FCPA Winter Review 2019

International Alert

Introduction

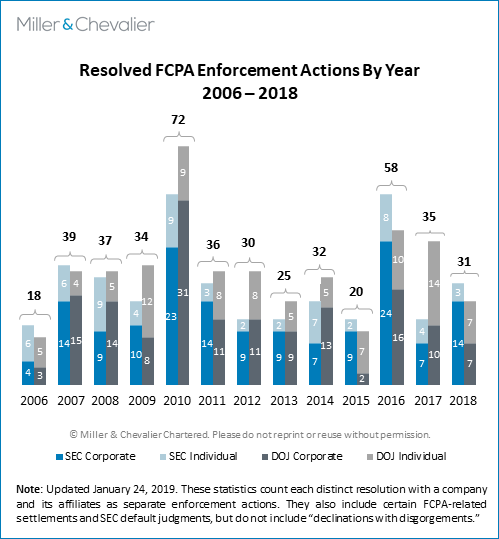

The U.S. Department of Justice (DOJ) and Securities and Exchange Commission (SEC) ended 2018 with a flurry of Foreign Corrupt Practices Act (FCPA)-related enforcement activity. Notably, the DOJ secured a jury conviction of an ex-Hong Kong government official for payments or attempted payments to high-level government officials in Chad and Ghana and unsealed a previously obtained guilty plea by a former New York investment banker at the center of a corruption scandal in Malaysia. The SEC reached settlements with three companies and one individual – the former CEO of a California-based avionics company – in connection with alleged FCPA books-and-records and internal-accounting-control violations. The settlements, conviction, and guilty plea resulted in 31 total FCPA-related enforcement actions for 2018, close to the DOJ's and SEC's combined overall average of 35 such enforcement actions per year over the past 10 years.

January 2019 also marks two full years under the Trump administration, providing data that can be used for a comparison of FCPA enforcement with statistics from the Obama administration. As discussed in greater detail below, there have been downward trends in some key measurements of FCPA enforcement activity under President Trump, although this decline is well within the normal fluctuation seen from year to year in past enforcement statistics and cannot clearly be attributed to the change in administration.

Corporate Enforcement Actions

In the fourth quarter of the year, the SEC resolved three corporate enforcement actions, rounding out the year with a total of 14 such actions. This number is slightly above the agency's 10-year average of 12 corporate enforcement actions per year. In contrast, the DOJ announced no new FCPA-related corporate enforcement actions during the fourth quarter, thus ending the year with a combined total of seven corporate guilty pleas, Deferred Prosecution Agreements (DPAs), or Non-Prosecution Agreements (NPAs). This figure is somewhat below the DOJ's 10-year average of 12 corporate enforcement actions each year, although it is within the range of fluctuation over the same period.

We summarize the SEC's three enforcement actions from the fourth quarter below:

- Vantage Drilling International: On November 19, 2018, the SEC announced that the Houston-based offshore-drilling company Vantage Drilling International had consented to a Cease-and-Desist Order, thereby resolving charges that the company had failed to devise a system of internal accounting controls to prevent potential bribery. The SEC's charges arose out of the company's 2007 recruitment of a Taiwanese shipping magnate as an outside director and investor, through which the company gained access to shipping/drilling assets owned by the new director. After joining the board of Vantage Drilling International, the Taiwanese magnate allegedly made payments to an official at the Brazilian state-owned oil-and-gas company Petroleo Brasileiro SA (Petrobras) with the assistance of a company third-party agent and in order to secure a leasing contract for an ultra-deepwater drillship from which both the director and Vantage Drilling International directly benefited. Vantage Drilling International agreed to pay $5 million in disgorgement to resolve charges arising out of this alleged misconduct. We provide details and analysis of the Vantage Drilling International settlement below.

- Centrais Elétricas Brasileiras S.A.: In another Brazil-related enforcement action, the Brazilian majority state-owned electric utility Centrais Elétricas Brasileiras S.A. consented to a Cease-and-Desist Order, announced by the SEC on December 26, 2018. According to the SEC, from approximately 2009 to 2015, former officers at the Brazilian utility's nuclear power-generation subsidiary engaged in a bid-rigging scheme with private Brazilian construction companies in connection with the Angra III nuclear power plant, whose construction has been on hold since 2015 due to the corruption scandal. Centrais Elétricas Brasileiras S.A. agreed to pay a civil money penalty of $2.5 million to resolved internal-accounting-controls and books-and-records FCPA charges arising out of this alleged misconduct. In August 2018, the company disclosed that the DOJ had investigated the same conduct but closed the investigation without enforcement. The company is the second Brazilian state-owned, U.S. publicly traded company to settle with the SEC in 2018, following Petrobras's settlement in September. We provide details and analysis of the Centrais Elétricas Brasileiras S.A. settlement below.

- Polycom, Inc.: Finally, on December 26, 2018, the SEC announced a Cease-and-Desist Order issued to Polycom, Inc., a San Jose, California-based voice and video communications provider. According to the SEC, from 2006 through 2014, senior executives at Polycom Inc.'s China subsidiary provided discounts to distributors and resellers, knowing and intending that these third parties would use the discounts to make payments to officials at Chinese government agencies and government-owned enterprises in exchange for assistance in obtaining government orders. In connection with this activity, senior executives allegedly used a parallel deal-tracking and email system located in China, outside of the company's approved systems. The SEC alleged that this conduct violated the internal-accounting-controls and books-and-records provisions of the FCPA, and imposed a penalty of approximately $16 million in disgorgement, prejudgment interest, and civil penalties. The DOJ also released a letter formally declining to prosecute Polycom, Inc., in exchange for the company agreeing to disgorge approximately $30 million representing the company's allegedly illegal profits from its China contracts, of which approximately $10.7 million was off-set by disgorgement paid to the SEC. We provide details and analysis of the Polycom, Inc. settlement below.

Individual Enforcement Actions

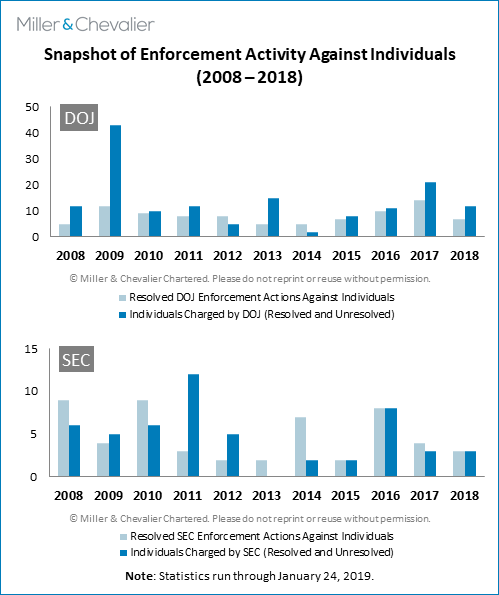

The final months of 2018 also saw three enforcement actions resolved against individuals – two by the DOJ and one by the SEC. In comparison with their totals in recent years, both agencies had previously lagged in individual enforcement actions for most of 2018. However, the year-end criminal convictions and civil penalties helped bring the year's statistics into line with the 10-year average. Specifically, the DOJ's two convictions brought the agency's total number of FCPA individual enforcement actions to seven for 2018, which is approximately equal to the agency's 10-year average of eight such actions, although a drop from last year's high of 14 convictions. Similarly, the SEC's single FCPA-related Cease-and-Desist Order issued to an individual brought the agency's total individual enforcement actions to three for 2018, which is somewhat below the 10-year average of about five such actions per year.

We summarize each of these individual enforcement actions below:

- Tim Leissner: On November 1, 2018, the DOJ unsealed a previously obtained guilty plea by Tim Leissner, a former managing director at the Goldman Sachs Group, Inc., a New York City-based investment bank and financial services company. The previous August, Leissner had pled guilty to one count of conspiracy to violate the anti-bribery and internal-accounting-controls provisions of the FCPA, as well as one count of conspiracy to commit money laundering. According to a criminal information published by the agency, from around 2009 to 2014, Leissner and his co-conspirators sought to knowingly and willfully circumvent the investment bank's internal controls in order to make kickback payments to government officials at 1Malaysia Development Berhad – a state-owned development fund established to make strategic investments in the Malaysian economy – in order to win business in connection with three 1Malaysia Development Berhad bond offering transactions in 2012 and 2013. Specifically, the DOJ alleges that Leisner and his co-conspirators distributed more than $2.7 billion of the $6.5 billion raised by the bond offerings to government officials in Malaysia and Abu Dhabi. We provide details and analysis of Leissner's guilty plea below.

- Patrick Ho: On December 5, 2018, the DOJ announced that it had secured a guilty verdict for Patrick Ho following a five-day jury trial on seven FCPA anti-bribery and money laundering-related counts. Ho, a former high-ranking Hong Kong government official, was the head of a non-government organization (NGO) based in Hong Kong and Arlington, Virginia, affiliated with the Shanghai-based multibillion-dollar oil, gas, and banking conglomerate CEFC China. According to the DOJ, in December 2014, Ho and a CEFC China official traveled to Chad to attempt to pay a $2 million bribe to the President of Chad in exchange for certain lucrative oil rights that were available for CEFC China to acquire. The President of Chad reportedly rebuffed the offer. Later, in May 2016, Ho and CEFC China officials travelled to Uganda, where they successfully paid a total of $1 million to government officials to obtain assistance for CEFC China in its acquisition of a Ugandan bank. Ho, who is not a U.S. citizen, sought to challenge U.S. jurisdiction over him during his trial. The court rejected the challenge on the grounds that Ho had acted on behalf of his U.S.-based NGO and planned some of the payments within the territory of the United States. We provide details and analysis of Ho's guilty verdict below.

- Paul Margis: On December 18, 2018, the SEC announced that former Panasonic Avionics Corporation CEO Paul Margis had consented to a Cease-and-Desist Order with the SEC in connection with alleged FCPA books-and-records and internal-accounting-controls violations. As discussed in our FCPA Summer Review 2018, Panasonic Avionics Corporation and its parent company Panasonic Corporation reached separate settlements with the DOJ and SEC in connection with allegedly improper payments made to third parties with connections to state-owned customers in the Asia Pacific region and the Middle East. Margis's individual SEC charges arose out of his alleged role in the same conduct. Specifically, according to the SEC's Cease-and-Desist Order, Margis used his position as CEO and President to authorize the retention of consultants through the company's "Office of the President Budget," allowing him to circumvent the company's processes for review and oversight for consultants. Consultants authorized by Margis received hundreds of thousands of dollars in compensation, despite apparently providing no legitimate services. Based on the conduct set forth above, the SEC found that Margis had violated the books-and-records and internal-accounting-controls provisions of the FCPA, as well as other related U.S. securities laws. Margis agreed to pay a civil money penalty of $75,000. In a separate, related action, former Panasonic CFO Takeshi "Tyrone" Uonaga consented to a Cease-and-Desist Order in connection with non-FCPA revenue recognition-related charges. We provide details and analysis for both men's settlements with the SEC below.

In addition to the FCPA-related individual enforcement actions noted above, the DOJ also announced guilty pleas by two former officials at the Venezuelan state-owned oil company Petroleos de Venezuela (PdVSA) – former Procurement Officer Ivan Alexis Guedez and former Financial Planning Director Abraham Edgardo Ortega. Both Guedez and Ortega pled guilty to money-laundering charges. The DOJ has relied on a combination of FCPA and money-laundering charges to prosecute several individuals in the ongoing investigation into alleged corruption at PdVSA, discussed most recently in our FCPA Autumn Review 2018, with FCPA charges for alleged bribe payers and money-laundering charges for alleged bribe recipients.

Investigations Closed Without Enforcement Action

As in past quarters, throughout the fourth quarter of 2018 Miller & Chevalier has tracked investigations closed without enforcement action, i.e., investigations that the DOJ and SEC have launched but then resolved without a DPA, NPA, Cease-and-Desist Order, guilty plea, jury conviction, or other final enforcement procedure. This quarter, we tracked three such investigations announced publicly as closed without enforcement actions: the DOJ's formal declination to prosecute Polycom, discussed above, and the DOJ's and SEC's closure of investigations without enforcement in connection with Laureate Education:

- Laureate Education, Inc.: On November 29, 2018, the Baltimore, Maryland-based education company Laureate Education, Inc. disclosed in a Form 8-K that both the DOJ and SEC had closed FCPA-related investigations into the company. The company noted that in 2014 it had discovered "irregularities with respect to a donation by our network institution in Turkey, Istanbul Bilgi University, to a charitable foundation." The company also noted that it launched an internal investigation in 2016 and voluntarily disclosed the matter to U.S. authorities.

Miller & Chevalier's tracking of investigations closed without enforcement relies on public statements by companies, statements by the DOJ or SEC, or companies' disclosure of such investigations in their securities filings. As such, our tracking is necessarily incomplete, because some companies may elect never to make public either the launch of a DOJ or SEC investigation or its resolution without enforcement action. Nevertheless, tracking investigations closed without enforcement provides a useful data point for assessing the enforcement climate.

A Look Back – Two Years of FCPA-Related Enforcement Under the Trump Administration

At the time of this newsletter's publication, President Trump has been in office for just over two years, providing an opportunity for reflection on FCPA enforcement under the current administration. Before running for the office, President Trump famously described the FCPA as a "horrible law" that "should be changed." This statement, along with other positions taken by current enforcement officials in their prior careers and roles (as discussed in our FCPA Winter Review 2017), led some to predict a slowdown in enforcement. Indeed, there have been recent media articles that argue that corporate criminal enforcement generally under the Trump administration has declined.

Two years into the Trump administration, there are downward trends in some of the measures that we have traditionally used to assess FCPA enforcement activity, although not to the extent that the critical statements and positions noted above may have predicted. Indeed, the data is mixed and, as we discuss below, somewhat incomplete in key areas (as snapshots of this kind often are). In addition, these trends may have been affected by shifts in enforcement focus, such as the continuing focus on individual accountability and corporate cooperation and the implementation of the DOJ's still-recent FCPA Corporate Enforcement Policy. The key takeaway for company compliance and legal personnel is that that any downward trends do not, in our view, signal any fundamental change in FCPA enforcement policy that affects FCPA-related compliance risks. Those risks, and the need to invest in effective compliance programs to remediate such risks, remain largely as they have been for at least the last 10 years.

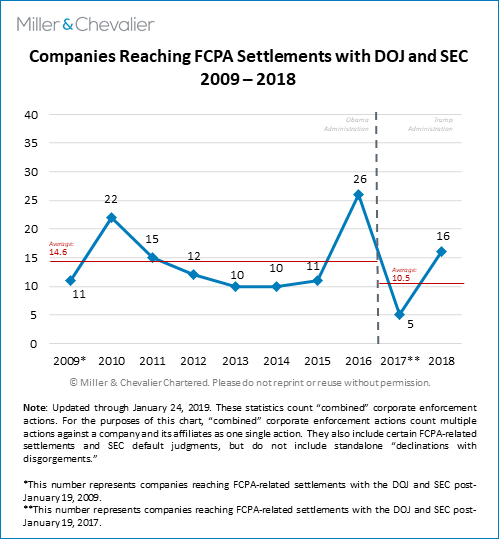

Twenty-four companies have reached FCPA-related resolutions with the DOJ and/or the SEC since President Trump's inauguration on January 20, 2017, translating into an average of 12 actions a year. This number is somewhat below the average of approximately 15 companies reaching such settlements during the eight years of the Obama administration. Although informative, we note that this baseline average is affected by unusually active FCPA enforcement figures during President Obama's last year in office, which likely contributed to unusually low FCPA enforcement numbers during President Trump's first year. Furthermore, the numbers in this category are mixed, with 16 corporate dispositions during the second year of the Trump administration, exceeding the Obama administration average.

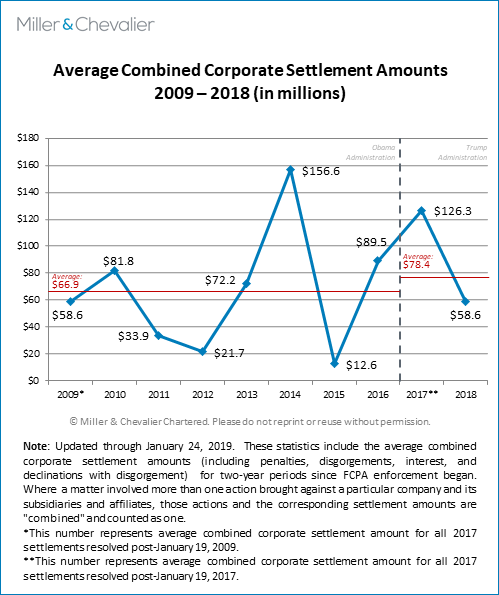

FCPA-related corporate penalty levels have not changed dramatically under President Trump. In fact, the average corporate penalty rose from $66.9 million under President Obama to $78.4 million under President Trump, although average penalty levels have varied widely year-to-year over the past 10 years. As we have noted when presenting these figures in the past, penalty level averages can be affected by the timing of dispositions and other factors that are not necessarily indicative of long-term trends.

With regard to individual enforcement actions, the data shows some increases, especially on the DOJ side, under the Trump administration. This increase is a reflection of active efforts by both agencies to hold culpable individuals accountable for illegal payments and related activities – efforts that the current administration has publicly and repeatedly supported, even as adjustments have been made to corporate enforcement.

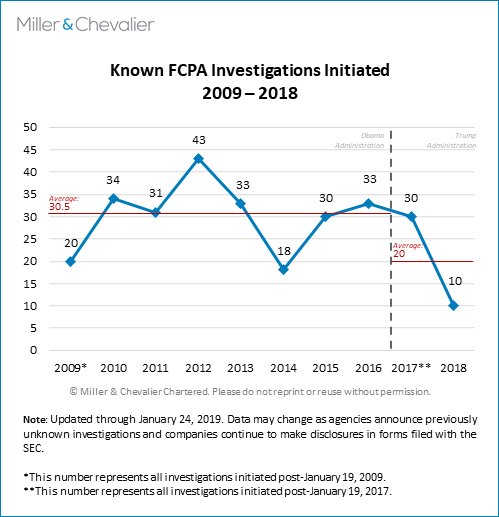

Another measure of FCPA-related enforcement is the number of new investigations launched each quarter, which Miller & Chevalier tracks through companies' public disclosures of such investigations, either to the press or to investors through their SEC filings, as well as other non-public sources of information. Thus far, Miller & Chevalier has counted 30 investigations launched during the first year of the Trump administration and 10 during the second, which comes to a total of 40 such investigations, or an average of about 20 per year.

This average of 20 investigations initiated each year under President Trump represents a significant decrease from the average of just over 30 such investigations initiated each year under President Obama. In particular, the number for 2018 is lower than any other year in the data set. It is this downward trend that raises the biggest question regarding the future of FCPA enforcement policy for the next two years of the Trump administration.

We note, however, that the reduced number of initiated investigations is almost certainly due, at least in part, to incomplete information. In particular, we are likely to learn of several more investigations launched in 2018 in the coming months, as companies disclose such information in their filings with the SEC. Because neither the DOJ nor the SEC disclose official investigations statistics and only some companies are likely to disclose such information through SEC filings or other means, our investigation statistics are necessarily incomplete. We will revisit this data set over the next two quarters to see whether the decline in reported investigations holds and will update our overall conclusions at that time.

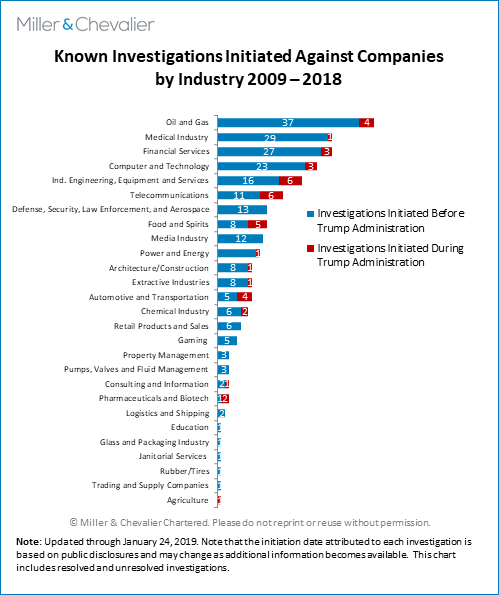

The industries and countries targeted by U.S. prosecutors have changed somewhat under the Trump administration as well, although not dramatically. With regards to industries implicated in alleged FCPA misconduct, most of the investigations under President Trump have focused on the life sciences, industrial engineering, information technology, telecommunications, and food services industries, all of which have been popular targets for the DOJ and SEC for the last 10 years. Two FCPA mainstays – the oil and gas industry and financial industry – also continued to see activity under the Trump administration.

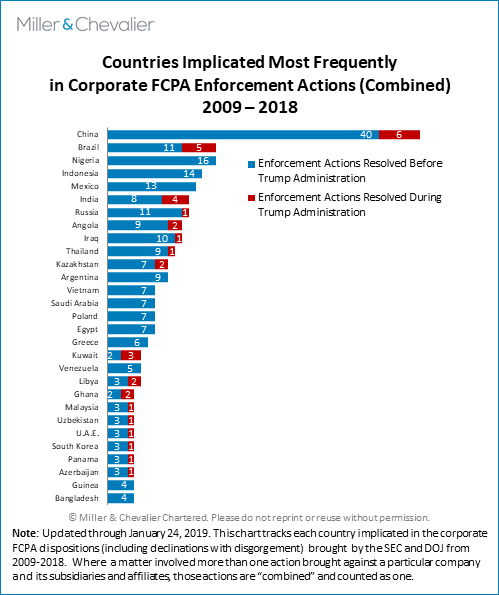

With regards to countries implicated, China, Brazil, and India continue to be in the spotlight, while enforcement activity in Nigeria, Iraq, Indonesia, Mexico, and Russia has tapered off somewhat. Notably, FCPA enforcement against "Chinese companies that compete with American businesses" is part of the DOJ's November 2018 "China Initiative," suggesting that FCPA-related cases involving China will continue to be common.

There are a number of variables that could potentially explain some of the trends observed over the past two years, independent of the change in administration. For example, during the late Obama administration, the DOJ first implemented its Pilot Program, modified and codified as the FCPA Corporate Enforcement Policy under President Trump, which may have nudged corporate enforcement actions downward by offering companies leniency in exchange for self-disclosure, cooperation, and remediation. Notably, our firm has counted 48 DOJ investigations closed without enforcement action since the announcement of the Pilot Program in April 2016 – an average of about 16 a year, which is significantly higher than the average of approximately 11 such investigations closed without enforcement action in the three years before the Pilot Program. This shift suggests that more companies have been able to avoid enforcement actions through self-disclosure, cooperation, and remediation, explaining part of the overall decline in enforcement actions in recent years. Of course, such agency-level enforcement policies may have interacted with the change in administration in difficult-to-measure ways – for example, a hypothetical DOJ under a President Clinton may have elected to rescind the Obama-era Pilot Program, while President Trump's DOJ elected to continue and expand it.

On a related note relevant to the 2019 enforcement statistics, the lapse in federal appropriations in late 2018 and early 2019 resulted in the furlough of key personnel at the DOJ, SEC, and the Federal Bureau of Investigation (FBI) for over a month. As a result, we may well see a slow-down in enforcement actions resolved and new investigations in the next few quarters, especially if there is another government shutdown during the first quarter of 2019.

Policy and Litigation Developments

The fourth quarter of 2018 also saw several FCPA-related policy and litigation developments of note. In October, the DOJ announced an internal guidance memorandum for the selection of corporate monitors in DOJ Criminal Division matters, including FCPA matters. As discussed in greater detail below, the new DOJ guidance on monitors may give companies better grounds to argue that a monitor is not needed in certain cases, for example, where the company has made significant investments in and improvements to a compliance program or where a corporate monitor would be disproportionately costly. Subsequently, in late November, the DOJ announced updates to its policy concerning individual accountability in corporate cases, previously set forth in the so-called "Yates Memorandum" and now included in the Justice Manual, formerly known as the United States Attorneys' Manual. Most notably, as discussed in greater detail below, the changes to the DOJ's individual accountability policy relax somewhat the requirements that companies seeking to cooperate with the DOJ disclose all relevant information on individuals implicated in misconduct. Finally, as also discussed in greater detail below, the retailer Walmart Inc. settled a collateral class action lawsuit arising out of alleged FCPA-related misconduct for $160 million.

International Developments

Several international developments of note occurred during the final quarter of 2018 as well. In Australia, the guilty plea of a former sales executive helped wrap up a seven-year investigation into improper payments made in Malaysia and other countries by Securency International Pty Limited and Note Printing Australia, two subsidiaries of the Reserve Bank of Australia. As discussed in greater detail below, the executive's guilty plea allowed the Reserve Bank of Australia to disclose the guilty pleas made by both subsidiaries in 2011, the first such enforcement actions under Australia's foreign bribery statute.

In Canada, the mining company Glencore Plc announced that it would pay approximately $22 million to settle allegations of misleading securities disclosures about the operations of its subsidiary operating in the Democratic Republic of the Congo (DRC). As discussed in greater detail below, the Glencore settlement does not involve the Canadian Corruption of Foreign Public Officials Act (CFPOA), although the company is reportedly under investigation in the United States and United Kingdom on corruption charges arising out of the same conduct.

In the United Kingdom, the Serious Fraud Office (SFO) secured convictions of three former senior executives at the logistics and freight-forwarding company FH Bertling Group for their roles in an alleged kick-back scheme with the U.S. energy company ConocoPhillips, discussed in greater detail below. Furthermore, the three current members of the North American Free Trade Association (NAFTA) signed the United States-Mexico-Canada Agreement (USMCA), a free trade agreement that contains a first-of-its kind anti-corruption chapter, also discussed below.

Finally, in the first quarter of 2019, the NGO Transparency International released its Corruption Perceptions Index for 2018. The widely cited Corruption Perceptions Index measures countries by their "perceived" public sector corruption, based on expert assessments and opinion surveys. We will discuss the changes in the 2018 Corruption Perceptions Index in an upcoming publication.

Enforcement Actions Against Companies

Vantage Drilling International Agrees to Pay $5 Million to SEC to Settle FCPA Accounting Violations in Connection with Brazil Drilling Contract

On November 19, 2018, the SEC announced that Houston-based offshore drilling company Vantage Drilling International (Vantage) had reached a settlement to resolve allegations that its former parent company, Vantage Drilling Company (VDC), violated the FCPA's internal-accounting-controls provisions. At the time of the conduct at issue, VDC was a U.S. issuer and had full control over its subsidiary, Vantage, up until February 2016, when VDC emerged from bankruptcy as Vantage. Vantage, which now fully owns and controls VDC, agreed to pay $5 million dollars in disgorgement arising out of alleged improper payments made by VDC's former outside director and substantial shareholder to an official from the Brazilian state-owned oil and gas company Petrobras in connection with an 8-year drilling services contract valued at over $1.8 billion.

According to the SEC's Cease and Desist Order, VDC failed to devise a system of internal accounting controls for VDC's transactions with a former outside director and shareholder (Director A) and failed to properly implement internal accounting controls related to its use of its third-party marketing agent (the Agent) in Brazil. In addition, the Order alleges that VDC failed to follow its own internal accounting controls by not conducting due diligence on the Agent and not responding to red flags suggesting that Director A and the Agent were making corrupt payments in connection with a Petrobras drilling contract.

VDC's Relationship with Director A

According to the Order, VDC's relationship with Director A began in 2007 when VDC sought to market itself as an "ultra-high end" driller but did not own any drilling assets. The company reached out to Director A – a Taiwanese shipping magnate – as a prospective investor and supplier. Through a series of agreements made between 2007 and 2008, VDC obtained the rights to purchase Director A's drilling assets, including the Titanium Explorer, an ultra-deepwater drillship then under construction with an expected 2012 delivery date. In return, Director A was "appointed to VDC's board, paid $56 million in cash, and issued 40% of VDC's common stock – making Director A VDC's largest shareholder." Despite the expansive nature of the agreement, the Order notes that VDC failed to conduct any due diligence on Director A and his related companies to assess his capacity to fulfill these obligations before coming to rely on him as its "sole source of drilling equipment and appointing him to its board of directors."

Ultimately however, VDC was unable to finance the purchase of the Titanium Explorer outright, which resulted in modification of the agreement. As amended, Director A would continue to own the Titanium Explorer and, in return, would pay VDC to oversee its construction and subsequent operation.

VDC's Third-Party Relationships and Improper Payments

According to the Order, in 2007, the CEO of VDC initiated relations with the Agent, a Brazilian third-party intermediary, requesting his assistance in marketing VDC to Petrobras. VDC allegedly conducted no due diligence on the agent, failing to follow the company's own internal policies. Specifically, the Order states:

- In mid-2008, during the bidding process to market the Titanium Explorer to Petrobras, an intermediary for a senior Petrobras official contacted the Agent, indicating that the official would be willing to award the contract to VDC in return for a payment.

- In November 2008, the Agent held a secret meeting with Director A to ask whether Director A was willing to make the improper payments requested by the Petrobras official, to which Director A allegedly agreed.

- In December 2008, the Agent, Director A, and the Petrobras official's intermediary met secretly in Brazil to finalize the arrangement whereby "Director A" would make payments from his personal funds to the Agent and the Petrobras official's intermediary. Director A agreed to make three installments of payments: "(1) $6.2 million when Petrobras' International Division (PBID) signed the drilling services contract with VDC; (2) $4.65 million six months after the contract was signed and (3) $4.65 million when the drillship began working for PBID."

- In February 2009, Petrobras and VDC signed the Titanium Explorer contract for an eight-year term. Shortly thereafter, VDC and Director A finalized their agreement relating to the Titanium Explorer. Under the new terms, VDC agreed to provide Director A all revenues received from Petrobras and, in exchange, Director A agreed to continue making all necessary installation payments to fund the drillship's construction.

The SEC Order alleges that, in the following months, Director A made two improper payments to the Agent and the Petrobras official's intermediary in accordance with the agreement made in December 2008. However, before the third improper payment was due, Director A sustained financial losses which resulted in Director A having to sell the Titanium Explorer to VDC. Once again, the Order states "VDC failed to have sufficient internal accounting controls associated with the transaction."

VDC's Failure to Respond to Red Flags

The SEC Order states that VDC failed to respond to the following red flags relating to Director A and the Agent, namely:

- In September 2012, a consultant who had previously worked with Director A hinted to the CEO of VDC that Director A expected that VDC would reimburse Director A for his "payment to P."

- The Agent allegedly reported to the CEO of VDC – around the time the final payment was due – that he had personally made a "final payment" relating to the Titanium Explorer contract.

- In August 2013, a Brazilian reporter sent an email to VDC's CEO and marketing department, "requesting clarification for a story she was writing concerning alleged payments made by Director A to obtain the Titanium Explorer contract."

VDC's Subsequent Bankruptcy and Reemergence as Vantage

The bribery scheme was exposed as part of a sweeping Operation Car Wash criminal investigation in Brazil, also known by its Portuguese name Lava Jato. In July 2015, the Brazilian Federal Public Prosecutor's Office entered into an agreement with the Agent. As part of the agreement, the Agent admitted to participating in the scheme involving the Titanium Explorer contract.

In September 2015, Petrobras cancelled its contract with Vantage for the drillship, alleging that the Houston-based company had breached its contractual obligations. Unable to meet its debt obligations as a result of the revenue loss caused by the contract cancellation, VDC entered into a restructuring agreement with its secured creditors in late 2015. Pursuant to the agreement, the Order states that VDC transferred its tangible assets and operations to Vantage – a wholly owned subsidiary of VDC – in exchange for a $61.5 promissory note. Finally, in December 2015, VDC commenced Chapter 11 bankruptcy proceedings, reemerging as Vantage in February 2016.

The Settlement Offer

Ultimately, the SEC accepted Vantage's settlement offer and refrained from imposing a fine, taking into consideration the company's cooperation, remedial efforts, and financial condition. Specifically, the Order states that Vantage "voluntarily disclosed information obtained during its own internal investigation, highlighted key documents and disclosed facts the Commission would not have easily discovered." In addition, the Order provides that Vantage undertook several remedial actions, including: "(1) reconstituting its Board of Directors in February 2016; (2) obtaining a new management team; (3) severing its relationship with Agent; (4) undertaking a comprehensive review of and enhancing its anti-corruption policies and procedures in consultation with outside counsel and consultants; (5) improving its third-party due diligence procedures; (6) undertaking a review of all its relationships with joint venture partners, agents, customs brokers, and freight forwarders; and (7) committing additional resources to the compliance and internal audit functions at a time when the company reduced its overall expenses."

In August 2017, various news sources reported that the DOJ closed its investigation into Vantage over possible violations of the FCPA without taking any further action.

Noteworthy Aspects:

- Risks at the Top: Companies can face serious risks deriving from actions of senior executives and directors, as illustrated by this case. Director A, who was not only on the Board of Directors, but also VDC's largest shareholder, allegedly engaged in corrupt behavior to benefit the company and himself, but those actions ultimately ended in financial ruin for the company. In addition, VDC's CEO did not take action regarding serious red flags based on information provided to him. Corporate compliance programs that are not applied to or engaged with by directors and senior managers have little chance of mitigating risks.

- Conflicts of Interest May Heighten Risk of Corruption: The circumstances presented by Vantage show that Director A's ownership interest in the Titanium Explorer drillship may have created a conflict of interest between his financial interest in the drillship and the company's best interests. Specifically, under the arrangement between VDC and Director A, Director A continued to wholly own the Titanium Explorer but would pay VDC to oversee construction and eventual operation of the drillship. Moreover, because he possessed full ownership of the Titanium Explorer, it seems Director A was able to exert unilateral control over relations with Petrobras, thus sidelining other corporate processes that could have identified or addressed corruption risks. This case therefore illustrates the benefits of a strong, effective conflict-of-interest policy for mitigating corruption risks, especially for board directors.

- Additional Fallout: In addition to the SEC's enforcement action against Vantage and the Brazilian government's prosecution of the Agent described above, the alleged payments to the Petrobras official have spawned additional enforcement actions and litigation in both the United States and Brazil. First, Brazilian federal prosecutors charged Director A – whose real identity is Hsin Chi Su – and former head of PBID Jorge Zelada with corruption and money laundering, alleging that Zelada accepted over $31 million in bribes from Hsin in exchange for the Titanium Explorer contract. In February 2016, Zelada was sentenced to 12 years in prison; charges against Hsin remain open. Second, Vantage initiated an arbitration dispute against Petrobras for cancelling the drillship contract. In July 2018, an arbitration tribunal determined that Petrobras improperly terminated its contract with Vantage Drilling International and issued Vantage a $622 million arbitration award, which Petrobras is currently challenging in Texas federal court. Third, following the arbitration tribunal's decision, Brazilian federal prosecutors charged former VDC CEO Paull Bragg with corruption and money laundering, accusing him of offering $31 million in bribes to public officials.

Brazilian State-Owned Utility Eletrobras Reaches Settlement with the SEC over FCPA Violations

On December 26, 2018, the SEC announced that it had charged Centrais Elétricas Brasileiras S.A. (Eletrobras) with violations of the books-and-records and the internal-accounting-controls provisions of the FCPA. Eletrobras agreed to pay a civil monetary penalty of $2.5 million in settling with the SEC to resolve the charges arising out of the alleged misconduct. Eletrobras consented to the order without admitting or denying the SEC's findings.

Eletrobras is a state-controlled Brazilian power generation, transmission, and distribution company based in Rio de Janeiro. The company is Latin America's biggest power utility company and has its stock registered with the SEC and traded on the New York Stock Exchange (NYSE). The federal government of Brazil currently owns a 51 percent stake in Eletrobras and has the right to appoint seven of the company's 11 supervisory board members. Eletrobras has a 99 percent ownership stake in Termonuclear S.A. (Eletronuclear), a nuclear power generation company. Eletrobras is the second Brazilian state-owned and U.S. publicly traded company to settle with the SEC in 2018, following the settlement of the state-owned oil-and-gas company Petrobras in September 2018.

According to the SEC's Cease-and-Desist Order, from approximately 2009 to 2015, former officers at Eletronuclear engaged in a bid-rigging scheme with several private Brazilian companies in connection with the construction of Angra III, a nuclear power plant whose construction has been suspended since 2015 as a result of the ongoing investigation and the pending charges against the contractors involved. According to the Order, the Eletronuclear officers "misused their official positions" and influence over the Angra III "prequalification, budgeting and procurement processes" and authorized the engagement of "unnecessary contractors," thereby "inflating the cost of an infrastructure project" related to the construction of the nuclear power plant. The SEC also found that, in return, executives from the Brazilian construction companies involved in the scheme paid the former Eletronuclear officers approximately $9 million. The former president of Eletronuclear allegedly received approximately $4.1 million. Other former Eletronuclear officers also collectively received approximately $4.9 million. In addition, the "construction company executives allegedly agreed to pay 2% of the Angra III contract value to officials associated with two of Brazil's largest political parties (1% each)." The SEC Order states that, after receiving illicit payments from the construction company executives, Eletronuclear officers, including the former president of Eletronuclear, allegedly rigged bids in favor of the relevant construction companies.

The SEC Order further alleges that Eletrobras's anti-corruption policies and procedures and accounting controls relied in part on "general and boilerplate prohibitions that did not apply to all employees or were ignored." For example, Eletrobras had adopted a code of ethics in 2005, but the code applied only to Eletrobras and made no mention of the company's subsidiaries and special purpose entities. Furthermore, the SEC found that Eletronuclear paid the invoices related to the inflated contracts in the ordinary course of its business because Eletrobras had failed to devise and maintain a sufficient system of internal accounting controls from 2009 through 2015. Eletronuclear recorded the payments made to the contractors as legitimate expenditures, even though a percentage of them were used for bribes. As a result of this alleged failure of internal accounting controls, Eletrobras's books and records inaccurately reflected the company's transactions on this project.

In a Notification of Late Filing (Form 12b-25) in April 2016, Eletrobras said that it first had become aware of press reports with bribery allegations in April 2015 when the company had announced that it was "in the process of engaging a specialized independent firm to conduct an external investigation into these allegations." According to Eletrobras, the investigation was triggered by testimony taken in conjunction with the Brazilian government's ongoing Car Wash investigation of corruption allegations against Petrobras. Specifically, that testimony alleged that the CEO of an Eletrobras subsidiary received illicit payments from a consortium of companies bidding for the Angra III power plant project. Two months later, in June 2015, Eletrobras also disclosed to investors that it had uncovered evidence of potential bribery and overbilling since 2008 in connection with construction contracts in Brazil. That same month, the company announced that it had engaged external counsel to conduct the internal investigation into potential violations of the FCPA and other anti-corruption laws (e.g., Brazil's anti-corruption law No. 12,846/2013) and corporate policies.

According to the Order, in determining to accept the settlement offer by Eletrobras, the SEC considered the cooperation of the company, including "sharing facts developed during the course of the internal investigation" and "voluntarily producing and translating documents." The SEC said it had also considered Eletrobras's remedial actions "promptly" undertaken by the company, including disciplining employees involved in the misconduct; enhancing internal accounting controls and compliance functions; remediating material weaknesses identified; and adopting new anti-corruption policies and procedures.

Noteworthy Aspects:

- Parallels with September 2018 Petrobras Settlement: Eletrobras's settlement with the SEC parallels a similar settlement with the DOJ and SEC by a sister Brazilian state-owned enterprise, Petrobras, discussed in our FCPA Autumn Review 2018. Most notably, Petrobras and Eletrobras were both found to have violated the accounting provisions of the FCPA despite the fact that the companies were also "victims" of corruption. Specifically, officials at both companies caused the companies to pay for inflated contracts that funded the payments to the companies' officials as well as other Brazilian officials. Nevertheless, the SEC determined that both companies violated the FCPA by maintaining weak compliance and internal accounting controls that facilitated the corruption and by recording the inflated transactions in their books and records.

- No DOJ Resolution: One key difference between the Petrobras and Eletrobras settlements with U.S. authorities, however, is the lack of a DOJ resolution involving Eletrobras, whereas Petrobras entered into an NPA with the DOJ. Although the NPA does not specify whether Petrobras violated the FCPA's anti-bribery provisions, the NPA refers to Petrobras officials acting as intermediaries for payments to public officials and political parties and suggests that the company itself, not just the executives receiving the bribes, benefited from the schemes. For example, the NPA states that the payments allowed Petrobras to "remain in the favor of many of Brazil's politicians and political parties." In contrast, on August 14, 2018, Eletrobras disclosed in an SEC filing that the DOJ had "declined to prosecute the Company for issues related to the" FCPA. The difference may potentially be due to the lack of evidence that Eletrobras benefited from any of the payments that the construction companies paid to Brazilian officials or a lack of a connection to the United States sufficient for jurisdiction under the anti-bribery provisions. In addition, the overall scale of the Eletrobras scandal pales in comparison to the Petrobras scandal, which is reflected by the size of the fines and penalties (USD 2.5 million for Eletrobras versus USD 853.2 million for Petrobras, which was offset by amounts paid in Brazil).

- SEC's Broad Definition of Internal Controls: The enforcement action against Eletrobras highlights the importance of and the SEC's continued focus on the design, implementation, and maintenance of an effective compliance program specifically tailored to the inherent risks associated with the operations not only of a parent company, but also of its subsidiaries. In the SEC's view, it is not enough for a company to create or maintain a perfunctory compliance program that does not take into account its risk profile and that of its subsidiaries. For example, the SEC's Order specifically discussed how "Eletrobras's anti-corruption policies or procedures and accounting controls relied, in part, on general or boilerplate prohibitions that did not apply to all employees or were ignored." The SEC found that Eletrobras had adopted a code of ethics in 2005 to ensure ethical behavior by company employees. However, the code "only applied to the holding company and made no mention of the subsidiaries and special purpose entities." In 2009, Eletrobras began anti-corruption training but only for a small number of its employees. A year later, the company also approved a code of conduct for its subsidiaries that required all employees to observe Eletrobras's ethical principles, which, among others, required the selection and engagement of suppliers based on specific criteria, including legal, technical, and quality, among others. However, the SEC found that many accounting controls designed to promote these ethical principles, such as contractual measurement criteria requiring that payments to suppliers be proportional to the work performed or prohibitions against direct payments to subcontractors, were ignored or circumvented because of significant material weaknesses in Eletrobras's internal control over financial reporting that allowed employees at Eletronuclear to pay for upfront costs for work not performed and that the company failed to remediate for many years. The settlement with Eletrobras thus emphasizes that a company needs to develop customized compliance policies and procedures in order to effectively address the specific risks faced by it and/or its subsidiaries. The enforcement action further highlights that an effective compliance program must be implemented simultaneously at all levels of a company. It is also critical that publicly-traded companies promptly address identified weaknesses in their internal controls over financial reporting.

Polycom, Inc. Obtains a Declination with Disgorgement from the DOJ and Settles with the SEC

On December 20, 2018, the DOJ entered into a letter agreement in which it declined to prosecute Polycom, Inc. (Polycom), a California-based communications solutions provider. From 1996 until 2016, Polycom was listed on Nasdaq. In September 2016, Polycom was acquired by a private equity firm and delisted. In July 2018, Plantronics, listed on NYSE, acquired Polycom.

The letter agreement stated that the DOJ was declining to prosecute Polycom "despite the bribery committed by employees of the company's subsidiaries in China, and these subsidiaries' knowing and willful causing of false books and records at Polycom." As part of the disposition of the investigation, Polycom agreed to disgorge $30,978,000, which, according to the letter agreement, "represents the profit to the company from the illegally obtained contracts in China." According to the letter agreement, the disgorgement amount was to be divided between the SEC, the U.S. Treasury Department, and the U.S. Postal Inspection Service Consumer Fraud Fund. In particular, the letter states that the company "will pay $10,672,926 in disgorgement of profits earned within the time limits prescribed by 28 U.S.C. § 2462" to the SEC.

On December 26, 2018, the SEC entered a Cease-and-Desist Order against Polycom for violations of the books-and-records and internal-accounting-controls provisions of the FCPA. In connection with the Order, Polycom agreed to pay disgorgement of $10,672,926 and prejudgment interest of $1,833,410. The disgorgement amount matches the amount paid to the SEC as cited in the DOJ's earlier declination letter. The Order also imposed a civil monetary penalty of $3,800,000.

The SEC's Order provided more details regarding the issues that led to the Polycom dispositions. The Order explained that Polycom's Vice President of China at the company's wholly-owned subsidiary Polycom Communications Solutions (Beijing) Co. (Polycom China) devised and carried out a system of payments designed to obtain business from Chinese government customers. According to the Order, from 2006 until at least 2014, Polycom China provided significant discounts to certain distributors and resellers with the knowledge and intention that those discounts would be used to pay Chinese government officials for their assistance in obtaining orders for Polycom products. Specifically, Polycom China employees, including senior managers, allegedly approved discounts requested by distributors which were designed to cover the cost of payments made by the distributors to Chinese officials. Polycom China employees recorded the discounts in parallel unofficial sales management and email systems that violated Polycom policies and procedures. Polycom China senior managers also recorded these transactions in the main Polycom customer relations management (CRM) system but did not reflect that the discounts were intended to pay Chinese officials, instead recording them as legitimate business expenses, in violation of the books-and-records provisions.

The Order states that when personnel at another Polycom entity were required for sign-off on the discounts, Polycom China managers never informed those individuals that the discounts funded improper payments to officials and instead cited legitimate business concerns. The SEC wrote that because the company did not have adequate controls to detect whether these explanations to personnel or the explanations recorded in the company's CRM system were accurate, Polycom failed to devise and maintain sufficient internal accounting controls.

Both the SEC and DOJ credited Polycom for self-disclosing the misconduct at issue, taking remedial steps – such as terminating eight employees "involved in the misconduct" and a third party – "disciplining 18 other employees," and enhancing the company's compliance program and internal accounting controls.

Noteworthy Aspects:

- First Declination with Disgorgement for a Publicly-Traded Company and in Connection with a Parallel SEC Action: The DOJ has concluded prior "declination with disgorgement" actions only with privately-held companies, and thus the SEC has not been involved in the related investigations. Polycom is not only the first publicly-traded company to obtain a declination with disgorgement, but also the first with a parallel action by the SEC. The DOJ agreement and the SEC Order show evidence of coordination with regard to the disgorgement paid by Polycom. To qualify for the benefits outlined in the DOJ's FCPA Corporate Enforcement Policy, which include the presumption of a declination, absent aggravating circumstances, "the company is required to pay all disgorgement, forfeiture, and/or restitution resulting from the misconduct at issue." The DOJ stated that this was occurring in the letter agreement, and noted that a portion of the disgorgement would be paid to the SEC. However, the portion that was paid to the SEC appears to have been limited by the Supreme Court's June 2017 decision in Kokesh v. SEC (discussed in our FCPA Summer Review 2017), which held that the SEC's disgorgement claims constitute a "penalty" under federal law and are therefore subject to a five-year statute of limitations under 28 U.S.C. § 2462, the same period that applies to the SEC's imposition of civil penalties. In Polycom's case, the SEC's Order states that the actions at issue took place from approximately 2006 to 2014, which places some of these activities outside of the SEC's reach in accordance with the statute as interpreted by Kokesh. This appears to be explicitly noted by the DOJ's statement that the disgorgement paid to the SEC covered only "profits earned within the time limits prescribed by 28 U.S.C. § 2462." The DOJ has stated publicly that it does not consider itself to be limited by Kokesh and thus disgorgement can cover profits from earlier timeframes so long as the company agrees.

- Parallel Email System: The use of parallel emails systems, as occurred with Polycom China, can create complications for companies seeking to cooperate with a DOJ investigation. According to the DOJ's FCPA Corporate Enforcement Policy, in order to receive full credit, companies are required to have "[a]ppropriate retention of business records, and prohibiting the improper destruction or deletion of business records, including prohibiting employees from using software that generates but does not appropriately retain business records or communications." Unregulated parallel email systems make it more difficult for companies to provide necessary records during their cooperation efforts, and companies must take steps to capture that information. Our firm has previously discussed the business-records retention aspects of the DOJ's FCPA Corporate Enforcement Policy in a post on the FCPA Blog.

- "Competition" as the Fraudulent Explanation for the Discount: According to the Order, on more than one occasion, in the company's official CRM database, Polycom China employees fraudulently justified the payments by recording that "competition" with other communications product providers was the reason for providing the discount that funded payments to officials. At least one entry cited a customer's refusal to pay a higher price as the justification for the discount. As companies work to evaluate and calibrate their compliance systems and internal accounting controls, it is important to stay up to date and aware of various methodologies for masking improper payments.

- Polycom's Second Internal-Accounting-Controls Violation: The SEC's Order stated that, in March 2015, the SEC had entered another order finding that Polycom had violated the Exchange Act and related rules in failing to properly record and disclose $190,000 of payments of its CEO's personal expenses from May 2010 to July 2013 and for failing to implement adequate internal accounting controls related to corporate purchasing cards and air travel. It is not clear from the Order whether the civil penalty Polycom paid in the current resolution was affected by the company's previous violation.

- Inadequate Due Diligence of a Distributor: The SEC Order drew attention to Polycom's failure to complete its due diligence review of a distributor even though Polycom had become aware during a due diligence exercise in 2013 that the distributor had made an improper payment to a Chinese government official in a matter unrelated to Polycom. Moreover, the SEC noted that Polycom had allowed Polycom China to continue using the distributor in connection with sales to government companies, despite having that information. The SEC's mention of this fact illustrates the need for companies to conduct thorough investigations and due diligence and take appropriate action based on information that comes to light, even if the information is related to actions outside of the company's relationship with a third party.

Enforcement Actions Against Individuals

Ex-Goldman Sachs Banker Pleads Guilty to FCPA and Money Laundering Conspiracy Charges in Connection with 1MDB Fund

On November 1, 2018, the DOJ announced a guilty plea by Tim Leissner, an ex-managing director at the New York-based investment bank and financial services company the Goldman Sachs Group, Inc. (Goldman Sachs). Leissner pled guilty to one count of conspiracy to commit money laundering and one count of conspiracy to violate the anti-bribery and internal-accounting-controls provisions of the FCPA in August. His plea was unsealed in November, along with the charges against his two alleged co-conspirators – the ex-Goldman Sachs banker Roger Ng and the Malaysian businessman Jho Low – all of whom were allegedly at the center of the 1Malaysia Development Berhad (1MDB) corruption scheme that gave rise to charges against all three men.

The 1MDB alleged corruption scheme has been the subject of media attention since at least 2015. 1MDB is a now-insolvent strategic development company established by the government of Malaysia and backed by the government of Abu Dhabi to raise capital and invest funds in strategic projects to help grow the Malaysian economy. According to the DOJ's Information against Leissner, from 2012 to 2013, 1MDB retained Goldman Sachs to underwrite a series of bond offerings that raised more than $6 billion, from which the New York investment bank allegedly earned more than $600 million in fees and revenues. At the same time, according to the DOJ, Leissner and Ng used their positions at Goldman Sachs to pay kickbacks and help embezzle at least $2.7 billion of the funds raised through these bond issuances for the benefit of Malaysian and Abu Dhabi officials, both at 1MDB and in other high-level government positions. Leissner's and Ng's alleged co-conspirator, Low, used his connections to the high-ranking Malaysian officials, including then-Prime Minister Najib Razak, to help facilitate the kickback and embezzlement scheme. The three co-conspirators allegedly laundering the embezzled funds through luxury real estate in New York City, artwork sold by a New York-based art house, and funding for Hollywood films, including The Wolf of Wall Street.

Leissner faced one count of conspiracy to violate the anti-bribery and internal-accounting-controls provisions of the FCPA and one count of conspiracy to commit money laundering. In particular, the information alleges that he knowingly and willfully circumvented Goldman Sachs's internal accounting controls designed to prevent FCPA-related misconduct – for example by lying to the investment bank's compliance and legal personnel about the involvement of his alleged co-conspirator Low, whose unexplained wealth raised red flags for the investment bank – and by causing proceeds earned from the deal to be wired to accounts controlled by the three alleged co-conspirators and 1MDB officials, in support of the FCPA conspiracy.

Leissner faces a maximum penalty of five years for the FCPA conspiracy count and twenty years for the money-laundering conspiracy count. As part of his plea bargain, Leissner was ordered to forfeit $43.7 million allegedly earned from his crimes, in addition to any additional penalties he may be required to pay after his sentencing. Because Leissner is a German but not a U.S. citizen, he may also face deportation as a result of his guilty plea.

In addition to the Leissner guilty plea and the charges against Ng and Low, the alleged 1MDB corruption scheme has led to a host of additional indictments and enforcement actions. Most notably, former Malaysian Prime Minister Najib Razak and his wife Rosmah Mansor have been arrested in Malaysia in connection with 1MDB, as have at least eight former agents from Malaysia's foreign intelligence agency. The DOJ has also filed forfeiture actions against more than $1 billion in assets connected with the 1MDB scheme, the largest civil forfeiture action to date under the agency's Kleptocracy Asset Recovery Initiative.

Former Hong Kong Government Official Convicted of FCPA Charges in Connection with Bribery of High-Level African Officials

On December 5, 2018, a jury in the Southern District of New York convicted Chi Ping Patrick Ho (Patrick Ho) of several FCPA anti-bribery and money laundering offenses after a five-day trial. The jury deliberated less than one day to find Ho guilty of conspiring to violate the FCPA and of violating the FCPA based on evidence that he sought to bribe the President of Chad and paid a bribe to the Ugandan Foreign Minister in order to obtain valuable contracts and other business advantages for CEFC China Energy, a Chinese conglomerate focusing on the oil, gas, and banking sectors.

The jury also convicted Ho of conspiracy to commit money laundering and of engaging in money laundering in connection with the same conduct underpinning the FCPA charges, while acquitting him on one count of money laundering. During the time at issue, Ho, a former Secretary for Home Affairs of Hong Kong, served as the head of China Energy Fund Committee (CEFC NGO), an NGO based in Hong Kong and Virginia that was funded by CEFC China.

Ho was initially named as a co-defendant alongside Chaikh Gadio, a former foreign minister of Senegal, in a sealed criminal complaint filed on November 16, 2017. Gadio ultimately testified as a prosecution witness in exchange for a NPA with the DOJ.

According to the complaint and indictment, Ho was at the center of two separate bribery schemes. The first, which took place over 2014 and 2015, involved an attempt to give $2 million in cash to the President of Chad in exchange for an opportunity for CEFC China to secure oil rights in Chad without a formal tender process. Gadio played a central role in this scheme, in part by connecting Ho and the President of Chad and advising Ho to "reward" the President with a "nice financial package," according to the DOJ. Gadio's trial testimony showed that the President of Chad refused the $2 million offered in person by Ho and CEFC China executives, which CEFC China then sought to recharacterize as a charitable donation for the benefit of the people of Chad. CEFC China did not go through with the acquisition of the oil rights, with Ho nonetheless paying $400,000 to Gadio for his role in the scheme.

In the second scheme, the government alleged that Ho authorized a payment of $500,000 requested by Ugandan foreign minister Sam Kutesa, in exchange for various benefits for CEFC China, including an invitation to the inauguration of Uganda's recently reelected President Museveni and business meetings with the President and high-level Ugandan officials. Ho had initially met Kutesa in 2015, when the latter was serving as President of the United Nations (U.N.) General Assembly in New York. According to the DOJ, they continued to discuss potential business ventures for CEFC China in Uganda until the conclusion of Kutesa's U.N. tenure, when he resumed his post as Uganda's foreign minister in February 2016. After the payment of $500,000 by CEFC NGO, Ho and CEFC China executives attended President Museveni's inauguration in May 2016 and met with the President and top officials at Uganda's Department of Energy and Mineral Resources regarding potential business opportunities for CEFC China. In addition, the DOJ introduced evidence that Kutesa assisted CEFC China in its effort to acquire a Ugandan bank as an initial business venture by the company in Uganda. The prosecutors alleged that CEFC NGO made the $500,000 payment in the name of a charitable foundation that Kutesa claimed to be launching, with Ho also advising the Chairman of CEFC China to provide $500,000 in cash to President Museveni as a campaign donation, even though he had already been reelected. The government introduced evidence that Ho also offered to "partner" with Kutesa and President Museveni and their "family businesses," implying that they or their families would benefit from potential business ventures involving CEFC China.

Ho's sentencing hearing is scheduled for March 14, 2019. Ho faces a maximum prison sentence of five years for each of the four FCPA charges on which he was found guilty, 20 years in prison for conspiring to commit money laundering, and 20 years in prison for money laundering.

Ex-Panasonic Aviation Corporation CEO Settles FCPA Accounting Charges with SEC

On December 18, 2018, the SEC announced charges against Paul Margis, the former CEO of the California-based Panasonic Avionics Corporation (PAC), the U.S. subsidiary of Japan's Panasonic Corporation (Panasonic). Margis was charged with violating the books-and-records and internal-accounting-controls provisions of the FCPA, as well as causing PAC's parent, Panasonic Corporation, to commit similar violations. Margis agreed to settle the SEC's charges without admitting or denying the allegations and pay a monetary penalty of $75,000.

The charges relate to the same conduct that led Panasonic Corporation and PAC to reach a combined settlement of $280 million with the DOJ and SEC earlier in 2018. As discussed in our FCPA Summer Review 2018, PAC entered into a DPA with the DOJ relating to charges that it had knowingly caused Panasonic to violate the FCPA's books-and-records and internal-accounting-controls provisions when it allowed unlawful payments to Middle East consultants to be improperly "rolled up" into Panasonic's SEC financial disclosures. The SEC simultaneously charged Panasonic itself with both anti-bribery and internal-accounting-controls violations for hiring the Middle Eastern official who assisted PAC in obtaining business from a state-owned airline and also misrepresenting those payments to the official as legitimate consulting expenses.

According to the SEC's Cease-and-Desist Order, between 2007 and 2016, Margis spearheaded the plan to make payments worth more than $184 million in commissions to an outside sales representative, who assisted PAC in contract negotiations with several Middle Eastern airlines, despite the individual having no experience in the aviation industry and no other sales qualifications. The SEC alleged that Margis was aware of internal employee complaints that the sales representative was paying bribes in order to win business for PAC, but nevertheless continued to pay him between $1 and $3 million every month. In addition, from 2007 to 2014, Margis allegedly authorized the payment of over $1.76 million to several other consultants, including a former government airline official who was given a post-retirement $200,000-a-year consulting position as compensation for prior assistance in helping PAC win a lucrative contract. The SEC Order states that payments to the government official and two other consultants, who provided little to no actual services, were made through a third-party vendor – such that Margis knowingly circumvented PAC's system of internal accounting controls – and falsely recorded as consulting expenses in PAC's books and records. Margis later misled PAC's auditor regarding the accuracy of the company's records and accounting controls.

In a separate but related Cease-and-Desist Order, the SEC also charged PAC's former CFO Takeshi "Tyrone" Uonaga for allegedly circumventing the company's internal accounting controls by knowingly causing Panasonic to improperly record $82 million in revenue based on a contract he knew was backdated. PAC's own financial records falsely recorded the revenue, which were then incorporated into Panasonic's consolidated financial statements and included in Panasonic's filings with the SEC. In addition, the SEC charged that Uonaga purposefully mislead PAC's auditor by making false representations regarding the accuracy of PAC's financial statements and providing fraudulent management representation letters. The charges against Uonaga centered on improper revenue recognition rather than any direct FCPA violation, although they arose out of the same alleged misconduct that led to PAC's and Margis's FCPA-related settlements.

Litigation and Policy Developments

DOJ Announces New Corporate Monitor Policy, Instructing Prosecutors to Balance Monitor Benefits and Costs

On October 11, 2018, the Assistant Attorney General for the Criminal Division of the DOJ, Brian Benczkowski, announced the publication of a new internal DOJ Policy on the Selection of Monitors in Criminal Division Matters (the Monitor Policy or the Policy). We noted the new Monitor Policy briefly in our 2018 FCPA Autumn Review and discuss it in more detail below.

The new Monitor Policy establishes "standards, policy and procedures" to be applied in all DOJ Criminal Division determinations regarding the appropriateness of a monitor in any case involving a DPA, NPA, or plea agreement between the DOJ Criminal Division and a business entity. The Monitor Policy elaborates on the considerations set forth in the DOJ's 2008 Morford Memorandum, which established that prosecutors should balance the potential benefits the imposition of a monitor may have for a corporation and the public interest against the potential costs and impact on a corporation.

The Monitor Policy also details the various factors that should guide DOJ personnel in performing this cost-benefit analysis. These factors include: "(a) the underlying misconduct involved the manipulation of corporate books and records; (b) the misconduct was pervasive across the business organization or approved or facilitated by senior management"; and (c) whether the corporation has invested in and improved its compliance program. On the other hand, in evaluating the costs, the Policy advises Criminal Division attorneys to take an expansive view, considering not only monetary costs but also whether the "proposed scope of a monitor's role is appropriately tailored to avoid unnecessary burdens to the business's operations." Noting that the imposition of a monitorship should never serve a punitive purpose, the Policy instructs Criminal Division attorneys to favor the imposition of a monitor only in cases where there is a "demonstrated need for, and clear benefit to be derived from, a monitorship relative to the potential costs and burdens."

In addition, under the new Monitor Policy, Criminal Division attorneys must receive approval from the Chief of the relevant DOJ section as well as the concurrence of the Assistant Attorney General for the Criminal Division as a pre-requisite for imposing a monitor. The Policy also provides for the creation of a Standing Committee on the Selection of Monitors, composed of the Deputy Assistant Attorney General supervising the Fraud Section, the Chief of the Fraud Section, and the Deputy Designated Agency Ethics Official for the Criminal Division, whose role will be to review each case in which imposition of a monitor is recommended. The Policy also expands on the Morford Memorandum's requirement that the selection of a monitor be based on the unique "facts and circumstances of each matter and the merits of the individual candidate" by requiring the selection process to "instill public confidence" and result in the selection of a highly qualified person…free from any actual or potential conflict of interest…." To achieve this end, the Policy sets out procedures for the nomination, review, and selection of candidates.

The Policy codifies long-standing DOJ practice in many respects. Aspects of the Policy have, for example, been incorporated into individual disposition agreements for several years, and the qualifications for monitors have been consistent over time. The Policy is intended to publicly affirm the DOJ's view that the imposition of a monitor is only appropriate when facts and circumstances dictate such a result and the imposition of a monitor is not unduly burdensome or punitive. While the Policy's full effect on companies remains to be seen, it is noteworthy that the new Policy emphasizes the importance of effective corporate compliance programs and specifically includes a company's investment in its compliance program as a guiding factor. Thus, it is clear that a key strategy for avoiding a monitorship continues to be investment in and maintenance of an effective compliance program and related internal accounting controls.

DOJ Announces Updated Justice Manual, Streamlining Process for Corporate Disclosure of Individual Wrongdoing

In late November 2018, Deputy Attorney General Rod Rosenstein announced changes to the DOJ's Justice Manual to reflect DOJ's updated polices on corporate enforcement and individual accountability. The changes reflect a continued emphasis on individual accountability as established by the earlier Yates Memorandum and incorporated into the Justice Manual, formerly known as the United States Attorneys' Manual, soon thereafter. As discussed in our FCPA Autumn Review 2015, the Yates Memorandum formalized the DOJ's policy of pursuing individual prosecutions, including in the context of the FCPA. Although not revolutionary, the November 2018 changes relax the cooperation required by corporations to receive cooperation credit in both criminal and civil cases.

Most notably, the DOJ will no longer condition corporate cooperation credit in criminal matters on the disclosure of "all relevant facts" about all individuals involved in the alleged misconduct. Instead, in order to receive cooperation credit, companies need only identify individuals who are "substantially involved in or responsible for the criminal conduct." In theory, the change will allow DOJ prosecutors to grant cooperation credit in circumstances where such credit previously would have been unavailable. Accordingly, companies may potentially avoid some of the expensive time and effort necessary to track down information about every individual involved in issues under investigation – which, in the FCPA context, can often mean individuals located outside the United States.

Of course, the DOJ still enjoys significant bargaining power with regard to what information is deemed satisfactory in individual investigations. Notably, the DOJ retains the power to deny cooperation credit if the DOJ determines that a company is not being forthright in identifying individuals involved in criminal conduct. In addition, when announcing the changes, Rosenstein emphasized that pursuing individuals involved in corporate fraud continues to be a top priority for the DOJ, noting that "the most effective deterrent to corporate criminal misconduct is identifying and punishing the people who committed the crimes." To this point, the new policy on corporate accountability emphasizes that a corporate resolution cannot shield individuals from criminal liability, absent "extraordinary circumstances."

Finally, the DOJ also adjusted the requirements for companies to receive cooperation credit for civil cases as well. Specifically, companies seeking cooperation credit must identify all wrongdoing by senior officials, including members of senior management or the board of directors. To receive maximum cooperation credit, the new Policy requires companies to identify every individual "substantially involved in or responsible for the misconduct." The DOJ does have authority to enforce the FCPA through civil as well as criminal actions; however, the SEC is the primary agency for such civil enforcement. The changes to the DOJ Justice Manual do not bind SEC practice in this area.

Retail Giant Walmart Settles FCPA-Related Securities Class Action for $160 Million

In December 2018, U.S. District Court Judge for the Western District of Arkansas Susan O. Hickey issued an order preliminarily approving a class action settlement between Wal-Mart Stores, Inc. (Walmart), the company's former CEO Michael T. Duke, and a class of Walmart investors. Plaintiffs filed the putative class action, which alleged securities fraud against Walmart and a group of company executives, in May 2012, and filed an Amended Complaint in February 2013, naming only Walmart and Mr. Duke as defendants.

Lead plaintiff City of Pontiac General Employees' Retirement System alleged that the defendants made materially false and misleading statements and failed to disclose known material facts surrounding the alleged payment of bribes by the company to government officials in Mexico, leading to a significant company presence in that country. Specifically, the Amended Complaint alleged that a 2011 securities filing concealed the truth regarding the company's internal review of potential corruption. The lead plaintiff further alleged that when the New York Times reported in April 2012 that the company had "hushed up" an investigation into the bribery scheme, Walmart stock fell significantly. Thus, the pleading alleged, "[t]he facts defendants had misrepresented and concealed revealed that Walmart's stock had not been worth as much as defendants had led investors to believe."

The settlement does not require the defendants to admit any wrongdoing but does require Walmart to pay $160 million. The settlement class encompasses shareholders who purchased Walmart stock between December 8, 2011 and April 20, 2012. Judge Hickey has scheduled a settlement hearing for April 2019 to, inter alia, determine whether the settlement is fair, reasonable, and adequate.

As previously reported in our FCPA Spring Review 2018, Walmart disclosed in November 2017 that it was setting aside $283 million for a potential settlement to resolve FCPA-related violations in Mexico, Brazil, China, and elsewhere. However, to date, no settlement with regulators has been announced.

International Developments

Reserve Bank of Australia Entities Disclose Past Settlements for More than AUD $21 Million to End Bribery Investigation in Australia

On November 28, 2018, the Reserve Bank of Australia (RBA) announced that the Supreme Court of Victoria, Australia, had lifted suppression orders allowing the bank to disclose its involvement in two prior corruption-related Australian enforcement actions. The court decision to lift the suppression orders stemmed from the final resolution of charges against one of the individuals involved in the case, who entered into a guilty plea and was sentenced to two years of imprisonment in December 2018. Accordingly, it can now be publicly disclosed that the RBA's subsidiary Note Printing Australia and former joint venture Securency (now known as CCL Secure Pty Limited) both pled guilty to conspiring to bribe foreign officials in 2011, were sentenced in 2012, and were fined more than AUD $21 million (approximately USD $15 million). As noted by the court in a now-public sentencing decision, the prosecutions against Note Printing Australia and Securency were the first corporate enforcement actions brought under the Australian Criminal Code's foreign bribery provision, which specifically prohibits the making and offering of bribes to foreign officials.