FCPA Autumn Review 2015

International Alert

Introduction

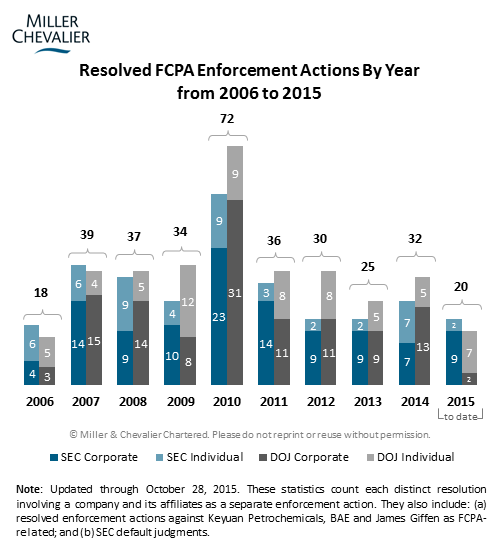

Following a slow first half of the year, the third quarter of 2015 saw a rise in resolved enforcement actions brought under the U.S. Foreign Corrupt Practices Act ("FCPA"), which nearly doubled the number of FCPA actions brought during the first two quarters combined. Notable aspects of this increase in enforcement are the steady stream of resolved corporate enforcement actions coming from the U.S. Securities and Exchange Commission ("SEC" or "Commission"), a lack of corresponding corporate enforcement by the U.S. Department of Justice ("DOJ" or "Department") and an uptick in resolved individual enforcement actions brought or unsealed by the DOJ. Accompanying the overall increase in resolved enforcement this quarter are several recently disclosed FCPA-related declinations -- i.e., decisions not to pursue enforcement -- and a spike in the number of new FCPA investigations identified.

A closer look at the agencies' enforcement efforts thus far this year suggests that the disparity in resolved corporate FCPA actions brought by the DOJ and SEC is likely attributable to a combination of factors, including: the lower burden of proof the SEC faces in bringing civil books-and-records and internal controls charges; an emphasis by the DOJ on the use of declinations to encourage corporate cooperation; and a Department focus on high-value corporate enforcement actions and the pursuit of individual wrongdoers. As discussed in greater detail in this review, recent agency pronouncements, such as the DOJ memorandum issued by Deputy Attorney General Sally Yates (the "Yates Memorandum"), indicate that the DOJ intends to continue this shift toward higher stakes "blockbuster" enforcement actions and the prosecution of individuals.

Enforcement Trends

As detailed in the chart below, since July, the SEC has resolved five corporate FCPA dispositions, along with one individual action, for a total of six enforcement actions this quarter. In contrast, the DOJ has resolved one corporate FCPA disposition, along with four individual actions, for a total of five enforcement actions this quarter. In addition to this, the DOJ unsealed an individual FCPA enforcement action in August that the Department had previously resolved in June.

Of note, the nine corporate FCPA enforcement actions the SEC has resolved through three quarters this year have already exceeded the total number of corporate actions the Commission resolved during all of 2014. Similarly, the seven individual FCPA enforcement actions the DOJ has resolved so far this year, including four plea agreements this past quarter alone, surpass the five individual actions it resolved during all of 2014.

The SEC's enforcement activity includes corporate settlements involving Mead Johnson Nutrition Co., The Bank of New York Mellon Corp., Hitachi, Ltd., Hyperdynamics Corp. and Bristol-Myers Squibb Co. (Note that the Bristol-Myers Squibb settlement, under which the company agreed to pay more than $14 million to settle charges that it violated the accounting provisions of the FCPA based on inaccurately recorded benefits provided by its Chinese joint venture to healthcare professionals in China, will be discussed in more detail in our forthcoming FCPA Winter Review 2016.) Of these five SEC enforcement actions, four were administrative proceedings, with Hitachi, Ltd. representing the only case filed in federal district court. This ratio mirrors the SEC's out-sized reliance on administrative proceedings in recent years, with administrative proceedings constituting 13 of the 16 corporate FCPA settlements entered into by the SEC since January 2014 -- a substantial increase from prior years when administrative proceedings were the exception rather than the rule. Recent district court decisions have cast doubt, however, on the constitutionality of certain aspects of the SEC's administrative proceedings. Those cases and public criticism, as well as the SEC's recent proposed changes to its Rules of Practice that assist defendants, may reverse or at least alter this trend. Only a few months ago, the SEC issued guidance identifying the factors that help determine whether to bring a new enforcement action as a civil action in a federal district court or as an administrative proceeding. The coming months will likely provide more clarity to the SEC's continued preference for and the form of its administrative proceedings.

On the DOJ side, the lone corporate FCPA enforcement action brought by the Department this quarter is a deferred-prosecution agreement ("DPA") with New Jersey construction company Louis Berger International, Inc. The individual FCPA enforcement actions include guilty pleas by two Louis Berger executives and a guilty plea by a former executive of an Argentine subsidiary of Siemens Aktiengesellschaft for conduct related to that company's $800 million settlement with the DOJ and the SEC in December 2008. The other two guilty pleas do not correspond to any corporate enforcement actions, either by the DOJ or SEC.

It is worth noting that none of the corporate FCPA resolutions entered into by the agencies so far this year involve parallel enforcement by the DOJ and SEC. As discussed in our FCPA Summer Review 2015, the DOJ's failure to undertake parallel enforcement alongside the SEC's numerous FCPA dispositions appears to be a conscious Department strategy to more frequently decline enforcement where appropriate (such as instances of self-disclosure and cooperation). DOJ Criminal Division spokesman Peter Carr recently provided context to the DOJ's shift in priorities, explaining that the Department is adjusting its focus from smaller cases, primarily those based on corporate self-reporting, to "bigger, higher impact cases, including those against culpable individuals, both in the U.S. and abroad, [which] take longer to investigate and absorb significant resources."

One driver of the announced shift in the DOJ's enforcement priorities is the aforementioned Yates Memorandum, which formalized as official policy the emphasis the Department has placed in recent years on encouraging companies to actively cooperate in the prosecution of culpable individuals. Issued in September 2015, the Yates Memorandum is intended to provide specific guidance to all federal prosecutors, and its core principles will likely have a lasting impact on FCPA enforcement efforts by both the DOJ and SEC.

Because of the length of time typically involved in the prosecution of individuals, from the initiation of an investigation, to the filing of criminal charges, to their ultimate resolution, the uptick in individual prosecutions by the DOJ this quarter cannot be attributed to the Yates Memorandum per se. However, as discussed in more detail below, the Yates Memorandum purports to clarify general principles followed by the DOJ over the last few years.

Declinations

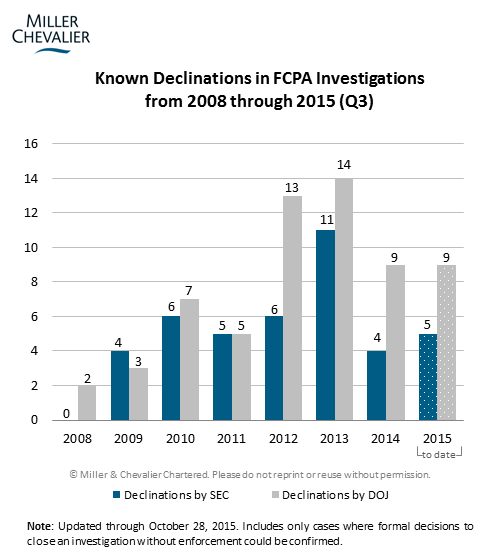

Accompanying the increase in resolved enforcement actions this quarter, both agencies have maintained a steady pace of declinations. We have identified five additional declinations involving three companies since the publication of our FCPA Summer Review 2015, including two by the SEC and three by the DOJ. Overall, known declinations for the year to date have already surpassed the number of known declinations in all of 2014.

The additional declinations we have identified are detailed below. Of note, the agencies' declinations with respect to Syngenta AG are an example of the lag time that we often encounter in tracking declinations, since companies generally announce the closure of investigations in their quarterly securities filings or annual reports (if they choose to disclose them at all). This lag time can be several months or more and, as such, our declination totals are always subject to revision.

- Syngenta AG: In a Form 2-F filed on February 12, 2015, Swiss agriculture company Syngenta disclosed as follows: "In 2011, Syngenta had been asked to provide information to US regulatory authorities concerning possible violations of applicable anti-corruption laws in Russia. The US regulatory authorities have concluded their investigation and recommended no further action."

- Mead Johnson: On July 28, 2015, Mead Johnson entered into a disposition with the SEC over alleged violations of the FCPA's books-and-records and internal controls provisions. In connection with that settlement, a Mead Johnson spokesperson stated that the company had "been informed by the U.S. Department of Justice that it has closed its inquiry into possible violations of the Foreign Corrupt Practices Act by Mead Johnson."

- NCR Corporation: In mid-2012, NCR disclosed the existence of investigations by the SEC and DOJ into possible violations of the FCPA. In a Form 10-Q filed on July 31, 2015, NCR reported that "on June 22, 2015, the SEC staff notified the Company that it did not intend to recommend an enforcement action against the Company with respect to these matters." The 10-Q goes on to suggest, however, that the DOJ investigation, remain opens, noting that "the Company responded to [the DOJ's] most recent requests for documents in 2014."

As reported in our FCPA Summer Review 2015, Assistant Attorney General for the DOJ's Criminal Division, Leslie Caldwell, earlier this year predicted "an uptick in declinations for companies that actually come in and do everything that they are supposed to do," while acknowledging the importance of companies being able to see that the Department is actually providing more declinations in exchange for greater corporate cooperation. The DOJ's declination in the PetroTiger Ltd. investigation, which hinged on the company's voluntary disclosure and cooperation in the Department's prosecution of several PetroTiger executives, serves as a prominent example of such cooperative benefits. Unfortunately, the number and nature of the DOJ's more recent declinations are not sufficient to draw similar conclusions.

The Yates Memorandum is likely to influence the future issuance of declinations by the DOJ. In connection with corporate criminal investigations, the Memorandum requires companies to provide "all relevant facts" relating to any individual responsible for the underlying misconduct to receive any consideration of cooperation as a mitigating factor. By raising the bar for cooperation, this requirement could result in fewer declinations if all other factors remain the same. A related concern is that companies may be less willing to voluntarily disclose misconduct either because they might be hesitant to turn over evidence against certain employees or executives, or due to concerns that the cooperation requirements in the Yates Memorandum may not be practically achievable in their circumstances.

Note that, as in the past, we have tracked "declinations" based on a broad interpretation of the term, counting any instance in which the DOJ or SEC chose to close an FCPA investigation without pursuing enforcement, regardless of the agency's reason for doing so. (See Discussion of Declinations by Miller & Chevalier Counsel Marc Alain Bohn.) The DOJ's approach to declinations under the Yates Memorandum may make it easier to draw better distinctions between those declinations issued as a result of corporate cooperation and those resulting from the DOJ's decision to not prosecute on jurisdictional, evidentiary or other related grounds.

Known Investigations Initiated This Year

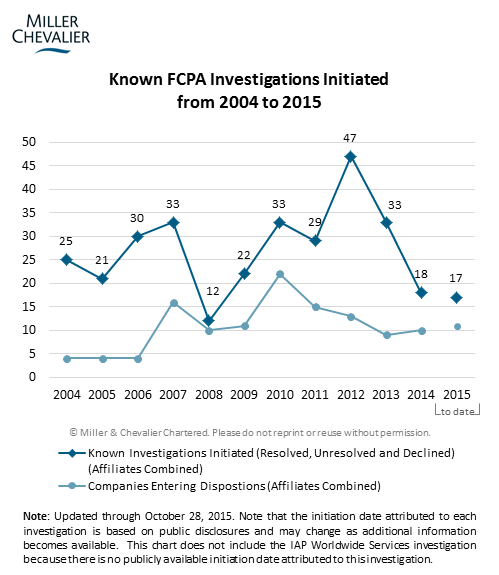

To date this year, we are aware of the DOJ and SEC initiating FCPA investigations against 17 companies, 13 of which we identified this past quarter. This uptick in known investigations is due in part to the public disclosure of ongoing investigations by several companies implicated in Brazil's continually expanding Operation Car Wash scandal (discussed below). We would caution, however, that the statistics in this category are always subject to change because of the delay that is involved in identifying new investigations (see explanation in our FCPA Summer Review 2015). For example, this past quarter we updated the investigation totals for several prior years in the chart above to account for older investigations we only recently identified, including Hitachi Ltd. and Louis Berger International, Inc., whose investigations were not publicly disclosed until they settled with the SEC.

The number of investigations identified to date this year is nearly equal to the total number of investigations initiated in all of 2014, and this 2015 total is likely to surpass that 2014 by year's end. Notwithstanding this increased pace, however, the overall number of newly initiated investigations in 2014 and 2015 is relatively low compared to totals from previous years, which could be attributable to a number of different factors we have discussed in previous FCPA Reviews, including more effective compliance programs and a drop in voluntary disclosures by companies.

Government's Focus on Actions against Individuals

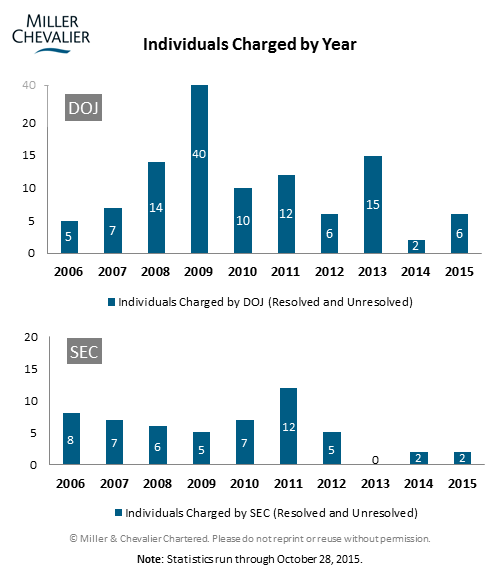

In light of the emphasis the Yates Memorandum places on the prosecution of individuals, we have examined recent trends related to the DOJ's and SEC's enforcement against individuals. The chart below reflects the number of individuals charged with FCPA violations by the SEC and DOJ by year, including 2015 to date.

It is worth noting that the DOJ has charged several more individuals in the first three quarters of this year than in all of 2014, which was a low-water mark for the DOJ in terms of individual prosecutions in the era of heightened enforcement. For its part, the SEC's prosecution of individuals is also slightly up this year, with the Commission having already brought as many actions against individuals in 2015 as it did in all of 2014. Based on past trends, these DOJ and SEC enforcement totals are likely to grow as both agencies charge and enter into settlements with additional individuals during the last quarter of the year.

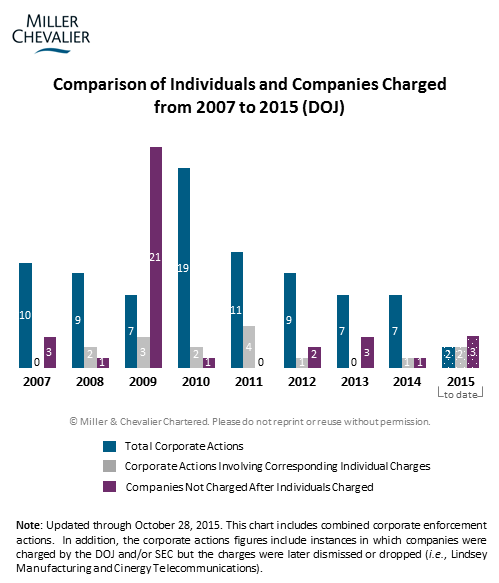

Notwithstanding the uptick in individual prosecutions by both the DOJ and SEC this year, it is important not to overstate this trend, as the increase we have seen to date is not particularly significant in absolute terms. What effect the Yates Memorandum will have on the prosecution of individuals is as yet unclear, but will become more evident over time as prosecutors incorporate its guidance into ongoing and new FCPA investigations. The chart below compiles some of the additional information necessary to begin such an analysis. To gauge the real impact of the Yates Memorandum, however, one will need to look beyond the simple number of individuals charged and instead compare the overall number of corporations charged by the DOJ (see left-hand column below) against the number of corporations charged alongside one or more individuals (see the middle-column below) and the number of corporations which avoided charges altogether while one or more individuals were prosecuted (see right-hand column).

While the Yates Memorandum suggests that the DOJ is increasing its focus on the pursuit of individual wrongdoers, the chart above highlights the fact that the vast majority of corporate FCPA enforcement actions brought by the Department since 2007 have not been accompanied by the prosecution of individual executives or employees.

Note that the spike in individual charges in 2009 without a corresponding spike in corporate actions is attributable to the so-called "SHOT Show" sting, in which the DOJ charged 22 individuals from 16 different companies as part of an alleged conspiracy (see our FCPA Spring Review 2010). The charges against all of these individuals were eventually dismissed, however, making the statistics for 2009 less valuable for comparison purposes.

As the aspirational principles in the Yates Memorandum are more uniformly applied by the DOJ over time, one might expect to see a variety of trends, including: a drop in the number of corporate FCPA enforcement actions that are not accompanied by individual prosecutions; a corresponding increase in the number of corporate FCPA enforcement actions that involve the prosecution of individuals; and/or an increase in the number of individuals prosecuted under the FCPA without corresponding corporate actions, possibly because of an increased number of declinations being provided.

Although the data set for 2015 is admittedly incomplete, the chart above demonstrates that on the DOJ side the enforcement statistics for 2015 largely mirror the principles embodied in the Yates Memorandum and match the Department's rhetoric on the positive benefits of cooperation. For instance, both of the corporate actions the DOJ has brought in 2015 have been accompanied by the prosecution of individual executives, several individuals have entered into resolutions without a parallel corporate settlement (though it is possible that parallel actions are forthcoming) and DOJ is reportedly declining a significant number of cases.

While the Yates Memorandum does not apply to the SEC, it could nevertheless end up affecting the SEC's prosecution of individuals if companies end up disclosing more evidence of individual misconduct as the companies seek to cooperate with DOJ's FCPA investigations. Regardless of whether such evidence is sufficient to support criminal charges, if an issuer is involved it could form the basis of civil charges by the SEC, which carry a lower burden of proof.

We will continue to track the evolution of the SEC's and DOJ's enforcement trends over time and relative to each other, particularly in view of the compulsory nature of the directives found in the Yates Memorandum.

International Developments

The most prominent international development this quarter is the continuing expansion of Operation Car Wash in Brazil, which has morphed from an investigation of corruption involving Petrobras to a wider inquiry into the activities of the Brazilian construction industry in various public projects across Latin America and actions by the Brazilian state-controlled power company Eletrobrás. More foreign companies have been implicated, as well. The Brazilian Supreme Court recently imposed some limits on the jurisdiction of the judge who has overseen most of the investigation to date, which may have an effect on the investigation's scope and further development. However, the Petrobras investigation has already spawned related investigations by U.S. authorities, as well as in Switzerland and throughout South America.

Other international developments this past quarter include the conviction in Norway of several former executives of Yara International for their roles in bribery schemes involving relatives of government officials in India and Libya, new anti-corruption laws in Belarus and the first settlement involving corporate failure to prevent bribery under the U.K. Bribery Act.

Actions Against Corporations

DOJ Enters into DPA with Louis Berger International

On July 17, 2015, the DOJ announced that Louis Berger International, Inc. ("LBI"), a New Jersey-based construction company, entered into a DPA with the DOJ. LBI, a domestic concern under the FCPA, is a wholly owned subsidiary of Berger Group Holdings, Inc. ("BGH"), and it had assumed responsibility for the international operations and liabilities of all other BGH subsidiaries and affiliates (collectively, the "Company") during a corporate restructuring. As part of the DPA, LBI admitted that the Company and its employees conspired to violate the anti-bribery provisions of the FCPA between 1998 and 2010 by paying more than $3.9 million in bribes to foreign officials in India, Indonesia, Vietnam and Kuwait in order to secure government construction contracts. In accordance with the DPA, LBI agreed to: (1) pay a $17.1 million criminal penalty to resolve the charges; (2) implement an anti-corruption compliance program and internal controls; (3) continue to cooperate fully with the DOJ; and (4) retain a compliance monitor for three years. In the same announcement, the DOJ disclosed that Richard Hirsch and James McClung, two former Senior Vice Presidents of the Company, pled guilty to related charges, as discussed below in a separate article.

The Company provides a broad range of engineering, planning, architecture, development and construction management services to national, state, local and private clients outside the United States. At the time of the underlying events, Hirsch was located in the Philippines and responsible for the Company's operations in Indonesia and Vietnam. McClung was located in India and was responsible for the Company's operations in that country and in Vietnam, where he succeeded Hirsch. Apart from Hirsch and McClung, the conspiracy charged in the criminal complaint involved three unnamed Company employees and several Company agents and partners.

Notably, on February 4, 2015, approximately five months before the DOJ's announcement of the DPA, the World Bank announced the debarment of Louis Berger Group, Inc. ("LBG"), the U.S.-based operating company of LBI. As the basis for the debarment, the Bank cited the same corrupt practices on two Bank-financed projects in Vietnam that were alleged in the FCPA enforcement action. The World Bank also imposed a one-year conditional non-debarment on BGH.

Overview of the Bribery Scheme

In the DPA, LBI admitted that, from 1998 through 2010, the Company's employees and agents paid more than $3.9 million in bribes to foreign officials in Indonesia, Vietnam, India and Kuwait. The resulting government contracts conferred benefits of more than $7 million on the Company. To conceal the true nature of the corrupt payments, the co-conspirators disguised the payments by using code words like "commitment fees," "counterpart per diems," "marketing fees" and "field operation expenses," or concealing them as other payments to third parties. The co-conspirators also utilized cash disbursement forms and invoices that falsely described the services provided or the purpose of the payments. The recipients of the bribes were foreign officials who had awarded contracts to LBI or who supervised LBI's work on contracts.

In internal discussions, employees and agents of the Company openly discussed how to structure transactions to hide bribe payments, including using a local firm to act as principal and receive a management fee from which bribes would be paid, while the Company served as its subcontractor. Employees and agents of the Company also submitted inflated and fictitious invoices to generate cash that was later used for the payment of bribes through intermediaries. At times, the employees wired funds from the Company's bank accounts in New Jersey to accounts in other countries in order to make payments to foreign officials.

Corrupt Conduct in Indonesia

From August 2003 through 2010, Hirsch oversaw the Company's operations in Indonesia. According to the pleadings, Hirsch, a Senior Vice President of the Company at the time, was familiar with and involved in the Company's payment of bribes to foreign government officials, openly discussing them via e-mail with an agent of the Company. In one such e-mail, quoted in the complaint, the agent informed Hirsch: "Commitment fee is the misnomer for bribe money. The fee ranges from 3.5 percent to 20 percent." The "commitment fee" for the projects discussed in that e-mail was $210,000.

Around 2005, Hirsch allegedly was instrumental in setting up an arrangement in which a one-man consulting company was introduced as the prime contractor in contracts with the Indonesian government, with the Company as a subcontractor, in order for the Company to avoid directly paying bribes. The payment of bribes to foreign officials continued under this scheme, with Hirsch explaining that he preferred to not "pay any commitment fees" but would "agree to a 'management fee' taken from our invoices by the lead firm."

According to the DPA, Hirsch and others associated with the Company discouraged an employee from speaking with the law firm conducting an internal review of the Company in connection with the bribery scheme. In one instance, an agent of the Company drafted a letter that the employee later sent to the lawyers, which stated that the employee did not want to speak with them due to the length of time since he had left the Company, as well as his age, health and memory problems. Several months later, Hirsch tried to hide this employee from investigators by stopping all payments to her. Hirsch also used his personal e-mail account to warn an agent of the Company to not send any emails about "evaluation committees" and "commitment expectations" because such words were red flags that forensic auditors would understand if the e-mails were audited or intercepted.

Corrupt Conduct in Vietnam

The conduct in Vietnam followed a similar pattern. The Company began operations in Vietnam in the early 1990s and secured numerous public contracts partly through the use of the so-called "Foundation," a non-government organization, which the Company funded. According to the disposition document, the Foundation served as the Company's "local sponsor" and labor pool and was the conduit for the Company's bribes to Vietnamese government officials. The Company and the Foundation shared a joint bank account in Vietnam, from which bribe money was withdrawn in cash and paid directly to foreign officials by Hirsch and his accomplices.

In 2005, when McClung assumed responsibility for the Company's operations in Vietnam, Hirsch told him that McClung would need a new scheme for the flow of bribe money because the Foundation would soon cease operations. Between 2005 and 2010, McClung and other Company employees and agents discussed the payment of "commitment fees," which had been customary in old Vietnam projects, and McClung and others exchanged e-mails discussing third-party invoices for nonexistent work and personal advances to Company employees, all as a way to generate money for payments to government customers and officials. Such arrangements continued through 2010.

Corrupt Conduct in India

In India, the Company likewise paid bribes to win water projects in Goa and Guwhati along with several consortium partners. The Company and its consortium partners disguised the bribes as payments to vendors for services that had never actually been rendered, and kept track of the bribes by circulating a spreadsheet identifying the portion of each bribe attributable to each company involved. McClung and other Company employees and agents received those e-mails. In 2010, for example, a payment tracking schedule prepared by one of the consortium partners showed that the Company paid more than $970,000 in bribes in connection with the Goa project.

Corrupt Conduct in Kuwait

The Company's conduct in Kuwait involved neither Hirsch nor McClung but exhibited a similar pattern of bribery to secure a public works project. Around 2005, the Company won a $66 million road construction project with the Kuwait Ministry of Public Works. To secure that contract, the Company's employees, agents and its joint venture partner made corrupt payments totaling approximately $70,000 to a Ministry of Public Works official. E-mails between a high-level Company executive and its local joint venture partner discuss the bribes, disguised as "proposal costs" or made through a purported contract for "business development" with another firm, and the ensuing meetings with a Kuwaiti government official.

DPA Terms

In entering into the three-year DPA with the Company, the DOJ considered the following factors: (1) BGH's voluntary self-reporting of the FCPA violations when BGH discovered them after the government made LBI and BGH aware of a False Claims Act investigation; (2) BGH's cooperation, including an extensive internal investigation, voluntarily making employees available for interviews, and turning over extensive information to the government; (3) BGH's extensive remediation program, including terminating the implicated employees; and (4) BGH's enhancements to its due diligence program for third-party agents and consultants and internal controls and the company's commitment to continue improvements. Additional factors included the nature and scope of the offense conduct and LBI's and BGH's agreement to continue to cooperate with the DOJ.

The DPA provides a detailed calculation of the applicable penalty amount. In particular, the DOJ applied the U.S. Sentencing Guidelines to arrive at the penalty range of $17.1 million to $34.2 million. The DOJ agreed for LBI to pay $7.1 million within 10 days and the remaining $10 million within one year of the date of the DPA.

An important factor the DOJ cited in reaching the DPA was BHG's "demonstrated commitment to improving its compliance program and internal controls." As part of the settlement, BGH agreed to continue implementing and enhancing an extensive corporate compliance program designed to detect and deter future violations of the FCPA and other anti-corruption laws by it and its subsidiaries and affiliates, such as LBI. Significantly, BGH also agreed to retain an independent compliance monitor for the duration of the DPA, i.e., three years.

Noteworthy Aspects

- Duration of Monitorship Reflects Severity of Violations: Three-year corporate compliance monitorships have become somewhat less common over the past few years. In this case, however, the full three-year term is not a surprise, given the severity of the conduct, seniority of personnel involved and the lengthy period over which the schemes went undetected -- all of which are clear signs of an ineffective compliance program.

- A Voluntary Disclosure?: The DOJ's press release and DPA highlight that the DOJ took into consideration LBI's self-reporting of the misconduct. The Sentencing Guidelines calculation in the DPA also credits the company for voluntarily disclosing. Yet LBI's discovery of its FCPA violations arose in the context of a DOJ investigation into possible violations of the False Claims Act by the Company, and at least part of it overlapped with an internal investigation of possible corruption in Vietnam triggered by a World Bank inquiry. This set of facts suggests that, under certain circumstances, a company may still receive self-reporting credit even if the government is already aware of potential other wrongdoing that may be related to the FCPA violations.

- Related Individual Prosecutions, Consistent with the Yates Memorandum: Although the DOJ's settlement with LBI predates the Yates Memorandum by almost two months, the prosecutions of LBI executives Hirsch and McClung in connection with the LBI settlement reflect the Yates Memorandum's theme of individual accountability for corporate misconduct. However, while the DPA identifies LBI's cooperation as a factor considered by the DOJ in entering the settlement, it does not expressly acknowledge LBI's cooperation in Hirsch's or McClung's prosecutions. It does appear that LBI provided significant information about Hirsch and McClung, judging from the detailed factual information in the court filings about their central roles in the bribery schemes that comprise LBI's culpable conduct. It will be interesting to see whether, in future settlement documents, the DOJ will refer more explicitly to the Yates Memorandum guidelines in its consideration of applicable cooperation factors.

- Construction Companies Particularly Susceptible to FCPA Risks: A number of construction companies have been the subject of FCPA enforcement actions in recent years. For example, Technip S.A., a French engineering and construction services firm, agreed in 2010 to pay $338 million to settle with the SEC and DOJ for bribing Nigerian officials over a 10-year period to win a portion of a $6 billion dollar project for the construction of liquefied natural gas facilities on Bonny Island, Nigeria. U.S.-based global engineering and construction company Kellogg Brown & Root, Inc. and Japanese construction firm JGC Corporation were also implicated in and settled charges related to the same bribery scheme in February 2009 and April 2011, respectively. More recently, in October 2014, Layne Christensen, a Texas-based water management, construction and drilling company, settled charges with the SEC for making improper payments to foreign officials in several African countries in order to obtain beneficial treatment and reduce its tax liability.

- Related World Bank Inquiry and Sanctions: In February 2015, the World Bank announced that it had barred LBI subsidiary LBG from working on Bank-funded projects for one year. The sanctions were based on findings of misconduct under the World Bank's standards in connection with the same Vietnam bribery scheme that formed part of the DOJ allegations, since the projects at issue were financed by the World Bank. The Bank also imposed a one-year conditional non-debarment on BGH for its failure to effectively supervise LBG. Notably, the Company's press release announcing the World Bank sanctions mentions that LBI self-reported the underlying misconduct to the U.S. government. This situation highlights the relationship between investigations under the anti-corruption regimes of the multilateral development banks and the FCPA, which was also an aspect of the SEC's settlement with Hitachi related to a project financed by the African Development Bank, discussed below.

- Timeline of Payments: The DOJ agreed that LBI would pay $7.1 million of the fine amount immediately, with the remaining $10 million payable within 12 months. Although there is no publicly available financial information on LBI, which is a privately held company, having an extra year to pay such a substantial amount will likely help the Company better manage its cash flow. Although not specifically stated in the DPA, the terms related to the payment schedule and the amount of the fine suggest that the DOJ has acknowledged the substantial, multi-million-dollar global compliance enhancements that LBI has implemented since 2010. According to a Company press release from July 17, 2015, this compliance effort has cost the Company more than $25 million to date and "resulted in new internal controls, new policies and procedures, and comprehensive systems investments, including a new global accounting system."

Mead Johnson Enters into FCPA Settlement with SEC over Alleged Bribery by Its Chinese Subsidiary

On July 28, 2015, Illinois-based infant-formula manufacturer Mead Johnson Nutrition Company Co. ("Mead Johnson") entered into an administrative settlement with the SEC, agreeing to pay more than $12 million to resolve allegations that the company violated the books-and-records and internal controls provisions of the FCPA in connection with bribes paid by the company's Chinese subsidiary.

Specifically, the SEC alleged that between 2008 and 2013, Mead Johnson's majority-owned subsidiary Mead China provided improper discounts, characterized as a "distributor allowances," to certain distributors tasked with performing marketing services. Using these discounts, Mead China generated more than $2 million in off-the-books funds that it reportedly directed its distributors to pay to healthcare professionals at government-owned hospitals in China to induce them to recommend Mead Johnson's infant formula products and provide the company with contact information for new or expectant mothers. These illicit discounts were then mischaracterized in books-and-records consolidated by Mead Johnson, which had failed to implement internal accounting controls at its Chinese subsidiary sufficient to prevent these illicit payments.

According to the SEC's order, Mead Johnson had anti-corruption policies in place that covered both the FCPA and local law considerations, and when allegations of misconduct surfaced in 2011, the company investigated the underlying allegations. The company eliminated the discount program at issue as a precautionary measure at that time, even though it found no evidence of improper payments -- a move that resulted in the discontinuation of all practices relating to Mead China's compensation of healthcare professionals by 2013. These efforts, however, ultimately did not immunize the company from liability.

In its order, the SEC highlighted Mead Johnson's failure to identify evidence of the improper payments during the 2011 investigation and faulted the company for: (1) choosing not to voluntarily disclose the original allegations to the SEC in 2011; and (2) failing promptly to inform the SEC about the prior investigation when approached by the agency in 2013. The SEC's criticism of Mead Johnson's failure to voluntarily disclose may have been rooted in the scope of the alleged misconduct, which stretched over a period of five years and involved Mead China employees systematically ignoring company policies and circumventing controls.

Although the company was not immediately forthcoming regarding its 2011 investigation, Mead Johnson went on to provide what the agency characterized as "extensive and thorough" cooperation, initiating a second internal investigation that reportedly confirmed the underlying allegations and responding with a range of significant remedial measures (including enhancements to the company's policies and procedures, a substantial increase in the resources devoted to compliance, and the termination of senior staff at Mead China). As part of its settlement, Mead Johnson, without admitting or denying the SEC's findings, consented to an administrative order and agreed to pay $7.77 million in disgorgement, $1.26 million in prejudgment interest, and a $3 million penalty.

Noteworthy Aspects:

- U.S. Parent Held Liable on a Strict Liability Basis: The alleged bribery was committed and conceded by Mead China, a majority-owned subsidiary of its "issuer" parent. Under the FCPA's accounting provisions, parent issuers can be held strictly liable for failing to ensure compliance by their majority-owned affiliates. No knowledge of or participation in the improper conduct is required.

- DOJ Declines Parallel Enforcement: According to press reports, the DOJ recently informed Mead Johnson that it has closed its parallel investigation into the underlying allegations of bribery. Based on the facts as set forth in the SEC's order, which do not allege knowledge or intent on the part of the parent and establish no U.S. nexus with respect to the subsidiary's reported misconduct, the DOJ may well have determined that it lacked jurisdiction to proceed in this matter.

- Relatively Quick Resolution: Compared against other FCPA-related investigations initiated by the agencies over the last 10 years, Mead Johnson's case was resolved relatively quickly, lasting only around two years from start to finish. Based on our research, well over half of known FCPA investigations last more than two years (see our FCPA Winter Review 2013).

- Weighing Voluntary Disclosure: In charging Mead Johnson, the SEC highlighted the company's decision to not voluntarily disclose the initial allegations and its later failure, whether by oversight or choice, promptly to inform the agency of the existence of the 2011 investigation when approached by the SEC in 2013. The calculus behind such decisions is often quite difficult. If a company ultimately chooses to not voluntarily disclose corruption-related allegations or red flags -- something it has no affirmative obligation to do -- it is critical that the company conduct a thorough, documented investigation that is clear-eyed about its findings, fully remediates any improper conduct and program weaknesses and can be defended to the agencies if the government ever becomes aware of the allegations. Even when such steps are taken, however, companies should be aware that the DOJ and SEC have each stated that companies will not receive disclosure credit in an eventual penalty calculation if they do not make a voluntary disclosure, even if they later cooperate with an investigation. In Mead Johnson's case, the company's failure to identify evidence of improper payments in 2011 and apparent lack of disciplinary action, suggest that the initial investigation may have lacked sufficient vigor in the eyes of the SEC, and the company's subsequent failure promptly to notify the SEC of that prior investigation when approached by the agency in 2013 indicates it may not have anticipated how to respond.

- Risk Posed by Stagnant Compliance Programs: The SEC and DOJ expressly recognize that compliance programs should be tailored to an organization's risk profile, and the agencies do not expect smaller companies to devote the same resources to compliance that larger companies routinely do. As a company grows, however, the agencies expect the resources it devotes to compliance to grow as well, enabling the company's compliance program to adapt and evolve to meet the risks and challenges that accompany expansion. In Mead Johnson's case, the SEC Order suggests the company's compliance program simply failed to keep pace with its meteoric growth in China, which included the expansion of Mead China's geographical presence from 28 to 241 cities between 2008 and 2013.

BNY Mellon Settles with the SEC and Agrees to Pay $14.8 Million for Hiring Relatives of Foreign Officials as Interns

On August 18, 2015, the SEC announced a settlement with The Bank of New York Mellon Corp. ("BNY Mellon"), stemming from violations of the FCPA's anti-bribery and internal accounting provisions under Sections 30A and 13(b)(2)(B) of the Exchange Act. The violations arose from the Bank's hiring of relatives of government officials for its summer internship program. BNY Mellon is the first official casualty of the SEC's probe of the hiring of so-called "princelings" -- the relatives of high-powered foreign officials -- particularly in the financial industry. BNY Mellon did not admit or deny the findings laid out in SEC's Cease-and-Desist Order (the "Order"), but agreed to pay $14.8 million in the resolution, comprised of $8.3 million in disgorgement, $1.5 million in prejudgment interest and a $5 million civil penalty.

According to the Order, in 2010 and 2011, BNY Mellon provided three internships to family members of two government officials in order to corruptly influence those officials and to retain and obtain business related to an unnamed Middle Eastern sovereign wealth fund ("SWF"). The Order describes the SWF as "a government body responsible for management and administration of assets of a Middle Eastern country." One of the officials at issue was a senior official in the fund and the other held a senior position in the fund's European Office. The SWF had been a client of BNY Mellon since 2000, when it awarded to BNY Mellon custody of certain assets, which amounted to $55 billion during the relevant time period. Moreover, in 2009 and 2010, the SWF invested $711 million through a wholly owned BNY Mellon subsidiary.

The Order alleges that emails and other documents prove BNY Mellon provided the internships to retain and obtain additional business from the SWF. The SWF officials requested the internships for their family members and proceeded to make numerous follow-up inquiries about the status of their requests. Certain BNY Mellon employees viewed the internships as a way to influence to the officials' decisions. Bank employees stated in writing that granting the internship requests would likely "influence any future decisions taken within" the fund and "help influence who ends up with more assets/retaining dominant position."

The three interns received the internships despite failing to meet the program's hiring criteria, according to the SEC, and BNY Mellon had no intention of converting their internships into full-time positions, a goal of the program. In addition, BNY Mellon coordinated and paid the legal fees and costs related to obtaining visas for all three interns. Moreover, the Bank hired the interns with the knowledge and approval of senior BNY Mellon employees.

The SEC determined that, by corruptly providing these internships to relatives of foreign officials in order to influence the acts or decisions of the SWF, a government entity, BNY Mellon violated the anti-bribery provisions of the FCPA. Moreover, the SEC claimed that BNY Mellon violated the FCPA's internal controls provisions by failing to devise and maintain a system of internal accounting controls sufficient to provide reasonable assurances that its employees are not bribing foreign officials. The SEC found that BNY Mellon had a code of conduct and a specific FCPA policy prohibiting violations of the statute but that the Bank did not ensure that all employees underwent its FCPA training or understood the policies. In addition, the SEC alleged that BNY Mellon had few controls relating to the hiring of customers and relatives of customers, including government officials. Human resources staff were not trained to spot potentially problematic hires, and internal controls were "insufficiently tailored to the corruption risks inherent in the hiring of client referrals."

The SEC acknowledged that BNY Mellon cooperated with the SEC's investigation and that it began enhancing its anti-corruption compliance program even before the investigation commenced. The anti-corruption program enhancements highlighted by the SEC include: explicitly addressing the hiring of government officials' relatives, requiring all full-time and internship job applications to be routed through a centralized HR application process and requiring certifications by employees that no hiring is performed outside of centralized channels. An additional enhancement requires all applicants to indicate whether they or any close personal associates are or have recently been a government official, which would trigger additional review by BNY Mellon's anti-corruption office.

Noteworthy Aspects

- Significance of Formal Procedures and Objective Criteria for Internship Programs: This settlement highlights the U.S. enforcement agencies' view of internships for relatives of foreign officials as an example of "anything of value" under the FCPA. In fact, the SEC's press release quotes Director of the SEC Enforcement Division Andrew J. Ceresney equating internships with "cash payments, gifts, . . . or anything else used in corrupt attempts to win business [that] can expose companies to an SEC enforcement action." This is likely to be the first of several settlements relating to the hiring of princelings by U.S. and European financial firms -- whether for internships or other positions -- as the SEC has reportedly approached other major firms for information about their hiring practices in Asia.

This settlement should prompt companies to confirm that their internal controls and compliance programs include mechanisms to detect and prevent improper hiring practices, including in the context of internship programs. There is no per se prohibition on hiring relatives of government officials, but a company should be able to demonstrate that such a hire was made based on objective factors and ideally, as part of a larger internship program that considered other candidates, in order to minimize FCPA exposure. Moreover, internships based on client referrals deserve additional due diligence.

- Disgorgement Calculation: The $14.8 million that BNY Mellon agreed to pay as part of the settlement includes $8.3 million in disgorgement. It is not clear, and the Order did not explain, how the SEC or the Bank calculated the disgorgement amount, particularly since BNY Mellon had a significant preexisting relationship with the SWF and there was no explicit quid pro quo between the internships at issue and particular aspects of the SWF's business with the Bank. According to the Order, BNY Mellon provided the internships "to assist [the Bank] in retaining and obtaining business." The SEC's and BNY Mellon's ability to calculate with precision the monetary value of the Bank's business with SWF, particularly the value of retaining business, is noteworthy given the subjective nature of such an assessment.

Hitachi Agrees to Settle SEC Enforcement Action

On September 28, 2015, the SEC announced that it had charged Hitachi, Ltd. ("Hitachi"), a Japanese corporation, with violating the books-and-records and internal accounting provisions of the FCPA, and that Hitachi agreed to pay $19 million in civil penalties to settle the charges. On the same day, the SEC filed a complaint against Hitachi in the U.S. District Court for the District of Columbia, together with a draft consent judgment, under which Hitachi agreed to the civil penalty amount and to be enjoined from violating the FCPA provisions cited in the complaint in the future.

Hitachi is a Tokyo-based multinational conglomerate that operates in a number of diverse business areas, including design and construction of power stations. During the time of the alleged violations, Hitachi's American Depositary Shares were listed and traded on the New York Stock Exchange, making Hitachi subject to the SEC's jurisdiction as an "issuer." The company voluntarily withdrew its shares in 2012 and was subsequently de-listed.

In 2007, a Hitachi subsidiary in South Africa, Hitachi Power Africa (Pty) Ltd. ("HPA"), won two contracts totaling $5.6 billion to build two power stations. During the time period at issue, HPA was a majority-owned subsidiary of Hitachi Power Europe GmbH ("HPE"), which was itself a German-based wholly owned subsidiary of Hitachi. According to the SEC complaint, Hitachi created HPA in 2005 to acquire contracts from the South African government-run public utility Eskom. HPA partnered with a local black-owned entity, Chancellor House Holdings (Pty) Ltd. ("Chancellor"), to help it win contracts and to receive preferred status in government contract procurements under the Black Economic Empowerment Act of 2003. Under this partnership agreement, Hitachi sold a 25 percent stake of HPA to Chancellor for $190,819.

According to the SEC, Hitachi specifically partnered with Chancellor not for its operational support but rather for its political influence. Hitachi allegedly understood that Chancellor had extensive political connections within the government, the African National Congress ("ANC"), which was the ruling political party, and the government-owned public utility Eskom. Chancellor, according to the complaint, was a "front" company for the ANC. Thus, the 25 percent stake in HPA allowed Chancellor, and in turn ANC, to receive a portion of the profits from the contracts that HPA acquired. The SEC complaint explicitly points out that "Hitachi was aware that Chancellor was a funding vehicle for ANC," but continued to partner with the organization and encouraged it to use its political say to obtain government contracts.

In addition to selling a portion of itself to Chancellor, HPA arranged to pay Chancellor "success fees" as an incentive to "help the company win orders." After HPA won both of the power plant construction contracts in 2007, worth $2.91 billion and $2.71 billion, respectively, Chancellor received more than $1.1 million in "success fees." HPA also paid Chancellor more than $5 million in dividends and bought back its 25 percent share for $4.4 million in 2012. In total, the SEC states that "Chancellor -- the ANC's funding vehicle -- received approximately $10.5 million from Hitachi, a return of over 5,000% investment in HPA."

The SEC complaint cites several FCPA violations on behalf of Hitachi. First, the company improperly recorded the "success fee" arrangement and the dividends paid out in 2011 and 2012. After paying Chancellor more than $1 million in "success fees," Hitachi inaccurately recorded this amount as "consulting fees" in its books-and-records. Additionally, the $5 million paid out in dividends were recorded as "Dividends Declared," without reflecting that the dividend was "in fact, an amount due for payment to a foreign political party in exchange for its political influence in assisting Hitachi land two government contracts."

Second, the SEC maintains that Hitachi's internal accounting controls were inadequate, enabling the "success fee" arrangement and improper recording of these fees and the dividends. Hitachi also allegedly failed to conduct adequate due diligence of Chancellor and to keep records of such due diligence. Finally, the SEC states that Hitachi failed to implement internal accounting controls that would provide reasonable assurance that the company would not violate its own codes of conduct and compliance policies, the FCPA or South African law. In this regard, the complaint specifically notes that HPA did not conduct any FCPA-specific compliance training.

Noteworthy Aspects

- Risk of Dealing with Political Parties: Unlike many FCPA enforcement actions that focus on improper payments to foreign government officials, the SEC found fault with HPA's relationship with Chancellor, an entity treated as a conduit to a political party. The FCPA prohibits both improper payments to foreign officials and to foreign political parties (and party officials). Consequently, corporations should be aware of FCPA risks involved in partnering with entities that reportedly have significant ties to a political party.

- No Evidence of DOJ Enforcement Activity: Available information suggests that Hitachi has not been the subject of accompanying enforcement activity by the DOJ, despite strong bribery allegations by the SEC. This may be due to jurisdictional issues, given that this case involved South African and German subsidiaries of a Japanese company allegedly making improper payments in South Africa. The only evident connection to the United States was Hitachi's issuance of American Depositary Shares.

- No Disgorgement by Hitachi: Although the SEC alleged in its complaint that Hitachi made more than $10 million in improper payments and received more than $5 billion in business, the company did not have to disgorge any gains as part of the settlement. Most FCPA enforcement actions include disgorgement, but the SEC only imposed a civil fine in this case. Notably, the SEC did not mention any voluntary disclosure or cooperation on behalf of Hitachi that could have contributed to this outcome.

- The Importance of Foreign Media: The South African press played an important role in the SEC case against Hitachi. The complaint mentions several instances in 2006 and 2007 when the press published articles exposing Chancellor as a funding vehicle for the ANC. A reporter also called an HPA director for a comment on whether a link existed between Chancellor, an HPA shareholder and the ANC. The SEC used this phone call and the newspaper articles to support its allegations that Hitachi knew "Chancellor was an ANC alter ego, and thus a foreign political party." In addition, the SEC points out that Hitachi continued its relationship with Chancellor despite the "confirmation in the press." This illustrates the importance of paying close attention to the media coverage in countries in which they operate so that they are aware of issues or concerns raised about them or their partners.

- Permanent Injunction, Even Though No Longer an Issuer: In 2012, Hitachi voluntarily withdrew its American Depositary Shares -- representing shares of common stock -- and was subsequently de-listed, thereby suspending its "issuer" status. Normally, the FCPA provisions would therefore not apply to any Hitachi actions after 2012. However, the settlement agreement permanently restrains and enjoins Hitachi from violating the books-and-records and internal accounting provisions of the FCPA, thereby binding Hitachi even if it were never to return to "issuer" status.

- FCPA Training Is Key: The enforcement action against Hitachi underscores the importance of FCPA training, even for companies that do not have a strong U.S. nexus. Hitachi is a Japanese company, and its South African activities did not involve any commercial activities in the United States. However, because Hitachi was an "issuer" under the FCPA during the tender period, the SEC emphasized that the company's lack of FCPA-specific compliance training contributed to the agency's evaluation that Hitachi's internal accounting controls were inadequate. As such, the complaint illustrates the importance of issuers conducting FCPA training, even if they do not conduct business in the United States or with U.S.-based companies.

- SEC Collaboration with the African Development Bank May Lead to Additional Fines and World Bank Debarment: In its press release, the SEC thanked the African Development Bank's Integrity and Anti-Corruption Department for its assistance and expressed hope that "this is the first in a series of collaborations." These statements suggest that future FCPA investigations and enforcement matters might benefit from the SEC's relationship with the Bank and are indicative of a larger trend of the DOJ and SEC collaborating with multilateral development banks and local enforcement authorities (also discussed above in the context of LBI's settlement with the DOJ and related World Bank sanctions). In addition, this relationship may prove beneficial for the African Development Bank, which is considering imposing additional fines on Hitachi and barring it from bidding on other contracts. Because the Bank loaned Eskom, the government-owned utility, $2.6 billion to fund contracts, including the ones won by Hitachi, the Bank may investigate, sanction contractors, impose fines and bar offenders from future tenders. Moreover, the Bank has agreements with the World Bank, which may extend debarment to Hitachi. This is a prime example of how an SEC enforcement action may have far-reaching ramifications because of the involvement of a multilateral development bank in the underlying commercial projects.

Hyperdynamics Reaches FCPA Settlement with SEC

On September 29, 2015, Hyperdynamics Corporation ("Hyperdynamics") announced a settlement with the SEC and the entry of a Cease-and-Desist Order (the "Order") against it, alleging that its failure to accurately record $130,000 in payments violated the books-and-records and internal controls provisions of the FCPA. Without admitting or denying the SEC's allegations, the company consented to the Order and a $75,000 civil penalty. This settlement came four months after the DOJ informed the company of the Department's decision to close its investigation into possible FCPA violations without enforcement, as noted in our FCPA Summer Review 2015. The SEC neither issued a press release about the settlement nor otherwise publicized it, contrary to its usual practice.

Hyperdynamics's website describes the company as an independent exploration and production company focusing on offshore exploration in the Republic of Guinea. The publicly traded company is incorporated in Delaware and headquartered in Houston, Texas. With a 37% non-operator interest covering approximately 25,000 square kilometers of acreage offshore the Republic of Guinea, Hyperdynamics holds extensive exploration and production licenses in West Africa.

The DOJ and SEC issued subpoenas to Hyperdynamics in September 2013 and January 2014, respectively. In a 2013 disclosure, Hyperdynamics stated that the FCPA investigation centered on whether its "activities in obtaining and retaining the concession rights" or "relationships with charitable organizations" potentially violated the FCPA or U.S. anti-money laundering statutes. Notably, however, the Order did not mention concession rights or improper payments to charitable organizations.

The Order states that in 2007 and 2008, Hyperdynamics paid $130,000 to two supposedly unrelated entities through its wholly owned Guinean subsidiary. The payments were $55,000 to BerMia Service SRL and $75,000 to Africa Business Service ("ABS"). The two payments were recorded as "public relations and lobbying services" in Hyperdynamics's books-and-records, which were consolidated with the subsidiary's books-and-records at the time. According to the Order, however, the company did not have sufficient supporting documentation to determine whether any public relations and lobbying services were provided in connection with those payments or to identify the funds' ultimate recipients.

In 2008, the company learned that a Guinean-based employee controlled the companies that received both payments at issue and was the sole signatory on the ABS account. The SEC concluded that Hyperdynamics could not determine what services BerMia or ABS provided or how they spent the funds. Moreover, Hyperdynamics's books-and-records continued to reflect the payments as public relations and lobbying expenditures, even though there was no evidence of any such activities stemming from the payments.

In addition, the Order states that the company failed to implement adequate internal-accounting controls to track its subsidiary's use of funds, determine whether the subsidiary paid other related parties or give reasonable assurances that the expenditures reported were accurate.

In agreeing to the terms of the settlement, the SEC recognized Hyperdynamics's remedial efforts and cooperation. In particular, the Order states that in July 2009, the company began replacing its senior management team and its entire Board of Directors. Further, Hyperdynamics hired its first in-house lawyer and increased its accounting personnel. The new counsel introduced trainings and policies and instituted procedures to identify and control fund transfers to Guinea, including the transfer of signature authority over Guinean accounts to employees based in Houston and requiring corporate pre-approval for all Guinean expenditures. Moreover, according to its most recent annual report, the company incurred approximately $12.7 million in legal and other professional fees associated with its FCPA investigation.

Noteworthy Aspects

- DOJ Decision to Close Investigation Without Enforcement: In May 2015, the DOJ closed its investigation into possible FCPA violations by Hyperdynamics without taking any enforcement action. Although the DOJ's letter informing Hyperdynamics of the Department's decision explicitly highlighted the company's cooperation, the circumstances surrounding this case suggest that the Department did not decline enforcement but instead lacked a basis for pursuing criminal violations of the FCPA. While Hyperdynamics received subpoenas in connection with the FCPA investigation from both the DOJ and SEC that sought documents relating to the company's pursuit of concession rights and its relationships with charitable organizations, the SEC Order filed against the company does not include any anti-bribery charges, contain allegations of improper payments, or mention concession rights or charitable organizations. Instead, the SEC action focuses solely on accounting violations relating to third-party payments the company made that lacked sufficient support. While it is impossible to know what facts Hyperdynamics might have negotiated to exclude from its SEC settlement, it is difficult to identify any conduct outlined in the SEC Order that might have formed the basis of a criminal FCPA or U.S. anti-money laundering charge against the company.

- SEC Silence on Settlement: Interestingly, the SEC did not issue a press release announcing the resolution of the Hyperdynamics investigation, as is its common practice, nor has it included the settlement on the FCPA enforcement webpage maintained by the Commission. While it is not clear why the SEC decided not to publicize this disposition, one possible reason for the omission of the settlement on the SEC's FCPA enforcement webpage is that, notwithstanding the previously disclosed focus of the investigation, the allegations in the SEC Order do not contain any allegations of improper payments to a foreign official, and the SEC has generally chosen not to classify violations of the FCPA's accounting provisions that do not relate to foreign bribery as "FCPA enforcement actions." The SEC's categorization decisions in this regard, however, have not been entirely consistent over the years. For instance, while the SEC chose not to categorize its insider-trading focused resolution with Keyuan Petrochemicals in 2013 as an FCPA enforcement action (see our FCPA Spring Review 2013), it nevertheless lists its 2012 settlement with Oracle on the Commission's FCPA enforcement webpage, despite there being no allegation of an improper payment to a foreign official in that case (see our FCPA Autumn Review 2012).

Actions Against Individuals

Two Former LBI Executives Plead Guilty to Participating in Bribery Scheme

The DOJ's announcement of its settlement with LBI on July 17, 2015, also disclosed its plea agreements with Richard Hirsch and James McClung, two former Senior Vice Presidents at the Berger Group Holdings, Inc. ("BGH") family of companies (the "Company"). Hirsch and McClung pled guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA and one substantive count of violating the anti-bribery provisions of the FCPA, admitting to playing a part in making and concealing corrupt payments to government officials in India, Indonesia and Vietnam during their employment with the Company. They are scheduled for sentencing on November 15, 2015, before the U.S. District Court for the District of New Jersey.

Also on July 17, 2015, and before the same court, BGH subsidiary LBI entered into a DPA with the DOJ and admitted to FCPA-related violations based in large part on Hirsch's and McClung's conduct. As part of the DPA, LBI agreed to pay a $17.1 million criminal penalty. The terms of the DPA and the events that led to the DOJ's enforcement action against LBI are the subject of a separate article above.

The Informations filed by the government in Hirsch's and McClung's individual prosecutions (available here and here) mirror the allegations described in the context of LBI's settlement with the DOJ. Hirsch is accused of participating in bribery of government officials in Indonesia and Vietnam, and McClung of similar activities in Vietnam and India. Notably, Hirsch's plea agreement specifies that the value of the bribes or loss to the government from his actions was between $400,000 and $1 million, while the corresponding value specified in McClung's plea agreement was between $1 and $2.5 million. With all other factors under the Sentencing Guidelines being the same, the magnitude of the bribery that each was accused of resulted in a two-point difference in their offense levels under the Guidelines -- 25 and 27, respectively. According to their plea agreements, each faces the same 10-year maximum prison sentence and monetary fine, as well as possible restitution.

Former SAP Executive Pleads Guilty and Settles with SEC in Connection with Payments to Panamanian Officials

On August 12, 2015, the DOJ announced that Vicente Eduardo Garcia, a Miami-based former executive of SAP International Inc. ("SAP"), pled guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA. Garcia is scheduled to be sentenced on December 16, 2015. Garcia also consented to the filing of a cease-and-desist order by the SEC for civil violations of the FCPA's anti-bribery and internal controls provisions. As part of his settlement with the SEC, Garcia agreed to pay $92,395, which equaled the total amount of kickbacks he received ($85,965) plus prejudgment interest ($6,430).

Garcia admitted to conspiring with a Panamanian lobbyist, a consultant and the principal of a Mexico-based SAP channel partner to bribe Panamanian government officials between 2009 and 2013. According to the cease-and-desist order, the conspirators paid one official $145,000 and offered to pay two others as part of a scheme to obtain four government contracts for SAP to sell software. According to the DOJ Information, Garcia estimated the value of the Panamanian government contracts at approximately $150 million. SAP's partner was successful in obtaining the first contract for $14.5 million, which included $2.1 million in SAP software licenses. The Panamanian government later awarded three additional contracts that included SAP software products valued at approximately $13.5 million to SAP's local partner.

To enable the scheme, Garcia allegedly caused SAP to sell software to a partner company in Panama at discounts of up to 82%. Garcia obtained approval for the discounted sales by circumventing SAP's internal controls systems with false contracts, invoices and approval forms. These discounts enabled the partner to create a slush fund from which to pay bribes. Additionally, the sales proceeds were used to provide Garcia with kickbacks. In addition, Garcia allegedly sent a fake invitation from SAP ostensibly for business meetings in Mexico to one of the Panamanian officials, to provide the official with cover for recreational travel to Mexico. The lobbyist used by Garcia also proposed entering into fake consulting contracts with the brother-in-law of one official, and Garcia and his co-conspirators e-mailed spreadsheets of payments to officials to one another.

According to the SEC, Garcia admitted that he believed that the bribes were necessary to secure the Panamanian government contracts.

Miller & Chevalier Member Matteson Ellis's article entitled "Multi-Party Conspiracies in Central America: The Latest FCPA Case," on the FCPAméricas Blog, discusses a number of notable points and lessons drawn from Garcia's plea. They include FCPA risks in Central America generally, the risks involved in dealing with distributors, resellers or channel partners that resell products or services and the role of SAP's compliance program in Garcia's wrongdoing.

Russian Foreign Official and U.S. Co-Conspirators Plead Guilty to Money Laundering and FCPA Charges

On August 31, 2015, the DOJ announced that Vadim Mikerin, a Russian foreign official residing in Maryland, pleaded guilty to one count of conspiracy to commit money laundering for spearheading a bribery scheme relating to contracts between a subsidiary of Russia's State Atomic Energy Corporation ("ROSATOM") and U.S. companies. Mikerin's co-conspirators, Daren Condrey and Boris Rubizhevsky, of Maryland and New Jersey, respectively, pleaded guilty to a combination of FCPA, wire fraud and money laundering charges in June 2015.

Mikerin admitted to receiving more than $2.1 million in illicit payments in exchange for awarding contracts related to the shipment of uranium from Russia to the United States. He is scheduled to be sentenced on December 8, 2015, in the U.S. District Court for the District of Maryland. In addition to a potential jail sentence of up to five years, court filings note that Mikerin has also agreed to forfeit of the full amount of the illicit payments.

Condrey and Rubizhevsky, both U.S. citizens, appear to be the unnamed co-conspirators and key participants in the underlying scheme whose actions are described in Mikerin's plea agreement. According to the DOJ, Condrey will be sentenced on November 2, 2015, for conspiracy to commit wire fraud and conspiracy to violate the FCPA, while Rubizhevsky will be sentenced on January 19, 2015, for conspiracy to commit money laundering.

Mikerin was originally indicted on November 12, 2014, on one count of conspiracy to commit extortion in relation to coerced kickback payments he received from a Florida-based lobbyist and consultant who contracted regularly with his company. A superseding indictment was filed on August 27, 2015, charging Mikerin instead with one count of conspiracy to commit money laundering -- the offense to which he then pleaded guilty.

As stated in the plea agreement, Mikerin was the President of TENAM Corporation, a Maryland-based wholly owned subsidiary and official U.S. representative of JSC Techsnabexport ("TENEX"), which is itself a Russia-based wholly owned second-tier subsidiary of ROSATOM, the Russian state atomic agency. TENEX is the Russian Federation's only supplier and exporter of uranium and uranium-enrichment services to nuclear power companies throughout the world.

According to court documents, Mikerin and his co-conspirators orchestrated a scheme whereby U.S. companies would make wire payments to offshore bank accounts in Latvia, Cyprus and Switzerland for the express purpose of securing an improper business advantage from Mikerin with respect to the award of uranium transportation contracts from TENEX. From 2004 to 2014, Mikerin received approximately $2,126,622 in corrupt payments, according to the plea agreement. The co-conspirators attempted to mask the payments in emails and other communications by using code words such as "lucky figure," "LF," "cake" and "remuneration." As part of his plea agreement, Mikerin admitted that the payments were made expressly to influence him to award TENEX contracts to companies owned by his co-conspirators. It is important to note that because foreign officials who receive bribes are not covered by the FCPA (which only addresses bribe payors), the charges against Mikerin instead arise under the money laundering statute.

Also of note, the DOJ press release states that this case was investigated by the U.S. Department of Energy Office of Inspector General, as well as the FBI, which conducts most FCPA investigations. In addition, according to earlier press reports, Mikerin refused to cooperate with investigators in their ongoing probe of potential corruption in Russia's nuclear industry. It remains unclear at this time whether he chose to cooperate and how his cooperation -- or lack thereof -- may affect his sentencing.

Former CFO of Siemens Argentina Pleads Guilty to FCPA Violations

On September 30, 2015, the DOJ announced that former Chief Financial Officer of Siemens S.A. ("Siemens Argentina") Andres Truppel pled guilty to conspiracy to violate the anti-bribery, internal controls and books-and-records provisions of the FCPA and to commit wire fraud. Truppel was indicted on December 12, 2011, in the United States District Court for the Southern District of New York, along with seven other former officers, directors and associates of the parent company of Siemens Argentina or its affiliates.

As a regional subsidiary of German company Siemens AG, Siemens Argentina sought to identify and secure contracts for public works projects. According to the indictment, Siemens Argentina created Siemens IT Services S.A. ("SITS") to bid on a $1 billion project designed to modernize the Argentine national identification card system ("the DNI Project"). In connection with the efforts to win the DNI Project bid, Truppel and his co-conspirators allegedly agreed to pay almost $100 million in bribes to Argentine government officials. The indictment alleges that Truppel and his co-defendants, all employees or agents of Siemens AG or its affiliated companies, achieved the objective of the conspiracy through methods including deceptive accounting practices, withdrawal of funds from general-purpose accounts, use of off-books accounts to conceal improper payments and intermediaries.

According to the DOJ press release, Truppel admitted that he engaged in the decade-long scheme to pay these bribes, employing methods including the laundering of funds through shell companies associated with intermediaries and a $7.4 million payment under a hedging contract with a foreign currency company in the Bahamas. Truppel also admitted that the defendants paid nearly $1 million dollars to a former official of Argentina's Ministry of Justice, which was then used to bribe another Argentine government official.

To date, Truppel is the first Siemens executive to plead guilty to the DOJ's charges and his prosecution may have been delayed by the fact that he initially contested extradition. As discussed in our FCPA Spring Review 2014, Truppel previously agreed to pay an $80,000 civil penalty to settle an SEC civil action based on the same conduct. Truppel's plea is the latest development in the continuing fall-out from Siemens AG's $800 million settlement with the DOJ and the SEC in 2008. In March 2015, Greece indicted 64 former Siemens AG and Hellenic Telecommunications executives on charges of bribery and money laundering, as noted in our FCPA Spring Review 2015. As discussed in our December 2008 FCPA Alert, the bribery at issue in the Truppel indictment was also part of the conduct that led to Siemens AG's settlement with the U.S. government.

Ongoing Developments and Related Litigation

DC Circuit Rules Upholds Privileged Nature of KBR's Internal Investigation Materials

On August 11, 2015, a unanimous three-judge panel of the U.S. Court of Appeals for the DC Circuit held that a district court erred in ordering Kellogg Brown & Root ("KBR") to produce 89 documents related to an internal investigation. The DC Circuit found that the district court erred in finding the documents not privileged and remanded the case for the district court to consider other timely arguments for why privilege might not attach. See In re Kellogg Brown & Root, Inc., 796 F.3d 137 (DC Cir. 2015). This action arose from a discovery dispute in an ongoing qui tam suit accusing KBR of defrauding the U.S. government by inflating costs and accepting kickbacks while performing reconstruction work in Iraq. See United States ex rel. Barko v. Halliburton Co. (Case No. 1:05-cv-1276, D.DC). The DC Circuit's decision represents the second time that the court has overruled an order by the district court compelling KBR to produce documents from its internal investigation.

As previously reported by Miller & Chevalier, the documents at issue relate to the company's internal investigations of its Code of Business Conduct -- namely witness statements from employees, investigator reports to KBR employees and communications among KBR attorneys and investigators concerning their finding. The district court found in March 2014 that the documents were discoverable as unprivileged business records. The DC Circuit disagreed, concluding that the documents were privileged under Upjohn Co. v. United States, 449 U.S. 383 (1981), and remanded the case.