FCPA Autumn Review 2013

International Alert

Introduction

The third quarter of 2013 was notable mostly for a continued focus by the U.S. Department of Justice (DOJ) and Securities and Exchange Commission (SEC) on individuals in Foreign Corrupt Practice Act (FCPA) matters, some "firsts" in anti-corruption enforcement in several countries, and developments in U.S. courts related to the reach and interpretation of the SEC's Dodd-Frank whistleblower protections.

U.S. Agency Activity

The third quarter of 2013 brought no new corporate dispositions. However, two cases from investigations that had already been publicly disclosed (Diebold, discussed below, and Stryker, to be discussed in out next Review) showed that the agencies continue their efforts to close ongoing investigations against companies. Both cases focus on the provision of improper gifts, hospitality, and entertainment, signaling that, despite some clarifications provided in the agencies' FCPA Resource Guide, these issues remain as critical risk areas.

A number of individuals reached dispositions in their cases with the agencies – almost all derived from earlier corporate dispositions. (The former Alstom employees are the exception, though the company reportedly remains under U.S. investigation.) However, consistent with previous cases, a number of individual defendants have chosen to challenge the agencies in court proceedings, providing the possibility of future court precedent related to enforcement interpretations of the FCPA and related statutes.

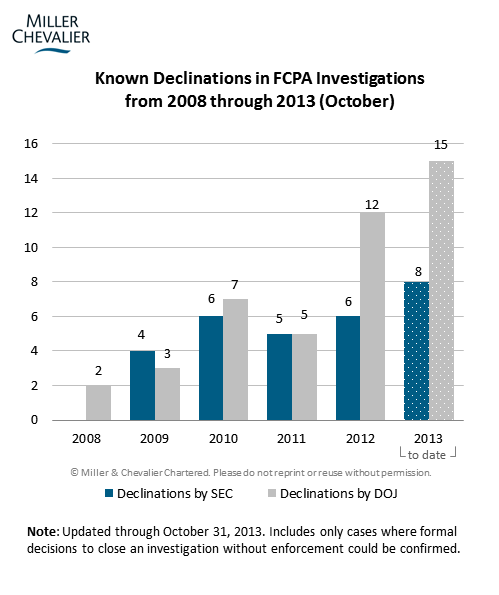

Continuing a relatively new, but growing trend, a variety of companies publicly announced declinations in their reported FCPA investigations. Most notably, six companies noted the end of inquiries into their Libyan business, triggered by information made available after the fall of the Qadaffi regime. These announcements make 2013 a record year for such public announcements (see the chart and article below).

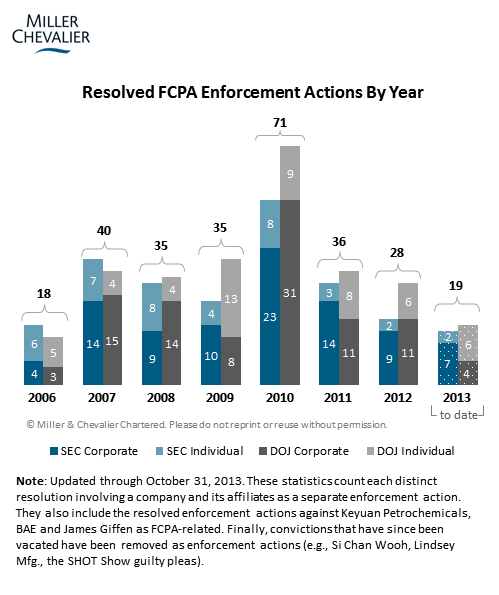

The chart below updates the overall case statistics through the third quarter:

International Developments

The quarter saw the first formal prosecution of an individual under the Canadian Corruption of Foreign Public Officials Act (CFPOA) and the U.K. Serious Fraud Office's (SFO) first formal charges under the U.K. Bribery Act – both significant enforcement milestones for those countries' anti-corruption efforts. Other cases, including a French court's acquittal of Total and almost 20 of its executives in July and the ongoing Chinese investigation of GlaxoSmithKline discussed below, illustrate the need for multinational companies to globalize their anti-corruption efforts and focus. Both matters show that corruption cases brought in other countries can create potential impacts equal to, or perhaps greater than, the risks from U.S. investigations.

Dodd-Frank's Whistleblower Rules

The whistleblower protection rules promulgated by the SEC under the Dodd-Frank financial reform legislation have had a significant impact on public companies' FCPA compliance programs, as discussed in our FCPA Winter Review 2011 and FCPA Summer Review 2011. As discussed below, several court decisions this quarter addressed key aspects of those rules, including their extraterritorial reach. The Fifth Circuit's Asadi decision sets up a split among the circuits regarding the provisions' application in instances where whistleblowers did not report their concerns to the SEC. That split will almost certainly lead to further litigation on this issue; in the meantime, companies should carefully evaluate which legal interpretations might apply to their operations, and have a plan for addressing potential conflicts.

Corporate Cases

Diebold Settles Anti-Bribery Books and Records Violations with the DOJ and SEC

On October 22, 2013, the DOJ and SEC announced the settlement of FCPA related charges against Diebold, Inc., related to the conduct of Diebold's subsidiaries in China, Indonesia, and Russia. The ATM manufacturer based in North Canton, Ohio, was charged with conspiring to violate the FCPA's anti-bribery and books and records provisions and violating the FCPA's books and records provisions. Pursuant to the settlement agreements, which included a three-year Deferred Prosecution Agreement (DPA) with the DOJ, Diebold agreed to pay a $25.2 million criminal penalty and $22.9 million in disgorgement and prejudgment interest. Diebold also agreed to implement rigorous internal controls and to appoint an independent compliance monitor for a minimum of 18 months.

According to the SEC complaint, between 2005 and 2010, Diebold Financial Equipment Company (China), Ltd. ("Diebold China") and P.T. Diebold Indonesia ("Diebold Indonesia") spent approximately $1.8 million on improper travel, entertainment, and gifts for senior officials of government-owned banks in China and Indonesia. Many of the functionaries were senior officials with influence over the banks' purchasing decisions. According to the complaint, in one case, a Diebold Indonesia supervisor approved a trip to Europe with a bank official with the hope that the trip would secure the company's success in an upcoming bid. The improper travel and entertainment included leisure trips to Bali, Paris, Rome, the Grand Canyon, Los Angeles, and Las Vegas, among other locations; sightseeing jaunts to amusement parks and wine country; and a dance performance in Las Vegas. In addition, Diebold China provided improper gifts to Chinese officials, including annual cash gifts of several hundred dollars for dozens of officials. The complaint noted that the improper travel, entertainment, and gift expenses were falsely recorded in the company's books and records as training or other legitimate business costs. According to the agencies, Diebold executives in Asia were aware of the improper expenditures and, in some cases, approved them or accompanied the officials on the leisure travel and entertainment excursions. Further, despite receiving FCPA training in 2007, some executives took steps to conceal the nature of the trips and, in at least one case, provided false information to Diebold's auditors in China.

In addition to the allegations of improper travel, entertainment, and gifts, the SEC complaint claimed that between 2005 and 2008, Diebold Self-Service Ltd. ("Diebold Russia") paid at least $1.2 million in kickbacks to employees of private banks in Russia in connection with ATM sales. Diebold Russia used false service contracts with a distributor to funnel the funds to the private banks.

The complaint notes that as early as 2007, Diebold was aware of corruption allegations relating to its operations in China and Russia. In 2007, a Chinese regional authority, the Chengdu Administration of Industry & Commerce, opened an investigation of Diebold concerning, among other issues, leisure travel and gifts provided to bank officials. According to the agencies, two Diebold Asia executives who were involved in providing the improper travel and entertainment managed Diebold's response to the investigation and payment of an administrative penalty to settle the investigation without corruption charges being filed. Thereafter, the improper expenditures continued into 2010. The public documents also state that in 2007, during pre-acquisition due diligence of Diebold's Russian distributor, Diebold discovered that the distributor made illicit payments to employees of Diebold's bank customers. A Diebold Asia executive, as well as legal and corporate executives, learned of the discovery and the acquisition was halted. Nonetheless, no further steps were taken to investigate or remediate the matter, and Diebold continued to do business with the distributor until 2010.

In July 2010, Diebold announced that the company was investigating possible FCPA violations in Russia and that the company had voluntarily disclosed the potential violations to the DOJ and SEC. The announcement did not specify the conduct under review, merely noting that it primarily implicated the FCPA's books and records provisions and had been identified during pre-acquisition due diligence of Diebold's Russian distributor. Subsequently, Diebold removed five executives from its Russian operations, terminated its relationship with the distributor, and announced plans to build the Russian operations without third party assistance.

According to later press reports, Diebold discovered potential FCPA violations in its Asia-Pacific operations.

Noteworthy Aspects

- Public announcement of agreement in principle: In August 2013, Diebold announced an agreement in principle with the DOJ and SEC to settle FCPA-related charges. The public disclosure by a company of an agreement in principle in these cases can be driven by a number of factors, including an assessment of the materiality of the information, the timing of regular reporting updates required under securities laws, and a desire to provide clarity to investors and the market regarding the quantum of liability and related impacts on the company as a result of a long-standing investigation. In practice, companies clear any disclosure with the agencies prior to making any announcement. There have been a number of past announcements of agreements in principle. One instance involved an industry-wide investigation: Panalpina customer Tidewater first announced an agreement in principle to settle bribery charges months before enforcement officials publicized the settlement of bribery charges against Panalpina and six customers, including Tidewater. (see our FCPA Winter Review 2011) In another instance, as reported in our FCPA Spring Review 2010 and our FCPA Summer Review 2011, enforcement officials reached an agreement in principle with Alcatel-Lucent months before formalizing the settlement of FCPA charges against Alcatel-Lucent and three subsidiaries.

- Previous SEC Settlement: Shortly before it announced the FCPA investigation and voluntary disclosure, Diebold in June 2010 settled an enforcement action with the SEC for non-FCPA related books and records violations and agreed to pay a penalty of $25 million. The former CEO, CFO, Controller, and Director of Corporate Accounting were implicated in underlying allegations that between 2002 and 2007, the company manipulated its earnings to meet financial performance forecasts and made material misstatements and omissions in dozens of SEC filings and press releases.

- Lavish Travel and Entertainment: Large-scale and lavish non-business related travel and entertainment in China were the subject of Lucent Technologies' 2008 FCPA settlement. Lucent improperly recorded the expenses for the trips to Niagara Falls, Disneyland, and the Grand Canyon as "factory inspections" or "training," even after Lucent no longer owned any factories. A number of other recent cases, including Ralph Lauren, Orthofix, Eli Lilly, and the 2011 IBM case all included allegations of improper gifts and entertainment, among other issues.

Increased Number of Reported Declinations

As discussed in previous Reviews, the pace of reported declinations - instances in which an agency decides to close an FCPA investigation without pursuing enforcement - continued to increase through 2013. Since our discussion in our last Review, eleven declinations involving another ten companies have become public, each discussed further below. Interestingly, most of the declinations related to companies probed in industry-wide sweeps — of the oil, medical device/pharmaceutical, and defense products industries.

Oil Companies (Exxon Mobil Corporation, Marathon Oil Corporation, ConocoPhillips, Occidental Petroleum Corporation, Total SA, and Eni S.p.A): Throughout the Spring and Summer of 2013, the SEC announced that it would take no action against at least six of the seven oil companies known to be under scrutiny for possible FCPA violations. This news, relayed to the companies directly via letter, came two years after the SEC had launched a probe into these companies' dealings with the regime of former Libyan leader Muammar Gaddafi.

Medtronic: According to Medtronic's SEC filings this summer, the SEC and DOJ informed the company this June that it was no longer the target of a U.S. foreign bribery probe. Medtronic was among the companies the government was reviewing in an industry wide sweep of medical device makers that was initiated in 2007.

Stryker: According to the Wall Street Journal, the DOJ advised Strkyer that it had closed its investigation of the company. Stryker did not, however, receive a declination from the SEC. Along with Medtronic, Stryker was among the companies the government was reviewing in an industry wide sweep of medical device makers that was initiated in 2007.

Owens-Illinois: DOJ informed Owens in July 2013 that the agency did not intend to pursue criminal enforcement against the company and was closing its inquiry into the matter. Owens had self-reported both to the DOJ and the SEC in October 2012. There is no publicly available information as to whether the SEC has similarly decided to close the matter.

Allied Defense Group Inc.: The company announced in August that they had learned earlier that month that the DOJ had concluded its investigation into the firm. The announcement came almost three years after the DOJ served the company a subpoena after an employee of its subsidiary was arrested in connection with a massive foreign bribery sting operation. The employee and 21 executives of other defense product companies were charged with participating in a scheme to pay an FBI agent posing as an official of Gabon. The government dropped the case after three acquittals and two mistrials, but the industry-wide review of defense products companies continued. The SEC had previously dropped its investigation into Allied in November of last year.

Actions Against Individuals

Three DAP Executives Plead Guilty to FCPA Charges

As discussed in our FCPA Summer Review 2013, the DOJ filed criminal charges against three Direct Access Partners (DAP) for their involvement in an alleged bribery scheme to direct bond trading business for Venezuela's state economic bank to DAP. Tomas Alberto Clarke Bethancourt ("Clarke") and Jose Alejandro Hurtado ("Hurtado") were charged on May 7, 2013, with conspiracy to violate the FCPA's anti-bribery provisions, violation of the FCPA anti-bribery provisions, conspiracy to commit money laundering, money laundering, conspiracy to violate the Travel Act, and violations of the Travel Act. On June 12, 2013, Ernesto Lujan ("Lujan") was similarly charged.

On August 29, 2013, Clarke and Lujan entered a guilty plea in New York federal court admitting all six counts alleged in the complaints. Hurtado entered his plea on August 30, 2013. Interestingly, each man also pleaded guilty to additional charges of conspiring to violate the FCPA in connection with bribes allegedly paid to a second state-owned Venezuelan bank, Banfoandes, as well as conspiracy to obstruct an SEC investigation by destroying emails. According to a DOJ press release, Lujan, Clarke, and Hurtado paid bribes to a Banfoandes official from 2008 through mid-2009 in exchange for directing financial trading business to DAP.

On September 16, 2013, a federal judge granted the government's request to stay its civil forfeiture action against Clarke, Hurtado, and Lujan until the DOJ's criminal cases have been resolved. In August, the government had similarly moved to stay the SEC's civil case.

Sentencing for Lujan and Clarke is scheduled for February 11, 2014, and Hurtado is scheduled to be sentenced on March 16, 2014. All three men face up to five years in prison for the FCPA and Travel Act-related offenses and up to 20 years for the money laundering violations.

Second Alstom Executive Pleads Guilty to FCPA Violations; Another Charged

On July 29, 2013, Frederic Pierucci, a French citizen and former Vice President of Global Sales for the Connecticut-based U.S. subsidiary of French power and transportation conglomerate Alstom, pleaded guilty to one count of conspiring to violate the FCPA and one count of substantively violating the FCPA for his role in an alleged scheme to pay foreign officials in Indonesia. He was allegedly one of several Alstom employees responsible for authorizing the payments made to Indonesian officials. As discussed in our FCPA Summer Review 2013, Pierucci (along with other former employees) had been charged in an April 30, 2013, superseding indictment with multiple counts of bribery and money laundering. He is the second Alstom executive to plead guilty for allegedly bribing Indonesian officials. David Rothschild, former Vice President of Sales for Alstom USA, pleaded guilty on November 2, 2012, to one count of conspiracy to violate the FCPA.

The next day, on July 30, 2013, the DOJ charged Lawrence Hoskins, a former senior executive of Alstom, in relation to his alleged participation in the Indonesian bribery scheme. In a second superseding indictment filed in federal court in Connecticut, Hoskins, a former Senior Vice President for Alstom Asia, was charged with conspiracy to violate the FCPA and to launder money, in addition to substantive charges of FCPA and money laundering. William Pomponi, another former Alstom executive who was previously charged in the superseding indictment filed on April 30, 2013, was subsequently charged along with Hoskins in the second superseding indictment (see our FCPA Summer Review 2013).

According to the second superseding indictment, Hoskins and Pomponi (along with others, including Pierucci and Rothschild) used outside consultants to bribe members of both the Indonesian Parliament and the state-owned Indonesian electricity company Perusahaan Listrik Negara (PLN) in exchange for favorable treatment in obtaining a $118 million power-services contract called the Tarahan Project. PLN was responsible for awarding the contract, which would provide power-related services to the citizens of Indonesia.

The DOJ's indictment includes an extensive discussion of electronic communications among the defendants about the alleged acts in question. According to the indictment, to facilitate the bribes, Alstom (through its executives) allegedly retained two consultants whose primary purpose was not to provide legitimate consulting services, but instead to pay bribes to Indonesian officials who had the ability to influence the award of the Tarahan Project contract. The DOJ alleges that Alstom and its consortium partner retained the first consultant, Consultant A, around 2002 and required him to pay bribes to various Indonesian officials out of a 3 percent commission he received for his services. Nearly $1 million was wired to Consultant A's Maryland bank account for this purpose. As noted in the indictment, around September or October 2003, Hoskins, Pomponi, and others became aware through internal employee emails that "PLN [had] expressed concerns over [the] agent . . . [and] whether they can count on the agent or not in regards to [the] ‘rewards' issue." The DOJ alleges that a short time later, Hoskins and others met with Consultant A in Indonesia and informed him that Alstom was going to retain another consultant to bribe PLN officials, and that Consultant A would thereafter only be responsible for bribing a member of the Indonesian Parliament. Consultant A's commission was subsequently reduced to 1 percent.

According to the indictment, Consultant B was hired at a 2 percent commission for services relating to bribing PLN officials; however, he required 95 percent of his payment be "up front" within the first twelve months of his contract rather than on a pro-rata basis. Although this payment schedule deviated from Alstom's usual method of compensating its consultants, Consultant B communicated that he was willing to fulfill his commitment "up front [in order to] get the right ‘influence.'" The DOJ submission notes that both Pomponi and Hoskins agreed that the terms of the contract were "lousy," but felt they "had no choice." An email between Hoskins and Pomponi further noted that the "mode of payment [was] necessary for the continuation of Consultant B's effectiveness." Over $1 million was subsequently wired to Consultant B's account in Singapore, and Alstom was successful in securing the Tarahan Project.

On October 8, 2013, Pomponi filed a series of motions requesting that the prosecution disclose trial exhibits, exculpatory evidence, and a bill of particulars supporting the government's allegations. In addition, Pomponi filed a motion seeking discovery of all evidence, including the "nature, date and place of any criminal offense or misconduct" that prosecutors intended to introduce under Rule 404(b) of the federal rules of evidence. Pomponi argued that because the admissibility of such evidence fell within the judge's discretion, the government should not have relied on it to make its case. As in the Africa "sting" case, Pomponi's counsel hopes to persuade the court, if necessary, not to admit any evidence of prior misconduct. As of the publication of this Review, Pomponi's motions are still pending before the court.

Former Digi CFO Settles SEC Action

On July 2, 2013, the SEC announced that it had settled an action against Subramanian Krishnan, the former Senior Vice President and Chief Financial Officer of Digi International, Inc. ("Digi").

Digi – a Minnesota-based company that develops wireless networking solutions – disclosed in its May 10, 2010, 10Q SEC filing that it was conducting an internal investigation into allegations of possible violations of its "gifts, travel and entertainment policy in the Asia Pacific region by a few employees." The filing stated that the investigation included a review of possible FCPA violations and that the company had voluntarily disclosed the matter to the DOJ and SEC. Shortly before that disclosure, Mr. Krishnan had resigned from his position as Digi's CFO.

On August 2, 2010, Digi announced that the DOJ and SEC would not initiate any enforcement proceedings or seek any monetary or other sanctions against the company.

Then, on September 28, 2012, the SEC filed a partially settled civil injunctive action against Mr. Krishnan in federal district court in Minnesota. The related SEC complaint alleged, among other things, that Mr. Krishnan allowed corporate funds to be used to pay for unauthorized personal expenses for Digi employees, approved expenses that "appeared to have marginal, if any business purpose," approved expenses that should have been approved by the CEO in violation of company policy, approved cash payments without supporting documentation or explanation, made "untrue" representations to the SEC about the effectiveness of Digi's internal controls, and made "untrue" representations to Digi's outside auditor.

In the complaint, the SEC asserted that, as a result of these actions, Mr. Krishnan had personally violated and aided and abetted Digi in violating several sections of the Securities Exchange Act, including the FCPA's books and records provisions by: filing reports and certifications with the SEC containing untrue statements; failing to make and keep accurate books and records; failing to maintain a system of internal accounting controls or circumventing the system of internal controls; and making false and misleading statements to an accountant.

That same day, Mr. Krishnan, without admitting or denying the SEC's allegations, consented to a final judgment permanently enjoining him from future violations of the Securities Exchange Act, including several provisions of the FCPA, and barring him from serving as an officer or director of any issuer. The Minnesota district court issued a partial judgment to that effect on October 17, 2012. On July 2, 2013, the court issued a final judgment ordering Mr. Krishnan to pay a civil penalty in the amount of $60,000.

None of the pleadings in this case suggest that any payment was made to a foreign official; instead, the alleged underlying FCPA books and records violations stem largely from unsupported travel and entertainment expenses incurred by Digi employees that lacked a business purpose. The settlement with Mr. Krishnan confirms that, as in some past cases, the SEC will hold companies and/or individuals to account for books and records and controls failings that fail to adequately account for the disposition of assets, whether or not such funds can be shown to have funded improper payments.

Ninth Circuit Denies Greens' Appeal of Restitution Order

In the latest chapter of the long-running saga of the prosecution of Gerald and Patricia Green, who were sentenced to six months in prison for paying bribes to a tourism industry official in Thailand (see our FCPA Autumn Review 2011, FCPA Autumn Review 2010, FCPA Winter Review 2010, FCPA Autumn Review 2009, FCPA Spring Review 2009, and FCPA Autumn Review 2008), the Ninth Circuit on July 11, 2013, denied the Greens' appeal for relief from the restitution they were ordered to pay as a result of their conviction.

In August 2010, in addition to their prison sentences (the length of which was first appealed by the DOJ, though that appeal was later dropped – see our FCPA Autumn Review 2011), the sentencing judge ordered the Greens to pay $250,000 in restitution. In appealing that aspect of the sentence, the Greens argued to the appellate court that the statutory basis for restitution in this type of case – a jury finding of "an identifiable victim or victims who suffered a pecuniary loss" – was not present. The sentencing judge had made such a finding, but the Greens argued that only a jury could do so, citing two Supreme Court cases. The Ninth Circuit held that the cited case law did not apply to restitution cases in the circuit, and thus affirmed the order.

Ongoing Investigations

GlaxoSmithKline Facing Anti-Corruption Investigations in China and the United States

The third quarter of 2013 brought a flurry of bad news for GlaxoSmithKline and its China business. According to press reports, during the last week of June, Chinese police detained GSK employees in Beijing, Shanghai, and Changsha for what the police at the time called "suspected economic crimes." Less than two weeks later, on July 11, 2013, the Chinese Ministry of Public Security publicly announced that "[GSK] suspects [have] fully confessed their crimes," and that "Public Security has found that in recent years, GSK China Investment used various channels like travel agencies to bribe without restraint government officials, drug associations, medical foundations, hospitals and doctors." In later announcements, the Ministry publicly accused GSK of being a criminal "godfather" that used a network of more than 700 middlemen and travel agencies to funnel nearly RMB 3 billion ($500 million) in kickbacks to doctors, hospitals, and other groups that prescribed the company's medicine.

As a part of its investigation, the Ministry of Public Security detained four high-level executives of GSK China and arrested at least 18 other employees. In the months following their detention or arrest, Chinese official news sources made additional, detailed allegations against GSK, often featuring interviews with or quoting these GSK China employees. For a period of time, Chinese authorities also prohibited GSK's finance chief for China, a U.K. national, from leaving China. According to China's official news outlet, Xinhua, GSK's operations in China were nearly paralyzed and many Chinese sales representatives left the firm.

In September, Xinhua asserted that "[i]t is becoming clear that [the corrupt conduct was] organized by GSK China, rather than [being] . . . sales people's individual behavior." The People's Daily echoed the position and alleged that GSK China "had turned a blind eye to illegal behavior." Reportedly, the Chinese central government is considering whether to impose massive fines on GSK, and the Ministry of Public Security has reportedly commented, with respect to the investigation, that "[w]e should learn from the practice of other countries in imposing astronomical fines."

Across the Pacific, GSK confirmed at the beginning of September that U.S. authorities, who were already investigating GSK for alleged FCPA violations in other countries, have initiated a new line of inquiry into the Chinese bribery allegations.

Specific Allegations Against GSK

The Chinese authorities' allegations against GSK echo those made by the SEC and/or DOJ in past prosecutions of other pharmaceutical companies for alleged corruption in China, such as the prosecution of Eli Lilly (reported in FCPA Winter Review 2013) and Biomet (reported in FCPA Spring Review 2012). As detailed in press stories, key allegations reportedly made against GSK include:

- Under the guise of expenses for seminars, GSK China sales representatives used GSK funds to pay for massages and sauna treatments, as well as prostitutes, for Chinese doctors. Xinhua quoted a GSK China sales representative who claimed that "half [of] the seminars were fake."

- GSK China employees paid doctors for lectures that they did not actually deliver, and some GSK China employees forged lecture materials in order to obtain reimbursements from the company.

- Doctors earned a seven to 10 percent "cut" from sales of GSK drugs they prescribed. One press report noted that "[e]ach doctor had a credit card from the company. The kickbacks were transferred to the cards the day after the drugs were prescribed."

- GSK China employees used false receipts to skirt company policies.

- GSK China managers themselves took kickbacks from colluding travel agencies, including reported "sexual bribery" provided to GSK China's managers.

- GSK China had set up a special team dedicated to maintaining relationships with key hospital officials, with an annual budget of nearly RMB 10 million.

- Local managers attempted to hide illicit payments by instructing sales staff to use only private, non-GSK email addresses to discuss improper marketing strategies.

Anti-Corruption Investigation with Chinese Characteristics

It appears that pharmaceutical companies operating in China are facing an "industry sweep," to borrow a popular U.S. FCPA investigations term, initiated by Chinese authorities and targeted at alleged corruption and antitrust violations. According to press reports, Chinese authorities contacted at least nine other companies in addition to GSK about potential corruption and/or antitrust violations. These investigations provide some hints of the difficulties that international companies should expect in other corruption investigation by Chinese authorities:

- Investigative Procedures: While SEC or DOJ attorneys manage all FCPA investigations in the United States, GSK is being investigated in China by the Ministry of Public Security, essentially the central government's police force. Chinese criminal procedures used during the GSK investigation, including detention, arrest, and interrogation without legal representation, apply different conceptions of legal process and may be jarring to those more familiar with U.S. government practices in FCPA cases.

- Multiple Authorities not Coordinating Together: Unlike the comparatively close coordination between the SEC and the DOJ in prosecuting a single company for alleged FCPA violations, distinct Chinese government entities with authority to investigate corruption allegations do not necessarily coordinate with each other when investigating the same company. GSK is being investigated by the Ministry of Public Security. Other authorities that are reportedly investigating corruption allegations against other international pharmaceutical companies include: local public security bureaus, State Administration of Industry and Commerce and its local counterparts, and the Ministry of Health and its local counterparts.

- Trial by Media: Chinese official media outlets have had regular access to detained or arrested GSK employees and have published quotes and interviews that are virtual confessions, even though none of those employees have been convicted, or even formally charged in some cases. In addition, while the whistleblower in GSK's case did not do so, whistleblowers of at least three other international pharmaceutical companies have made their allegations public through the news media. While none of GSK, GSK China, nor any of their employees has been charged or convicted of corruption, GSK's third-quarter pharmaceutical sales in China were down by 61 percent, a result the company attributed to local media reports of the bribery scandal.

International Developments

Four Individuals Charged in the SFO's First Bribery Act Cases

On August 14, 2013, the SFO announced that it had charged three British individuals with the offense of making and accepting a financial advantage in violation of sections 1(1) and 2(1) of U.K. Bribery Act 2010. The SFO also charged the three individuals and a fourth British individual with conspiracy to commit fraud by false representation and conspiracy to furnish false information in violation of the U.K.'s Criminal Law Act 1977.

All four individuals involved are connected to Sustainable AgroEnergy Plc, a company that sold biofuel investment products. According to the SFO, the charges stem from £23 million in alleged fraudulent activity in connection with the sale of biofuel investment products between April 2011 and February 2012.

Last year, Sustainable AgroEnergy Plc and its parent company, Sustainable Growth Group, were placed in administration (a procedure similar to Chapter 11 bankruptcy proceedings in the United States). According to press reports, 2,000 investors – many of whom made the investments through their pension plans – may have lost around £40 million after investing in Sustainable Growth Group.

While prior cases have been brought under the Bribery Act, which came into force on July 1, 2011, this is the first formal criminal prosecution brought by the SFO, which is the enforcement body charged with investigating high-value and more complex cases of bribery and corruption.

The four charged individuals appeared before Westminster Magistrates Court on September 23, 2013, and were scheduled for a second court appearance on October 7, 2013.

First CFPOA Prosecution of an Individual: Nazir Karigar

After waiting fifteen years since the enactment of the Corruption of Foreign Public Officials Act (CFPOA) to bring to trial a prosecution of an individual for violating the statute, Canadian authorities made certain that their first case was air-tight. On August 15, 2013, Mr. Nazir Karigar, a Canadian citizen, was found guilty by the Ontario Superior Court of Justice of one count of offering or agreeing to give or offer bribes to India's former Minister of Civil Aviation and other foreign officials associated with India's state-owned airline, Air India, in an attempt to secure a contract from the airline for the provision of facial recognition software and other related security systems.

As stated in the Court's ruling, in 2005, Mr. Karigar approached executives of Cryptometrics Canada, a subsidiary of Cryptometrics Corporation, a U.S. entity, and offered his services and connections with Air India officials to assist Cryptometrics in selling its facial recognition technology to the airline. Mr. Karigar's primary contacts at Cryptometrics were Robert Bell, an engineer and Vice President, Business Development, of the Canadian subsidiary; Mario Berini, the Chief Operating Officer for the Canadian subsidiary and its U.S. parent; and Robert Barra, the CEO of the Canadian subsidiary and the U.S. parent.

As stated in the Court's judgment, the prosecution's case against Mr. Karigar centered on two bribery attempts whose purpose was to influence Air India officials into awarding a security contract worth millions of dollars to Cryptometrics Canada. The first bribe agreed to by the conspirators occurred in June 2006. Mr. Karigar emailed Messrs. Bell and Berini, and asked for $200,000 for the deputy to Air India's Director of Security. Several days later, after another email to the same effect from Mr. Karigar to Mr. Berini, the money was transferred from Cryptometrics' parent company to Mr. Karigar's bank account in Mumbai. According to the Court, this money was intended to ensure that Air India only considered two proposals – one from Cryptometrics and one from a separate entity owned by Mr. Karigar. The latter proposal was engineered by Mr. Karigar and executives at Cryptometrics to be similar to but higher priced than Cryptometrics' own bid. The second bribe occurred in March 2007, when Mr. Barra and Mr. Karigar entered into a Letter of Agreement providing that $250,000 would be transferred to Mr. Karigar's bank account in Mumbai in order to secure the Air India contract.

In the end, neither of these bribery attempts had their intended effect, as Cryptometrics failed to obtain the contract it sought. In August 2007, Mr. Karigar attempted to blow the whistle on his co-conspirators at Cryptometrics by informing the DOJ about the two bribes. A joint investigation between the FBI and the Royal Mounted Canadian Police ensued, culminating in an indictment against Mr. Karigar in 2010.

At Mr. Karigar's trial, the prosecution's star witness was Mr. Bell, who was Mr. Karigar's primary connection with Cryptometrics and who not only had intimate familiarity with the entire course of events, but also scores of emails documenting communications between Mr. Karigar and Cryptometrics officials. Mr. Bell was given immunity by Canadian authorities. In addition to Mr. Bell's testimony, the prosecution also introduced statements made by Mr. Karigar in his disclosure of the bribes to U.S. authorities, as well as statements he made during a meeting in Mumbai in 2007 with Mr. Berini and a Canadian official at the Consulate General for Canada in which he disclosed that bribes had been paid to India's Minister of Civil Aviation. According to the Canadian official, Mr. Karigar stated during that meeting that "we know the [Minister of Civil Aviation] received the money" and "You didn't hear that from us."

In light of this overwhelming evidence against Mr. Karigar, much of which he admitted, his defense relied on two legal positions: that the prosecution was required but failed to show that a foreign public official received the bribes and was induced by them into acting on behalf of Cryptometrics; and that there was no jurisdictional basis for Mr. Karigar's prosecution when much of the activity at issue occurred in the United States or India. The Court rejected both of those defenses. With regard to the former argument, the Court stated: "[i]n my opinion if the word ‘agrees' in the Act is restricted to the act of essentially two parties, ‘one to pay the bribe and one to receive the bribe,' the scope of the Act would be unduly restricted and its objectives defeated." The Court continued, "[m]oreover, to require proof of the offer of or receipt of a bribe and the identity of a particular recipient would require evidence from a foreign jurisdiction, possibly putting foreign nationals at risk and would make the legislation difficult if not impossible to enforce . . . ." The Court also rejected Mr. Karigar's jurisdictional argument, noting that there was more than sufficient evidence that the requisite activity occurred in Canada to justify the Court's jurisdiction.

The Court's decision was issued soon after amendments to the CFPOA were enacted expanding the Act's reach. Two more CFPOA trials are in the pipeline, leading to speculation that Canada is ramping up its foreign bribery enforcement activities to keep pace with the United States and to address some criticisms from the OECD Anti-Corruption Working Group in its Phase 3 report. Speaking of U.S. enforcement activities, although a significant amount of evidence was introduced at Mr. Karigar's trial implicating Cryptometrics' U.S. parent, as well as its COO and CEO, there has been no indication to date that the U.S. government is planning to bring charges against the company or its executives.

World Bank Sanctions Board Overturns Debarment Decision

On June 24, 2013, the World Bank's Sanctions Board overturned a debarment decision by officials at the World Bank ("the Bank"). The decision reinstated privileges for the entity in question - an unnamed Colombian company ("contractor"), which had been previously suspended for 18 months as a result of the Bank's prior decision.

The contractor was initially debarred in December 2011, due to its alleged fraudulent activities related to a project that began in 1999. According to the Board's decision, in December 1999, the Bank and the District of Cartagena de Indias had entered into a loan agreement to finance the project, and at the same time the Bank had entered into an agreement with Aguas de Cartagena, the agency that the District of Cartagena had chosen to carry out the project. Six years later, Aguas had opened a bidding contest for a contract to build a sewage pipe.

The contractor in question submitted a bid for work on the project in 2006, listing the projects it had completed. When Aguas followed up asking for evidence that the experience listed was genuine, the contractor provided a performance certificate. The Bank's investigation arm – the Integrity Vice Presidency ("INT") – later concluded that the performance certificate contained false information and was likely forged. In particular, INT relied on the fact that the certificate provided by the contractor was signed by a signatory who did not have the authority to sign the Certificate, and also concluded that the Certificate contained inconsistencies on its face. Upon the conclusion of the INT's investigation, the Bank determined that debarment was appropriate.

In its decision to overrule the debarment decision, the Sanctions Board found that INT had not met the burden of proof of forgery or false statements on the certificate. The Board cited several reasons, including weaknesses in the evidence presented by INT, as well as concerns with respect to statements (from the person who had signed the allegedly fraudulent certificate) that were relied on by INT in making factual conclusions.

The overturned disciplinary decision was a rare move by the Sanctions Board that raised questions about the methods used in the Bank's anti-corruption investigations that have resulted in its much-lauded debarment record. Though not directly a result of the Colombian decision, the Bank has recently announced that it was opening a "consultation" with external stakeholders about the efficacy of its sanctions system, and the consultation period was running through October 30, 2013. The objective of these consultations is to receive input from the perspective of stakeholders, and recommendations on how to reform the existing processes to better serve the objectives of the system.

Ukraine Revamps Anti-Corruption Law

This past Spring, Ukraine revamped its anti-corruption legislation in order to enhance the government's ability to combat corruption and to create a more transparent business environment. The most significant part of the new law is that it will create corporate criminal liability for both public and commercial bribery. Namely, this means liability will attach for companies whose employees offer to pay bribes to public officials or officers of private companies if the offense was committed "on behalf of" and "in the interest of the company." The legislation also designates asset forfeiture as a penalty for certain corruption offenses and institutes whistleblower protection laws. Further, to increase transparency, the new law requires disclosure of information about corrupt government officials in a country-wide register as well as other revisions and clarifications to Ukraine's existing law to make it easier to prosecute cases of corruption. Various aspects of the new law will go into effect later this year.

Other Developments

Dodd-Frank Whistleblower Actions: Asadi and Liu

On July 17, 2013, the Fifth Circuit ruled that the "whistleblower-protection provision" in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act"), 15 U.S.C. § 78u-6(h), provides a "private cause of action only for those individuals who provide information relating to a violation of the securities laws to the SEC." Asadi v. G.E. Energy (USA), LLC, 720 F.3d 620, 623 (5th Cir. 2013). The plaintiff in this retaliation action reported his suspicions of possible FCPA violations through the company's internal channels, but did not make any disclosures to the SEC, and the Court found this to be dispositive.

The Fifth Circuit's decision stands in contrast to five previous district court decisions, all of which found that the statute is either conflicting or ambiguous and ultimately extended the statute's whistleblower-protection provision even to individuals who did not make disclosures to the SEC. The Fifth Circuit's decision also contradicts the SEC's own regulation, 17 C.F.R. § 240.21-F-2(b)(1), which, according to the Fifth Circuit, "redefines ‘whistleblower' more broadly by providing that an individual qualifies as a whistleblower even though he never reports any information to the SEC, so long as he has undertaken the protected activity listed in 15 U.S.C. § 78-u-6(h)(1)(A)." Asadi, 720 F. 3d at 629. Indeed, recently another district court in Massachusetts specifically noted this contradiction when it ruled in favor of extending protection to an employee who had not reported to the SEC. See Ellington v. Giacoumakis, No. 1:13-cv-11791-RGS, Mem. and Order at 7-8 (D. Mass. Oct. 16, 2013).

The Fifth Circuit's decision in Asadi affirmed the lower court's dismissal of the plaintiff's action, but its ruling was on different terms than the lower court, which had concluded that the statute's whistleblower-protection provision does not apply to extraterritorial activity. That question has now been addressed for a second time by a federal district court in another whistleblower action filed in the Southern District of New York – Liu v. Siemens, A.G., No. 13-0317 (S.D.N.Y.) (Pauley, J.).

In Liu v. Siemens, a former regional compliance officer for a Chinese subsidiary of the company accused Siemens of illegally retaliating against him by firing him after he raised concerns internally that employees of the subsidiary had violated anti-bribery internal controls that Siemens had installed as part of its 2008 plea agreement with the DOJ. After he was terminated, the plaintiff also filed a whistleblower disclosure with the SEC. In late August 2013, in support of its motion to dismiss the complaint, Siemens argued that the whistleblower-protection provision does not apply to foreign citizens complaining of overseas activities. The plaintiff countered that such a reading of the provision would be counter-productive, as it would merely encourage companies to move all of their compliance staff overseas to avoid the provision.

On October 21, 2013, the court sided with the company and dismissed the plaintiff's suit. Liu v. Siemens, No. 13 Civ. 317 (WHP), 2013 U.S. Dist. LEXIS 151005 (S.D.N.Y. Oct. 21, 2013). In its decision, the court noted that only the lower court in Asadi had addressed the extraterritorial application of the Dodd-Frank Act's whistleblower protection provision thus far and had concluded that such an application of the provision was improper. Id. at *6. The Liu v. Siemens court agreed, relying heavily on the Supreme Court decision in Morrison v. Nat'l Austl. Bank Ltd., 130 S. Ct. 2869, 2877 (2010), in which the Supreme Court articulated the principle that Congress must express an affirmative intention to give a statute extraterritorial affect in order for courts to find that a statute applies beyond U.S. borders. The Liu v. Siemens court noted that nothing in the Dodd-Frank Act's whistleblower protection provision indicated that it applied extraterritorially and contrasted that provision with another provision in the Act – Section 929P(b) – that does contain language that specifically permits an extraterritorial application. The court concluded that Congress's silence on extraterritoriality in the whistleblower protection provision was intentional in light of its inclusion of such language in Section 929P(b). 2013 U.S. Dist. LEXIS 151005 at *7-8.

The court acknowledged that persons outside of the U.S. can be whistleblowers under the SEC's regulations, but explained that it is another matter whether such a foreign whistleblower is protected by the Dodd-Frank Act's whistleblower protection provision. According to the court, "[t]he fact that a person outside the United States may be a ‘whistleblower' under Dodd-Frank does not compel the conclusion that he is protected by the Anti-Retaliation Provision." Id. at *8.

Simply put, given that this was a case brought by a "Taiwanese resident against a German corporation for acts concerning its Chinese subsidiary relating to alleged corruption in China and North Korea," id. at *9-10, the court was unwilling to extend the scope of the whistleblower protection provision simply because "Siemens has ADRs that are traded on an American exchange," noting that the same was true in Morrison where the Supreme Court had rejected the extraterritorial expansion of U.S. securities fraud law in the Securities and Exchange Act of 1934. Id. at *10.

The court also briefly analyzed whether the disclosure of FCPA violations could be considered "required or protected" disclosures under the Dodd-Frank Act's whistleblower protection provision. According to the court, "FCPA violations could only conceivably fall within [the protected category of] ‘fraud against shareholders,'" but noted that the plaintiff had not alleged such fraud. Id. at *12-13. Because he had not done so, the court highlighted this failure as another reason why his amended complaint had to be dismissed. Id. at *13. However, the court did not afford the plaintiff the right to amend his complaint to fix this error because of its primary conclusion that the "Dodd-Frank Act's Anti-Retaliation Provision does not apply extraterritorially." Id. at *19.

Transparency International Reports

The nonprofit organization Transparency International (TI) issued several reports of interest in the last quarter. On July 19, 2013, TI released its Global Corruption Barometer 2013, which surveys public opinion on corruption in 107 countries. On October 7, 2013, TI released its ninth annual "progress report" on enforcement by member countries of the OECD Convention on Combating Foreign Bribery.

On October 17, 2013, TI released Transparency in Corporate Reporting: Assessing Emerging Market Multinationals, which examined aspects of corporate transparency related to 100 large multinational companies based in emerging markets. Many of the corporations surveyed are based on one of the BRIC (Brazil, Russia, India, China) countries, and as TI points out, these companies are playing a greater role in international transactions and investment. This report is useful from several perspectives. First, it provides basic information on the state and transparency of the surveyed companies' anti-corruption program and related corporate governance practices. This information can inform due diligence related to business opportunities with these companies, especially when joint operations or investments will occur in countries with perceived corruption issues. In its press materials, TI also states its intention to place pressure on these companies, and others like them, to enhance their anti-bribery and corruption practices. Companies covered by the FCPA and UKBA might welcome this pressure, in light of complaints regarding emerging market multinationals' perceived disregard of the anti-corruption requirements of those laws.

Editors: John Davis, James Tillen, Marc Bohn*

Contributors: Leila Babaeva,* Jacqueline Ferrand,* Ben Gao,* Amelia Hairston-Porter,* Jonathan Kossak,* Saskia Zandieh*

*Former Miller & Chevalier attorney

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.