FCPA Winter Review 2024

International Alert

Introduction: Year in Review

2023 Year in Review

The headline for 2023 was policy changes, not necessarily enforcement. There was a relatively steady stream of enforcement actions against corporations and – for the U.S. Department of Justice (DOJ) at least – individuals, but there was no flood of enforcement actions, as perhaps some public remarks by DOJ officials suggested might happen. Moreover, while the various corporate resolutions were significant in various ways, there have been no blockbuster headlines for Foreign Corrupt Practices Act (FCPA) matters (in comparison to the $4 billion resolution with Binance related to charges of money laundering and sanctions violations in November, for example), and as discussed below, the list of top 10 resolutions remains unchanged for the second time in three years.

Before we dicuss policy and enforcement updates, we note that 2023 had significant legislative updates relevant to U.S. anti-corruption enforcement efforts, with the passage of the 2024 National Defense Authorization Act (NDAA) and the Foreign Extortion Prevention Act (FEPA), which now makes it illegal under U.S. law for foreign officials, as well as their family members or close associates, to solicit or receive bribes from persons or entities subject to the FCPA, assuming jurisdictional requirements are met. Congress also mandated important policy and reporting requirements in the NDAA, which are often overlooked, given the attention to the FEPA. We detailed the highlights of the legislative efforts in this alert.

DOJ Policy Revisions

On the policy front, we saw a continued effort to incentivize companies to follow what the DOJ has referred to as the "virtuous cycle" – identify issues, disclose those issues in a "timely" manner, fully cooperate with any investigation (in part by identifying all individuals who could be responsible), and fully remediate the issues. In these instances, the DOJ is willing to bestow a declination with disgorgement, as it did in 2023 with Corsa Coal in March and Lifecore Biomedical, Inc. (Lifecore) in November.

We have discussed the various policy initiatives in prior reviews or alerts, but below is a summary timeline, starting back at the end of 2022:

- September 15, 2022: Memorandum by DOJ Deputy Attorney General Lisa Monaco (the Monaco Memo). We discussed the Monaco Memo in this alert. The memorandum sets forth new guidance on holding individuals responsible, further guidance on credit for voluntary disclosure and corporate, new guidance for handling issues arising with recidivists (corporate entities with prior enforcement history), and how to evaluate compliance programs.

- January 17, 2023: Revisions to the DOJ's Corporate Enforcement and Voluntary Disclosure Policy. These revisions implemented many of the policy shifts in the Monaco Memo at the DOJ's Criminal Division. These revisions are discussed in this alert. Importantly, the revisions applied the existing FCPA Corporate Enforcement Policy to the entire Criminal Division, which was in line with actual practice for many years. The updated policy provides incentives in various forms, by increasing the range of possible reductions from criminal fines under the U.S. Sentencing Guideline ranges and by allowing some benefits and privileges for disclosures even if aggravating circumstances are present or the company disclosing the issue is a recidivist. This policy has led to still-ongoing discussions of when disclosures are done "immediately" and when cooperation is "extraordinary," although these standards are specific to disclosures of issues that involve aggravating circumstances.

- March 2-3, 2023: New Policies on Compensation Incentives and Clawbacks, Evaluation of Corporate Compliance Programs, and Selections of Monitors. During the ABA's annual White Collar National Institute in Miami, the DOJ announced three important policy updates:

- A three-year "Compensation Incentives and Clawbacks Pilot Program" that went into effect on March 15, 2023 (Clawbacks Pilot Program)

- Updated guidance on the "Evaluation of Corporate Compliance Programs" (Compliance Evaluation Guidance)

- A "Revised Memorandum on Selection of Monitors in Criminal Division Matters" (Monitor Memorandum)

- August 2023 and Afterward: Corporate Resolutions by DOJ Include Revisions to Attachment C on Minimal Elements for an Effective Compliance Program. In the corporate resolutions in the second half of 2023, the DOJ included significant revisions to the deferred prosecution agreements' (DPA) Attachment C, which sets forth minimum elements that a company subject to a DPA or guilty plea usually must satisfy to exit a monitorship or self-reporting period. In essence, the DOJ reprioritized certain actions (such as risk assessments) and significantly raised expectations in the areas of company culture, third party management, mergers and acquisitions (M&A) integration, and more, both by adding new paragraphs as well as a new section for an 11th hallmark. While these obligations are specific to the companies subject to the resolution, they reflect the DOJ's current thinking on compliance best practices and are a useful tool for companies to use in self-evaluation. We discussed the topic in more detail in this alert and this LinkedIn Live event.

- October 4, 2023: DAG Monaco Announcement of New M&A Safe Harbor Policy. On October 4, DAG Monaco delivered a speech at the Society of Corporate Compliance and Ethics' 22nd Annual Compliance & Ethics Institute and announced a new M&A Safe Harbor Policy (Safe Harbor Policy) to promote voluntary self-disclosure to the DOJ of misconduct discovered in the course of pre- and post-acquisition due diligence. We cover the policy in this alert. Like the Corporate Enforcement Policy, which used to be FCPA-specific but now applies to the entire Criminal Division, this new policy – which is similar to the pre-existing FCPA-related guidance– is intended to apply "Department-wide," with each part of the DOJ tailoring the policy as needed. Most importantly, the policy set targets of disclosure of misconduct within six months of closing a transaction and remediating any misconduct within one year of closing. The DOJ provides some flexibility on the deadlines based on specific facts (which will be an ongoing issue to monitor), and also makes clear that companies should not rely on these timelines when national security issues are involved – in other words, disclosures should happen more quickly if national security elements present, if companies hope for a favorable response.

- November 29, 2023: Announcement of International Corporate Anti-Bribery Initiative (ICAB). While not quite a policy, the DOJ announced an effort to facilitate cooperation with authorities in other jurisdictions where historically the DOJ has not had significant signs of cooperation. In 2023, the DOJ coordinated resolutions for the first time with authorities in South Africa and Colombia, for example, but the DOJ did not specify what markets may of particular interest for the DOJ. The ICAB will be driven through the efforts of three DOJ prosecutors and acting AAG Nicole M. Argentieri stated that the DOJ will "start by focusing on regions where we can have the most impact in both coordination and case generation, with a focus on key threats to financial markets and the rule of law."

In addition to the hot topics mentioned above, it is also worth noting that data and analytics played a prominent role across DOJ policy announcements, with the DOJ emphasizing that they are using data analytics to identify and pursue cases (including sector and industry sweeps), and that companies should be doing the same to assess risks and identify any wrongdoing. As a related theme, the DOJ in various venues has also emphasized the importance of companies having a single enterprise resource planning (ERP) platform, to the extent practicable, especially after M&A transactions (without recognizing explicitly how difficult this goal is likely to be in many instances).

And while not quite policies, especially because neither included much groundbreaking analysis, we note that the DOJ did issue two Opinion Procedure Releases (OPRs) in 2023, both involving entertainment and travel topics.

The U.S. Securities and Exchange Commission (SEC) did not make any formal policy announcements, but continued to rely on the Seaboard Report from 2001 as well as the FCPA Resource Guide, which was issued by both the DOJ and the SEC.

Corporate Enforcement Actions

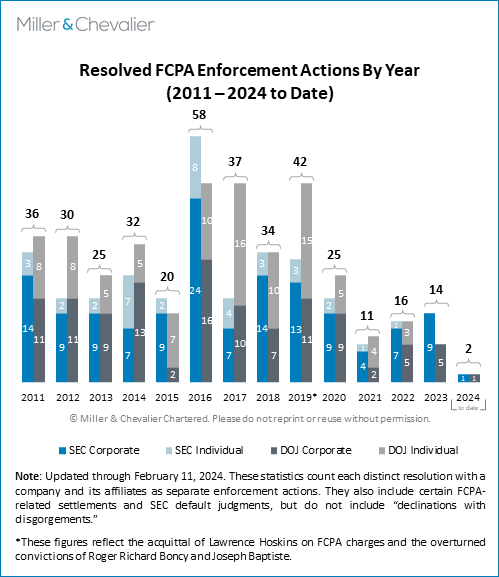

As noted, the DOJ and SEC both had levels of enforcement activity involving corporations that was on par with recent years, but well below activity levels from earlier eras. As shown below, the DOJ had five corporate enforcement actions, while the SEC had nine, for a total of 14, which is slightly below the 2022 combined total and above the 2021 combined total.

Those totals combine corporate and individual enforcement. On the corporate total alone, there were 14 resolutions in 2023, versus 12 in 2022, six in 2021 and 18 in 2020. As some commentators point out, these totals sometimes double-count investigations (for example, one company has a set of facts that led to parallel resolutions with the DOJ and SEC). The 2023 corporate total is remarkable in that there were very few parallel DOJ/SEC resolutions – making the total even more respectable, as it represented the resolution of 13 separate investigations.

| Company Name | Agencies | Date | Countries | Total Resolution Amount |

|---|---|---|---|---|

| Rio Tinto | SEC only | 3/6/2023 | Guinea | $15 million |

| Flutter Entertainment | SEC only | 3/6/2023 | Russia | $4 million |

| Frank's International | SEC only | 4/26/2023 | Angola | Almost $8 million |

| Philips | SEC only | 5/11/2023 | China | $62 million |

| Gartner | SEC only | 5/26/2023 | South Africa | Less than $3 million |

| Corficolombiana (and Grupo Aval for SEC) | DOJ and SEC | 8/10/2023 | Colombia | Over $60 million |

| 3M | SEC only | 8/25/2023 | China | $6.5 million |

| Albemarle | DOJ and SEC | 9/28-29/2023 | Vietnam, Indonesia, India for the DOJ; also China and the United Arab Emirates for SEC | $218.5 million |

| Clear Channel Outdoors | SEC only | 9/28/2023 | China | More than $26 million |

| Tysers | DOJ only | 11/20/2023 | Ecuador | More than $46 million |

| H.W. Wood | DOJ only | 11/20/2023 | Ecuador | $500k (reduced from almost $25 million) |

| Freepoint | DOJ and CFTC | 12/15/2023 | Brazil | More than $90 million (but subject to further offsets) |

The DOJ also issued two declinations with disgorgement, with the first for Corsa Coal in March and the second for Lifecore in November. Both have been touted by the DOJ as examples of how the DOJ is willing to avoid prosecution (or related agreements) for companies that act responsibly once misconduct is identified. The list above includes seven SEC-only resolutions, indicating that the DOJ decided not to take action with respect to those investigations, as well. These investigation closures fall into the bucket of traditional declinations pursuant to prosecutorial discretion, with no public resolution of any kind. We also note that on March 21, 2023, Ericsson pleaded guilty to the facts set forth in its DPA with the DOJ from 2019, following notices from the DOJ in 2021 and 2022 that Ericsson had breached its obligations under the DPA (Miller & Chevalier acted as co-counsel to Ericsson in this matter). Ericsson paid an additional fine of approximately $207 million as part of the plea agreement. Ericsson's plea was one of several resolutions in the last few years arising out of DOJ breach declarations in DPAs and non-prosecution agreements (NPAs) related to FCPA, money laundering, sanctions, fraud, and tax issues.

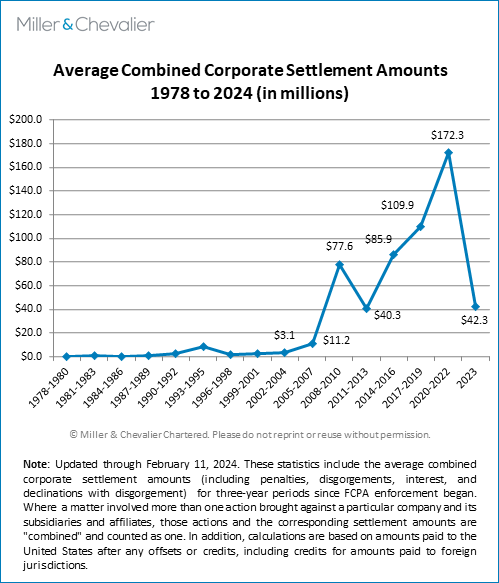

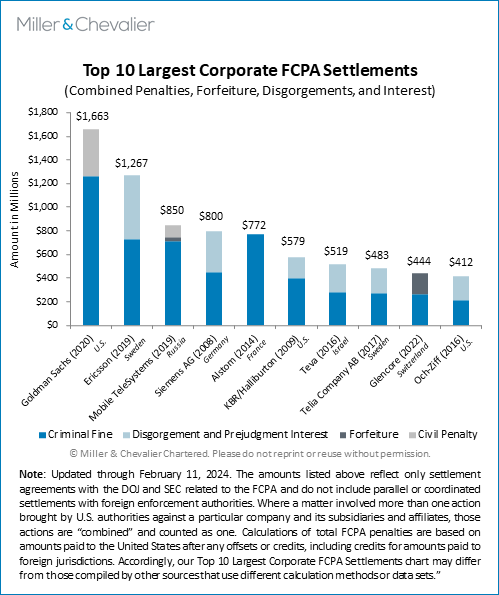

There are a few noteworthy takeaways from this list of 2023 enforcement actions. First, there has been a significant downward shift in the size of enforcement actions for the year. The largest resolution, Albemarle's NPA (on which Miller & Chevalier advised the company as co-counsel), was just north of $200 million, and the remainder included seven resolutions under $50 million and four resolutions under $10 million (although admittedly one – H.W. Wood – would have been higher except for the inability-to-pay analysis). Those statistics put the largest case at around half of the level needed to crack the top 10 FCPA settlements; that case also is only 28 percent of the size of the fifth largest case (Alstom) – see the chart below.

Overall, whereas the size of enforcement actions increased rapidly from $40.3 million in the period of 2011-2013 to $172.3 million for the period 2020-2022, the average for 2023 declined significantly to $42.3 million. That is one year of data alone versus a three-year period, and the figure may increase by the end of the current three-year period; indeed, the DOJ and SEC have already in 2024 concluded a large resolution north of $200 million with SAP SE (SAP). It is also worth noting that the high average for the 2020-2022 period is driven largely by the $1.6 billion Goldman Sachs resolution in 2020. That said, the data shows at least a short-term downward trend regardless of how the most recent periods are defined.

Because the year did not include any behemoth resolutions as measured through fines, penalties, and disgorgement, the list of top 10 enforcement actions has not changed. We include the chart below to show that the list remains intact and that it has remained largely intact since 2020, with only Glencore added, in the ninth spot, in May 2022. This data point may be contributing to the common perception that, although there were a steady number of resolutions in 2023, enforcement is down.

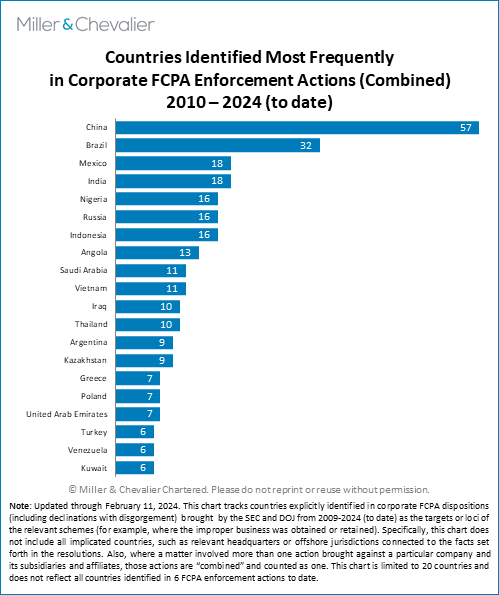

Consistent with prior years, companies doing business in China accounted for a proportionally large percentage of the enforcement actions. Brazil, historically the second largest market involved in enforcement actions, accounted for only one action in 2023, which perhaps correlates to the changing enforcement environment within Brazil. There were new enforcement actions involving other markets with high levels of enforcement actions (in order from the chart below, India, Russia, Indonesia, Angola, Vietnam, and the United Arab Emirates). There were also a number of enforcement actions from across sub-Saharan Africa (Guinea, South Africa) and the Andean region of Latin America (Ecuador, Colombia). With the recent actions, Ecuador enters the top 20 list for the period from 2010-2024 (although not in the chart, along with Egypt, both of which have six enforcement actions).

We also note that there were no monitorships imposed in 2023, although the DOJ now appears to require self-reporting as a usual term for corporate resolutions. Relatedly, the DOJ has continued to include an attachment to various resolutions that requires chief executive officers (CEOs) and chief compliance officers (CCOs) to certify as to the implementation of a resolving company's compliance program at the conclusion of a DPA or similar agreement.

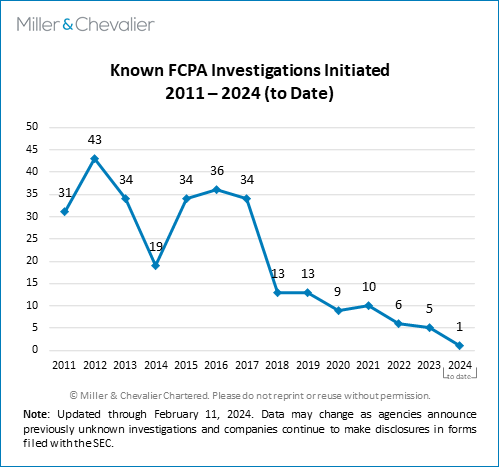

Looking forward, the DOJ continues to assert publicly that there is a robust pipeline of cases, and the DOJ and SEC have already started the year with sizeable resolutions involving SAP for bribery in numerous countries. Beyond that, it is difficult to predict the volume of investigations that may result in resolutions in 2024, but we track investigations from public disclosures and other open-source media. The chart below – based on public disclosures – suggests that recent years have seen fewer FCPA disclosures in recent years as compared to the mid-2010s, although that is in part because investigations often are not disclosed contemporaneously. It is also possible that companies may have changed disclosure practices over time, as various factors are involved in any decision to make a public disclosure.

Enforcement Actions Against Individuals

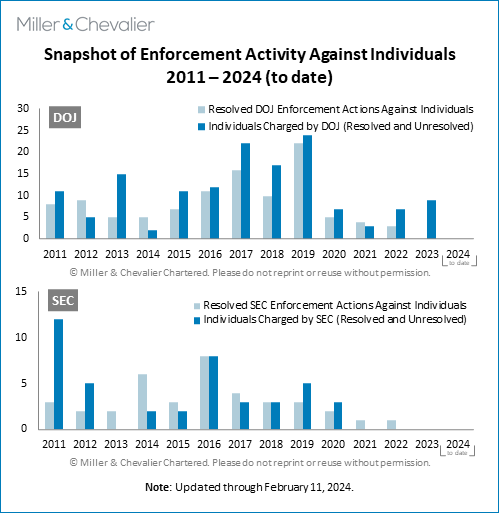

As shown in our first chart above, neither the SEC nor the DOJ resolved an enforcement action against an individual in 2023. For purposes of the DOJ and criminal enforcement, this means they did not have a guilty plea or a conviction for violations of the FCPA or conspiracies to violate the FCPA (we do not include adjacent charges for money laundering or other crimes, which are sometimes used for bribe recipients or intermediaries). The chart below provides more detail, showing both resolved enforcement actions (in light blue) along with new charges (in dark blue).

The SEC enforcement summary regarding individuals is simple – there have not been any new charges since 2020. At conferences, the SEC has pointed to two major limitations that affect its actions involving individuals. One, the SEC must use the FCPA itself and cannot use money laundering or other types of criminal charges for civil enforcement. And two, perhaps more importantly, the SEC must establish personal jurisdiction, but this is often difficult for the individuals that the SEC would be inclined to pursue – namely, employees of issuers' non-U.S. subsidiaries.

Regarding the DOJ, there have not been any resolved FCPA-specific cases against individuals (the FCPA Unit is involved in other enforcement actions involving foreign corruption based on money laundering or similar charges), but there are several trials either underway now or on the horizon. In particular, the trial of former Vitol S.A. (Vitol) trader Javier Aguilar is currently underway in New York, and the trial for the former CEO and General Counsel of Cognizant is scheduled for spring 2024. As noted below, the trial of former Freepoint Commodities LLC (Freepoint) executive Glenn Oztemel – as well as his brother Gary Oztemel and a Brazilian intermediary also involved in the scheme – is scheduled for the second half of 2024.

The DOJ brought new FCPA charges against eight individuals in 2023, with only the charges against the Oztemel brothers and Eduardo Inneco being related to a corporate resolution (Freepoint) on FCPA grounds:

- Sam Bankman-Fried: In a superseding indictment dated March 27, 2023, the DOJ added FCPA charges against Sam Bankman-Fried (as well as other charges) to a long list of previous allegations. Following Bankman-Fried's conviction in November 2023 (and the likely substantial penalties and jail time that will be issued by the trial court in March 2024), the DOJ indicated it would not pursue the FCPA charges, or any of the additional charges from the superseding indictment, in a second trial. It is unclear if any other enforcement actions will arise from the same facts regarding potential corruption in China.

- Glenn Oztemel, Gary Oztemel, and Eduardo Inneco: On February 17, 2023, the DOJ unsealed an indictment against Glenn Oztemel, a former trader from Freepoint, and Eduardo Inneco, a Brazilian intermediary, for FCPA and other charges. A superseding indictment was filed on August 29, 2023, and Gary Oztemel – Glenn's brother and the owner of the entity that served as Freepoint's customer – was added a defendant. All three face one count of conspiracy to violate the FCPA, while Glenn Oztemel and Inneco each face three additional counts for FCPA violations. And all three face at least one additional related money laundering count. Their trial is currently scheduled for the second half of 2024.

- Orlando Alfonso Contreras Saab (Contreras): On September 11, 2023, in Miami, the DOJ charged Venezuelan businessman Contreras with conspiring to bribe Venezuelan officials to obtain multi-million-dollar contracts in food and medicine distribution in Venezuela. Five people alleged to be co-conspirators to Contreras in the scheme were previously indicted in 2021 on money laundering charges.

- Amadou Kane Diallo: Also, as noted below, in September 2023, a federal grand jury indicted a California-based CEO, Amadou Kane Diallo, for his role with a scheme to bribe officials in Senegal. Diallo was already facing wire fraud and money laundering counts, and the superseding indictment added FCPA-related charges. A trial is currently scheduled for March 2024.

- Carl Zaglin and Aldo Nestor Marchena: As noted below, the DOJ announced charges in December 2023 related to a scheme to bribe government officials in Honduras for contracts related to the Honduran National Police. Zaglin is charged with one count of violating the FCPA, and Zaglin and Marchena are each charged with one count of conspiracy to violate the FCPA. A Honduran government official alleged to be a recipient of the bribes is facing related non-FCPA charges.

There were several other developments regarding individual enforcement in 2023 that did not involve new FCPA charges or convictions, but are relevant to the overall enforcement picture related to U.S. anti-corruption efforts:

- On January 26, 2023, a grand jury in Florida indicted current Venezuelan Supreme Court Justice Maikel José Moreno Pérez on charges of money laundering and conspiracy related to allegations that he received more than $10 million in bribes in exchange for influencing various legal cases between 2014 and 2019.

- On January 30, 2023, Saman Ahsani, the former Chief Operating Officer of Monaco-based intermediary company Unaoil, was sentenced pursuant to an earlier plea agreement related to allegations of conspiracy to violate the FCPA, money laundering, and obstruction of justice. The federal court in Houston imposed a monetary judgment in the amount of $1,500,000 and a sentence of one year and one day. His brother, Cyrus Ahsani, still awaits a sentence.

- On July 20, 2023, a federal court in the District of New Jersey denied the motions to suppress evidence under Garrity v. State of N.J., 385 U.S. 493 (1967), and motions to compel exculpatory evidence under Brady v. Maryland, 373 U.S. 83 (1963), in the ongoing case of former Cognizant President Gordon Coburn and former General Counsel Steven Schwartz. In short, the court ruled that although Cognizant was cooperating with the DOJ, the DOJ was not directing Cognizant's internal investigation, and the DOJ conducted its own investigation.

- On July 12, 2023, Manuel Chang, the former Finance Minister of Mozambique, was extradited to the U.S. from South Africa, where he had been held since being arrested in December 2018, to face criminal charges related to alleged fraudulent transactions in connection with loans for government-led projects that were intended to benefit Mozambique's tuna fishing industry. Other Mozambican defendants remain at large, though the scandal has resulted in other charges and a corporate disposition in 2021 involving Credit Suisse.

- On September 2, 2023, Judge Pamela K. Chen of the U.S. District Court for the Eastern District of New York (EDNY) threw out convictions for a former Fox executive Hernán Lopez and a South American sports media and marketing company Full Play Group SA (Full Play), citing recent judgments by the U.S. Supreme Court that narrowed the scope of certain public corruption prosecutions. In granting Lopez and Full Play's motions for acquittal on all counts for wire fraud and money laundering conspiracies, and subsequently staying their sentencing, the district court cited the U.S. Supreme Court's unanimous judgments in Percoco v. United States and Ciminelli v. United States (May 11, 2023), in which the Supreme Court narrowed the scope of federal wire fraud prosecutions and admonished prosecutors against extending their reach in mail and wire fraud cases without express statutory authorization. The DOJ has appealed the decision.

- On October 5, 2023, convicted former Goldman Sachs banker Roger Ng was ordered to be returned to the custody of Malaysian authorities just before his U.S. sentence was to begin. The Malaysian government had requested the return so that Ng could stand trial there. Ng previously asked for a reduced sentence in the U.S., in part based on the conditions of the prisons in Malaysia (where he previously was detained before his extradition to the U.S.).

- In rulings in November 2023 and again in January 2024, the Fifth Circuit affirmed the dismissal of FCPA and money laundering charges against Jorge Da Costa Casqueiro Murta, as discussed below, after his extradition to the U.S. in 2021. The district court will now decide whether the dismissal was with or without prejudice.

It is also noteworthy that forfeiture orders involving individuals rivaled various corporate resolutions in dollar amounts in 2023:

- On January 27, 2023, the EDNY issued final forfeiture orders for Luis Enrique and Ricardo Alberto Martinelli Linares, the sons of Panama's former president Ricardo Martinelli, ordering payment of monies and assets valued at $38 million in connection with a bribery and money laundering scheme.

- On April 19, 2023, a federal court sentenced former Venezuelan Treasurer Claudia Patricia Díaz Guillen and her husband, Adrian José Velásquez, each to 15-year prison sentences in the aftermath of the couple's December 2022 conviction at trial on money laundering charges related to bribes received from Venezuelan media mogul Raul Gorrin Belisario (Gorrin). In a separate order, the court ordered the couple to forfeit $136.7 million, which was the amount of the bribes determined to be accepted from Gorrin.

- On June 12, 2023, Alvaro Ledo Nass, a lawyer and former official at Venezuela's state-owned and -controlled oil company Petróleos de Venezuela, S.A. (PDVSA) was sentenced to three years in prison followed by three years of supervised release and fined $7,500 for conspiracy to commit money laundering. A plea agreement established that there would be a forfeiture money judgment of up to $11,510,025 and all assets on deposit in certain accounts under the names of Central Investment Holdings L.P., Vermon Global Inc., and Nass himself.

The DOJ continues to emphasize the importance of individual enforcement actions for their deterrence effect, and we expect that the DOJ will continue to devote more attention to such cases, although the trials already scheduled for 2024 appear likely to consume significant agency resources.

Q4 2023

In the final quarter of 2023, the DOJ continued its third quarter pace, publicly resolving three corporate investigations – two DPAs and a declination with disgorgement. In the final case announced in 2023 (Freepoint), the Commodity Futures Trading Commission (CFTC) joined with the DOJ in a combined disposition. The established pace continued into early 2024 with the announcement of a $220 million DPA with German-based software company SAP on January 10, 2024. By contrast, the pace of announced SEC settlements dipped, with no cases announced in the final quarter of 2023 (though the SEC also settled with SAP in early January 2024).

The fourth quarter of 2023 also produced several developments in cases involving individuals, including further indictments of former foreign officials accused of receiving bribes – a focus of the current administration as set out in the U.S. Strategy on Countering Corruption (SCC). Congress handed the DOJ a new tool to prosecute bribery recipients near the end of the year when President Biden signed the massive National Defense Authorization Act (NDAA) for fiscal year (FY) 2024, which included a section called the Foreign Extortion Prevention Act (FEPA). FEPA for the first time directly criminalizes the solicitation or receipt of bribes by a foreign official from U.S. persons. We discussed FEPA and its potential ramifications in detail in this January 2024 alert.

There were several relevant U.S. court decisions this quarter, as well as several international developments, including the U.K.'s DPA with online gambling company Entain plc (Entain), court rulings in corruption matters in France and South Africa, and further developments in Brazil's administrative toolkit for managing corruption cases.

DOJ and SEC Public Remarks

Officials from the DOJ and SEC continued to discuss policy matters in public speeches at various events. Most notably, Principal Associate DAG Marshall Miller spoke at a white collar symposium in New York on November 28, 2023 and Acting AAG Nicole M. Argentieri delivered a keynote address on November 29, 2023 at the American Conference Institute's (ACI) annual FCPA conference in Washington, DC – which was co-chaired this year by Miller & Chevalier's own Kathryn Cameron Atkinson.

In these and other public remarks, DOJ and SEC personnel focused on several topics, including:

- Highlighting the DOJ's dedicated data analytics team, which DOJ personnel state is creating new leads for investigations that have borne fruit and will likely increase the DOJ's abilities to detect potential violations outside traditional methods, such as company disclosures. At the ACI conference, SEC FCPA Unit Chief Charles Cain also noted the SEC's investments in and use of data analytics for pursuing investigation leads.

- Discussing a new DOJ team (the ICAB, as discussed above) that is working on developing relationships with prosecutors around the globe, including countries with whom there has not been cooperation in the past. Several recent cases have involved first-time formal coordination with other countries.

- Setting out how recent dispositions – such as those involving Albemarle Corporation in the third quarter and the Lifecore declination from this quarter (discussed below) – show the importance and beneficial results (at least as far as the DOJ sees them) of companies' self-disclosures, cooperation, and remediation under the DOJ's Corporate Enforcement and Voluntary Self-Disclosure Policy.

- In commentary about the Tysers Insurance Brokers Limited (Tysers) and H.W. Wood Limited (H.W. Wood) cases (discussed in detail below), describing the interplay among self-disclosures and consequent investigations of companies and individuals – which is an important reminder of how companies can be exposed to investigations risks by, for example, the actions of competitors. In particular, AAG Argentieri noted that the cases "grew out of the voluntary self-disclosure that resulted in a 2022 CEP declination for Jardine Lloyd Thompson" (JLT) which "not only led to the prosecution of four individuals involved in the bribery scheme, but also allowed us to secure the cooperation of those individuals and gather additional evidence demonstrating that others in the industry — namely, H.W. Wood and Tysers…were involved in similar misconduct."

- Commenting on how the DOJ's announced M&A Safe Harbor (discussed in this alert) should work, Principal Associate Deputy Attorney General Miller noted that in an M&A disclosure context, "the disclosing company is essentially operating as a corporate whistleblower, diming out illegal conduct that took place at a different entity – the M&A target." The safe harbor is designed to incentivize such behavior, "so that [DOJ] can continue to target our efforts at holding the most culpable individuals [corporate executives of the M&A target] accountable for their white-collar crimes." Miller also noted that the DOJ would be "scrutinizing every disclosure … since the policy only applies to bona fide, arm's length transactions"; what he called "sham transactions" "would not qualify for the protections of the policy."

- And finally, discussing the increasing national security implications of corruption cases and ties to other international compliance issues, such as economic sanctions, which highlight the importance of considering holistic approaches to managing linked risks.

These public remarks are worth a review by compliance professionals – while they are not statements of the actual law, they provide insights into the DOJ's and SEC's expectations for responsible corporate behavior.

Corporate Enforcement Actions

We discussed overall trends for 2023 trends in the Year in Review section above. We note that AAG Argentieri was quoted at the end of 2023 indicating that more corporate criminal resolutions (including FCPA dispositions) are coming in 2024, as several, such as SAP, just missed the end of the year.

On November 16, 2023, the DOJ issued a declination with disgorgement to Lifecore. The DOJ declined to prosecute Lifecore despite concluding that employees and agents of the company and a former U.S. subsidiary paid bribes to officials in Mexico in violation of the FCPA. The declination letter noted that, during post-acquisition integration of the former subsidiary, Lifecore learned of potential misconduct, initiated an internal investigation, and made a "timely" self-report of the issue to the DOJ. The DOJ cited the voluntary disclosure, extensive cooperation, remediation efforts, and the payment of a disgorgement amount of $406,505 as factors leading to the declination.

On November 20, 2023, two U.K.-based reinsurance brokers – Tysers and H.W. Wood – each entered into a three-year DPA with the DOJ based on allegations of bribery involving obtaining contracts from two Ecuadorian state-owned and controlled insurance businesses. The allegations involved payments through intermediary companies to relevant officials, and, as noted by AAG Argentieri in her November 29 speech, were part of a larger scheme that also involved at least one other company (JLT) and charges against several individuals, including at least one former official. Pursuant to its DPA, Tysers must pay a criminal penalty of $36 million and an administrative forfeiture of $10.5 million. H.W. Wood agreed to a criminal penalty of $22.5 million and a forfeiture of $2.3 million, but the DOJ reduced the actual penalty to $508,000, without any forfeiture required, based on the company's financial condition and a demonstrated inability to pay. Both companies agreed to continued cooperation with ongoing investigations and reporting to the DOJ regarding the state of their corporate compliance programs throughout the three-year terms of their respective DPAs.

Finally, on December 14, 2023, the DOJ announced that Connecticut-based Freepoint agreed to resolve parallel investigations by the DOJ and the CFTC related to alleged illicit payments to foreign officials at Brazilian state-owned oil company Petróleo Brasileiro S.A. (Petrobras) in exchange for various improper business advantages, including confidential business information helpful to obtaining contracts. The alleged schemes involved intermediaries and the use of slush funds and hidden "back-to-back" transactions, as well as code words, to conceal the improper activities. Freepoint entered a three-year DPA with the DOJ involving a criminal penalty of $68 million and an administrative forfeiture of $30.5 million, as well as a commitment to periodic reports on the state of its compliance program to the DOJ. Freepoint also accepted a CFTC Order alleging violations of the Commodity Exchange Act's (CEA) anti-manipulation and anti-fraud provisions and agreed to disgorge approximately $7.6 million to the CFTC. The agreements contained provisions allowing the company to receive credit for certain amounts paid to the CFTC and for potential future enforcement action in Brazil.

Enforcement Actions Against Individuals

There were developments in several announced DOJ cases involving individuals this quarter, including sentencing decisions, a new development in the ongoing Murta litigation, and new indictments. The SEC did not announce any FCPA-related actions against individuals this quarter.

In October 2023, rapper Pras Michel requested a new trial after being convicted in April 2023 on charges related to the massive 1MDB corruption scandal. Michel, represented by a new defense team, alleged that the trial court had allowed unduly prejudicial evidence to be heard by the jury and that his prior counsel "was ineffective and severely prejudiced the defense." The DOJ opposed the motion, and the court held a hearing on the matter in January 2024; the court will likely render its decision on the motion sometime in Q1 2024.

On November 30, 2023, a Florida district court granted a motion for a reduction in the sentence (from 58 to 40 months) of John Luzuriaga Aguinaga, a former official of Ecuador's public police pension fund, in light of his substantial assistance to the DOJ in other prosecutions.

On November 28, 2023 (and again in a superseding opinion dated January 5, 2024), the Fifth Circuit upheld a Texas federal district court's dismissal of an indictment of banker Paulo Jorge Da Costa Casqueiro Murta under the Speedy Trial Act. The trial court had dismissed that indictment in May 2023, and the DOJ had appealed that dismissal in June 2023. The appellate decision reversed the district court's order dismissing the case with prejudice, stating that the district court erred in its weighing of relevant factors and facts. The Fifth Circuit thus remanded the case back to the trial court level for an appropriate weighing of those factors to reach a final decision on whether the dismissal should be with or without prejudice. If the trial court decides to dismiss the indictment without prejudice, then the DOJ would be free to re-file charges against Murta. The Fifth Circuit also reassigned the cases involving Murta and another defendant, Daisy Rafoi-Bleuler (who is represented by Miller & Chevalier), to another district judge for further action.

On December 22, 2023, the DOJ announced charges against three persons, including a U.S. businessman and a former Honduran official, related to allegations of bribes paid by the businessman to the former official to obtain contracts from "a Honduran governmental entity that procured goods for the Honduran National Police."

Finally we note that, in the continuing fallout related to various convictions related to bribery at Fédération internationale de football association (FIFA) that have been called into question by recent Supreme Court precedent, several convicted former FIFA officials, including Juan Angel Napout, Jose Maria Marin, and Alfredo Hawit, have requested that their convictions be vacated on grounds similar to those that led the district court managing those prosecutions in New York to throw out earlier cases. The DOJ has appealed the September 2023 rulings.

Other Indicia of Enforcement Trends, Including Investigation Announcements

There was only one new corporate FCPA-related investigation announced during the quarter. On November 10, 2023, India-based renewables company Azure Power Energy Limited (APEL) – which had been listed on the New York Stock Exchange (NYSE) until July 2023, when it was delisted due to delays in issuing financial statements – announced that the company had made a self-disclosure to the DOJ and SEC regarding potential corruption issues. The company's release included an auditor report by BDO stating that the company's ongoing investigation had "identified evidence that certain former senior management of [APEL's parent] may have been involved and certain former directors of [APEL's parent] may have had the knowledge (sic) of an apparent scheme with persons outside of the Company to make improper payments in relation to certain projects."

On December 6, 2023, global commodities company Trafigura Beheer BV (Trafigura) announced an update on the ongoing investigations of the company by U.S., Swiss, and Brazilian enforcement authorities. The release stated that the company "anticipates resolving the [DOJ] investigation into improper payments made in Brazil shortly and will disclose in its 2023 Annual Report a provision of USD127 million." The announcement further stated that the Swiss Office of the Attorney General (OAG) "has asked the Federal Criminal Court to consider charges against [a Trafigura affiliate] for failing to prevent alleged unlawful payments via a third party to a former employee of Sonangol, the Angolan state energy company between 2009-2011." The company noted that it had offered a settlement but would "defend itself at court, including in view of the compliance and anti-bribery and corruption controls in place at the relevant time." The release also notes that the OAG has "announced charges against former Trafigura Chief Operating Officer Mike Wainwright," as well as a former Sonangol employee and a third-party consultant. At approximately the same time, the OAG announced charges against Trafigura for failure to prevent bribery in its Angola operations.

Policy and Legislative Developments

The primary legislative development this quarter was the passage of FEPA, as noted above. Criminalization of the demand side of bribery, as opposed to the prohibitions on the supply side represented by the FCPA, has been a key goal established by the current administration's SCC – specifically "pillar 3" on holding corrupt actors accountable. While long-sought by the U.S. as an enforcement tool against corrupt officials, as we noted in this alert, FEPA does not create a new area of potential direct liability related to corporate action.

On December 12, 2023, DOJ officials, including acting AAG Argentieri, testified before the U.S. Senate Judiciary Committee in a hearing on "Cleaning Up the C-Suite: Ensuring Accountability for Corporate Criminals." The Committee and its chair, Senator Richard Durbin of Illinois, raised questions regarding issues such as the role of national security in criminal prosecutions, public access to data on prosecutions of white-collar crime (especially as to corporate "leniency agreements" such as DPAs and NPAs), and the pace of corporate criminal prosecutions under the current administration.

The Criminal Division's defense of its policies and practices started with a call-back to the October 18, 2021 memorandum from DAG Lisa Monaco and its establishment of priorities for the DOJ. The testimony then asserts that the "resulting updated policies [are designed to] ensure individual accountability, discourage corporate recidivism, promote strong corporate culture, encourage cooperation and compliance, enable detection of wrongdoing with voluntary self-disclosure, and reinforce public confidence in the evenhanded administration of justice and the fairness of our system."

With regard to the FCPA, the DOJ testimony focused on the Goldman Sachs and related 1MDB actions (including the conviction of Roger Ng) as an example of being "focused on the worst of the worst offenders and achieve groundbreaking convictions against several senior executives in high-profile and complex matters." The testimony further asserts that "[t]he Fraud Section had a record number of trials—51. And in 2021 and 2022, we secured more individual fraud convictions than we had in any of the preceding six years." These numbers go beyond the FCPA to cover, for example, heath care fraud prosecutions, but provide some overall benchmarking as to DOJ activity levels. The testimony also noted that the DOJ "is expanding and deepening its international partnerships around the world, including, among others, with the United Kingdom, Brazil, Malaysia, Switzerland, Ecuador, France, South Africa, Colombia, the Netherlands, and Singapore."

Interestingly, for all the emphasis that the DOJ has placed on its enhanced data analytics capabilities, the testimony stated that the "Fraud Section's exciting data analytics programs are being run on a relatively modest annual budget of $400,000." The testimony notes that "[t]hese complex cases involve voluminous, usually electronic, evidence and require substantial investment of personnel and time to review materials, but the systems we have in place to help with the organization and review of this evidence are not cutting edge." This section concludes that, "[i]f we were to invest more, we could much more quickly build a technological framework to identify market manipulation and generate additional leads for FCPA cases." While some members of the Judiciary Committee agreed with the need for more resources for DOJ to combat corporate crime, it is unclear in the current political environment if Congress will be able to "put its money where its mouth is."

On October 25, 2023, the DOJ published a new FCPA OPR – FCPA OPR 23-2. The OPR covers certain stipends paid by the requestor to a U.S. "government officer" intended to be "subsequently deliver[ed] to foreign officials" in the context of training programs under the Foreign Assistance Act of 1961. The release notes that such stipends are specifically required under the relevant law and are for relatively low amounts, among other factors. The DOJ stated that it would not pursue action under these facts and circumstances for various reasons, including a lack of corrupt intent and the law's affirmative obligations. The OPR is thus likely of limited utility for companies operating outside of the foreign assistance framework discussed.

On December 13, 2023, Deputy AAG Kevin Driscoll spoke at a meeting on asset recovery and discussed recent anti-corruption actions by the DOJ's Money Laundering and Asset Recovery Section's (MLARS) International Unit, including related to the Kleptocracy Asset Recovery Initiative. He noted that the initiative had "recovered more than $1.7 billion" and that the U.S. "has returned and assisted in returning more than $1.6 billion for the benefit of the people harmed by the corruption through agreements and commitments designed to ensure transparency and accountability." Deputy AAG Driscoll also announced the return of $100 million to Malaysia recovered from prosecution of the 1MDB scheme. He also noted the return of corruption-related funds to Honduras and Nigeria – the latter of which occurred in February 2023.

The U.S. government continues to designate foreign officials and others as subject to economic sanctions and visa/immigration restrictions under the Global Magnitsky Human Rights Accountability Act and other statutory and regulatory authorities for acts of corruption. On November 16, 2023, the Department of the Treasury's (Treasury) Office of Foreign Assets Control (OFAC) sanctioned "eight individuals and six entities" in the Western Balkans for corruption and other "malign activities," including assisting with Russian influence in the region and undermining the goals of the Dayton Peace Accords. For example, in Montenegro, OFAC sanctioned Miodrag "Daka" Davidovic for "laundering money for decades for crime syndicates, strengthening his influence and carving out his criminal enterprise of cigarette, oil, and arms smuggling in Montenegro," noting that "his corrupt activities enabled Russia's efforts to compromise the independence of the country's democratic institutions and judiciary, including its efforts to influence electoral outcomes."

On Dec. 1, 2023, OFAC sanctioned Luis Miguel Martinez Morales, the "former head of the now-defunct Centro de Gobierno, a powerful quasi-cabinet level agency created by Guatemalan President Alejandro Giammattei at the start of his administration… for his role in corruption in Guatemala wherein he engaged in widespread bribery schemes, including schemes related to government contracts."

On Dec. 11, 2023, OFAC sanctioned two former Afghan government officials — Mir Rahman Rahmani and his son, Ajmal Rahmani for their extensive roles in transnational corruption, as well as 44 associated entities located in multiple countries, including Afghanistan, Germany, Cyprus, the United Arab Emirates, Austria, and the Netherlands. Per the OFAC press release, "[t]hrough their Afghan companies, the Rahmanis perpetrated a complex procurement corruption scheme resulting in the misappropriation of millions of dollars from U.S. Government-funded contracts that supported Afghan security forces." The announcement also noted that both men engaged in wide-ranging payment schemes to ensure that they were elected to the Afghan Parliament and in support of Mir Rahmani's "bid for Speaker of Parliament."

Also on December 11, 2023, Treasury released an updated fact sheet on its recent actions supporting the SCC. Among other data points, the fact sheet notes that OFAC "has designated more than 300 individuals and entities for these issues across more than 30 countries, leveraging more than a dozen different sanctions authorities." The fact sheet asserts further that "[t]hese designations have targeted corrupt activity relating to, among other issues, bribery, extortion, abuse of office, and the misuse of public funds for private gain [and] [m]ore than 40% of these designations have also related to kleptocracy issues." Treasury notes that in 2024 it "will prioritize—among other targets—the designation of financial facilitators and private enablers of public corruption, including through Global Magnitsky sanctions."

Treasury's fact sheet also noted the implementation of the 2021 Corporate Transparency Act, including the Financial Crimes Enforcement Network (FinCEN) issuance of "the final beneficial ownership information (BOI) reporting rule, which describes who must file a BOI report, what information must be reported, and when a report is due." That rule came into effect as of January 1, 2024. In this alert, Miller & Chevalier attorneys examine six key considerations for companies as they assess their new obligations under the rule.

International Developments

There were a number of international developments this quarter.

On October 12, 2023, the European Court of Human Rights (ECHR) issued a decision holding that the criminal convictions of Total S.A. (Total) and Vitol by French courts for bribing foreign public officials did not breach Article 7 of the European Convention of Human Rights. After their convictions became final in 2018, the companies had filed a claim at the ECHR alleging that at the time of their conduct they could not have known or foreseen that their actions were illegal, since the relevant French Criminal Code provisions entered into force only shortly prior to the criminal conduct. The ECHR disagreed, noting that both French law and relevant international treaty standards had been in place, and that the companies were sophisticated businesses and had knowledge that the related oil-for-food scheme for which they had been convicted violated local and international law.

On November 22, 2023, South Africa's National Prosecuting Agency (NPA) announced that it would refile its criminal case against certain individuals linked to a bribery scheme involving Swiss engineering company Asea Brown Boveri (ABB), after a judge struck the case from the court's rolls. The South African NPA for years has been investigating certain former ABB personnel potentially involved in the alleged corruption, as well as at least one former senior official at South African state-owned power company Eskom. The South African court found there had been an "unreasonable delay in the completion of the investigation," which violated the defendants' rights to a timely trial, though the decision gave the South African NPA the right to re-enroll the case.

On December 5, 2023, a U.K. court approved a DPA between the U.K. Crown Prosecution Service (CPS) and London-based gaming company Entain related to alleged bribery involved Entain's predecessor company's business in Turkey, where gambling, betting, and lotteries were illegal during the period covered by the related indictment. The DPA covers allegations that Entain's predecessor failed to have adequate procedures in place to prevent bribery at its former Turkish subsidiary between July 2011 and December 2017, resulting in four violations of Section 7 of the U.K. Bribery Act 2010 (UKBA). Under the terms of the DPA, Entain agreed to pay, in installments over a four-year period, a financial penalty of £465 million, disgorge profits of £120 million, and make a £20 million charitable donation to an unspecified cause or charity. Entain further agreed to contribute £10 million towards the costs of the related CPS investigations and promised to continue to cooperate with ongoing cases against individuals and to review and enhance its compliance procedures. The Entain DPA is the second largest corporate criminal settlement in the U.K., after the Serious Fraud Office's (SFO) January 2020 DPA with Airbus valued at €991 million. Converted to USD, the total is more than $750 million, which would make it a top 10 resolution of all time, had it occurred in the U.S. with the DOJ and SEC.

As noted above, on December 6, 2023, the Swiss OAG filed bribery charges in the Federal Criminal Court of Switzerland against the Netherlands-headquartered commodities trading company Trafigura. The case is significant because, according to the OAG, "[f]or the first time," the Swiss Federal Criminal Court is being "called upon to judge the criminal liability of a company for bribery of foreign public officials." The OAG also filed charges against the Trafigura entity's former chief operating officer (COO), although contrary to Trafigura's press release noted above, the OAG stated that it was not pursuing proceedings against the involved former Angolan official.

In Brazil, the Office of the Comptroller General (CGU) announced a new partnership with another Brazilian regulator, the Administrative Council for Economic Defense (CADE). CADE is responsible for investigating issues and potential violations of Brazil's competition laws, as well as promoting the "culture of competition" in Brazil. The CGU also released a report at the beginning of December 2023 that announced that it had reached a record number of actions against companies under the Clean Company Act (CCA).

Following the September 6, 2023 ruling by a judge on the Brazilian Federal Supreme Court holding that any evidence obtained by Brazilian prosecutors as a result of the leniency agreement signed by Odebrecht (now Novonor) in December 2016 was inadmissible in other cases, in December 2023 reports suggested that the same judge had ordered a pause on payments by J&F Investimentos (J&F) to the Brazilian Federal Prosecution Service (MPF) under the relevant leniency agreement (J&F also entered dispositions with the DOJ and SEC in October 2020). That ruling reportedly raised similar concerns about MPF behavior and handling of evidence as those noted in the Odebrecht ruling. More recently, on January 31, 2024, the same judge paused payments by Novonor under its MPF leniency agreement and authorized "the reevaluation of the leniency agreement," citing the same concerns. These court rulings potentially threaten some of the keystone resolutions and penalties obtained by the Brazilian authorities in the Lava Jato investigations.

We do not discuss them in this Review, but it is worth noting that there were two small Convention judiciaire d'intérêt public (CJIPs) (equivalents to DPAs in the French system) in December – one with ADP Ingénierie, a company of Groupe ADP, for €14.6 million relating to payments in Libya and the United Arab Emirates, and another with Seves Group for €13.373 million regarding bribery in Algeria, the Democratic Republic of Congo, Libya, and Nigeria.

Finally, on December 13, 2023, the EU Parliament announced a "political agreement [with the EU Council] on establishing an Anti-Money Laundering Authority (AMLA)" to enforce existing EU rules for combatting money laundering. Per the announcement, the AMLA "would be charged with directly supervising the most risky financial entities" in EU members states, "act as a central hub helping coordinate the actions of supervisors in different EU countries," and "support financial intelligence units in analysing suspicious transactions and detecting money laundering cases." Negotiations related to where AMLA will be headquartered and other issues will continue in 2024.

Actions Against Corporations

DOJ Issues Declination to Lifecore Biomedical

On November 16, 2023, the DOJ issued a declination with disgorgement to Lifecore Biomedical, Inc. (Lifecore). The DOJ declined to prosecute Lifecore despite the DOJ's stated conclusion that employees and agents of the company and its former U.S. subsidiary Yucatan Foods L.P. (Yucatan) committed bribery in Mexico in violation of the FCPA. Lifecore acquired Yucatan and Procesadora Tanok S. de R.L. de C.V. (Tanok), a facility owned and operated by Yucatan, on December 1, 2018, and subsequently divested the business on February 7, 2023.

According to the declination letter, the DOJ found that Yucatan's officers, employees, and agents, including Tanok's employees, paid bribes to Mexican government officials between May 2018 and August 2019, including approximately $14,000 paid by a third party to a government official to obtain "a wastewater discharge permit." Tanok personnel also allegedly "paid a third-party service provider approximately $310,000 to prepare fraudulent manifests purporting to show the provider had delivered wastewater to a municipal water company for disposal while knowing that a portion of the fee was used to pay bribes to…local Mexican government officials to sign the manifests to help make them appear legitimate." The alleged bribery and related conduct occurred "both prior to and after Lifecore's December 1, 2018, acquisition of Yucatan and Tanok."

During post-acquisition integration, Lifecore learned that at least one Yucatan officer "took affirmative steps to conceal the misconduct" and initiated an internal investigation, which resulted in Lifecore's voluntary self-disclosure to the DOJ. The DOJ cited five factors in its decision to decline to prosecute Lifecore:

- Timely and Voluntary Self-Disclosure. Lifecore made its disclosure to the DOJ within three months from when it first discovered the potential misconduct "and hours after [the] internal investigation confirmed that misconduct had occurred."

- Full and Proactive Cooperation. Lifecore provided "all known relevant facts about the misconduct" to the DOJ and agreed to continue to fully cooperate with the DOJ's ongoing investigations and any future prosecutions, including after its divestiture of Yucatan and Tanok.

- Nature and Seriousness of the Offense. DOJ did not provide more information on this factor, but the result suggests that the DOJ did not consider the offense to require a guilty plea or other action under the circumstances.

- Timely and Appropriate Remediation. DOJ mentioned that Lifecore terminated the Yucatan officer involved in the bribe scheme, withheld their bonus and other compensation (in line with the DOJ's policies and guidance on compensation incentives and clawbacks), and substantially improved its compliance program and internal controls.

- Disgorgement. Lifecore agreed to disgorge $406,505. This amount was not calculated based on Yucatan or Lifecore's profits. Instead, the DOJ and Lifecore calculated the amounts that "would have been due and payable to the Mexican regulatory authorities" but for the bribery (i.e., $1,286,060), and deducted the amount that Lifecore spent to conduct a wastewater plant and pay duties owed to Mexican regulators (i.e., $879,555) to reach the final disgorgement amount.

Key Takeaways

- Commitment to Cooperation by Successor Entities. As noted, Lifecore divested the relevant business involved in the wrongdoing (Yucatan) prior to the declination. The declination letter states that Lifecore "made continued cooperation with the [DOJ's] ongoing investigation a material condition of any transfer of control to Lifecore's successor-in-interest following its divestiture of the legacy Yucatan and Tanok business." Lifecore also "agree[d] that if it enters into a merger agreement or is acquired, it will require that its successor-in-interest agree to the obligations set forth in this letter agreement, including continued cooperation with the [DOJ's] investigation." There are no set periods or end dates attached to these commitments in the letter, suggesting that they will last for the lifetime of related investigations – which could take years. The latter provision, especially, could create significant financial obligations for any potential merging or acquiring entity and thus could present obstacles to future transactions involving Lifecore. The letter does not clarify the weight that the DOJ gave to these specific commitments, or whether these will be standard requirements for "full cooperation" under DOJ's policies.

- Post-Acquisition Due Diligence. This declination further shows the importance of effective post-acquisition due diligence, which can lead to the discovery and timely termination of misconduct committed by the target company and lay the foundation for taking prompt and appropriate remedial actions, including potential self-disclosure. In multiple conferences, DOJ officials have pointed to Lifecore declination as a model situation when a company may have acquired a company with violations that are not identified until after the acquisition.

- Timelines for "Timely" Voluntary Disclosure. The updated Corporate Enforcement and Voluntary Self-Disclosure Policy encourages self-disclosure of potential misconduct "at the earliest possible time." This declination provides another example of what the DOJ considers to be timely self-disclosure. While each case requires fact-specific inquiry, in Lifecore's case the DOJ allowed for a three-month internal investigation after the company's initial discovery of the potential misconduct. The letter also notes that Lifecore disclosed the misconduct "hours after [the internal investigation] confirmed that misconduct had occurred." That timing suggests that the company had made a contingent disclosure decision prior to completion of the investigation.

Two U.K.-Based Reinsurance Brokers Settle with DOJ Over FCPA Violations in Ecuador

On November 20, 2023, U.K.-based reinsurance brokers Tysers Insurance Brokers Limited (Tysers) and H.W. Wood Limited (H.W. Wood) each entered into separate three-year DPAs with the DOJ based on allegations that the companies conspired together and with others to violate the anti-bribery provisions of the FCPA related to misconduct in Ecuador. Pursuant to its DPA, Tysers — which was formerly known as Integro during the relevant period and which was acquired in September 2022 by AUB Group Limited (which is not a defendant in the matter) — must pay a criminal penalty of $36 million and an administrative forfeiture of $10.5 million. While H.W. Wood agreed that a criminal penalty of $22.5 million and a forfeiture of $2.3 million would be appropriate, the DOJ reduced the actual penalty to $508,000, without any forfeiture required, based on the company's financial condition and a demonstrated inability to pay.

The resolutions were brought under the jurisdiction established by 15 USC 78dd-3, because Tysers and H.W. Wood are neither issuers (with shares traded in the U.S.) nor domestic concerns (for example, companies incorporated in the U.S.). Instead, the resolutions are based on a conspiracy that involved several key meetings and financial transactions connected to the U.S.

According to the DPAs, between 2013 and 2017, employees and agents of Tysers and H.W. Wood "agreed to pay" $2.8 million in bribes to four Ecuadorian officials to obtain and retain business from two Ecuadorian state-owned and controlled insurance businesses, Seguros Sucre S.A. (Sucre) and Seguros Rocafuerte S.A. (Rocafuerte). As a result of the scheme, Tysers made approximately $10.5 million in commissions, while H.W. Wood made approximately $2.3 million.

The case documents state that Tysers and H.W. Wood engaged two companies registered in Panama and Ecuador but operating in Miami (collectively referred to as the "Intermediary Company" in the DPAs) in order for Tysers and H.W. Wood to gain and maintain reinsurance business with Sucre and Rocafuerte. According to press reports, it appears that the Intermediary Company did business using the name Royalty Re, however the Intermediary Company is not identified in court documents. Due to Ecuadorian law restrictions on the use of intermediaries—enacted by the President of Ecuador to prevent corruption in government business, according to the DPAs — the Intermediary Company's role in the scheme was intentionally concealed from Sucre and Rocafuerte employees by pre-planning correspondence or bcc'ing the Intermediary Company when communicating with Sucre and Rocafuerte. In at least one instance, an H.W. Wood employee lied to the state-owned entities about the role of the Intermediary Company. The Intermediary Company's employees — Esteban Merlo Hidalgo, Cristian Patricio Pintado Garcia, and Luis Lenin Maldonando Matute — secretly facilitated the introduction of the two reinsurance brokers to the officials at Sucre and Rocafuerte and "orchestrated the award" of business to be shared between Tysers and H.W. Wood as "co-brokers." Juan Ribas Domenech (Ribas), the then-chairman of Sucre and Rocafuerte, was one of the four officials who would later receive bribes as part of the scheme, including through coordination with his financial advisor, Fernando Martinez Gomez (Martinez). Martinez was employed by Biscayne Capital, which has had executives (including Martinez) involved in additional legal issues related to a real estate pyramid scheme.

Following the initial award of business, the Intermediary Company demanded a larger commission in order to pay the officials and ensure that the brokers retained the business. To reach an agreement on the commissions, the brokers negotiated with the Intermediary Company, who referred to the commission's purpose in correspondence as "to local contacts," "for local people," and "for Ecuador." The scheme was funded in two ways through insurance payments from Sucre and Rocafuerte to Tysers and H.W. Wood (the reinsurance brokers). In some instances, Tysers and H.W. Wood would pay commissions to the Intermediary Company, while passing the premiums on to reinsurance companies, the entities that would ultimately bear the risk for the insurance. In other instances, Tysers and H.W. Wood would retain a portion of the payments from the state-owned companies and then transfer the premiums directly to the Intermediary Company, which in turn would do the same – retaining a portion of the premiums and passing the remainder on to the reinsurance companies. The employees of the Intermediary Company then made payments to bank accounts in Florida, Panama, and Switzerland held in the name or on behalf of the Ecuadorian officials.

The DPAs note that, to conceal the scheme, the Intermediary Company executed a contract with Ribas's financial advisor, Martinez, to make it appear as though the payments made by the Intermediary Company were investments in a company owned by Ribas. Throughout the scheme, employees of the Intermediary Company met and corresponded with the Ecuadorian officials from and in the United States. In particular, the DPAs point to a key meeting between Merlo of the Intermediary Company and Martinez (on behalf of Ribas) in Florida, and another meeting involving the Intermediary Company and an H.W. Wood employee in Florida.

The Tysers DPA recounts a noteworthy episode in 2014 when a broker for Tysers informed the compliance team that he was obtaining business from Sucre via an intermediary "because 'the intermediary] is family with" a Sucre official. The compliance team reportedly flagged concerns under the "U.K. bribery and corruption laws," but otherwise the company continued with the business.

Tysers did not receive credit for self-disclosure under the DOJ's current policies, but the company did receive credit for its cooperation efforts, which included making foreign-based employees available for interviews, producing "voluminous" documents— including some located outside of the U.S. — to the DOJ, "conducting and producing financial analyses of voluminous transactions," and reaching and accepting a resolution promptly. The DPA also credited Tysers' remedial efforts, including placing involved employees on leave, terminating the business relationship with the Intermediary Company, and "comprehensively reviewing and enhancing its compliance program," including "engaging additional resources with appropriate expertise" and "adding new compliance resources and personnel." As a result of these and other considerations, Tysers' penalty reflects a 25 percent reduction off the bottom of the applicable Sentencing Guidelines' fine range.

H.W. Wood also did not receive voluntary disclosure credit, but like Tysers received cooperation credit for its efforts, including "endeavoring to make foreign-based employees available for interviews," producing foreign-based documents to the DOJ, and conducting extensive financial analyses of "voluminous transactions." H.W. Wood also engaged in "timely" remedial efforts cited in the DPA, including terminating an involved employee and enhancing its compliance program, including by "creating new compliance positions and compliance control improvements." While H.W. Wood's initial penalty reflected a 25 percent reduction off the bottom of the relevant Sentencing Guidelines fine range, the DOJ and H.W. Wood agreed to a lower penalty due to the company's inability to pay.

Notably, in calculating the "culpability score" for each company under the U.S. Sentencing Guidelines, the DOJ did not add points for any "high-level personnel" participating in, condoning, or being willfully ignorant of the offense, which often occurs in DOJ DPAs. As a result, the ranges of the potential fine as calculated under the U.S. Sentencing Guidelines were substantially lower for each company than if the DOJ had decided that the employees involved for each company had been "high-level personnel."

Tysers — and its parent company AUB — and H.W. Wood agreed to continue to cooperate with the DOJ's ongoing investigations, enhance their compliance programs to the meet the minimum requirements elements set forth in Attachment C of the respective DPAs, and report to the DOJ regarding their efforts throughout the three-year term as detailed in Attachment D of the respective DPAs. As has been the case under DOJ policy for recent cases, senior executives — the CEO and Chief Legal & Risk Officer of Tysers, and the CEO and CCO of H.W. Wood — must certify by executing Attachment F that the brokers have met their obligations pursuant to the agreements prior to the expiration of the three-year term.

Key Takeaways

- Industry Sweep Triggered by Voluntary Disclosure. The DPAs reached in these matter evidence a sweep of the participants in the reinsurance business in Ecuador, with three different companies resolving investigations. In the case of JLT — who engaged in a similar scheme in order to obtain reinsurance business with the Ecuadorian state — the DOJ declined to prosecute in March 2022 via a declination with disgorgement. According to the DOJ, the declination was reached based on JLT's voluntary self-disclosure, cooperation, the nature and seriousness of the offense, timely and full remediation, and the agreement to disgorge ill-gotten gains. As discussed above, the DOJ has confirmed in speeches that JLT's voluntary disclosure led to investigations of all transactions with Sucre and Rocafuerte. Thus, JLT's declination — which was reached approximately a year and a half before H.W. Wood and Tysers' agreements — demonstrates the importance of being the first company to disclose in such an industry sweep as well as the potential risks such a precedent sets for other industry participants. We also note that a fourth insurance company, Arthur J. Gallagher & Co., had disclosed that it had received a subpoena from the DOJ regarding its business with public entities in Ecuador, but in February 2024 the company announced that the DOJ had notified the company in Q4 2023 that the DOJ had "closed the inquiry and would not be pursuing enforcement action against" the company.

- Numerous Individuals Charged or Involved in Related Cases. The DPAs reached in this matter are part of a years-long series of enforcement actions against individuals involved corruption related to Sucre and Rocafuerte. According to its related press release, the DOJ has charged eight individuals in connection with the scheme. Three of the Intermediary Company employees, Esteban Merlo Hidalgo, Cristian Patricio Pintado Garcia, and Luis Lenin Maldonado Matute were charged for their participation. Merlo pleaded guilty in the Southern District of Florida in March 2023, while Pintado and Maldonado are fugitives. Juan Ribas pleaded guilty in September 2020 for money laundering related to the scheme and other misconduct (and in 2023 had his sentence reduced for cooperation), and his financial advisor, Fernando Martinez Gomez, pleaded guilty in March 2022 for his conduct in this and the separate Biscayne Capital scheme referenced above. Additionally, numerous co-conspirators remain unnamed, indicating that there may be future prosecutions. As noted above, the DOJ declined to prosecute JLT for similar misconduct, but prosecuted three individuals involved in that scheme: Felipe Moncaleano Botero (the former CEO of JLT's Colombian subsidiary), Jose Vicente Gomez Aviles, and Roberto Heinert. This combination of corporate and individual actions related to common conduct is an example of the DOJ's professed ideal in countering corruption, including providing benefits to companies under the Corporate Enforcement and Voluntary Disclosure Policy in exchange for remediation and corporate assistance in prosecuting culpable individuals.

- Inability to Pay Determination. The DOJ determined that H.W. Wood established its burden of proof regarding an inability to pay determination under the DOJ's Inability to Pay Guidance. Despite an analysis that a criminal penalty of $22.5 million would otherwise be reasonable based on the facts and law, the DOJ concluded that a penalty of $508,000 was "sufficient" since "paying a criminal penalty greater than $508,000 [within the applicable timeframe] would substantially threaten the continued viability of the [c]ompany." The DPA notes that after H.W. Wood provided information and access to appropriate personnel to respond to inquiries, the DOJ conducted its own independent analysis of the H.W. Woods' ability to pay, which involved a "forensic accounting expert."

Freepoint Commodities LLC Settles with DOJ and CFTC for FCPA and Related Commodity Exchange Act Violations

On December 14, 2023, the DOJ announced that Freepoint, a commodities trading company based in Connecticut, agreed to resolve parallel investigations by the DOJ and the CFTC, and indicated that a related resolution in Brazil may be forthcoming. As a result of the resolution, Freepoint entered a three-year DPA with the DOJ in connection with the filing of a criminal information charging the company with one count of conspiracy to violate the FCPA's anti-bribery provisions. The company also accepted an Order by the CFTC for violating the CEA's anti-manipulation and anti-fraud provisions.

Freepoint agreed with the DOJ to pay a criminal penalty of $68 million and an administrative forfeiture of $30.5 million. The company also agreed to disgorge approximately $7.6 million to the CFTC, as discussed in more detail below, which the DOJ agreed to credit toward the forfeiture amount. In addition, the DOJ agreed to require an immediate payment of only two-thirds of the criminal penalty (i.e., $45,560,000); the DOJ agreed to offset the remaining amount in the event Freepoint subsequently agrees to an anticipated resolution with Brazilian authorities related to the same bribery scheme within a year of the DPA's effective date.

According to the DPA and the CFTC Order, in 2012, Freepoint hired Glenn Oztemel, another employee (Co-conspirator #1), and others from a different Connecticut-based trading company, which press reports indicate was Arcadia Fuels Inc. According to the DPA, Glenn Oztemel, his brother Gary Oztemel, and Eduardo Innecco had already set up a corruption scheme involving Petrobras. Once at Freepoint, Glenn Oztemel and others established the same scheme at Freepoint. More specifically, the DPA states that between 2012 and 2018, Freepoint, "through its agents and employees" (including the Oztemel brothers and dual Brazilian-Italian intermediary, Eduardo Innecco), together with other entities, facilitated the transfer of approximately $3.9 million in illicit payments to the intermediary, knowing that some would be paid to foreign officials at Petrobras in exchange for improper business advantages. The Oztemels and Innecco have been separately indicted by the DOJ for the same matter, previously discussed here. In addition, one recipient of the alleged bribes is former Petrobras official Rodrigo Berkowitz, involved in other matters that covered here.

The public documents note that the Oztemel brothers and Innecco agreed to pay Berkowitz and others bribes in exchange for confidential information related to Petrobras's business. The individuals used the information to improperly obtain business advantages for Glenn Oztemel's prior employer Arcadia Fuels, Gary Oztemel's company Oil Trade & Transport S.A. (OTT), and subsequently Freepoint. Once Glenn joined Freepoint in 2012, he set up a traditional third-party scheme in which Innecco's entities were paid for little or no services. Specifically, he "caused" Freepoint to enter purported "Service Provision Agreements," whereby companies owned and controlled by Innecco would issue sham invoices to Freepoint for consulting or commission fees. The DPA states that, once Freepoint issued payments commensurate with the sham invoice amounts, totaling approximately $3.9 million between 2012 and 2018, Innecco used a portion of those funds to make bribe payments to Berkowitz and other Petrobras officials.

Additionally, Freepoint also established OTT as a customer in order to create slush funds with OTT, under the direction of Glenn's brother Gary. According to public documents, while OTT was an organization registered in Panama, it was treated as a Connecticut company as its principal place of business was in the state. In particular, to execute the scheme, the individuals utilized OTT to engage in "back-to-back" transactions with Freepoint and Petrobras "to obtain and retain business for Freepoint," which were reflected in Excel spreadsheets. In coordination with Freepoint, OTT purchased oil cargoes from Petrobras, then sold the same cargoes to Freepoint at an amount higher than the purchase price. Upon receipt of payment from Freepoint, OTT made "profit sharing" payments to Innecco based on sham invoices sent from Innecco's companies to OTT. Innecco used a portion of the "profit sharing" payments to pay bribes to Berkowitz and others "to obtain and retain business for Freepoint and OTT." The DPA states that Innecco paid the bribes through an account held at a Uruguay shell company or in cash.