FCPA Autumn Review 2010

International Alert

Introduction

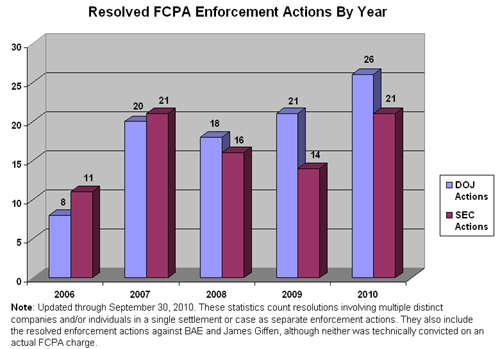

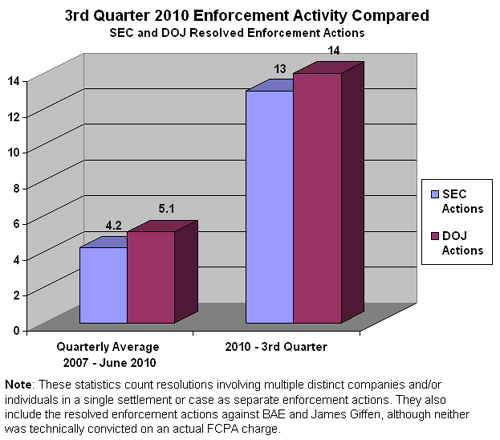

The third quarter of 2010 has maintained the record-breaking pace of Foreign Corrupt Practices Act ("FCPA") enforcement, with several new enforcement dispositions by the U.S. Department of Justice ("DOJ") and the U.S. Securities and Exchange Commission ("SEC"). Both agencies have already surpassed their 2009 totals as of September 2010.

New actions against corporations this quarter included SEC charges against General Electric related to the UN Oil-for-Food program and DOJ and SEC charges against ABB, Alliance One International Inc., and Universal Corporation or their affiliates. There were a total of 27 resolved FCPA-related enforcement actions in the third quarter of 2010, which is nearly triple the quarterly average of such actions from 2007 to 2010.

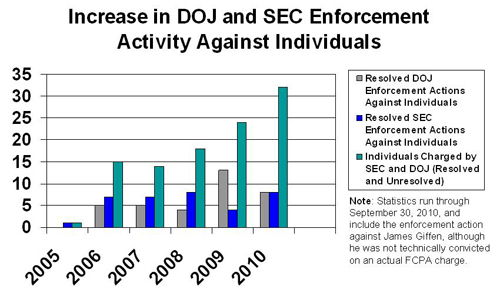

In the area of FCPA enforcement actions against individuals, the decade-long, politically charged case against James Giffen ended when he pled guilty on August 6, 2010, not to any FCPA-related charge, but instead to one misdemeanor tax count and agreed to pay a $25,000 fine. However, this outcome is not likely to blunt the DOJ's appetite for prosecuting individuals. Cases against individuals have more than doubled since 2008, with 8 individuals convicted and another 23 individuals charged so far in 2010, compared to 4 individuals convicted and an additional 9 charged in all of 2008.

The SEC has also been actively pursuing individuals this year, with several new settlements this quarter. Ousama Naaman and David Turner settled SEC charges related to alleged improper payments made on behalf of U.S. chemical producer Innospec Inc. In addition, the SEC announced settled charges against Joe Summers and Bobby Benton, two former employees of Pride International. These recent settlements add to the growing list of SEC actions against individuals, following the charges filed in April 2010 against four former executives of Dimon, Inc., the predecessor to Alliance One International, Inc.

The rising levels of FCPA enforcement at both the DOJ and the SEC continue to draw increasing attention from the plaintiffs' bar, with a growing number of civil suits filed against companies facing potential FCPA charges. Recent announcements of shareholder civil suits have followed quickly behind the disclosure of FCPA investigations in several cases, including SciClone Pharmaceuticals, Weatherford International, Avon Products, and Pride International. The suit against SciClone was announced less than a week after the company disclosed that it was under investigation by the DOJ and the SEC. In another example of FCPA-related civil litigation, a competitor of Innospec filed a lawsuit against the company on the basis of the conduct described in SEC and DOJ enforcement documents.

Beyond enforcement actions and other litigation, the third quarter of 2010 has also seen other developments that could have far-reaching reverberations in FCPA law and practice. Two statutory provisions that were buried in the massive Dodd-Frank financial reform legislation recently adopted by Congress introduce new dynamics that could affect FCPA enforcement. One is the requirement that oil, gas, and minerals companies that are "issuers" disclose all payments they make to foreign governments in connection with commercial projects. This mandate, which may be at odds with contractual confidentiality commitments of natural resource companies, will apply to entirely legitimate commercial payments and will likely raise some nettlesome issues. Another provision of Dodd-Frank authorizes substantial, Qui Tam-like financial incentives to whistleblowers who disclose actionable fraud or FCPA violations to SEC enforcement officials. Applying this new provision and integrating it with current incentives for corporate voluntary disclosures will present SEC officials, and corporations, with new sets of issues.

Finally, the new U.K. Bribery Act, about which so much is being said and written, promises a new set of issues for multi-national companies doing business in the U.K. Already the subject of lively debate and ominous forebodings, the statutory language of the new U.K. law presents a number of statutory ambiguities and raises unanswered questions. While recently published draft guidance provides some insight into the U.K. Ministry of Justice's current thoughts on certain elements of the act, whether and to what extent greater certainty will be provided by final official guidance that is to be forthcoming before the new law takes effect in April 2011 is commanding considerable commentary and concern. How issues of extraterritorial jurisdiction, acceptable compliance procedures, criminal intent, and permissible corporate promotional expenses and hospitality are resolved could themselves have extraterritorial implications for corporations based in the United States and other countries outside the U.K.

Actions Against Corporations

On September 29, 2010, the DOJ and SEC filed charges against ABB Ltd. and its subsidiaries ABB Inc. and ABB Ltd.-Jordan resulting in ABB Ltd. and ABB Inc.'s agreement to pay a total of $58.3 million. ABB Inc. is a Swiss electrical technology giant which voluntarily disclosed its FCPA violations to the DOJ and SEC beginning in 2005.

According to a DOJ press release, ABB Ltd. entered into a Deferred Prosecution Agreement ("DPA") with the DOJ by which ABB Ltd. agreed to pay a criminal penalty of $1.9 million and to the filing of a criminal information against ABB Ltd.-Jordan. The criminal information filed against ABB Ltd.-Jordan charges ABB Ltd.-Jordan with one count of conspiracy to commit wire fraud and to violate the books and records provision of the FCPA. According to the criminal information, ABB Ltd.-Jordan engaged in a scheme through its subsidiary ABB Near East Trading Ltd. ("ABB Near East") to pay over $300,000 in kickbacks to the Iraqi government in conjunction with United Nations Oil-for-Food Program. ABB Near East allegedly received contracts worth over $5.9 million to provide goods and services to the government-owned Iraqi Electricity Companies. In order to win the contracts, ABB Near East inflated the price of the contracts by 10% before submitting them to the United Nations for approval and thereby generated the funds to pay kickbacks. Those kickbacks were then falsely recorded on both ABB Near East and ABB Ltd.-Jordan's books and records.

The DOJ also filed a criminal information against ABB Inc., ABB Ltd.'s Texas-based subsidiary. The information charges ABB Inc. with conspiracy to violate the antibribery provisions of the FCPA and violation of the antibribery provisions of the FCPA. According to the information, ABB Inc., through its ABB Network Management ("ABB NM") business unit, made illicit payments through a Mexican intermediary company to the Comisión Federal de Electricidad ("CFE"), a state-owned Mexican electric utility company. Specifically, the information alleges that John Joseph O'Shea, a former ABB NM General Manager, and Fernando Maya Basurto, a former sales representative at ABB NM, made corrupt payments totaling approximately $1.9 million through the Mexican intermediary to CFE officials in order to secure CFE contracts worth more than $81 million in revenue.

The day the criminal information was filed, ABB Inc. pled guilty to the charges in the criminal information and the court imposed a sentence that included a $17.1 million criminal fine. As discussed in our FCPA Winter Review 2010, in November 2009, O'Shea was charged for his involvement in the scheme and Basurto pled guilty. In addition, as discussed below in this FCPA Review, Enrique Faustino Aguilar Noriega and Angela Maria Gomez Aguilar were indicted in September 2010 for their role in acting as intermediaries between ABB NM and the CFE.

For its part, the SEC filed a civil complaint against ABB Ltd. alleging violations of the FCPA's books and records and internal controls provisions related to its involvement in the Oil-for-Food Program and CFE-related schemes described above. Specifically, the SEC complaint alleges that from 1997 to 2004, ABB NM paid over $1.9 million in bribes to CFE officials and to officials of the government-owned Luz y Fuerza del Centro ("LyFZ") in order to win contracts worth $90 million in revenues and $13 million in profits. In addition, the complaint alleges that seven other ABB subsidiaries paid kickbacks to Iraqi officials from 2000 to 2004 to obtain contracts under the Oil for-Food Program. The kickbacks totaled approximately $810,793 and the contracts generated $13,577,727 in revenues and $3,801,367 in profit.

According to the SEC press release, without admitting or denying the SEC's allegations, ABB Ltd. settled the SEC action by consenting to entry of a final judgment. That final judgment permanently restrains and enjoins the company from future FCPA violations, orders ABB Ltd. to disgorge ill-gotten gains and pay prejudgment interest in the amount of $22,804,262, to pay a civil penalty in the amount of $16,510,000, and to improve its FCPA compliance program.

Noteworthy Aspects

- Continued Oil-for-Food Prosecutions - According to the SEC, this is the Commission's sixteenth FCPA enforcement action against a company involved in the Oil-for-Food scandal. In total, the SEC's Oil-for-Food-related enforcement actions have recovered more than $243 million in civil penalties and disgorgement.

- Training Point - In light of the past FCPA prosecutions of ABB and formerly ABB related Aibel and Vetco Gray, discussed in our FCPA Winter Review 2009, FCPA Autumn Review 2007, and in our July 9, 2004 Alert, this enforcement action highlights the extent to which corruption can be systemic, even in large multinational companies. Generalized non-compliance with the FCPA can occur in companies with a culture of corruption or with weak internal controls. The ABB prosecution is an example of why it is particularly important for any company considering the acquisition of an entity related to a past FCPA violator to conduct thorough due diligence, including a review of the target's FCPA-related controls.

Alliance One International Inc.

On August 6, 2010, leaf tobacco merchant Alliance One International Inc. ("Alliance") and two foreign subsidiaries settled charges with the DOJ and SEC regarding improper payments in Thailand, Kyrgyzstan, Greece, China, and Indonesia. In a related matter described below, leaf tobacco merchant and processor Universal Corporation ("Universal") and a foreign subsidiary also settled DOJ and SEC charges related to payments made to government officials in Thailand and two other countries.

In their plea agreements, Alliance's Swiss subsidiary Alliance One International AG ("AOI") and Kyrgyz subsidiary Alliance One Tobacco Osh LLC ("AOT") each pled guilty to three DOJ charges: one count of conspiring to violate the anti-bribery provisions of the FCPA; one count of violating the anti-bribery provisions of the FCPA; and one count of aiding and abetting the falsification of books and records in violation of the accounting provisions of the FCPA. AOI and AOT agreed to pay a combined criminal penalty of $9.45 million. Separately, Alliance entered into a Non-Prosecution Agreement ("NPA") with the DOJ, according to which the DOJ agreed not to prosecute Alliance for conduct related to improper payments in Kyrgyzstan and Thailand or the associated accounting and record-keeping practices. In addition, Alliance consented to a final judgment with the SEC regarding charges of: violating the anti-bribery provisions of the FCPA; failing to make and keep accurate books, records, and accounts; and failing to devise and maintain a system of internal controls. In doing so, the parent company agreed to disgorge $10 million. Pursuant to the NPA and the SEC's Final Judgment, Alliance agreed to engage an independent compliance monitor for a period of three years.

Alliance was formed in May 2005 by a merger of two wholesale leaf tobacco merchants, Dimon Incorporated ("Dimon") and Standard Commercial Corporation (“Standard”). According to a sentencing memorandum, U.S. enforcement agents began investigating Alliance for conduct pre-merger after counsel for Dimon filed a filed a May 2004 voluntary disclosure. According to charging documents, Dimon and Standard paid bribes in the form of kickbacks to government officials at the Thailand Tobacco Monopoly ("TTM"), a Thai government-owned entity responsible for purchasing imported tobacco, in order to obtain and retain sales contracts. As part of the conspiracy, the disposition documents stated that the two entities allegedly coordinated their sales prices with a Universal subsidiary in order to ensure each company a share in the Thai tobacco market. According to the charging documents, the sales prices were elevated in order to secure funds that agents and subsidiaries used to pay kickbacks to TTM officials. Thereafter, the subsidiaries allegedly mischaracterized the bribes in their books, records, and accounts as “commissions” (legitimate business expenses) and the falsified entries were incorporated into Dimon’s and Standard’s consolidated financial statements.

In addition, the SEC complaint alleged that Dimon and Standard were responsible for corrupt payments in Eastern Europe and Asia. Those other charges include: payments of over $2.6 million to an official at the Kyrgyz export authority; payments of over $260,000 to local Kyrgyz officials who had influence over local police to prevent tobacco sales; payments of more than $220,000 to tax officials in Kyrgyzstan, Greece, and Indonesia to reduce penalties, persuade officials not to pursue alleged tax irregularities, and resolve an audit; a $50,000 payment to a Thai agent who was also a political candidate; and gifts, non-business travel, and entertainment to Chinese and Thai officials.

In a related matter, discussed in our FCPA Summer Review 2010, former Dimon executives Bobby Elkin Jr., Baxter Myers, Thomas Reynolds, and Tommy Lynn Williams settled charges with the SEC on April 28, 2010, relating to improper payments to officials in Kyrgyzstan and Thailand. On August 4, 2010, Bobby Elkin, Jr. pled guilty to DOJ charges of conspiring to pay bribes to Kyrgyz officials in violation of the FCPA's anti-bribery provisions. According to court documents, Mr. Elkin's sentencing is scheduled for October 21, 2010.

On August 6, 2010, Universal and its wholly-owned Brazilian subsidiary, Universal Leaf Tabacos Ltda. ("Universal Brazil"), settled charges with the DOJ and SEC regarding alleged improper payments in Thailand, Mozambique, and Malawi.

In a plea agreement, Universal Brazil pled guilty to one count of conspiring to violate the anti-bribery provisions of the FCPA and one count of violating the anti-bribery provisions of the FCPA. As part of the plea agreement, Universal Brazil agreed to a criminal penalty of $4,400,000. In addition, on August 3, 2010, Universal entered into an NPA with the DOJ concerning the same conduct, with an agreement to retain an independent compliance monitor for three years. In a settlement with the SEC, Universal consented to entry of a court order settling charges of FCPA anti-bribery, accounting, and internal controls violations and agreed to pay the SEC $4,581,276.51 in disgorgement and prejudgment interest, and to retain an independent compliance monitor for three years.

Universal had been under investigation by U.S. enforcement officials since June 2006 as a result of its March 2006 voluntary disclosure of potentially improper payments made by an unspecified number of subsidiaries. As charged in the SEC complaint, the improper conduct involved seven subsidiaries in Belgium, Brazil, Europe, Malawi, Mozambique, and the U.S. According to the Criminal Information filed by the DOJ and the U.S. Attorneys Office, Universal Brazil paid kickbacks to government officials at the TTM in order to obtain and retain sales contracts. To secure the kickback funds, Universal Brazil and two competitors, Alliance predecessors Dimon and Standard, allegedly agreed to a price for their Brazilian leaf tobacco that included excess funds intended to be paid as kickbacks to TTM officials through the companies' agents. Thereafter, according to the charging documents, the payments were recorded in Universal's subsidiaries' books, records, and accounts as "commission payments," in other words, as legitimate business expenses. From 2000 to 2004, Universal Brazil allegedly paid TTM officials a total of $687,800 to obtain orders for sale of tobacco worth over $9 million. According to the statement of facts attached to both the NPA and the plea agreement, the kickback scheme eventually ended when the TTM adopted an electronic auction process to award orders, increasing bid transparency and allowing for more open competition.

The SEC complaint further alleged that another Universal subsidiary paid over $100,000 to TTM officials to obtain orders for sale of tobacco worth over $2 million. In addition, the SEC complaint alleged that other Universal subsidiaries paid approximately $900,000 to officials and relatives of officials in Mozambique and Malawi. The payments in Mozambique to officials and relatives of officials allegedly were intended to obtain rights to purchase tobacco from a designated growing region, to procure beneficial legislation for the subsidiary, and to avoid paying an export tax on unprocessed tobacco.

Noteworthy Aspects for Alliance and Universal:

- Pre-Existing Controls and Remedial Steps Linked to Reduction in Fines - Both Alliance and Universal received substantial credit for their cooperation with the government and for implementing specific compliance measures. AOI paid a fine of $5.25 million, on the low end of the sentencing range, while AOT paid $4.2 million, the minimum fine according to the sentencing range. In Alliance's NPA and sentencing memorandum, the DOJ noted the company's voluntary disclosure, "timely and thorough" cooperation, acceptance of responsibility, and specific remedial measures, including enhancement of controls on cash transactions, discipline or termination of responsible employees, and a requirement for all personnel to re-take an online FCPA training course. For Universal, the fine assessed by the DOJ was approximately 30% below the applicable Sentencing Guidelines range. According to Universal's plea agreement and sentencing memorandum, the reduction reflected Universal's voluntary disclosure and "extensive cooperation" in the investigation in addition to a pre-existing compliance program and remedial actions taken after the conduct was discovered. The remedial steps highlighted in the sentencing memorandum included establishing a Compliance Committee and Chief Compliance Officer position, terminating or disciplining responsible personnel, improving the company's payment approval policy, enhancing the due diligence process for agents, and conducting in-person FCPA training for employees.

- Alliance: Payment to a Political Candidate - The SEC accused Alliance's predecessor Standard of paying $50,000 to a political candidate who was also an agent for tobacco sales in Thailand. The FCPA prohibits payments to "any foreign political party or official thereof or any candidate for foreign political office" for an improper purpose. The SEC Complaint states that Standard disguised the payment in its books as a payment for "consulting work" but does not describe the payment's purpose.

On July 27, 2010, the SEC filed FCPA books and records and internal controls charges against General Electric Co. ("GE") and two subsidiaries, Ionics Inc. ("Ionics") and Amersham plc. ("Amersham"), for which the SEC stated GE assumed liability upon acquiring the companies. The SEC alleged that Ionics and Amersham, along with two other GE subsidiaries, made approximately $3.6 million in illicit payments to the Iraqi Health Ministry and the Iraqi Oil Ministry to secure contracts to supply Iraq with medical equipment and water purification equipment under the UN Oil-for-Food Program. In settling these allegations, GE agreed to pay a combined $23.4 million in penalties, disgorgement, and pre-judgment interest. In addition, GE, Ionics and Amersham, without admitting or denying the allegations, consented to the entry of a final judgment permanently enjoining them from violating the FCPA.

According to the SEC Complaint, two long-time GE subsidiaries, the German-based Marquette-Hellige ("Marquette") and the Swiss-based OEC-Medical Systems (Europa) AG ("OEC-Medical"), made approximately $2.04 million in illicit payments in the form of computer equipment, medical supplies, and services to the Iraqi Health Ministry from 2000 to 2003. In addition, subsidiaries of Ionics and Amersham, both publicly-registered companies that GE acquired after 2003, allegedly made approximately $1.55 million in cash payments to the Iraqi Oil Ministry and Iraqi Health Ministry from 2000 to 2002, respectively.

Marquette and OEC-Medical, both medical equipment manufacturers, allegedly declined to make cash payments to the Iraqi Health Ministry, but agreed to provide in-kind equipment, supplies and services to secure Oil-for-Food contracts worth millions. Both subsidiaries channeled these goods and services through the same Iraqi agent. According to the SEC Complaint, Marquette's in-kind kickbacks included approximately $1.2 million in payments made and another $250,000 in payments offered. The complaint stated that the kickbacks were made "with the knowledge and approval of Marquette officials" and the secured contracts were worth approximately $8.8 million. OEC-Medical allegedly made an in-kind kickback worth approximately $870,000 to secure a contract on which it earned a profit of $2.1 million. To conceal the corresponding increase in the Iraqi agent's commission, OEC-Medical and the Iraqi agent entered into a sham "services provider agreement" that purported to identify additional services justifying the increase.

From 2000 to 2002, Amersham's Norway-based subsidiary Nycomed Imaging AS ("Nycomed"), a manufacturer of X-Ray and MRI contrast agents, allegedly made approximately $750,000 in cash payments to the Iraqi Health Ministry to secure nine Oil-for-Food contracts on which it earned $5 million in profits. According to the SEC Complaint, the contracts were negotiated by Nycomed's Jordanian agent and "explicitly authorized" by the company's salesperson in Cyprus. To cover the costs of the kickbacks, Nycomed's salesperson raised the agent's commission percentage significantly and artificially increased the underlying contract prices by 10%.

From 2000 to 2002, Ionics' Italy-based subsidiary Ionics Italba S.r.L. ("Ionics Italba"), a manufacturer of water purification equipment, allegedly made $795,000 in cash payments to the Iraqi Oil Ministry to secure five Oil-for-Food contracts on which it earned $2.3 million in profits. According to the SEC Complaint, Ionics Italba concealed these payments on most of its contracts under fictitious line items. On one occasion, the company colluded with the Iraqi Oil Ministry to provide false details about a line item in response to inquiries by UN inspectors. On four of the five contracts, Ionics Italba and the Ministry negotiated side letters documenting the kickback payments. These letters were concealed from UN inspectors in violation of Oil-for-Food Program requirements.

In charging GE and its subsidiaries, the SEC alleged that the companies failed to maintain adequate systems of internal controls to detect and prevent the illicit payments, and that they failed to properly record the true nature of these payments in their books and records. GE cooperated with the investigation, and, as part of its settlement, was ordered to pay $18,397,949 in disgorgement of profits, $4,080,665 in prejudgment interest, and a civil penalty of $1 million.

Noteworthy Aspects

- No Parallel DOJ Enforcement - In conjunction with the SEC settlement, GE issued a press release announcing that the DOJ "has closed its investigation and will take no action relating to these matters," marking the first time the DOJ has not brought a parallel enforcement action alongside the SEC in an Oil-for-Food-related FCPA case.

- No Anti-Bribery Violations - As with most other Oil-for-Food enforcement actions, the FCPA charges filed against GE were FCPA accounting violations, not antibribery violations. The kickbacks in Oil-for-Food cases typically have been paid to the Iraqi government rather than to individual "foreign officials," therefore the elements of an antibribery charge are not satisfied.

- Successor Liability - In its press release, GE noted that of the 18 contracts identified in the SEC Complaint, 14 took place at companies that were not owned by GE at the time and for whom GE was only responsible because the "SEC alleges that, in acquiring these companies, GE acquired their liabilities as well as their assets." In the SEC's Press Release, Cheryl J. Scarboro, Chief of the SEC's FCPA Unit, noted that "corporate acquisitions do not provide GE immunity from FCPA enforcement of the... two subsidiaries involved."

Actions Against Individuals

Nexus Employees and Former Partner Sentenced

On September 16, 2010, three former employees and a partner of Nexus Technologies Inc. ("Nexus") were sentenced in the U.S. District Court for the Eastern District of Pennsylvania for their roles in a conspiracy to bribe employees of Vietnamese state-owned companies in exchange for contracts to supply equipment and technology. As reported in our FCPA Spring Review 2010, Nexus, a Philadelphia-based export company, pled guilty earlier this year to conspiracy, money laundering, FCPA, and Travel Act charges related to the same underlying conduct, as did former Nexus employees Nam Nguyen, Kim Nguyen, and An Nguyen. As part of Nexus's plea, it agreed to cease operations. In 2009, Joseph T. Lukas, Nexus's former partner who was a cooperating witness against the other defendants, also pled guilty for his role in the conspiracy.

In the current proceeding, Nam Nguyen, the president and owner of the company, was sentenced to a term of 16 months in prison and two years of supervised release. An Nguyen, his sibling, was sentenced to nine months imprisonment and two years supervised release. Kim Nguyen, his other sibling, was sentenced to two years of probation and fined $20,000. Lukas was also sentenced to two years of probation and fined $1,000.

The sentencing is notable in that the court refused to follow requests in the DOJ's sentencing memorandums, and instead imposed more lenient sentences. Specifically, the DOJ requested a sentence of 168 to 210 months for Nam Nguyen (he received 16 months), 87 to 108 months for An Nguyen (he received 9 months), a "substantial" term of imprisonment below the advisory guidelines range of 70-87 months for Kim Nguyen (she received probation), and a "substantial" term of imprisonment below the advisory guidelines range of 37 to 46 months for Lukas (he received probation). While Lukas's sentence can be explained, at least in part, by his cooperation, the court's lenient treatment of the other defendants may reflect differences in the court's and the DOJ's views regarding the seriousness of the FCPA violations in this case.

Noteworthy Aspects

- Inconsistent Sentences - The sentencing imposed by the court appears inconsistent with sentences in other recent enforcement actions involving defendants who paid lesser amounts of bribes. As the DOJ pointed out in its sentencing memorandum, Charles Jumet, who paid less than one third of the bribes paid by Nam Nguyen, recently received a sentence of 87 months imprisonment (see our FCPA Summer Review 2010 for further information on the Jumet case).

SHOT Show Informant Pleads Guilty to Conspiracy

On September 16, 2010, Richard Bistrong pled guilty to one count of conspiracy to violate the FCPA, the International Emergency Economic Powers Act, and the Export Administration Regulations. According to his plea agreement, Bistrong faces up to five years in prison, a fine of not more than $250,000 or twice the pecuniary gain or loss derived from the offense, and up to three years' supervised release.

As reported in our FCPA Spring Review 2010, Bistrong is the former Vice President of International Sales for Armor Holdings Inc. ("Armor"), a military equipment manufacturer based in Florida, which has been a subsidiary of U.K.-based BAE Systems since 2007. As part of Bistrong's plea agreement, which is dated February 2, 2009, Bistrong agreed to help the government build its case against others in the firearms industry. This cooperation included "working in an undercover role to record meetings and telephone calls" and "attend[ing] all meetings at which the Government request[ed] his presence." In exchange, the DOJ indicated in the plea agreement that it could recommend a downward departure from the sentencing guidelines if it determined that Bistrong provided substantial assistance in its investigation.

Bistrong's cooperation with the Government resulted in the arrest of the 22 SHOT Show defendants who allegedly engaged in a scheme to pay bribes to the minister of defense of an unnamed African country -- reportedly Gabon -- to win a $15 million contract to provide law enforcement and defense equipment to the country's presidential guard. In actuality, the scheme was a sting operation arranged by the FBI with Bistrong's help. The SHOT Show arrests and subsequent indictments constituted one of the largest set of indictments of individuals for FCPA violations to date. No trial date has been set for the 22 defendants, and the next status hearing is set for November 2010.

Bistrong pled guilty to violating the FCPA for helping to conceal approximately $4.4 million in payments to intermediaries who assisted Armor in securing business from the United Nations and the National Police Services Agency of the Netherlands as outlined in the January 21, 2010 criminal information. Specifically, Bistrong was charged with conspiring to help obtain United Nations body armor contracts worth $6 million by causing Armor to pay $200,000 in commissions knowing that the agent to whom the commission was paid would pay a portion of the money to a United Nations procurement officer. In addition, Bistrong helped pay a Dutch agent $15,000 while knowing that the money would be passed on to a procurement officer at the Dutch Police Services Agency in order to secure a $2.4 million contract for pepper spray. Lastly, Bistrong made kickback payments to an intermediary in a failed attempt to help Armor secure a contract for fingerprint ink pads for the Independent National Elections Commission of Nigeria.

Noteworthy Aspects

- United Nations Employees Are FCPA "Foreign Officials" - Bistrong's prosecution highlights the attention companies must pay to FCPA compliance when dealing with international organizations. The FCPA's definition of the term "foreign official" includes officers, employees, or any person acting in an official capacity for or on behalf of any public international organization such as the United Nations.

- Actions in a Non-Red Flag Country - The Bistrong prosecution included payments to officials of the Netherlands, a country not typically considered to be corrupt. In fact, the Netherlands is ranked sixth in Transparency International's 2009 Corruption Perceptions Index, which measures the perceived level of public-sector corruption in 180 countries and territories around the world. This prosecution is a reminder that individuals and companies doing business abroad cannot ignore the FCPA simply because they are not doing business in a high-risk country.

Greens Sentenced to Six Months in Jail

On August 12, 2010, Gerald and Patricia Green, two L.A. film producers, were sentenced for their roles in bribing Thai tourism officials in connection with a yearly film festival in Thailand. The Greens were convicted in September 2009 on numerous counts of conspiracy, violating the antibribery provisions of the FCPA and money laundering for providing more than $1.8 million in bribes to secure contracts for the festival (See our FCPA Autumn Review 2009).

Following a series of delays (See, e.g., FCPA Winter Review 2010), Judge George H. Wu sentenced each defendant to six months in jail followed by six months home confinement. He also ordered the Greens to pay $250,000 each in restitution and forfeit a combined $1,049,465, plus each defendant's share of the "Artist Design Corp. Defined Benefit Plan," which together represents the amount of money defendants obtained as proceeds of the offenses.

The sentences appear strikingly lenient when compared with the maximum each defendant could have received; Mr. Green could have received up to 185 years imprisonment and Ms. Green up to 188 years. Initially, prosecutors pushed for sentences of roughly 20 years for each defendant, later reducing this recommendation to 10 years.

In sentencing the defendants to six months of jail time each, Judge Wu rejected government arguments that individuals who did not plead guilty in FCPA cases consistently received longer sentences than this. According to press reports, Judge Wu offered insight into his sentencing during the August 12th hearing, explaining that, "The crimes involved here are serious crimes, but they're not as serious as other crimes in these types of situations… I do not feel, given the defendants' lack of criminal conduct, that they pose a danger to the public." Judge Wu reportedly saw the defendants' crime as victimless, because Thailand and the Thai people seemingly benefited from the film festival the Greens helped to organize. According to press reports, he also noted at the hearing that a lengthy prison sentence would adversely affect Mr. Green's health, as he is 78 and suffers from numerous medical problems, including emphysema.

The Greens are tentatively scheduled to surrender to authorities on November 29, 2010.

Noteworthy Aspects

- Reduced Sentences - Similar to the sentencing in the Nexus Technologies case discussed above, the court refused to follow the DOJ's sentencing recommendations, and instead exercised independent judgment in imposing sentences that appear lenient compared to those in other recent cases. For example, Juan Diaz, sentenced in July 2010, received 57 months in prison. John Warwick, sentenced in June 2010, received 37 months in prison. Charles Jumet, sentenced in April 2010, received 87 months in prison.

- Related Prosecutions - Juthamas Siriwan and her daughter Jittisopa Siriwan, the Thai officials whom the Greens allegedly bribed, were charged in the United States in January 2010 (see FCPA Spring Review 2010) and are currently under investigation in Thailand.

Enrique Faustino Aguilar Noriega and Angela Maria Gomez Aguilar Indicted

On September 15, 2010, a federal grand jury issued a seven count indictment against Enrique Faustino Aguilar Noriega and Angela Maria Gomez Aguilar ("the Aguilars"). Both the Aguilars were indicted on money laundering charges, and Mr. Aguilar was indicted on charges of conspiracy to violate the antibribery provisions of the FCPA and violation of the antibribery provisions of the FCPA. The Aguilars were the directors of Groupo Internacional de Asesores S.A., a Houston brokerage firm which provided sales representation services for companies doing business with Mexico's state owned Comisión Federal de Electricidad ("CFE").

The indictment alleges that from approximately February 2002 to March 2009, the Aguilars used their brokerage firm to pass bribes to Mexican government officials at the CFE. According to press reports, Néstor Moreno, the CFE's head of operations, received a Ferrari, a luxury yacht, and several million dollars in exchange for securing contracts for the Aguilars' clients.

Press sources report that these bribes were paid on behalf of ABB Inc., the U.S. subsidiary of Swiss electrical engineering giant ABB Group, and Lindsey Manufacturing, a manufacturer of emergency electrical restoration systems. According to court documents, the CFE awarded approximately $81 million in contracts to ABB, Inc. from 1997 to 2003, and approximately $34 million in contracts to Lindsey Manufacturing from 2004 to 2007. Bank records indicate that Lindsey Manufacturing paid Gomez and her husband $5.33 million from 2003 to 2008. Moreno, who has taken an unpaid leave of absence from the CFE, denied the allegations and Lindsey Manufacturing said it never knowingly paid money to be used as bribes. Angela Maria Gomez Aguilar was arrested on August 13, 2010, and the whereabouts of Mr. Aguilar are not known.

Noteworthy Aspects

- Prosecutions of Employees and Intermediaries - The indictment against the Aguilars follows the related arrests of Fernando Maya Basurto and John O'Shea, reported in our FCPA Winter Review 2010. In 2006, ABB Group alerted U.S. prosecutors that employees of ABB, Inc. may have violated the FCPA. That investigation resulted in the arrests of John O'Shea, the former general manager of ABB, Inc., on charges of having orchestrated bribes to Mexican officials, and Fernando Maya Basurto, a Mexican citizen and sales representative for ABB, Inc. Maya pled guilty to having conspired to violate the FCPA, to launder money, and to falsify records in April 2009 and is awaiting sentencing. O'Shea's trial is set for April 18, 2011. The prosecution of the Aguilars and Basurto demonstrate the government's intent to pursue enforcement actions against intermediaries, both domestic and foreign, and not merely the companies funding the bribery.

James Giffen and Mercator Corp. Plead Guilty

James Giffen, who was arrested and indicted in 2003 on multiple charges of violating the FCPA, pled guilty on August 6, 2010 to one misdemeanor tax count and agreed to pay a $25,000 fine, signaling the end of a nearly decade-long saga.

Giffen, an American citizen who is now 69, worked in the 1990s as an intermediary for oil giants including Texaco, Amoco, Phillips Petroleum and Mobil Oil in Central Asia to facilitate oil transactions. The DOJ began its investigation of Giffen over nine years ago, at which time it was one of the most prominent FCPA prosecutions of an individual. In March 2003, Giffen was arrested in New York and charged with, among other things, 13 FCPA violations, 35 counts of money laundering, and four counts of conspiracy. In addition, the indictment alleged that Giffen's actions violated the honest services fraud statute, 18 U.S.C. § 1346 by depriving the citizens of Kazakhstan of the honest services of their government officials. The DOJ alleged that Giffen diverted over $70 million of funds to escrow accounts at Banque Indosuez, a Swiss bank account, and its successor Credit Agricole Indosuez, and made at least $78 million in improper payments to two Kazakh officials between 1995 and 2000 in connection with six oil transactions.

Giffen denied the charges and asserted that his actions were taken with the knowledge and support of the Central Intelligence Agency ("CIA"), the National Security Council, the State Department, and the White House. In order to support his public authority defense, the court allowed Giffen to seek discovery from the government. According to media sources, there was significant infighting between the DOJ and the CIA over access to documents; the CIA was particularly concerned about providing information on its intelligence sources and intelligence gathering methods to the defense. Because of the government's resistance to providing the requested documents and disputes over who could see the documents, the case remained in the discovery phase for the last seven years. In 2007, the United States reached a deal with Kazakh and Swiss officials to freeze $84 million in secret accounts that Giffen maintained in Switzerland.

According to press reports, the Kazakh government tried to limit the FCPA investigation by attempting to exclude Kazakh President Nursultan Nazarbayev from the probe. A lawyer for Kazakhstan also told the Justice Department that pursuing an investigation of Kazakh officials would negatively impact U.S.-Kazakh relations.

On August 6, 2010, Giffen pled guilty to failing to check a box on a 1996 tax return to indicate he had an interest in and signatory authority over an overseas bank account in violation of 26 U.S.C. § 7203. That misdemeanor tax charge has a maximum incarceration period of one year and, in Giffen's case, a maximum fine of $25,000. Press reports indicate that Giffen, whose sentencing date is November 19, 2010, is not likely to be sentenced to more than six months in prison. Giffen also agreed to give up his claims to the frozen foreign accounts worth $84 million; according to the DOJ's press release, those funds will be used to pay for child welfare programs and for an initiative to improve transparency in the Kazakh oil industry.

In addition, the Mercator Corporation, a private bank of which Giffen was the principal shareholder and CEO, pled guilty to violating the anti-bribery provisions of the FCPA by giving two snowmobiles worth $16,000 to Kazakh officials.

Noteworthy Aspects

- Public Authority Defense - The outcome of this case highlights the difficulties of prosecuting a defendant who raises a public authority defense. In this instance, Giffen's defense reportedly caused inter-agency infighting over whether classified documents could be provided to the defense, resulting in significant delays in discovery and, ultimately, an order that the Government comply with the discovery requests under the Classified Information Procedures Act. The CIA's resistance to providing the information, in addition to the fact that, had the case gone to trial, the evidence would have aged significantly, may have created hurdles to the DOJ's prosecution of Giffen. These burdens may have affected the DOJ's decisions regarding charging that lead to the surprising outcome of this case.

Ousama Naaman and David Turner Settle SEC Charges

On August 5, 2010, Ousama Naaman and David Turner settled charges with the SEC related to their involvement in making improper payments in Iraq and Indonesia on behalf of U.S. chemical producer Innospec Inc. ("Innospec") and its foreign subsidiaries. As reported in our FCPA Spring Review 2010, Innospec and its U.K. subsidiary recently settled enforcement actions brought by U.S. and U.K. authorities related to various improper payments in Iraq and Indonesia to secure the sale of the fuel additive tetraethyl lead ("TEL"). In particular, among other misconduct, Innospec admitted making or promising: (1) kickback payments to the former Iraqi government under the UN Oil-for-Food Program to secure contracts for the sale of TEL; (2) bribes to Iraqi Ministry of Oil officials after the fall of the Hussein regime to secure TEL sales and to prevent a competing product from being approved for use in Iraq; and (3) bribes to Indonesian officials to secure TEL sales. All of these payments were made through intermediaries, and many were disguised as commissions or legitimate travel expenses.

As reported in our FCPA Summer Review 2010 and FCPA Autumn Review 2008, Naaman allegedly acted as an intermediary for the improper payments to Iraqi officials. Turner served as Business Director of Innospec's TEL group. Naaman was arrested in Germany and extradited to the United States, where he pleaded guilty to conspiracy and anti-bribery charges in June 2010. Naaman's sentencing on the criminal charges is scheduled for December 9, 2010. He faces up to 10 years imprisonment and fines up to twice the gain from the offences.

In the current enforcement action, the SEC charged Naaman and Turner with antibribery violations, accounting violations, and aiding and abetting Innospec's misconduct. The facts set out in the SEC's complaint for the most part track the allegations in prior pleadings against Innospec and Naaman. To settle the charges, Naaman agreed to disgorge $810,076 plus prejudgment interest of $67,030, and to pay a civil penalty of $438,038 that will be deemed satisfied by a criminal fine at least equal to the civil penalty amount. Turner, from whom the SEC reportedly received "extensive ongoing cooperation," agreed to disgorge $40,000.

Noteworthy Aspects

- Size of Monetary Penalties - The monetary penalties assessed against Naaman are among the largest assessed against an individual in an FCPA enforcement action to date. Other monetary penalties of note against individuals include those imposed on the Greens ($250,000 each in restitution, forfeiture of $1,049,465 plus shares in a company, as discussed above), Frederic Bourke ($1 million criminal fine), and Robert Phillip (combined penalties of over $250,000).

- Jurisdictional Reach - This action is also noteworthy in the SEC's apparent departure from the DOJ's asserted basis of U.S. jurisdiction over Naaman, and demonstration of the government's broad interpretation of the FCPA's jurisdictional reach. As discussed in our FCPA Summer Review 2010, the basis of the DOJ's jurisdiction over Naaman was left unclear in his criminal indictment. Specifically, the DOJ claimed jurisdiction over Naaman, a Lebanese/Canadian dual national, on the basis of the FCPA's "Alternative Jurisdiction" (15 U.S.C. § 78dd-1(g)), which does not apply to foreign nationals. In the current enforcement action, however, the SEC does not cite the FCPA's "Alternative Jurisdiction," but rather claims Naaman and Turner (a U.K. national) are subject to the FCPA because they made use of U.S. mails and interstate commerce in carrying out their schemes. Although not specifically cited, § 78dd-1(a) applies to U.S. Issuers and their employees and agents (such as Naaman and Turner) that make use of U.S. mails and interstate commerce. It thus appears that the SEC, by not specifically citing any basis of jurisdiction, avoided problems in the DOJ's pleadings (i.e., citing an apparently inapplicable basis of jurisdiction). The specific activities mentioned in the SEC's pleadings providing a U.S. nexus of Naaman's misconduct were emails he sent to and received from the United States while he was out of the country.

- Violations of Internal Policies - Finally, the resolutions provide examples of how violations of internal policies and procedures can serve as evidence of FCPA accounting violations. In particular, the SEC's complaint notes that Turner made false statements to Innospec's internal auditors and false statements on annual compliance certifications to conceal improper payments.

Former Pride Employees Settle SEC Charges

On August 5, 2010, the SEC announced that it had charged Joe Summers, formerly of Pride International, Inc. ("Pride"), with one count each of violating and aiding and abetting the violation of the anti-bribery provisions of the FCPA, and one count each of violating and aiding and abetting the violation of the internal controls and books and records provisions of the FCPA. Summers served as the Venezuela Country Manager for Pride International Personal Ltd., a wholly owned subsidiary of Pride. Without admitting or denying the allegations, Summers agreed to the entry of a permanent injunction and to the payment of a $25,000 civil penalty.

The SEC also settled a related action with Bobby Benton, Pride’s former Vice-President of Western Hemisphere Operations, who was charged in December 2009 with violating the antibribery, internal controls and books and records provisions of the FCPA, aiding and abetting violations of those provisions, as well as making false representations to accountants (as reported in our FCPA Winter Review 2010). Specifically, Benton was accused of redacting the $384,000 in illicit payments Summers authorized in Venezuela from a company action plan, of personally authorizing a third party to make another $10,000 payment to a Mexican Customs official in exchange for overlooking deficiencies in the inspection of a supply boat, and of having knowledge of a $15,000 payment to a Mexican Customs official to assist in the export of a rig with non-conforming equipment. Without admitting or denying the allegations, Benton consented to the entry of a final judgment of the charges against him and agreed to pay a $40,000 civil penalty.

According to the pleadings, from 2003 to 2005 Summers authorized or allowed payments totaling over $400,000 to third parties, believing that all or a portion of the funds would be given to officials and employees of Petróleros de Venezuela S.A. ("PDVSA"), Venezuela's state-owned oil company, to secure contract extensions or to secure an improper advantage in obtaining payments of certain receivables. Specifically, the complaint alleges Summers authorized several payments totaling $384,000 to a "Venezuelan Intermediary" who represented a PDVSA official and told Summers the official could assist a Pride company in obtaining a contract extension. Additionally, the Complaint alleges Summers paid $30,000 to a PDVSA accounts payable employee through a third party to obtain legitimate, unpaid receivables. The PDVSA employee held up payment of the receivables and requested, through a third party, the $30,000 payment to release them.

According to the Complaint, Pride uncovered allegations regarding the payments in early 2006 during the course of an internal audit and an investigation of certain Latin American operations. As reported in our FCPA Spring Review 2010, following the discovery, Pride voluntarily disclosed the information to the SEC and conducted a worldwide compliance review of its internal operations.

Noteworthy Aspects

- Breadth of "Obtain and Retain Business" - The SEC charged Summers with paying PVDSA employees to secure receivables legitimately owed to Pride by PVDSA, an act that shows the government's broad interpretation of the "obtain or retain business" element of the FCPA. In 1994, the DOJ similarly asserted violations of the anti-bribery provisions of the FCPA by Vitusa Corp. for its payment to a Dominican official to secure payment of legitimately owed receivables. The Vitusa and Summers matters involved relatively large payments ($20,000 and $30,000, respectively); it is possible that significantly smaller payments could have been successfully defended as facilitating payments, even though the statute does not set a monetary limit on such payments.

- Related Actions - Pride has accrued $56.2 million in anticipation of settling FCPA charges associated with its voluntary disclosure. A settlement is reportedly expected soon.

Florida Businessman Sentenced to 57 Months for Role in Haiti Teleco Scheme

On July 30, 2010, Miami businessman Juan Diaz was sentenced to 57 months in prison for his role in a scheme to bribe Haitian government officials at the state-owned Telecommunications d'Haiti ("Haiti Teleco"). As noted in our FCPA Spring Review 2009, in May 2009, Diaz pled guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA and to violate the Money Laundering Control Act of 1986 ("MLCA"). According to the criminal information, Diaz used his company, J.D. Locator, to receive approximately $1 million in illicit payments from three unnamed Florida-based telecommunications companies ("telecom companies") and passed the money on to Haiti Teleco officials to secure business advantages for the telecom companies. In addition to his prison term, Diaz was sentenced to serve three years of supervised release and ordered to pay a combined $1.1 million in restitution and disgorgement.

Seven other individuals have been implicated in the conspiracy. Among them are Antonio Perez, the former controller of J.D. Locator; Jean Fourcand, president and director of Miami-based Fourcand Enterprises, Inc.; and two former directors of Haiti Teleco, Robert Antoine and Jean René Duperval. Perez pled guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA and to violate the MLCA and is scheduled for sentencing on December 17, 2010. Fourcand pled guilty to one-count of engaging in monetary transactions in property derived from specified unlawful activity and was sentenced to a six month prison term and ordered a payment of a $100 special assessment. Antoine pled guilty to money laundering and was sentenced to 48 months in prison and three years of supervised release and was ordered to pay $3.1 million in restitution and disgorgement. A jury trial for Duperval and three other individuals involved in the conspiracy, Joel Esquenazi, Carlos Rodriguez, and Duperval's sister Marguerite Grandison, is currently scheduled to begin on November 29, 2010, in U.S. District Court in Miami.

Noteworthy Aspects

- Prosecution of Intermediaries - Diaz is the second intermediary associated with the Haiti Teleco matter to settle charges related to the bribery scheme. As noted in the Aguilar case and as reflected in the Ousama Naaman resolution, the government is increasingly prosecuting intermediaries for their roles in making corrupt payments.

- Prosecution of Officials - As foreign officials alleged to have taken bribes, Antoine and Duperval are not directly covered under the FCPA. Their prosecution demonstrates the DOJ's willingness to prosecute foreign officials for corrupt activity under legal theories other than the FCPA.

Ongoing Developments

Pharmaceutical Industry Investigation

In August 2010, two more pharmaceutical companies joined the list of companies subject to FCPA enforcement inquiries. On August 6, Merck disclosed in a Form 10-Q filing that the company had received letters from the DOJ and SEC referencing the FCPA and requesting information about its activities "in a number of countries" not specified in the filing. On August 9, SciClone Pharmaceuticals Inc. ("SciClone") made a similar disclosure in its own 10-Q, discussed below in the context of a civil suit filed against the company, reporting that it had received a subpoena from the SEC and a letter from the DOJ in reference to investigations of the company's sale, licensing and marketing of its products in foreign countries, including China.

Merck and SciClone are the latest additions to a growing list of pharmaceutical companies subject to FCPA inquiries in 2010, including Pfizer, Eli Lilly, AstraZeneca PLC, Baxter International Inc., and Bristol-Myers Squibb Co. As reported in our FCPA Winter Review 2010, industry-wide investigations are a continuing trend in FCPA enforcement. Assistant Attorney General Lanny Breuer specifically warned of a DOJ inquiry into the pharmaceutical industry during comments in November 2009 at the American Conference Institute's 22nd National Conference on the FCPA, and in separate comments at the Pharmaceutical Regulatory and Compliance Congress and Best Practices Forum. He noted that the depth of government involvement in foreign nations' health care systems creates an environment ripe for corrupt payments. Because many doctors and hospital personnel are employed by state-owned facilities, they are considered to be foreign officials under the FCPA. As a result, U.S. pharmaceutical companies can interact with officials in connection with any aspect of their business, from imports to clinical trials to marketing to sales to doctors and hospitals.

The enforcement agencies' focus on pharmaceutical sales dates back even further than Assistant Attorney General Breuer's comments, however. The investigation of Eli Lilly began with a letter from the SEC in 2003, and Pfizer made a voluntary disclosure of potential FCPA violations in 2004. Beginning with the Syncor matter in 2002, the medical industry more generally has been subject to a significant number of FCPA enforcement actions, second only to the oil and gas industry. While many of the earlier enforcement actions focused on medical device sales and participation in the UN Oil-for-Food program in Iraq, the current focus on the industry is broader in scope, covering activities in many different countries.

Civil Litigation

SciClone Pharmaceuticals Announces SEC and DOJ Investigations; Civil Suit Filed

On August 9, 2010, SciClone, a NASDAQ-listed pharmaceutical company headquartered in Hong Kong, announced in a Form 10-Q that the SEC and the DOJ had initiated FCPA investigations of the company related to sales in foreign countries, including China. According to the filing, the SEC contacted the company on August 5, 2010, to advise them that the agency had initiated a formal investigation. The company also received a subpoena from the SEC requesting documents regarding "activities related to sales in China" and interactions with regulators and state-owned entities in the country. On August 6, the company received a letter from the DOJ indicating that the agency was investigating FCPA issues in the pharmaceutical industry generally and had received information about the company's practices that suggested possible FCPA violations. SciClone shares declined 41% the day after the announcement of the FCPA inquiry.

Four days after SciClone's 10-Q filing, a law firm press release announced the filing of a securities fraud class action against SciClone, alleging "illegal and improper sales and marketing activities in China and abroad regarding its products." The complaint, filed in U.S. District Court for the Northern District of California, brings claims against the corporation and its CEO and CFO for violations of Sections 10(b) and 20(a) of the Exchange Act and Rule 10b-5 thereunder. The suit is part of an increasing trend of parallel civil litigation following FCPA disclosures. Announcements of shareholder civil suits have closely followed the disclosure of FCPA investigations in several other cases, including Weatherford International, Avon Products, and Pride International. With a turnaround of only four days between SciClone's announcement of the investigation and the filing of a class action suit, SciClone serves as a compelling reminder of the risk of follow-on litigation even before the completion of a DOJ or SEC FCPA investigation.

Civil Suit Filed Against Innospec by Competitor

Innospec, after settling enforcement actions with the DOJ and SEC, described in our FCPA Spring Review 2010, was sued on July 23, 2010 by its competitor NewMarket Corp. ("NewMarket"). According to press reports, NewMarket's civil case, filed in U.S. District Court in Richmond, Virginia, alleges that Innospec committed unlawful conspiracy in violation of the Virginia Business Conspiracy Act and unlawful commercial bribery in violation of the Robinson-Patman Act and the Virginia Antitrust Act. Reportedly, the company became aware of Innospec's alleged actions after reading the DOJ and SEC documents related to their enforcement actions, which includes an allegation that Innospec's bribe payments in Iraq and Indonesia ensured the failure of a competitor's fuel additive field test. NewMarket claims that this competitor was its subsidiary Ethyl Petroleum Additives, Inc., which today goes by the name Afton Chemical Corp.

U.S. Agency Developments

FCPA Opinion Procedure Release No. 10-02

On July 16, 2010, the DOJ responded to a request from a non-profit microfinance institution based in the U.S. ("the Requestor") for an opinion regarding a proposed grant by a foreign subsidiary of the Requestor in an unnamed Eurasian country ("Eurasian Subsidiary") to a local microfinance institution ("MFI") in the country.

In connection with the Eurasian Subsidiary's attempt to obtain a license to operate as a bank, a regulatory agency of the country required the subsidiary to make a grant to a local MFI. The regulatory agency provided a list of local MFIs in the Eurasian country and stated that the Eurasian Subsidiary could not fulfill its localization obligation under local law unless it provided grant funding to one or more of them. According to the release, the Requestor was "concerned that compelled grants to an institution on a short list of institutions - without appropriate safeguards - raise red flags under the FCPA." The Requestor offered alternative proposals to satisfy the requirement, but the regulatory agency rejected its proposals. However, the agency stated that the Eurasian Subsidiary could perform due diligence on the local MFIs and could impose controls on the use of grant funds. Thus, the Eurasian Subsidiary undertook a three-stage due diligence process on the prospective grantee organizations, which resulted in an elimination of five of the six potential grantees.

During the last stage of the due diligence, the subsidiary discovered that a board member of the remaining potential grantee and its parent organization was a sitting government official. According to the Requestor, the sitting government official served in a capacity that was wholly unrelated to the microfinance industry. Moreover, the requester stated that sitting government officials could not be compensated for this type of board service under local law, and the local MFI confirmed that neither its board members nor the board members of its parent organization received compensation for their board service.

The release noted that the grant would be subject to several "significant controls" proposed by the Requestor, including: staggered payment of grant funds; ongoing monitoring and auditing; earmarking of funds for capacity-building; prohibition on the compensation of board members, and anti-corruption compliance provisions in the grant agreement.

The DOJ noted that the due diligence performed by the Requestor and the controls it implemented "would ensure with reasonable certainty that the grant money from the Eurasian Subsidiary would not be transferred to officials of the Eurasian country." Therefore, the DOJ stated that it would not take any enforcement action with respect to the proposed transaction.

Noteworthy Aspects

- New Trend of Incorporating Past Guidance - In the release, the DOJ referenced three prior releases addressing charitable contributions and donations to communities: FCPA Opinion Release 95-01 (Jan. 11, 1995), 97-02 (Nov. 5, 1997), and 06-01 (Oct. 16, 2006). The release synthesized several due diligence procedures and controls that were built into the donations discussed in previous releases, providing a useful shortcut for guidance when considering donations. These steps included: FCPA certifications by the recipient (95-01); due diligence to confirm that none of the recipient's officers were affiliated with the foreign government at issue (95-01); a requirement that the recipient provide audited financial statements (95-01); a written agreement with the recipient restricting the use of funds (97-02, 06-01); steps to ensure that the funds were transferred to a valid bank account (06-01); confirmation that contemplated activities had occurred before funds were disbursed (06-01); and ongoing monitoring of the efficacy of the program (06-01). In the present release, the DOJ noted that the Requestor undertook each of the above steps in addition to implementing further controls to reduce the possibility that anything of value would be given to officials of the Eurasian country. Thus, the DOJ concluded that the proposed grant is "consistent with the Department's past approach to grant-related requests."

FCPA Opinion Procedure Release No. 10-03

On September 1, 2010, the DOJ responded to a request from a U.S. limited partnership (the "Requestor") for an opinion concerning the hiring of a lobbyist (the "Consultant") who had previously held and currently holds contracts to represent a particular foreign government. The Requestor retained the Consultant and its sole owner, a U.S. citizen, to assist it in entering into discussions with the same foreign government about natural resource infrastructure development.

The Consultant, a registered agent of a foreign government pursuant to the Foreign Agents Registration Act, 22 U.S.C. § 611 et seq., represented ministries of the foreign government at issue, and had "extensive contacts in the business community and the government in the foreign country." When the consulting contract is signed, the Consultant will receive a signing bonus; the bulk of any payment to the Consultant will depend on its efforts resulting in the foreign government entering into a business relationship with the Consultant.

The Requestor noted that it put several safeguards in place because of the Consultant's prior role in representing the foreign government, and because the Consultant would continue to represent the foreign government subsequent to becoming a consultant for the Requestor. These include: walling off employees of the Consultant who would continue to work on behalf of the foreign government during the consultancy; fully disclosing the relationships to the relevant parties; receiving an opinion that, under local law, the Consultant is not an official of the foreign government; and prohibiting the Consultant from lobbying on behalf of the foreign government while working for the Requestor.

The DOJ noted that because the Consultant is an agent of the foreign government, certain circumstances could render the Consultant and its employees "foreign officials" for purposes of the FCPA. Relying in part on several previous opinion procedure releases (Nos. 80-02, 82-02, 86-01, and 94-01), the DOJ determined, however, that in the circumstances presented by the Requestor, the Consultant and its owner are not acting on behalf of the foreign government in performing the consulting contract with the Requestor. The DOJ concluded that the Consultant and its owner were not, therefore, foreign officials for purposes of the payments under the consulting contract, and the DOJ would not take enforcement action based solely on payments to the Consultant.

Noteworthy Aspects

- An Agent of a Foreign Government Is Not Always a "Foreign Official" - The opinion release demonstrates that even if a party is an agent of a foreign government in certain circumstances, it might not necessarily be a "foreign official" for purposes of the FCPA. In this regard, the DOJ highlighted the safeguards put in place by the Requestor, finding that they were "sufficient to ensure that the Consultant will not be acting on behalf of the foreign government in performing the consulting contract."

- Potential Pitfalls of the Consultancy - In the opinion release, the DOJ warned that while the Consultant was not a foreign official for FCPA purposes under the limited facts and circumstances described by the Requestor, the proposed relationship increases the risk of potential FCPA violations. While the DOJ emphasized that it was not opining on any other aspect of the proposed contract or any other conduct involved, it specifically noted that its opinion as to the consultancy payments did not foreclose it from taking enforcement action should an FCPA violation occur during the execution of the consultancy.

DOJ Requests Enhancement of FCPA Sentencing Guidelines

On June 28, the DOJ submitted its annual report to the U.S. Sentencing Commission, "commenting on the operation of the sentencing guidelines, suggesting changes in the guidelines that appear to be warranted, and otherwise assessing the Commission's work." Among its recommendations was to change Section 2C1.1 of the U.S. Sentencing Guidelines, the starting point in calculating a criminal fine for an FCPA anti-bribery violation. The DOJ believes the Commission ought to add an enhancement in 2C1.1 - similar to the one found in §2B1.1 - that increases penalties for defendants who "increase the prosecutorial expenses associated with detection and investigation by committing a substantial part of their offense outside the United States." See p. 5, n. 2. Sec. 2B1.1(b)(9)(B): "If ... (B) a substantial part of a fraudulent scheme was committed from outside the United States; ... increase by 2 levels. If the resulting offense level is less than level 12, increase to level 12." This proposed change is surprising because the DOJ often assesses fines below the minimum floor currently set by the Sentencing Guidelines.

U.S. Legislative Developments

On September 15, 2010, the U.S. House of Representatives passed legislation to debar from federal contracting any individual or company that violates the FCPA. H.R. 5366, the "Overseas Contractor Reform Act," was introduced by Rep. Peter Welch (D-VT) in May 2010 and favorably reported without amendment by the Committee on Oversight and Government Reform. The bill was reportedly motivated by allegations that government contractor Blackwater Worldwide, now known as Xe Services LLC, paid $1 million in bribes to Iraqi government officials to avoid revocation of their operating license after the killings of 17 civilians in Nisoor Square in Baghdad.

Under the bill, which passed the House by a vote of 409-0, any individual, partnership, or corporation found to be in violation of the FCPA "shall be proposed for debarment from any contract or grant awarded by the federal government within 30 days after a final judgment of such violation." The bill also states that it is the policy of the U.S. government that no government contracts or grants should be awarded to individuals or companies that violate the FCPA. However, the bill allows the head of a federal agency to waive the debarment provision, requiring only that the agency head report the waiver to Congress, "along with an accompanying justification," within 30 days.

Depending on how the language of the bill is interpreted, it could have a significant impact on the bargaining power of the DOJ and the SEC in settlement negotiations with companies facing FCPA enforcement actions. The bill proposes for debarment any person "found to be in violation of" the FCPA within 30 days after a "final judgment" of the violation, and a judgment becomes "final" when all appeals of the judgment have been finally determined, or all time for filing such appeals has expired. Both the text of the bill and the conference report are silent on the issue of what constitutes a "finding" of a violation. Yet according to a plain reading of the language, many FCPA resolutions would not meet the threshold for debarment. For example, SEC settlements often state that the company neither admits nor denies the allegations. Moreover, Non-Prosecution Agreements and Deferred Prosecution Agreements would not appear to qualify as a "final judgment" required for debarment. If going to trial or entering into a plea agreement adds the risk of debarment while a settlement avoids that risk, there is an increased incentive for companies to settle and more leverage for the government in seeking resolutions.

Notably, the legislation defines the FCPA to include "section 30A of the Securities Exchange Act of 1934 (15 U.S.C. § 78dd-1)" and "sections 104 and 104A of the FCPA (15 U.S.C. § 78dd-2)." Although section 104A also includes § 78dd-3, the FCPA provisions covering non-U.S. nationals or issuers, that provision is not specifically mentioned. In addition, the bill wholly omits the accounting provisions (15 U.S.C. § 78m), leaving books and records violations outside the scope of the debarment requirement.

The bill now awaits consideration by the Senate Committee on Homeland Security and Governmental Affairs.

New Disclosure Requirements under the Dodd-Frank Act

On July 21, 2010, President Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 ("Dodd-Frank Act"), which implements sweeping financial and banking regulatory changes. As discussed in our FCPA Summer Review 2010, the Dodd-Frank Act established a significant new program to reward whistleblowers who assist in SEC investigations. In addition, section 1504 of the Dodd-Frank Act, which amends section 13 of the Exchange Act, requires the SEC, not later than 270 days after the date of enactment, to issue final rules requiring "resource extraction issuers" to disclose payments they make to foreign governments and to the U.S. Federal Government "for the purpose of the commercial development of oil, natural gas, or minerals." The SEC will also be required to make available online a compilation of the information submitted.

Proponents of section 1504 argue that the increased transparency created by the disclosure requirements will increase stability and decrease corruption around the world by allowing citizens of countries with abundant natural resources to hold their leaders accountable for the misuse of resources or misappropriation of the revenue paid by those in the extractive industry to governments. In addition, supporters argue that the increased transparency will allow policymakers, investors, and others to better model and benchmark country risks, including political and economic risks related to investment in oil, gas, and mineral extraction.

Opponents of section 1504 argue that the requirement to disclose every payment made to a foreign government is overly broad because it requires the disclosure of perfectly legitimate and legal payments. This will increase compliance costs for companies that often already have costly FCPA compliance programs in place. In addition, some opponents have noted that certain local laws or contract provisions restrict the disclosure of such information, thus setting up a dilemma for companies attempting to comply with all applicable laws.

In addition, opponents of section 1504 indicate that the language of that provision is drafted too broadly for companies to know whether they are subject to the law. Section 1504 covers all payments made to foreign governments by issuers engaged in the commercial development of oil, natural gas, or minerals which "includes exploration, extraction, processing, export, and other significant actions relating to oil, natural gas, or minerals, or the acquisition of a license for any such activity, as determined by the [SEC]." While the SEC's final rules may provide further clarity on this point, this definition could include companies that are only tangentially linked to the extractive industry (e.g., parts manufacturers that sell products to a subsidiary of an energy company which will eventually use the machines for which those parts are bought in the commercial development of oil).

Lastly, opponents argue that it is unfair to allow rival companies learn what they are paying for rights to overseas oil and gas fields. While supporters of section 1504 argue that most major oil companies operating internationally are covered by the provision, several large state-owned oil and gas companies are not "issuers" and, therefore, fall outside of the ambit of the FCPA and section 1504. These companies include Russia's OAO Gazprom, China National Petroleum Corporation, Petroleros de Venezuela, India's Oil and Natural Gas Corporation, and Malaysia's Petronas.

International Developments

United Kingdom - U.K. Ministry of Justice Provides Guidance on the U.K. Bribery Act

On September 14, 2010, the U.K.'s Ministry of Justice ("MoJ") published a long-awaited consultation paper regarding one of the most significant provisions of the recently-passed U.K. Bribery Act, the offense of failure to prevent bribery. As reported in our FCPA Summer Review 2010, under Section Seven of the new Act, a company is guilty of an offense if a person "associated" with the company (e.g., an employee, agent, subsidiary) bribes another person intending to obtain or retain business or a business advantage for the company. The provision contains an affirmative defense under which a company may avoid liability by demonstrating that it had in place "adequate procedures" to prevent such conduct. While the Act does not define "adequate procedures," it requires the Secretary of State to publish guidance on its meaning. The present consultation paper provides a draft of that guidance.

The draft guidance in the consultation paper consists of six general principles, each followed by commentary and explanation. The principles are (1) risk assessment, (2) top level commitment (tone from the top), (3) due diligence, (4) clear, practical and accessible policies and procedures, (5) effective implementation, and (6) monitoring and review. The paper also provides an overview of the Act with section-by-section guidance, illustrative scenarios, as well as a subsection covering certain specific issues.

The draft guidance, while non-prescriptive and outlined in general terms, does provide valuable insight into the MoJ's thinking on several issues of significant concern for multinational companies, including hospitality, promotional expenditures, and facilitation payments. As reported in our FCPA Summer Review 2010, in contrast to the FCPA, the U.K. Bribery Act contains neither a defense for reasonable and bona fide business expenses directly related to promotional activities, nor an exception for facilitating payments. The Bribery Act's lack of this defense and exception, combined with its broadly worded anti-bribery provisions, generated concern that the Act may prohibit all promotional activities involving foreign public officials, and uncertainty as to whether the Act would be used to prosecute small-scale facilitating payments. Here, the consultation paper directly addresses hospitality and promotional expenditures and facilitation payments in its "Some Specific Issues" section.

The MoJ's statements on hospitality and promotional expenditures confirm that the Act is not intended to prohibit all such payments. Indeed, it recognizes that "reasonable and proportionate hospitality or promotional expenditure which seeks to improve the image of a commercial organisation, better to present products and services, or establish cordial relations, is…an established and important part of doing business." It also provides examples of permissible expenditures, including ordinary travel and lodgings to showcase a company's track record and expertise. Regarding facilitation payments, the paper confirms that the Act does not provide an exception for such payments. However, the paper notes that U.K. authorities will exercise discretion in deciding whether to prosecute hospitality, promotional expenditures and facilitation payments.

The MoJ will consider input from interested individuals regarding the draft guidance prior to issuing final guidance in early 2011. To accommodate this consultation process, the U.K. government postponed the Act's entry into force until April 2011.

Germany - Deutsche Telekom Investigation