FCPA Winter Review 2014

International Alert

Introduction

While 2013 was not necessarily a ground-breaking year like 2012 (which featured the roll-out of the Foreign Corrupt Practices Act ("FCPA") Resource Guide, among other activities), last year did feature some notable developments, including the resolution of several long-running cases, a substantial uptick in monetary penalties, continued judicial scrutiny of key FCPA provisions, and the continuing "globalization" of anti-corruption laws and, perhaps more significantly, enforcement actions.

Enforcement Trends in 2013

The last quarter of 2013 featured more corporate dispositions than any other quarter of the year, with ten enforcement actions involving five companies (including the Diebold settlement, which was covered in our FCPA Autumn Review 2013). One case, brought against oilfield services provider Weatherford International Ltd. in November, ranks among the ten largest FCPA-related settlements ever, with $154 million in fines and disgorgement (excluding penalties for export controls and related violations). This settlement, along with the $398 million in combined fines and disgorgement to which Total SA consented in May, helped make 2013 the third most expensive year on record in terms of FCPA-related monetary penalties, with more than $720 million in fines and disgorgement imposed. This represents a three-fold increase from 2012. This trend looks to continue into 2014, as the $384 million in fines and disgorgement to which Alcoa agreed as part of its settlement in January already exceeds 2012's total of $260 million. (The Alcoa settlement will be covered in our next Review).

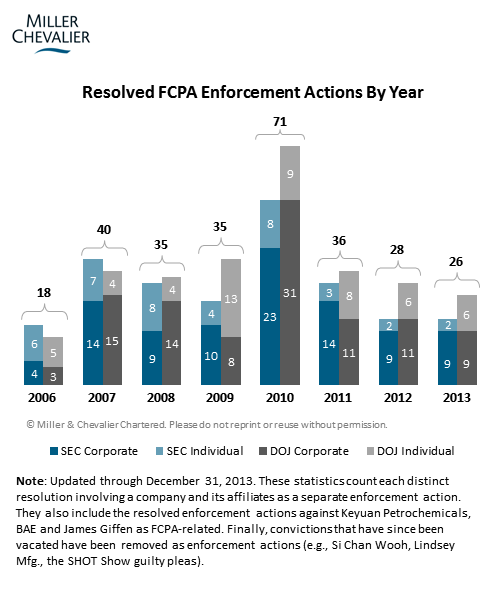

In terms of resolved enforcement dispositions, enforcement activity in 2013 was almost a carbon copy of 2012:

The Securities and Exchange Commission ("SEC") tallies were exactly the same, and the Department of Justice ("DOJ") managed the same number of individual dispositions. The DOJ completed two fewer corporate dispositions in 2013 as compared to 2012. However, given the number of investigations known to be under way and the various factors that can affect the timing of announced settlements, this result does not appear to represent any statistically significant change in the overall enforcement climate.

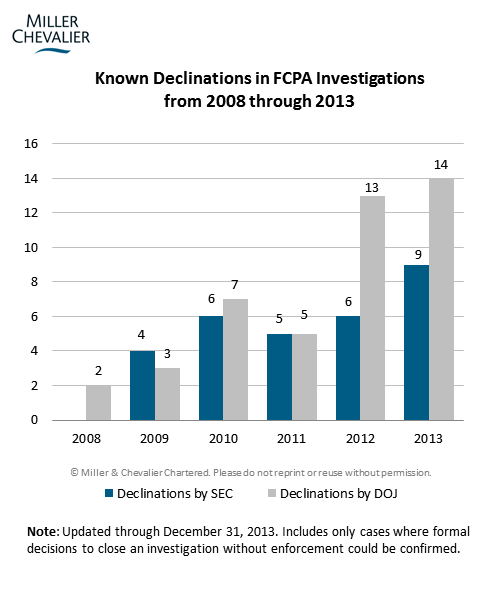

2013 set another record for the number of known declinations (instances where the agencies have informed companies they are closing investigation without enforcement):

As discussed in past Reviews (notably, in our FCPA Autumn Review 2012), the reasons for the increase in declinations are complex, and include concerted efforts by the DOJ and SEC to formally close-out long-running investigations and greater disclosure of such results by the affected companies.

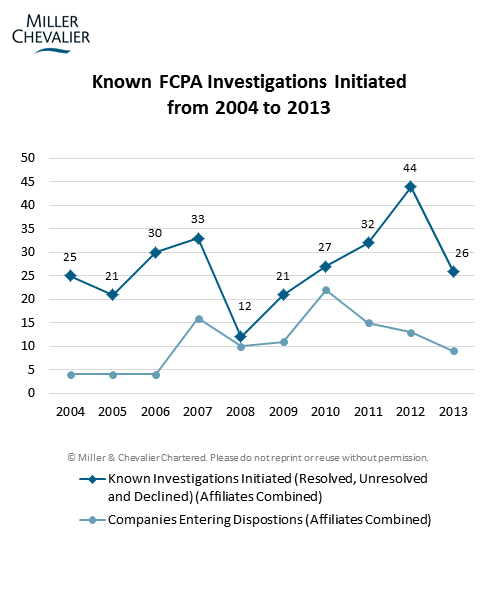

One area that did see an apparent drop during 2013 is the number of known FCPA investigations initiated by the agencies:

It is too soon to tell whether this decline represents an actual trend, however, as there can be a lag in identifying new investigations because companies may wait months (or even years) to disclose the existence of an investigation in their public filings. A drop in the number of investigations initiated would not be surprising, however, given the agencies' push to close out old cases and possible resource issues, including the DOJ experiencing significant turn-over during the latter half of the year.

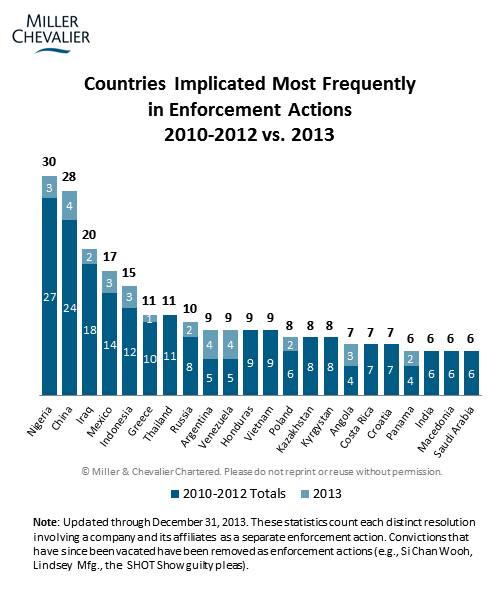

A final observation on 2013 enforcement trends focuses on the countries in which improper payments or related activity occurred. The chart below compares the countries most frequently implicated in dispositions brought this past year with the countries most frequently implicated in cases dating from 2010-2012:

The chart shows that many countries long considered to be high-risk continue to generate compliance problems, including Nigeria, China, and Iraq. There was a notable increase in issues arising out of Latin America in 2013 -- Argentina and Venezuela tied with China as the countries most frequently implicated in enforcement actions. Combined with the latest Transparency International Corruption Perceptions Index rankings, discussed below, this chart can assist compliance professionals in focusing their efforts on operations in higher-risk jurisdictions.

Focus on Relationship between "Internal Accounting Controls" and Corporate Compliance Programs

Several dispositions from the fourth quarter of 2013 (notably ADM, Weatherford, and Stryker) emphasized violations by the relevant issuers of the FCPA's requirement that they maintain an adequate "system of internal accounting controls" throughout their operations. As has been noted in prior Reviews, this requirement can allow the SEC (and, sometimes, the DOJ as well) to impose penalties on issuers for improper payments made by non-U.S. employees or foreign affiliates that fall outside the jurisdictional scope of the FCPA's anti-bribery provisions.

Recent dispositions have included the failure to implement certain FCPA compliance program elements, such as due diligence on third parties or program responses to certain "red flags," as failures to maintain sufficient "internal accounting controls." Some in the FCPA defense bar have noted that the inclusion of compliance and ethics programs within the definition of "internal accounting controls" expands the scope of that term beyond the plain meaning of the statute and past statements by the SEC.

International Developments

On the international front, enforcement actions related to corrupt activities continued to present a mixed record. At the end of 2013, the UK's Serious Fraud Office ("SFO") faced another in a series of setbacks with the dismissal of the high profile Dahdaleh case as it went to trial, due to evidentiary challenges (discussed below). The SFO continues, however, to investigate several other cases against UK companies, including Rolls Royce. Meanwhile, other UK regulators remained active in the anti-corruption area -- the Financial Conduct Authority ("FCA") and its predecessor agency, the Financial Services Authority, have reached a number of dispositions (see FCPA Autumn Review 2011; FCPA Winter Review 2009). Though it arises out of a regulatory regime specifically focused on the financial services industry, the FCA's latest action, against JLT Specialty, shows a focus on companies' failures to implement "adequate risk management systems" -- which, as noted above, is a prominent theme of the U.S. agencies' cases citing the inadequacy of compliance programs and internal controls.

Actions Against Corporations

Weatherford International and Subsidiaries Resolve FCPA Charges

On November 26, 2013, the DOJ and SEC announced the settlement of FCPA and export controls charges against Weatherford International ("Weatherford") and several of its subsidiaries related to conduct in Africa, the Middle East, and other locations. Weatherford, a Swiss oilfield services company with significant operations in Houston and shares listed on the New York Stock Exchange, entered into a Deferred Prosecution Agreement ("DPA") with the DOJ to settle charges of violating the FCPA's internal controls provisions, while its African subsidiary, Weatherford Services Limited ("WSL"), pleaded guilty to FCPA anti-bribery violations. In the related SEC enforcement action, Weatherford consented to a final judgment to settle charges of FCPA anti-bribery and accounting violations. In addition, Weatherford and four of its subsidiaries settled export controls enforcement actions brought by the U.S. Department of Commerce and the U.S. Department of the Treasury. In total, Weatherford and its subsidiaries agreed to pay more than $254 million in penalties and fines related to these settlements, of which $154 million stemmed from FCPA charges, and $100 million from export controls violations.

According to the DOJ pleadings, Weatherford failed to establish an effective system of internal controls, creating a "permissive and uncontrolled environment" that allowed its subsidiaries in Africa and the Middle East to engage in several corrupt schemes between 2002 and 2011. In Africa (specifically, Angola as identified in WSL's pleadings), WSL allegedly used a joint venture to channel hundreds of thousands of dollars in improper payments to Angolan foreign officials who (with their relatives and associates) controlled two local partners. At least one meeting with the officials took place in Houston, possibly serving as the basis of jurisdiction over WSL; the company was charged under 15 U.S.C. §§ 78dd-3, which extends jurisdiction to entities taking an act in furtherance of an improper payment while in the territory of the United States. In exchange, the officials allegedly awarded the joint venture lucrative contracts, provided inside information about competitors' pricing, and took contracts away from WSL's competitors and awarded them to the joint venture.

The DOJ pleadings state that WSL also allegedly used a freight forwarding agent to channel bribes to an Angolan official to approve the renewal of an oil services contract. In an unnamed country in the Middle East, Weatherford Oil Tools Middle East Limited ("WOTME," another Weatherford subsidiary) allegedly gave approximately $15 million in "volume discounts" to a distributor, believing that the discounts would be used to create a slush fund for improper payments to officials of a government-owned national oil company. WOTME also allegedly paid and improperly recorded over $1.4 million in kickbacks to the government of Iraq in connection with the United Nations' Oil for Food Program.

The SEC's allegations covered the same basic misconduct outlined in the DOJ pleadings, as well as additional schemes. In particular, the SEC asserted that Weatherford's misconduct went beyond its use of joint ventures, agents, or other third parties, and involved improper travel and entertainment for officials of an Algerian state-owned company (a FIFA World Cup trip, a honeymoon for an official's daughter, and a religious trip to Saudi Arabia for an official and his family); misappropriation of funds and improper payments to Albanian tax auditors by employees of Weatherford's Italian subsidiary; and false accounting and inventory records to hide sales to Cuba, Syria, Sudan, and Iran, in violation of U.S. sanctions and export controls. The SEC also claimed that Weatherford and its subsidiaries made improper payments to obtain commercial business (i.e., to employees of private companies) through a Swiss agent in Congo.

To settle the FCPA-related charges, Weatherford agreed to pay an $87.2 million criminal penalty, and over $65 million in disgorgement and civil penalties. Under its settlements with the DOJ and SEC, Weatherford also agreed to retain an independent corporate compliance monitor for at least 18 months. In addition, to resolve violations of U.S. export controls laws and sanctions regulations, Weatherford agreed to pay a total of $100 million in settlements with the U.S. Department of Commerce and U.S. Department of the Treasury.

Noteworthy Aspects

- Risk Profile and Compliance Program Gaps Used as Evidence of "Knowing" Internal Controls Violations - Under the statute, a company can only be charged with criminal internal controls failures when such failures are "knowing." Though the term is not defined in the FCPA's accounting provisions themselves, this standard is understood to require more than mere negligence, and may be satisfied by actual knowledge or deliberately ignoring relevant circumstances (similar to the term's use in the FCPA's anti-bribery provisions regarding vicarious liability). Here, the DOJ noted that Weatherford failed to implement effective internal controls despite "operating in an industry with a substantial corruption risk profile and growing its global footprint in large part by purchasing existing companies, often themselves in countries with high corruption risks." The agencies also noted the absence of certain basic compliance program elements, including a lack of a dedicated compliance officer and compliance personnel, lack of due diligence on certain high-risk third parties, failure to provide FCPA training, and failure to investigate allegations of misconduct reported in annual ethics questionnaires, among other program deficiencies.

- Mixed Messaging from Agencies on Consequences of Alleged Company Misconduct in Initial Part of Investigation - The SEC alleged that misconduct by Weatherford employees threatened to compromise the investigation at its outset. In particular, the SEC claimed that in several instances, Weatherford employees deleted emails prior to the imaging of their computers, and that potentially complicit employees (rather than independent actors) were allowed to collect subpoenaed documents. The SEC also claimed that its staff was told that Weatherford's Iraq Country Manager was missing or dead when, in fact, he remained employed by the Company. Though the SEC indicated that Weatherford's cooperation subsequently improved (and that employees responsible for the misconduct were disciplined), the SEC nevertheless imposed a $1.8 million penalty in part for lack of cooperation early in the investigation. In contrast, the DOJ praised Weatherford's cooperation and remediation efforts, and awarded cooperation credit in its fine calculation.

- FCPA Accounting Liability Based on Export Controls Violations and Commercial

Bribery - The SEC's allegations of FCPA accounting violations in part stemmed from improper payments to employees of private-company employees (not government officials) and efforts to conceal export controls violations. The allegations demonstrate the potential broad reach of the FCPA's accounting requirements, which can be used to punish conduct beyond bribery of foreign officials.

Stryker Corporation Settles FCPA Charges

On October 24, 2013, Stryker Corporation - a Michigan-based medical technology company - agreed to pay $13,283,523 to settle FCPA books and records and internal accounting controls violations. According to the SEC press release and the Cease-and-Desist Order, the SEC found that Stryker's wholly-owned subsidiaries in Mexico, Poland, Romania, Argentina, and Greece paid approximately $2.2 million in improper payments from approximately August 2003 to February 2008. Stryker employees allegedly made these payments to government employees, including health care professionals working in public institutions, in order to obtain or retain business. The SEC also determined that the Stryker subsidiaries lacked an adequate system of internal accounting controls and incorrectly described the payments in the various subsidiaries' books and records, which were consolidated into Stryker Corporation's books.

The SEC Order describes the specific conduct resulting in the violations in the various countries as follows. First, in Mexico, Stryker's subsidiary directed a Mexican law firm to pay $46,000 to an employee of a government agency in order to retain a winning bid to sell knee and hip products to public hospitals. The Order states that the law firm then billed the payment as legal services, and the subsidiary incorrectly recorded the improper payment as such services in its books. Stryker Mexico also made two additional payments to officials through intermediaries.

Second, Stryker subsidiary employees in Poland made 32 improper payments totaling $460,000 to foreign officials in order to obtain or retain business at public hospitals. Among other payments, Stryker Poland paid for a six night stay in New York City, tickets to two Broadway shows, and a five-day trip to Aruba for a director of a public hospital and her husband. The Order notes that only one day of this trip had a business purpose. The payments were improperly recorded as reimbursement for legitimate business travel, consulting services, and charitable donations.

Third, Stryker's subsidiary in Romania made 192 improper payments in the amount of close to $500,000 to officials for conference-related costs to obtain or retain business with public hospitals. The Order cites internal business forms that noted, in at least one instance, that the "business benefit" of a sponsored trip would be the receipt of a contract for a specific sale.

Fourth, from 2005 to 2008, a Stryker subsidiary in Argentina made 392 commission payments totaling just under $1 million to doctors associated with sales to public hospitals. These payments were booked as "Honorarios Medicos," or medical honorariums. However, the Order asserts that these honorariums were not paid in return for services, but rather were calculated based on a percentage of total sales to the hospital, for which the paid officials were allegedly responsible.

Finally, in Greece, the Order states that Stryker's subsidiary made a "sizable and atypical" donation of $197,055 to a public university to fund a laboratory established by a foreign official in order to secure sales to the public hospitals with which the official was affiliated. The Order details email communications involving Stryker country and regional management related to the size of the donation and the linkages to future sales. The Order further notes that the donation was "improperly booked as a legitimate marketing expense" in a "donations and grants" account.

The Order indicates that Stryker took numerous actions to remediate the conduct, including retaining outside counsel to conduct an internal investigation that went beyond the issues raised by the SEC in its investigation, voluntarily producing reports to the SEC summarizing the findings of the internal investigation, producing over 800,000 pages of documents to the SEC, providing the SEC with courtesy translations of key documents, implementing an anti-corruption compliance program, and engaging a third-party consultant to perform regular FCPA compliance assessments.

In order to settle the charges, Stryker agreed to pay $7,502,635 in disgorgement, $2,280,888 in prejudgment interest, and a civil penalty of $3,500,000. In addition, Stryker agreed to cease and desist from committing or causing any future books and records or internal accounting controls violations.

Noteworthy Aspects

- No Anti-Bribery Violations - Despite the SEC's findings on the facts, which indicate numerous improper payments that appear to meet most of the elements necessary to prove anti-bribery violations, the settlement does not include any such violations. This result may be due to jurisdictional challenges, as all of the conduct appears to be by foreign subsidiaries acting outside of the United States (the only parent conduct cited by the Order is the consolidation of the subsidiaries' accounts into its own books and records).

- No DOJ Action - According to press reports, Joe Cooper, the director of communications for Stryker, publicly stated that the DOJ had advised Stryker that it closed its investigation, which means Stryker will not be subject to criminal penalties for its actions. The reason for this is unclear, though it may well relate to the jurisdictional challenges described above.

- Need for Adequate Internal Accounting Controls for Non-U.S. Subsidiaries - This case highlights the importance of parents' obligations to ensure that their subsidiaries, no matter their size, maintain accurate records and sufficient internal accounting controls. The SEC found that Stryker failed to do so, and asserted in the Order that "Stryker incorrectly booked over $2.2 million in illicit payments to foreign officials as legitimate expenses without properly examining the circumstances surrounding the accounting treatment of these payments. In many instances, even a cursory review of the underlying documentation, such as travel authorization forms and itineraries, would have revealed the illegitimate nature of the payments."

- Continued Focus on FCPA Risks for Pharmaceutical and Medical Device Industries - This case is the latest in a line of dispositions that highlight the FCPA risks faced by pharmaceutical and medical device companies. Recent prior cases include: Eli Lilly (see our FCPA Winter Review 2013); Orthofix and Pfizer (see our FCPA Autumn Review 2012); Biomet and Smith & Nephew (see our FCPA Spring Review 2012); and Johnson & Johnson (see our FCPA Spring Review 2011). Many employees of clients/customers in the health care industry may meet the FCPA's definition of "foreign officials" by virtue of the fact that they work for public hospitals. In addition to everyday interactions, health care professionals routinely request sponsorship assistance to attend medical conferences or congresses from health care companies. While such sponsorships are common in the industry and do not necessarily constitute FCPA violations, they should be subject to compliance procedures and internal accounting controls to ensure that relevant risks are addressed. This case also highlights the need to review and adequately control the payment of speakers' honorariums or fees -- while these are common in the industry, if they are paid as part of an improper quid pro quo for business gains or advantages, they can form the basis for an FCPA-related violation.

Bilfinger Prosecuted for FCPA Anti-bribery and Related Violations Arising from Business with Willbros

On December 9, 2013, the German engineering and services firm Bilfinger SE entered into a DPA with the DOJ to settle FCPA-related charges and agreed to pay a $32 million penalty. The charges relate to the promise or payment of over $6 million in bribes by Bilfinger SE, Willbros Group, Inc. ("WGI"), and their affiliates to Nigerian government officials and a Nigerian political party. The companies allegedly made these promises and payments between late 2003 and June 2005 in order to obtain and retain contracts related to Nigeria's Eastern Gas Gathering System ("EGGS") project. As reported in our FCPA Spring Review 2008 and later issues, WGI and its subsidiary Willbros International, Inc. ("WII") settled FCPA charges in 2008 with both the DOJ and the SEC for their role in several bribery schemes, including the EGGS project.

The DOJ charged Bilfinger SE with one count of conspiring with WGI and WII to violate the FCPA's anti-bribery provisions, and with two counts of violating, and aiding and abetting WGI and WII's admitted FCPA violations of, the anti-bribery provisions. According to the Information, Bilfinger SE is a German company headquartered in Mannheim, Germany. During the relevant period, Bilfinger SE operated in Nigeria through its Nigerian and German subsidiaries (collectively "Bilfinger"), none of which was based in the United States or had shares traded on a U.S. exchange. However, the Information alleges jurisdiction over Bilfinger SE for the substantive FCPA anti-bribery claims based on two occasions on which a "means of interstate commerce" was utilized by the company: a flight from Houston, Texas to Boston, Massachusetts "to discuss promised bribe payments" and a later wire transfer from Houston to Frankfort, Germany "in connection with the EGGS contract."

The Information alleges that Bilfinger SE and WGI formed an "EGGS Consortium," composed of their affiliates, to bid on contracts to build two natural gas pipelines in the Niger Delta, a part of the EGGS project. The Consortium parties conspired to win those contracts "through the promise and payment of over $6 million in bribes," and decided to fund the bribes by "inflat[ing] the price of its bid for the EGGS projects by 3%." Specifically, the Information alleges that Bilfinger employees paid $150,000 in bribes to a Nigerian official in late 2004 at the direction of James Tillery, WII's then President, and agreed to pay two other Nigerian officials around $55,000 in bribes.

According to the Information, the parties divided up their bribe payment responsibilities: Bilfinger was responsible for paying officials at the Nigerian government-owned entities that owned a controlling share in the EGGS Project, while WGI and its affiliates were responsible for paying officials with the operator of the EGGS project. Bilfinger mailed or flew cash to Nigeria from Germany for use in making the alleged bribes. Bilfinger employees commonly referred to the bribes as "landscaping" payments. According to the DOJ, the EGGS Consortium won contracts to build the two pipelines worth a combined total value of approximately $387 million.

The Information also alleges that, in early 2005 -- after WGI had commenced an internal investigation, announced Tillery's resignation, and ceased to make promised bribe payments -- Bilfinger employees took steps to ensure that WGI's local affiliates continued to make the promised bribe payments so that the EGGS contracts would not be put at risk. In particular, the DOJ alleged that Bilfinger sent one of its employees, who was in Houston, Texas at the time, to meet with Tillery in Boston, Massachusetts to "find out what payments had been promised to officials." Later, Bilfinger employees agreed to loan WII $1 million so that WII could continue to pay its share of the bribes. Bilfinger delivered the $1 million in cash in a suitcase to Tillery's replacement in Nigeria.

As a part of its settlement, Bilfinger SE entered into a three-year DPA with the DOJ and agreed to pay a $32 million penalty. It also agreed to implement a compliance program that satisfies the elements specified in the DPA, as well as retaining an independent compliance monitor for at least 18 months, and thereafter self-reporting every six months for the remainder of the DPA's term.

Noteworthy Aspects

- Delayed Resolution - The last alleged overt act by Bilfinger took place in May 2005. WGI and WII settled the FCPA charges against them in May 2008. Nothing in the court documents explains why the Bilfinger settlement did not occur until December 2013. Possibly relevant are the four individual prosecutions arising out of the EGGS scheme. Two of the four defendants, both WII executives, pleaded guilty and were sentenced in January 2010. The third defendant, Paul Novak, a WGI consultant, pleaded guilty in November 2009, but was not sentenced until May 2013. The fourth, Tillery, remains a fugitive. One possible explanation for Bilfinger's late settlement is that the government delayed Novak's sentencing and Bilfinger's settlement in hope of first apprehending and prosecuting Tillery.

- Potential Consequences of Continued Improper Activities - The difference in penalties imposed on Bilfinger and WGI/WII may demonstrate the benefits of active remediation and early cooperation by WGI/WII and the aggravating effects of Bilfinger's continued improper activities after WGI's internal investigation. As reported in our FCPA Spring Review 2008, WGI and WII settled with both the DOJ and the SEC in 2008. That settlement covered the EGGS bribery scheme, but also two other alleged bribery schemes that together involved more than $4.3 million in promised corrupt payments, and a tax-avoidance scheme that constituted a books and records violation. To settle these four alleged schemes, WGI and WII agreed to a three-year DPA, paid a combined penalty and disgorgement of $32.3 million, and retained a compliance monitor. Bilfinger, however, received similar levels of penalties, but for its much smaller relative role in the EGGS scheme only. WGI voluntarily disclosed its violations after discovering the payments in the course of an internal audit, and promptly conducted a wide-ranging internal investigation. In contrast, after finding out that WGI had begun an internal investigation and had ceased making promised payments, Bilfinger took steps to ensure that WGI and WII continued to pay the promised bribes.

- External Monitor Imposed - Presumably, Bilfinger SE has had since at least 2008 to improve its compliance program and to convince the DOJ of its program's sufficiency and the company's commitment to compliance; yet, the DOJ still imposed an independent monitor. The court documents do not explain why the DOJ believed that an external compliance monitor was necessary, though it is possible that the underlying activity was deemed serious enough to require independent review of Bilfinger's program no matter how it was presented to the agency.

- Potential Individual Prosecutions - The DOJ has not charged any Bilfinger SE employees. However, the Information makes specific allegations against several Bilfinger SE employees that hint at potential FCPA and money laundering violations. To successfully prosecute Bilfinger employees, most of whom are likely to be non-U.S. nationals or residents, the DOJ would need to overcome the twin hurdles of personal jurisdiction and the statute of limitations, two issues recently litigated in several FCPA individual criminal prosecutions (see Magyar executives, Siemens executives, and Noble executives). In this case, the DOJ may be able to establish FCPA jurisdiction against at least some Bilfinger employees because the Information suggests that they took actions to further the alleged scheme while physically in the United States (see 15 U.S.C. § 78dd-3). The DOJ could also attempt to establish jurisdiction over some Bilfinger employees by charging them with conspiracy or aiding and abetting. In response to statute of limitations objections, the DOJ could attempt to argue in appropriate cases that the charged employees have not been "physically present in the United States," and that the running of the limitations period should be suspended during the period of that absence (see our FCPA Spring Review 2013 (Contrasting Motions to Dismiss)).

Archer Daniels Midland Company and Subsidiaries Settle FCPA Charges with DOJ and SEC

On December 20, 2013, the Archer-Daniels-Midland Company ("ADM") and its subsidiaries settled charges with the DOJ and SEC. ADM is a global food-processing and commodities-trading corporation, headquartered in Decatur, Illinois. The charges relate to ADM's failure to prevent illegal payments made by its foreign subsidiaries to government officials in Ukraine and Venezuela. Specifically, ADM's Ukrainian subsidiary pleaded guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA, while ADM, the parent, admitted to violations of the books and records and internal controls provisions of the statute. In total, ADM and its affiliates agreed to pay about $54 million to the enforcement authorities (more than $17 million in criminal fines to the DOJ and $36.5 disgorgement and prejudgment interest to the SEC).

The DOJ filed a Criminal Information in the U.S. District Court for the Central District of Illinois charging ADM's Ukrainian subsidiary Alfred C. Toepfer International (Ukraine) Ltd ("ACTI Ukraine") with a single count of conspiracy to violate the FCPA. ACTI Ukraine resolved this charge via a plea agreement through which it will pay $17.7 million in fines. The DOJ also entered into a 3-year NPA with ADM, which admitted that it failed to have adequate internal controls needed to prevent bribery in Ukraine and in Venezuela.

The SEC filed a Complaint against ADM in the same court alleging violations of the books and records and internal controls provisions of the FCPA. ADM consented to a proposed final judgment that ordered the company to pay roughly $36.5 million in disgorgement and prejudgment interest.

DOJ Claims

The DOJ alleged that from 2002 to 2008, ACTI Ukraine and ADM's German subsidiary Alfred C. Toepfer International G.m.b.H. ("ACTI Hamburg") paid $22 million in bribes to Ukrainian government officials. During the relevant period, ACTI Ukraine sold commodities both inside and outside of Ukraine. Ukraine imposed a value added tax (VAT) on goods purchased in-country, which was refunded if the goods were exported. At certain times, the Ukrainian government either delayed or altogether refused to pay such refunds. ACTI Hamburg and ACTI Ukraine allegedly devised a scheme by which they bribed government officials to assure and/or expedite refunds of approximately $100 million in overdue VAT refunds.

In order to disguise the bribes, ACTI Ukraine and ACTI Hamburg devised schemes involving two vendors. According to DOJ documents, one vendor purportedly provided the companies with export-related services, but actually was used to funnel bribes to Ukrainian government officials in exchange for assistance from those officials in obtaining ACTI Ukraine's outstanding VAT refunds. The other vendor used funds provided by ATCI Ukraine for so-called "insurance" policies to bribe Ukrainian government officials on ACTI Ukraine's behalf, in exchange for those officials' assistance in obtaining the Company's outstanding VAT refunds.

The DOJ documents state that, in sum, ACTI Ukraine and ACTI Hamburg paid roughly $22 million to these two vendors, nearly all of which was passed on to Ukrainian government officials, and obtained over $100 million in VAT refunds in return.

With regard to the conspiracy charge against ACTI Ukraine, the DOJ alleged that ACTI Ukraine and ACTI Hamburg employees communicated with ADM executives about the accounting treatment of VAT refunds, during which ACTI executives mischaracterized the bribe payments as "charitable donations" and "depreciation." The DOJ documents state that these communications took place via telephone, email, and in person when the ACTI employees visited ADM headquarters. The NPA also asserts that, despite concerns about ACTI's actions, ADM executives "failed to implement sufficient anti-bribery compliance policies and procedures, including oversight of third-party vendor transactions, to prevent corrupt payments at ACTI Ukraine and ACTI Hamburg."

As evidence of ADM's lax compliance policies and procedures, the DOJ pointed to ADM's conduct vis-à-vis its joint venture in Venezuela. The NPA states that "from at least in or around 2004 to in or around 2009, when customers in Venezuela purchased commodities through ADM Venezuela (a joint venture between ADM's Latin America subsidiary called ADM Latin and several individuals in Venezuela), the customers paid for the commodities via payment to ADM Latin." During this time, a number of customers overpaid ADM Latin for commodities by including a brokerage commission in the cost of the commodities. The NPA further notes that, "[a]t the instruction of ADM Venezuela…, rather than repaying these excess amounts to the customer[s] directly, ADM Latin made payments to third-party bank accounts outside of Venezuela, which, in many instances, were used to funnel payments to accounts owned by employees or principles of the customers."

According to the NPA, during an evaluation of its potential joint venture partner, ADM discovered that the partner was making payments as described in the preceding paragraph. At that time, ADM employees specifically noted that the payments could be construed as violations of the FCPA, and ADM instituted a policy that prohibited the repayment of excess funds to any account other than that originally used by the customer to make the payment. However, though the policy was made known to some key employees, it was not formalized, and the practice prohibited by the policy continued from 1999 through 2004. The NPA further states that in 2004, an ADM audit of ADM Venezuela uncovered the payments to third-party bank accounts and recommended some remedial measures, some of which were implemented. However, the NPA notes that ADM "did not train ADM Latin employees and did not take adequate steps to monitor ADM Latin and ADM Venezuela to prevent" other kinds of improper payments. As a result, according to the NPA, ADM Latin and ADM Venezuela employees effectively continued the same improper practices and payments, albeit via different coding mechanisms.

As part of the NPA, ADM agreed to adopt new, or to modify its existing, internal controls, compliance code, policies and procedures in order to ensure that it maintains: (a) a system of internal accounting controls designed to ensure that the company makes and keeps fair and accurate books, records, and accounts; and (b) a rigorous anti-corruption compliance code, policies, and procedures designed to detect and deter violations of the FCPA and other applicable anti-corruption laws.

SEC Claims

The SEC based its claims on the DOJ allegations described above relating to ADM's payments to Ukrainian government officials. In particular, the SEC noted that between 2002 and 2008, ADM's anti-corruption policies and procedures relating to ACTI were decentralized and did not prevent improper payments by ACTI to third-party vendors in the Ukraine or ensure that these transactions were properly recorded by ACTI.

Noteworthy Aspects

- Charitable Donations - Both the DOJ and SEC pleadings note that one of the ways the ACTI executives mischaracterized the bribe payments to ADM was by describing them as "charitable donations." For example, the SEC's complaint states that ADM's tax department was told by ACTI Hamburg executives that the way in which ACTI Ukraine was recovering its VAT refunds was by paying thirty percent of the total VAT amount to local charities when in fact, ACTI was paying bribes to government officials. The SEC documents show that the tax department personnel raised questions, including compliance and accounting treatment concerns, about this practice, but the documents do not discuss any additional remedial measures taken to address these concerns. This practice reinforces the need to monitor charitable donations for issues, as seen not only here but in other past cases.

- Benefits Properly Owed Can Be Defined by Agencies as Improper Business Advantages - As noted, ADM allegedly made improper payments to Ukrainian government officials to ensure that it received VAT refunds that were owed to it by the Ukrainian government. The pleadings do not indicate that ADM made the payments with the expectation of any benefits or rewards that they were not properly owed. This is of note because under the "business purpose test," the FCPA applies to payments intended to induce or influence a foreign official to use his or her position "in order to assist…in obtaining or retaining business for or with, or directing business to, any person" or "securing any improper advantage." Various enforcement actions have involved a broad range of benefits, such as bribes to obtain or retain contracts or evade taxes. In 2004, the Fifth Circuit in United States v. Kay found that congressional intent with regard to the FCPA was to target "bribery paid to engender assistance in improving the business opportunities of the payor or his beneficiary, irrespective of whether that assistance can be direct or indirect, and irrespective of whether it be related to administering the law, awarding, extending, or renewing a contract, or executing or preserving an agreement." At least two prior cases involve a scenario similar to that presented in ADM: the SEC action against former Pride International country manager Joe Summers, who authorized a payment to an employee of the Venezuelan state-owned oil company PDVSA to obtain legitimate unpaid receivables (see our FCPA Autumn Review 2010), and the 1994 Vitusa case, in which a company made payments to officials to obtain an outstanding balance due on a government contract. The Vitusa case especially has been the subject of criticism by various commentators regarding its definition of "business purpose"; ADM has raised similar concerns regarding overreach. Nonetheless, in agreeing to this disposition, ADM effectively accepted that the VAT refund fell within the Kay definition.

- Inclusion of Compliance Program Within "Internal Accounting Controls" - As noted, the agencies cited ADM for a number of failures to extend compliance policies to its affiliates. The SEC Complaint clearly states that one of ADM's violations (resulting in liability under the FCPA accounting provisions) was that it "failed to implement sufficient anti-bribery compliance policies and procedures, including oversight of third-party vendor transactions, to prevent these payments at ACTI Hamburg and ACTI Ukraine." The DOJ NPA Statement of Facts includes virtually the same language. The SEC also noted that "ADM's anti-corruption policies and procedures relating to ACTI were decentralized and did not prevent improper payments by ACTI…." The agency pleadings thus clearly include a company's compliance program, defined broadly, as part of the scope of an issuer's "internal accounting controls." While these formulations were accepted by ADM in the settlement of this case, there are questions regarding whether the plain language of the relevant statutory provisions and past SEC regulatory guidance allow for such a broad scope.

Actions Involving Individuals

Former Officer of Maxwell Technologies, Inc. Indicted

On October 15, 2013, Alain Riedo, a Swiss citizen and former officer of Maxwell Technologies, Inc. ("Maxwell") was charged with nine counts of conspiracy and substantive violations of the FCPA's anti-bribery and accounting provisions in connection with a scheme to bribe Chinese officials. Between 2002 and 2009, Riedo and his co-conspirators allegedly authorized payments of over $2 million to a Chinese agent, who used the funds to bribe officials at state-owned and/or controlled electric utility infrastructure companies ("state utility companies"). A warrant was issued for Riedo's arrest on October 15; however, press accounts indicate that he is a fugitive. As detailed in our FCPA Spring Review 2011, Maxwell paid over $14 million in 2011 to settle DOJ and SEC charges of violating the anti-bribery, books and records, and internal accounting controls provisions of the FCPA relating to the same conduct for which Riedo was charged.

During the relevant period, Riedo was Vice President and General Manager of Maxwell Technologies S.A. ("Maxwell S.A."), Maxwell's wholly-owned Swiss subsidiary. For part of that period, Riedo also served as a Senior Vice President and officer of Maxwell. The indictment alleges that Riedo and several co-conspirators, at least one of whom was a U.S. citizen and senior officer of Maxwell, engaged the Chinese agent as an intermediary to funnel improper payments to officials at the state utility companies in connection with sales of Maxwell's high voltage capacitors. The agent added a mark-up of approximately 20% to Maxwell S.A.'s quoted prices and passed on the additional cost to the state utility companies. The agent also invoiced Maxwell S.A. for the additional 20%, which he characterized on his invoices as an "extra amount," "special arrangement," or "consulting" fees ("extra amounts"). Once the state utility companies issued payment, Maxwell S.A. transferred the 20% mark-up to the agent, who then made payments to officials of the state utility companies. In one instance, Maxwell lost a sale to a competitor when the company refused to pay "extra amounts" to officials at a state utility company; however, Maxwell obtained new orders from the customer after agreeing to continue paying the "extra amounts."

In addition, the indictment alleges that Riedo and the U.S. citizen co-conspirator caused Maxwell S.A.'s books and records, which were consolidated into Maxwell's books and records, to falsely record the "extra amounts" as commissions, sales expenses, or consulting fees. Moreover, Riedo and the co-conspirator prevented other Maxwell executives from learning the truth about Maxwell S.A's operations and finances.

At the time of the Maxwell disposition, we and others speculated about the possibility of an individual action against Mr. Riedo and the jurisdictional issues it might present. The indictment notes a number of bases for jurisdiction (some relevant only to certain violations), including Mr. Riedo's sending of emails from Switzerland to Maxwell Technologies headquarters in California related to payments to the agent that were designed to fund bribes; Mr. Riedo's signing and sending to California of a "sub-certification" related to Maxwell's Sarbanes-Oxley process; the transmission of false books and records to Maxwell's headquarters in California; and Mr. Riedo's execution of a false FCPA certification that appears to have been part of the company's FCPA compliance program testing (this last was cited only as a basis for the conspiracy charge).

New Developments in Actions Against Former Siemens Executives

On October 25, 2013, the SEC moved for a default judgment against three former executives of Siemens A.G. ("Siemens"), all non-U.S. persons, whom the SEC and DOJ charged in December 2011 with violating the anti-bribery, books and records, and internal accounting controls provisions of the FCPA, and with aiding and abetting violations of the same provisions by Siemens. The SEC alleges that Ulrich Bock, the former head of commercial projects for the Siemens Business Services division; Stephan Signer, Bock's successor; and Andres Truppel, former CFO of Siemens S.A. ("Siemens Argentina"), neither appeared nor filed responsive pleadings in the action against them. Accordingly, the SEC seeks civil monetary penalties from all three former executives. In addition, the SEC seeks over $316,000 disgorgement and prejudgment interest from Bock, representing payments he received as sham consulting fees in exchange for concealing evidence of bribery from a World Bank arbitration panel. Soon after the motion was filed, Truppel entered into an agreement in principle to settle SEC charges.

Between 1996 and 2007, executives at Siemens and Siemens Argentina allegedly authorized payments of approximately $100 million in bribes to Argentine officials to obtain and retain a $1 billion government contract ("DNI contract") to produce national identity cards for Argentine citizens. The payments were made through intermediaries to current and former Argentine officials, including two presidents and members of their cabinets, to obtain the DNI contract and prevent its cancellation. Ultimately after the DNI contract was cancelled, Siemens filed an arbitration claim against Argentina before the World Bank International Centre for Settlement of Investment Disputes seeking damages and lost profits. During the arbitration proceeding, Signer and others arranged for Bock to receive over $316,000 through sham consulting agreements in exchange for not testifying about Siemens' procurement of the DNI contract through corrupt means.

In April 2013, the SEC settled FCPA charges against another former executive, Uriel Sharef, a member of Siemens' managing board and the senior most executive charged by the SEC (see our FCPA Summer Review 2013). SEC and DOJ charges remain pending against the other former executives. More recently, in December 2013, an Argentine judge charged seventeen individuals, including Bock, Truppel, and Sharef, for bribery relating to the DNI contract. The judge credited the UAE, Dubai, Hong Kong, and the United States for providing information that led to the charging decision.

Supreme Court Denies Certiorari for Greens' Restitution Order

In what appears to be the final action in the long quest of Gerald and Patricia Green to overturn an order that they pay $250,000 in restitution for paying bribes to a tourism industry official in Thailand (see our FCPA Autumn Review 2013 and earlier Reviews cited therein), on November 18, 2013, the Supreme Court denied the couple's certiorari petition. The Greens were challenging the Ninth Circuit's July 11, 2013 decision on the issue. The lawyer for the Greens stated publicly that he would take no further legal action, and that the restitution order would therefore likely stand.

Litigation

Hearing Held in First Appellate-Level Challenge to U.S. Government's "Instrumentality" Definition under the FCPA

On October 11, 2013, a three-judge panel at the U.S. Eleventh Circuit Court of Appeals heard oral arguments in the first appellate-court level challenge to the U.S. government's interpretation of the "instrumentality" definition under the FCPA. Two ex-executives of Terra Telecommunications Corporation ("Terra"), Joel Esquenazi and Carlos Rodriguez, brought the challenge following their FCPA conviction for bribing officials of Telecommunications D'Haiti ("Haiti Teleco" or "Teleco") in order to receive rebates, tariff reductions, and other benefits for Terra. Mr. Esquenazi was sentenced to a fifteen-year prison term and Mr. Rodriguez to a seven-year prison term. We have extensively covered the underlying prosecution, as well as the parties' appellate briefings, in past FCPA Review issues, most recently in our FCPA Autumn Review 2012.

The FCPA defines "foreign official" as "any officer or employee of a foreign government or any department, agency, or instrumentality thereof" (emphasis added). The statute does not separately define the term "instrumentality." Before trial, the DOJ asserted that because of government ownership and control of Haiti Teleco, it was an "instrumentality" under the FCPA, and its employees were "foreign officials." The district court that oversaw the appellants' prosecutions instructed the jury that "instrumentality" is "a means or agency through which a function of the foreign government is accomplished," and that "state-owned or state-controlled enterprises that provide services to the public may meet this definition." The court also provided the jury with the below non-exhaustive list of five factors to consider in determining whether Teleco was an instrumentality:

- Whether Teleco provides services to the citizens or inhabitants of Haiti;

- Whether its key officers and directors are government officials or are appointed by government officials;

- The extent of Haiti's ownership of Teleco, including whether the Haitian government owns the majority of Teleco's shares or provides financial support such as subsidies, special tax treatment, loans, or revenue from government-mandated fees;

- Teleco's obligations and privileges under Haitian law, including whether Teleco exercises exclusive or controlling power to administer its designated functions; and

- Whether Teleco is widely perceived and understood to be performing official or governmental functions.

Mr. Esquenazi and Mr. Rodriguez argue on appeal that the district court's jury instruction on instrumentality was overbroad and unconstitutionally vague as applied to them.

During the oral argument at the Court of Appeals, the appellants and the U.S. government each posited a definition of "instrumentality":

- Mr. Rodriguez's counsel argued that an instrumentality is a part of, or a unit of, the government (such as the FDIC or the U.S. Federal Reserve in the case of the U.S. government).

- Mr. Esquenazi's counsel argued that an instrumentality is a state-owned and -controlled entity that performs traditional, or core, government functions (such as defense or police).

- The U.S. government argued that an instrumentality is an entity through which a government performs its function, and over which the government has dominion and control.

The portion of the hearing relevant to the instrumentality definition focused primarily on: (1) the definition of "government function," a term used in both Mr. Esquenazi's and the U.S. government's definition; and (2) whether the U.S. government's definition is unconstitutionally vague as applied.

"Government Function"

In Mr. Esquenazi's as well as the U.S. government's definition, an entity must perform a government function to qualify as an instrumentality. Mr. Esquenazi distinguished his definition from the government's by emphasizing that the government function performed must be a "traditional" or "core" government function, such as police and defense activities. In contrast, the U.S. government contended that the function could be any activity that the foreign government has decided is its function and whether the foreign government considers a particular activity as its function should be determined by examining those factors enumerated in the district court's jury instruction.

Applying his definition to the facts, Mr. Esquenazi contended that providing telecom service cannot be a traditional government function in Haiti because Haiti Telecom was originally created as a private company, and only later came to be owned by the government (possibly in a debt transaction). In contrast, the U.S. government contended that the Haitian government clearly considers telecom service as a government function because the government: (1) owns 97% of Teleco; (2) controls Teleco through its board and management; (3) takes profit from Teleco and covers its debts with government revenue; and (4) has established Teleco as a monopoly in the telecom sector.

Mr. Esquenazi's attorney pointed out that under the challenged jury instruction--which stated that "state-owned or state-controlled enterprises that provide services to the public may meet [the instrumentality] definition"--all state-owned and -controlled enterprises would be considered as instrumentalities because all enterprises provide some services to the public. This argument echoes a concern often expressed by FCPA defense counsel that the enforcement agencies appear to sometimes treat ownership and control as the primary, if not the sole, factor in determining instrumentality status. In his brief, Mr. Esquenazi pointed to General Motors Company ("GM") as an example, noting that for a period of time after bailing out GM, the U.S. government owned a majority of GM shares; thus, under the challenged jury instruction, GM was an instrumentality of the U.S. government.

The U.S. government called Mr. Esquenazi's GM example "absurd" and stated that the government would not consider GM an instrumentality because, while the U.S. government did own a majority of GM shares for a "very short" period of time, the government was only temporarily bailing out the company. The government did not control GM, did not own a majority of GM shares for an extended period, and did not enter the relevant market.

The U.S. government's position on GM suggests that majority foreign-government ownership, by itself, is insufficient to establish government control or an entity's instrumentality status. The Court of Appeals panel pressed the government on how ownership relates to control and instrumentality status, in the context of plurality of ownership, and in the context of temporary or recently acquired ownership (referencing GM). The government explained that questions of control and instrumentality are multi-factor, totality-of-circumstances considerations, and ownership is only one factor in those considerations.

Vagueness

Citing the potential wide scope of the U.S. government's instrumentality definition, and the multiple totality-of-circumstances considerations (to assess control and government function) necessary to apply that definition, both the Court of Appeals panel and the appellants expressed concern with the potential notice problem posed by the government's definition.

Focusing on the specifics of their case, the appellants argued that the U.S. government's definition is unconstitutionally vague as applied to them because even the Prime Minister of Haiti offered conflicting declarations on Teleco's instrumentality status, and the government's own expert could not determine when and how Haiti Teleco became government-owned after the company's original founding as a private company. In response, the U.S. government appeared to acknowledge that, in marginal cases, vagueness as to an entity's instrumentality status may pose a problem. But, the government maintained that the appellants' case is far from the margins because: (1) the appellants' conduct was clearly criminal; and (2) the appellants are sophisticated international businessmen and, in a past insurance matter, their attorney had referred to Teleco as an instrumentality of the Haitian government. Neither the appellants nor the panel seemed satisfied with the U.S. government's response. One of the judges pointed out that not all criminal conduct violates federal law. Mr. Rodriguez's attorney argued that even "smart attorneys" struggle with the scope of the term instrumentality.

However, the panel did not appear to find that the appellants' proposed definitions were any clearer. In discussing Mr. Rodriguez's definition, the panel wondered about the difficulty of determining what "a unit of [a foreign] government" is because governments around the world organize themselves differently and written laws often do not reflect actual practice.

Conclusion

The panel's interest in what constitutes a "government function" suggests the possibility that the court could utilize the term in identifying entities that are "instrumentalities" of a foreign government. More broadly, arguments made at the hearing suggest that even if the Appellate Court rejects the U.S. government's definition, it is unlikely that the Court will be able to significantly clarify the scope of instrumentality in this single case. As the panel pointed out during the hearing, foreign governments and government-owned enterprises are organized in many different ways. Consider China, where governments at all levels own, or partially own, and in some cases, operate, commercial businesses that compete in the marketplace against private enterprises. Chinese government bodies at all levels also extensively regulate and sometimes directly intervene in markets, sometimes for the benefit of those same commercial enterprises. In this context, it would be exceedingly difficult to draw a bright line distinguishing those government-owned enterprises that qualify as instrumentalities from those that do not. More clearly defining "instrumentality" may require multiple judicial opinions, each distinguishing a different fact pattern.

Developments in Cilins Prosecution

As outlined in our FCPA Summer Review 2013, on April 13, 2013, the DOJ announced the arrest of a French citizen, Frederic Cilins, in Florida on charges related to an ongoing federal grand jury investigation concerning potential FCPA and money laundering violations committed by BSG Resources, Ltd. ("BSGR"), a foreign company engaged in the mining of iron ore in the Republic of Guinea.

On April 15, 2013, a criminal complaint ("Complaint") was filed against Cilins charging three separate counts of (1) tampering with a witness; (2) obstruction of a criminal investigation; and (3) destruction, alteration, and falsification of records in a federal investigation, all of which stemmed from Cilins's alleged attempts between March and mid-April 2013 to bribe a cooperating witness in the investigation in exchange for the witness's promise to destroy documents responsive to a grand jury subpoena.

The charges against Cilins exposed the existence of a federal grand jury investigation into BSGR's procurement of a concession to extract iron ore from Guinea's Simandou Mountains ("Simandou Concession"), described as the site of one of the world's largest known deposits of untapped iron ore. According to the Complaint filed against Cilins, BSGR's activities in Guinea have been under investigation since January 2013. Press reports have noted that a corresponding investigation is also ongoing in Guinea itself. At issue is whether BSGR obtained the Simandou Concession through the payment of bribes to officials of the former government of Guinea. Prosecutors have stated that the FCPA investigation into BSGR's activities continues.

Despite the larger issues at play, prosecutors have downplayed the Cilins case as a straightforward bribery/obstruction case. Bail was initially set in May at $15 million, but the government argued that Cilins was a flight risk and the court revoked his bail on July 3, 2013. Jury selection is now set for March 31, 2014, in the District Court for the Southern District of New York.

International Developments

UK Update - SFO and FCA Activity

SFO Abandons Dahdaleh Prosecution; Opens Investigation of Rolls Royce

The SFO's efforts to move beyond a recent string of highly-publicized missteps stalled in December, when it declined to offer evidence in the trial of Jordanian-born British-Canadian businessman Victor Dahdaleh. Dahdaleh had been alleged to have made over £35 million in bribes to officials at Aluminum Bahrain ("Alba"), a state-controlled Bahraini entity, on behalf of the U.S. company Alcoa.

The SFO admitted to the Southwark Crown Court on December 10, 2013 that it no longer believed there was a reasonable prospect of conviction, while maintaining that the evidence in the case was "strong." The SFO at trial attributed the deterioration of the likelihood of conviction to a shift in conspirator Bruce Hall's evidence from that which he offered in his witness statement, as well as the unwillingness of two other witnesses to submit to cross-examination. The two witnesses in question are partners of Alba's outside law firm, whose role in the provision of assistance to the SFO in connection with the case had been questioned by Dahdaleh's attorneys. The SFO accepted the defense position that refusal of the witnesses to attend the trial had resulted in unfairness for the accused, and elected to present no evidence, resulting in Dahdaleh's acquittal. A review of the circumstances of the failed prosecution is said to be underway at the SFO "with a view to learning any lessons that can be applied to future cases." The sting of its failure to obtain a conviction of Dahdaleh undoubtedly was intensified by the January 2014 announcement of Alcoa's FCPA disposition (and resultant large penalties) with the DOJ and SEC (which will be covered in our next Review).

However, in an indication that it intends to continue its anti-corruption work undaunted, on December 23, 2013, the SFO issued a brief confirmation that it had opened a criminal investigation into allegations of bribery and corruption at Rolls-Royce. Rolls-Royce, which previously had announced that it had was co-operating with the SFO following requests for information about alleged "malpractice" related to the company's business in China and Indonesia, acknowledged that it had been informed by the SFO that a formal investigation had been commenced. Earlier last year, in announcing its 2012 financial results, the company stated that it had appointed Lord David Gold to lead a review of its compliance procedures and report his findings to the Ethics Committee of the Board. Rolls-Royce has scheduled a presentation on its 2013 results for February 13, 2014, and this should present an opportunity to learn more about the status of the investigation and the company's response, including the status of Lord Gold's investigation. One curious aspect of the case reported in the press involves allegations by a whistleblower and former Rolls-Royce employee that bribes were paid in the 1990s to the son of a former Indonesian dictator, Tommy Suharto, whose attorneys are said to have issued a formal denial of the allegations to the SFO. Given the timing of this particular alleged misconduct, it is unlikely that it will form the basis for any charges that may be filed under the Bribery Act (2010) or its predecessor legislation.

Failure to Control Corruption Risks Leads to Fine for JLT Specialty

The FCA ended the year on a more effective note, imposing a financial penalty of over £1.8 million on JLT Specialty Limited ("JLT") for failing to adequately counter the risks of bribery and corruption in connection with the making of payments to overseas third parties. The FCA, which regulates the UK financial industry and has rule-making, investigative and enforcement powers, found that JLT had breached its fundamental regulatory obligation to "take reasonable care to organise and control its affairs responsibly and effectively, with adequate risk management systems." This obligation is set out in the FCA's Handbook as Principle 3.

JLT provides specialist insurance, brokering, risk management and claims consulting services to an international clientele. The Final Notice ("the Notice") issued by the FCA on December 19, 2013, focused on the company's relationships with third parties referred to as "Overseas Introducers," who aided JLT in securing and retaining foreign business. The Notice cited JLT for breach of Principle 3 through its:

- Failure to conduct sufficient due diligence before engaging an Overseas Introducer;

- Failure to adequately assess the risk associated with each new business opportunity presented by its Overseas Introducers;

- Failure to adequately implement its own anti-bribery and corruption policies; and

- Failure to perform adequate checks on the implementation of its policies that would have uncovered compliance shortcomings.

The failures cited in the Notice occurred during the period from February 19, 2009 to May 9, 2012, with the result that the financial penalty was calculated both under the FCA's former penalty regime (for breaches through March 5, 2010) and its current policy on the imposition of financial penalties. Penalties assessed under both regimes were discounted by 30% as a result of JLT's early settlement of the investigation.

Notably, the FCA stated that it found no evidence of illegal payments or inducements to Overseas Introducers, nor that the company intended to permit such payments or inducements. However, balanced against these and other mitigating factors were a number of factors that the FCA found aggravated the breach. On three separate visits to JLT, the FCA had identified "significant concerns" with respect to the company's anti-bribery and corruption systems and controls as they pertained to Overseas Introducers. Furthermore, the FCA noted that its enforcement actions and publication of guidance for commercial insurance brokers had created a "backdrop of heightened awareness" in the industry to which JLT should have responded.

Although not a bribery case per se, the detailed analysis presented in the Notice of both the compliance failures and the related mitigating and aggravating factors serves as a primer for regulated and non-regulated companies alike when assessing compliance risks and striving to implement effective controls.

Swiss Authorities' Investigation of Maxwell Technologies Revealed

Continuing a growing trend from the last several years, a company that has settled a recent FCPA enforcement action with the U.S. government now faces scrutiny in other jurisdictions for the same or similar behavior. As discussed above and in prior FCPA Reviews, Maxwell Technologies settled an FCPA case in January 2011. The case centered on activities by its Swiss affiliate and that affiliate's General Manager, Alain Reido.

As noted above, Mr. Reido was indicted by U.S. authorities on October 16, 2013. Shortly thereafter, in its 10-Q form released on October 24, 2013, Maxwell Technologies announced that its Swiss offices had been subject to a search warrant from the Swiss federal prosecutor's office in August 2013. The disclosure document further stated:

We believe this action to be related to the same or similar facts and circumstances as the FCPA action previously settled with the SEC and the DOJ. We are in the process of undergoing a comparison of the FCPA statutes and the Swiss bribery laws and regulations in order to determine the amount of overlap between the two matters. We are currently unable to determine the extent to which we will be subject to fines and penalties in accordance with Swiss bribery laws and what additional costs and expenses will be needed to prepare ourselves to defend this matter. During initial discussions, the Swiss prosecutor has acknowledged both the existence of our DPA with the DOJ and our cooperation efforts thereunder, both of which should have a positive impact in our discussions going forward.

This matter bears watching to determine how the Swiss authorities do account for the U.S. settlement.

Other Items

DOJ Issues Opinion Procedure Release Permitting U.S. Attorney to Pay Medical Expenses for Foreign Official's Family Member

On December 19, 2013, DOJ published an Opinion Procedure Release ("OPR") stating that it would not take action if a U.S. private attorney paid approximately $13,500 - $20,500 in medical bills related to treatment of the daughter of a foreign official who works for a foreign country's Office of the Attorney General ("OAG"), which is an ongoing client of the attorney's law firm.

The OPR noted that the U.S. attorney had become a personal friend of the foreign official, thus taking the relationship beyond business. In addition, release stated that the daughter's severe medical condition could not effectively be treated in the foreign country, and that the foreign official lacked the means to pay for the treatment recommended by her doctors. The release further noted that the attorney will make the payment from his personal funds (the law firm is not involved) directly to the third country medical facility, and that the foreign official will pay the travel costs associated with the treatment abroad.

The release also stated that, to avoid any appearance of corruption, both the requestor and foreign official have transparently discussed the matter with their respective offices, which have both indicated they have no objection to the medical assistance. The file included a certified letter in which the Attorney General of the foreign country stating that paying for the medical treatment will have no impact on current or future decisions by the OAC in hiring international counsel and does not violate any laws in the foreign country. The release further noted that the U.S. attorney was not the lead or relationship attorney with the OAG or the government of the foreign country, although he had participated in business selection presentations before these entities and expected to continue such activities. The release also indicated that the law firm believes that, in addition to two ongoing matters, the foreign country government may retain the law firm to work on new matters if they arise, given its successful track record and the strong relationship between the two groups. Further, the release noted that the foreign country's public contracting laws require transparent reasons for awarding contracts and punish corrupt behavior. Finally, the foreign official stated in writing that he has not had and will not have in the future any role in hiring decisions involving international counsel, the attorney or his law firm.

The OPR indicates that "the facts presented suggest an absence of corrupt intent and provide adequate assurances that the proposed benefit to the Foreign Official's daughter will have no impact on" the law firm's present or future business with the foreign country. As such, the release concludes that the DOJ does not intend to take any enforcement action, although the OPR contains a paragraph stating that paying medical or other expenses of a foreign official or his family could violate the FCPA (citing United States v. Liebo, 923 F.2d 1308, 1311 (8th Cir. 1991)).

Transparency International's Corruptions Perceptions Index -- 2013 Edition

On December 3, 2013, Transparency International ("TI") released its 2013 Corruption Perceptions Index ("CPI"), an annual ranking list that compares the perceived levels of public sector and governmental corruption in 176 countries and territories based on data from a combination of surveys and assessments of businesses and experts in each country. The CPI looks at factors such as accountability of national and local governments, effective enforcement of anti-corruption laws, access to government information, and abuse of government ethics and conflict of interest rules. Many companies use TI scores in their anti-corruption compliance risk assessments as one measurement of country-based risk.

TI uses a CPI score scale of 0-100, with zero representing the highest level of perceived corruption. The CPI score assigned to a country reflects the country's raw score, calculated based on data gathered for the year. TI has stated that it believes that this methodology, instituted last year, will enable the corruption perception of each country to be compared and tracked on absolute basis, year over year.

For 2013, Denmark and New Zealand ranked as the world's least corrupt countries, each with a score of 91. Finland and Sweden came in next with a score of 89 each. Rounding out the bottom three, repeating from last year, were Afghanistan, North Korea, and Somalia, each with a score of 8. The United States remained in the same place as last year--19th, with the same score of 73. Conversely, the United Kingdom rose three places to 14th, with a score of 76.

Notably, no country received a perfect score, and two-thirds of countries scored below 50, which, according to TI, indicated that the levels of perceived, and probably actual, corruption are high. Many of the world's emerging economies scored below 50, suggesting high inherent corruption risks for foreign investments in some of the world's fastest growing economies. For example, the scores for the BRIC countries, which are very similar to their scores in 2012, were:

- Brazil: score 42, rank 72

- Russia: score 28, rank 127

- India: score 36, rank 94

- China: score 40, rank 80

Editors: John Davis, James Tillen, Marc Bohn*

Contributors: Leila Babaeva,* Abigail Cotterill,* Jacqueline Ferrand,* Ben Gao,* Jonathan Kossak,* Barbara Linney,* Nathan Lankford, Claire Palmer, Saskia Zandieh*

*Former Miller & Chevalier attorney

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.