FCPA Winter Review 2013

International Alert

Introduction

The year 2012, especially the last quarter, witnessed historic developments that brought additional clarity to the FCPA. Below, we recount these late 2012 developments, review 2012 enforcement trends, and look forward to 2013.

The Resource Guide and FCPA Reform

Foremost among 2012 developments is the issuance on November 14, 2012 of the Resource Guide to the U.S. Foreign Corrupt Practices Act ("Resource Guide") by the Department of Justice ("DOJ") and the Securities and Exchange Commission ("SEC"). The first written guidance issued jointly by the agencies since the FCPA was enacted in 1977, the Resource Guide is designed to provide details regarding the enforcement agencies' views of and practices related to FCPA interpretation and enforcement. The Resource Guide touches on many of the issues raised by critics of the agencies' enforcement positions. Miller & Chevalier has previously published an analysis of the Resource Guide, accessible here.

Judicial Review

The past year also saw additional clarification of certain FCPA-related issues from another source, judicial review. In spite of the FCPA's long history and extensive enforcement record, most of the enforcement agencies' FCPA-related legal interpretations have not been tested in court. The primary reason for this lack of judicial scrutiny is that corporate dispositions have nearly always come in the form of settlement agreements with the agencies that have been routinely approved by the courts, while individual prosecutions have historically been sporadic.

Over the last few years, however, the DOJ and SEC have placed greater emphasis on charging individuals and seeking harsher penalties, including prison terms. The increased number of individual defendants has led to more trials, several cases that ultimately resulted in acquittals or pleas, and a rising number of appeals. Litigation surrounding these individual defendants has produced judicial opinions at both the trial and appellate levels that have helped to clarify often conflicting legal positions regarding key aspects of the FCPA. In 2012, the following issues were litigated in court; some have already produced opinions that are on appeal, while others have rulings expected in 2013:

- What constitutes "conscious avoidance" and the associated evidentiary standard was assessed by the Second Circuit in Frederick Bourke's appeal of his conviction for FCPA-related offenses. The Circuit Court issued an opinion in late 2011, discussed in our FCPA Winter Review 2012. Bourke's certiorari petition is now pending at the U.S. Supreme Court.

- The meaning of "instrumentality" in the "foreign official" definition is currently under consideration by the Second Circuit in the Esquenazi and Rodriguez appeal, discussed in our FCPA Summer Review 2012.

- Facilitation payments issues, specifically, what constitutes a facilitation payment, who has the burden to plead the exception, and whether the exception is unconstitutionally vague, were considered by the Southern District of Texas, which issued a ruling in the prosecutions of Noble Drilling executives in December 2012, as discussed below.

- The pleading standard for willfulness in individual prosecutions was also considered in the same opinion regarding Noble Drilling executives.

- Statute of limitations issues, specifically, the application of the fraudulent concealment doctrine, the application of the continuing violations doctrine, whether the general five-year statute of limitations applies to FCPA equitable remedies, and the effect of defendants not being "found within the United States," were litigated in the prosecutions of executives from Noble Drilling, Siemens, and Magyar Telekom, as discussed below.

- The personal jurisdiction reach of the FCPA under the constitutional due process standard is being litigated in Siemens and Magyar Telekom, with rulings expected in 2013.

- The jurisdictional reach of §78-dd3's "while in the territory of the United States" provision was considered by a District of Columbia court during a bench ruling in the Shot Show trial in 2011 (see our FCPA Summer Review 2011). The same issue is currently being litigated in the prosecution of an executive of Siemens.

Enforcement Trends in 2012

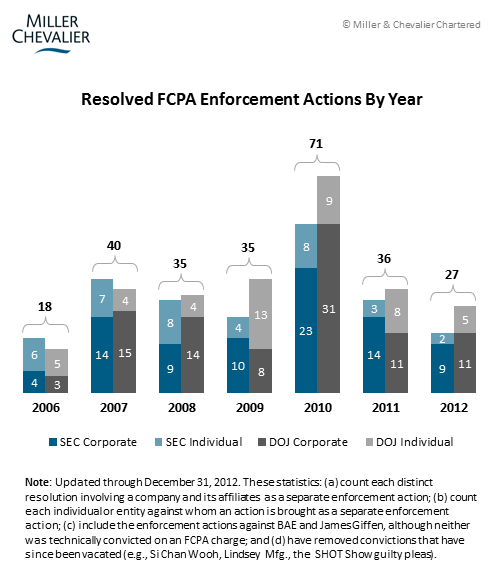

Two new corporate enforcement actions, Allianz and Eli Lilly, were brought this past quarter. Overall, as reflected in the Resolved FCPA Enforcement Actions Chart below, there were 27 FCPA-related dispositions in 2012, the lowest since 2006. This year's tally included 20 enforcement actions against 13 companies (counting Wyeth separately), along with seven enforcement actions against seven individuals. 2012 is the second year in a row that the number of resolved enforcement actions has dropped – a trend that is likely attributable to the large number of individuals being brought to trial and agency efforts leading up to the issuance of the Resource Guide.

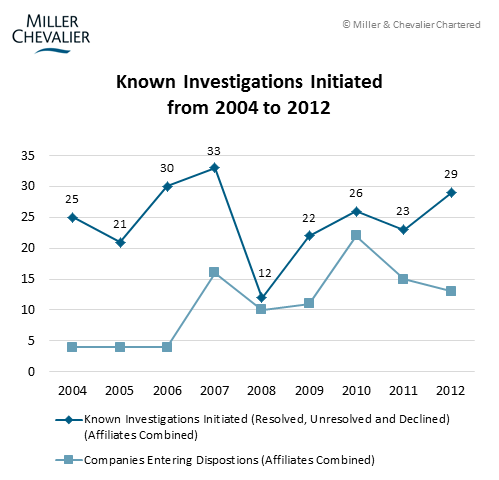

In contrast to the drop in resolved enforcement actions, the number of publicly disclosed FCPA investigations initiated in 2012 rose significantly, as reflected in the Known Investigations Initiated Chart below. Miller & Chevalier is also currently tracking over 100 pending investigations by the DOJ and/or SEC (not including matters for which we can identify no new developments or public pronouncements for the last five years). Given the rising number of pending investigations, and enforcement agency resources now freed from drafting the Resource Guide and the FCPA trials of the past few years, we expect FCPA enforcement to increase in 2013.

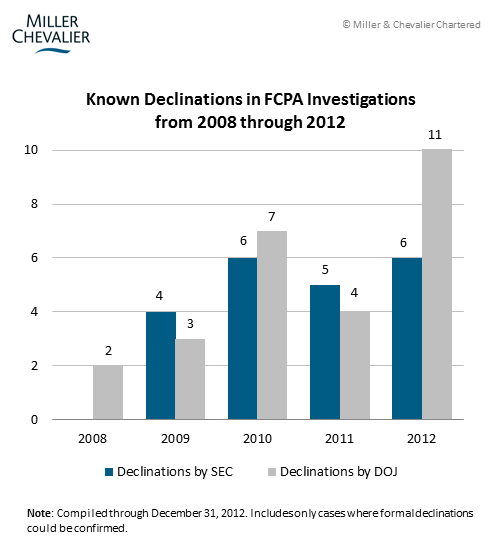

In addition, as reflected in the following chart, the number of known declinations has continued to rise. Whether this is due to an actual increase in declinations or simply more declinations being disclosed—either by the agencies or the companies involved—is unclear. (See additional discussion in our FCPA Autumn Review 2012.)

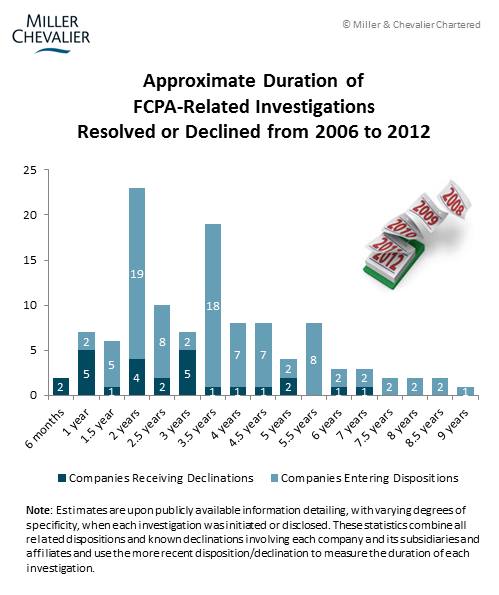

A sometimes overlooked cost indicator for FCPA enforcement is the duration of FCPA investigations. As the chart below shows, based on available information, approximately 58% of FCPA investigations last three years or longer, and more than 20% last five years or longer (e.g., Pfizer and its subsidiaries' investigation lasted eight years). A longer investigation suggests higher attorneys' fees, longer period of uncertainty, and greater disruptions to business operations, whether or not a company is ultimately charged.

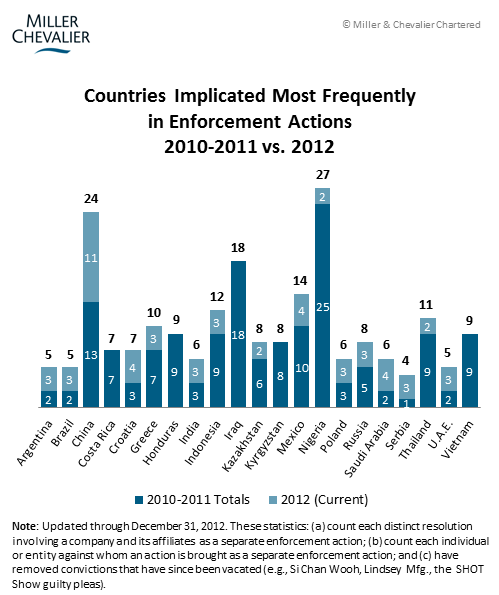

We also track where alleged FCPA violations occur. In 2012, the countries most frequently implicated in FCPA-related enforcement actions were China, Croatia, Mexico and United Arab Emirates, as reflected in the Countries Chart below. Over the last three years, the most frequently implicated countries are: Nigeria, China, Iraq, and Mexico.

A final trend worth noting in 2012 is the increased use of self-reporting requirements in corporate settlements, as opposed to monitors or no reporting requirements at all. While the Resource Guide does not explicitly signal a change in enforcement policies relating to the use of monitors, FCPA dispositions in 2012 show the agencies imposing self-reporting requirements much more frequently than external monitors. We also saw several hybrid monitorships – an abbreviated period of monitorship followed by a period of self-reporting. Notably, self-reporting was imposed on eight out of 13 companies that resolved enforcement actions, while a full monitorship was imposed on only two:

- Monitorship/independent consultant (2) – Marubeni, Eli Lilly

- Hybrid monitorship (2) – Smith & Nephew, Biomet

- Self-reporting (6) – BizJet, Data Systems, Orthofix, Nordam, Pfizer, Tyco

- No monitorship or self-reporting (3) – Wyeth, Oracle, Allianz

- Potential Significant Developments in 2013

Potential Significant Developments in 2013

2013 has the potential to be a year of ground breaking developments. The FCPA reform effort, having successfully pushed for the additional guidance reflected in the Resource Guide, appears to be charting its next steps. More judicial interpretations of the FCPA are expected. On the other hand, increased international anti-corruption enforcement by various non-U.S. authorities is resulting in greater complexity and increasing costs for companies under scrutiny as anti-corruption enforcement and compliance become more multi-jurisdictional.

Continued Legal Developments

The Resource Guide is a response to the FCPA reform drive spearheaded by certain industry and other stakeholder groups. While the Guide addresses one of the key complaints of the reform proponents – lack of clarity in the enforcement agencies' legal and enforcement positions – it does not address some of the more fundamental concerns. Of the reform priorities named in the U.S. Chamber of Commerce's October 2010 position paper, Restoring Balance, Proposed Amendments to the Foreign Corrupt Practices Act, most remain outstanding. Since 2010, some of the legal issues underlying the reform proposals have come under judicial review, as discussed above. It is not clear yet whether in 2013 the reform proponents will continue to vigorously pursue a full reform agenda, pause and wait for judicial clarification, or perhaps focus on a subset of issues that require legislative action, such as adding a compliance defense or narrowing the definition of "foreign official."

Expanded International Enforcement Leading to Increased Complexity

Signs suggest that international anti-corruption enforcement is continuing to intensify. Last quarter, Transparency International and the OECD Working Group on Bribery both released reports, discussed below, suggesting that more countries are actively enforcing laws against cross-border corruption. The two organizations noted particular improvements in three countries: Australia, Austria, and Canada. Among countries with more established anti-corruption regimes, the United Kingdom, in the past two quarters, took steps to present a more aggressive enforcement posture through a revision of its enforcement guidance, and further enhanced its enforcement capabilities through the adoption of deferred prosecution agreements ("DPAs") similar to those used in the United States. Finally, in 2012, multilateral institutions, especially the World Bank, enhanced their anti-corruption enforcement mechanisms, increasing the need for companies with issues to pay attention to the attendant potential consequences of these institutions' actions.

In the longer term, increased international anti-corruption enforcement arguably helps law-abiding companies by lowering levels of corruption globally and thereby reducing the competitive pressure to pay bribes. However, in the short to medium term, such increased enforcement will likely create multi-jurisdictional difficulties that could multiply complexities of an anti-corruption enforcement action and dramatically increase the cost of compliance. Some common risks include duplicative prosecutions, difficulty coordinating multi-jurisdictional settlements, and difficulty complying with varying or conflicting national laws and policies (anti-corruption, court procedure, privacy, voluntary disclosure, settlement, etc.).

Foreign Government Entities Seeking Recovery for FCPA Violations

This past quarter saw the first civil settlement payment to a foreign government entity for alleged harm from FCPA violations by a U.S. company. (See Alcoa Settlement below.) The settlement sum, $85 million, is larger than the combined penalty paid by any of the companies that settled with the DOJ and/or the SEC this year.

This suit is not the first attempt by a foreign entity to recover money from companies accused of FCPA violations, and likely will not be the last. In August 2012, the 11th Circuit denied a petition for victim status by the Instituto Constarricense de Electricidad of Costa Rica ("ICE"), which alleged that it was a victim of Alcatel-Lucent's bribe payments to its employees. (See our prior coverage of ICE's petition in FCPA Summer Review 2011). Whether these types of suits become another source of follow-on litigation is worth watching.

Actions Against Corporations

Allianz Settles SEC Charges Involving Improper Payments to Indonesian Government Officials

On December 17, 2012, the SEC charged Germany-based insurance and asset management company Allianz SE ("Allianz") with violating the books and records and internal controls provisions of the FCPA. The charges were based on the activities of certain employees at an Allianz subsidiary in Indonesia, PT Asuransi Allianz Utama Indonesia ("Utama").

Without admitting or denying the charges, Allianz agreed to pay disgorgement of approximately $5.3 million, prejudgment interest of $1.7 million, and penalty of $5.3 million, for a total of $12.3 million. According to the SEC's administrative order, after SEC contacted Allianz, the company's cooperation with the SEC "improved over time," and Allianz took steps to remedy its accounting practices.

In its administrative order, the SEC alleged that Utama created an "off-the-books" account for the purpose of bribing government officials to win large insurance contracts. According to the SEC, Utama made approximately $650,626 in improper payments to obtain and retain 295 insurance contracts on government projects. These contracts garnered approximately $5.3 million in profits for Allianz. The payments allegedly occurred between 2001 and 2008, while Allianz's shares and bonds were traded on the NYSE (i.e., while Allianz was an issuer under the FCPA).

According to the SEC, when Allianz first opened operations in Indonesia in 1981, it opened a "special purpose account" to pay a local Indonesian broker for the business it generated for Allianz. From 1981 to 2001, Utama used this account legitimately. However, the disposition documents state that beginning in 2001, an Indonesian agent for Utama, Utama's then-CEO, and Utama's CFO worked together to open a separate, off-the-books, "special agent account" in the name of the Indonesian agent. Utama allegedly used this account to make improper payments to employees of Indonesian state-owned entities to procure contracts related to government projects. According to the SEC, the agent and the CEO also executed a "Paying Agency Agreement" that arranged specifically for the payments to employees of state-owned enterprises. Utama disguised the improper payments as "overriding commissions" in its books and records, and accounted for the payments as legitimate transaction costs.

The disposition documents state that Allianz first discovered the improper payments in December 2005, after a whistleblower contacted the company's whistleblower hotline. Allianz then opened an internal audit, and instructed Utama to close the special agent account and to cease making payments to government officials. Nevertheless, according to the SEC, Utama continued making the payments, unbeknownst to Allianz. A second whistleblower complaint was made in 2009 to KPMG, Allianz's external auditor, who then presented the complaint to Allianz. As a result, Allianz convened a committee to conduct an internal investigation and retained counsel to investigate Utama's payment practices in Indonesia. The disposition documents note that Allianz did not disclose either of the whistleblower complaints, or its ensuing investigations, to the U.S. Government. Rather, the SEC received an anonymous tip on potential FCPA violations at Utama and contacted Allianz directly.

The SEC charged that Allianz failed to maintain adequate controls over its subsidiary Utama's accounting system, which allowed the payments to be made without Allianz's knowledge. Utama maintained its own accounting system in Indonesia, even though Allianz had a majority share in Utama and consolidated the subsidiary's accounts into its own books and records. The SEC alleged that Allianz did not have sufficient access to Utama's accounting system and, therefore, could not detect movement in and out of the special agent account.

Noteworthy Aspects:

- Failure to Self-Disclose a Possible Factor in Penalty Calculation. As noted above, Allianz elected not to disclose to the SEC either of the 2005 and 2009 whistleblower complaints alleging corrupt payments. Ultimately, a whistleblower informed the SEC, who then contacted Allianz. While there is no legal obligation to self-report potential FCPA violations, the enforcement agencies have made clear that they place "a high premium" on self-reporting. (See our analysis of the FCPA Guidance.) In this case, the SEC issued a cease and desist order and imposed a penalty of approximately $5.3 million. As far as we know, this may be highest penalty amount ever imposed in a case involving only a SEC cease and desist order. In such cases, any penalty imposed (as opposed to disgorgement of proceeds, which can be much higher in amount) is generally under $1 million (the penalty in the Diageo case, at $3 million, is another exception). Notably, the SEC stated in its order that Allianz's cooperation "improved over time," suggesting that the company's initial non-cooperation may have also played a role in the large penalty imposed.

- Alleged Misconduct by Another Allianz Subsidiary in Which Allianz Made Passive Private Equity Investment. According to Reuters, another Allianz subsidiary, a Swiss entity called manroland AG, may have also made improper payments in Europe and elsewhere. However, the SEC disposition documents do not contain any allegations related to manroland AG. The Reuters report explained that although Allianz owned a 60% stake in the Swiss entity, Allianz's investment was passive, made through its private equity arm, and Allianz did not exercise day-to-day control over the entity's operations. Moreover, the report noted that, because Allianz did not exercise day-to-day control, under German data privacy and other laws, Allianz could not compel the Swiss subsidiary to make information available to the SEC, making it difficult for the U.S. Government to obtain information for an enforcement action. Therefore, it appears possible that foreign data privacy laws have acted as a barrier to the reach of U.S. enforcement authorities.

- No Concurrent DOJ Criminal Prosecution. The DOJ did not take its own enforcement action against Allianz. The DOJ's absence may be explained by the Cease and Desist Order's statement that Allianz was "not aware" of Utama's improper payments. Without the knowledge element, it is arguable that Allianz could not be criminally prosecuted for FCPA violations. (See our analysis of the FCPA Guidance.) In addition, the Order also did not allege certain other elements of the bribery offense against Allianz, a non-U.S. person issuer, including the use of "instrumentality of interstate commerce" in furtherance of the alleged improper payments.

- Lack of "Access" to Foreign Subsidiary's Accounting System. By faulting Allianz for the lack of remote "access" to its Indonesian subsidiary's accounting system, the SEC's order could be establishing a new internal controls standard in this area. While the FCPA requires companies to have internal controls sufficient to provide reasonable assurances that a company's assets are properly managed and its transactions authorized and properly recorded, the SEC generally has not singled out a parent's ability to remotely access its foreign subsidiary's accounting system as a benchmark of sufficiency. Practically, such access could necessitate the use of a single enterprise resource planning ("ERP") accounting system throughout a company's global operations -- a potentially onerous requirement for many companies. However, if the end goal is detection and prevention, then Allianz's whistleblower investigation and statutory audits could have been sufficient if properly conducted and followed up on.

Eli Lilly Settles FCPA Violations by Subsidiaries in China, Brazil, Poland, and Russia

On December 20, 2012, the SEC charged Indianapolis-based pharmaceutical firm Eli Lilly and Company ("Lilly") with violations of the FCPA's anti-bribery, books and records, and internal controls provisions relating to the activities of its subsidiaries in China, Brazil, Poland, and Russia. Without admitting or denying the charges in the Complaint, Lilly consented to the entry of a final judgment permanently enjoining the company from future violations of the FCPA. In addition, Lilly agreed to pay disgorgement of $13,955,196, prejudgment interest of $6,743,538, and a civil penalty of $8.7 million, for a total payment of $29,398,734, to settle the SEC's charges. The judgment also required Lilly to retain independent consultant FTI Consulting ("FTI") to review and make recommendations designed to improve Lilly's foreign corruption policies and procedures.

China

The SEC alleged that between 2006 and 2009, employees of Lilly's Chinese subsidiary ("Lilly-China") falsified expense reports and used the reimbursements to provide improper gifts and entertainment to government-employed physicians in order to induce them to prescribe Lilly drug products. The gifts included wine, specialty foods, meals, jewelry, visits to bath houses and karaoke bars, and card games. In addition, the SEC alleged that between 2008 and 2009, members of Lilly-China's marketing "Access Group" used expense report monies to provide spa treatments, meals, and cigarettes to government health officials in order to encourage them to list Lilly products on government reimbursement lists. The SEC noted that, although the dollar amount of each gift was comparatively small, the falsification of expense reports was widespread throughout the company.

Brazil

The SEC alleged that in 2007, Lilly's Brazilian subsidiary ("Lilly-Brazil") knowingly allowed one of its third-party pharmaceutical distributors to pay bribes of approximately $70,000 to government health officials in order to facilitate the sale of Lilly drug products to state institutions. According to the disposition documents, Lilly-Brazil historically sold its products to third-party distributors at a discount between 6.5% and 15%, with the majority of distributors receiving a 10% discount. The distributors then resold the products to private and government entities at higher prices, taking the discount as compensation. The SEC found, however, that Lilly-Brazil granted one distributor unusually high discounts of 17% and 19% but failed to perform any additional verification or analysis to ensure that no payments were being made to officials. The SEC stated that the distributor subsequently used approximately $70,000 of the resale markup to bribe Brazilian officials to buy $1.2 million worth of Lilly products.

The SEC further alleged that the typical policies and procedures Lilly-Brazil used to flag unusual distributor discounts were deficient. For the discount in question, the company's pricing committee relied on the representations of sales and marketing personnel without conducting additional verification and analysis of the surrounding circumstances of the transactions. According to the SEC, no efforts were made to assess whether, despite the existence of superficially acceptable paperwork, the transactions posed a risk of illicit payments to government officials.

Poland

The SEC alleged that from 2000 to 2003, Lilly's subsidiary in Poland ("Lilly-Poland") made eight improper payments totaling approximately $39,000 to the Chudow Castle Foundation ("Chudow Foundation"), a small charitable foundation founded and run by the Director of one of Poland's regional health funds. The payments were made to the Foundation at the request of the Director, in exchange for the Director's support for allocating public monies for the purchase of Lilly drugs. Notably, the SEC found that at least one request for payment came only days after the Director and a Lilly-Poland manager met to negotiate a purchase of cancer drugs. The payments were recorded in the company's accounts as charitable donations, but, according to the SEC, in all eight cases, none of the payments were actually used for the described charitable purpose. Rather, a Lilly-Poland manager requested approval from the Medical Grant Committee ("MGC") for each payment to the Chudow Foundation with the intent of inducing the Director to support the allocation of health fund money to purchase Lilly drug products. The MGC approved the payments based solely on the recommendation of the Lilly-Poland manager and accompanying paperwork. It conducted no additional analysis or due diligence of the Chudow Foundation and its connection to government officials.

Russia

The SEC alleged that from 1994 through 2005, Lilly's Russian subsidiary ("Lilly-Vostok") entered into over 96 "marketing" or "service" agreements with dozens of offshore third-party entities wherein fees under the agreements were funneled to government officials or government-selected distributors as inducements for the purchase of Lilly drug products. The broadly drafted agreements stated that each third-party entity would provide certain "services" to Lilly-Vostok, such as "immediate customs clearance," "promotion of products," or "marketing research." Fees paid to these entities were recorded on Lilly-Vostok's books as payments for services, discounts, or commissions. The SEC asserted that, contrary to both the contracts and the company's records, no legitimate services were provided under these third-party agreements.

The SEC described two specific instances in which payments under third-party marketing agreements were funneled to Russian officials in exchange for arranging the government's purchase of Lilly drug products. In the first instance, Lilly-Vostok paid approximately $5.2 million to a Cypriot entity beneficially owned by an individual who advised an important member of the Russian parliament. In the second instance, approximately $2 million was paid to a BVI entity beneficially owned by the General Director of a government-owned distributor. The SEC stated that in both instances, Lilly-Vostok conducted limited due diligence and made no effort to ascertain the beneficial owners of either entity.

Significantly, in both 1997 and 1999, Lilly conducted a review of Lilly-Vostok's business risks and assessed its policies and procedures. Both reports raised concerns about Lilly-Vostok's internal controls and due diligence procedures regarding agreements with third-party entities. The reports recommended that Lilly-Vostok modify its internal controls to ensure that third-party services were properly documented and that agreements accurately reflected the services to be provided. The SEC noted that, despite these recommendations, Lilly allowed Lilly-Vostok to continue to use third-party service and marketing agreements and made no efforts to require modification of Lilly-Vostok's internal control procedures. Payments under the third party marketing contracts continued until as late as 2005, despite recognition that the marketing agreements were being used to "create sales potential" or "to ‘support' activities leading to agreement-signing" with government entities or officials.

Noteworthy Aspects:

- Importance of Third Party Controls. Throughout the disposition documents, the SEC criticized the quality of both Lilly and its subsidiaries' internal controls, particularly with respect to third-party controls. The Complaint alleged that Lilly's audit department had no specific procedures to assess FCPA risk in transactions with offshore and third-party entities. Auditors relied on only traditional accounting testing procedures, with no assessment of bribery risk. In the SEC's press release announcing the settlement, Kara Novaco Brockmeyer, Chief of the SEC's FCPA Unit, observed that "Eli Lilly and its subsidiaries possessed a ‘check the box' mentality when it came to third-party due diligence. Companies can't simply rely on paper thin assurances by employees, distributors, or customers. They need to look at the surrounding circumstances of any payment to adequately assess whether it could wind up in a government official's pocket."

- Anti-bribery Violation Alleged Based Solely on Russian Subsidiary Conduct. Despite allegations that improper payments were made by each Lilly subsidiary mentioned, only the activities of Lilly's Russian subsidiary gave rise to allegations of FCPA anti-bribery violations against Lilly, the parent company. Conducts by subsidiaries in China, Brazil, and Poland elicited only allegations of books and records and internal controls violations. This result may be because only in the case of the Russian subsidiary did the SEC allege facts showing that Lilly had knowledge of the improper payments – through its 1997 and 1999 audits of the subsidiary. The SEC likely assessed Lilly as liable under the anti-bribery provisions when it found out about the payments, identified their risks, but allowed them to continue.

- Schering-Plough Revisited. The facts recited in the disposition documents related to Lilly-Poland largely mirror the facts of the 2004 Schering-Plough case, which also involved charitable contributions (made during the same timeframe as those discussed in this case) to the Chudow Foundation that were alleged to have influenced a government official. In that case, the SEC found accounting and books and records violations, and the company was required to retain an independent consultant to conduct a 150-day review of FCPA compliance policies and procedures.

- Unique Monitor Arrangement. In a difference from other monitor arrangements, where generally a lawyer or law firm is appointed as the compliance monitor, the SEC has required Lilly to hire a consulting firm. According to the Consent and the Final Judgment, Lilly is required to retain FTI Consulting within 60 days of entry of the final judgment and task it with a comprehensive review of the company's business policies, internal controls, record-keeping and financial procedures. In addition, FTI is required to generate a written report within 60 days after being retained in which it must summarize its review and make recommendations that are "reasonably designed to improve [Lilly's] Policies and Procedures." Lilly must then adopt all recommendations in FTI's report within 60 days, except any classified as unduly burdensome. A follow-up review by FTI is required after one year, to ensure that all recommendations have been duly adopted.

Actions Against Individuals

Control Components Executives Sentenced

During the fall of 2012, U.S. District Judge James V. Selna sentenced four former executives of Control Components Inc. ("CCI"): Stuart Carson (CEO), Hong Rose Carson (sales director), Paul Cosgrove (head of worldwide sales), and David Edmonds (vice president).

Stuart and Rose Carson

As described in FCPA Summer Review 2012, Stuart Carson and his wife Rose Carson each pleaded guilty to one count of violating the FCPA's anti-bribery provisions on April 16, 2012. They admitted to "corruptly [causing] an e-mail to be sent authorizing" bribes to officials in Poland and Taiwan.

Stuart Carson was sentenced to four months in prison, eight months of home detention and was also ordered to pay a $20,000 fine. Under his plea agreement, Mr. Carson faced up to ten months in prison, three years supervised released and a fine of up to $20,000. The prosecution sought a prison term of six months, noting Mr. Carson's cooperation and willingness to testify against his co-defendants. Mr. Carson's lawyer had filed a sentencing memorandum under seal, citing privacy concerns related to his health issues. Judge Selna's Sentencing Memorandum noted that though Mr. Carson's medical needs are extensive, they are not atypical of a person in his 70s, and that the Bureau of Prisons has the ability to meet these needs. Judge Selna noted that "deterrence is the overriding factor in the Court's conclusion that a term of imprisonment is required here" and "[t]he court needs to make clear that the Foreign Corrupt Practices Act has a serious purpose, and that it will be enforced."

Hong Rose Carson was sentenced to three years of probation, which includes six months home detention, and was ordered to pay a fine of $20,000 and to complete 200 hours of community service. Prosecutors had recommended no jail time for Ms. Carson in part because she lacked the American education and early business training of her co-defendants -- Ms. Carson was born in and lived in China until age 26. Prosecutors also noted Ms. Rose's cooperation and willingness to testify against other CCI defendants. Notably, in its Sentencing Memorandum, the Court said that it did not "give credit to the fact that she was educated in China," as there is "no cultural defense to the present crime or any other under black letter law."

Paul Cosgrove

Paul Cosgrove pleaded guilty to one count of violating the FCPA's anti-bribery provisions (for more details, see FCPA Summer Review 2012). According to the indictment, the charges against him were partially based on his alleged involvement in making corrupt payments of approximately $1.9 million to officials and employees of state-owned companies in China.

Judge Selna sentenced Cosgrove to 13 months of home confinement, three years of probation and ordered him to perform 200 hours of community service. Cosgrove had faced up to 15 months in prison, three years supervised release, and a fine of up to $20,000. The government's sentencing memorandum recommended a sentence near the high end of the sentencing guidelines range because it said Cosgrove's conduct involved aggravating factors. Specifically, the government noted that the defendant advocated a sales model which ultimately led to the illegal conduct. However, the Probation Officer recommended a sentence of three years of probation and six months of home confinement because Cosgrove has "serious health issues," including a prior quadruple bypass surgery, and a variety of chronic health problems. The government's final recommendation was a term of incarceration of 15 months. The prosecution had noted that "to the extent the Court believes that the defendant's health condition warrants a non-incarceratory sentence, the government recommends that the term of home confinement be 15 months."

David Edmonds

Edmonds pleaded guilty to one count of making a corrupt payment to a foreign official in Greece and faced up to 15 months in prison (for more details, see FCPA Summer Review 2012). Judge Selna sentenced him to four months in prison, four months of supervised release and ordered him to pay a $20,000 fine.

In a separate indictment, CCI had admitted to paying bribes in excess of $6 million and paid a fine of $18.2 million (see FCPA Autumn Review 2009). Three other former executives, Mario Covino, Richard Morlok, and Flavio Ricotti, have pleaded guilty to violating the FCPA and are expected to be sentenced in March 2013.

Siemens and Magyar Telekom Executives Challenge SEC on Personal Jurisdiction and Statute of Limitations Grounds

Currently pending in the United States District Court for the Southern District of New York are two FCPA cases brought by the SEC against employees of Siemens and Magyar Telekom. In both cases, the defendants have filed motions to dismiss on the basis that the court does not have personal jurisdiction over the defendants, all of whom are foreign nationals residing abroad, and on the basis that the applicable statute of limitations has expired.

As reported in our FCPA Winter Review 2008, Siemens AG and Siemens Argentina paid a record $1.6 billion in fines in the United States and Germany to settle charges resulting from a scheme to pay bribes in Argentina. Three years later, on December 13, 2011, the DOJ and SEC brought charges against Siemens executives involved in the scheme, including Herbert Steffen, a German national. (See FCPA Winter Review 2012.)

Also in December 2011, Magyar Telekom and its parent, Deutsche Telekom, settled FCPA charges with the DOJ and SEC. That same month, the SEC filed a complaint against three former Magyar Telekom executives -- Elek Straub, Andras Balogh, and Tamás Morvai (the "Magyar defendants") – all of whom are Hungarian nationals. (See FCPA Winter Review 2012.)

Personal Jurisdiction

Both the Siemens and Magyar defendants argued that the contacts alleged by the SEC are not sufficient to subject them to U.S. personal jurisdiction under the due process clause. The Magyar defendants, in their motion to dismiss, observed that the SEC's jurisdictional theory "would provide personal jurisdiction over any individual director, officer, or employee of an issuer in any FCPA case -- even if there is no nexus to the United States for that individual." Defendants in both cases argued that the defendants' actions were not "expressly aimed" at the United States, that the SEC has failed to allege that defendants' conduct has approximately caused any injury in the United States, and the SEC in fact had failed to allege any injury at all. The Magyar defendants, in their reply brief, also specifically disputed the SEC's contention that, even without alleged injury, foreseeably causing false SEC filings in the United States is sufficient to establish personal jurisdiction.

The defendants noted that, after establishing minimum contacts, the court must consider whether the assertion of personal jurisdiction would comport with notions of fair play and substantial justice. Mr. Steffen argued, both in his motion and reply brief, that it is not fair or reasonable to subject him to suit in the United States because: (1) doing so would create a great burden for Mr. Steffen who is retired and has limited English language skills and limited resources; and (2) U.S. courts have little interest in adjudicating the dispute because the DOJ and SEC have already obtained both civil and criminal remedies against Siemens and because Germany and Argentina, which have greater interest in the alleged misconduct, have already taken or are taking action to police their interests. The SEC responded that "unlike a private diversity action, there is no alternative forum available to the government. If the SEC cannot proceed against Steffen in the federal courts of the United States, then he will effectively have been immunized for the securities violations with which he is charged." Because Congress has recognized that the United States has a compelling interest in the enforcement of federal securities laws, "[w]hatever the inconvenience of defending himself in the United States, it does not ‘shock the conscience' for Steffen to answer the SEC's charges here."

More generally, the SEC, in its oppositions to Steffens's and the Magyar defendants' motions to dismiss, argued that under the applicable constitutional due process standard, the district court has personal jurisdiction over defendants in both cases because "[a] foreign defendant is deemed to have purposefully directed his activities at the United States sufficiently to create personal jurisdiction when he ‘performs an act that he knows or has good reason to know will have effects in the forum.'" Applied in the securities litigation context, the SEC maintained that "courts routinely uphold personal jurisdiction over foreign defendants whose actions abroad are directed at the United States by virtue of their involvement in falsifying financial statements filed with the SEC."

With respect to Mr. Steffen of Siemens, the SEC alleged in its opposition that personal jurisdiction exists because: (1) he was an officer of a foreign company that registered securities in the United States who coerced another Siemens executive to make bribe payments to Argentine government officials, which was an action "that he knew or should have know would result in the falsification of Siemens' SEC filings" and that caused the falsification of Siemens' Sarbanes Oxley certifications on its form 20-F; (2) Mr. Steffen received one or more phone calls from the United States regarding the bribery scheme; and (3) at least some of the bribe payments were deposited in a New York bank.

In the case of the Magyar defendants, the SEC argued that the defendants falsified Magyar's books and records, and knowingly and foreseeably caused Magyar's annual and quarterly filings with the SEC to be false. While not a ground for supporting personal jurisdiction, the SEC also pointed to emails sent by one of the defendants from abroad and routed through or stored on servers located in the United States as facts establishing the "instrumentality of interstate commerce" element of 15 U.S.C. § 78dd-1, the applicable FCPA anti-bribery provision.

Statute of Limitations

Mr. Steffen and the Magyar defendants also argued that the SEC's cases against them should be dismissed because the statute of limitations has run. Because the Exchange Act itself contains no statute of limitations, the catch all five-year statute of limitations of 28 U.S.C. § 2462 applies in FCPA cases. This provision provides that:

Except as otherwise provided by Act of Congress, an action, suit or proceeding for the enforcement of any civil fine, penalty, or forfeiture, pecuniary or otherwise, shall not be entertained unless commenced within five years from the date when the claim first accrued if, within the same period, the offender or the property is found within the United States in order that proper service may be made thereon.

Defendants in both cases challenged the SEC's assertion that the cases against them were timely filed on three bases. First, they argued against the SEC's claim that the statute of limitations is tolled indefinitely as to foreign defendants who have not been to the United States or established minimum contacts in the United States based on the plain language of the statute, which requires that the "offender … is found within the United States in order the proper service maybe made thereon." Mr. Steffen and the Magyar defendants asserted that this interpretation of Section 2462 is nonsensical in light of the fact that they were all easily served with process using the Hague Service Convention, which allows service of process in signatory countries without having to use diplomatic or consular channels.

The defendants next responded to the SEC's claims that the statute of limitations has not yet run in either case on the basis that Section 2462 applies to civil monetary penalties and other remedies that are sought to punish the defendant, but not to claims for equitable relief of the type sought in these cases, including permanent injunctions, disgorgement of profits, and bars from serving as an officer of a public company. Mr. Steffen, against whom the SEC is seeking an injunction of future violations, argued that the injunction's goal is to punish him rather than regulate future behavior, citing the fact that he is a retiree with no history of violations and no involvement with any public company in nearly ten years. The Magyar defendants similarly argued that the equitable relief sought by the SEC constitutes penalties, hence is subject to the statute of limitations.

Lastly, the defendants attempted to rebut the SEC's assertion that the statute of limitations has not yet run in these cases because the bribery schemes were not concluded until Siemens and Magyar received the benefits resulting from the payment of bribes, which occurred less than five years before the SEC filed its complaints, and because the defendants were part of the schemes that caused the bribes to be paid. For his part, Mr. Steffen argued that he retired from Siemens in 2003, more than five years before the SEC filed its December 2011 complaint, suggesting that the statute of limitations should begin to run as to him personally at the time his involvement in the scheme ended. The Magyar defendants argued that the 2011 complaint in their case was filed over five years after the time the last payment was allegedly received by a foreign official, and over five years after all of the defendants had left Magyar Telekom. They urged that the statute of limitations should begin to run at the time the last payment was made, rather than at the time Magyar received the benefits resulting from the bribes.

Because of the lack of precedent on these issues in the FCPA context, it is difficult to predict the outcome of these cases. At this time, oral argument is scheduled for January 17, 2013 in the Magyar case, and the proceedings in the Steffen case are suspended pending settlement talks.

Noble Drilling Executives' Motions to Dismiss Granted in Part and Denied in Part

On December 11, 2012, the Southern District of Texas granted in part and denied in part the motions to dismiss of two former executives of the Noble Corporation, an offshore drilling contractor ("Nobel Drilling"), the SEC's civil enforcement complaint against them alleging violations of the FCPA and other securities laws. As reported in our FCPA Spring Review 2012, the SEC charged the two executives, former Noble Drilling Chief Executive Mark Jackson and current Noble Drilling executive James Ruehlen, with both primary FCPA bribery and books and records violations, and aiding and abetting Noble Drilling's books and records violations.

The charges, for which the SEC is seeking monetary damages and injunctive relief, center around improper payments made to government officials in Nigeria to obtain temporary import permits, using false paperwork, for Noble Drilling's off-shore oil rigs, and to obtain extensions for those permits. (See FCPA Spring Review 2012.) The business purpose alleged by the SEC was to avoid paying either import duties, or the cost of removing and re-importing those rigs. The defendants moved to dismiss the SEC's charges against them in May 2012, arguing, among other things, that (1) the SEC had failed to plead that the alleged improper payments were not facilitating payments; (2) the facilitating payments exception is unconstitutionally vague; (3) the SEC had not sufficiently pleaded that the defendants acted "corruptly," and (4) the statute of limitations barred the SEC's charges.

With respect to those four issues, District Judge Ellison ruled that: (1) while the SEC has the burden to plead that the alleged payments were not facilitating payments, the SEC had met its burden with respect to payments for obtaining the permits, but not with respect to payments for extending those permits (though leave for the SEC to amend was granted); (2) the facilitating payments exception is not unconstitutionally vague; (3) the bar for pleading that the defendants' acted "corruptly" is low and the SEC had met that burden; and (4) the statute of limitations barred the SEC's claims for monetary penalties, but the SEC could amend to plead the effects of tolling agreements.

Facilitating Payments: SEC Has Burden to Plead

Defendants first argued that the SEC bore the burden of negating the FCPA's facilitating payments exception, and that the SEC had failed to do so. The SEC countered that, by default, the agency is not required to plead the absence of an exception to a statute in order to state a claim. Relying largely on statutory history, the Court agreed with the defendants. While recognizing the default rule the SEC cited, the Court determined that the facilitating payments provision is in fact not an exception. The provision was part of the 1988 amendments to the FCPA, and the Court emphasized that Congress had added the facilitating payment language in order to clarify its original intent that facilitating payments were effectively not "corrupt." Hence, according to the Court, the "facilitating payment exception is best understood as a threshold requirement to pleading that a defendant acted ‘corruptly.'"

The Court reviewed the facts the SEC had pled and held that, with regard to payments made to acquire the permits, the SEC's pleadings "easily negate the ‘facilitating' payments exception" because "grant of permits by government officials that have no authority to grant permits on the basis [of false paperwork]" and validation of such false paperwork are not "ministerial act[s]" covered by the exception. In contrast, with respect to payments allegedly made for obtaining extensions of those permits, because the SEC had failed to sufficiently plead that granting of those extensions is a "discretionary action," the Court held that the SEC had failed to negate the facilitating payments exception, which does permit payments to "expedite or secure the performance of a routine government action." The Court granted the SEC leave to amend its complaint to address this finding.

Facilitating Payments Exception: Not Unconstitutionally Vague

The Court dismissed, in short order, the defendants' challenge that the facilitating payments exception is unconstitutionally vague. With respect to the payments to obtain permits, the Court pointed out "a person of common intelligence should have no difficulty understanding that routine government actions do not include the granting of permits based on fraudulent documents." And, the Court noted that if the permit extensions are discretionary, then case law -- citing United States v. Kay, 359 F.3d 738 -- would have "adequately put persons of common intelligence on alert that bribery to influence discretionary decisions was prohibited under the FCPA."

Corrupt Intent: SEC Has Burden to Plead

The defendants also argued that the SEC had failed to sufficiently plead a requisite element for an anti-bribery provision violation: that they had acted "corruptly." The defendants claimed that they believed, in "good faith," that they were acting lawfully. Specifically, the Court noted that "Jackson argues that he had a good faith belief in the legality of the payments as facilitating payments," while "Ruehlen argues that he relied in good faith on the approval of the payments by supervisors, including Jackson."

Borrowing from the definition of "corruptly" in statutory history, the Court defined "corruptly" as "an act done with an evil motive or wrongful purpose of influencing a foreign official to misuse his position." Referencing United States v. Kay, 513 F.3d 432, in which the Fifth Circuit, in a criminal FCPA prosecution, held that the willfulness requirement requires "only a showing that a defendant knew that his actions were in some way unlawful," the Court suggested that, since the defendants face only civil prosecution, the applicable intent requirement should be even less stringent. The Court concluded that "the SEC has no obligation to plead that Defendants knew that they were violating a law, or even that they were seeking an illegal result to state a civil FCPA violation." The Court acknowledged the defendants' claims of good faith belief, but explained that those are factual disputes irrelevant at the motion to dismiss stage. Consistent with its prior conclusion, the Court thus held that the SEC had sufficiently pleaded the intent element with regard to payments made to acquire permits. The Court reminded the SEC to augment its intent-related allegations with respect to the permit extensions payments.

Statute of Limitations

The defendants also raised the defense that "all of the events giving rise to the claims occurred outside of the limitations period and the SEC's Complaint has failed to raise any basis for tolling." The SEC had a number of responses.

The SEC first alleged, and the defendants did not dispute, that the defendants had signed tolling agreements that would make timely any claims based on conduct occurring after May 10, 2006. However, the Court noted that the SEC had failed to plead the effect of these agreements.

The SEC also argued that the conduct involved fraudulent concealment. In response, the Court noted that the Fifth Circuit requires the agency to prove two elements. First, the defendant must have concealed the conduct complained of, and that the concealment must involve "some trick or contrivance tending to exclude suspicion and prevent inquiry." Second, it must be shown that the SEC failed, despite exercising due diligence, to discover the facts that form the basis of the claim.

Ruling on the pleadings, the Court decided that the SEC's allegations support the conclusion that defendants concealed their conduct – they logged payments known to be improper as legitimate operating expenses, and they signed, as CFO and CEO, personal certifications supporting the accuracy of Noble's public filings when they knew that those certifications were false. However, since the SEC did not plead any facts with respect to its diligence, the Court granted the SEC leave to amend its pleadings.

The Court deferred decisions on questions related to the statute of limitations effects of a continuing violations allegation, and the pursuit of an equitable remedy, rather than a penalty/fine. On the latter question, the Court noted that equitable remedies are not subject to the statute of limitations in principle, but that in the Fifth Circuit, injunctive remedies could be considered penalties. But, the Court determined that deciding "[w]hether an injunction constitutes a ‘penalty' . . . depends on an objective evaluation of the ‘degree and extent of the consequences to the subject of the sanction'," an inquiry, the Court decided, best left to a later stage of the litigation with a more developed factual record. Hence, the Court let stand the SEC's claims that sought only injunctive relief.

Aside from the issues highlighted above, the Court also decided that:

- The SEC had sufficiently alleged that the executives aided and abetted Noble Drilling's FCPA anti-bribery violations;

- The SEC had sufficiently alleged that the executives violated the FCPA's books and records provisions and aided and abetted Noble Drilling's books and records violations;

- The SEC had sufficiently pleaded its claims against Jackson under 17 C.F.R. § 240.13b2-2 (representations in SEC filings) and 17 C.F.R. § 240.13a-14 (disclosure certification); and

- The SEC had sufficiently pleaded "control person" liability against Jackson under 15 U.S.C § 78t(a).

Ongoing Developments

On November 2, 2012, the DOJ submitted a motion to dismiss the outstanding FCPA charges against Pride International, Inc. ("Pride") and end the company's corporate compliance reporting obligations under its DPA one year ahead of schedule. Prosecutors sought the early termination of the DPA — believed to be the first of its kind in connection with an FCPA matter — based on, among other things, Pride's adherence to the compliance obligations under its settlement agreement. The DOJ also submitted a motion to terminate the unsupervised probation of Pride's French subsidiary, Pride Forasol SAS ("Pride Forasol") on the same basis.

As reported in our FCPA Winter Review 2011, Pride originally entered into its DPA on November 4, 2010, to settle FCPA-related charges with the DOJ. While Pride's DPA had a three-year term, it also explicitly provided that: "in the event the Department finds . . . that there exists a change in circumstances sufficient to eliminate the need for the corporate compliance reporting obligation… and that the other provisions of this Agreement have been satisfied, the Term of the Agreement may be terminated early."

In support of its motions to dismiss the criminal charges against Pride and terminate Pride Forasol's term of probation, the DOJ highlighted that Pride:

(1) had acknowledged responsibility for the actions of its employees and agents;

(2) fully met its obligation under the DPA to cooperate with the U.S. government;

(3) paid in full the $32,625,000 criminal penalty imposed as part of its settlement disposition;

(4) adhered to its compliance undertakings required by the DPA (e.g., instituting and maintaining an effective compliance and ethics program; reducing its reliance on and subjecting third-party business partners to appropriate due diligence requirements);

(5) voluntarily initiated a comprehensive anti-bribery compliance review of its business operations in certain high-risk countries prior to its DPA, reported the findings to the DOJ, and undertook, of its own accord, remedial measures; and

(6) was acquired by Ensco plc ("Ensco") in May 2011, which assumed Pride's DPA obligations and made numerous compliance-related representations to the DOJ in connection with the acquisition.

The early termination of Pride's DPA is the latest example of credit provided by the DOJ to companies that have made good-faith efforts to implement effective, risk-based compliance programs and cooperate with the agency in its investigations. In 2012, there was a significant increase in the number of FCPA-related DOJ declinations (see Known Declinations Chart above), which included declinations that the DOJ, for the first time, publicly attributed to the compliance and cooperation of the companies involved (see our FCPA Autumn Review 2012).

On November 5, 2012 and November 7, 2012, respectively, Judge Lynn N. Hughes of the U.S. District Court for the Southern District of Texas granted the motions to dismiss and terminate.

IBM's Settlement Terms Facing Judicial Skepticism

Judicial approval of FCPA corporate settlements generally has been routine, until recently, when, on December 20, 2011, Judge Richard Leon of the District of Columbia refused to approve IBM's March 2011 settlement with the SEC for alleged FCPA books and records violations (see our FCPA Spring Review 2011). According to the publication Corporate Crime Reporter, Judge Leon has demanded additional reporting requirements that IBM has claimed to be too burdensome and has so far refused to adopt, including reporting to the Judge and the SEC, "‘immediately upon learning that it is reasonably likely' that the company violated the FCPA." Instead, press reports note that IBM wishes to limit this reporting requirement to specific allegations of bribery. According to Bloomberg, IBM has represented that "[a]s a practical matter it would be impossible to track" the number of possible books and records/accounting violations. Based on these accounts, IBM appears to be concerned that the Judge's demand would require the company to report nearly all "reasonably likely" mis-recordings of expenditures, even if minor and not related to bribery.

In addition to possible FCPA violations, Judge Leon has also demanded that IBM report "within 60 days of learning that it is the subject of ‘any investigation or enforcement proceeding by any federal government agency, a party to any major federal administrative proceeding, a party to any major civil litigation in the United States, or the subject of any criminal investigation by the Department of Justice.'" IBM has asked that the requirement be restricted to "FCPA related proceedings, litigation and investigation." The Judge has asked IBM to produce evidence substantiating its claim of burden by February 4, 2013.

Judicial disapproval of FCPA corporate settlements has been rare. Judge Leon's insistence on additional compliance requirements may be motivated by the fact that IBM had previously settled FCPA books and records violations in 2000 (see FCPA Spring Review 2011). Judge Leon is distinguished by his involvement in several large FCPA cases, including presiding over the "Shot Show" trials and approving the Daimler AG settlement. Notably, in approving the Daimler settlement in 2010, Judge Leon demanded that Daimler's monitor and counsel periodically update him on Daimler's compliance, a requirement not commonly imposed by reviewing judges. (See FCPA Spring Review 2010.)

Civil Litigation

Alcoa Settles with Aluminum Bahrain for $85 Million

On October 10, 2012, Aluminum Bahrain BSC ("Alba"), an aluminum smelter primarily owned by the Bahrain government, and Alcoa Inc. ("Alcoa") reached a $85 million dollar, out-of-court settlement in a high-profile civil case alleging fraud and corruption that began in 2008.

As we reported in FCPA Spring Review 2008 and FCPA Summer Review 2010, Alba had long purchased alumina (raw material for aluminum) from the Pittsburgh-based Alcoa. In February 2008, Alba filed suit against Alcoa, alleging that Alcoa had paid $9.5 million in bribes to Bahrain officials, senior members of the Bahraini royal family, and Alba executives in return for de facto permission to overcharge Alba for raw materials. Alba alleged that, between 1997 and 2009, Alcoa's bribes led Alba to overpay, by $420 million, for raw materials such as alumina that it purchased from Alcoa. Alba asserted several causes of action, including conspiracy, fraud, and RICO claims based on FCPA violations, and sought $1 billion in damages. Without admitting liability, Alcoa agreed to pay $85 million to Alba to settle all of Alba's claims. Available settlement documents and press statements stated that Alcoa and Alba also agreed to resume a commercial relationship and have entered into a long-term alumina supply contract.

The case is of particular interest as it was brought against Alcoa by Alcoa's customer, Alba, even though Alba executives had accepted bribes and presumably facilitated Alcoa's making sales at inflated prices. Although the $85 million settlement would, if an FCPA penalty, be the largest imposed this year and close to being one of the ten largest FCPA penalties ever assessed, U.S. enforcement agencies have yet to announce any penalties. Such penalties may be on the horizon, however, as Alcoa has stated that it would recognize a future charge in the event of settlements with the DOJ and SEC. As far as we are aware, this settlement represents the first time a foreign corporation has recovered money from a U.S. company in a civil suit alleging losses due to bribery and kickback. To the extent that buyers of goods or services were to bring suits of this sort in other similar circumstances, they could further raise the stakes for companies being investigated for FCPA violations.

The civil suit ran parallel to still-on-going U.S. and U.K. criminal investigations. In March 2008, the DOJ notified Alcoa that it had opened a formal criminal investigation of the company, and that same month, a U.S. district court judge granted the DOJ's request to stay Alba's civil action so that the DOJ could conduct its investigation without the interference and distraction of the civil litigation. Most recently, in October 2011, the SFO announced that Alcoa's former agent in Bahrain, Victor Dahdaleh, who is a British and Canadian national, was arrested and charged in corruption related offenses.

U.S. Agency and Legislative Developments

DOJ Issues Second Opinion Procedure Release of 2012

On October 18, 2012, the DOJ issued its second Opinion Procedure Release of the year. Nearly 20 U.S. non-profit adoption agencies (the "Requestors") asked the DOJ for its enforcement position on their proposal to host 18 government officials from an unnamed country to visit the United States to learn about the Requestors' work. The officials would include employees of their country's adoption ministry, an adoption court judge, and several executive and legislative officials who could affect the adoption process in their country. The Release noted that during the proposed visit, the officials would interview the Requestors' staff, inspect their files, and meet with families who have adopted children from the officials' home country.

In connection with the visits, the Requestors would pay for business-class airfare for international portions of flights for high-ranking officials, coach-class airfare for non-high-ranking officials, accommodations for all officials at a business-class hotel, meals, and local transportation. The Requestors also represented that they would not pay for certain expenses, such as entertainment (other than organizing events to meet families who adopted children from the officials' home country), expenses for spouses or family members of the officials, stipends, and spending money.

Noting that the proposal was consistent with past favorable Opinion Releases involving travel and related expenses for officials, the DOJ opined that the proposed expenses were reasonable, bona fide, and directly related to the "promotion, demonstration, or explanation of [the Requestors'] products or services" under the FCPA's affirmative defense for promotional expenses. As a result, the DOJ indicated that it did not intend to take any enforcement action with respect to the proposed hosting of the officials.

This Opinion Release does not address any significant novel questions about travel and hospitality under the FCPA; rather, it reinforces the DOJ's enforcement positions as reflected in various other sources of enforcement agency guidance. In particular, the recent FCPA Resource Guide, issued roughly a month after this Opinion Release, directly addresses all types of expenditures contemplated in the Requestors' proposal. In particular, one of the Guide's hypotheticals specifically notes that business class airfare for a lengthy international flight, hotel accommodations, moderately priced dinners, and ground transportation would be reasonable in the context of an appropriate inspection visit. In addition, Opinion Release 11-01 addressed a very similar proposal from a U.S. adoption service provider, with a similar result. The DOJ's consistent analysis of questions about travel and hospitality may alleviate the need for organizations to continue to seek the DOJ's opinion on the specific types of expenditures discussed in this Opinion Release.

SEC Issues Annual Report on the Dodd-Frank Whistleblower Program

On November 15, 2012, the SEC issued its annual report on the Dodd-Frank whistleblower program for fiscal year 2012. This report is required by the Dodd Frank Wall Street Reform and Consumer Protection Act and summarizes the activities of the SEC's Office of the Whistleblower.

As previously reported in our FCPA Winter Review 2012, under the Dodd-Frank Whistleblower program, the SEC is able to make financial awards to whistleblowers that provide high-quality, original information about violations of securities law that lead to successful SEC enforcement action with more than $1 million in monetary sanctions. These awards can range from 10 to 30 percent of the sanctions collected.

In fiscal year 2012, the Office of the Whistleblower received 3,001 tips. The tips were received from individuals in all 50 states, the District of Columbia, and Puerto Rico, as well as 49 countries outside the United States. The most common complaint categories reported were Corporate Disclosures and Financials (18.2%), Offering Fraud (15.5%), and Manipulation (15.2%). FCPA related tips, numbering 115, made up 3.8% of the total.

Of the 3,001 tips received by the Office of the Whistleblower, there were 143 enforcement judgments and orders issued during the 2012 fiscal year that are potentially eligible for a whistleblower award. The SEC made its first award under the new whistleblower program on August 21, 2012, paying a whistleblower 30% of what the Commission recovered in an enforcement action involving a multi-million dollar fraud scheme.

International Developments

U.K. Bribery Act Enforcement Practice Developments

SFO Revised Policies and Guidance

As mentioned in our FCPA Autumn Review 2012, on October 9, 2012, the SFO published revised policies regarding the treatment of facilitation payments, business expenditures (hospitality), and corporate self-reporting under the U.K. Bribery Act (the "Act"). Along with publication of the revised guidance, the SFO also modified its Joint Prosecution Guidance (published in conjunction with the Director of Public Prosecution ("DPP")) regarding the Act. The stated purposes of the revisions were to reemphasize the SFO's primary role as an investigator and a prosecutor rather than as a provider of corporate guidance, to ensure consistency with other prosecuting bodies, and to address certain recommendations from the OECD Working Group's Phase 3 report. Publication of the revised policies also came in the months following the appointment of David Green as the new Director of the SFO. Throughout the revised policies, the SFO underscored the key point that there will be no presumption in favor of civil settlements.

Overall, the revised policy statements on facilitation payments, business expenditures, and corporate self-reporting indicate that the SFO's decision regarding whether or not to prosecute will continue to be governed by the Full Code Test ("FCT") of the Code for Crown Prosecutors, the SFO and DPP's Joint Prosecution Guidance on the Act, and the Joint Guidance on Corporate Prosecutions (Miller & Chevalier previously published an in-depth analysis regarding the SFO and DPP guidance as well as concurrent guidance published by the U.K. Ministry of Justice ("MOJ") regarding adequate procedures). In accordance with the FCT, the SFO states that it will only prosecute a case if the evidence presents a realistic prospect of conviction and if it is in the public interest to proceed. Public interest considerations include the analysis of factors listed in the guidance documents. The revised policies all state that the SFO reserves the right to seek civil recovery under the Proceeds of Crime Act of 2002 ("POCA") as an alternative or in addition to criminal prosecution and note that it will publish its reasons, the details of the illegal conduct, and the details of the disposal for any case utilizing POCA. The revised policies and supporting questions and answers also note that the SFO may consider civil recovery as an alternative to criminal prosecution where the requirements of the FCT are not met.

The SFO's revised policy on facilitation payments does not mark a departure from its previous stance, but rather reaffirms that under U.K. law (both before and after the Act took effect) facilitation payments are considered illegal and are treated as bribes, regardless of size or frequency. Notwithstanding this position, the SFO notes in its questions and answers regarding the revised policies that, "it would be wrong to say that there is no flexibility" regarding whether to prosecute a company engaging in facilitation payments. In support of this statement, the SFO and DPP's Joint Prosecution Guidance on the Act includes a list of various public interest factors which weigh for or against prosecution of a company for engaging in facilitating payments. For example, a single payment likely to result in only a nominal penalty is a factor weighing against prosecution.

Similarly, the SFO's revised policy on business expenditures expressly reaffirms its previous position that "bona fide hospitality or promotional or other legitimate business expenditure is recognized as an established and important part of doing business." Nevertheless, the revised policy recognizes that bribes may be disguised as legitimate business expenditures, and states that the SFO will prosecute cases involving corporate hospitality where the seriousness or complexity of the bribes fall within the SFO's remit and the requirements of the FCT are met.

In contrast, the revised policy on corporate self-reporting is a marked departure from the SFO's previous position which had suggested that it might settle cases civilly, rather than criminally, if a company self-reported bribery issues. Instead, in accordance with the Guidance on Corporate Prosecutions, the SFO will now treat self-reporting only as a relevant public interest consideration weighing against prosecution where the self-reporting forms part of a "genuinely proactive approach adopted by the corporate management team when the offending is brought to their notice." The revised policy emphasizes that "self-reporting is no guarantee that a prosecution will not follow," and that "each case will turn on its own facts." Nevertheless, the SFO encourages corporate self-reporting both in its Joint Guidance with the DPP and in its questions and answers accompanying the revised policies.

The revised policies and guidance did not include any changes regarding the "adequate procedures" defense to Section 7 violations of the Act for failing to prevent bribery. However, given the new focus on the SFO's prosecutorial role, it will be more important than ever for companies to ensure that they have adequate procedures in place in accordance with the MOJ guidelines.

Deferred Prosecution Agreements

Notwithstanding publication of the revised policies which emphasize the SFO's prosecutorial role and remove references to civil remedies in the context of voluntary disclosures, the United Kingdom has taken considerable steps towards authorizing the SFO to enter into Deferred Prosecution Agreements ("DPAs") with corporations as an alternative to criminal prosecution. As detailed in our FCPA Summer Review 2012, in May 2012 the MOJ released a consultation paper and formal request for comments on the introduction of DPAs in the United Kingdom. In response to the request for comments, the MOJ received 75 responses from a variety of stakeholders, including businesses, judges, and prosecutors and found that there was strong support for the use of DPAs. As a result, the MOJ announced on October 23, 2012 that it will introduce legislation to allow the use of DPAs for corporations in the United Kingdom. We will provide detailed analysis of the legislation and its expected effects once it is close to becoming law.

Enforcement Actions

While the SFO has withdrawn its guidance suggesting that voluntary disclosures will likely result in civil recovery orders rather than criminal prosecutions, none of the resolved enforcement actions involving bribery undertaken by the SFO or its equivalent agency in Scotland, the Crown Office and Procurator Fiscal Service ("OPFS"), in 2012 involved formal criminal prosecutions. Most recently, as covered immediately below, the OPFS announced a £5.6 million ($9 million) civil recovery in November against Scottish drilling company Abbot Group Limited, representing the first settlement following self-disclosure in Scotland. As discussed in our FCPA Spring Review 2012 and FCPA Autumn Review 2012 respectively, the SFO also resolved actions against Mabey Engineering (Holdings) Ltd and Oxford Publishing Ltd this year following corporate self-reporting without criminal prosecution.

While the appointment of Mr. Green as the new SFO Director and publication of the revised policies and guidance indicate that the SFO has adopted a stronger prosecutorial stance vis-à-vis the public, the MOJ's announcement that DPAs will be introduced into legislation and SFO's continued practice and general encouragement of self-reporting has left uncertainty regarding whether companies should expect more criminal prosecutions rather than civil settlements under the Act in the future.

Abbot Settles with Scottish Enforcement Agency

On November 23, 2012, Scotland's public prosecutors, the Crown Office and Procurator Fiscal Service (the "OPFS"), announced that the Scottish drilling company, Abbot Group Limited ("Abbot"), agreed to pay £5.6 million ($9 million) to settle charges that it benefitted from corrupt payments overseas. The OPFS charged Abbot under the Proceeds of Crime Act 2002 ("POCA"), which allows civil recovery actions. This enforcement action did not involve the U.K. Bribery Act because the conduct at issue preceded the Act's passage.

According to the OPFS's announcement, Abbot admitted that it benefited from corrupt payments made in connection with a contract entered into by one of its overseas subsidiaries and an overseas oil and gas company. The OPFS did not identify either party or their countries of operation. The announcement stated that the contract was entered into in 2006, and the corrupt payments were made in 2007 (the U.K. Bribery Act came into effect in July 2011). The corrupt payments came to light following inquiries by an overseas tax authority, which in turn prompted Abbot to conduct an internal investigation using outside legal and accounting firms. Abbot reported the results of its investigation to the OPFS in July 2012. Neither the OPFS nor Abbot provided any further details on the corrupt payments at issue.

Noteworthy Aspects:

- First Company to Benefit from Voluntary Reporting Initiative. The Head of the OPFS's Civil Recovery Unit stated that Abbot is the first company to have met the "strict criteria" of a self-reporting initiative introduced in 2011 to coincide with the U.K. Bribery Act taking effect. This initiative, described in a guidance issued by the OPFS, is similar to a program overseen by the SFO in other parts of the United Kingdom. Under the OPFS's initiative, it evaluates self-reported cases on a number of factors (which in many respects resemble U.S. enforcement agencies' enforcement principles) in determining whether to forego criminal enforcement in favor of a civil settlement. The OPFS's willingness to reach a civil settlement with Abbot in which it will pay no penalty other than disgorgement (the £5.6 million reflects Abbot's profits from the contract at issue) may have been designed to encourage other companies in a similar position to take advantage of the self-reporting initiative.

- Extensive Remediation. Media reports following the OPFS's announcement indicate that Abbot made broad efforts to investigate the corrupt payments and improve its compliance program. In particular, Abbot's general counsel reportedly stated that upon learning of potential improper payments, the company immediately hired independent legal counsel and accountants to investigate over 100 contracts covering a period of 12 years, interview 30 people, and review over one million emails. The general counsel also reportedly stated that Abbot has reviewed its policies, procedures and practices with the assistance of external advisers, and has conducted anti-bribery and ethics audits of the company's business in high-risk areas.

Four Individuals Charged in the United Kingdom for Bribery of Nigerian Officials

On December 17, 2012, the SFO announced that four former employees of Swift Technical Energy Solutions Ltd. were charged in Westminster Magistrates' Court with two offences of conspiracy to corrupt. The defendants were charged, following a two-year investigation, with conspiring to bribe Nigerian officials to avoid, reduce or delay paying taxes on behalf of workers Swift sent to Nigeria.