FCPA Winter Review 2011

International Alert

Introduction

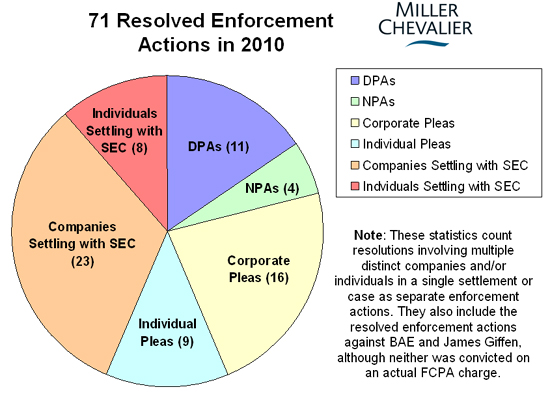

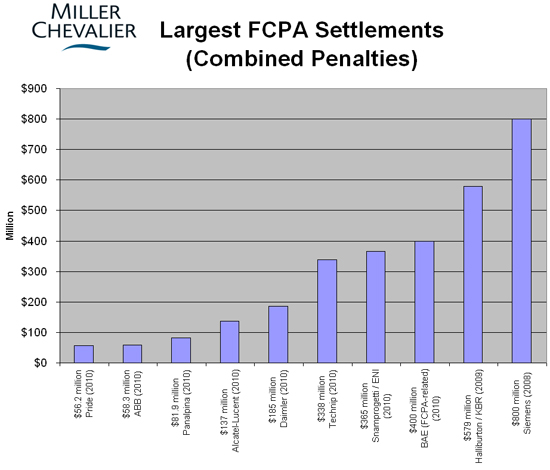

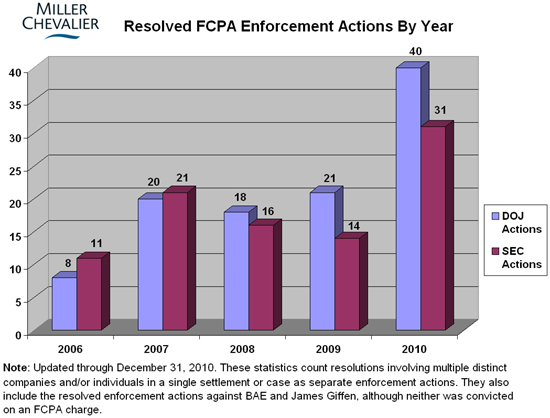

The new year provides the opportunity to reflect upon trends that developed in Foreign Corrupt Practices Act ("FCPA") enforcement in 2010. From 2009 to 2010, the number of enforcement actions more than doubled and total fines nearly tripled. In fact, 2010 set a new record for fines with $1.8 billion in FCPA-related fines, penalties, and disgorgement collected by the Department of Justice ("DOJ") and the U.S. Securities and Exchange Commission ("SEC"). Some of the largest fines were paid by non-U.S. companies, including ABB (Swiss), Alcatel-Lucent (French), BAE Systems (U.K.), Daimler (German), Snamprogetti/ENI (Italian, plus Dutch subsidiary), and Technip (French). Also notable were the concurrent settlements by Panalpina and six of its customers, namely: Shell, Transocean, Pride, GlobalSantaFe, Tidewater, and Noble, which paid a combined total of $236.5 million to resolve related FCPA enforcement actions.

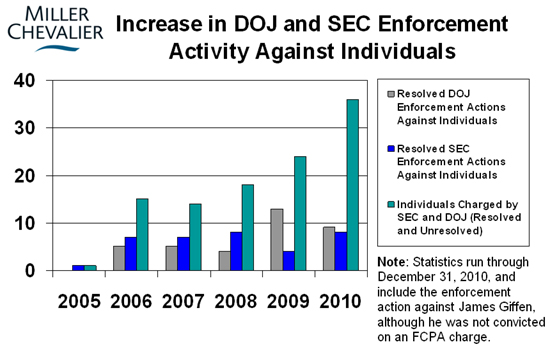

U.S. enforcement agencies were no less aggressive in 2010 in bringing FCPA enforcement actions against individuals. The year kicked off with the arrests of the 22 "SHOT Show" defendants at a gun show in Las Vegas, resulting from an undercover sting operation. Charles Jumet received a prison sentence of seven years, the longest in FCPA history, after pleading guilty to conspiring to violate the FCPA by making illicit payments to foreign officials in Panama. Additionally, in a Senate Judiciary Committee hearing in November, Senator Arlen Specter expressed his support for increased FCPA prosecutions against individuals, noting that corporate fines and penalties alone do not serve as an adequate deterrent to bribery of foreign officials. The focus on individuals is likely to continue and grow in the years to come.

The most notable exception to this trend in 2010 was the anti-climatic end to James Giffen's decade-long prosecution for alleged bribery of Kazakh officials, which included claims that he worked for the U.S. Central Intelligence Agency. The prosecution ended in November 2010, when he was sentenced to time served for a misdemeanor tax charge and described by the judge as a "Cold War hero."

Civil suits related to FCPA issues were also on the rise in 2010. Although the FCPA does not provide for a private right of action, companies and individuals subject to FCPA enforcement actions are increasingly at risk of being the target of a civil suit. A primary example of the increase in civil litigation stemming from FCPA issues in 2010 was SciClone Pharmaceuticals, against which seven class action securities suits were filed within two weeks of SciClone receiving notice of an SEC FCPA investigation. Other causes of action stemming from FCPA related activity include wrongful termination, unfair competition, and antitrust claims.

In addition to civil litigation, foreign governments launched investigations and brought charges against both corporations and individuals on the heels of U.S. FCPA enforcement actions. Most notably, the Government of Nigeria brought charges against Halliburton and former U.S. Vice President Dick Cheney, who was Halliburton's CEO when Halliburton's subsidiary, KBR, was working on Nigeria's Bonny Island project. Those charges were dropped in December 2010 after Halliburton agreed to pay a $35 million fine. In some cases, foreign countries are filing suit in the U.S. against corporations subject to FCPA investigations. In addition, the governments of Malaysia and Honduras have opened investigations into the events in their countries that gave rise to the Alcatel-Lucent FCPA enforcement.

This activity signals a rise in other governments' interest in enforcing anti-corruption laws. In 2010, Transparency International found that seven parties to the OECD Anti-Bribery Convention actively enforced laws complying with the Convention's obligations in 2010, up from the four countries it cited in 2009. Nevertheless, this number is small compared to the number of states that have ratified the convention, which now stands at 38. The most notable development in non-U.S. law enforcement is the United Kingdom ("U.K.") Bribery Act, which will enter into force in April 2011. Unlike the FCPA, the Bribery Act does not contain an exception for so-called "facilitation" payments. The Act does, however, provide for an "adequate procedures defense," which is designed to shield companies with strong compliance programs from U.K. prosecutions. The actual impact of the Bribery Act remains to be seen. According to media sources, the Prime Minister's office recently ordered a review of the Bribery Act amid business concerns regarding its impact. As reported in our FCPA Autumn Review 2010, the Ministry of Justice is expected to issue final guidance on implementation of the Act early this year, but the recently-announced review may delay the issuance of the guidance.

The new SEC whistleblower program enacted in July under the Dodd-Frank Act is already a hot topic for FCPA compliance and promises to create more challenges in the coming year. The SEC predicts that it will receive 30,000 tips a year and reportedly receives at least one FCPA-related tip every day. In the last quarter of 2010, the SEC issued proposed rules for the whistleblower program. Final rules will be implemented by April 21, 2011. The vast financial incentives for whistleblowers to report FCPA violations directly to the agency likely will significantly impact the level of enforcement activity at the SEC, the speed with which a company makes a voluntary disclosure in the race to the Commission's doorstep, and companies' internal reporting and response processes.

With continuing aggressive enforcement, enactment of the U.K. Bribery Act, and implementation of the whistleblower rules, 2011 likely will be another record-breaking year.

Actions Against Corporations

Alcatel-Lucent Pays Over $137 Million to Settle FCPA Charges

On December 27, 2010, Alcatel-Lucent, S.A. ("Alcatel-Lucent") and three of its subsidiaries agreed to pay over $137 million in penalties and disgorgement of profits to settle charges that the company violated the FCPA. This follows Alcatel-Lucent's announcement in its February 11, 2010 consolidated financial statement that it had entered into settlement agreements in principle with the DOJ and SEC, as reported in our FCPA Spring Review 2010.

The DOJ's FCPA investigation covered the global sales practices from 2001 to 2006 of Alcatel, S.A., a Paris-based telecommunications equipment and services company with American Depositary Receipts sold on the New York Stock Exchange ("NYSE"), prior to its 2006 merger with Lucent Technologies, Inc. According to court documents, five Alcatel S.A. subsidiaries, Alcatel Lucent France S.A. (formally known as Alcatel CIT, S.A.), Alcatel Lucent Trade International A.G. (formally known as Alcatel Standard, A.G.), Alcatel Centroamerica S.A. (formally known as Alcatel de Costa Rica, S.A.), Alcatel-Lucent Deutschland, A.G (formally known as Alcatel SEL, A.G.), and Alcatel Malaysia, hired consultants who paid bribes to foreign officials to assist the company in obtaining business opportunities. Typically, Alcatel Standard entered into agreements with business consultants worldwide on behalf of other Alcatel subsidiaries.

Specifically, in Costa Rica, Alcatel CIT bribed employees of the Instituto Costarricense de Electridad ("ICE"), a government-owned company, from December 2001 to October 2004. Alcatel Standard, on behalf of Alcatel CIT, hired numerous consultants as conduits who performed little to no actual work, including one who was a relative of Edgar Valverde, then President and Country Senior Officer of Alcatel de Costa Rica. The pleadings highlighted numerous red flags associated with the consultants, including the fact that the consultants were paid much higher commissions than were normally paid to similar consultants, and the consulting service agreements contained only vague descriptions of the services covered.

In all, Alcatel CIT transferred approximately $18.4 million from an ABN Amro Bank account in New York to the consultants' bank accounts in Costa Rica. According to the pleadings, the consultants paid at least $7 million in bribes to ICE employees and to a high-ranking executive branch official. In addition, Alcatel CIT reimbursed $25,000 in expenses incurred by ICE officials on a vacation-oriented trip to France in October 2003. As a result of the payments, Alcatel CIT obtained telecommunications contracts valued at approximately $303 million.

In Honduras, Alcatel CIT paid bribes to Honduran foreign officials from December 2002 to June 2006 to obtain or retain at least $48 million in telecommunications contracts. Christian Sapsizian, then Alcatel CIT's Director for Latin America, met with the brother of a high-ranking executive branch official who asked Sapsizian to retain a specific consultant in Honduras with access to officials at the Empresa Hondureña de Telecommunicaciones ("Hondutel"), the Honduran government-owned telecommunications provider. Despite the fact that the consultant was actually a perfume distributor, Alcatel CIT informally retained the consultant in 2002. It was only after the Alcatel CIT was awarded the contracts that Alcatel Standard memorialized its agreement with the consultant.

According to the disposition documents, because Alcatel CIT hired the consultant, Hondutel kept Alcatel CIT and another Alcatel subsidiary on existing contracts valued at $48 million despite Alcatel's performance failures, which otherwise could have resulted in termination of the contracts. From September 2004 to June 2006, Alcatel CIT paid the consultant $704,388, which, according to the pleadings, Alcatel employees expected would be paid to a Honduran official. As with the Costa Rican officials, Alcatel CIT also paid for Hondutel employees and their families to travel to Europe.

In Taiwan, Alcatel SEL bribed foreign officials from October 2003 to May 2004 to obtain a railway axle counting contact valued at approximately $27 million. A senior Alcatel employee hired two consultants with close ties to Taiwanese legislators to pressure the Taiwan Railway Administration ("TRA") to favor Alcatel in the bid process. Alcatel SEL paid one of the consultants $920,000 from an ABN Amro Bank account in New York, part of which was then paid in bribes to Taiwanese legislators. Again, Alcatel SEL reimbursed the European travel costs of a Taiwanese minister and a Taiwanese legislator, both of which were personal trips. Alcatel SEL, without the authorization of Alcatel Standard, also retained the second consultant because he was the brother of a Taiwanese legislator. According to the pleadings, that consultant did no work other than to pass bribes along to his brother. Because of the bribe payments, TRA granted an Alcatel affiliate a contract worth $27 million.

In Malaysia, the court documents alleged that Alcatel Malaysia paid bribes to employees of Telekom Malaysia from October 2004 to February 2006, in order to obtain confidential information relating to a public tender. The information assisted Alcatel Malaysia in obtaining a contract with a potential value of $85 million. A total of $700,000 was transferred to consultants from U.S. banks in exchange for the confidential information. Although the Malaysian Ministry of Finance only owned 43% of Telekom Malaysia, the enforcement agencies determined that Telekom Malaysia employees were foreign officials because the Ministry of Finance has veto power over all major expenditures, the Minister of Finance has status of a "special shareholder," and because most Telekom Malaysia officers are political appointees.

Lastly, Alcatel-Lucent admitted that it had violated the internal controls and books and records provisions of the FCPA related to the hiring of third-party agents in Kenya, Nigeria, Bangladesh, Ecuador, Nicaragua, Angola, Ivory Coast, Uganda, and Mali.

As a result, the SEC filed a complaint alleging that Alcatel-Lucent violated the FCPA's anti bribery, books and records, and internal controls provisions. The books and records violations stem from the fact that Alcatel established and used a system of intermediaries to obscure the source and destination of funds, made payments pursuant to consulting agreements that inaccurately described the services provided, generated false invoices, disbursed funds in cash with inaccurate supporting documentation, and recorded illicit payments as legitimate consulting fees. In addition, the SEC alleged that Alcatel failed to maintain adequate internal controls by, among other things, falsifying books and records, falsifying invoices, violating its internal policies on retaining consultants, and by performing inadequate due diligence.

For its part, the DOJ filed a criminal information charging Alcatel-Lucent with one count of violating the internal controls provisions of the FCPA and one count of violating the books and records provision of the FCPA. The DOJ also filed a criminal information against the three Alcatel subsidiaries for conspiring to violate the anti-bribery, books and records, and internal controls provisions of the FCPA.

Alcatel-Lucent resolved the SEC's charges by consenting to a court order permanently enjoining it from future FCPA violations, agreed to pay more than $45 million in disgorgement of profits, and agreed to retain an independent monitor for three years. Alcatel-Lucent also entered into a three-year deferred prosecution agreement ("DPA") with the DOJ and agreed to pay a penalty of $92 million, implement rigorous compliance enhancements, and engage an independent compliance monitor for the duration of the DPA. The three Alcatel subsidiaries, Alcatel-Lucent France S.A., Alcatel-Lucent Trade International A.G., and Alcatel Centroamerica S.A., pled guilty to the DOJ charges on December 20, 2010 and agreed to implement rigorous compliance enhancements.

Noteworthy Aspects

- Broad Definition of the Term "Foreign Official" - In both Costa Rica and Honduras, Alcatel paid bribes to employees of state-owned enterprises. Although the DOJ and SEC have long taken the position that SOEs are "instrumentalities" of governments and, thus, their employees are "foreign officials" for purpose of the FCPA, the Malaysian case is noteworthy because the Malaysian government did not own a majority of Telekom Malaysia. The enforcement agencies determined that Telekom Malaysia employees are "foreign officials" because of other indicia of the Malaysian government's significant control over the entity.

- Penalties for Securing an Improper Advantage - The actions in Malaysia for which Alcatel was penalized are only indirectly related to the actual securing of business. The company paid bribes in order to receive confidential information, which, based upon the pleadings, then allowed the Alcatel subsidiary to modify its bid sufficiently to win the contract without additional, direct official intervention.

- Companies Penalized for Failing to Respond to Red Flags - According to the pleadings, Alcatel employees ignored significant red flags that its third parties were paying bribes. These red flags included unusually high commissions, instructions by public officials to hire specific consultants, the fact that a Taiwanese consultant was the brother of a foreign official, an unqualified consultant (perfume distributor), vague agreements, and the lack of any substantial work product generated by the contractors. The DOJ and SEC pleadings make it clear that companies must act on such red flags.

- Increased Penalty for Non-Cooperation - The DOJ noted in its press release that the high penalty amount reflects the fact that there was "limited and inadequate cooperation by the company for a substantial period of time" prior to Alcatel S.A.'s merger with Lucent Technologies, Inc. Alcatel-Lucent's settlement ranks at the seventh largest in the FCPA's history despite the fact that the DOJ credited Alcatel-Lucent for "making an unprecedented pledge to stop using third-party sales and marketing agents in conducting its worldwide business."

- Consequences Abroad - In addition to U.S. enforcement actions, French, Malaysian, Honduran, and Costa Rican authorities have launched investigations into the bribery schemes and numerous individuals have been prosecuted both in the U.S. and in Costa Rica. In addition, Alcatel paid $10 million in January 2010 to settle a case brought by the Costa Rican government against an Alcatel subsidiary seeking damages for the injury caused by the alleged corrupt payments "to the people and the Treasury of Costa Rica, and for the loss of prestige suffered by the Nation of Costa Rica." According to a Department of Justice press release, this settlement was the first time in Costa Rica's history that a foreign corporation agreed to pay the government damages for corruption. In August 2007, ICE took steps to terminate a 2001 contract awarded to Alcatel CIT and the Costa Rican authorities have taken steps to ban CIT from participating in government procurement contracts within Costa Rica for a certain period. On April 30, 2010, ICE filed a civil Racketeer Influenced and Corrupt Organizations ("RICO") claim in Miami-Dade County circuit court. That claim was dismissed on January 18, 2011, on the basis that Costa Rica may be a more convenient forum for adjudication of the case. In addition to risking potential prosecution by the United States under the FCPA and now the by United Kingdom under the Bribery Act, companies operating abroad may increasingly face adverse consequences in the countries in which the bribery occurs or claims brought by foreign countries in the United States.

- Related Actions - Prior FCPA settlements have involved Lucent and an Alcatel employee (See our FCPA Autumn Review 2007, FCPA Autumn Review 2008, and FCPA Winter Review 2008). On December 21, 2007, Lucent settled criminal and civil charges with the SEC and the DOJ relating to FCPA violations prior to the merger with Alcatel involving travel and entertainment provided to Chinese government officials. Lucent agreed to payment of a $1 million criminal fine to the DOJ and a $1.5 million civil fine to the SEC. On September 23, 2008, Christian Sapsizian, former Director for Latin America for Alcatel CIT, was sentenced to 30 months in prison after pleading guilty in June 2007 to paying more than $2.5 million in bribes.

RAE Systems Settles with SEC and DOJ Concerning Improper Payments Made Through Joint Ventures

On December 10, 2010, the DOJ and SEC filed settled enforcement actions against RAE Systems Inc. ("RAE"), a San Jose-based issuer listed on the New York Stock Exchange that develops gas and chemical detection products, each alleging violations of the books and records and internal controls provisions of the FCPA. Additionally, the SEC alleged violations of the FCPA's anti-bribery provisions. Without admitting or denying the SEC's allegations, RAE agreed to pay $1,147,800 in disgorgement and $109,212 in prejudgment interest as part of its settlement. In the related DOJ matter primarily based upon the same set of facts, RAE agreed to pay a $1.7 million fine as part of a three-year non-prosecution agreement ("NPA"). In addition, as part of the NPA, RAE agreed to compliance program enhancement and to report annually to the DOJ regarding implementation of its compliance program.

According to the disposition documents, from 2004 to 2008, RAE provided improper payments and gifts totaling approximately $400,000 to employees of state-owned enterprises and government departments through two of its joint venture entities in China in order to obtain government contracts. Recipients included employees of a city mining bureau, regional fire departments, emergency response departments, and entities under the supervision of a provincial environmental agency, among others. Sales personnel at the two joint ventures, RAE-KLH (Beijing) Co., Ltd. ("RAE-KLH") and RAE Coal Mine Safety Instruments (Fushun) Co., Ltd. ("RAE-Fushun"), obtained cash advances and reimbursements from their accounting personnel in order to fund the improper payments and gifts. Gifts provided to the employees of the state-owned enterprises and government departments included a notebook computer, jade, fur coats, kitchen appliances, business suits, and high-priced liquor. According to both pleadings, the joint ventures obtained contracts worth approximately $3 million in revenues and $1,147,800 in profits as a result of the improper payments. Additionally, expenses associated with these cash advances were improperly recorded by the two joint ventures as "business fees" or "travel and entertainment" expenses, violating the books and records provisions of the FCPA.

Both the SEC and the DOJ charged that RAE violated the FCPA's accounting provisions by failing to institute sufficient controls to address the improper activities taking place. For example, the NPA alleged that RAE deliberately chose not to conduct pre-acquisition due diligence of RAE-Fushun. It further noted that given RAE's experience with KLH, the high-risk nature of the location, and the existence of numerous government customers, pre-acquisition corruption-focused due diligence was warranted. Both the SEC and DOJ also noted that while RAE instituted anti-corruption policies as well as FCPA compliance training and employee certification requirements in response to the misconduct that was discovered, the company allegedly failed to make any meaningful changes to the practice of sales personnel obtaining cash advances and more generally failed to impose internal controls to prevent other violations. For example, while RAE-KLH was instructed to stop paying bribes discovered both prior to and following acquisition, no actual controls or checks were put into place to make sure that these instructions were being followed.

Separately, in alleging violations of the FCPA's anti-bribery provisions, the SEC highlighted facts indicating its view of RAE's level of knowledge of bribery practices at RAE-KLH. In particular, the SEC pointed out that RAE was aware of existing bribery practices at RAE-KLH through the pre-acquisition due diligence process, its CFO's 2005 visit to RAE-KLH and subsequent observations made in a written report of "possible continuing bribery" evidenced by $500,000 of cash advances with no "fapiaos" (government-issued tax receipts), and an email message sent by a terminated General Manager in 2006 alleging ongoing bribery practices, including a money laundering contract (subsequently cancelled but never audited) that RAE-KLH had entered into. While the improper payments in this case were made exclusively in China by employees of RAE's joint ventures and never under the direct instruction or supervision of RAE, the SEC found that the level of knowledge present was sufficient to allege anti-bribery violations against the parent company under the "knowledge" element of the Act.

Noteworthy Aspects

- Anti-bribery Violations Brought Only by the SEC - While the SEC and DOJ settlements in this case are essentially based on the same set of facts, only the SEC charged RAE Systems with alleged violations of the FCPA's anti-bribery provisions. As with the recent Alcatel-Lucent settlement discussed in this review as well as the DaimlerChrysler China Ltd. case discussed in the FCPA Spring Review 2010, this result may suggest a jurisdictional gap, or that the SEC employs a less strict standard in evaluating whether red flags can establish the requisite knowledge to establish civil violations of the anti-bribery provisions than the DOJ does in assessing criminal violations of the provisions.

- Importance of Effective Controls Over Joint Ventures and Pre-Acquisition Due Diligence - The RAE resolution is the latest example of the government's focus on the importance of effective compliance programs and internal controls. The government expected RAE Systems to exercise effective internal controls over activities which took place wholly outside the United States by the employees of its foreign joint ventures. FCPA trainings, employee certifications and corporate instructions to cease improper activities were considered to be only half-measures that failed to meet the threshold for effective internal controls in the absence of other programs and procedures, especially in light of alleged deliberate actions taken to limit the implementation of compliance measures. In addition, the RAE resolution reaffirms the importance of conducting pre-acquisition due diligence and fully integrating acquired enterprises into compliance programs, a frequent theme of FCPA resolutions over the past several years.

Panalpina and Six of its Customers Settle FCPA Charges

On November 4, 2010, Panalpina and six of its customers settled related charges with the DOJ and/or SEC and were assessed a combined total of approximately $236.5 million in fines and disgorgement. This group included Royal Dutch Shell plc, Transocean Inc., Tidewater Marine International Inc., Pride International Inc., Noble Corp., and GlobalSantaFe Corp. As noted in our FCPA Autumn Review 2007, the government investigation began in 2007 following Vetco International Ltd.'s voluntary disclosure that it made corrupt payments through Panalpina in Nigeria. According to the settlement documents, Panalpina initially rebuffed the DOJ's efforts to inquire into these allegations. In response, the DOJ began sending letters of inquiry to the company's customers asking them to detail their relationship with the freight forwarder. In addition, some companies made voluntary disclosures of improper payments made through Panalpina. Panalpina soon relented and began cooperating with U.S. authorities. Upwards of ten other oil and gas related companies are reportedly still under investigation in connection with their use of Panalpina, and additional Panalpina-related settlements are expected this coming year. As a variant of an industry sweep, this first batch of resolutions allows for interesting comparisons of charges and resolutions across similar matters.

On November 4, 2010, the DOJ and SEC settled FCPA charges with Panalpina World Transport (Holding) Ltd. ("PWT"), a Swiss-based global freight forwarding and logistics services provider, and its U.S. subsidiary Panalpina, Inc. (collectively "Panalpina"), for a combined $81.9 million in fines, penalties, and disgorgement.

In settling with U.S. authorities, Panalpina admitted to bribing foreign officials in numerous countries on behalf of customers in the oil and gas industry. According to the pleadings, Panalpina, acting through foreign subsidiaries and affiliates, made the payments to circumvent local rules and regulations on the import of goods and materials into foreign jurisdictions and obtain preferential treatment for its customers. Specifically, Panalpina admitted that, between 2002 and 2007, it paid thousands of bribes totaling approximately $49 million to foreign officials in at least seven countries, including Angola, Azerbaijan, Brazil, Kazakhstan, Nigeria, Russia and Turkmenistan. Approximately $27 million of this total related to and was paid on behalf of customers that were U.S. issuers or domestic concerns as defined by the FCPA. According to settlement documents, some of Panalpina's customers allegedly approved of or condoned the payment of the bribes on their behalf. Although the scope of the allegations covers seven countries, the majority of the bribes Panalpina paid went to Nigerian officials in connection with imports into Nigeria -- approximately $30 million of the total identified illicit payments and $19 million of those related to U.S. issuers or domestic concerns.

According to the pleadings, the bribes varied by jurisdiction and transaction, but often included payments to customs officials "to avoid the customs process altogether, to avoid the assessment of proper duties, and/or to avoid penalties for items improperly imported." These bribes were paid on behalf of customers to, among other things, "cause officials to overlook insufficient, incorrect, or false documentation and/or to circumvent the local laws and inspections in order to ship contraband (primarily unauthorized food and clothing, but also included pharmaceuticals, explosives, and hazardous chemicals)." Panalpina also made payments occasionally for its own direct benefit, such as to secure contracts from government entities or avoid tax audits or tax assessments.

To pay bribes on behalf of their customers, the pleadings state that Panalpina entities would make illicit cash payments to local officials and then invoice their customers for these payments along with other legitimate fees associated with the services. On the invoices, Panalpina would inaccurately characterize the illicit payments in a variety of ways, including "local processing fees," "interventions," and other "special" charges, when in fact the payments were bribes to secure improper benefits.

According to the pleadings, these "longstanding" violations of the FCPA resulted from, among other things: "(1) an inadequate compliance structure; (2) a corporate culture that tolerated and/or encouraged bribery; (3) involvement of senior corporate management in Switzerland who tolerated the improper payments; (4) involvement of management in the United States and other countries who encouraged the improper payments; and (5) in some instances, pressure from Panalpina's customers to have services performed as quickly as possible and to secure preferential treatment in obtaining services."

As part of the settlement, Panalpina entered into a DPA with the DOJ to resolve a two-count criminal information that included charges of both conspiring to violate the anti-bribery provisions of the FCPA and violating them. The DPA also imposes a $70.56 million criminal fine, details the contours of the state-of-the-art compliance program the company is expected to implement, requires the company to prepare an initial report for the DOJ on the current state of its compliance program followed by at least three additional reports summarizing annual reviews of the program, and calls for mandatory disclosure of any additional issues that surface during the term of the DPA. Separately, Panalpina, Inc., pled guilty to a three-count criminal information that included charges of conspiring to violate the anti-bribery provisions of the FCPA, aiding and abetting anti-bribery violations, and aiding and abetting books and records and internal controls violations. The terms of the plea include three years of organizational probation and require that Panalpina Inc., be folded into PWT's compliance program and join its parent in self-reporting to the DOJ.

To ensure that it meets its compliance and reporting obligations under the DPA, Panalpina announced in a press release that it will appoint an outside compliance consultant, who will assist Panalpina in communicating with the DOJ. Notably, the monetary penalty imposed here falls below the range called for by the sentencing guidelines, which recommend a penalty between $72.8 and $145.6 million. This downward departure almost certainly represents the fruits of Panalpina's extensive cooperation with the government during the investigation and its significant remedial efforts -- both of which were specifically highlighted by the DOJ in the pleadings.

In a related proceeding, the SEC brought a three-claim complaint against Panalpina, Inc. for the same conduct, including one claim of violating the anti-bribery provisions of the FCPA, one claim of aiding and abetting violations of the anti-bribery provisions of the FCPA, and one claim of aiding and abetting FCPA books and records and internal controls violations. Although neither Panalpina Inc. nor PWT is an issuer for the purposes of the FCPA, the SEC exercised jurisdiction over Panalpina Inc. on the grounds that it served as an agent for its issuer customers. To settle charges with the SEC, Panalpina, Inc. consented to the entry of a final judgment ordering the disgorgement of $11,329,369 in ill-gotten profits and permanently enjoining it from future FCPA violations.

Noteworthy Aspects

- Internal Counsel Implicated - According to the Plea Agreement, a former Senior Attorney for Panalpina Inc. had knowledge that bribes were being paid to avoid customs duties and did not divulge this information to certain customers that questioned the charges, including once in 2005 after a customer questioned a $40,000 invoice that the Senior Attorney had been told was an improper payment. In June 2006, the Senior Attorney informed Panalpina Inc.'s former CEO of the creation of two internal compliance policies intended to pacify some of the company's customers in the oil and gas sector. The Senior Attorney noted, however, that "there is a big difference between adoption of the policy and active enforcement. Mere adoption is a great defense in a government investigation." Additionally, in July 2006, the Senior Attorney advised a customer and the customer's in-house counsel that a proposed $50,000 un-receipted cash payment to a Nigerian customs official could be categorized as a "facilitating payment" under the FCPA. Internally, however, the Senior Attorney advised Panalpina employees in Switzerland of numerous factors indicating the "troublesome" payment was, in fact, a bribe (i.e., it was a large, un-receipted cash payment to a customs official that Panalpina had been informed was to be re-distributed to various customs employees).

- "Exemplary Cooperation" - After initially not cooperating with the investigation for several months, the DOJ said Panalpina changed course and "on the whole exhibited exemplary cooperation" with both the DOJ and SEC investigations. This "exemplary cooperation" likely resulted in a more lenient penalty than otherwise would have been imposed (and possibly fewer charges). In describing Panalpina's cooperation, the DOJ specifically noted that the company: (a) conducted a comprehensive anti-bribery compliance investigation of its operations in the seven identified countries, as well as separate investigations related to its U.S. and Swiss operations; (b) conducted a review of certain transactions and operations in another 36 countries; (c) promptly and voluntarily reported the findings from these investigations to the DOJ; (d) mandated employee cooperation from the top down and facilitated the interviews of more than 300 employees and former employees; (e) expanded the scope of the investigations where necessary to ensure a thorough and effective review; (f) promptly and voluntarily reported any improper payments identified after the DOJ investigation had begun; and (g) provided substantial assistance into ongoing FCPA investigations of the company's directors, officers, employees, agents, lawyers, consultants, contractors, subcontractors, subsidiaries and customers.

- Employee Amnesty Program - Similar to Siemens during its FCPA sizeable investigation several years ago (see our FCPA Alert Siemens Agrees To Landmark $800 Million Settlement), Panalpina instituted a limited employee amnesty program to encourage employee cooperation with the investigation.

- Significant Remediation - The DOJ also noted substantial remedial measures taken by Panalpina, including, among other things: (a) the creation of a well-resourced compliance department with sufficient authority and a direct reporting line to the Board of Directors; (b) the implementation of a new compliance program; (c) an upgraded code of conduct, upgraded compliance policies, and the global implementation of updated training; (d) systematic risk assessments in 33 high-risk countries and compliance counsel-assisted on-site compliance audits; (d) the development of mechanisms to review and evaluate the legality of hundreds of processes on a global basis; (e) the retention and promotion of senior management who have a significant commitment to compliance; (f) the oversight of personnel turnover globally, which included individuals unwilling to work within the new compliance standards; (g) the coordination of the company's compliance and internal audit functions; (h) the hiring of outside compliance counsel to advise and assist the company in undertaking further remedial measures and compliance enhancements; and (i) the complete withdrawal from the Nigerian market, which was done at "substantial cost."

- Continued Investigation but Conditional Release from Criminal Liability - Both the DOJ and SEC pleadings note that the government investigations into the conduct of Panalpina and its directors, officers, employees, agents, lawyers, consultants, subcontractors, subsidiaries, and customers relating to violations of the FCPA are continuing, and Panalpina, as part of its disposition with the DOJ, has agreed to continue cooperating. The company, however, negotiated a conditional release from criminal liability in its settlement documents that essentially provides PWT and its wholly-owned or controlled subsidiaries immunity not only for disclosed conduct, but for "undisclosed conduct of a similar scale and nature that took place prior to the signing of this Agreement and was not discovered by PWT's or Panalpina U.S.'s internal investigations, notwithstanding [their] reasonable efforts…"

The other Panalpina-related dispositions entered into on November 4, 2010, include:

On November 4, 2010, Houston-based offshore drilling company Pride International ("Pride") and its French subsidiary, Pride Forasol SAS ("Pride Forasol") settled FCPA charges with the DOJ related to alleged corrupt payments made to foreign officials in Mexico, Venezuela, and India. In a related SEC matter, Pride, an issuer on the NYSE, settled charges related to the aforementioned alleged payments as well as additional payments in Kazakhstan, Nigeria, Saudi Arabia, Republic of the Congo, and Libya.

According to the DOJ pleadings, Pride made illicit payments of at least $804,000, both directly and indirectly to foreign officials. As a result, the company realized a benefit of approximately $13 million through the extension of drilling contracts on offshore rigs in Venezuela, securing a favorable judicial decision in an Indian customs dispute, and avoiding customs duties and penalties in Mexico.

In a criminal information filed in the Southern District of Texas, Pride was charged with (1) conspiracy to violate the anti-bribery and books and records provisions of the FCPA in connection with an alleged scheme to bribe a Mexican customs official, (2) violation of the anti bribery provisions regarding an alleged scheme to bribe a Venezuelan official in order to obtain contract extensions, and (3) violation of the books and records provision based upon an alleged scheme to bribe an administrative judge in India.

In addition, Pride Forasol pled guilty to a three-count criminal information related to the alleged scheme to bribe a judge on the Customs, Excise, and Gold Appellate Tribunal in India. The charges included (1) conspiracy to violate the anti-bribery and books and records provisions of the FCPA via a scheme to bribe the judge and to falsify Pride's books and records to make the payments appear as legitimate business expenses, (2) violation of the anti-bribery provisions by making payments of approximately $500,000 with the intent that some or all of the money would be paid to the judge to secure a favorable decision, and (3) aiding and abetting Pride's false recording of the payments in violation of the FCPA. The plea agreement mandates a three-year term of organizational probation requiring Pride to maintain a corporate compliance program and to provide an annual report to the DOJ on behalf of itself and Pride Forasol.

As part of the settlement, Pride entered a DPA to resolve the charges against both entities. The DPA is effective for a period of three years, but may be extended for up to one year for knowing violations of the agreement or, conversely, terminated early in the DOJ's discretion. The DPA imposed a criminal penalty of $32,625,000, significantly below the sentencing guidelines range of $72.5 million to $145 million.

In a separate civil enforcement action, the SEC filed a two-claim complaint against Pride alleging (1) violations of the FCPA anti-bribery provisions and (2) violations of the books and records and internal controls provisions. The claims related to a wider range of activities than those covered in the DOJ pleadings, including payments made through a freight forwarder to Kazakh customs authorities and payments through a tax consultant to Kazakh tax officials, payments through Panalpina for temporary imports of rigs in Nigeria, payments made directly and indirectly through a tax agent to Nigerian tax officials, payments made directly to a Saudi customs official for clearance of a rig, payments made directly to a Congo Merchant Marine official for a paperwork deficiency, and payments to Libya's social security agency through a Libyan tax agent. According to the SEC complaint, the illicit payments totaled approximately $2 million and led to benefits of more than $19.3 million. Pride consented to the entry of judgment in the action ordering $23.5 million in disgorgement and prejudgment interest as well as a permanent injunction against future violations.

Noteworthy Aspects

- Significant Discount on Fine - The fine assessed against Pride is approximately $40 million below the U.S. Sentencing Guidelines fine range minimum (a 55% discount). As in the Panalpina resolution, the departure from the Guidelines appears to reflect the company's extensive cooperation and remediation efforts. According to the sentencing documents, the reduction was based upon Pride's early voluntary disclosure, extensive cooperation, substantial assistance with other DOJ investigations, expansive internal investigation, voluntary and comprehensive anti-bribery compliance review of other high-risk countries, and extensive remedial efforts.

- Both Actual and Imputed Knowledge - The allegations against Pride comprise both claims of actual knowledge of corrupt payments and imputed knowledge that payments might be made to foreign officials. For example, the SEC complaint describes payments by a Pride employee to a Venezuelan intermediary "believing that all or a portion of the funds would be given" to a Venezuelan official -- while the allegations concerning Libya state merely that payments to a Libyan tax agent were made "without adequate assurances" that the agent would not pass some or all of the fees to Libyan officials.

- Related Actions - Pride's settlement follows separate enforcement actions by the SEC against two former Pride employees, Bobby Benton and Joe Summers, which were settled on August 5, 2010. As reported in our FCPA Autumn Review 2010, the SEC charged Benton, Pride's former Vice-President of Western Hemisphere Operations, with violating the anti-bribery, internal controls and books and records provisions of the FCPA, aiding and abetting violations of those provisions, and making false representations to accountants in connection with illicit payments in Mexico and Venezuela. Without admitting or denying the allegations, Benton consented to the entry of a final judgment of the charges and agreed to pay a $40,000 civil penalty. Joe Summers served as the Venezuela Country Manager for Pride International Personal Ltd., a wholly owned subsidiary of Pride. The SEC charged him with one count each of violating and aiding and abetting the violation of the anti-bribery provisions, and one count each of violating and aiding and abetting the violation of the internal controls and books and records provisions for his alleged involvement in authorizing corrupt payments to employees of Venezuela's state-owned oil company. Without admitting or denying the allegations, Summers agreed to the entry of a permanent injunction and to the payment of a $25,000 civil penalty.

In another Panalpina-related case announced on November 4, the DOJ filed a criminal information against Shell Nigerian Exploration and Production Company Ltd. ("SNEPCO"), a Nigerian subsidiary of Royal Dutch Shell plc ("Shell"), for its role in allegedly approving and reimbursing bribes paid by Panalpina to Nigerian customs officials, allegedly in violation of the FCPA. In a related administrative proceeding, the SEC also found that Shell and its indirect subsidiary Shell International Exploration and Production Inc. ("SIEP"), a Delaware company with headquarters in Houston, had violated the FCPA. Shell is a U.K. company headquartered in the Netherlands with ADRs traded on the New York Stock Exchange.

According to the criminal information and the SEC administrative proceeding, the facts are as follows. In 1995, a subsidiary of Shell commenced the first deepwater offshore oil and gas project in Nigeria, known as the "Bonga Project." The Bonga Project was executed by several Shell entities, including SNEPCO and SIEP. The project required the importation of equipment and parts into Nigeria. SNEPCO was responsible for arranging for the importation of such items and for paying customs duties on the items as well. To facilitate this process, SNEPCO hired a number of contractors, who, in turn, hired Panalpina to transport the goods and clear customs.

The Nigerian customs clearance process was routinely delayed, the Bonga Project was over-budget and behind schedule, and a "significant amount of equipment" needed to be imported into Nigeria. To clear these hurdles, Panalpina entered into an "on the side" agreement with members of the Nigerian Customs Service ("NCS"), in which Panalpina made corrupt payments to NCS officials to bypass the normal customs process.

According to the pleadings, Panalpina invoiced the contractors for its services, characterizing the bribes to NCS officials as "local processing fees" or "administration/transport charges." The contractors ultimately paid Panalpina's bills and then sought approval for reimbursement from SIEP and SNEPCO. Despite knowing or being substantially certain that all or a portion of the money paid by the contractors to Panalpina was bribe money, SIEP and SNEPCO authorized the reimbursements and the continued use of Panalpina's services.

By bypassing the normal customs process and importing equipment into Nigeria faster than it would have had the payments not been made, Shell allegedly profited approximately $14 million. In turn, this allegedly provided Shell with the value of its oil production profits sooner than if it had not made the payments.

SNEPCO's books and records, which contained false characterizations of the payments to NCS officials, were ultimately incorporated into the books and records of Shell, an issuer. Moreover, SNEPCO allegedly conspired with SIEP employees in Houston, Texas via emails sent to and from the United States, thereby establishing a jurisdictional nexus according to the DOJ. On this basis, the criminal information charged SNEPCO with conspiracy to violate the FCPA's anti-bribery and books and records provisions (SNEPCO and its co-conspirators authorized the use of Panalpina, knowing that it was paying bribes to NCS officials, and SNEPCO falsely characterized those payments in its own books), and aiding and abetting a books and records violation (SNEPCO caused Shell to inaccurately reflect in its books and records the allegedly illicit NCS payments as "administration/transport charges," when SNEPCO knew that they were bribes). To resolve the criminal charges, SNEPCO and Shell entered into a DPA with the DOJ and agreed to pay a criminal fine of $30 million — more than double the amount Shell allegedly took in profits from the scheme. SNEPCO and Shell also agreed to fully cooperate with U.S. and foreign authorities in any ongoing investigations of corrupt payments and to implement and adhere to a set of enhanced corporate compliance and reporting obligations.

In a parallel administrative proceeding, the SEC made findings that SIEP, acting as an agent of an issuer (Shell), violated the anti-bribery provisions by authorizing the reimbursement and continued use of Panalpina's services. In addition, the SEC alleged that Shell violated the books and records provisions by failing accurately to reflect the nature of the improper payments and violated the internal controls provisions by failing to devise and maintain an effective system of internal controls to prevent or detect those payments. Without admitting or denying the allegations, Shell and SIEP consented to the entry of a cease-and-desist order and agreed to pay disgorgement of $14,153,536 as well as prejudgment interest of $3,995,923.

In total, Shell was assessed approximately $48 million in fines, disgorgement, and pre-judgment interest by the SEC and DOJ.

Noteworthy Aspect

- Use of Panalpina by a Contractor - In a more attenuated chain of responsibility than in other Panalpina settlements, the Shell enforcement action involved the use of Panalpina by contractors rather than by Shell or its subsidiaries. According to the information, SNEPCO contracted with two U.K. corporations to provide construction services for the Bonga Project, and those U.K. contractors hired Panalpina to act as their freight forwarding and customs clearance agent.

The slate of Panalpina settlements also included FCPA charges against a New Orleans-based operator of offshore service and supply vessels, Tidewater Inc. ("TDW") and its subsidiary, Tidewater Marine International Inc. ("TMII") (collectively "Tidewater"). The DOJ filed a three count criminal information against TMII for conspiracy to violate the FCPA's anti-bribery and books and records provisions in connection with alleged payments to officials in Nigeria and Azerbaijan and for aiding and abetting books and records violations by inaccurately recording the payments. In addition, the SEC filed a three-claim complaint against TDW for alleged violations of the anti-bribery, books and records, and internal controls provisions regarding the same conduct.

According to the pleadings, Tidewater made or authorized illicit payments totaling approximately $1.76 million to officials in Azerbaijan and Nigeria. The payments in Azerbaijan were allegedly intended to secure the favorable resolution of three tax audits initiated by the Azeri Tax Authority. According to the information filed by the DOJ, the Azeri Tax Authority conducted tax audits of TMII's operations in 2001, 2003, and 2005. In 2001, TMII learned about an impending tax audit related to a contract for expatriate personnel in Azerbaijan. The information notes that TMII employed a consulting firm incorporated in the United States and headquartered in Baku to provide accounting services and tax advice (the "Azerbaijan Agent"). In response to the tax audits in 2001, 2003, and 2005, the Azerbaijan Agent repeatedly advised the company to bribe Azeri tax inspectors to resolve the audit issues.

In total, TMII allegedly caused approximately $160,000 to be paid to a Dubai entity associated with the Azerbaijan Agent's consulting firm "while knowing that some or all of the money would be paid, with the assistance of the Azerbaijan Agent[,] to Azeri tax inspectors." As a result of the alleged corrupt payments, TMII avoided a potential tax liability of approximately $820,000.

With respect to Nigeria, Tidewater and its subsidiaries allegedly authorized reimbursements of approximately $1.6 million to its freight forwarding agent for bribes paid to Nigerian customs officials. Tidewater operated in Nigeria through a subsidiary, Tidex Nigeria Limited ("Tidex"), a Nigerian company 60% owned by Tidewater Marine LLC. According to the pleadings, from in or around January 2002 through March 2007, Tidex authorized frequent reimbursements to Panalpina for its payments to Nigerian customs officials to disregard regulatory requirements for temporary imports into Nigeria. The information states that Panalpina referred to these payments as "interventions" or "recycling" payments, and they were allegedly understood by Tidex employees to be bribes, in whole or in part, paid to Nigerian Customs Service employees. By around August 2004, TMII managers and employees allegedly "were aware of and condoned the payments."

According to the information, certain TMII employees then authorized the payment of at least 129 additional "interventions" to induce Nigerian officials to disregard regulations, to not impose fines and penalties, and to allow Tidewater vessels to operate in Nigerian waters" without a valid temporary import permit. This specific conduct served as the basis for the count of aiding and abetting a violation of the books and records provision, as TMII allegedly inaccurately recorded the payments, totaling approximately $1,089,000, as freight forwarding agent costs when they were partly or wholly bribes to Nigerian customs officials. The total benefit received by TMII in avoided costs, duties, and penalties was valued at approximately $5.8 million.

Tidewater admitted the allegations in a DPA and agreed to a $7,350,000 criminal penalty. As in the other Panalpina settlements, the agreement term is three years and seven days and may be extended up to one year for knowing violations of the agreement. Under the terms of the DPA, Tidewater must implement an enhanced corporate compliance program and specific remedial measures, and the company is required to file three annual reports on its progress with the DOJ.

In a related civil proceeding, the SEC alleged that TDW committed violations of the anti-bribery, books and records, and internal controls provisions in connection with the same conduct. Without admitting or denying the allegations, the company agreed to an injunction against future violations and the payment of $8,104,362 in disgorgement and a $217,000 civil penalty. The SEC also included a provision for an additional $3 million contingent penalty if Tidewater did not pay a supplementary fine within 18 months to another U.S. government agency. However, the SEC noted in its Litigation Release on the action that the additional penalty would not be imposed given that Tidewater would pay a criminal fine to the DOJ.

Noteworthy Aspects

- 30% Discount on Fine - The criminal penalty imposed by the DOJ is 30% below the minimum fine in the U.S. Sentencing Guidelines' fine range. The DPA noted several considerations that contributed to the agreement terms, including: Tidewater's prompt internal investigation of its dealings with Panalpina and voluntary disclosure to the DOJ; Tidewater's expansion of the internal investigation to numerous operations outside of Nigeria and reporting of relevant findings to the Department; establishing a Corporate Compliance Committee and appointment of a Corporate Compliance Officer; issuing an enhanced stand-alone FCPA compliance policy as well as additional policies such as a vetting and approval process for third parties; exhibiting leadership in the oil and gas industry by leading an industry initiative to address the conduct described in the Information; and the company's continued cooperation with the DOJ's investigation.

- Improper Payments Related to Expatriate Personnel Issues - As in the NATCO case (discussed in our FCPA Spring Review 2010), the improper payments alleged in the Tidewater enforcement action related to compliance with regulations on expatriate employees. In the enforcement action against NATCO in January 2010, immigration authorities in Kazakhstan threatened to fine, jail, or deport expatriate workers if a NATCO subsidiary did not pay cash fines to the officials.

Transocean Inc., a Cayman Islands corporation with offices in Houston, Texas, also settled FCPA allegations with the DOJ and the SEC related to the use of Panalpina in Nigeria. To resolve the allegations, Transocean entered into a DPA with the DOJ in which it acknowledged the alleged conduct and agreed to pay a $13.44 million criminal penalty. Transocean also settled charges with the SEC, without admitting or denying the allegations, and agreed to pay $7.27 million in disgorgement and prejudgment interest. Transocean shares were traded on the New York Stock Exchange during the relevant period, and after a merger in which Transocean Inc. became a wholly-owned subsidiary of Transocean Ltd. in Switzerland, the merged company continued to trade on the NYSE.

The DOJ filed a four-count criminal information charging Transocean Inc. with conspiracy to violate the anti-bribery and books and records provisions, violation of the anti-bribery provisions, and two violations of the books and records provisions. According to the information, Transocean made or authorized illicit payments of approximately $90,000 to circumvent Nigeria's temporary import regulations. In exchange for the payments, the company allegedly realized net profits of approximately $2,129,839 on rig operations that otherwise would have been suspended due to failure to comply with temporary import rules.

Specifically, the information alleges that Transocean subsidiaries in Nigeria, Sedco Forex Nigeria Limited ("SFNL") and Transocean Support Services Nigeria Ltd. ("TSSNL"), made bribe payments through customs agents in Nigeria in 2002 and 2007 to obtain false paperwork reflecting physical movement of rigs in and out of Nigeria, when in fact the rigs remained in Nigeria. To obtain the documentation for these "paper moves" of rigs, payments to customs officials were invoiced back to Transocean entities as "freight and shipping/courier charge," "crewboat, workboat, tug hire," or "miscellaneous operating expenses."

According to the information, Transocean Nigeria employees "knew or were aware of a high probability that [Panalpina] was making bribe payments to Nigerian Customs Service officials on behalf of SFNL and TSSNL to cause such officials to disregard certain customs regulatory requirements relating to importing goods and materials into Nigeria for use on Transocean's rigs in Nigeria, and sought reimbursement from SFNL and TSSNL for these payments."

In a parallel civil proceeding, the SEC filed a three-claim complaint alleging that Transocean violated the anti-bribery, books and records, and internal controls provisions by making the aforementioned illicit payments through their freight forwarding and customs agents to Nigerian officials. According to the SEC, Transocean realized benefits of approximately $5,981,693 from the illicit payments, including the profits gained and the costs avoided by facilitating "paper moves" of the rigs. Thus the company was ordered to pay the same amount in disgorgement as well as $1,283,387 in prejudgment interest. In total, Transocean was assessed combined penalties of approximately $20.7 million by the DOJ and SEC.

Noteworthy Aspect

- 20% Discount on Fine - The criminal penalty imposed on Transocean is 20% below the minimum fine in the U.S. Sentencing Guidelines' fine range. The DPA noted several of the same considerations included in the other enforcement actions highlighting company cooperation, including: Transocean's prompt internal investigation of its dealings with Panalpina; expansion of the internal investigation to numerous operations outside of Nigeria and reporting of relevant findings to the Department; hiring of a new Corporate Compliance Officer; issuing a revised FCPA compliance policy and a worldwide training program for employees; implementing a "well-defined" due diligence process for third party service providers and business partners that interact with government officials; and cooperating with the DOJ's investigation.

Noble Corporation ("Noble"), a Switzerland-based offshore drilling contractor oil with an office in Texas, settled FCPA allegations with the DOJ and SEC that its wholly-owned subsidiary Noble Drilling (Nigeria) Ltd. ("Noble Nigeria") had made improper payments to Nigerian Customs officials through its customs agent. At the time of the conduct alleged in the pleadings, Noble was a Cayman Islands company that issued securities publicly traded on the New York Stock Exchange and thus was an issuer within the meaning of the FCPA. To resolve these allegations, Noble entered into a NPA with the DOJ in which it acknowledged the alleged conduct and agreed to pay a $2.59 million criminal fine. Noble also settled charges with the SEC, without admitting or denying the allegations, and agreed to pay $5,576,998 in disgorgement and prejudgment interest, for a combined monetary penalty of $8,166,998.

According to the settlement documents, certain Noble Nigeria employees made payments to the company's Nigerian customs agent from approximately January 2003 through May 2007 knowing that a portion of these payments would be provided to Nigerian customs officials. Noble Nigeria made these payments, through its customs agent, to help process false documentation (created by the customs agent) related to at least eight new TIPs for drilling rigs that, under Nigerian law, should have been exported out of Nigerian waters after the existing TIPs and any extensions expired, but in fact were never moved. The NPA states that these "paper moves" were done "to avoid the time, cost, and risk associated with exporting the rig and reimporting it into Nigerian waters."

In February 2004, a former internal audit manager (and U.S. citizen) at Noble flagged these "paper moves" during an audit of the company's West Africa Division and brought them to the attention of several former Noble executives and officers, many of whom were likewise U.S. citizens. This included, among others, the Head of Internal Audit (and former Noble Controller), the Vice President-Eastern Hemisphere (with responsibility over Nigeria), and the Chief Financial Officer. The "paper moves" were subsequently reported Audit Committee and "members of Noble's senior management," though no mention was made of the payments to Nigerian officials. Members of Noble's senior management tasked the Vice President-Eastern Hemisphere with following up and taking corrective action to address the audit report findings.

Although corrective action was initially considered, the Vice-President-Eastern Hemisphere and other executives ultimately decided that "due to the time, cost, and risk of permanently importing or moving the rigs," the "paper process" would continue in the interim to be used. These executives -- all U.S. citizens -- subsequently approved payments to secure five TIPs that involved "paper moves." The Audit Committee was not advised of this decision or these paper moves and, in fact, was told in June 2004 that the "paper process" would no longer be used. Beginning in July 2004, the former Head of Internal Audit took steps to ensure the Audit Committee remained unaware that the "paper process" had resumed.

Noble Nigeria initially paid its customs agent a lump sum (typically around $75,000) to secure TIPs through the "paper process." Beginning in July 2004, after the internal audit flagged the "paper process" issue, Noble Nigeria requested that its customs agent provide more detailed invoices for its services, including a line item for "special handling charges." These payments ranged from between $13,800 to $17,000 and, according to the NPA, totaled approximately $74,000. Noble Nigeria initially recorded these payments in operating expense accounts and later in a "facilitating payment" account. The settlement documents specifically state, however, that these payments did not qualify as "facilitating payments" for routine governmental actions within the meaning of the FCPA. As a result, the SEC's Complaint alleged that these illicit payments were not accurately reflected in Noble Nigeria's books and records, which were then rolled up into Noble's records. The Complaint also claimed that although Noble had an FCPA policy during the relevant period, the company nevertheless "lacked sufficient FCPA procedures, training, and internal controls to prevent the use of the paper process and making of payments to Nigerian government officials."

Estimates of the benefit Noble Nigeria realized through these improper payments differs, with the DOJ's NPA estimating approximately $2,973,000 in avoided costs, duties, and penalties, while the SEC's Complaint put the total gain at approximately $4,294,933, including both profits and avoided costs. While the reasons for the respective agencies differing calculations are not explicitly delineated, the settlement documents suggest the SEC included the additional revenue Noble earned on its rigs by virtue of not having physically exported them while the DOJ did not.

Noble voluntarily disclosed the discovery of these issues in June 2007, shortly after having initiated an internal investigation in Nigeria in the wake of the Vetco International Ltd. enforcement action. In settling with the SEC, Noble consented to the entry of final judgment on charges that it violated the anti-bribery, books and records and internal controls provisions of the FCPA. In addition to the SEC's monetary penalties, the company also agreed to an injunction against future violations of the FCPA. In settling with the DOJ, beyond the criminal fine, Noble agreed to continue the implementation of an enhanced corporate compliance program, to take appropriate remedial measures, and to conduct follow-up reviews of these activities and the company's ongoing compliance, including the submission of an initial report and two annual reports to the DOJ. Both the DOJ and SEC noted Noble's self-reporting, its substantial cooperation, and its remediation efforts.

Noteworthy Aspects

- Non-Prosecution Agreement - Among this first wave of Panalpina-related dispositions, Noble was the only company that entered into an NPA with the DOJ. According to the DOJ, the NPA recognizes Noble's: (a) own discovery of the violations; (b) "timely, voluntary, and complete" self-disclosure of the violations; (c) "extensive, thorough, real-time cooperation;" (d) voluntary investigation of its worldwide operations; (e) pre-existing compliance program and steps taken by its proactive Audit Committee; (f) remedial efforts to date; (g) agreement to continue to implement enhanced compliance measures; and (h) agreement to provide ongoing written reports to the DOJ.

- Isolated Violations - The settlement documents in this case specifically note that Noble conducted a worldwide review of its operations, yet they cite to no other conduct either in Nigeria or any other country, suggesting that these violations were isolated and not representative of systemic compliance issues within the company.

GlobalSantaFe Corporation ("GlobalSantaFe"), an offshore oil and gas drilling services company (and U.S. issuer) that merged with a Transocean Inc. subsidiary in November 2007, settled FCPA charges with the SEC for allegedly making illegal payments to foreign customs officials through its customs brokers (including Panalpina) from approximately January 2002 through July 2007. Without admitting or denying the charges, GlobalSantaFe agreed to pay a $2.1 million civil penalty and $3,758,165 in disgorgement and prejudgment interest.

According to the SEC's complaint, when GlobalSantaFe's temporary import permits ("TIPs") and TIP permit extensions on at least four of the company's drilling rigs in Nigeria expired, rather than move the rigs out of Nigerian waters as required by local law, the company, through its customs brokers, made illegal payments to Nigerian officials. In exchange, GlobalSantaFe received documentation stating that the rigs had been properly exported out of Nigerian waters, when in fact, the rigs had not moved at all. The SEC alleged that GlobalSantaFe's Nigerian managers knew these rigs were never properly exported and either knew or were aware of the high probability that the line item "additional charges for export" the customs broker invoiced

The SEC also alleged that GlobalSantaFe, again through its customs brokers, made other "suspicious payments" to government officials in Nigeria, Angola, Equatorial Guinea and Gabon to secure preferential treatment during the Customs process, including, for example, payments characterized on invoices as "interventions," "customs vacation," "customs escort," "costs extra police to obtain visa," "official dues," and "authorities fees." The SEC's complaint stated that none of these illicit payments was accurately reflected in GlobalSantaFe's books and records, nor were the company's internal controls during the relevant period sufficient to detect and prevent them.

In total, the SEC specifically identified at least $469,500 in questionable payments it attributed to GlobalSantaFe from 2002-2007 that resulted in at least $2.7 million in profit for the company through "avoided customs-related costs."

In settling with the SEC, GlobalSantaFe consented to the entry of final judgment against it on charges that it violated the anti-bribery, books and records and internal controls provisions of the FCPA. In addition to the monetary penalties, the company also agreed to an injunction against future violations of the FCPA.

Noteworthy Aspects

- No Parallel DOJ Enforcement - It is unclear why the DOJ declined to bring a parallel enforcement action, though it may relate to GlobalSantaFe's merger with the Transocean subsidiary, as Transocean itself settled Panalpina-related FCPA charges with both the DOJ and SEC. Alternatively, the DOJ's decision not to bring an action may result from Global Santa Fe's voluntary disclosure to the government.

- "Avoided Costs" as Profit - The SEC attributed $2.7 million in ill-gotten profits to GlobalSantaFe on the theory that the company had realized these profits through improperly avoided costs. Specifically, the SEC claimed that GlobalSantaFe had avoided approximately $1.5 million in costs from not physically moving the rigs, $619,000 in costs from uninterrupted rig operations, and $268,000 in customs-related costs.

|

Company |

Entity | Agency | Charges | Resolution | Monetary Penalties | Voluntary Disclosure |

| Panalpina World Transport Ltd. (Switzerland) | Panalpina World Transport Ltd. | DOJ | (1) Conspiracy to violate anti-bribery provisions (2) Anti-bribery violation |

DPA | $70,560,000 criminal penalty | No |

| Panalpina Inc. (U.S. Sub) | DOJ | (1) Conspiracy to violate books and records provisions (2) Aiding and abetting books and records violations |

Guilty Plea | |||

| Panalpina Inc. (U.S. Sub) | SEC | (1) Anti-bribery violation (2) Aiding and abetting anti-bribery violations (3) Aiding and abetting books and records and internal controls violations |

Injunction and Consent Judgment | $11,329,369 disgorgement | ||

| Pride International Inc. (Houston) | Pride International Inc. | DOJ | (1) Conspiracy to violate the anti-bribery and books and records provisions (2) Anti-bribery violation (3) Books and records violation |

DPA | $32,625,000 criminal penalty | Yes |

| Pride Forasol S.A.S. (French subsidiary) | DOJ | (1) Conspiracy to violate the anti-bribery and books and records provisions (2) Anti-bribery violation (3) Aiding and abetting books and records violations |

Guilty Plea | $32,625,000 criminal penalty | ||

| Pride International Inc. | SEC | (1) Anti-bribery violations (2) Books and records and internal controls violations |

Injunction and Consent Judgment | $19,341,870 disgorgement and $4,187,848 prejudgment interest | ||

| Royal Dutch Shell plc (Netherlands) | SNEPCO (Nigerian subsidiary) | DOJ | (1) Conspiracy to violate anti-bribery and books and records provisions (2) Aiding and abetting books and records violations |

DPA | $30,000,000 criminal penalty | No |

| Royal Dutch Shell plc and SIEP (indirect subsidiary) | SEC | No charges, but allegations include: (1) Anti-bribery violations (2) Books and records violations (3) Internal controls violations |

Cease-and-desist order | $14,153,536 disgorgement and $3,995,923 prejudgment interest | ||

| Tidewater Inc. (New Orleans) | Tidewater Marine Int'l Inc. (Panama subsidiary at time of conduct; redomiciled in Cayman Islands in Aug. 2009) | DOJ | (1) Conspiracy to violate anti-bribery provisions (2) Conspiracy to violate books and records provisions (3) Aiding and abetting a books and records violation |

DPA | $7,350,000 criminal penalty | Yes |

| Tidewater Inc. | SEC | (1) Anti-bribery violations (2) Books and records violations (3) Internal controls violations |

Injunction and Consent Judgment | $7,223,216 disgorgement and $881,146 prejudgment interest; $217,000 civil penalty | ||

| Transocean Ltd. (Switzerland) | Transocean Inc. (Cayman subsidiary) | DOJ | (1) Conspiracy to violate the anti-bribery and books and records provisions (2) Anti-bribery violation (3) Books and records violation (4) Books and records violation |

DPA | $13,440,000 criminal penalty | No |

| Transocean Inc. (Cayman subsidiary) | SEC | (1) Anti-bribery violations (2) Books and records violations (3) Internal controls violations |

Injunction | $5,981,693 in disgorgement and $1,283,387 in prejudgment interest | ||

| Noble Corp. (Formerly Cayman Islands, now Switzerland) | Noble Corp. | DOJ | No charges, but allegations include anti-bribery, books and records and internal controls violations. | NPA | $2,590,000 criminal penalty | Yes |

| Noble Corp. | SEC | (1) Anti-bribery violation (2) Books and records violation (3) Internal controls violation |

Injunction and Consent Judgment | $4,294,933 disgorgement and $1,282,065 prejudgment interest | ||

| GlobalSantaFe Corp. (Formerly Cayman Islands, now merged with Transocean) | GlobalSantaFe Corp. | SEC | (1) Anti-bribery violation (2) Books and records and internal controls violations [NOTE: These were brought as one claim rather than two separate claims] |

Injunction and Consent Judgment | $2,694,405 disgorgement; $1,063,760 prejudgment interest; and $2,100,000 civil penalty | Yes |

Panalpina Settlements: Lessons Learned

- Continued Industry-Wide Investigations - In the wake of this first wave of Panalpina related settlements, Cheryl J. Scarboro, Chief of the SEC's FCPA Unit, noted that "This investigation was the culmination of proactive work by the SEC and DOJ after detecting widespread corruption in the oil services industry. The FCPA Unit will continue to focus on industry-wide sweeps, and no industry is immune from investigation." There are currently several such industry-wide sweeps underway, including investigations involving both the medical device and pharmaceutical industries.

- Focus on Customs Brokers and Freight Forwarders - The settlements with Panalpina and its customers highlight one of the key risk areas for FCPA violations, the interactions between customs brokers and freight forwarders and customs officials at ports of entry. Demonstrating the long reach of FCPA liability, even a freight forwarder hired by a subsidiary's subcontractor (as in the Shell case) can result in violations. This again demonstrates the importance of third party due diligence and a risk-based compliance effort.

- Expansion of Investigation Beyond Panalpina and Nigeria - Several of the Panalpina related enforcement actions encompass conduct beyond that of Panalpina. For example, in Tidewater, the actions of a tax consultant in Azerbaijan provided part of the basis for the DOJ and SEC pleadings. Encouraged by the SEC and DOJ inquiry of "where else did you look?," the scope of FCPA internal investigations frequently expand beyond the allegation prompting the investigation. As noted above, the DOJ specifically cited Tidewater's expansion of its investigation beyond Nigeria as a factor that contributed to the terms of the DPA.

- Benefits of Voluntary Disclosure - As shown in part by the differing fine levels in the actions described above and reflected in the chart above, voluntary disclosure by some of Panalpina's customers resulted in a break in the criminal penalties imposed by the DOJ. Notably, Pride's voluntary disclosure contributed to a 55% "discount" off the minimum fine in the U.S. Sentencing Guidelines Range, while Royal Dutch Shell, which did not voluntarily disclose, received a "discount" of only 12% off the minimum fine range.

- No Imposed Compliance Monitors - In resolving this set of Panalpina-related investigations, the DOJ imposed no compliance monitor obligations on any defendant (although Panalpina opted voluntarily to retain an outside compliance consultant to assist it in complying with its DPA). Instead, the DOJ required all of the companies entering dispositions with the DOJ to provide annual reports to the DOJ regarding the implementation of the companies' anti-corruption compliance program -- in effect, "self-monitoring." Assistant Attorney General Lanny A. Breuer highlighted this fact at a recent FCPA conference, citing the lack of compliance monitors as evidence of the "range of options" available not only to the DOJ, but "to corporations that are serious about cooperation and prevention."

- Compliance Program Specifics from the DOJ - In what appears to be a new trend in FCPA enforcement pleadings, the DOJ settlement documents in several of the Panalpina-related actions included very specific language regarding compliance program requirements. For example, the DOJ lists certain policies that should be included in the compliance program, including policies governing gifts, hospitality, entertainment, and expenses; customer travel; political contributions; charitable donations and sponsorships; facilitation payments; and solicitation and extortion. The new language, and the provision on compliance policies in particular, closely tracks the recommendations of the OECD Working Group on Bribery discussed in our FCPA Spring Review 2010.

Lindsey Manufacturing and Two Executives Criminally Indicted

On October 21, 2010, Lindsey Manufacturing Company of Azusa, California and two of its executives were criminally indicted for their alleged roles in conspiring to pay bribes to employees of the Comisión Federal Electricidad ("CFE"), a Mexican state-owned utility company, through their sales representative Grupo Internacional de Asesores S.A. ("Grupo"). Lindsey Manufacturing produces emergency restoration systems and other equipment used by electrical utility companies.