FCPA Autumn Review 2019

International Alert

Introduction

The third quarter of 2019 witnessed a burst of activity in Foreign Corrupt Practices Act (FCPA)-related dispositions – especially by the Securities and Exchange Commission (SEC), which announced seven corporate resolutions and two resolutions with individuals during the quarter. Meanwhile, the Department of Justice (DOJ) had at least seven individuals sentenced and announced three guilty pleas, but otherwise had a relatively quiet quarter on the corporate side, announcing only one non-prosecution agreement. The DOJ also won appellate victories in the Second Circuit Court of Appeals, as the court upheld two separate convictions after the defendants attempted to use the Supreme Court's narrow reading of the term "official acts" in 2016's McDonnell v. United States to challenge convictions under the FCPA and other statutes. For the DOJ, however, the third quarter was likely a period of "quiet before the storm," as the DOJ was preparing for the six FCPA-related trials on the calendar for the current fourth quarter (many of which have recently concluded, as discussed below). Additionally, three known DOJ and SEC corporate investigations closed without enforcement action. Overall, the corporate enforcement actions resulted in penalties and disgorgement of nearly $80 million, which is a relatively modest amount given the number of resolutions (for example, in the third quarter of 2018, the total penalties and discouragement were nearly $2 billion; however, nearly $1.8 billion of that amount was attributable to the Petrobras FCPA resolution). This trend is consistent with the fact that many of the resolutions in Q3 2019 were civil resolutions by the SEC for violations of the FCPA's accounting provisions alone.

Since the close of 2019's third quarter, there have been a number of significant FCPA developments, especially on the DOJ side. We quickly summarize them here but note that we will discuss them in greater detail in the FCPA Winter Review 2020. For example, on October 30, 2019, the DOJ announced that two former senior executives at Monaco-based Unaoil, the former CEO and the former Chief Operations Officer, together with a former business development manager at the company, had pleaded guilty in March 2019 and August 2018, respectively, each to one count of conspiracy to violate the FCPA. These guilty pleas are linked to a large number of resolutions and investigations of companies and executives who employed Unaoil as an agent, including the TechnipFMC resolution with the SEC discussed below. On the same day (October 30, 2019), the DOJ reached a settlement of its civil forfeiture cases to recover more than $700 million in assets that had been acquired by Low Taek Jho and his family using funds allegedly misappropriated from 1Malaysia Development Berhad (1MDB), Malaysia's investment development fund.

As indicated above, the DOJ had six FCPA trials scheduled for the fall. On October 11, 2019, Frank Roberto Chatburn Ripalda pleaded guilty to a money laundering conspiracy for his role in using the U.S financial system to launder money to promote violations of the FCPA and Ecuadorian bribery law, thus avoiding the trial that had been scheduled to begin on October 15. Two other trials were delayed.

In November 2019, the DOJ had three high-profile trials, including two convictions with deliberations scheduled to resume after the Thanksgiving holiday . On November 8, 2019, a jury in Connecticut convicted Lawrence Hoskins – a former Alstom executive – of six counts of violating the FCPA, three counts of money laundering, and two counts of conspiracy. On November 22, 2019, a jury in Maryland convicted Mark Lambert, the former president of Transportation Logistics, Inc., of participating in a scheme to bribe a Russian official to secure contracts for his company to transport uranium to and from Russia. On December 2, 2019, a jury in Brooklyn, New York, acquitted Jean Boustani of charges related to allegations that he had defrauded U.S. investors involving $2 billion in loans for Mozambican government projects, through various bribes and kickbacks. As indicated, we plan to discuss each of these resolutions or trials in the forthcoming Winter Review in the new year.

Before returning to third quarter developments, we also note that on November 20, 2019, the DOJ implemented a subtle change to its FCPA Corporate Enforcement Policy (Policy), which offers companies the presumption that the DOJ will decline prosecution if they self-report foreign bribery, fully cooperate with a subsequent government investigation, and remediate the compliance failures. Specifically, the DOJ clarified certain of its expectations from companies under the Policy when they self-report foreign bribery and seek to cooperate with the DOJ that may not have been apparent in the previous language.

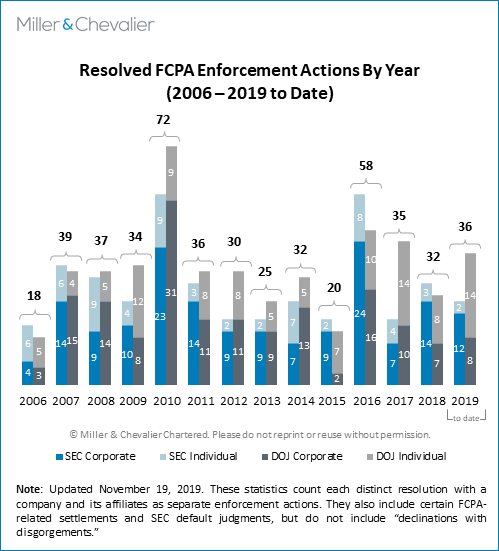

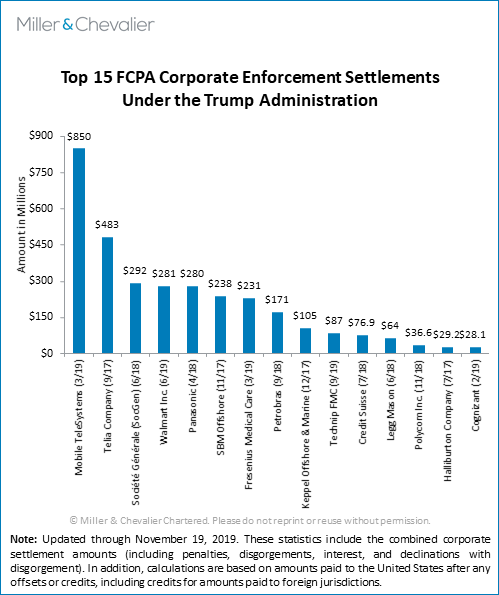

The first chart presented below shows that announced dispositions by the DOJ and SEC through three quarters of 2019 are already on par with most prior years – except the record years of 2010 and 2016 – with regard to both corporate and individual resolutions. It is unlikely that the 2019 statistics as a whole will rival those from 2010 or 2016, but these numbers show that the DOJ and SEC both remain committed to aggressive enforcement of the FCPA. The second chart shows the largest corporate resolutions – based on total corporate settlement amounts in the resolution papers – during the Trump administration, and again this chart shows that the DOJ and SEC continue to collect large amounts in penalties, fines, disgorgement, and more, based on FCPA and related law violations.

We summarize this quarter's corporate enforcement actions, individual enforcement actions, investigations closed without enforcement, and other policy, litigation, and international developments below.

Corporate Enforcement Actions

During the third quarter of 2019, there were some DOJ-SEC joint resolutions, but also a large number of SEC-only resolutions during the quarter – thus, all of the resolutions this quarter involved issuers.

- Microsoft Corporation. On July 22, 2019, the SEC announced that Microsoft Corporation (Microsoft), a U.S. issuer, consented to a Cease-and-Desist Order (Order) with the SEC and agreed to pay more than $16 million to resolve charges that it had violated the books-and-records and internal-accounting-controls provisions of the FCPA with improper conduct by the company's wholly-owned subsidiaries in Hungary, Saudi Arabia, Thailand, and Turkey. On the same day, the DOJ announced that a Hungarian subsidiary entered into a Non-Prosecution Agreement (NPA) for willingly and knowingly causing Microsoft to falsely record and maintain inaccurate books, records, and accounts by incorrectly recording amounts disguised as discounts that were in fact used to fund improper payments under the FCPA. Under the terms of the NPA, Microsoft's Hungarian subsidiary agreed to pay a criminal penalty of $8.7 million, bringing the DOJ-SEC combined total payments to $25.3 million. The NPA further stated that Microsoft failed to "exercise meaningful oversight…to ensure that discounts that Microsoft approved were passed on to [Microsoft] Hungary's end customers instead of being used to facilitate" a corrupt scheme and that "[a]lthough this failure of oversight at Microsoft did not amount to a criminal violation by the parent company" the DOJ viewed it as "a discretionary factor" that the DOJ considered when entering into an agreement with Microsoft Hungary. We discuss the Microsoft enforcement actions in greater detail below.

- Deutsche Bank AG. On August 22, 2019, the SEC announced that it had entered a Cease-and-Desist Order (Order) against Deutsche Bank AG (Deutsche Bank), marking, along with the Barclays resolution discussed below, the latest enforcement actions arising out of SEC's investigations into the hiring of so-called "princelings" (i.e., relatives of senior government officials) by financial services companies. Focusing on the bank's efforts to win business in the Asia Pacific region and Russia, the SEC found that Deutsche Bank had violated the books-and-records and internal-accounting-controls provisions of the FCPA. Pursuant to the Order, Deutsche Bank agreed to pay disgorgement of almost $11 million, prejudgment interest of $2.4 million, and a $3 million civil penalty. According to the SEC, the settlement reflected Deutsche Bank's cooperation and remediation, including sharing factual findings developed during the internal investigation and remedial measures that Deutsche Bank put into place, such as enhancements to its compliance program and internal accounting controls. We discuss the Deutsche Bank enforcement action in greater detail in the next section.

- Juniper Networks, Inc. On August 29, 2019, the SEC announced that it had entered a Cease-and-Desist Order (Order) against Juniper Networks, Inc. (Juniper), a California-based networking and cybersecurity solutions provider, in connection with violations of the FCPA. According to the Order, from 2008 through 2013, sales employees of JNN Development Corp. (JNN), Juniper's subsidiary in Russia, secretly agreed with third-party distributors to fund leisure trips for customers, including government officials, through the use of off-book accounts, and that Juniper's initial efforts to remediate the situation were ineffective. The SEC also found that from 2009 through 2013, sales employees of Juniper's subsidiaries in China had falsified trip and meeting agendas for customer events to understate the true amount of entertainment involved in the trips, which, in contravention of Juniper's travel policies, Juniper's legal department had approved without adequate review and after they had already taken place. Pursuant to the SEC's Order, Juniper agreed to resolve charges that it had violated the internal-accounting-controls and recordkeeping provisions of the FCPA and pay more than $11.7 million in monetary relief, including $4 million in disgorgement, $1.25 million in prejudgment interest, and a $6.5 million civil penalty. We discuss the Juniper settlement in greater detail below.

- TechnipFMC. On September 19, 2019, the SEC announced that it had issued a Cease-and-Desist Order (Order) against TechnipFMC plc (TFMC), a global oil and gas services provider, to resolve FCPA charges involving conduct in Iraq by FMC Technologies, Inc. (FMC) prior to its merger with Technip S.A. (Technip) in 2017. The SEC resolution follows TFMC's earlier resolution with the DOJ in June 2019 on the same facts, as well as conduct by Technip in Brazil to pay bribes to Brazilian officials, including at the country's state-controlled oil-and-gas company Petrobras, and a scheme by FMC to pay bribes to officials in Iraq, which we discussed in detail in our FCPA Summer Review 2019. The SEC's Order charges TFMC, as a successor in interest for FMC, with violations of the anti-bribery, books-and-records, and internal-accounting-controls provisions of the FCPA. Specifically, the SEC found that from at least 2008 through 2013 FMC paid almost $800,000 to a third-party consultant, which then used part of the funds to bribe Iraqi government officials to procure business with Iraq state-owned oil companies. According to the Order, FMC paid the consultant without evidence of services rendered, allowed the consultant to use subagents and success-fee-based compensation without adequate due diligence, and falsely characterized the payments in its books and records. The Order also found that FMC "failed to properly assess and manage its anti-corruption risks in Iraq, and devoted insufficient resources to compliance" regarding its business in Iraq. Pursuant to the Order, TFMC agreed to pay more than $5 million in disgorgement and prejudgment interest and to self-report to the SEC on its compliance program for three years. We discuss the TFMC settlement with the SEC in greater detail in the next section.

- Quad/Graphics. On September 26, 2019, the SEC announced that it had entered a Cease-and-Desist Order (Order) against Quad/Graphics, Inc. (Quad), a Wisconsin-based provider of digital and print marketing services, to resolve charges that it had violated the anti-bribery, books-and-records, and internal-accounting-controls provisions of the FCPA. The SEC found that from at least 2011 to January 2016, Quad/Graphics Peru S.A. (Quad Peru), Quad's subsidiary in Peru, paid or promised bribes to Peruvian government officials to secure sales contracts and tried to improperly influence the outcome of a dispute with the Peruvian tax authorities, which had imposed over $12 million in value-added tax, interest, penalties, and fines. Quad Peru also created false records to conceal transactions with a state-controlled Cuban telecom, which was subject to U.S. sanctions and exports controls laws. The Order further found that from 2010 to 2015, Quad/Tech Shanghai Trading Company (Quad/Tech China), Quad's subsidiary in China, used sham sales agents to make or promise approximately $182,000 in improper payments to employees of private and government customers to secure business. According to the SEC, Quad failed to ensure that its internal accounting controls were sufficient to prevent the bribery in Peru and China and the concealment of the sales in Cuba. Pursuant to the Order, Quad agreed to pay nearly $10 million in total monetary relief, including nearly $7 million in disgorgement, nearly $1 million in prejudgment interest, and a civil penalty of $2 million. Earlier, on September 19, 2019, Quad received a letter from the DOJ, in which the DOJ stated that, consistent with the FCPA Corporate Enforcement Policy, it declined prosecution of the company for violations of the FCPA. According to the letter, the DOJ "ha[s] reached this conclusion despite the bribery committed by employees of the Company's subsidiaries in Peru and China." We discuss the Quad/Graphics enforcement action in greater detail below.

- Barclays Bank Plc. On September 27, 2019, the SEC announced that Barclays Plc (Barclays or the Bank) agreed to settle charges that it had violated the FCPA's books-and-records and internal-accounting-controls provisions, when Barclays' Asia Pacific (APAC) region hired relatives and friends of foreign government officials to improperly influence them in connection with the Bank's investment banking business in the APAC region. According to the SEC's Cease-and-Desist Order (Order), between 2009 and 2013, Barclays' APAC hired approximately 117 job candidates referred by or connected to government officials or executives of the Bank's non-government clients, with some of the employment offers made as a personal benefit to those officials and executives with the expectation that the Bank would obtain or retain investment banking business. Pursuant to the Order, Barclays agreed to pay more than $6 million in disgorgement, prejudgment interest, and a civil penalty. We discuss the Barclays Bank enforcement action in greater detail in the next section.

- Westport Fuels. In another press release on September 27, 2019, the SEC announced that Westport Fuels Systems, Inc. (Westport), a Vancouver, Canada-based clean fuel technology company, and Nancy Gougarty, its former CEO, had agreed to pay more than $4.1 million combined to resolve charges that they had violated the anti-bribery, books-and-records and internal-accounting-controls provisions of the FCPA. According to SEC's Cease-and-Desist Order (Order), Westport, acting through Gougarty and others, engaged in a scheme to bribe a Chinese government official to obtain business and a cash dividend payment from a joint venture (JV) between Westport and the state-owned enterprise (SOE) that employed the relevant government official (the Chinese SOE had a controlling stake in the JV). In exchange for a transfer of shares of stock in Westport's Chinese JV at a reduced rate to a Chinese private equity fund in which the official held a beneficial interest, Westport and Gougarty believed that the government official would influence the JV to authorize a dividend payment of $3.5 million to Westport and to execute a framework supply agreement between Westport and the JV. Westport agreed to pay $2.5 million in disgorgement and prejudgment interest and a civil penalty of $1.5 million, while Westport's former CEO agreed to pay a civil penalty of $120,000. We discuss the Westport Fuels enforcement action in greater detail below.

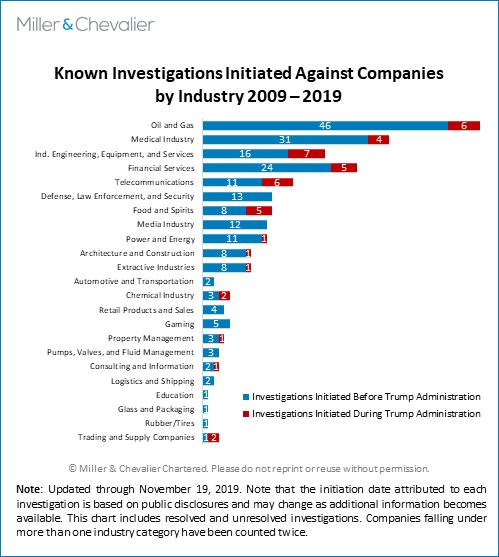

The chart below shows an update on known investigations by industry over the last ten years. It shows that industries that have historically attracted FCPA enforcement attention continue to do so in the current environment. This is partly due to inherent risks in some sectors that feature heavy government regulation or the involvement of state actors in transactions, and likely in part caused by the nature of investigations, which often focus on multiple companies implicated in the same or similar behaviors.

Individual Enforcement Actions

Below we summarize recent developments related to individual enforcement actions that either occurred during the third quarter or were reported in the third quarter, including appellate victories for the DOJ, sentencings for six individuals, three guilty pleas, and two individuals reaching settlements with the SEC (although one settlement involving Westport's former CEO is summarized above).

- On August 5, 2019, the Second Circuit Court of Appeals upheld the convictions of Macau, China-based billionaire real estate developer Ng Lap Seng and the former Guinean mining minister Mahmoud Thiam. As discussed in greater detail in our FCPA Autumn Review 2017, a federal jury had found Ng guilty in 2017 of paying approximately $1.3 million in bribes to two former U.N. officials in exchange for U.N. support for a multi-billion-dollar conference center he planned to construct in Macau. Thiam, on the other hand, had been convicted in 2017 by a New York federal jury for laundering $8.5 million in bribes he had received in exchange for valuable mineral mining rights in violation of U.S. money laundering statues and Guinea's bribery law. During his trial and on appeal, Ng argued that McDonnell's narrow interpretation of the term "official act" in the U.S. domestic bribery statute should also apply to the FCPA and the federal program bribery statute. Specifically, Ng argued that the DOJ failed to prove that the bribes he paid resulted in any "official acts" by the former U.N. officials, and that the jury was not properly instructed that an "official act" was required to fulfill the "quid pro quo" elements of the FCPA and the federal program bribery statute. The Court rejected Ng's appeal and declined to extend McDonnell to other anti-corruption and fraud statutes. The Second Circuit rejected a similar appeal from Thiam, who had tried to apply McDonnell to Guinea's anti-bribery law, which had been used as the basis for the money laundering charge against him. The Second Circuit panel disagreed, ruling that principles of international comity weigh against applying McDonnell's definition of an "official act" to Guinean law.

- On April 12, 2019, Jose Luis de la Paz Roman (Roman) was sentenced to 36 months in prison for his role in a conspiracy to make bribe payments to officials at PetroEcuador, the state-owned and state-controlled oil company of Ecuador. Although Roman's sentence was imposed on April 10, 2019 and entered into the docket two days later, the case did not get reported until August 2019.

- On June 26, 2019, Julia Vivi Wang (Wang), a naturalized U.S. citizen born in China and a former executive of South-South News, a media group that promoted U.N. development goals, was sentenced to three years of supervised release and restitution of $629,295 after she had pleaded guilty in April 2018 to one count of conspiracy to violate the FCPA, one count of violating the FCPA, and one count of submitting fraudulent tax returns in which she failed to report to the IRS a total of approximately $2 million in income from 2010 to 2013. In April 2013, Wang wired $500,000 to John Ashe who, before leading the U.N. General Assembly between late 2013 and September 2014, had served as the Permanent Representative of Antigua and Barbuda to the U.N. In exchange for the bribe, Wang sought to obtain a diplomatic position for herself or her late husband with the government of Antigua.

- On July 22, 2019, in two separate hearings, James Finley, a British citizen and a former senior Rolls-Royce executive, and Andreas Kohler, an Austrian citizen and a former managing director at an engineering firm, were each sentenced to four months of imprisonment in connection with a scheme to bribe Kazakh and Chinese officials. As part of their sentences, Finley and Kohler also received eight and four months of home confinement and were required to pay fines of $500,000 and $72,000, respectively.

- On July 31, 2019 and August 21, 2019, respectively, Enrique Pinto Franceschi (Pinto), a former sales representative of a Miami-based equipment supplier to Venezuela's state-owned energy company Petróleos de Venezuela S.A. (PDVSA), and Franz Herman Muller Huber (Muller), the president of the same supplier, each pleaded guilty to two counts – conspiracy to violate the FCPA and conspiracy to commit wire fraud. Pinto and Muller were both Venezuelan nationals residing in the United States. They had been charged on February 21, 2019 in a five-count indictment in the U.S. District Court for the Southern District of Texas, including conspiracy to violate the FCPA, conspiracy to commit wire fraud, wire fraud, and conspiracy to launder money, for their alleged roles in a scheme to corruptly secure contracts and other business advantages from PDVSA.

- In related proceedings, on August 28, 2019, Moises Abraham Millan Escobar (Millan), a former employee of a Venezuelan businessman, Abraham Jose Shiera Bastidas (Shiera), was sentenced in the Southern District of Texas to three years' probation and fined $15,000 for his role in an alleged scheme to bribe three PDVSA officials. In January 2016, Millan had pleaded guilty to one count of conspiracy to violate the FCPA and agreed to forfeit proceeds from the bribery scheme amounting to more than $533,000. Shiera had been charged in December 2015 and pleaded guilty in March 2016 for violating the FCPA by bribing the three Venezuelan officials to secure energy contracts. A day later, on August 29, 2019, a former employee of PDVSA, Jose Luis Ramos-Castillo, received an 18-month-long sentence, two years of supervised release, and a fine of $15,000 for accepting bribes in exchange to assisting companies in winning energy contracts with PDVSA and for conspiracy to commit money laundering.

- On September 13, 2019, the SEC resolved civil FCPA charges against Sridhar Thiruvengadam, a former Chief Operating Officer of New Jersey-based technology-related outsourcing services provider Cognizant Technology Solutions Corporation (Cognizant), that he had violated the FCPA by participating in a scheme with three other Cognizant executives to bribe an Indian government official on behalf of the company. According to the Cease-and-Desist Order, the $2 million bribery payment was made in response to the official's demand to procure a construction planning permit. Thiruvengadam also concealed the true nature of the payment by signing false sub-certifications to the company's management representation letters. As part of the settlement, Thiruvengadam paid a penalty of $50,000 and agreed to cooperate with the SEC, as the SEC currently has pending enforcement actions against two other former Cognizant executives.

- On September 25, 2019, Luis Alberto Chacin Haddad (Chacin) of Miami, Florida, was sentenced to 51 months in federal prison and two years of supervised release for bribing officials at Venezuela's national electricity company in exchange for $60 million in contracts for his companies. In June 2019, Chacin had pleaded guilty to one count of conspiracy to violate the FCPA. As part of the plea agreement, Chacin forfeited approximately $5.5 million in profits he had made from the corrupt contracts as well as real estate in the Miami area that he had purchased with the proceeds of the bribery scheme.

Each of these developments is discussed below in more detail.

Investigations Closed without Enforcement Actions

For the third quarter of 2019, we have identified the following two investigations that have been closed without enforcement action:

- Misonix, Inc. (Misonix): We reported in our FCPA Summer Review 2019 that on June 18, 2019, Misonix had received a letter from the SEC stating the SEC did not intend to recommend an enforcement action against Misonix. On August 16, 2019, Misonix publicly disclosed in its Form 8-K that the company had received two days earlier a letter from the DOJ, dated August 13, 2019, stating that DOJ had closed its inquiry into Misonix without any action.

- Ciena Corp. (Ciena): On September 11, 2019, Ciena disclosed in its Quarterly Report that the SEC had closed its FCPA investigation into potentially improper payments to an individual employed by one of Ciena's customers in the ASEAN region and that the Commission's staff did not intend to recommend any enforcement action by the SEC against the company. The DOJ had closed a parallel investigation in December 2018, declining to prosecute the matter.

Policy & Litigation Developments

On September 9, 2019, SEC Chair Jay Clayton gave a speech to the Economic Club of New York that focused in part of FCPA enforcement issues. Among other issues, Mr. Clayton commented that he had not seen "meaningful improvement" in efforts by other countries to enforce laws against foreign bribery, citing economic game theory as a possible reason for this perceived lack of effort. He thus noted that FCPA enforcement has sometimes placed U.S. companies at a disadvantage in relation to their competitors from countries that do not enforce similar laws.

Mr. Clayton's speech received media attention in part because of comments critical of certain aspects of FCPA enforcement that he made well before taking his current position as SEC Chair. We note that, in the same speech, Mr. Clayton also stated: "To be clear, I do not intend to change the FCPA enforcement posture of the SEC." We also note that Mr. Clayton's focus on enforcement activities by other countries has been a consistent theme for U.S. policy since at least the early 1990s, when the United States supported efforts to negotiate international treaties such as the Organisation for Economic Co-operation and Development (OECD) Anti-Bribery Convention in an effort to promote enforcement by other countries. Indeed, a key aspect of the OECD's ongoing work in this area is testing and critiquing the enforcement efforts of Convention signatories.

As noted above, on November 20, 2019, the DOJ slightly changed its FCPA Corporate Enforcement Policy. Companies were previously required under the Policy to "disclose all relevant facts known to [them]" to qualify for voluntary disclosure credit under the Policy. Recognizing that the previous language may have been confusing and may have created a disincentive for companies to come forward with information about wrongdoing, companies are now expected to disclose "all relevant facts known to [them] at the time of the disclosure, including as to any individuals substantially involved" in the misconduct.

Another change to the Policy relates to proactive cooperation, with the updated policy now stating that companies must inform the DOJ "where the company is aware of relevant evidence not in the company's possession." In contrast, the Policy previously required companies to inform the DOJ "where the company is or should be aware of opportunities for the Department to obtain relevant evidence not in the company's possession and not otherwise known to the Department." Similar to the tweak to the self-reporting requirement, the change to the cooperation language potentially makes this requirement less onerous and comes after the DOJ has realized that the language was potentially ambiguous, likely creating confusion about what a company "should" be doing or looking for in order to satisfy the proactive cooperation requirement.

International Developments

Finally, this quarter saw several significant anti-corruption developments outside of the United States, with several corporate enforcement actions and one individual enforcement action that ended in a conviction and confiscation order. In Brazil, Camargo Correa entered into a leniency agreement with the Controller General and the Attorney General of Brazil, agreeing to pay approximately $339 million in connection with bribery and price fixing-related conduct that the company had admitted to in a previous settlement with the Brazilian authorities in July 2015. Also in Brazil, EcoRovias settled corruption and money laundering allegations related to road concession contracts. EcoRovias agreed to pay approximately $100 million as part of the agreement with Brazil's Federal Prosecution Service and obtain an independent compliance monitor for 32 months, the first Brazil-only compliance monitorship. Another corporate enforcement action in Brazil was Odebrecht's Negotiated Resolution Agreement (Agreement) with the Inter-Development Bank Group (IDB) following an investigation by IDB's Office of Institutional Integrity. The Agreement covered two of Odebrecht's subsidiaries, CNO S.A. and OEC S.A., and resulted, among other disciplinary actions, in CNO's (but excluding its African branches) six-year debarment from participating in any IDB-financed projects.

And in the United Kingdom, the Serious Fraud Office (SFO) obtained a confiscation order in September 2019 against Peter Chapman, the former manager of Innovia Securency PTY Ltd. (Securency), requiring him to pay approximately $545,000 as repayment of the benefits of bribes he had paid to government agents. An earlier five-week trial in 2015 had resulted in Chapman's conviction on four counts of making corrupt payments and acquittal on two. Finding that he had paid more than $205,000 to an agent of Nigerian Security Printing and Mining PLC in exchange for contracts with Securency, the court sentenced him to 30 months in prison. The SFO also completed a DPA with Serco Geografix Ltd., which had in 2013 reached a civil settlement with the U.K.'s Ministry of Justice related to fraud and false accounting in connection with electronic monitoring contracts. We discuss the Camargo Correa leniency agreement, EcoRovias's settlement, Odebrecht's Negotiated Resolution Agreement, SFO's confiscation order against Securency's former manager, and SFO's DPA with Serco Geografix in greater detail below.

Corporate Enforcement Actions

Microsoft Corporation and Its Hungarian Subsidiary Settle Criminal and Civil Charges Related to Conduct in Hungary, Saudi Arabia, Thailand, and Turkey

On July 22, 2019, Microsoft Corporation (Microsoft), a global provider of technology and software solutions headquartered in Redmond, Washington, and its direct, wholly-owned Hungary-based subsidiary, Microsoft Magyarország Számítástechnikai Szolgáltató és Kereskedelmi Kft. (Microsoft Hungary), resolved civil and criminal charges with the SEC and DOJ, respectively. Microsoft consented to a Cease-and-Desist Order (Order) with the SEC to resolve charges that it had violated the books-and-records and internal-accounting-controls provisions of the FCPA. On the same day, Microsoft Hungary reached a Non-Prosecution Agreement (NPA) with the DOJ for willingly and knowingly causing Microsoft, a U.S. issuer, to falsely record and maintain inaccurate books, records, and accounts by incorrectly recording amounts disguised as discounts used to fund improper payments under the FCPA. The NPA stated that Microsoft failed to "exercise meaningful oversight…to ensure that discounts that Microsoft approved were passed on to [Microsoft] Hungary's end customers instead of being used to facilitate" a corrupt scheme and that "[a]lthough this failure of oversight at Microsoft did not amount to a criminal violation by the parent company" the DOJ viewed it as "a discretionary factor" that the DOJ considered when entering into an agreement with Microsoft Hungary. As a result of the SEC's Order and DOJ's NPA, Microsoft and Microsoft Hungary agreed to pay $25.3 million in penalties, disgorgement, and prejudgment interest.

Microsoft's stock is registered pursuant to Section 12(b) of the Exchange Act is and publicly-traded on the NASDAQ, making it an "issuer" under the FCPA. The financial results of Microsoft's wholly-owned foreign subsidiaries, including those in Hungary, Saudi Arabia, Thailand, and Turkey, are ultimately consolidated into Microsoft's financial statements.

The allegations described in the Order cover conduct related to the operations of Microsoft's foreign-based wholly-owned subsidiaries in four markets—Hungary, Saudi Arabia, Thailand, and Turkey—while the DOJ NPA relates only to conduct in Hungary (which overlaps with the Hungary-based conduct discussed in the Order).

The violations set forth in the Order include the following:

- Hungary: The SEC Order covers two distinct schemes in Hungary—one related to inflated discounts in connection with licensing transactions, and the other related to unjustified consulting service engagements.

- Licensing Transactions. First, in 2014 and 2015, the SEC Order states that Microsoft Hungary employees requested "excessive discounts," using false or "vague justifications," including "competition with other bidders, end customer price sensitivity, and the possibility of winning related services contracts." The discounts were approved by Microsoft's Business Desk—a group managed by Microsoft personnel in Redmond, Washington with employees around the world responsible for approving discounts above certain thresholds. However, according to the Order, there was no process to determine if discount requests were legitimate, and Microsoft lacked visibility into whether the end customer would be the ultimate beneficiary of the approved discounts. In two examples described in the SEC Order, Microsoft Ireland Operations Limited (MIOL), an indirect wholly-owned Microsoft subsidiary, sold software licenses to approved distributor and/or third-party resellers called Licensing Solution Partners (LSPs) at heavily discounted rates. In one instance, MIOL sold licenses to an LSP that did not bid on the tender at issue. As a result, that LSP resold the licensing rights to another LSP, which resold the licensing rights to the end-government customer without passing on the full discount amount. In another instance, MIOL sold the licenses to an LSP that resold them to a non-approved third party. Again, the third party did not pass on the full discount amount to the end customer. In both cases, the SEC Order states that a portion of the "discount" not passed on to the end customer was used to pay government officials to allegedly influence the transactions. In turn, according to the SEC Order, the amounts paid to government officials to win business were improperly recorded in Microsoft Hungary's books and records, which were consolidated into Microsoft's financials. As a result of improper payments to government officials connected to the licensing transactions, the SEC Order alleged that Microsoft received $13,780,733 in business.

- Consulting Service Engagements. In addition, in 2014 and 2015, Microsoft Hungary contracted third parties in connection with consulting service engagements that Microsoft Hungary had entered into with government customers in Hungary. In certain instances, there was minimal, if any, evidence supporting the nature of the services provided by the third parties. Also, the SEC Order notes that Microsoft Hungary employees and third-party employees falsely recorded supposed work performed on various service engagements in Microsoft's timekeeping system. In one instance, Microsoft failed to conduct due diligence on a third party that was hired upon request by a government customer. In another instance, Microsoft Hungary contracted a third-party entity that used a government employee to provide services—Microsoft failed to conduct due diligence on both parties. The purported services provided were incorrectly recorded as legitimate transactions in Microsoft Hungary's books and records.

- Saudi Arabia: From 2012 through 2014, according to the Order, employees in Microsoft's indirect, wholly-owned subsidiary Microsoft Arabia (Microsoft Saudi Arabia) funneled at least $440,000 intended to be used for marketing expenses and business proposals to a "slush fund." The SEC Order states that the slush fund was used to cover travel expenses for seven Saudi government employees as well as for gifts, furniture, electronics, and other equipment for government agencies. Microsoft Saudi Arabia funded the slush fund through "larger than usual discounts" as well as through payment to four third parties—two vendors and two LSPs. Two of Microsoft Saudi Arabia's vendors managed the fund and disbursed payments at the direction of Microsoft Saudi Arabia employees; the SEC Order alleges that the vendors received approximately $130,000 in commissions and service fees for maintaining the fund. According to the SEC Order, Microsoft's records did not accurately reflect the total amount and use of the funds.

- Thailand: From January 2013 through April 2015, the Order alleges that an employee at Microsoft's indirect, wholly-owned subsidiary Microsoft Thailand Ltd. (Microsoft Thailand) and a Microsoft Thailand LSP employee provided at least $100,000 in gifts and travel benefits to employees of a non-government banking customers. Specifically, the SEC Order states the Microsoft Thailand LSP established an account funded through discounts provided by Microsoft and funds intended for end-customer training. Instead, the individuals used the funds to purchase technology equipment and pay for travel for employees of Microsoft Thailand's non-government end customers. To cover up the scheme, the Microsoft Thailand employee directed the Microsoft Thailand LSP employee to submit false purchase orders to Microsoft Thailand's training vendors. In turn, the vendors would submit an invoice in connection with the purchase order that was paid from an account managed by the LSP that was intended for training. Similar to conduct in Saudi Arabia, the vendors were compensated for their role in the scheme.

- Turkey: In July 2014, executives from Microsoft's indirect, wholly-owned subsidiary Bilgisayar Yazilim Hizmetleri Limited Sirketi (Microsoft Turkey) approved an "excessive discount" in connection with a public tender issued by Turkey's Ministry of Culture for Microsoft licenses and services. The tender was awarded to an unauthorized third party, a "system integrator." As a result, a Microsoft Turkey employee directed an authorized LSP to work on the transaction with the system integrator and did not disclose the system integrator's role in the transaction. The Microsoft Turkey employee negotiated the payment terms between the system integrator and the LSP and Microsoft Turkey authorized a seven percent discount over the standard discount. According to the Order, "Microsoft's records do not reflect what services, if any, the system integrator provided, and the authorized reseller informed Microsoft that it provided the services on the transaction. Moreover, there is no evidence the additional discount was passed on to the government customer." As a result, the Order notes that Microsoft violated the internal-accounting-controls and books-and-records provisions of the FCPA.

The DOJ NPA covers Microsoft Hungary's scheme related to creating inflated margins associated with certain licensing deals that it entered into with government customers (which overlaps with the first of the two Hungary-related schemes summarized by the SEC above). Specifically, from approximately 2013 to June 2015, an executive at Microsoft Hungary and other employees falsely told Microsoft that discounts were necessary to close deals with government customers. Once discounts were approved, they were not fully passed on to the government customers and were instead used to improperly compensate government officials who played a role in the sale of Microsoft software to the Hungarian government agencies. As a result, the NPA states that Microsoft Hungary knowingly and willfully caused Microsoft to record false discounts in its books and records. According to the NPA the licensing deals that led to the false reporting of discounts resulted in USD $14,586,325 in profits for Microsoft Hungary.

In connection with its NPA with the DOJ, Microsoft Hungary agreed to pay a criminal penalty of $8,751,795. In calculating the penalty amount, the NPA notes that the DOJ applied a 25 percent discount off the bottom of the Guidelines fine range – the maximum discount allowable for companies that did not voluntarily disclose the misconduct – as a result of the company's cooperation and remediation. The SEC did not impose a civil penalty in addition to the criminal penalty resulting from Microsoft Hungary's NPA with the DOJ. However, it ordered Microsoft to pay disgorgement of $13,780,733 and prejudgment interest of $2,784,417.92.

Noteworthy Aspects

- Cooperation and Foreign Data Privacy Laws: In the NPA, the DOJ noted that despite not receiving voluntary disclosure credit, Microsoft Hungary received full cooperation credit including for "producing documents to the Fraud Section and the Office from foreign countries in ways that did not implicate foreign data privacy laws (emphasis added)." This language has appeared in several recent settlement agreements (see e.g., Walmart, TechnipUSA, Fresenius, Credit Suisse) and affirms that the DOJ is aware of the complex challenges raised by these laws, that prosecutors expect companies in a cooperative posture to find solutions to get relevant information to investigators despite the presence of such laws, and that the DOJ rewards companies that do so.

- Importance of Visibility in Discount Process: Various past FCPA enforcement actions involve schemes whereby inflated margins from discounts were used to facilitate improper payments to officials (see e.g., Polycom, Orthofix, General Cable, SAP, Mead Johnson, Weatherford International, Eli Lilly, Pfizer, Smith & Nephew, and Daimler). Moreover, as noted below, another resolution this quarter for Juniper Networks also included inflated discounts to third parties that did not relay the discount to the ultimate customer. According to the DOJ's NPA, Microsoft had in place procedures to "ensure consistency in Microsoft pricing and to avoid improper use of discounts by sales personnel" and a specific unit—the Microsoft Business Desk—responsible for reviewing requests for larger-than-normal discounts to ensure appropriate factors were considered before approving certain discounts. Indeed, in one of the schemes described in the NPA, the Microsoft Business Desk initially rejected a discount request because the estimated reseller margin was deemed too high. However, as demonstrated by this settlement, processes to review and approve discounts at the initial stages of a transaction may not be sufficient to effectively address risks. Rigorous business justification and documentation requirements throughout the life of a transaction, targeted training that enables reviewers to spot red flags, and assertive auditing processes are additional tools that companies should consider using to limit employees' ability to fund "off the books" schemes and to deter other conduct that can create risks for companies, such as revenue recognition and related financial reporting issues.

- Data Analytics for Identifying High-Risk Transactions: In the NPA, the DOJ summarized "extensive remedial measures" by both Microsoft and Microsoft Hungary. Among the standard list was a measure that has seen increasing use in the compliance space -- the two companies had "develop[ed] and us[ed] data analytics to help identify high-risk transactions." Prior to the NPA with Microsoft Hungary, the DOJ had issued guidance to prosecutors, suggesting that they ask companies, "What information or metrics has the company collected and used to help detect the type of misconduct in question? How have the information or metrics informed the compliance program?" Since this resolution, DOJ prosecutors have had public comments on the importance of data analytics in compliance programs. In September 2019, the DOJ said that data analytics are "an area of focus," which would soon be used across the board in compliance, according to both the DOJ and SEC. The SEC views the use of data analytics by companies positively, calling it "absolutely a good thing," and expects that companies will eventually have an analytics program as the technology develops. For its part, the DOJ said in November 2019 that various factors would determine whether or how companies use data analytics but "it can be helpful."

- Scope of SEC Cease-and-Desist Order Versus Scope of Disgorgement Amount: It is noteworthy that the SEC Cease-and-Desist Order summarizes conduct from four countries, including one country (Thailand) in which the SEC summarized payments to employees of "non-government banking customers" without mention of government officials, indicating that the SEC was targeting commercial bribery rather than public bribery. At the same time, however, the SEC used only the profits from the business in Hungary in calculating the disgorgement owed by Microsoft. Thus, the activity in Thailand, Saudi Arabia, and Turkey did not appear to affect the financial terms of the Cease-and-Desist Order.

Deutsche Bank Settles Hiring Practice Allegations with the SEC for $16 Million

On August 22, 2019, the SEC entered a Cease-and-Desist Order (Order) against Deutsche Bank AG (Deutsche Bank) to resolve alleged violations of the books-and-records and internal-accounting-controls provisions of the FCPA. Pursuant to the Order, the bank agreed to disgorge $10,785,900, pay $2,392,950 in prejudgment interest, and pay a civil monetary penalty of $3 million. In total, Deutsche Bank agreed to pay just over $16 million to resolve the matter with the SEC.

With shares traded on the NYSE since 2001, Deutsche Bank is a publicly traded, multinational financial services corporation and an "issuer" under the FCPA. The SEC alleged that between 2006 and 2014, the bank employed the relatives of government officials in an effort to influence the officials and obtain or retain business for the bank. By 2009, Deutsche Bank had internal policies which recognized the corruption risks presented by providing employment at the request of clients and government officials, but the SEC stated that the bank did not sufficiently address those risks through effectively implemented global policies and practices until 2015. Further, the SEC alleged that Deutsche Bank falsified books and records and failed to maintain sufficient internal accounting controls around its hiring practices "sufficient to provide reasonable assurances that its employees did not bribe foreign government officials."

The SEC alleged that hires made at the request of government officials in China and Russia generated $10,785,900 in unjust enrichment for the bank. The SEC specifically pointed to five alleged hires by Deutsche Bank or its China-based joint venture as supporting this conclusion: the daughter of the chairman of a Chinese state-owned entity (SOE), the son of two SOE executives, the son of the chairman of another Chinese SOE, the daughter of a Deputy Minister at a Russian government entity, and the son of a senior executive at a Russian SOE. According to the Cease-and-Desist Order, Deutsche Bank hired these persons at the request of government officials and SOE executives, despite the prospective employees lacking work experience and performing poorly during the admission and interview process. According to the SEC's Order, one "human resource employee stated that … [one of the hires] failed to come to work, cheated on an exam, and was 'a liability to the reputation of the program, if not the firm…'"

The settlement reflected Deutsche Bank's cooperation with regulators, which the SEC said included sharing factual findings developed during the bank's internal investigation, as well as remedial measures put into place by the bank, including enhancements to its compliance program and internal accounting controls.

Noteworthy Aspects

- Deutsche Bank Held Responsible for Hires by China Joint Venture: Two of the five hires the SEC specifically described in the Cease-and-Desist Order were at least initially made by the China joint venture at the request of the bank. In one case, allegedly due to headcount restrictions and because "the hire request would likely have been rejected by Deutsche Bank human resources and compliance" functions, Deutsche Bank's Chairman of the Asia-Pacific region (APAC) Corporate Finance and the lead banker for an SOE instructed the joint venture to make the hire. The individual was later hired by the bank itself following her request for a transfer. In another case, Deutsche Bank's compliance team allegedly rejected the proposed hire twice because the circumstances were determined to potentially violate the bank's hiring policy. Nonetheless, according to the Cease-and-Desist Order, the candidate was hired by the joint venture and Deutsche Bank senior APAC management allowed that person to work on Deutsche Bank business and at the bank, despite knowing compliance had previously rejected the hire.

- SEC Continues to Investigate Hiring Practices in the Financial Industry: The Deutsche Bank settlement and the Barclays resolution summarized below mark the latest enforcement actions arising out of the SEC's investigation into the hiring of so-called "princelings," a term given to the relatives (usually dependents) of senior government officials by companies in the financial industry. As we reported in 2015, a $14.8 million settlement with The Bank of New York Mellon Corp. marked the first official casualty of the SEC's princeling investigation. Since then, other banks have settled with the SEC and other agencies over similar allegations, including a 2016 settlement between the DOJ, SEC, Federal Reserve Board, and JPMorgan Securities (Asia Pacific) Limited for a total of approximately $264.4 million in penalties and a 2018 settlement between the DOJ, SEC, and Credit Suisse (Hong Kong) Limited (CSHK) for a total of approximately $76.8 million in penalties. Deutsche Bank is the only resolution to include the hiring of children of Russian officials, however.

Juniper Networks Settles with SEC Over FCPA Allegations in Russia and China

On August 29, 2019, California networking equipment provider, Juniper Networks (Juniper) agreed to pay more than $11 million in penalties and disgorgement to resolve charges that the company had violated the books-and-records and internal-accounting-controls provisions of the FCPA as a result of certain activities by several of its subsidiaries in Russia and China. Juniper is a Delaware incorporated corporation, registered on the New York Stock Exchange, and is thus an "issuer" under the FCPA.

According to the SEC's Cease-and-Desist Order (Order), from 2008 to 2013 certain sales employees from the company's Russian subsidiary, JNN Development Corp. (JNN), entered into an agreement with third party intermediaries known as "channel partners" to "increase the incremental discount on sales made to customers through those channel partners without passing those increased discounts on to customers." The resulting pool of funds was then used in part to pay for customer trips which had "little to no educational or business purpose." The Order also states that from 2009 to 2013 certain sales employees from Juniper's Chinese subsidiaries "falsified trip and meeting agendas for customer events that understated the true amount of entertainment involved on the trips." The SEC alleges that Juniper "failed to accurately record the incremental discounts and travel marketing expenses in its books and records, and failed to devise and maintain a system of internal accounting controls sufficient to prevent and detect off-book accounts, unauthorized customer trips, falsified travel agendas and after-the-fact travel approvals."

Russia

The SEC Order states that between 2008 and 2013, certain JNN sales employees in Russia misrepresented the need for "increased discounts to meet [Juniper's] competition." The SEC Order alleges that – in fact – these JNN employees "secretly agreed" with channel partners that the increased discounts, referred to as "common funds," would be retained by channel partners in off-book accounts rather than passed to the customer. According to the SEC Order, JNN employees structured these transactions in this manner "to keep the common funds off Juniper's books so that local JNN and channel partners could thereafter direct the funds without obtaining proper internal Juniper approvals."

The proceeds were in part used by JNN employees and channel partners to fund customer trips, which the SEC characterized as "excessive, inconsistent with Juniper policy, predominantly leisure in nature" and lacking "any legitimate business purpose." Examples contained in the SEC's Order include: "travelling to international tourist destinations, such as Italy, Portugal, and various U.S. cities where there were no Juniper facilities, industry specific conferences or other business justifications." More specifically, some of these trips also included "sightseeing tours, [trips to] amusement parks, national park excursions and meal entertainment for customers" and sometimes customer family members. Some of the customers involved in the trips were government officials, according to the Order.

The SEC noted that former JNN employees discussed "their desire to have a business impact based on this leisure travel and entertainment." The Order cites one internal communication seeking approval for a "five-day international sightseeing trip", whereby an employee explained that the "purpose of the trip" was to meet with a "top [state-owned customer] manager to speed up Q2 bookings." In another case, a JNN employee allegedly asked to take a state-owned customer "on a seven-day leisure trip to the U.S., explaining his belief that if the trip was not approved, Juniper would lose customer sales."

The SEC Order further alleges that in late 2009 a former member of senior management became aware that JNN employees in Russia had created "off-book accounts that were funded in part by improperly obtained incremental discounts" both of which were in contravention of Juniper's policies. While Juniper instructed JNN employees to discontinue the practices, they nevertheless persisted through 2013. Moreover, the SEC notes that the company's "overall remedial efforts were ineffective" and consequently, Juniper "failed to properly account for these off-book funds and failed to implement or maintain a system of effective internal accounting controls to prevent off-book accounts, improper expenses, and the misuse of product discounts."

China

In China, the SEC Order alleges that between 2009 and 2013, employees of Juniper's Chinese subsidiaries engaged in improper travel practices by funding domestic travel and entertainment of customers, some of whom were foreign officials, "that was excessive and inconsistent with Juniper policy." In support of such activities, certain local marketing employees in China falsified agendas for trips provided to customer employees, which understated the extent of the entertainment involved in the trips. According to the SEC Order, "these falsified and misleading trip agendas" were submitted to Juniper's legal department for approval, though the Order notes that, in other instances, no such approvals were obtained in contravention of company policy. The SEC also alleges that marketing employees "also provided these falsified agendas to their customer invitees to assist the invitees in obtaining their own internal approvals to attend events."

The SEC Order also notes that members of Juniper's legal department "regularly approved events that had already" occurred. Such actions, according to the SEC, "[violated] Juniper's policies and undermin[ed] its internal accounting controls over travel and entertainment."

Resolution and Remediation

As a result of the conduct described above, the SEC imposed a total fine of $11,745,018 on Juniper, which included $4 million in disgorgement, $1,245,018 in prejudgment interest and a civil penalty in the amount of $6.5 million. However, the SEC also recognized Juniper's cooperation which included "timely disclosure" of the facts ascertained during the company's internal investigation, voluntary production and translation of documents, and presentations to SEC staff regarding the company's investigation.

According to the SEC Order, Juniper also took the following remedial actions: "revisiting its compliance policies and making enhancements to its compliance group…realign[ing] its compliance function into an integrated unit" funneling all reporting into a "newly created and empowered Chief Compliance Officer…implement[ing] a mandatory escalation police to ensure the Company's Board of Directors is informed of serious issues…institut[ing] a compliance preview and requir[ing] pre-approval of non-standard discounts…requir[ing] pre-approval for third-party gifts, travel, and entertainment, channel partner marketing expenses, and…certain operating expenses in high risk markets." Finally, the SEC's Order also notes that Juniper conducted "additional employee training on anti-corruption issues and improved its process for conducting internal investigations of potential violations of anti-corruption laws."

Noteworthy Aspects

- Risks at the Top: Notably, the SEC Order points to deficiencies in senior management's response, including the company's legal department, in connection with the off-book accounts in Russia and travel and hospitality expenses in China. As mentioned above, upon learning that JNN employees in Russia created "off-book accounts," in contravention to company policies, senior management failed to adequately address the issue such that the practices persisted through 2013. In China, the SEC Order suggests that Juniper's legal department contributed to the problem by "regularly approv[ing] events that had already" occurred. In doing so, Juniper's legal department not only violated company policies but also "undermin[ed] its internal accounting controls over travel and entertainment."

- No DOJ Declination: Juniper's settlement with the SEC comes more than a year after the company disclosed that the DOJ closed its FCPA investigation of the company in a public filing dated February 9, 2018. Specifically, according to the company's February 9, 2018 Form 8-K, the DOJ closed its investigation without taking any action against the company, and "acknowledged the Company's cooperation in the investigation." In closing the investigation, the DOJ did not identify this decision as a declination.

TechnipFMC Plc and U.S. Subsidiary Settle with SEC Related to Conduct in Brazil and Iraq

On September 19, 2019, the SEC issued a Cease-and-Desist Order (Order) against TechnipFMC Plc (TFMC), a global provider of oil and gas services based in Texas, to resolve FCPA charges involving conduct in Brazil and Iraq. This Order is issued in connection with the June 25, 2019 DPA that TFMC entered with the DOJ. As noted in our FCPA Summer Review 2019 (which has additional background on the facts at issue), the resolution with the SEC was foreshadowed through the Board resolution attached to the DPA between TFMC and the DOJ. The SEC's Order charges TFMC with violations of the anti-bribery, books-and-records, and internal-accounting-controls provisions of the FCPA. TFMC is the result of a 2017 merger between Technip S.A. and FMC Technologies, Inc., and as such, TFMC is a successor in interest for both Technip S.A. (Technip) and FMC Technologies, Inc. The SEC Order states that TFMC began trading in the United States on January 17, 2017 under FMC Technologies' old ticker, "FTI."

In connection with its resolution with the SEC, TFMC agreed to pay disgorgement of $4,327,194 and prejudgment interest of $734,712. TFMC also agreed to self-reporting to the SEC on its compliance program for a period of three years. Thus, the agreement corresponded to the terms outlined in the board resolution attached to the DPA. The SEC did not impose a civil penalty, citing the imposition of a $296,184,000 criminal fine as part of TFMC's resolution with the DOJ. For the full summary and analysis of allegations against TFMC, please refer to our previous article in the 2019 Summer Review.

Printing Services Provider Quad/Graphics Settles with SEC for Books-and-Records and Internal-Accounting-Controls Violations in Peru and China

On September 26, 2019, the SEC announced a Cease-and-Desist Order (Order) against Quad/Graphics, Inc. (Quad), a marketing solutions and printing services provider headquartered in Sussex, Wisconsin. Under the Order, Quad agreed to pay a total of $9,895,334—including disgorgement of $6,936,174, prejudgment interest of $959,160, and a civil penalty of $2,000,000—to resolve charges that it had violated the books-and-records and internal-accounting-controls provisions of the FCPA.

Approximately one month prior, on September 19, 2019, the DOJ declined to prosecute Quad for the same conduct, formally finding that criminal prosecution was warranted but that the company had met the conditions set forth in the DOJ's FCPA Corporate Enforcement Policy, most notably by voluntarily self-disclosing potential misconduct and by agreeing to disgorge "the full amount of its ill-gotten gains" to the SEC. Nevertheless, the DOJ made clear that the formal declination for Quad "does not provide any protection against prosecution of any individuals" associated with Quad, leaving open the possibility that the DOJ may bring individual charges against Quad executives.

The conduct giving rise to Quad's dispositions with the DOJ and SEC occurred between 2010 and 2016. Prior to 2010, Quad was a private company primarily focused on sales in the United States. In 2010, Quad acquired World Color Press, Inc. (World Color), another printing company headquartered in Montreal, Canada, but with shares registered on the NYSE. After the acquisition, such shares in World Color became shares in Quad, making the company an "issuer" under the FCPA. Quad also acquired several former World Color subsidiaries outside the United States, most notably Quad/Graphics Peru S.A. (Quad Peru) and Quad/Tech Shanghai Trading Company, Ltd. (Quad/Tech China).

According to the public documents, this acquisition substantially changed Quad's FCPA risk profile. Quad's new status as an issuer under the FCPA meant that it was now subject to the books-and-records and internal-accounting-controls provisions of the FCPA. Furthermore, Quad's new foreign subsidiaries in Peru and China increased the risk that company personnel might come into contact with foreign officials, potentially increasing the risk of improper payments. Despite this change in risk profile, Quad reportedly failed to put in place measures to appropriately mitigate FCPA risk. According to the SEC Order, the company's compliance program immediately after acquisition was "non-existent" and the company's "internal audit had no visible role in anti-corruption testing and the company failed to conduct broad FCPA or ethics training until approximately 2012."

Against this backdrop, the SEC found that Quad failed to meet its FCPA books-and-records and internal-accounting-controls obligations in a number of areas, namely:

- Failure to prevent payments to MINEDU and INEI officials in Peru: According to the SEC Order, from 2011 to 2015, Quad Peru's insufficient bookkeeping and internal accounting controls allowed senior executives at Quad Peru to make improper payments to government officials at the Peruvian Ministry of Education (MINEDU), the Peruvian National Institute of Statistics Information (INEI), and various Peruvian municipalities. Quad Peru executives allegedly made payments to sham vendors for various services that were in fact handled by Quad Peru employees in house or by unrelated external third parties. The Order states that the sham vendors, three of which were owned by an individual with influence in the Peruvian government, then allegedly passed these payments onto officials at MINEDU, INEI, and various Peruvian municipalities in order to obtain various benefits for the company, including assistance in securing contracts and leniency in meeting delivery dates and avoiding penalties under existing contracts. In 2013, finance personnel within Quad Peru had notified a finance executive for Latin America who was based in the U.S. about certain suspicious invoices issued by the sham vendors, raising concerns about red flags such as identical dates and dollar amounts for certain invoices, as well as consecutive invoice numbers. However, it was only after the departure of a senior Quad Peru finance manager in 2015 that the invoices were reported up to the chain to Quad's U.S. legal department.

- Failure to prevent judicial bribery in Peru: From 2011 to 2013, Quad Peru's management allegedly arranged for payments to Peruvian judges through a local law firm initially retained to handle ongoing litigation with the Peruvian tax authority, Superintendencia Nacional de Aduanas y de Administraciόn Tributaria (SUNAT). Specifically, after litigation settlements, the local law firm allegedly suggested that Quad Peru make payments to certain Peruvian judges to influence their decisions in the SUNAT court case, which would be facilitated by the law firm itself. According to the Order, with approval from at least one operations executive based in the United States, Quad Peru executives agreed to the law firm's proposed plan and funneled payments to litigation and administrative court judges, either through invoices issued directly by the law firm to Quad Peru for "success fees" or "extraordinary fees" or through invoices issued to Quad Peru by other third-party vendors, which were then paid and the funds returned to a Quad Peru executive to pay the law firm. The SEC noted that specific payments through the law firm coincided with favorable judicial decisions in the litigation. The law firm also allegedly refunded some payments after a setback in the litigation at the appellate level.

- Concealment of prohibited business with Cuban state-owned entity in Peru: From 2010 to 2013, Quad Peru also continued certain pre-acquisition contracts for the printing telephone directories with the Cuban state-controlled telecommunication company, Empresa de Telecomunicaciones de Cuba S.A. (ETECSA). Possibly due to concerns about compliance with sanctions against Cuba by the United States, Quad Peru executives sought to conceal the nature of these contracts from the company's U.S. legal department after acquisition. Per the Order, such concealment efforts included removing any references to Cuba and the Cuban company's full name in company reports, as well as hiring a "broker" or "pass through" in Peru whose name would appear on contracts, shipping documents, invoices, and journal entries when the true customer was in fact ETESCA in Cuba. The Order alleges that executives in both Peru and the United States also actively misled the U.S. legal department, writing in e-mails that sales with Cuba had been discontinued. Quad Peru executives also allegedly paid hotel bills for ETESCA officials who visited Peru to review sample telephone directives and paid for sales representatives to travel to Cuba to meet with officials about pending printing projects.

- Failure to prevent kickbacks in China: Finally, the SEC Order alleges that Quad/Tech China employees engaged in a scheme to bribe customers and win business in China from 2010 to 2015. Specifically, Quad/Tech China allegedly paid fake commissions of approximately two percent of sales orders to sales agents. According to the SEC, these sales agents did not provide any legitimate services, but instead transferred the two percent to employees of Quad/Tech China's customers, including Chinese state-owned entities and privately-owned companies. These payments were allegedly described in invoices as "technical service fees" and in Quad/Tech China's books and records as "commissions."

Noteworthy Aspects

- Use of the FCPA Books-and-Records and Internal-Accounting-Controls Provisions to Investigate Potential U.S. Sanctions Violations: As noted above, a portion of the alleged misconduct by Quad involved concealing ongoing business with a Cuban entity in company reports, contracts, shipping documents, invoices, and journal entries. While rare, this is not the first time that the FCPA's books-and-records and the internal-accounting-control provisions have been cited in a settlement in relation to conduct that may have violated U.S. sanctions law. Most recently, in 2013, the SEC reached a settlement with the Swiss oilfield equipment and services provider Weatherford International Ltd. that included sanctions-related issues. While the SEC has been criticized for using settlements to expand the scope of the accounting provisions beyond their statutory definition, much of the misconduct cited here in relation to potential sanctions issues – falsifying company reports, invoices, and accounting journal entries – falls within the generally understood ambit of the books-and-records provisions.

- Improper Payments Arranged Through Local Law Firm: Quad Peru's local law firm played a central role in the judicial bribery scheme, allegedly first suggesting that the company make payments to certain judges after litigation setbacks and offering to arrange for the payment on top of the legitimate legal service also provided. This highlights the potential corruption risks posed by local counsel, which, like other higher-risk third parties, often interact directly with government officials (judges and regulators) on companies' behalf. Indeed, payments funneled through local counsel have been the basis for charges in past enforcement actions, including Layne Christensen Company and Stryker Corporation. Managing these risks can also be challenging, as law firm services can also be more difficult to benchmark than services rendered by other agents. Generally, however, this FCPA risk can be mitigated if companies subject local law firms to the same controls as other third-party service providers, including due diligence, benchmarking, and auditing, among other measures.

- Alleged Lack of Sufficient Compliance Measures Following Acquisition: Although the FCPA books-and-records and internal-accounting-controls provisions cover only certain accounting and controls obligations, the SEC tends to consider such technical provisions alongside broader compliance failures, including failure to conduct training, failure to adopt sufficient policies and procedures, and failure to include anti-corruption during internal audits. The SEC appeared to follow the same playbook here, noting the company's "non-existent" compliance program at the time of acquisition and initial failure to make use of internal audit's capabilities and FCPA or ethics training.

Barclays Plc Resolves Hiring Practices-Related FCPA Allegations with SEC for $6.31 Million

On September 27, 2019, the SEC issued a Cease-and-Desist Order (Order) to resolve allegations that Barclays PLC (Barclays) violated the books-and-records and internal-accounting-controls provisions of the FCPA. During the period in question, Barclays, a bank holding company headquartered in London, United Kingdom, registered American Depository Receipts on the New York Stock Exchange and filed periodic reports with SEC and, therefore, was an "issuer" for the purposes of the FCPA.

As described more fully below, according to the Order, from at least 2009 through August 2013, offices in Barclays' Asia Pacific (APAC) region provided employment opportunities to approximately 117 relatives and friends of government officials and private sector clients, with most provided through an "unofficial internship program." The Order further alleges "Barclays failed to devise and maintain a system of internal accounting controls" to provide reasonable assurances that its "employees were not using employment opportunities as an improper inducement."

The Order required Barclays to pay $3,824,686 in disgorgement, $984,040 in prejudgment interest, and a civil penalty of $1,500,000. The Order indicated that the SEC considered that Barclay self-reported prior to the SEC launching an investigation, undertook remedial steps including the termination of senior personnel, revisions to hiring policies, and enhancements to other elements of its compliance program, in addition to making factual information and personnel available to the SEC.

In the Order, the SEC alleged that although Barclays' policies prohibited leveraging employment opportunities for future business, Barclays did not train APAC employees or monitor adherence to the policies. The Order details instances, for example, where Barclays executives indicated that they "did not know that offers of internships or employment were items of value or that such offers could not be used to obtain business." The Order also details how certain executives, even compliance personnel, were unaware of Barclays' anti-bribery policies or the FCPA. For example, the Order notes that "a senior regional compliance executive said that he had never read the 2009 anti-bribery and corruption policy, which required pre-approval by compliance before Barclays could offer internships to public officials or their close family members." This same individual also said, according to the Order, "that it was not until 2012 that the he understood that an internship was considered an item of value for compliance purposes." Compliance personnel also indicated a lack of awareness of how to monitor policy compliance.

The Order indicated that in April 2009, an "unofficial intern program" for Barclays Korea was approved by a senior executive in APAC. The unofficial program was not part of the bank's formal internship program. Ostensibly, the unofficial program's purpose was to provide professional experiences for students and occasionally to offer employment opportunities to individuals who had a relationship with Barclays and were qualified for the opportunity. Rather than being an occasional practice, the Order noted that "[a]pproximately half of the candidates between 2009 – 2013" were connected to a client of the bank. A Barclays senior executive responsible for the program said that he believed "the key factor" in hiring a candidate was the business the associated client could provide to Barclays.

The Order provided numerous examples of internship offers to the children of government decision-makers. For example, in April 2009, a Korea-based banker suggested that Barclays extend an internship offer to the child of an influential figure at a state-owned entity (SOE) while Barclays vied to manage the SOE's bond offering. Barclays extended the internship offer and, shortly thereafter, was named the bond offering's lead manager, which generated approximately $971,000 in fees for the bank. A month later, in May 2009, after an executive at a Korean SOE requested that Barclays hire a specific individual for a permanent position notwithstanding that candidate performed worse than another candidate, a Barclays banker endorsed the hiring indicating it was important to honor the request "to avoid potentially losing that client's business," according to the Order. Without compliance's preapproval, which was required under Barclay's policy, a senior executive approved the hire. Just one month later, in June 2009, at the request of the same SOE, Barclays hired the specific individual for an internship. Later that month Barclays received bond offering work from the SOE, earning approximately $1.15 million in revenue.

The Order indicated that by June 2009, APAC compliance officers knew of the practices described above but failed to fully perform their responsibilities consistent with the anti-bribery policy. For example, the Order notes that if "compliance officers reviewed relationship hiring requests, their review was generally limited to potential conflicts of interest, despite an April 2009 Barclays policy that expressly addressed anti-corruption risks" for such hires. The Order provides that compliance officers were unaware of the policy's anti-bribery aspects, with one senior compliance officer stating that he had not read the policy, while a senior compliance officer who was responsible for the review of relationship hires represented that "he never reviewed information relating to pending business with Barclays' clients even though he had access to that information."

Notwithstanding the requirement for compliance review and approval, referral hires were made without involving compliance, involving compliance but withholding or falsifying information to hide the person who referred the candidate, or failing to implement safeguards required by compliance. For example, in September 2010 bankers requested to hire the daughter of an influential official of a Chinese SOE. The candidate did not perform well in the interview process, but still the banker advocated for her hire due to the "tangible business" she would bring. The Order provided that when a compliance officer raised the issue to a more senior compliance officer, the latter responded, "I am sure this is not the first time," and approved the hire provided the business attested that she would be hired "for her qualifications and her skills, not for any other reason." No such attestation was provided and, nevertheless, Barclays offered the individual a spot in their graduate program, according to the Order.

Barclays adopted a "work experience program" in APAC in May 2011, to better address relationship hires, according to the Order. As part of the program's controls, Barclays personnel had to disclose whether a client had referred the candidate and to document the reasons for hiring the individual. Notwithstanding the enhanced controls, violations of the new program occurred. For example, a SOE executive asked the bank to hire the daughter of a close friend whose employer regulated the SOE. Barclays hired the individual even though the compliance department was aware the bank was vying for a role in the SOE's bond issuance. The SOE hired Barclays for the issuance, resulting in approximately $300,000 in fees for Barclays.