FCPA Summer Review 2019

International Alert

Introduction

Foreign Corrupt Practices Act (FCPA) enforcement started slowly in the second quarter of 2019, with only one relatively low-value Securities and Exchange Commission (SEC) settlement during April, May, and the first half of June. Although the timing of individual investigation dispositions often depends on case-specific factors, as we have noted in past review, here the relative lull in enforcement actions may be attributable, in part, to the partial government shutdown, which sidelined some U.S. Department of Justice (DOJ) and SEC personnel for nearly a month in early January 2019.

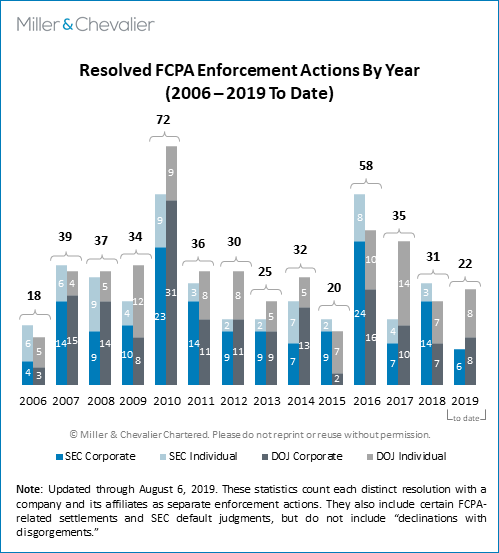

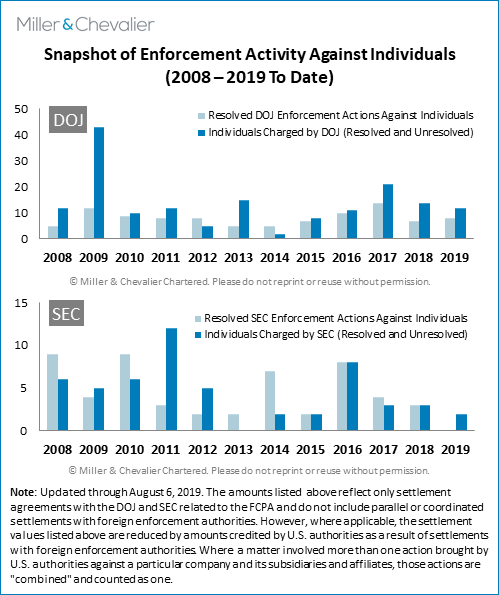

The DOJ ended this lull with a burst of activity at the end of the quarter, announcing two corporate enforcement actions and five enforcement actions against individuals between June 20 and June 27, one of the busiest weeks in FCPA enforcement history. The DOJ's late-June activity resulted in four corporate enforcement actions against three companies and five individual enforcement actions for the quarter, in line with the average of approximately six corporate enforcement actions and four individual enforcement actions per quarter over the last 10 years. Of particular note, one of the settlements announced was with Walmart Inc. (Walmart), the Arkansas-based retailer; the Walmart disposition covered, in part, alleged improper payments in Mexico that were the subject of a series of articles published by the New York Times in 2012.

We summarize the quarter's corporate enforcement actions, individual enforcement actions, investigations closed without enforcement, and other policy, litigation, and international developments below.

Corporate Enforcement Actions

As noted above, the DOJ and SEC brought four enforcement actions against three companies in the second quarter of 2019,1 a number that is somewhat below the 10-year average of six such enforcement actions per quarter.

- On May 9, 2019, the SEC announced a Cease-and-Desist Order with Telefônica Brasil S.A. (Telefônica Brasil), the largest telecommunications company in Brazil and a subsidiary of Spanish multinational broadband and telecommunications provider Telefónica S.A. According to the Order, Telefônica Brasil violated the books-and-records and internal-accounting-control provisions of the FCPA when it provided tickets to the 2014 World Cup and 2013 Confederations Cup to numerous government officials, including mayors, senators, federal congressmen, and one ambassador. Although Telefônica Brasil had a Code of Ethics in place prohibiting gifts or hospitality to government officials, the SEC maintained that the company lacked sufficient internal accounting controls to implement the policy and mischaracterized the ticket expenses as "Publicity Institutional Events" and "Advertising & Publicity" in its books and records. Telefônica Brasil agreed to pay a civil money penalty of $4.13 million to settle the charges, without admitting or denying the SEC's findings except as to the SEC's jurisdiction and the subject matter of the proceedings. We discuss the SEC settlement in greater detail below.

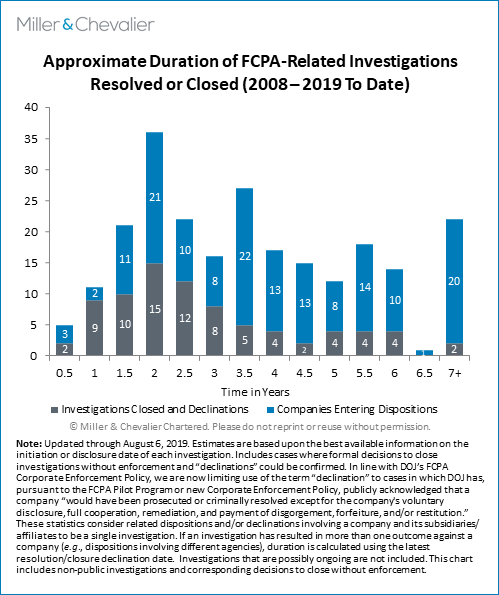

- On June 20, 2019, the U.S.-based retailer Walmart announced the resolution of a DOJ and SEC investigation into alleged corruption in Brazil, China, India, and Mexico. As a part of the settlement, Walmart reached a Non-Prosecution Agreement (NPA) with the DOJ and consented to a Cease-and-Desist Order with the SEC to resolve charges that it had violated the books-and-records and internal-accounting-controls provisions of the FCPA. Simultaneously, Walmart's subsidiary WMT Brasilia S.a.r.l. (WMT Brasilia) – which was the majority owner of Walmart's wholly-owned Brazilian subsidiary – pleaded guilty in the Eastern District of Virginia to one count of violating the books-and-records provisions of the FCPA. No anti-bribery charges were alleged against either Walmart or its subsidiary. The alleged misconduct involved payments to government officials in Brazil, China, India, and Mexico to obtain store operating permits and licenses, often through local third-party intermediaries. To resolve the FCPA charges, Walmart agreed to pay a total of $282 million, to engage an independent compliance monitor for a period of two years under the NPA with the DOJ for limited topics and country operations, and to self-report to the SEC, also for a two-year period. This seven-year investigation lasted longer than 90 percent of FCPA investigations, as indicated in our chart showing known investigation lengths below. We discuss the Walmart settlement in greater detail below.

- On June 25, 2019, the DOJ announced a Deferred Prosecution Agreement (DPA) with TechnipFMC Plc (TFMC), an offshore energy services company formed in 2017 from the merger of Technip S.A. and FMC Technologies, Inc. The DOJ's charges arose out of alleged separate misconduct by both Technip S.A. and FMC Technologies, Inc. prior to the merger. TFMC's predecessor entity Technip S.A. owned a joint venture with Keppel Offshore & Marine Ltd. (Keppel), which, from 2003 to 2014, allegedly paid $69 million to a third-party intermediary and a Brazilian political party knowing that a portion would be used to pay bribes to officials at Petroleo Brasiliero S.A. (Petrobras), the Brazilian state-owned energy company. TFMC's predecessor entity FMC Technologies allegedly made improper payments to government officials from 2008 to 2013 in connection with contracts to provide oil and gas production measurement technologies to the Government of Iraq. TFMC agreed to pay a criminal fine of $296 million to resolve these allegations against its predecessor entities, including $81 million to be paid to U.S. authorities and $214 million to Brazilian authorities. We discuss the TFMC settlement in greater detail below.

Individual Enforcement Actions

As noted above, the DOJ also obtained five convictions of individuals in the second quarter of 2019, including two jury convictions and three guilty pleas.

- On June 20, 2019, the DOJ announced that a federal jury in Boston had convicted two U.S. businesspeople, Joseph Baptiste and Roger Richard Boncy, in connection with the alleged solicitation of bribes from FBI agents posing as potential investors in connection with a proposed port development project in the Môle St. Nicolas area of Haiti. Baptiste and Boncy allegedly told Federal Bureau of Investigations (FBI) agents that, in order to secure Haitian government approval for the project, it would be necessary to funnel bribes to a Haitian official through a non-profit controlled by Baptiste, which Baptiste and Boncy promised to disguise as funds falsely earmarked for social programs. Baptiste was convicted of one count of conspiracy to violate the FCPA and the Travel Act, one count of violating the Travel Act, and one count of conspiracy to commit money laundering. Boncy was convicted of one count of conspiracy to violate the FCPA.

- On June 25, 2019, the DOJ announced that Zwi Skornicki, a Brazilian citizen, had pleaded guilty to one count of conspiracy to violate the FCPA. According to the Criminal Information filed against him, Skornicki served as a consultant to both Keppel and Technip S.A. from approximately 2001 to 2014, during which time he used a portion of commissions received from those entities to pay approximately $55 million in bribes to officials at Petrobras. Keppel reached a DPA to resolve related FCPA charges in December 2017, as discussed in our FCPA Winter Review 2018. Technip's successor entity TFMC reached its own DPA to resolve related FCPA charges in June 2019, as noted above and discussed in greater detail below. According to media reports, Skornicki has already been convicted on corruption-related charges in Brazil, where he was required to pay a penalty of approximately $25 million.

- On June 27, 2019, the DOJ announced that Luis Alberto Chacin Haddad of Miami, Florida, and Jesus Ramon Veroes of Venezuela had each pleaded guilty to one count of conspiracy to violate the FCPA. According to the plea agreements, Chacin and Veroes were part of a scheme to make corrupt payments to officials at Venezuela's state-owned and controlled electricity company, Corporación Eléctrica Nacional (Corpoelec), in exchange for "lucrative" procurement contracts. As part of their guilty pleas, Chacin and Veroes will each be required to forfeit at least $5.5 million—the amount each acquired through the corruption scheme—as well as real estate located in Florida that was purchased with the proceeds of the scheme. On the same day of the announcement of Chacin's and Veroes's pleas, the DOJ announced money-laundering charges against the two former Venezuelan government officials who had allegedly conspired with Chacin and Veroes to receive the improper payments, one former official who served as Minister of Electrical Energy and President of Corpoelec, and another former official who served as Corpoelec's procurement director.

There were no SEC individual enforcement actions this quarter.

Investigations Closed Without Enforcement Action

For the second quarter of 2019, we have identified the following investigations that have been ended without enforcement:

- PAR Technology Corporation: On May 7, 2019, the New York-based global provider of restaurant software solutions filed a Form 10-Q stating, "[o]n April 10, 2019, the SEC notified the Company that based on current information, it did not intend to recommend enforcement against the Company" and that "shortly, thereafter, the DOJ advised that it did not intend to proceed." According to the Company's SEC filing, from 2016-2019, it conducted an internal investigation in connection with its China and Singapore offices to "determine whether certain import/export and sales documentation activities were improper," cooperating with both the SEC and the DOJ.

- Gerdau S.A.: In a Form 20-F filed on May 8, 2019, the Brazilian-based steel producer revealed that the SEC had closed its inquiry in connection to the SEC's investigation into "specific political contributions made by the Company" and "interactions with Brazilian authorities." Moreover, the Company stated that the SEC is "not seeking any further information from the Company regarding these matters."

- OSI Systems, Inc.: On June 5, 2019, the California-based specialized electronic systems manufacturer and designer announced via press release that the DOJ and SEC had "informed the Company that they have closed their respective investigations into possible violations of the Foreign Corrupt Practices Act by the Company."

- Misonix, Inc.: On June 20, 2019, the New York-based ultrasonic surgical device provider filed a Form 8-K and issued a press release indicating that it had received a letter from the SEC on June 18, 2019, stating that "the SEC has concluded its investigation of Misonix and that … it does not intend to recommend an enforcement action by the SEC against Misonix" in connection with the business practices of Misonix's independent Chinese entity and "Misonix's knowledge of those business practices … as well as various internal controls issues identified during the investigation." Specifically, Misonix stated that it conducted a "voluntary" investigation "with the assistance of outside counsel," noting that it "voluntarily contacted" the SEC and the DOJ in 2016 to "advise both agencies of these potential issues and has fully cooperated with those agencies in their subsequent inquiry and investigation." As discussed below, there have been related developments in litigation between Misonix and its former business partner in China.

Miller & Chevalier tracks investigations through public sources, most often filings made to investors through the SEC. Tracking such investigations is necessarily imperfect. Companies may elect to never disclose either the initiation or closure of an FCPA-related investigation. However, available numbers can provide valuable insights into the DOJ's and SEC's activities and current enforcement posture.

Litigation, Policy, and International Developments

The second quarter of 2019 also witnessed litigation, policy, and international developments that will impact anti-corruption practice and compliance.

- In a judicial decision likely to influence future FCPA-related litigation, the U.S. District Court for the Eastern District of New York (EDNY) held that the ultrasonic surgical devices Misonix, Inc. was not required to produce documents produced into an internal FCPA investigation to a former Chinese business partner in collateral litigation. The court specifically rejected the Chinese business partner's argument that documents collected by investigations counsel were not privileged because they were collected for the purpose of fact-finding, rather than legal analysis. As noted above, Misonix also announced this quarter that the SEC had concluded its investigation into the company without bringing an enforcement action. This decision can help bolster the maintenance of privilege for the results of internal investigations under U.S. law, as we discuss in greater detail below.

- In April, the DOJ released an updated Evaluation of Corporate Compliance Programs intended to guide prosecutors in assessing the effectiveness of compliance programs, most notably when assessing the appropriateness of any reduction in penalties in corporate enforcement actions. As we discuss in greater detail below, the April 2019 Evaluation Guidance takes a more holistic evaluation approach than previous DOJ compliance guidance, focusing on a company's documented rationale for design and implementation of its compliance programs.

- Finally, the French National Financial Prosecutor (PNF) and the French Anti-Corruption Agency (AFA) published the first written guidelines on the negotiation of a convention judiciaire d'interêt public (CJIPs), the French judicial agreement modeled, in part, after the U.S.-style DPA. As discussed in greater detail below, the guidelines set forth certain factors that the PNF will consider before exercising its discretion to enter into a CJIP and in calculating any associated fine, including self-reporting, conducting an internal investigation, and cooperating with prosecuting authorities.

Corporate Enforcement Actions

Telefônica Brasil Resolves World Cup-Related FCPA Allegations with SEC for $4.13 Million

On May 9, 2019, the SEC announced a Cease-and-Desist Order with Telefônica Brasil S.A. to resolve alleged violations of the books-and-records and internal-accounting-control provisions of the FCPA. Telefônica Brasil, the largest telecommunications company in Brazil, is a subsidiary of Spanish multinational broadband and telecommunications provider Telefónica S.A. Telefônica Brasil's American Depositary Receipts are registered with the SEC and are traded on the New York Stock Exchange (NYSE), making them an issuer for purposes of the FCPA. The SEC's charges stemmed from activity related to Telefônica Brasil's hospitality program for the Confederations Cup and the World Cup, two international association football (soccer) tournaments held in Brazil in 2013 and 2014, respectively. As part of the administrative proceeding, the SEC issued a Cease-and-Desist Order in which Telefônica Brasil agreed to pay a civil money penalty of $4.13 million to settle the charges, without admitting or denying the SEC's findings.

Specifically, the SEC alleged that Telefônica Brasil purchased tickets for the 2014 World Cup held in Brazil valued at approximately $5.1 million, and provided a portion of the tickets, a total of 194, to 93 government officials. The SEC cited an internal memorandum by Telefônica Brasil's Marketing Director from 2012 that explained the ticket purchase was "for relationship-building activities with strategic audiences." The company also paid for hospitality for officials receiving the tickets, with the total value for the tickets and hospitality at $621,576. While it was known that a portion of the tickets would be provided to government officials, internal book-keeping and paperwork regarding approval for the expense failed to disclose this fact. The government officials included, among others, mayors, senators, federal congressmen, and one ambassador.

Similarly, Telefônica Brasil allegedly purchased a total of 38 tickets to the 2013 Confederations Cup and gave them to 34 government officials and paid for related hospitality costs. The total amount paid for the Confederations Cup tickets and related hospitality was $117,230. Government ministry officials as well as congressmen were among the government officials that received the tickets.

While the company had a Code of Ethics that prohibited providing gifts or hospitality to government officials, the SEC maintained that Telefônica Brasil lacked proper internal accounting controls to implement the policy properly and avoid the gifting of the World Cup and Confederations Cup tickets to such officials. Particularly of interest, the SEC cited emails where company employees suggested specific government officials to target to receive the World Cup tickets in light of support the company had received from the officials. According to the Order, the company's Institutional Relations Department Manager noted he "took 'into account the importance of the actions that each guest has already effectively done in our favor.'" Likewise, the SEC also pointed to emails from June 2014 indicating that a "free trade zone official responsible for providing customs clearances was given a ticket and asked for his 'ongoing support' in receiving a customs clearance for a particular invoice."

While the World Cup and Confederations Cup tickets and hospitality were provided to government officials, in the company's books the costs were recorded under "Publicity Institutional Events" and "Advertising & Publicity," which the SEC cited as a mischaracterization of the costs and a failure to "accurately and fairly reflect the transactions and dispositions of the company's assets." Specifically, the SEC explained that the policy in the code of ethics "was not followed due to the lack of internal accounting controls, a compliance breakdown, and a deficient internal audit function."

The SEC took into account remedial actions and cooperation with the investigation in accepting the company's offer and issuing the Order. Specifically, the SEC cited the company's new anti-corruption policy and improved internal accounting controls and compliance structure.

Noteworthy Aspects:

- Effective Controls Required to Implement General Policies: This settlement provides another reminder of the importance of appropriate controls and processes to ensure that general policies in companies' codes of conduct are effectively implemented, especially with regard to high-risk areas such as hospitality for government officials. In that regard, this case has parallels to the 2015 BHP Billiton settlement with the SEC, which also involved tickets to a popular sporting event and which resulted in a $25 million penalty. In that instance, the SEC alleged that BHP Billiton invited government officials to the 2008 Summer Olympic Games and paid for hospitality expenses for the officials, including event tickets and travel accommodations. In the SEC's Cease-and-Desist Order regarding BHP Billiton, the agency noted that the company did not "devise and maintain sufficient internal controls over a global hospitality program that the company hosted in connection with its sponsorship" of the Olympic Games. In addition, the SEC explained that BHP Billiton's internal "books and records, namely certain internal forms that employees prepared in order to invite a government official to the Olympics, did not, in reasonable detail, accurately and fairly reflect BHPB's pending negotiations or government dealings with the" public official when the invitation was made. We discuss BHP Billiton's case in greater detail in our FCPA Summer Review 2015. In both cases, the SEC determined that, while each company had adopted some policies to address the risks of hospitality to officials, in each case the processes developed to carry out those policies failed to account for information relevant to actual risks and thus did not adequately control such risks or properly identify risky transactions in company records. According to the SEC, in neither case did the implementing processes sufficiently identify or remediate connections between the tickets being provided and actions taken in favor of the company that presented at least the appearance of an improper quid pro quo. Policies are not enough – effective implementation of review and approval processes that appropriately engage with the risk being addressed is critical.

- Continued FCPA Enforcement in Brazil: This latest settlement also continues the SEC's enforcement of FCPA-related actions in Brazil, following its enforcement of FCPA-related violations recently associated with Petrobras and Eletrobras in November and December of 2018. Our previous coverage of these enforcement actions can be found in our FCPA Winter Review 2019. While previous enforcement actions in Brazil appeared to focus on the oil and gas industry, the Telefônica Brasil action highlights that other industries are also under scrutiny.

Walmart and Brazilian Subsidiary Resolve FCPA Charges for $282 Million

In December 2011, Walmart – currently ranked number one in the Fortune 500 list of American companies – disclosed that it had conducted a review of its "policies, procedures, and internal controls pertaining to its global anti-corruption program," that the company had started an internal investigation into issues identified in part during that review, and that the company had "voluntarily disclosed" this investigation to the DOJ and SEC. On April 21, 2012, the New York Times published a lengthy and in-depth account of a potential bribery scheme perpetuated by the Mexican subsidiary of Walmart. This reporting later won a Pulitzer Prize for the reporters, while sparking substantial public interest into the foreign operations of one of the nation's largest retailers.

On June 20, 2019, after more than seven years and at least $900 million in pre-enforcement investigation costs and compliance enhancement expenses,2 Walmart and its wholly-owned Brazilian subsidiary, WMT Brasilia, finally agreed to resolutions with the DOJ and SEC to resolve allegations that they had violated the books-and-records and internal-accounting-controls provisions of the FCPA. During the relevant time period, WMT Brasilia was the majority-owner of Walmart's Brazilian subsidiary, Walmart Brazil. The alleged misconduct centers on the failure to maintain appropriate books and records and anti-corruption-related internal-accounting controls for company operations in Mexico, Brazil, China, and India. The company agreed to a three-year NPA with the DOJ and WMT Brasilia pleaded guilty to one count of violating the books-and-records provisions of the FCPA. In a related resolution, the SEC filed a Cease-and-Desist Order finding that the company violated the books-and-records and internal-accounting controls provisions of the FCPA. Walmart stock is listed and traded on the NYSE, and therefore the company was an "issuer" for purposes of the relevant time

In connection with its DOJ settlement, Walmart agreed to pay a total monetary penalty of $137,955,249 (of which $3,624,490 constituted forfeiture and $728,898 constituted a criminal fine, both paid by Walmart on behalf of WMT Brasilia). According to the Information, the forfeiture amount represents the $3,624,490 in profits earned by Walmart Brazil traceable to its books-and-records violations of the FCPA – namely, for causing books-and-records violations by Walmart. Under the SEC Order, Walmart agreed to pay disgorgement of $119,647,735 and prejudgment interest of $25,043,437 (for a total monetary penalty of $144,691,172). While in some instances the SEC may agree to reduce disgorgement payments based on amounts paid to the DOJ as forfeiture, there is no explicit indication that the SEC has allowed Walmart to offset the forfeiture amount against the amount owed as disgorgement.

In addition to the fines and payments, the DOJ imposed an independent compliance monitor for a two-year period and Walmart agreed to self-report to the SEC for a two-year period. As discussed in more detail below, the penalties were adjusted to account for the company's cooperation and remediation efforts. The NPA notes that the financial penalty was approximately 25 percent below the bottom of the U.S. Sentencing Guidelines fine range for the portion of the penalty applicable to conduct in Brazil, China, and India, but the penalty was only 20 percent off the bottom of fine range for the portion of the penalty applicable to conduct in Mexico.

According to the NPA and SEC order, from 2000 to 2011 the company failed to operate and maintain a system of sufficient internal-accounting controls to protect against corruption risks involving its foreign subsidiaries. Specifically, the NPA alleges that these internal controls failures allowed Walmart subsidiaries in Mexico, Brazil, India, and China to hire third-party intermediaries (TPIs) without ensuring that the contractual arrangements contained sufficient controls to prevent those TPIs from making improper payments to government officials to secure expedited store permits and licenses. In addition, the NPA states that in some instances the senior personnel responsible for implementing and maintaining the company's system of anti-corruption internal-accounting-controls were aware of the controls failures and potential improper payment issues. However, Walmart did not take steps to remediate its internal-accounting controls until 2011. Similarly, the SEC Order cites Walmart's "rapid international growth, combined with its low-cost philosophy" as a major contributor to the "Company's insufficient anti-corruption related internal accounting controls," which resulted in significant anti-corruption risks that were neither sufficiently investigated nor mitigated during the period in question.

The NPA and SEC Order describe with particularity the following conduct by Walmart and its affiliated entities in Mexico, China, India, and Brazil:

- Sporadic Adoption of Comprehensive Anti-Corruption Compliance Program: The DOJ and SEC both include summaries of Walmart's compliance program development starting in the early 2000s. Despite developing an anti-corruption policy and related materials in 2003, Walmart did not formally adopt an anti-corruption compliance program until early 2005. Implementation of the program was subsequently put on hold indefinitely in late 2005 and was not re-instituted until 2008, when Walmart issued an updated Global Anti-Corruption Policy. However, implementation of this policy was inconsistent and the company's foreign subsidiaries failed to follow all the requirements. In 2009, the company announced a new anti-corruption standard called "Freedom within a Framework," which decentralized the anti-corruption program and allowed each foreign subsidiary to design and implement its own compliance program based on the global "Freedom" standards. The Global Anti-Corruption Policy was re-issued again in 2010 but was never implemented, and Walmart's foreign subsidiaries continued to design and operate their own compliance programs. In 2011, Walmart hired an international law firm and international consulting firm to conduct a global compliance risk assessment and review of the company's foreign subsidiaries. As result of the assessment, the company began remediation in April 2011 to address internal controls and other structural failures in the compliance programs in Mexico, China, India, and Brazil. Thus, Walmart was already investing in its anti-corruption compliance program before the New York Times article was published in 2012 on Walmart's operations in Mexico.

- Use of "Gestores" to Secure Permits and Licenses in Mexico and Limited Investigations or Remediation: From 1999 to 2004, Walmart's Mexican subsidiary utilized TPIs called "gestores" to obtain real estate permits and licenses. These gestores were attorneys who, according to the settlement documents, in some cases made improper payments to Mexican officials to expedite approvals for new store projects. The improper payments, which were overseen by senior personnel at the Mexican subsidiary, were identified as "legal services" on invoices provided by the gestores and recorded in each store's budget as line items for "external services" or "contract services." The invoices also contained a specific numeric or alphabetic code developed by senior subsidiary personnel to track the reason for the improper payment. According to the NPA, these three-digit codes, or "claves," indicated the quid pro quo for each payment, including: (1) avoiding a requirement; (2) influence, control, or knowledge of privileged information known by the government official; and (3) payments to eliminate fines.

Upon learning of the allegations, Walmart engaged outside counsel in 2005 to provide advice and draft an investigation plan. The company then utilized its internal audit and corporate security functions to perform a preliminary internal investigation. The investigation reports from both internal audit and security identified potential violations of law and recommended additional investigative steps to further corroborate allegations regarding the use of gestores. According to both the NPA and the SEC Order, Walmart did not follow the recommendations and instead transferred the remainder of the investigation to an attorney in the Mexican subsidiary who allegedly had previously known about the misconduct. After conducting additional inquiries, the Mexican attorney's report concluded that the corruption allegations were unsubstantiated; however, the report did identify deficient internal-accounting controls and made recommendations for improvement. According to the settlement documents, Walmart failed to address the recommendations and did not remediate its internal-accounting controls until 2011. In addition, the NPA alleges that Walmart failed to investigate allegations that local government officials had forced a store to close in order to force the Mexican subsidiary to make unlawful payments. - Historical Practice of Donations Also Created Risk in Mexico: From 2006 to 2011, the Mexican subsidiary donated cash, services, and merchandise to local municipalities and other local governmental entities. Many of those donations, such as cars and computers, were capable of being converted to personal use by local officials. According to both the DOJ and SEC, Walmart failed to implement sufficient internal controls to ensure the donations were used properly.

- Repeated Anti-Corruption Internal Controls Deficiencies Flagged by Internal Audit in China: Between 2003 and 2011, both the international division of Walmart's internal audit team as well as its China subsidiary's internal audit team issued multiple reports detailing weaknesses in the China subsidiary's anti-corruption internal controls. These weaknesses included inconsistencies between the company's global anti-corruption standards and the China subsidiary's anti-corruption policy, the exclusion of employees of state-owned and controlled entities from the definition of "government official," and a failure to provide adequate anti-corruption training to the subsidiary's employees. This historical lack of FCPA awareness and training for subsidiary personnel, despite repeated requests, resulted in problems relating to the provision of small payments (approximately $20) to government officials to maintain relationships and help obtain approvals and licenses. In addition, internal audit identified issues with third-party contracts lacking appropriate anti-corruption clauses; lack of required third-party due diligence, approvals, and FCPA certifications; and payments to TPIs without required documentation or approvals. These issues included a payment of approximately $60,000 to the landlord of a China subsidiary store in exchange for providing government relations consulting services. According to both the DOJ and SEC, although these controls issues were raised repeatedly by internal audit and were known to certain company executives, enhancements to the China subsidiary's internal-accounting-controls did not begin until 2011.

- Risks Associated with the India Joint Venture (JV) Partner and Whistleblower Allegations of Improper Payments in India: Prior to Walmart's establishment of a JV in India in 2007, the company's preliminary due diligence revealed significant anti-corruption-related red flags about the local Indian partner. According to the DOJ and SEC, an employee of the India JV partner allegedly gave a Walmart employee a "wink and a nod" when that employee attempted to discuss "clean" transactions from an FCPA perspective. The India JV partner employee also allegedly admitted that the local partner had used "speed payments" in the past to acquire permits and licenses. According to the SEC, Walmart did not address these concerns prior to entering the India JV and subsequently tasked the local partner with obtaining all the necessary permits and licenses to build stores.

In 2011, senior executives received an anonymous whistleblower allegation stating that employees at Walmart's India JV partner had been making improper payments to Indian officials in exchange for store operating permits and licenses. The payments were allegedly falsely recorded in theJV's books as "miscellaneous," "professional fees," "government fees," etc. According to the DOJ, company executives received several more emails from the same whistleblower, but the allegations were never investigated, and remedial measures were not instituted. In addition, company executives received several internal audit reports from 2008 and 2011 that detailed significant weaknesses in the India JV's anti-corruption internal-accounting controls, particularly with respect to the retention of TPIs without adequate safeguards. On at least one occasion, the standard company anti-corruption and audit rights provisions were removed from a vendor services agreement by an employee of the India JV prior to the execution of the contract. - Improper Payments worth $527,000 to Secure New Store Permits in Brazil: From 2008 to 2012, Walmart Brazil employed a third-party construction company to assist with the building of eight new stores. No due diligence was performed prior to engaging the construction company and the construction company repeatedly failed preliminary due diligence assessments in subsequent years. Despite these failures and red flags concerning the construction company's alleged history of corrupt conduct, Walmart Brazil did not terminate its contract or otherwise halt its business with the construction company as the due diligence was completed. In late 2009, Walmart Brazil directed the construction company to retain a TPI to assist with the permits needed to open two stores in an expedited manner. According to the DOJ, Walmart Brazil executives were aware of red flags indicating the Brazilian TPI was also a government employee who was later known by the nickname "sorceress" or "genie" because of her ability to quickly resolve permitting issues. Rather than hire the TPI directly, which it knew it could not do given her status as a government employee, Walmart Brazil instead amended its contract with the construction company to include a description of the work to be performed by the intermediary to secure the necessary permits and the costs associated with that work. According to the Information, the intermediary was paid $527,000 to obtain construction licenses for the two new stores. However, the payments were falsely recorded in Walmart Brazil's books as payments to the construction company, even though Walmart Brazil intended to pay the TPI. According to the settlement documents, the intermediary subsequently made improper payments to government inspectors to obtain the necessary construction licenses, and Walmart Brazil ultimately earned approximately $3.6 million in profits from those stores.

Noteworthy Aspects:

- Agencies Did Not Bring Anti-Bribery Charges: Despite clear descriptions of improper payments by intermediaries to government officials in both the NPA and SEC Order, neither agency charged Walmart with violating the FCPA's anti-bribery provisions. However, both agencies also made clear that those payments were made by intermediaries without the knowledge or awareness of Walmart employees, which suggests an intentional decision on the part of the enforcement agencies to emphasize that the "knowledge" or intent elements were not present, or at least that the facts were insufficient to justify anti-bribery charges. The nature of the charges also likely was subject to negotiation between the parties. Notwithstanding the lack of anti-bribery charges, the SEC still required Walmart to disgorge $119 million in allegedly illicit profits stemming from the company's books-and-records and internal-accounting-controls violations.

- No Voluntary Disclosure Credit with the DOJ and Allocated Cooperation Credit: In December 2011, Walmart had announced that it had "voluntarily disclosed" an internal investigation on anti-corruption issues to the DOJ and the SEC. In the 2019 NPA, however, the DOJ indicated that Walmart did not voluntarily disclose issues in Mexico, and therefore Walmart did not receive credit for such action under the FCPA Corporate Enforcement Policy. On the other hand, the SEC did give Walmart credit for "self-disclosure" of the Mexico issues in 2011 and subsequent voluntary expansion of its investigation. In addition, although DOJ noted in the NPA that Walmart did later disclose the conduct related to Brazil, China, and India, the disclosure came after the agency was already investigating conduct in Mexico. Moreover, the DOJ awarded only partial cooperation credit for its investigation in Mexico while it awarded full cooperation credit for the Brazil, China, and India conduct. According to the NPA, Walmart received partial cooperation credit related to the Mexican conduct because the company "did not timely provide documents and information … in response to certain requests" and "did not deconflict" with the DOJ's request to interview a specific witness before the company did so. The DOJ's decision to award less than full credit for Walmart's cooperation in Mexico is also reflected in the overall penalty amount, where the portion of the penalty applicable to conduct in Mexico was given a 20 percent, rather than 25 percent, discount under the U.S. Sentencing Guidelines. The DOJ's decision to allocate credit based on country-specific investigations emphasizes the high value the agency continues to place on voluntary disclosure, cooperation, and deconflicting investigation interviews.

- Two-Year, Limited Scope Monitorship Imposed Despite Extensive Remediation Efforts: As part of its resolution with the DOJ, Walmart agreed to engage an independent compliance monitor for a period of two years. Moreover, Walmart agreed to a two-year self-reporting period with the SEC. The DOJ decision to impose a compliance monitor at all is noteworthy, especially given the DOJ's detailed discussion of Walmart's remediation efforts. The breadth of Walmart's remediation efforts and commitment to ongoing compliance enhancements was extensive and included: (1) hiring a new Global Chief Ethics and Compliance Officer; (2) significantly increasing the number of compliance officers and anti-corruption-focused personnel in foreign markets; (3) enhancing anti-corruption monitoring activities and implementing upgraded internal audits to test internal-accounting controls and procedures; (4) enhancing internal-accounting-controls on the selection and use of third parties, including onboarding and due diligence procedures; and (5) terminating business relationships with the TPIs involved in the conduct at issue. The DOJ's new internal policy on corporate monitors requires prosecutors to balance monitor benefits and costs when evaluating the appropriateness of imposing a monitor, including the company's corporate compliance program at the time of a resolution, the financial costs of a monitor to the company, and any unnecessary burdens to the company's operations. The imposition of a compliance monitor in this case suggests that the DOJ did not consider Walmart's remediation efforts to completely address future compliance risks, despite the more than $900 million the company reportedly spent investigating and remediating the conduct at issue through significant compliance program enhancement, and millions more in future monitor costs. However, the DOJ did take the unusual step of narrowing the scope of the monitor's mandate beyond the standard boundaries, which suggests that DOJ tried to account for monitor costs in light of what the company had done. According to the NPA, the Walmart monitor will focus only on the company's internal accounting controls "as they relate to permits and licensing, real estate development and construction, donations, and third-party intermediaries" in four specific "monitor countries."

- No Statute of Limitations Issues: As noted above, the general public has been aware of Walmart's FCPA issues since the New York Times published the first in a series of articles chronicling the company's conduct in April 2012, as well as Walmart's own disclosure in December 2011. The SEC alleges that the conduct at issue took place from approximately 2000 to 2011, which places the majority of the actionable conduct outside of the five-year statute of limitations imposed by the Supreme Court's Kokesh decision. Given the SEC's imposition of disgorgement here, it is likely that Walmart either entered into a tolling agreement with the SEC or waived the limitations period. Such an action would be consistent with Walmart's cooperative posture throughout the investigation, as well as with most other companies' decision to either toll or waive the statute of limitations pre-Kokesh.

TechnipFMC Plc and U.S. Subsidiary Settle Criminal Charges Related to Conduct in Brazil and Iraq

On June 25, 2019, TechnipFMC Plc (TFMC), a global provider of oil and gas services headquartered in London, and its wholly owned U.S.-based subsidiary Technip USA, Inc. (TUSA), resolved charges related to the FCPA in connection to conduct in Brazil and Iraq. TFMC's DPA charges the company with one count of conspiracy to violate the FCPA's anti-bribery provisions in Brazil and one count of conspiracy to violate the anti-bribery provisions in Iraq. On the same day, the DOJ filed a single count information in the EDNY and a plea agreement in which TUSA agreed to plead guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA related to conduct in Brazil.

TFMC is the result of a 2017 merger between Technip S.A. of France and FMC Technologies, Inc. of Texas, and as such, TFMC is a successor in interest for both Technip S.A. (Technip) and FMC Technologies, Inc. TFMC was an "issuer" for the purposes of the FCPA during only part of the relevant time period, while FMC was an issuer for the entire relevant period. Some of the conduct at issue in the TFMC resolution occurred during the same time period as Technip S.A.'s 2010 resolutions with the DOJ and the SEC and subsequent two-year monitorship related to alleged bribe payments in Nigeria.

The Technip allegations relate to the same conduct described in Keppel Offshore & Marine Ltd.'s 2017 resolution with the DOJ, while the FMC allegations relate to a broader investigation into the actions of Unaoil, a Monaco-based consultant. We discuss the Keppel Offshore & Marine Ltd. resolution in our FCPA Winter Review 2018.

While the SEC has not yet announced any agreement with TFMC, the DPA's Certificate of Corporate Resolutions discloses that the TFMC board approved an agreement to resolve "the investigation by the SEC related to the intermediary Unaoil," including an obligation to pay a total of $5,061,906 in disgorgement and prejudgment interest to the SEC. The disgorgement amount corresponds roughly to the profits attributed to FMC in the DOJ DPA ($5.3 million).

In connection with its resolution with the DOJ, TFMC agreed to pay a total criminal fine of $296,184,000, of which $81,852,966.83 would be paid to the United States and $214,331,033.17 would be paid to Brazilian authorities in connection with a resolution relating to the same conduct. TFMC agreed that that $500,000 of the $81,852,966.83 paid to the United States Treasury would be paid as a criminal fine on behalf of TUSA. The DPA notes that the DOJ applied a 25 percent discount from the criminal fine – the maximum discount allowable for companies that did not voluntarily disclose the misconduct – as a result of the company's cooperation and remediation. However, the amount for the fine was higher than it otherwise would have been, because the DOJ added two points to the culpability score due to Technip S.A.'s status as a repeat offender. Also, pointing out that "Technip S.A. is a recidivist," the DOJ increased the fine by applying the 25 percent discount against an amount from the middle of the Sentencing Guideline fine range, which is a departure from its typical practice of using the bottom of the range. In addition to the criminal fines, TFMC agreed to self-report to the DOJ the progress of its remediation and implementation of compliance measures for a period of three years. Based on the corporate resolution included with the DOJ, TFMC was poised to conclude a similar three-year self-reporting requirement with the SEC.

Brazil

According to the DPA, from 2003 to 2014, Technip S.A., TUSA, and a joint venture (the JV) established by TUSA and Keppel Offshore & Marine Ltd. (KOM) and incorporated in Brazil made commission payments to Zwi Skornicki (the Consultant) and the Workers' Party of Brazil, knowing that a portion of the payments would be used to pay bribes to Brazilian government officials from Petrobras. As summarized below, Skornicki pleaded guilty to related crimes on the same day that TFMC's DPA was announced. The DPA states that Technip, TUSA, the JV, and KOM made at least $69 million in illicit payments, of which Technip directly paid $20.9 million, during the relevant time period resulting in approximately $135.7 million in profits for Technip from the business obtained with Petrobras.

In particular, the DPA describes the following actions by Technip, TUSA, KOM, and the JV:

- P-51 and P-52 Projects. In 2003, the Consultant, who had an existing business relationship with KOM, informed an executive from Technip and an executive from the KOM subsidiary (Technip and KOM Executives) that the JV could win two offshore oil platform projects, P-51 and P-52, "by paying bribes to two Petrobras officials." The Technip and KOM executives authorized the Consultant to make payments equal to a percentage of the contracts' value to Petrobras officials and the Workers' Party and its candidates. E-mail exchanges between the Consultant and the JV following the payments noted that negotiations on price for the P-52 project were "all a show for [Petrobras Official 1's] benefit." In December 2003, the P-52 project was awarded to the JV. Through the Consultant, Petrobras Official 2 warned the Technip and KOM Executives that its bid would need to be altered by $2 million in order to win the P-51 project. After the bid was revised according to the official's instructions, Petrobras awarded the P-51 project to the JV in June 2004. After obtaining the project, the Technip and KOM executives authorized several payments to a candidate from the Workers' Party and billed the payments to the P-51 project.

- P-56 Project. In 2007, the Consultant informed the Technip and KOM executives that the JV could win offshore oil platform project P-56 if the JV made bribe payments to a Petrobras official and donations to the Workers' Party equal to one percent of the contract value of the project. After the Technip and KOM executives authorized the Consultant to make the payments, Petrobras awarded the P-56 project to the JV.

- Consultant Payments. The Technip and KOM executives continued to make payments associated with the P-51, P-52, and P-56 projects between April 2004 and July 2013, during Technip's prior DPA and two-year monitorship, including to two Petrobras officials and officials from the Workers' Party and Workers' Party candidates. Until 2009, the JV paid a percentage of the money received from Petrobras into the Technip Subsidiary's bank account in New York, which would be important for establishing jurisdiction given that Technip was either a foreign issuer or non-issuer located outside the United States during the relevant times. Transfers were then made to bank accounts in Switzerland held in the Consultant's name. Starting in 2009, in order to conceal the payments from the company's due diligence processes, the Technip and KOM executives changed the payment structure so that all payments to the Consultant were made by the KOM subsidiary, which then invoiced the JV for Technip's portion of the payments.

- Non-Joint Venture Payments: Some Technip executives, who were involved in the previous Consultant payments, retained the Consultant on two additional projects involving Petrobras for Technip. In September 2007, Technip retained the Consultant to help in a settlement negotiation between a consortium of Technip subsidiaries and Petrobras over offshore oil platform project P-50. In September 2009, Technip retained the Consultant to help in obtaining an engineering project with Petrobras in relation to two offshore oil platforms, P-58 and P-62.

- Hiring Children of Petrobras Officials: Between December 2006 and September 2008, Technip's foreign subsidiary hired the child of a third Petrobras official as a "favor." Between June 2011 and May 2014, with the approval of a Technip executive, the Technip foreign subsidiary hired the child one of the Petrobras officials that had previously received payments through the Consultant and seconded the child to TUSA.

Iraq

According to the DPA, from 2008 to 2013, FMC Technologies (FMC) made improper payments to five Iraqi government officials in connection with seven contracts to provide metering technologies for oil and gas production measurement to the Iraqi government. The DPA states that, as a result of the improper payments FMC made through agency agreements with an intermediary and the intermediary's sub-agent, FMC obtained approximately $5.3 million in profits from the business obtained with the Iraqi government.

In particular, the DPA describes the following actions by FMC:

- SOC Projects 3614-3620. In 2008, the South Oil Company of Iraq (SOC), an Iraqi oil and gas company owned by the Iraq Ministry of Oil, invited FMC to bid on a contract to provide metering technologies for oil and gas production in connection with seven projects (the SOC Projects). FMC entered into a System Sales Consultant Agreement for the SOC Projects with an intermediary company (Intermediary), which stated that the Intermediary would receive a six percent commission after FMC received "full customer payment." Around the time that FMC submitted its proposal to SOC, Intermediary had agreed with a manager at FMC that the Intermediary would pay a portion of its expected commission to an Iraqi official. Following concerns that the Iraqi official was too junior to impact the outcome of the bid, Intermediary discussed providing one percent of the anticipated commissions to another Iraqi official, totaling approximately $130,000, with FMC managers. In August 2009, the SOC technical evaluation committee determined that FMC was technically unsuitable to provide services for the SOC Projects and awarded the contracts to a different company, Company A. The Intermediary speculated that the result reflected that the SOC technical committee had been "bought and sold" by Company A.

- MOC Projects 58-09-4046. In mid-2010, the Missan Oil Company of Iraq (MOC), which was owned by the Iraq Ministry of Oil, invited FMC to bid on a contract to provide metering technologies in connection with another project (the MOC Project). FMC entered into a System Sales Consultant Agreement for the MOC Project with the Intermediary, which stated that the Intermediary would receive a nine percent commission after FMC received "full customer payment." In October 2010, the MOC awarded the MOC Project to FMC Technologies.

- SOC Projects 4165-4168. In early 2011, SOC invited FMC Technologies to bid on a contract to provide metering services in connection with four projects (the SOC Projects 2). FMC signed a System Sales Consultant Agreement for the MOC Project with the Intermediary, which stated that the Intermediary would receive a six and a half percent commission after FMC received "full customer payment." Following concern that an agent for Company A was "very active and gaining friends with his generosity," the Intermediary sent an e-mail to Iraqi official 7, stating "This is a metering station and you are being added to the evaluation committee[;] [p]lease discuss this job only with me." Shortly after, the SOC awarded the SOC Projects 2, worth $17 million, to FMC in 2011. Between 2009 and 2013, FMC paid the Intermediary approximately $795,000 from a bank account in Texas through the EDNY to Monaco, and the routing through the EDNY presumably established venue for the DPA.

Noteworthy Aspects:

- No Simultaneous SEC Action: In a departure from previous U.S. enforcement practice, the DOJ and the SEC did not simultaneously enter resolutions with TFMC. While the SEC has not yet announced an agreement with TFMC, the DPA's Certificate of Corporate Resolutions discloses that a resolution with the SEC may be forthcoming. The Certificate further discloses TFMC's possible agreement to pay a total of $5,061,906 in disgorgement and prejudgment interest to the SEC along with a similar three-year self-reporting period.

- Successor Liability Following Merger: All of the conduct at issue in the resolution predates January 2017, when Technip S.A. merged with FMC Technologies in a $13 billion deal. The resulting new entity, Technip FMC Plc, one of the largest offshore energy services companies in the world, assumed all of Technip S.A.'s and FMC Technologies' legal obligations as their successor-in-interest. The misconduct alleged in Technip FMC Plc's DPA therefore occurred prior to the existence of TFMC as an entity.

- Emphasis on International Cooperation and FBI Capabilities: In describing the resolution, DOJ officials have emphasized the multinational efforts involved corruption cases as well as the FBI's role in investigating corruption. According to the DOJ Announcement, the governments of Australia, Brazil, France, Guernsey, Italy, Monaco, and the United Kingdom provided significant assistance in the Technip resolution. Assistant Attorney General Benczkowski stated that the TFMC resolution was "a testament to the strength and effectiveness of international coordination in the fight against corruption." Interestingly, the majority of the penalty, $214.3 million of the $296 million, will be paid to Brazil.

- Higher Criminal Fine for History of Prior Resolution, But No Imposition of Compliance Monitor: Pursuant to its settlements with the DOJ and the SEC (at least, according to the corporate resolution included in the DPA), TechnipFMC was not ordered to retain an independent compliance monitor, and instead agreed to self-report for a period of three years. Although the DPA notes that the total criminal fine reflects a multiplier of 2.8 due to Technip S.A.'s prior criminal conduct and the nature and seriousness of the newly identified misconduct, the DOJ applied a 25 percent discount from a midpoint of the fine range as a result of the company's cooperation and remediation. While the 25 percent discount represents the maximum allowable discount, it is important to note that the DOJ's decision to apply the discount to the middle of the fine range as opposed to the bottom of the range had a net effect of increasing the penalty amount by more than $100 million. In contrast to the recent DPA entered with MTS, where an independent compliance monitor was mandated, the DOJ described the allocation of full cooperation credit to TechnipFMC as resulting from thorough internal investigations, meeting the DOJ's requests promptly, proactively identifying issues and facts of interest, making regular factual presentations, voluntarily making foreign-based employees available for interviews in the United States, producing documents, and collecting and organizing voluminous evidence for the DOJ. The difference in outcome for the two companies suggests that the level of cooperation during the DOJ's investigation may affect the determination of whether the imposition of a compliance monitor is necessary. Also noteworthy is TechnipFMC's commitment to developing "rigorous anti-corruption compliance program." This terminology differs from the DOJ's longstanding standard of "effective" compliance programs described in the U.S. Sentencing Guidelines at U.S.S.G. §§ 8B2.1, 8C2.5(f), and 8C2.8(11) as well as the "Principles of Federal Prosecution of Business Organizations" in the Justice Manual at JM 9-28.300. It is unclear whether the term "rigorous" is intended to reflect that TechnipFMC committed to investing in a compliance program that exceeds its previous standard, which may have been a factor in the decision not to require a compliance monitor.

Individual Enforcement Actions

Two U.S. Citizens Convicted of Soliciting Bribes from Undercover FBI Agents in Connection with Haitian Port Project

On June 20, 2019, the DOJ announced that a federal jury in Boston convicted two businessmen, Joseph Baptiste and Roger Richard Boncy, of corruption charges arising out of an investigation into a port development project in Haiti. Baptiste was initially indicted for his role in October 2017. One year later, a Superseding Indictment was jointly filed against Baptiste and Boncy. Boncy is a dual U.S.-Haitian citizen previously residing in Madrid, while Baptiste is a U.S. citizen and head of the Maryland-based non-profit discussed below. According to the Miami Herald, the investigation of Boncy and Baptiste began after the FBI received a tip about an alleged scheme.

According to the Superseding Indictment, Boncy served as the Chairman and Chief Executive of a company whose purpose was to promote development projects in Haiti; Baptiste was also a board member. The government alleged that Baptiste and Boncy solicited bribes from two undercover FBI agents posing as potential investors in a proposed $84 million port development project in the Môle St. Nicolas area of Haiti. In recorded conversations, the co-conspirators allegedly told the undercover agents that five percent of the funding would have to allocated to bribe Haitian government officials. The agents then wired a total of $50,000 in two equal payments to the Maryland-based non-profit run by Baptiste as part of the scheme and Baptiste's non-profit allegedly issued statements that the payments were charitable, tax-deductible donations. In the indictment, the government alleged that Baptiste used these funds for his own personal expenses but planned to use future amounts to fund bribes to Haitian government officials. The government also alleged that Boncy and Baptiste had discussed offering to hire government officials – for example, as an engineer or an advisor – if the government officials assisted in approving the project before leaving office. In addition to recorded discussions with undercover agents, the government also recorded phone calls between Boncy and Baptiste.

Before the trial, Boncy had tried to dismiss the charges against him after learning that the government had destroyed potentially-exculpatory recordings of conversations between Boncy and one of the undercover agents. However, the district court judge ruled that the destruction was "careless" but "not intentional," based on "sloppiness and unforeseen technical issues," and that Boncy had provided insufficient evidence to demonstrate that that the destroyed evidence was in fact exculpatory.

The government charged both defendants with conspiracy to violate the FCPA and the Travel Act, violating the Travel Act, and conspiracy to commit money laundering. The jury found Baptiste guilty on all three counts but acquitted Boncy of the Travel Act and conspiracy to commit money laundering charges, finding him guilty of only the conspiracy to violate the FCPA and the Travel Act. Both defendants are scheduled to be sentenced on September 12.

Former Consultant for Technip and Keppel Pleads Guilty to Payments to Brazilian Officials

On June 25, 2019, Zwi Skornicki, a citizen of Brazil, pleaded guilty to a one-count Criminal Information charging him with conspiracy to violate the FCPA. According to the Criminal Information filed against him, Skornicki served as a consultant to Keppel Offshore and Marine, Ltd. (Keppel), Technip S.A., and Technip USA (TUSA) from approximately 2001 to 2014. During this time, he entered into a conspiracy to pay approximately $55 million to foreign officials at Petrobras, the Brazilian state-owned energy company to in connection with at least 13 projects in Brazil tendered by Petrobras, Brazil's state oil and gas company. Keppel (headquartered in Singapore), as well as Technip (headquartered in Paris), each had subsidiaries in Brazil and the U.S. that were "domestic concerns" during the relevant time period. Skornicki, therefore, was subject to the FCPA as an agent of these "domestic concern" subsidiaries.

According to the information, to facilitate the bribes, Skornicki and employees of Keppel and Technip executed false agreements using consulting companies controlled by Skornicki. Skornicki then used the commissions for bribes to Petrobras employees as well as the prominent Brazilian Workers' Party and its candidates, securing approximately $500 million in profits for Keppel and Technip. Keppel and the successor entity of Technip (TFMC) each resolved separate enforcement actions brought by the U.S. government; these corporate resolutions are discussed in greater detail in our FCPA Winter Review 2018 and above, respectively.

Skornicki is scheduled to be sentenced on September 23, 2019, and he technically faces up to five years in prison. As reported by the media, however, because the Brazilian authorities have already convicted Skornicki and because he agreed to pay $25 million in fines to the Brazilian authorities, the DOJ has agreed not to oppose his request for probation.

Florida and Venezuela-Based Businesspeople Convicted in Procurement Kickback Scheme at Venezuelan State-Owned Electricity Company

On June 27, 2019, the DOJ announced that it had reached plea agreements with Luis Alberto Chacin Haddad of Miami, Florida and Jesus Ramon Veroes of Venezuela. Chacin and Veroes each pleaded guilty to one count of conspiracy to commit violations of the FCPA's anti-bribery provisions. According to the Information filed in the Southern District of Florida, both men unlawfully enriched themselves by making corrupt payments to officials at Venezuela's state-owned and state-controlled electricity company, Corporación Eléctrica Nacional (Corpoelec), in exchange for attaining and maintaining contracts from Corpoelec. In connection with their guilty pleas, Chacin and Veroes admitted that, beginning in 2016, their Florida-based companies received contracts worth more than $60 million for the supply of transformers, generators, forklift trucks, and light bulbs to Corpoelec.

Each defendant agreed to forfeit at least $5.5. million, the total amount each man individually acquired through the offense. In addition, the plea agreements require both men to forfeit certain real estate property located in Miami-Dade County, Florida, that was purchased using the proceeds from their offenses. Both men are scheduled to be sentenced on September 4, 2019.

In a related enforcement action, the DOJ also announced on June 27, 2019, that it had brought charges against Venezuelan residents Luis Alfredo Motta Dominguez and Eustiquio Jose Lugo Gomez. Motta is the former Venezuelan Minister of Electrical Energy and head of Corpoelec. Lugo is a former procurement director at Corpoelec. According to the DOJ, Motta and Lugo received approximately $270,000 in cash payments from Veroes and Chacin in exchange for "lucrative contracts and improper business advantages." Additional payments totaling approximately $472,550 were made to a "unrelated third-party nominees" in Spain to conceal the corrupt nature of the payment from a Florida-based Citibank account and an oversees account controlled by Chacin, respectively. Motta and Lugo each face eight counts of money-laundering charges, including one conspiracy count and seven substantive counts. The charges against Motta and Lugo are consistent with the DOJ's practice of charging bribe payers with FCPA-related charges and bribe recipients with money-laundering-related charges, as discussed most recently in our FCPA Autumn Review 2018.

Litigation, Policy, and International Developments

Federal Court Holds Documents Created During FCPA Investigation Are Covered by Attorney-Client Privilege in Misonix v. Cicel

On April 11, 2019, the U.S. District Court for the EDNY held that a U.S. company was not required to produce certain documents prepared by its outside counsel in support of an internal investigation to a former Chinese business partner during collateral litigation. Although the court ultimately held that the documents were protected by the attorney-client privilege, the decision serves as a reminder that companies and law firms conducting such investigations need to be mindful of potential challenges to privilege by third-party litigants and need to enact appropriate safeguards.

The court's decision arose during litigation between Misonix, Inc. (Misonix), a U.S. provider of ultrasonic surgical devices, and its former Chinese distributor, Cicel Science & Technology Ltd. (Cicel). Following the initiation of an investigation into potential FCPA violations by the SEC, Misonix retained Morgan Lewis & Bockius (Morgan Lewis) to conduct an internal investigation. In September 2016, Misonix terminated its distribution contract with Cicel, almost two years before it was due to expire. In a Form 8-K disclosure filed the day after the termination, Misonix explained that, through its internal investigation, the company had learned that it "may have had knowledge of certain business practices" by its Chinese distributor (without referring to Cicel by name) that "raise questions" under the FCPA and was conducting an internal investigation into the potential violations.

In March 2017, Cicel sued Misonix in U.S. federal court alleging wrongful termination of a contract and seeking damages for lost business and Cicel's harmed "hard-earned business reputation." Cicel denied any wrongdoing and argued that Misonix had terminated the contract "in bad faith" as part of a "scheme to damage Cicel's business reputation" after spreading "false and defamatory rumors" that Cicel was involved in bribing Chinese government officials in violation of the FCPA. Misonix, however, maintained during the litigation that the company terminated the contract "after uncovering evidence that Cicel's business practices were inconsistent with Misonix's policies and raised concerns under the [FCPA]."

In an attempt to acquire more evidence and strengthen its case, Cicel requested in June 2018 that Misonix hand over "any transcripts, notes, recordings, or videotapes" related to the questioning of two Cicel executives by Misonix's outside counsel. Cicel also requested that Misonix produce "all documents pertaining to Misonix's purported investigation of Cicel's conduct … that purportedly led to Misonix's termination of Cicel's exclusive distributorship agreement." Underlying Cicel's requests was its claim that documents from the internal investigation were not privileged because Misonix had hired Morgan Lewis to make findings of fact, not to provide legal advice, which, Cicel claimed, was the role of Williams & Connolly, another law firm that Misonix had retained to represent it in the lawsuit. Cicel further argued that conducting the internal investigation, "a role that could have been performed by non-counsel," and drafting investigative reports are "fact-finding" missions and, therefore, not protected by the attorney-client privilege. Cicel also contended that Misonix had waived any applicable privilege over the documents as a matter of law by, among other things, disclosing materials pertaining to its investigation to the SEC.

Magistrate Judge Steven Locke of the U.S. District Court for the EDNY rejected Cicel's "legally unsupported" argument, stating that fact-finding is a crucial part of determining proper legal advice and that the two roles are not mutually exclusive. The court then went on to rule that the documents created by Morgan Lewis were protected by attorney-client privilege and would not have to be produced to Cicel. The court cited to Upjohn Co. v. United States, in which the Supreme Court held that interview notes and memoranda prepared by a corporation's inside counsel in connection with an internal investigation were protected by the attorney-client privilege. Judge Locke further cited In re Gen. Motors LLC Ignition Switch Litig., in which the Southern District of New York relied heavily on Upjohn to conclude that the claim to privilege was strengthened by the fact that an investigation was conducted by outside counsel rather than in-house counsel. In ruling that "Misonix has adequately demonstrated that the 'primary purpose' of Morgan Lewis's internal investigation was 'the provision of legal advice' such that the privilege should apply," the District Court also relied on In re Kellogg Brown & Root, Inc., where the DC Circuit held that the attorney-client privilege applies if obtaining or providing legal advice is one of the significant purposes of an internal investigation.

Regarding whether Misonix had waived privilege by producing documents pertaining to the investigation to the SEC, the court agreed that the company's disclosure to the SEC did not amount to a privilege waiver. Misonix argued that the company "has never disclosed any attorney work product or attorney-client privileged documents to the government." Rather, Misonix stated that it had "voluntarily disclosed to the government … the underlying documents related to Cicel's business practices in China and Misonix's concerns about those business practices." The court agreed that Misonix's disclosure to the SEC did not waive privilege but ordered that the Company immediately produce to Cicel any responsive materials provided to the SEC but not produced to Cicel in the litigation. The judge further ruled that Misonix will have to submit to the court relevant emails listed on its privilege log sent between Misonix employees and involving solely non-lawyers for an in-camera review to determine if they are protected by the privilege.

As noted above, on June 20, 2019, Misonix filed a Form 8-K disclosure and issued a press release announcing that the Company had received a letter from the SEC on June 18, 2019 stating that the SEC had concluded its investigation of Misonix. The disclosure stated that the SEC had informed Misonix that the agency did not intent to recommend an enforcement action against the Company with respect to the internal investigation conducted into Cicel's business practices and the Company's knowledge of those practices, as well as into various internal controls issues identified during the investigation.

DOJ Issues Updated Guidance on Evaluating Corporate Compliance Programs

On April 30, 2019, the DOJ's Criminal Division issued updated guidance on the "Evaluation of Corporate Compliance Programs" (the 2019 Evaluation Guidance) intended to guide prosecutors in making determinations regarding the effectiveness of a corporation's compliance program at different periods of time. Consistent with past guidance issued by the DOJ, the Updated Evaluation Guidance does not establish a "rigid formula" or a mandatory set of questions to be asked, but rather offers useful insights for companies regarding the DOJ's views on the design and operation of their compliance programs.

As we discuss in our International Alert, the 2019 Evaluation Guidance incorporates much of the same content included in a previous DOJ guidance document issued in February 2017 (the 2017 Evaluation Guidance), the document has been reorganized to include 12 topic areas (instead of the 11 hallmarks that appeared in the 2017 Evaluation Guidance). The 2019 Evaluation Guidance's 12 topics are grouped to track the three core questions about compliance program effectiveness contained in Section 9-28.800 of the Justice Manual: whether a corporation's compliance program is well designed; whether the program is being implemented effectively; and whether the program works in practice.

General Themes

- A More Holistic Evaluation Approach. Whereas the 2017 Evaluation Guidance included questions titled towards a retrospective analysis of specific misconduct and the corresponding program issues, the 2019 Evaluation Guidance applies a broader lens that first seeks to capture the company's general approach to compliance and then focus on how the program did or did not work in connection with the alleged misconduct under investigation.

- Emphasis on Decision-Making Rationale. The 2019 Evaluation Guidance includes several new questions prompting prosecutors to inquire about a company's documented rationale for decision-making related to the design and implementation of its compliance. Accordingly, the inquiries do not preclude a company from choosing a particular course but suggest that a company should be prepared to defend rationales that informed program design and resource allocations.

- A Focus on Program Integration. The 2019 Evaluation Guidance prompts prosecutors to determine not only if certain elements of the program exist, but also how those elements work in concert with other program components; whether the program elements are integrated into the day-to-day rhythms of the company; and how such elements are reinforced through the company's internal control systems.

- Operationalizing Continuous Improvement. Across various sections, the 2019 Evaluation Guidance prompts prosecutors to evaluate how a company measures program effectiveness, emphasizing the importance of capturing and tracking data to analyze trends and missed opportunities.

Notable Topic-Specific Updates

- Risk Assessment as the Starting Point. The section entitled "Risk Assessment" was moved to be the first of the 12 topics addressed in the 2019 Evaluation Guidance. Accordingly, the guidance emphasizes that the "starting point for a prosecutor's evaluation of whether a company has a well-designed compliance program is to understand the company's business from a commercial perspective, how the company has identified, assessed, and defined its risk profile and the degree to which the program devotes appropriate scrutiny and resources to the spectrum of risks." Notably, the 2019 Evaluation Guidance highlights the importance of "risk-tailored resource allocation" and the importance of updates and revisions to a company's risk assessment and policies and procedures "in light of lessons learned." Companies can expect prosecutors to spend more time understanding how risk assessments informed resource allocations, and to scrutinize those decisions.

- Additional Guidance Related to Reporting Mechanisms and Investigations Response. The 2019 Evaluation Guidance includes a twelfth topic by splitting the earlier guidance's "Confidential Reporting and Investigation" into two separate sections: "Confidential Reporting Structure and Investigation Process" and "Investigation of Misconduct." Accordingly, the 2019 Evaluation Guidance includes new questions as to whether the company has: established and publicized an anonymous reporting mechanism; timely and effectively responded to the results of the investigation and remediated identified issues; and tracked and learned from investigation results.

- Emphasis on Proactive Justification of Business Rationales for Third Parties. The 2019 Evaluation Guidance's section on "Third Party Management" assesses how the company ensures appropriate business rationales for use of third parties. These questions evidence the view that a critical step in managing compliance risk posed by third parties is to evaluate whether there is a clear business need to engage them, and if so, to articulate what qualifications are required to meet that need. Therefore, companies will be well served to consider whether their compliance programs require this step, and if so, whether that step is documented and maintained as part of the due diligence file.

In sum, the 2019 Evaluation Guidance provides more context for each of the topics covered and supports the DOJ using a more holistic evaluation approach to assessing compliance program effectiveness, with an emphasis on decision-making rationale, program integration, and operationalizing continuous improvement.

French Anti-Corruption Regulators Issue First Guidelines Regarding Negotiation of CJIPs

On June 27, 2019, the French National Financial Prosecutor (PNF) and the French Anti-Corruption Agency (AFA) published their first joint guidelines (the Guidelines) regarding the negotiation of conventions judiciaire d'interêt public (CJIPs), or "judicial agreements in the public interest." The CJIP procedure, which was first introduced in December 2016 by France's anti-corruption legislation, Sapin II, generally mirrors U.S.-style DPAs. These Guidelines constitute a major development in French anti-corruption enforcement.