FCPA Summer Review 2022

International Alert

Introduction

The second quarter of 2022 featured an increase in resolved corporate enforcement actions, showing some evidence of the enforcement intensity emphasized in public statements by the U.S. Department of Justice (DOJ) and Securities and Exchange Commission (SEC). Other notable developments in this quarter included the conclusion of a significant individual criminal trial, the DOJ's termination of another long-running set of individual prosecutions, several developments involving combatting corruption created by kleptocratic activities, and notable enforcement actions and court decisions in the U.K., Canada, and Sweden.

Enforcement Actions Against Corporations

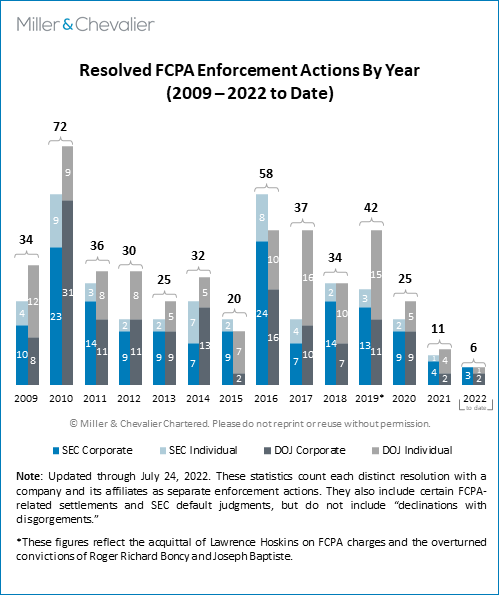

The DOJ and SEC announced between them three FCPA-related corporate enforcement dispositions in the second quarter – actions involving medical waste management company Stericycle, Inc. (Stericycle) in April, Swiss trading company Glencore International A.G. (Glencore) in May, and Luxembourg-based energy supplier Tenaris S.A. (Tenaris) in June. When adding the Credit Suisse resolution from Q1, this pace of four corporate announcements halfway through the year puts the agencies on track to exceed their 2021 numbers, but more will be needed to match their pre-pandemic averages over the medium- to long-term.

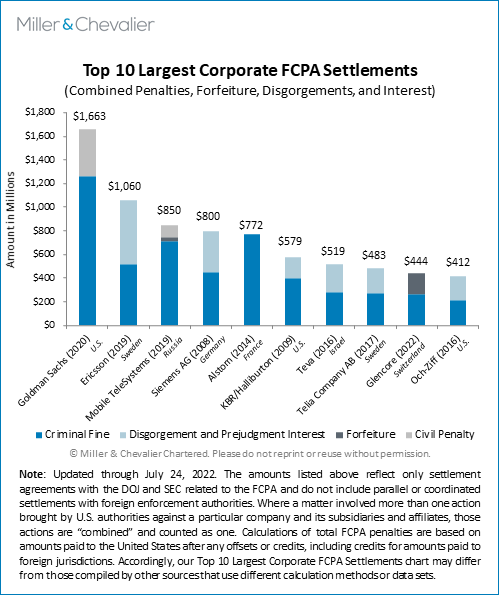

The Glencore disposition is the ninth largest corporate FCPA settlement in the history of the statute when viewed solely in terms of the penalties paid to the U.S. authorities (over $440 million), though that may change once all of the related matters are completed.

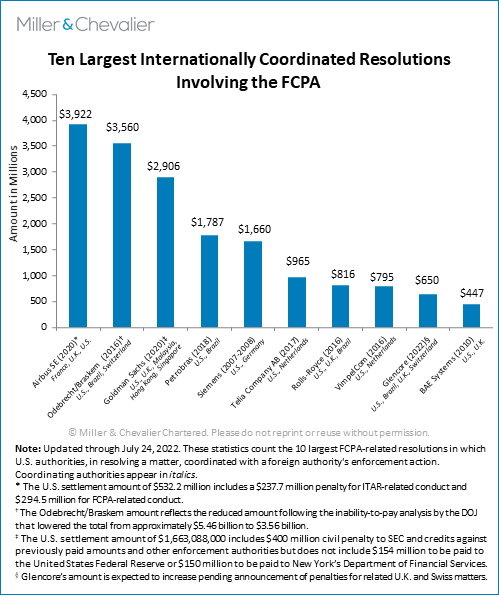

The Glencore result also currently ranks as the ninth largest internationally coordinated corruption case involving the FCPA, based on the combined U.S. and Brazilian penalties ($650.3 million). As discussed below, that number (and potentially the company's position on the chart) is expected to increase once penalties for the related U.K. and Swiss matters are announced.

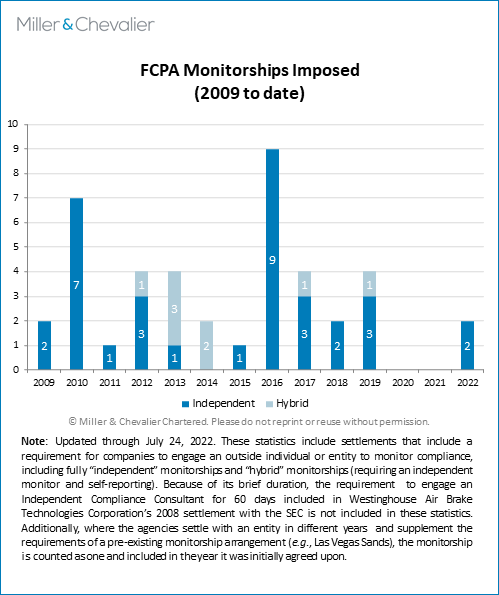

The recent corporate dispositions also show a trend that the DOJ has been telegraphing for some time: the return of corporate monitorships as elements of dispositions. Deputy Attorney General Lisa Monaco issued guidance in October 2021 clarifying that the DOJ will impose Independent Compliance Monitors in cases of "demonstrated need" and "clear benefits" for the company and enforcement goals, marking a change in focus from the prior administration, as seen in the chart below. On March 25, 2022, Assistant Attorney General Kenneth A. Polite, Jr. described monitorships as "effective tools for strengthening corporate compliance programs" and stated it is expected that DOJ impose Independent Corporate Monitors "whenever it is appropriate". Two of the three dispositions this quarter – Stericycle and Glencore – included an Independent Compliance Monitor requirement.

Enforcement Actions Against Individuals

The primary development during the second quarter regarding actions against individual defendants was the conviction in April by a federal jury in New York of Roger Ng, former managing director for Goldman Sachs, on three counts of conspiracy related to the multi-billion-dollar attempts by Ng and others to steal and launder money through 1Malaysia Development Berhad (1MDB), Malaysia's state-owned investment development agency. Ng's former employer Goldman Sachs pleaded guilty to conspiracy to violate the FCPA and paid over $2.9 billion in penalties in October 2020 for the company's role in the scheme.

The DOJ faced some headwinds in other cases against individuals, including most notably in the long-running prosecutions of two businessmen, Joseph Baptiste and Roger Richard Boncy, for conspiracy to bribe public officials in connection with a port development project in Haiti. Though the two defendants were convicted in 2019, a federal court threw out those convictions in 2020 due to ineffective assistance and ordered a new trial (a finding that was confirmed on appeal in 2021). While preparing for the new trial, the Federal Bureau of Investigation (FBI) turned over previously undisclosed documents containing exculpatory evidence to the DOJ. The DOJ immediately shared the evidence with the defendants and moved to dismiss the charges, thus ending the years-long prosecution.

The DOJ is also appealing its trial court loss in another prosecution, that of Swiss national Daisy Rafoi-Bleuler. As reported in our FCPA Winter Review 2022, in November 2021, Houston federal district judge Judge Kenneth M. Hoyt dismissed a three-count indictment against Rafoi-Bleuler, citing jurisdictional issues, which the DOJ appealed in December 2021. At the end of March, the DOJ filed its opening brief with the U.S. Court of Appeals for the Fifth Circuit, arguing that the district court's jurisdictional analysis was flawed and that the FCPA's term "agent" was not unconstitutionally vague. At the end of May, Rafoi-Bleuler (who is represented by Miller & Chevalier) filed her brief, which raised a number of arguments about the extraterritorial application of the conspiracy statute in both the FCPA and money laundering contexts, as well as related arguments about flaws in the indictment against her. On July 11, 2022, Judge Hoyt dismissed the indictment against an alleged co-conspirator not only on lack of jurisdiction grounds but also on statute of limitations grounds related to foreign evidence collection.

There were no newly announced FCPA-related pleas in the second quarter and the SEC did not announce any decisions related to individual actions. One sentencing occurred in May and one in early July. Also in May, another sentenced defendant (Frank Chatburn Ripalda) was given early release due to his cooperation with prosecutors. As was the case with the first quarter of 2022, these statistics are consistent with the slower pace of such cases in 2021 but are well behind the pace that marked recent higher volume years such as 2017-2019.

Declinations and Other Indicia of Enforcement Trends

The DOJ did not announce any public declinations this quarter. At least two companies – PetroNor (in April) and Millicom (in May) – publicly disclosed FCPA-related investigations. PetroNor's U.S. investigation appears to build on an active investigation by Norwegian authorities that was confirmed in December 2021.

Policy and Legislative Developments

On April 14, 2022, the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) issued an Advisory on Kleptocracy and Foreign Public Corruption, which gave guidance to financial institutions in relation to their Suspicious Activity Reports (SAR). FinCEN requested that financial institutions highlight in their SARs any transactions possibly associated with kleptocracy and foreign public corruption and set out 10 financial red flags that institutions should use to identify such activities.

As discussed below, at the end of April, the DOJ sent to Congress a package of legislative proposals to bolster the DOJ's efforts to combat kleptocracy and public corruption, including expanded forfeiture authority, adding to the Racketeer Influenced and Corrupt Organizations Act's (RICO) definitions of racketeering, and extending statutes of limitations to prosecute kleptocrats and to seek forfeiture of their assets. The DOJ has also initiated several forfeiture and related actions to seize assets deemed to be the result of public corruption, including multi-million-dollar mansions in Los Angeles and the Washington, DC areas, as well as a superyacht owned by a Russian oligarch.

Finally, as evidenced by the Glencore disposition, the DOJ is pressing forward with Assistant Attorney General Polite's March 2022 announcement that company Chief Compliance Officers (CCOs) will be required "to certify at the end of the term of the agreement that the company's compliance program is reasonably designed and implemented to detect and prevent violations of the law (based on the nature of the legal violation that gave rise to the resolution, as relevant), and is functioning effectively." This requirement has been questioned and challenged by compliance professionals and the defense bar, who have raised a variety of concerns, but as of now the DOJ appears to be committed to such certifications for most, if not all, FCPA-related resolutions.

U.S. Court Decisions

This quarter saw the issuance of judicial decisions relevant to enforcement and to shareholder disputes arising from FCPA-related corporate dispositions.

While not an FCPA-related case, the Fifth Circuit's decision in the case of Jarkesy v. SEC, which involved the SEC's administrative proceedings against Jarkesy for securities fraud, creates further challenges for the SEC's use of in-house administrative dispositions – potentially including FCPA matters. The relevant constitutional issues raise stakes for the agency not seen since the Lucia case.

In May, Goldman Sachs agreed to settle a 2019 shareholder derivative action against the company and certain of its officers and directors related to the Goldman Sachs' 2020 FCPA case in connection with the 1MDB bribery scandal. Under the settlement, Goldman Sachs and the individual defendants did not admit liability, but Goldman's directors and officers (D&O) insurance carriers agreed to pay $79.5 million to fund Goldman Sachs's compliance activities, including the company's agreement to implement extensive compliance measures beyond those already in place.

In other FCPA-related shareholder litigation results in this quarter, Airbus reached a $5 million settlement in its shareholder litigation and the Second Circuit upheld a lower court decision to dismiss a claim by shareholders of Mobile TeleSystems PJSC.

International Developments

In May, a U.K. court issued findings in the long-running dispute between Eurasian Natural Resources Corp. (ENRC) and the law firm Dechert LLP (Dechert), in which ENRC alleged that Dechert and the firm's former head of white collar crime, Neil Gerrard, breached their duties to ENRC in a Serious Fraud Office (SFO) investigation of corruption in various countries. ENRC alleged that Gerrard leaked ENRC's confidential client information to the media and the SFO in a bid to run up client fees, failed to disclose relevant information, and provided poor advice to ENRC. The court found that Gerrard leaked privileged and confidential information to the media, made unauthorized contacts with the SFO, and "was negligent (and for the most part reckless)" in his professional obligations to ENRC. The court also found that the SFO had acted improperly when it accepted information from Gerrard that was "plainly unauthorized and against his client's interests," though the court did not fully agree with ENRC's characterizations of the SFO's actions and intent and denied ENRC's request to prohibit the SFO's use of information improperly received from Gerrard in future proceedings. Future proceedings will determine causation and damages related to ENRC's claims. The court's findings represent yet another in a line of judicial rebukes to the SFO for its handling of investigations and cases under the U.K. Bribery Act (UKBA).

In other U.K. developments, on April 28, 2022, GPT Special Project Management Ltd (GPT), an Airbus subsidiary, pleaded guilty to corruption before Justice Bryan at the Southwark Crown Court in London concerning certain contracts awarded to the company by the Saudi Arabian National Guard. The company was sentenced to pay an aggregate amount of $36.3 million. This follows charges brought by the SFO in 2020 against the company and three individuals who are currently on trial (although the trial recently halted abruptly, without a clear conclusion). Airbus itself previously settled with U.S., U.K., and French authorities. As we noted at the time, the SFO's investigation into GPT appeared to remain open.

And in May, the U.K. Financial Reporting Council announced that it had issued a Final Decision Notice under the Audit Enforcement Procedure against KPMG and one of its partners for alleged deficiencies in the audit of Rolls-Royce's 2010 financial statements concerning two payments made by the company to agents in India several years earlier. These two payments were amongst the 12 ultimately included in the Deferred Prosecution Agreement (DPA) entered into by Rolls-Royce with the SFO in 2017, under which the company paid more than £497 million in fines. Although the Final Decision Notice specifically "does not allege that the [audit] failings in question caused any misstatement in the FY2010 financial statements to go undetected," KPMG was fined £3,375,000 and subject to: (1) "a requirement that KPMG shall commission a review by an appropriate external independent expert of the effectiveness of the firm's policies, guidance, and procedures for audit work in the area of an audited entity's compliance with laws and regulations;" (2) "a Severe Reprimand;" and (3) "a declaration that the Statutory Audit Report for the Audit did not satisfy the Relevant Requirements." KPMG partner Anthony Sykes was fined £112,500, given a Severe Reprimand, and "a declaration that the Statutory Audit Report for the Audit did not satisfy the Relevant Requirements."

On May 31, 2022, the Supreme Court of Quebec approved Canada's first Remediation Agreement (the Canadian version of a DPA) between the Quebec criminal prosecution office and engineering company SNC Lavalin. The agreement resolved allegations that the company had made improper payments to secure a contract to restore a bridge in Montreal in 2002. The terms of the Agreement included a total payment of C$29.6 million, as well as the appointment of an Independent Compliance Monitor for a three-year period. Canada first introduced the Remediation Agreement regime in 2018. As previously reported, in 2019, a subsidiary of SNC Lavalin resolved allegations that it had bribed officials in Libya to obtain contracts.

On June 21, 2022, a district court in Stockholm acquitted four former Ericsson employees on bribery charges. The prosecution had brought charges against the individuals in May 2021, alleging that they paid bribes to three government officials in the Republic of Djibouti to obtain an agreement for Ericsson with Djibouti Telecom SA. The court found that the prosecution had not shown that two of the officials – Djibouti president Ismail Omar Guelleh and Attorney General Djama Souleiman – had influence over the contract, and that the third official – the CEO of Djibouti Telecom – had received funds. Ericsson itself entered into resolutions with the DOJ and SEC in 2019, as reported previously.

In May 2022, the European Research Centre for Anti-Corruption and State-Building (ERCAS), the Anti-Corruption & Governance Center (ACGC), and the Center for International Private Enterprise (CIPE) launched the Corruption Risk Forecast (CRF). The CRF is based on certain data indicators, such as budget transparency, administrative burden, judicial independence, press freedom, and e-citizenship, to measure corruption levels in more than 120 jurisdictions and provides trends analysis.

Enforcement Actions Against Corporations

Stericycle Settles FCPA-Related Charges with U.S. and Brazilian Authorities

On April 20, 2022, the DOJ and SEC announced that Stericycle, an Illinois based medical waste management company, agreed to resolve parallel investigations by the two agencies and the Brazilian Controladoria-Geral Da União (CGU), Advocacia-Geral da União (AGU), and Ministèrio Publico Federal (MPF) involving charges against the company for violating the FCPA's anti-bribery and accounting provisions.

As a result of the resolution, Stericycle entered a three-year DPA with the DOJ in connection with the filing of a criminal information charging the company with two counts of conspiracy to violate the FCPA's anti-bribery and the books and records provisions. The company also consented to the entry of SEC's Cease-and-Desist Order (SEC Order). The company agreed to pay over $84 million in penalties, which included $52.5 million in criminal penalties to the DOJ and $28.2 million in disgorgement and prejudgment interest to the SEC. The DOJ agreed to credit up to a third of the criminal penalty against fines that Stericycle would pay to the Brazilian authorities, potentially up to $17.5 million to resolve investigations by the Brazilian CGU, AGU, and MPF. The SEC also agreed to offset up to $4.1 million in disgorgement paid to the Brazilian authorities. Additionally, the U.S. resolutions require a two-year Independent Compliance Monitor, after which the company will need to self-report for one year (assuming the Monitor certifies Stericycle's compliance program within the two-year period).

According to the DPA and the SEC Order, between 2011 and 2016, Stericycle – through its employees and agents, together with other entities – paid nearly $10.5 million in improper payments to foreign officials in Brazil, Mexico, and Argentina. The bribes were to "secure improper advantages and to obtain and retain business from [the foreign] government[s]" connected to "providing waste management services [and] obtaining authorization for priority release of payments owed under contracts with government agencies." The SEC Order also states that Stericycle failed to incorporate effective internal controls to detect and prevent such misconduct.

Payments in Brazil

The DPA notes that Stericycle employees conspired to bribe at least 25 local government agencies and instrumentalities in Brazil, earning the company up to $13.4 million in profits from the scheme. Executives from Stericycle's Latin America division directed executives from Stericycle's wholly owned subsidiary in Brazil (Stericycle Brazil) to distribute cash to its sales employees, who then delivered the payments through third-party intermediaries to government officials. In exchange for the payments, Stericycle Brazil received priority payment on invoices that the government agencies already owed based on underlying contracts with the company.

The DPA asserts that Stericycle Brazil executives ordered the subsidiary's finance employees to conceal the illicit payments in accounting records by making the transactions appear as legitimate business expenses. The DPA asserts that Stericycle Brazil initially "inflated invoices" by Brazilian vendors that did provide legitimate services at the time to conceal the payments. However, Stericycle Brazil eventually retained additional Brazilian vendors for the sole purpose of issuing fake invoices. Stericycle Brazil finance employees then documented the transactions as advance payments to the Brazil vendors for debt collection services that were never provided to hide the true nature of the payments.

Payments in Mexico

Like the scheme conducted in Brazil, Stericycle employees used agents to make payments to foreign officials employed by "15 Mexican-state owned entities" and local government agencies to secure business and improper advantages. Stericycle's wholly owned subsidiary in Mexico (Stericycle Mexico) earned up to $3.7 million from the scheme.

Together, executives in Stericycle's Latin American division (Stericycle LATAM) and Stericycle Mexico executives approved distribution of funds to various Mexico vendors that were depicted as providing services to Stericycle Mexico. Those funds were used to bribe officials employed by Mexican state-owned and -controlled hospitals. To hide the illicit payments, Stericycle Mexico executives received fake invoices from approximately 45 Mexico-based vendors that did not provide legitimate services, despite the descriptions provided on the invoices such as "forklift rental," "publicity," and "promotional products." Once the funds were distributed to the Mexican vendors, they passed the cash generated from the payments on fake invoices to Stericycle Mexico employees to pay the bribes, or sometimes the Mexico vendors directly delivered the bribes.

Payments in Argentina

Through the Argentina scheme, Stericycle's wholly owned subsidiary in Argentina (Stericycle Argentina) earned up to $4.4 million in profits. According to the DPA, "Stericycle Argentina Country Management," at the direction of Stericycle LATAM executives, calculated and approved cash payments that were used as payments delivered by sales employees to various officials. When a payment was needed, sales employees would email management and, after the payment was approved, the sales employees would retrieve the cash payment and deliver to the foreign officials accordingly.

The public documents state that for each operation conducted, Stericycle LATAM executives and executives from each applicable subsidiary maintained and documented payments using Excel spreadsheets. The spreadsheets detailed the names of the sales employee responsible for retrieving and delivering the bribe payment, the names of the recipient foreign officials, the fabricated description to justify the illicit payments, and the amount paid and received. The DPA and SEC Order note that some of the payments were referenced using code names such as "little pieces of chocolate," "IP," "alfas" or "alfajores," which are popular, traditional cookies in Argentina.

Key Takeaways

- Two-Year Independent Compliance Monitor: Despite DOJ's acknowledgement of Stericycle's cooperation and remedial measures, such as: conducting an internal investigation prior to the government's own investigation; divesting its subsidiaries in Mexico and Argentina, and taking steps to address risks in Brazil; enhancing its compliance program by updating its code of conduct, policies, procedures, and internal controls specifically related to anti-corruption, management of third-parties, etc.; terminating those involved with the corrupt scheme; and enhancing its internal reporting, investigations and risk assessment processes, the agency decided a two-year Independent Compliance Monitor was still necessary. The DPA notes that while Stericycle has taken these steps to enhance and commits to continue in enhancing its compliance program and internal controls, "the company to date has not fully implemented or tested its enhanced compliance program."

- M&A Lessons Learned: The SEC Order in particular emphasizes that Stericycle entered Argentina, Brazil, and Mexico and grew the operations there through M&A transactions (including a joint venture (JV) in Mexico), while maintaining decentralized accounting systems. Moreover, the SEC noted that Stericycle did not have a centralized compliance function and did not implement an FCPA policies or procedures prior to 2016 (without specifying if that was in the countries at issue or the company as a whole). Ultimately, the SEC and DOJ resolutions note that Stericycle remediated these issues in part by divesting the operations in Mexico and Argentina. This pattern shows the importance of M&A due diligence and integration efforts as part of an effective FCPA compliance program.

- High-Level Individuals Involved: The operations were carried out at the sole direction and under the oversight of executives in Stericycle's Latin America division located in Miami, Florida, and executives of Stericycle's subsidiaries in Brazil, Mexico, and Argentina. While the DPA notes that the individuals involved have been terminated, there is no public evidence to date of DOJ actions against those individuals, though such cases may yet be made public.

Glencore Pleads Guilty to FCPA Violations and Commodity Price Manipulation in Coordinated Multinational Resolutions

On May 24, 2022, the DOJ announced that Glencore pleaded guilty in the Southern District of New York (SDNY) to one count of conspiracy to violate 15 U.S.C. § 78dd-3 of the anti-bribery provisions of the FCPA. On the same day in the District of Connecticut, Glencore Ltd., a U.S. subsidiary of Glencore, pleaded guilty to one count of conspiracy to commit commodity price manipulation. Both pleas are tied to additional civil and criminal resolutions with the Commodity Futures Trading Commission (CFTC) in the U.S. and MPF, as well as with charges brought by the SFO. The coordinated resolutions have resulted in the assessment of over $1.1 billion in fines and disgorgement to be paid to the relevant law enforcement authorities, with additional penalties to be assessed in the U.K. The DOJ imposed Independent Compliance Monitors for terms of three years in each of the FCPA and commodity fraud criminal dispositions.

Glencore International and Glencore Ltd. are part of Glencore plc, a multinational natural resource trading and mining firm based in Baar, Switzerland, with shares traded in London and Johannesburg. The FCPA plea agreement claims jurisdiction over the relevant conduct because agents and employees of Glencore approved bribes while in the territory of the U.S., and at least $39 million of improper payments were paid out from or were transmitted through bank or correspondent accounts held at institutions in New York.

The FCPA plea agreement states that between 2007 and 2018, Glencore and various of its subsidiaries, employees, and agents paid over $100 million in bribes to foreign officials in Nigeria, Cameroon, Ivory Coast, Equatorial Guinea, Brazil, Venezuela, and the Democratic Republic of the Congo (DRC). The agreement notes that these bribes sought to secure commodities contracts, end government audits, and facilitate favorable results in litigation, among other business goals. The DOJ press release states that "Glencore paid bribes to secure oil contracts. Glencore paid bribes to avoid government audits. Glencore bribed judges to make lawsuits disappear. At bottom, Glencore paid bribes to make money – hundreds of millions of dollars. And it did so with the approval, and even encouragement, of its top executives."

The plea agreement references various unnamed executives (including senior executives) and employees, but only one former employee, oil trader Anthony Stimler, is named in the official documents for facilitating bribes in West Africa. Stimler pleaded guilty to one count of conspiracy to violate the FCPA's anti-bribery provisions and one count of conspiracy to commit money laundering in July 2021. Another former Glencore trader, Emilio Heredia, pleaded guilty to conspiracy to manipulate commodity prices in March 2021. Media articles have identified other former senior executives involved in the alleged improper payments as the former head of the company's oil business and former head of the copper business.

The bribery scheme described in the plea agreement and corresponding press releases spans many entities and relied on the use of third-party intermediaries in different regions.

- In West Africa, multiple executives and employees of Glencore's U.K. subsidiaries paid about $79.6 million to regional and Nigerian intermediary companies. They used "sham consulting agreements," "inflated invoices," and fake "commissions" to conceal the fact that these intermediaries were channeling bribes to government officials on Glencore's behalf in exchange for securing oil contracts and cargoes or manipulating the price of those cargoes to favor Glencore. The company's employees used language including "newspapers," "journals," "pages," and "filings" to conceal and discuss the bribe payments. In other instances, the company paid out cash from its offices in Switzerland and London. The public documents state that the bribes facilitated crude oil contracts with a Nigerian state-owned oil company that resulted in profits of approximately $124 million. In other West African countries, the bribes resulted in more than $92 million in profits. Due to the central role of U.K. subsidiaries, these facts are the primary focus of the SFO charges against Glencore, which include seven counts of bribery.

- In Brazil, Glencore, through certain employees and agents, caused $147,202 to be used, at least in part, as corrupt payments to be made to or for the benefit of state-owned oil company officials in exchange for the opportunity to buy oil cargo. The plea agreement asserts that arrangements were made "to disguise the 'delta' or bribe payment as an inflated service fee of $0.50 per barrel of the purchased cargo."

- In Venezuela, Glencore paid bribes through local intermediaries to facilitate priority repayment of overdue invoices by Venezuela's state-owned oil company. Glencore paid the intermediary a "percentage fee" for any money recovered from the state-owned entity. The public documents state that Glencore recovered over $11 million in payments from Petróleos de Venezuela, S.A. (PDVSA) through the intermediary.

- In the DRC, Glencore mining companies, executives, and employees paid over $27.5 million to officials through third parties to limit liabilities related to government audits of mining operations and private litigation. Glencore paid a tax consultant who created fraudulent invoices for professional services, the money (or "gratuities") for which was intended for DRC officials. Glencore's estimated audit fines were reduced by over $500,000, and a $16 million lawsuit was decided in the company's favor. The plea agreement states that, overall, Glencore "obtained at least $43 million in benefits related to their mining operations" as a result of the payments, without providing additional details linking the $43 million to the two schemes in the DRC.

For many years, there has been significant press related to Glencore's dealings in the DRC with businessman Dan Gertler, who is subject to sanctions in the U.S. for "engag[ing] in extensive public corruption." Glencore acquired stakes from Gertler for multiple mines in the DRC and has paid royalties to Gertler's companies, based on press releases as recent as 2018. Various journalists also asserted that Dan Gertler was the "DRC partner" or "Israeli businessman" referenced in the 2016 Och-Ziff resolutions regarding mining interests in the DRC, in which the partner allegedly "paid over $100 million in bribes to DRC government officials to secure special access and lower pricing in the mining sector between 2005 and 2015," as reported in our FCPA Autumn Review 2016. Gertler and his companies, however, have denied any wrongdoing. It is unclear whether any connection to Gertler or his businesses is suggested in the Glencore resolution. Glencore's FCPA guilty plea does refer to an agent in the DRC, but there is no identifying information.

In the related commodity price manipulation case, Glencore Ltd. pleaded guilty to conspiring to manipulate the price of two benchmarks for fuel oil products at the Port of Los Angeles and the Port of Houston. The plea agreement stipulates that Glencore traders, including one individual, Emilio Jose Heredia Collado – who pleaded guilty in connection with this activity in March 2021 – submitted bids and offers during the trading windows in which the price was assessed not for any legitimate economy purpose but solely to manipulate prices up or down to benefit existing Glencore contracts to buy or sell fuel oil.

Glencore agreed to an aggregate penalty of over $700 million to resolve the DOJ's corruption investigation. The DOJ assessed a criminal fine of $428,521,173. The plea agreements state that this fine amount was discounted by 15 percent from the minimum Sentencing Guidelines fine range to reflect "partial cooperation and remediation." In addition to the fine, the DOJ assessed a criminal forfeiture amount of $272,185,792 (which may be the $315 million pecuniary gain used to calculate criminal fine, minus the $43 million of benefits received via the schemes in the DRC). The DOJ noted that Glencore did not receive credit for voluntary disclosure and "did not at all times demonstrate a commitment to full cooperation." However, the DOJ credited many of the company's remediation measures, including the creation of a centralized compliance function, a Head of Compliance position, and more robust internal and third party-specific controls, as well as its cooperation with parallel domestic and international investigations. Full remediation credit was not given, as the DOJ noted that the company "did not timely and appropriately remediate with respect to disciplining certain employees involved in the misconduct."

The four additional resolutions announced on May 24 also assessed – or will assess, in the case of the SFO – penalties, some of which the DOJ credited in the FCPA plea agreement in the following amounts:

- Up to $136,236,140 for yet-determined payments to the SFO

- Up to $29,694,819 for possible payments to Swiss authorities, depending on the outcome of their open investigation

- $90,728,597 for disgorgement to the CFTC

The DOJ did not credit the $39,598,367 penalty levied by the MPF.

The DOJ commodity price manipulation criminal case and CFTC civil order likewise credit segments of their penalties to each other and the SFO. On June 21, 2022, the judge in the District of Connecticut commodities case agreed to postpone sentencing until September so that Petroleos Mexicanos (Pemex), a Mexican state-owned oil company, could file a restitution claim in the case as a victim of Glencore's fraud. Pemex and its trading arm P.M.I. Trading DAC are both repeatedly referenced, though not by name, in the plea agreement signed by Glencore.

In its press release on the resolution, Glencore estimates that the final global penalty amount – including for dispositions not yet completed – will not exceed $1.5 billion. This includes $1,060,013,258 immediately payable to the U.S., $444,047,409 of which is required to settle the FCPA case, once credits to other agencies have been taken into account.

In addition to monetary sanctions, the DOJ imposed an FCPA-focused Independent Compliance Monitor on Glencore International for a term of three years, and, in accord with new DOJ policies, requires the CEO and Chief Compliance Officer (CCO) to certify at the end of the term of the monitorship that Glencore has complied with the requirements for remediation and has a compliance program that incorporates all the elements required by the plea agreement. The plea agreement also requires the CEO and Chief Financial Officer (CFO) to certify that the company is compliant with its disclosure obligations under the agreement. Unusually, the plea agreement includes language that, if Glencore International cannot, "despite its best efforts," retain a Monitor by the sentencing date, the company may instead retain a Monitor for Glencore UK Ltd. (while simultaneously completing enhanced self-reporting by Glencore International for the duration of the term). The reasons for such contingency language are unclear. The DOJ noted that a Monitor was deemed necessary and appropriate because "some of [Glencore's] compliance enhancements are new and have not been fully implemented or tested to demonstrate that they would prevent and detect similar misconduct in the future."

The coordinated agreement with Glencore Ltd. for commodity price manipulation also requires the appointment of a Monitor for a term of three years, and the agreement is subject to the same certification requirements.

At the time that the coordinated resolutions were announced, the SFO announced that it charged Glencore UK Ltd. with seven counts of bribery under the UKBA – five counts under the substantive bribery provisions and two for corporate failure to prevent bribery. As anticipated by company statements on the case, on June 21, 2022, Glencore pleaded guilty to the charges. The related SFO press release stated that the company would be sentenced later this year, on November 2-3, 2022.

The company has reported that it continues to cooperate with open investigations in Switzerland and the Netherlands. According to company statements, the Swiss Attorney General is investigating Glencore for "failure to have the organisational measures in place to prevent alleged corruption," and the investigation by the Dutch Public Prosecution Service is said to be "of similar scope." According to press reports, Cameroon has also announced an investigation into Glencore. It remains to be seen whether these investigations will result in further charges and penalties being added to the global resolution.

Key Takeaways

- Use of Guilty Plea vs. DPA: Unusually for recent FCPA corporate dispositions, the Company was required to plead guilty to violations, as opposed to agreeing to a DPA. This stance likely reflects both the public goals stated by senior DOJ officials to hold companies to account for criminal actions and the seriousness and extent of Glencore's activities.

- First Use of CCO Certifications and Concerns: This plea agreement marks the first DOJ settlement to incorporate the DOJ's new requirement that the CEO and CCO certify that the company's compliance program is "reasonably designed" to prevent and remediate future violations of applicable laws, focused on anti-corruption and anti-fraud laws. This new policy was announced by the head of the Criminal Division, Assistant Attorney General Kenneth A. Polite, Jr., in an address to compliance professionals in March 2022. The DOJ has stated that it believes that this policy will empower and increase the authority of CCOs within the business organization to drive the changes required by dispositions – including compliance program and controls upgrades and other remediation. However, some practitioners and CCOs have signaled concerns that the certification requirement could create personal liability for, or put undue pressure on, CCOs. In addition, the Glencore agreements also require that the CEO and CFO certify at the end of the term that the company has disclosed all information it is required to disclose under the agreement, including "any evidence or allegation of conduct that may constitute a violation of the FCPA anti-bribery provisions had the conduct occurred" with U.S. jurisdiction. This requirement is broad and in other dispositions has proven to be a difficult and expensive process, requiring the development of substantial specialized internal mechanisms. The DOJ has renewed its focus on whether companies are adequately complying with such requirements. Given the concerns raised over the CCO certification requirement, DOJ officials publicly stated in mid-June that certifications are "not meant to be a gotcha game" or to "'provide fodder' to prosecute CCOs or CEOs."

- Importance of Third Parties: In every instance of bribery cited in this case, Glencore personnel made or authorized payments to officials through a third party, using a wide variety of methods to disguise the bribes. Close to 75 percent of FCPA cases involve intermediaries of some type, making the management of third parties a critical concern for compliance personnel. The Glencore case illustrates the breadth of ways in which employees can use intermediaries to hide improper payments, as well as the importance of internal controls sufficient to identify risks and potentially stop problematic payments to third parties.

- Global Coordination on Penalties, Mostly: This resolution stops just shy of a fully coordinated global resolution, in that there remain open investigations in Switzerland and the Netherlands, but the terms agreed to at least partially anticipate those future resolutions. The practice of multilateral, coordinated settlements among multiple agencies (including non-U.S. enforcement authorities) that share credit and financial penalties is strongly supported by the U.S. agencies and provides benefits to both the various agencies and the companies under investigation. Coordinated settlements incentivize mutual legal assistance efforts among law enforcement, and they can help to "clear the decks" for companies, so that the companies can concentrate resources on remediation and compliance program improvements instead of protracted defense and investigation management efforts. While Glencore is still awaiting sentencing in the U.K., and there remain open investigations in Switzerland and the Netherlands, the U.S. resolutions have already credited some amounts – $136,236,140 to the U.K. and $29,694,819 to the Swiss – to those pending cases.

- Imposition of Multiple Monitors for Different Violations: The Glencore resolution marks the second monitorship that the DOJ has recently imposed, along with the Stericycle monitorship, that has been justified by reference to the company's new but untested compliance program. The DOJ stated in their press release that the fact that Glencore's compliance processes have not been fully implemented or tested "necessitate[ed] the imposition of an independent compliance monitor." What is more unusual in this case is the imposition of two Monitors, one in the DOJ resolution to focus on anti-corruption compliance and one in the CFTC resolution to focus on the prevention of commodities fraud. The specifics of the Glencore case (in which the U.S. subsidiary was responsible for most of the commodities violations and the U.K. subsidiary most of the FCPA-related violations), as well as the potentially different areas of focus for remediation of these two types of issues, are likely responsible for this dynamic. It remains to be seen whether this situation may be replicated going forward, as specialized agencies like the CFTC become more assertive with international corporate enforcement.

Luxembourg Energy Supplier Tenaris S.A. Settles FCPA Charges with SEC

Luxembourg-based steel pipe manufacturer and supplier Tenaris S.A. agreed to pay the SEC more than $78 million (a civil penalty of $25 million plus over $53 million in disgorgement and prejudgment interest) to settle charges that the company violated provisions of the FCPA by providing improper payments to a Brazilian government official. Specifically, the SEC alleged that Tenaris violated the FCPA's anti-bribery, books and records, and internal accounting controls provisions through actions by agents and employees of its Brazilian subsidiary to influence Petrobras, a Brazilian state-owned entity, to favor the company in contract awards. Tenaris is part of the Techint Group and its controlling shareholder is San Faustin, a private company owned by the Rocca family. As noted below, there has been a related trial in Italy for related individuals and entities there, which concluded just prior to the SEC resolution with acquittals on jurisdiction grounds.

Tenaris settled with the SEC without admitting or denying the findings. In the SEC order, Tenaris agreed to report to the SEC for two years regarding the status of its remediation and implementation of compliance efforts and to report to the SEC if the company discovers any "credible evidence" of "questionable or corrupt payments" offered or given by the company or any person acting on the company's behalf, as well as any potential related accounting provision violations.

According to SEC documents, in 2008, an agent of Tenaris' Brazilian subsidiary entered into an "understanding" with a "high-ranking manager in Petrobras' supply procurement and tender process department" under which that government official would influence Petrobras to "forgo an international tender process for certain contracts for pipes and tubes, thereby favoring [the Brazilian subsidiary] by continuing its status as the only domestic supplier, and allowing direct negotiations with [the subsidiary]." In return, the Brazilian official received .05 percent of the revenue obtained from these contracts and the Brazilian subsidiary's continuing stream of business. To conceal the payments, the Brazilian official (through an "associate") formed a shell company in Uruguay, to which the Tenaris subsidiary deposited the payments. Between 2008 and 2013, the bribe payments to the Uruguayan company came from various bank accounts and offshore holding companies, all of which were affiliated with Tenaris, its management, and its controlling stakeholder. In at least some cases, "fake" consultancy contracts were executed to justify and conceal the real purpose of the payments. The bribes, which totaled "at least $10.4 million," passed through both U.S. and foreign jurisdictions. The inaccurate books and records of the Brazilian subsidiary "were consolidated into Tenaris' for purposes of [SEC] filings."

The payments were made by "companies affiliated with Tenaris' controlling shareholder," San Faustin, and not by Tenaris itself, although some personnel "had roles or close associational ties with Tenaris and/or its management." The SEC order requires Tenaris to report on its anti-corruption compliance measures, specifically focusing on "preventing the use of unaccounted funds for illicit purposes to benefit Tenaris, including the use of funds available to Tenaris' officers, directors, employees and/or agents as a result of their dual affiliation with Tenaris and San Faustin and related entities." We note that there have been various criminal enforcement actions related to Tenaris and its owners. Most recently, in May 2022, an Italian court acquitted San Faustin, its owners Paolo and Gian Felice Rocca, and executive Roberto Bonatti, following an 18-month trial regarding the payments to the Brazilian official, citing a lack of jurisdiction. In another matter, an Argentine court in August 2021 acquitted Tenaris S.A. Chairman and CEO, Paolo Rocca, of all charges regarding alleged bribes paid by Tenaris S.A. to secure contracts from the government of Argentina.

The SEC press release and the order note that in 2011, Tenaris entered into an non-prosecution agreement (NPA) with the DOJ and a DPA with the SEC because of alleged bribes "paid to obtain business from a [state-owned entity] in Uzbekistan." The order further states that, despite these prior dispositions and "known corruption risks in connection with its Brazilian operations," Tenaris "failed to devise and maintain a system of internal accounting controls sufficient to provide reasonable assurances to detect and prevent the payment of bribes and to adequately identify and disclose related party transactions."

The order summarizes Tenaris' remedial actions and cooperation, including "encouraging parties outside of the [SEC]'s subpoena power to provide relevant evidence and information." Tenaris terminated its commercial agents in Brazil and "significantly reduc[ed] its use of commercial agents worldwide."

Key Takeaways

- Effects of Tenaris' Prior Resolutions with SEC and DOJ, Acquittal in Italy: The order noted Tenaris' history with U.S. agencies and implied these prior resolutions, at least in part, impacted this new resolution. Unlike the DOJ, the SEC does not have a specific policy on the effects of recidivism by companies. Thus, the impact of this past history is unclear based on the public documents. The SEC also chose not to impose an Independent Compliance Monitor on Tenaris, despite the company's stated history of failing to mitigate corruption risks. The SEC accepted Tenaris's offer of settlement without Tenaris having to admit or deny the findings – which has long been standard practice. Regarding prior history, the SEC order does not note the acquittal in Italy for San Faustin and its owners and executive noted above, which occurred just prior to the resolution, but presumably this affected the settlement negotiations for all parties involved.

- Payments by Tenaris S.A. Affiliates within the Broader Corporate Family: The payments to the Brazilian official were made by companies and individuals with "close associational ties with Tenaris" and its management, but not by Tenaris itself. One of the focus areas for the self-reporting requires Tenaris S.A. to review and prevent Tenaris executives from using funds available through affiliations with San Faustin related entities for illicit purposes.

- No Parallel DOJ Action. The DOJ conducted a separate investigation into these issues. However, Tenaris' press release stated that the DOJ informed Tenaris that it "closed its parallel inquiry" without taking action. The order does note that the recipient of the bribes "pled guilty in Brazil to corruption-related crimes in connection with his position at Petrobras." Because the DOJ did not pursue an enforcement action with Tenaris, the SEC order has elements that are similar to requirements in standard DPAs. For example, Tenaris has an obligation to report discover of "credible evidence" of corrupt or questionable payments, as discussed above. Moreover, the SEC notes that the civil penalty is based on the company's cooperation, but that the SEC may increase the civil penalty if the SEC discovers that Tenaris "knowingly provided false or misleading information or materials to the Commission."

Enforcement Actions Against Individuals

Former Goldman Sachs Managing Director Roger Ng Convicted of Conspiracy to Violate FCPA and Money Laundering

On April 8, 2022, a federal jury in the Eastern District of New York (EDNY) convicted Ng Chong Hwa, also known as Roger Ng, of three conspiracy counts: to violate the bribery provisions of the FCPA, to violate the FCPA's internal accounting controls provision, and to commit money laundering. Ng's sentencing hearing is scheduled for September 2022.

Ng, a Malaysian national and former Managing Director at Goldman Sachs, was indicted alongside Low Taek Jho, or "Jho Low," a wealthy Malaysian national, in October 2018 for actions in the multi-billion-dollar attempt to launder money through 1MDB, Malaysia's state-owned investment development agency, and through Abu Dhabi government officials from 2009 to 2014. In 2018, another Goldman Sachs executive, Tim Leissner, pleaded guilty to two conspiracy counts related to his role in the 1MDB bribery scheme, as discussed in our 2019 FCPA Winter Review. Leissner also served as a cooperating witness for the DOJ in Ng's trial. In October 2020, as reported in our 2021 FCPA Winter Review, Goldman Sachs pleaded guilty to conspiracy to violate the FCPA and paid over $2.9 billion as a part of its deferred prosecution agreement with the DOJ – currently the largest corporate FCPA resolution, based on amounts paid to the U.S. Treasury. Low is currently a fugitive.

Conspiracy to Commit Bribery

According to the prosecution, Ng coordinated with Leissner and Low to obtain and retain contracts for Goldman Sachs through bribe payments to Malaysian officials. Low served as an intermediary for Ng and the high-ranking Malaysian individuals working on 1MDB, after a Malaysian official told Leissner and Ng that it was "best to get [Low] involve[d] at every stage". Through these contracts, Goldman Sachs helped 1MDB finance three bond transactions, which enabled the purchase of Malaysian energy companies. Once Goldman Sachs transferred the funds, a 1MDB subsidiary in turn transferred significant portions of the funds to a shell company ultimately controlled by Low. Low then diverted funds from these projects into other shell companies and used these funds to pay bribes and kickbacks, including to Ng (through an account controlled by Ng's spouse, Hwee Bin Lim). The prosecution also argued that Lim helped Ng move improper payments from 1MDB into her bank accounts. The defense argued that these assets were funds that Leissner's ex-wife, Judy Chan, owed Lim from her former investments in Chan's family businesses.

Conspiracy to Circumvent Accounting Controls

Also according to the indictment, Ng conspired to circumvent Goldman Sachs' internal accounting controls for business contracts. Goldman Sachs earned $600 million in fees and revenues from the 1MDB contracts. Goldman Sachs' internal compliance group, known as the "Business Intelligence Group," worked to review the three 1MBD bond deals, but court documents state that the priority of Goldman Sachs was on "consummating deals," which at the time took precedence over compliance operations, especially in Southeast Asia. Under Goldman Sachs' governance rules, the transactions with 1MDB had to be approved by a "Firmwide Capital Committee" and the "Firmwide Sustainability Committee." Although Leissner and Ng coordinated with Low using personal email accounts, neither disclosed the role of Low to the committees, and Leissner – at least once in the presence of Ng – stated that Low was not involved to circumvent the company's controls. The public documents note that Ng only "selectively disclosed" Low's role as a designated intermediary to divert funds in the scheme to certain Goldman Sachs employees, knowing that revealing Low's role as an intermediary to more individuals would have triggered an investigation by the compliance division, which had already rejected Low as a client because of questions regarding the source of his wealth.

Conspiracy to Commit Money Laundering

Along with diverting funds to shell companies for bribe payments, the documents state that Ng and his co-conspirators also used diverted funds to pay himself and his co-conspirators. Ng conspired to launder embezzled funds via wire transfer to accounts within the U.S. and abroad. Some of the wire transfers were made to relatives of co-conspirators. Furthermore, Low, Ng, and their co-conspirators used shell companies to acquire art at auctions, to provide funding for Hollywood films, including The Wolf of Wall Street, purchase handbags and diamond necklaces, and to acquire luxury real estate properties, routing funds through at least two different unnamed U.S. law firms. In total, over $2.7 billion in funds were laundered and misappropriated through these accounts. Through offshore accounts, Ng received $35 million for his role in the scheme.

Rule 29 Motion on Internal Accounting Controls Provision

Prior to his conviction, Ng moved for judgement under Rule 29 of the Federal Rules of Criminal Procedure (FRCP) for dismissal of count two: conspiracy to circumvent internal accounting controls in violation of the FCPA, or offense 15 U.S.C. §78m(b)(2)(B). Rule 29 states that if there is insufficient evidence beyond a reasonable doubt to sustain a conviction, the defendant must be acquitted. Ng argued that "the Government has read the word 'accounting' out of the 'internal accounting controls' provision, and contends that if this word is to be given any effect, it is clear that internal 'accounting' controls are 'a limited and defined set of controls' that are 'only one aspect of a company's total control system' and that are to be distinguished from legal, risk-management, compliance, and other controls." Therefore, Ng argued he could not be convicted for conspiring to violate the internal accounting controls and should be acquitted on that count.

The court denied Ng's motion for judgement, stating that internal accounting controls are not intended to apply to only literal accounting, but also oversight procedures, such as compliance controls. The key quote is the following: "The statute defines an adequate system of internal accounting controls by reference to the objective of such a system, and the plain language of the statute indicates that such systems are intended not only to provide reasonable assurances of accurate internal accounting for purposes of external financial reporting … but also to provide reasonable assurances that the company is adequately controlled." In this case, Goldman Sachs set up committees for decisions, requested information for those committees to review, and Ng and Leissner either knowingly withheld material information (Low's involvement and their own interests in the transactions) or providing false information, thereby circumventing the process. This judicial order could become a basis for important precedent under the FCPA, especially if it is upheld on appeal (although currently no appeal has been filed).

Key Takeaways

- Court Decision Upheld DOJ's Broad Reading of Internal Controls Provision: As noted above, while the statute's language could have been interpreted narrowly, Judge Margo K. Brodie stated that reading the statute literally would be inconsistent with the entirety of the statute. In its entirety, the court opined, "accounting controls" do not only refer to financial reporting, but also compliance-related controls, such as ensuring that management approves of transactions. This ruling does not necessarily mean that courts may consider all compliance program-related violations to be internal accounting controls violations, however. In Ng's case, the court found that the fact that Ng and Leissner withheld the material information from "groups responsible for enforcing [Goldman's] internal accounting controls" was sufficient to create a violation of the relevant statutory provision. The court noted that if such information had been known, "it would have triggered an investigation in accordance with those controls that likely would have prevented the authorization of the bond transactions." In a separate discussion, the court also found that the relevant provision was not unconstitutionally vague.

- Prevalence of U.S. Companies Involved in Overt Acts Related to Money Laundering: It is notable that a significant portion of the laundered funds emerged in U.S. assets. For example, a shell company transferred over $35 million to an account "owned and controlled" by a U.S. law firm, then transferred that money a few days later to an account controlled by another U.S. law firm. Involvement from auction houses in New York, jewelry designed by New York artists, major American film studios, and luxury American real estate all highlight the degree of engagement that U.S. companies and individuals had in this case.

- Maintaining Compliance Programs in Fast-Paced Environments: Ng was able to circumvent internal accounting provisions in part because of Goldman Sachs' focus on "consummating deals" instead of focusing on compliance programs. This should serve as a reminder that, while encouraging successful deals and business development, corporations should also ensure that their compliance programs are actively enforcing and managing transactions.

Court Dismisses Criminal Charges Against Businessmen Ahead of Trial

On June 28, 2022, the U.S. District Court in Massachusetts granted a motion from the DOJ to dismiss with prejudice the superseding indictment against two businessmen, Joseph Baptiste, a retired U.S. Army colonel, and Roger Richard Boncy, a Madrid-based businessman, based on newly discovered evidence. Both were accused of conspiracy to bribe public officials in connection with a port development project in Haiti. Their retrial had been scheduled for July 5, 2022.

The defendants were first tried and convicted in 2019. Both Baptiste and Boncy were convicted of one count of conspiracy to violate the FCPA and the Travel Act. Baptiste was also convicted of one count of violating the Travel Act and one count of conspiracy to commit money laundering.

As reported in previous editions of the FCPA Review, in March 2020, District Judge Allison Burroughs tossed out the convictions and ordered a new trial for both Baptiste and Boncy, on the basis that Baptiste's lawyer, Donald LaRoche, had rendered ineffective assistance such that the jury verdict could not stand. In August 2021, the U.S. Court of Appeals for the First Circuit affirmed that ruling over the DOJ's objections.

In preparation for the retrial and in response to a motion from defense counsel, the FBI turned over certain evidence to the prosecutors, consisting of text messages related to December 19, 2015 calls between Boncy and an FBI undercover agent, which had not been previously disclosed. The text messages included statements made by defendant Boncy who, when asked about certain payments connected to the port project, responded they would not be used to pay bribes. The DOJ moved to dismiss the superseding indictments against Baptiste and Boncy, in part based on the "belated" disclosure of the communications and the loss of the recordings of those calls.

After reviewing the new evidence, and given the late disclosure of the communications, the DOJ decided not to seek a retrial and moved instead to dismiss the indictment.

Policy and Legislative Developments

U.S. Adds Tools to Combat Kleptocracy – FinCEN Advisory and DOJ Budget Enhancements

In April 2022, FinCEN and the DOJ took action to combat kleptocracy. First, FinCEN issued an Advisory to financial institutions on kleptocracy and foreign public corruption. Second, Congress is reviewing legislative enhancements to support the DOJ's kleptocracy asset recovery efforts. These are independent actions that, in the context of Russia's invasion of Ukraine, seek to hold corrupt Russian officials accountable.

On April 14, 2022, FinCEN issued an Advisory on Kleptocracy and Foreign Public Corruption, which urged financial institutions to be more diligent in their Suspicious Activity Reports (SAR) in relation to kleptocracy. As part of the Biden administration's United States Strategy on Countering Corruption, the Advisory defined Russia as a kleptocracy and highlighted the role that illicit wealth plays in Russia's ability to finance its invasion of Ukraine and conduct other foreign activities that can jeopardize U.S. national security.

In its Advisory, FinCEN outlined two main typologies of kleptocracy and foreign public corruption: wealth extraction and the laundering of illicit proceeds. The Advisory notes that wealth extraction often involves bribery, extortion, embezzlement, and misappropriation of public funds and assets. Kleptocrats and other corrupt public officials often launder their illicit proceeds through shell companies, offshore bank accounts, and the purchase of real estate, luxury goods, and other high-value assets. In March 2022, FinCEN released a related Alert on Real Estate, Luxury Goods, and Other High Value Assets Involving Russian Elites, Oligarchs, and their Family Members.

FinCEN requested that financial institutions highlight in their SARs transactions that set off red flags associated with kleptocracy and foreign public corruption. The Advisory identified ten financial red flags. These include:

- Long-term government contracts consistently awarded to the same legal entities

- Services for state-owned companies or public institutions by companies in high-risk jurisdictions

- Official foreign government business conducted through personal accounts

- Public officials and unusual high-value assets

- Public officials transferring funds across countries

- Payments with inconsistent, vague, or dated documentation

- Fake emails

- Use of third parties to obfuscate the source of funds

- Government contracts with significantly above-market rates or vague documentation

- Assets held by intermediate legal entities with beneficial owners tied to kleptocrats

The Advisory is part of a broader Treasury effort to combat kleptocracy. In March 2022, Treasury launched the Kleptocracy Asset Recovery Rewards Program, which offers rewards payments for information leading to the recovery of assets linked to foreign government corruption, including Russia.

Separately, on April 28, 2022, the DOJ publicly released a package of legislative proposals to bolster the DOJ's efforts to combat kleptocracy. The proposed enhancements include:

- Streamlining asset forfeiture proceedings

- Allowing for forfeited funds to be used towards remediating harms specific to Ukraine and resulting from the Russian invasion

- Expanding forfeiture authorities under the International Emergency Economic Powers Act (IEEPA) to capture tools and property used to facilitate sanctions violations

- Updating the RICO Act to include criminal violations of IEEPA and the Export Control Reform Act (ECRA) in RICO's definition of racketeering activity

- Extending the statute of limitations to prosecute kleptocrats for foreign offenses and to seek forfeiture of their assets

- Facilitating international cooperation towards asset recovery related to foreign corruption

The request was transmitted to Congress "as part of the President's supplemental budget request to support Ukraine." The package is currently under negotiation in Congress.

These proposed additional authorities are part of a wider set of economic initiatives targeting Russian kleptocracy. Task Force KleptoCapture, an interagency law enforcement taskforce launched in March 2022, was created to impede Russia's invasion of Ukraine via financial tools like sanctions and export controls. This task force was responsible for the seizure of a $90 million yacht owned by a sanctioned Russian oligarch, Viktor Vekselberg, by Spanish authorities April 2022.

The DOJ has also taken recent public steps to combat global kleptocracy under its more permanent Kleptocracy Asset Recovery Initiative. In May 2022, the DOJ secured a forfeiture of a $3.5 million Potomac, Maryland mansion owned by the former Gambian president, Yahya Jammeh. The U.S. government alleges that Jammeh solicited bribes and stole public funds in his capacity as a public official. Also in May, the DOJ sought the forfeiture of a $63 million Los Angeles mansion, alleging it was purchased by Gagik Khachatryan, a former high-level Armenian public official, and his family with bribes they had received from an Armenian businessman so that his businesses could receive favorable tax treatment within Armenia.

Key Takeaways

- Continued U.S. Government Focuses on Russian Kleptocrats:The legislative enhancements and other recent activities show that the DOJ intends to invest resources into sanctions and forfeitures in the context of the U.S. government's economic strategy to counter Russia. Seizures of illicit Russian assets seem to be a policy priority.

- Need for Financial Institutions to Focus on Red Flag Indicators Associated with Foreign Public Corruption: The FinCEN Advisory suggests that financial institutions should assess whether their process for identifying suspicious transactions and reporting such transactions through SARs include all of the red flags and other factors cited in the Advisory.

U.S. Court Decisions

Individual Cases

Early Release

- On May 6, 2022, the U.S. District Court for the Southern District of Florida reduced the sentence of Frank Robert Chatburn Ripalda (Chatburn) to time served. Chatburn is a Miami-based financial advisor convicted in 2019 for his role in the bribery scheme at Ecuador's state-owned oil company, Petroecuador. Prosecutors had asked the court to reduce his sentence based on his "substantial assistance in the investigation and prosecution of related matters."

Plea

- On July 12, 2022, former Venezuelan National Treasurer Claudia Patricia Diaz Guillen pleaded not guilty before the U.S. District Court of the Southern of Florida on money laundering charges predicated on violations of the FCPA in connection with the bribery of public officials (including herself) in Venezuela. Ms. Guillen had been extradited from Spain to the U.S. to face charges stemming from a conspiracy to corruptly secure a Venezuelan businessman the rights to conduct foreign currency exchange transactions for the Venezuelan government at favorable rates. Alleged co-conspirator Alejandro Andrade Cedeno was sentenced to 10 years in 2018 for his role.

Sentencing

- On July 7, 2022, Luis Enrique Martinelli Linares and Ricardo Enrique Martinelli Linares were each sentenced to 36 months in prison, to forfeit more than $18.8 million, pay a $250,000 fine, and serve two years' supervised release. The Martinelli brothers previously pleaded guilty and admitted to laundering $28 million in a bribery and money laundering scheme involving Odebrecht, the Brazil-based construction conglomerate, for the benefit of a high-ranking public official in Panama.

- On May 22, 2022, Carlos Enrique Urbano Fermin (Urbano), a Venezuelan businessman involved in a PDVSA bribe scheme, was sentenced to five years' probation, after the prosecution filed a motion to reduce Urbano's sentence based on his cooperation. As reported previously, Urbano entered into a plea agreement in April 2021.

Goldman Sachs Settles Shareholder Derivative Action Related to 1MDB

On May 13, 2022, Goldman Sachs agreed to settle a 2019 shareholder derivative action against the company and certain of its officers and directors related to the Goldman Sachs' FCPA case in connection with the 1MDB bribery scandal (which Goldman Sachs and its subsidiaries resolved with the DOJ and SEC in 2020). The lawsuit, filed on February 19, 2019 by the Fulton County Employees' Retirement System (Fulton County), alleged that Goldman Sachs and various of its employees "breached their fiduciary duties and violated sections 10(b) and 14(a) of the Securities Exchange Act of 1934 and various state laws" when they conspired to pay more than "$1.6 billion to, or for the benefit of, foreign officials and their relatives" in exchange for obtaining several projects by 1MDB, including three bond issuances in 2012 and 2013.

On May 13, 2022, Fulton County, Goldman Sachs, and the individual defendants (the parties) signed a stipulation of settlement, in which Goldman Sachs and the individual defendants did not admit liability, but Goldman's D&O insurance carriers agreed to pay $79.5 million to fund Goldman Sachs's compliance activities. Goldman Sachs also agreed to implement extensive compliance measures, including:

- Extension of the corporate compliance program provisions outlined in Attachment C of Goldman Sachs' DPA for one year following the expiration of the DPA on October 22, 2023

- Enhanced authority for the CCO, such as quarterly reporting to the board or audit committee on certain compliance topics and authority to discretionarily hire internal and external resources

- Maintenance of an anonymous reporting hotline for reporting of issues to the CCO, to be managed by the Compliance Department, and a process for the CCO (or a designee) to investigate reported issues

- Designation of an outside party to monitor and report any public media and industry reports that may raise compliance concerns to the CCO involving Goldman Sachs for potential further action

According to the settlement, both parties acknowledged that, prior to the acceptance of the settlement proposal, Goldman Sachs had implemented certain enhancements to its compliance program that satisfied the plaintiff's request for relief. These included:

- "Heightened controls and procedures relating to electronic surveillance, due diligence on proposed transactions and/or clients, and the use of third-parties intermediaries; and anti-corruption training for management and relevant employees"

- "Compensation actions against several current and former officers and other employees, including approximately $174 million in clawbacks, forfeitures, and compensation reductions, in light of its acknowledgement of the Company's institutional failures related to the 1MBD transactions"

The Goldman Sachs settlement is the largest FCPA-related shareholder litigation settlement of this quarter. Airbus recently reached a $5 million settlement with certain shareholders to resolve litigation filed on August 5, 2020, following Airbus SE's resolution with the DOJ and SEC for FCPA-related violations. And, on March 31, 2021, the U.S. Court of Appeals for the Second Circuit upheld a lower court decision to dismiss a claim by shareholders of Mobil TeleSystems PJSC, arising out of that company's 2019 settlement with the DOJ and SEC for FCPA-related violations.

Key Takeaways

- No Admission of Liability; Goldman's Insurers Responsible for Monetary Consideration: Goldman Sachs and its officers and directors did not admit liability, and rather than Goldman Sachs being liable for the Monetary Consideration per the settlement, the company's insurers agreed to pay $79.5 million instead, including up to 25 percent of attorneys' fees and expenses, to fund Goldman's compliance measures. This allows both Goldman and its shareholders to benefit from the company's insurers and allows Goldman to receive funding for compliance measures that it was already obligated to undertake pursuant to its DPA.

- Private Extension of DPA Requirements: According to the settlement, corporate compliance measures included in DPA Attachment C are to be extended for one year, meaning that Goldman Sachs agrees to abide by Attachment C commitments on its compliance program, although the counterparty for the obligations would be the shareholders, not a regulator.

- Collateral Consequences Following FCPA Enforcement Action: As previously reported, on October 22, 2020, Goldman Sachs, together with certain of its subsidiaries, agreed to pay more than $2.9 billion to criminal authorities and regulators in the U.S., U.K., Hong Kong, and Singapore to resolve the FCPA charges against them. Goldman Sachs also entered a three-year DPA with the DOJ. In previous years, there have been shareholder litigations involving companies following a FCPA enforcement action, such as Cognizant, which settled a shareholder lawsuit in 2021 following a 2019 FCPA enforcement action; and Petrobras, which settled both a U.S. class action lawsuit and a lawsuit from Brazilian shareholders connected to a 2018 FCPA enforcement action. This settlement between Goldman and its shareholders further suggests that companies are continuously subject to collateral consequences following an enforcement action by government regulators such as lawsuits by shareholders or class action lawsuits

International Developments

Dechert LLP Loses Long-Running Legal Battle with ENRC

On May 16, 2022, a Commercial Court in London issued a long-awaited opinion regarding the claims of mining company ENRC that Dechert and its former head of white collar crime Neil Gerrard breached their duties to ENRC and that the SFO induced those breaches of duty. Principally, ENRC alleged that Gerrard leaked ENRC's confidential client information to the media and the SFO in a bid to run up client fees, failed to disclose relevant information and provided wrong advice to ENRC. ENRC argued that for its part, the SFO inappropriately encouraged the disclosures and that the use of the confidential and privileged information inappropriately received should not be allowed in connection with the SFO's investigation of ENRC, and that the attorneys who received the information should be barred from the ENRC investigation. The court found that Mr. Gerard "was in at least reckless breach of duty" to ENRC through unauthorized contacts with the SFO and "was negligent (and for the most part reckless)" in his professional obligations to ENRC. With respect to the SFO, although the court found that the SFO had induced, to an extent, the disclosures, the court did not find misfeasance and therefore ordered no relief as to the claims against the SFO.

The dispute originated out of a 2011-2013 internal investigation led by Gerrard, into a whistleblower's accusations of bribery and corruption at ENRC's subsidiary in Kazakhstan. Dechert and Gerrard originally estimated the investigation would cost about £2 million, but – according to the court – due to Gerrard's leaks and "scaremongering," the SFO quickly became involved, ultimately opening a still-ongoing criminal investigation. Gerrard's investigation grew to cover conduct in the DRC and Zambia and Dechert charged ENRC £13.1 million in legal fees, £11.5 million of which ENRC alleged to be "unnecessary," and ENRC paid an additional £11.1 in third party costs due to the expanded investigation.

The court found Gerrard was in "gross and deliberate breach of duty" to his client when he leaked privileged and confidential information to the press, engaged in unauthorized contact with the SFO, and failed to record his professional advice in writing including "a failure to take notes where appropriate [] so basic and so legion [] that there is no alternative but to find that he was committing a reckless breach of duty in this regard." The court also found Gerrard at fault because he did not inform ENRC that its global head of compliance was being interviewed by the SFO as a potential whistleblower, and overstated the risks of engaging with the SFO and the extent of ENRC's potential criminal liability, including telling ENRC that they could be liable under the UKBA which was not in force at the time of the alleged misconduct, and that they could be liable for "willful blindness" which is relevant only to mens rea and is not a stand-alone criminal offense. Gerrard claimed that his informal contacts with the SFO were not improper and were part of an approved effort to negotiate a civil settlement for his client with the SFO. He maintained that ENRC had authorized his revelations to the SFO and that the disclosure of potentially damaging information was necessary to ensure ENRC would be eligible for full cooperation credit, through "full and frank disclosure" and self-reporting. The court rejected this defense and found the disclosures were not authorized by ENRC.

The decision was slightly more favorable to the SFO. Although the court found that the SFO had acted improperly when it accepted information from Gerrard that was "plainly unauthorized and against his client's interests," the judge characterized those actions as "bad faith opportunism" and unrelated to Gerrard's efforts to increase his fees. The court rejected the charges of public misfeasance against the SFO and refused to grant ENRC's request to prohibit the SFO's use of information improperly received from Gerrard in future proceedings.

Further proceedings are expected to determine causation and damages for findings against Dechert, Gerrard, and the SFO.

Miller & Chevalier Recent Publications and Podcasts

Podcasts

EMBARGOED! is intelligent talk about sanctions, export controls, and all things international trade for trade nerds and normal human beings alike, hosted by Miller & Chevalier Members Brian Fleming and Tim O'Toole. Each episode will feature deep thoughts and hot takes about the latest headline-grabbing developments in this area of the law, as well as some below-the-radar items to keep an eye on. Subscribe for new bi-monthly episodes so you don't miss out: Apple Podcasts | Spotify | Amazon Music | Google Podcasts | Stitcher | YouTube

Recent Publications

| 07.27.22 | Them's the Breaks: What Companies Can Learn from Boris Johnson's Downfall (Alejandra Montenegro Almonte, Nicole Gökçebay) |

| 06.21.22 | Trade Compliance Flash: Analysis: U.S. Government's UFLPA Enforcement Strategy and Guidance to Importers (Richard Mojica, Virginia Newman, Dana Watts) |

| 06.08.22 | How Can Outside Counsel Sidestep Ethical Pitfalls in Internal Investigations of Antitrust Wrongdoing? (Kathryn Cameron Atkinson, Lauren Briggerman, Ann Sultan, Alexandra Prime) |

| 06.03.22 | Trade Compliance Flash: DDTC Provides Latest ITAR Enforcement and Regulatory Updates (Christopher Stagg) |