FCPA Winter Review 2025

International Alert

Introduction

Looking Beyond a "Paused" FCPA Enforcement Landscape

President Trump directed Attorney General Pam Bondi to "pause" Foreign Corrupt Practices Act (FCPA) enforcement, barring unique circumstances, in his February 10, 2025 executive order (E.O.). This E.O. and related policy shifts by the U.S. Department of Justice (DOJ) represent the most significant changes to FCPA enforcement since the advent of the modern FCPA enforcement period in the mid-1990s. While the E.O. and other policy memoranda have generated sometimes-bombastic headlines, many questions remain as to the practical effects of these changes for companies, especially amidst an international anti-corruption landscape that has evolved substantially beyond a sole focus on FCPA enforcement. However, the FCPA is still in effect and there continue to be compelling reasons for companies to take appropriate steps to manage ongoing risks for corruption and related fraud and self-dealing, including the business benefits of strong compliance, the prospect of non-U.S. authorities moving to increase their enforcement activity, and a statute of limitations period for FCPA violations that will run well past the current administration.

We recently discussed the E.O. and other policy changes, and our initial take on how companies should react, in this alert. There are many questions raised by the Trump administration's actions that, for now, remain open. As noted, the FCPA and other laws used to combat corruption (such as anti-money laundering (AML) laws or wire fraud) remain in effect. The E.O. does not create any new legal defenses or exceptions for companies or individuals, and new investigations can still be approved by the attorney general (albeit only in exceptional circumstances for the 180 days following the E.O.). Companies should assess the administration's recent actions in the context of a complex international business and enforcement environment. The exact contours of the pause are still in flux, as shown by the DOJ recently providing mixed messages to the court about whether it would like to proceed in the trial of former Cognizant executives currently scheduled to start this month.

The FCPA pause is part of a DOJ shift in priorities toward an increased focus on cartels or transnational criminal organizations (TCOs). Even prior to the Trump administration, companies have faced increasing enforcement and civil litigation risks for operations in markets with security concerns, and these risks have significantly increased. We discuss how DOJ's changes in enforcement priorities create increased compliance risks for corporations that might face interactions with cartels or TCOs in this recent alert.

The path ahead is unclear, but we recap FCPA developments from 2024, including specific enforcement actions during the fourth quarter of 2024, because they offer compliance lessons that remain relevant for companies' understanding of corruption and related risks both during and after the DOJ's "pause."

New Personnel at the DOJ and SEC

As with every change in presidential administration, new officials have taken the reins at the DOJ and the Securities and Exchange Commission (SEC). On the DOJ side, Pam Bondi, the former attorney general of Florida who has also represented President Trump in past actions, was nominated as U.S. Attorney General and received Senate consent on February 4, 2025.

The president nominated Todd Blanche as Deputy Attorney General – a key role in managing the DOJ and its cases on a day-to-day level and often the senior policymaker as to DOJ criminal policies – and Emil Bove as Principal Associate Deputy Attorney General. Bove has been the acting Deputy and a key player in the DOJ's push to re-focus enforcement efforts. Both men have experience as former federal prosecutors in the powerful and influential Southern District of New York. After spending time in private practice as white-collar defense lawyers, Blanche and Bove formed a litigation boutique law firm, and most notably, the two lawyers served as defense counsel for President Trump in three high-profile criminal cases brought against him after the 2020 election. Blanche had his Senate confirmation hearing on February 12 and was confirmed by the full Senate on March 5, 2025.

As of the date of publication, new leaders for the DOJ's Criminal Division and the Fraud Section have not been announced. Glenn Leon remains for the time being as the chief of the Fraud Section. However, the Fraud Section, like other DOJ components, has seen a substantial number of departures over the past year, including by experienced litigators and policy personnel; it is unclear how much of that capacity will be replaced and whether further personnel reductions will occur – for example, through transfers of line prosecutors in the Fraud Section to other areas that are being prioritized by the new administration, such as immigration enforcement and a focus on violent crime.

One other potentially fundamental change in DOJ enforcement is evidence that the White House and senior DOJ leadership will actively intervene in individual cases, sometimes citing political goals or dynamics. The recent instructions by Acting Deputy Attorney General Bove to the U.S. Attorney's Office for the Southern District of New York regarding the disposition of the case against New York Mayor Eric Adams – which in part focuses on allegations that the mayor received lavish entertainment and travel from the Turkish government in a covert scheme to provide the Turkish government with preferential treatment – provides an example of this potential trend and the issues raised by such intervention.

On the SEC side, Commissioner Jaime Lizárraga left the Commission on January 17, 2025, and SEC Chair Gary Gensler departed on January 20. The departures have left three Commissioners in place – two Republicans (Commissioners Mark Uyeda and Hester M. Peirce) and one Democrat – Commissioner Caroline Crenshaw, though Crenshaw was not renominated for another term and will be replaced. President Trump appointed Commissioner Uyeda as the agency's temporary Chair on January 21. Commissioner Uyeda's interim appointment will last until a permanent chair is approved via the Senate confirmation process. Acting Chair Uyeda has appointed several interim senior staff, including Samuel Waldon as acting Director of the Division of Enforcement; Waldron had been the division's chief counsel.

Former Commissioner Paul Atkins, who served from 2002 to 2008, has been nominated to become the permanent Chair of the Commission. As of the date of publication, Senate hearings on Atkins' nomination have not been scheduled, but it is likely that he will be approved. Due to agency rules, another Republican commissioner will be needed to muster the three votes necessary for the SEC to adopt or roll back major rules, although such an addition will likely occur soon. That said, Commissioner Uyeda, with support from Commissioner Peirce, will have the power to modify various SEC policies, including enforcement policies.

In the short term and as a predictor of likely positions that will be taken by a Republican-dominated SEC over the next few years, it is notable that all of the Republicans, including Atkins, will focus significantly on issues outside of the FCPA itself, including with regard to the treatment of crypto assets; rolling back reporting and other requirements related to so-called "DEI" and other non-financial issues, such as environmental impact reporting; lowering corporate fines due to perceived negative impacts on non-culpable shareholders; and ending what Commissioner Uyeda recently criticized as "regulation by enforcement."

The last two goals could affect aspects of the SEC's FCPA-related activities. Acting and likely future SEC leadership have criticized the sometimes aggressive definitions of the breadth of the FCPA's accounting provisions taken under the Biden administration; the two current Republican Commissioners have called for a rollback of the "Swiss Army Knife" use of the internal accounting controls provision in various settings. At the same time, Commissioner Peirce recently has supported "[r]estoring the internal accounting controls and disclosure controls and procedures requirements to their important, but limited intended purposes" – some of which support FCPA-related goals.

Recent media reports have suggested that the Commission has directed SEC Enforcement Division staff that they must obtain Commission approval for all formal orders of investigation. This reported directive changes recent practice, restoring the model that existed before 2009 and restricting the use of administrative subpoenas. While the SEC has not to date commented publicly on this reported change, the same media sources have suggested that Enforcement Division personnel can still conduct informal investigation inquiries – such as voluntary requests for information – without Commission approval. Most SEC FCPA investigations begin with such informal inquiries, which themselves can involve significant time and resources.

Finally, Commissioners Uyeda and Peirce have also issued recent critiques regarding the operation of the SEC's whistleblower program under Dodd-Frank. In a September 19, 2024 statement related to the SEC's announcement of several awards, the Commissioners said, "[w]e did not support these determinations, but we are unable to explain our reasons because the public final orders determining the awards redact certain information necessary to the explanation." They noted that "[a]s an inadvertent result of these redactions, the legal reasoning in the [relevant] final orders… is immunized from effective public scrutiny." They then discuss their view that the SEC has been "overbroad" in its redaction of whistleblower-related information under the applicable standard – that is, information "which could reasonably be expected to reveal the identity of a whistleblower." Limiting public scrutiny of awards, in their expressed view, undermines the critically important need for "allowing appropriate outside scrutiny" of awards, given that "[m]ost direct participants in the program share a common incentive—to maximize awards." Given this, it is possible that the Commissioners might proceed in the future with revising the award redaction process to allow for more details to be made public.

Looking Back at 2024

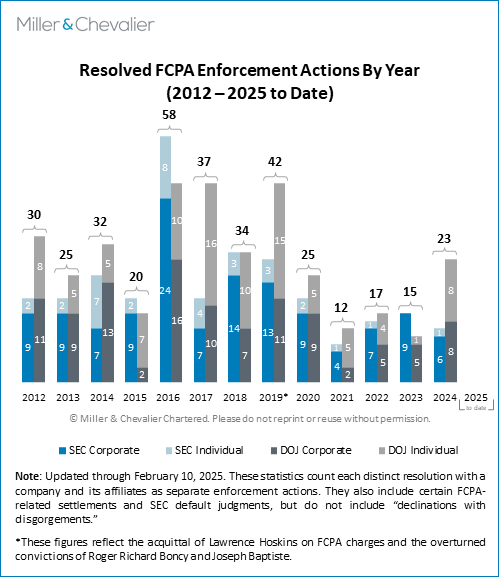

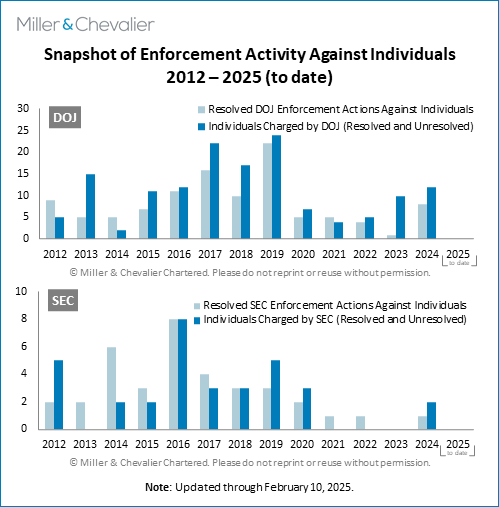

2024 continued a DOJ trend that focused as much on new and updated policies as on enforcement matters in the FCPA space, though both the DOJ and SEC matched their 2023 totals in terms of the number of announced corporate enforcement actions. As to cases against individuals, the DOJ exceeded its 2023 results and the SEC charged individuals with FCPA violations for the first time since 2020. However, despite these increases (including a flurry of corporate resolutions in Q4 2024, discussed in detail below) the Trump administration's FCPA enforcement "pause" means there will be a sharp decrease in case numbers for 2025. And the various DOJ policy initiatives are currently under review and may change significantly. Even the signature legislative development of 2024 – passage and amendment of the Foreign Extortion Prevention Act (FEPA) with bipartisan support – has been affected by the DOJ's recent turn targeting cartels and TCOs, and it remains unclear how FEPA and related cases that focus on the "demand" side of bribery will affect corporate interests.

Corporate Enforcement Actions – 2024

As noted, the DOJ and SEC both had levels of enforcement activity involving corporations that was on par with recent years, but well below activity levels from earlier eras. As shown below, the DOJ had eight corporate enforcement actions, while the SEC had six, for a total of 14 resolutions covering 11 companies, which is equal to the 2023 combined total.

Those totals in the chart combine corporate and individual enforcement. As was the case in 2023, most of the dispositions involved only one of the two enforcers; four cases involved parallel resolutions. There are various reasons for single agency resolutions, including differences in jurisdiction or burden of proof, policy reasons, and the nature of the underlying facts.

| Company Name | Agencies | Date | Countries | Total Resolution Amount |

|---|---|---|---|---|

| SAP SE | DOJ and SEC | 1/10/2024 | South Africa and Indonesia | More than $220 million (actual amount paid: more than $112 million) |

| Gunvor Group Ltd | DOJ only | 3/1/2024 | Ecuador | More than $661 million (actual amount paid: more than $474 million) |

| Trafigura Group Pte. Ltd. | DOJ only | 3/28/2024 | Brazil | More than $127 million (actual amount paid: more than $100 million) |

| Deere & Company | SEC | 9/10/2024 | Thailand | $9.9 million |

| Moog, Inc. | SEC | 10/11/2024 | India | $1.7 million |

| RTX Corporation/ Raytheon Company |

DOJ and SEC | 10/16/2024 | Qatar | More than $383 million (including related ITAR Part 130 fine) |

| Telefonica Venezolana, C.A. | DOJ | 11/08/2024 | Venezuela | More than $85.2 million |

| BIT Mining Ltd. | DOJ and SEC | 11/18/2024 | Japan | $10 million |

| McKinsey and Company Africa (PTY) Ltd. | DOJ | 12/05/2024 | South Africa | $122.9 million |

| AAR Corp. | DOJ and SEC | 12/19/2024 | Nepal and South Africa | More than $55 million |

The DOJ also issued a declination with disgorgement (totaling $14.4 million) to Boston Consulting Group in August 2024 in line with the DOJ's Corporate Enforcement and Voluntary Disclosure Policy (CEP).

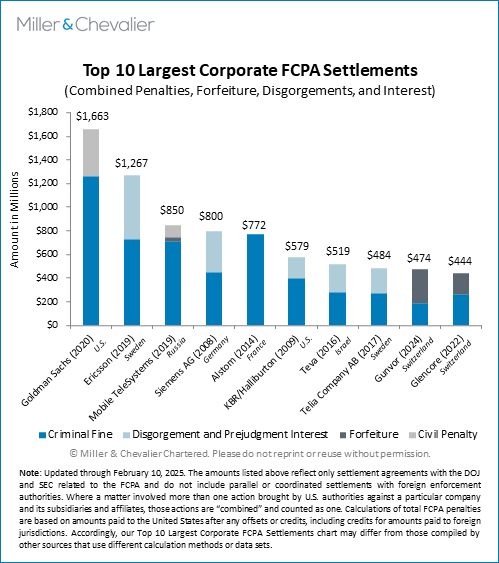

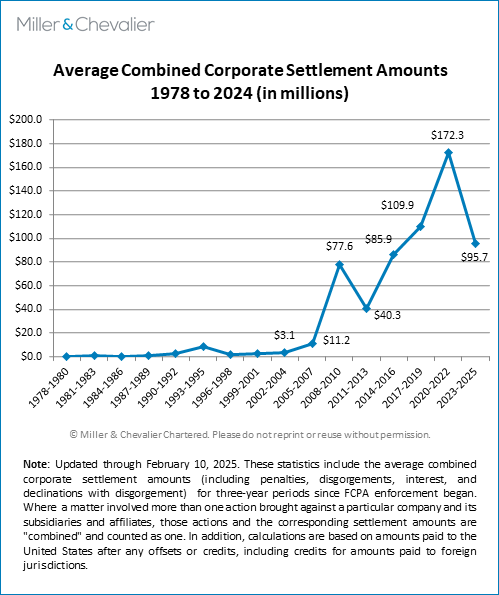

One 2024 trend worth noting was an increase in the average size of enforcement actions, compared to the significant downward shift in value in 2023. In 2023, the largest resolution, Albemarle's non-prosecution agreement (NPA) (on which Miller & Chevalier advised the company as co-counsel), was just north of $200 million and the average penalty level was just $42.3 million. By contrast, in 2024, we saw one resolution that cracked the Top 10 FCPA-related penalty list (Gunvor), as seen in these charts:

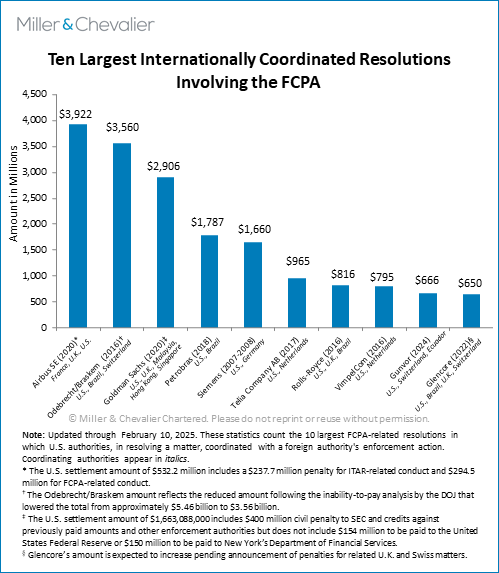

The Gunvor resolution also made the list of Top 10 largest internationally coordinated resolutions that involved the FCPA:

2024 also featured two other dispositions with penalty and disgorgement levels above $200 million and an additional two with those amounts exceeding $100 million. Indeed, seven of the resolutions in 2024 were larger than the 2023 average. The resulting 2024 average penalty level of $154.1 million is thus one of the highest levels in recent years, as seen in the chart below:

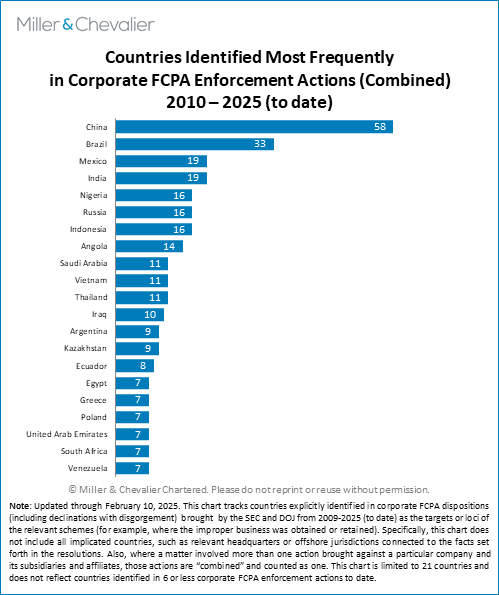

Looking at where illicit payments and related issues occurred as set out in the 2024 resolutions, for the first time in years activity in China was not cited (BIT Mining – previously 500.com – was headquartered in China, but the alleged illicit payments occurred in Japan). The country most cited in 2024 cases was South Africa, which featured in three matters (SAP, McKinsey Africa, and AAR); only one case (Gartner) centered on activities there in 2023. This result was likely based on specific facts in each case, though cooperation with South African enforcement authorities was noted in several public speeches by DOJ personnel in 2024 as part of the DOJ's International Corporate Anti-Bribery Initiative (ICAB), which was formally announced in November 2023. That said, China remains the country most cited in FCPA cases over the years, and it remains possible that the country could receive a renewed focus under this administration (notably, President Trump's first administration pursued a "China Initiative" that included an FCPA focus). Brazil, historically the second largest market involved in enforcement actions, accounted for only one FCPA action in 2024, which perhaps correlates to the changing enforcement environment within Brazil. There were new enforcement actions involving other markets with high levels of enforcement actions, as seen above and in the chart below:

One FCPA monitorship was imposed in 2024 – related to the RTX/Raytheon case. Even without the general FCPA enforcement "pause," given the first Trump administration's policy that scaled back monitorships, it is likely that the RTX/Raytheon monitorship will be the last one for several years. The DOJ has continued to require self-reporting as a usual term for corporate resolutions – though that may change with potential upcoming amendments to the DOJ's CEP and under the FCPA E.O.'s directive that "the Attorney General shall determine whether additional actions, including remedial measures with respect to inappropriate past FCPA investigations and enforcement actions, are warranted and shall take any such appropriate actions... " Relatedly, in 2024 the DOJ continued to include an attachment to various resolutions that requires chief executive officers (CEOs) and chief compliance officers (CCOs) to certify as to the implementation of a resolving company's compliance program at the conclusion of a deferred prosecution agreement (DPA) or similar agreement; again, those requirements might change or fall away under revised future DOJ policies.

Looking forward, one key question for both agencies that remains unclear is what happens when companies or whistleblowers disclose potential FCPA-related wrongdoing. Rules that push public companies toward public disclosures of such issues in securities filings have not changed (and, as we discussed in our alert on the FCPA "pause," relevant medium- and long-term risks remain for companies). There will thus continue to be public knowledge of such issues within companies – knowledge likely to be increased by already announced heightened scrutiny of corporate activities by the media and non-U.S. enforcement authorities. We will continue to track investigations from public disclosures and other open-source media, as well as agency responses, to assess this effect.

Enforcement Actions Against Individuals

As shown in our first chart above, after a 2023 in which neither the SEC nor the DOJ resolved an enforcement action against an individual, the agencies resolved several cases against individual defendants, including through securing guilty verdicts at trial. The DOJ's numbers related both to resolved actions and individuals charged exceeded the department's annual totals for the rest of the 2020s, while the SEC's numbers, which remained low, saw a slight rebound. All said, as with corporate enforcement, the "pause" in FCPA enforcement will substantially reduce the overall case numbers and potentially cause ongoing cases to be dropped or resolved quickly.

The DOJ concluded eight cases against individuals, including convictions following trials of former Vitol commodities trader Javier Aguilar (who also pleaded guilty to additional charges later in the year) and former Freepoint Commodities executive Glenn Oztemel. The DOJ obtained guilty pleas on various FCPA-related charges from former executives of Stericycle, Maxwell Technologies, Freepoint (Gary Oztemel), AAR, and McKinsey Africa.

The DOJ also continued to resolve criminal actions against former foreign officials who received bribes or intermediaries involved in payment schemes, mostly using money laundering and conspiracy charges. Notable cases included convictions at trial of Carlos Ramón Polit Faggioni (Polit), the former Comptroller General of Ecuador, and Manuel Chang, the former Finance Minister of Mozambique. The DOJ also entered plea agreements with, for example, a former major in the Venezuelan National Guard, an Argentinian banker, and the Florida-based ex-banker son of Polit. The DOJ also ended its long-running case against Swiss-Portuguese banker Paulo Jorge Da Costa Casqueiro Murta with a plea agreement and a sentence of time served.

Finally, the DOJ announced several high-profile indictments related to FCPA and related allegations, though the fate of these cases in light of the new Trump administration policies is unclear. Such indictments covered, for example, a former Nigerian state oil company manager, three businessmen associated with voting machine company Smartmatic and a Philippines official, the Chinese former CEO of BIT Mining (formerly 500.cm), and current and former executives and directors of power companies Adani Green Energy and Azure Power Global.

The SEC finally took direct action based on FCPA charges against individuals for the first time since 2020. The agency charged a former Azure Power director with violating the FCPA anti-bribery provisions in November 2024 and entered an FCPA-based cease-and-desist order (with a monetary penalty) against a former manager at AAR in December 2024.

Key International Developments

Various countries continued to enforce their own anti-bribery laws, sometimes in conjunction with U.S. authorities and sometimes on their own. The agencies announced dispositions in 2024 involving parallel corporate settlements with or cooperation involving authorities in South Africa (SAP, McKinsey Africa); Switzerland (Gunvor, Trafigura); and Japan (500.com/BIT Mining). SAP also entered a separate agreement with Brazilian authorities for non-related conduct at the end of the year. The U.K., France, Brazil, and Switzerland continued to announce corporate and individual case results throughout the year. And Australia updated its anti-corruption law and issued related corporate compliance guidelines for companies subject to the law's scope that brought the country in line with similar laws and guidance elsewhere.

Looking forward again to 2025, it is possible that non-U.S. authorities may step up enforcement efforts in light of the "pause" in FCPA enforcement. The U.K., for example, will begin enforcement of the Economic Crime and Corporate Transparency Act (ECCTA) in September 2025, giving its authorities another tool in addition to the U.K. Bribery Act to pursue corporate fraud and corruption. The U.K. Serious Fraud Office's (SFO's) current Strategy for 2024-2029 establishes the goal of the SFO being a "proactive, authoritative player in the global and domestic justice system" with the specific goals of "[b]olster[ing] global defences against serious fraud, bribery and corruption" and "[f]ortify[ing] international anti-bribery efforts by building our role within the OECD working group on bribery." As we have discussed, the French Parquet National Financier (PNF) and Swiss authorities have also been active in 2024. That said, none of these agencies have had the same resources and experience (as well as political leverage in international efforts) as the DOJ in the past, so many questions remain as to the potential impact of increased non-U.S. enforcement on multinational companies.

Review of Q4 2024 Developments

The last quarter of 2024 marked a relative high point in announced FCPA dispositions, with the DOJ and SEC completing nine corporate resolutions involving six companies – a number not seen in a single quarter since the third quarter of 2018, in which there were nine resolutions involving seven companies. With this Q4 boost, the DOJ and SEC ended the year with a total of 14 corporate resolutions involving 11 companies, which matched their 2023 total.

The fourth quarter also saw continued action related to individuals, including the first formal FCPA charges issued by the SEC against individuals since 2020. Continuing a trend over the past few years, the agencies' charges and convictions targeted both givers and takers of corrupt payments, including foreign officials and their relatives accused of receiving bribes. Most notably, the son of the ex-Comptroller General of Ecuador pled guilty to conspiracy to commit money laundering for actions in support of his father's laundering of bribes; the father, Carlos Ramón Polit Faggioni, was himself sentenced on October 1, 2024 to a decade in prison for taking bribes from Odebrecht and others, following his conviction in April 2024. In December, the DOJ unsealed a guilty plea by a former senior partner at global consultancy McKinsey when announcing a DPA with the consultancy's South African affiliate. In November, the DOJ and SEC charged three senior executives at Indian-based power companies Adani Green and Azure Power with various violations, including one SEC charge accusing a former director of violating the FCPA anti-bribery provisions. Only weeks later, the SEC entered a cease-and-desist order (with a monetary penalty) against a former manager at aviation services company AAR for that individual's violations of the FCPA's anti-bribery and accounting provisions.

In the U.S. courts, the most notable set of cases have been the litigation surrounding the implementation of the Corporate Transparency Act (CTA), which has faced challenges from multiple plaintiffs related to the law's original deadline for compliance – January 1, 2025. The recent back and forth in the courts has been largely mooted (at least temporarily) by a March 2, 2025 announcement by the Department of Treasury stating that "not only will [the Department] not enforce any penalties or fines associated with the beneficial ownership information reporting rule under the existing [CTA] regulatory deadlines, but it will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies or their beneficial owners after the forthcoming rule changes take effect either." The press release also stated that Treasury "will further be issuing a proposed rulemaking that will narrow the scope of the rule to foreign reporting companies only."

Finally, there were several notable developments on the international front in Q4 2024, including new guidance from U.K. Home Office on the offense of failure to prevent fraud under the 2023 Economic Crime and Corporate Transparency Act (which we discussed in a separate alert), various new cases in Brazil, and several developments in the European Union (EU) related to the application and scope of attorney-client privilege.

DOJ and SEC Public Remarks and Updates

Officials from the DOJ and SEC continued to discuss policy matters in public speeches at various events in the last quarter of 2024. However, these speeches and remarks occurred prior to or just after the presidential election, and – as discussed in the 2025 Outlook section above – the enforcement policies discussed in those speeches are now under review at both agencies during the administration's "pause" in FCPA enforcement and likely will be superseded by (per the FCPA E.O.) "updated guidelines or policies, as appropriate, to adequately promote the President's Article II authority to conduct foreign affairs and prioritize American interests, American economic competitiveness with respect to other nations, and the efficient use of Federal law enforcement resources."

The DOJ's new Corporate Whistleblower Awards Pilot Program, announced on August 1, 2024, and discussed in detail in this separate alert, continued to be a focus of public speeches by DOJ officials. For example, in a speech at the American Bar Association's London White Collar Crime Institute on October 15, 2024, as reported in Global Investigations Review (GIR), Principal Deputy Assistant Attorney General (PDAAG) Nicole M. Argentieri noted that more than 180 reports had been received to date and that the Criminal Division was "exploring these tips and they may inform a decision to expand" the pilot program in the coming months. In a keynote speech on December 5, 2024, delivered at the American Conference Institute's International FCPA Conference, Department Chief Counselor Brent Wible stated that the report count had increased to over 250, "[a]bout 60 of [which] are under close review by our expert team." Wible further noted that the DOJ had "seen reports about potential FCPA violations in non-issuer cases, a gap in other agencies' whistleblower programs that [the pilot program] filled" and that "[w]e are also seeing tips related to corruption in matters where we are already open, and these tips are adding to the information we have from other sources."

The following day, on December 6, 2024, Principal Associate Deputy Attorney General Marshall Miller delivered the keynote speech at the Practicing Law Institute's White Collar Crime 2024 Program, in which he also discussed the importance of the DOJ's expansion of whistleblower programs, stating that these "have [had] a… track record of success, across decades and under administrations of both parties." Likely messaging the incoming administration, Miller noted that "Jay Clayton, who served as SEC Chair during the first Trump Administration and has been identified as a nominee for U.S. Attorney in the Southern District of New York in the next one, [has publicly stated that] the SEC's successful whistleblower program 'stopped frauds and prevented losses for countless investors.'" Miller also stated that "[Republican] Senator Charles Grassley… and Democratic Senator Elizabeth Warren don't agree on much — but they do agree that 'whistleblower incentive programs are powerful tools to prevent, detect, and prosecute criminal misconduct, wrongdoing, and fraud.'" Despite these statements (and perhaps in line with current SEC Commissioner critiques of certain aspects of the SEC program, as discussed above), it remains to be seen at this point whether the pilot program will continue in its current form under the new DOJ management.

Both the Wible and Miller speeches had a valedictory tone – discussing the prosecutorial and policy steps that the DOJ has taken in the past few years with regard to FCPA, fraud and corporate criminal matters generally, and recapping again such developments as the updated CEP, the various revisions to the Evaluation of Corporate Compliance Program (ECCP) Guidelines, and work related to expanding international cooperation, including through the DOJ's ICAB initiative, which focused on building ties with other countries' enforcement authorities that have not been traditional partners to the DOJ and SEC's anti-corruption investigations.

The same themes are echoed in a blog post by now-former PDAAG Argentieri dated November 22, 2024, titled "Transparency in Criminal Division Enforcement," which discussed the Criminal Division's recent policymaking. While covering several initiatives, the post also noted several changes to existing policies during Q4, including a modification of the Compensation Incentives and Clawbacks Pilot Program (introduced in March 2023 and about which the DOJ issued a status report at the same time as the blog post in November 2024) to "award fine reductions not only to companies that recoup compensation from qualifying employees, but also to those that withhold the money from ever being paid'; removal of "significant profit" as an aggravating circumstance under the CEP; and an addition to the CEP stating that "where a company's self-disclosure does not meet the definition of 'voluntary self-disclosure' as articulated in the CEP, but the company has demonstrated that it acted in good faith to self-report the misconduct — and that it fully cooperated and timely and appropriately remediated — prosecutors will [favorably] consider the company's self-disclosure in determining the appropriate resolution." The blog post also noted that the CEP "now makes clear that, to qualify as a voluntary self-disclosure, [a] company must disclose… information about which the department was not already aware" and that "[a]lthough we will consider a company's good faith disclosure of information that — unbeknownst to them — we already knew about under the CEP amendment we're announcing today, a declination with disgorgement will not be available."

The last of the changes in the blog post is the least likely to survive a more company-friendly DOJ going forward; however, it bears repeating that none of these policies may continue after the fundamental assessments of FCPA enforcement policy under the new administration discussed in the 2025 Outlook section above – a point emphasized on the DOJ's own website, which added a banner to the top of the Argentieri blog post and the various speeches noted above that states, "[t]his is archived content from the U.S. Department of Justice website. The information here may be outdated and links may no longer function."

We note that now-departed SEC enforcement personnel made similar speeches after the U.S. election – the impact of which on new SEC leadership remains unclear.

Q4 Corporate Enforcement Actions

As noted, the agencies ended the year with a relative flurry of announced corporate resolutions – nine dispositions involving six companies. With this burst of activity, the agencies managed to equal the number of corporate resolutions for 2023 – for a total of 14 – despite a second quarter without any case conclusions. The cases ranged in penalty levels from $1.7 million (Moog) to over $383 million (Raytheon/RTX) and included – for Raytheon – the first monitorship imposed in an FCPA case since the 2022 Glencore DPA, though with the change in DOJ management under the new administration, this may be the last monitorship for a while. The cases are discussed in detail below.

Enforcement Actions Against Individuals

There were developments in several announced DOJ cases involving individuals this quarter, including, as noted, announcements of guilty pleas from John Christopher Polit, the son of the former Comptroller General of Ecuador, and former McKinsey partner Vikas Sagar. Previously convicted individuals were sentenced in the fourth quarter, including former oil trader Gary Oztemel, Miami-based businessman Fernando Ardila-Rueda, and John Polit's father, Carlos Ramón Polit Faggioni. Finally, as discussed above and in the relevant articles, the agencies brought new charges against senior executives alleged to have violated the FCPA, including former 500.com CEO Zhengming Pan and a former director of Azure Power, Cyril Cabanes.

In other news involving individuals, former Unaoil executive Cyrus Ahsani, who was scheduled to be sentenced in November 2024 following his October 2019 guilty plea, requested that the sentencing be delayed until at least March 2025. In an October 7, 2024 filing, Ahsani's counsel noted that he "is cooperating with the Australian Federal Police (AFP) in their ongoing prosecution" of two Australian businessmen and Leighton Offshore as a result of a long-running investigation into foreign bribery known as "Operation Trig." According to the pleading, Ahsani's testimony is part of his cooperation commitment to the AFP and Ahsani "wishes to continue fulfilling his commitment to the Australian government and have his continued, truthful testimony considered by the Court when it imposes his sentence."

Pretrial disputes continued in the long-running prosecution of former Cognizant executives Gordon Coburn and Steven Schwartz, which had been scheduled to go to trial in the fall of 2024 but has been repeatedly delayed. In late October, both the DOJ and Cognizant petitioned the court to establish a "procedure" "related to third-party Cognizant's corporate privilege that may arise at trial" – primarily the results of the company's internal investigation involving the defendants. Defendants' counsel responded and opposed the proposed "procedure" and cited previous rulings by the court that Cognizant had effectuated a "significant" waiver of privilege when it disclosed to the DOJ information from its internal investigation into potential FCPA violations. To date, the court has not issued any orders as to this issue, though various filings have occurred under seal. The DOJ has switched its position on whether it intended to move the case forward under the administration's recent FCPA enforcement "pause." In a letter dated February 21, 2025, the DOJ stated that it "intends to proceed to trial [as scheduled]." However, in a subsequent letter on March 4, 2025, the new acting U.S. Attorney in charge of the case requested "a 180-day adjournment of the trial" "to allow sufficient time for my consideration of the application of [the February 10 E.O.] to this matter." As of the writing of this newsletter, U.S. District Court Judge Michael Farbiarz has not ruled on the government’s request for an adjournment, but did push jury selection from March 5, 2025 to March 17, 2025.

On January 17, 2025, a U.S. court sentenced Manuel Chang, the former Finance Minister of Mozambique who was tried and convicted on August 8, 2024, on two counts related to his obtaining $7 million in bribe payments in exchange for signing guarantees to secure $2 billion in funding for projects to be carried out by Mozambican state-owned companies, to over eight years in prison, according to media accounts. Earlier, in an order dated November 13, 2024, the judge denied Chang's motion for acquittal or retrial.

More recently, Glenn Oztemel (brother of Gary), who was tried and convicted by a jury on September 26, 2024, of conspiracy to violate the FCPA, conspiracy to commit money laundering, three counts of violating the FCPA, and two counts of money laundering in relation to a Petrobras-related bribery and money laundering scheme involving his former employer, Freepoint Commodities LLC, filed a petition on January 23, 2025, asking the court for acquittal or a new trial. Oztemel argued, in part, that there were "material errors" in the jury instructions that "conflat[ed] the elements of distinct theories of substantive FCPA liability" and that "failed to inform the jury of the statute of limitations requirements for the conspiracy counts." He also asserted that the "government offered virtually no evidence at trial that Oztemel committed any criminal conduct within the statutory limitations period."

In another high profile case that in part involved public corruption, on January 29, 2025 a U.S. district judge sentenced former Senator Robert Menendez to eleven years in prison and required him to forfeit $922,188 as a result of Menendez's July 16, 2024 conviction for bribery, conspiracy, and honest services fraud. Two other New Jersey businessmen who were also found guilty in the case received sentences of more than eight and seven years, respectively, in prison, as well as fines well over $1 million.

Other Indicia of Enforcement Trends, Including Investigation-Related Announcements

Q4 2024 saw the announcement of at least three new corporate FCPA investigations, as well as updates on at least one previously disclosed matter beyond the announcement of a formal resolution with the agencies.

On October 10, 2024, Swedish defense contractor Saab issued a press release stating that the company had "received a subpoena from the U.S. Department of Justice… request[ing] information about the Brazilian Government's acquisition of 36 Gripen E/F fighter aircraft for its air force" pursuant to a 2014 contract. The company's release notes that Saab was cooperating with the DOJ inquiry, and that "[b]oth Brazilian and Swedish authorities have previously investigated parts of the Brazilian fighter procurement process [and] [t]hese investigations were closed without indicating any wrongdoings by Saab."

On November 27, 2024, media reports noted that Jamaican-headquartered telecommunications company Digicel Group had told creditors that the DOJ had opened an investigation into potential FCPA violations and that the company was cooperating with the probe. Follow-up reports stated that the company "disclosed that the potential violations occurred in a number of jurisdictions and that the outcome of the DOJ's probe could be material to the company's financial condition."

On December 5, 2024, Methode Electronics disclosed that the company had "received a subpoena from the SEC dated November 1, 2024 seeking documents and information relating to, among other things, the Company's operations in certain foreign countries, certain financial and accounting matters relating thereto, compliance with the [FCPA] and other anti-corruption laws, and material weaknesses in the Company's internal control over financial reporting previously reported in its public filings." The disclosure noted that "[t]he Company is cooperating with the SEC."

The fate of these and other ongoing investigations remains unclear under new administration policies.

In other news, on October 29, 2024, Stanley Black & Decker disclosed in an SEC filing that "[t]he Company previously disclosed that it had identified certain transactions relating to its international operations that may raise compliance questions under the [FCPA] and voluntarily disclosed this information to the [DOJ] and [SEC] [and] [r]ecently, the SEC and DOJ informed the Company that they have each closed their inquiries with no action taken against the Company in connection with these matters." The company had disclosed this investigation in its 10K dated February 23, 2023. The disclosure further noted that "[t]he Company is committed to upholding the highest standards of corporate governance and is continuously focused on ensuring the effectiveness of its policies, procedures, and controls [and] is in the process, with the assistance of professional advisors, of reviewing and further enhancing relevant policies, procedures, and controls."

Policy and Legislative Developments

The DOJ's Corporate Whistleblower Pilot Program and updates to the DOJ's ECCP guidance – both launched in Q3 2024 – were the last major initiatives announced by either the DOJ and the SEC in the FCPA space. As noted above, the DOJ tweaked the CEP as indicated by PDAAG Argentieri's November 2024 blog post, but potentially fundamental changes to all of these DOJ policies are likely forthcoming in the wake of the "pause."

The U.S. government continued to designate foreign officials and others as subject to economic sanctions and visa/immigration restrictions under the Global Magnitsky Human Rights Accountability Act (Global Magnitsky) and other statutory and regulatory authorities for acts of corruption. On December 9, 2024, the Treasury Department sanctioned "28 individuals and businesses involved in a global gold smuggling and money laundering network based in Zimbabwe" led by "Kamlesh Pattni, [who] has facilitated illicit activities by bribing officials, deploying trusted supporters to mask ownership, and weaving a global web of businesses to hide the illicit activities." The press release noted the cooperation of U.K. authorities and sets out the international natures of the illicit network in significant detail. The release also contained a section summarizing the Treasury Department's Global Magnitsky and related anti-corruption efforts for 2024; that section states that in 2024 the Treasury Department's Office of Foreign Assets Control (OFAC) "designated over 100 individuals and entities across more than a dozen countries for these activities, leveraging several Treasury tools and authorities" and that "[s]ince 2021, Treasury has designated more than 500 individuals and entities for corruption and related activities."

Though not directly related to corruption, Treasury and the U.S. Department of State also issued Global Magnitsky and other sanctions in Q4 2024 against persons in Russia, Georgia, Syria, Uzbekistan, and Bosnia and Herzegovina related to human rights violations, cyber-currency scams, and human trafficking activities, many of which are supported through corrupt activities.

On December 18, 2024, OFAC settled with an unnamed "corporate officer" over allegations that the person involved "executed six payments totaling $45,179 on behalf of a blocked individual [under the Global Magnitsky Human Rights Accountability Act] with knowledge that the individual was sanctioned." The person charged agreed to pay the same amount as a penalty for these transactions. The OFAC release states that the "corporate officer" was the treasurer of a company when the company's CEO was sanctioned under U.S. laws and that the officer "learned of the [Specially Designated National's (SDN's)] designation shortly after it occurred." However, the release notes that the officer "did not seek or obtain information or guidance about the legal implications of the SDN's designation for themselves or the company, nor did [the officer] seek or obtain guidance or authorization from OFAC to continue dealing with the SDN." Thus, the officer made or authorized the six payments in violation of the sanctions as part of "their usual duties." The release discusses OFAC's weighting of various aggravating and mitigating factors, which included the fact that the officer "was aware of the SDN's sanctioned status and acted recklessly by failing to take steps to understand the implications of the SDN's designation" but also "cooperated extensively with OFAC's investigation."

International Developments

There were several international developments of note this quarter.

As discussed in this separate alert, on November 6, 2024, the U.K. Home Office issued new guidance for companies "on the offense of failure to prevent fraud" under the 2023 ECCTA. The guidance, in part, outlines procedures that organizations can put in place to help them prevent fraud and, in so doing, satisfy the defense available to organizations that had "reasonable procedures in place to prevent fraud" at the time of misconduct subject to the law. The procedures defined by the Home Office cover many of the compliance expectations set forth by the DOJ's ECCP, but the guidance includes both additional and more detailed expectations, particularly to address fraud risk. Although not binding, the guidance provides key insights into what U.K. courts might consider when assessing whether companies satisfy reasonable procedures defense to ECCTA offenses.

On November 22, 2024, the U.K. SFO stated publicly that Guralp Systems Ltd., a U.K.-based seismic testing company, allegedly had "breached" "the terms of [the company's October 22, 2019] DPA" and that the SFO had "request[ed] a hearing at Southwark Crown Court" on the issue. On January 31, 2025, the court ruled that it had jurisdiction over the dispute over the agreement, allowing the proceedings to proceed toward the SFO's goal of terminating the DPA and reinstating the case. Per the judgment, Guralp had argued that the DPA had already expired prior to the SFO's petition, but the court disagreed. The judgment also clarifies that the basis for the SFO's allegation of a breach lies in a dispute as to Guralp's payment of disgorgement of profits per the DPA's terms. In August 2018, the DOJ formally declined to prosecute Guralp (which at the time was represented by Miller & Chevalier, though the firm does not represent the company related to the U.K. proceedings).

Also on November 22, the U.K. Foreign Secretary announced new financial sanctions under the Global Anti-Corruption Sanctions Regulations 2021 against "three notorious kleptocrats who have siphoned wealth from their home countries, as well as their friends, families and fixers who helped them." The targeted persons are: "Isabel Dos Santos, the daughter of Angola's former president who systematically abused her positions at state-run companies to embezzle at least £350 million [and who] has been subject to an Interpol Red Notice since November 2022"; "Dmitry Firtash, an infamous oligarch who has extracted hundreds of millions of pounds from Ukraine through corruption and his control of gas distribution and has hidden tens of millions of pounds of ill-gotten gains in the UK property market"; and "Aivars Lembergs, one of Latvia's richest people, who abused his political position to commit bribery and launder money [and who in 2021] was found guilty of 19 charges including extorting bribes, forgery of documents, money laundering, and improper use of office in a court in Riga." The sanctions, which include asset freezes and travel bans, cover associated persons and entities.

Elsewhere in Europe, there were several legal developments related to attorney-client privilege (and its use in investigations) in three jurisdictions: the Netherlands, France, and the EU. These decisions, overall, reaffirm protections related to the confidentiality of attorney-client communications (at least with regard to external counsel) in these jurisdictions – though as discussed below, questions remain under French law.

On December 9, 2024, the French PNF announced that a French court had "validated" a convention judiciaire d'intérêt public (CJIP) signed on December 2, with two French nuclear energy companies, Areva and Orano Mining, related to allegations of bribery involving at least one senior official in Mongolia responsible for the award of uranium mining licenses. The announcement noted that Areva agreed to pay a fine of €4.8 million and that Orano agreed to "the implementation of a compliance programme for a three-year period within the ORANO group under the control of the French [Anti-Corruption Agency]… up to a maximum amount of" €1.5 million. The French government maintains significant ownership stakes in both Areva and Orano.

Most recently, after a multi-week trial in December 2024, a Swiss federal court issued a ruling on January 31, 2025 that commodities trading company Trafigura was guilty of failing to implement required internal controls and related systems during the time period in which bribes were paid in Angola to at least one official of a Sonangol affiliate regarding the award of oil-related contracts. The court ordered the company to pay a penalty of 3 million Swiss francs (approximately $3.30 million) and to forfeit over $145 million in illegally obtained profits. The court also found Trafigura's former Chief Operating Officer, Mike Wainwright, guilty of arranging the payment of bribes and sentenced him to 12 months in prison, together with an additional 20-month suspended prison term; according to media sources, Wainwright has already stated that he will appeal the verdict. The court also found two other individuals – a former Trafigura employee who acted as an intermediary for the payments, and the former CEO of the Sonangol affiliate who received the bribes – guilty of various charges. We will discuss this case in more detail in our next Review after the complete text of the court's judgments is released publicly. The DOJ announced that Trafigura pleaded guilty to an FCPA conspiracy charge in March 2024.

Moving to Latin America, on November 14, 2024, the Brazilian Office of the Comptroller General (CGU) and the Attorney General's Office (AGU) announced a leniency agreement with commodities trader Freepoint Commodities LLC related to allegations of bribery involving Petrobras officials. Under the leniency agreement, Freepoint agreed to pay Reais 132,253,647.32 (approximately $22.6 million) in government fines and reimbursement to Petrobras and to enhance its "compliance and governance policies" as a prerequisite for engaging in new transactions or conducting business operations in Brazil. The leniency agreement follows a December 14, 2023 announcement of a three-year DPA issued to Freepoint by the DOJ for similar corruption violations, which contained provisions allowing for an offset of U.S. fines in the event the company agreed to pay fines to the Brazilian authorities.

On December 3, 2024, the Comptroller General of the State of Minas Gerais (CGE), the Attorney General of the State of Minas Gerais (AGE), and the Minas Gerais Public Prosecutor's Office (MPMG) in Brazil announced a leniency agreement with SAP Brasil Ltda related to "evidence of illicit practices, in collusion with other companies and state public agents, to defraud the bidding process" for a Minas Gerais State procurement of "an Integrated Human Resources Management system." Under the agreement, the company will pay 66.3 million Reais (approximately $11 million), an amount that includes a fine, disgorgement, and "moral damages" to the State of Minas Gerais. The company will also continue to cooperate with ongoing investigations, having already "collaborated" with the investigation to date. Notably, the announcement states that "CGE conducted a detailed review of SAP Brasil Ltda.'s compliance program and concluded that the company currently has an effective program in place, [though] [t]he company has also committed to continuing to improve and monitor its governance and compliance policies." The Brazilian agreement follows dispositions by SAP with the DOJ and South African authorities in January 2024 involving alleged bribery schemes in other countries.

Earlier in Q4, on September 20, 2024, the CGU and AGU announced the negotiated revision of leniency agreements signed with seven companies related to the massive Lava Jato investigation. Per the announcement, the revision process began when terms of the agreements were questioned by several political parties in Brazil. The announcement states that the CGU and AGU's goals in amending the leniency agreements included "continuity of economic activity, with the preservation and generation of jobs in the construction industry, a strategic sector for national development; the preservation of the public integrity agenda, with the maintenance of current leniency agreements; and the strengthening of the consensus mechanism for overcoming conflicts in the Judiciary." This last goal may be linked to ongoing criticism from the Brazilian Supreme Court (STF) related to allegations of tainted evidence and other issues in the Lava Jato operation that have led to court actions in these cases, including a September 6, 2023 ruling in which an STF judge held that any evidence originating from the leniency agreement signed by Odebrecht in December 2016 is tainted and thus inadmissible in other cases. The CGU/AGU announcement notes that the seven revised leniency agreements will be submitted to the STF for approval.

On October 10, 2024, the CGU announced that it had "reache[d] 70 [Administrative Accountability Proceedings, or] PARs [with companies], surpassing the previous record of 67 processes judged in 2023." Such PARs cover many types of corporate "illegal acts," including bribery and financial fraud, as well as the filing of false documentation with government authorities – the focus of two of the most recent cases that set the new record. One of the other announced cases, involving the company Dema Participações e Empreendimentos LTDA, alleged that the company "act[ed] as an intermediary in the payment of bribes to public agents of Eletrobras Termonuclear SA… in the public bidding process." Per the public release, "Dema Participações was declared ineligible to bid and contract with the public administration for a minimum period of two years." The CGU announcement notes that this case is part of "Operation Fiat Lux" – "one of the offshoots of Operation Lava Jato."

In Peru, on October 21, 2024, former President Alejandro Toledo was sentenced by criminal court in Lima to 20 years and six months in prison for "the crimes of collusion and money laundering" as a result of his taking bribes from Odebrecht. Toledo was tried after his extradition from U.S. to Peru in early 2023; until his extradition he had been living in exile in California since 2017. The verdict stated that Toledo "colluded with interested parties such as Odebrecht so that, through a bribe of [$35 million], [Odebrecht] was awarded the contract for the construction of sections 2 and 3 of [Peru's] Interoceanic Highway, causing harm to the State." Media sources noted that three other former officials and businessmen were given jail time related to the scheme. Toledo has stated that he will appeal the verdict and sentence.

Actions Against Corporations

Aerospace and Defense Company Moog Inc. Settles with the SEC for Indian Subsidiary Conduct

On October 11, 2024, New York-based aerospace and defense company Moog Inc. agreed to pay $1.7 million in penalties, disgorgement, and interest to resolve charges that the company violated the books and records and internal accounting controls provisions of the FCPA as a result of bribes paid to Indian foreign officials by its wholly owned Indian subsidiary, Moog Motion Controls Private Limited (MMCPL).

The SEC's Cease-and-Desist Order (Order) details two primary schemes to obtain business by MMCPL in India and notes other efforts to improperly influence tender processes. In July 2020, MMCPL engaged an agent (referred to as Agent A in the Order) via a "liaison agreement" to assist the company in obtaining a contract with the government-owned Indian railway company South Central Railway (SCR). The Order details that the agent made payments to an SCR employee in order to place MMCPL on a designated supplier list managed by the Research Design and Standards Organization (RDSO), an agency of the Indian Ministry of Railways that "functions as a technical advisor and consultant to the Railway Board with respect to the design and standardization of railway equipment." In return, the agent would receive 10 percent of the value of the contract. The Order notes that, after being placed on the list, MMCPL employees contemplated in engaging in "additional misconduct" in order "to remove [a] competitor from the supply list." MMCPL won the contract in September 2020, and in April 2022 "commission[s]" were paid to the agent and "falsely recorded as legitimate contractor services."

According to the Order, in May 2021, MMCPL wanted to participate in a public tender for the government-owned Indian aerospace and defense company Hindustan Aeronautics Limited (HAL). Internal employee discussions noted that "bribe payment[s]" in "cash" would be paid to HAL in order to disqualify other competitors and win the bid. In November 2021, HAL awarded MMCPL the contract. According to the Order, money for the bribe was generated through a false invoice from a MMCPL third party (referred to as Distributor B in the Order); the Order notes that the MMCPL finance manager was directed to execute this arrangement after "[v]arious cash generation schemes through inflated and false invoices and connections to other entities were discussed to fund the bribe payment." Distributor B "was not in fact capable" of undertaking the project for which the "fabricated invoice" was prepared. The expense was recorded in MMCPL's books as a "legitimate expense" and "falsely booked" as an expense under the HAL contract.

The Order details other efforts to "improperly influence tenders," "at times" using Agent A and Distributor B. For example, an employee discussed using Agent A to disqualify a competitor from the supplier list managed by the RDSO in relation to a November 2020 tender; the discussed amount of the bribe was one percent of the relevant contract value.

As a result of the conduct described in the Order, the SEC imposed a total fine of $1,683,815, including a civil penalty of $1,100,000, disgorgement of $504,926 (the amount of "unjust" profits related to the improper activities), and prejudgment interest of $78,889.

The Order notes that Moog cooperated with the investigation. Specifically, Moog initially reported the misconduct to the DOJ and provided the SEC "with facts developed during its own internal investigation," as well as "subsequently" providing the SEC with key documents and witness statements. The Order details that Moog also engaged in remediation efforts, including by "terminat[ing] the employees and third parties involved in the misconduct," enhancing controls related to third party payments, and improving certain elements of its compliance program. For example, the Order highlights that Moog "increased the frequency of its audits and monitoring of distributor and intermediary activities" and "increased training of employees on anti-bribery issues and tender specific procedures."

Key Takeaways

- Culture and Management Tone Named as a Cause of Violations: In addition to "deficient internal accounting controls," the Order emphasizes that the culture at MMCPL created an environment that allowed for the conduct to occur, and that the weak tone at the top was a root cause of the misconduct. Specifically, "[e]mployees freely discussed their misconduct, which reflected a prevailing culture to win business at any cost, including improper means. The widespread misconduct at MMCPL reflected a breakdown in internal accounting controls, training, compliance, and tone at the top of the subsidiary." Indeed, the Order relies heavily on quotes from internal correspondence among employees where they discussed the efforts to win tenders, use of third parties to funnel funds to government officials, and a desire to remove competitors through improper payments. The subsidiary's finance manager was aware of the actual nature of various payments and was in a position to be "directed" to make them by other MMCPL employees. The Order also highlights that unique market entry challenges may have also contributed to employees' willingness to engage in misconduct.

- DOJ Disclosure: The Order highlights Moog's disclosure to the DOJ as a key element of Moog's cooperation. Notably, public records and filings do not indicate whether the DOJ has or is currently conducting an investigation of the company for the conduct.

- No FCPA Bribery Charge: As with the SEC's August 25, 2023 settlement with 3M, detailed in our Autumn Review 2023, the SEC did not charge Moog with violating the FCPA's anti-bribery provisions despite stating that MMCPL bribed Indian officials "to win business" and "cause[d] public tenders in India to favor Moog's products and exclude competitors." While the exact reasoning for the decision is not clear, the SEC in its press release hints at the message other companies should take from the resolution, specifically that it "highlights the need for issuers operating internationally to have appropriate compliance and internal accounting controls over third parties and third-party payments, as weaknesses in those systems heighten corruption risk[.]"

RTX and Subsidiary Raytheon Resolve FCPA and Related Export Control Violations with SEC and DOJ, Agreeing to Retain Compliance Monitor and Pay More than $383 Million

On October 16, 2024, the DOJ and SEC announced that they finalized agreements with U.S. defense contractor and "issuer" RTX Corporation (RTX) and its wholly owned subsidiary Raytheon Company (Raytheon) related to previously disclosed legal matters including allegations of (1) foreign bribery and related export control violations regarding business in Qatar, and (2) major government fraud and Truth In Negotiations Act (TINA) violations related to sole source contracts with the U.S. government. The companies agreed to pay approximately $383 million to the DOJ and SEC to resolve the FCPA-related allegations related to business in Qatar, with additional amounts to be paid relating to the allegations of government fraud. In parallel, Raytheon and the DOJ also announced a civil settlement of related False Claims Act litigation, with Raytheon agreeing to pay $428 million for knowing or acting with deliberate ignorance or reckless disregard to the fact that it failed to disclose accurate, complete, and current cost or pricing data regarding its costs on numerous government contracts between 2009 and 2020 and that its certifications to the government about its proposed costs were inaccurate.

Two DPAs with the DOJ were announced in an October 16, 2024 press release. One DPA – dated October 16, 2024, and filed in the Eastern District of New York – included two conspiracy counts, one for conspiracy to violate the FCPA, and a second conspiracy to violate the Arms Export Control Act (AECA), specifically the Part 130 requirements of the ITAR (FCPA DPA). We focus on the FCPA DPA below. Related to the same conduct in the FCPA DPA, RTX agreed to an administrative order (SEC Order) with the SEC, agreeing to a civil fine, disgorgement, and interest of just over $100 million. A second DPA – dated October 16, 2024, and filed in the District of Massachusetts - alleged that Raytheon "engag[ed] in two separate schemes to defraud the Department of Defense… in connection with the provision of defense articles and services, including PATRIOT missile systems and a radar system." Raytheon agreed to pay a criminal penalty of more than $146 million. Both DPAs and the SEC order require that Raytheon retain an independent compliance monitor for three years.

These resolutions followed an announcement in August 2024 of an agreement between RTX and Directorate of Defense Trade Controls (DDTC) regarding export control violations, with RTX agreeing to a civil penalty of $200 million and committing to use half of that amount to fund compliance enhancements and the appointment of an external Special Compliance Officer.

The allegations regarding transactions in Qatar go back to roughly 2012, or in the case of the SEC Order, back to the "early 2000s." In April 2020, Raytheon and United Technologies Corp – both longstanding public companies trading on the New York Stock Exchange (NYSE) –merged, with Raytheon Company shares ceasing to be traded publicly, and the United Technologies entity changing its name to Raytheon Technologies Corp. Just prior to the merger, in Raytheon's 10-K filed on February 12, 2020, Raytheon noted that the SEC had issued a subpoena to the company in 2019 in connection with company and joint venture (JV) contracts "in certain Middle East countries since 2014." According to press reports, the investigation followed litigation in California involving a third party used by Raytheon in Qatar. Raytheon Technologies Corp. disclosed in May 2020 that the DOJ had also initiated an investigation during the first quarter of 2020, and later disclosed in October 2020, that the SEC had issued a second subpoena. The corporate announcements that year noted cooperation with the authorities. In 2023, the company changed its name to RTX Corporation, combining the pre-merger trading symbols RTN and UTX.

Use of Contracts for "Sham Defense Studies" to Make Improper Payments in Qatar and Related ACEA/ITAR Violations

The FCPA DPA and SEC Order address an alleged scheme involving payments to third parties in Qatar affiliated with a government official there (or multiple officials, per the SEC Order), without any services being provided. The SEC Order also highlights an agency relationship with a member of the Qatari royal family, emphasizing concerns about potential corruption for payments that over time exceeded $30 million and a lack of measures to ensure that services were provided under the agency agreement.

The FCPA DPA focuses on the conduct of five Raytheon employees. It alleges that Raytheon employees entered into transactions between 2012 and 2016 with a "high-ranking official" of the Qatar Emiri Air Force (QEAF) using different entities affiliated with the foreign official, making payments of nearly $2 million to secure profits of more than $36 million. In particular, the FCPA DPA focuses on efforts to gain business under four "additions" to a contract between a Raytheon entity and the Gulf Cooperation Council (GCC). According to the FCPA DPA, Raytheon and the foreign official at issue agreed to increase the scope of the relevant contracts to include various studies; Raytheon then subcontracted with entities affiliated with the foreign official to acquire the studies, although ultimately Raytheon personnel, not the subcontracted entities, prepared the materials. Raytheon's personnel also tried to enter into a teaming agreement with one of the same entities for another contract to funnel bribes to the foreign official in order to receive the foreign official's assistance to help Raytheon win the contract with QEAF, although this contract ultimately did not go forward.

The FCPA DPA states that Raytheon personnel used personal email accounts to communicate with the foreign official, sending draft contracts and other materials to the foreign official as well as coaching the official and another representative on how to pass Raytheon's due diligence process. The DPA alleges that the transactions were initially contemplated using a construction company, but then the official at issue organized new companies intended to be specific to the defense industry. The Qatari entity then submitted false and incomplete information during the due diligence process, "fail[ing] to disclose… [the official's] involvement or ownership stake." To obscure the connection, the official began to use an alias (in emails and some corporate documents for the entities); meanwhile the Qatari third party also provided documents to Raytheon showing that the official, in his QEAF position, had received and approved the reports. Raytheon paid the Qatari entity $975,000 in 2014 for three studies under the contract.

Payments for the second contract allegedly followed a similar pattern. According to the FCPA DPA, the contract scope was amended late in the process to include a requirement for studies, and Raytheon employees used personal email accounts to liaise with the QEAF official and other representatives to assist a second entity to pass due diligence and conclude an agreement with Raytheon. Raytheon paid this second entity $950,000 for another three studies under this second contract in 2017.

The SEC Order states that the third parties involved in the studies were majority owned by a member of the Qatari royal family – specifically, someone who was "an immediate family member of the current Emir of Qatar." The SEC indicates that there were two Qatari military officials affiliated with the entities involved in the payments for "sham defense studies." The SEC Order also details that, despite apparent efforts noted in the FCPA DPA to conceal official connections, Raytheon's due diligence process did identify one of the military officials as a shareholder of one of the suppliers, but "no action was taken to resolve the issue." In addition to detailing various other red flags and the use of personal email accounts, the SEC also emphasizes Raytheon employees used personal computers and phones as well as off-channel communications to communicate with the Qatari third parties and foreign officials.

The DOJ alleges that "as a result of the bribery scheme, Raytheon earned approximately $36.7 million in profits from the four additions to the GCC Contract… and expected to earn over $72 million more, had the [contract related to a teaming arrangement] come to fruition." The SEC ordered disgorgement of $37 million, as detailed below.

The FCPA DPA also details that the AECA and ITAR Part 130 required Raytheon to apply for export licenses for the services covered by the relevant contracts and that Raytheon should have "inform[ed] DDTC whether Applicant or its Vendors… had paid, offered, or agreed to pay political contributions, fees or commissions in connection with the sale or transfer of a defense article or defense service," with an aim to "prevent 'improper influence' in those sales." Raytheon did not disclose the payments at issue. The FCPA DPA's statement of facts alleged that four of the Raytheon personnel involved in the payments to the third parties knew of these obligations under AECA and ITAR (through trainings and other communications) and – in some cases – sent emails to other employees encouraging them to be aware of the obligations. Consequently, other Raytheon personnel submitted false information with the export licenses, without knowledge that the relevant certification was false. The involved Raytheon personnel allegedly also coached the Qatari entity on submitting false certifications to Raytheon.

Raytheon "Failed to Obtain Proof that Services Were Provided" and "Made Unsupported Payments" to the Agent

In addition to covering the contracts for studies as summarized in the FCPA DPA, the SEC Order also summarized an agent relationship in Qatar, flagging various concerns. First, the SEC detailed how the agent is a "cousin of the Qatari Emir, at times advised the Emir on financial matters, and was a member of the Qatari Council of the Ruling Family." The SEC never explicitly declares the agent to be a foreign official under the FCPA, but states that "[f]or years, [Raytheon] relied on a poorly drafted two-page opinion that [the agent] was not a government official, despite the agent being a royal family member and a member of the Council of the Ruling Family."

Second, the SEC Order notes various additional red flags related to the agent and the commercial relationship, including the following: he had no military experience; the agent was required to exercise only "best efforts" to help Raytheon develop relationships and good will with the Qatari military; the agent did not in fact help with "the few substantive tasks that were itemized in the agreements"; the agent did not need to submit invoices to Raytheon for payments; Raytheon did not require reports on the agent's activities as a condition for payment until 2019 (over a decade after retention of the agent); Raytheon personnel believed the agent could represent Raytheon only because the Emir had granted an exception to a prohibition against such companies using sales representatives (without inquiries into whether the agent "engaged in corruption to obtain the exception"); a company employee ghost-wrote a report for the agent regarding what work the agent had performed; the Qatari country manager was considered the agent's "handler, controlling all access" to the agent, and "untouchable"; when required to submit information under the company's "compliance and due diligence program," the agent's submissions were "chronically late"; the company knew that the agent was interacting with officials on the company's behalf, but company personnel did not know "the names or titles of the government officials" or what happened during the meetings; and more. The SEC also notes that the Raytheon country manager for Qatar would sometimes ghost-write communications for the agent in disputes with Raytheon, and that other Raytheon personnel were aware of this fact. The SEC further details how various internal controls did not halt or reduce payments, with financial limits being "raised or manipulated" to accommodate payments to the agent, and with internal sign-offs "represent[ing] the epitome of a paper program."

The SEC Order notes these red flags and quotes a Raytheon compliance employee stating that "we basically accepted to live with" the red flags. The SEC notes that "numerous Raytheon employees raised concerns regarding red flags of high corruption risk," but these employees were "overruled by management, who allowed the contracts with [the agent] to be extended." The SEC concludes that "[t]ime and time again, managers and employees raised concerns over red flags of corruption regarding the agent," but "the relationship… continued unchecked." Moreover, "any attempt to gather information about what [the agent] was doing through the activity reports was a meaningless, check-the-box exercise that neither enhanced compliance efforts nor mitigated corruption risks." The SEC noted that the company paid the agent more than $30 million, including $17 million in March and April 2020, "in an effort to exit the relationship quickly," without disclosing the "known corruption concerns and amounts paid" to the SEC "until new management became aware following the merger that created RTX and [new management] determined to cooperate fully with the [SEC's] investigation." The SEC notes that Raytheon credited the agent with assisting in contracts worth more than $5.8 billion, including five contracts between 2015 and 2020 worth $3.2 billion.

Penalty Calculations, Cooperation, and Remediation

For the FCPA conspiracy count, the DOJ calculated a criminal penalty of $230,400,000 and forfeiture amount of $36,696,068. However, the DOJ agreed to offset the forfeiture amount by $7,400,090 (approximately 20 percent) based on the agreement to disgorge profits to the SEC, making the DOJ FCPA-specific total $259,335,978. The DOJ also imposed a criminal fine of $21,904,850 for the ACEA/ITAR-related conspiracy violation, bringing the DOJ total for that DPA to $281,600,828.

Meanwhile, the SEC and RTX agreed to the following: disgorgement of $37,400,090, prejudgment interest of $11,786,208, and a civil penalty of $75,000,000, for a total of $124,186,298. However, the SEC agreed to reduce the civil penalty (based on the DOJ's criminal fine) by $22.5 million, bringing the SEC Order total to $101,686,298.

Overall, RTX and Raytheon agreed to pay $361 million to the DOJ and SEC for the FCPA resolutions, and nearly $383 million including the ACEA/ITAR fine. The DOJ did not give the company voluntary disclosure credit because it did not voluntarily and timely disclose to DOJ the underlying conduct. The DOJ did give Raytheon the full two-point deduction under the Sentencing Guidelines in calculating the culpability score, but noted that "in the initial phases of the investigation, prior to [and] in or around 2022, the Company was at times slow to respond to the [DOJ's] requests and failed to provide relevant information in its possession; for example, the Company withheld relevant, material information from the government and gave incomplete and misleading presentations regarding the nature and scope of a relevant third-party intermediary relationship." Raytheon did receive cooperation and remediation credit of 20 percent. For cooperation, the DOJ cited providing factual information obtained through its internal investigation, facilitating interviews, "proactively" sharing evidence that the DOJ did not already know, and "engaging experts to conduct financial analyses." Similarly, the SEC noted that "[a]fter a period of uncooperativeness and following the merger, Raytheon provided significant cooperation under new management, who also hired new outside counsel." The SEC also noted that "new management also took steps to remediate, including terminating employees involved in the misconduct, some of which were still working with the company despite their known roles in the misconduct."

Regarding FCPA-specific remediation, the DOJ noted that Raytheon added subject matter experts and enhanced its training and communications while taking multiple efforts to reduce third party risk – "recalibrating third party review and approval processes to lower… risk tolerance," "implementing data analytics over third parties, and enhancing controls over sales intermediaries." The SEC included similar points, while also noting that RTX improved its anticorruption risk assessments.

Compliance Monitorship and Other Measures

Under both DPAs and the SEC Order, Raytheon and RTX are required to retain an independent compliance monitor(s) for a three-year term, as well as to continue to implement enhancements to its compliance and ethics program.

Key Takeaways