FCPA Spring Review 2020

International Alert

Introduction

As with most things, the global coronavirus pandemic is having the greatest current impact on current U.S. Foreign Corrupt Practices Act (FCPA)-related enforcement trends – an impact that likely will continue through at least the rest of 2020. The pandemic has led the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) to redirect their resources, publicly announcing (here and here, respectively) that they will focus their efforts on combatting misconduct related specifically to the COVID-19 pandemic for the near future.

We are seeing an impact on FCPA-related investigations in some – but not all – areas. Most notably, practical limitations on the agencies' abilities to conduct in-person interviews have arisen, though both the DOJ and SEC are moving to adapt to potential video and other on-line solutions in some cases. Such alternative methods raise their own concerns regarding, for example, security/confidentiality (e.g., secure video feeds, awareness of who is involved but not seen, unauthorized recording) and whether company or individual counsel can effectively represent their clients in such remote settings. On the other hand, some other core investigation activities, such as the production of documents by companies to the agencies and status calls and factual briefings, have continued with relatively few adjustments. There have been significant impacts on FCPA cases involving individuals, including grants of petitions for early or home release and delays and even challenges to sentencing processes. It is clear that the pandemic will produce a decline in the pace of existing enforcement cases in at least the short term. This is especially true in cases that will require multilateral cooperation (as most cases these days do), since the virus is already having vastly different impacts in different countries and their governing institutions.

There is still an open question about how the epidemic will impact the pace of new investigations – while agency attention and resources may be focused elsewhere or taking time to adapt, the current and accelerating trend of corporate employee layoffs may also lead to greater levels of whistleblower activity, for example. Currently, grand juries are not sitting – and thus no new criminal indictments or court-ordered subpoenas are being issued. However, both agencies have options available to open investigations that do not require such formal action – the DOJ through its FCPA Corporate Enforcement Policy, which encourages self-disclosure and voluntary cooperation by companies, and the SEC through its various administrative processes.

What is foreseeable is that the economic environment almost certainly will increase FCPA-related compliance risks (and, in the long term at least, related investigation and enforcement risks). Many critical compliance activities – including internal investigations, compliance risk assessments, third-party due diligence and monitoring, and operating company audits – have been curtailed by limits on travel and in company Enterprise Resource Planning (ERP) and other controls systems. At the same time, companies' risk profiles are in many cases changing rapidly, with plant closures, supply chain disruptions (and in many cases increasing reliance on third parties), restrictions on the movement of gatekeeper personnel and management compliance champions, pressures on financial targets, and more – many of which create additional opportunities for corruption and fraud. There is and will continue to be significant pressure on transactions deemed critical to company success or survival, with attendant calls by management to get them done quickly and without the time or expense associated with normal compliance-related due diligence and other safeguards.

Managing these compliance-related challenges in the face of time pressures and reduced resources will require active planning and creativity. Staying on top of changing company risk profiles is critical to adapting and targeting diminished compliance resources to their best use. Among other actions, company compliance personnel should consider such activities as new and updated management messaging on company values and the program, increased virtual trainings, and accelerating planned monitoring activities through virtual methods when possible. And compliance personnel can take valuable data from this time period to learn longer-term lessons regarding where companies should invest in, for example, upgrades to ERP systems or tools for remotely-directed investigation activities to be better prepared for the next crisis.

Miller & Chevalier lawyers have been active in many fora discussing the impacts of the ongoing COVID-19 pandemic on investigations and compliance efforts and will continue to provide guidance on various issues as they arise in this fact-changing environment. Below are links to recent and upcoming discussions by firm lawyers of these issues:

Recent and Upcoming Speaking Engagements:

Recent Podcasts, News, and Publications:

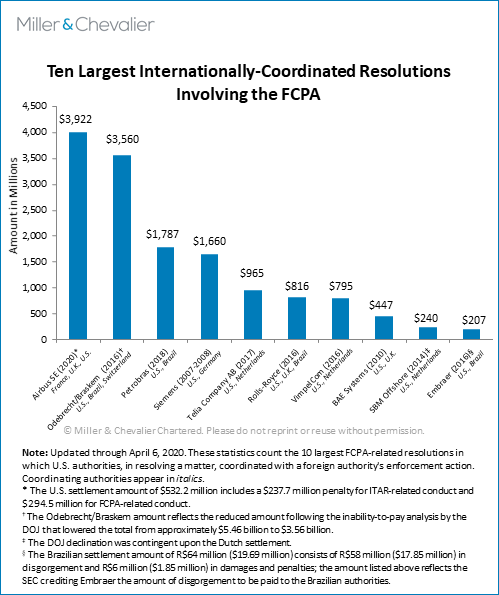

Despite the significant impact of the pandemic, FCPA enforcement activity through Q1 2020 remained steady and relatively on track with previous first quarters, which generally do not include as many enforcement actions. Following the surge of enforcement activity during the last quarter of 2019, the first three months of 2020 were relatively quiet in terms of FCPA-related corporate and individual resolutions, except for a monumental multi-jurisdictional set of resolutions involving Airbus SE (Airbus). While the DOJ-portion of the Airbus resolution does not affect our FCPA-specific list of largest resolutions (based on amounts paid to the U.S. Treasury), the major global multi-billion-dollar settlement with Airbus now tops our chart of the largest internationally-coordinated resolutions involving the FCPA (see chart below). Notably, the resolution with Airbus continued the trend of record-setting corporate resolutions from 2019 into 2020, as the DOJ collaborated with authorities in the U.K. and France to bring coordinated enforcement actions against Airbus that resulted in almost $4 billion in fines and disgorgement shared among the enforcement agencies of the U.S., France, and the U.K., with France collecting the largest share.

With respect to individuals, the quarter witnessed two resolved individual enforcement actions by the DOJ; two acquittals (including that of Lawrence Hoskins of one FCPA conspiracy count and six substantive FCPA counts, with the federal judge overturning a jury verdict); three sentencings (including, notably, that of Hoskins on money laundering-related counts); and three indictments (unsealed on February 18, 2020), among others. Lastly, in another setback for the DOJ, the first quarter of this year also saw the scheduling of a new trial for two defendants that had been convicted last year of conspiracy to violate the FCPA and the Travel Act by trying to bribe government officials in Haiti, after a federal judge concluded that one defendant's attorney had failed to provide effective counsel.

The first quarter of 2020 also brought some notable international and policy developments, including Güralp Systems Limited's deferred prosecution agreement (DPA) with the U.K. Serious Fraud Office (SFO) and the trial of related executives in the U.K.; the SFO's release of guidance on evaluating the effectiveness of companies' anti-bribery and anti-corruption compliance programs; the publication of the 2019 Sanctions Board Law Digest by the Sanctions Board Secretariat of the World Bank Group; and the publication of a new Internal Audit Code of Practice by the Chartered Institute of Internal Auditors.

We summarize this quarter's corporate enforcement actions and their noteworthy aspects, individual enforcement actions, and other policy, litigation, and international developments below.

Corporate Enforcement Actions

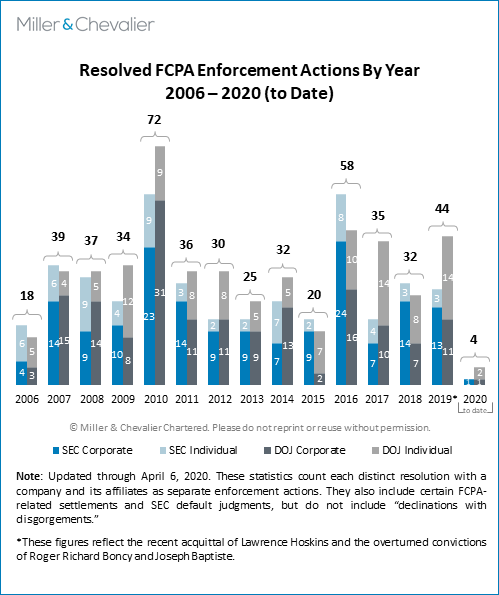

Only two corporate FCPA enforcement actions were resolved during the first calendar quarter of 2020. With the exception of the first quarter of 2017 at the end of the Obama administration, which saw eight FCPA-related corporate resolutions in January 2017 (four each by DOJ and SEC), that number is not out of sync with what we have seen in terms of enforcement activity during the first quarters of the past four years (i.e., 2015-2016 and 2018-2019).

On January 31, 2020, the DOJ announced that Airbus had agreed to pay almost $4 billion in combined penalties as part of a global resolution with authorities in the U.S., France, and the U.K. arising from the company's scheme to use third-party business partners to bribe government officials and airline executives to obtain business advantages, as well as the company's violation of the Arms Export Control Act (AECA) and its implementing regulations, the International Traffic in Arms Regulations (ITAR), in the United States. Although the DOJ acknowledged that Airbus was not a U.S. issuer or a domestic concern, a large portion ($294 million) of the global settlement amount was related to the FCPA enforcement action. Specifically, the DOJ had charged Airbus with one count of conspiracy to violate the FCPA's anti-bribery provisions (citing actions by Airbus executives while in the United States) and conspiracy to violate the AECA and the ITAR. Notably, Airbus's resolved corporate FCPA investigation did not include a monitorship requirement as part of the settlement, in part given the French government's requirement for compliance program supervision and auditing, as discussed below.

This quarter also saw the SEC resolving a corporate enforcement action with the Ohio-based pharmaceutical company Cardinal Health, Inc. via an administrative proceeding. On February 28, 2020, the SEC announced that Cardinal Health had agreed to pay almost $9 million ($5.4 million in disgorgement, plus prejudgment interest of almost $917,000 and a $2.5 million civil penalty) to resolve charges that the company, through the marketing operations of its former subsidiary in China, had violated the books and records and internal accounting controls provisions of the FCPA following an acquisition in China. The resolution with Cardinal Health highlights the SEC's continued efforts to enforce the FCPA's accounting provisions and the importance of anti-corruption compliance controls and procedures related to marketing employees and marketing funds in high-risk jurisdictions like China, as well as the importance of post-acquisition compliance program implementation.

The quarter also witnessed two other significant developments related to corporate enforcement actions – the extension of the Odebrecht monitorship for another nine months and the end of the Braskem monitorship. The underlying resolutions with Odebrecht and Braskem were related to Operation Car Wash, which was launched in 2014 to investigate bribes paid to officials at state-controlled oil behemoth Petroleo Brasileiro S.A. (Petrobras).

We discuss each of these corporate enforcement actions in more detail below.

Corporate Investigations Closed without Enforcement Actions

Following our practice from past years, throughout the first quarter of 2020, Miller & Chevalier has tracked investigations closed without an enforcement action, i.e., known investigations that the DOJ and the SEC have initiated but closed without a DPA, NPA, Cease-and-Desist Order, guilty plea, jury conviction, or other final enforcement procedure.1 During the first three months of 2020, we tracked only one such investigation announced publicly as closed without enforcement action: In a January 2020 filing with the SEC, Uber said that it had received a notice from the DOJ stating that the DOJ had closed its investigation into possible FCPA violations of the company in several countries, including Indonesia, Malaysia, and China, among others, "and will not be pursuing enforcement action against the Company in relation to previously disclosed […] investigation of possible violations of the [FCPA].

Potential Corporate Resolutions

Lastly, we note two other recent developments involving the Scotland-based oilfield services company John Wood Group plc (the Wood Group) and the Italian oil and gas company Eni, S.p.A. (Eni). Specifically, the Wood Group said in an annual investor report in March 2020 that the company expected to reach a $46 million settlement with U.S., Brazilian, and Scottish authorities over bribery allegations related to the Monaco-based Unaoil.

On April 19, 2020, Eni, which has recently faced and in the past resolved corruption allegations, agreed to resolve charges by the SEC related to alleged improper payments made by Saipem S.p.A. (Saipem) from 2007 to 2010 to win government oil contracts in Algeria. At the time of the payments, Eni owned 43 percent of Saipem. The SEC found that Eni failed to proceed in good faith to cause Saipem to devise and maintain sufficient internal accounting controls as required by the language of the FCPA's accounting provisions addressing issuers that hold 50 percent of less of the voting power of an entity. The SEC also found that Eni violated the books-and-records provisions of the FCPA because it consolidated Saipem's financial statements, which included the improper payments, into its own. As part of the settlement, Eni agreed to pay to the SEC $24.5 million, consisting of $19.75 million in disgorgement and $4.75 million in prejudgment interest. The next edition of the FCPA Review will cover the Eni resolution in detail.

Eni had said in an April 2, 2020 filing with the SEC that the company was in "advanced discussions" with the SEC in connection with a potential settlement related to the alleged misconduct. That filing came six months after Eni had announced in October 2019 that the DOJ had closed its investigation into possible FCPA violations in Nigeria and Algeria, including allegations that Saipem had paid bribes to Algerian officials to secure contracts.

The DOJ and SEC had initiated their investigations into Eni in 2012 after the company had disclosed to the agencies that it was under investigation by Italian prosecutors regarding the alleged misconduct in Algeria. We discussed the July 2010 resolutions of Eni, Eni's former Dutch subsidiary Snamprogetti Netherlands B.V., and Saipem with the SEC and DOJ and their two-year DPA with the DOJ in our FCPA Summer Review 2010.

Known FCPA Investigations Initiated

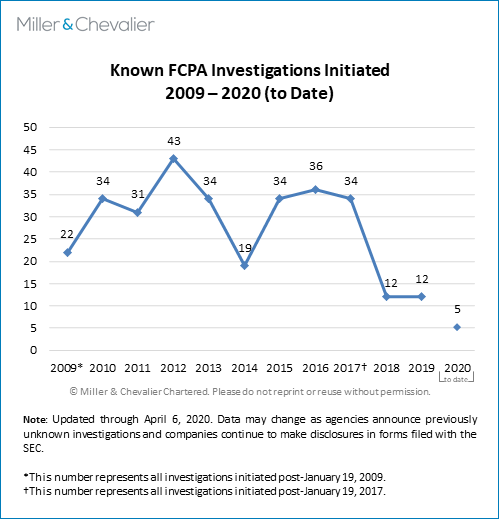

The chart of known FCPA investigations initiated from 2009 to date below shows that only three such investigations were opened during the first three months of 2020. Notably, the chart shows a general decline in FCPA investigation since 2016-2017. As we have done in the past, we note that this low number of initiated investigations is almost certainly due to incomplete information. In particular, we are likely to learn of more investigations launched in late 2019 and 2020 in the coming weeks and months, as companies disclose such information in their public disclosure filings. Because neither the DOJ nor the SEC disclose official investigations statistics in anything close to real time and only some companies are likely to disclose such information through SEC filings or other means, our investigation statistics are necessarily incomplete.

Individual Enforcement Actions

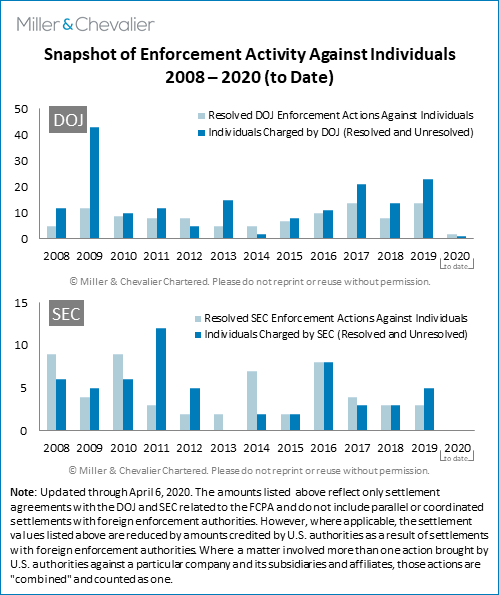

The chart below shows snapshots of enforcement activities against individuals by the DOJ and SEC, respectively. As can be seen from the chart, the SEC did not bring or resolve enforcement actions against individuals during the first quarter of 2020. The DOJ resolved two actions against individuals through guilty pleas.

As discussed above, during the quarter, there were two acquittals, three sentencings, and three indictments unsealed, among other developments. Plus, the first quarter of this year saw the scheduling of a new trial for Roger Richard Boncy and Joseph Batiste, two defendants convicted last year of conspiracy to violate the FCPA and the Travel Act by trying to bribe government officials in Haiti in exchange for approvals related to a port project worth $84 million. We discuss the more notable of these developments and individual enforcement actions in more detail below.

Lastly, we also note here several developments related to Goldman Sachs. First, on April 13, 2020, the SEC filed a case against Asante Berko, a former Goldman Sachs executive in London, charging him with having taken part in a $4.5 million bribery scheme in Ghana to help a client win a contract to build and operate an electrical power plant in the country. Notably, the SEC did not charge Goldman Sachs with any misconduct.

Second, in December 2019, there were multiple press reports that Goldman Sachs was in talks with the U.S. government to pay an almost $2 billion fine, plead guilty to violating U.S. bribery laws, and retain an independent monitor to oversee and recommend compliance policy changes in order to resolve a criminal investigation into the bank's role in the 1Malaysia Development Berhad (1MDB) corruption and money laundering scandal. However, these negotiations did not result in an agreement during Q1 2020, obviously. While negotiations between Goldman Sachs and the U.S. government are presumably still ongoing, at the end of February 2020, three units of the bank (i.e., in Singapore, Hong Long, and London) pleaded not guilty to charges filed in December 2018 in Malaysia of misleading investors in connection with more than $6 billion in bond sales the investment bank helped raise for 1MDB.

Also, on April 14, 2020, the DOJ announced that it had repatriated to Malaysia approximately $300 million in additional funds misappropriated from 1MDB, bringing the total amount of funds the U.S. has returned or assisted Malaysia in recovering to more than $600 million. The DOJ's action is related to an initial forfeiture complaint filed by the DOJ in July 2016, on which we reported in our FCPA Winter Review 2020. In October 2019, the DOJ announced a civil forfeiture settlement with Low Taek Jho (aka Jho Low), the accused mastermind of a multibillion-dollar international money laundering and bribery scheme involving 1MDB, and members of his family. On November 4, 2019, a District Court judge entered the consent judgments forfeiting more than $700 million in assets acquired by Jho Low and his family. According to the DOJ press release, combining the newly-recovered $300 million with funds recovered previously in related 1MDB forfeiture cases, the U.S. has to date recovered or helped with the recovery of more than $1 billion in assets associated with 1MDB. Notably, this represents the largest civil forfeiture concluded by the DOJ and the largest recovery under its Kleptocracy Asset Recovery Initiative. We have covered developments related to the 1MDB corruption scheme in several of our past FCPA reviews (e.g., here, here, and here). Notably, as we have reported, the 1MDB case involves Goldman Sachs and two ex-Godman Sachs bankers, Tim Leissner and Roger Ng. Leissner pleaded guilty in November 2018 and could face deportation as a German national, while Ng, a Malaysian national, was extradited from Malaysia to the U.S. to face charges of conspiring to violate the FCPA and to launder billions of dollars embezzled from 1MDB.

Policy and Litigation Developments

Technically not in Q1 2020, the Sanctions Board Secretariat of the World Bank Group announced at the end of December 2019 the publication of the 2019 WBG Sanctions Board Law Digest. In addition to providing information on the work of the Sanctions Board, the Law Digest reviews the Sanctions Board's holdings in more than 100 decisions issued in the past twelve years, covering topics ranging from assessment of allegations of misconduct to factors affecting the choice of sanction to the Sanctions Board's treatment of procedural issues in the course of sanctions proceedings. We discuss this policy development in more detail below.

International Developments

There were several noteworthy international developments during the first quarter of 2020.

In the United Kingdom, the SFO entered into a DPA with Güralp Systems Limited (GSL) requiring the company to pay a disgorgement of £2,069,861 and undertake a review of its corporate compliance program for the company's role in a conspiracy to make corrupt payments, in violation of the Criminal Law Act of 1971, and failure to prevent company employees from paying bribes, in violation of the U.K. Bribery Act. The DPA was signed on October 22, 2019 but not made public until December 20, 2019. The SFO had also charged GSL's founder, Head of Sales, and Finance Director with conspiracy to make corrupt payments but who, by the time the DPA was made public, were acquitted of the charges on December 18 and 20, 2019, as we discuss in more detail below.

Also in the United Kingdom, the SFO released long-awaited guidance, an update to its internal Operational Handbook, on evaluating the effectiveness of companies' anti-bribery and anti-corruption compliance programs, similar to the revised guidelines that the DOJ had issued in April 2019.

In France, the Sanctions Committee of the French Anti-Corruption Agency (AFA) found in its second decision that a French company, Imerys S.A., had failed to comply with compliance requirements of Sapin II, France's 2016 anti-corruption law, yet declined to impose the penalties requested by the AFA against the company and its former interim CEO.

In South Korea, the National Assembly passed legislation designed to strengthen the country's anti-corruption law by establishing an independent anti-corruption agency, to be set up by July 2020, to investigate high-level public officials in relation to their official duties.

In Colombia, the Colombian Attorney General's Office raided the Bogota offices of Avianca Holdings as part of an investigation into the alleged bribery of foreign officials disclosed by the company to the Superintendence of Industry and Commerce (SIC) and the SEC in 2019. The raid came mere weeks after French authorities had revealed, as part of their settlement with European airplane manufacturer Airbus, that Airbus had intended to pay bribes to a senior Avianca executive as part of negotiating the sales of Airbus aircrafts.

We discuss these and other international developments in more detail below.

Although we do not cover it below, we also note the publication by the Chartered Institute of Internal Auditors in January 2020 of a new Internal Audit Code of Practice to strengthen corporate governance and to serve as guidance and an industry benchmark to improve the effectiveness of internal audit professionals in the U.K. and Ireland. As several specialized internal audit publications have already noted, "[t]he new code aims to increase the status, scope, and skills of internal audit and makes 38 recommendations" to companies, as , including, among others:

- "Unrestricted access for internal audit so it is not restricted from looking at any part of the organization it serves and key management information;

- The right to attend and observe executive committee meetings;

- A direct line to the CEO and a direct report to the audit committee chair to increase the authority and status of internal audit;

- The direct employment of chief internal auditors in every business, even when the internal audit function is outsourced in order to ensure chief internal auditors have sufficient and timely access to key management information and decisions; and

- Regular communication and sharing of information by the chief internal auditor and the partner responsible for external audit to ensure both assurance functions carry out their duties effectively."

Corporate Enforcement Actions

Odebrecht Agrees to Extend Plea Agreement with DOJ while Braskem Announces End of Monitorship

As we covered in our FCPA Winter Review 2017, in December 2016 Odebrecht and Braskem, a company in which Odebrecht held a controlling stake, entered into a massive global corruption settlement, including guilty pleas by both companies. Under Odebrecht's original global settlement, the company was subjected to penalties totaling approximately $2.6 billion (reduced from a larger penalty level of approximately $4.5 billion based on an inability to pay analysis) and agreed to retain an independent compliance monitor for three years and implement a compliance and ethics program. The Odebrecht monitorship was originally set to expire in February 2020.

This year, on January 29, 2020, the DOJ made public a filing stating that Odebrecht had failed to fulfill obligations under its plea agreement. Specifically, the filing stated that the company failed to adopt recommendations made by the monitor and failed to implement a compliance and ethics program designed to prevent and detect violations of certain anticorruption laws. According to court filings, Odebrecht agreed to extend the monitorship and other terms of its plea agreement with the DOJ. As a result, the company now has until November 16, 2020 to fulfill its obligations under the extended plea agreement or face potential prosecution.

After confirming the extension, Odebrecht reportedly said in a public statement that this measure was taken due to "financial issues related to the payment of monitors." The Odebrecht conglomerate, which filed for bankruptcy last June to restructure 51 billion reais in debt, said it is trying to solve the problem in the short term.

In a separate development related to the petrochemical company Braskem, Brazil's Federal Prosecution Service (MPF) announced on March 11, 2020 that Braskem has fulfilled the compliance obligations in Brazil arising from its 2016 foreign bribery settlement. The company also released the news on its website that same day. As part of the resolution with the authorities, Braskem had agreed to retain independent monitors in Brazil and the U.S. for a period of three years. According to MPF, the company has ceased all illicit practices, set up mechanisms to ensure "maximum levels of ethics and transparency," and will pay Brazil $460 million pursuant to the 2016 settlement. MPF's decision to conclude the monitorship was based on a report from the independent monitors who had certified that the company had "implemented all the recommendations for structuring and executing its compliance program." However, in the company's news release on March 11, 2020, Braskem also announced that the DOJ and SEC had not certified the effectiveness of its enhanced compliance program yet.

Airbus SE Settles with U.S., U.K., and French Authorities in Connection with Alleged Corruption Schemes Around the World

On January 31, 2020, authorities in the United States, the United Kingdom, and France announced that they had settled corruption-related charges with Airbus SE (Airbus). Airbus, an aerospace manufacturer currently registered in Leiden, The Netherlands, with its main offices in Toulouse, France, agreed to pay almost $4 billion in combined global penalties to resolve allegations that the company engaged in schemes around the world to bribe government officials, as well as non-governmental airline executives, in exchange for lucrative business deals. In addition to bribery allegations, Airbus also settled alleged International Traffic in Arms Regulations (ITAR) violations with U.S. authorities.

Although Airbus had previously initiated internal reviews of third-party relationships, the government investigations began in April 2015 when U.K. Export Finance requested information from Airbus, including information on a specific third party from Sri Lanka. Following Airbus's responses to U.K. Export Finance, both the SFO and the Parquet National Française (PNF) opened investigations and established a joint task force to coordinate their investigations. Subsequently, the DOJ and the U.S. Department of State (State Department) also initiated investigations. In the coordinated resolutions announced in January, the PNF resolution took primacy, with the three governments separately covering different conduct and/or adjusting criminal penalties to take into account the full array of enforcement actions.

In France, Airbus entered into a convention judiciaire d'interêt public (CJIP), or "judicial agreement in the public interest" with France's PNF to resolve violations of Articles 445-1 (bribery of private individuals) and 435-3 (bribery of foreign or international public officials) of the French Criminal Code. As part of the agreement, Airbus will disgorge €1,053,377,113 (approx. $1.2 billion) in profits and pay an additional penalty of €1,029,760,342 (approx. $ 1.1 billion) for a total penalty of €2,083,137,455 (approx. $2.3 billion). The CJIP states that the amount reflects a 50 percent discount rate and a deduction of funds owed to the DOJ for the FCPA violation. In addition, Airbus must cover the fees associated with France's Agence Française Anticorruption (AFA) three-year supervision program (described below), up to a total of €8.5 million ($9.41 million). The PNF's investigation focused on bribery-related conduct that took place in approximately 16 jurisdictions: United Arab Emirates, China, South Korea, Nepal, India, Taiwan, Russia, Saudi Arabia, Vietnam, Japan, Turkey, Mexico, Thailand, Brazil, Kuwait, and Colombia. As described below, the CJIP describes eight schemes involving alleged bribes paid to public and private individuals with decision-making power over Airbus's aircraft sales.

In the U.K., Airbus entered into a judicially-approved DPA with the SFO to resolve five counts of failure of a commercial organization to prevent bribery pursuant to Section 7 of the U.K. Bribery Act. The SFO's investigation focused on South Korea, Indonesia, Sri Lanka, Malaysia, Taiwan, Ghana, Colombia, and Mexico. While the CJIP in France addressed the findings regarding South Korea, Colombia, and Mexico, the SFO's DPA addressed conduct which took place between approximately 2011 and 2015 in five jurisdictions: Malaysia, Sri Lanka, Taiwan, Indonesia, and Ghana. As part of the U.K. DPA, Airbus will disgorge an additional €585,939,740 (approx. $653 million) in profits from four of the five countries (the SFO did not seek disgorgement of the profits from Ghana, citing the fact that the DOJ would fine Airbus an equivalent amount for ITAR violations related to Ghana) and pay a fine of €398,034,571 million (approx. $444 million), reflecting a 50 percent reduction. Airbus must also cover the SFO's costs of €6.9 million (approx. $7.71 million). The Statement of Facts attached to the DPA states that the SFO's findings were a result of a "joint investigation" with PNF and a "parallel investigation" conducted by DOJ and the U.S. State Department and that "[e]ach of the prosecuting authorities has taken responsibility for a number of geographical areas or customers," as noted.

In the United States, Airbus entered into a DPA with DOJ, agreeing to pay $294,488,085 (after a credit of up to $1,797,490,796 owed to the French National Financial prosecutor (PNF), as described below, for conspiring to violate the anti-bribery provisions of the FCPA. Airbus also settled ITAR violations by agreeing to pay a criminal penalty of $237.7 million under the DPA and, as part of a civil forfeiture action, to forfeit a €50 million ($55 million) bond that was "traceable to the proceeds of the ITAR-related conduct." The FCPA violations focused on business in China, whereas the ITAR violations covered conduct with business partners in Ghana, Indonesia, Vietnam, Austria, and Lebanon (covering contracts in multiple other countries). In addition, Airbus reached a $10 million settlement with the U.S. State Department to resolve ITAR violations (of which $5 million has been suspended and reserved for corporate compliance improvements).

With respect to the FCPA violation, according to the U.S. DPA, Airbus admitted that between approximately 2008 and 2015, through its employees, executives, and agents, it "engaged in and facilitated a massive scheme to offer and pay bribes to decision makers and other influencers, including foreign officials in multiple countries…to obtain improper business advantages." Although the DPA mentions the involvement of foreign officials in "multiple countries," it describes only an alleged scheme to provide gifts and hospitality to public officials in China. According to the U.S. DPA, the alleged misconduct was part of a facilitated effort from several company executives, third-party consultants, the company's Strategy and Marketing Organization (SMO), which "manage[d] Airbus's international business development, strategy, and marketing activities outside of its home markets," and the Company Development and Selection Committee (CDSC), which was responsible for reviewing proposals concerning the selection of and finalizing agreements with third-party "Business Partners" that Airbus used to assist with commercial negotiations with private and public customers.

Corporate History & Current Structure

Established as the European Aeronautic Defence and Space Company (EADS) on July 10, 2000 by the merger of three European aerospace companies, Airbus underwent various changes in corporate structure, beginning in 2013 when the core shareholder partnership dissolved. Specifically, the U.K. DPA explains that following the 2013 reorganization, the governments of France, Germany, and Spain collectively held only 28 percent of the shares. Moreover, shareholders did not retain veto or director appointment rights and a "new and independent Board was established under an independent chairman" with the sole executive director being Airbus's CEO. In May 2014, Airbus changed its name to Airbus Group NV and a year later, in May 2015, Airbus Group NV became a European public-limited company, resulting in the name Airbus Group SE, shortened to Airbus SE in April 2017. Throughout these changes, Airbus remained the same legal entity, registered in the Netherlands.

SMO International

As noted above, according to the U.S. DPA, Airbus established the SMO division in 2008, tasking its subdivision, SMO International, with management of third-party business partners engaged to assist Airbus's Commercial Division, including International Marketing and Development Projects (IMD Projects), as well as to support sales across divisions and "specifically to manage Airbus's international business development, strategy and marketing activities outside its home markets and the United States." To this end, the SMO International consisted of two "operational sub-divisions": International Operations and International Development, with approximately 150 employees. Per the U.S. DPA, between 2008-2015, SMO International received an "annual maximum allowance" of approximately $300 million, funded primarily through "quarterly reimbursements."

While SMO International assumed responsibility for agreements with business partners, "approval for the business partners was formally given by the Company Development and Selection Committee" (CDSC), which at various times, consisted of Airbus executives, including those alleged to have directly participated in the alleged bribery scheme and the alleged violations of the ITAR. Moreover, as illustrated by the discussion below, SMO International played a significant role in the alleged misconduct set forth in the U.S. DPA by, inter alia, facilitating relationships with business partners and other third parties to improperly influence government officials in exchange for business advantages. Each of the alleged bribe schemes detailed in the U.S., U.K., and French resolutions are discussed in turn below, starting with the U.S. resolution first.

U.S. DPA

Bribery Scheme

China. According to the U.S. DPA, in or around 2013, Airbus's SMO engaged consultants to facilitate and conceal bribe payments intended to be paid to Chinese officials in order to obtain or retain business, including to obtain or retain General Terms Agreements (GTAs) between Airbus and Chinese government agencies responsible for approving the sale of aircraft to state-owned and state-controlled airlines in China. According to the DPA, the Chinese government must sign a GTA, which sets the quota on the number of aircrafts permitted to be sold to state-owned and state-controlled airlines in China, prior to the import of the aircraft to China. Airbus hired a consultant, identified as "Consultant 1," who was known to have had a "long term relationship with the political level…knowing personally some key decision makers of the customer" to assist with the GTA negotiation; Airbus did not retain any executed agreement with "Consultant 1" that described the scope, nature, or terms of the engagement. "Consultant 1" requested "comfort paper" from Airbus. Ultimately, Airbus paid "Consultant 1" approximately $14 million dollars via a bank account owned by "Consultant 3," an Airbus Business Partner allegedly approved to receive payments pursuant to a "fake consulting agreement" for which services were never rendered in relation to other contracts in China that did not in fact involve consultants. The head of compliance emailed an Airbus executive regarding the basis for approving "Consultant 3," and at least one executive responded to the head of compliance with an email while he was in the United States, asking him to alter the proposed justification. The same executive sent other relevant emails while in the United States, according to the DPA. Airbus also explored working with "Consultant 3" to extend a loan facility of Euro 7.7 million and signing an agreement directly with "Consultant 1" to include "expected remuneration" of USD 18 million. Based on the DPA, it appears that these further payments did not proceed, due to a freeze in Airbus on consultant payments in late 2014. In addition, Airbus China, along with a Chinese government entity, established a fund that was intended to support projects "related to services for the Chinese commercial aviation industry, including but not limited to aviation related management education, seminars, and pilot educational facilities" but instead was used at least in part to pay event agencies to host social events for Chinese government officials and airline executives that fell outside of the fund's scope. According to the DPA, an Airbus executive – while located in the United States – emailed an approval for a golf invitational. In addition, Airbus funded travel for officials and their families to the United States for "all expense-paid events, including events held at Park City, Utah, and Maui, Hawaii." While the Statement of Facts attached to the U.S. DPA indicates that a small portion of the trips consisted of "half-hour business related presentations," the majority of the time was spent on leisure activities such as snorkeling, surfing lessons, and horseback riding.

ITAR Violations

As noted above, Airbus also agreed to pay more than $290 million to resolve allegations that it violated certain ITAR provisions, specifically Parts 130, 129, and 126. The alleged misconduct giving rise to certain ITAR violations occurred in various countries, including in Ghana, Indonesia, Vietnam, Thailand, Lebanon, and Austria. While the conduct at issue was not ultimately labelled as FCPA violations under the terms of the disposition, we include a discussion here because the underlying conduct often involved the use and supervision of third parties for sales purposes that raised corruption-related red flags and issues, and there is some overlap between the ITAR violations and the conduct discussed in the U.K. DPA (in the case of Airbus's business in Ghana). They are discussed in greater detail below.

Part 130. According to the U.S. DPA, Airbus violated ITAR Part 130, which requires, in relevant part, that applicants for export licenses disclose to the United States Department of State, Directorate of Defense Trade Controls (DDTC) ( whether applicants or related parties "pa[id], offered or agreed to pay political contributions, fees or commissions in connection with the sale or transfer of a defense article or defense service" by "paying political contributions, fees, or commissions on at least forty transactions and failing to properly report" them to DDTC. Moreover, the U.S. DPA states that Airbus repeatedly filed license applications affirming that "Part 130 did not apply to the application" or that "no business partner payments were made" without verifying the accuracy of those representations. Finally, the U.S. DPA also alleges that Airbus failed to comply with the recordkeeping obligations of Part 130, requiring records related to license applications to be kept for a period of five years.

Part 129. With respect to ITAR Part 129, which requires person(s) engaged in brokering activities by "facilitat[ing] the manufacture, export, transfer, re-export, or re-transfer of a U.S. or a foreign defense article or defense service" to register with DDTC and provide annual status reports on brokering activities, Airbus allegedly failed to disclose that its business partners with a U.S. nexus performed "brokering activities while receiving commissions from Airbus." To this end, the U.S. DPA notes that Airbus did not have adequate processes in place to ensure that these business partners registered with the DDTC and filed the required reports under ITAR Part 129.

Part 126. ITAR Part 126, prohibits, in relevant part "the sale of defense articles and defense services to any listed Prohibited Country or any person from any listed Prohibited Country acting on its behalf" without DDTC's approval. In this regard, the U.S. DPA points to Airbus's failure to "implement policies and procedures to ensure" that business partners engaging in brokering activities on the company's behalf were not "nationals of or incorporated" in the Prohibited Countries listed in Part 126.1. Consequently, the U.S. DPA alleges that certain business partners with relevant ties to Prohibited Countries engaged in facilitating the sale of ITAR articles and services on Airbus's behalf and did not obtain written approval from the DDTC for their activities.

Examples of the ITAR violations identified in the named countries are set forth below:

Ghana:

- Among the misconduct described related to Ghana, the U.S. DPA alleges that between 2009 and 2015, through business partners that were approved by SMO International division and foreign subsidiaries, including the company's Defence & Space Division's Spanish subsidiary, Airbus sold three C-295 military aircraft to Ghana, two of which "were the subject of false ITAR Part 130 certifications." Specifically, senior Airbus export compliance management at the Defence & Space Division's Spanish subsidiary signed export license applications asserting that Airbus and its vendors had not "paid, offered, or agreed to pay political contribution, fees or commission in connection with the sale" when "[i]n fact" Airbus made payments to business partners and related third parties in connection with the aircraft sales totaling approximately € 3.6 million. As discussed above with regard to the U.K. DPA, Airbus hired a business partner who was the brother of a high-ranking Ghanaian government official to assist with the sale of C-295 aircrafts, ultimately using him as a conduit for communications with the Ghanaian official as well as a U.K. consultant, without "any written business partner agreement and without completing due diligence."

- In 2011, Airbus's compliance staff rejected the proposed contract between Airbus and the business partner and the U.K. consultant's company, identifying the red flag of the business partner's familial relationship with the Ghanaian official. However, the DPA notes that leadership in SMO International and the Defence & Space Division "deliberately circumvent[ed]" the company's compliance rules by allegedly using another Spanish third-party business partner's company previously used in other Defence & Space campaigns to pay the business partner, using it "solely as a pass through-entity." Under this scheme, with authorization from SMO International, the U.S. DPA states that Airbus paid more than € 3.5 million to the Spanish company, which was transferred to the business partner and U.K. consultant.

Indonesia:

- According to the U.S. DPA, alleged violations of ITAR Part 130 occurred between 2010-2015 in connection with the sale of eleven C-295 aircraft, "nine of which were the subject of false ITAR Part 130 certifications." Like the Ghanaian scheme, the Indonesian sales campaign also allegedly involved executives from the Defence & Space Division and SMO International. Specifically, the U.S. DPA states that Airbus made payments to (1) an Indonesian consultant company whose founder had connections to Indonesia's "political leadership" and employed several former "high-ranking" Indonesia military and government officials; and (2) an Indonesian-based business partner, in connection with these sales, which amounted to approximately € 16,100,000, despite ITAR Part 130 certifications signed by an Airbus export compliance manager to the contrary.

- Significantly, Airbus's relationship with the Indonesian consultant company, which started working for Airbus military aircraft campaigns in approximately 2010 "on the basis of an oral agreement" was directly overseen by SMO International. To this end, executives at SMO International "reviewed and approved contracts" between Airbus and the Indonesian consultant company, "despite being told about compliance risks" such as the fact that its "business address listed no sign of the company" as well as its office space which "appeared partially vacant and generally unused." Moreover, the U.S. DPA explains that it wasn't until "after the sale of C-295s to Indonesia was consummated" that the Defence & Space Division submitted an application for the Indonesian consultant company to assist in sales to Airbus compliance.

Vietnam:

- The U.S. DPA states that between approximately 2009-2014, Airbus sold three C-295s, "all of which were the subject of false ITAR Part 130 certifications" with the direct assistance of the Defence & Space Division and some involvement from SMO International executives, culminating in approximately €6 million in improper payments. The U.S. DPA states that Airbus used a Hong Kong company doing business in Vietnam, whose controlling partners were all foreign nationals, some of whom had "long-standing personal connections with senior Vietnamese government officials as well as airline executives." Notably, according to the U.S. DPA, Airbus entered into consultant agreements with the Hong Kong company retroactively "following the success of a particular sales campaign."

Austria:

- From approximately 2000-2011, Airbus implemented a sales campaign to sell Eurofighter Typhoon aircraft and other related services to the Austrian Ministry of Defense, resulting in the sale of fifteen aircraft, equipment, and related services "all of which contained ITAR-controlled content, and involve[d] false ITAR applications." Specifically, the U.S. DPA states that Airbus or its vendors made improper payments totaling approximately €55 million in connection with the sale of Eurofighter Typhoons. As part of its sales campaign in Austria, Airbus entered into a joint venture with a German company, tasking it with the responsibility of filing the appropriate ITAR license applications to the DDTC. Further, the U.S. DPA states that Airbus made payments to "fourteen individuals, consultants or organizations that should have been reported under Part 130, including multiple Austrian consultants with close ties to Austrian government officials, at least one of whom was managed by SMO International."

Ultimately, the U.S. DPA states that Airbus's "gross gain" on the sales of C-295s to Ghana, Indonesia, and Vietnam, "on which Airbus failed to file or falsely filed Part 130 disclosures," was approximately $165 million.

In addition to the Part 130 violations, the U.S. DPA identifies several Part 129 and 126 violations. The Part 129 violations, arose, in part, from Airbus's use of third-party business partners to "facilitate the manufacture, export, permanent import, transfer… or retransfer of aircraft and other platforms" containing ITAR-controlled defense articles. Specifically, according to the U.S. DPA, several business partners "engaged in brokering activities while receiving fees and commissions from Airbus that were not disclosed in brokering reports" as required by ITAR Part 129. For example, Airbus hired a Thai consultant with connections to Thai government officials to work on sales campaign to the Government of Thailand, including multiple branches of the Thai Armed Forces, who failed to register as a broker with the DDTC. Moreover, the U.S. DPA notes that Airbus did not follow up to ensure compliance with ITAR 129, by requiring (for example) proof of broker registration with the DDTC.

According to the U.S. DPA, Airbus "also failed to implement policies and procedures to ensure that no business partners engaged in brokering activity on its behalf were nationals of or incorporated" in the Prohibited Countries listed in ITAR Part 126. For example, Lebanon was at all relevant time period a Prohibited Country, but Airbus nevertheless allegedly used a Lebanese consultant with connections to Kuwaiti government officials from 1996-2016 despite "Airbus's awareness thereof." Airbus's relationship with the Lebanese consultant was managed by SMO International, with executives providing the consultant with "comfort letters" purporting to promise compensation "above and beyond what had been approved by Airbus." The Lebanese consultant was ultimately paid approximately € 860,000 for services "in connection with Airbus Helicopter campaigns that may have contained ITAR-controlled products…to a bank account located in Lebanon."

U.K. DPA

- Malaysia. The SFO alleged that between July 2011 and June 2015 Airbus failed to prevent persons associated with Airbus from bribing executives at AirAsia and AirAsia X airlines, which are not government-owned or -controlled. Specifically, Airbus paid $50 million to a sports team owned by two AirAsia executives and offered to provide an additional $55 million more (although the later offer was never fulfilled). As a result of the improper sponsorship and the offer of a further improper payment, the airlines purchased 180 aircrafts from Airbus.

- Sri Lanka. The SFO alleged that between July 2011 and June 2015, Airbus failed to prevent persons associated with Airbus paying bribes to executives at SriLankan Airlines (SLA), which is 99.1 percent owned by the Government of Sri Lanka. The bribes were paid through a Brunei-based straw company, an approved Airbus business partner, set up by the wife of a SriLankan Airlines official with no relevant expertise. Specifically, Airbus offered to pay the Brunei-based company $16.84 million (and ultimately paid $2 million) to "influence SLA's purchase of 10 Airbus aircraft and the lease of an additional 4 aircraft." According to the DPA, in approximately 2013, to disguise the fact the SLA official's wife was the principal of the Brunei-based company, Airbus employees "misled [U.K. Export Finance] as to her name and sex."

- Taiwan. Between 2010 and 2013, Airbus allegedly channeled payments to an executive of the private Taiwanese airline, TransAsia Airways (TNA), for his personal benefit through two approved business partners, making total payments of more than $14 million. As a result, TNA bought 20 aircraft from Airbus. (Of course, the U.K. Bribery Act covers commercial bribery as well as bribery of government officials.)

- Indonesia. Between 2011 and 2014, an Airbus business partner paid more than $3.3 million to or for the personal benefit of senior officials and/or their family members at Indonesia's national airline Garuda and its low-cost subsidiary, Citilink. One of the payments was in the form of purchasing luxury property. As a result, Garuda/Citilink purchased 55 aircrafts from Airbus.

- Ghana. Between 2009 and 2015, Airbus hired a business partner who was a close relative of a high-ranking Ghanaian government official to assist with a sale of three C-295 aircrafts to the Government of Ghana (through an Airbus defense subsidiary in Spain). According to the U.K. DPA, various Airbus employees knew that the intermediary was a close relative of the Ghanaian government official, who was a key decision maker with respect to the sales. The intermediary had "no prior experience in the aerospace industry." To disguise "commission payments" made to the business partner, false documentation was created "by or with the agreement of Airbus employees." Concerns were identified regarding dealing with a company owned in part by the intermediary, and the transactions were instead routed through a different intermediary, with the understanding that they would be passed along to the original company and intermediary. Significantly, some of the payments culminating in the sale of two of the above-mentioned aircrafts also resulted in the ITAR violations contained in the U.S. DPA.

French CJIP

- Air Arabia. In November 2007, Airbus and Air Arabia entered into a purchase agreement for 34 aircrafts, as well as options for an additional 15 aircrafts. As part of the agreement, an Airbus Middle East executive allegedly made a "commitment" to pay "concealed compensation" to an Air Arabia executive – later described to be $10 million. According to the CJIP, Airbus executives considered multiple ways to make the "concealed compensation payment," including by acquiring a company owned by the executive, through the purchase of luxury real estate properties for the executive, and via a fake business partner. However, the payment was not carried out due to measures taken by the company including a 2014 payment freeze and "vigilance of other departments within Airbus."

- Chinese GTAs & China Aviation Cooperation Fund. According to the CJIP, and similar to the facts detailed in the U.S. DPA (discussed above), to finalize two GTAs with the Chinese government, Airbus allegedly paid a third-party intermediary (via another intermediary that had been used by Airbus in the past to "discreetly" transit funds) approximately €10.3 million ($11.41 million), which, at least in part, was passed on to Chinese officials involved in approving the GTAs. In 2015, company financial records showed that an additional $13 million was scheduled to be paid to the same intermediary in China related to the GTAs, but Airbus's 2014 payment freeze stopped the payment. In addition, from in or around 2011 to 2017 Airbus contributed at least $2 million to the China Aviation Cooperation Fund (CACF) through credit notes offered to the CACF following the delivery of an aircraft by Airbus. Some of CACF's funds were used outside of the intended scope, including to finance leisure events, which were organized at the same time that Airbus was negotiating the sale of aircrafts. In addition to funding the CACF, Airbus organized and incurred expenses for trips in and outside of China that were "primarily or even exclusively composed of leisure activities" for Chinese officials and their "entourages" and offered luxurious gifts and event tickets to Chinese public officials and airline executives.

- Korean Air. Between 1996 and 2000, Airbus finalized three purchase agreements for the sale of a total of 10 aircrafts to Korean Air, a private South Korean airline, in exchange for committing to pay $15 million to a former senior executive of Korean Air. According to the CJIP, Airbus's SMO Division was tasked with carrying out the commitment and payments were executed between 2010 and 2013. In 2010, Airbus purchased $10 million in shares of an entity owned by the son of a third-party intermediary. Airbus paid the funds from accounts opened in Lebanon by Airbus's subsidiary incorporated in the United Arab Emirates. Documents show that the former Korean Air executive received at least $2 million of that amount. In 2011, Airbus entered into a fictitious consulting agreement with a different intermediary pursuant to which Airbus paid $6.5 million. According to the CJIP, most of the funds were intended for the former Korean Air executive. Finally, in 2013, Airbus paid $6 million to South Korean and U.S. academic institutions for a research project, in which the Korean Air executive "had personal interests." The CJIP notes that the investigation did not establish that the academic institutions had knowledge of the cause or origin of the payments.

- Nepal Airlines. According to the CJIP, from in or around 2009 to 2015, documents show that to finalize the sale of two aircrafts, Airbus likely agreed to pay $ 1.8 million through intermediaries who were in contact with Nepalese public officials and executives of Nepal Airlines, which is state-owned and controlled, although it does not appear that the full amount was in fact paid, according to the CJIP.

- China Airlines (Taiwan). According to the CJIP, in January 2008, Airbus signed a purchase agreement with China Airlines, a state-owned Taiwanese airline, for the sale of fourteen aircraft with an option for an additional six. Airbus allegedly used two intermediaries to assist with the deal, one of which had close contacts within China Airlines (and was able to obtain confidential information) and the other who admitted to having close ties to a member of China Airlines' Board of Directors. Airbus allegedly transferred the funds to the intermediaries in a variety of ways including through making a €15 million ($16.6 million) investment in a mining venture in Africa in which one of the intermediaries appears to have had a financial interest (the investment quickly resulted in a "total loss, following a rapid and significant depreciation of the underlying assets"), fictitious engagements on other sales campaigns, and through using other third parties and offshore structures.

- Russian Satellites Communications Company. Russian Satellites Communications Company (RSCC) is the state-owned Russian national satellite operator. In 2011, RSCC entered into two contracts to purchase two satellites from Astrium (now Airbus Defence and Space); in which Airbus's SMO Division assisted with the sales. As part of the sales, Astrium fictitiously engaged a commercial intermediary through a consultant contract signed retroactively and made three payments totaling €8.7 million ($9.6 million) to the intermediary, which, at least in part, were understood to be intended for Russian officials. According to the CJIP, a SMO executive and the fictitious commercial intermediary regularly conferred about requests made by the Airbus compliance department. In one email, the SMO executive emailed the intermediary, stating: "Compliance is buying the story, we now only need to 'justify' your past experience", to which the intermediary responded: "Sir, Yes Sir! [...] I am going to try to find something to write for you ;-)." An external company conducted due diligence on the company behind which the fictitious commercial intermediary was operating and numerous red flags were identified (e.g., a registered office could not be identified, no financial accounts were available, and the company's ability to provide the services offered was "questionable"). Despite the red flags identified, the engagement was approved and Astrium transferred the funds to the intermediary.

- Arabsat. Arabsat is an intergovernmental organization created by (and of which the shareholders are) the Member States of the Arab League to provide international civil telecommunications services. In February 2009, Arabsat and Astrium (now Airbus Defence and Space) entered into a contract for a satellite. According the CJIP, Astrium entered into a consultant agreement with the same intermediary used in the RSCC scheme and made eight payments to the intermediary for a total of €1 million. A SMO executive (who has since retracted his statement) said that Astrium hired the same commercial intermediary used in the RSCC negotiations to pass funds to an Arabsat official.

- Avianca. According to the CJIP, between 2006 and 2014, Airbus signed several consultant agreements with a commercial intermediary to assist Airbus with negotiations with Avianca, the national airline of Colombia and part of Synergy Group, a South American conglomerate that owns various airlines in South America. The intermediary was also hired to assist with other negotiations with companies of the Synergy group. Airbus's agreements with the intermediary included "success fees, either as a fixed fee per aircraft or per campaign, or as a percentage of price of the sale," as well as proposed investment projects. According to the investigation, in 2014, part of the intermediary's fee was intended to be transferred secretly to a senior executive of Avianca Holdings who was a key contact for Airbus during the ongoing commercial negotiations. Despite continued pressure during the negotiations to make the payments to the intermediary, Airbus's "freeze of payments to commercial intermediaries and the enhancement of Airbus' compliance measures prevented the promised payment from being made."

Noteworthy Aspects

- No Voluntary Disclosure Credit for Bribery Violations in United Kingdom, France, or United States. The U.S. DPA states that, even though Airbus disclosed the issues to U.S. authorities in a "reasonably prompt time of becoming aware of corruption-related conduct that might have a connection to the United States," the company did not receive voluntary disclosure credit for the FCPA-related violations because the company failed to disclose the underlying facts to the DOJ until after the SFO initiated and made public its investigation. Interestingly, according to the U.K.'s Statement of Facts, Airbus initiated review of its third-party relationships in September 2014 and found "significant breaches of compliance policies," freezing "all payments arranged by SMO International to BPs" in October 2014. However, Airbus did not begin discussions with the SFO until after the U.K. Export Finance had notified Airbus that they intended to contact the SFO regarding potential irregularities. Moreover, the discussions with the French authorities did not begin until after that date. With respect to the FCPA violation, Airbus did receive full cooperation credit and remediation credit of 25 percent off the bottom of the applicable United States Sentencing Guidelines fine range (the maximum permitted for companies that do not self-disclose under the DOJ's FCPA Corporate Enforcement Policy). Similar to the DOJ, the PNF acknowledged that, "even though Airbus did not self-report to the PNF the facts which led it to start an internal investigation, from March 2017 the company offered exemplary cooperation with the JIT's investigation," which included the collection of more than 30.5 million documents from more than 200 custodians. The PNF awarded Airbus a 50 percent discount rate on the additional penalty amount. Notably, Airbus received credit from U.S. authorities for voluntarily disclosing the ITAR violations.

- Extraordinary Cross-Border Cooperation and Related Settlements. While the SFO opened its criminal investigation into Airbus in the summer of 2016, several legal challenges delayed the investigation. Among them was French Law No. 68-678 of 26 July 1968, known as the "French Blocking Statute," which prevents French persons from communicating information that would constitute "evidence in foreign judicial or administrative proceedings" and the French Code of Criminal Procedure, granting French authorities the power to exclude information that would be "detrimental to the essential interests of France" when responding to a mutual legal assistance request. The French government (as well as the German and Spanish governments) owned stakes in Airbus throughout the relevant time period, adding to the dynamic. To resolve these issues, the SFO and PNF entered into a Joint Investigation Team (JIT) Agreement in January 2017. The historic cooperation efforts made possible by the JIT aided the SFO and PNF to overcome significant legal and practical hurdles, which included developing policies and procedures for the collection of documents and interviews in France that SFO personnel attended.

- AFA to Conduct Supervision Over Three Years and DOJ Self-Reporting on FCPA Violations Required. Notably, the DOJ and the SFO found the imposition of an independent anti-corruption compliance monitor unnecessary within their own dispositions because, as part of the Company's resolution with the PNF, Airbus accepted auditing and supervision of its compliance program by France's AFA for a term of three years. The U.S. DPA specifically noted that the DOJ determined such a monitor was "unnecessary," in relevant part, "based on…the fact that the Company will separately be entering into a resolution with the Parquet National Financier in France and will be subject oversight by authorities in France." In addition, Airbus agreed to self-report annually to the DOJ for the term of the DPA regarding the status of its remediation efforts and its anti-corruption compliance program. The SFO did not impose any self-reporting requirements. The DOJ and SFO's decisions to forgo imposing anti-corruption compliance monitors reflects an ever-increasing cross-border coordination and trust among certain anti-corruption authorities that goes beyond investigative information sharing and penalty-splitting. As background, the U.K. Approved Judgement also noted that Airbus had already established a three-member Independent Compliance Review Panel "to complete an independent review of Airbus' ethics and compliance procedures," issuing reports in 2018 (with 55 recommendations) and 2019, with a third report expected in 2020. As an aside, as part of the Consent Agreement entered into between Airbus and the U.S. Department of State related to the ITAR violations, Airbus will engage an "external Special Compliance Official" to oversee the Consent Agreement, which will also require Airbus to conduct two external audits of its ITAR-related compliance program and implement additional compliance measures.

- Despite DOJ's Acknowledgement of "Limits" to Jurisdiction, Section 78dd-3 Used to Authorize U.S. Investigation and Penalties. The U.S. DPA acknowledged the United Kingdom and France's "significantly stronger" jurisdictional bases given that Airbus is "neither a U.S. issuer nor a domestic concern" and the "limited" nature of its territorial jurisdiction over the alleged misconduct. Nevertheless, the DOJ relied on the fact that former Airbus executives acted in furtherance of the corrupt schemes to bribe Chinese officials while in the territory of the United States, including sending emails while in the United States, and accompanying officials on trips to the United States, which the DOJ asserted was sufficient to provide a jurisdictional hook under 15 U.S.C. § 78dd-3.

- Ongoing Issues for Airbus Remain. As part of the U.K. DPA, the SFO agreed to close its investigation of Airbus and its controlled subsidiaries other than SFO's separate investigation into GPT Special Project Management Ltd. (GPT), an investigation the SFO launched in April 2012 to review GPT's business in Saudi Arabia (see here). GPT was a subsidiary of Airbus S.E.'s predecessor entity EADS and, in June 2019, announced it would cease operations. It is unclear what additional measures, if any, the SFO will take to resolve its investigation into GPT. In addition, according to press reports, Austrian prosecutors announced in February 2020 that they widened their fraud investigation into Airbus and the Eurofighter consortium (which includes BAE Systems and Leonardo) related to a $2 billion Eurofighter jet purchase. Airbus and the consortium members deny the fraud allegations.

SEC Settles with Cardinal Health for FCPA Violations Involving China

The SEC issued a Cease-and-Desist Order against Ohio-based pharmaceutical company Cardinal Health, Inc. (Cardinal Health) on February 28, 2020, as the parties agreed to a total resolution of nearly $9 million, including a civil penalty of $2.5 million, $5.4 million in disgorgement, and $916,887 in prejudgment interest. Through the agreement, the SEC and Cardinal Health resolved allegations that Cardinal Health and its subsidiary violated the books-and-records and the internal-accounting-controls provisions of the FCPA. Cardinal Health is listed on the New York Stock Exchange and is an "issuer" for purposes of the FCPA. As a result of the conduct described further below, the Order stated that Cardinal Health violated (i) the books-and-records provisions by incorrectly recording improper payments channeled through two accounts the company maintained for a third party (which payments were made surreptitiously by certain marketing employees technically employed by Cardinal Health but working for that third party), and (ii) the internal-accounting-controls provisions by failing to maintain accountability for these assets, as Cardinal Health did not implement appropriate controls over the accounts or the marketing employees.

Per the Order, in 2010, Cardinal Health acquired a subsidiary in China. Rebranded "Cardinal China," the Chinese subsidiary served as an exclusive distributor for certain businesses, including an unnamed "large European dermocosmetic company." As part of the commercial arrangement, Cardinal China maintained so-called "marketing accounts" for the dermocosmetic company on Cardinal China's own books and records. The marketing accounts generally were funded through "excess distribution margin." Cardinal China also hired approximately 2,400 employees on behalf of the dermocosmetic company. This workforce, whose day-to-day activities were not supervised by Cardinal China, included sales and marketing employees who utilized funds from the marketing accounts to pay for marketing-related expenses.

According to the SEC, the company knew that a substantial gap in internal controls relating to the arrangement existed because Cardinal terminated other marketing accounts for other suppliers but did not apply its full internal accounting controls to the marketing accounts or to the conduct of the marketing employees that Cardinal China retained on behalf of the dermocosmetic company. As a result, Cardinal China regularly authorized and made payments from the marketing accounts at issue (a total of $250 million over four years) as directed by the dermocosmetic company but did not require reasonable assurance that the transactions were authorized, such as sufficient supporting documentation to verify the purpose of the transactions. Cardinal China also failed to accurately record these payments on its books and records.

The Order states that in 2016, six years after the acquisition, Cardinal Health discovered that the marketing employees had made and concealed improper payments through the marketing accounts in Cardinal China's records, directing funds to government-employed healthcare professionals who marketed for the dermocosmetic company and employees of state-owned retailers with influence over relevant purchasing decisions related to those products. According to the SEC, because of Cardinal's insufficient internal accounting controls, the marketing employees were able to "easily disguise" the improper payments and falsify documentation. The SEC noted that Cardinal China benefitted from the distribution arrangement and thus was "unjustly enriched by approximately" $5.4 million during the relevant period. The SEC identified March 2013 as the start date for the relevant period, but without a clear explanation of how that start date was selected, given that Cardinal China was acquired in 2010. As detailed below, the SEC noted that Cardinal Health initially instructed Cardinal China to discontinue all marketing accounts shortly after its acquisition of Cardinal China, but that numerous market accounts still remained in use. The SEC also identified numerous instances in which Cardinal Health and/or Cardinal China personnel identified risks – or received reports identifying the risks – regarding marketing accounts, including various internal reports from 2012-2015 and a related fine in 2014 by the Shanghai Administration of Industry and Commerce. The SEC did note that Cardinal Health voluntarily disclosed the matter in 2016 and undertook significant remedial measures.

Noteworthy Aspects

- Failure to Properly Evaluate Risks. The SEC's Order calls out multiple issues related to the design and implementation of Cardinal Health's and Cardinal China's compliance program and internal accounting controls. Among these issues is risk evaluation. According to the SEC, at the time of acquisition, Cardinal Health was well aware that Cardinal China operated marketing accounts related to distribution agreements for various global manufacturers and that "Cardinal China also operated and maintained on its own books, financial accounts that certain distribution customers used to fund their operations and marketing efforts in China." After the acquisition, "Cardinal China terminated most of the marketing accounts due in part to known FCPA-related compliance risks associated with channeling the marketing expenses of third parties through its own books and records." Despite this general risk assessment, the Order notes that Cardinal China continued to operate the marketing accounts for the dermocosmetic company because Cardinal Health assessed the FCPA-related risks of that specific arrangement to be "minimal." However, according to the SEC, this assessment effectively failed to account for corruption red flags known to the company and for the lack of transparency that Cardinal Health and Cardinal China had regarding the nature of payments from the marketing accounts.

- Failure to Extend Appropriate Internal Accounting Controls to Marketing Account Activities. The SEC noted that, based on its "minimal" risk assessment of the arrangement, Cardinal Health did not apply its full internal accounting controls to the marketing accounts at issue or establish any effective supervisory controls over the activities of the dermocosmetic company's marketing personnel. Examples of these issues cited by the SEC include a failure to provide anti-bribery training to the marketing personnel, the marketing personnel's use of "email accounts and computer systems" that were "inaccessible to Cardinal Health's and Cardinal China's compliance personnel," and Cardinal China's repeated approval of payments "without requiring sufficient supporting documentation to verify the purpose of the transactions." The SEC blamed the gap in controls for enabling the marketing employees to disguise and conceal any improper payments from Cardinal China.

- Inadequate Responses to Red Flags. The Order provided various examples of subsequent red flags that arose during the period between the acquisition and the beginning of the investigation that the SEC states were not adequately addressed. For example, in 2012, Cardinal Health received a report from a Cardinal China employee, "raising questions about the legality of the marketing" arrangement and recommending an external audit, but, according to the SEC, neither Cardinal Health nor Cardinal China took "sufficient steps" in response to the audit's findings. In 2012 and 2013, allegations surfaced that other marketing accounts had been used to facilitate improper payments, leading Cardinal China to suddenly close those accounts. Nevertheless, Cardinal Health did not monitor the subsidiary's compliance with its initial instructions to terminate such accounts or implement stricter controls. Then in 2014, authorities in Shanghai fined Cardinal China for providing "secret commissions" to employees of a retailer through the two marketing accounts for the dermocosmetic company, in violation of Chinese competition law. Despite this reprimand, Cardinal Health and Cardinal China did not implement effective safeguards, such as enhancing its "supervision of the marketing employees or oversight of the marketing accounts." The SEC noted 2015 communications among Cardinal China's compliance personnel and leadership discussing the "enormous compliance risk" caused by the "gap in controls" over the marketing employees and accounts. One email noted, "this is a big exposure... as we have no control [over] how [the marketing employees] may be gifting and spending on entertaining."

Individual Enforcement Actions

SEC Settles with Ex-Goldman Sachs Banker

On December 16, 2019, the SEC announced charges against Tim Leissner for engaging in a corruption scheme where he obtained millions of dollars through paying unlawful bribes to government officials, while working for Goldman Sachs. The SEC charges came after Leissner pleaded guilty in the Eastern District of New York to crimes that included conspiracy to violate the FCPA, which was announced in November 2018. The Federal Reserve Board also permanently barred Leissner in March 2019 and fined him $1.42 million. The SEC charged Leissner for authorizing and paying bribes and kickbacks to government officials in Malaysia and the Emirate of Abu Dhabi to secure business for Goldman Sachs.

Specifically, the misconduct was in connection to the Malaysian sovereign wealth fund called 1Malaysia Development Berhad, otherwise known as 1MDB. Between approximately 2009 and 2014 when 1MDB was raising capital to fund its project, billions of dollars were diverted from the fund. During the scheme, Mr. Leissner and others bribed government officials in Malaysia and Abu Dhabi to obtain and retain lucrative business for Goldman Sachs, according to the SEC. This business included the 2012 and 2013 bond deals where Goldman Sachs earned approximately $600 million.

The settlement with the SEC states that Leissner's actions resulted in violations of the antibribery, books-and-records, and circumvention of internal-accounting-controls provisions of the FCPA. The settlement describes that Leissner violated Section 30(A) of the Exchange Act (the FCPA's anti-bribery provision) by making use of interstate commerce to send wire transfers from a foreign bank account to a U.S. bank account in furtherance of his corrupt offers and promises to bribe foreign officials.