FCPA Spring Review 2018

International Alert

Introduction

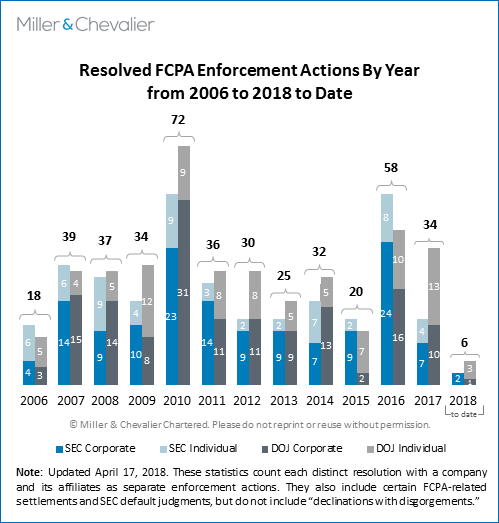

Enforcement of the U.S. Foreign Corrupt Practices Act (FCPA) was relatively slow during the first quarter of 2018, with only two individual enforcement actions and three fairly low-value corporate enforcement actions announced during the period. This relatively slow quarter continues the reduced pace of reported enforcement decisions under the Trump administration, particularly in terms of corporate actions. It remains an open question, however, whether this decrease in enforcement announcements truly reflects a less aggressive posture by the Department of Justice (DOJ) and Securities and Exchange Commission (SEC), with some statistics suggesting a more nuanced picture.

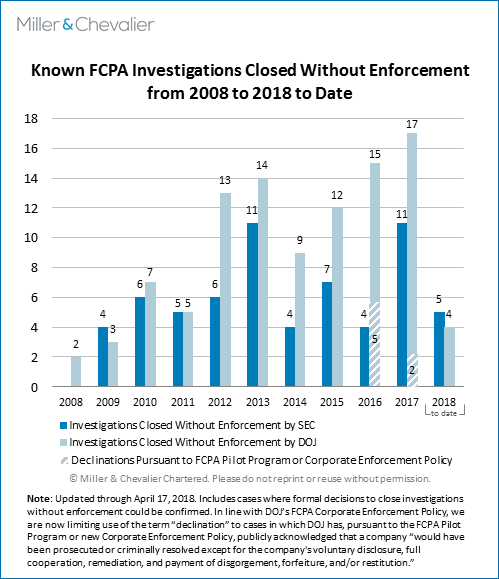

Notably, even as resolved enforcement activity remains below average as compared to the previous Administration, this quarter was above average in terms of the number of investigations disclosed to have been ended without enforcement – nine investigations involving seven companies ended between January 1 and April 1 without further action by the agencies. For the sake of comparison, for each quarter since 2008, there have typically been between three and four disclosures related to investigations closed without enforcement action. This combination of below-average enforcement activity and the above-average investigations concluded without penalties may signal the beginnings of a broader trend. Specifically, it may be that that the DOJ and SEC are continuing to investigate potential FCPA violations, but have become more selective in the actions they choose to pursue, deciding against enforcement, for example, in cases in which they deem a company's cooperation and remediation efforts to have been satisfactory. However, it is likely too soon to determine whether such a trend indeed exists, or whether the various factors that traditionally affect the timing of investigations are primarily responsible for this quarter's statistics.

Resolved Enforcement Actions

In the first quarter of 2018, U.S. enforcement agencies announced the conclusions of three corporate FCPA-related enforcement actions – one through a Deferred Prosecution Agreement (DPA) by the DOJ and two via Cease-and-Desist Orders by the SEC. Looking back 10 years, these numbers are slightly below the norm, as compared to an average of about six corporate enforcement actions a quarter since 2008 or four corporate enforcement actions during the first quarter of each year. In addition, this quarter's corporate enforcement actions were relatively low-value in terms of the penalties imposed:

- In the year's first corporate enforcement action on March 8, 2018, Israeli holding company Elbit Imaging Ltd. (Elbit) agreed to pay $500,000 to settle FCPA books-and-records and internal-accounting-controls charges by the SEC arising out of the company's failure to conduct due diligence on two real estate valuation consultants in Romania, whom the company had engaged in connection with efforts to develop shopping and entertainment centers in Central and Eastern Europe.

- A few days later, on March 13, the DOJ announced a DPA with Maryland-based Transport Logistics International Inc. (TLI), whereby the company agreed to pay $2 million (reduced from $28 million due to inability to pay) to settle charges that it bribed officials at JSC Techsnabexport (TENEX), a subsidiary of Russia's state-owned nuclear energy corporation Rosatom.

- Finally, on March 26, the Canadian mining company Kinross Gold Corporation (Kinross) agreed to pay $950,000 to settle books-and-records and internal-accounting-controls charges by the SEC arising out of its failure to properly implement appropriate controls at mines acquired in Ghana and Mauritania.

As discussed in greater detail below, each of these cases offers insights into the need for compliance with the FCPA's accounting provisions – especially for small- or medium-sized companies – as well as the agencies' current enforcement focus.

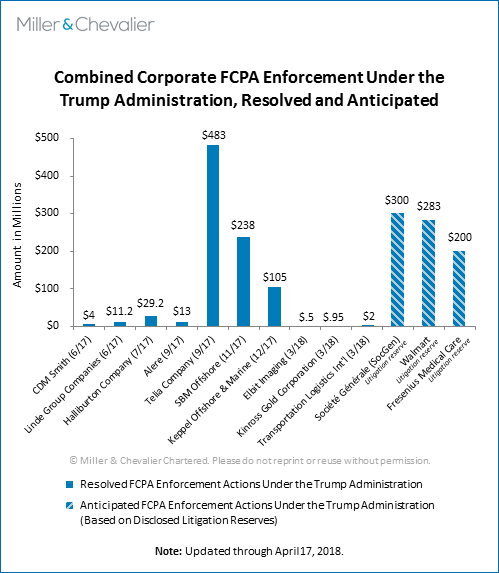

Despite this relatively quiet first quarter, at least a handful of potentially large FCPA-related settlements appear to be on the horizon. Several of these cases have dragged on for years, likely due to their size and complexity. Notably, over the past six months, at least three companies have publicly announced sizable reserves to settle long-running investigations:

- In September 2017, the France-based banking and financial services company Société Générale S.A. (SocGen) disclosed that it had increased its litigation reserve by $300 million in connection with continuing negotiations with U.S. authorities to resolve allegations of improper payments to Libyan government officials and the company's reported role in a scheme to manipulate the London Interbank Offered Rate (Libor) rate. The SocGen disclosure does not indicate how much of this $300 million relates to the alleged FCPA violations.

- In November 2017, Arkansas-based retailer Walmart Inc. announced that it would set aside $283 million for a potential settlement to resolve its six-year investigation into potential FCPA-related violations in Mexico, Brazil, China, and elsewhere.

- Finally, in February 2018, Germany-based dialysis provider Fresenius Medical Care A.G. announced a litigation reserve of $200 million for a potential FCPA resolution with the DOJ and SEC.

Assuming these companies have correctly predicted the timing and amount of any upcoming settlements, we should see at least some sizeable settlements this year on par with last year's Telia, SBM Offshore, and Keppel Offshore resolutions.

The pace of enforcement against individuals also lagged during the first quarter of 2018, with only two individuals pleading guilty during the quarter, slightly below the average of about three individual actions a quarter over the past 10 years:

- On January 5, 2018, former New Jersey-based real estate broker Joo Hyun "Dennis" Bahn pled guilty to one count of conspiracy to violate, and one count of violating, the anti-bribery provisions of the FCPA. Bahn's charges arose out of his involvement in the "Landmark 72" corruption scheme in 2014, under which the New Jersey real estate broker and his father Ban Ki Sang allegedly bribed a fraudster posing as a Qatari agent, Malcolm Harris, in exchange for the promise of Qatari investment in the Landmark 72 skyscraper in Hanoi, Vietnam, in which Bahn and Ban had a financial interest. As discussed most recently in our FCPA Autumn Review 2017, the DOJ's investigation into the Landmark 72 deal has already resulted in an indictment for Ban and a conviction for Harris.

- On March 15, 2018, former Siemens executive Eberhard Reichert pled guilty to one count of conspiring to violate the anti-bribery, internal controls, and books-and-records provisions of the FCPA and to commit wire fraud. Reichert's conviction arose out of his time as an executive at Siemens from the mid-nineties to the early 2000s – the same period Siemens was paying bribes to officials in Argentina, Bangladesh, China, Iraq, Nigeria, Russia, Venezuela, and Vietnam, resulting in its $800 million penalty in 2008 – still the largest in FCPA history. Reichert is one of the "Siemens 8," a group of former executives indicted in 2011 for payments made to Argentinian government officials to win and then retain a $1 billion contract to modernize the country's National Identity Card system. Reichert is only the second of the Siemens 8 to be convicted. He avoided apprehension for years, until finally being arrested in Croatia and consenting to extradition to the United States.

In addition to these resolved individual enforcement actions, this quarter's sole new indictment is of Mark Lambert, a former executive at TLI, the Maryland-based nuclear fuel transportation whose DPA with the DOJ is noted above. Lambert's indictment, like the DPA for the company he used to head, arises out of allegations that Lambert and two other TLI executives made unlawful payments to officials at TENEX, a subsidiary of Russia's state-owned nuclear energy corporation Rosatom. Lambert's former Co-President Daren Condrey and former TENEX official Vadim Mikerin have previously pled guilty on charges arising of out the same alleged scheme.

During the first quarter of 2018, the DOJ also made public its latest indictments under the ongoing investigation into corruption at the Venezuelan state-owned oil company Petróleos de Venezuela, S.A. (PDVSA), which thus far has resulted in 15 individual DOJ indictments, including several against Florida-based businesspeople. The most recent DOJ charges are against five members of PDVSA's so-called "management team," all of whom the DOJ considers to be government officials under the FCPA for their roles in an "instrumentality" of a foreign government. Although all five members of the management team face money laundering charges, only two – Luis Carlos De Leon Perez (De Leon) and Nervis Gerardo Villalobos Cardenas (Villalobos) – face FCPA charges for their alleged role in forwarding bribes to other government officials. Furthermore, these indictments, while filed in 2017, were only unsealed on February 12, 2018. Per Miller & Chevalier's standard practice, therefore, we count only the charges against De Leon's and Villalobos's as FCPA enforcement actions individuals and count them during the fourth quarter of 2017.

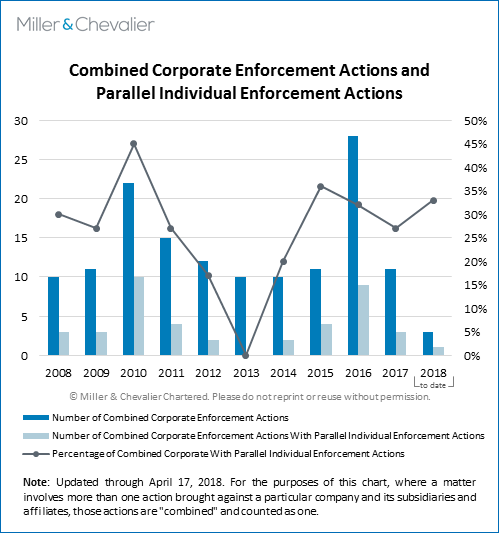

Of this quarter's individual enforcement actions, the guilty plea by Eberhard Reichert is noteworthy for being associated with the Siemens FCPA case, a corporate enforcement action resolved nearly 10 years ago. Reichert's case is therefore a reminder that many corporate enforcement actions lead to parallel individual actions where the DOJ or SEC brings criminal or administrative charges against individuals allegedly involved in the misconduct, often armed with information collected during the corporate investigation. Reichert's case also demonstrates that such parallel individual actions can last for years after a corporate disposition.

Since 2008, the percentage of FCPA-related corporate enforcement actions that have resulted in publicly-announced parallel individual enforcement actions has averaged around 25 percent of the total number of corporate dispositions. This percentage has fluctuated over time – for example, there was an uptick in parallel individual enforcement actions in 2010 – a result of several individual enforcement actions associated with corporate enforcement actions, as well as a downturn in 2013, a year where no corporate enforcement actions saw a parallel individual enforcement action, either that year or in subsequent years.

Investigations Ended Without Enforcement Action

As noted above, the first quarter was above average in terms of the number of announcements of DOJ or SEC investigations that ended without enforcement.1 Specifically, the first quarter of 2018 saw the end of at least nine investigations that the DOJ or SEC had previously launched into seven companies, with two companies subject to investigations by both the DOJ and SEC. This number represents an unusually high number of investigations ended without enforcement action, compared to an average of about six for the first quarters of the last five years. Although such investigation statistics are inherently flawed – not all companies are required to or chose to disclose such investigations – the number of companies that have recently disclosed such resolutions may suggest a broader trend.

For the first quarter of 2018, we have identified the following investigations that have been ended without enforcement:

- Cobalt International Energy, Inc.: On January 30, 2018, the Texas-based oil exploration company Cobalt International Energy, Inc. filed a Form 8-K stating, "[o]n January 29, 2018, the United States Securities and Exchange Commission (the SEC) concluded its FCPA investigation relating to the Angolan operations of Cobalt International Energy, Inc. (Cobalt) and advised that the SEC staff does not intend to recommend any enforcement action by the SEC against Cobalt. This formally concludes the SEC investigation, which was opened in March 2017."

- Juniper Networks, Inc.: In a Form 8-K filed on February 9, 2018, the California-based network products company Juniper Networks stated that "it received a letter from the U.S. Department of Justice (DOJ) notifying the Company that the DOJ has closed the Company's previously disclosed investigation into possible violations by the Company of the U.S. Foreign Corrupt Practices Act (FCPA) without taking any action against the Company. In its letter, the DOJ acknowledged the Company's cooperation in the investigation. As previously disclosed, the Securities and Exchange Commission is also conducting an FCPA investigation, and that matter has not yet been resolved." The company first disclosed its FCPA investigation in August 2013.

- Core Laboratories N.V.: On February 12, 2018, Amsterdam-based Core Laboratories N.V., which provides core and fluid analysis to the petroleum industry, filed a Form 10-K stating, "[i]n a letter dated February 5, 2018, the Company was informed by the SEC, that they have concluded their investigation as to the Company's connection with Unaoil and they do not intend to recommend an enforcement action by the Commission against the Company." As discussed in our FCPA Autumn Review 2017, the company reported in October 2017 that the DOJ had closed an investigation into the company without enforcement.

- Teradata Corporation: On February 23, 2018, the Ohio-based database products and service provider Teradata Corporation filed a Form 10-K stating that "[o]n January 16, 2018, the SEC advised that its staff would not recommend any enforcement action by the SEC against Teradata and that its investigation into this matter is closed. On February 20, 2018, the DOJ also advised the Company that it will not take any enforcement action and that its investigation into this matter is closed." The company reported that it alerted the SEC and DOJ of "questionable expenditures for travel, gifts and other expenses" at a subsidiary doing business in Turkey in February 2017.

- Sanofi S.A.: In a Form 20-F filed March 7, 2018, the French multinational pharmaceutical company Sanofi, S.A., noted that "[I]n February 2018, the DOJ notified Sanofi that it had decided to close its inquiry into the allegations. Sanofi is still cooperating with the SEC's review of the allegations." Sanofi had acknowledged U.S. authorities began investigating the company in 2014 following allegations by a whistleblower of payments in the Middle East and Africa from 2007 to 2012.

- Exterran Corporation: On February 28, 2018, the Houston-based Exterran Corporation, which leases and services natural gas and crude oil equipment, filed a 10-K stating, "[t]he SEC staff has notified us that they have concluded their investigation concerning our compliance with the FCPA and that they do not intend to recommend an enforcement action concerning our compliance with the FCPA. The DOJ has similarly informed us that it does not intend to proceed with any further investigation or enforcement." Exterran first disclosed potential compliance problems to the SEC in April 2016.

In addition to the investigations resolved without enforcement listed above, we are aware of another issued by the SEC in 2018 to date. We cannot report any other details for this closure, including the name of the target company, because it has not been publicly reported. As is our standard practice, we do not report the details of non-public declinations.

Notably, two of the companies listed above – Cobalt International Energy, Inc. and Teradata Corporation – first disclosed their investigations in the early months of 2017, making them perhaps the first two FCPA investigations to have been launched and concluded entirely under the current Administration.

However, none of the above investigations ended without enforcement appear to count as "declinations"2 made under the DOJ's new FCPA Corporate Enforcement Policy announced November 2017. As discussed in our Winter 2018 FCPA Review, the new FCPA Corporate Enforcement Policy established a "presumption that the company will receive a declination," absent aggravating circumstances, when the company voluntary self-discloses, cooperates in any subsequent investigation, and properly remediates, all as carefully defined by the DOJ. This Policy extends and amends the DOJ's prior "Pilot Program," which the DOJ has credited with prompting an increase in corporate self-disclosures, although the effects of the amendments to the Program remain unclear.

Investigations

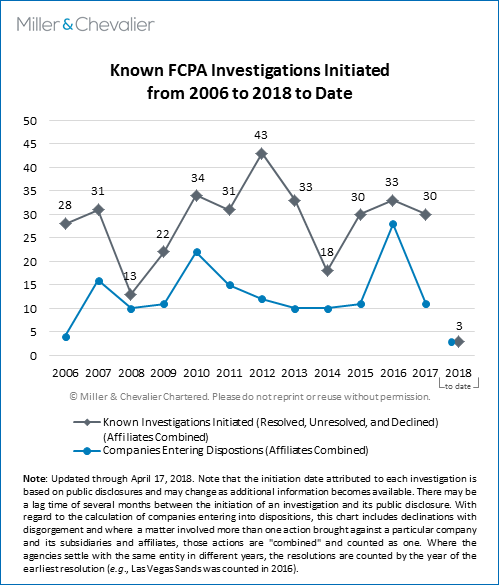

Another useful data point for assessing enforcement climate is the number of FCPA investigations launched during a quarter. From publicly available information such as press reports and corporate SEC filings, Miller & Chevalier was able to identify only three new investigations launched this quarter, which is somewhat below average.

While this below-average number can be a useful statistic, it is important to remember that the number of known investigations initiated is not an exact predictor of the numbers of future resolved enforcement actions, because a single investigation can result in multiple enforcement actions or end without enforcement entirely. Moreover, there are likely additional investigations initiated each quarter of which we are not yet aware, because the government agencies or companies involved have chosen to not publicly disclose them. With respect to the chart above, since public companies sometimes wait months, or even years, to disclose the existence of an investigation in their securities filings – with some choosing never to do so – and since non-issuer companies often never disclose the existence of an investigation, the numbers in the chart are likely to rise, even for past years. Finally, we have also identified two disclosures this quarter that discuss investigations about which Miller & Chevalier already had information. However, per our standard practice, we do not count these investigations as being initiated this quarter.

Continuing FCPA Risk

Whatever the trend in FCPA enforcement, it is important to note that potential signs of reduced FCPA enforcement do not necessarily translate into reduced FCPA risk for companies or individuals. To begin with, given the vagaries of any individual investigation, FCPA enforcement naturally fluctuates from quarter to quarter and from year to year. For example, a relatively slow first and second quarter of 2015 gave way to a relatively active third quarter of that year, followed by a slow fourth quarter, followed by a blockbuster first quarter of 2016 – almost certainly due more to the timing of the then-ongoing investigations than any larger trend. Such contingent fluctuations in the DOJ's and SEC's ongoing investigations may explain at least part of the current slow-down, especially given that we know that there are likely large settlements for SocGen, Walmart, and Fresenius Medical Care in the near future.

Furthermore, over the past few years, companies of all sizes, in all industries, and in many countries have invested significant resources into new, best-in-class compliance programs. If these compliance programs are operating effectively, they should naturally lead to a decrease in FCPA violations and therefore a decrease in FCPA enforcement actions. The above-mentioned steady continuation in FCPA investigations closed without enforcement action may support this explanation, as more companies are disclosing potential misconduct discovered by effective compliance programs to the agencies and receiving a clean bill of health.

Perhaps paradoxically, a decline in FCPA enforcement actions for this reason may actually signal an increase in FCPA enforcement risk, as regulators focus their attention on the remaining bad actors and companies that fail to keep up with increasing compliance expectations. In addition, even if the slowdown in FCPA enforcement truly does reflect lowered enforcement risk under the Trump Administration, it is important to remember that, under the applicable statute of limitations, companies and individuals may still face liability for their actions for up to five years after the "completion" of any misconduct (with an additional three years in certain circumstances), which could allow a future Administration to investigate specific issues.

Finally, as we have noted over the last few years, more countries are actively increasing their investigations of potential bribery by multinational companies and their employees and agents, either under foreign bribery laws enacted pursuant to multilateral conventions or under domestic corruption laws. Thus, in the current operating environment for many companies, enforcement risk for potential corruption can emerge from many possible sources.

International Developments

The first quarter of 2018 also saw several noteworthy international developments. Following the trend in several countries, Canada announced an analogue to the U.S.-style DPA, called a "Remediation Agreement Regime," which will give Canadian prosecutors access to an anti-corruption enforcement tool that has been increasingly popular in many jurisdictions. France issued enforcement guidelines under its new Sapin II anti-foreign corruption law and reached settlements with two French companies under its new DPA-style Judicial Public Interest Agreement (known in French as a "Convention judiciaire d'intérêt public"). Israel issued the second fine under its new anti-foreign bribery statute, this time for the Israeli generic drug manufacturer Teva Pharmaceutical Industries. In addition, the United Kingdom concluded its first contested prosecution under Section 7 of the U.K. Bribery Act, which imposed criminal liability for failure to prevent bribery.

Finally, in February 2018, the Berlin-based non-governmental organization Transparency International (TI) issued its often-cited Corruption Perceptions Index (CPI) for 2017, which measures perceptions of corruption for 179 countries on a scale from 100 (least corrupt) to zero (most corrupt), and has been used by many companies to assess potential corruption risks as part of their compliance programs. This year, TI emphasized that its metrics of perceived corruption had seen little change over the past decade in most of the world, with notable exceptions in Côte d'Ivoire, Senegal, and the United Kingdom, all of which TI singled out as having seen their scores improve over the last few years.

Corporate Enforcement Actions

Israel-Based Holding Company Settles with SEC in Connection With Third-Party Payments Related to Projects in Romania and the United States

On March 9, 2018, the SEC announced that Elbit Imaging Ltd. (Elbit) reached a settlement to resolve allegations that the company violated the FCPA's books-and-records and internal-accounting-controls provisions. Elbit – an international holding company with activities focused on real estate development based in Petach Tikva, Israel – agreed to pay a $500,000 civil money penalty to the SEC. The alleged misconduct occurred through Netherlands-based Plaza Centers NV (Plaza), an indirect subsidiary of Elbit focused on developing shopping and entertainment centers in Eastern Europe. Elbit trades on the Tel Aviv Stock Exchange and NASDAQ, making it an issuer under the FCPA.

According to the SEC Cease-and-Desist Order (the Order), from 2006 to 2011, Plaza attempted to obtain development rights in the Casa Radio Project, a large real estate development in Bucharest, Romania. In August 2006, a key company executive who owned 50 percent of Elbit's equity, served as Elbit's CEO and Plaza's Executive Director, and sat on the board of directors for both companies (the Executive), directed Plaza to enter into an agreement with a third-party consultant (Consultant 1). Plaza allegedly engaged Consultant 1 to help obtain an invitation from the Romanian government to participate in the Casa Radio Project and to acquire the necessary government approvals to perform development work. In February 2007, the Romanian government allowed Plaza to purchase a 75 percent interest in the Casa Radio Project for approximately $40 million. Plaza also agreed to develop a Romanian public authority building at Plaza's expense in exchange for the interest in the Project.

In September 2011, the same Executive allegedly directed Plaza to enter into another contract with a third-party offshore consultant (Consultant 2) to assist in acquiring governmental approvals and to help Plaza purchase an additional 15 percent interest in the Casa Radio Project.

According to the SEC Order, neither Consultant 1 nor Consultant 2 underwent due diligence. Between 2007 and 2012, Plaza allegedly paid Consultant 1 and Consultant 2 approximately $14 million. The SEC noted that both Consultants were paid despite having no supporting documentation that they performed services.

In October 2011, Elbit and Plaza held a 45.4 percent interest in a joint venture that owned a portfolio of 47 shopping centers located in the United States. The Executive allegedly engaged a third-party sales agent (Sales Agent 1) to assist Elbit and Plaza in selling the shopping centers, but apparently did not involve the joint venture in the agreement with the sales agent. In exchange for locating potential buyers and negotiating sales contracts, Sales Agent 1 would receive a 0.9 percent commission of the portfolio's gross sales price. Without disclosing to Elbit or Plaza, Sales Agent 1 allegedly assigned the majority of its commission – 0.88 percent – to another sales agent that was beneficially owned by the Executive (Sales Agent 2). According to the SEC Order, although there was no evidence that services were rendered by either sales agent, Elbit and Plaza paid approximately $13 million to Sales Agent 1, who in turn paid $12.75 million to Sales Agent 2.

In 2014, Elbit began to sell its assets to former debtholders through debt arrangement agreements similar to Chapter 11 bankruptcy proceedings in the United States. According to the SEC Order, Elbit is in the process of wind down and does not develop current or new businesses.

When Elbit discovered that certain payments related to the Casa Radio Project may have been improper, a special committee of its board of directors hired outside counsel to conduct an independent investigation. Elbit and Plaza self-reported the information to authorities in both Romania and the United States and shared the investigation's findings with the SEC as additional facts were learned concerning the payments,. Elbit and Plaza also adopted and implemented revisions to the companies' internal accounting controls and anti-bribery policies and procedures recommended by outside counsel. The Executive who directed the arrangements with the Consultants and Sales Agents passed away in June 2016.

The SEC found that Elbit's and Plaza's internal accounting controls failed to flag the $27 million in payments to Consultant 1, Consultant 2, and Sales Agent 1, "despite having no evidence that these counter-parties actually provided any of the contracted for services." The SEC found that Elbit and Plaza failed to maintain internal accounting controls sufficient to provide reasonable assurances that transactions were recorded accurately and noted the limited role that Plaza's legal department had in supervising the contracts between Plaza and third parties. According to the SEC Order, neither company had policies or procedures in place to detect corruption risks. The SEC found that Elbit and Plaza violated the books-and-records provision of the FCPA because they mischaracterized the payments made to Consultant 1, Consultant 2, and Sales Agent 1 as legitimate business expenses, "even though some or all of the funds may have been used to make corrupt payments to Romanian government officials or were embezzled."

Noteworthy Aspects

- Lack of Due Diligence and Supporting Documentation Sufficient Basis for Internal Controls and Books-and-Records Violation. The SEC does not allege that a portion of the funds paid to Consultant 1 and Consultant 2 were in fact given to government officials or embezzled. Rather, the SEC found that the company violated the internal controls provision of the FCPA based on the company's failure to flag payments totaling approximately $27 million made without supporting documentation. The lack of confirmation that fees paid to the consultants and agents were in fact given to a foreign official is yet another example of the broad reach of the FCPA accounting provisions in comparison to the anti-bribery provisions. The SEC's analysis suggests that making payments without documenting the legitimacy of the payments is sufficient to find that a company has inadequate internal accounting controls. Further, recording such payments as legitimate business expenses was considered inaccurate and sufficient to violate the books-and-records provision. Interestingly, it also shows the reach of accounting provisions with respect to domestic activity, as the activity with respect to the Sales Agents occurred in the United States, where, even if the agents had paid officials, those payments would have been out of scope for the FCPA's anti-bribery provisions.

- Consideration of Business Finances in Determining Fine. In the SEC Order, the SEC states that it considered the company's disclosure, cooperation, and Elbit's financial posture when determining whether to accept the agreement. The fact that Elbit is in the process of winding down and is not engaged in new business may be relevant to why the fine, $500,000, is relatively low compared to other FCPA actions. The SEC's approach is consistent with other SEC actions such as Key Energy, Alcoa, and Innospec, in which the companies' poor financial situation resulted in lower fines.

- Disclosure in Other Countries. In addition to the SEC, Elbit also disclosed its potential violations to Romanian authorities. Elbit's approach follows a pattern where companies are recognizing that other countries' authorities have an interest in corruption allegations and it is no longer sufficient to disclose to U.S. authorities alone. Interestingly, there is no reference to Elbit disclosing to Israeli authorities despite trading on the Tel Aviv Stock Exchange. At this time, neither Romania nor Israel have publicly initiated actions against Elbit.

Transport Logistics International Inc. Settles FCPA-Related Charges for $2 Million

On March 13, 2018, the Maryland-based nuclear fuel transport company Transport Logistics International Inc. (TLI) agreed to pay a $2 million criminal penalty to settle one charge of conspiring to violate the anti-bribery provisions of the FCPA. According to TLI's DPA, the company was at the center of a conspiracy to pay bribes to an executive at JSC Techsnabexport (TENEX) named Vadim Mikerin. TENEX is a Russian uranium-export company owned by the Russian nuclear energy corporation Rosatom, which is in turn owned by the Russian state – such that, according to the DOJ, Mikerin counted as a "foreign official" for FCPA purposes. In exchange for these payments, the executive allegedly assisted TLI in obtaining uranium transportation contracts from TENEX, including by passing confidential information that gave an improper advantage to TLI in relation to other competitors.

According to the DPA's statement of facts, between 2004 and 2014, former TLI Co-Presidents Mark Lambert and Daren Condrey, along with an unnamed, now-deceased former TLI executive, arranged for payments of more than $1.7 million to Mikerin, who at that time served as a director at TENEX and president of TENAM, TENEX's wholly-owned subsidiary based in Maryland. Lambert, Condrey, and the unnamed TLI executive allegedly made the payments to offshore bank accounts belonging to shell companies associated with Mikerin. The TLI executives then "caused fake invoices to be prepared" that were purportedly issued to TLI for services provided by TENEX, so that TLI could make payments to the Russian uranium export company without attracting scrutiny from internal TLI personnel. The three TLI executives also allegedly used terms such as "remuneration" and "commission" when discussing these payments on internal company documentation, and utilized code words such as "lucky figures," "LF," "lucky numbers," and "cake" in internal emails and emails sent to Mikerin's personal email account. According to the DPA, TLI earned profits of approximately $11.6 million from business won as a result of these payments.

As discussed in our FCPA Autumn Review 2015, the DOJ has already obtained three guilty pleas in connection with this case: former TLI Co-President Daren Condrey pled guilty to conspiring to violate the anti-bribery provisions of the FCPA and conspiring to commit wire fraud, while former TENEX official Vadim Mikerin and a former intermediary who facilitated TENEX corruption, Boris Rubizhevsky, both pled guilty to conspiracy to commit money laundering. In addition, in January, 2018, the DOJ issued an 11-count indictment, including FCPA anti-bribery and conspiracy charges, against former TLI Co-President Mark Lambert.

The charging documents do not make clear how the DOJ discovered the misconduct, although the TLI's DPA states that the company was not entitled to credit for voluntarily disclosing the misconduct. Nevertheless, the agency did grant full credit for the company's "substantial cooperation," which included interviewing a witness in Russia to which the DOJ did not have access and "voluntarily organizing, identifying, and producing documents that assisted the government's prosecution of individuals." Based on this cooperation, the DOJ deemed TLI eligible to receive a 25 percent reduction off the bottom of the fine range under the applicable U.S. Sentencing Guidelines, producing a penalty of $21,375,000. After financial analysis, the DOJ also determined that TLI was financially unable to pay the calculated penalty and agreed to reduce the penalty to $2 million.

TLI also agreed to implement a compliance and ethics program designed to prevent and detect violations of anti-corruption laws, including designating a Chief Compliance Officer. The DOJ also required the company to conduct and prepare annual reviews and reports over a three-year period, but the company is not obligated to retain an independent compliance monitor.

Noteworthy Aspects

- Enforcement Actions Against Both Bribe Payers and Bribe Recipients. As noted above, the DOJ's investigation into TLI has resulted in charges against not only the company itself, but also former TLI executives Daren Condrey and Mark Lambert; former TENEX director Vadim Mikerin, a Russian government official under the FCPA in the view of the DOJ; and Boris Rubizhevsky, an intermediary convicted for his role in facilitating the payments. This means that the DOJ has brought charges against all sides of the covered corrupt transactions – the bribe payers, the bribe recipient, and the middleman. The DOJ accomplished this result with FCPA and wire fraud charges for the briber payers, as well as money-laundering charges for the bribe recipient and the intermediary. Notably, this pattern of enforcement parallels the DOJ's actions in the PDVSA cases discussed below, where the agency first brought FCPA-related charges against several Florida-based businessmen for their payments to PDVSA officials and then, in January 2018, brought primarily money-laundering charges against the officials themselves.

- Documents Provided by Company Used to Build Case Against Former Executives. As we have discussed in our FCPA Winter Review 2018, current DOJ policy focuses on enforcement efforts against individuals while offering leniency to companies in exchange for cooperation including, per the most recent FCPA Corporate Enforcement Policy, by disclosing "all relevant facts about all individuals involved in the violation of law." TLI's case is an excellent example of this policy in practice, with the DOJ bringing an 11-count indictment against former TLI Co-President Mark Lambert but offering the company a significant discount in penalties, in part for "voluntarily organizing, identifying, and producing documents that assisted the government's prosecution of individuals."

Canada-Based Kinross Gold Corporation Agrees to Pay $950,000 to SEC to Settle FCPA Accounting Violations from Acquisitions in West Africa

On March 26, 2017, the SEC imposed a Cease-and-Desist Order (the Order) against Kinross Gold Corporation (Kinross), a Canadian gold and silver mining company listed on the New York Stock Exchange. Under the terms of the Order, Kinross agreed to pay a civil penalty of $950,000 to settle alleged books-and-records and internal-accounting-controls violations of the FCPA. The violations arose out of Kinross's 2010 acquisition of two mining operations in west Africa: the Chirano underground and open-pit gold mine in Ghana and the Tasiast open-pit gold mine in Mauritania.

According to the Order, Kinross conducted pre-acquisition due diligence on the owner of the two mines and determined that the mining operations lacked any anti-corruption compliance program and associated anti-corruption controls. Despite this red flag, Kinross failed to implement basic new anti-corruption controls after the acquisition for almost three years, from 2010 to 2013. For example, Kinross continued the previous owner's practice of allowing low-level personnel to contract directly with vendors without involvement from the procurement department and to pay these vendors from petty cash. Furthermore, Kinross failed to address the warnings of its own internal auditors, who conducted a review soon after the acquisition and found that both mines' Enterprise Resource Planning (ERP) accounting and disbursement systems did not "include much detail on the nature of disbursements," such that it was "not possible" to identify suspect payments or assess compliance with the FCPA.

As a result of these known compliance weaknesses, the SEC Order states that Kinross made payments to "vendors and consultants, often in connection with government interactions, without reasonable assurances that the transactions were consistent with their stated purpose or the prohibition on improper payments to government officials." For example, according to the SEC Order:

- In 2012, Kinross faced delays in the issuance of a mining production permit by the Ghana Environmental Protection Agency due to issues with an Environmental Impact Study prepared with the assistance of a third-party environmental consultant. During this delay, Kinross received a $12,000 invoice from the third-party environmental consultant for services purportedly provided a year earlier, with no supporting documentation. Kinross employees allegedly used petty cash to pay the $12,000 without properly documenting the payment in the company's books and records. A month later, the Ghana Environmental Protection Agency issued the mining production permit.

- From 2012 to 2013, Kinross paid a Ghanaian customs official for expenses incurred when traveling to the Chirano mine site in order to sign papers to transfer the title (and attendant shipping risk) of recently mined gold to the buyer. The official received the same fixed payment regardless of actual travel expenses, even for weeks when he did not travel to Chirano at all.

In 2013, the company did implement some new policies and internal controls, but allegedly sidestepped them for certain high-risk transactions. For example, according to the SEC:

- In 2014, Kinross was preparing to award a $50 million, three-year logistical support contract to an international shipping company whose bid best fit the combination of low cost and high technical capabilities required by company policies. After preliminarily selecting the international shipping company, however, company personnel learned that a powerful Mauritanian government official favored a different international shipping company – one that cost more and lacked the same technical capabilities, but one in whose local affiliate a businessman with ties to the Mauritanian government official had recently acquired an interest. Kinross personnel then convinced management to select the shipping company favored by the government official on the grounds the it was the "preferred option of Gov[ernment] stakeholders."

- Also in 2014, an individual with connections to a powerful Mauritian official approached Kinross personnel and proposed establishing a continuing, semi-formal liaison relationship between senior executives at Kinross and senior government officials. Kinross ignored its own company policies – which would have required the highest level of due diligence before engaging such an individual – and engaged the individual as consultant under a "Corporate, General, and Non-Routine Expenditures" contract for approximately $715,000 between September 2014 and August 2015.

Despite these compliance weaknesses related to transactions involving government officials, the SEC Order does not allege that any of these failures resulted in bribes to officials. Instead, as with the Elbit Imaging Order discussed above, Kinross's civil liability arose out of a failure to accurately record transactions and to maintain the accounting and recordkeeping systems sufficient to provide reasonable assurances that transactions were executed according to proper authorization. The Order states that the SEC accounted for the company's significant remediation efforts – which included implementing a new ERP system, increasing the number of compliance personnel, and instituting more formalized controls over the use and documentation of petty cash – when calculating the civil penalty of $950,000. The Order also requires Kinross to prepare an initial report on the company's controls and to issue a follow-up report for the SEC over a one-year term, as well as to implement additional new compliance safeguards.

Noteworthy Aspects:

- Post-Acquisition Integration Risks. Since the DOJ and SEC issued the FCPA Resource Guide in 2012, it has been well established that companies can, in certain circumstances, face pre-acquisition "successor liability" for misconduct by the target company before the merger or acquisition, on the theory that the acquiring company assumes all legal liabilities of the target. The Guide states that companies can mitigate this potential liability by performing appropriate post-acquisition due diligence and implementing compliance programs and related controls. This case shows the risk of liability a company faces from not implementing appropriate controls post-acquisition, even absent true successor liability. Namely, the Order does not mention any pre-acquisition misconduct, but rather focuses on misconduct that occurred after acquisition due to Kinross's failure to sufficiently remediate risks raised by due diligence and internal audit findings, such that personnel at Kinross's mine sites entered into post-acquisition transactions that created new liability for the company. Other companies that have faced liability for similar FCPA violations include plumbing and flow-control solutions provider Watts Water, which failed to properly integrate a recently-acquired Chinese subsidiary, and diagnostic-tests manufacturer Alere, Inc., which received a $13 million SEC fine due to conduct by the former owner of an acquisition who was subsequently retained as a general manager and continued to make improper payments to government officials, both before and after acquisition.

- Focus on Mining Industry. The enforcement action against Kinross illustrates some of the FCPA risks arising in the mining industry, which often requires interactions with government officials such as customs officials and environmental permitting agencies in countries with medium or high corruption risk. Accordingly, although mining has not been as frequent a focus of FCPA enforcement as, for example, the oil and gas sector, several mining companies have faced FCPA investigations or enforcement actions in recent years. Examples include Sociedad Química y Minera de Chile S.A (SQM) and BHP Billiton Ltd (which paid $30.5 million and $25 million, respectively, to settle FCPA charges by the SEC); Newmont Mining Corporation and Gold Fields Limited (each of which faced SEC investigations that were later closed without enforcement action); and Rio Tito (which disclosed potential misconduct to U.S., U.K., and Australian authorities in 2016 that has not yet been resolved).

Individual Enforcement Actions

Nephew of Former UN Chief Pleads Guilty to Bribery in Skyscraper Deal

On January 5, 2018, New Jersey-based real estate broker Joo Hyun "Dennis" Bahn pled guilty in Manhattan federal court to one count of conspiracy to violate the anti-bribery provisions of the FCPA and one count of violating those provisions, both relating to his involvement in a scheme to bribe an ultimately fictitious Qatari official in exchange for financing the $800 million sale of a high-rise commercial building in Vietnam. Bahn, a South Korean citizen based in New Jersey, is the nephew of Ban Ki-moon, former Secretary-General of the United Nations. Bahn pled guilty to one count of conspiracy to violate the FCPA anti-bribery provisions and one count of violating the FCPA anti-bribery provisions. Sentencing is scheduled for June 29, and Bahn faces a maximum sentence of 10 years in prison.

Bahn and his father, Ban Ki Sang, were charged in December 2016 in connection with a $500,000 payment intended for a Qatari official to secure financing to benefit Keangnam Enterprises Co. Ltd., a South Korean construction company where Ban Ki Sang was a senior executive. As discussed in our 2017 FCPA Autumn Review, Bahn and his father were indicted alongside Malcom Harris, who purported to be an agent of the Qatari official and a conduit for the bribe. Bahn admitted to agreeing to pay $500,000 to Harris to pass on to the official, who he thought could influence Qatar's sovereign wealth fund to purchase the building. However, Harris instead pocketed the money and spent it on various luxury purchases. Harris subsequently pled guilty to wire fraud and money laundering and was sentenced to 42 months in prison.

Bahn's father, Ban Ki Sang, has yet to address the charges and is currently at large.

Former Executive at Siemens Subsidiary Pleads Guilty to FCPA Charges from 2011

On March 15, 2018, German national Eberhard Reichert pled guilty to one count of conspiring to violate the anti-bribery, internal controls, and books-and-records provisions of the FCPA and to commit wire fraud. Reicher's charges arose out of his role in the worldwide corruption scheme that led to the $800 million FCPA settlement by Siemens Aktiengesellschaft (Siemens AG) in 2008 – still the largest FCPA penalty of all time, as discussed in our Winter 2009 FCPA Review. Reichert, now 78, is one of the "Siemens 8," a group of eight former executives associated with Siemens AG who were indicted in 2011 for their role in an alleged corrupt scheme in Argentina. Specifically, in 1998 a Siemens AG subsidiary won a contract with the Argentine government worth approximately $1 billion to modernize the country's national identity cards, allegedly by promising to pay nearly $100 million in bribes to members of the Argentine government, members of the opposition party, and candidates who might come to power during the performance of the contract.

This scheme went awry, however, when Argentina entered a period of economic crisis, forcing the government to suspend the national identity cards project in 1999. In response, according to the DOJ's 2011 indictment, Reichert and other members of the Siemens 8 paid millions more in bribes to high-ranking government officials in an effort to persuade them to revive the contract. Even after the Argentine government terminated the contract for good in 2001, Siemens AG initiated a sham arbitration scheme in Switzerland, through which it made millions of dollars more in payments to Argentinian government officials, all in order to prevent disclosure of the previous corruption in a separate arbitration action against Argentina in Washington, DC Siemens eventually prevailed in the Washington, DC arbitration, winning an award of $220 million for expenses incurred and expected profit, plus interest. (As a result of corporate anti-corruption agreements with the United States and Germany, Siemens agreed to forgo this award.)

According to the DOJ, Reichert played important roles at each stage of the corrupt scheme: he served as Technical Manager of the Major Projects division at Siemens Business Services GmbH & Co. OGH (SBS), a Siemens AG subsidiary that played a crucial role in winning the national identity cards project; he later approved a sham contract between a Siemens subsidiary and a shell company to funnel $27 million to Argentine officials; and, even after leaving the company in 2001, he testified in the Swiss arbitration as part of the conspiracy to thereby make additional payments to Argentine officials.

Reichert's 2018 guilty plea is also noteworthy for occurring a full seven years after the 2011 charges against him. Although the details of Reichert's life between 2011 and 2018 are unclear, the DOJ press release notes that "[h]is guilty plea followed his September arrest in Croatia and subsequent voluntary extradition to the United States in December," suggesting that he may have avoided arrest for years by living outside U.S. jurisdiction. Reichert is the second of the Siemens 8 to be convicted: as discussed in our FCPA Autumn Review 2015, Andreas Truppel, the former CFO of Siemens's Argentine subsidiary, pled guilty to conspiring to violate the anti-bribery, internal controls, and books-and-records provisions of the FCPA and to commit wire fraud on September 30, 2015.

Former Government Official Extradited from Spain in DOJ's Investigation of PDVSA Energy Contracts

On February 9, 2018, Spain extradited Cesar Rincon, a former PDVSA official, to the United States to face money laundering charges involving an alleged bribery scheme. The DOJ unsealed indictments against Rincon and four other former government officials known as the "management team" of PDVSA on February 12, 2018. In October 2017, Spain arrested three other defendants – Luis Carlos De Leon Perez, Nervis Gerardo Villalobos Cardenas, and Rafael Ernesto Reiter Munoz – but has yet to extradite them to the United States. The fifth defendant – Alejandro Isturiz Chiesa – has not been arrested.

All five defendants face various money-laundering charges, and two – Luis Carlos De Leon Perez and Nervis Gerardo Villalobos Cardenas – face FCPA-related charges. The indictment alleges that the five defendants used their significant influence with PDVSA to solicit bribes and kickbacks from vendors in the United States, with De Leon and Villalobos arranging for some of the bribes and kickbacks to be directed to other PDVSA officials, an alleged conspiracy to violate the anti-bribery provisions of the FCPA. The DOJ has previously indicted and convicted several United States-based individuals who allegedly paid the bribes and kickbacks to the PDVSA management team and other officials in exchange for having their energy companies put on PDVSA's vendor list, as reported in our Spring 2016, Summer 2016, Spring 2017, and Winter 2018 FCPA Reviews.

The DOJ's sweep of both the bribe payers and the bribe recipients in the PDVSA matter parallels the agency's indictments against parties on both side of the corrupt transaction in the TLI case, including the alleged bribe payers (Mark Lambert and Daren Condrey), the bribe recipient (Vadim Mikerin), the intermediary who facilitated the bribes (Boris Rubizhevsky), and the company that obtained or retained business from the bribe (TLI itself). The indictments against TLI in greater detail above.

Ongoing Policy Developments and Related Litigation

Supreme Court Holds That Whistleblowers Must Report to SEC to Receive Anti-Retaliation Protection Under Dodd-Frank

On February 21, 2018, the Supreme Court published its opinion in Digital Realty Trust, Inc., v. Somers, clarifying the definition of "whistleblower" under the whistleblower-protection provisions of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank), which seek to encourage company insiders to report securities violations to the SEC, including violations of the FCPA. More specifically, the court held that, in order to receive anti-retaliation whistleblower protections under Dodd-Frank, a whistleblower must report allegations of misconduct to the SEC prior to the retaliatory conduct, rather than waiting to report misconduct to the SEC until after alleged retaliation has occurred.

As the Supreme Court noted, "[t]o assist the Commission 'in identifying securities law violations,' [Dodd-Frank] established 'a new, robust whistleblower program designed to motivate people who know of securities law violations to tell the SEC.'" Under Dodd-Frank, whistleblowers are both eligible to receive an award from the SEC and are protected from retaliation. Dodd-Frank defines "whistleblower" as a person who provides "information relating to a violation of the securities law to the Commission." However, in implementing this statute, the SEC created a split definition of the term "whistleblower." The Commission said that a whistleblower needed to report to the SEC in order to receive an award under the award program, but did not need to report to the SEC in order to receive the statute's anti-retaliation protections. Circuit courts were divided as to whether the SEC's split definition of whistleblower was appropriate in light of Dodd-Frank's single statutory definition. In a unanimous decision, the Supreme Court resolved that split, holding that the statutory definition of whistleblower "unequivocal[ly]" required the employee to report violations to the SEC in order to be eligible for anti-retaliation protections.

Because of the statutory language, the decision was unanimous in favor of the petitioner Digital Realty Trust. However, in some ways, the ruling runs counter to the interests of the business community. For years, the DOJ and SEC have encouraged companies to set up internal reporting mechanisms that can detect and remediate wrongdoing before government regulators get involved. Those regulators have encouraged companies to create a "tone at the top" that promotes internal reporting. By saying that whistleblowers only receive anti-retaliation protection if they report to the SEC, this ruling appears to run counter to that guidance and undermine some of the internal reporting mechanisms that companies have developed, including in the context of the FCPA.

However, even though the ruling may create challenges for some businesses, it will not necessarily destroy the ability of companies to elicit internal complaints, as some have speculated. In fact, there are many reasons to question whether the outcome of this case will actually result in more complaints to the SEC. First, that expectation is based on the assumption that whistleblowers act with the expectation of retaliation and with full knowledge of the statutory anti-retaliation schemes. But much anti-retaliation litigation is reactive rather than proactive, with plaintiffs interacting with lawyers only after they have been retaliated against.

Second, that expectation also assumes that any individuals who do proactively consider anti-retaliation protections when deciding whether to report misconduct do not feel sufficiently protected by the anti-retaliation provisions in Sarbanes-Oxley, which continues to protect against retaliation for entirely internal reporting of securities violations, including FCPA violations. Substantively, the anti-retaliation protections of Sarbanes-Oxley are similar to Dodd-Frank, although Dodd-Frank allows for greater damage awards for back pay. The major differences between the two regimes are procedural: Sarbanes-Oxley has a short (180-day) statute of limitations and requires suits to be filed first with the Department of Labor, whereas lawsuits under Dodd-Frank must be filed within six years and can be filed directly in federal district court. Though there are reasons plaintiffs may prefer to litigate under Dodd-Frank, those advantages may not be enough for whistleblowers to adjust their behavior before the fact.

Third, the expectation of increased SEC complaints is based on the assumption that whistleblowers make no distinction between reporting internally and reporting to a government regulator – and are willing to report the same misconduct to both. In reality, whistleblowers may be hesitant to report less significant violations if they feel they have to take the relatively significant step of reporting to the government.

Without a doubt, Dodd-Frank has resulted in increased whistleblower complaints to the SEC; According to the SEC's annual report, the Commission received more than 4,400 tips in 2017, an increase of nearly 50 percent over FY 2012. However, it remains to be seen how much of that increased whistleblower activity is based on the awards program rather than the anti-retaliation protections.

Of course, since the Supreme Court's ruling was one of statutory interpretation, Congress could always change the statutory language. But it is clear that Congress has no intention to do so any time soon. Shortly after the Supreme Court's opinion in Digital Realty Trust, the Senate passed S.2155, which modified portions of Dodd Frank but did nothing to address the anti-retaliation provisions. If Congress had the appetite to modify the Supreme Court's holding, that bill would have been an obvious vehicle for doing so. For now, the business community will need to determine how to continue to promote internal reporting in the wake of Digital Realty Trust while waiting to see how the ruling affects external reporting.

International Developments

Former Brazilian President Begins Serving 12-Year Prison Sentence

We have previously covered the corruption investigation and subsequent charges against former President of Brazil Luiz Inácio Lula da Silva (commonly known as "Lula") that also formed part of Operation Car Wash. (See, e.g., our FCPA Summer Review 2017 and our FCPA Autumn Review 2016).

On July 12, 2017, Lula was convicted of passive corruption (i.e., the receipt of a bribe) and money laundering and sentenced to 9.5 years in prison for allegedly accepting more than $1 million in kickbacks from the engineering firm OAS. As we previously described, OAS allegedly paid the kickbacks in the form of renovations to a beachfront triplex in Guarujá that Lula allegedly owned. In exchange, Lula allegedly helped the firm win contracts with Petrobras. Judge Serio Moro presided over the matter.

On January 24, 2018, three judges of the Federal Regional Court of the 4th Region (TRF-4) unanimously ruled to uphold Lula's conviction and voted to increase his prison sentence from 9.5 years to 12 years and one month. Lula was permitted to remain free pending appeal before the TRF-4 and while he awaited Brazil's Supreme Federal Court (Supremo Tribunal Federal or STF) to rule on his preventive petition for habeas corpus, in which he argued that he should be permitted to remain free until he exhausted all appeals.

The TRF-4 unanimously rejected a subsequent appeal on March 26, 2018, and just after midnight on April 5, 2018, the STF rejected Lula's habeas petition by a vote of 6-5. The STF's decision, in turn, cleared the way for Judge Moro to issue a warrant for Lula's arrest.

On April 7, 2018, Lula surrendered to the Brazilian Federal Police in São Paulo, missing the deadline set by Judge Moro by more than 24 hours. He was subsequently transported to the Headquarters of the Federal Police in Curitiba, where he is being held in a private cell, which Judge Moro stated was in consideration of the "dignity of the office he held."

In denying Lula's habeas petition, the STF upheld a 2016 ruling that permits trial judges to order defendants to begin serving their sentence after an initial appeal has been rejected, rather than waiting until all appeals have been exhausted. Minister Rosa Weber, who was thought to be the "deciding vote," ruled against Lula's petition, insisting that the prevailing jurisprudence establishes that executing a sentence prior to all appeals having been exhausted does not jeopardize the presumption of innocence. While Weber stated that she is personally opposed to the idea of jailing defendants before all appeals are exhausted, she emphasized the need for judicial certainty, stating that the judicial process must avoid "sudden breaks."

In the coming weeks, the STF is likely to revisit the hotly-debated constitutional question of whether individuals should be permitted to remain free until all appeals have been exhausted. If the 2016 decision is overturned, it will retroactively apply to Lula's petition, allowing him to go free until all of his appeals are exhausted.

Nonetheless, at this time Lula remains an eligible presidential candidate for the October 2018 election. Assuming Lula officially registers as a candidate in August, Brazil's Supreme Electoral Tribunal (Tribunal Superior Eleitoral or TSE), the country's highest court for electoral-related issues, will address the eligibility question. The TSE has grounds to disqualify Lula pursuant to Brazil's "Clean Slate Law" (Lei da Ficha Limpa), which, among other things, bars individuals who have been convicted of a crime on appeal from running for public office for eight years. However, Lula could attempt to receive an exception under the law.

To date, Lula is the highest-ranked official to be convicted in Operation Car Wash. Previously, Eduardo Cunha, as former Speaker of the House of Deputies, claimed this title, as discussed in our FCPA Spring Review 2017. Lula continues to deny wrongdoing. He is currently the target of several other Car Wash-related investigations.

Canada Updates Anti-Corruption Law and Enforcement Tools

On March 27, 2018, Canada announced that it has introduced amendments to its Integrity Regime to create a "made-in-Canada" version of the DPA: a Remediation Agreement Regime. According to the Canadian government, Remediation Agreements "would help to advance compliance measures, [and] hold eligible organizations accountable for misconduct, while protecting innocent parties such as employees and shareholders from the negative consequences of a criminal conviction of the organization." The Canadian government explained that the Remediation Agreement Regime adds incentives for companies to self-disclose to authorities and enhance their compliance programs. Remediation Agreements will be subject to judicial approval and oversight, as well as to prosecutorial discretion.

The addition of the Remediation Agreement Regime to Canada's Integrity Regime will be reflected in an updated Ineligibility and Suspension Policy that will be released on November 15, 2018, and will come into effect on January 1, 2019. The Remediation Agreement Regime is expected to come into force 90 days after the Budget Implementation Act receives Royal Assent.

The Canadian government accepted comments on the government's tools to address corporate wrongdoing last year, from September to December 2017. According to a summary report released in February 2018, Canadians commented on topics such as: the advantages and disadvantages of Remediation Agreements, the scope of offenses to be covered, the role of the courts, conditions for negotiating and terms of potential Remediation Agreements, and the potential publicity of Remediation Agreements. The government of Canada anticipates further review of comments received.

French Anti-Corruption Agency Issues First Official Guidelines

On December 22, 2017, the French Anti-Corruption Agency (AFA) published its official anti-corruption guidelines. The publication of the Guidelines comes one year after France's anti-corruption legislation, Sapin II, came into force. Titled "Guidelines to help private and public sector entities prevent and detect corruption, influence peddling, extortion by public officials, unlawful taking of interest, misappropriation of public funds and favouritism" (the Guidelines), and available in an English-language version here, they are not legally binding but are intended to provide a framework around which organizations can develop their compliance policies and programs.

The stated scope of coverage of the Guidelines is broad. They apply to "all private and public-sector entities, regardless of their size, legal structure, business area, revenue or number of employees" and "are applicable everywhere on French territory." Further, the Guidelines reach "all companies, including subsidiaries of foreign groups, if such subsidiaries are established in the French Republic" and all such "corporations and entities, regardless of where they do business, including other countries that do not have more rigorous standards for preventing and detecting corruption."

The bulk of the document details eight characteristics of a "coherent and indivisible policy framework." Not surprisingly, the topics are consistent with international anti-corruption compliance best practices: (1) "top management's commitment to preventing and detecting corruption"; (2) an "Anti-Corruption Code of Conduct"; (3) a reporting mechanism; (4) risk mapping; (5) third-party due diligence procedures; (6) accounting controls "to prevent and detect corruption"; (7) corruption risk training; and (8) an "internal monitoring and assessment system." Acknowledging that organizations necessarily will need to adjust the described standards according to their own "risks, business models and issues," the Guidelines emphasize the importance of risk mapping as a priority for compliance, the outcome of which "will determine the contents and level of detail of organisations' anti-corruption compliance programmes."

France Enters into Two More Bribery-Related Negotiation Resolutions

On March 7, 2018, the AFA announced two Conventions Judiciaire d'Interêt Public (CJIPs), or Judicial Agreements in the Public Interest. A CJIP is a French settlement mechanism that has been compared to a U.S. DPA or NPA. As reported in our FCPA Winter Review 2018, the first CJIP was announced in the last quarter of 2017 and was based on violations of French tax law. The two recently announced settlements between the Public Prosecutor's Office of Nanterre and French companies SET Environnement (SET) and Kaeffer Wanner (KW) mark the first CJIPs based on bribery charges.

According to both agreements, the investigation into the corruption scheme started in July 2011, when the Director of Security at Electricité de France (EDF), a partially state-owned company, informed the police of a years-long corruption scheme inside the EDF purchasing department, whereby a member of the department was demanding payments in return for awarding or continuing contracts. This investigation eventually revealed that SET, a pollution clean-up company with 125 employees, and KW, a larger company contracting across multiple sectors with nearly 1,800 employees, had both made payments to the EDF employee over several years in return for obtaining contracts.

More specifically, SET made direct and indirect payments, including paying for travel expenses amounting to €136,621.28 between 2009 and 2012, in return for contracts worth €5 million. The investigation concluded that the profit on those contracts was €680,000. KW paid hundreds of thousands of euros in cash and benefits between 2004 and 2011, at a rate of approximately €75,000 per year, in return for contracts worth a total of €33 million. The investigation concluded that the profit on those contracts was €3.3 million.

In calculating the penalties owed by both companies, the CJIPs reflect consideration of two aggravating factors: the long duration of the scheme and the involvement of a public service provider. With respect to SET, the departure or dismissal of three implicated executives, and the fact that the company is owned by new shareholders and run by new management who were not implicated in the scheme, were considered mitigating factors. SET was fined a total of €800,000, an amount that was based on the profit on the contracts and an additional €120,000 penalty, as well as an additional €30,000 in reparation. Furthermore, the AFA imposed a two-year monitorship on SET, with costs up to €200,000 to be paid by the company. With respect to KW, although it did not self-report, its cooperation during the investigation and its remediation and subsequent enhancements to its compliance program were considered mitigating factors. KW was fined a total of €2,710,000. The CJIP also imposed an 18-month monitorship on KW, the fees for which are capped at €290,000.

Airbus to Pay Approximately $100 Million to End Bribery Investigation in Germany

On February 9, 2018, the Public Prosecutor's Office (Prosecutor's Office) in Munich, Germany, announced that it had issued a €81.25 million (approximately $100 million) administrative penalty notice to Airbus Defense and Space GmbH (the Company or Airbus), one of the world's leading defense and aerospace manufacturers, in connection with €100 million in unaccounted-for payments made to two U.K. shell companies while the company was negotiating the sale of 18 Eurofighter Typhoon aircrafts to the Austrian government in 2003.

As reported in a press release issued at the same time as the penalty, the Prosecutor's Office had launched an "extraordinarily extensive" probe back in 2012 into the two-billion euro Eurofighter Typhoon transaction. The investigation expanded to include cooperation with the Austrian law enforcement authorities and extensive investigative steps in other EU countries. However, German prosecutors did not find sufficient evidence of bribery, instead concluding that payments to the two U.K. companies were "generally legal and customary in such transactions" but "largely used for unclear purposes."

In exchange for the terminating the investigation, Airbus admitted that unidentified members of its former management had negligently failed to perform their supervisory duties and to ensure that proper internal controls were in place, a violation of § 130-1 of the German Act on Administrative Misdemeanors. Accordingly, Airbus agreed to pay the penalty comprised of a €250,000 (approximately $309,000) administrative fine and €81 million (approximately $100 million) in disgorgement. The company also waived its right to appeal. The Prosecutor's Office noted that in calculating the penalty, it took into account the large funds involved as well as the long-term inadequate internal controls of the company.

The Prosecutor's Office further acknowledged the Airbus's full cooperation and the extensive and appropriate compliance measures implemented by the company to prevent future violations. According to the company's press release, the scope of the Airbus' cooperation during the investigation included the provision of an independent fact-finding report the Prosecutor's Office.

As reported by multiple media, Airbus is currently under multiple bribery and fraud investigations by Austria, France, and the United Kingdom.

Teva Pharmaceutical Industries Limited Resolves Bribery Charges with Israeli Authorities

On January 15, 2018, the Taxation and Economic Section of Israel's State Attorney's Office within the country's Ministry of Justice ("the Ministry") announced that it had reached a Conditional Agreement (the Agreement) with the Israeli drug manufacturer and U.S. issuer Teva Pharmaceutical Industries Limited (Teva) with respect to the bribery allegations that the company had resolved with the U.S. authorities in December 2016. Under the Agreement with the Ministry, Teva, which is the world's largest generic drug manufacturer and Israel's largest company by market value, agreed to pay an administrative fine of ILS 75 million (approximately US $22 million) to settle charges that it had bribed public officials and doctors in Russia, Ukraine, and Mexico for a decade in order to entice them to prescribe its profitable multiple sclerosis drug Copaxone, among others. In particular, the alleged conduct involved bribes paid to a high-ranking Russian official and doctors employed by the Mexican government to increase drug sales, as well as bribes paid to a senior Ukrainian official to influence the registration of Teva's products in Ukraine. The Ministry agreed not to file criminal charges against the company as part of the Agreement.

The settlement in Israel grew out of the allegations that had been investigated by U.S. authorities and followed the company's resolutions with the DOJ and SEC of the investigations into Teva's violations of the FCPA. As described in detail in our FCPA Winter Review 2017, on December 22, 2016, the company and its wholly-owned Russian subsidiary, Teva LLC, entered into a combined settlement with the DOJ and SEC over the alleged bribery of government officials in Russia and Ukraine and internal-controls violations in Mexico. To resolve the charges with both U.S. government agencies, Teva agreed to pay more than $519 million in criminal penalties, disgorgement, and interest – a combined settlement which is the fourth-highest in the history of the FCPA (after Siemens, Alstom S.A., and KBR/Haliburton) and the largest fine ever paid by a pharmaceutical company for FCPA violations. The Israeli authorities launched their own investigation into Teva following the company's settlement with the U.S. authorities "to examine the ramifications of the affair in Israel," according to the Ministry.

Teva reached the settlement with the Israeli authorities a month after announcing plans to lay off 14,000 employees and shut down up to 25 manufacturing plants. The settlement spared Teva a potential criminal trial but required the company to admit all charges and pay the $22 million fine within two months. In setting the amount of the fine, the Ministry noted that the company had already admitted its offenses and taken steps to prevent future violations. The Agreement also specifically referred to Teva's financial hardships, including the fact that the company had already paid more than half a billion dollars to the U.S. authorities and had fully cooperated with them. In addition, the Israeli authorities considered the organizational changes the company had made to prevent future violations (e.g., Teva had implemented an extensive compliance program and terminated all employees involved in the wrongdoing). Thus, instead of pressing criminal charges, the Ministry decided only to fine Teva, arguing that such resolution to the case best serves the public interests. According to the Israeli authorities, a criminal conviction "could cause significant damages" to a global company like Teva as it was trying to deal with the consequences of increasing competition, poor decisions by its previous management, and falling prices for generic drugs.

The enforcement action by the Israeli authorities against Teva was only the second such case under Israel's foreign bribery statute since its enactment in 2008. As discussed in our FCPA Spring Review 2017, the indictment and subsequent conviction of Nikuv International Projects Ltd., an Israeli IT company that pled guilty and paid a fine of NIS 4.5 million (approximately $1.2 million), was the first enforcement action under the statute, which was enacted as part of Israel's obligations under the OECD Anti-Bribery Convention. In particular, the stature, codified as Section 291A of Israel's Penal Law 5737-1977, makes it a crime to offer, provide, or facilitate bribery to a foreign public official for the purpose of promoting business activities or to obtain an advantage relating to such activities.

Teva's case is also notable because it may signal the Israeli authorities' intention to resolve more bribery cases using Conditional Agreements. Teva's settlement was the first time that an Israeli bribery case was resolved through a Conditional Agreement, an adjudication method which had been limited to instances of minor crimes in the past. Although there are significant differences between a Conditional Agreement and a DPA, the use of a Conditional Agreement in a bribery case of such nature indicates Israel's willingness to join other jurisdictions that have passed legislation allowing them to use similar agreements to resolve bribery cases. Both Conditional Agreements and U.S.-style DPAs allow a company to resolve bribery charges by agreeing, among other requirements, to pay a criminal penalty and/or an administrative fine, as well as disgorgement and restitution, if appropriate; to cooperate with the domestic and foreign authorities in any ongoing investigations and prosecutions relating to the conduct (including that of individuals); and to implement a robust compliance program.

Prosecution of Skansen Offers Guidance Regarding "Adequate Procedures" under the UKBA and Self-Reporting Considerations

On February 21, 2018, a jury found London-based interior construction company Skansen Interiors Limited (Skansen) guilty of failing to prevent bribery by an employee under Section 7 of the U.K. Bribery Act (UKBA). According to news reports, the alleged bribery came to light in 2014, after Skansen's newly installed CEO uncovered indications that the company's former managing director sought to gain business by bribing a project manager at a real estate company. Given the facts of the case, the verdict provides some guidance regarding the minimum components of a UKBA compliance program. In addition, the circumstances of this case may influence decisions by other companies regarding whether to voluntarily report corporate misconduct under the UKBA.

This matter was brought by the Crown Prosecution Service (CPS) under Section 7 of the UKBA, titled "Failure of commercial organisations to prevent bribery." This section imposes criminal liability on a corporate entity if an employee or an associated individual engages in bribery with the intent of obtaining business for the entity, unless the entity can show that it had implemented "adequate procedures" designed to prevent such conduct.