FCPA Spring Review 2014

International Alert

Introduction

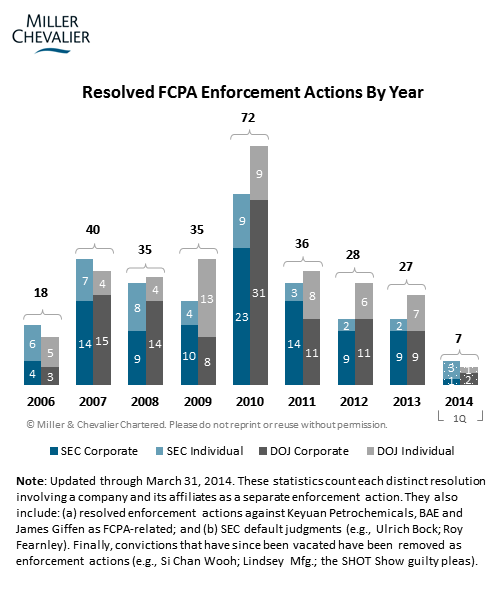

Public indications of Foreign Corrupt Practice Act ("FCPA") enforcement activity during the first quarter of 2014 declined in number, as compared to the last quarter of 2013. However, the agencies remained active -- in total, the U.S. Department of Justice ("DOJ") and the U.S. Securities and Exchange Commission ("SEC") brought three corporate enforcement actions against two companies, secured default judgments against two long-standing defendants and resolved a civil complaint against a third, and unsealed charges against three new individuals.

The second quarter of 2014 has gotten off to a fast start with enforcement actions by the DOJ and SEC against Hewlett-Packard Co. for FCPA violations in Russia, the unsealing of a June 2013 indictment charging five individuals of conspiracy to violate the FCPA in connection with the mining of titanium minerals in India, and charges against more individuals affiliated with Direct Access Partners LLC for actions involving a state-owned bank in Venezuela. These developments will be covered in our FCPA Summer Review 2014.

Declinations

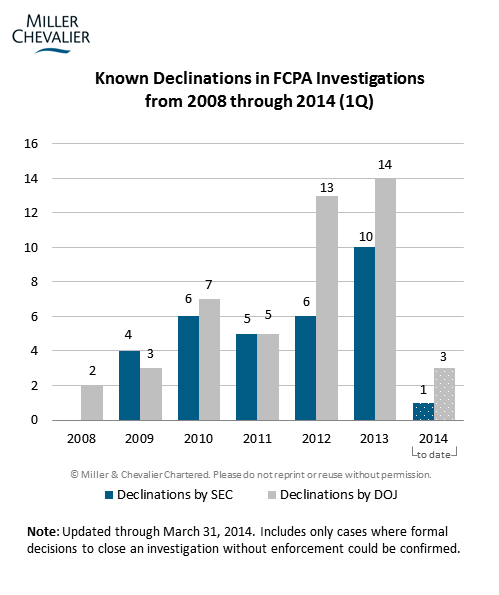

Recent disclosures made by several companies in their periodic SEC filings have added to the record number of known declinations that occurred in 2013, while identifying four thus far in 2014 (see Declinations, below). We define "declinations" here broadly to refer to instances in which the DOJ or SEC have decided to close an FCPA investigation without pursuing enforcement. Since the agencies as a matter of policy do not generally acknowledge declinations publicly, it is difficult to know whether a non-enforcement decision represents a benefit in recognition of a company's self-reporting, cooperation, and/or remediation, or whether an agency simply lacked the facts necessary to establish elements of an offense (see FCPA Blog: Revisiting the Definition of 'Declinations').

In fact, there are likely many considerations that inform an agency's decision not to pursue a case. As we have noted in past reviews, the agencies' current focus on closing out their existing backlog of cases may explain the recent increase in known declinations (as reflected in the chart below) and may be one reason why enforcement levels in recent years have dipped from the record pace in 2010.

Known Initiated Investigations

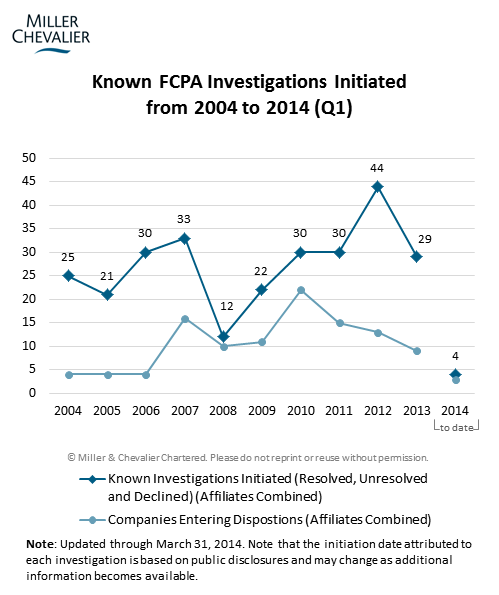

The agencies' aforementioned backlog of cases is clearly expanding -- while the annual number of resolved enforcement actions brought by the DOJ and SEC has dropped significantly since 2010, the number of known investigations initiated has not.

This backlog of investigations is significant, because even in situations where the DOJ and SEC ultimately decline to pursue an enforcement action and relevant penalties, the costs borne by companies subject to open investigations can be substantial. For instance, in mid-2009, Team Inc. initiated an internal investigation into allegations of improper payments by its subsidiary in Trinidad & Tobago and subsequently voluntarily disclosed the matter to U.S. enforcement authorities, who proceeded to initiate investigations of their own. Although both the DOJ and SEC ultimately closed these investigations in mid-2011 without bringing enforcement actions, Team Inc. nevertheless disclosed investigation-related costs that exceeded $3 million. While sometimes staggering investigation-related costs have been reported by companies such as Avon Products Inc. (more than $346 million since 2008) and Wal-Mart Stores Inc. ($439 million since 2011 and an estimated $200- $240 million anticipated for fiscal 2015), there are numerous mid-sized companies that have recently reported spending lower but still significant sums, including Bruker Corp. (more than $20 million since 2011), Dun & Bradstreet Inc. (more than $20 million since 2012), Nordion Inc. (more than $22 million since 2012), and NCR Corp. (more than $6 million since 2012).

Trends in Enforcement Against Individuals

FCPA enforcement against individuals is again on the rise, reflecting an enforcement priority that DOJ and SEC officials frequently have highlighted over the past year. Patrick Stokes, Head of the DOJ's Foreign Corrupt Practices Act unit, said on March 7, 2014, "Prosecuting individuals as well as institutions is a significant focus for the FCPA unit, and it's a trend that's going to continue." Similarly, on September 26, 2013, Mary Jo White, Chair of the SEC, stated: "Another core principle of any strong enforcement program is to pursue responsible individuals wherever possible. That is something our enforcement division has always done and will continue to do. Companies, after all, act through their people. And when we can identify those people, settling only with the company may not be sufficient."

Including recently unsealed enforcement activity, the DOJ and SEC charged 20 individuals in 2013, the highest number charged since 2009, when the agencies charged a record 45 individuals, fueled in large part by the African Sting prosecutions that the DOJ unsealed in January 2010 (see FCPA Winter Review 2010).

Administrative Proceedings

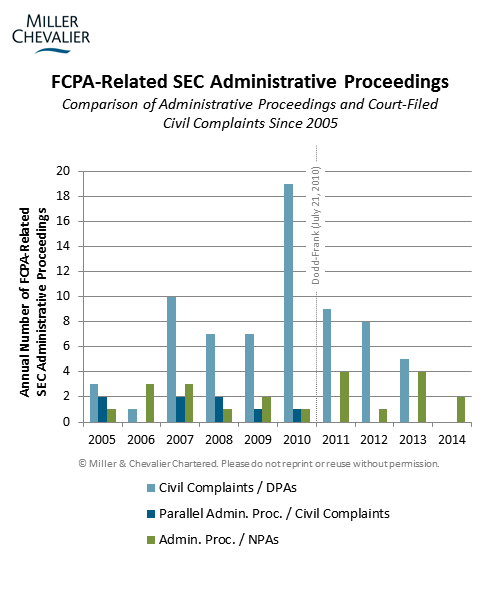

On multiple occasions in the last six months, SEC FCPA Unit Chief Kara N. Brockmeyer has indicated that the SEC expects to rely more frequently on administrative proceedings (as opposed to more traditional civil court actions) to resolve FCPA-related enforcement matters. This change in approach was facilitated by a 2010 Dodd-Frank amendment to the Securities and Exchange Act of 1934 that enables the SEC to collect civil penalties through administrative proceedings (which previously had been restricted to ordering disgorgement and imposing cease-and-desist orders). The SEC may be attracted to administrative proceedings as a basis for pursuing FCPA cases because the resolutions produced require no judicial approval, as opposed to the settlement of formal civil complaints. This distinction is important because district court judges have complicated several SEC prosecutions in recent years by demanding changes to negotiated settlement (see, e.g., Tyco and IBM) or dismissing charges or otherwise limiting claims (see e.g., Mark Jackson, James Ruehlen, and Herbert Steffen). In addition, the imposition of a cease-and-desist order under an administrative proceeding requires only that the SEC establish a likelihood that a defendant will violate federal securities law, as opposed to the "reasonable likelihood" that a court-ordered injunction would require.

Historically, the FCPA cases the SEC pursued using administrative proceedings either were settled in conjunction with a court-filed civil complaint (which enabled the imposition of a civil fine) or were smaller matters that the DOJ frequently declined to pursue. Since the passage of Dodd-Frank, however, the nature of cases handled via administrative proceeding has changed, as have the size of monetary assessments imposed in connection with these proceedings. For example, last fall's administrative action against Stryker Corp., which imposed a civil fine and involved parallel criminal charges filed by the DOJ, is a case that the SEC previously would have had to pursue in court. Over the last year, the SEC has also begun handling very large settlements, such as Total, Alcoa, and Hewlett-Packard, via administrative proceeding. While these cases imposed no civil penalty (but rather, disgorgement) and therefore technically could have been brought as administrative orders even before Dodd-Frank, because of their size, scope, and the parallel criminal charges involved, the SEC traditionally sought to resolve cases of this magnitude through civil complaints in court (see, e.g., SEC actions against Siemens (2008) and Halliburton/KBR (2009)). The chart below examines FCPA-related administrative proceedings since 2004, highlighting recent trends.

Actions Against Corporations

Alcoa and Subsidiary Agree to Fifth Highest FCPA Penalty

On January 9, 2014, the SEC and the DOJ announced settlements with Alcoa Inc. ("Alcoa"), the Pennsylvania-based aluminum manufacturer, and Alcoa World Alumina LLC ("AWA"), a global alumina sales company majority-owned and controlled by Alcoa, in connection with millions of dollars in bribes that Alcoa and its subsidiaries allegedly paid to Bahraini officials. The SEC charged Alcoa as an issuer with violating the anti-bribery, books and records, and internal controls provisions of the FCPA, while the DOJ charged AWA as a domestic concern for violating the anti-bribery provisions of the FCPA and aiding and abetting others' violations of the those provisions. Alcoa entered into a cease-and-desist order with the SEC and AWA entered into a plea agreement with the DOJ, pursuant to which the two companies agreed to pay $384 million in criminal penalties and disgorgement, the fifth-highest combined penalty in FCPA history. In addition, under the plea agreement between AWA and DOJ, Alcoa agreed to implement an enhanced global anti-corruption compliance program.

According to the pleadings, AWA and Alcoa of Australia Limited ("AofA") used a sales consultant to assist in negotiating contracts with Aluminum Bahrain B.S.C. ("Alba"), an aluminum manufacturer which is 77% owned by the Bahraini government, while knowing or consciously disregarding "the fact that the relationship with the consultant was designed to generate funds that facilitated corrupt payments to Bahraini officials." While these pleadings refer to the consultant as "Consultant A" rather than by name, other sources have identified him as the Jordanian-born British-Canadian businessman Victor Dahdaleh (see discussion below: Dahdaleh Seeking to Dismiss Lingering Civil Suit), who had close ties to Bahraini government officials and members of the Bahraini royal family. As stated in the SEC’s cease-and-desist order, Alcoa used the consultant over a twenty-year period to funnel over $110 million in bribes to Bahraini officials. According to both sets of pleadings, AofA supplied alumina to Alba through the consultant’s shell companies, for which the consultant earned a commission on sales plus a "markup" on sales for which he acted as a distributor. According to the pleadings, however, the consultant did not provide any legitimate distribution services; instead, he used the shell companies to issue fraudulent invoices to Alba at a significant markup and then drew on the excess funds to pay bribes to Bahraini officials, including senior Alba officials and members of the royal family. At the same time, according to the plea agreement, AofA continued to distribute alumina directly to Alba.

The SEC claimed that at the time of retaining the consultant and throughout his engagement, Alcoa and its subsidiaries ignored multiple red flags. As stated in the cease-and desist order, the red flags included the decision to supply some of Alba's alumina through one of the consultant's shell companies, which would then "pay the 'required commission,'" and an understanding (reflected in unidentified company documents) that the consultant was "well versed in the normal ways of Middle East business" and "will keep the various stakeholders in the Alba smelter happy…." The SEC contended that AofA's in-house counsel approved the retention "without conducting any due diligence or otherwise determining whether there was a legitimate business purpose for the use of a third party intermediary" and that subsequently the Alcoa companies failed to monitor the consultant's activities.

The SEC credited Alcoa for its voluntary disclosure to the agencies in February 2008, use of independent counsel to investigate the allegations under the oversight of a Special Committee of the Board of Directors, regular updates to and cooperation with the SEC, and extensive review of and enhancement to its anti-corruption compliance program, including efforts to develop and implement due diligence and contracting procedures for intermediaries. Similarly, the DOJ acknowledged Alcoa’s use of the Special Committee to oversee an internal investigation by independent counsel, the "substantial cooperation" Alcoa provided to the DOJ, including an "extensive" internal investigation, "voluntarily" making employees available for interviews, and collecting, analyzing, and organizing significant amounts of evidence and information for the DOJ. The DOJ noted that Alcoa accepted responsibility for its misconduct and implemented remedial efforts, including hiring new senior legal and ethics and compliance officers and implementing enhanced due diligence reviews of third party agents and consultants. The DOJ also recognized Alcoa's separate commitment to maintain an anti-corruption compliance program consistent with the Corporate Compliance Program standards appended to the plea agreement.

The $384 million settlement includes $174 million in disgorgement, payable in five annual installments of $32.2 million to the SEC, of which $14 million would be satisfied by the company’s penalty in the related DOJ matter. AWA agreed to pay a $209 million criminal penalty, payable in five annual installments of $41.8 million, plus an administrative forfeiture of $14 million payable to the IRS, the latter representing funds involved in corrupt transactions. In calculating the penalty amount, the DOJ departed significantly from the minimum base fine of $446 million, recognizing that a penalty within the guidelines "would pose an undue burden" on AWA and Alcoa. In so doing, the DOJ cited a provision of the 2012 U.S. Sentencing Guidelines, § 8C3.3(b), which permits a court to impose a fine that is under the recommended range when it finds that an entity cannot and is not likely to be able to pay the minimum fine.

Noteworthy Aspects

- Clear Agency Theory of Liability for Alcoa for Anti-Bribery Violations: The SEC order clearly articulates that it made "no findings that an officer, director or employee of Alcoa knowingly engaged in the bribe scheme." Instead, the order continues, "Alcoa violated [the FCPA anti-bribery provisions] by reason of its agents, including subsidiaries AWA and AofA, indirectly paying bribes to foreign officials in Bahrain in order to obtain or retain business. AWA, AofA, and their employees all acted as 'agents' of Alcoa during the relevant time, and were acting within the scope of their authority when participating in the bribe scheme." The order then lists a number of facts to support this finding of an agency relationship, including various indicia of affiliate control and support and approval of related contracts by “senior managers of Alcoa’s Alumina Segment in the United States."

- Parent Company Obligations: Although the DOJ charged Alcoa's subsidiary AWA and not Alcoa with violating the FCPA, the plea agreement includes binding obligations for Alcoa in several respects. First, Alcoa agreed to provide resolutions of the board of directors certifying that Alcoa and all subsidiaries, divisions, groups, and affiliates other than AWA will comply with the terms of the agreement, including continued cooperation with the DOJ, IRS, FBI, and SEC. Second, Alcoa, with AWA, agreed to forfeit $14 million, sign any documents necessary to complete the forfeiture, and waive any Eighth Amendment claim concerning the forfeited assets. Third, Alcoa committed to maintain an anti-corruption compliance program consistent with the DOJ's minimum requirements, including, among other measures, instituting appropriate risk-based due diligence pertaining to retention and oversight of all agents and business partners.

- Cross-Jurisdictional and Inter-Agency Cooperation: At roughly the same time as the DOJ and SEC settlement of FCPA charges with Alcoa and AWA, the U.K. Serious Fraud Office's ("SFO") prosecution of Consultant A -- Victor Dahdaleh -- for corruption-related offenses fell apart, as discussed below. U.S. enforcement officials, however, did benefit from the assistance of officials in the United Kingdom, as well as Switzerland, Guernsey, Australia, Canada, Liechtenstein, and Norway. The DOJ and SEC also credited officials at the FBI and IRS for their assistance with the investigation.

Marubeni Subject to FCPA Action Again

On March, 19, 2014, Marubeni Corporation ("Marubeni"), a Japanese trading company, pleaded guilty in the U.S. District Court for the District of Connecticut to one count of conspiracy to violate the anti-bribery provisions of the FCPA, and seven substantive counts of FCPA bribery violations. According to the DOJ's announcement and pleadings, Marubeni's guilty plea stemmed from its role in a scheme to bribe high-ranking Indonesian government officials to secure a $118 million power project for Marubeni and its consortium partner, French power and transportation conglomerate Alstom (the pleadings refer to individuals previously identified in press reports as employed by Alstom during the relevant time period, but do not mention that company by name) and its subsidiaries.

According to the pleadings, from 2002-2009, Marubeni conspired with employees of Alstom and affiliated entities and consultants to obtain the power project by bribing a Member of Parliament and two officials at Indonesia's state-owned electricity company, Perusahaan Listrik Negara ("PLN"). The pleadings state that Marubeni and its co-conspirators retained a consultant to pay the bribes, and later determined that the consultant was not doing so effectively. The pleadings state that as a result, the conspirators hired a second consultant who could more effectively pay the bribes. The pleadings describe extensive email discussions about the consultant among Marubeni and Alstom employees, and payments by both partners to the consultants.

To settle the charges, Marubeni agreed to pay an $88 million criminal fine. Under the plea agreement, Marubeni also agreed to implement an enhanced global anti-corruption compliance program and to cooperate with the DOJ's ongoing investigation.

Noteworthy Aspects

- Second FCPA Enforcement Action Against Marubeni: As reported in our FCPA Spring Review 2012, in January 2012, Marubeni entered a two-year DPA with the DOJ for its alleged role in the Bonny Island bribery scheme in Nigeria. To settle those charges, Marubeni agreed to pay a $54.6 million criminal penalty, retain an independent compliance consultant (similar to a compliance monitor), enhance its compliance program, and cooperate with the DOJ in ongoing investigations. On February 26, 2014 (several weeks before Marubeni's guilty plea in the Indonesian activities), that DPA ended and the charges against Marubeni were dismissed. In addition to alleged involvement in the Bonny Island scheme, Marubeni also faced corruption allegations in the 1970s (before the FCPA passed into law), when it was implicated in a scandal involving alleged bribery of Japanese government officials to secure the sale of a Lockheed Martin plane.

- Refusal to Cooperate: The plea agreement states that the fine was appropriate in light of, among other factors, Marubeni's failure to voluntarily disclose the new corruption issues and refusal to cooperate with the DOJ's investigation when given the opportunity to do so. Marubeni's agreement to cooperate with the DOJ under its old DPA (discussed above) raises the question of how Marubeni could have successfully emerged from the DPA (and avoided a potential extension, which was allowed under the DPA) if it had refused to cooperate in this case. One possible explanation is that the DOJ's investigation into the Indonesian bribery scheme may have pre-dated Marubeni's settlement of the Bonny Island charges. It is also unclear how Marubeni's failure to cooperate affected the amount of the fine -- despite numerous negative factors cited in the plea agreement, the $88 million fine is on the lower end of the fine range under the U.S. Federal Sentencing Guidelines ($63.7-127.4 million).

- Jurisdiction: In Marubeni's prior settlement, the DOJ did not explicitly identify the basis for jurisdiction over Marubeni (a Japanese entity that is not traded on U.S. stock exchanges), but alleged that it was an agent of a U.S. company and an agent of a non-U.S. "issuer," and that Marubeni employees took certain actions in the United States. By contrast, in the current case, the basis for U.S. jurisdiction over Marubeni is relatively clear. Marubeni was charged with violating 78dd-3, which applies to non-U.S. persons acting within the United States. Marubeni's guilty plea states that its employees attended meetings in Connecticut, and that it made payments to one of the consultant's bank accounts in Maryland.

- Latest in Series of Enforcement Actions Related to Alstom: As reported in our FCPA Autumn Review 2013, two individuals previously identified in press reports as being formerly employed by Alstom pleaded guilty to FCPA charges, and another two individuals reported to be former Alstom executives are currently facing FCPA charges for their alleged roles in the Indonesian bribery scheme. As reported in our FCPA Spring Review 2013 and FCPA Summer Review 2013, Alstom and its subsidiaries have also been subject to Swiss and World Bank proceedings for activities in other countries, and the U.K.'s SFO arrested three Alstom directors in 2010. According to media reports, Alstom remains under investigation by authorities in several countries, and may soon face enforcement actions in the United States and the United Kingdom.

Declinations

Since our last review, we are aware of four companies that disclosed declination decisions by the DOJ and SEC in their periodic SEC filings (see Introduction above for context):

- In mid-2010, Baxter International Inc. and Merck & Co. Inc. were among a large group of pharmaceutical and medical device companies caught up in an industry-wide investigation initiated by the DOJ and SEC to review industry practices for compliance with FCPA. In connection with this investigation, the agencies requested information about these companies' activities "in a number of countries" not specified in public disclosures, but reported by press outlets to include Brazil, China, Germany, Greece, Italy, Poland, Russia, and Saudi Arabia. On February 21, 2014, after an investigation of more than three and a half years, Baxter disclosed in its 2014 10-K that the company had been notified by both the DOJ and the SEC in January 2014 "that their respective investigations were closed as to Baxter without any further action taken by either agency." Merck similarly disclosed in its 10-K filed on February 27, 2014, that the company had been advised by the DOJ that "based on the information that it has received, it has closed its inquiry into this matter as it relates to the [c]ompany." Merck's disclosure made no mention of the status of the SEC's investigation.

- In March 2012, SL Industries Inc., a manufacturer of power electronics and equipment, voluntarily disclosed an internal investigation the company was conducting into allegations that certain employees at three of the company's indirect wholly-owned subsidiaries in China may have improperly provided gifts and entertainment to government officials. In its 10-K on March 19, 2014, SL Industries disclosed that the DOJ notified the company on September 26, 2013, "that it had closed its inquiry into this matter without filing criminal charges." The company also noted that it "has not received an update from the SEC regarding the status of its inquiry" and "cannot predict at this time whether any action may be taken by the SEC."

- In March 2010, LyondellBasell Industries NV, a multinational chemical company, voluntarily disclosed to the DOJ an agreement related to a former project in Kazakhstan under which a $7 million payment was made that raised compliance concerns under the FCPA. In its 10-K filed on February 20, 2014, LyondellBasell reported that the DOJ advised the company in January 2014 "that it had closed its investigation into this matter" and that "[n]o fine or penalty was assessed." The SEC was not involved in this matter because LyondellBasell was not listed on a U.S. exchange at the time of the voluntary disclosure.

Actions Involving Individuals

Judgments Entered Against Three Former Siemens Executives

On February 3, 2014, New York district court judge Shira Scheindlin entered a default judgment against two former Siemens executives, ordering each to pay over half a million dollars in connection with their alleged involvement in violations of the anti-bribery, books and records, and internal accounting controls provisions of the FCPA, and with aiding and abetting violations of the same provisions by Siemens. Also on the same date, the judge entered a consent judgment against another former Siemens executive who submitted to the court's jurisdiction in the same action and was ordered to pay a fraction of the civil penalties adjudged against his former colleagues.

Judge Scheindlin ordered Ulrich Bock and Stephan Signer each to pay a $524,000 civil penalty and ordered Bock to pay an additional $413,957 in disgorgement and prejudgment interest. At the same time, the judge ordered Andres Truppel to pay an $80,000 civil penalty. These resolutions follow the SEC's October 2013 motion for a default judgment against the three foreign nationals for failing to appear in response to the SEC's December 2011 complaint (see our FCPA Winter Review 2014).

According to SEC allegations, the three former executives were involved in a scheme to pay more than $100 million in bribes to Argentine government officials to procure a $1 billion contract for national identity cards ("DNI contract"). The SEC also contends that Signer and others arranged for Siemens to pay Bock a "hush fee" of approximately $316,000 in exchange for his concealing the corruption surrounding the DNI when testifying before World Bank and ICC arbitration panels. Bock and a relative allegedly received the funds between 2005 and 2007 pursuant to sham consulting agreements.

As likely reflected in the penalty size, Bock and Signer never consented to the district court's jurisdiction, whereas counsel for Argentine national Truppel entered an appearance on Truppel's behalf and negotiated a settlement with the SEC. Though the court documents do not reveal why Truppel decided to submit to the court's jurisdiction, a post (Dec. 2013) suggests a potential connection between Truppel's decision to settle and his pending extradition from Argentina to the United States in the related DOJ matter. According to Argentine news sources, an Argentine federal judge reviewed and approved the DOJ's extradition request and Truppel appealed the decision, claiming that he would be subject to double jeopardy if extradited. In December 2013, the same Argentine judge, Ariel Lijo, charged Truppel and sixteen other former Siemens executives for bribery relating to the DNI contract.

As stated in the SEC complaint, Truppel and Bock had significant contacts with the United States in connection with the Siemens bribery scheme, while Signer's were more attenuated. With respect to Truppel, the SEC alleged that while serving as CFO of Siemens' Argentine division, Truppel participated in meetings in Miami and New York at which executives planned and negotiated bribe payments to Argentine officials and caused Siemens to pay millions of dollars of bribes, some of which were paid through bank accounts in the United States. The SEC claimed that Bock participated in one of the aforementioned meetings in Miami and provided false testimony at an arbitration proceeding in Washington, DC As for Signer, the SEC claimed his connection to the United States was limited to allegedly helping cause bribes to be paid through U.S. bank accounts.

As outlined in the FCPA Summer Review 2013 (and updated in the Winter Review 2014), on April 13, 2013, the DOJ announced the arrest in Florida of a French citizen, Frederic Cilins, on charges related to an ongoing federal grand jury investigation concerning potential FCPA and money laundering violations committed by BSG Resources, Ltd. ("BSGR"), a foreign company engaged in the mining of iron ore in the African Republic of Guinea. Nearly eleven months to the day later, Cilins pleaded guilty to one count of obstructing a federal criminal investigation.

Cilins was originally charged on April 15, 2013, with three separate counts: (1) tampering with a witness; (2) obstruction of a criminal investigation; and (3) destruction, alteration, and falsification of records in a federal investigation. All of these stemmed from Cilins' alleged attempts between March and mid-April 2013 to bribe a cooperating witness in the investigation with money in exchange for the witness's promise to destroy documents responsive to a grand jury subpoena related to BSGR.

On February 18, 2014, the DOJ increased the pressure on Cilins by filing a superseding indictment that alleged six counts of criminal behavior. Less than a month later, Cilins made a deal with the prosecutors to plead guilty to one count of obstruction of a federal criminal investigation. During his plea hearing, Cilins told the court that he had tried to bribe a government witness with money ($20,000 initially and then more later) to persuade her to leave the country to avoid questioning by the FBI. Cilins admitted he knew his actions were wrong, but he did not know that the witness was cooperating with the government.

The initial charges against Cilins, in April 2013, exposed the existence of a federal grand jury investigation into BSGR's procurement of a concession to extract iron ore from Guinea's Simandou Mountains, described as one of the world's largest known deposits of untapped iron ore. Cilins' plea deal does not require him to cooperate with the government's ongoing investigation into BSGR, but does subject him to up to four years in federal prison. BSGR reportedly commented on Cilins' plea deal by reasserting that no one at the company has engaged in any wrongdoing.

Three Former PetroTiger Executives Involved in Colombian Bribery Scheme

On January 6, 2014, the DOJ unsealed charges against two former chief executive officers of PetroTiger Ltd. in relation to their participation in an alleged scheme to pay bribes to an official at Ecopetrol SA, the Colombian state-owned oil company, in order to secure a lucrative oil services contract. In addition, the DOJ unsealed the guilty plea of PetroTiger's former general counsel on charges of bribery and fraud in connection with the same scheme.

The DOJ filed criminal complaints on November 8, 2013, against former PetroTiger CEOs Joseph Sigelman and Knut Hammarskjold, charging both men with conspiracy to commit wire fraud, conspiracy to violate the FCPA's anti-bribery provisions, conspiracy to launder money, and substantive violations of the FCPA. In addition, former general counsel Gregory Weisman pleaded guilty on November 8, 2013, to one count of conspiracy to violate the FCPA's anti-bribery provisions and conspiracy to commit wire fraud.

According to the charges in the various public filings, from May 2010 through December 2010, Sigelman, Hammarskjold and Weisman transferred approximately $333,500 in bribes from PetroTiger bank accounts to an Ecopetrol official in order to secure approval for an oil services contract with Mansarovar Energy Colombia Ltd. (the "Mansarovar Contract") worth approximately $39.6 million. The DOJ stated that the defendants first attempted to conceal the payments by wiring money to the bank account of the official's wife and submitting false invoices claiming the payments were for finance and management consulting services purportedly performed by the official's wife for PetroTiger. The wire transfers to the bank account of the official's wife failed as a result of incorrect account information, and the defendants then wired the payments directly to the official's bank account instead. The DOJ stated that the defendants were subsequently successful in obtaining Ecopetrol's approval for the Mansarovar Contract.

In addition to the bribery scheme, the defendants allegedly participated in a kickback scheme from June 2009 through February 2010, relating to the acquisition by PetroTiger of a separate Colombian oil services company. According to the charges, Sigelman negotiated the acquisition of the target company for $435,000 more than the offer price in exchange for an agreement by two of the owners of the target company to kick back their portions of the overage to the defendants. The pleadings state that the funds were then wired to Sigelman's bank account in the Philippines, and subsequently apportioned among the defendants. Sigelman retained $239,015 for himself and wired $106,592 to Hammarskjold and $51,618 to Weisman. The pleadings then assert that the defendants did not disclose to PetroTiger that they received a kickback of the purchase money. In addition, the pleadings allege that the defendants attempted to disguise the payments by referring to them by the code name "Manila Split" and creating a false "side letter" that purportedly justified the payments as a return of funds due to overstated capital expenditures.

Actions Against Foreign Officials: Abacha and Portillo

In recent years, the U.S. government's focus on foreign corruption has extended beyond the limitations of the FCPA, which only applies to the payors of bribes to officials. Two events this quarter illustrate the use of other laws by U.S. prosecutors in combating foreign bribery.

First, a complaint unsealed on March 5, 2014, against the assets of former president of Nigeria, General Sani Abacha, revealed the largest kleptocracy forfeiture action in the DOJ's history. According to a press release, the DOJ has frozen more than $458 million of Abacha's and his co-conspirators' corruption proceeds in accounts around the world. In the Bailwick of Jersey and France, arrest warrants for the assets in question were enforced through mutual legal assistance requests and in the United Kingdom though litigation pursuant to the U.K. Civil Jurisdiction and Judgments Act. The complaint seeks the recovery of more than $550 million and alleges that Abacha and his conspirators embezzled billions from the Central Bank of Nigeria, caused the government of Nigeria to purchase government bonds at inflated prices from entities that gave them a windfall and extorted millions from a French company in connection with payments on government contracts.

Second, on March 18, 2014, the former president of Guatemala, Alfonso Portillo, pleaded guilty in federal court in New York to one count of conspiracy to launder money in connection with accepting $2.5 million in bribes for diplomatic recognition of Taiwan. Mr. Portillo admitted to funneling the proceeds through American banks. He was extradited from Guatemala by the United States and his sentencing is scheduled for June 23, 2014.

Litigation

Dahdaleh Seeking to Dismiss Lingering Civil Suit

The U.K. SFO's highly-publicized missteps in the criminal trial of Jordanian-born British-Canadian businessman Victor Dahdaleh -- which led to Dahdaleh's acquittal -- are still reverberating in federal district court in Western Pennsylvania, where Dahdaleh remains a lingering defendant in the 2008 civil suit brought by Aluminum Bahrain ("Alba"), a state-controlled Bahraini entity.

As first explained in our FCPA Winter Review 2008 (and later in our FCPA Summer Review 2010), Alba's civil suit alleged a bribery scheme engineered by Alcoa, a U.S. company, in which funds were funneled through overseas accounts controlled by Alcoa's agent, Dahdaleh, who then allegedly used the money to bribe Alba's executives in return for supply contracts. Alba claimed that Alcoa had paid $9.5 million in bribes to Bahrain officials, senior members of the Bahraini royal family, and Alba executives through this scheme in return for de facto permission to overcharge Alba for raw materials. Alba claimed to have paid hundreds of millions of dollars in overcharges to Alcoa over a fifteen year period and Dahdaleh was alleged to have made nearly $60 million in the scheme.

At the request of the DOJ, which was pursuing a criminal investigation triggered by Alba's civil allegations, the suit was stayed in March 2008. In October 2011, the SFO arrested and charged Dahdaleh with corruption-related offenses. In October 2012, Alcoa settled Alba's civil suit for $85 million. Dahdaleh's trial began in the United Kingdom in 2013, but fell apart by the end of the year when several of the SFO's key witnesses, who were Alba's long-time attorneys at a DC-based law firm and who represented Alba in the civil case in Pennsylvania, refused to testify about their investigation into Dahdaleh and his dealings with Alba. The SFO was forced to abandon its case and the presiding judge ordered Dahdaleh's acquittal.

In January 2014, after the announcement of Alcoa's FCPA disposition (and resultant large penalties) with the DOJ and SEC, Dahdaleh's attorneys filed a motion in federal district court to dismiss the stayed civil suit against him or move it into arbitration. Dahdaleh's attorneys explained that Alba's U.S. law firm faced an investigation by U.K. authorities into possible misconduct connected to their work for Alba. A hearing was held on March 13, 2014, before the U.K.'s Southwark Crown Court, in which Dahdaleh's attorneys sought a ruling from the Crown Court that Alba's U.S. law firm engaged in "serious misconduct." On March 21, 2014, the Crown Court declined to find that Alba's U.S. law firm had engaged in "serious misconduct," deeming the conduct merely "discourteous." Dahdaleh had hoped that a "serious misconduct" ruling would force Alba's U.S. law firm to pay for part of Dahdaleh's legal costs following the collapse of his criminal case, and would lead to the firm's disqualification in the U.S. civil suit. The impact of the U.K. court's decision on Dahdaleh's motion in federal district court remains to be seen.

Other U.S. Developments

DOJ Opinion Procedure Release 14-01

On March 17, 2014, the DOJ published an Opinion Procedure Release ("OPR") stating that the DOJ would not take enforcement action if an issuer's foreign subsidiary purchased shares from a foreign businessman who was appointed to, and now holds, a senior government position in the foreign country.

In 2007, the issuer's subsidiary purchased a majority interest in a foreign company founded and owned by a foreign businessman. When the businessman was appointed to a high-level government position in 2011, he became a foreign official for the purposes of the FCPA. In early 2012, the subsidiary and the official began negotiations for the subsidiary to purchase the official's shares in the foreign company.

The OPR notes that upon his appointment, the foreign official had ceased to have any role at the foreign company other than that of a passive shareholder. The official also recused himself from any decision at the foreign agency regarding the award of business to the foreign company or its affiliates. Moreover, the official did not involve himself in any supervisory or regulatory matter concerning the foreign company.

The release also states that the parties engaged, as part of the buy-out negotiations, a leading global accounting firm to conduct an independent and binding valuation of the shares. The DOJ states that this engagement provided "additional assurance that the payment reflects the fair market value of the Shares, rather than an attempt to overpay Foreign Shareholder for a corrupt purpose."

In addition, the OPR notes three important facts: (1) the issuer obtained compliance representations from the foreign official and obtained written assurance from local counsel that the purchase of the shares was lawful in that country; (2) the issuer demonstrated appropriate and meaningful disclosure of the parties' relationships prior to completion of the buy-out; and (3) the subsidiary made efforts to isolate the foreign official from business decisions involving the foreign agency, the foreign company, or its affiliates until completion of the buyout, including informing the issuer's senior employees about the official's recusal obligations.

The OPR indicates that "the facts, representations, and warranties described in the Request demonstrate at present that the only purpose of the payment to Foreign Shareholder is consideration for the Shares." The DOJ found no indicia of corrupt intent, as "the proffered purpose of the payment is to sever the parties' existing financial relationship, which began before the Foreign Shareholder held an official position." As such, the release concludes that the DOJ does not intend to take any enforcement action, but that intent is conditioned upon the issuer and the official "making all required notifications and obtaining all required approvals" for the asset purchase.

The DOJ's foreign-bribery enforcement team has experienced significant turnover in the past few months. According to press reports, between November 2013 and February 2014, four out of the approximately 20 members of the FCPA Unit, including the Unit's chief, left for private practice. In addition, the Acting Assistant Attorney General of the Criminal Division, the Deputy Assistant Attorney General who had been overseeing the Fraud Section, as well as two deputy chiefs in the Fraud Section who were not part of the FCPA Unit but had prosecuted FCPA cases, also resigned from the Department during the first quarter of 2014.

FCPA Unit Turnover

Chuck Duross, who joined the Fraud Section in 2006 as a senior trial attorney and rose to become a deputy chief in charge of the FCPA Unit in 2010, resigned from the Department in February to enter private practice. Duross oversaw the publication of the November 2012 Resource Guide to the U.S. Foreign Corrupt Practices Act. The DOJ tapped Patrick Stokes, previously one of the co-heads of the Fraud Section's Securities and Financial Fraud unit, to succeed Duross.

In addition to Duross, three other FCPA Unit prosecutors also resigned recently. Senior trial attorney Joey Lipton (SHOT Show (see FCPA Review Spring 2012)) resigned in November 2013, and trial attorneys Kathleen Hamann (Nexus Technologies, Inc.; Tyson Foods, Inc.; Smith & Nephew, Inc.; Weatherford International Ltd.) and Stephen Spiegelhalter (Maxwell Technologies, Inc.; Garth Peterson; NORDAM Group, Inc.; BizJet International Sales and Support, Inc.; Parker Drilling Company) resigned in January 2014.

According to media reports, the FCPA Unit has hired two veteran prosecutors, Kevin R. Gingras and Leo R. Tsao, and possibly others, to replenish its ranks. Gingras was involved in prosecuting September 11, 2001, conspirator Zacarias Moussaoui, and Tsao assisted in the prosecution of Kurt Mix, the former BP plc engineer convicted of intentionally destroying evidence related to the April 2010, Deepwater Horizon disaster. Notably, Tsao is reportedly a fluent Mandarin speaker, which will be an asset to the DOJ's investigation and prosecution of FCPA violations involving China.

Other Criminal Division Departures

Mythili Raman, who led the Criminal Division as the Acting Assistant Attorney General after her predecessor Lanny Breuer's departure in February 2013, resigned from the Department in March. The Senate is currently considering President Obama's nominee for the next head of the Criminal Division, Leslie Caldwell, who led the Justice Department's Enron Task Force between 2002 and 2004. Caldwell cleared the Senate Judiciary Committee in early March and is awaiting full Senate confirmation. In the interim, the DOJ has appointed David A. O'Neil to take over Raman's position. O'Neil began his DOJ career as a Southern District of New York federal prosecutor focusing on cases involving international investigations and fraud on the government and financial institutions. Most recently, O'Neil was the Chief of Staff to the Deputy Attorney General.

Denis McInerney, the Deputy Assistant Attorney General who oversaw the Criminal Division's Fraud, Appellate, and Capital Case sections, resigned from the Department in March. McInerney previously headed up the Fraud Section and was promoted to Deputy Assistant Attorney General at around the time of Lanny Breuer's departure. Jeffery Knox, another attorney in the FCPA Unit, replaced McInerney as the head of Fraud Section at that time.

Glenn Leon, a Deputy Chief in the Fraud Section who assisted with the SHOT Show trials, resigned from the Department to enter private practice in January 2014.

Adam Safwat, another Deputy Chief in the Fraud Section, resigned in January 2014 to enter private practice. While at the Fraud Section, he was involved in several high-profile FCPA cases, including the prosecution of Panalpina World Transport (Holding) Ltd. and Alcoa World Alumina LLC.

International Developments

African Development Bank Group Bonny Island Enforcement

According to media reports, on March 21, 2014, the African Development Bank Group ("AfDB") announced that Kellogg, Brown & Root LLC ("KBR"), Technip S.A. ("Technip"), and JGC Corp. ("JGC") agreed to pay a total of $17 million to settle allegations of corruption by their affiliates in an AfDB-financed project. As reported in our FCPA Spring Review 2012, these companies and Snamprogetti Netherlands B.V. ("Snamprogetti") were part of the TSKJ joint venture that allegedly agreed to pay approximately $180 million in bribes to Nigerian officials in order to obtain a $6 billion liquefied natural gas construction contract on Bonny Island. In total, the TSKJ partners and Marubeni (discussed in preceding sections) have agreed to pay over $1.7 billion to settle separate U.S. enforcement actions for their alleged involvement in the Bonny Island bribery scheme. The AfDB reportedly contributed $100 million in financing to the $6 billion project. In the current AfDB settlement, KBR, Technip, and JGC reportedly agreed to pay $6.5 million, $5.3 million, and $5.2 million respectively, and the AfDB has debarred three affiliated Madeira companies that allegedly participated in the Bonny Island corruption scheme.

Norwegian Government Prosecutes Yara International and Employees for Alleged Foreign Bribes in Libya, India and Russia

According to press reports, in January 2014, the Norwegian National Authority for Investigation and Prosecution of Economic and Environmental Crime (ØKOKRIM) fined Oslo-based Yara International NOK 295 million (approximately $48.3 million) for paying, or agreeing to pay, around $12 million in foreign bribes. Yara is one of the largest fertilizer firms in the world, with sales to 150 countries and around 9,000 employees worldwide. The Norwegian government owns 36.2% of the company. Reportedly, the fine was the largest ever assessed by the Norwegian government against a Norwegian company.

Alleged Misconduct

According to press reports, between 2004 and 2009, Yara paid bribes to senior government officials in Libya and India, as well as to a Russia supplier. In Libya, in 2007, Yara reportedly agreed to pay around $5 million in bribes to a relative of a Libyan oil minister in relation to negotiations to establish operations in Libya. In 2009, Yara, along with the Libyan Investment Authority and the National Oil Corporation of Libya, formed a joint venture called the Libyan Norwegian Fertiliser Company to operate a fertilizer plant in Libya. It is unclear whether the alleged bribe payment is directly related to this venture.

In India, Yara reportedly agreed to pay $3 million in bribes in 2007 to a relative of an Indian official in the Ministry of Chemicals & Fertilizers. These payments allegedly were tied to joint-venture negotiations with the Krishak Bharati Cooperative Ltd. (Kribhco), an Indian cooperative society that manufactures fertilizers. Kribhco was partly owned by the Indian government at the time.

In Russia, Yara allegedly paid millions of dollars in bribes to a supplier to secure favorable commercial terms. While ØKOKRIM did not provide details, press speculation has linked Yara's alleged payment in Russia to OJSC PhosAgro, the Russian fertilizer giant, and Phosagro's subsidiary Apatit JSC, a fertilizer raw-materials supplier.

Individual Indictments

ØKOKRIM has reportedly indicted four people in relation to the alleged corruption, including former Yara chief executive Thorleif Enger, former executive Tor Holba, former chief operating officer and deputy chief executive Daniel Clauw, a French national, and former chief legal officer Kendrick Taylor Wallace, a U.S. national. Reportedly, Mr. Holba was still working for Yara when the indictments issued, and he has been put on paid leave pending his prosecution.

According to press reports, ØKOKRIM alleged that Mr. Wallace made the 2007 agreement to pay the Libyan oil minister, and that Mr. Enger, Mr. Holba, and Mr. Clauw all approved that payment. Separately, ØKOKRIM reportedly alleged that Mr. Wallace and Mr. Clauw made the 2007 agreement to pay the Indian official, and that Mr. Enger approved the arrangement. All four have denied the allegations made against them.

Self-reporting and Cooperation

Press reports noted that Yara employees allegedly first reported the suspicious payments to company management in 2008. The Company then hired external counsel to investigate the alleged payments, and in 2011, voluntarily reported the payments to Norwegian authorities. While the Company took three years to make its disclosure to the government, Økokrim reportedly stated that, in assessing the fine, it gave Yara credit for its voluntary reporting and "good and constructive" cooperation.

KPMG Settles Anti-Bribery Case with Dutch Authorities for €7 million

On December 30, 2013, KPMG and the Dutch Public Prosecution Department settled allegations that the accounting firm knowingly helped its client, Ballast Nedam, a Dutch construction company, disguise bribes by failing to verify payments to foreign agents and determine the ultimate beneficiary of the payments between 2000 and 2003. KPMG agreed to pay €3.5 million in fines and also forfeit €3.5 million, for a total of €7 million (approximately $9.66 million).

Ballast Nedam, the fourth largest Dutch construction and engineering company, which separately agreed to a fine of €17.5 million in December 2012, is accused of paying foreign agents hundreds of millions of euros to receive large construction projects in Saudi Arabia between 1997 and 2004.

Dutch tax authorities opened their investigation of Ballast Nedam in 2009, some six years after the last suspicious payments were allegedly made. Ballast Nedam conducted an internal investigation, which results were presented to Dutch authorities in 2011. This internal investigation led Dutch authorities to KPMG. Although the companies have both settled, three former KPMG accountants and several former executive of Ballast Nedam remain under investigation.

Brazilian Anti-Bribery Law Enters Into Force

On January 29, 2014, Brazil's new anti-bribery law known as the "Clean Company Act" ("the Act") (Law No. 12,846/2013) entered into force. As discussed in our FCPA Summer Review 2013, the Act significantly expands Brazil's anti-bribery legal framework and represents an effort by the country to better comply with its obligations under the OECD Convention on Combating Bribery of Foreign Public Officials in International Business. While Brazil is not an OECD member state, it ratified the Bribery Convention in 2000, and passed initial implementing legislation that entered into force in 2002. The Act is designed to further harmonize Brazilian anti-corruption laws with those of other Bribery Convention signatories.

Under the Act, it is unlawful "to promise, offer or give, directly or indirectly, an undue advantage to a public agent or to a third person related to the public agent." Additionally, the Act prohibits:

- Financing, subsidizing or sponsoring a violation of the Act;

- Making use of third party or entity to conceal interests or identities;

- Participating in various kinds of fraud in connection with public tenders or contracts; and

- Hindering or interfering with investigations or audits by public agencies, entities or agents.

There is no exception for facilitating payments, which are prohibited under Brazilian law and can lead to civil or administrative liability for companies, and fines and imprisonment for up to 12 years for individuals.

The Act applies to entities, legal or de facto, including business organizations and sole proprietorships, foundations or associations of entities or persons, and foreign companies with offices, branches or representations in the Brazilian territory. It also establishes successor liability in the event of a merger, acquisition, transformation, or amendment to the articles of association. Notably, companies may be strictly liable for the acts of their directors, officers, employees, and agents under a theory of respondeat superior. The Act's application to corporations is a significant development in Brazil, a country that has historically given only limited recognition to the concept of corporate liability. In spite of the breadth of the prohibitions, the Act does not define several key terms, including domestic public official. Forthcoming regulations will likely provide further guidance.

The possible penalties for the prohibited bribery offenses are significant. Companies liable for violations will be subject to administrative fines of between 0.1% and 20% of the gross revenue of the legal entity in the previous fiscal year. The methodology for calculating gross revenue under the law is unstated, but may be clarified in future regulations. If gross revenue cannot be determined, a fine of between R$6,000 (approximately US$3,000) and R$60,000,000 (approximately US$30,000,000) will be applied. In either case, the administrative fine shall not be smaller than the benefit obtained through the prohibited conduct. Furthermore, condemnatory decisions will be published. For judicial actions, possible sanctions include disgorgement of the gains obtained from the misconduct, dissolution of the legal entity, confiscation, and debarment from receiving public incentives or financing.

In setting sanctions levels the Act instructs authorities to consider various factors, including the gravity of the offense, the advantage obtained or sought, whether or not the offense was completed, the nature of damages, and the existence of other harmful effects. Additionally, the Act provides credit for anti-corruption compliance programs and requires the Brazilian government to establish criteria for evaluation of such programs. Regulations are expected to detail the substantive requirements for a compliance program to receive credit under the Act. Brazilian authorities may also establish leniency agreements with legal entities that are under investigation. To qualify for a leniency agreement, the company must first state its interest in cooperation, end its involvement in wrongdoing, and fully cooperate with the enforcement authorities. The collaboration must also result in the identification of the responsible individuals and the rapid collection of information that proves the wrongful acts at issue in the investigation.

European Union Issues First Biannual Anti-Corruption Report

On February 4, 2014, the European Union ("EU") issued its first ever Anti-Corruption report, which was mandated by the European Commission in June 2011, in an effort to strengthen political engagement to effectively address corruption. The report is to be published on a biannual basis going forward.

The report, which takes a broad definition of corruption to include any "abuse of power for private gain," includes the results of the Eurobarometer survey and general findings organized both by country and thematically.

The Eurobarometer survey revealed that 76% of European respondents think corruption is widespread in their country, with country-specific responses ranging from a low of 20% in Denmark, to over 50% in Germany, the Netherlands, Belgium, Estonia, and France, and to 99% in Greece. Eight percent of Europeans said they had experienced or witnessed a case of corruption during the 12 months preceding the survey.

With respect to companies, 40% of those surveyed reported that they consider corruption to be a problem for doing business with 81% of Europeans agreeing that too-close links between business and politics in their country lead to corruption.

Thematically, the report addresses a number of issues, including the political dimension of corruption, control mechanisms for preventing corruption, and enforcement of corruption. The sectors identified as particularly vulnerable to corruption in Europe are urban development and construction, environmental planning, healthcare, and tax administration.

With respect to foreign bribery, the report notes that while many EU Member States effectively address corruption domestically, they face challenges with the way in which their companies conduct business abroad, particularly in countries where corruption is endemic. The report cites the U.K. Bribery Act as one of the strongest anti bribery laws in the world because it criminalizes bribery of foreign officials and the failure of businesses to prevent bribery committed on their behalf.

United Kingdom Releases First Sentencing Guidelines for Corporate Offenders

The U.K. Sentencing Council released the "Fraud, Bribery, Money Laundering: Corporate Offenders Definitive Guideline" ("Guideline") on January 31, 2014. The Guideline will apply to all sentencing of corporate entities on or after October 1, 2014, regardless of when the offense took place. The Sentencing Council issued the Guideline in accordance with section 210 of the Coroners and Justice Act 2009.

The Guideline provides a 10-step process for determining the type and amount of the sentence and monetary fine:

- Step 1 requires the Court to consider requiring compensation rather than a fine from the offender, especially where the offender's means are limited;

- Step 2 requires the Court and prosecutor to consider confiscation before assessing other fines or financial orders;

- Step 3 directs the prosecutor on how to weigh the factors that help determine the level of culpability and harm;

- Step 4 provides the starting point and harm multipliers to apply to offenses;

- Step 5 lists factors for the Court (not the prosecutor) to consider in adjusting the level of the fine;

- Step 6 allows for sentence mitigation if, for example, the defendant cooperates with the prosecution;

- Step 7 permits a sentence reduction for a guilty plea;

- Steps 8 and 9 direct the Court to consider whether ancillary orders and the total sentence are proportionate and appropriate; and

- Step 10 requires that there be an explanation of the sentence and the reasoning behind it.

This approach is similar to the use of the Sentencing Guidelines factors to calculate recommended fines in the United States. As permitted with respect to the U.S. Sentencing Guidelines, Courts in the United Kingdom may also ignore the Guideline. The underlying law, the Coroners and Justice Act 2009, at Section 125(1), states that the court must follow the sentencing guideline "unless the court is satisfied that it would be contrary to the interests of justice to do so." This allows the Court to evaluate negotiated settlements, which have been a source of contention between prosecutors and justices in the past. In the Innospec case, for example, the court refused to bless the settlement and required it to be renegotiated.

Editors: John Davis, James Tillen, Marc Bohn,* Ann Sultan*

Contributors: Kuang Chiang,* Abigail Cotterill,* Jacqueline Ferrand,* Ben Gao,* Amelia Hairston-Porter,* Jonathan Kossak,* Nate Lankford, Claire Palmer,** Saskia Zandieh*

*Former Miller & Chevalier attorney

**Former Miller & Chevalier consultant

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.