compliance Conference (Ann Sultan) |

| 06.06.22 | Export Compliance Training Institute Seminar (Tim O'Toole) |

| 05.31.22 | Firm Webinar: The UFLPA - Crafting Your Due Diligence Game Plan for a New Legal Framework (Richard Mojica, Virginia Newman) |

Recent Publications

Latin America Compliance Landscape: Brazil Video Series

Hosted by Miller & Chevalier Member Jeff Lehtman and StoneTurn Partner Steven Neuman, our Latin America Compliance Landscape series consists of short videos featuring both corporate and outside counsel speakers from different jurisdictions across Latin America discussing a wide variety of topics related to trends, recent events, and best practices for corporate compliance in their jurisdiction.

- Is ESG a Revolution Which Changes How Boards Operate?

- How Has the Role of the Board Evolved Over Time?

- How Did You Get Involved with Boards of Directors?

International Department Publications

Editors: John E. Davis, Daniel Patrick Wendt,* and Ann Sultan*

Contributors: Maame Esi Austin, Alexandra Beaulieu, Connor W. Farrell, Nicole Gökçebay,* Abi Hollinger,* Maryna Kavaleuskaya,* Arman Krpoyan,* FeiFei Ren,* Ricardo Rincón,** and Connor Wilson*

*Former Miller & Chevalier attorney

**Former Miller & Chevalier consultant

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.