FCPA Spring Review 2019

International Alert

Introduction

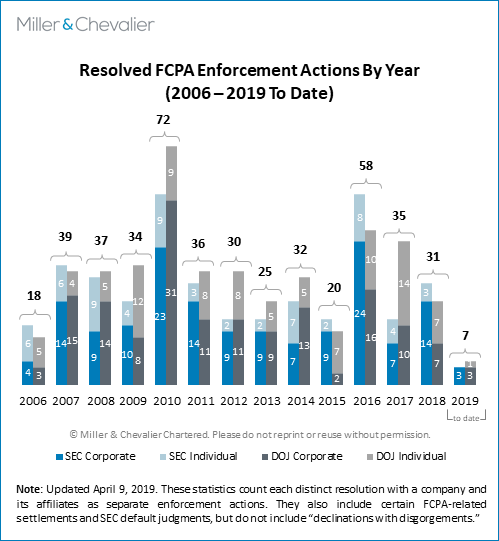

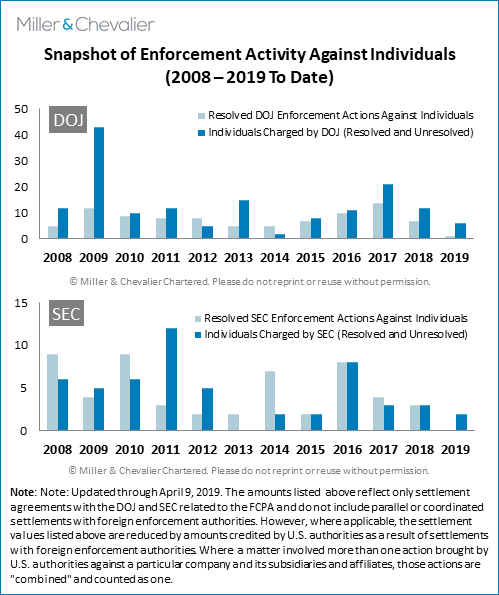

In the first quarter of 2019, the pace of announced Foreign Corrupt Practices Act (FCPA)-related dispositions was somewhat below the 10-year average. The quarter saw only three corporate enforcement actions, one individual enforcement action, and one known investigation closed without enforcement action—all below-average numbers compared to the last 10 years, potentially presaging reduced overall numbers for 2019. One likely factor contributing to this slowdown was the U.S. federal government shutdown that sidelined personnel from both the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) from December 22, 2018, to January 25, 2019.

Despite the lower aggregate number of cases announced, the first quarter did include the completion of two major cases, including one that resulted in the largest FCPA penalty in history—$850 million in fines and forfeiture amounts assessed against Russian telecommunications provider Mobile TeleSystems PJSC to resolve charges that the company conspired to pay millions of dollars in bribes to Gulnara Karimova, the daughter of the former Uzbekistan President, in order to secure assistance in entering and maintaining business operations in that country. In addition, the Federal Bureau of Investigation (FBI) announced the establishment of a new "International Corruption Squad," based in Miami, Florida, which will focus on "criminal acts occurring outside U.S. borders but having a nexus to the U.S," such as "foreign bribery, kleptocracy, and international antitrust matters." The MTS enforcement action, the new FBI squad, and other significant cases and developments this quarter signal the U.S. government's continued commitment to aggressive anti-corruption enforcement.

Corporate Enforcement Actions

During the first quarter of 2019, three companies and their subsidiaries reached FCPA-related settlements with the DOJ and SEC:

- Cognizant Technology Solutions Corporation: On February 15, 2019, the SEC released a Cease-and-Desist Order against the publicly traded, New Jersey-based technology services company Cognizant Technology Solutions Corporation (Cognizant), charging violations of the anti-bribery, books-and-records, and internal-accounting-controls provisions of the FCPA. According the SEC, Cognizant authorized and reimbursed a third-party construction company to make approximately $2 million in bribe payments to Indian government officials in exchange for assistance in securing certain permits related to the construction of an office park in Tamil Nadu, India. Under the Order, Cognizant will pay approximately $16 million in disgorgement, $2.8 million in pre-judgement interest, and a civil monetary penalty of $6 million. Two days prior to the announcement of the SEC Cease-and-Desist Order, the DOJ entered into a Letter Agreement with Cognizant declining to prosecute the company for violations of the anti-bribery provisions of the FCPA, but requiring disgorgement of $19 million, credited against disgorgement paid to the SEC. Altogether, Cognizant is required to pay $28.14 million, taking into account the SEC penalties and the disgorgement imposed by the DOJ and SEC. Cognizant's full declination from prosecution reflects the company's substantial cooperation with the DOJ by voluntarily self-disclosing, fully cooperating, and remediating the alleged misconduct. Notably, the DOJ granted a full declination in spite of the alleged involvement of senior leadership, namely the former President and the former Chief Legal Officer, who now face separate DOJ and SEC criminal and civil charges. Absent Cognizant's substantial cooperation with the DOJ, the involvement of such senior leadership may well have resulted in additional criminal and civil liability for the company. We discuss the Cognizant enforcement action in greater detail below.

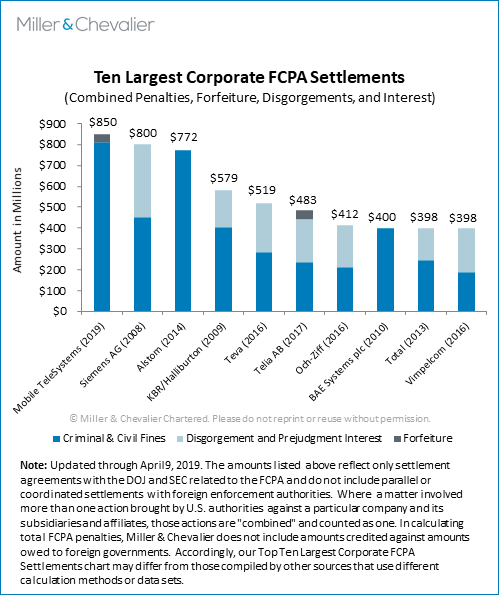

- Mobile TeleSystems PJSC: On March 6, 2019, the DOJ announced a Deferred Prosecution Agreement (DPA) and the SEC announced a Cease-and-Desist Order with the Russian telecommunications provider Mobile TeleSystems PJSC (MTS) and its Uzbek subsidiary Kolorit Dizayn Ink LLC (Kolorit). According to the DOJ, MTS and its subsidiary conspired to violate the criminal anti-bribery and books-and-records provisions of the FCPA. According to the SEC, MTS violated the civil anti-bribery, books-and-records, and internal-accounting-control provisions of the FCPA. As noted above, the charges against MTS arose out of alleged payments to Gulnara Karimova, the daughter of the former President of Uzbekistan, in exchange for support for business operations in Uzbekistan. The MTS disposition is the third major FCPA case, after Telia Company AB and VimpelCom Ltd., involving telecommunications companies making unlawful payments to Karimova. Under the DOJ's DPA and SEC Order, MTS agreed to pay total penalties and forfeiture of $850 million—the largest amount ever paid to the U.S. government in an FCPA action, breaking the 10-year record held by Siemens AG, as shown in our Top Ten Largest Corporate FCPA Settlements chart, below.1 We discuss the MTS enforcement action in greater detail in the next section.

- Fresenius Medical Care AG: On March 29, 2019, the DOJ announced a Non-Prosecution Agreement (NPA) and the SEC announced a Cease-and-Desist Order with the German health care company Fresenius SE & Co. KGaA (FMC). According to the DOJ, FMC offered or paid bribes to publicly employed health care providers and government officials and knowingly and willfully failed to implement reasonable internal-accounting controls and maintain adequate books and records. According to the SEC, the company violated the anti-bribery, books-and-records and internal-accounting-controls provisions of the FCPA by, for example, failing to take basic anti-corruption steps such as training of employees or conducting due diligence on agents. The alleged misconduct spanned more than a dozen countries, including Angola and Saudi Arabia, most prominently, but also Benin, Bosnia, Burkina Faso, Cameroon, Chad, China, Gabon, Ivory Coast, Mexico, Morocco, Niger, Senegal, Serbia, Spain, and Turkey. Under the DOJ's NPA and the SEC Order, FMC must pay a total penalty of $231 million. We discuss the FMC enforcement action in greater detail below.

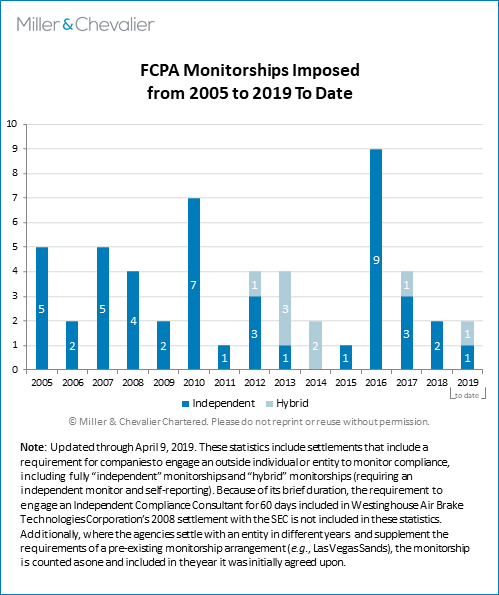

Notably, both the MTS and FMC settlements with the DOJ and SEC required that the companies each appoint an independent compliance monitor to assess and report on the effectiveness of the companies' respective anti-corruption compliance programs and related internal accounting controls. Accordingly, 2019 has already tied 2018 in terms of the number of monitorships imposed. These cases show that the agencies will still impose monitorships in appropriate circumstances, even in light of the DOJ's recent Corporate Monitor Policy, which instructs prosecutors to balance monitor benefits and costs.

Individual Enforcement Actions

The first quarter of 2019 saw one individual enforcement action:

- Frank James Lyon: On January 22, 2019, the DOJ unsealed a plea agreement by Frank James Lyon, the owner of an engineering and consulting company based in Honolulu, Hawaii. According to the DOJ, from 2006 to 2016 Lyon and his co-conspirators paid over $200,000 to transportation and congressional officials from the Federated States of Micronesia (FSM), as well as $240,000 to a Hawaiian state agency. In exchange, Lyon's company allegedly obtained contracts valued at approximately $7.8 million from the FSM government and an additional contract with the Hawaiian state agency. An FSM government official who allegedly received payment from Lyon, Master Halbert, currently faces related charges for conspiracy to commit money laundering. These cases are unusual examples where the DOJ has used both foreign and domestic bribery charges to punish corrupt conduct, encompassing the actions of both for the bribe payer and the bribe taker. We discuss Lyon's plea agreement in greater detail below.

The DOJ and SEC have also brought several new charges against individuals in the first quarter of 2019, including both criminal and civil charges against Gordon Coburn and Steven Schwartz, the former President and Chief Legal Officer, respectively, of Cognizant, noted above and discussed in greater detail below.

Policy and Litigation Developments

The first quarter of 2019 witnessed several significant FCPA-related policy and litigation developments. On February 26, 2019, the U.S. Court of Appeals for the Ninth Circuit issued an opinion in Wadler v. Bio-Rad Laboratories, Inc., holding that the FCPA is not a "rule or regulation" of the SEC, such that FCPA-related whistleblowers are not entitled certain whistleblower protections under the Sarbanes–Oxley Act (SOX). On March 6, 2019, the Commodity Futures Trading Commission (CFTC) issued an Enforcement Advisory indicating that it would begin to investigate violations of the Commodity Exchange Act that "involv[e] foreign corrupt practices." The CFTC's announcement potentially brings the number of government agencies investigating FCPA violations, in at least certain circumstances, to three—the DOJ, the SEC, and, now, the CFTC. And on March 8, 2019, the DOJ issued an update to its FCPA Corporate Enforcement Policy, loosening requirements that companies prohibit employees' use of ephemeral messaging platforms such as WhatsApp in order to receive full remediation credit when facing a DOJ investigation. We discuss Wadler, the CFTC Enforcement Advisory, and the updated FCPA Corporate Enforcement Policy on ephemeral messaging platforms below.

International Developments

Finally, anti-corruption developments continued apace outside the United States as well, with several key individual enforcement actions that ended in convictions or acquittals. In the United Kingdom, a former executive at the oilfield services provider Petrofac pled guilty to 11 counts of bribery in violation of the U.K. Bribery Act, based on alleged payments made to obtain contracts in Iraq and Saudi Arabia totaling more than $4 billion. In Sweden, three former executives from Telia Company AB were acquitted on the grounds that the recipient of the alleged bribes, Gulnara Karimova, was not a "bribable" individual under relevant Swedish law, because she was not officially a government employee or in a relevant position of trust with the government. And in Canada, the Royal Canadian Mounted Police (RCMP) successfully prosecuted two executives from the high-tech security company CryptoMetrics Canada, Inc. under the Corruption of Foreign Public Officials Act (CFPOA) but were forced to suspend charges against two former executives from the engineering, procurement, and construction services company SNC-Lavalin Group Inc. due to a delay in prosecution that the Canadian court deemed unfair. We discuss the Petrofac conviction, the Telia acquittals, the CryptoMetrics convictions, and the SNC-Lavalin dismissals in greater detail below.

Corporate Enforcement Actions

Cognizant Technology Solutions Corporation Settles with the SEC and Receives Declination With Disgorgement from the DOJ

On February 13, 2019, the DOJ entered into a Letter Agreement in which it declined to prosecute Cognizant Technology Solutions Corporation (Cognizant) for violations of the anti-bribery provisions of the FCPA. Cognizant is a publicly traded technology services company based in New Jersey and is thus a U.S. "issuer." According to the Letter Agreement, Cognizant agreed to disgorge $19,370,561, which was offset by any disgorgement amounts, but not prejudgment interest, paid to the SEC.

Two days later, on February 15, 2019, the SEC entered a Cease-and-Desist Order against Cognizant for violations of the anti-bribery, books-and-records, and internal-accounting-controls provisions of the FCPA. Pursuant to the Cease-and-Desist Order, Cognizant agreed to disgorge $16,394,351, pay prejudgment interest of $2,773,017, and pay a civil monetary penalty of $6,000,000. In all, Cognizant agreed to pay the SEC and DOJ approximately $28 million in disgorgement, prejudgment interest, and penalties.

According to the Letter Agreement and Order, Cognizant authorized and reimbursed a third-party construction company for approximately $2 million in bribe payments to one or more Indian government officials for their assistance with, as described by the DOJ, "securing and obtaining a planning permit" related to the construction of an office park in Tamil Nadu, India, for Cognizant's India subsidiary (Cognizant India). In order to hide the payments to officials, Cognizant employees allegedly used construction invoices and fictitious "change orders" to reimburse the construction company. Similarly, Cognizant employees in the United States and India allegedly falsified and caused to be falsified the company's books and records and failed to disclose the payments during the company's SOX process. Specifically, per the Letter Agreement and Order, a Cognizant India employee "selected change order requests from [contracting firm] invoices that Cognizant had previously rejected and retroactively 'accepted' them, adjusting the cost amounts so that they would total $2.5 million." Then, the fraudulent invoices, along with "supporting" Excel spreadsheets, were sent for approval to a Cognizant executive in the U.S. (as discussed below, likely Cognizant's former President).

The SEC Order noted that two Cognizant senior executives based in the United States, Senior Executive-1 and Senior Legal Executive-1, approved the bribe payment and reimbursement while on a conference call from the United States. According to the Order, the executives also sent email messages from the United States to approve concealing payments. As discussed below, public filings in related cases show that these individuals are Gordon Coburn, the former President of Cognizant, and Steven Schwartz, the former Chief Legal Officer of Cognizant. These public filings allege that these two individuals made false and misleading statements or omissions to Cognizant's auditor to conceal the improper payments, which the Order noted included a $500,000 commission to the construction company for acting as an intermediary for the $2 million in bribe payments.

The SEC Order provided information on additional alleged violations by Cognizant:

- In Pune, Maharashtra, Cognizant India allegedly authorized the same construction company to pay $700,000 to an Indian official for issuing an environmental clearance. The payment was made in early 2013. The construction company sought reimbursement from Cognizant India through a change order, which Cognizant India rejected when it was submitted with a description of "Liasoning [sic] and consultations charge towards Environmental clearance." However, Cognizant India made the reimbursement payment in 2014 after receiving a revised change order description of "Change in the make of Workstation from Featherlite to Art matrix."

- In Siruseri, Tamil Nadu, Cognizant India allegedly authorized the same construction company to make $840,000 in bribe payments to government officials for a number of permits, including permits for planning, power (from the local electricity board), and environmental clearance. The construction firm made the payments and Cognizant India received the permits in 2012. Again, Cognizant India approved change orders with "sham descriptions" and reimbursed the construction company in 2015 and 2016.

- Between 2013 and 2016, Cognizant India also allegedly made approximately $27,000 in bribe payments to Indian government officials to obtain licenses related to the operation of buildings for six facilities in India. Cognizant's books and records described the payments with "false generic descriptions," including "liaison," "consulting," and "miscellaneous."

The SEC stated that, in addition to paying bribes to Indian government officials in violation of the FCPA's anti-bribery provisions, Cognizant violated the books-and-records provisions by "falsely characterizing illicit payments to government officials as legitimate business expenses" and violated the internal-accounting-controls provisions by having a system for contractor change orders that allowed managers in India to conceal bribe payments. The Order also noted that Cognizant's procurement process "did not include effective review of the disbursement of funds for change orders" and did not "include an effective review of the application or renewal of facility permits and licenses."

As part of its settlement with the SEC, Cognizant agreed to report to the SEC for a period of two years on the company's remediation and implementation of compliance measures, as well as on any credible evidence of questionable or corrupt payments or false books and records.

On February 14, 2019, a grand jury in New Jersey issued an indictment against Gordon Coburn and Steven Schwartz, the former President and former Chief Legal Officer, respectively, of Cognizant for their roles in Cognizant's FCPA violations, specifically for one count of conspiracy to violate the anti-bribery, books and records, and internal controls provisions of the FCPA, three counts of anti-bribery provisions of the FCPA, seven counts of falsifying Cognizant's books and records, and one count of circumventing Cognizant's internal controls. On February 15, 2019, the SEC filed a Complaint against the two executives demanding a jury trial and alleging that Coburn and Schwartz violated the anti-bribery provisions of the FCPA, that they aided and abetted Cognizant's violation of the anti-bribery provisions of the FCPA, aided and abetted the company's books-and-records and internal-accounting-controls violations, falsified books and records, and made or caused to be made false or misleading statements to auditors in connection with the preparation or filing of required documentation and reports.

Noteworthy Aspects:

- Declination Despite the Involvement of Senior Management: The Letter Agreement specifically notes that the DOJ determined to decline prosecution of Cognizant "[d]espite the fact that certain members of senior management participated in and directed the criminal conduct at issue." In evaluating the other factors set forth in the DOJ's Corporate Enforcement Policy, the DOJ highlighted that Cognizant had voluntarily disclosed the matter to the DOJ "within two weeks of the Board learning of the criminal conduct." The DOJ also noted that Cognizant's "timely voluntary disclosure" allowed the DOJ to "conduct an independent investigation and identify individuals with culpability for the corporation's malfeasance." This result demonstrates that the involvement of senior management in wrongdoing, an aggravating factor in the Corporate Enforcement Policy, does not itself preclude the possibility of obtaining a declination if the DOJ determines that other mitigating factors are sufficient.

- DOJ and SEC Actions Against Cognizant's Former President and Former Chief Legal Officer: As noted above, both the DOJ and SEC have commenced actions against Cognizant's former President and former Chief Legal Officer. These actions are significant as a demonstration of the government's pursuit of individuals at corporations alleged to have violated the FCPA and are consistent with messaging from both the SEC and DOJ, including the SEC's stated priority of focusing on "gatekeepers" who enable misconduct. Prior actions against top legal officers include plea deals with Jeffrey Chow, Keppel Offshore Senior Legal Counsel (as discussed in our FCPA Winter Review 2018) and with PetroTiger's former General Counsel Gregory Weisman (as discussed in our FCPA Spring Review 2014).

- Cognizant's Continued Cooperation in Related Litigation: Both the DOJ and the SEC drew attention to Cognizant's commitment to ongoing cooperation, specifically as related to ongoing litigation. As mentioned above, the DOJ praised Cognizant for its timely disclosure, noting that it provided the DOJ with the ability to "identify individuals with culpability." The DOJ also noted that Cognizant agreed to "fully cooperate in the [DOJ's] ongoing investigations and/or prosecutions." Similarly, the SEC Order noted that Cognizant agreed to produce information with a fast turnaround ("within 14 days of request") and use its "best efforts to secure the full… provision of testimony" from current and former directors, officers, employees, and agents, as well as "us[e] its best efforts to ensure its directors, officers, and employees testify at trial and other judicial or administrative proceedings when requested to do so." Such commitments from companies can be particularly important in cases against former executives and is consistent with expectations for corporate cooperation as set out in the 2015 Yates Memorandum and now incorporated into the Justice Manual (see more in our FCPA Winter Review 2019). Specifically, the Justice Manual requires that cooperating companies "identify every individual who was substantially involved in or responsible for the misconduct at issue, regardless of their positions, status or seniority, and provide to the Department all relevant facts relating to that misconduct."

- More Disgorgement Paid to the DOJ than to the SEC: The disgorgement amount agreed to be paid to the DOJ is almost $3 million more than the amount agreed to be paid to the SEC. Neither the DOJ Letter Agreement nor the SEC Order provides information on how the agencies calculated disgorgement amounts, except that the DOJ's Letter Agreement states that the DOJ disgorgement amount was calculated through a "cost avoidance calculation." Often, disgorgement is calculated in the context of business contracts obtained, but in Cognizant's case, the improper payments were made in connection with the construction of the company's own facilities, so the connection to profit obtained is less evident. The DOJ's Indictment of Coburn and Schwartz notes that the payments were made to "avoid millions of dollars in costs." In its declination of Polycom last year (another instance of a declination disgorgement amount difference between the DOJ and SEC), the DOJ noted that disgorgement paid to the SEC covered only "profits earned within the time limits prescribed by 28 U.S.C. § 2462," consistent with the Kokesh v. SEC decision (discussed in our FCPA Summer Review 2017). There was no such public statement in the Cognizant matter.

Mobile TeleSystems PJSC and an Uzbek Subsidiary Settle Charges in Third U.S. Enforcement Action Involving Alleged Bribes in Uzbekistan Telecommunications Market

On March 7, 2019, Mobile TeleSystems PJSC (MTS), the largest mobile telecommunications company in Russia, and its wholly owned Uzbek subsidiary, Kolorit Dizayn Ink LLC (Kolorit), entered into resolutions with the DOJ and SEC to resolve charges related to the FCPA in Uzbekistan. Specifically, MTS's DPA with the DOJ charges the company with one count of conspiracy to violate the anti-bribery and books-and-records provisions of the FCPA and one count of violating the internal-accounting-controls provisions of the FCPA. Kolorit pled guilty to one count of conspiracy to violate the anti-bribery and books-and-records provisions of the FCPA. On the same day, the SEC filed a Cease-and-Desist Order (SEC Order) based on MTS's alleged violation of the anti-bribery, books-and-records, and internal-accounting controls provisions of the FCPA. According to the Information, MTS maintained a class of securities in the United States and was an "issuer" for the purposes of the FCPA during the relevant time period, 2004 through 2012. Until 2019, MTS was listed on the New York Stock Exchange, but press reports in February of this year suggested that MTS shares would be listed only on the Moscow Stock Exchange.

In connection with its DOJ settlement, MTS agreed to pay criminal penalties and forfeiture in the amount of $850,000,000 (of which $40,000,000 would be paid as forfeiture by MTS on behalf of Kolorit, and $500,000 would be paid as a criminal fine by MTS on behalf of Kolorit), offset the $100,000,000 in civil penalties paid by MTS to the SEC in connection with the same matter that the DOJ agreed to credit as part of its agreement with MTS. According to the Information, the forfeiture amount represents proceeds of Kolorit's alleged conspiracy to violate the anti-bribery and books-and-records provisions of the FCPA. Notably, although the DOJ's forfeiture amount was based on the "gross pecuniary gains" of Kolorit, the DOJ did not attribute any pecuniary gain to its parent company. According to the DPA, the Uzbek government expropriated MTS's telecommunications assets in Uzbekistan, "resulting in no realized pecuniary gain" to MTS as a result of the $420 million allegedly paid in bribes (emphasis added). The DPA notes that the financial penalty was approximately 25 percent above the low-end of the Sentencing Guidelines fine range, due to issues with cooperation and remediation discussed below. Similarly, the SEC did not require any disgorgement, presumably for the same reason as the DOJ. The DOJ and SEC also imposed an independent compliance monitor for a three-year period.

According to the DPA and SEC order, from 2004 to 2012, MTS offered and paid bribes to a high-ranking government official who had influence over the Uzbek Agency for Communications and Information (UzACI) and who was also a family member of the President of Uzbekistan (Uzbek Official), in order to obtain and retain business in Uzbekistan. The DPA states that MTS made at least $420,825,848 in illicit payments during the relevant time period in order to enter and continue to operate in the Uzbek telecommunications market. Documents in related cases and media reports confirm that this official was Gulnara Karimova.

In particular, the DPA and the SEC Order describe the following actions by MTS and its affiliated entities:

- Initial Purchase of Shares in Uzdunrobita for $100 Million: In 2004, MTS acquired 74 percent of the now-liquidated Uzbekistan-based company Uzdunrobita by purchasing a 41 percent stake from an American company and a 33 percent stake from Swisdorn, a shell company that MTS allegedly knew was beneficially owned by the Uzbek Official. MTS allegedly paid $100 million to Swisdorn, which was six times more per share than was paid to the American company. According to the DPA, at least a portion of the payment to the shell company was made in exchange for Uzdunrobita's ability to operate in Uzbekistan. The DOJ considered the entirety of the payment to the shell company to be improper. The shell company retained 26 percent of Uzdunrobita, but under the agreement, either MTS or the shell company could exercise an option to buy or sell this remaining stake for approximately $37.7 million, plus interest, after three years.

- Permits for 3G Frequencies: In 2005, MTS sought to acquire a block of new telecommunications frequencies to complement its 3G technology, but Uzbek law prohibited private companies from purchasing and selling frequencies. According to the SEC's Cease-and-Desist Order, to circumvent this prohibition, MTS and Uzdunrobita allegedly agreed to pay $12 million to another telecommunications operator that was owned in part by the Uzbek Official for the rights to its frequencies. The Uzbek Official allegedly ensured that the Uzbek regulatory authority approved the intended reallocation.

- Purchase of Additional Shares in Uzdunrobita for $250 Million: In 2006, allegedly at the request of the Uzbek Official, MTS negotiated an amendment to the option agreement that extended the time period for the shell company's put option and removed the fixed price for the remaining stake, which the DOJ alleges MTS management understood would result in a significant pecuniary benefit to the Uzbek Official because Uzdunrobita's value had increased since the initial option agreement. In April 2007, allegedly due to the Uzbek Official's influence, UzACI granted Uzdunrobita licenses for additional frequencies. Ten days later, the shell company notified MTS of its intention to sell its remaining stake in Uzdunrobita. MTS ultimately paid approximately $250 million for the shell company's shares (the value proposed by an investment bank) through financial institutions in New York. Again, the DOJ considered the entirety of this payment to be improper.

- Payment of $30 Million for 4G Frequencies: In April 2008, Uzdunrobita received a letter from UzACI claiming that Uzdunrobita was in violation of its license, and that the company's license could be suspended or revoked if the violations were not corrected within one month. The same day, Uzdunrobita received another adverse letter from a different state-owned entity. Both letters were forwarded to an executive at MTS, who allegedly stated the letters were "revenge" by the Uzbek Official for MTS's refusal to engage in another transaction to benefit her. According to the case documents, MTS decided to resume direct negotiations with the Uzbek Official, and an MTS foreign subsidiary contracted to pay Takilant Ltd., a second shell company, $30 million to reassign certain frequencies to Uzdunrobita. MTS allegedly knew that the beneficial owner of Takilant Ltd. was the Uzbek Official. Despite issues raised in due diligence, MTS executed the agreement with Takilant Ltd. and approved a loan mechanism to fund the agreement between the MTS foreign subsidiary and the second shell company. The Uzbek Official allegedly ensured that the frequency rights were assigned to Uzdunrobita, and MTS made six installment payments of $5 million from October 2008 to July 2009.

- Payment of $39.6 Million Through 2009 Acquisition of Kolorit: The Uzbek Official allegedly required a $50 million commitment in exchange for various government benefits, of which $30 million had been achieved through the payment to the second shell company, leaving a balance of $20 million. In December 2008, a senior MTS executive who had been involved with the previous transactions allegedly proposed acquiring Kolorit, a design company that "was created by the same shareholders as Uzdunrobita" and that was "connected to MTS by a long history of relations." According to the DPA, MTS management deemed Kolorit an "unattractive" and "toxic" investment. MTS's Department of Strategic Planning issued a written recommendation to reject the transaction to MTS Management. Nonetheless, MTS's Board of Directors approved the transaction at the inflated price following a presentation from the senior MTS executive using materials that did not disclose how the Uzbek Official would benefit from the transaction. In September 2009, Uzdunrobita paid the shareholders of Kolorit approximately $40 million for the shares of Kolorit; a $17,000 payment to one shareholder's Uzbek account was also made by an MTS subsidiary "through transactions into and out of correspondent bank accounts at financial institutions in New York."

- Payments of $1.1 Million Through 2012 Charitable Contributions and Sponsorships: In response to requests from the Uzbek Official, Uzdunrobita allegedly made payments totaling approximately $1.1 million between March 2012 and May 2012 to charitable entities related to the Uzbek Official. In June 2012, Uzdunrobita's Supervisory Board retroactively approved the charity payments, although the company's procedures required pre-approval of such payments.

- Currency Conversion Transactions: Due to Uzbek currency restrictions that limited the ability of foreign companies from converting Uzbek sums into U.S. dollars, Uzdunrobita was unable to convert enough currency to pay its equipment vendors. The case documents state that between 2009 and 2011, Uzdunrobita paid approximately $460 million to third-party companies to purchase network equipment. According to the SEC Order, there was a difference of approximately $143 million between the Uzbek Central Bank exchange rate and the rate agreed to by the parties. Uzdunrobita allegedly failed to conduct due diligence on the third parties to determine whether they were under the ownership of the Uzbek Official. The SEC Order states that Uzdunrobita's books and records—which did not reflect an appropriate level of detail and support for the $143 million difference—were consolidated into MTS's books and records and therefore violated the books-and-records provisions of the FCPA.

According to the DPA, the Uzbek Official became increasingly dissatisfied with the amount of improper payments made by MTS and Uzdunrobita in 2012 and began to threaten retaliation against the company. The senior MTS executive involved in previous payments allegedly communicated to other MTS management the Uzbek Official's belief that "the company stopped being loyal." According to the DPA, when MTS and Uzdunrobita failed to meet the Uzbek Official's demands for payment, an Uzbek court, allegedly influenced by the Uzbek Official, granted UzACI's petition to withdraw all operating licenses from Uzdunrobita and denied Uzdunrobita's appeal in August 2012. This decision caused Uzdunrobita to lose its ability to operate in the telecommunications sector in Uzbekistan. The same week, MTS filed a Form 6-K with the SEC stating that it was taking a $579 million impairment charge of goodwill and assets in Uzbekistan as well as a $500 million provision for tax and anti-monopoly claims in Uzbekistan.

Noteworthy Aspects:

- Effect of Expropriation on Penalty Calculation: Unlike in the other two cases associated with the same Uzbek Official, related to VimpelCom and Telia, MTS was not required to disgorge profits made as a result of the alleged bribe payments (although, as noted above, MTS's subsidiary Kolorit paid $40 million in forfeiture, representing the proceeds of Kolorit's alleged illegal activities). According to the DPA, because the Uzbek government expropriated MTS's telecommunications assets in Uzbekistan, MTS's operations in Uzbekistan "result[ed] in no realized pecuniary gain" to the company. MTS lost its investment through tax disputes and expropriation in 2012 that cost the company over $1 billion. The SEC states that the improper payments generated $2.4 billion in revenues, but neither the SEC nor DOJ discuss MTS's profits before the expropriation. Thus, rather than calculating the base fine using the Sentencing Guidelines' fine table or the company's pecuniary gain (as the DOJ often does in deferred prosecution agreements), the DOJ relied on the $420 million in alleged improper payments when setting the base fine and reaching the determination to penalize MTS $850 million. The majority of the improper payments ($390 million out of $420 million) were made to acquire Uzdunrobita and Kolorit, and, interestingly, in each of those instances, the DOJ appeared to consider the entire purchase price as an improper payment to the Uzbek Official.

- No Benefit from Disclosure and Only Limited Benefits from Cooperation: MTS did not disclose the issues to the agencies, and therefore received no credit for such action under the FCPA Corporate Enforcement Policy. Moreover, the DOJ stated in the DPA that MTS did not qualify for "additional credit for cooperation and remediation" under the policy because the company "significantly delayed production of certain relevant materials, refused to support interviews with current employees during certain periods of the investigation, and did not appropriately remediate, including by failing to take adequate disciplinary measures with respect to executives and other employees involved in the misconduct." The DOJ did give MTS full cooperation credit in determining the culpability score for MTS under the Sentencing Guidelines penalty calculation set out in the DPA but set the penalty level at 25 percent above the minimum number of the resulting guidelines range. Cooperation and remediation credit often allows companies to pay penalties below the applicable guidelines range.

- Imposition of Compliance Monitor: Pursuant to its settlements with the DOJ and SEC, MTS agreed to retain an independent compliance monitor for a period of three years, making it the first company headquartered in Russia that has retained such a monitor for alleged violations of the FCPA. The decision to impose an independent compliance monitor is noteworthy given the DOJ's recent policy updates and statements on corporate monitorships. The DOJ and SEC enumerated several examples of gaps in MTS's internal controls environment and remediation efforts, including that MTS "fail[ed] to comply with management approval requirements," "failed to follow established corporate governance protocols with respect to the Board of Directors," "failed to implement an adequate system for conducting, recording, and verifying due diligence on third parties," "lacked adequate payment controls," "knowingly lacked a sufficient internal audit function to provide reasonable assurances that corporate assets were not used to pay bribes to foreign officials," and "fail[ed] to take adequate disciplinary measures with respect to executives and other employees involved in the misconduct." While the DPA acknowledged that MTS had been working to enhance its compliance program and internal accounting controls, the DOJ determined that the company had not yet fully implemented or tested its compliance program and therefore imposed an independent compliance monitor to reduce the risk of misconduct.

- Associated Conspiracy and AML Cases: On the same day that MTS entered resolutions with the DOJ and SEC, the DOJ unsealed indictments against Bekhzod Akhmedov, the former head of MTS Uzbek subsidiary Uzdunrobita, and Gulnara Karimova, the daughter of the former Uzbek president who is the "Uzbek Official" named in the disposition documents. Akhmedov was charged with two counts of violating the FCPA, one count of conspiracy to violate the FCPA, and one count of conspiracy to commit money laundering. Karimova was charged with conspiracy to commit money laundering. As noted in our FCPA Spring Review 2016, the DOJ has filed related civil complaints seeking forfeiture of more than $850 million from accounts presumably controlled by Karimova. Those cases are ongoing.

- Failure to Heed Due Diligence Findings: The DPA describes due diligence reports provided to members of MTS's management that uncovered Karimova's beneficial ownership of the shell companies. In February 2007, after a new MTS executive insisted that MTS conduct additional due diligence on Swisdorn, members of MTS management retained a U.S. law firm to conduct due diligence on Swisdorn but allegedly failed to disclose that Karimova was its beneficial owner. In August 2008, members of MTS management requested due diligence on Takilant Ltd. but again failed to disclose that Karimova was its beneficial owner. Despite management's omission, the due diligence firm reported that Takilant was beneficially owned by the family of Karimova. In July 2009, members of MTS management again retained the due diligence firm to investigate, from an FCPA perspective, Kolorit and its associated companies. Although MTS management did not disclose that Karimova would benefit from the transaction, the due diligence firm reported rumors that a shareholder of Kolorit was a close associate of Karimova's. According to the DPA, MTS moved forward with all transactions in spite of the due diligence findings.

Fresenius Medical Care AG & Co. KGaA Settles with DOJ and SEC in Connection with Anti-Bribery and Accounting Violations in at Least 17 Countries

On March 29, 2019, the DOJ and SEC announced that each agency had agreed to settle FCPA-related charges with German-headquartered Fresenius Medical Care AG & Co. KGaA (FMC), a global provider of dialysis products and services. FMC trades American Depository Receipts (ADRs) on the New York Stock Exchange, making it an "issuer" under the anti-bribery and accounting provisions of the FCPA. Under an NPA with the DOJ, FMC agreed to pay a criminal penalty of $84,715,273, which represents an amount 40 percent below the applicable Sentencing Guidelines range, as well as to disgorge $147 million in profits and prejudgment interest. Under a separate Cease-and-Desist Order with the SEC, FMC must pay $147 million in disgorgement and prejudgment interest, which the DOJ will credit against its disgorgement amount, bringing the total penalty amount to be paid by FMC to $231,715,273. In addition, pursuant to both the DOJ and SEC settlements, the company has agreed to retain an independent compliance monitor for two years followed by one year of self-monitoring.

According to the NPA's Statement of Facts, between approximately 2007 and 2016, FMC, through its agents and employees, engaged in various schemes "to pay bribes to publicly-employed health and/or government officials to obtain or retain business for and on behalf of the company." Specifically, the NPA alleged FCPA anti-bribery and accounting violations in Angola and Saudi Arabia, as well as accounting violations in Morocco, Spain, Turkey, and eight countries in West Africa—Benin, Burkina Faso, Cameroon, Ivory Coast, Niger, Gabon, Chad, and Senegal.

The SEC's Cease and Desist Order notes that from at least 2009 through 2016 "millions of dollars in bribes were paid to procure business through [the company's] operations," allowing FMC to "benefit[] by over $135 million." The Order requires FMC to cease and desist anti-bribery, internal-accounting-controls, and books-and-records violations throughout its operations.

Examples of anti-bribery violations in the named countries are set forth below:

- Angola: Among the misconduct described related to Angola, the NPA alleges that FMC (the parent) through its wholly-owned subsidiary in Portugal, FMC Portugal, and FMC Angola—an entity "overseen by FMC Portugal" that was "established for the purpose of expanding FMC into the Angolan dialysis market", offered or provided things of value to a high-ranking official in the Medical Services Division of the Angolan Armed Forces (Military Health Officer), his family members, and Angolan government-employed doctors, including shares in a joint venture, storage contracts, and consultancy agreements to obtain and retain business in Angola. For example, in establishing FMC Angola's local joint venture, FMC Portugal executives offered 35 percent of the capital to "local partners" including the Military Health Officer (ultimately his son received the capital) and two government-employed doctors. According to the NPA, an executive at the parent company knew that the "local partners" included public officials but did not disclose their participation when he or she prepared and presented the proposal to FMC's Board of Management in 2010. Also, around 2010, FMC Portugal began selling products and entered into services agreements at government hospitals where several of the proposed local partners worked. According to the NPA, it was not until six months after representatives from FMC (the parent company) signed the shareholder agreement with the local partners in mid-2012 that the Board of Management was made aware of the ownership of public officials (as a result of an internal audit). The two government-employed doctors, as well as the son of the Military Health Officer, received shares in FMC Angola free of charge—in exchange, they directed customers to FMC Angola. The NPA notes that an FMC subsidiary employee from FMC Portugal emailed a spreadsheet describing the total number of shares that each shareholder would receive to the Military Health Officer and one of the government-employed doctors using an "internet-based" email account of a U.S.-based service provider. The SEC alleged similar conduct, in addition citing other accounting violations.

- Saudi Arabia: The NPA alleges that FMC (the parent company), through its Saudi Distributor, made improper payments to publicly-employed doctors to expand its market share in KSA. The NPA provides examples—including various email exchanges—where employees of FMC and its minority-owned Saudi joint venture demonstrated knowledge of the misconduct but failed to take steps to stop it. Specifically, the NPA alleges that the general manager of a third-party distributor in Saudi Arabia (Saudi Distributor GM) engaged in a "check cashing scheme" to funnel payments to publicly-employed doctors, including instructing employees to cash checks made payable to them and return the cash to him. In turn, the Saudi Distributor GM made payments to publicly-employed doctors. The Saudi Distributor GM recorded the transactions as "Project Marketing Expenses" or "Collection Commissions" in the Saudi Distributor's books and records, which were ultimately consolidated with FMC's records. In addition, the same Saudi Distributor used "sham consulting and commission agreements for which no services were ever performed" to make payments to government doctors, purchased laptops for nurses at government hospitals, make payments to a government charity run by a government doctor, and provided other gifts and travel with "no business or educational justification," including "luxury accommodations" to government doctors and their families. The same Saudi Distributor also made improper payments through a third-party freight and logistics company that served as a customs agent to customs officials to speed up clearance times and avoid or reduce associated customs fees. The NPA cites emails sent by the Saudi Distributor related to the misconduct, including emails sent using "internet-based" email accounts of service providers located in the United States.

- West Africa: The SEC Order notes that from 2007 to at least 2016, a senior officer and a sales manager from FMC's parent entity in Germany engaged "in schemes to bribe publicly-employed hospital doctors and administrators in eight West African countries to win FMC business," including Benin, Burkina Faso, Cameroon, Ivory Coast, Niger, Gabon, Chad, and Senegal. For example, FMC (the parent entity) paid a third-party agent operating in various West African countries (West African Supplier) "service fees," who would pass the funds to public health care professionals (HCPs) and hospital administrators; FMC previously paid the same HCPs through fictitious consultancy agreements. Subsequently, FMC changed its relationship with the West African Supplier from a purported third-party agency relationship to a distributor relationship. As a result, instead of paying West African Supplier "service fees," FMC provided to the West African Supplier significant margins on sales to public hospitals throughout the region. Throughout the scheme, the Order notes that several red flags existed to demonstrate that the West African Supplier was not a true distributor including that FMC was receiving almost 50 percent less revenue than what it had received under the previous agency scheme. According to the SEC Order, "[t]hroughout the schemes, an FMC West Africa manager used his personal internet-based email accounts [of U.S.-based service providers] to send spreadsheets of bribe payments to hospital employees to FMC Germany supervisors, who ensured the improper payments were made."

In addition, the settlement documents describe numerous internal-accounting-controls and books-and-records violations across the various jurisdictions, including:

- In Bosnia, FMC (the parent) allegedly made improper payments to a Bosnian government doctor to win a public tender to establish and operate clinics in two regions, including Brcko. The doctor was elected to the Brcko Assembly and in his 2008 fourth quarter activity report to FMC he listed his activities as "removing all problems regarding the tender in Brcko." To support violations of the accounting provisions, the SEC Order notes that FMC initially failed to investigate the meaning of the activity report entry. In addition, after the doctor became the mayor of Brcko, the consultancy agreement was placed in the name of the doctor's wife and by 2009 FMC had paid the doctor over $1,300,000 in connection with the tender. Further, FMC made over $957,000 in payments to a Bosnian healthcare executive to establish clinics without evidence that any services were rendered.

- In China, FMC China's clinic business, NephroCare, allegedly created incentive programs that facilitated bonus payments to publicly-employed HCPs based on the number of treatments provided and/or the number of new patients treated. According to the SEC Order, emails suggested that the true intention of the bonus payments was to influence procurement decisions. FMC China inaccurately recorded the bonus payments, which were generally described as "center marketing fees." According to the SEC Order, the inaccurate bookkeeping may have been caused by a senior FMC China manager's direction to avoid the use of the term "bonus" due to "internal legal compliance" concerns.

- In Mexico, FMC Mexico allegedly used a Mexican Distributor to pay kickbacks to IMSS officials (i.e., officials of Mexico's state-run social security agency) to win a tender with IMSS. A year after FMC Mexico won a portion of the tender at an agreed reimbursement price, FMC retroactively executed a contract, agreeing to pay commissions to the Mexican Distributor. The contract improperly identified commissions as being for "advice," and FMC Internal Audit identified $213,500 in improper commissions paid to Mexican Distributor intended for IMSS officials.

- In Morocco, two senior FMC officials from Germany allegedly entered into a sham marketing agreement with the chief nephrologist at two-state-owned hospitals to obtain contracts, which included a 10 percent commission on an initial contract and afterwards 12.5 percent commission annually. They paid additional bribes for other projects to the same nephrologist through paying fake bonuses to FMC managers, who in turn, passed the funds on to the nephrologist; the payments were improperly recorded in FMCs books.

- In Serbia, FMC, among other cited violations, allegedly paid four doctors serving on the Serbian Health Fund commission and other public tender commissions over $329,000, from which FMC sought business through a Serbian Agent. In addition, in 2008, FMC paid the same four doctors and their family members $393,000 for travel and accommodations to attend a conference in Philadelphia, which included leisure trips to New York City and Cancun.

- In Spain, FMC Spain allegedly made improper payments and provided benefits such as travel to medical congresses and trips to the United States to obtain advance information about tender specifications from publicly-employed doctors and administrators through consultancy agreements that were entered into with limited or no due diligence, as well as through other mediums. In some cases, FMC Spain requested that doctors modify tender specifications before the tenders were announced. The SEC Order and NPA state that many of the above-described payments were improperly recorded as consulting expenses in the books and records of FMC and FMC Spain. The NPA further notes that FMC Spain failed to implement reasonable internal controls, which allowed the improper payments to continue until 2014.

- In Turkey, FMC allegedly entered into four joint ventures with publicly-employed doctors in exchange for obtaining business from the doctors' public employers; the doctors did not provide capital for their shares. In one instance, FMC purchased the doctor's joint venture shares back without ever requiring the doctor to pay for his shares, resulting in $356,000 profit to the doctor. According to the NPA, the improper payments to publicly-employed doctors through joint ventures were a result of FMC's lack of reasonable internal controls.

According to the NPA, FMC engaged in substantial remediation in connection with the investigation, including: "(1) removing at least ten employees who were involved in or failed to detect the misconduct to be removed from the Company, because their employment was terminated, they resigned after being asked to leave, or they voluntarily left once the Company's internal investigation began; (2) enhancing its compliance program, controls, and anti-corruption training; (3) terminating business relationships with the third party agents and distributors who participated in the misconduct described in the Statement of Facts; (4) adopting heightened controls on the selection and use of third parties, to include third party due diligence; and (5) withdrawing from consideration of pending public contracts potentially related to the misconduct."

Noteworthy Aspects:

- Multiple Theories to Establish Anti-Bribery Violations in Angola: To establish anti-bribery violations in Angola, the DOJ and SEC used several aggressive legal theories to establish the presence of the requisite interstate commerce for transactions in Angola, including an agency theory of liability for acts of a foreign subsidiary and the use of "internet-based" email accounts hosted by U.S. service providers.

- Although the settlement documents describe some involvement by employees of the parent company, the DOJ and SEC apparently relied on an agency theory to establish anti-bribery violations in Angola. For example, the SEC Order notes that regarding all anti-bribery violations identified, "each FMC subsidiary and entity was also an 'agent' of FMC within the meaning of the [FCPA]." The NPA states that, in Angola, FMC's Portuguese subsidiary, FMC Portugal, as well as FMC Angola, an entity described as "overseen by FMC Portugal" acted as "agents" of the parent company pursuant to 15 U.S.C. § 78dd-1(a). Consistent with the legislative history of the FCPA and the DOJ's and SEC's Resource Guide to the U.S. Foreign Corrupt Practices Act, the parent- subsidiary relationship, in and of itself, is not enough to establish an agency theory of liability. Rather, traditional agency law principles related to criminal liability for principals generally would require that, in this case, the parent entity directly participated in the misconduct or exerted some level of control over the acts of the foreign subsidiary. Therefore, the DOJ's and SEC's assertions that an agency relationship existed likely rested on the fact that the parent company in this case exerted sufficient control over the relevant subsidiaries in Angola. The NPA notes that "FMC Portugal" was "under the responsibility of FMC (the parent)'s EMEA Division" but does not provide specific examples of directives from the parent to FMC Portugal to engage in misconduct or other specific actions by the parent upon which any agency liability rested. What constitutes an agency relationship sufficient to create FCPA liability for the covered entity remains a hotly contested issue (see e.g., U.S. v. Hoskins), though here, as in other settlements, it appears that FMC accepted the DOJ/SEC assertions in the disposition negotiations.

- To establish FMC's nexus to the United States for the anti-bribery violations, the DOJ and SEC relied on the fact that aspects of the illicit activities involved the use of email accounts hosted by U.S. service providers. As a foreign issuer, under Section 78dd-1, FMC must "make use of the mails or any means or instrumentality of [U.S.] interstate commerce" to satisfy the jurisdictional requirement of an anti-bribery violation. To meet this requirement with regard to the misconduct in Angola, the NPA describes two emails that an executive from FMC's Portuguese subsidiary sent to Angolan public officials allegedly discussing the bribes to be paid using an "internet-based email account" hosted by a service provider located in the United States. In other words, the DOJ stated that emails between foreign persons outside of the United States that presumably transited through servers hosted by U.S. service providers was in this case sufficient to meet the "interstate commerce" requirement of the FCPA's anti-bribery provisions. The SEC adopted a similar approach in its civil suit against the executives at Hungarian-based telecommunications company Magyar Telekom, explicitly stating that the servers themselves were located in the United States (see discussion in our FCPA Autumn Review 2016). In that instance, the reviewing court ultimately decided that the interstate commerce requirement was met by submitting filings on the SEC-registered EDGAR website and, therefore, did not reach the question of whether emails routed through servers in the United States satisfied the interstate commerce requirement. The question of whether "internet-based email accounts" hosted by service providers located in the United States are themselves sufficient to meet the "interstate commerce" requirement of the FCPA's anti-bribery provisions remains unanswered by the courts.

- Involvement of High-Level Management: The SEC Order highlights "the involvement of FMC senior-level management throughout the scheme, including their efforts to thwart the company's internal investigations." For example, the Order states that, after receiving a preservation notice related to allegations in Morocco, FMC managers destroyed records and deleted files from computers. In addition, with respect to misconduct related to the business in Turkey, a senior FMC manager in Germany advocated for a government doctor to be awarded joint venture shares free-of-charge, writing, "[t]he professor who is our shareholder has very strong relations with all state authorities including the university and other state hospitals. He is in a way protector of our interests, benefits and operation in the city…. It is very hard to compete and operate in this city if a powerful local is not backing you…. He should stay as our doctor for the health and well-being of our system in this city." Further, in Angola, a high-level executive in Germany proposed to the company's management board "local partners" in FMC Angola but did not explicitly state that those included public officials. The involvement of high-level management, including individuals from FMC (the parent entity), may have supported the agencies' pursuit of anti-bribery violations in certain jurisdictions.

- Partial Cooperation Credit: FMC received a 40 percent discount off of the bottom of the Sentencing Guidelines range, which reflected only "partial credit" for cooperation, notwithstanding the fact that FMC voluntarily self-disclosed the misconduct in April 2012. The DOJ said the company did not qualify for a declination under the Department's Corporate Enforcement Policy because the company "did not timely respond to certain requests by the DOJ and, at times, did not provide fulsome responses to requests for information." In addition, the DOJ noted that the misconduct was widespread and "yielded profits of more than $140 million, and continued in certain countries until 2016, and the company has not yet had the opportunity to test the effectiveness of its compliance enhancements." In discussing the company's cooperation efforts, the SEC similarly noted that FMC's "cooperation with the Commission's investigation varied at times."

- FMC Failures to Address Corruption Red Flags: The settlement documents describe various instances in which the company was made aware of issues but failed to timely address the relevant red flags. For example, according to the DOJ NPA, shortly after FMC finalized its joint venture shareholder agreement in Angola, an internal audit report put the company on notice that minority shareholders were foreign officials and the related conflicts of interest. In addition, according to the SEC Order, in 2010, the company's internal auditors found FMC Spain failed to comply with the company's policy related to interactions with foreign officials, but the misconduct continued; in 2014, internal auditors re-circulated the 2010 report to the same recipients, as well as to the entire FMC Management Board, but the payments ultimately continued until 2015. In addition, in April 2012, FMC received a whistleblower email raising various allegations about payments to government officials in Morocco, and in May 2013, it received another, more specific, complaint about improper payments related to business at military hospitals. However, FMC did not initiate an investigation until January 2014, nearly eight months after the company received the second complaint. The company's repeated failure to adequately address issues raised by various internal channels, as well as the fact that misconduct occurred at least as late as 2016, likely contributed to the assignment of an independent compliance monitor.

- "Hybrid" Monitorship: Pursuant to its settlements with the DOJ and SEC, the company agreed to a "hybrid" monitorship (i.e., a monitorship requiring elements of independent monitoring and self-monitoring). According to publicly-available information, this is the eighth "hybrid" FCPA monitorship. The "hybrid" monitorships include SQM, Alstom, Avon, Bilfinger, Weatherford, Diebold, and Smith & Nephew. We note that Alstom was a non-traditional hybrid monitorship in that the company agreed to three years of self-monitoring, but the non-imposition of an independent monitor was contingent on the successful completion of a World Bank monitorship. This list does not include Biomet's 2012 settlement in which it agreed to 18 months of an independent compliance monitor and 18 months of self-monitoring, since that arrangement was later converted into a three-year independent monitorship. Notably, the most recent two hybrid monitorships we have identified, SQM, and now FMC, included a two-year monitoring period followed by a one-year self-monitoring period; all other hybrid arrangements identified (with the exception of Alstom's non-traditional monitorship arrangement) required 18 months of a monitor and 18 months self-monitoring.

Individual Enforcement Actions

U.S. Businessman Pleads Guilty to Bribing Hawaiian and Micronesian Officials

On January 22, 2019, the DOJ released a plea agreement for Frank James Lyon, who admitted to paying approximately $450,000 in bribes to officials in the Federated States of Micronesia (FSM) and officials of a Hawaiian state agency in exchange for government engineering contracts. According to the criminal information filed in the District of Hawaii and unsealed in January, Lyon, the owner of an engineering company based in Honolulu, was charged with one count of conspiracy to violate the anti-bribery provisions of the FCPA and to pay bribes to an agent of a domestic organization receiving more than $10,000 in federal funds in violation of 18 USC § 666(a)(2), the federal program fraud statute. Lyon's plea deal alleges that from 2006 to 2016, he and his co-conspirators paid approximately $200,000 in bribes to FSM transportation and congressional officials in exchange for $7.8 million in engineering and project management contracts, including a local airport construction project. The bribes were primarily gifts and entertainment and included vehicles, vacations, and college tuition expenses for various FSM officials. In addition, Lyon admitted to committing federal program fraud by paying over $240,000 in cash bribes to Hawaiian state officials between 2011 and 2016 in order to win a $2.5 million contract. He allegedly transferred funds from his engineering company to his personal bank account, from which he then withdrew the cash to pay the Hawaiian officials.

On February 12, 2019, the DOJ unsealed charges against Master Halbert, a FSM transportation official who, along with other officials, allegedly received bribes from James Lyon in exchange for airport management contracts. Halbert's primary responsibility was the administration of the FSM's aviation contacts, including oversight of contracts relating to FSM airports. Because he was an alleged bribe recipient and not a bribe payer, the complaint charged Halbert with one count of conspiracy to commit money laundering in the District of Hawaii, rather than with any substantive FCPA violations. He was arrested in Honolulu the day the charges were unsealed while attempting to board a departing flight. Halbert was released on bond over the objections of the U.S. Attorney's office, who argued that his ties to high-ranking Micronesian officials and access to significant financial resources (including potential access to the bribe payments) made him a flight risk. A preliminary hearing is currently scheduled for April 15, 2019.

Lyon is scheduled to be sentenced on May 13 and faces up to five years in prison. This case is an interesting and rare example of both foreign and domestic bribery charges being used to punish corrupt conduct, encompassing the actions of both for the bribe payer and the bribe taker.

Policy and Litigation Developments

Ninth Circuit Rules that FCPA Statutory Provisions Are Not "Rules or Regulations" of the SEC under SOX in Wadler v. Bio-Rad Laboratories

On February 26, 2019, the U.S. Court of Appeals for the Ninth Circuit published an opinion in Wadler v. Bio-Rad Laboratories, Inc., holding that the statutory provisions of the FCPA do not constitute "rules or regulations of the SEC" under the Sarbanes-Oxley Act (SOX). Specifically, Section 806 of SOX prohibits retaliation against employees who report, inter alia, violations of "any rule or regulation of the [SEC.]" Under the Ninth Circuit's ruling, therefore, an employee who reports statutory violations of the FCPA, rather than violations of an SEC administrative rule or regulation, is not protected from retaliation under SOX. At the same time, the Circuit upheld the verdict against Bio-Rad under California common law, stemming from Tameny v. Atlantic Richfield Co. (the "Tameny claim"), leaving in place a significant compensatory and punitive damages award corresponding to that verdict, though the upheld award did not include the damages that would have been doubled under Dodd-Frank.

In 2015, Sanford Wadler, the former general counsel of Bio-Rad Laboratories, Inc. (Bio-Rad), sued Bio-Rad and its CEO alleging, in brief, that he had been fired as retaliation for an internal report he delivered to the company's audit committee which described violations of the FCPA by Bio-Rad employees in China. The suit alleged violations of SOX, the Dodd-Frank Act, and California public policy. Following a jury trial, Wadler prevailed on all three claims, leading to a total award of nearly $11 million. The Ninth Circuit vacated and remanded the SOX verdict for a potential new trial, reasoning that the reference to "rule or regulation" in Section 806 of SOX refers only to "administrative rules or regulations" and not to statutory provisions and that the district court's error in instructing the jury otherwise was not harmless.

However, the Ninth Circuit acknowledged, and Bio-Rad conceded, that "one of the FCPA books-and-records provisions," which bars knowing falsification of books and records and is referenced in the jury instruction "is also an SEC regulation within the scope of § 806," namely 17 C.F.R. § 240.13b2-1, which bars direct or indirect falsification of books and records. The Circuit therefore concluded that a "properly instructed jury could return a [SOX] verdict in Wadler's favor" and remanded for the trial court to consider whether a retrial would be warranted.

The Circuit also vacated the Dodd-Frank verdict under Digital Realty Trust, Inc. v. Somers, because, as the Circuit explained, the report was internal and Digital Realty "held that Dodd-Frank does not apply to purely internal reports." Because the compensatory damages awarded to Wadler had been doubled under Dodd-Frank, that portion of the damages award was not affirmed.

However, the Circuit also affirmed the California public policy verdict against Bio-Rad. The Court assumed without deciding that a plaintiff allegedly "retaliated against (1) for engaging in SOX-protected activity or (2) for reporting conduct that he reasonably believed violated the FCPA's bribery or books-and-records provisions" can bring a claim under state law. The Court concluded that error in the SOX instructions "was harmless as to the Tameny verdict because Wadler's Tameny claim . . . did not depend on SOX." This ruling left the damages awarded to Wadler under state law in place, "except for the portion of damages attributable to Dodd-Frank's doubling provision." In March, Bio-Rad's counsel sought rehearing on this decision.

Bio-Rad previously settled with the SEC and DOJ in November 2014, based on alleged violations of the FCPA concerning the Company's operations in Russia, Vietnam, and Thailand.

This appellate decision represents a mixed result for whistleblowers and companies. The decision left open the possibility of SOX protections for potential FCPA reporters, so long as they also include books and records issues in their allegations. The decision also highlights the role of state law and public policy in these matters. On the other hand, the decision reaffirmed the precedent set under Digital Realty regarding limitations to the Dodd-Frank's damages provisions. We will monitor the remanded case going forward.

CFTC's Latest Enforcement Advisory on Self-Reporting and Cooperation for CEA Violations Involving Foreign Corrupt Practices Potentially Adds to the List of Regulatory Bodies Committed to Fighting Corruption

On March 6, 2019, the U.S. Commodity Futures Trading Commission's (CFTC) Director of Enforcement, James McDonald, announced the publication of a new Enforcement Advisory on Self Reporting and Cooperation for Commodity Exchange Act (CEA) Violations Involving Foreign Corrupt Practices (the Enforcement Advisory). The Enforcement Advisory was designed "to provide further guidance regarding circumstances under the [CFTC's] cooperation and self-reporting program in which [the CFTC] may recommend a resolution with no civil monetary penalty."

Specifically, the Enforcement Advisory underscores the CFTC's commitment to incentivize companies and individuals to voluntarily disclose any "violations of the CEA involving foreign corrupt practices" to the CFTC's Division of Enforcement (Division) and to fully cooperate and appropriately remediate violations in accordance with previously-issued CFTC advisories. In exchange for voluntary disclosure and full cooperation, and absent "aggravating circumstances involving the nature of the offender or the seriousness of the offense," the Enforcement Advisory states that "the Division will apply a presumption that it will recommend to the Commission a resolution with no civil monetary penalty." In evaluating aggravating circumstances, the Enforcement Advisory notes that the Division will weigh a variety of factors such as whether: "executive or senior level management of the company was involved; the misconduct was pervasive within the company; or the company or individual previously engaged in similar misconduct." Additionally, in cases where the Division recommends to the Commission a resolution without a civil monetary penalty, the Enforcement Advisory instructs that the Division would "still require payment of all disgorgement, forfeiture, and/or restitution resulting from misconduct at issue" while also seeking all available remedies such as "appropriate" and "substantial" civil monetary penalties for companies or individuals that were involved in the misconduct but did not participate in submitting the voluntary disclosure.

In his announcement, McDonald emphasized that behavior involving foreign corrupt practices could constitute "fraud, manipulation, false reporting" or other violations under the CEA, which would fall under the CFTC's enforcement powers. Specifically, McDonald explained that corrupt practices can be used to "manipulate benchmarks that serve as the basis for related derivative contracts." While neither the Enforcement Advisory nor McDonald's announcement specifically elaborated further on the kinds of CEA violations that can be "carried out through foreign corrupt practices," McDonald did describe scenarios whereby bribes are used to earn business benefits relating to regulated activities like "trading, advising, or dealing in swaps or derivatives."

In his remarks, McDonald acknowledged that that violations of CEA provisions that encompass foreign corrupt practices might also violate the FCPA and that the CFTC will work closely with the DOJ and the SEC to ensure that "any investigations are properly coordinated and are appropriately aimed at identifying and eliminating any gaps in…investigative and regulatory frameworks." To this end, McDonald explained that the Division would not "pile onto other existing investigations" and reiterated that the Division will work in parallel with other enforcement authorities, including as to the coordination and crediting of fines and other penalties. Specifically, in cases were the CFTC imposes disgorgement or restitution, the agency will "give dollar-for-dollar credit for disgorgement or restitution payments in connection with other related actions."

The Enforcement Advisory bears similarities to the DOJ's FCPA Corporate Enforcement Policy, which sets out similar mitigating factors for the DOJ's determinations regarding corporate dispositions. By applying a presumption of declination and a recommendation of resolution without a civil monetary penalty, both the FCPA Corporate Enforcement Policy and the Enforcement Advisory apparently are seeking to achieve appropriate corporate accountability while encouraging disclosure and remediation of improper conduct and risks.

It remains to be seen how the CFTC will coordinate in practice with other regulatory agencies and which violations of the CEA might encompass foreign corrupt practices. In the meantime, companies that may be subject to the CEA will need to account for this heightened CFTC interest in assessing operations risks.

DOJ Updates FCPA Corporate Enforcement Policy on Ephemeral Messages

On March 8, 2019, the DOJ updated the FCPA Corporate Enforcement Policy, a part of the U.S. Justice Manual. As we discuss in a recent post on the FCPA Blog, the DOJ's revised policy provides further detail on the practices that the agency expects corporate entities to adopt when managing business records. Specifically, the update relaxes some of the conditions the DOJ imposes on companies seeking full remediation credit in the event of an FCPA investigation in connection with employees' use of ephemeral messaging platforms, such as WhatsApp.

As discussed in our previous publications, the FCPA Corporate Enforcement Policy explains the DOJ's perspective on handling FCPA matters and sets forth guidelines, which, if followed, may allow the corporation to enjoy certain benefits afforded under the policy. Specifically, provided there are no aggravating circumstances, a company that has self-disclosed, cooperated, and remediated the wrongful actions and relevant compliance and controls gaps in conformity with the standards stated in the policy will receive a "presumption" of a declination from the DOJ.

When the policy was announced originally in November of 2017, we raised concerns regarding the section discussing the remediation actions companies should take in FCPA matters for business records. Specifically, at the time, the policy stated that with respect to business records, the following was required for a company to gain full credit for remediation:

"[a]ppropriate retention of business records, and prohibiting the improper destruction or deletion of business records, including prohibiting employees from using software that generates but does not appropriately retain business records or communications."

Such guidance was a remarkable step by the DOJ, in effect requiring that companies prohibit employees from using ephemeral messaging platforms in order to be eligible for full remediation credit in the event of an FCPA investigation. As discussed in our previous posts here and here, such platforms are widely used in day-to-day business in many parts of the world, such that the DOJ expectation may be very difficult to satisfy.

In contrast, the newly amended guidance sets forth the following requirements for full remediation credit:

"[a]ppropriate retention of business records, and prohibiting the improper destruction or deletion of business records, including implementing appropriate guidance and controls on the use of personal communications and ephemeral messaging platforms that undermine the company's ability to appropriately retain business records or communications or otherwise comply with the company's document retention policies or legal obligations." (Emphasis added.)

Most notably, under the new guidance, companies need not prohibit the use of ephemeral messaging platforms altogether but must instead ensure that guidance and controls are "appropriate"—language that, in effect, establishes a reasonableness standard that may allow the use of some such platforms. Based on the DOJ's past use of similar language in the Resource Guide to the U.S. Foreign Corrupt Practices Act, the agency will likely expect companies to design and implement risk-based controls over ephemeral messaging platforms that are tailored to a company's specific operations.

DOJ officials have corroborated this interpretation of the amended Corporate Enforcement Policy in recent public statements. For example, in a speech at the American Bar Association's National Institute on White Collar Crime Conference, Assistant Attorney General Brian Benczkowski explained that the updated policy provides what the DOJ considers to be useful information for companies to "engage in rational decision-making about the steps they should take to qualify for a declination," including when designing compliance programs. Notably, the revised guidance suggests that a company should implement controls on ephemeral communications before any FCPA matter arises. Indeed, it remains the case that under the updated policy, it is possible that a lack of communication controls for messaging data and other communications could potentially result in a company losing full credit for remediation under the policy.

Similarly, at a recent American Conference Institute Anti-Corruption conference in Mexico, Christopher Cestaro, the Assistant Chief of DOJ's Criminal Division, FCPA Unit, noted that the DOJ expects companies to prohibit individuals from improperly destroying communications and records, and to develop policies and controls around ephemeral communications. Cestaro further explained that the DOJ was moving toward a reasonableness standard for ephemeral communications and expects companies first to be able to show that they have thought through the proper controls for such data. The DOJ also expects that companies will have implemented the controls in a way that is demonstrable and based on a reasoned assessment. In light of the revised guidance, establishing and applying risk-based controls to such communications would likely benefit companies so that they may gain full credit under the policy and maintain their credibility with the agency as having a well-planned and implemented compliance program.