FCPA Autumn Review 2020

International Alert

Introduction

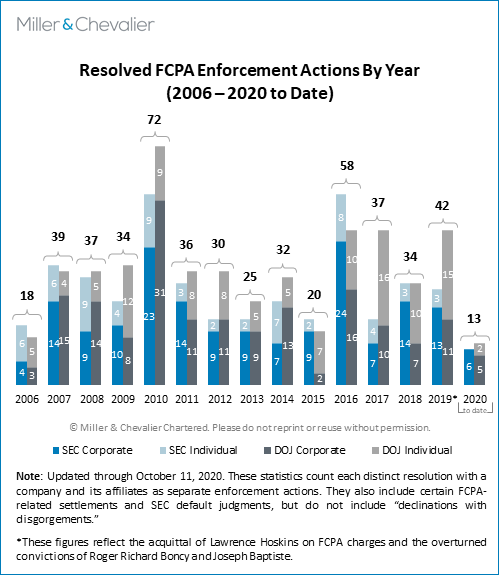

The third quarter of 2020 saw the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC) resolve four FCPA-related corporate actions, involving Alexion Pharmaceuticals Inc. (SEC), World Acceptance Corporation (SEC), Herbalife Nutrition Ltd. (SEC and DOJ), and Sargeant Marine Inc. (DOJ). While this number of resolutions is higher than the numbers generated in the first two quarters of 2020, the pace lags that of third quarters in previous years. For example, there were five corporate FCPA-related resolutions in Q3 2017, six such resolutions in Q3 2018, and seven such resolutions in Q3 2019 (see our FCPA Autumn Review 2017, FCPA Autumn Review 2018, and FCPA Autumn Review 2019).

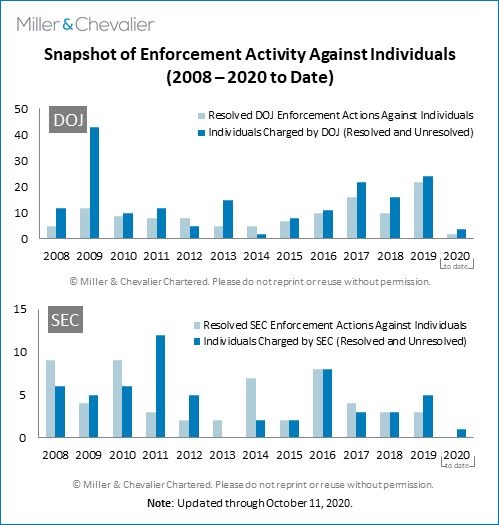

In the third quarter of 2020, the DOJ announced new FCPA-related charges against three individuals in two matters. There was also one FCPA-related sentencing. In addition, in September 2020, the DOJ disclosed six previously unannounced individual guilty pleas connected to the corporate resolution with Sargeant Marine, which we discuss in this Review below. Although the pleas were announced in this quarter, we do not count them in our charts for 2020; rather, we have included them in the respective years in which they were entered. The 2020 pace of actions against individuals is lower than the pace in third quarters in previous years. For example, in Q3 2017, there were three resolved enforcement actions against individuals, while in Q3 2018 and Q3 2019, there were four individual enforcement actions (two each by the DOJ and SEC) and eleven individual enforcement actions (i.e., six sentencings, three guilty pleas, and two settlements with the SEC), respectively.

It is likely that the ongoing challenges of COVID-19 have affected the pace of enforcement activity this quarter, though it is also clear that the agencies are continuing to adapt and push ongoing FCPA-related investigations. For example, our experience and public information show that document and data production activities in such investigations have been little hindered by pandemic-related restrictions, with the notable exception in some cases involving the collection of information from some other countries that have been substantially impacted by the virus. The agencies have moved forward with conducting remote interviews in some cases, and also are moving forward in some instances with in-person interviews – though the conditions for those have been the subject of sometimes intensive negotiations between the agencies and counsel. And it appears that the agencies are continuing efforts to keep companies focused on FCPA-related issues – one example from Q3 2020 is the issuance of the DOJ's first Opinion Procedure Release in almost six years.

The agencies have repeatedly assured the public that they remain committed to enforcement and have predicted that the remainder of the year will see a spike in enforcement announcements similar to trends in previous years. One potential early indicator of this trend is the October 14, 2020 announcement of FCPA-related dispositions by the DOJ and SEC involving the Brazilian company J&F Investimentos S.A., which resulted in a criminal penalty of over $256 million and additional disgorgement paid to the SEC.

More significant are the announcements on October 22, 2020 of the resolution of the long-running FCPA and other legal investigations of Goldman Sachs' connections to the Malaysian 1MDB scandal. On the DOJ side, the firm's Malaysian subsidiary pled guilty to conspiracy to violate the FCPA's anti-bribery provisions, and the U.S. parent entered a deferred prosecution agreement (DPA) and agreed to pay a penalty and disgorgement of over $2.9 billion. The SEC entered a Cease-and-Desist Order with Goldman Sachs and the firm agreed to pay a $400 million civil penalty and $606.3 million in disgorgement. Goldman Sachs or its affiliates also entered resolutions with several other U.S. agencies and authorities in other countries, including the U.S. Federal Reserve, the New York State Department of Financial Services, the U.K.'s Financial Conduct Authority and Prudential Regulation Authority, several Singapore entities including the Attorney General, and the Hong Kong Securities and Futures Commission. The firm benefitted from coordinated credits among the relevant authorities for payments made to other authorities, including in earlier dispositions – for example, the SEC stated in its order and press release that the disgorgement "shall be deemed satisfied by the payment previously made to the Government of Malaysia and 1MDB pursuant to a parallel Settlement Agreement entered into by Goldman Sachs on August 18, 2020." Despite discussions by multiple authorities of shortcomings in Goldman Sachs' compliance program and internal controls, the U.S. agencies did not impose a requirement for an independent compliance Monitor. We will cover these cases in our next review.

For a further discussion of the FCPA enforcement and compliance trends during the COVID-19 era, see the article by John Davis and Ivo Ivanov, "FCPA Enforcement, Compliance Trends During the Pandemic" published in Law360 in August 2020.

The third quarter of 2020 also brought some notable policy and agency staffing developments, including, as noted above, the issuance of the first FCPA Opinion Procedure Release by the DOJ in nearly six years, in response to a request from a multinational investment advisor firm that manages private funds serving institutional investors; the adoption by the SEC of new rules governing the agency's whistleblower program; the departure of a Co-Director of the SEC's Division of Enforcement; and several personnel changes at the Fraud Section of the DOJ's Criminal Division.

There were several noteworthy international developments in this quarter as well, including the sentencing on July 23, 2020 of former Unaoil executive Ziad Akle to five years in prison for bribery and the conviction on July 28, 2020 of former Malaysian prime minister Najib Razak of seven counts of abuse of power, money laundering, and breach of trust by the Kuala Lumpur High Court. In addition, on July 9, 2020, the French Anti-Corruption Agency (AFA) published its Annual Activity Report for fiscal year 2019, which discussed the AFA's guidance and monitoring activities during 2019, highlighted the first decision issued by the AFA's Sanctions Commission in 2019, and underscored its participation in international anti-corruption cooperation efforts.

Many of the multilateral public and civil society organizations that focus on corruption have taken action or issued guidance on their views of the pandemic's effects on corruption risks. For example, the International Monetary Fund (IMF) has begun to offer COVID-19-related recovery funding and debt relief to some client countries, and confirmed in late July 2020 that such assistance will be subject to the IMF's governance and anti-corruption requirements, including steps such as conducting and making public "independent ex-post audits of crisis-related spending" and taking steps to identify companies (and, importantly, their beneficial owners) that receive "crisis-related procurement contracts" and the terms of such contracts. In response, Transparency International (TI) has instituted a project to monitor the disbursement of these IMF funds and to call out countries using these funds that are not appropriately prioritizing anti-corruption. TI is also emphasizing the importance of protecting whistleblowers, especially in these times of economic hardship, which makes disguising retaliation as the product of cost-cutting easier. On September 24, 2020, TI issued a paper tracking "Documented corruption and malfeasance cases" related to COVID-19 public spending efforts, largely based on media reports. These and other efforts could highlight FCPA-related issues of interest to the DOJ and SEC for future investigations.

We summarize this quarter's corporate enforcement actions along with their noteworthy aspects, individual enforcement actions, and other policy, litigation, and international developments below.

Corporate Enforcement Actions

As mentioned above, in the third calendar quarter of 2020, the SEC and DOJ entered into FCPA-related resolutions with four companies. The SEC settled with three companies (Alexion Pharmaceuticals, World Acceptance Corporation, and Herbalife), while the DOJ completed resolutions with two companies (Herbalife and Sargeant Marine). We note that the SEC did not bring any FCPA enforcement actions during the last month of the third quarter of 2020, a period which, based on past third quarters, is usually characterized by increased activity as the agency is getting closer to the end of the fiscal year. The ongoing challenges of COVID-19 may have affected the overall pace of enforcement activity this quarter, as we mentioned earlier.

On July 2, 2020, the SEC announced that Alexion Pharmaceuticals, a Boston-based pharmaceutical company, had agreed to pay approximately $21.5 million to resolve charges that it violated the books and records and internal accounting controls provisions of the FCPA. According to the SEC's Cease-and-Desist Order, two Alexion subsidiaries paid government officials in Turkey and Russia to improperly influence them to approve patient prescriptions and favorably influence the regulatory treatment for Alexion's primary drug, Soliris. Alexion agreed to pay approximately $14.2 million in disgorgement, more than $3.7 million in prejudgment interest, and a $3.5 million penalty. We discuss this resolution in more detail below.

On August 6, 2020, the SEC announced that the South Carolina-based consumer loan company World Acceptance Corporation had agreed to pay $21.7 million to resolve charges that the company violated the FCPA. We discuss this resolution in more detail below. According to the SEC's Cease-and-Desist Order, for more than six years, World Acceptance Corporation's former Mexican subsidiary paid more than $4 million in bribes to Mexican government officials and union officials to secure the ability to make loans to government employees. Among other things, the Order also stated that the bribes were inaccurately recorded in the company's books and records as legitimate business expenses and that the company lacked internal accounting controls sufficient to detect or prevent the payments of such bribes. The total amount that World Acceptance Corporation agreed to pay consisted of approximately $17.8 million in disgorgement, $1.9 million in prejudgment interest, and a $2 million penalty.

On August 28, 2020, the DOJ and SEC announced that Herbalife Nutrition Ltd. agreed to pay a combined total of $123 million in penalties and disgorgement to resolve FCPA-related violations in China. In its Cease-and-Desist Order, the SEC charged Herbalife with violating the books and records and internal controls provisions of the FCPA by falsely recording transactions, including making payments and providing benefits to government officials, in connection with the company's obtaining licensing approval in China. According to the DOJ's Information, Herbalife conspired to falsify its books and records and provide corrupt payments and benefits to Chinese government officials. In the SEC enforcement action, Herbalife agreed to pay $58.7 million in disgorgement and $8.6 million in prejudgment interest. In resolving the criminal charges with the DOJ, Herbalife agreed to pay a criminal penalty of $55.7 million and entered into a three-year DPA. We analyze Herbalife's resolutions with the DOJ and SEC, including their noteworthy aspects and the company's DPA, in more detail below.

On September 22, 2020, the DOJ announced that Sargeant Marine Inc., a Florida-based asphalt company, pleaded guilty to conspiracy to violate the anti-bribery provisions of the FCPA and agreed to pay a fine of $16.6 million to resolve criminal charges stemming from a scheme to pay bribes to foreign officials in three South American countries. As part of the disposition, the DOJ conducted an "inability to pay" analysis of Sargeant Marine's financial condition that resulted in a decrease of the penalty amount from $90 million to $16.6 million. The public documents state that, for about eight years, the company paid millions of dollars to foreign officials in Brazil (including a government minister, a high-ranking member of the Congress, and senior executives at Petrobras), Venezuela (four PDVSA officials), and Ecuador (an official at the country's state-owned oil company) to secure contracts related to asphalt purchases and sales to and from the countries' state-owned and state-controlled oil companies. The bribes resulted in profits for Sargeant Marine and its affiliated companies amounting to more than $38 million, according to the Sargeant Marine Information.

Corporate Investigations Closed without Enforcement Actions

Following our practice from past years, Miller & Chevalier has tracked throughout the third quarter of 2020 investigations closed without an enforcement action, i.e., known investigations that the DOJ and the SEC have initiated but closed without a DPA, NPA, Cease-and-Desist Order, guilty plea, jury conviction, or other final enforcement procedure.1

Miller & Chevalier tracked three FCPA-related investigations announced publicly as closed without enforcement action.2 First, on August 5, 2020, the DOJ issued a formal declination letter to World Acceptance Corporation. The next day, the SEC announced its FCPA resolution with the company, as we discuss in greater detail below.

Then, on August 6 2020, KBR announced that the DOJ, SEC, and the U.K.'s Serious Fraud Office (SFO) were no longer investigating the company's ties to the Monaco-based consultancy Unaoil. KBR had disclosed in a 10-Q report in April 2016 that the authorities had initiated investigations into the company's relationship with Unaoil in connection with alleged bribes to government officials in exchange for contracts.

Lastly, GlaxoSmithKline (GSK) also announced on September 28, 2020 that the SEC and DOJ had closed inquiries (on March 8, 2020 and May 4, 2020, respectively) the agencies had initiated in 2018 in connection with third-party advisers the company had hired in China. The DOJ and SEC had made their inquiries after GSK informed the SEC and DOJ that the SFO had sought additional information as part of the investigation into the company, which the SFO had started in May 2014. In September 2016, GSK had settled with the SEC allegations that the company had violated the FCPA.

Known FCPA Investigations Initiated

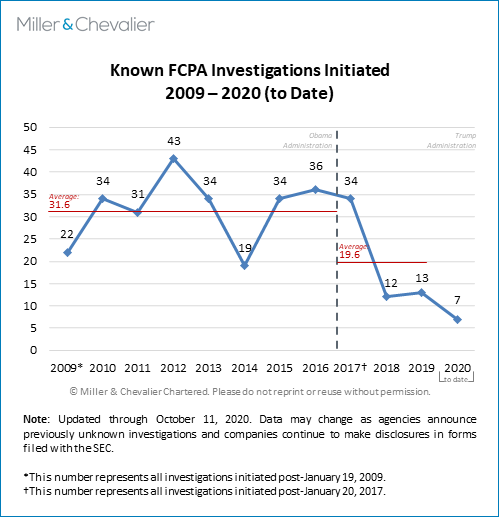

As we have discussed in our previous FCPA Reviews in 2020, available public information indicated that only four FCPA-related investigations were opened during the first half of 2020. We noted that this low number (as compared to the long term figures) was consistent with a decline in announced FCPA investigations since 2016-2017.

In the third quarter of 2020, however, at least three companies disclosed new or potential FCPA-related investigations. First, on July 24, 2020, Johnson & Johnson disclosed that the DOJ and SEC have initiated FCPA-related inquiries into the company in connection with an investigation in Brazil. Second, on September 8, 2020, Pactiv Evergreen Inc. (Pactiv) disclosed that it had identified and disclosed voluntarily to the DOJ and SEC "certain practices in the company's Evergreen Packaging Shanghai business ... that involved acts potentially in violation of the FCPA." Pactiv, however, did not indicate in its disclosure whether the DOJ or SEC or both agencies had initiated investigations into the companies. Lastly, on October 8, 2020, Smith & Nephew plc, a Watford, England-headquartered multinational medical equipment manufacturer, disclosed in an SEC filing that the company "is investigating allegations of possible violations of anti-corruption laws in India and responding to related requests for information from the SEC."

As has been our practice in the past, we note here that the figures for investigations initiated in the third quarter of 2020 are based on incomplete information. We are likely to learn of more investigations launched in 2020 in the coming weeks and months, as companies disclose such information in their public disclosure filings or as journalists acquire relevant statistics through FOIA requests. Our investigation statistics are necessarily incomplete because neither the DOJ nor the SEC disclose official investigations statistics in real time and only some companies choose to disclose such information through SEC filings or other means.

Individual Enforcement Actions

The chart below shows snapshots of enforcement activities against individuals by the DOJ and SEC, respectively. As can be seen from the chart, during the third quarter of 2020, the SEC did not resolve any FCPA enforcement actions against individuals; however, one individual was sentenced and the DOJ brought FCPA-related charges against three other individuals (two of whom are part of an ongoing investigation in which DOJ has previously charged another individual, as noted below). As noted above, the six previously undisclosed guilty pleas in connection with the recent corporate resolution with Sargeant Marine have been added to their relevant time frames in terms of numbers on the chart.

On July 20, 2020, Edward Thiessen, the former senior executive in Indonesia for Alstom S.A., received a sentence of time-served for his role in an alleged scheme to bribe Indonesian government officials, which reflected his extensive cooperation in the DOJ's investigation of Thiessen's former Alstom colleague, Lawrence Hoskins, who was found guilty of various offenses. (See FCPA Winter Review 2020.) We discuss this sentence and related issues below.

On August 17, 2020, in addition to the charges that the DOJ had already brought against Robin Longoria in August 2019, the DOJ brought FCPA-related charges against Dorah Mirembe and Debra Parris in the Uganda-related adoption bribery scheme to corruptly facilitate adoptions of Ugandan children through bribing Ugandan officials and defrauding adoptive parents in the U.S. According to the indictment, Mirembe and Parris were charged with one count of conspiracy to violate the FCPA, three substantive FCPA charges, and other criminal charges. Another defendant was charged with conspiracy to defraud a U.S. agency.

On September 22, 2020, the DOJ announced that Javier Aguilar, an oil trader at the U.S. subsidiary of a multination oil distributor and trading company, had been criminally charged in connection with his alleged participation in a five-year Ecuador bribery scheme involving corrupt payments to Ecuadorian officials. Specifically, Aguilar was charged with conspiracy to violate the anti-bribery provisions of the FCPA and conspiracy to commit money laundering "for his involvement in a scheme to pay approximately $870,000 in bribes to Ecuadorian government officials in exchange for their assistance to help Aguilar's employer secure a $300 million contract for fuel oil from Ecuador's state-owned oil company." According to press reports, Aguilar was formerly employed by Vitol, which itself has been reported in the media as potentially under investigation.

We discuss the September DOJ announcements regarding the prior guilty pleas by individuals related to the Sargeant Marine investigation as part of our general discussion of the matter below.

Policy and Litigation Developments

We note three significant policy and litigation developments during the third quarter of 2020.

First, on August 14, 2020, the DOJ published its first FCPA Opinion Procedure Release (Opinion) since November 7, 2014, in response to a request from a multinational investment advisor firm that manages private funds serving institutional investors (Requestor). According to the Opinion, the Requestor entered into negotiations with a foreign subsidiary of a foreign investment bank indirectly owned by a foreign government to purchase a portfolio of assets in 2017. The Requestor later engaged a second foreign subsidiary of the bank to assist with the negotiations, to which the Requestor paid a fee of $237,500 or 0.5 percent of the value of the assets purchased after the transaction was completed in 2019. The DOJ determined that it "does not presently intend" to bring an enforcement action, noting, among other things, that there were no signs of improper diversion of the payment to any individuals and that the payment was "commercially reasonable" and "commensurate with" the "specific, legitimate services" that the payee provided in relation to the transaction. We discuss the Opinion in more detail below.

On September 23, 2020, the SEC adopted amendments to its Whistleblower Program, which was established under the Dodd-Frank legislation. The amendments will become effective 30 days after publication in the Federal Register. According to the SEC's press release, the rules "are designed to provide greater clarity to whistleblowers and increase the program's efficiency and transparency." The amendments provide a revised whistleblower definition and whistleblower protections against retaliation only for individuals who make written reports to the SEC. They also include provisions to facilitate faster resolution of non-meritorious whistleblower claims and clarify that DPAs and NPAs (which are commonly used in FCPA-related dispositions), among other types of resolutions, could be a basis for a whistleblower award.

In addition, the SEC's Office of the Whistleblower published interpretive staff guidance regarding the process for determining award amounts for eligible whistleblowers "to provide additional efficiencies, as well as clarity and transparency in the award determination process." The guidance clarifies that in order to qualify as "independent analysis," the whistleblower's submission must provide "evaluation, assessment, or insight beyond what would be reasonably apparent to the Commission from publicly available information." The SEC amendments also affirm that award amounts are to be determined exclusively based on the application of the award factors set forth in the agency's whistleblower rules. Lastly, the amendments grant the SEC authority to adjust small awards as well as to clarify the Commission's discretion in determining awards.

Finally, we reported in our FCPA Spring Review 2020 that in March 2020, following their convictions of FCPA-related and other charges in connection with a Haitian bribery scheme, U.S. District Judge Allison Burroughs granted Roger Boncy and Joseph Baptiste a new trial based on ineffective assistance of Baptiste's trial attorney. On September 18, 2020, the DOJ appealed Judge Burroughs's order to the U.S. Court of Appeals for the First Circuit. In its brief, the DOJ argued that the district court had failed to properly apply the prejudice standard in Strickland v. Washington, 466 U.S. 668 (1984), according to which "[w]ithout proof of both deficient performance and prejudice to the defendant, 'it cannot be said that [a] conviction . . . resulted from a breakdown in the adversary process that renders the result unreliable.'" According to the DOJ, "in granting Baptiste's motion for a new trial, the district court effectively reached that conclusion based on deficient performance alone." The DOJ pointed out that the court had not identified "any specific materials, witnesses, or avenues for cross-examination that would have undermined confidence in the jury's verdict."

The DOJ further argued that the district court had also erred in ruling that Boncy was prejudiced by Baptiste's counsel's deficiencies. The DOJ pointed out that the district court and Boncy had failed to identify a single case where a court had granted a defendant relief based on the ineffective assistance of another defendant's counsel. Furthermore, citing to United States v. Sabatino, the DOJ argued that the Court of Appeals for the First Circuit had expressly considered and rejected such a claim in the past on the ground that the Sixth Amendment right to counsel is "personal in nature and cannot be asserted vicariously."

DOJ and SEC Staffing Changes

There were several recent noteworthy staffing changes at the Fraud Section of the DOJ's Criminal Division. In early September, the DOJ appointed Daniel Kahn as the acting Chief of the Fraud Section. Kahn replaced Robert Zink, who became the Acting Deputy Assistant Attorney General tasked with oversight of the fraud and appellate sections in the Criminal Division. Zink took over from John Cronan, who was confirmed as a federal judge in August 2020. Christopher Cestaro is the Chief of the Fraud Section's FCPA Unit.

SEC Division of Enforcement Co-Director Steven Peikin departed in August to return to private practice. The SEC announced that Stephanie Avakian, the former Co-Director with Peikin, will remain as the sole Director of the Enforcement Division.

International Developments

There were several noteworthy international anti-corruption related developments in the third quarter of 2020, some of which we discuss in more detail below.

On July 23, 2020, a London court sentenced former Unaoil executive Ziad Akle to five years of imprisonment for his role in paying $500,000 in bribes to secure a $55 million contract in post-war Iraq. According to the U.K. SFO, Akle and other conspirators funneled bribes to public officials at Iraq's state-run South Oil Company to secure the contract. A jury previously found Akle and his alleged co-conspirator Stephen Whiteley of Unaoil guilty on two counts of conspiracy to make corrupt payments.

On July 28, 2020, the Kuala Lumpur High Court found former Malaysian prime minister Najib Razak guilty of seven counts of abuse of power, money laundering, and breach of trust, related to the allegations that he illicitly received millions of dollars from the 1Malaysia Development Berhad (1MDB) fund. Mr. Najib claimed no wrongdoing and argued that the Malaysian financier, Jho Low, misled him regarding the funds, and that Mr. Najib believed the money transferred to his personal bank account to be a gift from a Saudi royal. As covered in our FCPA Spring Review 2020, Mr. Low is alleged to have led the money laundering and bribery scheme related to 1MDB overall.

On July 9, 2020, the French Anti-Corruption Agency (AFA) published its Annual Activity Report for fiscal year 2019, as required under France's 2016 anti-corruption legislation, known as Sapin II. The Report highlighted the AFA's guidance and monitoring activities during 2019, noting that it had conducted 36 new audits of regulated companies' anti-corruption compliance programs, including three global audits of CAC 40 companies, 50 training sessions, and nearly 70 awareness raising interventions. The Report also highlighted the first decision issued by the AFA's Sanctions Commission in 2019 and underscored its participation in international anti-corruption cooperation efforts. Specifically, the AFA received 43 foreign delegations, strengthened partnerships with the World Bank and the Inter-American Development Bank, and consolidated coordination with the prosecutors in the United Kingdom, the United States, and France.

Corporate Enforcement Actions

Pharmaceutical Company Alexion Resolves SEC Charges

As mentioned in our FCPA Summer Review 2020, on July 2, 2020, the biopharmaceutical company Alexion Pharmaceuticals Inc., (Alexion), a Nasdaq-listed "issuer," reached an agreement with the SEC to pay approximately $21.5 million to resolve alleged violations of the accounting provisions of the FCPA. Alexion had publicly disclosed the agreement in its corporate filings back in May 2020. As set out in the Cease-and-Desist Order (Order), the SEC alleged that Alexion violated the FCPA when (a) its books and records did not accurately reflect certain expenses and payments, including improper payments to foreign officials and third parties made by subsidiaries in four different countries; and (b) the company "failed to devise and maintain sufficient internal account controls over the payments to foreign officials and third parties," which allowed improper payments to be made for several years. Without admitting or denying the SEC's findings, Alexion agreed to pay the SEC a $3.5 million civil penalty, along with over $14.2 million in disgorgement and over $3.7 million in prejudgment interest.

According to Alexion's corporate filings, the SEC initiated an investigation in 2015 into Alexion's grant-making activities and FCPA-related compliance worldwide, particularly focused on Brazil, Colombia, Japan, Russia, and Turkey. The SEC Order states that wholly owned subsidiaries of Alexion in Turkey, Russia, Brazil, and Colombia – whose books and records were consolidated into Alexion's own financial statements – made improper payments to foreign officials which they recorded inaccurately. Notably, the Order makes no mention of activities in Japan.

According to Alexion, a parallel DOJ inquiry resulted in no action.

The Order focuses on the alleged schemes by Alexion subsidiaries in Turkey and Russia to promote Soliris, a drug Alexion developed to treat certain rare diseases and sold through a "named patient sales" (NPS) process under which physicians could request controlled, pre-approval access to certain drugs on behalf of specifically "named" patients before the drug is licensed in that country.

Turkey

As described in the Order, the NPS process in Turkey required government approvals at several stages of the treatment process for each patient – such as an approval for a specific patient requesting the treatment, for each prescription payment, and for the continued treatment of each patient. In addition, the drug faced various regulatory hurdles.

According to the SEC, obtaining approvals for Soliris through the NPS process in Turkey proved difficult for Alexion when it began in 2009. Then in 2010, a member of the Ministry of Health intimated that payments to government officials might help with the approvals. The SEC alleges that, from 2010 to 2015, Alexion Turkey made improper payments to foreign officials, including government members of the Ministry of Health as well as healthcare providers (HCPs) commissioned by the Ministry or otherwise involved in the approval process.

These alleged payments to influence government officials to treat the drug favorably were made largely through a third-party consultant that Alexion Turkey hired to assist with the approval process. The subsidiary allegedly paid the consultant, who had connections with the Ministry of Health, a total of $1.3 million over the five-year period, a portion of which the consultant conveyed to government officials as cash, meals, or gifts. The Order also states that Alexion Turkey requested third-party vendors to pay the consultant and submit falsified invoices to Alexion Turkey for reimbursement.

According to the SEC, in return for these payments, Alexion received not only approvals for drug prescriptions, but also assistance in regulatory submissions such as confidential information and advanced feedback from government officials.

The SEC also alleges that, from 2012 to 2015, subsidiary managers made payments totaling $100,000 in the guise of honoraria and grants to HCPs who served on the Ministry of Health's commissions, for which the subsidiary also gained prescription approvals as well as favorable support in regulatory matters such as treatment guidelines and reimbursement criteria for the prescriptions.

The Order alleges that Alexion was unjustly enriched by over $6.6 million through these improper payments.

Russia

In Russia, Alexion also sold Soliris through the NPS process, which involved reimbursement through regional government healthcare spending. According to the SEC, from 2011 to 2015, Alexion Russia made improper payments amounting to over $1 million to foreign officials, particularly state-employed HCPs, some of whom served in regional or federal government roles in the healthcare system. Thinking that these HCPs held authority in budgeting and regulatory matters, the subsidiary allegedly paid them for research, consulting on specific topics, and hosting educational events and activities. These payments, which the Order states that Alexion Russia improperly recorded as of honoraria, educational expenses, business meeting expenses, and scientific research, were intended to influence government budget allocations for the drug, the approval of prescriptions, and the drug's regulatory treatment.

As detailed by the Order, one HCP who allegedly received a total of $100,000 in the guise of honoraria and research payments provided the subsidiary opportunity to comment and revise draft diagnostic standards before their submission to the Ministry of Health; in addition, the Ministry of Health's budget for the HCP's region allocated 52 percent for treatment with Soliris. Alexion Russia also allegedly paid two other HCPs who were responsible for providing the Ministry of Health with a list of rare diseases for treatment and advice on Alexion's application for inclusion on the list of drugs for treating certain diseases. In return, the SEC stated that Alexion Russia received support in funding and reimbursement matters, as well as favorable treatment under regulatory standards.

The SEC alleges that Alexion was unjustly enriched by $7.5 million through these improper payments over four years.

Brazil and Colombia

The SEC Order also states that from 2013 to 2015 certain employees of the Alexion subsidiaries in Brazil and Colombia created or maintained inaccurate or inadequate books and records. Personnel from those subsidiaries allegedly directed third parties to create false records including fictitious invoices to cover, for example, personal expenses – including for alcohol and travel – of a manager of the Brazil subsidiary. Certain kinds of records for numerous financial transactions were also not regularly maintained at both subsidiaries. According to the Order, certain employees of the Brazil subsidiary also destroyed relevant documents.

Noteworthy Aspects

- Use of Consultants to Disguise Payment Purposes. As with many FCPA cases, this settlement illustrates the often-key roles that consultants play in effecting improper payments. The Order details various types of improper accounting and recordkeeping practices that employees at the relevant Alexion affiliates used in conjunction with third party activities to disguise the real purpose of payments. For example, in Turkey, the Order states that "managers made some of the payments to the Consultant by asking a third-party vendor to pay the Consultant and provide falsified invoices for reimbursement to Alexion Turkey." The Order continues, "[f]urther, an Alexion Turkey manager directed that the description of the Consultant's claimed expenses should be written in pencil… [to] allow the description of the expenses to be easily changed or concealed." In other instances, the Order notes that the "Consultant provided little or no explanation for many expenses, and failed to provide independent documentation for most of the purported expenses… [e]xpense documentation that was submitted often sought reimbursement for large, vague expenses (e.g., categorized only as 'other expense')."

- Consideration for Remedial Measures and Cooperation. According to Order, Alexion conducted an internal multinational investigation into the alleged conduct and a forensic accounting review, sharing the facts uncovered in regular briefings with the SEC as well as key documents. The Order also states that Alexion had made a number of remediation efforts, such as "strengthening and expanding its global compliance organization"; "enhancing policies and procedures for payments to third parties", particularly by "implementing a centralized system to track and monitor third party payments"; "revamping its HCP engagement process and oversight" by improving its internal audit function; engaging in "proactive compliance market review"; and improving its anti-corruption training provided to employees. In line with the SEC-recommended risk-based compliance approach, these measures appear to correlate directly with the risks evidenced for those particular regions. These measures appear to have satisfied the SEC to the extent that the agency decided not to impose further conditions such as a monitorship.

World Acceptance Corporation Resolves Previously Disclosed FCPA Investigation

On August 6, 2020, the SEC announced that World Acceptance Corporation (WAC) had settled charges related to its alleged FCPA violations. WAC did not admit to or deny the findings of the SEC described in the Cease-and-Desist Order (Order) and agreed to pay $21.7 million in total, including $17.826 million in disgorgement, $1.9 million in prejudgment interest, and a $2 million fine. In the Order, the SEC stated that the former Mexican subsidiary of the corporation, WAC de Mexico S.A. de C.V. (WAC Mexico), had paid over $4 million in bribes to Mexican government officials, as well as union officials, in an effort to secure and maintain business related to loans to government employees. The SEC stated in the Order that WAC violated the antibribery, books and records, and internal accounting provisions under the FCPA.

According to the Order, WAC Mexico's "Préstamos Viva" business line offered small loans to both state and federal government employees. WAC Mexico established Viva contracts with various government entities and workers unions that in turn represented government employees. The Order states that, to provide these loans, the subsidiary allegedly paid bribes that were referenced internally as the "glove" to the Mexican public officials. In addition, WAC Mexico paid numerous other payments to help guarantee that the government employees repaid the loans on time. The Order further states that the improper payments were paid via deposits in bank accounts of the officials and/or their relatives and friends. The subsidiary also hired intermediaries to assist in making these payments, and the intermediaries were paid a fee for their work based upon the amount of the bribe paid. These payments were inaccurately referred to "commission" expenses in WAC Mexico's books and records.

The SEC found that WAC did not have appropriate internal accounting controls in place to prevent such improper payments, and stated that WAC Mexico lacked "a vendor management system, did not maintain a master list of approved vendors, did not conduct formal due diligence of new vendors, and did not have formal procedures or controls in place to approve new vendors."

Ultimately, in agreeing to the resolution of the matter the SEC took into consideration a number of WAC's remedial measures, including various management changes in 2017 and 2018, such as the termination of the senior vice president of WAC Mexico, WAC's general counsel, and WAC's CEO. Additionally, WAC divested itself of the subsidiary in 2018.

Noteworthy Aspects

- DOJ Declination. The DOJ released a declination letter dated August 5, 2020 declining to prosecute WAC for related FCPA violations. The DOJ letter stated that WAC Mexico from 2010 through 2017 had made improper payments to Mexican public officials in order to obtain business to make loans to government employees. The DOJ based its decision to decline prosecution "on an assessment of the factors set forth in the Corporate Enforcement Policy" and noted, among other things, WAC's voluntary self-disclosure, the company's full remediation and cooperation in the matter, as well as WAC's agreement to disgorge improper profits to the SEC.

- Tone at the Top Issues. The SEC stated in the Order that the "tone at the top from WAC management did not support robust internal audit and compliance functions" which ultimately impeded the proper functioning of the audit and compliance groups. As an example, the agency noted that WAC's CEO at that time "terminated the vice president of audit after he raised compliance concerns, including concerns about the lack of internal accounting controls at WAC Mexico." WAC's public disclosures regarding the FCPA-related issues in 2017 noted that the company began an investigation after the company's outside auditor received an "anonymous letter" raising potential compliance issues.

Nutrition Company Herbalife Settles Allegations of FCPA Accounting Violations with SEC and DOJ for $123 Million

On August 28, 2020, Herbalife Nutrition, Ltd. (Herbalife), a Los Angeles-based, multinational nutrition company, agreed to pay U.S. regulators more than $123 million to resolve allegations of FCPA violations. As previously reported, Herbalife telegraphed the financial terms of the impending settlement in May 2020, when it announced in its 10-Q filing that it had "reached an understanding in principle" to pay $123 million to resolve foreign bribery investigations by the SEC and DOJ. In its Cease-and-Desist Order (Order), the SEC concluded that the company had violated the books and records provision of the FCPA and Herbalife agreed to pay disgorgement of $58,669,993.00 and prejudgment interest of $8,643,504.50. Under its DPA with the DOJ, Herbalife admitted to a single count of conspiracy to violate the books and records provision of the FCPA and to pay a criminal fine of $55,743,093.

The parallel settlements arose out of a series of events that date to the mid-2000s. As set out in both the SEC's Order and the Information filed by the DOJ, Herbalife China, a group of Herbalife's China-based subsidiaries, applied for their first Chinese direct selling license in 2006. A prerequisite for any company to conduct direct selling business, the license is awarded by one Chinese government agency, which in turn is required to consider input from a second government agency. According to the DOJ's Information, beginning at the end of 2006, Herbalife China provided improper benefits to officials employed by both agencies, including cash payments and gift cards.

According to the DOJ's press release and the Information, the improper benefits continued for a decade following Herbalife's receipt of its first direct selling license. The Information also states that, in addition to providing benefits to officials involved in licensing decisions and in investigations into the company's compliance with Chinese law related to those licenses at retail locations, Herbalife China employees also provided improper benefits to employees of Chinese state-owned media outlets in order to manipulate coverage of the company. More specifically, according to the public case documents, Herbalife China employees took officials from all three agencies out for expensive meals, made cash payments to officials, and provided other benefits to officials, including a shopping and spa trip, providing an official's son with a false internship reference, and opening a bank account to benefit the son of an official who worked at the bank.

The Information also states that the Herbalife China employees submitted fake invoices and expense reports to the company in order to obtain reimbursement for their expenditures on officials, framing them as legitimate expenses. The documents also note that, from 2008 through February 2017, former Herbalife China executive Yangliang Li, who participated in the false books and records scheme, regularly signed and submitted false Sarbanes-Oxley sub-certifications.

Although Herbalife did not voluntarily disclose its conduct to the DOJ, it did receive full cooperation credit and was praised for its remediation and compliance program efforts, leading the DOJ to apply a 25 percent discount to the fine. The SEC also acknowledged the company's remediation efforts. Both agencies are requiring Herbalife to engage in future cooperation with the regulators, including by providing updates on compliance measures, disclosing certain conduct to the regulators, and providing written reports to the agencies over the next three years.

Noteworthy Aspects

- DOJ Debuts Changes to DPA "Attachment C." The DOJ traditionally sets out its minimum expectations for a company's corporate compliance program in Attachment C to its DPAs. Attachment C to the Herbalife resolution differs from prior resolutions in a few respects, largely aligning it with the DOJ's updated Evaluation of Corporate Compliance Programs guidance. To highlight a few key changes, rather than focusing on a "high-level commitment" to compliance alone, the Herbalife Attachment C further emphasizes the need for a commitment from middle management and a culture of compliance at all levels of the company. It also underscores the need for risk-based assessment and due diligence on third parties and the importance of ensuring that compliance personnel have access to "sufficient direct or indirect access to relevant sources of data to allow for timely and effective monitoring and/or testing" of compliance policies, processes, and controls.

- Written Reports to SEC and DOJ. Herbalife avoided the appointment of a compliance monitor but agreed to a three-year term over which the company is required to submit written reports regarding its remediation efforts and proposals to improve its policies and procedures. Herbalife is required to submit an initial review and at least two-follow up reviews and reports, essentially self-monitoring and assessing the quality of its compliance policies and related internal controls and procedures.

- Internal Audit Received Reports Reflecting Lavish Spending But No Action Taken. As explained by the SEC, Herbalife's audit function in China regularly reviewed the expenses of the unit responsible for providing the improper benefits to officials. The Chinese audit department reported its results to Herbalife's Internal Audit department, which in turn provided a report to Herbalife's management. According to the SEC documents, these reports to management showed excessive spending, including, for example, one director in China being reimbursed for over $1 million in a single, six-month period during which her department as a whole was reimbursed approximately $3.7 million. The SEC noted that two members of Herbalife's Board of Directors had questioned the high spending in China but were told by the Internal Audit Director that the spending was "within 'tolerance.'"

Sargeant Marine Pleads Guilty to Paying Bribes to South American Government Officials

On September 22, 2020, Sargeant Marine Inc. (SMI), an asphalt company based in Boca Raton, Florida, pleaded guilty to conspiracy to violate the anti-bribery provisions of the FCPA and agreed to pay a fine of $16.6 million. DOJ recommended that fine amount after an "inability to pay" analysis concluded that a fine greater than that level "would substantially threaten the continued viability of" SMI.

As noted in the DOJ's press release, SMI pleaded guilty and paid the criminal fine to "resolve charges stemming from a scheme to pay bribes to foreign officials in three South American countries." The conduct under investigation spanned from 2010 to 2018, and DOJ stated that SMI paid "millions of dollars in bribes to foreign officials in Brazil, Venezuela, and Ecuador" to obtain contracts related to asphalt purchases or sales. The bribes were paid to officials at Petroleo Brasileiro S.A. – Petrobras (Petrobras) in Brazil, Petroleos de Venezuela S.A. (PDVSA) in Venezuela, and Empresa Publica de Hidrocarburos del Ecuador (Petroecuador) in Ecuador.

The DOJ noted several mitigating factors in addition to the "inability to pay" analysis, including the fact that SMI fully cooperated with the investigation; the fact that SMI is "no longer operating in Brazil, Venezuela, Ecuador or Chile"; discipline of employees, including at least one referenced separation; and pledges of continuing cooperation with related investigations. In terms of aggravating factors, the company did not receive credit for self-reporting, and the DOJ noted that the conduct was serious, pervasive, and "included executives at the highest level of the [c]ompany."

Through the plea agreement, SMI also represented that it had implemented and will continue to implement an FCPA compliance program. The agreement imposes a three-year self-reporting requirement on the company as to the status of implementation of and improvements to the compliance program and related internal controls, with an initial report due one year from the date of the plea agreement. The company must file two annual follow-up reports over the following two years.

According to the stipulated facts from the plea agreement, SMI earned over $38 million in profits as a direct result of the bribery scheme. To effectuate the scheme, SMI entered into fake consulting contracts and made payments through various entities, such as "Asphalt Trading" company, a company incorporated in the Bahamas and based in the United States. The DOJ noted that Asphalt Trading was related to SMI, had its principal place of business in Boca Raton, Florida, and was itself a "domestic concern" under the FCPA.

The plea agreement states that SMI engaged in the conduct at issue in three countries: Brazil, Venezuela, and Ecuador.

Brazil

According to the DOJ, the scheme in Brazil occurred between 2010 and 2015 and included bribery payments made directly and through several intermediaries to two Brazilian politicians and two Petrobras officials. The purpose of the bribes was to "secure an improper advantage" for obtaining and retaining business with Petrobras.

The plea agreement states that Asphalt Trading executives sought out and hired an intermediary to funnel improper payments to Brazilian officials, and that at least one Asphalt Trading executive communicated about this to Daniel Sargeant, who was an executive and part owner for SMI, Asphalt Trading, and SMI Affiliate between 2006 and 2016. The intermediary told a Brazilian politician and Petrobras official at a dinner that if they agreed to assist SMI with "winning business from Petrobras," they would receive payments. Following this dinner, the Petrobras official directed subordinates to award asphalt-related business to SMI.

To hide the payments, SMI and Asphalt Trading entered into "fake consulting agreements with shell companies" that were controlled by intermediaries. SMI and affiliated companies, including Asphalt Trading, paid more than $5 million dollars to shell companies controlled by the intermediaries. The intermediaries then made payments to the Petrobras officials and Brazilian politicians through cash payments or via payments to offshore shell company accounts controlled by the officials or their relatives. As a result of the bribery scheme, SMI and its affiliated companies earned about $26.5 million dollars in profits.

Venezuela

The plea agreement states that the Venezuelan bribery scheme occurred between 2012 to 2018 and that bribes were paid to four PDVSA officials to obtain and retain PDVSA-related business. Similar to the Brazilian scheme, to facilitate and hide the origin of the payments, SMI made payments from the United States to offshore shell companies controlled by intermediaries, documented as payments for fake consulting services.

A key issue related to SMI's business in Venezuela was PDVSA's refusal to sell asphalt to SMI or other SMI-related companies. To circumvent this restriction, the plea agreement states that SMI worked with a "Swiss Asphalt Company" that was a sometime competitor of SMI. The plea agreement explains that between 2012 and 2015, Asphalt Trading entered into various contracts with the Swiss Asphalt Company "to purchase and sell asphalt" – thus using the Swiss company as a "front" for business with PDVSA. At least some of the bribe payments supported this arrangement, as SMI coordinated with several intermediaries to pay bribes to PDVSA officials, who then awarded contracts to the Swiss Asphalt Company. SMI and its affiliates paid over $1 million dollars to the shell companies controlled by intermediaries. SMI made approximately $8.2 million in profits from the Venezuela bribery scheme.

Ecuador

According to the plea agreement, SMI paid bribes in Ecuador to "obtain and retain business with PetroEcuador and win lucrative contracts." The bribery payments occurred in 2014 and were paid to one PetroEcuador official through "fake consulting contracts" and "fake invoices." Like the Brazilian and Venezuelan schemes, payments were made from the U.S. to shell companies controlled by intermediaries. A portion of the payments to the intermediary shell companies were then paid to the PetroEcuador official. In total, SMI earned approximately $3.2 million from the bribery scheme in Ecuador.

Cases Against Individuals

On the same day (September 22, 2020), the DOJ announced previously undisclosed guilty pleas by six individuals in connection with the Sargeant Marine matter. Roberto Finocchi, a Sargeant Marine trader active in Brazil, Venezuela, and Ecuador, pleaded guilty on November 17, 2017. In addition, according to the DOJ press release on Sargeant Marine, the following five individuals also have pleaded guilty in connection with the matter: Luiz Eduardo Andrade (an agent) and David Diaz (a consultant), who "acted as bribe intermediaries in Brazil and Venezuela, respectively" (September 22, 2017 and March 28, 2018, respectively; their respective Informations are found here and here); Jose Meneses, a Sargeant Marine trader active in Brazil, Venezuela, and Ecuador (one-count Information filed on August 2, 2018); Daniel Sargeant, a "senior executive" for Sargeant Marine, for conspiracy to violate the FCPA and conspiracy to commit money laundering (two-count Information filed on December 18, 2019); and Hector Nunez Troyano, a former Venezuelan government official who allegedly received some of the bribes (one-count Information filed on March 15, 2019). According to the press release, all five of the individuals noted pled guilty to the relevant charges on the same date as their respective Informations were filed against them.

In addition, according to the DOJ press release, on September 10, 2020, the DOJ unsealed a criminal complaint charging Daniel Comoretto, a former PDVSA official, with conspiracy to commit money laundering in relation to Sargeant Marine Venezuelan scheme.

Noteworthy Aspects

- Attempts to Hide Information in Electronic Communications. The plea agreement notes in several places that certain SMI personnel used various methods to attempt to conceal the existence and nature of the various payments in electronic communications. Most notably, in communications related to the payments in Brazil, SMI, Asphalt Trading personnel, and various intermediaries shared login and password information for a U.S.-based email account and negotiated through saved draft emails. When one "member of the conspiracy" wanted to share information with another member, they logged in to the email account, drafted the message, saved the email to the drafts folder, and then alerted the other member to check the drafts folder. Through this method, the involved persons never actually transmitted emails. Despite these precautions, the plea agreement notes that other emails discussing the illicit transactions were sent among SMI personnel, including references to trips with "crooks." In Venezuela, participants communicated using "U.S.-based email accounts and U.S.-based text messaging platforms" but in some cases used code names or words. For example, one PDVSA official was referred to as "Oiltrader" and confidential information secured by bribes was labelled "chocolates."

- Successful "Inability to Pay" Arguments. The plea agreement states that the formulas set forth in the U.S. Sentencing Guidelines provided a fine range between $120 million and $240 million for the misconduct, and that the parties agreed that the appropriate fine was $90 million (which reflected the company's cooperation and remediation-based discount off the bottom of the fine range). However, as noted, after the DOJ conducted an "inability to pay" analysis pursuant to its updated October 2019 guidance, the plea agreement recommended that SMI be ordered to pay only $16,600,000. The agreement notes that the analysis considered a range of factors "including but not limited to (i) the factors outlined in 18 U.S.C. § 3572 and the United States Sentencing Guidelines (the Guidelines or USSG) § 8C3.3(b); (ii) the Company's current financial condition arising from the recent sale of its joint venture interest; and (iii) the Company's alternative sources of capital, including from potential loans against guaranteed future assets." The October 2019 guidance contains a questionnaire that sets out the financial information required to conduct such an analysis, and the plea agreement notes that the DOJ used "the assistance of a forensic accounting expert." The guidance places the burden of establishing the relevant facts on the company requesting such consideration, which in this case was met by SMI in the DOJ's judgment.

- Plea Agreement Uses Updated Attachment C. "Attachment C" to the SMI plea agreement contains requirements for SMI's corporate compliance program. The version used is very similar to the updated Attachment C used in the earlier Herbalife disposition, which emphasizes aspects of the latest DOJ compliance program evaluation guidance, including "direct or indirect access to relevant sources of data" that allows compliance personnel to conduct "timely and effective monitoring and/or testing of transactions."

Individual Enforcement Actions

Alstom Executive Receives No Prison Time Following Extensive Cooperation

In July 2020, Edward Thiessen, the former senior executive in Indonesia for Alstom S.A., received a sentence of time-served for his role in an alleged scheme to bribe Indonesian government officials. The sentence reflected his extensive cooperation in the DOJ's investigation of Thiessen's former Alstom colleague, Lawrence Hoskins, who was found guilty of various offenses. (See FCPA Winter Review 2020.) In connection with Thiessen's sentencing, the government submitted a detailed memorandum describing Thiessen's cooperation and asking the U.S. District Court for the District of Connecticut to impose a sentence far below the 15 months that Hoskins received.

The government's cooperation memorandum described at least a dozen meetings between Thiessen and the DOJ's prosecution team, as well as three days of testimony by Thiessen at the trial of Hoskins, which the government described as "a critical part of the Government's case." The memorandum also noted that several other individuals and entities pled guilty or signed deferred prosecution agreements, and that even though Thiessen's cooperation at the time was not public, Alstom was likely aware that Thiessen was working with the government. In its memorandum, the government noted that it disagreed with the court's 15-month sentence of Hoskins but still believed that "the Court should sentence [Thiessen] far more leniently than Lawrence Hoskins" because of Thiessen's substantial cooperation.

Thiessen officially pled guilty to conspiracy to violate the FCPA in July 2019 after signing his plea agreement four years earlier, in April 2015. According to his sentencing memorandum, in 2003, Thiessen participated in the hiring of consultants to bribe Indonesian officials in connection with a gas fired plant known as the MuaraTawar Project. He was also allegedly privy to discussions regarding bribe payments around another project known as the Tarahan Project. In 2010, while Thiessen was Alstom's senior executive for Indonesia, he took steps to help consultants get paid pursuant to consulting agreements that were designed to funnel bribes to Indonesian government officials. Thiessen's offense came with a statutory maximum sentence of five years in prison and a Sentencing Guidelines range that exceeded five years, but Thiessen, who is a Canadian citizen, spent almost no time in prison in connection with his offense, after having spent most of his pre-trial release in Canada.

As we previously reported in our FCPA Winter Review 2015, in December 2014, Alstom resolved a large, multinational enforcement action and paid a $772 million fine, which was at that time the second largest FCPA-related fine ever. According to the company's plea agreement, Alstom and related entities "attempted to secure various power projects in Indonesia through Indonesia's state-owned and state-controlled electricity company, Perusahaan Listrik Negara (PLN)." As described in the company plea agreement, Alstom and its subsidiaries retained consultants who transferred a portion of their commissions to PLN officials. These bribes helped Alstom win contracts for the Tarahan Project, valued at $118 million, and the MuaraTawar Project, valued at $260 million.

Policy and Litigation Developments

Och-Ziff Settles Restitution Claims for $136 Million

On July 23, 2020, Och-Ziff Capital Management (now Sculptor Capital Management) entered a conditional agreement in principle to pay $136 million in restitution for losses suffered by shareholders of Africo Resources Limited. The agreement came over two years after shareholders of the Canadian mining company filed a letter in 2018 with the Eastern District of New York disagreeing with the DOJ's decision to exclude a restitution requirement from the settlement agreement and claiming entitlement to compensation for their losses. The claimants alleged that they are victims of the bribery scheme executed by Och-Ziff executives to acquire interests in several lucrative copper and cobalt mines to which Africo had exclusive ownership rights, and they asked the court to officially recognize their victim status under the Mandatory Victims Restitution Act (MVRA). As we reported in our FCPA Autumn Review 2016, Och-Ziff agreed to pay approximately $412 million in fines, disgorgement, and interest to settle FCPA-related allegations that third parties associated with the company bribed foreign officials in connection with Och-Ziff's projects in several African countries.

Africo's restitution claim argued that the 2016 settlement between Och-Ziff and U.S. enforcement authorities failed to properly hold the hedge fund accountable for actions that resulted in a loss of hundreds of millions of dollars to Africo's shareholders, who were the claimed victims of the scheme. Africo further argued that the DOJ, in its haste to secure a settlement for the "significant harms" caused by Och-Ziff, "abdicated its legal obligations" in favor of putting its own interests…ahead of victims." A federal judge in the Eastern District of New York ruled on August 29, 2019 that Africo's shareholders were victims under the MVRA and therefore were entitled to restitution. According to the court, the MVRA defines "'victim' broadly [and] contains no carve-out for holders of intangible property rights, such as shareholders who hold interests through special-purpose vehicles for tax purposes." As a result, Africo's shareholders were eligible for a "restitution award in the amount of the value of the property in question, either at the time of the crime or at the time of sentencing (whichever is greater)." However, the judge's order did not specify an amount and directed the parties to submit additional arguments on the appropriate level of compensation.

The parties argued over the true value of the loss for many months. Och-Ziff noted in its August quarterly report that the parties had each submitted differing calculations relating to the restitution amount, with Africo arguing that the value of the mining rights at issue was $421.8 million, but the DOJ estimated that the rights were worth approximately $151.5 million. Och-Ziff's filing also noted that although the parties have tentatively agreed to an amount of $136 million, the proposed settlement remains subject to final negotiation with the claimants and approval by the court.

Noteworthy Aspects

- Delayed Sentencing for OZ Africa Management. Och-Ziff had previously agreed with the DOJ in a letter filed with the court on January 23, 2020 to extend the DPA for an additional 61 days pursuant to the entry of a final judgment against Och-Ziff subsidiary OZ Africa Management. Despite pleading guilty in 2016, OZ Africa's sentencing has been delayed during the pendency of the restitution claim, and the parties had requested an extension to the DPA in order to fully resolve the issues.

- Rise in Collateral Victim Suits. The resolution of the restitution claim in favor of Africo's shareholders sets a precedent that could potentially lead to an increase in so-called "investor victim" suits as part of corporate settlement actions. Because every major FCPA-related corporate enforcement resolution has the potential for collateral shareholder litigation, companies may end up ultimately paying amounts far above negotiated settlement amounts to account for additional compensation to shareholders or other parties who may now qualify as "victims" of FCPA violations.

DOJ Releases New FCPA Opinion Procedure Release for the First Time Since 2014

On August 14, 2020, the DOJ released its first FCPA Opinion Procedure Release (Opinion) since November 7, 2014, in response to a request from a multinational investment advisor firm that the Opinion states is a domestic concern under the FCPA (Requestor). The request related to the payment of a fee to a state-owned enterprise in an asset purchase transaction.

According to the Opinion, in 2017, the Requestor entered negotiations with a foreign subsidiary of a foreign investment bank indirectly owned by a foreign government to purchase "a portfolio of assets." During negotiations, the Requestor engaged a second foreign subsidiary of the foreign investment bank to assist with negotiations. The Requestor later engaged a local foreign finance firm to assist in the transaction, which was eventually completed in 2019 "with the assistance of" the local foreign finance firm. The Opinion concerned the payment of the second foreign subsidiary's requested fee of $237,500, or 0.5 percent of the value of the assets purchased for the services it provided.

The DOJ determined that, based on the facts presented by the Requestor, it "does not presently intend" to bring an enforcement action. Consistent with the approach taken in other Opinions, the DOJ focused on several important safeguards, including the facts that the payment went to an entity with no signs of improper diversion to any individuals and that the payee provided "specific, legitimate services" related to the transaction. In addition, the DOJ determined that the payment was "commercially reasonable" and "commensurate with" the services provided. The Opinion's assessment also noted the approval certifications made by the Chief Compliance Officer of the second foreign subsidiary.

This Opinion provides a reminder of the process that companies might be required to undertake to receive a DOJ Opinion. For this Opinion, the Requestor made four supplemental submissions, and the DOJ took nine months to issue the Opinion, with what appears to be a gap in information flow between February and June. It is not clear whether the COVID-19 pandemic impacted the timing of the Opinion's release.

International Developments

AFA Publishes 2019 Annual Report

On July 9, 2020, the French Anti-Corruption Agency (AFA) published its Annual Activity Report for fiscal year 2019, as required under France's 2016 anti-corruption legislation, known as Sapin II. The Report highlighted the AFA's guidance and monitoring activities during 2019, noting that it had conducted 36 new audits of regulated companies' anti-corruption compliance programs, including three global audits of CAC 40 companies, 50 training sessions, and nearly 70 awareness raising interventions. The Report also highlighted that the AFA's Sanctions Commission issued its first decision in 2019. In that decision, the Sanctions Commission declined to sanction French electronics company Sonepar, finding that its anti-corruption compliance program complied with Sapin II.

The AFA also underscored its participation in international anti-corruption cooperation efforts. Among other efforts, the Report stated that the AFA had received 43 foreign delegations, strengthened partnerships with the World Bank and the Inter-American Development Bank, and consolidated coordination with the prosecutors in the U.K. (SFO), the U.S. (DOJ), and France (PNF).

The AFA offered several takeaways regarding the quality of anti-corruption programs and the impact of AFA's audits following the 2019 fiscal year, including that: (i) the commitment of company boards of directors to anti-corruption compliance is progressing but remains generally insufficient; (ii) the methodology used by companies to establish risk mapping and third party assessments is often insufficiently precise (as contrasted with codes of conduct, training, and whistleblowing procedures); and (iii) violations of Sapin II's compliance requirements have related primarily to non-compliance or failure to implement particular compliance procedures rather than to a total lack of anti-corruption compliance procedures.

The AFA's Director Charles Duchaine emphasized the importance of the "seriousness and credibility of the French model" to increasing France's attractiveness to foreign companies and to "restor[ing] judicial sovereignty by dispelling the doubts of foreign prosecution authorities or criticism from international organizations." In the past, France faced criticism, including by the OECD Working Group on Bribery in 2014, for its lack of proactive enforcement against French companies of French anti-corruption law and international anti-bribery conventions. In addition, press reports from as recently as 2018 hinted at tensions between the DOJ and French enforcement authorities in connection with the DOJ's investigations of French companies.

Despite the AFA's efforts, however, France dropped two places in Transparency International's Corruption Perceptions Index—from 21st to 23rd place out of 180 countries and territories examined. Quoting Transparency International France that there is urgency in the need to "relaunch the fight against corruption," Mr. Duchaine concluded that "a strengthening of the Agency's mission appears needed today."

Former Unaoil Executive Receives Five-Year Sentence in U.K. for Bribery

On July 23, 2020, a London court sentenced former Unaoil executive Ziad Akle to five years in prison for his role in paying $500,000 in bribes to secure a $55 million contract in post-war Iraq. Akle and fellow alleged conspirator Stephen Whiteley of Unaoil had been previously found guilty by a jury on two counts of conspiracy to make corrupt payments.

The Iraqi government sought to rebuild its oil industry using offshore buoys to increase supply ship capacity. According to the U.K. SFO, Akle and other conspirators funneled bribes to public officials at Iraq's state-run South Oil Company to secure the lucrative contract. At Akle's sentencing, Judge Martin Beddoe decried Akle's exploitation of a war-torn country seeking to rebuild its fragile political and economic infrastructure.

The sentences are the latest development in the SFO's investigation into Unaoil, which began in March 2016. Unaoil has faced scrutiny from both U.K. and U.S. prosecutors over its methods of helping Western corporations obtain energy contracts in the Middle East.

Ex-Malaysian Prime Minister Found Guilty of Corruption Charges Related to 1MDB Scandal

On July 28, 2020, former Malaysian prime minister Najib Razak was found guilty of seven counts of abuse of power, money laundering, and breach of trust, related to the 1MDB scandal. He was sentenced to 12 years in prison to be served concurrently. In addition, the High Court judge Justice Nazlan Mohammed Ghazali fined Mr. Najib nearly $50 million dollars. The case is part of a number of charges against Mr. Najib stemming from allegations that he illicitly received millions of dollars from the 1MDB fund. Mr. Najib pleaded not guilty to the charges, and his lawyers have stated that he will appeal the decision.

The 1MDB fund was a Malaysian investment fund that Mr. Najib established in 2009 when he was prime minister. The development fund was intended to assist the economic development of Malaysia. However, Malaysian authorities ultimately alleged that approximately $4.5 billion dollars was stolen from the fund between 2009 and 2014 by officials. Indeed, media reports over time have noted allegations that some of these funds were used to buy artwork, to help produce the film The Wolf of Wall Street and to purchase luxury real estate. Mr. Najib claimed no wrongdoing and argued in his defense that a Malaysian financier, Jho Low, misled Mr. Najib regarding the funds, and that Mr. Najib believed that the money transferred to his personal bank account was a gift from a Saudi royal.

The court's July decision related to claims that Mr. Najib received roughly $10 million dollars that was siphoned from SRC International Sdn Bhd, a former unit of 1MDB. As previously noted in our FCPA Spring Review 2020, Mr. Low is alleged to have led the money laundering and bribery scheme related to 1MDB overall. The Kuala Lumpur High Court ultimately rejected Mr. Najib's defense, finding him guilty on all seven charges brought against him in the case at hand.

Mr. Najib was prime minister of Malaysia from 2009 to 2018, losing the 2018 election to Mahathir Mohamad. Mr. Najib's electoral loss was viewed as a surprise and a result of the 1MDB corruption allegations. Goldman Sachs was the main banker of the fund, and the 1MDB scandal also led to charges against a former Goldman Sachs banker, as covered in our FCPA Winter Review 2020. Goldman Sachs itself resolved various multilateral investigations of the firm's role in the 1MDB issues on October 22, 2020, as noted in the introduction.

Miller & Chevalier Upcoming Speaking Events, Recent Publications, and Recent Podcasts

Miller & Chevalier Coronavirus Task Force

The outbreak of COVID-19 is creating significant business and legal challenges for companies throughout the world. In response to client demand, the firm has formed an interdisciplinary task force to help businesses navigate these issues.

COVID-19 Resource Library

We also maintain a resource library of legislative responses and regulatory guidance related to COVID-19.

Recent Podcasts

EMBARGOED! is intelligent talk about sanctions, export controls, and all things international trade for trade nerds and normal human beings alike, hosted by Miller & Chevalier Members Brian Fleming and Tim O'Toole. Each episode will feature deep thoughts and hot takes about the latest headline-grabbing developments in this area of the law, as well as some below-the-radar items to keep an eye on. Subscribe for new bi-monthly episodes so you don't miss out: Apple Podcasts | Spotify | Amazon Music | Google Podcasts | Stitcher | YouTube

¡(H)Ola Compliance! explora la ola de cumplimiento de anticorrupción que ha surgido por Latinoamérica. Inmerso en su cariño para la región, Matteson Ellis y Alejandra Montenegro Almonte (Socios de Miller & Chevalier), navegan las aguas de regulaciones de cumplimiento corporativo desde sus oficinas en Washington, DC y trazan las normas de anticorrupción que afectan a la región. A la vez destacan los desafíos y oportunidades que enfrentan las empresas comprometidas a la ética. ¿Te sientes que estás nadando contra la corriente? ¡Entonces tome la ola de cumplimiento en ¡(H)Ola Compliance! Apple Podcasts | Spotify | Amazon Music | Google Podcasts | Stitcher | YouTube

Upcoming Speaking Engagements

| 11.19.20 | IBA 2020 Virtually Together Conference (Kathryn Cameron Atkinson) |

Recent Publications

| 10.01.20 | Executives at Risk: Early Fall 2020 (Katherine E. Pappas, Lauren E. Briggerman, Kirby D. Behre, Marcus A.R. Childress, Nina C. Gupta, Ian A. Herbert, Aiysha S. Hussain, Margot Laporte, and Calvin Lee) |

| 09.28.20 | Growing Corruption Risks and Compliance Practices Detected in Latin America (Matteson Ellis and Demarest partner Eloy Rizzo) |

| 09.24.20 | Managing Corruption in Latin America's Police Forces (James G. Tillen and Gregory W. Bates) |

| 09.08.20 | Corruption and Coronavirus in Latin America (Alejandra Montenegro Almonte and Gregory W. Bates) |

| 08.28.20 | Political Interference Threatens Advances in Cross-Border Market Regulation (Paul A. Leder) |

| 08.27.20 | The Latest Developments Under Section 889 Part B: New SAM Representation and DoD Waiver (Brian J. Fleming, Alex L. Sarria, and Jason N. Workmaster) |

| 08.25.20 | FCPA Enforcement, Compliance Trends During the Pandemic (John E. Davis and Ivo Ivanov) |

| 08.11.20 | Criminal Liability Risks for Compliance Officers: A Multi-Jurisdictional Perspective - Part II (Ann Sultan) |

| 08.07.20 | DOJ Creates New Burden for Compliance Officers (James G. Tillen, Ann Sultan, and Brittany Neihardt) |

Editors: John E. Davis, Daniel Patrick Wendt,* Ivo K. Ivanov,* FeiFei Ren,* and Nicole Gökçebay*

Contributors: Marcus A.R. Childress,* Ian A. Herbert, Margot Laporte,* Calvin Lee,* Katherine E. Pappas, Chervonne Colón Stevenson,* Caroline J. Watson, and Adam R. Harper**

*Former Miller & Chevalier attorney

**Former Miller & Chevalier law clerk

---------

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.