FCPA Winter Review 2015

International Alert

Introduction

After a slow start through three quarters, the pace of resolved enforcement in 2014 picked up significantly in the fourth quarter, with an increase in quarterly activity to levels not seen since 2010. In late 2013, then-Deputy Chief of the Foreign Corrupt Practices Act ("FCPA") Unit for the U.S. Department of Justice ("DOJ") predicted that the DOJ would bring "very significant[,] top 10 quality type cases" in 2014. The flurry of settlements announced by the agencies to end the year helped to fulfill this pledge, bringing to a close several long-running investigations and cementing 2014 as a banner year in terms of penalties and disgorgement imposed.

Enforcement Trends in 2014

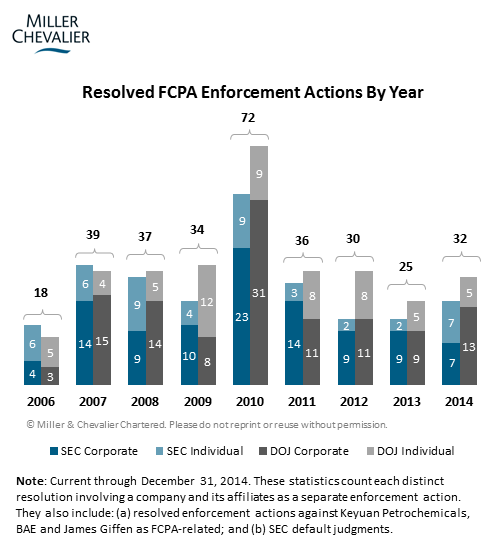

Overall, the DOJ and U.S. Securities and Exchange Commission ("SEC") brought 32 resolved FCPA enforcement actions in 2014, a slight uptick from 2012 and 2013, but still less than half the number of FCPA actions brought by the agencies in 2010, when enforcement in terms of resolved dispositions hit its all-time high.

The agencies resolved sixteen of these enforcement actions during the fourth quarter of the year, including twelve corporate actions against six different companies, which represents the most active quarter in four years from a resolved enforcement perspective.

Collectively, in 2014, the agencies assessed more than $1.56 billion in combined penalties, disgorgement, and pre-judgment interest as part of 20 corporate FCPA actions involving 10 different companies. In terms of sheer numbers in FCPA-related corporate cases, this amount represents the second highest total on record, behind the $1.8 billion assessed in 2010 and significantly more than the $890 million assessed in 2008. However, the average settlement amount in 2014, at $156 million per corporate family, was nearly $70 million more than the average assessment from the next highest year ($89 million in 2008). This record-breaking mean was driven by several unusually large settlements, including combined enforcement actions against Alcoa Inc., Hewlett Packard Co., Avon Products Inc., Alstom SA, and their subsidiaries, each of which exceeded $100 million and two of which landed among the 10 largest FCPA enforcement actions of all time. The largest of these was the Alstom case (as discussed below), whose $772 million criminal penalty is the largest the DOJ has ever imposed in an FCPA-related enforcement action.

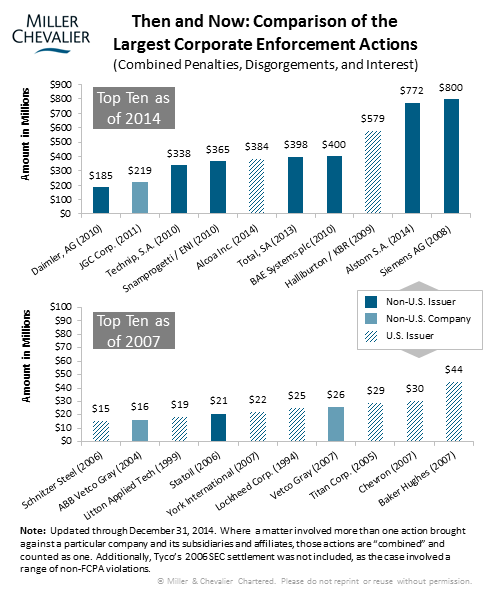

The rapid growth in the size and scope of FCPA enforcement actions is reflected in the chart below, which compares the 10 largest corporate dispositions as of 2007 with the 10 largest corporate dispositions as of 2014. Of note, none of the resolutions from the 2007 list rank among the 25 largest combined enforcement actions today. In fact, only two corporate settlements entered into prior to 2010 currently claim a spot in the top 25 list.

Another trend captured by the chart above is aggressive pursuit of non-U.S. companies by U.S. enforcement authorities. While the addition of Alcoa this past year increases the number of U.S. companies represented in the current top 10 chart to two, in 2007 U.S. companies made up the bulk of the list with seven. More broadly, of the 25 largest FCPA dispositions brought to date, only 10 settlements now involve U.S. companies, compared with 22 as of 2007.

Although the overall percentage of non-U.S. companies targeted under the FCPA increased significantly in recent years (from approximately 26% of companies entering dispositions from 2005-2009 to approximately 43% of companies entering dispositions from 2010-2014), enforcement in 2014 bucked this trend, with U.S. companies comprising eight of the 10 combined corporate settlements.

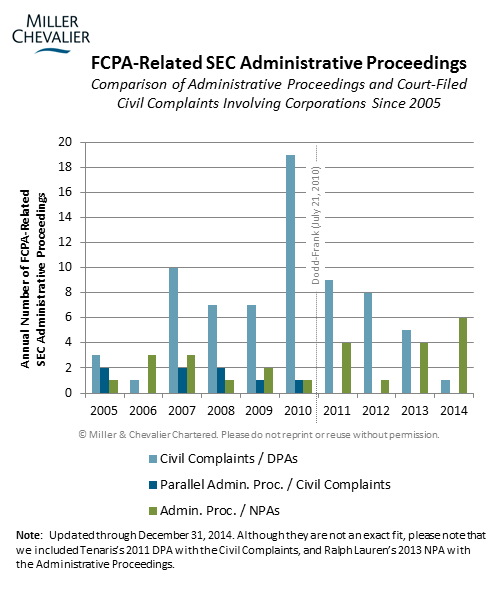

Continuing a trend we highlighted in our FCPA Spring Review 2014, the SEC continues to rely on expanded authority under the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank") to prosecute FCPA-related misconduct via administrative proceedings rather than through court-filed civil complaints -- a development that Kara Brockmeyer, Chief of the SEC's FCPA Unit, characterized as "the new normal." Of the seven corporate FCPA enforcement actions the SEC brought in 2014, a record six were handled via administrative proceeding.

This trend toward administrative action as the SEC's preferred means for pursuing FCPA cases is significant because the resolutions involved require no judicial approval, as opposed to the settlement of formal civil complaints. Administrative proceedings are now being used to handle cases of a much greater magnitude, such as the recent Total and Alcoa dispositions, that the SEC traditionally sought to resolve in federal court because of their size and scope.

Some critics have suggested that the SEC is increasingly seeking to bypass the federal court system to avoid to avoid having to deal with district court judges who have complicated several SEC prosecutions in recent years by demanding changes to negotiated settlements (see Tyco and IBM) or dismissing charges or otherwise limiting claims (see Mark Jackson, James Ruehlen, and Herbert Steffen). In a recent speech, U.S. District Court Judge Jed S. Rakoff questioned this "administrative creep," stating that the "informality and arguable unfairness" of administrative proceedings could present "serious problems for those defending such actions" and, more importantly, hinder "the balanced development of securities laws." During a panel in mid-November, Charles Cain, Deputy Chief of the SEC's FCPA Unit, directly rebutted such criticisms, stating that "there's nothing unjust or unfair about administrative proceedings," which give defendants "unique due process rights."

As this alert was going to press, the SEC announced the first resolved enforcement action of 2015, a $3.4 million deferred prosecution agreement ("DPA") with Florida-based engineering and construction firm PBSJ Corporation for allegedly offering and authoring payments to Qatari officials. This is just the second DPA the SEC has entered into in the FCPA context. The SEC also entered into an administrative settlement with former PBSJ executive Walid Hatoum for his role in the alleged scheme. We will analyze both actions in our next edition of the FCPA Review.

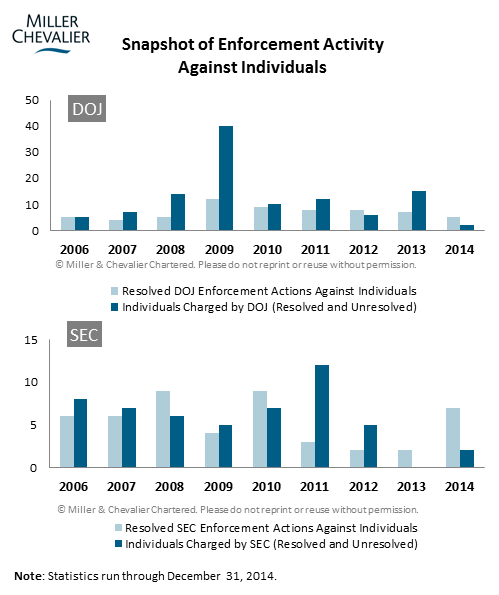

On the individual prosecution front, 2014 was a relatively active year for the DOJ, even if statistics might suggest otherwise. Beyond the five individuals who pled guilty to criminal FCPA violations in 2014, two of whom were indicted earlier in the year and entered pleas in December (see Benito Chinea and Joseph DeMeneses, discussed below), the DOJ also announced FCPA charges against nine other individuals whose indictments and criminal information/plea were filed under seal in 2013 so as not to compromise the confidentiality of ongoing investigations. As noted in our FCPA Autumn Review 2014, the disclosure of these FCPA cases served to make 2013 one of the busiest years on record in terms of the DOJ's prosecution of individuals for FCPA-related misconduct, second only to 2009 when the agency brought charges against, among others, 22 executives in connection with a sting operation in the defense and law enforcement product industries (see our January 2010 FCPA Alert).

Given the consistent, public emphasis the agencies have placed on the prosecution of individuals, including the suggestion that to receive "full cooperation credit" companies under investigation must identify and produce specific evidence of alleged individual culpability, one might expect 2015 to feature an uptick in the number of individuals charged, including the disclosure of additional individuals against whom charges were previously filed but held under seal. To this end, the DOJ has already charged its first individual in 2015, Dmitrij Harder, the former owner and president of the Chestnut Consulting Group, who was indicted by a grand jury on January 6, 2015, on numerous FCPA, Travel Act, money laundering and conspiracy counts. This action will be discussed in our next Review.

For its part, the SEC resolved seven FCPA-related enforcement actions against individuals in 2014, the most since 2010. Five of these actions involved the resolution, either through settlement or default judgment, of long-pending civil charges filed against current and former executives of Noble Corporation and Siemens for their alleged roles in well-publicized FCPA violations at those companies. However, the other two actions, involving two former employees of defense contractor FLIR Systems Inc. (discussed below), represent the first new FCPA-related charges filed by the SEC against an individual in over two years. As we noted in our FCPA Autumn Review 2014, one reason for the absence of new actions against individuals by the SEC may have been that the Commission's resources were focused for several years on resolving a number of contested actions, including the civil charges against the current and former executives from Noble Corporation and Siemens. Now that the majority of these contested actions have been resolved, it will be interesting to see whether enforcement activity by the SEC picks up this coming year, particularly since Brockmeyer has repeatedly mentioned that the SEC has a number of actions against individuals "in the pipeline."

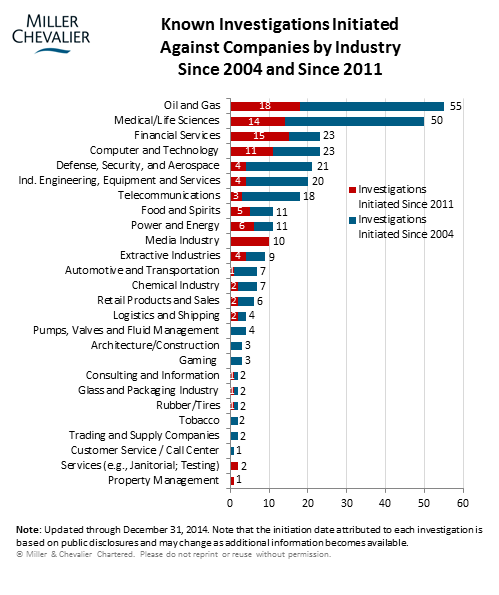

In our FCPA Autumn Review 2014, we explored how, although enforcement levels have dipped in recent years, the number of new investigations initiated by the DOJ and SEC each year has remained high. The chart below details the various industries that have been the focus of DOJ and SEC scrutiny since 2004 and since 2011.

While the oil and gas and medical/life sciences industries remain within the agency crosshairs (see discussion of the new Petrobras investigation below), several additional industries have begun to attract disproportionate attention over the last three years, including the financial services, computer and technology, and media sectors. At a recent conference, Deputy Assistant Attorney General Sung-Hee Suh suggested that cracking down on corruption and financial fraud at large financial institutions in the U.S. and abroad would remain a priority for the DOJ.

A final observation on 2014 focuses on the countries in which improper payments or related activity most frequently occurred. The chart below identifies the countries most frequently implicated in FCPA-related dispositions since 2009.

Over the past six years, China was implicated in over 27% of all combined corporate FCPA resolutions, followed by Nigeria at over 17% and Indonesia at over 13%. Enforcement in 2014 followed similar established patterns, with 70% of the combined corporate enforcement actions involving misconduct in high-risk countries such as Indonesia, China, or Russia. Of note, however, no corporate FCPA dispositions implicated Nigeria in 2014. And, while not reflected on the chart above, several dispositions this year implicated a handful of countries in resolved FCPA enforcement actions for what is believed to be the first time, including: Burkina Faso (Layne Christensen below), Peru (Dallas Airmotive below), and the Bahamas (Alstom below).

Among other fourth quarter developments, U.S. Attorney General Eric Holder also announced his resignation pending the appointment of a successor. President Obama nominated Loretta Lynch, the current United States Attorney for the Eastern District of New York to replace Holder, although Lynch has yet to be confirmed by the Senate. As a U.S. Attorney, Lynch helped lead the FCPA-related prosecution of Garth Peterson, the former Managing Director in charge of Morgan Stanley's Shanghai, China real estate group. (See our FCPA Autumn Review 2012). Lynch later stated in an interview that "corruption, whether here in Brooklyn or on the other side of the globe, has real and far-reaching consequences."

In addition, in the opening days of 2015, the DOJ announced that Andrew Weissmann would take the helm as Chief of the Fraud Section, a position that has been vacant since Jeffrey Knox left for private practice in September 2014. Until recently, Weissman had been teaching at the NYU School of Law, prior to which he held various government positions, including General Counsel for the Federal Bureau of Investigation, first Deputy and then Director of the Enron Task Force (where he worked with Assistant Attorney General for the Criminal Division Leslie Caldwell), and Chief of the Criminal Division of the U.S. Attorney's Office for the Eastern District of New York (where he overlapped with Loretta Lynch). While in private practice, Weissmann assisted with the American Chamber of Commerce's efforts to secure FCPA statutory reforms. That work will undoubtedly prompt additional interest in his approach to FCPA enforcement, which will now be under his direction.

As discussed below, there were also significant international developments this quarter, including the first prosecutions under the U.K. Bribery Act and SBM Offshore's record settlement with the Dutch government.

Actions Against Corporations

Alstom and Subsidiaries Agree to Second Largest FCPA Settlement

On December 22, 2014, the DOJ announced a record-breaking FCPA resolution with Alstom S.A. ("Alstom"), a French electricity generation and rail transport company, and three of its subsidiaries in connection with millions of dollars in bribes that the entities allegedly paid to government officials in Indonesia, Egypt, Saudi Arabia, the Bahamas, and Taiwan. The resolutions are part of a wave of multinational enforcement actions brought against Alstom entities and the government officials who profited from Alstom's alleged FCPA violations. DOJ officials stated that the "investigation is not over yet." Alstom and its subsidiaries entered into a plea agreement with the DOJ, pursuant to which Alstom agreed to pay $772,290,000 in criminal penalties -- the largest FCPA penalty collected by the DOJ itself and the second highest settlement in FCPA history.

Alstom's Corporate Resolutions with the United States

The resolutions focus on the employees and consultants of four Alstom entities -- specifically, (1) Alstom itself, a French entity headquartered in Paris, with two relevant business units directly involved in securing business globally; (2) Alstom Network Schweiz AG ("Alstom Schweiz," formerly Alstom Prom AG or "Alstom Prom"), a Swiss entity responsible for overseeing compliance regarding consultancy agreements for many of Alstom's power sector subsidiaries; (3) Alstom Power Inc. ("Alstom Power"), a U.S. subsidiary of Alstom, headquartered in Connecticut; and (4) Alstom Grid Inc. ("Alstom Grid," formerly Alstom T&D Inc. or "Alstom T&D"), an entity headquartered in New Jersey providing power grid related services around the world. Significantly for these resolutions with the DOJ, Alstom had shares registered on the New York Stock Exchange until August 2004 and was an "issuer" subject to the FCPA, as many of the acts leading to the resolutions occurred from 2000-2004.

To resolve the criminal exposure from these activities, Alstom and the relevant subsidiaries agreed to the following enforcement actions:

- Alstom S.A. pled guilty to two counts of criminal violations of the books and records and internal accounting controls provisions of the FCPA. Alstom agreed to pay a fine of $772.29 million, which also satisfied the obligations of its subsidiaries.

- Alstom Schweiz pled guilty to conspiracy to violate the anti-bribery provisions of the FCPA.

- Alstom Power and Alstom Grid each entered into deferred prosecution agreements, admitting a conspiracy to violate the anti-bribery provisions of the FCPA -- specifically, 15 U.S.C. § 78dd-2, which applies to U.S. entities.

The four Alstom entities agreed to report credible evidence or allegations of FCPA violations to the DOJ to enhance their compliance programs, to undertake various other self-reporting obligations, and to accept a monitor if the monitorship under the company's 2012 Negotiated Resolution Agreement with the World Bank is not successfully completed. This obligation will be satisfied when the World Bank's Integrity Compliance Office ("ICO") determines Alstom has implemented a corporate compliance program that is in accord with the World Bank's Integrity Compliance Guidelines. If the ICO does not find Alstom completed its monitoring requirement, the pleadings state that the company "shall be required to retain an independent compliance monitor."

With some exceptions, the same factual predicate served as a basis for the actions against the four Alstom entities. These focused on Alstom efforts to secure business by hiring consultants who would in turn pass payments to government officials in Indonesia, Saudi Arabia, Egypt, the Bahamas, and Taiwan. Overall, the DOJ reported that Alstom entities paid $75 million in bribes to secure $4 billion in projects, realizing a profit of approximately $296 million.

Indonesia

According to Alstom's plea agreement, between 2002 and 2009, Alstom, Alstom Power, Alstom Indonesia and other Alston entities "attempted to secure various power projects in Indonesia through Indonesia's state-owned and state-controlled electricity company, Perusahaan Listrik Negara ("PLN")." As described in the plea agreement, Alstom and its subsidiaries retained consultants, including Consultant A and Consultant B, who received commissions based on the overall value of the suspect contracts and then transferred a portion of these proceeds to PLN officials and a high-ranking member of Indonesia's Parliament. The bribes helped Alstom and a consortium partner win two contracts valued at $118 million and $260 million. The Indonesia bribery scheme was known by at least four Alstom and subsidiary executives, including Lawrence Hoskins, former Senior Vice President of Alstom Asia, and Frederic Pierucci, a French national and former Vice President of Global Sales for Alstom Power. (See FCPA Summer Review 2013). Most of the Indonesia activity described in the plea agreement occurred while Alstom was listed on the New York Stock Exchange.

Egypt

According to Alstom's plea agreement, between 2002 and 2011, Alstom and its subsidiaries, including Alstom Power, made improper payments to influence "bidding on various power projects with the Egyptian Electricity Holding Company ("EEHC")," Egypt's state-controlled electricity company. Alstom retained Consultant G, who reportedly made payments to Egyptian officials overseeing the bidding process relating to two projects, the Nubaria power station, valued at approximately $70 million, and the El Tebbin power station, valued at approximately $60 million. Alstom paid Consultant G approximately €5 million, which was recorded in Alstom's books and records as "consultancy fees" and "commissions," although Consultant G then transferred more than $3 million to the bank accounts of various Egyptian officials.

Between 2002 and 2010, the plea agreement states, Alstom and Alstom T&D bribed Egyptian officials to win contracts to build electrical grids in Egypt, including the Reactive Power Compensation ("RPC") Project and the Three Substations Project, valued at $15 million and $30 million respectively. The DOJ stated again that Alstom paid bribes to Egyptian officials through at least three intermediaries, including Consultant H. According to the plea agreement, Alstom often "paid invoices submitted by Consultant H despite the absence of a sufficient description of services rendered or backup documentation." The pleadings also assert that Alstom T&D submitted falsified certifications to the U.S. Agency for International Development ("USAID"), which funded, at least in part, both projects and had required the company to "disclose if Alstom or Alstom T&D was using any third-party vendors or consultants" on the projects.

Saudi Arabia

In 2000, Alstom acquired the Saudi Arabia operations of a separate international power company. During and after this period, Alstom's plea agreement states, Alstom, along with its predecessor and subsidiaries, made bribe payments to Saudi officials in order to obtain projects with the state-owned Saudi Electric Company. These projects, known as the Shoaiba Projects, were valued at approximately $3 billion. Although the described scheme originated under Alstom's predecessor in Saudi Arabia, "Alstom honored, continued, and in certain instances renewed" the arrangement. Alstom's plea agreement asserts that Alstom and its related entities retained at least six consultants to obtain the Shoiba Projects, including Consultant C, Consultant D, and Consultant E. Consultant D was the brother of a board member for Saudi Electric Company while Consultant D was a close relative of another high-level Saudi Electric Company official. Together, these consultants were paid approximately $39 million in fees "with no documentation of any legitimate services having been performed." The documents state that these consultants passed a significant portion of these fees to "key decision makers" at the Saudi Electric Company. Alstom and its subsidiaries, however, also gave $2.2 million to a U.S.-based Islamic education charity affiliated with a Saudi official.

The Bahamas

According to Alstom's plea agreement, between 1999 and 2004, Alstom and "several subsidiaries" bribed Bahamian officials to win projects with the state-owned Bahamas Electricity Corporation ("BEC"). Alstom retained Consultant I, who was known by certain Alstom employees to be a close friend of a BEC board member. Throughout this period, the plea agreement states, Alstom paid Consultant I approximately $650,000 in six installments. The plea agreement states that Consultant I then "issued six checks to [a Bahamian official] for roughly half of that amount in exchange for [the official's] assistance in securing power projects for Alstom and its subsidiaries."

Taiwan

Between 2001 and 2008, Alstom's plea agreement states, Alstom and its subsidiaries, Alstom Transport S.A. and Alstom Signaling US, made payments to various Taiwanese officials to obtain contracts with Taipei, Taiwan's Department of Rapid Transit System ("DORTS"), including the Command and Control Room ("CCR") project, valued at $15 million. Alstom's subsidiaries hired Consultant J, whose "expertise was listed as a 'wholesaler of cigarettes, wines, and pianos.'" The plea agreement asserts that the Alstom subsidiaries paid Consultant J $380,000 to assist with the CCR project while failing to implement sufficient internal controls to ensure Consultant J's fees "would not be used to make illegal payments to Taiwanese officials."

Penalty Considerations

As outlined in Alstom's plea agreement, the base fine for its penalty was $296 million, the overall pecuniary gain to Alstom for its alleged offenses. The maximum penalty agreed to by Alstom was $592 million per offense, amounting to $1.184 billion in potential penalties for two counts (books and records and internal accounting controls). In imposing a fine substantially over the $296 million minimum amount, the DOJ outlined a number of considerations, including: (1) Alstom's failure to voluntarily disclose its conduct, even though the company "was aware of related misconduct at Alstom Power, Inc., a U.S. subsidiary, which entered into a resolution for corrupt conduct in connection with a power project in Italy;" (2) Alstom's initial failure to cooperate with the DOJ's investigation, which changed only once the DOJ "had publicly charged multiple Alstom executives;" (3) the uncommon nature and seriousness of Alstom's conduct, which "spanned many years and a number of countries and business lines;" (4) Alstom's lax compliance and ethics safeguards at the time of the offenses; and (5) Alstom's prior conduct, including its 2012 World Bank corruption settlement.

Relationship to Other Enforcement Actions

The wave of enforcement activity relating to Alstom began in 2004, when the Swiss Federal Banking Commission identified documents on potential improper payments.

In 2008, Forbes reported, Swiss police searched Alstom's offices and arrested an Alstom Prom executive suspected of "fraudulent business activity, corruption and money laundering." According to The Wall Street Journal, in 2011, the Swiss Attorney General fined Alstom approximately $42 million for failing to stop foreign bribery.

On February 22, 2012, Alstom completed a Negotiated Resolution Agreement with the World Bank to settle claims that Alstom made improper payments to Zambian officials in connection to a World Bank-financed power project. As described above, Alstom currently has a monitor under this arrangement.

In 2013, the DOJ initiated actions against four executives of Alstom and/or its subsidiaries regarding contracts in Indonesia. (See FCPA Autumn Review 2013, FCPA Summer Review 2013, FCPA Spring Review 2014, and FCPA Autumn Review 2014). Three of those executives reached plea agreements with the DOJ, while the fourth -- Lawrence Hoskins -- has a trial scheduled for June 2015.

On July 24, 2014, the UK Serious Fraud Office ("SFO") announced charges against a London-based Alstom Network UK Ltd. and two of its executives with respect to alleged offenses between 2000 and 2006 concerning "large transport projects in India, Poland, and Tunisia." According to Reuters, on December 22, 2014, the same day the DOJ announced its settlement with Alstom, the SFO charged another Alstom subsidiary, Alston Power Ltd., with bribing officials of a state-controlled energy company in Lithuania. According to the BBC, there is also an open investigation of Alstom operations in Brazil.

Additionally, government officials benefiting from Alstom's payments have been sent to jail. In April 2014, former Indonesian Member of Parliament Izedrik Emir Moeis was sentenced to three years in jail by the Jakarta, Indonesia Anti-Corruption Court for taking $357,000 in bribes from Alstom. (The Jakarta Globe). On December 4, 2014, a former Egyptian official Asem Elgawhary pled guilty to DOJ allegations of mail fraud, conspiring to launder money, and tax fraud for accepting payments from Alstom and other companies. Elgawhary is scheduled to be sentenced on March 23, 2015, and faces up to 42 months in prison and asset forfeiture of $5.2 million.

Moreover, Alstom's business partner in Indonesia, Marubeni Corporation, pled guilty in March 2014 to one count of conspiracy to violate the FCPA and seven counts of violating the FCPA for related activities in Indonesia, agreeing to pay $88 million criminal fine to the DOJ. (See our FCPA Spring Review 2014).

Noteworthy Aspects

- Prospective Acquisition by General Electric: Alstom's resolution comes amidst an impending deal with U.S.-based General Electric ("GE") to purchase Alstom's energy division, which is predicted to be finalized by the middle of 2015. GE's pursuit of Alstom's energy assets, which are valued at approximately $16 billion, includes most of the Alstom divisions involved in the current resolutions. On November 5, 2014, according to the New York Times, the French government approved GE's bid to purchase Alstom's energy business, although approval is still required from antitrust regulators in 20 different countries. According to Alstom, "no part of the fine can be passed on to General Electric as part of the projected sales of Alstom's energy business." However, the agreed-upon monitorship will still attach to the relevant entities after their acquisition by GE.

- No SEC Action: Although Alstom had shares registered on the New York Stock Exchange until August 2004 and was an "issuer" subject to the FCPA, there was no parallel enforcement action against Alstom by the SEC. As a result, Alstom's penalty is the largest FCPA penalty ever issued by the DOJ. In Siemens, the largest FCPA settlement overall at $800 million, the DOJ assessed Siemens with a criminal fine of $450 million while Siemens and the SEC agreed to a $350 million civil settlement. (See our December 2008 FCPA Alert).

- Broad Interpretation of Internal Accounting Controls: The DOJ broadly interpreted the FCPA's internal accounting controls provision when it cited Alstom and its subsidiaries for knowing failure to implement a system of internal accounting controls. Conduct cited in support of this count included: disguising improper payments to officials in Alstom's books and records, in part by hiring consultants; creating false records, including consultancy agreements that prohibit improper payments with knowledge that consultants would make such payments; approving consulting agreements without adequate review by compliance staff; and conducting no meaningful due diligence in third-party hiring and retention, including ignoring red flags such as consultants' inexperience in their hired field, multiple consultants for one service, and location in different countries.

- Sentencing Credit for Cooperation: Alstom's lack of cooperation early in the investigation may have cost the company more than $200 million in its eventual settlement. In its penalty calculations, the DOJ subtracted one point from Alstom's Culpability Score for its eventual cooperation in the investigation. That point for cooperation lowered the fine range by between $59.2 million to $118.4 million. However, the fine range could have been lowered twice this amount if Alstom had received a two-point reduction by cooperating from the beginning of the investigation. At the same time, the DOJ increased the maximum penalty against Alstom by charging the company with both books and records and internal accounting controls violations, thereby counting the same pecuniary gain twice to increase the maximum penalty against Alstom from $592 million to $1.184 billion. If the DOJ had used one count, as it did in its settlement with Weatherford (see our FCPA Winter Review 2014), then the fine would have been lower by at least $180 million ($772 million minus $592 million). It is likely, however, that Alstom's lack of cooperation induced the DOJ to include two counts rather than one.

- International Cooperation: In its press release announcing the settlement, the DOJ acknowledged the assistance of law enforcement agencies in a number of countries, including Indonesia's Corruption Eradication Commission, the Office of the Attorney General in Switzerland, the UK SFO, and authorities in Germany, Italy, Singapore, Saudi Arabia, Cyprus, and Taiwan.

Avon Settles with U.S. Agencies for $135 Million

On December 17, 2014, the DOJ and the SEC announced settlements with Avon Products Inc. ("Avon"), the New York-based global beauty company, and its indirect subsidiary Avon Products (China) Co. Ltd. ("Avon China"), in connection with Avon China's provision of more than $8 million in gifts, cash, travel, and entertainment to Chinese government officials in order to obtain and retain business benefits. Avon voluntarily disclosed the potential FCPA violations to the DOJ and SEC in October 2008, spawning an extensive and costly global investigation with expenses in the range of $400 million. The DOJ closed its investigation by signing a DPA with Avon to resolve charges of conspiracy to violate the books and records provisions of the FCPA and violation of the internal controls provisions, and a plea agreement with Avon China to settle one charge of conspiring with Avon to violate the books and records provisions of the FCPA by falsifying Avon China's books and records, which were incorporated into Avon's books and records. Pursuant to the DPA, Avon must pay a criminal fine of $67,648,000, appoint an independent compliance monitor for an 18-month term, and thereafter must provide regular reporting on the company's compliance program through the expiration of the three-year DPA. For its part, the SEC entered into an agreement with Avon, approved by a U.S. District Court judge in the Southern District of New York, to settle charges of violating the books and records and internal controls provisions of the FCPA in exchange for disgorgement of $52,850,000 plus prejudgment interest of $14,515,013.13. In total, consistent with the disclosure in Avon's March 2014 10-Q filing, Avon will pay over $135 million in criminal penalties, disgorgement, and pre-judgment interest. The size of this figure and the imposition of a monitor, in spite of Avon's voluntary disclosure of the potential violations to the DOJ and SEC, is a clear indication of the agencies' displeasure with Avon's failure to address and prevent recurrence of the misconduct after discovering it.

According to the pleadings, from 2004-2008, Avon and Avon China falsified Avon's books and records by mischaracterizing the nature and purpose of over $8 million in cash and other benefits that employees in Avon China's Corporate Affairs, State Government, and Media Relations Group ("Corporate Affairs" or "lobbying group"), gave to Chinese government officials. The pleadings state that Corporate Affairs employees provided cash, gifts, travel, and entertainment to officials at the national, provincial, and local levels of Chinese government to obtain direct-sale licenses, avoid fines, avoid negative media reports, obtain favorable judicial treatment, and obtain government approvals for direct sales of nutritional supplements and other products that had not met government standards. The pleadings describe gifts of luxury items from Gucci, Louis Vuitton, and Tiffany; non-business travel for government officials (and occasionally spouses and children) to tourist locations such as Las Vegas, Hawaii, Washington, DC, and Macau, and wire transfers to a government official's personal bank account, among other examples. According to the DOJ's DPA and plea agreement, Avon China's Corporate Affairs executives deliberately gave the instruction to group personnel not to maintain accurate, detailed records of the items of value given to Chinese government officials in part because they believed that officials did not want a paper trail recording the items of value received from Avon China and also because they knew that the expenses were not incurred for legitimate business purposes.

The pleadings also describe an environment of inadequate internal controls over employee expenses and the integrity of the internal audit process. In several respects, the DOJ and SEC plead different facts, so the discussion below purposefully draws a distinction between the two. As detailed in the Statement of Facts to Avon's DPA, despite having policies relating to the review and approval of employees' expenses, Avon and certain subsidiaries lacked adequate controls to ensure the expenses complied with those policies, resulting in inadequate review of expenses to ensure they were reasonable, bona fide, or properly documented. The DOJ alleged that Avon also lacked sufficient controls to ensure the integrity of its internal audit process, particularly with respect to reviewing allegations of improper payments to government officials and preventing and detecting corruption-related violations.

Discovery of Improper Payments in 2005

The pleadings depict in great detail how Avon's internal audit group discovered the potential improper payments in 2005 and how, despite that, Avon and Avon China executives allowed the problematic practices to continue with full knowledge of their FCPA implications. According to the pleadings, Avon's internal audit group identified gifts and other things of value given by employees in Avon China's Corporate Affairs group as an area of concern, conducted a review, and wrote a draft internal audit report containing their conclusions. The pleadings state that the draft report described how the Avon China employees regularly provided high-value gifts, meals, and entertainment to government officials while failing to document the officials' names or the business purpose of the expenses. In addition, the DPA refers to conclusions in the draft report concerning Avon China's problematic retention of a third-party consultant to interact with government officials. According to the DPA, the report described how Avon China failed to contractually obligate the third-party consultant to comply with the FCPA and failed to actively monitor the consultant's activities, thus paying a substantial sum for vague and unknown services.

Continued Improper Payments throughout 2005 and 2006

According to both sets of pleadings, the draft report construed the problematic payments and inadequate recording of them as potential violations of the FCPA. Nonetheless, the pleadings state that Avon China executives persuaded Avon executives to direct internal audit personnel to remove the FCPA conclusions from the report, which they did. According to the SEC complaint, Avon China executives told internal audit personnel that recording the officials' names and the purpose of the interactions with them would have a "chilling effect" on the officials. As explained in the DPA, Avon China executives wanted that information excised from the report out of concern that Chinese officials, other Avon or Avon China employees, or Avon China's competitors might see the report. The SEC complaint describes how internal audit personnel brought the Avon China executives' concerns to their superiors, resulting in review of the report by Avon's General Counsel and a justification of the legal department in favor of the deletion because FCPA conclusions were within the purview of legal, not internal auditors.

Thereafter, the SEC complaint describes how Avon's General Counsel, Vice President of Legal & Government Affairs, and Asia-Pacific Counsel discussed further steps, including follow-up with internal audit and consulting outside counsel, which fell short result of actual change to Avon China's practices. According to the complaint, shortly after the Vice President of Legal & Government Affairs consulted outside counsel about potential FCPA issues, the executive terminated the relationship, telling the firm that Avon had "moved on" from the issues, despite having received further proof of problematic payments based on a follow-up review. According to the pleadings, Avon's internal audit group conducted a follow-up review of Avon China's Corporate Affairs group's expenses, which confirmed the concerns in the draft audit report, yet these findings were kept secret. The pleadings state that internal audit personnel were instructed to avoid referring to the FCPA in any written document and to refrain from creating electronic records (including email communications) of their review. According to the SEC complaint, certain remedial measures at Avon China were identified but not implemented, such that Avon China continued to provide gifts and other things of value to Chinese government officials without properly recording the business purpose and attendee names in their reports, and continued to use third parties without obligating them to comply with the FCPA. In addition, the SEC complaint states that while Avon's internal audit group considered providing FCPA training to Avon personnel in China and other countries in the region in 2005, ultimately the company decided not to provide the training based on budgetary considerations.

Continued Improper Payments after a 2006 Review

The pleadings state that in December 2006, following another review of Avon China's Corporate Affairs expenses, Avon's internal audit group resurfaced concerns about improper payments. Again, the pleadings indicate that no remedial measures were implemented in response. Further, the DPA states that in January 2007, an executive in the internal audit group informed Avon's Compliance Committee that the matter regarding potential FCPA violations by Avon China personnel had been closed as "unsubstantiated," despite knowing that the problematic payments continued. Around the same time, the SEC complaint states that Avon's head of internal audit and General Counsel, among others, received an email from an Avon China executive informing them that the Associate Director of Avon China's Corporate Affairs was terminated for submitting false expense reports seeking reimbursement for gifts and entertainment provided to government officials, yet no action appears to have been taken. The complaint states that Avon did not commence an internal investigation until after the terminated Associate Director of Avon China's Corporate Affairs wrote a letter in May 2008 to Avon's CEO reporting the improper provision of gifts and other items of value to Chinese government officials. According to the complaint, the letter to the CEO was forwarded to Avon's Legal Department and then to the audit committee of Avon's board of directors, which subsequently initiated an internal investigation of the bribery allegations.

Factors Considered by the DOJ

When entering into the DPA, the DOJ considered Avon's cooperation, remediation (including terminating individuals responsible for the misconduct), commitment to compliance program enhancements, and continued cooperation with the DOJ's investigation of the company and its officers, directors, employees, and agents. Although the DOJ acknowledged Avon's voluntary disclosure of potential wrongdoing "which came relatively soon after the Company received a whistleblower letter alleging misconduct," it also criticized the company for making that disclosure "years after senior executives of the Company had learned of and sought to hide the misconduct in China." In a similar vein, SEC Associate Director of Enforcement Scott W. Friestad said that the company "missed an opportunity to correct potential FCPA problems at its subsidiary, resulting in years of additional misconduct that could have been avoided."

Noteworthy Aspects

- Nature of the Charges: Despite careful descriptions in the pleadings of the improper payments scheme, neither the DOJ nor the SEC charged Avon or Avon China with improper payments violations, focusing instead on accounting and internal controls violations. The pleadings do not cite any initial U.S. involvement, including involvement by U.S. persons in the scheme, but do describe how U.S. persons, including several attorneys and executives in the Legal and Internal Audit departments, became aware of the payments based on the 2005 audit report and failed to do anything to stop them.

- Breadth of Investigation and Settlement Scope Limited to China: As reported by Bloomberg, Avon's investigation included other countries in Asia as well as in Latin America, yet the DOJ and SEC resolutions are limited to Avon's business in China. The DOJ tempered its commendation of Avon's efforts to investigate wrongdoing and resulting compliance program and internal controls enhancements with a criticism of how the company's efforts "were taken without Department request or guidance, and at times caused unintended delays in the progress of the Department's narrower investigation."

- Penalty Size: Avon's failure to detect and prevent improper payments by its Chinese subsidiary, despite multiple internal audit reviews documenting the practice, is a likely contributing factor to the substantial penalty levied by the DOJ and SEC. In contrast, the SEC's investigation of Bruker Corporation (discussed below) for potential improper payments, books and records, and internal controls violations relating to its business in China resulted in a significantly lower penalty of $2.4 million, based on its prompt reaction to discovering improper payments to Chinese government officials -- initiating an internal investigation, voluntary reporting to the agencies, and remediation. Another likely factor contributing to the penalty size is the awareness of senior executives, including in Avon's Internal Audit, Finance, and Legal departments, of the payments scheme and/or involvement in allowing it to continue.

- Training Examples: In addition to serving as another example for how a company should not react to allegations of improper payments, Avon contains a wealth of useful examples for training modules. These include: the purpose of the gifts and other things of value, which were intended not to win contracts but instead to gain market access, avoid fines, and avoid negative press; the types of improper payments, which included cash, luxury gifts, entertainment, and non-business travel; the use of third party consultants without due diligence, under short contracts, and despite knowing that the consultants served no legitimate business purpose; and the mischaracterization of improper payments in expense reports, referring to gifts as "samples" or "public relations business entertainment" and non-business travel as "study trips" or "site visits."

Bruker Corporation Enters into Administrative Settlement with SEC

On December 15, 2014, life sciences company Bruker Corporation ("Bruker") entered into an administrative settlement with the SEC to resolve allegations of FCPA violations relating to the company's China operations. As stated in the SEC's Cease and Desist Order ("the Order") the SEC charged the Massachusetts-based issuer with violating the books and records and internal controls provisions of the FCPA. Bruker agreed to pay nearly $2.4 million in penalties, consisting of $1,714,852 in disgorgement, $310,117 in prejudgment interest, and a $375,000 penalty.

The SEC charged Bruker with violating the accounting provisions of the FCPA related to payments made to employees of Chinese state-owned enterprises ("SOEs") who were Bruker customers. According to the Order, between 2005 and 2011, employees in the offices of four Bruker subsidiaries in China ("Bruker China Offices") "made unlawful payments of approximately $230,938" in the form of travel and sham expenses to Chinese officials. These employees allegedly "funded leisure travel for Chinese government officials to visit the United States, the Czech Republic, Norway, Sweden, France, Germany, Switzerland, and Italy." Many of these trips occurred in conjunction with business-related trips paid for by the Bruker China Offices. In 2006, for example, the Bruker China Offices paid for the training expenses of a Chinese government official as part of a sales contract with a Chinese SOE. This payment allegedly included sightseeing, tours, shopping, and other non-business activities in Frankfurt and Paris. The settlement documents also assert that the Bruker China Offices funded trips for Chinese officials with no legitimate business component, including a 2010 sightseeing trip for three Chinese officials to Austria and Germany. Overall, Bruker China Offices employees paid around $119,710 to fund 17 trips, alleged to have yielded $1,131,740 in profits for Bruker.

The SEC further alleged that between 2008 and 2011, a Bruker China Office paid $112,228 to Chinese government officials pursuant to Collaboration Agreements. Under these agreements, the SOEs committed to provide research on Bruker products or use the products in demonstration laboratories. According to the Order, the contracts provided no specific work product the SOEs needed to provide, and no work product was ever provided. Furthermore, the Order states that some of the Collaboration Agreements were executed directly with a Chinese government official, rather than the SOE itself and Bruker paid the government official directly. Overall, Bruker allegedly earned approximately $583,112 from contracts obtained from SOEs whose officials were paid by the Bruker China Offices under the suspect Collaboration Agreements.

Bruker accepted the SEC's allegation that the company consolidated the payments made by its China affiliates in its books and records and had insufficient internal controls with respect to its international operations. According to the SEC, the payments to Chinese officials were mis-recorded by the Bruker China Offices as legitimate business and marketing expenses when they were actually suspected of being improper payments intended to benefit Chinese officials. With respect to internal controls, the SEC noted that the Bruker China Offices "had no independent compliance staff or an internal audit function that had authority to intervene in management decisions and, if appropriate, take remedial actions." Bruker also failed to translate its FCPA and ethics compliance materials into Mandarin or other local languages.

The SEC acknowledged Bruker's cooperation with the investigation, noting the company's decision to self-disclose the results of its internal investigation. Bruker also revised its compliance program, updated its financial accounting controls, and terminated its senior staff at the relevant Bruker China Offices.

Noteworthy Aspects

- Travel and Entertainment Concerns in China: The Bruker action represents the latest enforcement action featuring a company funding the vacation travel of Chinese officials. As reported in our FCPA Autumn Review 2013, the DOJ and SEC settled FCPA-related charges with Diebold Financial Equipment Company (China), Ltd. ("Diebold China") after Diebold China employees provided leisure travel and entertainment excursions to Chinese officials. Other enforcement actions featuring improper travel for Chinese officials include the 2012 Biomet enforcement action (FCPA Spring Review 2012), the 2010 Daimler AG action (FCPA Spring Review 2010), the 2009 UTStarcom Inc. settlement (FCPA Winter Review 2010), and the 2007 Lucent enforcement action (FCPA Winter Review 2008).

- Extensive Scope of Internal Controls: Along with the Alstom enforcement action discussed above, Bruker is the latest example of the SEC considering a lax FCPA compliance program to be a violation of the FCPA's internal accounting controls provision. Under 15 U.S.C. § 78m(b)(2), an issuer must maintain internal accounting controls sufficient to provide reasonable assurances that transactions are recorded in accordance with management's authorization and as necessary to prepare financial statements and maintain accountability for assets. The Order cites Bruker for its failure to translate its compliance program into Mandarin Chinese and for a lack of internal compliance staff in China. The Order also notes that Bruker's toll-free employee hotline was not available in Mandarin.

- SEC Accounting Action Only: Despite allegations of improper payments, Bruker was not charged with anti-bribery violations and the DOJ did not take action against Bruker or its Chinese subsidiaries. Beyond the funding of trips to New York and Los Angeles, the SEC did not reference other actions by employees of Bruker China Offices in the United States or knowledge of, or authorization by, parent company employees sufficient to establish anti-bribery liability for the Bruker entities.

- Pharmaceutical and Life Science Industry Focus: This action is another example of the government's focus on the healthcare industry, from pharmaceutical companies to medical device manufacturers and research companies. With Bio-Rad Laboratories' DOJ and SEC settlement in November 2014, discussed below, Bruker is the second medical industry enforcement action to settle this quarter alone.

Dallas Airmotive Enters into DPA with DOJ

On December 10, 2014, Dallas Airmotive, Inc. ("DAI"), a Texas-based provider of aircraft maintenance, repair, and overhaul ("MRO") services, entered into a DPA with the DOJ to resolve alleged FCPA violations relating to the company's operations in Brazil, Peru, and Argentina. As stated in the DPA, the DOJ charged the company with one count of violating the anti-bribery provisions of the FCPA and one count of conspiracy to violate the anti-bribery provisions of the FCPA. DAI agreed to pay a $14 million fine to resolve the allegations.

According to the information, between 2008 and 2012, DAI made payments to officials in the Brazilian Air Force, the Peruvian Air Force, the Office of the Governor of the Brazilian State of Roraima, and the Office of the Governor of the Argentinian State of San Juan to win government MRO contracts. According to a DOJ press release, DAI and its Brazilian affiliate, Dallas Airmotive do Brasil ("DAB") "used various methods to convey the bribe payments, including by entering into agreements with front companies affiliated with foreign officials, making payments to third-party representatives with the understanding that funds would be directed to foreign officials, and directly providing things of value, such as paid vacations, to foreign officials." Much of the alleged conduct occurred through email contact with DAI employees located in Texas.

Argentina

According to the information, DAI's violations began in Argentina when DAI employees allegedly paid illegitimate sales commissions to San Juan Province officials to obtain an MRO contract. In February 2008, the DOJ alleged, a DAI sales employee ("DAI Sales Agent") emailed another sales employee ("DAI Sales Director") and other DAI employees to inform them that the commission paid to a third-party commercial representative would be increased to enable the representative to "pay the end user" in the Office of the Governor of San Juan a commission of $5,000. In March 2008, DAI Sales Agent emailed DAI Sales Director and a third-party representative with the closing price for an MRO contract with the San Juan government. The third-party representative responded, after removing the DAI Sales Director, that the work authorization should include a $15,000 commission per engine. The DOJ did not state whether DAI eventually signed a contract with the San Juan government or states the contract's value.

Brazil

In Brazil, the DOJ alleged that DAI and DAB employees bribed three Brazilian officials with sham consulting fees and non-business travel: Official 1, a sub-officer in the Brazilian Air Force; Official 2, a sergeant in the Brazilian Air Force; and Official 3, a captain for the Governor of the state of Roraima. Payments to Official 1 were disguised as consulting fees to a business in which Official 1 was listed as a partner. On February 5, 2012, for instance, a DAB manager ("DAB Manager B") emailed DAI Sales Agent to propose a commission of $20,000 to Official 1's company. Furthermore, DAI and DAB employees paid for the vacation travel of Official 2 and his wife. The DOJ alleged that DAI Sales Agent later forwarded airfare invoices for Official 2 and his wife to DAI Sales Director, suggesting "this is for you to understand the charges we are trying to recover on the engines we send." Finally, DAB Manager B sent a contract proposal to Official 3 valued at $300,000 via the official's personal email account, which Official 3 promised to mark up to $350,000 and present to the Roreima Province government.

Peru

In Peru, according to the information, DAI paid inappropriate commissions through a retired Peruvian Air Force commander who had been retained as a consultant. Specifically, the DOJ alleged that on April 28, 2011, the commander emailed DAI Sales Director to note that a delay in commission payments was causing problems: "because there are 4 people that call me every day for me to pay what was agreed to …." The DOJ did not reference any specific contracts resulting from DAI's alleged payments to Peruvian officials.

Noteworthy Aspects

- Dallas Airmotive's Parent Not Charged: Dallas Airmotive is owned by UK-based BBA Aviation, an issuer on the London Stock Exchange. BBA was not named in the DOJ's settlement documents and no BBA staff members appear to have been involved in the alleged conduct.

- Peru's First FCPA Action: Dallas Airmotive is the first FCPA enforcement action to allege bribery of Peruvian government officials. Peru currently ranks 85th out of 175 countries in Transparency International's Corruption Perceptions Index (discussed below). In contrast, Brazil ranks 69th and Argentina ranks 107th.

- Aircraft Services Companies Implicated: Dallas Airmotive is the third aviation industry FCPA settlement since 2012. In 2012, Nordam Group, an Oklahoma-based aircraft maintenance provider entered into a non-prosecution agreement ("NPA") with the DOJ relating to alleged bribery in China (see our FCPA Autumn Review 2012) and BizJet International Sales and Support, Inc. agreed to resolve charges that it made illicit payments to Mexican and Panamanian officials to influence the award of MRO contracts (see our FCPA Spring Review 2012).

Bio-Rad Settles FCPA Enforcement Action

On November 3, 2014, Bio-Rad Laboratories, Inc. ("Bio-Rad") agreed to pay over $55 million to settle parallel DOJ and SEC FCPA investigations with respect to its business operations in Russia, Vietnam, and Thailand. Bio-Rad is a medical diagnostics and life sciences manufacturing and sales company that is an issuer incorporated in Delaware and headquartered in California. The DOJ alleged criminal violations of the FCPA's books and records and internal accounting controls provisions, and the SEC found that the company engaged in civil violations of the FCPA's anti-bribery, books and records, and internal accounting controls provisions.

Russia

According to the pleadings, a substantial portion of Bio-Rad's Russia business, run through its wholly-owned Moscow-based subsidiary, Bio-Rad Laboratorii OOO ("Bio-Rad Russia"), consisted of sales to the Russian government of clinical diagnostic products, including HIV testing equipment and blood bank equipment. According to the DOJ NPA and the SEC Cease and Desist Order ("the SEC Order"), Bio-Rad SNC, an indirect wholly owned Bio-Rad subsidiary headquartered in France, retained an agent to assist with sales in Russia. From 2005 to 2010, the pleadings assert, the agent received commission payments of 15-30% purportedly to assist the company in acquiring new business by creating and distributing marketing materials, training customers, and delivering products. However, the SEC Order explains that the agent did not perform these services. In fact, the agent was an individual who established a number of foreign intermediary entities with no employees, bank accounts in Latvia and Lithuania, at least one phony address, and no capability to perform the services at issue.

The DOJ NPA alleges that Bio-Rad managers, including the Emerging Markets Manager and an accounting manager in the Emerging Markets sales division, ignored red flags suggesting the high probability that the agent was making improper payments to Russian officials in order to win government contracts for Bio-Rad Russia. These red flags included, among other things, that the agent did not have the ability to perform the services at issue, that the commissions were excessive, that they were paid to foreign bank accounts, that the Russian country managers used code words and took other steps to conceal the agent's work, and that some of the agent's invoices were generated internally by Bio-Rad Russia. In all, the agent was paid a total of $4.6 million resulting in sales of $38.6 million.

Vietnam

While the DOJ's NPA is limited to Bio-Rad's activities in Russia, the Order also includes certain business practices in Vietnam and Thailand. The Order alleges that from 2005 to 2009, the Vietnam country manager authorized the payment of bribes to government officials to obtain their business. Bio-Rad Singapore's Southeast Asia regional sales manager learned of the practice from a finance employee in 2006. The Order states that when asked about the practice, the Vietnam country manager told the regional sales manager and the finance employee that Vietnam sales would decrease by 80% if the company did not pay bribes. According to the Order, in hopes of insulating the company from liability, the country manager proposed using a middleman to pay the bribes, and the regional sales manager and the Asia Pacific general manager allowed the practice to continue. The Order asserts that this proposal resulted in the payment of $2.2 million to agents or distributors that were recorded as commissions, advertising fees, and training fees, which generated revenues of $23.7 million.

Thailand

According to the Order, in Thailand, Bio-Med acquired a 49% interest in Diamed Thailand through the acquisition of Diamed Thailand's Swiss parent, Diamed AG in October 2007. Prior to the acquisition, the Order asserts, Diamed Thailand began paying an inflated commission to a Thai agent of which the agent was to pay a percentage to Thai government officials in exchange for business. This arrangement continued after the 2007 acquisition. The Order states that in March 2008, Bio-Rad's Asia Pacific general manager learned of the arrangement and tasked the Bio-Rad Singapore controller with investigating the matter. The controller confirmed that bribes were being paid, but the General Manager did not instruct Diamed Thailand to stop making the payments. This arrangement continued until early 2010 and resulted in the payment of $708,608 to the agent and $5.5 million in gross sales revenues. The Order notes that Bio-Rad performed very little due diligence of Diamed Thailand prior to the acquisition of Diamed AG.

According to the pleadings, all of the above-described payments were mischaracterized (including as commission payments) on Bio-Rad's subsidiaries' books, records, and financial accounts, which were consolidated into Bio-Rad's books and records and reported in its financial statements. This resulted in the DOJ finding the company engaged in criminal violations of the FCPA's books and records and internal accounting controls provisions, and the SEC finding the company engaged in civil violations of the FCPA's anti-bribery, books and records, and internal accounting controls provisions.

The DOJ NPA notes that the company discovered potential FCPA violations during an internal audit, voluntarily disclosed the issue, fully cooperated with the DOJ's investigation, and took significant remedial actions. As a condition of the NPA, Bio-Rad agreed to: bring its compliance program and internal controls into conformity with a DOJ Attachment outlining required program and controls elements; continue to cooperate with the DOJ in any ongoing investigations, including into the actions of company employees; cooperate with domestic and foreign law enforcement, regulatory agencies, and the Multilateral Development Banks; report annually during a two-year term regarding remediation and implementation of compliance measures; and pay a $14.35 million penalty.

For its part, the SEC required the payment of $35,100,000 in disgorgement and prejudgment interest of $5,600,000 and annual reporting during a two-year period.

Noteworthy Aspects

- SEC Only Finds Anti-Bribery Violation: While the SEC found Bio-Rad's actions in Russia constituted civil violations of the FCPA's anti-bribery provisions, the DOJ's NPA does not include violations of the anti-bribery provisions. This result suggests the DOJ could not meet the higher burden of proof required for a criminal violation, but that the SEC found the facts were sufficient to support a finding of a civil anti-bribery violation.

- DOJ Criminal Books and Records and Internal Accounting Controls Violations: Though the DOJ did not find Bio-Rad engaged in criminal violations of the anti-bribery provisions, it did allege that the company engaged in criminal violations of the books and records and internal accounting controls provisions for its actions in Russia. Traditionally, it has been rare for the DOJ to find criminal books and records violations, particularly in cases where the company's settlement with the SEC includes civil violations of those provisions, but DOJ took this tack in three settlements in 2014; in addition to Bio-Rad, the DOJ settlements with Hewlett-Packard on April 9, 2014, (see our FCPA Summer Review 2014) and Alstom on December 22, 2014, (see above) also include criminal violations of the accounting provisions.

- Implications of the Strict Liability Nature of Civil Books and Records and Internal Accounting Controls Violations: Because of the apparent lack of U.S. nexus regarding the activities in Vietnam and Thailand, the DOJ could not find the company's actions resulted in criminal violations for those activities. However, the SEC could find that the company engaged in civil violations of the FCPA's books and records and internal accounting controls provisions for actions occurring in Vietnam and Thailand because those are strict liability provisions when brought civilly, meaning that the SEC need not prove any mens rea element. This result highlights the need for issuers to ensure all entities whose books are consolidated into the issuers' keep accurate books and records and have in place adequate internal controls.

- Pre-Acquisition Due Diligence Requirement: The SEC's indication that the company performed insufficient due diligence of Diamed Thailand serves as a reminder that the agencies expect companies to perform thorough pre-acquisition due diligence with an FCPA component whenever possible.

- Rigorous Compliance Program Requirements: The DOJ cited numerous compliance program deficiencies, supporting the agencies' stance that the FCPA's internal accounting controls provision requires companies to have in place an effective compliance program, which is arguably broader than what the plain language of the statute and the legislative history suggests.

Layne Christensen Agrees to SEC Administrative Settlement

On October 27, 2014, the SEC announced its settlement with Layne Christensen Company ("Layne Christensen"), a global water management, construction, and drilling company. As discussed below, the underlying charges arose out of improper payments made to foreign officials in several African countries in violation of the anti-bribery, books and records, and internal controls provisions of the FCPA. Under the terms of the settlement, Layne Christensen agreed to pay disgorgement of $3,893,472.42, prejudgment interest of $858,720.68, and a civil money penalty of $375,000, totaling just over $5.1 million. As reported in the FCPA Autumn Review 2014, Layne Christensen had previously set aside $5.3 million for an anticipated settlement with the SEC.

As described in the SEC's cease and desist order ("the SEC Order"), Layne Christensen's liability stems from payments made "through its wholly-owned subsidiaries in Africa and Australia." The requisite knowledge was fulfilled by the actions of the president of Layne Christensen's Mineral Exploration Division ("MinEx"). The MinEx President, who was based in Salt Lake City, Utah, was a corporate officer of Layne Christensen and reported directly to Layne Christensen's CEO. As described in the SEC order, the MinEx President had knowledge of, and in some instances authorized, the improper payments at issue.

The two types of payments at issue were (a) payments to achieve favorable tax treatment and (b) payments to reduce customs duties and obtain customs clearance.

With respect to the former, the SEC Order states that between 2005 and 2009, through its subsidiaries, Layne Christensen paid bribes to foreign officials in the Republic of Mali, the Republic of Guinea, and the Democratic Republic of the Congo ("DRC"), resulting in $3.2 million in improper tax savings. In Mali and the DRC, the SEC Order recounts, the payments were made through a local agent, and in Guinea they were made through two lawyers retained at the suggestion of tax authorities. In all three countries, the MinEx President was made aware of substantial savings but did not question how the tax savings were achieved. Indeed, the SEC Order asserts that in the DRC, the MinEx CFO sought and obtained the MinEx President's approval to retain a lawyer as a local agent.

With respect to the customs payments, the SEC alleged that between 2007 and 2010, through its customs clearing agents, Layne Christensen made multiple improper payments to customs officials in Burkina Faso and the DRC and various smaller payments totaling more than $10,000 to foreign officials through various customs and clearing agents in the Republic of Tanzania, Burkina Faso, the Republic of Mali, Mauritania, and the DRC. Moreover, between 2006 and 2010, Layne Christensen, through its subsidiaries, made more than $23,000 in cash payments to police, border patrol, immigration officials, and labor inspectors in Burkina Faso, Guinea, Tanzania, and the DRC.

In Burkina Faso, the SEC Order alleges that the subsidiary retained a former customs clearing agent to negotiate a reduction in a customs assessment from $2 million to less than $300,000. The MinEx President approved payment of the negotiated customs assessment and a $100,000 commission to the agent. In the DRC, the SEC Order asserts, the subsidiary made improper payments to obtain customs clearance to import equipment and to export goods and equipment. The subsidiary hired the nephew of a DRC official and a customs clearance agent who was managed by a brother of that official. The SEC Order states that the MinEx president was told by the subsidiary's finance manager that someone "more connected" had been found to "get things moving for us."

Noteworthy Aspects

- Subsidiary Actions Create Liability for Parent Company: Layne Christensen provides an example of how a parent company may be held liable for actions undertaken "through its subsidiaries." Notably, the actions of the American-based MinEx President provided the requisite knowledge.

- Lawyers Not Immune to Corruption Risks: This action provides another example that lawyers can pose a corruption risk, particularly when acting as third-party intermediaries or consultants. As reported in our FCPA Spring Review 2012, Jeffrey Tesler, a British attorney, acted as an agent for a joint venture, TSKJ, helping to negotiate and pay bribes to Nigerian officials. The OECD Bribery Report, discussed below, also found that 6% of all bribery cases involve lawyers as intermediaries.

- Strong Cooperation, DOJ Declination: Despite the direct connection to the United States, through the MinEx President, as reported in the FCPA Autumn Review 2014, the Department of Justice declined to file charges following its investigation into potential FCPA violations. The declination may reflect a benefit from Layne Christensen's voluntary disclosure and its "high level of cooperation," as described by the SEC, including producing English language translations of documents, making foreign witnesses available for government interviews, and sharing summaries of witness interviews and reports prepared by forensic consultants. In addition, Layne Christensen strengthened its internal compliance program and hired full-time compliance personnel. And rather than having a monitorship imposed as part of its settlement with the SEC, the Company is required to self-report to the SEC periodically on its FCPA and anti-corruption remediation and compliance measures. The imposition of self-monitoring may reflect another benefit of Layne Christensen's high cooperation.

Actions Against Individuals

Two Direct Access Partners Executives Plead Guilty to Giving Kickbacks to Venezuelan Bank Official

On December 17, 2014, former Direct Access Partners ("DAP") executives Benito Chinea and Joseph DeMeneses pleaded guilty to conspiring to violate the anti-bribery provisions of the FCPA. According to a DOJ Press Release, Chinea and DeMeneses each pleaded guilty to one count of conspiracy to violate the FCPA and the Travel Act before U.S. District Judge Denise L. Cote of the Southern District of New York. Collectively, they agreed to pay over $6 million in forfeiture: Chinea agreed to pay $3,636,432 and DeMeneses agreed to pay $2,670,612. Both executives will be sentenced on March 27, 2015. As outlined in our FCPA Summer Review 2014, the U.S. charged Chinea and DeMeneses in April 2014 for their role in concealing multi-million dollar kickback payments to Maria de los Angeles Gonzalez de Hernandez, an official in Venezuela's state-owned development bank, to direct investment business to DAP.

SEC Sanctions Two Former FLIR Employees for FCPA Violations

On November 17, 2014, the SEC announced sanctions against two former employees of Oregon-based defense contractor FLIR Systems Inc. ("FLIR") for violations of the anti-bribery and internal controls provisions of the FCPA in connection with a scheme to provide expensive travel, entertainment, and gifts to officials of the Saudi Arabian Ministry of the Interior ("MOI") in order to acquire new business and retain existing business. In addition, the two employees later provided false explanations and documentation to the company in an attempt to conceal the true value of the gifts.

As stated in the SEC's Cease and Desist Order, Stephen Timms and Yasser Ramahi, without admitting or denying the findings agreed to settle the SEC's charges and pay financial penalties of $50,000 and $20,000 respectively for their roles in the scheme. In addition to the anti-bribery and internal controls violations, the SEC's order found that Timms and Ramahi, both U.S. citizens and former employees in the sales department of FLIR's Dubai office, also caused FLIR's violations of the FCPA's books and records provisions when they submitted false documentation to cover their misconduct.

According to the SEC's order, in November 2008, FLIR was actively involved in contracting with the MOI for the sale of thermal binoculars and security cameras. The contract for thermal binoculars required FLIR's Boston office to conduct a "Factory Acceptance Test" as the final step before delivery of the product. This test was a required condition to the fulfillment of the contract. In March 2009, several months before the factory test, Timms and Ramahi traveled to Saudi Arabia and provided five MOI officials each with a luxury watch, a total expense of approximately $7,000 in hopes of securing additional sales of FLIR's equipment. In June 2009, Timms and Ramahi arranged for key MOI officials, including two who received the luxury watches, to go on a "world tour" both before and after the factory test in Boston. This "world tour" included 20 nights of luxury travel to Paris, Dubai, Beirut, and New York City and entertainment with all expenses paid exclusively by FLIR.

As noted in the settlement papers, FLIR's finance department flagged the $7,000 expense reimbursement request for the watches during an unrelated audit. In response, Timms and Ramahi procured a fabricated invoice and directed FLIR's third-party agent to provide false information indicating that the cost of the watches was actually 7,000 Saudi Riyal instead of U.S. $7,000. When questioned about the "world tour" expenses, Timms and Ramahi claimed that they were also a mistake and provided additional fabricated expense documents to mislead the finance department as to the true cost of the trip.

Finally, the SEC's order notes that in the year before the trip to Saudi Arabia, both Timms and Ramahi had received specific FCPA training on the provision of prohibited gifts and travel. There has been no corporate action against FLIR stemming from these events; however the SEC has noted that its investigation is ongoing.

DOJ Reaches $30 Million Asset Forfeiture Settlement with Equatoguinean Vice President

On October 10, 2014, the DOJ issued a press release announcing that it had reached a settlement of its civil forfeiture cases against U.S.-based assets owned by Teodoro Teodoro Obiang Mangue, the Second Vice President of the Republic of Equatorial Guinea ("E.G."). The DOJ sought forfeiture of the assets on the grounds that Teodoro Obiang purchased them using the proceeds of corruption. While the investigation has not led to any criminal charges against Teodoro Obiang, he will be required to give up roughly $30 million in the form of a Ferrari automobile, Michael Jackson memorabilia, and a Malibu mansion.

As Second Vice President and the son of E.G.'s long-time ruler, Teodoro Obiang holds significant power in the small, West African nation. Before his appointment as Second Vice President in 2012, Teodoro Obiang served as the country's Minister of Forestry and Agriculture for several years, a position in which the DOJ alleged he was able to abuse his authority for significant financial gain. Teodoro Obiang's position gave him oversight of the nation's most lucrative industries -- oil, gas, and timber -- which have produced billions of dollars in revenue in the last several years alone. Little of this wealth has reached the general Equatoguinean populace. The DOJ alleged that Teodoro Obiang, for his part, engaged in extensive corruption, drawing money away from the people of E.G. and funding his lavish lifestyle.

According to the DOJ, Teodoro Obiang's specific acts of corruption included extortion, bribery, and misappropriation of funds. The government's complaint states that Teodoro Obiang required timber companies to pay him personal fees in order to obtain licenses and gain access to forests. He then regularly levied illegal "taxes" that the companies had to pay in order to continue their business activities. Teodoro Obiang also allegedly misappropriated public funds by fixing construction bids so he would personally receive millions of dollars from contracts between construction companies and the E.G. government, and he diverted Forest Ministry funds into a private bank account. To conceal these activities, Teodoro Obiang created shell companies, which he claimed were the actual sources of his wealth. These shell companies, in turn, enabled Teodoro Obiang to deceive American banks about the sources of his wealth, funnel his money into the United States, and make the multi-million dollar purchases at the center of the government's forfeiture case.

American investigations of Equatoguinean government corruption stretch back to the early 2000s, when the U.S. Senate's Permanent Subcommittee on Investigations ("PSI") uncovered the Obiang family's practice of concealing ill-gotten gains in American banks. A 2004 PSI report exposed Riggs Bank's complicity in the Obiang family's scheme, and the bank itself later pled guilty, paying $41 million in fines and penalties. The PSI report moved the E.G. government to make some cosmetic changes, but the government did little to curb the corruption that was the focal point of the Senate's investigation. In response to the report, U.S. financial institutions became unwilling to deal with the Obiangs. However, through further use of shell companies and intermediaries, Teodoro Obiang deceived American banks and continued transferring his money into the United States to fuel his lavish lifestyle.