FCPA Spring Review 2024

International Alert

Introduction

In the first quarter of 2024, the Department of Justice (DOJ) evidenced continuing active FCPA-related enforcement, publicly resolving three corporate investigations involving SAP, Gunvor, and Trafigura. The Securities and Exchange Commission (SEC) resolved a parallel case with SAP. The Gunvor disposition entered the top 10 for FCPA-related penalties, and two of the three cases (involving Gunvor and Trafigura) involved relatively rare corporate guilty pleas.

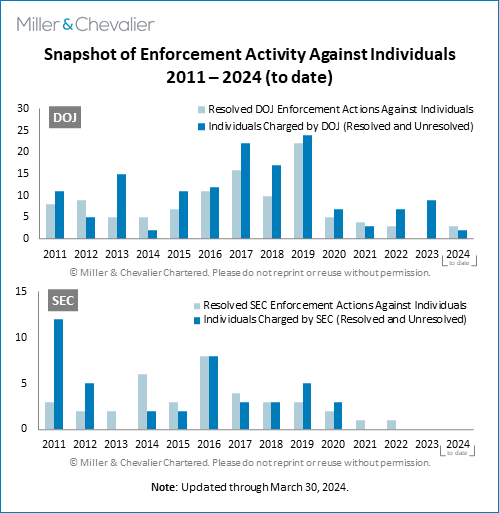

The first quarter also produced several developments in cases involving individuals, including further indictments of former foreign officials accused of receiving bribes – a focus of the current administration as set out in the U.S. Strategy on Countering Corruption (SCC) that will likely also see new prosecutions under the recently enacted Foreign Extortion Prevention Act (FEPA). The DOJ scored a guilty verdict at trial involving former Vitol trader Javier Aguilar and secured three other guilty pleas this quarter from individuals in cases involving official corruption. The SEC did not enter any FCPA-related dispositions with individuals this quarter and has not done so since 2022.

There were relevant U.S. court decisions this quarter, as well as several international developments, including with regard to various U.K. enforcement actions, issues in Brazil, and the long-sought passage of an updated foreign bribery law in Australia.

DOJ and SEC Public Remarks, Including New Whistleblower Reward Program

Officials from the DOJ and SEC continued to discuss policy matters in public speeches at various events, including as to their views on how companies should respond to the incentives and expectations established by recent DOJ modifications to corporate enforcement policies.

Multiple DOJ officials spoke at the annual ABA White Collar National Institute in early March 2024. Deputy Attorney General (DAG) Lisa Monaco led off with a speech that covered DOJ actions as to individuals, a discussion of how recidivism can affect penalties, and a reminder on the potential positive impact of self-disclosures and compliance remediation. DAG Monaco then announced a new DOJ initiative: a whistleblower rewards program designed to "fill the gaps" in other such policies (most importantly, the Dodd-Frank program administered by the SEC that covers public companies). The companies most likely to be affected would be non-issuer/private companies still subject to DOJ jurisdiction, and DAG Monaco noted that the DOJ will be particularly interested in tips related to the FCPA, FEPA,

The next day, Assistant Attorney General (AAG) Nicole Argentieri, speaking at the same event, delivered a speech with more details on the new program. She confirmed that the DOJ will likely issue the formal program in early June 2024, and that the key requirements for a reward to be given will likely include:

- Submission of "original, non-public, truthful information not already known to the [DOJ]";

- Information that is "provided voluntarily and not in response to any government inquiry, preexisting reporting obligation, or imminent threat of disclosure"; and

- "[S]ome sort of monetary threshold" – noting that "both the SEC and CFTC whistleblower programs limit rewards to cases in which the agency orders sanctions of $1 million or more."

AAG Argentieri also noted that the DOJ's Money Laundering and Asset Recovery Section (MLARS) "will play a leading role in designing the nuts and bolts of the pilot" program, given that team's expertise with the forfeiture statutory structure. She reiterated that the DOJ will be in a "90-day 'policy sprint'… to gather information, consult with stakeholders, and design a thoughtful, well-informed program" with the goal of rolling out in the summer of 2024.

In other parts of her speech, AAG Argentieri discussed DOJ efforts at "holding gatekeepers to account" via individual prosecutions involving "corporate executives, lawyers, or medical professionals" (note that these statements related to all white collar cases). She also noted that the DOJ is "bring[ing] impactful cases across a range of industries" including "the energy trading business" in which "prosecutors have entered into corporate resolutions for FCPA violations with the world's largest oil and energy trading firms — including Vitol, Glencore, Freepoint, and, just last week, Gunvor — and prosecuted multiple individuals [including ex-Vitol trader Javier Aguilar] in connection with these cases."

AAG Argentieri also highlighted some effects of the DOJ's revised Corporate Enforcement and Voluntary Self-Disclosure Policy (CEP), stating that "[i]In 2023, we received nearly twice as many [corporate] disclosures as in 2021" and detailing how the CEP affected the treatment of and penalties related to the SAP and Gunvor resolutions (some of which will be discussed in detail in the articles below). She discussed both how SAP had used the DOJ's compensation clawback pilot program and how Gunvor was credited with having "already updated and evaluated its compensation policy to better incentivize compliance with the law and corporate policies" prior to its guilty plea.

Finally, AAG Argentieri confirmed that the Justice Manual had been amended to spell out that FEPA investigations and prosecutions will be handled "the same way we've treated FCPA cases — with centralized supervision by the Fraud Section, working in partnership with U.S. Attorneys' Offices across the country."

As reported by Global Investigations Review (GIR), on March 21, 2024, at the GIR Live conference, FCPA Unit Chief David Fuhr stated that companies looking for guidance as to the DOJ's application of CEP factors should look to recent dispositions, including the December 2022 ABB resolution, the September 2023 Albemarle non-prosecution agreement (NPA), and the SAP case. Chief Fuhr also stated that "[t]he remediation of those cases was effective in part because each of those companies tried to address the root causes of what happened early on." The GIR article also stated that Fuhr confirmed that "the DOJ would stop short of dictating how each company manages its own internal management structures, relationships with sales agents, and use of third-party vendors."

AAG Argentieri also spoke at GIR Live and reiterated several of the themes noted above. She noted that the DOJ is "one-million-percent focused on individual accountability" and that DOJ "policies are gearing towards getting companies to tell us about criminal conduct that we don't otherwise know about so that we can hold individuals accountable." She also highlighted the increase in self-disclosures driven by the CEP, stating that "when you see these declinations…they're just a fraction of the self-reports that we're getting…with many self-reports, maybe we kick the tyres and it doesn't end up being a criminal case [or] [m]aybe it's an ongoing criminal investigation." Finally, among other topics, AAG Argentieri discussed how the DOJ's M&A Safe Harbor policy has been applied in practice, noting, for example, that even when declinations are granted, companies (including the acquirers) will likely still be required to disgorge profits from any disclosed misconduct.

As we have noted, while these public statements do not necessarily reflect regulatory guidance (indeed, AAG Argentieri specifically denied that the DOJ was becoming a regulator at the March 21 GIR Live event), nor do they have binding effect on the agencies' actions, they provide insights into the DOJ's and SEC's expectations for responsible corporate behavior.

Corporate Enforcement Actions

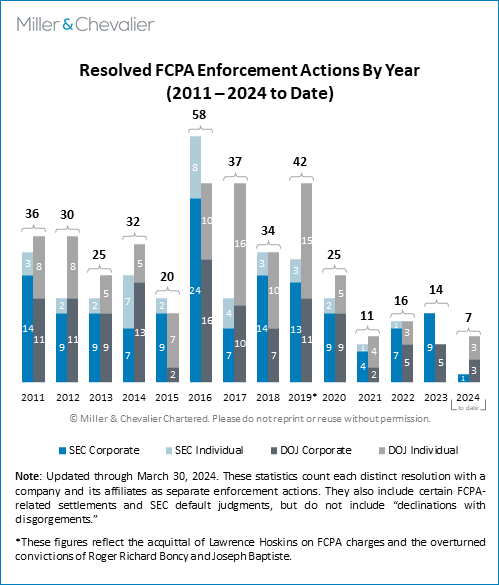

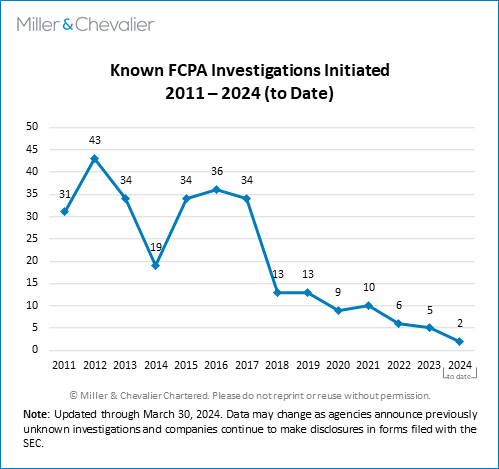

Based solely on Q1 results, in terms of overall numbers of resolved enforcement actions, the DOJ and SEC are on their best pace since 2020, with seven resolutions – involving both corporations and individuals – as of the end of the quarter. The SEC has had a slower start than in 2023, while the DOJ's pace bettered its Q1 2023 equivalent significantly. There is also evidence of several ongoing investigations based on past corporate disclosures. As always, we note that many factors underlie the timing of case dispositions, and thus changes in quarterly levels of output should not be read as longer-term indicators.

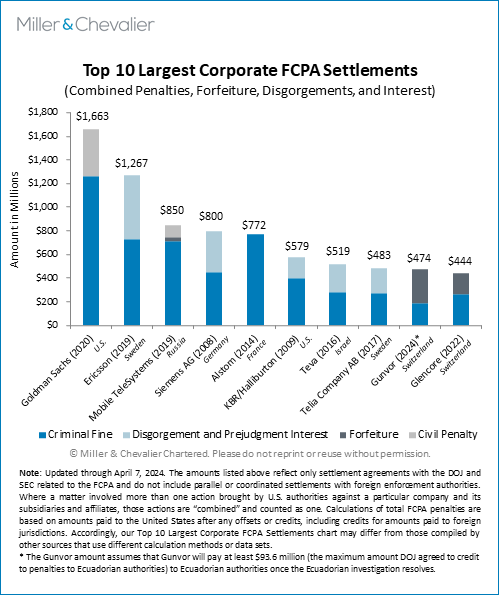

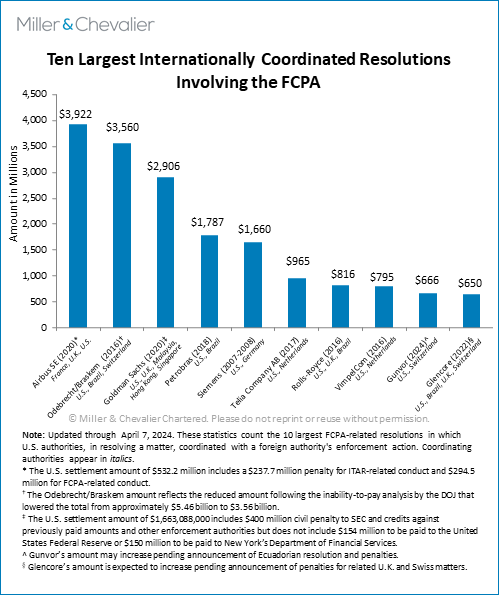

For the first time since the announcement of the Glencore disposition in May 2022, there has been a change in the Top 10 largest corporate FCPA dispositions, with the Gunvor plea agreement entering at the ninth position. This position relies on some assumptions regarding the allocation of penalty credits among the various enforcement agencies (as discussed in the Gunvor article below, an Ecuador case remains open), but the overall penalty figure shows that current enforcement matters can create significant impacts. The Gunvor case also takes the ninth position on the chart of the ten largest internationally coordinated resolutions that involve the FCPA.

On January 10, 2024, SAP SE (SAP) announced that it reached agreements with the DOJ, SEC, and South Africa's National Prosecuting Authority (South Africa NPA) involving corruption-related charges against the company. SAP entered a three-year deferred prosecution agreement (DPA) related to two counts of conspiracy to violate the FCPA's anti-bribery provision and books and records provision related to SAP's scheme to bribe South African and Indonesian officials. SAP also accepted a Cease-and-Desist Order from the SEC for violating the FCPA's anti-bribery, books and records, and internal accounting controls provisions for conduct in various countries. SAP agreed to pay more than $220 million to resolve matters with the DOJ and SEC, including a criminal penalty of $118.8 million and $103.3 million in administrative forfeiture, though the authorities and company agreed to various credits that had the practical effect of significantly lowering the overall penalty levels paid out by the company. Despite its cited recidivist history, SAP received substantial reductions in penalty levels due to the company's extensive cooperation and remediation efforts. The remediation activities also spared SAP from the appointment of an independent compliance monitor.

On March 1, 2024, Swiss commodities trader Gunvor S.A. (Gunvor) pleaded guilty to conspiracy to violate the FCPA and entered into a plea agreement with the DOJ. The resolution addressed alleged misconduct by Gunvor and its agents to obtain business with the Ecuador's state-owned oil company through manipulation of a complex government program "oil-backed loans." In light of the plea agreement, a U.S. federal court in New York sentenced Gunvor to over $661 million in penalties -- a criminal fine of $374,560,071 and forfeiture in the amount of $287,138,444 – though there are provisions for credits to the company for penalties paid in related cases brought by Switzerland and Ecuador. While the company did not receive credit for self-disclosure, the DOJ credited Gunvor for various significant actions involving cooperation and remediation. Gunvor's penalties were, however, impacted by the company's status as a recidivist. As AAG Argentieri noted in her March 8 speech discussed above, "Gunvor committed the scheme to bribe Ecuadorian officials, in part, while it was under investigation by Swiss authorities for a separate scheme to bribe officials in Africa, which ultimately was resolved in 2019."

On March 28, 2024, Swiss commodities trader Trafigura Beheer B.V. (Trafigura) pleaded guilty to a December 13, 2023 criminal information charging the company with one count of conspiracy to violate the FCPA's anti-bribery provisions. According to the plea agreement, Trafigura personnel and agents conspired with middlemen and foreign officials to make corrupt payments in order to secure contracts with Petrobras, the state-owned Brazilian oil company, and other business advantages. As discussed below, information in the disposition documents and media reports suggest that former senior executives of the company were involved with or approved the payments. Trafigura agreed to a criminal fine of approximately $80.5 million and forfeiture of approximately $46.5 million, although Trafigura will pay only two-thirds of the criminal fine ($53.7 million) now, and the DOJ agreed to credit up to approximately $26.8 million of any future fine Trafigura will pay to resolve a related criminal investigation in Brazil. Trafigura received only limited credit for its cooperation and remediation efforts, in part because the company took certain positions "inconsistent with full cooperation" in the earlier phases of the investigation and "was slow to exercise disciplinary and remedial measures for certain employees whose conduct violated company policy." As detailed below, public records suggest the district court had some concerns regarding the plea agreement and its implementation, creating the delay between the filing of the criminal information in December and the guilty plea in March.

Enforcement Actions Against Individuals

There were developments in several announced DOJ cases involving individuals this quarter, including the conviction at trial of former Vitol trader Javier Aguilar and three other corruption-related guilty pleas – including one (for former Maxwell Technologies executive Alain Riedo) occurring over a decade after the initial indictment. Q1 2024 also saw two corruption-related sentencings and one new indictment by the DOJ without a guilty plea. The SEC did not resolve any FCPA-related actions against individuals this quarter and, as noted above, has not done so since 2022.

After a trial that lasted over seven weeks, on February 23, 2024, a federal jury in New York returned a verdict finding former Vitol trader Javier Aguilar guilty of three criminal charges: (1) conspiracy to violate the FCPA's antibribery provision; (2) violating the FCPA's antibribery provision; and (3) conspiracy to commit money laundering. The charges related to Aguilar's alleged role in paying bribes to officials of Petroecuador, Ecuador's state-owned oil company, and to officials at PEMEX Procurement International (PPI), a subsidiary of Mexico's state-owned oil company, PEMEX. In exchange for these alleged payments, the DOJ claimed that Aguilar obtained trades and lucrative oil contracts for Vitol. The trial featured testimony, in part, from former Ecuador officials who received the payments. As discussed in the article below, the trial court also issued rulings related to questions of Mexican anti-corruption law and the operation of the FCPA's affirmative defense. Per the DOJ's press release on the verdict, Aguilar faces a maximum penalty of 30 years in prison — five years each for the FCPA counts and 20 years for the money laundering count. He also faces a second trial later this year in Texas, for additional conduct.

On February 27, 2024, Mauricio Gomez Baez (Gomez Baez), the former Senior Vice President of Stericycle's Latin America division, pleaded guilty to conspiracy to violate the anti-bribery provisions of the FCPA in connection with a scheme to bribe government officials in Mexico, Brazil, and Argentina. Gomez Baez admitted to directing, in coordination with other employees and agents of Stericycle, the payment of approximately $10.5 million in bribes intended to secure medical waste collection contracts, obtain the release of payments owed, and avoid fines. He is currently scheduled to be sentenced on May 16, 2024.

As noted above, on March 7, 2024, a plea agreement involving former Maxwell Technologies executive Alain Riedo was filed with federal district court in Southern California. Riedo pleaded guilty to falsifying the books and records of Maxwell in connection with an alleged Chinese bribery scheme – a scaled-back plea compared to the original charges. Riedo was originally indicted on October 15, 2013, in connection with Maxwell's 2011 dispositions with the DOJ and SEC. Riedo agreed to pay $55,000 in penalties and will be formally sentenced in May.

On March 4, 2024, Nepmar Jesus Escalona Enriquez (Escalona), a former Major in the Venezuelan National Guard who most recently resided in Florida, pleaded guilty to money laundering conspiracy in connection with a scheme to defraud two Venezuelan financial institutions. Escalona admitted that between 2010 and 2017, he and two others coordinated to submit fraudulent applications to the Venezuelan currency regulation authority to obtain money for themselves. To facilitate the scheme and prevent detection, the conspirators paid a series of bribes to government officials in Venezuela. Escalona's sentencing hearing is currently scheduled for May 23, 2024.

On January 10, 2024, a federal grand jury in California indicted Paulinus Iheanacho Okoronkwo, an immigration and personal injury lawyer, for money laundering, tax evasion, and obstruction of justice. The allegations stem from Okoronkwo's time as the former general manager of the upstream division of the state-owned Nigerian National Petroleum Corp. (NNPC). The indictment states that Okoronkwo received a bribe of $2.1 million in exchange for influencing the negotiation for favorable drilling rights and financial terms for Addax Petroleum (Addax), an affiliate of Chinese state-owned oil company Sinopec.

On March 19, 2024, in a case related to the Gomez Baez plea noted above, the former Finance Director of Stericycle's Latin America division, Abraham Cigarroa Cervantes (Cigarroa), was separately indicted for his role in the same scheme. The indictment charges Cigarroa with one count of conspiracy to violate the FCPA's anti-bribery provisions and one count of conspiracy to violate the books-and-records provisions, based on allegations that Cigarroa took steps to conceal the relevant bribe payments in his financial role.

Finally, there were two significant sentencings during the first quarter. On January 17, 2024, Venezuelan businessman Tulio Anibal Farias-Pérez was sentenced to three years of probation and ordered to forfeit $1.5 million to the U.S. for his role in a scheme to pay bribes to the former manager in Citgo's Special Projects Group; he had pleaded guilty in February 2020 to one count of conspiracy to violate the FCPA. And on February 16, 2024, a judge in Florida sentenced another Venezuelan businessman, Orlando Alfonso Contreras Saab, to six months in prison, followed by three years of supervised release, for his role in bribing Venezuelan officials to obtain multi-million-dollar contracts in food and medicine distribution in Venezuela. The sentence followed a December 8, 2023 order requiring Contreras to forfeit close to $6 million, the approximate value of the proceeds traceable to his offenses.

In other developments, on January 26, 2024, a federal judge in the Eastern District of New York postponed the sentencing of former Goldman Sachs banker Tim Leissner, a key figure in the long-running 1MDB corruption saga, to September 2024.

Finally, we note several developments in the continuing fallout related to various convictions related to bribery at FIFA that have been called into question by recent Supreme Court precedent. On January 2, 2024, the DOJ asked the U.S. Court of Appeals for the Second Circuit to vacate the trial court's ruling dismissing the convictions of former media executive Hernán Lopez and Argentine company Full Play Group SA. On January 30, former Costa Rican football official Eduardo Li, who pleaded guilty to charges in 2016 and was sentenced in 2018, filed a motion requesting reversal of his conviction in light of the Lopez/Full Play decision. The presiding judge in various FIFA cases has indicated that no action will be taken on this or other similar requests until after the Second Circuit has ruled.

Other Indicia of Enforcement Trends, Including Investigation Announcements

Q1 2024 saw the announcement of two new corporate FCPA investigation, as well as updates on four previously disclosed matters. On January 31, 2024, Calavo Growers, Inc. stated that the company had disclosed "certain…matters related to…operations in Mexico raised potential issues under the" FCPA to the DOJ and SEC and "intends to fully cooperate with" the agencies related to "this ongoing investigation." The public disclosure noted "that [the company's] internal audit process had identified" the matters and that the Audit Committee and a Special Committee of the company's Board of Directors were engaged in the investigation.

In a 10-K filed on February 14, 2024, biopharmaceutical company Biogen, Inc. stated, "The Company has received a subpoena from the DOJ seeking information relating to our business operations in several foreign countries." The disclosure also noted that, "[t]he Company is also providing information relating to our business operations in several foreign countries to the SEC." Though the company's disclosure did not offer further details, it is noteworthy that in September 2022 the company paid "$900 million [in a DOJ disposition] to resolve allegations that it caused the submission of false claims to Medicare and Medicaid by paying kickbacks to physicians to induce them to prescribe Biogen drugs."

In an important reminder that a DOJ declination does not necessarily spell the end of a company's legal issues when potential FCPA-related misconduct arises, Lifecore Biomedical, which received a DOJ declination in November 2023, noted in a March 20 securities filing that the company "continues to cooperate in the government investigations and requests for information" that commenced after a self-disclosure to the DOJ, SEC, and Mexican authorities. As the filing notes the DOJ declination and a decision by the Mexican Office of the Attorney General not to press charges against the company, this language suggests that the SEC investigation is ongoing. Investigations by "other regulators in Mexico" also appear to be continuing.

On February 5, 2024, aerospace and defense company RTX Corporation provided an update related to an ongoing SEC and DOJ investigation into "whether there were improper payments made by Raytheon Company, our joint venture known as Thales-Raytheon Systems (TRS), or anyone acting on their behalf, in connection with TRS or Raytheon Company contracts in certain Middle East countries since 2014." The public disclosure noted that "[a]lthough the investigation of these issues remains ongoing, information indicating that such conduct has occurred with respect to certain contracts has been identified." The company further stated, "based on the information available to date, we cannot reasonably estimate the range of potential loss or impact to the business that may result, but do not believe that the results of these inquiries will have a material adverse effect on our results of operations, financial condition, or liquidity."

On February 9, 2024, insurance broker Arthur K. Gallagher & Co. publicly disclosed that, in relation to a DOJ inquiry disclosed in November 2022 "seeking information related to our insurance business with public entities in Ecuador," the DOJ had informed the company "that it has closed its inquiry and would not be pursuing enforcement action against us." The DOJ inquiry was part of a series of investigations in the reinsurance industry that resulted in enforcement actions involving JLT, Tysers, and H.W. Wood.

In mid-March, there were media reports suggesting that an ongoing DOJ probe into various affiliates of Indian conglomerate Adani Group had expanded to include FCPA issues. The company denied such reports initially, though one affiliate acknowledged in a subsequent statement that the cited investigation involved an unrelated third party rather than the company.

Finally, on January 31, 2024, Novartis announced that its FCPA-related DPA and SEC Order's terms had ended in June 2023, and that on December 21, 2023, "the court formally dismissed the Information filed against Novartis Hellas S.A.C.I at the request of the DOJ" so that "[the FCPA] matter is now concluded."

Policy and Legislative Developments

Beyond the new DOJ whistleblower reward program announced in March (which will not formally take effect until the summer), there were no new policy initiatives announced by the DOJ or SEC directly related to the FCPA. The Southern District of New York (SDNY) announced a whistleblower pilot program effective on February 13, 2024, but that program explicitly "does not apply to individuals who provide information regarding violations of the Foreign Corrupt Practices Act…," due to the role that the DOJ's Fraud Section plays in FCPA and related cases.

The U.S. government continues to designate foreign officials and others as subject to economic sanctions and visa/immigration restrictions under the Global Magnitsky Human Rights Accountability Act and other statutory and regulatory authorities for acts of corruption. Actions in the first quarter of 2024 focused on a former head of state and mining minister in Guatemala and the current President of Zimbabwe and related individuals and entities.

On January 17, 2024, the Treasury Department's Office of Foreign Assets Control (OFAC) announced sanctions against former Guatemalan Minister of Energy and Mining "Alberto Pimentel Mata (Pimentel) for his role in exploiting the Guatemalan mining sector through widespread bribery schemes, including schemes related to government contracts and mining licenses." These sanctions build upon a Department of State visa ban for Pimentel and other individuals in September 2023 related to similar allegations. The OFAC announcement stated that, among other things, Pimentel "reportedly requested large bribes of more than $1 million from mining industry groups in Guatemala in exchange for mining licenses" and "reportedly engaged in retaliation against companies operating in the Guatemalan energy and mining sector that would not offer to pay him bribes."

In addition, on the same day, the Department of State "designat[ed] Alejandro Eduardo Giammattei Falla [Giammattei], the former president of Guatemala, as generally ineligible for entry into the United States due to his involvement in significant corruption." The announcement cited "credible information indicating that Giammattei accepted bribes in exchange for the performance of his public functions during his tenure as president of Guatemala, actions that undermined the rule of law and government transparency." The visa restriction also covers the former president's adult children.

On March 4, 2024, OFAC announced sanctions against the current President of Zimbabwe, Emmerson Mnangagwa, and others "for their involvement in corruption or serious human rights abuse." This designation occurred in the aftermath of an executive order that ended OFAC's general Zimbabwe sanctions program and is designed to "to make clear what has always been true: our sanctions are not intended to target the people of Zimbabwe." The Treasury Department's statement emphasized that "we are refocusing our sanctions on clear and specific targets: President Mnangagwa's criminal network of government officials and businesspeople who are most responsible for corruption or human rights abuse against the people of Zimbabwe." The public release further alleged that Mnangagwa "is involved in corrupt activities, in particular those relating to gold and diamond smuggling networks," "provides a protective shield to smugglers to operate in Zimbabwe and has directed Zimbabwean officials to facilitate the sale of gold and diamonds in illicit markets, taking bribes in exchange for his services." The sanctions also target 11 other individuals (including Mnangagwa's spouse) and three entities that are allegedly at the center of the President's "corrupt business network."

On February 23, the Department of State released its annual report on Global Magnitsky Act actions in 2023.

Court Cases

While not directly tied to FCPA enforcement, a federal district court in Alabama ruled on March 4, 2024 that the beneficial ownership requirements established by the Corporate Transparency Act (CTA), which are designed to combat money laundering and illicit financing through anonymous shell companies, are unconstitutional. The DOJ, on behalf of the Treasury Department, appealed the decision days later, and Treasury's Financial Crimes Enforcement Network (FinCEN) issued a notice that the agency will continue to enforce the CTA against all companies not covered by the district court's injunction while the district court's decision is reviewed on appeal. The CTA has been touted as a key component of the SCC.

International Developments

There were several noteworthy international developments this quarter.

In Brazil, on February 26, 2024, Singapore company Seatrium Limited (Seatrium), an entity created by the 2023 merger of Keppel Offshore & Marine Ltd and Sembcorp Marine (Sembcorp), disclosed provisional leniency agreements with various authorities in Brazil resulting from those authorities' long-running Lava Jato investigations. The activities at issue occurred at Sembcorp, which has been the subject of investigation by the Brazilian authorities since at least 2019, related to allegations of corrupt payments involving contracts with Sete Brasil, a subsidiary of Petrobras that operates rigs. Per Seatrium's investor release, the provisional payments owed to the Brazilian authorities amount to RS$670.7 million (approximately $134.2 million). The release notes that Seatrium has also provisionally agreed to continued compliance obligations and cooperation with the authorities.

In a related case, on March 28, 2024, it was announced that the Singapore Public Prosecutor is in DPA-related discussions with Seatrium related to Sembcorp's alleged corruption offenses in Brazil. Under the proposed DPA, Seatrium would be required to pay a penalty of $110 million, though up to $53 million of this total could be credited to the penalties tied to the provisional settlement agreements with the Brazilian authorities.

In another set-back for the Lava Jato prosecutions, on January 31, 2024, a judge of Brazil's Federal Supreme Court paused payments by Novonor S.A. (formerly Odebrecht) related to the company's December 2016 leniency agreement with the Federal Prosecution Ministry (MPF). The judge noted that there was sufficient reasonable doubt to question whether Novonor's decision to sign the leniency agreement was in fact voluntary in light of possible collusion between the prosecution and judges from Lava Jato. The judge also held that Novonor could petition the Office of the Attorney General (AGU) and Office of the Comptroller General (CGU) to reevaluate the terms of a separate leniency agreement with these authorities to correct the alleged judicial wrongdoings and abuses.

In the U.K., on March 6, 2024, after a 12-week trial that began in November 2023, a London jury acquitted Jeffrey Cook, a former Airbus affiliate director and Ministry of Defence (MoD) employee, and former Airbus affiliate executive John Mason, of allegations that they knowingly paid bribes to public officials in Saudi Arabia. The jury did, however, convict Cook for misconduct in public office – specifically for receiving kickbacks of £45,000 and two cars between 2004 and 2008 while working for the MoD. These verdicts potentially represent the final stages of a long-running U.K. Serious Fraud Office (SFO) investigation that included a corporate guilty plea in April 2021 by the former employer of Cook and Mason, GPT Special Project Management Limited (GPT), which paid over £40 million in fines and confiscation.

In other U.K. news, on February 20, 2024, a London jury convicted Romy Andrianarisoa, the former Chief of Staff to the President of Madagascar, of one count of requesting/accepting a bribe under the U.K. Bribery Act (UKBA). Andrianarisoa and a French associate had been accused of soliciting a bribe from U.K.-based mining company Gemfields "in exchange for their help securing an exclusive mining joint venture with the Government of Madagascar." The U.K. National Crime Agency release states that, once the bribe had been solicited, "Gemfields reported concerns about corruption to the NCA, who launched an investigation which made use of surveillance and other covert tactics" that ultimately resulted in the pair's arrest in London in August 2023, and in Andrianarisoa's resulting termination of her official position. Both defendants (the French associate pleaded guilty in September 2023) are scheduled for sentencing on May 10, 2024.

On February 16, 2024, the SFO charged two former senior executives of U.K.-based engineering and construction company Petrofac – Marwan Chedid and George Salibi – with bribery related to their roles in "offering and paying agents over $30 million USD to influence the awarding of contracts [in the United Arab Emirates] worth approximately $3.3 billion USD in Petrofac's favour." According to media reports, both defendants pleaded not guilty and the court set a trial date of October 5, 2026. These charges follow an October 2021 guilty plea by the company under the UKBA.

In Australia, after years of effort, on February 29, 2024, both Houses of the Australian Parliament ratified the Crimes Legislation Amendment (Combatting Foreign Bribery) Bill 2024, which brought the country's legal framework into alignment with international standards (including the Organisation for Economic Cooperation and Development (OECD) Anti-Bribery Convention) and introduced new legal obligations requiring corporations to take proactive steps to prevent bribery by their associates. Separately, on January 30, 2024, the U.S.-Australia Agreement on Access to Electronic Data for the Purpose of Countering Serious Crime entered into force, allowing U.S. and Australian authorities to obtain timely access to electronic data held by service providers in the partner country.

Finally, on January 30, 2024, Transparency International (TI) issued its 2023 Corruption Perceptions Index (CPI), a ranking list that compares the perceived levels of governmental corruption in 180 countries and territories based on a combination of surveys and assessments of businesses and experts in each country. The CPI is a composite index that looks at multiple factors, including government accountability, existence and enforcement of anti-corruption laws, access to government information, and abuse of government ethics and conflict of interest rules. The index scores countries on the level of perceived corruption on a scale of zero to 100, with zero representing the highest level of perceived corruption and 100 representing a hypothetical corruption-free country. The top scoring country (with the lowest perceived corruption) in 2023 was Denmark, with a score of 90; the countries perceived as most corrupt were Somalia (with a score of 11) and South Sudan, Syria, and Venezuela, all of which had scores of 13.

TI's accompanying press release materials painted a grim picture, noting that the 2023 CPI "shows that only 28 of the 180 countries measured by this index have improved their corruption levels over the last twelve years, and 34 countries have significantly worsened." The TI release further states that "corruption levels remain stagnant" despite "progress made across the planet in criminalizing corruption" and that over 80 percent of the world's population lives in countries with CPI scores below the global average of 43." TI also provides commentary highlighting observed trends and corruption issues specific to various regions and countries. The TI CPI rankings and associated data continue to be a touchstone used by many companies for evaluating country corruption risks, though a number of other surveys and databases, such as the Corruption Risk Forecast and World Justice Project (WJP) Rule of Law Index, are also potentially valuable resources.

Miller & Chevalier and 14 Latin American Partner Firms Release 2024 Latin America Corruption Survey

Corruption remains pervasive throughout Latin America despite sustained efforts to criminalize, investigate, and prosecute misconduct, according to new survey data. In fact, corporate compliance – not enforcement – is the key driver for addressing these endemic issues.

The 2024 Latin America Corruption Survey, released today by Miller & Chevalier Chartered and 14 collaborating law firms in Latin America, measures perspectives on how corruption impacts companies' ability to do business in the region. The report, which builds on previous surveys dating back to 2008, reveals that nearly half of all respondents view corruption as a significant obstacle to doing business – and less than a third say the U.S. Foreign Corrupt Practices Act (FCPA) or other anti-corruption laws significantly mitigate corruption risk.

"Having tracked this data for 15 years, the results cannot be more clear – businesspeople working in Latin America consistently perceive significant corruption risk in their operations; this, despite significant efforts over the last 10 years to strengthen local anti-corruption laws," said Matteson Ellis, Miller & Chevalier's Latin America Practice Lead. "Nonetheless, in the absence of consistent enforcement, executives in the region are confronting this pervasive problem. Eighty percent of survey respondents report that their companies are taking action to protect against corruption risk, while 56 percent say that dealing with corruption risk is a top priority for their organizations."

The survey report is available in English, Portuguese, and Spanish.

Corporate Enforcement Actions

SAP SE Settles with DOJ, SEC, and South African Authorities For Alleged Corruption

On January 10, 2024, SAP SE (SAP) announced that it had reached agreements with the DOJ, SEC, and South Africa's National Prosecuting Authority (South Africa NPA) involving corruption-related charges against the company. On that same day, the DOJ and SEC announced their resolutions with the company. SAP is a Germany-based publicly traded global software company with its shares listed on the New York Stock Exchange (NYSE) in the form of American Depositary Receipts (ADRs).

In resolving with the DOJ, SAP entered a three-year DPA in connection with the filing of a criminal information charging the company with two counts of conspiracy – one to violate the FCPA's anti-bribery provision, and one for violating the books and records provision – related to SAP's scheme to bribe South African and Indonesian officials. SAP also accepted a Cease-and-Desist Order (Order) from the SEC for violating the FCPA's anti-bribery, books and records, and internal accounting controls provisions for conduct in numerous countries, as noted below. Accordingly, SAP agreed to pay more than $220 million to resolve matters with the DOJ and SEC, including a criminal penalty of $118.8 million and $103,396,765 in administrative forfeiture. However, the actual amount paid under these agreements is lower. In particular, the DOJ agreed to credit up to $55.1 million of the criminal penalty against any amount that SAP pays to resolve the investigation with the South Africa NPA and will reduce the forfeiture amount based on the disgorgement SAP pays to the SEC or the South Africa NPA for the same conduct. The Order required disgorgement of $85 million plus prejudgment interest of more than $13.4 million, of which the SEC agreed to offset up to $59 million that SAP pays to the South African authorities. As a result of the myriad resolutions in South Africa for approximately $158 million (summarized below), our understanding is that SAP will pay $63,590,859 in criminal penalties under the DOJ DPA and no forfeiture amount, while paying the SEC $26 million in disgorgement and $13 million in prejudgment interest.

On January 11, 2024, the South Africa NPA also announced a resolution with SAP and its South African subsidiary, SAP SA, for the same offenses. The resolution follows the company's voluntary self-disclosure, which ultimately led to the U.S. government investigations. According to the South Africa NPA's resolution, SAP agreed to pay 2.2 billion South African rand (approximately $117,898,000) in restitution to government entities in South Africa, including a repayment of 500 million rand (approximately $26.4 million) to Eskom Holdings Limited (Eskom), one of the entities targeted in the bribery scheme. The SEC resolution notes a subset of the restitution payments, highlighting how SAP entered three prior resolutions with the South African Special Investigating Unit in 2022 and 2023. The three resolutions were related to the improper misconduct concerning the Department of Water and Sanitation (DWS), Transnet, and Eskom, as described in the Order. SAP is also required to pay 750 million South African rand (approximately $40.2 million) to South Africa's Criminal Assets Recovery Account as "punitive reparation payments," which will be credited against the $118.8 million criminal penalty the DOJ imposed. The South Africa NPA resolution also requires SAP to implement both local and international corporate compliance programs to combat future corrupt acts.

As noted, while the DPA focuses on misconduct by SAP and its subsidiaries in South Africa and Indonesia between 2013 and 2018, the Order discusses the bribery schemes in those regions plus misconduct in Malawi, Tanzania, Ghana, and Kenya (referred to as "Greater Africa" in the Order), and Azerbaijan during the relevant period.

Bribery Schemes in South Africa and the Greater Africa Region

The DOJ and SEC resolutions focus on various schemes orchestrated in South Africa and several other African countries (using SAP's entities based in South Africa). The resolutions detail that to secure certain high dollar valued contracts with various government entities in the South Africa and Greater Africa regions, SAP and its subsidiaries paid amounts ranging between 2.2 million South African rand (approximately $155,555) and nine million South African rand (approximately $900,000) to foreign officials through intermediaries. The intermediaries transferred the illicit funds through corporate entities or bank accounts affiliated with the foreign officials. According to the resolutions, SAP entities paid the intermediaries a "sales commission" or "consulting fees" even though the intermediaries did not provide legitimate services commensurate with the fees received. The public documents also indicate that in addition to the cash payments, employees of SAP South Africa paid for certain South African government officials' trips to New York in May and September 2015, including their "meals and golf outings."

The following government entities and its affiliated officials implicated in the South Africa scheme include the City of Johannesburg (CoJ), Department of Water and Sanitation (DWS), City of Tshwane (CoT), and Eskom. Notably, Eskom has been involved in another FCPA-related matter, ABB Ltd. (ABB), upon a finding that a high-ranked employee of Eskom was involved in receiving bribes from ABB subsidiaries. We discuss this more in detail here. For Greater Africa, the Order states that the bribery schemes impacted several government entities: the Tanzania Ports Authority (TPA), Ghana National Petroleum Corporation (GNPC), and the Kenya Revenue Authority.

To conceal the nature of the illicit transactions and receipt of such funds, the involved parties communicated via email and text messages. According to DOJ, in one instance, SAP employees and a director of an involved intermediary stressed the need to destroy all "documents associated with the transaction," and "fabricate an explanation for the payments."

We also note that the South Africa NPA press statement and public reporting in 2023 indicates that Atul, Rajesh, and Ajay Gupta (the Gupta brothers) were heavily involved in the schemes to defraud various entities in the region, including Eskom and Transnet. While the Gupta brothers were arrested in Dubai in 2022, the Dubai authorities subsequently released them, despite an extradition agreement between South Africa and Dubai. Authorities in South Africa claimed they will appeal the Dubai Court of Appeal decision.

Bribery Scheme in Indonesia

Similarly, between 2015 and 2018, SAP Indonesia, together with third party intermediaries, improperly acquired contracts with two Indonesian government entities – BP3TI, an Indonesian state-owned and -controlled telecommunications agency, and KKP, the Indonesian Ministry of Maritime Affairs and Fisheries – by making corrupt payments to officials.

According to the public documents, SAP Indonesia and the intermediaries used "fake training invoices" to generate funds that created slush funds to pay the bribes. In some cases, the sham invoices created "kickback payments," whereas others "paid for customer excursions, and others generated cash payments." In at least one instance, an SAP employee along with the intermediaries coordinated to transfer the bribe payments in cash. Specifically, the employee was told to meet in the lobby of KKP and to "bring an empty envelope," which was understood to be code for bribes to government officials. Additionally, an SAP employee took a BP3TI official and his wife on a trip to the U.S. and purchased luxury items for them such as "handbags, keychains, novelties, gifts, and other items," and a "luxury watch."

Bribery Scheme in Azerbaijan

The Order also details how SAP Azerbaijan obtained a $1,645,703 deal in May 2022 with the State Oil Company of the Republic of Azerbaijan (SOCAR) in exchange for improper gifts valued at approximately $3,000. In addition, an SAP employee created a false "Act of Acceptance" between SOCAR and an SAP Azerbaijan partner, which was reported to the SAP contract booking team on February 4, 2022, in an attempt to receive a commission from the deal. The employee fabricated this document three months prior to the actual deadline to receive a commission because her upcoming promotion with SAP Azerbaijan would have barred her from receiving the commission. SOCAR signed the "real Act of Acceptance" on May 12, 2022.

Across the misconduct discussed herein, the DOJ and SEC both note that the corrupt payments and purchases of luxury gifts by the relevant subsidiaries of SAP were documented in text messages, messaging platforms like WhatsApp, or email. In addition, the SEC specifies that the illicit payments by the relevant SAP subsidiaries were falsely documented in SAP's books and records as legitimate "commissions" to conceal the illicit nature of the transactions.

In describing the internal accounting controls failures, the SEC noted SAP had internal policies and procedures in place – such as conducting due diligence on third parties, requiring documentation of sales commission contracts in writing to "clearly define" all services to be provided therein, and processes for approving internal payments. However, the SEC alleged that the SAP subsidiaries violated the company's internal accounting controls when they or their representatives engaged in the bribery schemes. The SEC also noted that because payments to third parties occurred outside SAP's systems, the company did not retain sufficient records to properly assess the scope of the bribery schemes. Moreover, the SEC notes that SAP did not have the proper internal accounting controls to detect or prevent the bribe payments by the SAP subsidiaries. There was an overall lack of monitoring to ensure these wholly-owned subsidiaries were compliant with the company's internal accounting controls and relevant policies.

Under the DPA, SAP agreed to disclose potential FCPA violations and to report annually on the state of the company's compliance program to the DOJ for three years. Moreover, the company's Chief Executive Officer (CEO) and the Chief Compliance Officer (CCO) signed the agreement, which requires both executives to certify that SAP has met the DOJ's compliance standards upon termination of the DPA.

Key Takeaways

- No Independent Compliance Monitor Based on Compliance Improvements: This resolution reflects SAP's third official involvement with U.S. government authorities, as the company had settled a previous FCPA case in 2016, which we discuss in detail here, and had entered a NPA with the DOJ's National Security Division (NSD) in 2021 for alleged export control and sanctions violations. Despite SAP's history of misconduct, the DOJ determined an independent compliance monitor was unnecessary due to the "state of its compliance program." Notably, the DOJ acknowledged that the company had implemented several actions including, "conducting an analysis of the root causes…and gap analysis" and "undertaking a comprehensive risk assessment focusing on high-risk areas and controls around payment processes and enhancing its regular compliance risk assessment process…." Perhaps more significantly, the DOJ and SEC both highlighted how the company had eliminated its third-party sales commission program globally – a substantial change in business operations that addressed a core issue across the various allegations. In her March 8, 2024 speech noted in the Introduction above, AAG Argentieri also noted that SAP "expanded the data analytics capabilities of its compliance program to over 150 countries, including all high-risk countries globally,…[a] type of decision we saw only rarely 10 years ago." The Order notes various remedial efforts, such as "termination of employees and third parties responsible for the misconduct" and "implementation of analytics to identify and review high-risk transactions and third party controls," among many others.

- Despite Recidivist History, Favorable Reductions in Criminal Penalty Based on Cooperation Efforts: SAP did not receive voluntary disclosure credit as it failed to voluntarily and timely disclose the abovementioned misconduct to the DOJ and SEC (as opposed to the South African authorities). However, the company still received a significant 40 percent reduction in its criminal penalty with the DOJ. According to the DPA, the company "immediately [began] to cooperate after South African investigative reports made public allegations of the South Africa-related misconduct in 2017." The DOJ took into consideration SAP's proactive measures at the preliminary stages of SAP's internal investigation, which included among other things, "translating voluminous foreign language documents [and] imaging the phones of relevant custodians." The imaging of phones allowed proper preservation of the "relevant and highly probative business communications sent on mobile messaging applications," which later assisted the DOJ's investigation. SAP also received cooperation credit for "raising and resolving potential deconfliction issues" that arose between the company's internal investigation and the DOJ's own investigation. The 40 percent reduction reflects one of the largest cooperation-based reductions that the DOJ has provided recently, second only to the award of a 45 percent reduction of a criminal penalty to Albemarle, which we discuss here. The DOJ increased the maximum amount possible from 25 percent to 50 percent in 2023. Moreover, while the DOJ noted that the criminal penalty was increased because of SAP's recidivist history (and the fine was calculated using the 10th percentile in the Sentencing Guidelines range, rather than the low end, as is common), this too was a favorable result in comparison to other recidivist resolutions. For example, in the Gunvor resolution, the DOJ used a much higher starting point in the Sentencing Guideline range (the 30th percentile) due to other factors, as discussed below.

- Incentive under DOJ's Clawbacks Pilot Program (Pilot Program): The DPA specifies that SAP "withheld bonuses totaling $109,141" from key employees who were affiliated with the bribery scheme and "engaged in substantial litigation to defend its withholding from those employees." As a result, the DOJ reduced SAP's criminal penalty by $109,141 under the DOJ's Pilot Program. This highlights an incentive for corporate entities with respect to the DOJ's Pilot Program, though there is no public information related to the extent of SAP's legal and other costs incurred with regard to this "substantial litigation."

- U.S.-South Africa Cross-Border Cooperation: According to the DOJ, "[t]his successful resolution against SAP is another example of the power of relationships and persistence. The sustained diligence by the prosecution team and continuous collaboration with South African law enforcement, regulators and prosecutors identified corrupt activity in multiple countries." This resolution marks the DOJ's second coordinated resolution with authorities in South Africa, following their December 2022 resolution with ABB Ltd. The DOJ has also recently established the International Corporate Anti-Bribery Initiative (ICAB), as discussed in our FCPA Winter Review 2024, an effort to deepen relationships with prosecutors around the globe. It is possible that the U.S.-South Africa enforcement relationship may grow even stronger, if U.S. prosecutors are dedicated to working with South African prosecutors under this initiative.

Gunvor Reaches Resolution with U.S. and Swiss Authorities for Misconduct in Ecuador

On March 1, 2024, Swiss international commodities trading company Gunvor S.A. (Gunvor) pleaded guilty to a one-count criminal information charging Gunvor with conspiracy to violate the FCPA and entered into a plea agreement with the DOJ. The resolution related to misconduct by Gunvor to obtain business with Ecuador's state-owned oil company, Empresa Publica de Hidrocarburos del Ecuador (Petroecuador). The U.S. District Court for the Eastern District of New York (EDNY) sentenced Gunvor to pay a criminal fine of $374,560,071 and to forfeit $287,138,444. The DOJ required Gunvor to pay 50 percent of the criminal fine ($187,280,036) within 10 days of the judgment and agreed to credit the remaining amount (up to 25 percent of the criminal fine or $93,640,017 each) for amounts that Gunvor pays to the Swiss and Ecuadorian authorities within one year of the judgment. Also on March 1, the Office of the Attorney General of Switzerland announced a parallel resolution with Gunvor, requiring the company to pay the Swiss authorities $98 million. Meanwhile, the Ecuadorian Attorney General noted – also on March 1, 2024 – in a press release that they have an ongoing case, the Alianza case, against Gunvor and other related individuals, which has not yet been resolved. Thus, the total amount paid to the U.S. authorities will be $474,414,480, assuming there is a resolution in Ecuador that exceeds $98 million. In addition to coordinating with Ecuador and Switzerland, we note that the DOJ thanked authorities in the Cayman Islands, Colombia, Panama, Portugal, and Singapore for their assistance in the matter.

According to the resolution's public documents, between 2012 to 2020, personnel associated with Gunvor paid bribes totaling approximately $97 million to Ecuadorian officials in order to obtain business with Petroecuador. The scheme involved a program where state-owned entities from outside of Ecuador provided loans to Petroecuador in exchange for oil, which the state-owned entities could then market and sell (referred to as "oil-backed loans" in the plea agreement). According to the guilty plea, Petroecuador could enter into transactions with fellow state-owned entities without following processes for competitive bids. In turn, Gunvor, acting through three employees (Raymond Kohut and two unnamed "Managers"), conspired with two agents (and brothers) – Antonio Pere Ycaza (Antonio Pere) and Enrique Pere Ycaza (Enrique Pere) – to secure business between Petroecuador and two state-owned entities based in Asia (referred to as "State-Owned Entity #1" and "State-Owned Entity #2" in the plea agreement and which press accounts indicate may have been Chinese and Thai entities). Thus, Gunvor would enter into separate agreements with the state-owned entities to "pre-finance" their loans to Petroecuador and then used "back-to-back" agreements to market and sell the oil products. As a result of this scheme, Gunvor avoided Petroecuador's competitive bidding process and earned $384 million in profits, according to the DOJ.

The criminal information states that, in order to secure the business and obtain confidential information about Petroecuador, Kohut and the Gunvor Managers transferred funds to the two agents through false service agreements, with the knowledge that at least some of the funds would be used to bribe at least five Ecuadorian officials, including Nelson Arias Sandoval (Arias), a senior manager at Petroecuador. Specifically, the Pere brothers are alleged to have set up two shell companies (OIC and EIC) that entered into service agreements with Gunvor, created fake invoices, and created email accounts. The information notes that the service agreements "provided for certain pre-payments and success fees, but the bulk of the compensation was through per-barrel 'volume fee' payments…that depended on the amount of oil purchased by [the state-owned entities] in connection with the oil-backed loan contract." The Pere brothers then shared some of the "volume fees" with Arias and other Petroecuador officials, either directly or indirectly.

The case documents note that, in order to conceal the scheme, the Gunvor personnel and the agents used aliases, "personal and pseudonymous" email accounts, and "mobile messaging applications" (including WhatsApp). These personnel also made efforts to "avoid speaking about bribery" and "avoid explicit mention[s] of bribery."

The plea agreement and criminal information state that, "[b]etween in or about May 2018 and in or about May 2020, Gunvor executives and compliance personnel made requests to [the Pere brothers] (i) for supporting documentation to justify the commission payments [under the services agreements] and (ii) to meet with executives and compliance personnel." However, the Pere brothers "failed repeatedly to provide complete responses to Gunvor's documentary requests and would not travel to Gunvor's headquarters for the requested meeting." "Notwithstanding these repeated failures," Gunvor continued to make payments to the Pere brothers until January 2020, ultimately terminating the last services agreement in May 2020. Notably, these payments continued even while Gunvor concluded a separate resolution with the OAG in 2019 for different conduct, as noted below.

The plea agreement notes that Gunvor did not receive voluntary disclosure credit as it failed to voluntarily and timely disclose the conduct. However, Gunvor did receive cooperation credit due to its acceptance of responsibility and other increasingly-standard cooperation measures (for example, "producing documents…from multiple foreign countries expeditiously while navigating foreign data privacy and criminal laws" (which may have included Chinese and Thailand laws), factual presentations to the DOJ, "arranging for the interview of an employee based outside of the [U.S.]," production of financial information and forensic firm analysis, and – notably, given the recent emphasis on ephemeral messaging – imaging phones of relevant custodians "at the beginning of" Gunvor's internal investigation"). Gunvor also provided the DOJ with "all non-privileged facts" related to the individuals involved in the conduct. The plea agreement also highlights "timely and appropriate" remedial measures, including by "engaging resources to review the Company' s compliance program and test the effectiveness of the Company's overall reporting process, its reporting hotline and the effectiveness of the investigation of reports made through the hotline" and "developing and implementing a risk-based business communications policy that addresses the use of ephemeral and encrypted messaging applications."

Among other obligations in the plea agreement, Gunvor agreed to continue cooperating with the DOJ until the end of any investigation or the three-year term (whichever is later), and to cooperate with any foreign authority at the DOJ's request for the three-year term. Gunvor also agreed to report — in accordance with Attachment D of the plea agreement — to the DOJ and MLARS annually during the term regarding the "remediation and mediation of the compliance measures described in Attachment C" of the plea agreement. Finally, Gunvor agreed to report any evidence or allegation of a violation of the FCPA, and consistent with recent DOJ requirements, Gunvor's Chairman of its Board of Director and its CFO must certify at the end of the three-year term that they have met these disclosure obligations.

Key Takeaways

- Effect of Gunvor's Prior Misconduct. Gunvor's prior history of corruption and controls issues, which were not previously the subject of a U.S. enforcement action, was a key factor in the DOJ's decision to charge Gunvor and require the company to enter a guilty plea. During the period in which the misconduct was occurring in Ecuador, Gunvor reached a resolution with the Swiss authorities in 2019 for a bribery scheme in Republic of Congo and Ivory Coast between 2009 and 2012. According to the plea agreement, Gunvor admitted in the Swiss resolution that it "lacked sufficient controls" and did not take "reasonable organizational measures" to prevent the misconduct. The DOJ notes that they took into account this prior history in deciding on the fine, and the DOJ also set the fine at the 30th percentile in the range of fines set by the U.S. Sentencing Guidelines (rather than using the low-end of the range, which is common). In a speech after the resolution, AAG Argentieri stated that Gunvor paid a higher fine based on its prior misconduct.

- Individuals Convicted for Their Involvement in the Scheme. Gunvor's plea agreement represents another step in a four-year effort by the DOJ to prosecute the conduct at issue, with four individuals involved in the Gunvor-related scheme having already been convicted for their role in the conduct. The Pere brothers each pleaded guilty in October 2020 to one count of conspiracy to violate the FCPA and one count of conspiracy to commit money laundering. Discussed further below, the Pere brothers were also involved in the conduct at issue in Vitol's DPA. As detailed in our Summer 2021 issue of Money Laundering Enforcement Trends, Raymond Kohut pled guilty to one count of conspiracy to commit money laundering for his role, and he remains the sole Gunvor employee facing charges to date. The plea agreement notes that two other Gunvor executives involved have been residents of Switzerland, but as of the time of publishing there is no public information as to indictments of the executives. Finally, per the DOJ press release, former Petroecuador official Arias pleaded guilty to one count of conspiracy to commit money laundering in January 2022. Several other Petroecuador officials remained unnamed in the plea agreement, but the Ecuadorian Attorney General's press release indicates that the Alianza case is targeting "several former Petroecuador officials" and Gunvor. In November 2022, seven individuals (five of whom were government officials) were arrested for their role in the bribery scheme related to Arias. In September 2023, the Swiss authorities published a press release stating that they had indicted an unnamed former Gunvor employee for the misconduct at issue in the 2019 resolution — related to the Republic of Congo — with the Swiss Attorney General.

- Emphasis on Personal and Encrypted Means of Communication. The plea agreement demonstrates the DOJ's continuing focus on how companies are managing employee's use of personal and encrypted means of communication, and the DOJ's emphasis on providing access to such data when evaluating companies' cooperation in investigations. The use of such communication modes in many potentially illegal activities and the DOJ's expectations around the retention of these messages highlight the importance of prompt data collection during internal investigations. The plea agreement details how the co-conspirators used personal or alias email accounts and WhatsApp to communicate about the scheme in order to avoid detection. As noted above, the DOJ credits Gunvor for its "imaging of the phones of relevant custodians at the beginning of the Defendant's internal investigation, thus preserving business communications sent on mobile messaging applications" (emphasis added). The DOJ also highlights the remediation efforts that Gunvor has taken to implement a policy to manage such forms of communication in the future – a topic also discussed in the DOJ's 2023 Guidelines on the evaluation of compliance programs.

Trafigura Pleads Guilty to Foreign Bribery Scheme

On March 28, 2024, Trafigura Beheer B.V. (Trafigura), a Swiss commodities trading company registered in the Netherlands, pleaded guilty to a December 13, 2023 criminal information charging the company with one count of conspiracy to violate the FCPA's anti-bribery provisions. Pursuant to the plea agreement, Trafigura has agreed to a criminal fine of approximately $80.5 million and forfeiture of approximately $46.5 million, although Trafigura will pay only two-thirds of the criminal fine ($53.7 million) now, and the DOJ agreed to credit up to approximately $26.8 million of any future fine Trafigura will pay in connection with an open criminal investigation in Brazil stemming from related conduct. Thus, barring surprises in the Brazil investigation, Trafigura will pay a net amount of $100.2 million to the U.S. Treasury under the guilty plea.

According to the plea agreement – signed by Trafigura’s CEO and both Co-General Counsels – between approximately 2003 and 2014, Trafigura personnel and agents knowingly and willfully conspired with middlemen and foreign officials to secure and retain improper business advantages in contracts with Petrobras, the state-owned Brazilian oil company. According to the agreement, Trafigura and its co-conspirators made corrupt payments to Brazilian officials to secure these advantages and to unjustly enrich themselves. The total amount of "corrupt commissions" paid was approximately $19.7 million, a portion of which was used for improper payments to officials. And although Trafigura is a Dutch entity with the company's headquarters in Switzerland, the improper payments were coordinated and planned – at least in part – during meetings held in the U.S., and various payments were made through U.S. banking institutions. Based on this background and other facts, the DOJ asserted jurisdiction for the matter under 15 USC 78dd-3.

Origin of the Scheme

According to the plea agreement, in or about 2003, Co-Conspirator 1, who at that time worked for a Petrobras subsidiary in Houston, Texas, informed Trafigura Executive 2 that Trafigura would need to pay bribes to Co-Conspirator 1 if Trafigura wanted to obtain business in the Caribbean market. News sources suggest that Trafigura Executive 2 is Mariano Marcondes Ferraz, a former Trafigura management board member who was convicted in 2018 of related corruption charges in Brazil. Trafigura Executive 2 then agreed to pay approximately 5 to 10 cents per barrel of oil bought from or sold to Petrobras. Between approximately 2003 and 2008, Trafigura Executive 2 paid Co-Conspirator 1 about $500,000 in bribe payments, which were described as "commissions" in their communications. During this time, Trafigura Executive 2 also paid bribes to another Petrobras employee (Brazilian Official 1) based on agreed-upon prices for oil trades and corresponding bribe payment amounts. Furthermore, Trafigura Executive 2 directed Co-Conspirator 1 to deliver bribe payments on behalf of Trafigura to additional Petrobras officials in cash. In addition to wire transfers, Trafigura Executive 2 used "doleiros" – or exchangers working in Brazilian "illicit-market" money exchange – to generate cash for the bribe payments. After the completion of the trades, cash deliveries would take place at meetings in Brazil.

Second Phase of the Scheme

The plea agreement states that, in 2009, Trafigura Executive 2 – after leaving Brazil and moving to Europe – had become the CEO of a "Trafigura-affiliated joint venture in Singapore," and Co-Conspirator 1 "left Petrobras and begin working as an agent for Trafigura in Brazil," becoming an employee of Trafigura in 2010. At that time, there was another personnel change at Petrobras, with Brazilian Official 2 replacing Brazilian Official 1. Brazilian Official 2 "told Trafigura Executive 2 that Trafigura would have to pay a bribe on every deal," and Trafigura Executive 2 "agreed to pay up to 20 cents for each barrel of oil products" that Trafigura bought from or sold to Petrobras.

According to the plea agreement, Co-Conspirator 1 made bribe payments to Brazilian Official 2 on Trafigura's behalf at the request of Trafigura Executive 2. The parties also agreed to conceal the bribe payments by orchestrating them through various shell companies or through another agent (Co-Conspirator 3). Co-Conspirator 1 would ultimately procure cash in Brazil from these transactions and pay bribes using the cash. The plea documents note that, around this time, Co-Conspirator 1 also began paying bribes to Rodrigo Berkowitz, a Petrobras fuel oil trader based in Houston and Rio de Janeiro, in cash, through one of Berkowitz's relatives. Berkowitz would then pick up the payments in Brazil. Co-Conspirator 1 and Berkowitz also met in Houston to discuss bribe payments "on numerous occasions."

New Petrobras Officials Included in 2011

Additionally, starting in or around 2011, Brazilian Officials 3 and 4 "came into positions of influence at Petrobras." According to the guilty plea, in October 2011, Co-Conspirator 1 met with Berkowitz and Brazilian Officials 3 and 4 in Miami Beach where they agreed to continue the bribe payments on a per-barrel rate. After this meeting, Trafigura Executive 2 sent an email regarding an agency agreement with Co-Conspirator 2, saying that Trafigura Executive 1, who press reports speculate is late Trafigura founder and former CEO Claude Dauphin, and other Trafigura employees had given their approval.

The guilty plea also states that in 2012, Trafigura Executives 1 and 2 "caused Trafigura Singapore" to enter into an agreement with Co-Conspirator 2 for commissions that would be shared in part with foreign officials. Co-Conspirator 2 signed invoices addressed to Trafigura Singapore for purported consultancy services, including one transaction for $500,000. Various people – including a Petrobras official – shared spreadsheets showing commission amounts owed to different persons. In total, Trafigura Singapore paid more than $1.63 million in commissions to Co-Conspirator 2. Co-Conspirator 2 worked with Co-Conspirator 3 to move the funds in Brazil. The payment chain included moving Euro-denominated amounts through financial institutions in the U.S., even though some of the payments were directed to a Hong Kong bank account in the name of a Chinese company associated with Co-Conspirator 3. For example, on or about February 10, 2014, Co-Conspirator 3 sent Co-Conspirator 2 a $390,240 invoice from a Hong Kong company for purported consulting services for prospecting "floor and wall tiles" in Brazil. On February 12, 2014, Trafigura Singapore paid approximately $390,240 (in Euros) to Co-Conspirator 2 on behalf of Trafigura. On February 17, Co-Conspirator 2 transferred $390,240 from a Hong Kong bank account for the Hong Kong consulting company through a financial institution in the U.S. for eventual benefit of Petrobras officials.

Criminal Fine and Forfeiture

The guilty plea and the DOJ's press release on this matter noted that Trafigura obtained over $61 million in profits from the scheme. The DOJ used this number to calculate the criminal fine, using a Sentencing Guideline range of $85,172,530 (min) to $170,345,061 (max) after multiplying the profits by different factors. The DOJ next calculated the fine using the fifth percentile above the lower limit, based on Trafigura's prior misconduct (in other words, increasing the fine from the low end of the range to the 5th percentile). Specifically, regarding prior misconduct, the guilty plea notes a guilty plea for Trafigura Aktiengesellschaft in 2006 for violating a U.S. customs law, 18 U.S.C. §542, or entry of goods by means of false statements (while also noting that it was many years ago) as well as Trafigura's conviction for violating Dutch export and environmental laws in 2010 related to petroleum discharge in Côte D'Ivoire.

In calculating the fine, the DOJ then provided Trafigura with limited credit for cooperation and acceptance of responsibility, at 10 percent, setting the fine at $80.5 million. The guilty plea notes that Trafigura did not voluntarily disclose the conduct at issue, and we summarize the key reasons for the relatively low cooperation credit below. However, DOJ did credit Trafigura's cooperation and remediation, citing numerous categories of such efforts, including "producing relevant nonprivileged documents and data to the government, including documents located outside the United States in ways that navigated foreign data privacy laws" and "proactively discontinuing the use of third-party agents for business origination."

While the DOJ calculated the criminal fine using profits of approximately $61 million, the DOJ and Trafigura agreed to the forfeiture of criminally-derived proceeds at approximately $46.5 million, without providing any detail regarding how the amount was established.

Other Compliance-Related Commitments

The guilty plea states that Trafigura has a compliance and ethics program that meets the minimal elements set forth in Attachment C to the guilty plea, and that the company will continue to implement the program. Trafigura also agreed to self-reporting requirements for the three-year term in accordance with Attachment D to the guilty plea. The agreement also contains two certifications to be used at the term of the agreement, which are now standard in such resolutions – Attachment E, affirming that Trafigura has disclosed all information regarding potential FCPA violations (to be signed by the CEO and CFO); and Attachment F, certifying that the compliance program meets the standards set under Attachment C (to be signed by the CEO and the CCO).

Judicial Review of Guilty Plea

The DOJ filed the Information against Trafigura on December 11, 2023, and a hearing was scheduled for December 22, 2023. In a forfeiture memo prior to the hearing, the DOJ stated that Trafigura intended to plead guilty at the hearing. Instead, based on information currently available in the docket, it appears that Judge Kathleen Williams requested additional briefing on aspects of the proposed agreement, including the level of court supervision over Trafigura's compliance obligations. In January, the DOJ and Trafigura submitted letters to the court, with the DOJ asserting that similar "plea agreements … have been reviewed and approved by this Court [the Southern District of Florida] and numerous others throughout the country for corporate pleas." The DOJ noted that "each of these plea agreements imposed contractual obligations on the defendant, requiring, among other things, compliance program improvements, and did not provide for the Court's continuing jurisdiction." The DOJ thus stated that the court "should not refrain from approving the Guilty Plea due to the additional contractual obligations contained in the Plea" and that the DOJ "has tools at its discretion to ensure compliance with the Plea Agreement." Trafigura made similar points, while also explaining the process and findings for why "the Government determined that it was unnecessary to require independent oversight of [Trafigura's] efforts to fulfill its compliance obligations" and that "modifying the structure of the Plea Agreement would not reflect the parties' intent." Transcripts for the December 22 hearing that discuss this determination were not available at the time of this publication. As noted, the guilty plea was subsequently accepted by the court on March 28, 2024.

Related Enforcement Actions Involving Trafigura

As we discussed in our FCPA Winter Review 2024, the Swiss Office of the Attorney General filed an indictment in its Federal Criminal Court on December 5, 2023 against Trafigura and three individuals related to a Trafigura bribery scheme in Angola. According to a Trafigura press release, the company is currently involved in an ongoing civil case in Brazil, and the DOJ guilty plea suggests forthcoming criminal resolutions there as well. In December 2023, the company acknowledged that the international investigations "stem in part from statements made by Mariano Marcondes Ferraz… as a part of a plea agreement" related to his corruption conviction in Brazil.

Key Takeaways

- DOJ Press Release Regarding Commodity Trading Firms: Following the announcement of this plea agreement, the DOJ issued a press release on the same day (March 28) highlighting that the DOJ's "investigation" (singular) into international commodities trading schemes has resulted in six corporate resolutions and the convictions of 20 individuals (including "six government officials, eight corrupt intermediaries, and five trading company employees" in addition to ex-Vitol trader Javier Aguilar, whose conviction is covered below). In addition to the resolution for Trafigura, we have covered the resolution in this quarter for Gunvor and in prior FCPA Reviews for Sargent Marine, Vitol, Glencore, and Freepoint. The DOJ also noted that the aggregate fines, forfeitures, and other penalties from the combined investigation exceed $1.7 billion. We noted in previous FCPA Reviews that Rodrigo Berkowitz, the Petrobras official named in the Trafigura guilty plea, also featured in the December 14, 2023 Freepoint DPA and the August 29, 2023 superseding indictment against the Oztemel brothers and Eduardo Innecco, for their conduct related to Freepoint. Moreover, Berkowitz was also tied to the Vitol bribery case resolved in 2020. Vitol's arrangement in Ecuador was facilitated by the Pere brothers (who were unnamed in the Vitol DPA at the time) and involved a similar scheme as the oil-backed loans used by Gunvor. This DOJ press release suggests an industry sweep, but does not use that term, and is consistent with AAG Argentieri's March 8, 2024 speech, discussed in the Introduction, that asserts the DOJ is "bring[ing] impactful cases across a range of industries" including "the energy trading business." AAG Argentieri also noted in that speech that the relevant "schemes were strikingly similar."