FCPA Winter Review 2023

International Alert

Introduction: 2022: Year in Review

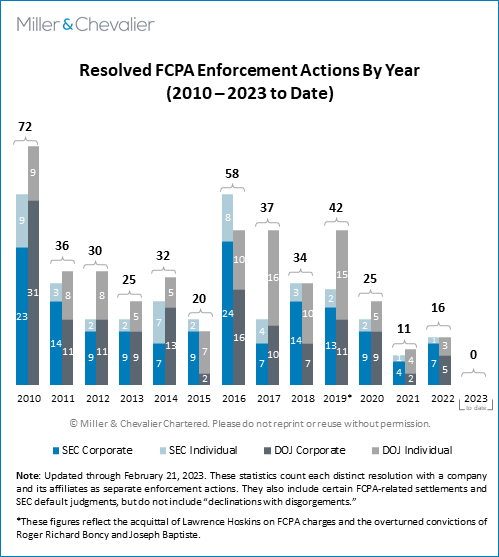

Calendar year 2022 saw a rebound in the number of announced enforcement actions related to the Foreign Corrupt Practices Act (FCPA) as compared to the low point in 2021, though the 2022 numbers did not reach pre-COVID-19 levels. The Department of Justice (DOJ) and Securities and Exchange Commission (SEC) are still investigating matters that predate the pandemic, but for the most part the effects of the COVID-era are in the rearview mirror. 2022 saw the new DOJ leadership deliver some significant changes, including updates to corporate enforcement policies. Continued turnover in the Fraud Section and (as always) the individual facts and dynamics of each matter under investigation likely contributed to the investigation disposition numbers. However, with the announcement of policy changes and of substantial corporate resolutions (including one, Glencore, that ranks in the top 10 largest corporate FCPA dispositions), the DOJ and SEC are clearly continuing to prioritize FCPA enforcement.

New and Updated Corporate Enforcement Policies

Perhaps the most noteworthy FCPA enforcement developments in 2022 (and into early 2023) were the various policy changes announced by U.S. authorities, which we have covered in detail in earlier FCPA Reviews and firm publications.

Following on an initial policy document issued in October 2021, DOJ Deputy Attorney General (DAG) Lisa Monaco issued a new policy memorandum (now often referred to as the Monaco Memorandum) on September 15, 2022. We discussed this significant policy document in detail in this alert. The memorandum announces new guidance for DOJ prosecutors in several key areas of interest, including:

- "Guidance on individual accountability" including the prioritization of building cases against culpable individuals in parallel with related corporate investigations and how the DOJ will assess whether corporate voluntary disclosures are "timely" for purposes of assessing cooperation

- Additional discussion of corporate recidivists and how prosecutors should evaluate a company's history of prior corporate misconduct in making decisions about resolving new investigations

- Further guidance on assessment of credit for voluntary self-disclosures and cooperation, designed to harmonize this analysis across the DOJ

- New commentary on how to evaluate a company's corporate compliance program, including new specific discussion of the role of executive compensation structures (incentives and disciplinary mechanisms) and guidance on corporate policies related to use of personal devices and "third party applications" (such as WhatsApp and other chat applications)

- New discussion on the imposition, selection, and management of Independent Compliance Monitors, including the need for active DOJ engagement throughout the term of any monitorship

As a follow-up to implement elements of the Monaco Memorandum, on January 17, 2023, the DOJ's Criminal Division issued its revised Corporate Enforcement and Voluntary Self-Disclosure Policy (CEP). We discussed this revision extensively in this alert. Overall, the revised CEP continues the DOJ's efforts to convince companies to self-disclose potential criminal issues "at the earliest possible time" and introduces new potential rewards for doing so, especially for companies with prior criminal histories. The revised CEP also gives prosecutors more discretion to reward degrees of corporate cooperation and remediation. However, as our alert details, companies will need to consider factors beyond the scope of the CEP to effectively weigh the risks and benefits of disclosure, and those looking for new guidance on DOJ expectations on such hot-button issues such as how to manage compensation clawbacks or business communications on personal devices will have to wait for future DOJ pronouncements – hopefully in 2023.

Another area of note is the increasing use of economic sanctions and other actions against corrupt officials and other actors. Such action is authorized by Executive Order (E.O.) 13818 (issued in December 2017) to build upon and implement the Global Magnitsky Human Rights Accountability Act. As of December 2021, according to a Congressional Research Service (CRS) report, more than 148 individuals and 189 entities were subject to economic sanctions under E.O. 13818. Three senior Liberian officials were sanctioned in August 2022. Other recent notable examples of persons sanctioned for corruption include Israeli businessman Dan Gertler (in 2017), along with various persons and entities identified as connected to him related to activities in the Democratic Republic of the Congo (DRC); certain Cambodian officials cited in November 2021 related to "significant corruption" in defense procurement; and current and former Bulgarian officials and 64 related entities in June 2021 related to corruption and the undermining of the rule of law in Bulgaria. Such sanctions align with nationals security goals directly related to corruption (established in the December 2021 Strategy for Combatting Corruption (SCC)) and pendant interests, such as sanctioning kleptocrats and Russian oligarchs considered allied with President Vladimir Putin.

Corporate Enforcement Actions

Overall, the DOJ resolved five cases against companies (Stericycle, Glencore, GOL, ABB, and Honeywell) and three actions against individuals in 2022, while the SEC concluded seven settlements with companies (four in conjunction with the DOJ noted above (the SEC was not involved in Glencore), plus KT Corporation, Tenaris, and Oracle) and one action related to an individual. The DOJ also issued two public declinations with disgorgement, involving Jardine Lloyd Thompson (JLT) and Safran.

The next corporate action occurred on April 20, 2022, when the DOJ and SEC announced that U.S. medical waste company Stericycle had agreed to resolve parallel investigations by the two U.S. agencies and several Brazilian authorities involving improper payments to foreign officials in Brazil, Mexico, and Argentina related to contracts and priority release of payments from government agencies and hospitals. Stericycle entered a three-year DPA with the DOJ and consented to the entry of a Cease-and-Desist Order with the SEC, resulting in over $84 million in penalties, which included $52.5 million in criminal penalties to the DOJ and $28.2 million in disgorgement and prejudgment interest to the SEC. Additionally, because Stericycle "ha[d] not fully implemented or tested its enhanced compliance program," the U.S. resolutions required a two-year Independent Compliance Monitor, after which (assuming Monitor certification) the company is required to self-report for one year. Kathryn Cameron Atkinson of Miller & Chevalier has been appointed as the Monitor for Stericycle.

The largest corporate disposition of 2022 began a series of announcements on May 24, 2022, when the DOJ announced that Glencore International A.G. (Glencore) had pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA. On the same day, Glencore Ltd., a U.S. subsidiary of Glencore, pleaded guilty to one count of conspiracy to commit commodity price manipulation. Both pleas are tied to additional civil and criminal resolutions with the Commodity Futures Trading Commission (CFTC) in the U.S. and the Brazilian Ministerio Publico Federal (MPF), as well as with charges brought by the U.K. Serious Fraud Office (SFO).

Glencore's FCPA plea agreement stated that between 2007 and 2018, Glencore and various of its subsidiaries, employees, and agents paid over $100 million in bribes to foreign officials in Nigeria, Cameroon, Ivory Coast, Equatorial Guinea, Brazil, Venezuela, and the DRC. The agreement noted that these bribes sought to secure commodities contracts, end government audits, and facilitate favorable results in litigation, among other business goals. It was noteworthy that in every instance of bribery cited in the public documents, Glencore personnel made or authorized payments to officials through a third party, using a wide variety of methods to disguise the bribes. The coordinated resolutions resulted in the assessment of over $1.1 billion in fines and disgorgement that have been or will be paid to the relevant law enforcement authorities. The DOJ imposed Independent Compliance Monitors for terms of three years in each of the FCPA and commodity fraud criminal dispositions. Additional developments related to the various investigations of Glencore by several governments occurred in Q4 2022 and are discussed below.

On June 2, 2022, Tenaris agreed to pay the SEC more than $78 million (a civil penalty of $25 million plus over $53 million in disgorgement and prejudgment interest) to settle charges that the company violated the FCPA by providing improper payments to a Brazilian official at Petrobras, the state-owned oil and gas company, to favor the company in contract awards. Tenaris also agreed to report to the SEC for two years regarding the status of its remediation and implementation of compliance efforts and to report to the SEC if the company discovers any "credible evidence" of "questionable or corrupt payments" offered or given by the company or any person acting on the company's behalf, as well as any potential related accounting provision violations. Per the company's press release, the DOJ closed a parallel inquiry without action. In addition to highlighting issues related to payments by and among affiliated companies, the settlement also provides an example of how the SEC views past violations in the absence of a formal policy (such as the DOJ's CEP).

The next corporate action, announced on September 15, 2022, involved GOL Linhas Aéreas Inteligentes S.A. (GOL), the second largest domestic Brazilian airline and an "issuer" for purposes of the FCPA, which agreed to resolve parallel investigations by the DOJ and SEC involving charges against the company for violating the FCPA's anti-bribery and accounting provisions. The bribes detailed in the public disposition documents were paid through intermediaries, supervised largely by a member of GOL's Board, and focused on obtaining legislative benefits for the airline. GOL entered a three-year DPA with the DOJ and consented to a Cease-and-Desist Order with the SEC. The company agreed to pay over $41 million in penalties, including $17 million in criminal penalties to the DOJ and $24.5 million in disgorgement and prejudgment interest to the SEC. The original DOJ penalty was much higher – set at $87 million – but GOL successfully petitioned under the DOJ's "inability to pay" guidance to have the penalty reduced due to the company's financial condition and other factors. GOL also entered a parallel settlement with Brazilian authorities as part of the long-running Lava Jato inquiry.

Later that month, on September 27, 2022, Oracle agreed to pay the SEC $22.9 million (a civil penalty of $15 million plus $7.9 million in disgorgement and prejudgment interest) to settle charges that the company violated provisions of the FCPA due to the conduct of agents and employees at its subsidiaries in Turkey, the United Arab Emirates, and India. The SEC's Order in the case highlighted gaps in controls the SEC states permitted improper discounts and marketing reimbursements that generated excess funds to be paid as bribes. For example, in both Turkey and the United Arab Emirates, excessive discounts and reimbursements funded off-book accounts at Oracle's "value added distributors" and "value added resellers," highlighting the risks of indirect sales models.

On December 2 and 3, 2022, the DOJ and SEC announced that ABB Limited (ABB) agreed to resolve parallel investigations by the two agencies and the criminal authorities in South Africa and Switzerland involving FCPA and other charges. The disposition and penalties stemmed from the alleged bribery of a South African official through subcontractors to win a large construction and engineering contract from the South African state-owned power company Eskom. The U.S. authorities' documents state that the payments were funded through various "sham" transactions, including inflated prices, fake "variation orders" and "advance payments" on contracts.

ABB entered into a three-year DPA with the DOJ and a cease-and-desist order with the SEC, agreeing to pay over $460 million in penalties to the U.S. authorities. But both agencies agreed to offset significant amounts related to investigations by Swiss, South African, and German authorities (the German matter is ongoing). ABB reached a resolution with the Swiss Attorney General, agreeing to pay $4.3 million for the misconduct in South Africa, and reached two separate dispositions with the South African authorities, the most recent of which resulted in "punitive reparations" of $144.51 million to be paid to the South African federal prosecutors. This is the third resolution reached by ABB for FCPA violations, following earlier resolutions in 2004 and 2010.

Finally, on December 19, 2022, Honeywell International agreed to pay more than $200 million to resolve investigations by U.S. and Brazilian authorities regarding the company's alleged misconduct in Brazil and Algeria. The investigations found that in Brazil certain subsidiary employees, with the help of an intermediary, offered $4 million to a Petrobras official in exchange for a various business advantages connected to a $425 million contract to design and construct a refinery. The SEC also noted payments related to business from Algerian state-owned company Sonatrach that involved Unaoil. Honeywell entered into a three-year DPA with the DOJ with $79.2 million in criminal penalties and $105.7 million in forfeiture to resolve DOJ-related charges and agreed to a Cease-and-Desist Order with the SEC with $81.2 million in disgorgement and prejudgment. A Honeywell affiliate also entered into leniency agreements with the MPF, Controladoria-Geral da União (CGU), and Advocacia-Geral da União (AGU) to settle charges related to conduct in Brazil. The U.S. agencies agreed to various credits and offsets. Of note and as discussed in the main article, Honeywell will not receive self-disclosure credit despite an attempt to notify the DOJ of issues that was preempted by media accounts.

Declinations with Disgorgement

The DOJ announced two formal "declinations with disgorgement" under the FCPA CEP in 2022. First, on March 18, 2022, the DOJ announced it had declined to prosecute Jardine Lloyd Thompson Group Holding Ltd., or JLT, a British multinational insurance corporation for violations of the anti-bribery provisions of the FCPA. The DOJ declined to prosecute despite evidence of bribes paid and authorized by a JLT employee and JLT agents to Ecuadorian government officials to obtain and retain contracts with surety company Seguros Sucre, an Ecuadorian state-owned and controlled entity. Consistent with the CEP's requirements, the DOJ cited JLT's self-disclosure, "full and proactive cooperation," and "timely and full remediation," along with the company's agreement to disgorge approximately $29 million (some of which was credited to a June 2022 settlement with the U.K. SFO). One other issue of note – JLT was acquired by Marsh & McLennan in April 2019, and given the timing and some public disclosures at that time, it is possible that mergers and acquisitions (M&A)-related due diligence discovered this issue and led to the self-disclosure.

On December 21, 2022, the DOJ issued a letter declining to prosecute the French aerospace company Safran for violations of the FCPA by subsidiaries related to alleged bribery of Chinese officials (through payments to a China-based business consultant who was a close relative of that official) to obtain government contracts. The DOJ highlighted as key to its declination Safran's "timely and voluntary self-disclosure," "full and proactive cooperation," and various remediation steps, including the "termination of involved personnel and withholding the deferred compensation of another employee involved in the misconduct who had previously left the company." Another factor cited was the fact that the misconduct occurred prior to Safran's acquisition of the involved entities (and was stopped before the acquisition); thus, as the letter notes, Safran was only the "successor-in-interest" to the offending companies.

It is likely that the DOJ will try to issue further such declinations with disgorgement in 2023 to showcase the benefits of the CEP revisions announced in January 2023.

In addition to these CEP-driven declinations, several other companies announced terminations of investigations without action, including Cisco Systems (in February 2022), Tenaris in June 2022 (related to the DOJ, with the disclosure made at the time of the SEC disposition announcement), Jacobs Engineering in August 2022, and Frank's International, now Expro Group Holdings (in November 2022).

Actions Against Individuals

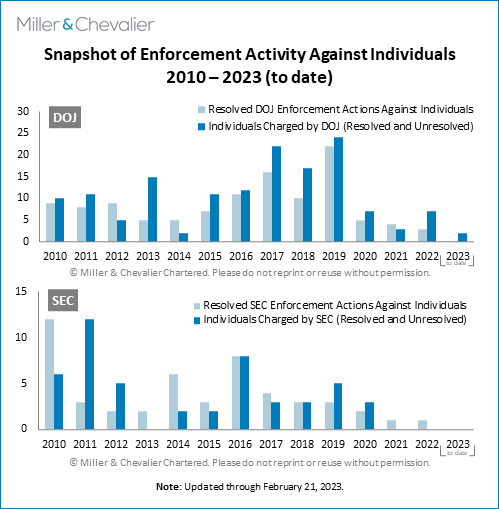

Both U.S. enforcement agencies, and especially the DOJ, have continued to emphasize their strong commitment to the pursuit of culpable individuals, including as a key element to policy updates. Announced DOJ actions in 2022 rebounded from the historically low 2021 numbers back to 2020 levels, with trendlines pointing to a continuing increase in 2023. The SEC numbers were roughly the same as in 2021, but the agency continues to signal its interest in future resolutions.

The most public case of 2022 involved former Goldman Sachs Director Roger Ng, who on April 8, 2022 was convicted by a jury in the Eastern District of New York (EDNY) of three conspiracy counts: to violate the bribery provisions of the FCPA, to violate FCPA internal accounting controls provision, and to commit money laundering. Ng had been indicted in October 2018 for actions related to a multi-billion-dollar attempt to launder money through 1MDB, Malaysia's state-owned investment development agency, and through Abu Dhabi government officials from 2009 to 2014. In October 2020, Goldman Sachs pleaded guilty to conspiracy to violate FCPA, obtaining a deferred prosecution agreement (DPA) from the DOJ and paying over $2.9 billion in penalties. Another ex-Goldman Sachs executive, Tim Leissner, pleaded guilty in 2018 and was key cooperating witness at Ng's trial. According to the prosecution, Ng coordinated with Leissner and Low Taek Jho, or "Jho Low," a wealthy Malaysian national who was indicted with Ng but remains a fugitive, to obtain and retain contracts for Goldman Sachs through bribe payments to Malaysian officials. Low served as an intermediary for Ng and the high-ranking Malaysian individuals working on 1MDB.

As we discussed previously, the trial court issued a decision in response to a Rule 29 motion by Ng opining that "accounting controls" do not only refer to financial reporting, but also compliance-related controls, such as ensuring that management approves of transactions. Thus, per the court, Ng's (and Leissner's) withholding of material information from "groups responsible for enforcing [Goldman's] internal accounting controls" was sufficient to create an internal controls violation by Ng. Ng, who is appealing the decision, faces up to 30 years in prison. His sentencing, originally scheduled for December 2022, is now scheduled to occur sometime in February 2023.

In a less favorable development for the DOJ, on June 28, 2022, the U.S. District Court in Massachusetts granted the DOJ's motion to dismiss with prejudice indictments against Joseph Baptiste and Roger Richard Boncy, based on newly discovered evidence, thus ending the long-running prosecution of these two individuals. The defendants were first tried and convicted in 2019 for conspiracy to bribe public officials in connection with a port development project in Haiti. However, in March 2020, a district judge tossed out the convictions and ordered a new trial for both Baptiste and Boncy, on the basis that Baptiste's lawyer had rendered ineffective assistance such that the 2019 jury verdict could not stand. In preparation for a new trial and in response to a motion from defense counsel, the Federal Bureau of Investigation (FBI) turned over new exculpatory evidence to DOJ prosecutors, including text messages with statements from Boncy who, when asked about certain payments connected to the port project, responded that they would not be used to pay bribes. After reviewing this new evidence (and noting that other related evidence had been lost) and based on the lateness of the disclosure of the evidence to defense counsel, the DOJ decided to move to dismiss the indictments.

The SEC's main case related to an individual involved a June 27, 2022 decision by a federal judge in the Southern District of New York that ordered Yanliang "Jerry" Li, former Managing Director of a Chinese subsidiary of Herbalife, Ltd., to pay approximately $550,000 in civil penalties for an FCPA-related settlement. The SEC had brought civil charges against Li in November 2019 (around the same time as a DOJ indictment of Li) alleging that Li had directed a scheme from 2006 to 2016 to bribe officials in China – using "cash, gifts, travel, meals, and entertainment" – to obtain licenses for, stop Chinese regulatory investigations into, and prevent negative media coverage of Herbalife China. Li allegedly falsified expense reports and otherwise circumvented internal accounting controls to hide the bribe payments, and the DOJ and SEC both asserted that Li overtly lied to SEC staff during their investigation. Li, a Chinese national believed to be in Shanghai, never responded to the SEC's complaint, and the agency moved for default judgment, which the court granted in its June 2022 decision.

Also regarding individuals, the DOJ resolved several higher-profile cases involving foreign bribery using other statutes or causes of action besides the FCPA, primarily the anti-money laundering (AML) laws. The aim of such charges was, in part, to continue to focus on recipients and facilitators of such corruption, as highlighted, for example, by the December 2021 Strategy on Countering Corruption.

One such case involved a guilty plea on July 19, 2022, by the former Minister of Economy of Guatemala, Asisclo Valladares Urruela, for conspiracy to launder approximately $350,000 derived from unlawful bribes between 2014-2018. Federal prosecutors in Florida brought charges against Urruela in August 2020, alleging that he conspired with a corrupt Guatemalan politician, a major drug trafficker, and a rogue Guatemalan bank employee, and executed a complex money laundering scheme related to the movement of illegal money. In October 2022, Urruela was sentenced to 12 months of imprisonment followed by a three-year term of supervised release, as well as forfeiture of $140,000; he will be deported thereafter.

Other cases involving public official recipients of corrupt payments in 2022 included the prosecution of a former Venezuelan Treasurer and her husband (Claudia Diaz Guillen and Adrian Velasquez Figueroa), who were convicted of money laundering charges on December 13, 2022, after a federal trial. According to the DOJ, the couple received over $100 million in bribes a Venezuelan businessman in exchange for access to Venezuela National Treasury bonds with favorable exchange rates. On October 20, 2022, Arturo Carlos Murillo Prijic, a former Bolivian Minister of Government, pleaded guilty to one count of conspiracy to commit money laundering in Florida for receiving at least $532,000 in bribes from a U.S. company in exchange for helping secure a contract with the Bolivian Ministry of Defense. Prijic was sentenced to 70 months of imprisonment, followed by a supervised release of three years. On February 2, 2022, John Robert Luzuriaga Aguinaga, a former Ecuadoran public pension fund official, pleaded guilty to one count of conspiracy to commit money laundering in connection with bribery at Ecuador's public police pension fund; Luzuriaga also agreed to forfeit close to $1.4 million in ill-gotten gains from the bribes. And in March 2022, two former Venezuelan prosecutors (Daniel D'Andrea Golindano and Luis Javier Sanchez Rangel), were charged with money laundering for receiving bribes in exchange for not bringing corruption charges; the two remain at large.

Finally, we note as always that the public tallies do not tell the whole story regarding the state of direct FCPA enforcement, especially as to likely enforcement trends in 2022 and beyond. Throughout 2022, we saw numerous, non-public signs of the DOJ's and SEC's continuing work on corporate and individual investigations, including precursors to enforcement positions and policies that have since been announced publicly. The agencies have continued to close various matters without further investigation in the traditional, non-public fashion. And, as we note in our tracking statistics, the number of investigations that are in public view is an undercount of the actual tally of active investigations by the agencies – as most investigations take years to reach maturity and companies make individual decisions regarding whether and when to disclose such investigations publicly.

Countries Implicated Most Frequently

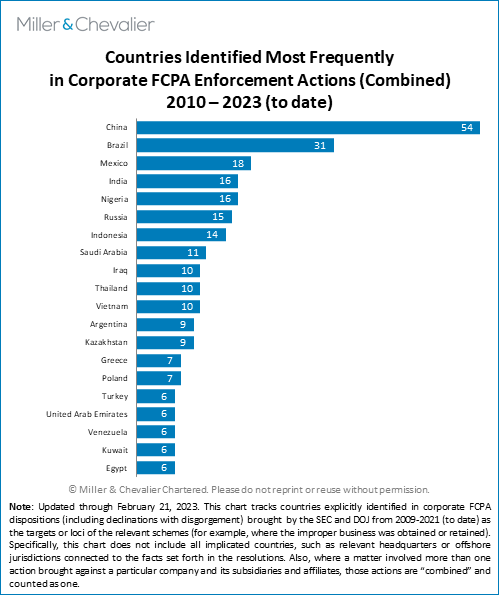

Regarding countries implicated most frequently in corporate FCPA enforcement actions, China and Brazil remain in the spotlight, with China taking the lead with 54 actions in the past 12 years.

Known FCPA Investigations Initiated

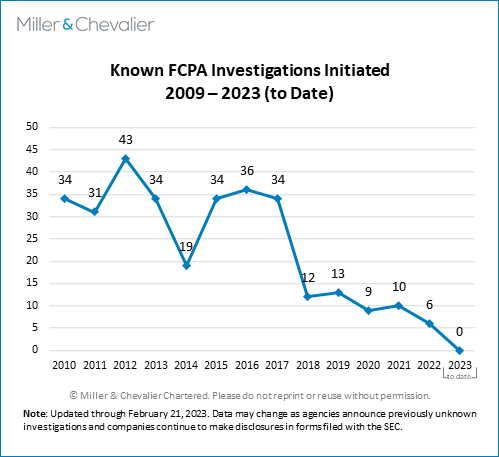

The following chart provides an update on known FCPA investigations initiated against companies over the past 12 years. Six companies disclosed new FCPA-related investigations in 2022 – Leidos Holdings, Inc., Boston Scientific Corporation, Millicom International Cellular S.A., PetroNor, JLT (which, as discussed above, received a declination in 2022), and Arthur J. Gallagher & Co (on November 2, 2022, the company disclosed a DOJ subpoena related to Ecuador).

As always, we note that the numbers in this chart are subject to limitations on available public information, and because neither the DOJ nor the SEC disclose official investigations statistics in anything close to real time and only some companies are likely to disclose such information through SEC filings or other means, our investigation statistics are necessarily incomplete.

U.S. Litigation Developments

U.S. courts issued several key FCPA-related rulings in 2022 of interest to FCPA compliance professionals, including cases involving FCPA issues and contract termination, risks of privilege waiver when cooperating in DOJ investigations, and the dismissal of the long-running Hoskins prosecution.

On January 20, 2022, an EDNY federal court granted the summary judgment motion of Misonix, Inc., finding the company lawfully terminated its distribution agreement with a Chinese distributor due to concerns regarding the distributor's potential FCPA risks. In 2016, Misonix uncovered what the court characterized as "incontrovertible proof" that the distributor had engaged in misconduct, as well as information that Chinese authorities had fined the distributor in 2014 for committing bribery. As the court noted, "given the existential threat…posed by potential FCPA violations," Misonix swiftly terminated the contract, and the distributor sued for breach of contract. The court held that Misonix had a "right and an obligation to act promptly to protect themselves from FCPA liability" and that the distributor's illegal conduct rendered the contract unenforceable under New York law, without regard to any contract clauses. The court's decision supports companies that decide to terminate contracts when the contracting partner may potentially be creating FCPA risk (even if relevant contract does not have specific anti-corruption clauses), although such risks are still best managed through specific contractual rights.

The case involving the scope of waiver of privilege concerns arose from ongoing litigation involving two former Cognizant Technology Solutions Corporation (Cognizant) executives. On February 1, 2022, a federal district court in New Jersey held that Cognizant had effectuated a "significant" waiver of privilege when the company disclosed to the DOJ information from its internal investigation into potential FCPA violations. Specifically, the court ruled that Cognizant's disclosures to the DOJ of "detailed accounts" of interviews conducted during the company's internal investigation entailed a sweeping subject matter waiver that extended to memoranda and related records of those interviews, in some cases the underlying documents, and "documents and communications that were reviewed and formed any part of the basis of any presentation, oral or written, to the DOJ in connection with [the] investigation." The court reasoned that Cognizant's disclosure to the DOJ, a potential adversary, "under threat of prosecution," undermined the purposes of both attorney-client privilege and work-product protection, and thus constituted a subject-matter waiver of privilege as to communications that "concern the same subject matter" and "ought in fairness be considered together" with the disclosures to the DOJ.

The case is the most recent example of the potential ramifications of a company's decision to disclose potentially privileged material to the government. While companies and outside counsel have long known that outright disclosure waives privilege as to the disclosed materials themselves, this opinion highlights the risks that companies must consider when deciding whether to disclose summaries or findings from specific internal investigation interviews – including whether they are risking waiving privilege as to the broader universe of undisclosed documents related to the subject matter of the disclosures. Even though the DOJ's newly revised CEP and other guidance encourage robust cooperation in line with Cognizant's actions (which led to a February 2019 declination with disgorgement for the company), companies will need to continue to weigh all the relevant risks and benefits, with knowledge that waiver findings may now be more prevalent than before.

On August 12, 2022, the U.S. Second Circuit affirmed a district court ruling that Lawrence Hoskins, a U.K. citizen who formerly worked for Alstom Power, Inc (API), was not an "agent of a domestic concern" within the meaning of the FCPA and upheld Hoskins's resulting acquittal from FCPA charges. The decision was 2-1, in which the majority held that the district court properly acquitted Hoskins because there was no agency or employee relationship between Hoskins and API's U.S. subsidiary. Over the long-running case, the DOJ used two theories to attempt to hold Hoskins liable for FCPA-related violations. The first was as a co-conspirator or accomplice to an FCPA violation by Alstom's U.S. subsidiary; this theory was rejected by the Second Circuit in 2018, which held that a person could not be "guilty as an accomplice or a co-conspirator for an FCPA crime that he or she is incapable of committing as a principal." The second was as an "agent" of a "domestic concern" under the FCPA, which the district court rejected and the Second Circuit affirmed in August 2022.

The dissenting opinion found that the evidence presented by the DOJ was sufficient to reject Hoskins's motion to vacate and raised concerns about the potential consequences that the majority's decision might have on compliance with U.S. international obligations under the Organisation for Economic Cooperation and Development (OECD) Anti-Bribery Convention. Whatever those possible consequences, the ruling has created continuing challenges for the DOJ in extending FCPA jurisdiction over the actions of non-U.S. persons.

In other noteworthy litigation developments, Goldman Sachs in May 2022 settled a shareholder derivative suit related to the 1MDB FCPA case, two different U.S. federal circuit courts in March 2022 dismissed cases brought by Mexican agencies against Zimmer Biomet and Stryker seeking damages for corrupt activities on the basis of forum non conveniens, and in July 2022, another federal circuit court held that the FCPA is not a "rule or regulation" of the SEC under the Sarbanes-Oxley Act's whistleblower protections – a case that could have a potential chilling effect on FCPA whistleblowers.

International Enforcement and Policy Updates

International anti-corruption enforcement actions and multilateral cooperation efforts continued apace in 2022. Five of the seven corporate FCPA-related cases announced in 2022 were coordinated with enforcement agencies from other countries; one other (KT Corporation) involved a parallel action by the South Korean authorities.

Authorities in various countries continued to bring their own significant cases, many of which involved equivalents to U.S. DPAs/non-prosecution agreements (NPAs) (which the OECD terms as "non-trial resolutions"). Significant cases were announced in Brazil (a leniency agreement with Keppel Marine tied to the long-running Lava Jato investigation), France (two conventions judicaire d'intérêt public (CJIPs) involving Idemia Group and Doris Group S.A., plus an "extension" of the Airbus CJIP), the U.K. (an April 2022 guilty plea by GPT Special Project Management Ltd, an Airbus subsidiary), and Canada (the first approved remediation agreement in May 2022 involving SNC Lavalin, with a second approved in September 2022 with Ultra Electronics).

As in the U.S., courts in other countries issued rulings that set back enforcement authorities' efforts in specific cases. In the U.K., the SFO faced adverse rulings in efforts to prosecute individuals, both involving failing to provide key relevant evidence to the defendant (the same issue that led to the dismissal of the Baptiste and Boncy cases in the U.S.). On July 19, 2022, the Milan Court of Appeal upheld a Milan trial court's March 2021 acquittal of multinational energy companies Shell and ENI, as well as former senior company executives, related to actions in Nigeria involving alleged corruption by senior Nigerian officials related to oil licenses. The decision and related actions effectively concluded the criminal side of the Italian court proceedings, although the Government of Nigeria is continuing to appeal on the civil side to claim restitution totaling $3.5 billion. On July 21, 2022, the Dutch Public Prosecutor's Office (OM), which had been conducting its own investigation of Shell since 2016 in coordination with the Italian authorities, announced that it was also dismissing any criminal case against Shell, citing the finality of the Italian acquittal and the international law principle of ne bis in idem.

On the international policy front, agencies in France and Brazil published new rules or guidance on the management of corruption investigations and expectations for corporate compliance programs under relevant laws, adding to the expanding list of compliance expectations for multinational companies.

Despite the various developments noted above and others, the non-governmental anti-corruption organization Transparency International (TI) stated in its recent "Exporting Corruption 2022" report that enforcement of anti-corruption laws by countries that have signed onto the OECD Anti-Bribery Convention "continues to decline significantly" from past years. In what the organization termed a "historic low," TI placed "[o]nly two of the 47 countries (United States and Switzerland) … in the category of active enforcement." TI further noted that "[t]his is down from four countries in 2020 … and seven countries in the 2018 report." Among other results, TI stated that "[t]he United Kingdom and Israel dropped from active to moderate enforcement" in 2022. TI also noted that, [s]ince 2020, nine countries have dropped in an enforcement level and only two (Latvia and Peru) have moved up a level" – though the report note the likely effects of COVID-19 restrictions on enforcement levels.

The TI report states that "[i]nternational cooperation is increasing but still faces significant obstacles," including "insufficient or incompatible legal frameworks, limited resources and know-how, a lack of coordination, and long delays." TI also asserts that "[d]espite some improvements, nearly every country has serious inadequacies in laws and institutions that hamper enforcement results" including "problems related to whistleblower protection, the level of sanctions, a lack of training and resources, the underfunding of key enforcement agencies, poor inter-agency coordination, and – in some countries – the insufficient independence of prosecution services and the courts." The TI report sets out various recommendations to address these and other issues.

Finally, we note that in May 2022, the European Research Centre for Anti-Corruption and State-Building (ERCAS), the Anti-Corruption & Governance Center (ACGC), and the Center for International Private Enterprise (CIPE) launched the Corruption Risk Forecast (CRF). The CRF is based on certain data indicators, such as budget transparency, administrative burden, judicial independence, press freedom, and e-citizenship, to measure corruption levels in more than 120 jurisdictions and provides trends analysis. The scope of data is somewhat broader than that used by TI and preliminary evaluation suggests that the CRF may at least be a helpful addition to compliance professionals' toolkit.

Q4 2022

The last quarter of 2022 was more active than Q4 2021, featuring two significant corporate dispositions (Honeywell and ABB), a corporate declination under the CEP (Safran), some new developments in the Glencore matters, and several individual cases resulting in guilty pleas or verdicts. There were also two cases of note involving whistleblowers. Q4 2022 also featured two significant international corporate dispositions and other international developments.

Corporate Dispositions. The Honeywell and ABB U.S. corporate dispositions, as well as the declination with disgorgement for Safran, are summarized above and discussed in more detail below. We also note the various developments in the ongoing Glencore matters below, including the company's sentencing in the CFTC and U.K. SFO cases, the filing by Crusader Health of a Victim Impact Statement and Request for Restitution in the U.S. Southern District of New York (SDNY) under the Mandatory Victims Restitution Act (MVRA), and a settlement with the DRC. Also of note, on February 13, 2023, Global Investigations Review reported that an Independent Compliance Monitor in the FCPA case had been selected after negotiations between U.S. and Swiss authorities.

In other corporate developments, on December 14, 2022, telecommunications company Ericsson announced a one-year extension of the term of the company's Independent Compliance Monitor, which is now scheduled to end in June 2024. Ericsson entered an FCPA-related disposition with the DOJ and SEC in December 2019.

On December 13, 2022, the Danish financial institution Danske Bank entered a plea agreement with the DOJ related to various money-laundering and fraud charges. The terms of the agreement included a forfeiture of over $2 billion. The SEC also entered a separate agreement alleging fraud. Of note, the DOJ agreement included a requirement that Danske Bank implement various "compliance commitments" similar to the elements of an FCPA-related compliance program, including a requirement that the bank "will implement evaluation criteria related to compliance in its executive review and bonus system so that each Bank executive is evaluated on what the executive has done to ensure that the executive's business or department is in compliance with the Compliance Programs and applicable laws and regulations" such that "a failing score in compliance will make the executive ineligible for any bonus for that year." It remains to be seen whether in 2023 similar language enters any new FCPA dispositions given the DOJ's focus on this issue stemming from the Monaco Memorandum and other policy pronouncements.

Actions Against Individuals. Several individual cases resulted in guilty pleas or verdicts during Q4 2022, as discussed below. Notable among them were the December 2022 guilty verdicts return in the Florida trial of former Venezuelan Treasurer Claudia Diaz Guillen and her spouse for money laundering bribes, the October 2022 guilty plea by former Bolivian minister Arturo Carlos Murillo Prijic related to money laundering of bribes received in a defense contracting case, and the December 2022 guilty pleas by Cary Yan and Gina Zhou, two former employees of a U.S. based non-governmental organization who admitted to having paid bribes to officials of the Republic of the Marshall Islands.

In other developments related to individual cases, on November 14, 2022, the DOJ allowed the deadline to file an en banc appeal in the case against Lawrence Hoskins (discussed above) to pass without action. On October 5, 2022, the Second Circuit rejected arguments by Donville Innis, a former government minister from Barbados, in his appeal of his conviction at trial in January 2020 for money laundering related to his alleged receipt of bribes. Finally, we note that Roger Ng, whose conviction is discussed above, on November 11, 2022 filed a fraud action in New York state court against his former colleague Tim Leissner, in part, according to an article in Bloomberg, because Ng needs money to fund his appeal.

In a corruption-related development, the London Privy Court in November 2022 dismissed the appeal of former Fédération Internationale De Football Association (FIFA) Vice President Jack Warner, a citizen of Trinidad (a Commonwealth country) arguing against his extradition to the U.S. to face charges in the ongoing FIFA corruption scandal; the extradition process is thus underway. Former Salvadoran soccer federation President Reynaldo Vasquez was extradited to the U.S. to face bribery charges in connection with the FIFA corruption investigation in mid-2021. There is also a trial underway in the EDNY for bribery-related money laundering charges against two former executives of Fox International Channels and a sports marketing company (Full Play Group SA).

U.S. Litigation Developments. There were two significant developments in whistleblower-related litigation in Q4 2022. First, on October 24, 2022, JPMorgan Chase Bank NA settled a whistleblower retaliation lawsuit brought by a former lawyer in its anti-corruption unit, Shaquala Williams, who had asserted that she was fired after raising concerns about JPMorgan's anti-corruption policies. Second, on November 15, 2022, in the case Doe v. SEC, the Second Circuit affirmed the denial of a bid from a whistleblower who provided the SEC with information that led to a successful enforcement action because the whistleblower had been convicted in a separate, but related, action.

International Developments. The last quarter of 2022 saw several significant dispositions by various authorities outside of the U.S., including two substantial December 2022 leniency agreements with Brazilian authorities involving Keppel Offshore and BRF S.A., a September 2022 Canadian remediation agreement with Ultra Electronics, and a November 25, 2022, French CJIP with Airbus that supplemented the $3.9 billion settlement agreement that Airbus reached with the authorities in France, Britain, and the U.S. in January 2020.

In the area of international cooperation, an agreement between the U.S. and U.K. on data access and sharing between authorities of the two countries entered into force on October 3, 2022. Signed in 2019 and authorized on the U.S. side by the Clarifying Lawful Overseas Use of Data (CLOUD) Act, the agreement, per the DOJ, allows "each country's investigators to gain better access to vital data to combat serious crime in a way that is consistent with privacy and civil liberties standards." The agreement allows for a faster process than traditional requests for mutual legal assistance, which can take many months or longer. The focus of the data access agreement is on terrorism, "child exploitation" and "transnational organized crime" – the last of which could involve actions involving corruption and money laundering related to, for example, anti-kleptocracy efforts consistent with the U.S. Strategy on Countering Corruption.

At the same time, efforts at increasing cooperation and transparency in the EU have encountered some potential obstacles. On November 22, 2022, the EU Court of Justice issued a ruling that invalidated provisions of an EU AML directive that allowed for public access to corporate beneficial ownership registers. The Court's associated release stated that "the general public's access to information on beneficial ownership constitutes a serious interference with the fundamental rights to respect for private life and to the protection of personal data" established by the EU Charter of Fundamental Rights. The decision weighed the interest of allowing such access for the goal of combatting money laundering and other financial crime against the rights of listed owners, finding that the latter outweighed the former and that certain allowed exemptions were insufficient to protect such owners' data from "abuse." The decision has been criticized by various anti-corruption non-governmental associations (NGOs), such as TI, and by media organizations – all of which cited such access to information as critical to anti-corruption efforts that have resulted in, for example, the Panama Papers. In response, EU countries have restricted public access to such registers, though such data remains accessible to law enforcement authorities.

On October 7, 2022, President Biden issued an executive order implementing U.S. obligations under the March 2022 EU-U.S. Data Privacy Framework, which was negotiated in the wake of the July 2020 EU Court of Justice decision in Schrems II that invalidated the prior data sharing arrangement, Privacy Shield. On December 13, 2022, the EU Commission launched its "adequacy decision" process by issuing a draft decision finding that the current U.S. framework modified by the October 2022 executive order "ensures an adequate level of protection for personal data transferred from the EU to the U.S." based on "an in-depth assessment of the Data Privacy Framework itself and its obligations for companies, as well as the limitations and safeguards on access by U.S. public authorities to data transferred to the U.S., in particular for criminal law enforcement and national security purposes." However, on February 14, 2023, a committee of the EU Parliament issued a draft resolution statement "urg[ing] the Commission not to adopt the adequacy finding" because the Data Privacy Framework "fails to create actual equivalence in the level of protection" for personal data under EU law. Thus, the fate of the framework remains unclear, continuing uncertainty regarding key aspects of data sharing, including potentially in corporate investigations.

Corporate Enforcement Actions

Glencore's Large International Resolutions Continue to Develop

To close out 2022, there have been several developments involving Glencore, following its landmark resolutions earlier in the year. As we covered in our FCPA Summer Review 2022, on May 24, 2022, Glencore pleaded guilty in the SDNY to one count of conspiracy to violate the anti-bribery provisions of the FCPA. On the same day, Glencore Ltd., a U.S. subsidiary of Glencore, pled guilty to one count of conspiracy to commit commodity price manipulation.

First, while Glencore Ltd. was sentenced for the commodity price manipulation issues, Glencore's sentencing for the FCPA conspiracy remains unresolved. Specifically, on September 23, 2022, Judge Sarala Nagala of the U.S. District Court for the District of Connecticut sentenced Glencore Ltd. to pay a $341 million fine and $144 million in forfeiture, with three years' probation after its guilty plea to conspiracy to commit commodity price manipulation. The sentencing follows an agreement between Petróleos Mexicanos SA de CV (Pemex) and Glencore to resolve Pemex's claim for restitution. In a court filing on September 12, 2022, both Pemex and Glencore stated Pemex will not submit a claim for restitution after reaching a confidential settlement agreement. Meanwhile, on November 15, 2022, U.S. District Judge Lorna Schofield of the SDNY delayed Glencore's sentencing for its FCPA violations until February 28, 2023. The delay came on the same day that U.S. Attorneys Damian Williams, Michael C. McGinnis, and Juliana N. Murray filed a request for delay in the sentencing due to the U.S. Attorneys' ongoing coordination with Swiss authorities relating to "issues" arising out of imposing a compliance monitorship on Glencore, an issue that the request states will be determined by the Swiss authorities by mid-January 2023 (but has still not been publicly resolved). This was the second request by U.S. Attorneys to delay sentencing, following an August 31, 2022 request that was granted by Judge Schofield on September 1, 2022, delaying sentencing to November 21, 2022.

Second, on October 26, 2022, London's Southwark Crown Court denied Nigeria's bid to file a compensation order against the British subsidiary of Glencore for alleged bribes paid to Nigerian state oil company officials, claiming status as a victim of Glencore's offenses. Judge Peter Fraser of the Southwark Crown Court ruled Nigeria does not have the right to be heard, as only the SFO, the prosecutors in the case, and the defense can make arguments at the sentencing hearings. Judge Fraser ruled that third parties have no standing to make representations about a compensation order and that compensation orders were to be used in clear-cut cases, while stating the Glencore dispute was not such a case.

Third, outside the U.S., Glencore Energy UK Ltd., a U.K. subsidiary of Glencore, was sentenced on November 3, 2022, to pay over £281 million after pleading guilty to seven counts of bribery in June 2022 as a result of an SFO investigation. The SFO noted it worked "in parallel" with DOJ. This brings the total coordinated amount Glencore will pay to approximately $1.45 billion to U.S. and U.K. authorities.

Fourth, in another international development, on December 5, 2022, Glencore announced that it had reached an agreement with the DRC for $180 million that covered all present and future claims from alleged acts of corruption in the DRC between 2007 and 2018. Glencore also stated that it will continue to implement its Ethics and Compliance Program in the DRC, as included in the May 2022 DOJ FCPA resolution.

Finally, on February 27, 2023, Glencore was ordered to pay $29.6 million to Crusader Health. Crusader Health's owners, Ian and Laurethé Hagen, had filed a Victim Impact Statement and Request for Restitution in the SDNY under the Mandatory Victims Restitution Act (MVRA) on October 25, 2022 for $50 million, claiming Glencore's DRC subsidiary wrongfully terminated contracts with Crusader Health as retaliation for an investigation into a medical professional who worked at clinics serving mining workers and families. In its November 8, 2022 response, Glencore countered that it should only pay $12 million in restitution for Crusader Health's claims.

ABB Settles with the DOJ and SEC for Misconduct in South Africa

On December 2 and 3, 2022, the DOJ and SEC announced that Swiss technology company ABB Limited (ABB), a "foreign issuer" as defined by the FCPA, agreed to resolve parallel investigations by the two agencies and the criminal authorities in South Africa and Switzerland involving charges against the company for violating the FCPA's anti-bribery and accounting provisions. The violations stemmed from the alleged bribery of a South African official to win a large construction and engineering contract from the South African state-owned power company Eskom.

This is the third resolution reached by ABB for FCPA violations. The first was in 2004 relating to $1.1 million bribes paid to officials in Nigeria, Angola, and Kazakhstan. The second was in 2010 relating to bribes paid to officials in Mexico and kickbacks paid to the former regime in Iraq.

As a result of the resolution, ABB entered into a three-year DPA with the DOJ in connection with the filing of a criminal information in the Eastern District of Virginia charging the company with two counts of conspiracy to violate FCPA and two counts of violating the FCPA. The company also consented to a Cease-and-Desist Order with the SEC (SEC Order) for violations of the anti-bribery, books and records, and internal control provisions of the FCPA.

The company agreed on paper to pay over $460 million in penalties to the U.S. authorities, which included: $315 million in criminal penalties to the DOJ, a $75 million civil penalty to the SEC, and $72.5 million in disgorgement and prejudgment interest to the SEC. Both agencies agreed to offset significant amounts, and the total paid to the U.S. authorities will likely be $154.2 million pending the resolution with the German authorities. The DOJ agreed to credit up to $63 million against fines that ABB pays to the SEC, $157.5 million against fines that ABB pays to the South African authorities, $11 million against fines that ABB pays to the Swiss authorities, and $11 million against anticipated fines that ABB may be required to pay to German authorities so long as the fines are paid to the German authorities within 12 months. Depending on exact offset calculations, the net result for the DOJ was $79.2 million, with $72.5 million to be paid within 10 days of the DPA. The SEC deemed the $72.5 million in disgorgement and prejudgment interest satisfied by a payment previously made to the South African authorities.

ABB reached a resolution with the Swiss Attorney General, agreeing to pay $4.3 million for the misconduct in South Africa, and reached two separate resolutions with the South African authorities. The most recent settlement in 2022 resulted in "punitive reparations" of $144.51 million to be paid to the South African federal prosecutors. ABB had previously agreed in 2020 to pay $92.48 million back in "reparations" to Eskom specifically. The SEC offset explicitly references the 2020 settlement, while the DOJ does not specify which settlement it offset. The company's press release states that "cash out of pocket" is $327 million.

As part of the DPA, two of the company's subsidiaries pleaded guilty — ABB South Africa (Pty) Ltd. and ABB Management Services Ltd. — and each must pay $500,000 in criminal penalties. The subsidiaries each pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA.

As discussed below, ABB did not get credit for a voluntary disclosure, despite its best intentions. The DOJ noted that the penalties established by the resolution reflected a 25 percent reduction from the DOJ's penalty calculation under the U.S. Sentencing Guidelines because of ABB's "extraordinary" cooperation, remedial measures, commitment to enhance their compliance program, and agreement to continue cooperating. However, the base fine – before the DOJ applied the 25 percent reduction – was significantly increased based on ABB's prior history, including both resolutions in the U.S. and administrative actions in Europe and Brazil, as discussed below.

According to the DPA and the SEC Order, between 2014 and 2017, certain ABB subsidiaries and employees engaged in a bribery scheme related to obtaining cabling and installation contracts for the Kusile Power Station run by Eskom. In 2013, ABB formed a "Capture Team" consisting of executives from Swiss headquarters (including an executive with experience doing business with Eskom from a prior job at another company), a local South African manager, and a sales expert from ABB Germany to work on winning the relevant contract. According to the DOJ, to secure the contract, ABB would need to ensure compliance with South Africa's Black Economic Empowerment requirements, and therefore ABB's selection of suppliers would be important for Eskom. Members of the team met with an Eskom official, whom they had identified as the decision-maker on the bid, to obtain information regarding the contract. The official, in turn, introduced the team to a "friend" – the chair of a South African engineering firm. Subsequently, ABB retained that "friend" as its first subcontractor for the project, despite what the case documents state regarding the subcontractor's "poor technical qualifications and lack of experience" and without competitive bidding – actions that were "contrary to internal company policy." In related internal communications, certain ABB managers discussed the need for "local sponsors" for the bidding, who one manager described as "the ones who don't do anything for us but cash in because they are [members of a South African political party], etc."

The case documents state that ABB South Africa promised to pay bribes to the Eskom official through this first subcontractor if Eskom selected ABB for the contract under consideration. The subcontractor provided confidential Eskom information to ABB South Africa, including "confidential Eskom pricing information" during the contract negotiations. Ultimately, ABB South Africa won the contract for $160 million despite having a bid $45 million higher than the closest competing bid. Soon after, ABB South Africa entered into a new agreement with the subcontractor which called in part for an "advanced payment" of $798,000, with the understanding that the payment would be passed to the Eskom official; the case documents note that "ABB South Africa falsely recorded the payment in its books and records as an 'advanced payment' for services to be performed by" the subcontractor. However, due to an interpersonal conflict between the subcontractor and the Eskom official that ABB South Africa personnel "unsuccessfully attempted to mediate," ABB personnel had concerns that the subcontractor had not given the "advanced payment" to the Eskom official.

Per the DPA and the SEC Order, now-former ABB managers thus worked to engage a second subcontractor to facilitate payments to the Eskom official. However, the proposed second subcontractor "failed multiple aspects of ABB's routine due diligence, raising questions among ABB personnel based in South Africa and the United States about [the subcontractor's] qualifications and financial stability." ABB managers involved in the scheme pushed for "a waiver of ABB's standard subcontractor qualification requirements" – ultimately successfully.

To fund payments to the South African official, ABB personnel and the official "agreed to inflate the cost of ABB's work on the Kusile Project via multiple contract 'variation orders.'" According to the DPA, the involved personnel agreed to an inflated price and then engaged in "sham negotiations" resulting in a variation order for the target price. In total, ABB paid the second subcontractor $37 million in total, with the understanding that a portion would be funneled to the Eskom official. The DPA notes that some of that portion benefitted the official "via [the official's] close relative, who served as a director of [the second subcontractor] and also held an ownership interest in [the second subcontractor] through a trust soon after ABB engaged [the second subcontractor] to work on the Kusile Project."

The DPA and SEC Order note that the bribes involved false purchase orders and contracts and were inaccurately recorded as legitimate engineering services in ABB South Africa's books and records. ABB then consolidated ABB South Africa's financial statements into its own. The SEC Order notes that despite prior FCPA settlements, ABB failed to devise and maintain sufficient internal accounting controls.

Key Takeaways

- Involvement of Multiple Executives in Overriding Third Party Processes and Internal Controls: The DPA details how ABB managers were involved in pushing to override or bypass processes and internal controls to onboard subcontractors, despite concerns raised by supply chain management personnel. These efforts focused on "requir[ing] ABB procurement and compliance-related employees in the United States to draft [the above-noted] waiver of ABB's standard subcontractor qualification requirements." The DPA states, "[d]espite concerns about [the second subcontractor's] qualifications, ABB subsequently granted the requested waiver … premised on [the second subcontractor] working through other subcontractors who were qualified for the job." The SEC Order also notes that "[a]s [the second subcontractor's] employees were already at the Kusile site working, and the message from ABB-South Africa was that [the second subcontractor] was required to be used by Eskom, the American [supply chain management] employee felt he had no choice but to arrange this waiver…." The documents do not state how involved supply chain management and compliance personnel considered the Eskom requirement to use the subcontractor – a clear red flag – to be mitigated by the waiver process. Business pressure on compliance and other gatekeeper personnel is common, but corrupt actors can override even robust controls if the culture of the company does not adequately support gatekeepers who raise legitimate concerns regarding third parties.

- Merely Requesting Meeting with DOJ Not Sufficient for "Timely" Voluntary Disclosure: The DPA notes that ABB did not receive voluntary disclosure credit because their disclosure to DOJ officials was not timely. Specifically, the DOJ stated that ABB requested a meeting with the DOJ without detailing the matter they wanted to discuss. Between the scheduling and the actual meeting, the media reported the misconduct. However, the DOJ noted in the DPA that "in evaluating the appropriate disposition of this matter -- including the appropriate form of the resolution – [the DOJ] considered evidence" that showed ABB's intent to disclose "within a very short time of learning of the misconduct." In a speech delivered on December 6, 2022, Principal Associate DAG Marshall Miller stated, "far from taking a narrow, technical approach, the [DOJ] assigned significant weight to ABB's documented efforts to self-disclose in arriving at the ultimate result." That said, Miller emphasized that the DOJ "is placing a new and enhanced premium on voluntary self-disclosure" – a message echoed repeatedly in the last few months in the wake of the Monaco Memorandum and in the January 2023 revisions to the CEP.

- No Independent Monitor Despite Lack of Effective Self-Disclosure and Recidivism: The DOJ gave ABB credit under the U.S. Sentencing Guidelines and the CEP for the company's "extraordinary cooperation," including "demonstrated recognition and affirmative acceptance of responsibility for their criminal conduct," providing information from its internal investigation, making factual presentations to the DOJ, "voluntarily making foreign-based employees available for interviews in the United States," producing foreign-based documents to the DOJ "in ways that did not implicate foreign data privacy laws," and collecting and translating materials. As noted, the company did not receive the formal reduction that an effective self-disclosure could have provided, but its demonstrated intent to self-disclose, as well as what Principal Associate DAG Miller labeled "A+ cooperation," were factors weighed by the DOJ.

Given the DOJ's recent focus on penalizing recidivist companies, it is not surprising that the DPA listed multiple past actions in ABB's "criminal history" – including the 2004 and 2010 FCPA dispositions, as well as a 2001 guilty plea in Italy on bid rigging and "resolution of administrative actions with European and Brazilian competition authorities in 2013 and 2014" – as issues relevant to the outcome of this case. The DPA does not discuss how these actions were weighed, but in his speech, Principal Associate DAG Miller noted that "ABB entered into [the] prior FCPA resolutions…way back in 2004 and then in 2010 — 12 years ago — when the company had a completely different management team." The DOJ picked a base fine in the middle of the Sentencing Guidelines range, whereas the DOJ often uses the low end of the range. The DOJ also added points to ABB's culpability score under the Sentencing Guidelines based on ABB's prior history. Together, these actions increased ABB's criminal fine range by tens of millions.

ABB also avoided the imposition of an Independent Compliance Monitor, with the DOJ emphasizing in the DPA that the company enhanced its compliance program and internal controls, and engaged in "extensive" remedial measures such as "hiring experience compliance personnel," conducting "a root cause analysis of the conduct described in the Statement of Facts," "restructuring of reporting by internal project teams to ensure compliance oversight," investing "significant" resources for company-wide compliance and monitoring, and "promptly disciplining employees involved in the misconduct." As to this last point, the SEC Order states, "ABB terminated all employees involved in the misconduct." The SEC Order also cites specific program and controls "enhancements" related to "public tenders; misuse of confidential information; supplier due diligence, monitoring and payments; scrutiny of variation orders; risk review; [and] management visibility and accountability." The DPA thus states that "based on the Company's remediation and the state of its compliance program" and ABB's agreement to "enhanced corporate compliance [testing and] reporting" during the course of the DPA (a requirement also found in the SEC Order), the DOJ decided that a Monitor was "unnecessary." Despite avoiding a Monitor, ABB does have a self-reporting obligation "regarding remediation and implementation of the compliance measures" and the Chief Executive Officer and Chief Compliance Officer, are required to certify that ABB has met its compliance obligations at the end of the DPA's term.

Honeywell Settles with U.S. and Brazilian Authorities for Misconduct in Brazil and Algeria

On December 19, 2022, Honeywell International Inc. (Honeywell) agreed to pay more than $200 million to resolve investigations by U.S. and Brazilian authorities regarding the company's alleged misconduct in Brazil and Algeria. Specifically, UOP, LLC (UOP), a U.S.-based subsidiary of Honeywell International Inc., entered into a three-year DPA with the DOJ with $79.2 million in criminal penalties and $105.7 million in forfeiture to resolve charges involving one count of conspiracy to violate the anti-bribery provisions of the FCPA for its conduct in Brazil. Honeywell International Inc. agreed to a Cease-and-Desist Order with the SEC (SEC Order) with $81.2 million in disgorgement and prejudgment interest to settle allegations that the issuer violated the anti-bribery, books and records, and internal accounting controls provisions of the FCPA for conduct in Brazil and Algeria. In addition, UOP entered into leniency agreements with the Brazilian MPF, CGU, and AGU to settle charges related to UOP's conduct in Brazil. The DOJ agreed not to collect any portion of the forfeiture amount on the basis that the company would pay the disgorgement amounts to the SEC and the Brazilian authorities; the DOJ also agreed to "credit up to approximately $39.6 million of [the] criminal penalty against amounts the company has agreed to pay to authorities in Brazil." The SEC agreed to an offset of up to $38.7 million for any disgorgement paid to the Brazilian authorities within 90 days of the SEC Order. Honeywell reported the total amount paid to U.S. and Brazilian authorities as $202.7 million.

Honeywell did not receive credit for a timely voluntary disclosure but received full cooperation credit. The DPA notes that such cooperation included "proactively disclosing certain evidence of which the [DOJ units were] previously unaware;" "voluntarily facilitating interviews of employees;' and "collecting and producing voluminous relevant documents and translations to the [DOJ]… including documents located outside the United States." As a result of its cooperation, and "extensive" remedial measures undertaken by the company (including employee discipline and termination), the criminal penalty reflects a 25 percent reduction off the bottom of the applicable fine range based on the U.S. Sentencing Guidelines. The DPA also focused on that fact that UOP "has no prior criminal, civil, or regulatory history," though the DOJ also noted that "Honeywell has one prior criminal resolution from 2011 relating to the storage of hazardous waste without a permit" and that "Honeywell and other of its subsidiaries have had additional prior civil and administrative settlements."

Honeywell avoided the imposition of a Monitor, with the DOJ stating that Honeywell had already established "monitor and audit processes to regularly review and update the compliance program." Nonetheless, the company must continue cooperation with other investigations, continue to enhance its compliance program, and provide annual reports to the DOJ on the status of improvements over the DPA's three-year term. Per recent policy changes by the DOJ Fraud Section, the DPA also requires Honeywell's CEO and CCO to certify that the Company has met its compliance obligations under the DPA thirty days prior to the expiration of the DPA's term. The leniency agreement requires a similar report after one year to the Brazilian agencies.

Brazil

The DPA and SEC Order state that between 2010 and 2014 UOP employees, with the help of an intermediary, offered $4 million to a Petrobras official in exchange for a $425 million contract to design and construct a refinery. Per the DPA, the Petrobras official provided "business advantages, including inside information and secret assistance," to UOP in exchange for the payments.

During the early stages of the bidding process for the refinery contract, UOP executives determined they needed the help of an intermediary and engaged an agent (referred to as the "Brazil Sales Company" in the DPA) with connections to a director at Petrobras responsible for the project. According to the DPA, when seeking approval to engage the agent from Honeywell's compliance department, the UOP employees knowingly misrepresented information about the agent to ensure that the agent passed due diligence. For example, the employees "lied on the request form, stating that Brazil Sales Company had been 'known to' … UOP and a … UOP employee for two years, when, in fact, the companies had no common history and the … UOP employee had no prior knowledge of Brazil Sales Company." The SEC Order also noted that "the request … omitted the fact that the Brazil [agent's] work would entail interacting with government officials." After, as noted by the SEC, "high-level" UOP and Honeywell executive approval of the request, the agent worked with UOP employees to meet with and negotiate with the director at Petrobras for the contract, promising one percent of the contract ($4 million) in exchange. A lobbyist (referred to as "Intermediary 1" in the DPA) would collect the bribe on behalf of the official. It was agreed that the $4 million bribe would come from the agent's commission, who had an expected commission of $12 million.

Per both the DOJ and SEC documents, throughout the bidding process, internal communications at UOP were exchanged referencing the director as the "King." When an initial UOP bid was rejected, UOP executives discussed having the "King" intercede and pass them the target number for a winning bid. UOP won the bid after submitting a revised proposal using Petrobras's confidential target number. UOP paid the agent $10.4 million total in commissions from 2011 to 2014. The government documents state that the commissions were paid to a Swiss bank account beneficially owned by the owner of the Brazil Sales Company (referred to as "Intermediary 2" in the DPA). UOP earned $425 million in gross revenue and $106 million in profits from the contract.

Algeria

The SEC Order notes that in Algeria employees of Honeywell Process Solutions (HPS), with the help of an intermediary, paid more than $75,000 to an Algerian official to secure a "contract amendment" with state-owned oil company Sonatrach. According to the SEC, HPS, on behalf of Honeywell Belgium, engaged the "Monaco Agent" (which is named as Unaoil in Honeywell's press release regarding the settlement) to develop business opportunities in Algeria. The Monaco Agent was asked to make a pass-through payment to "a group of people in Europe" who had helped Honeywell Belgium come to an oral agreement with Sonatrach. Another intermediary (referred to as the "Consultant" in the Order) was retained by HPS on behalf of Honeywell Belgium to pay $75,000 to Sonatrach officials. After the payment was made from the Consultant, Sonatrach and Honeywell Belgium were able to come to an agreement on the contract amendment. An unidentified Honeywell subsidiary entered into a fictitious sales consultancy agreement with the Monaco Agent to "promote sales" in Algeria with a commission — but the Monaco Agent never obtained any new business of HPS. Honeywell approved the invoice for the Monaco Agent's work without questioning the basis for the payment, and, the SEC stated, the Monaco Agent then paid the intermediary who had bribed the Sonatrach official.

Key Takeaways

- Continued International Cooperation: The Honeywell settlement is another example of continuing domestic and international cooperation and coordination among and between U.S. authorities and foreign authorities in pursing investigations against corporate actors who engage in misconduct. Since the start of Lava Jato, U.S. authorities have worked closely with Brazilian prosecutors in resolving complex corruption enforcement matters, including three other resolutions in 2022 (Glencore, Stericycle, and GOL).

- Implementation of Recent DOJ Policies: The DPA illustrates how the DOJ is implementing recent policy announcements regarding considerations for prosecutors into charging decisions. First, as there was no voluntary disclosure, it is evident from the result and under the DOJ's CEP that the company was not eligible for a declination with disgorgement. Also consistent with DOJ pronouncements in the Monaco Memorandum and elsewhere, despite Honeywell not receiving credit for timely voluntary disclosure, the company still qualified for 25 percent discount in fines and avoided a corporate monitor by engaging in full cooperation and extensive remediation. As noted above, the DPA also provides an example of how the DOJ considers and weighs prior misconduct and is consistent with a policy announced in March 2022 by Assistant Attorney General (AAG) Kenneth A. Polite, Jr., requiring prosecutors, where a corporate monitor is not imposed, to consider imposing a certification requirement on the CCO and CEO.

- Different Conduct at Issue in DPA and SEC Order: The SEC charged Honeywell for violations of the FCPA accounting provisions for misconduct in Algeria and Brazil, whereas the DPA only addressed the misconduct in Brazil. Despite the DPA's narrower focus, the DOJ still imposed a larger forfeiture than the SEC required for disgorgement. As noted, the Algerian conduct involved Unaoil, a Monaco consultancy that has been at the center of several major FCPA and related dispositions. The former CEO and COO of Unaoil pleaded guilty in October 2019 to FCPA related charges and have been cooperating with U.S. authorities. This cooperation appears to be reflected in Honeywell's SEC Cease-and-Desist Order, which contains information potentially sourced from Unaoil personnel. For example, the SEC noted that "an executive of the Monaco Agent received a panicked phone call from the HPS Regional GM asking him to make a pass-through payment to a group of people in Europe who purportedly had helped Honeywell Belgium secure a contract with Sonatrach. The Monaco Agent executive understood this to mean that the payment was possibly a bribe."

DOJ Issues Declination with Disgorgement for French Aerospace Company Safran

On December 21, 2022, the DOJ issued a letter declining to prosecute the French aerospace company Safran S.A. for violations of the FCPA in line with the DOJ's CEP. Safran agreed to disgorge $17.2 million in profits "from the corruptly obtained and retained contracts" that related to actions by Safran's U.S. subsidiary, Monogram Systems.

According to the letter, the DOJ's investigation determined that, "from approximately 1999 until 2015," Monogram and a German company, EVAC GmbH "paid millions of dollars to a China-based business consultant who was a close relative of a then-senior Chinese official" with knowledge that at least some of the funds would be transferred to the official. The companies did so "to obtain lucrative train lavatory contracts with the Chinese government."

Consistent with the requirements of the CEP, the DOJ highlighted as key Safran's "timely and voluntary self-disclosure" of the issues and the company's "full and proactive cooperation" with the DOJ's investigation. The declination letter also noted various remediation steps, including the termination of involved personnel and (consistent with recent DOJ policy announcements) "withholding the deferred compensation of another employee involved in the misconduct who had previously left the company." Another factor cited was the fact that the misconduct occurred prior to Safran's acquisition of Monogram and EVAC (and was stopped before the acquisition). Thus, as the letter notes, Safran was only the "successor-in-interest" to the offending companies. The letter also notes that Safran identified the issues through "post-acquisition due diligence," which led to the company's voluntary disclosure.

Safran is a French multinational, listed on Euronext, with American Depository Receipts (ADRs) listed in the U.S. Notably, the French government is the largest shareholder, owning more than 10 percent of the equity, which may have factored into the enforcement decision. In 2017-2018, Safran acquired Zodiac Aerospace, another French entity with ADRs listed in the U.S. and the parent for both Monogram Systems and EVAC. Thus, Monogram Systems and EVAC appear to have been owned by foreign issuers both during and after the misconduct identified in the declination (and of course Monogram Systems was and is a domestic entity).