FCPA Summer Review 2023

International Alert

Introduction

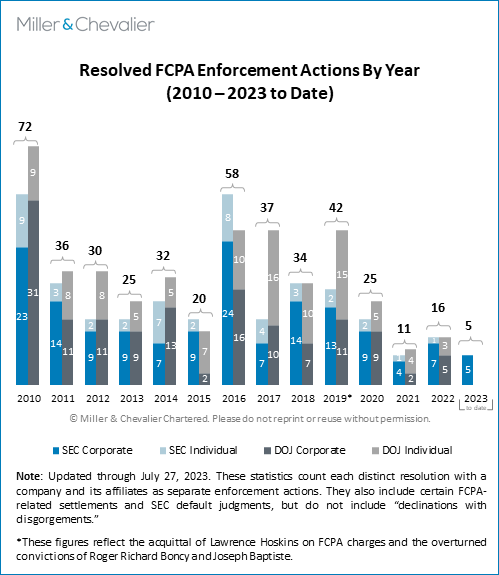

The U.S. Securities and Exchange Commission (SEC) continued to take center stage in corporate enforcement of the Foreign Corrupt Practices Act (FCPA) in the second quarter of 2023, releasing three dispositions (on top of the two issued in the first quarter). The U.S. Department of Justice (DOJ) did not publicly resolve any corporate matters during the quarter, though there were several developments related to actions against individuals. There were several notable international developments, including in Canada, South Africa, Switzerland, and France, as well as the announcement of a proposed EU directive on standards for enforcement against corruption-related crimes.

The DOJ continues to discuss its recent policy updates, often focusing on company and bar questions related to the operation of the DOJ's clawback pilot program and related guidance on compliance-based incentives and on updates to voluntary disclosure policies.

On May 16, 2023, DOJ Fraud Section Chief Glenn Leon stated at a compliance conference that the DOJ's guidance on the evaluation of compliance programs (which includes sections on compensation-related incentives and other program elements) is "not intended to be a prescriptive document" and reiterated the DOJ messages that "[t]here is no one size [that] fits all." As to ephemeral messaging applications, Leon summarized the recent guidance in that the DOJ is not banning companies from using any such technology but expects companies to have policies and processes in place to ensure appropriate retention and availability of business data relaying in such applications, consistent with applicable privacy policies.

At a May 24, 2023, speech at the New York City Bar's White Collar Crime Institute, Assistant Attorney General (AAG) Kenneth Polite, Jr., asserted that the DOJ has observed a "'shift in the frequency' of voluntary self-disclosures" since announcing updated policies and that he expected more announced cases in 2023 as various investigations continue their course.

At the June 22, 2023, GIR: Live Women In Investigations conference, a DOJ official acknowledged corporate concerns about how clawbacks and other compensation should work in practice, but stated that the DOJ is not focused on clawbacks alone and that the DOJ's "view is that we'll reward companies that reward compliance-promoting behavior." The DOJ official added, "the overall view is, let's have some skin in the game to make sure they're incentivized personally, employee by employee, to do the right thing at every level, in every decision." Conference co-chair and Chair of Miller & Chevalier Kathryn Cameron Atkinson noted that, while "companies have long found it really hard to embed incentives in compensation packages," the DOJ expects companies to "figure it out." A DOJ official on the panel emphasized that "DOJ would like to see companies designing compensation packages based on what works for their specific risk profiles."

There are two recent and upcoming changes at the DOJ. AAG Polite recently announced that he will be leaving at the end of July 2023 and his deputy, Nicole Argentieri, will replace him in an acting capacity for now. In early May 2023, David Fuhr became the acting Chief of the DOJ's FCPA Unit, replacing David Last, who left for private practice.

Corporate Enforcement Actions

Through June 30, the SEC has been responsible for all corporate FCPA dispositions involving penalties in 2023 (with three in Q2). The DOJ's one corporate matter, the Corsa Coal declination issued in March, involved only disgorgement.

Overall, the pace of announced resolutions for the first six months of 2023 represents a relatively slow start for the agencies as compared to some past years (and a historically slow rate for the DOJ), especially considering public rhetoric from the agencies about a strong push in enforcement. It is still possible, of course, that the announcements will accelerate through the remainder of the year, as there are several publicly disclosed investigations that could be resolved in 2023.

On April 26, 2023, the SEC resolved its investigation of oilfield services provider Frank's International N.V. (Frank's), for almost $8 million over alleged violations of the anti-bribery, books and records, and internal accounting provisions of the FCPA. The investigation involved alleged payments by Frank's subsidiaries in Africa of approximately $5.5 million to an Angolan third party with knowledge by certain Frank's personnel that the third party would bribe officials of the state-owned Angolan oil company Sonangol to obtain contracts. The payments took place from 2008 through October 2014, including after Frank's became an "issuer" in 2013.

On May 11, 2023, the Dutch consumer products company Koninklijke Philips N.V. (Philips) agreed to pay over $62 million to settle FCPA accounting provision charges. The SEC alleged multiple Philips subsidiaries in China and certain third parties engaged in improper conduct to influence government-owned hospitals to purchase their products and that Philips did not take sufficient steps to control discounts and other payments to third parties, especially in light of various corruption risks. The settlement also requires Philips to self-report to the SEC over a two-year period, focusing on the management of and controls related to third parties. Philips entered a previous FCPA resolution with the SEC in 2013 for books and records and internal controls violations in connection with misconduct related to their business in Poland.

Finally, on May 26, 2023, U.S. consulting firm Gartner, Inc. settled with the SEC for $2.46 million over allegations that the company had violated the FCPA's anti-bribery and accounting provisions in relation to payments to a South African consultant connected to efforts to obtain business from a South African government entity. Some of the issues involved participation in the South African Broad-Based Black Economic Empowerment (B-BBEE) program, which has been a focus for corruption concerns.

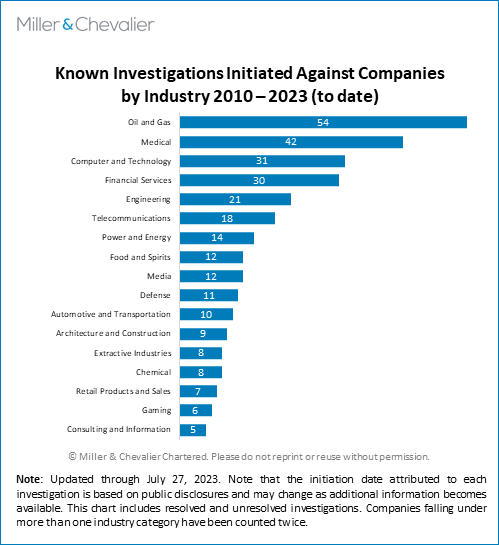

When looking at FCPA dispositions by industry, the oil and gas sector remains an area of high risk, as the recent Frank's International case illustrates. Medical sector cases have been driven by past industry "sweeps" (that is, investigations of multiple companies for similar issues) and by the "foreign official" status of medical professionals in many countries, especially China. The financial services sector has produced several recent blockbuster cases, including resolutions with Goldman Sachs, Credit Suisse, and Deutsche Bank.

Enforcement Actions Against Individuals

The DOJ announced some new FCPA-related resolutions and sentencings in Q2 of 2023. The SEC did not announce any FCPA-related actions against individuals this quarter.

Following a plea agreement announced on March 29, 2023, Alvaro Ledo Nass, a former Board Secretary and General Counsel at Venezuela's state-owned and -controlled oil company Petróleos de Venezuela S.A. (PDVSA), was sentenced on June 12, 2023, to three years in prison for conspiracy to commit money laundering. Nass will also be subject to three additional years of supervised release and a fine. Nass was charged with approving illegal currency exchange manipulation schemes and receiving $11 million in money laundered from PDVSA, which he used to acquire property in Florida and elsewhere.

On May 16, 2023, a federal court in the Southern District of New York (SDNY) sentenced Cary Yan, the former president of a non-governmental organization (NGO), to three years and six months of imprisonment for conspiracy to violate the anti-bribery provisions of the FCPA. Yan and Gina Zhou, his assistant, were indicted in August 2020 on allegations that they bribed government officials in the Marshall Islands in exchange for supporting legislation that would create a semi-autonomous region within the Marshall Islands, which would benefit Yan's business interests. Zhou was sentenced in February 2023 to a prison term equivalent to her time served in custody.

As previously reported, on March 27, 2023, the DOJ filed a superseding indictment of Sam Bankman-Fried, founder and principal of bankrupt cryptocurrency exchange company FTX, that included new charges, including one count of conspiracy to violate FCPA's anti bribery provisions related to alleged cryptocurrency payments to Chinese officials. The charges supplemented various fraud and other charges linked to FTX's business and its spectacular implosion. Bankman-Fried responded with a motion on May 8 that alleged the new charges violated the terms of the extradition treaty with the Bahamas and the "rule of specialty," which can limit a country prosecuting a defendant who has submitted to extradition to pursuing only those charges for which extradition was initially granted. Bankman-Fried also filed litigation in the Bahamas, with which the DOJ also engaged.

Rather than await the outcome of the Bahamas litigation (which could have delayed Bankman-Fried's scheduled October 2, 2023, trial date), the DOJ consented to severance of the FCPA charges. On June 15, 2023, the federal district trial judge in New York scheduled the trial on the FCPA charges for March 11, 2024. On June 27, the trial judge also issued a memorandum opinion holding in part that the FCPA charges were sufficiently pleaded by the DOJ and that Bankman-Fried did not have individual standing to invoke the rule of specialty.

Finally, we note that 1MDB-related activity continues and, on April 26, 2023, per a DOJ announcement, a federal trial jury convicted rapper/entertainer Prakazrel "Pras" Michel of conspiring with "Low Taek Jho, aka Jho Low, of Malaysia…and others to engage in undisclosed lobbying campaigns at the direction of Low and [a Chinese government minister]… to have the 1MDB embezzlement investigation and forfeiture proceedings involving Low and others dropped and to have a Chinese national sent back to China." The DOJ announcement noted that "Michel also conspired with Low to orchestrate and conceal a foreign and conduit contribution scheme in which they funneled millions of dollars of Low's money into the 2012 U.S. presidential election as purportedly legitimate campaign contributions, all while concealing the true source of the money." This case is one of many that have spun out of the massive 1MDB fraud investigation that resulted in a 2021 FCPA-related disposition by Goldman Sachs in which the company paid almost $3 billion in penalties and the imposition in March 2023 of a 10-year jail term for former Goldman Sachs banker Roger Ng.

Declinations and Other Indicia of Enforcement Trends

The DOJ did not announce any declinations in the second quarter of 2023.

One company disclosed in a filing that the DOJ had closed its investigation. In its Form 20-F filed in May 2023, Brazilian power company Companhia Energética de Minas Gerais (Cemig) disclosed that "[i]n July 2019, pursuant to the DOJ's Corporate Enforcement Policy, the Company disclosed [an investigation 'regarding certain alleged irregularities in public bidding and purchasing processes'] to the DOJ and the SEC…." The report noted further that "[i]n December 2022, the SEC concluded its investigation with no further enforcement action" and "[i]n February 2023, the DOJ closed its inquiry on possible violations of the FCPA." The Form 20-F stated also that the "Company awaits completion of [related] investigations by the Public Attorneys' Office of Minas Gerais State ('MPMG') and by other Brazilian and international authorities that are still ongoing."

In our summary of the SEC's resolution with Frank's, we also discuss Frank's relevant public statements in 2022 that the DOJ had decided not to pursue any further action against the company, contingent on an SEC resolution. Now that Frank's has concluded a resolution with the SEC, the DOJ investigation can be considered closed.

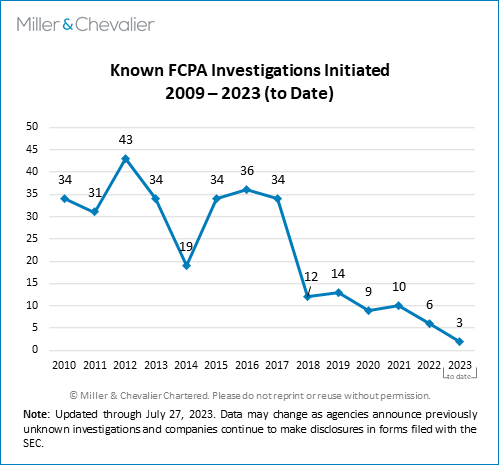

There was only one new corporate FCPA-related investigation announced during the quarter. On May 10, 2023, pharmaceutical company Pfizer Inc. announced in its 10-Q that the company had "received an informal request from the U.S. Department of Justice's FCPA Unit seeking documents relating to our operations in Mexico." This investigation supplements the ongoing FCPA-related investigations initiated by the DOJ and SEC previously disclosed by Pfizer related to its Russian operations (2019) and China operations (2020).

We note, as always, that the numbers in this chart are necessarily incomplete because neither the DOJ nor the SEC disclose official investigations statistics in anything close to real time and only some companies disclose such information through SEC filings or other means.

U.S. Court Decisions

The most prominent FCPA-related court decision in the second quarter of 2023 was the May 17, 2023, dismissal by a Texas federal district court judge of the indictment against Swiss-Portuguese banker Paulo Jorge Da Costa Casqueiro Murta. This marks the second time that Murta's case has been dismissed; the Fifth Circuit Court of Appeals overturned a previous dismissal of cases against Murta and Daisy Rafoi-Bleuler in February 2023. As explained in the trial judge's subsequent June 6, 2023, memorandum and order, the order was based on a finding that the U.S. government had violated Murta's right to a speedy trial under the Speedy Trial Act and the Sixth Amendment of the U.S. Constitution. The court cited several specific factors in its analysis, including that "the government sought a delay based on irrelevant classified information that it had access to for an undetermined number of months prior to December 2021" and that "[i]t failed to disclose that it had the information until March 2022, after Murta filed his [Speedy Trial Act] motion." The court concluded that the "government has failed to offer persuasive evidence or arguments that justify its lack of diligence in timely revealing that it was in possession of classified information, which delay is an act of bad faith that cannot be excused based on negligence or inadvertence." The court also noted that dismissal of the case with prejudice "will not result in Murta being declared immune from prosecution in Portugal"; "[t]o the contrary, a dismissal expedites his return to Portugal to face those charges."

The DOJ appealed this dismissal to the Fifth Circuit on June 14, 2023, and asked the trial court to extend a stay on the dismissal order due to concerns about Murta's potential deportation in light of the substantial time and effort needed for Murta's initial extradition for the case.

Policy and Legislative Developments

The DOJ launched a new corporate crime case database in June 2023. The DOJ site states that "[w]hile it is still in the process of being populated, [the database] will eventually contain the significant, relevant cases from each component and U.S. Attorney's Office, resolved since the beginning of 2023," including FCPA cases.

On May 5, 2023, the SEC announced that it had paid out by far the "largest ever" award to a whistleblower – nearly $279 million. The related order is heavily redacted per the SEC's standard practice and does not disclose the related case. SEC Enforcement Director Gurbir S. Grewal asserted that the award "not only incentivizes whistleblowers to come forward with accurate information about potential securities law violations [including FCPA violations], but also reflects the tremendous success of our whistleblower program."

The U.S. government continues to designate foreign officials as subject to economic sanctions and visa/immigration restrictions under the Global Magnitsky Human Rights Accountability Act and other statutory and regulatory authorities for acts of corruption. On July 11, 2023, the U.S. Department of the Treasury sanctioned Aleksandar Vulin, Director of Serbia's Security Information Agency who was previously Serbia's Minister of Defense and Minister of the Interior, for corrupt activities related to a "mutually beneficial relationship with U.S.-designated Serbian arms dealer Slobodan Tesic, helping ensure that Tesic's illegal arms shipments can move freely across Serbia's borders." The sanctions release stated that "Vulin's acts have advanced corruption within Serbia's governing institutions" and that Vulin has "leverage[ed] his authority for personal gain, including involvement in a drug trafficking ring."

International Developments

There were several international developments this quarter.

On May 3, 2023, the European Commission and the EU High Representative for Foreign Affairs jointly submitted a proposed draft anti-corruption directive to the European Parliament. The draft directive would obligate all Member States to create specialized anti-corruption bodies and cultivate stronger communication and cooperation related to anti-corruption efforts. The draft directive also recommends that the anti-corruption bodies be provided with sufficient resources and training to address a concern that the responsibilities, resources, scope, and jurisdiction of Member States' enforcement authorities vary widely. The draft encourages the harmonization and expansion of the definition of actionable corruption and covered "public officials" as well. Finally, the draft aims to establish some consistency in the consequences for violating anti-bribery laws, with minimum terms for imprisonment of natural persons and guidance on sanctions against corporate entities/"legal persons," which the directive states should equal to no less than five percent of an entity's total worldwide turnover in the business year the entity was charged. The draft directive requires various approvals before coming into force.

In Canada, on March 7, 2023, an Ontario judge released a written explanation for her January 2023 acquittal of Damodar Arapakota, the former Chief Executive Officer (CEO) of Toronto-based Imex Systems Inc., who was charged in 2020 with violating Canada's Corruption of Foreign Public Officials Act (CFPOA). The court's decision clarified several components of the CFPOA and the standards for conviction, including required evidence to prove guilt beyond a reasonable doubt. After an examination of the facts, the court found that Arapakota had provided a material benefit to a public foreign official, but that the largely circumstantial evidence presented failed to demonstrate beyond a reasonable doubt that this benefit was provided as a quid pro quo to obtain or retain an advantage in business, per the CFPOA's relevant provisions.

On April 20, 2023, South Africa's National Prosecuting Agency (NPA) announced that it had secured a provisional asset forfeiture order from the High Court of South Africa against former ABB South Africa employees, their wives, and subcontractors of state-owned power company Eskom totaling 584 million rand ($32 million). This action follows December 2022 resolutions between ABB and U.S. and South African authorities and July 2022 criminal charges brought against the individuals and entities involved in the asset forfeiture order involving corruption, money laundering, fraud, and forgery in relation to ABB's work for Eskom.

On April 27, 2023, the Office of the Attorney General of Switzerland (SOAG) announced that SICPA SA, a company that offers tamper-proof certificates and security inks for banknotes, had been convicted of criminal liability in connection with acts of corruption. The announcement identified a failure "to take all necessary and reasonable organisational precautions to prevent bribes to foreign public officials" that resulted in improper payments to foreign public officials in Brazil, Colombia, and Venezuela between 2008 and 2015 as the bases for conviction. The penalty order included a fine of CHF 80 million (approximately $90.6 million). The SOAG also announced that a former SICPA sales manager had been "sentenced to a conditional prison term of 170 days" for his role in the bribery. The announcement noted that related proceedings against SICPA's CEO were "being discontinued."

In May 2023, the French Anti-Corruption Agency (AFA) published a study analyzing the French, American, and U.K. legal frameworks for the prevention of national and foreign corruption. The study compares and summarizes the requirements and offences of each jurisdiction and analyzes the corruption prevention and detection measures defined and/or suggested in each country, as well as in the World Bank Group's compliance and integrity guidance. The study is a helpful tool for comparing anti-corruption approaches in the covered jurisdictions.

On May 16, 2023, the Superior Court of Québec published details regarding the court's approval of the September 2022 remediation agreement involving Ultra Electronics Forensic Technology (Ultra Electronics) and alleged violations of the CFPOA. The court announcement stated that Ultra Electronics had been charged with "two counts of bribing officials of the Republic of the Philippines [under the CFPOA] and one count of defrauding the Filipino government." The announcement stated further that "[t]he objective of the scheme was to secure the procurement of a ballistic identification system to the Philippine National Police." Ultra Electronics agreed to pay a penalty of C$6.6 million and to forfeit C$3.3 million "for the advantage obtained from the wrongful conduct." During the four-year term of the agreement, Ultra Electronics also agreed to "report to the [Public Prosecution Service] on the implementation of the agreement" and to "abide by the terms of an anti-bribery and corruption program under the supervision of an external auditor, retained at [the company's] expense." The company must also continue to cooperate in other investigations, including potentially ongoing actions against former company personnel. In light of these considerations, the court concluded that the remediation agreement "is in the public interest and that its terms are fair, reasonable and proportionate" and noted that "approving this agreement will encourage corporations to voluntarily disclose wrongdoing."

On June 22, 2023, the Australian government tabled new legislation to update that country's existing laws on foreign bribery. The accompanying Attorney General's memorandum states that the new legislation, among other things, "removes the existing requirement that the benefit or business advantage be 'not legitimately due' and replaces it with the concept of 'improperly influencing' a foreign public official" and "makes it clear that the foreign bribery offence does not require the prosecution to prove that the accused had a specific business, or business or personal advantage, in mind." The proposal also "introduce[s] a new indictable corporate offence of failing to prevent foreign bribery" using language similar to that in the U.K. Bribery Act (UKBA), noting that the new proposed "offence will be an incentive for companies to implement and maintain measures to prevent bribery." The memorandum acknowledges criticisms of Australia's foreign bribery enforcement record by, for example, the Organisation for Economic Cooperation and Development's (OECD) Anti-bribery Working Group and states that the legislative proposal "seek[s] to overcome the limitations of the current foreign bribery offence which has proven to be overly prescriptive and difficult to use."

Finally, on June 28, 2023, a French tribunal approved a convention judiciaire d'interet public (CJIP) between the National Financial Prosecutor's Office (PNF), the U.K. subsidiary of oilfield services company TechnipFMC, and a French company formerly affiliated with TechnipFMC that has since been spun off related to allegations of corrupt payments to government officials in Africa, including in Equatorial Guinea and Ghana, from 2008-2017. The PNF published the CJIP in July. Both the CJIP and Technip FMC's related press release state that the U.K. subsidiary will pay a fine of almost €155 million and the French company will pay a fine of just over €54 million as part of the settlement. TechnipFMC's press release also notes that the company "will not be required to retain a monitor." The PNF says that information on the African payments was provided by TechnipFMC as part of an investigation originally covering alleged corruption in Brazil. TechnipFMC and a U.S. subsidiary entered a deferred prosecution agreement (DPA) with the DOJ in 2019 and paid a fine of almost $300 million to U.S. and Brazilian authorities related to FCPA and Brazilian law charges for conduct in Brazil and Iraq.

Corporate Enforcement Actions

Frank's International N.V. Settles with SEC Over FCPA Violations in Angola

On April 26, 2023, the SEC announced a resolution with global provider of engineered tubular services, Frank's International N.V., for almost $8 million over alleged violations of the anti-bribery, books and records, and internal accounting provisions of the FCPA. Frank's agreed to disgorge $4,176,858, pay prejudgment interest of $821,863, and pay a civil money penalty of $3,000,000. Frank's became an issuer in August 2013, and the company merged into Expro Group Holdings N.V. (Expro, also an issuer) in October 2021. According to the Order, between January 2008 and October 2014, Frank's subsidiaries in Africa paid approximately $5.5 million to an Angolan third party (referred to as the "Angola Agent" in the SEC's Order), with the knowledge that he would bribe officials from Sonangol, a state-owned Angolan gas company.

According to the SEC, Frank's operation in Angola included providing tubular services and drilling technology to international oil companies that had received concessions from Sonangol. In 2007, Frank's learned that "Sonangol was blocking its hiring and it could no longer use Frank's to provide tubular services." According to a Sonangol executive, Sonangol could change its mind if Frank's opened a "consulting company" in Angola and "paid five percent of the value of the contract to the consulting company for the benefit of high ranking Sonangol officials."

In November 2007, Frank's declined to set up a consulting firm, but retained the Angola Agent. Frank's did so despite the agent not having the "relevant technical background to advocate on the company's behalf before Sonangol." Frank's did not conduct due diligence or execute a contract with the agent, who allegedly had personal relationships with an Angolan official and Sonangol employees but would skip technical meetings with Sonangol. Moreover, the Order states that "employees based in the region were aware of the high probability that Angola Agent would use the payments he received from Frank's to bribe Angolan government officials." According to the Order, after hiring the agent, Frank's was able to secure multiple contracts and was successfully engaged by its usual customers.

In late 2008, Frank's Chief Accounting Officer and Chief Financial Officer (CFO) raised questions about the scheme. Frank's Regional Executive then signed an "agency agreement" with the Angola Agent and backdated it to early January to justify the prior payments (approximately $688,000). Up until 2014, three more agreements were signed, two of which were drafted and approved by Frank's General Counsel based in Houston, according to the SEC. Frank's recorded these payments as "business expenses – entertainment and meals." In reality, the Angola Agent used the money to bribe Sonangol's officials. For example, according to the SEC, "in January 2012, Frank's Angolan Operations received and paid a $328,000 invoice from Angola Agent" and in "March of that year, Angola Agent paid Angola Official $289,000."

The Order also singled out the company's continued use of the Angola Agent after it became an "issuer" in 2013 and subject to SEC jurisdiction. The Order notes that "during this period after becoming as issuer, Frank's Angolan Operations obtained five new contracts in Angola." In addition to continuing paying the Angola official, Frank's VP of Africa & the Middle East authorized benefits to the same Angolan official who benefited from payments via the agent, while claiming that the official worked for Frank's. The payments were approved for securing a visa and providing for "airfare, lodging, dining, sightseeing tours, and local transportation."

In determining the appropriate penalty, the SEC listed mitigating factors which weighed in favor of Frank's. Specifically, the Order states that Frank's cooperated with the investigation by making foreign witnesses available for interviews in the U.S. and voluntarily produced documents, including sharing misconduct that happened before the company became public. Further, the Order noted Frank's remediation efforts, like terminating the relationship with the Angola Agent and improving its internal controls after the merger with Expro.

Key Takeaways

- No Voluntary Self-disclosure Credit Cited by SEC. In an 8-K form filed on June 13, 2016, Frank's stated that "the Company voluntarily disclosed the existence of its extensive internal review to the U.S. Securities and Exchange Commission and the United States Department of Justice." But the Order does not mention any voluntary disclosure by Frank's. This could indicate that the SEC had a whistleblower or had otherwise already started an investigation.

- Frank's Reported a DOJ Declination, But the DOJ Has Not Done So. In a 10-Q form filed on November 3, 2022, Frank's disclosed that "the DOJ has provided a declination, subject to the Company and the SEC reaching a satisfactory settlement of civil claims." But the declination has not been included on the DOJ's website to date and it is not otherwise mentioned on the Order. This contrasts with the Quad/Graphics resolution, for example, when the DOJ publicly announced a declination when the company also had a resolution with the SEC.

- No Action by Dutch Authorities. The Dutch Public Prosecution Service (OM) has been actively prosecuting Dutch corporations over corruption allegations, such as the 2014 SBM Offshore resolution and the 2021 SHV Holdings resolution. However, the OM has not yet commented on this case, even though Frank's was a Dutch company later acquired by Expro, another Dutch company. We note, however, that the Dutch presence for Frank's appears to be primarily a corporate holding for its Houston-based business. At the same time, we also note that the company's public disclosure from February 24, 2017, adds to the original text of the release that Frank's was also cooperating with "other governmental entities," which may have indicated some interaction with the Dutch authorities.

Philips Agreed to Pay Over $62 Million in Second SEC Resolution for FCPA Violations

On May 11, 2023, Koninklijke Philips N.V. (Philips), an Amsterdam headquartered global manufacturer of consumer products and healthcare technology, agreed to pay over $62 million to settle charges for violating the FCPA. This total consists of $41,126,170 in disgorgement, $6,047,633 in prejudgment interest, and $15,000,000 as a civil penalty. The SEC alleged that Philips violated the books and records and internal accounting control provisions of the FCPA when its multiple subsidiaries in China (collectively, Philips China) and their employees, distributors, and sub-dealers engaged in improper conduct to influence government-owned hospitals to purchase their products. The SEC also alleged that Philips China did not maintain sufficient records for discounts provided to distributors and sub-dealers and otherwise did not take steps to manage the third parties (such as conducting due diligence or requiring training). As noted below, this is Philips' second FCPA resolution with the SEC; the first happened 10 years ago in 2013.

According to the facts set forth in SEC's Order (which Philips did not admit or deny), Philips China used special price discounts related to sales to government-owned hospitals from 2014 through 2019 that contributed to inaccurate books and records and internal accounting controls violations. The SEC found that the discounts were not adequately documented and, in some cases, included incorrect information. More specifically, Philips China did not maintain information on the business justification or management approval of the special price discounts. Philips failed to "devise and maintain an adequate system of internal accounting controls with respect to the approval process and recording of the special pricing discounts to provide reasonable assurances of appropriate management authorization of the discounts." The SEC concluded that "[t]his deficiency, combined with pressure to win additional sales, created an environment in which there was a risk that excessive distributor margins could be used to fund improper payments to employees of government-owned hospitals." The SEC also noted that Philips China did not fully implement its procedures for distributors with respect to due diligence or training and that it did not conduct "adequate testing in high-risk areas of sales to identify controls failures."

The SEC also alleged that Philips China and its third parties (distributors and sub-dealers) engaged in misconduct, highlighting three different scenarios. The SEC noted that all transactions during 2014-2019 in public tenders included at least some combination of misconduct. In one scenario, hospital employees would write technical specifications in consultation with Philips China employees or third parties, determining the hospital's preferences in a manner that was favorable to Philips, granting Philips a competitive advantage prior to the bidding period opening. In a second scenario, the hospital employees would draft "specifications to increase the likelihood that the selected manufacturer would qualify for the winning bid," although it is unclear how Philips China personnel or third parties contributed to this misconduct. And in the third scenario, the hospital employees would direct a winning bidder (a distributor or sub-agent) to prepare its bid plus two additional bids for other manufacturers to "meet the three-bid requirement of public tenders and give the appearance of legitimacy." According to the SEC, Philips China "district sales managers, sales employees, and employees in the technical group that supported sales" participated in these specified types of misconduct.

While the SEC did not allege any anti-bribery violations, it did allege that a Philips China district sales manager delivered the "equivalent" of $14,500 to the home of a director of a hospital's radiology department after the hospital had taken steps to increase the likelihood of Philips' devices being selected for a procurement award. Philips China eventually won the award, worth $4.6 million.

The SEC considered Philips' completed and ongoing remedial efforts, which included "structural improvements to its policies and procedures; improving its tone at the top and the middle, with a focus on Philips China; increased accountability for enforcing compliance policies by its business leaders; highlighting compliance as a key component of ethical business practices; terminating or disciplining Philips China employees involved in the conduct described above; and terminating business relationships with distributors involved in the previously described misconduct. The Order notes that Philips revised its compliance training and "improved its internal accounting controls relating to distributors, bidding practices, and the use of discounts and special pricing."

Key Takeaways

- SEC Charged Philips for Similar Conduct 10 Years Ago. In 2013, the SEC fined Philips more than $4.5 million when the company's subsidiary in Poland, Philips Polska sp. z o.o. (Philips Poland) violated the FCPA from 1999 through 2007. In 2007, Philips became aware of improper employee conduct when Polish officials searched three Philips Poland offices and arrested two Philips Poland employees. The SEC stated in its Order that Philips Poland made improper payments to Polish healthcare officials "to increase the likelihood that public tenders for the sale of medical equipment would be awarded to Philips." When Philips conducted an internal audit and investigation, it terminated and disciplined several Philips Poland employees and implemented new management. Philips made changes to its internal controls by establishing strict due diligence procedures for retaining third parties. Philips also reformed its contract processes when it "formalized and centralized its contract administration system and enhanced its contract review process and established a broad-based verification process related to contract payments." Additionally, the company implemented an anti-corruption training. Noting the prior efforts by Philips, Charles Cain, Chief of the SEC Enforcement Division's FCPA Unit, stated that "[d]espite remediation done in connection with its prior violations, Philips nevertheless failed over the course of several years to implement sufficient internal accounting controls with respect to its sales of medical technology products in China." The SEC notes this failure in its 2023 Order: "Philips China did not enforce certain of its due diligence and training procedures for the engagement of distributors or conduct adequate testing in high-risk areas of sales to identify control failures." It is unclear if or how the SEC took into account Philips' past misconduct in setting the civil penalties or self-reporting requirements. The DOJ has made clear that when evaluating prior corporate misconduct to enforce the FCPA, resolutions regarding misconduct that were made within 10 years are to be given the most weight and resolutions regarding misconduct that were made over 10 years ago are considered but given less weight.

- Philips to Self-Report for Two-Year Term. Rather than engaging in a monitorship, Philips will self-report to the SEC over a two-year period, with an emphasis on specific topics: "The reports will focus particularly on due diligence on prospective and existing third-party consultants and vendors, FCPA training, and the testing of relevant controls, including the collection and analysis of compliance data." The SEC Order stipulates that if Philips comes across "credible evidence, not already reported to Commission staff, that corrupt payments or corrupt transfers of value to a foreign official may have been offered, promised, paid, or authorized by [Philips], or any entity or person while acting on behalf of [Philips], or that related false books and records have been maintained," Philips should "promptly report" the conduct to the SEC. In other words, the SEC imposed a "Paragraph 6" requirement – based on the similar paragraph common in DOJ DPAs. Additionally, the SEC requires Philips "to provide its external auditors with its annual internal audit plan and reports of the results of internal audit procedures," and provide "its assessment of its FCPA compliance policies and procedures." The SEC also requires Philips to give written reports of the external auditors' response to information they were provided.

- SEC Endorses Philips Remediation to Improve "Tone at the Middle" and Business Accountability for Compliance. In listing Philips remediation, the SEC noted Philips' commitment to improving tone at the top and the middle and efforts to increase "accountability for enforcing compliance policies by its business leaders." With Philips' prior resolution and remediation efforts connected to the 2013 resolution, these efforts reflect a next step in compliance program sophistication and effectiveness.

Gartner Settles with SEC Over FCPA Violations in South Africa

On May 26, 2023, U.S. consulting firm Gartner, Inc., settled with the SEC for $2.46 million over the SEC's allegations that the company had violated the FCPA's anti-bribery and accounting provisions. According to the SEC's Cease-and-Desist Order, a former Gartner manager authorized payments to a South African consultant connected to efforts to obtain business from a South African government entity. Gartner neither admitted nor denied the SEC's findings but agreed to pay $856,765 in disgorgement and prejudgment interest, as well as a $1.6 million civil penalty.

The SEC stated that in December 2014, one of the Gartner's local South African sub-agents notified Gartner of a chance to bid for a contract with the South Africa Revenue Service (SARS). The opportunity came through a private company unnamed in the SEC's Order. Executive leaders from the private company and sub-agent drew up proposed terms for the SARS project and discussed them with SARS senior officials. The SARS officers used those terms to draft a proposal request. Soon after receiving Gartner's response to the request, SARS suggested that Gartner hire the private company to qualify for the contract under South Africa's Broad-Based Black Economic Empowerment (B-BBEE) legislation. Gartner complied and was awarded the contract.

B-BBEE is a series of policies initiated in the wake of apartheid to redress inequities in economic opportunity and participation, in part by requiring South African government entities to extend preferential procurement to companies that comply with the Broad-Based Black Economic Empowerment Amendment Act of 2013. Companies pursuing government contracts receive holistic B-BBEE scores based on their percentages of Black ownership and management and promotion of related initiatives. The controlling code at the time of Gartner's conduct required Gartner to demonstrate at least 40 percent ownership by Black South Africans to achieve compliance as a B-BBEE Contributor.

The SEC noted that the former Gartner manager "explained in an email to Gartner management that, in order to win the contract, Gartner had no option but to agree to SARS' request to use" the private company. However, Gartner signed a contract that "contained no reference to the [private company] or any provisions regarding B-BBEE qualifications or requirements." Instead, the sub-agent hired several individuals tied to the private company for consulting work and separately invoiced Gartner, which passed along costs to SARS using a single line item for "professional fees." The Order also discusses a follow-up project for which SARS again required use of the private company through an opaque structure, allegedly to meet B-BBEE requirements -- even though its former contract with Gartner cited another Gartner sub-agent as the entity present for B-BBEE compliance.

The SEC stated that the former Gartner manager authorized several payments to the private company under both projects in the face of multiple red flags. The SEC noted that the manager knew "of (i) the [private company]'s executive director's close relationship to a senior SARS official; (ii) his role in introducing Gartner to SARS and in setting expectations with SARS officials; and (iii) SARS' directives to Gartner to hire the [private company] and pay it fixed percentages of the SARS contracts in order to win the contracts on a sole-source basis." The SEC also found that the manager "knew or consciously avoided knowing that the purported justification for hiring the [private company] – to qualify for the contracts under South Africa's B-BBEE legislation – was false." Thus, Gartner's former manager "knew or consciously disregarded the high probability that the [private company]'s executive director would offer, provide or promise the payments his company received" to SARS officials, "to induce the officials, in violation of their lawful duty, to award multi-million-dollar sole-source contracts to Gartner."

The Order also noted that Gartner's internal FCPA risk assessments had identified the SARS contracts as potential bribery risks, but Gartner had failed to address the misconduct due to a lack of effective anti-corruption policies regarding third party hiring and monitoring. The SEC concluded that "Gartner failed to devise and maintain sufficient internal accounting controls around identified FCPA risks relating to sales agents, consultants and third-party relationships with public sector clients."

The Order does not identify either the private company or specific SARS officials. However, South African news sources have inferred a connection to a 2018 investigation into Gartner's subcontracting with Rangewave Consulting and former SARS commissioner Tom Moyane. The South African commission responsible for that investigation recommended that Gartner's SARS contracts be voided.

The Order cited improved compliance procedures and training among its rationales for accepting Gartner's settlement offer, as well as Gartner's enhanced compliance resources. The Order also credited Gartner with self-disclosing "following press reports in South Africa" and cooperating with the SEC's investigation, including by "making foreign-based employees available for interviews in the United States, and encouraging cooperation by former employees."

Key Takeaways

- Anti-Bribery/30A Violations and Emphasis on "Knowledge": The SEC alleged the presence not only of accounting provision violations but anti-bribery (Section 30A of the Exchange Act) violations. The Order's language included an emphasis on what Gartner managers knew or consciously disregarded about various aspects of the transactions at issue – emphasizing that the FCPA's definition of "knowing" is not limited to actual knowledge, but rather to the presence of red flags or signs that, in this case, Gartner's payments would likely be offered as bribes to SARS officials.

- Corruption Concerns Related to B-BBEE: The Gartner Order marks the second FCPA enforcement action in the past year that involves alleged corruption related to South Africa's Black economic empowerment requirements, following the December 2022 ABB disposition with the DOJ and SEC. Both cases have arrived at a key moment given the increased corruption concerns and heated debate surrounding B-BBEE this year — particularly considering the SEC's findings that SARS officials recommended Gartner hire the private company to qualify for a contract under B-BBEE. South Africa issued temporary updates to its preferential procurement policy that took effect in January and introduced a draft Public Procurement Bill four days before the SEC's Gartner decision. Additionally, in 2015, the SEC resolved allegations of corruption related to the B-BBEE with Hitachi; in that case, the SEC found that Hitachi selected B-BBEE partners as vehicles for political influence. Notably, the Hitachi allegations, like those relevant to the ABB resolution (and an ongoing forfeiture matter), involved Eskom, South Africa's government-owned public utility.

Actions Against Individuals

Former General Counsel for PDVSA Sentenced for Money Laundering

On June 12, 2023, Alvaro Ledo Nass, a former official at Venezuela's state-owned and -controlled oil company PDVSA was sentenced to three years in prison followed by three years of supervised release and fined $7,500 for conspiracy to commit money laundering. The sentence follows a plea agreement where he pled guilty of the cited charges in February 2023.

According to the related factual proffer, between 2011 and 2015, Nass held various positions in PDVSA and its subsidiaries, including Secretary of the Board and General Counsel. Between 2012 and 2017, Nass and his co-conspirators "exploited… Venezuela's fixed foreign currency exchange rate, which accorded Venezuelan Bolivars an artificially high value compared to the open foreign currency exchange market," creating "illegal profits" that were "paid as bribes to those involved in obtaining the loan contracts, including the defendant, who agreed to let the loan approval process proceed and to distribute the funds to certain of the co-conspirators involved in approving the contract."

For his participation in the scheme, Nass received a portion of the illicit proceeds totaling over $11 million. He then engaged in various transactions involving property acquired using these criminal proceeds in Florida. The plea agreement established that there would be a forfeiture money judgment of up to $11,510,025 and all assets on deposit in certain accounts under the names of Central Investment Holdings L.P., Vermon Global Inc., Nass.

The Nass sentencing is the latest in a long-running series of DOJ prosecutions of former Venezuelan officials linked to PDVSA, many of which have been conducted as part of the DOJ's "Operation Money Flight." We discussed similar cases in past FCPA Reviews, including here and here.

Former NGO Head Cary Yan Sentenced to Three and a Half Years for Paying Bribes to Marshall Islands Officials

On May 16, 2023, the DOJ announced that an SDNY federal court sentenced former NGO president Cary Yan to three years and six months of imprisonment for conspiracy to violate the anti-bribery provisions of the FCPA. Yan and Gina Zhou, his assistant, were indicted in August 2020 on allegations that they bribed government officials in the Marshall Islands in exchange for supporting legislation that would create a semi-autonomous region within the Marshall Islands, which would have benefitted Yan's business interests. Yan and Zhou met with Marshall Islands officials as representatives of the NGO, which media sources identify as the World Organization of Governance and Competitiveness (WOGC). WOGC was created in 2016 with a mission focused on improving governance and enhancing competitiveness in developing countries through capacity building, sharing of best practices and promotion of public-private partnership. As previously reported, in September 2022 Yan and Zhou were extradited from Thailand and in December 2022 pled guilty to one conspiracy count each. In February, Zhou was sentenced to two years and three months, which was equivalent to her time served.

DOJ Agrees to Sever FCPA Charges Against Samuel Bankman-Fried to Avoid October 2023 Trial Delay; FCPA Trial Now Scheduled for March 2024

On March 27, 2023, the DOJ filed a second superseding indictment against Samuel Bankman-Fried, the former founder and CEO of the bankrupt cryptocurrency exchange FTX, adding a charge of conspiracy to violate the FCPA to the litany of criminal charges in the previous indictments. On May 8, 2023, Bankman-Fried filed a motion arguing that the FCPA charges should be dismissed for failure to properly allege the business nexus element of an FCPA anti-bribery violation and on "rule of specialty" grounds. The rule of specialty is an international law principle which limits a nation that is seeking to prosecute a defendant obtained by extradition to trying the defendant for only those charges for which the extradition was initially granted. Charges brought post-extradition may be dismissed based upon this rule in certain circumstances. In his reply brief, Bankman-Fried further sought the remedy of severing the FCPA charge in the alternative.

While the DOJ promptly notified the Bahamian executive authorities of its intent to seek a "specialty waiver," Bankman-Fried filed a motion in Bahamian court seeking the right to "make representations" to the Bahamian executive authorities on whether they should grant the specialty waiver. The Bahamian court granted Bankman-Fried leave to file "an application for judicial review" and enjoined the Bahamian executive authorities from deciding on the DOJ's specialty waiver request until the court resolved litigation on Bankman-Fried's motion. Instead of waiting for the pending litigation in the Bahamas to play out, which could have delayed Bankman-Fried's scheduled October 2, 2023 trial date, the DOJ consented to the severance of the FCPA charges. The FCPA charges are now scheduled for trial on March 11, 2024, per the trial court's June 15, 2023 order.

On June 27, 2023, the trial court issued a memorandum opinion ruling on Bankman-Fried's motion to dismiss. The court held that the rule of specialty generally may only be invoked by the "asylum state," in this case the Bahamas. The court found that Bankman-Fried lacked standing as an extraditee to seek relief for non-compliance with the U.S.-Bahamian extradition treaty because the treaty lacks specific language to grant the extraditee a right of action through private enforcement. With respect to his motion to dismiss the FCPA charge "on the [basis] that [the indictment] fails to state an offense and that its allegations are defective as a matter of law," the court held that the relevant language in the indictment was sufficiently pleaded at this stage of the proceedings, allowing the charges to move forward.

International Developments

European Commission Unveils Newly Proposed Anti-Corruption Directive

The European Commission and the High Representative for Foreign Affairs jointly submitted a proposed draft anti-corruption directive to the European parliament on May 3, 2023. The Commission and High Representative announced this proposal for increased anti-corruption measures in the EU after EU President Ursula von der Leyen's State of the Union address on September 14, 2022. Von der Leyen's speech advocated for a greater commitment to fighting corruption throughout the EU following the "Qatargate" scandal in Europe. The proposed directive will require passage by the EU parliament and the European Council before entering into force, so there are no imminent changes.

The proposed directive emphasizes three key elements to fighting corruption. First, it suggests there must be stronger communication on corruption, including an EU network against corruption that would cultivate the exchange of best practices and guidance. Second, the proposal requires Member States to establish stronger rules and better enforcement against corruption by having specialized anti-corruption bodies and fostering a culture of integrity. Third, the proposed directive calls for the harmonization of the definitions of corruption (and related offenses) in criminal prosecution, sanctions for criminal violations, and enforcement action for corrupt practices.

Key Takeaways

- Specialized Anti-Corruption Bodies: Importantly, under the draft directive, all Member States should ensure that they have specialized anti-corruption bodies. The directive seeks to establish a culture of integrity by raising awareness of corruption and ensuring that there is accountability for actions that might vitiate corruption. Creating anti-corruption agencies would provide more resources and training for the authorities responsible for detecting corruption and handling it. A study conducted by the EU found that responsibilities and enforcement actions of anti-corruption authorities currently vary drastically. Creating specialized bodies should yield more responsibility and accountability in addressing corruption throughout the EU. Article 4 of the proposal states that anti-corruption bodies must be transparent, known to the public, and function independently from the government.

- Harmonization: The draft directive encourages the harmonization of both the definition of corruption for criminal prosecution and the subsequent actions taken against corruption. Articles 7-14 of the draft directive define the relevant offenses in detail. EU Member States all include bribery of public officials as a form of corruption in their national legislation, but the draft directive would also require Member States to include misappropriation, trading in influence, abuse of functions, obstruction of justice, enrichment from corruption offenses, and aiding and abetting to their lists. Additionally, the directive suggests expanding the definition of "public official" from the 1997 EU Directive to explicitly state that public officials include "...persons working in third countries, international organizations, including the institutions of the European Union, and national and international courts." With the harmonization of the expanded definition of corruption, the proposed directive would raise the level of scrutiny for many Member States with weaker regulations on corrupt practices, such as for the two Member States without trading influence as an offense and the 17 Member States without illicit enrichment as an offense.

- Scope of Penalties: As noted, the draft directive also aims to establish some consistency in the consequences for violating anti-bribery laws. Articles 15-17 would impose imprisonment term ranges and regulations on the sanctions of legal and natural persons. As for sanctions, natural persons found guilty of corruption will be excluded from the ability to hold office or acquire public benefits and disqualified from commercial activities, among other restrictions. Sanctions on legal persons will be equal to no less than five percent of their total worldwide turnover in the business year the person has been charged. On the topic of corporate criminal law, under the proposed directive, any natural person that acts with actual authority to represent, make decisions, or exercise control on behalf of the corporation can be held personally liable and attaches liability for corruption under their authority to the corporation.

If passed, the proposed directive would be only a baseline for anti-corruption action in the EU. Several Member States already have anti-corruption regulations in place, such as the French Sapin II and the German Gesetz zur Bekämpfung der Korruption. However, a significant number of Member States would need to adjust their anti-corruption practices to comply with the rules of the new directive, if passed.

First Acquittal under Canada's Corruption of Foreign Public Officials Act

On March 7, 2023, Ontario Superior Court of Justice Judge Rita-Jean Maxwell released a written explanation for her January 16, 2023, acquittal of Damodar Arapakota, the former CEO of Toronto-based Imex Systems Inc., who was charged in 2020 with violating the CFPOA. The decision provides important insight into standards for conviction under Canada's version of the FCPA.

The charges stemmed from a December 2015 trip to New York City and Orlando that Arapakota arranged and paid for, in part, on behalf of Dr. Omponye Coach Kereteletswe, an official of the Government of Botswana. The value of the trip, which also included the families of both men, was estimated at $40,000, of which $20,000 was attributed to flights and hotels, with the rest comprised of meals, attractions, trip insurance, and certain retail purchases. Kereteletswe ultimately reimbursed Arapakota for $15,000, in cash, explaining that infrastructure issues in Botswana made consistent access to bank accounts difficult. The Crown alleged that in exchange for the trip, Kereteletswe provided Arapakota with letters confirming that the Government of Botswana intended to hire Imex Systems to complete an e-services project for which Imex had previously served as a subcontractor.

Arapakota was charged with violating section 3(1)(a) of the CFPOA, which makes it a crime for any person who "in order to obtain or retain an advantage in the course of business, directly or indirectly gives offers or agrees to give or offer a loan, reward, advantage or benefit of any kind to a foreign public official or to any person for the benefit of a foreign public official... as consideration for an act or omission by the official in connection with the performance of the official's duties or functions."

In its decision acquitting Arapakota, the court clarified several components of the CFPOA and the standards for conviction under section 3(1)(a). To prove guilt beyond a reasonable doubt, the Crown must demonstrate that the accused:

- Directly or indirectly gave, offered, or agreed to give or offer a loan, reward, advantage, or benefit of any kind

- To a public foreign official or to any person for the benefit of the public foreign official

- In order to obtain or retain an advantage in the course of business

- As consideration for an act or omission by the official in connection with the performance of the official's duties or functions

The Court further elaborated that, section 3(1)(a) "requires proof of subjective fault as the requisite mens rea for the offense," i.e., that Arapakota "intentionally offered or conferred a benefit, reward, or advantage to Kereteletswe; that he did so knowing that Kereteletswe was a public foreign official; that he knowingly or intentionally bestowed the benefit on Kereteletswe as consideration for official acts done by Kereteletswe; and that he did so for the purpose of, or in order to obtain or retain an advantage in the course of his business (regardless of whether a business advantage was actually realized, or whether the business advantage would have been received without the consideration)."

Interestingly, the court's finding regarding the scope of section 3(1)(a) of the CFPOA, that there must be a quid pro quo to satisfy the consideration prong, contrasts with section 3(1)(b), which the court suggests does not contain such a requirement. The court also clarified that the benefit provided under section 3(1)(a) must either provide a "material or tangible gain" or a "material economic advantage."

While the court found that Arapakota had in fact provided a material benefit to a public foreign official, given that Arapakota conducted all of the logistics planning and the reimbursement was unlikely to have covered the total expenses of Kereteletswe and his family, the largely circumstantial evidence presented failed to demonstrate beyond a reasonable doubt that this benefit was provided in order to obtain or retain and advantage in business or as consideration for the letters provided. According to the court, "[a] temporal connection, and the fact that the letters were generally helpful to Arapakota and Imex, does not establish the element of "as consideration for" specified in s. 3(1)(a) of the CFPOA." The court also stated that "the evidence does not establish that Arapakota perceived the letters as giving him an advantage in business, such that it can be inferred that the letters were obtained in order to obtain or retain an advantage in business."

South Africa Obtains $32 Million Provisional Asset Forfeiture Order Against Former ABB Employees in Eskom Bribery Fallout

On April 20, 2023, South Africa's National Prosecuting Agency (SNPA) announced that it had secured a provisional asset forfeiture order from the High Court of South Africa against former ABB South Africa (ZAABB) employees, their wives, and Eskom subcontractors totaling 584 million rand ($32 million). This action follows December 2022 resolutions between ABB and authorities in both South Africa and the U.S., charges against the individuals and entities involved in the asset forfeiture order, and rolling power shortages in South Africa (Eskom, ABB's customer, is a state-owned power company).

Specifically, prosecutors in South Africa charged former ZAABB employees Mohammed Essop Mooidheen and Vernon Pillay and Eskom subcontractors Impulse International (Pty) Ltd and Indiwize Construction with corruption, money laundering, fraud, and forgery in relation to contracts between ZAABB and Impulse International, related to ABB's work for Eskom. The charges also apply to the wives of Mooidheen and Pillay – Raeesa Mooidheen and Aradhna Pillay, respectively – because the wives held assets that were acquired from the transactions. SNPA alleges that Mooidheen and Pillay played a role in approval decisions and the manipulation of the procurement process to award contracts to Impulse at excessive rates. In return for the favorable contracts, Mooidheen, Pillay, and their wives received payment from Impulse, laundered through Indiwize, consisting of cash and motor vehicles that were registered in the wives' names allegedly to hide the proceeds of the money laundering and fraud. The stepdaughter of Matshela Koko, Eskom's CEO at the time, served as a director at Impulse from March 31, 2016, through October 6, 2016.

All four individuals were previously arrested on criminal charges in July 2022 and subsequently released on bail.

In December 2022, the SNPA reached a settlement with ABB to resolve the corruption charges related to contracts with Eskom. ABB agreed to pay $143 million in "punitive reparations" to South Africa to resolve alleged corruption charges related to these contracts with Eskom. As previously reported, in December 2022, ABB also settled with the DOJ and SEC to pay over $460 million in penalties as part of a three-year DPA in connection with charges of violating the FCPA.

SICPA Convicted of Criminal Liability for Bribery of Public Officials in Brazil, Colombia, and Venezuela

On April 27, 2023, the Office of the Attorney General of Switzerland (SOAG) announced that SICPA SA, a global provider of security inks as well as secured identification, traceability, and authentication solutions, had been convicted of criminal liability via a penalty order in connection with acts of corruption.

According to the SOAG press release, SICPA "has acknowledged that it failed to take all necessary and reasonable organisational precautions to prevent bribes to foreign public officials." These deficiencies permitted "employees of SICPA to bribe public officials in the conduct of business in Brazil, Colombia and Venezuela."

The penalty order included a fine of CHF 1 million (approximately $1.1 million) and a claim for compensation of CHF 80 million (approximately $89 million).

The SOAG also announced that a former sales manager of SICPA was sentenced to a conditional prison term of 170 days for paying bribes to high-ranking officials in Colombia and Venezuela in 2009. By contrast, criminal proceedings against SICPA's CEO (and main shareholder) were discontinued, although he was ordered to bear a portion of the costs of the proceedings.

A side letter from the SOAG stated that SICPA "did not take all necessary and reasonable organisational measures to prevent employees and consultants from violating the law" but that since the infractions, the company has "voluntarily and fully remedied this organizational deficiency."

In a press release issued the same day, SICPA noted that the investigation had been opened in 2015 and covered its "organizational deficiencies" for the period of 2008-2015. SICPA's release noted the "absence of penal measures in the countries where the offences were allegedly committed," and specifically that the individuals who actions had led SICPA to enter into a Leniency Agreement with Brazil's Office of the Comptroller-General (CGU) and the Attorney General's Office (AGU), on June 7, 2021, had been acquitted in 2022. SICPA also mentioned that the "other two countries" – presumably Colombia and Venezuela – had not prosecuted SICPA.

French Anti-Corruption Agency Presents Study Analyzing Regulatory Frameworks on Business Integrity

In May 2023, the AFA published a study analyzing the French, American, and U.K. legal frameworks for the prevention of national and foreign corruption. To make the comparison more comprehensive, the AFA also included soft law considerations, analyzing the World Bank Group's compliance and integrity guidelines.

The study summarizes the requirements and offences of each jurisdiction. The document then analyzes and contrasts the corruption prevention and detection measures defined or suggested for each country, describing how compliance program elements had been understood and developed in France, the U.K., the U.S., and in the World Bank Group's guidance. For example, it analyzes the standards for senior management commitment, the characteristics of an effective compliance function, and how to draft corruption risk mapping.

The AFA also includes an overview of corruption prevention measures, such as criteria applicable to the implementation of Codes of Conduct, standards for gifts and hospitality, requirements for management of conflicts of interest, controls for sponsorships and charitable donations, provisions on facilitation payments, training and monitoring practices and third party due diligence, and M&A due diligence considerations. In addition, the AFA guide addresses whistleblowing channels, investigation procedures, accounting controls, monitoring practices, and remedial actions through corrective measures and disciplinary rules.

The study provides valuable insight for multinational companies interested in a summary of their main obligations and considerations for the implementation of anti-corruption programs in France, the U.S., and the U.K.

Miller & Chevalier Upcoming Speaking Events, Recent Publications, and Podcasts

Podcasts

EMBARGOED! is intelligent talk about sanctions, export controls, and all things international trade for trade nerds and normal human beings alike, hosted by Miller & Chevalier. Each episode will feature deep thoughts and hot takes about the latest headline-grabbing developments in this area of the law, as well as some below-the-radar items to keep an eye on. Subscribe for new bi-monthly episodes so you don't miss out: Apple Podcasts | Spotify | Amazon Music | Google Podcasts | Stitcher | YouTube

Upcoming Speaking Engagements

| 08.11.2023 | ComplianceLatam Webinar: What's Up with WhatsApp? (Maria Lapetina, Leah Moushey) |

| 08.29.2023 | Bogota Chamber of Commerce: The 360° of International Arbitration (Margarita Sánchez) |

| 09.11.2023 | Export Compliance Training Institute: Export Controls Seminar Series (Timothy O'Toole) |

Recent Publications

Editors: John E. Davis, Ann Sultan,*** Daniel Patrick Wendt,*** Nicole Gökçebay,*** and Ricardo Rincón****

Contributors: Alexandra Beaulieu, Samuel B. Cutler,*** Florencia Fuentealba,* Facundo Galeano,** Abi Hollinger,*** Alexandra S. Prime,*** and Surur Fatema Yonce***

Summer Associates: Katie Cantone-Hardy, Igor Sampley dos Santos, Odessa Ernst, and Mena Sawyer

*Visiting law clerk

**Law clerk

***Former Miller & Chevalier attorney

****Former Miller & Chevalier consultant

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.