FCPA Winter Review 2016

International Alert

Introduction

In 2015, enforcement of the U.S. Foreign Corrupt Practices Act ("FCPA") by U.S. enforcement authorities, at least in terms of resolved actions, dropped to its lowest level since 2006, which is also the year that prosecutions under the statute began to sharply escalate due to a range of factors, including new reporting and certification requirements under the Sarbanes–Oxley Act of 2002 and the increasingly aggressive pursuit of foreign corruption by U.S. enforcement agencies.

During the last quarter of 2015 in particular, the pace of enforcement nearly slowed to a halt after a fairly robust third quarter (see our FCPA Autumn Review 2015), with the U.S. Securities and Exchange Commission ("SEC" or "Commission") entering into only one resolved enforcement action and the U.S. Department of Justice ("DOJ" or "Department") entering into none. This lack of activity by the agencies was somewhat surprising because, as we noted in our FCPA Summer Review 2015, the pace of FCPA enforcement has tended to pick up towards the end of the year.

Enforcement Trends

The lone FCPA disposition entered into by the agencies in the fourth quarter of 2015 was the SEC's settlement with Bristol-Myers Squibb ("Bristol-Myers"), which centered on the company's activities in China. Beyond this, as discussed in greater detail below, Standard Bank Plc entered into parallel settlements with the United Kingdom's Serious Fraud Office ("SFO") and the SEC in November 2015 in connection with an improper payment to a third party with ties to Tanzanian government officials. Because Standard is not a U.S. issuer, however, the SEC had no jurisdiction to bring an FCPA action related to this bribery; instead, the SEC charged Standard with making material misrepresentations in connection with a securities offering. Thus, we have not included Standard's settlement as a resolved FCPA enforcement action in our statistics.

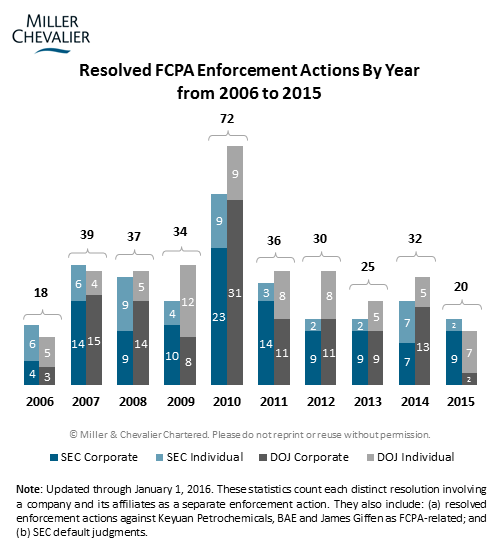

Overall, the DOJ and SEC brought 20 resolved FCPA enforcement actions in 2015, which, as noted above, represents a significant drop in the average number of cases brought by the agencies since 2006. As the chart below reflects, this development can largely be attributed to the precipitous decline in corporate criminal FCPA prosecutions. The two corporate FCPA dispositions the DOJ entered into last year are the fewest such actions the Department has brought since 2003. The SEC's enforcement levels, by contrast, have remained relatively stable.

The decline in resolved corporate enforcement actions by the DOJ is likely attributable to several factors, including:

- A shift in DOJ priorities. This fall, DOJ Criminal Division spokesman Peter Carr explained that the Department is adjusting its focus from smaller cases, primarily those based on corporate self-reporting, to "bigger, higher impact cases, including those against culpable individuals, both in the U.S. and abroad, [which] take longer to investigate and absorb significant resources." This adjusted focus might explain why the DOJ failed for the first time since 2003 to bring a parallel action in a single one of the SEC's corporate FCPA cases this year, as all of these cases could be fairly characterized as smaller and lower impact.

- The ongoing prosecution of individuals. The DOJ is currently prosecuting several individuals who are actively contesting the FCPA charges against them. While always a time-consuming and resource-intensive endeavor, the DOJ is likely devoting significant resources to the individual FCPA-related cases on its docket in light of the mixed record the Department has had in securing convictions in such cases at trial, most recently former PetroTiger Co-CEO Joseph Sigelman, against whom the government dropped five of six charges mid-trial last summer (see our FCPA Summer Review 2015). In this context, it would not be surprising if the increased focus on individual accountability by the DOJ, particularly since the issuance of the "Yates Memorandum" (discussed in more detail in the Actions Against Individuals section below and in our FCPA Autumn Review 2015), has interfered with its FCPA enforcement efforts generally, at least temporarily.

- The increase in international anti-corruption enforcement. As international anti-corruption enforcement reaches new heights, the DOJ's reported cooperation with foreign enforcement authorities in these matters may be giving rise to more situations where the DOJ defers, in whole or part, to foreign regulators who have a better claim over and are equally committed to pursuing allegations that may also violate the FCPA (see the analysis of SBM Offshore in our FCPA Winter Review 2015).

- Turnover and the training of new personnel. Increased turnover and hiring at the DOJ are likely affecting the DOJ's efficiency in FCPA matters, at least until the new staff transition into their roles. For instance, the effort to hire and integrate 10 additional prosecutors into the Fraud Section's FCPA Unit, announced by Assistant Attorney General Leslie Caldwell in November 2015, and the addition of the DOJ's first-ever compliance expert, discussed in detail below, have both diverted DOJ resources from enforcement.

Just as notable as the decline in resolved enforcement actions brought in 2015 is the significant drop in penalties (including disgorgement and prejudgment interest) associated with these cases. The DOJ and SEC imposed only $139 million in total penalties in connection with the 11 corporate FCPA actions brought last year (or approximately $12.5 million per case), which represents the lowest yearly total since 2006 and the lowest average per case penalty since 2007. To put this into context, not only are 2015's combined corporate penalties less than one-tenth of the more than $1.5 billion in corporate penalties imposed in FCPA-related cases in 2014, they are also less than the average per case penalty in 2014, which was approximately $156.5 million.

We should be mindful, however, that enforcement levels for a given quarter or year, both in terms of enforcement actions and penalty amounts, are not always predictive of what is to come or helpful in identifying emerging trends. When asked about the apparent drop in FCPA-related enforcement in a recent interview, Andrew Weissmann, Chief of the Criminal Division's Fraud Section, specifically highlighted the "complexity" involved in prosecuting more individuals and the Department's "high number of open investigations," while also cautioning that "one year isn't long enough to tell the whole story." He said that "[i]f we just wait three months, it might be a very different picture." If Weissmann is correct, the slow pace of enforcement in the fourth quarter of 2015 could simply be a harbinger of a significant settlement (or settlements) in the coming months along the lines of Alcoa Inc.'s $384 resolution with the DOJ and SEC in January 2014 (see our FCPA Spring Review 2014).

Thus far, FCPA enforcement in 2016 is mirroring the pattern we saw developing in 2015, with the SEC spearheading corporate enforcement with "lower impact" actions while the DOJ declines enforcement. During the first week of February, the SEC entered into two corporate FCPA dispositions. On February 2, 2016, the SEC announced a settlement with software company SAP SE relating to alleged corruption in Panama that had formed the basis of former SAP executive Vicente Eduardo Garcia's FCPA-related SEC settlement and DOJ guilty plea in August 2015. And two days later, on February 4, 2016, the SEC announced a settlement with the U.S.-based SciClone Pharmaceuticals relating to marketing and promotional practices by its Chinese subsidiary that allegedly violated the FCPA. The same day of the SciClone disposition, the SEC also entered into its first individual FCPA action of 2016, a settlement with the former CEO of LAN Airlines, Ignacio Cueto Plaza, over improper payments Plaza allegedly authorized in Argentina to help resolve a labor dispute. We will cover the SAP, SciClone and Plaza settlements in detail in our forthcoming FCPA Spring Review 2016.

Declinations

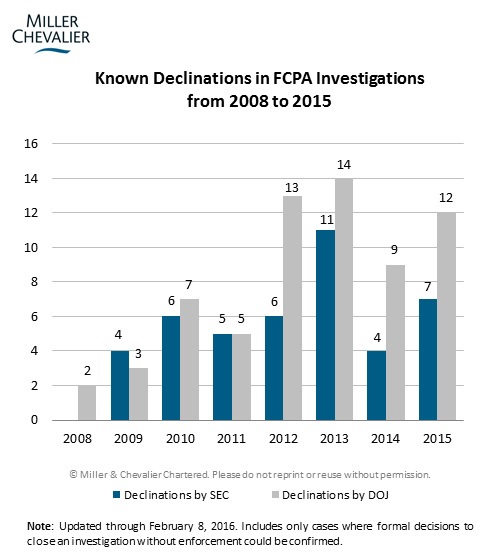

The low number of resolved FCPA enforcement actions in 2015 was partially counterbalanced by an uptick in known declinations, or decisions not to bring an enforcement action, over the same period. In fact, the recent emphasis on declinations by the agencies, particularly the DOJ, may have contributed to the decline we have seen in resolved enforcement.

To date, we have identified 19 declinations from 2015, the second highest year on record and a total likely to further increase given the typical lag time of several months or more that we encounter in identifying declinations, since companies generally announce the closure of investigations in their quarterly securities filings or annual reports (assuming they choose to disclose them at all). Note that, as in the past, we have tracked "declinations" based on a broad interpretation of the term, counting any instance in which the DOJ or SEC chose to close an FCPA investigation without pursuing an enforcement action regardless of the agency's reason for doing so (See Discussion of Declinations by Miller & Chevalier Counsel Marc Alain Bohn).

Declinations we identified over the fourth quarter of 2015 are:

- Brookfield Asset Management: In its quarterly report published in November 2015, Brookfield announced that it had been cooperating in anti-bribery investigations by the SEC and the DOJ relating to its Brazilian subsidiary, and that "[i]n June 2015 the SEC staff informed [the Company] in writing that it concluded its investigation and, based on the information it has to date, does not intend to recommend an enforcement action against [it]." The agencies' investigations of Brookfield were not triggered by a voluntarily disclosure, and it is not clear whether the SEC considered the company's cooperation in its declination decision.

- Bristol-Myers Squibb: In a Form 10-Q filed on October 27, 2015, Bristol-Myers referred to its October 5, 2015, settlement with the SEC and announced that "[t]he Company has also been advised by the Department of Justice that it has closed its inquiry into this matter." The agencies' investigations of Bristol-Myers were not triggered by a voluntarily disclosure, and it is not clear from the company's filing why the DOJ declined to prosecute the company. However, given that the SEC's Cease-and-Desist Order did not allege direct involvement by U.S. management in the payment scheme, the DOJ may have lacked the jurisdiction to bring a criminal anti-bribery charge.

- Affinia Group Intermediate Holdings Inc.: In a Form 10-Q filed on November 12, 2015, the auto-parts manufacturer stated: "As previously disclosed, the Company conducted a review of certain allegations arising in connection with business operations involving its subsidiaries in Poland and Ukraine. The allegations raised issues involving potential improper payments in connection with governmental approvals, permits, or other regulatory areas and possible conflicts of interest. The Company's review was supervised by the Audit Committee of Affinia's Board of Directors and conducted with the assistance of outside professionals. Affinia voluntarily self-reported on these matters to the [DOJ and SEC] and cooperated fully with the U.S. government. The [DOJ] has advised that it has decided to decline to prosecute the Company in this matter." It is unclear whether Affinia's disclosure here is citing the actual correspondence received from the DOJ, but the explicit reference to a decision to "decline to prosecute" is not the typical language most companies use in disclosing an agency notification that an investigation has been closed; instead, most such filings simply reference the government's decision to "close an investigation" without pursuing enforcement.

- Qualcomm, Inc.: In a Form 10-Q filed on January 27, 2016, the California-based technology company disclosed that: "On November 19, 2015, the DOJ notified the Company that it was terminating its investigation and would not pursue charges in this matter. The DOJ's decision is independent of the SEC's investigation, with which we continue to cooperate." The investigation was reportedly related to Qualcomm's hiring practices and alleged bribery of government officials in China. The agencies' investigations of Qualcomm were not triggered by a voluntarily disclosure, and it is not clear from the company's filing why the DOJ issued a declination in this matter.

- Xylem Inc.: In a Form 10-Q filed on October 29, 2015, the U.S. water technology company disclosed that: "The Company is fully cooperating with any government investigation and has been informed recently by the SEC that it will not bring an enforcement action against the Company in connection with the events at Xylem South Korea." After broadening an internal antitrust investigation in South Korea to include an FCPA component based on allegations made by certain employees, Xylem voluntarily disclosed the existence of the investigation to the agencies in late January 2015. It is not clear from the company's filing why the SEC declined to prosecute the company, and the status of any DOJ investigation is unknown.

On a related note, in a November 18, 2015, presentation, Weissmann publicly alluded to the DOJ's effort to provide greater transparency with respect to its declinations. Weissmann acknowledged that many companies do not wish to publicize that they were investigated by the DOJ, but added that the Department is "working through [the declinations] that we can publicize by name, others that we can do on in terms of overall numbers, and still others on an anonymized basis, with enough facts that it becomes meaningful to you but not so much that it reveals what company it is." Weissmann also opined on the Department's need to clarify what actually counts as a "declination." He pointed out that matters are often brought to the DOJ's attention that do not rise to a level necessitating a criminal investigation, and counting any consequent non-enforcement as a declination may "overstate" what is actually happening. However, until the DOJ finds a way to clarify its declination decisions from instances of mere non-enforcement – which is what it may have been doing in the Affinia matter above – we are left using the broader definition of the term described near the beginning of this section.

Known Investigations Initiated This Year

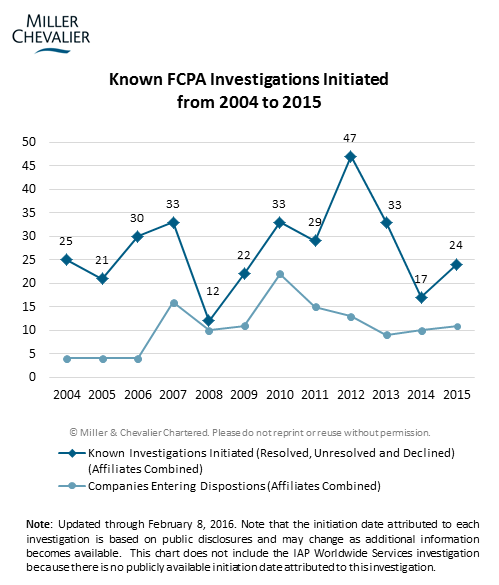

Although resolved FCPA enforcement actions fell in 2015, the agencies nevertheless initiated a large number of new FCPA-related investigations. To date, we have identified 24 FCPA-related investigations initiated by the DOJ and/or SEC in 2015 (compared with only 17 in 2014), with that number likely to rise in the coming months as U.S. issuers make new disclosures in their upcoming annual reports filed with the SEC.

This influx of new investigations initiated by the DOJ and SEC, along with pronouncements by agency officials of a "high number" of open investigations, suggests that a significant number of matters remain in the agencies' pipeline for potential resolution—a pipeline that includes some investigations initiated more than six years ago. In fact, we are currently tracking more than 120 open FCPA investigations by the DOJ and SEC that do not appear to have been resolved or declined.

The DOJ and SEC are also almost certainly pursuing additional FCPA investigations of which we are not yet aware because the companies involved have chosen not to publicly disclose them at this time.

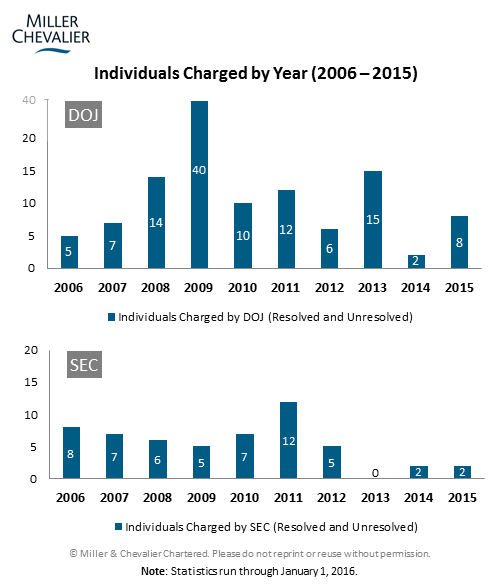

We continue to separately track the enforcement agencies' charges against individuals under the FCPA, in large part to evaluate the impact of the Yates Memo and the corresponding shift in the enforcement agencies' – particularly the DOJ's – priorities.

As reflected in the corresponding chart, the eight individuals the DOJ charged with FCPA-related offenses in 2015 constitute a significant year-over-year increase from the two individuals the Department charged in 2014; and it clearly evidences a continued focus by the DOJ on the prosecution of individuals. The Yates Memo, which requires companies seeking cooperation credit to, among other things, fully disclose the identity of culpable individuals and all facts related to their misconduct, further underscores this focus, though it has yet to trigger any discernable increase in the prosecution of individuals under the FCPA, at least in terms of individuals charged (see our FCPA Autumn Review 2015). The DOJ charged only two individuals with FCPA-related offenses during the fourth quarter of 2015, which mirrors the pace of individual FCPA enforcement by the Department for the year. Since the Yates Memo is largely seen as formalizing existing DOJ policy, it will be interesting to see whether it eventually produces an uptick in individual prosecutions. As noted in our FCPA Autumn Review 2015, we expect the full impact of the Yates Memo's guidance to become more apparent with time, and we will continue to analyze the developments in this area and their relationship to corporate FCPA enforcement actions.

While SEC officials have expressed similar sentiments about the importance of holding individual executives accountable for FCPA-related misconduct, this has translated into far fewer individual prosecutions by the Commission. The SEC brought FCPA enforcement actions against only two individuals in 2015, and has charged only 10 individuals on FCPA grounds since 2012 (compared with 31 by the DOJ over the same period). Included among these SEC actions, however, is the first individual FCPA action of 2016: the aforementioned settlement with the former CEO of LAN Airlines on February 4, 2016.

International Developments

In contrast to the drop in FCPA enforcement actions by U.S. agencies in 2015, we observed a dramatic rise in international anti-corruption enforcement by foreign enforcement authorities across the globe, which is likely one of the factors contributing to the U.S. downturn.

Below we analyze a few prominent examples of this surge in international anti-corruption enforcement, including two landmark prosecutions by U.K. authorities under the U.K. Bribery Act of 2010 ("UKBA"), and the continuing development of the wide-ranging corruption scandal in Brazil. In the United Kingdom, the SFO announced a landmark Deferred Prosecution Agreement ("DPA") with Standard Bank in November 2015 in connection with a "failure to prevent bribery" charge under Section 7 of the UKBA, representing not only the SFO's DPA, but also the first use of Section 7 by any prosecutor. And the SFO followed up on this action less than three weeks later, with construction conglomerate Sweett Group Plc pleading guilty to to its own Section 7 charge, making it the SFO's first corporate conviction under the UKBA. In Brazil, the investigation into corruption allegations related to the state-owned oil company Petroleo Brasileiro S.A. ("Petrobras") continues to grow in size and scope, with authorities now targeting dozens of additional Brazilian government officials and expanding the probe to encompass the Brazilian construction industry.

Actions Against Corporations

Bristol-Myers Squibb Reaches Settlement with the SEC

On October 5, 2015, the SEC announced its settlement with Bristol-Myers Squibb, a New York-based pharmaceutical company. Under the settlement, Bristol-Myers will pay approximately $14.7 million to settle the SEC's finding that Bristol-Myers and its joint venture in China violated the books-and-records and internal controls provisions of the FCPA. The payment includes more than $11 million in disgorgement, representing the profits gained as a result of the alleged improper conduct, $500,000 in interest and a civil payment of $2,750,000. In addition, the settlement requires Bristol-Myers to submit to a two-year self-monitorship.

Background

Bristol-Myers, an international biopharmaceutical company headquartered in New York, primarily conducts business in China through Bristol-Myers Squibb (China) Investment Co. Limited ("BMS China"), which was the focus of the SEC investigation. Bristol-Myers China operates through a joint venture called Sino-American Shanghai Squibb Pharmaceuticals Limited ("SASS"), in which Bristol-Myers holds a 60% equity interest. Bristol-Myers shares are traded on the New York Stock Exchange, making Bristol-Myers an "issuer" for the purpose of the FCPA. Bristol-Myers began operating in China in 1982 and has experienced significant growth during the past decade.

According to the SEC Cease-and-Desist Order ("Order"), between 2009 and 2014, certain BMS China sales representatives made cash payments and provided other benefits to healthcare providers ("HCPs") at state-owned and state-controlled hospitals in China in exchange for prescriptions and drug listings. The Order identifies other benefits, such as gifts, meals, entertainment, travel and sponsorships for conferences and meetings.

Alleged FCPA Violations

The Order states that BMS China failed to respond effectively to red flags that revealed the company's improper payments and benefits. In particular, external and internal reviews conducted during the period in question identified various irregularities in documentation, including faked invoices, receipts and purchase orders. In addition, certain terminated employees of BMS China claimed that the practice of using false reimbursement claims was widespread, but Bristol-Myers failed to investigate these claims. Instead, the SEC alleges, BMS China's books and records inaccurately recorded these payments and benefits as legitimate business expenses, and Bristol-Myers then consolidated them into its own books and records.

In addition to the books-and-records violations, the Order alleges compliance weaknesses and controls deficiencies in violation of the FCPA's internal control provisions. According to the SEC, Bristol-Myers did not have a formal FCPA compliance program until 2006 and did not conduct audits and reviews of internal controls in China until that time. The Order states that the internal reviews and audits conducted at that time revealed substantial gaps in the monitoring of payments made to the HCPs, which were reported to senior management of BMS China and Bristol-Myers' global compliance department. However, the SEC found that Bristol-Myers did not have sufficient compliance resources and was slow to remediate these gaps. The Order specifically notes that Bristol-Myers had no permanent compliance position in China until 2010 and that the BMS China sales force received limited and largely inaccessible training. The Order further notes that Bristol-Myers has implemented significant changes as part of its remedial efforts to address the alleged compliance and controls failings. Specifically, the SEC points to pre-reimbursement review of all expense claims, the retention of a third-party vendor to conduct surprise checks, termination and discipline of employees and the revision of the compensation structure for BMS China employees, among other measures.

Noteworthy Aspects

- General China-specific Risks: This case highlights the risks associated with conducting business in China, a country that has been implicated in significantly more FCPA-related dispositions since 2010 than any other country. By our count, the U.S. enforcement agencies have brought enforcement actions against 23 companies for FCPA-related misconduct in China over the last five years, compared with 13 for Indonesia, 10 for Mexico and five for Nigeria. Particular challenges stem from fraudulent reimbursements, as was the case with Bristol-Myers, reflecting accurate accounting as a considerable problem in China. The Order cites numerous documentation irregularities, including fake and altered invoices and receipts, consecutively numbered receipts, fake purchase orders and attendance sheets for meetings with HCPs that may not have occurred. The fapiao system of receipts in China, which involves the sale of "official" invoices in books rather than itemizing or describing purchases, facilitates such fraudulent reimbursement schemes. These receipts may be used by employees to mask payments made to third parties or government officials. Given the lack of itemization and description of purchases, companies must therefore rely on blank tax receipts and an employee's honesty as evidence of a legitimate payment. Moreover, false reimbursements frequently take the form of off-the-record accounts and transactions. (See, for example, our discussion of the Keyuan Petrochemicals case, which involved the alleged funding of an off-balance-sheet account through the use of fictitious or false reimbursement claims in China.) These cases highlight the importance of being mindful of financial and accounting improprieties in China.

- Focus on Chinese Healthcare Sector: The Bristol-Myers resolution represents the third China-related healthcare action since the GlaxoSmithKline investigation broke in July 2013, and comes on the heels of the Mead Johnson settlement, both covered in our past Reviews. This focus on the pharmaceutical industry, combined with the large number of state-owned enterprises in the Chinese healthcare system, could presage a stream of China-related enforcement actions in the future, particularly since there remains a large number of open investigations involving the healthcare space in China.

- Another Case Involving No Parallel DOJ Enforcement: On October 27, 2015, Bristol-Myers disclosed in its quarterly report to the SEC that the Company received a DOJ declination. The SEC's action against Bristol-Myers represents the eighth FCPA disposition in 2015 involving no parallel DOJ enforcement, following the SEC-only actions against the Hitachi Ltd., Mead Johnson Nutrition Co., Bank Mellon Corp., Goodyear Tire & Rubber Co., FLIR Systems Inc., BHP Billiton and PBSJ Corp. Given that the SEC did not bring an action under the FCPA anti-bribery provisions and the Order does not allege any direct involvement by U.S. management in the payments to the officials, the facts do not appear to support the DOJ bringing a criminal anti-bribery action.

- A Compliance Program Does Not Suffice: The Bristol-Myers case demonstrates the critical importance of following up on audits and reviews and shows why simply having a compliance program is insufficient. The Order describes in depth Bristol-Myers' failure to investigate claims and to respond to internal-controls gaps identified in internal reviews. For example, the Order notes that the Internal Audit of BMS China repeatedly cited the lack of due diligence assessments of distributor compliance and the fact that BMS China's controls around the review and approval of travel and entertainment expenses were ineffective. Given these findings, the SEC alleges that Bristol-Myers' response was not timely. Specifically, the Order details that the "corporate compliance officer responsible for the Asia-Pacific region through 2012 was based in the U.S. and rarely traveled to China. … In addition, the Bristol-Myers sales force in China received limited training and much of it inaccessible to a large number of sales representatives who worked in remote locations." In response to these shortcomings, Bristol-Myers has instituted a number of remedial efforts, including disciplinary actions and replacing certain BMS China officers to change the "tone at the top."

- Liability for Joint Ventures: This matter further demonstrates the importance of assessing the FCPA risk of joint ventures, especially for majority stakeholders. As an issuer and majority owner in the joint venture, Bristol-Myers was liable for the internal controls of that venture. The Order notes that Bristol-Myers owns a 60% share in SASS (through which BMS China operates) and has held operational control over this entity since 2009, when Bristol-Myers obtained the right to name SASS's President and a majority of its Board of Directors. The Bristol-Myers settlement, together with the recent Goodyear settlement (which arose from improper payments allegedly paid by Goodyear's Kenyan joint venture following an increase in Goodyear's ownership interest), highlight that a change in ownership or control of a joint venture should trigger additional due diligence and assessment of FCPA risk by the joint venture's participants.

U.S. Agency Developments

DOJ's Fraud Section Hires Compliance Expert

On November 3, 2015, the DOJ's Fraud Section retained Hui Chen as its first ever "compliance expert." According to the announcement and comments by DOJ officials, the compliance expert will help prosecutors to evaluate defendant companies' compliance and remediation efforts – including assessing compliance-related Filip factors when making charging and sentencing decisions, deciding what remedial measures to impose in resolutions and evaluating companies' post-resolution remediation efforts. The expert will reportedly also be tasked with developing industry-specific benchmarks to help prosecutors evaluate whether a particular compliance program is keeping pace with best practices in the relevant industry. In practical terms, this could mean that the expert will sit in on compliance presentations, work with monitors on work plans or reports and track and evaluate self-monitoring reports. In addition, she may be called upon to provide expert testimony on the Department's behalf in court proceedings.

Chen is a former Assistant U.S. Attorney in the Eastern District of New York and has executive-level anti-corruption and compliance experience in-house at three companies. The DOJ announcement describes her role and the distinct set of compliance challenges at each of those companies – Standard Chartered Bank, Pfizer, Inc., and Microsoft Corporation. Chen's compliance experience extends to a range of geographies and cultures: She worked in New York, Munich and Beijing while in-house and led compliance efforts focusing on several distinct regions around the globe. In her new role, Chen reports to Pablo Quiñones, the Chief of the Strategy, Policy and Training Unit in the Fraud Section, and in turn to Andrew Weissmann, the Chief of the Fraud Section.

According to Department statements, the compliance expert role is designed to boost the Fraud Section's ability to prevent corporate crimes by incentivizing companies to implement more effective compliance programs. According to DOJ officials, the compliance expert can create such incentives by helping prosecutors to distinguish "real" programs from "paper" programs when they make charging, sentencing and post-resolution evaluation decisions, thereby allowing the DOJ to give greater recognition to effective programs while giving less credit to ineffective ones.

Chen has publicly identified the following four broad considerations that, in her view, separate a "real" compliance program from a "paper-based" one:

- Whether the program is "thoughtfully designed." Foremost, this means that companies need to proactively identify risks and thoughtfully examine the company's business: For example, doing significant business in a country like Syria but failing to realize associated sanctions risks is not acceptable. Another facet of thoughtful design is involving stakeholders – i.e., those governed by compliance policies and procedures – in program design. Instead of asking lawyers to put together "beautiful" paper policies in isolation, companies should create "workable" and "sustainable" policies by talking to stakeholders who must follow the policy. Consulting stakeholders is particularly important for complicated business processes such as procurement, where stakeholders have significant relevant expertise. Finally, thoughtful design also means that compliance programs must change over time, tracking changes in the company's business and environment, and tracking the DOJ's and SEC's enforcement priorities.

- Whether the program is "operational." "Operational" means that compliance program pieces must be integrated into business processes, such as payment management, procurement or human resources. Operational integration of compliance and business processes, from the standpoint of the business stakeholder, makes compliance policies easier to follow and more difficult to ignore. Similarly, audit and investigation findings must find their way back to enhancing business processes on an ongoing basis.

- Whether there is good communication among stakeholders. According to Chen, compliance personnel cannot function in isolation but must closely coordinate with business functions. Chen recounted that some of her "most fascinating and helpful conversations" have been with ground-level employees, such as an accounts payable clerk, and that she had gained "tremendous insights" by travelling to operating locations and observing business processes, including participating in marketing meetings and looking inside gift bags. According to Chen, a key part of achieving "good communications" is having a company culture that promotes open communication for raising questions and concerns. Such a culture is also important for encouraging whistleblowers to raise complaints and allowing them to feel secure in doing so. Beyond communicating with business stakeholders, the core compliance stakeholders – finance, legal, HR, audit and investigation – must also coordinate with each other if a compliance program is to function effectively.

- Whether the compliance program is supported by adequate resources. Resources, in this context, do not refer just to money but also to time and to attention granted to the compliance function by others within the company. As Chen put it, "are your compliance people at the table when you make important decisions that have compliance implications?" According to Chen, boards and senior management should regularly ask their compliance team how best to empower the compliance function, and then take action accordingly. In evaluating a program, Chen said that she may ask how often the board receives in-person briefings from the compliance function and, similarly, how often the CEO and regional management receive such briefings. The contents of such briefings also matter. For example, whether the briefings are based on collected data or just anecdotal information.

Chen's considerations do not significantly depart from prior enforcement agency guidance, but her comments place particular emphasis on how effectively a compliance program operates in practice. Chen has noted in her public comments that she plans to listen to the "compliance community" and expects her views on this topic to evolve.

It is too soon to predict the practical implications of this experiment at the DOJ. If the role evolves as suggested in the DOJ's early public discussion, it should lead to improved compliance expertise at the DOJ, greater scrutiny of program implementation and greater consistency in DOJ's evaluations. It could also lead to more differentiation in dispositions based on the strength or weakness of companies' compliance programs. Regardless of where it leads, in the immediate term companies with matters in front of the DOJ should be prepared to answer detailed questions about the design and operation of their compliance programs. The arrival of the DOJ compliance counsel is one more reason for companies to adopt a continuous improvement approach to compliance.

International Developments

United Kingdom Enforcement Update

SFO Secures First DPA and First Use of Section 7 of the UKBA, and SEC Relies On Disclosure Laws, in Coordinated Enforcement Actions against Standard Bank

On November 30, 2015, the SFO and the SEC announced coordinated settlements with London-based Standard Bank Plc in connection with payments related to a debt issuance by the Government of Tanzania. Standard agreed to pay a total of approximately $36.9 million to settle the SFO and SEC charges. In its announcement, the SFO stated that this resolution is the SFO's first DPA, and that it also marks the first use of Section 7 of the UKBA by any prosecutor. Also of note, the SEC acknowledged that it did not have jurisdiction to bring charges under the FCPA, and it therefore charged Standard under a statute prohibiting fraud and misrepresentation in the offer or sale of securities.

The SFO charged Standard with failing to prevent bribery in violation of Section 7 of the UKBA. The charge relates to a $6 million payment by Standard's former sister company, Stanbic Bank Tanzania ("Stanbic"), to a local partner in Tanzania, Enterprise Growth Market Advisors ("EGMA"). In the SFO's DPA and Statement of Facts, the SFO alleged that the payment was intended to induce Tanzanian government officials to select Standard's and Stanbic's proposal for a debt issuance that generated $8.4 million in transaction fees for Standard and Stanbic. In particular, the SFO alleged that there was no evidence that the payment represented reasonable consideration for services, that EGMA's chairman and one of its three shareholders and directors was a Tanzanian government official and key advisor to the government on financing, that the Tanzanian government approved the deal only after an indication that a local partner would be engaged, and that the vast majority of the funds were withdrawn in large cash amounts within days of the payment to EGMA. In its Statement of Facts, the SFO also alleged specific gaps in Standard's compliance program, including Standard's policies not clearly requiring it to conduct any inquiries into EGMA, Standard's reliance on Stanbic to conduct due diligence and no questions or concerns having been raised within Standard about EGMA's role or fees despite multiple indicators of significant bribery risk.

Under its DPA with the SFO, Standard agreed to pay more than $32 million in financial penalties, including $8.4 million in disgorgement, $7 million in compensation to the government of Tanzania and £330,000 (approx. $481,000) in costs related to the SFO's investigation and subsequent resolution of the matter. Standard also agreed to continue to cooperate with the SFO and to be subject to a review of its compliance program by an independent outside reviewer.

The SFO emphasized that this resolution was the SFO's first application for a DPA, noting that Standard's attorneys reported the matter to the SFO the month following the payment at issue and reported its investigatory findings three months later, suggesting that the Company's prompt disclosure, response, and ongoing cooperation were significant factors in the SFO's decision to enter a DPA. In approving the settlement, Lord Justice Leveson at Southwark Crown Court noted that "it is important to underline that no allegation of knowing participation in an offence of bribery is alleged either against Standard Bank or any of its employees; the offense is limited to an allegation of inadequate systems to prevent associated persons from committing an offense of bribery." Lord Justice Leveson also expressed appreciation to the parties in presenting the case, stating that it "should create the benchmark against which future such applications may fall to be assessed."

On the same day as the U.K. settlement, the SEC announced that Standard agreed to pay a $4.2 million penalty to settle SEC charges in connection with the same underlying misconduct. In addition to the penalty, the SEC also ordered Standard to pay $8.4 million in disgorgement, which was deemed satisfied by the U.K. settlement.

Recognizing that it lacked jurisdiction to bring charges under the FCPA because Standard is not an "issuer" as defined by the FCPA, the SEC charged Standard with misleading investors by failing to disclose the payment to EGMA in its offering documents and in statements to potential issuers. In particular, the SEC charged Standard with violating Section 17(a)(2) of the Securities Act of 1933, which prohibits obtaining money by any materially untrue statement or omission. According to the SEC's Order, Standard was negligent in not taking any steps to understand EGMA's role and the basis for its fees, and failed in its duty to disclose material facts about the transaction. The SEC's use of non-FCPA charges in this case highlights that the agency may use alternative legal bases to bring enforcement actions related to alleged bribery even if it lacks jurisdiction under the FCPA.

Sweett Group Admits Failure to Prevent Bribery under Section 7 of the UKBA

On December 18, 2015, the Sweett Group PLC, a U.K. construction conglomerate, pled guilty in Southwark Crown Court to failing to prevent an associated person bribing another to obtain or retain business for the company under Section 7(1) of the UKBA. The SFO charged the company on December 9, 2015, under Section 7(1) of the UKBA for its alleged failure to prevent its subsidiary Cyril Sweett International Ltd. from bribing Khaled Al Badie between 2012 and 2015 to win a contract with Abu Dhabi-based insurance company Al Ain Ahlia relating to a hotel construction project in Dubai. Douglas McCormick, CEO of the Sweett Group, announced the company's cooperation with the SFO and its admission of an offence under Section 7(1) of the UKBA in an Interim Results and SFO Investigation Update posted with the London Stock Exchange on December 2, 2015. The Sweett Group's guilty plea is the SFO's first corporate conviction under the UKBA. Sentencing is scheduled to take place at the Southwark Crown Court on February 12, 2016.

Brazil's Investigation of Petrobras and Related Corruption Continues to Grow

The Brazilian government's investigation into alleged corruption involving Brazil's national oil company Petrobras, known as "Operation Car Wash," shows no signs of slowing down, as evidenced by events over the last quarter of 2015. Noteworthy developments include the first arrest ever of a Brazilian senator, as well as the arrest of one of Brazil's richest businessmen. The quarter also saw additional sentences handed down to executives of major construction companies, several new plea agreements and a leniency agreement and additional convictions of former high-level Brazilian political figures. Our earlier coverage and analysis of the Petrobras investigation can be found in our FCPA Reviews from Winter 2015, Spring 2015, Summer 2015 and Autumn 2015. Note that the following updates are based on reports in U.S. and Brazilian news media.

According to Brazilian press, on October 29, 2015, Judge Sergio Moro sentenced former Congressman Pedro Corrêa to 20 years and seven months in prison for passive corruption and money laundering, in connection with the receipt of at least 11.7 million reais as part of the Petrobras corruption scheme. Judge Moro highlighted the fact that Corrêa was already under house arrest for his involvement in the "Mensalão" scandal, a cash-for-votes scheme in Brazil's Congress more than 10 years ago, when he received the bribes at issue here.

On November 3, 2015, Judge Moro handed down sentences to several construction executives who participated in a corruption scheme related to securing agreements with Petrobras. According to Reuters, Sérgio Cunha Mendes, a former Vice President of construction company Mendes Júnior, was sentenced to 19 years and four months in prison for the payment of 31.5 million reais ($8.3 million) in bribes to secure contracts for Mendes Júnior with Petrobras. Seven other individuals, including former Mendes Júnior executives and intermediaries, and former Petrobras director of refining and supply Paulo Roberto Costa, were also sentenced.

On November 16, 2015, Judge Moro sentenced former congressman Luiz Argôlo to 11 years and 11 months in prison, also requiring him to return approximately $385,000 (1.47 million reais) received in bribes from Petrobras suppliers between 2011 and 2014, and imposing an $82,450 fine. According to Judge Moro, there was sufficient proof that Argôlo received bribes in the amount cited above during his term as a congressman, paid by construction companies that had commercial relations with Petrobras.

On November 24, 2015, cattle rancher José Carlos Bumlai, allegedly a close friend of former president Luiz Inácio Lula da Silva ("Lula"), was arrested during the 21st phase of Operation Car Wash. This phase involved 25 search-and-seizure operations and was named "Free Pass," an allusion to the alleged access that Bumlai had to the Presidential Palace during Lula's term as a president. According to The Wall Street Journal, Bumlai acted as an intermediary to pass millions of dollars in bribes from the Schahin Group, a São Paulo-based conglomerate, to the ruling Workers' Party. Authorities claim that the Schahin Group camouflaged suspected bribe payments of 12 million Brazilian reais ($3.23 million) made in 2004 by structuring them as a series of loans to Bumlai through a bank that it controlled. On December 14, 2015, Bumlai was formally charged in the Petrobras corruption case. In addition to Bumlai, 10 other people were charged, including Bumlai's son and daughter-in-law, three Schahin executives, former Petrobras managers and directors, Workers' Party former treasurer João Vaccari Neto and the lobbyist Fernando Soares, known as "o Baiano."

One of the grounds for Bumlai's arrest was a plea agreement by Salim Schahin, a major shareholder of Schahin Group, ratified by Judge Moro on November 17, 2015. Bumlai allegedly made an agreement with Schahin, which is active in the engineering sector, under which the bank forgave his debt in return for a $1.6 billion contract to operate a drillship named Vitoria 10000 for Petrobras in 2009. Notably, the Vitoria 10000 also played a role in the conviction of former director of Petrobras's international division Nestor Cerveró, discussed in our FCPA Autumn Review 2015, for his alleged facilitation of bribes from Samsung Heavy Industries for the construction contract for the drillship.

On November 25, 2015, Brazilian federal police arrested Senator Delcídio Amaral, the leader of the Workers Party in the Brazilian Senate, and André Esteves, the CEO and controlling shareholder of Brazilian investment bank BTG Pactual. Reuters reported that on December 7, 2015, prosecutors charged Amaral and Esteves with attempting to obstruct the government's investigation of Petrobras. According to press reports, both Amaral and Esteves tried to interfere in the Car Wash investigations, conspiring to pay millions to Cerveró in exchange for not being mentioned in the plea agreement he was negotiating. In addition, Amaral supposedly proposed a plan for Cerveró to seek habeas corpus relief and to then escape from the country. Amaral is the first Senator in Brazilian history to be arrested while in office.

On November 27, 2015, the second largest Brazilian construction company, Andrade Gutierrez ("Andrade"), entered into a settlement with the prosecutors from the Car Wash Task Force. According to articles in Reuters and Bloomberg, Andrade will confess to having paid bribes for 2014 World Cup contracts and for business with Petrobras and Eletrobras, the Brazilian state-controlled power company. Andrade will also pay a one billion reais ($263 million) civil fine. The admission makes Andrade the first contractor in Brazil to admit to paying bribes related to the World Cup. This matter is the largest bribe-related settlement any company has ever reached with Brazilian authorities.

On December 15, 2015, the Federal Police in Brazil executed 53 search warrants issued by a Supreme Court Judge at the request of federal prosecutors, including at two residences and the Chamber offices of the President of the Brazilian Chamber of Deputies, Eduardo Cunha, the residences of two Cabinet members, a senator and a congressional representative. The federal police reportedly sought the warrants so that "important evidence in the mega-corruption scandal would not be destroyed by those being investigated." The target of another warrant was the home of Sergio Machado, a former President of Transpetro, the largest oil-and-gas transportation company in Brazil and a fully owned subsidiary of Petrobras.

The next day, on December 16, 2015, the Ethics Committee in Brazil's Chamber of Deputies approved to continue the investigation into Cunha, who is accused of money laundering, receipt of bribes and passive corruption in the Car Wash bribery scandal. The allegations against Cunha include the receipt of 45 million reais (close to $12 million) from the investment bank BTG Pactual, and the receipt of $5 million related to Petrobras contracts, previously noted in our FCPA Autumn Review 2015. According to Ethics Committee members, a factor that contributed to the continuation of the investigation into Cunha was his formal denial of having had foreign bank accounts during the Special Congressional Investigation into Petrobras. Cunha's statement, however, turned out to be false when Swiss bank authorities later gave the Brazilian Prosecutor's Office proof that Cunha and his wife had accounts at the Julius Baer bank in Switzerland.

That same day, December 16, 2015, Rodrigo Janot, the Attorney General of Brazil, petitioned the Supreme Court to remove Cunha from office for allegedly blocking judicial investigations. In a statement on the Attorney General's website, Attorney General Janot asserted that Cunha had used his position to "embarrass and intimidate fellow deputies, witnesses, lawyers and civil servants in an attempt to stall investigations against him." On December 18, 2015, the Supreme Court announced that it would delay the decision on whether or not to remove Cunha from office until after the Brazilian Carnival in February 2016. In the meantime, on January 8, 2016, Supreme Court Judge Teori Zavascki reportedly authorized the breach of tax and banking secrecy regulations with respect to Cunha and his wife and daughter, and the release of their financial and telephone records. Judge Zavascki's decision came in response to a request by the Attorney General, who had argued that Cunha used family members to hide financial assets in Switzerland.

Miller & Chevalier Upcoming Speaking Engagements and Recent Articles

Upcoming Speaking Engagements

| 02.09.16 |

GIR Live DC |

| 02.10.16 | Strafford Webinar: FCPA Compliance in Hiring in Foreign Markets (James Tillen) |

| 02.26.16 | IBA's Women's Leadership Summit (Homer Moyer) |

Recent Articles

| 01.29.16 | Latin America's Top 4 Anti-Corruption Compliance Mistakes (Matteson Ellis) |

| 01.21.16 | Managing Continued FCPA Scrutiny in Pharmaceutical Industry (Marc Alain Bohn) |

| 01.07.16 | Executives at Risk: Navigating Individual Exposure in Government Investigations - Volume 2 (Kirby Behre, Lauren Briggerman, Jonathan Kossak, Charles McAleer, Dawn Murphy-Johnson, Andrew Strelka) |

| 12.17.15 | Evolution of the Anti-Corruption Legal Framework Worldwide (Homer Moyer) |

| 11.20.15 | Banco De Brasil's New York Branch Learns the Hard Way to Beware of the "Good Guy Exception List" (Timothy O'Toole) |

Editors: James G. Tillen, Matthew T. Reinhard,* Marc Alain Bohn,* Michael Skopets,* and Austen Walsh*

Contributors: Theresa Androff,* Irina Anta,* Ben Gao,* Ivo Ivanov,* Nate Lankford, and Eloy Rizzo

*Former Miller & Chevalier attorney

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.