FCPA Winter Review 2012

International Alert

Introduction

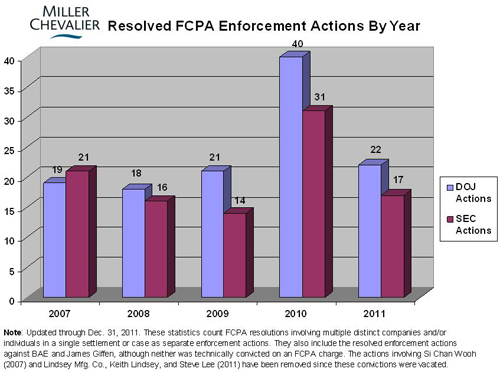

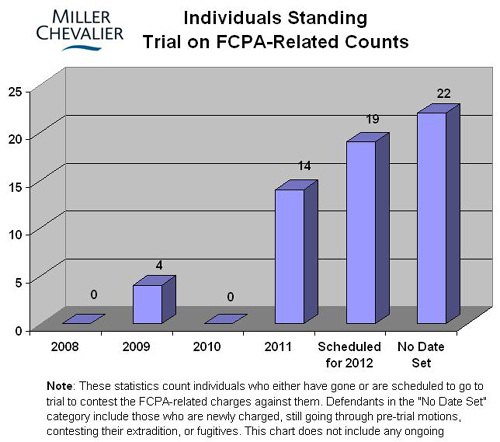

Our first review of 2012 gives us the opportunity to reflect on the developments of the past twelve months. 2011 was another exciting year in the history of the Foreign Corrupt Practices Act ("FCPA") and anti-corruption enforcement around the world. As reflected in the charts below, there were 39 resolved enforcement actions brought by the Department of Justice ("DOJ") and the Securities and Exchange Commission ("SEC") in 2011, a significant decrease from the record 71 enforcement actions brought in 2010. On the DOJ side, one possible reason for this decline is the increase in the number of trials, which may be diverting DOJ resources from settling corporate actions. A total of four trials formally commenced in 2011 involving fifteen defendants faced with FCPA-related charges (fourteen of them individuals). This far outstrips any year on record in terms of individuals litigating against personal criminal liability and represents just the first wave in a series of individual prosecutions expected to flood the U.S. court system over the next two years, including 19 currently scheduled for 2012 (see below chart). In large part, this trend is the product of a backlog of FCPA-related charges the DOJ has brought over the last five years against nearly eighty individual defendants, roughly a four-fold increase from the preceding five years. Accompanying this dramatic rise in enforcement against individuals is a similar increase in the number of defendants choosing to go to trial rather than plea bargain, particularly since the DOJ has, with some success, begun to seek hefty prison sentences for those convicted.

The increase in individuals being tried also has resulted in some setbacks for the DOJ, which has had to redirect resources to prosecuting these cases, many of which are beginning to stretch out for years. Two such setbacks occurred during the last quarter of 2011.

In the Lindsey Manufacturing case, the district court dismissed the May 2011 convictions of the company and its top executives, citing, among other things, the DOJ's reckless behavior in allowing untruthful testimony by its witness and inserting "material falsehoods" into affidavits.

In the second of four trials scheduled for defendants in the January 2010 SHOT Show arrests, U.S. District Judge Richard J. Leon dismissed conspiracy charges against six defendants after twelve weeks of trial. Prior to the first trial, three SHOT Show defendants pled guilty to related charges. The first four SHOT Show defendants to go to trial contested the charges over the summer of 2011 in front of Judge Leon, who was forced to declare a mistrial in the case in September 2011 when the jury could not agree on a verdict.

Despite those results, the DOJ succeeded in obtaining a number of lengthy prison sentences this year for several defendants, including three executives indicted in connection with the Haiti Teleco case, Carlos Rodriquez, Juan Diaz and Joel Esquenazi. In particular, the 180-month prison term imposed on Esquenazi, the former president of Terra Telecommunications, is the most severe sentence ever imposed in an FCPA prosecution. At least one of those defendants (Rodriguez) has filed a notice of appeal, so it is possible that 2012 will see additional legal rulings on these cases.

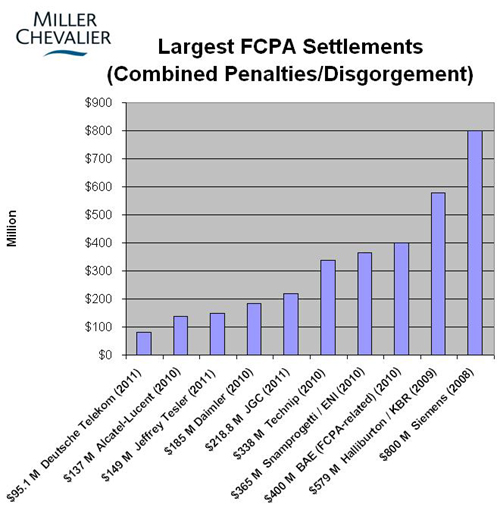

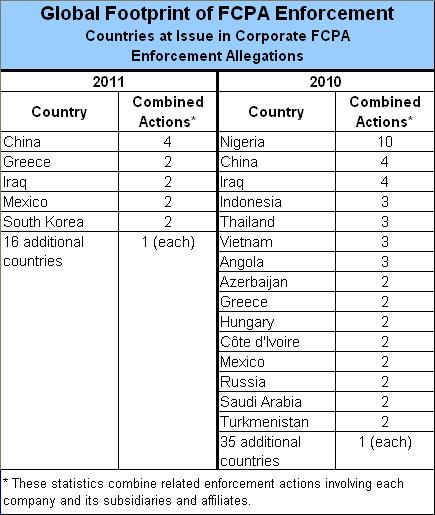

For the first time in recent years, 2011 did not set a new record for total fines. The DOJ and SEC imposed $508.7 million in penalties, disgorgement and pre-judgment interest, down from just under $1.8 billion in 2010. Mirroring this trend, the global footprint of the agencies' enforcement efforts also dropped considerably in 2011, with allegations in corporate dispositions implicating FCPA-related misconduct in only 21 countries, down from 50 in 2010 (see below chart). However, the year did end with a bang. In late December 2011, the DOJ and SEC entered into an FCPA settlement with the Hungarian telecommunications firm Magyar Telekom Plc and its parent company, the Germany-based Deutsche Telekom AG. In total, Magyar Telekom and Deutsche Telekom agreed to pay a combined $95.1 million to resolve FCPA allegations brought by the SEC and DOJ, making this resolution one of the ten largest FCPA-related settlements in terms of total penalties and disgorgement.

A number of developments and trends in 2011 offer a glimpse of what corporations and individuals can expect on the anti-corruption front in 2012:

- New Guidelines: Last fall, Assistant Attorney General Lanny A. Breuer announced the DOJ's intent to release new guidance in 2012 on the FCPA's criminal and civil enforcement provisions. This is a potentially significant development that appears to be a reversal of a 1990 decision by the DOJ that guidelines were not necessary, and is likely a response to increased pressure on the DOJ from the business community and Congress to provide greater clarity and predictability regarding the interpretation and enforcement of the FCPA. Depending on the specificity of the guidelines and how they address various challenging issues, they could be a useful tool in building and benchmarking corporate compliance programs.

- Increased International Enforcement: In 2011, both German and Swiss authorities imposed large fines against corporations accused of bribery. In the Alstom case, Swiss authorities fined the French power and engineering group approximately $40 million following a two-year investigation that encompassed fifteen countries and probed allegations that the firm had paid government officials to secure contracts. In the Ferrostaal case, the company and executives entered into a settlement with German authorities over bribery allegations surrounding the sale of submarines to Greece and agreed to pay fines totaling more than $200 million. The United Kingdom obtained its first conviction under its new Bribery Act this past quarter against a London court clerk who admitted to asking for a bribe to help clear a suspect of a speeding ticket. And for the first time in its history, Canada assessed a multimillion dollar fine in an anti-bribery enforcement action. In Nigeria, several Panalpina-related cases led to multimillion dollar settlements with the Nigerian government. Taken together, there appears to be a rise in meaningful international enforcement and it is likely that this surge in enforcement will continue. This progress notwithstanding, Transparency International's Bribe Payers Index still found "supply-side" corruption to be rampant in many places around the world, particularly among companies resident in emerging powers such as China and Russia.

- Legislative Developments: Congress, industry associations, and civil society groups have taken a renewed interest in the FCPA, and members of Congress have presented a variety of FCPA-related bills that are similar to bills introduced in the recent past. One such bill would give domestic companies and individuals the right to sue non-U.S. corporations and individuals for anti-bribery violations, while another bill would debar from federal contracting any individual or company that violates the FCPA. Additionally, the Open Society Foundation issued a white paper opposing the U.S. Chamber Institute for Legal Reform's proposed amendments to the FCPA. The Open Society Foundation's white paper came on the heels of hearings in both the Senate and the House of Representatives discussing FCPA enforcement and possible reforms. While reform legislation has not yet materialized, various members of Congress have indicated their intent to propose amendments to the FCPA in 2012. Also, in December, the House Financial Services Subcommittee on Capital Markets and Government Sponsored Enterprises approved the Whistleblower Improvement Act which, if passed, would significantly alter the recently-operative whistleblower provisions of the Dodd-Frank Act.

- Multiple SEC Developments: In 2011, the SEC launched an FCPA-specific website that lists SEC-related FCPA enforcement actions from 1978 to the present and, in many cases, provides links to original source documents. The SEC also issued its first Annual Report on the Dodd-Frank Whistleblower Program. In the seven-week period from the time the rules came into effect to the end of the Commission's 2011 fiscal year on September 30, 2011, the SEC received 334 whistleblower tips. Of those, fewer than four percent were related to potential FCPA violations. Those numbers will certainly increase in 2012.

Actions Against Corporations

Magyar Telekom and Parent Company Deutsche Telekom Settle FCPA Charges

On December 29, 2011, the DOJ and SEC announced that it settled FCPA charges against Magyar Telekom PLC ("Magyar Telekom") (a Hungarian telecommunications provider) and its parent company Deutsche Telekom AG ("Deutsche Telekom"), the German telecommunications giant. The charges relate to alleged improper payments by Magyar Telekom to government and political party officials in Macedonia and Montenegro. At the time of the alleged FCPA violations, both Magyar Telekom and Deutsche Telekom had American Depository Receipts ("ADRs") traded on the New York Stock Exchange and thus qualified as issuers within the meaning of the FCPA. The SEC also brought unresolved FCPA charges against three senior Magyar executives for allegedly orchestrating, approving, and executing the illicit scheme.

The SEC filed a complaint in the Southern District of New York against Magyar Telekom and Deutsche Telekom alleging anti-bribery violations by Magyar Telekom as well as books and records and internal controls violations by both Magyar Telekom and Deutsche Telekom. Without admitting or denying the allegations in the complaint, Magyar Telekom consented to entry of final judgment imposing a permanent injunction against FCPA violations and payment of approximately $31.2 million in disgorgement and prejudgment interest. Deutsche Telekom also consented to entry of final judgment imposing a permanent injunction against FCPA violations. Both judgments included the assessment of a contingent civil fine, $5 million for Magyar Telekom and $4 million for Deutsche Telekom, that were satisfied by the DOJ's assessment of criminal penalties.

The SEC filed a separate complaint against three former Magyar Telecom executives: former Chairman and CEO Elek Straub, former Director of Central Strategic Organization Andras Balogh, and former Director of Business Development and Acquisitions Tamas Morvai. All three former executives are Hungarian citizens believed to be residing in Hungary. The complaint alleges that the executives "violated or aided and abetted violations of the anti-bribery, books and records, and internal controls provisions of the FCPA; knowingly circumvented internal controls and falsified books and records; and made false statements to the company's auditor." The executives have signaled that they plan to contest the charges.

For its part, the DOJ filed a criminal information against Magyar Telekom in the Eastern District of Virginia charging the company with one count of violating the FCPA's anti-bribery provisions and two counts of violating the books and records provisions. To resolve the charges, Magyar Telekom entered into a two-year deferred prosecution agreement ("DPA"), agreed to pay a $59.6 million criminal penalty, implement a compliance program, and undertake annual self-reporting to the DOJ. Deutsche Telekom entered a two-year non-prosecution agreement ("NPA") containing an agreement to pay a $4.36 million criminal penalty and to make enhancements to its compliance program.

The court documents allege that Magyar Telekom and its executives authorized payments through intermediaries to foreign officials and political party officials in Macedonia and Montenegro in order to secure business and regulatory benefits for Magyar Telekom. With respect to Macedonia, Magyar Telekom allegedly entered into a secret agreement with senior officials in 2005 to mitigate the effects of a new telecommunications law that Magyar Telekom considered detrimental to its Macedonian subsidiary, Makedonski Telekommunikacii AD Skopje ("MakTel"). In order to secure benefits for MakTel under the secret "Protocol of Cooperation," Magyar Telekom allegedly paid €4.875 million (approximately $6.2 million) to a Greek intermediary through false contracts for consulting and marketing services, with the knowledge or belief that some or all of the funds would be paid to the Macedonian officials. In addition, Magyar Telekom allegedly offered a contract for a valuable business opportunity to a Macedonian political party in exchange for the party's support for the benefits to MakTel.

In Montenegro, Magyar Telekom allegedly made improper payments to government officials in exchange for their support of Magyar Telekom's acquisition of the state-owned telecommunications company, Telekom Crne Gore A.D., on favorable terms. The SEC complaint against three former Magyar Telekom executives alleges that the defendants authorized the company to make payments of €7.35 million (approximately $9.4 million) to third-party consultants under false contracts, intending for the funds to be forwarded to Montenegrin officials.

As reported in our FCPA Autumn Review 2010, the alleged violations initially surfaced during a 2005 internal audit of financial statements. Deutsche Telekom voluntarily disclosed the violations to U.S. and Hungarian regulatory agencies, and U.S. authorities requested that German officials launch an inquiry into the company's business operations in Hungary. The DPA and NPA acknowledge Magyar Telekom and Deutsche Telekom's voluntary disclosure and Magyar Telekom audit committee's "thorough global internal investigation concerning bribery and related misconduct."

Noteworthy Aspects

- Top Ten FCPA Settlement - With the disposition totaling more than $95 million, the case against Magyar Telekom and Deutsche Telekom joins the ten largest FCPA settlements to date in terms of combined penalties and disgorgement, exceeding Panalpina's combined $81.8 million settlement to clinch the number ten spot on the list.

- International Cooperation - The SEC press release acknowledges the assistance provided by the Hungarian Financial Supervisory Authority, the German Federal Financial Supervisory Authority, and the Swiss Office of the Attorney General. Similarly, the DOJ press release cited cooperation from partners in Switzerland, Germany, Greece, Hungary and the Republic of Macedonia.

- Self-Monitoring - Continuing a recent trend discussed in our previous FCPA Reviews, the DOJ did not impose a monitor in this case. Instead, Magyar Telekom must self-monitor, reporting annually to the DOJ on its remediation efforts and implementation of compliance measures. For other recent examples of this trend, see our discussion of Armor Holdings in FCPA Autumn Review 2011, Johnson & Johnson and Maxwell Technologies in FCPA Spring Review 2011, and the Panalpina settlements in FCPA Winter Review 2011.

- Expansive Scope of the FCPA - The charges against Magyar Telekom and Deutsche Telekom reflect the expansive jurisdictional reach of the FCPA. Both are foreign companies whose ADRs on the New York Stock Exchange subjected them to the FCPA. Moreover, Deutsche Telekom, which was not involved in the misconduct at issue, holds only a 60% controlling interest in Magyar Telekom, but was nevertheless held liable for the accounting violations of Magyar Telekom and its subsidiaries.

On December 20, 2011, the Chicago-based insurance brokerage firm Aon Corporation ("Aon") settled charges with the DOJ and SEC for FCPA violations associated with alleged improper payments made by Aon's subsidiaries in Bangladesh, Bulgaria, Costa Rica, Egypt, Indonesia, Myanmar, Panama, the United Arab Emirates, and Vietnam.

With the DOJ, Aon entered into a two-year non-prosecution agreement ("NPA") in which it agreed to pay a $1.76 million criminal penalty for violations of the anti-bribery, books and records and internal controls provisions of the FCPA and to implement improvements to its anti-corruption compliance program. With the SEC, Aon consented to the entry of a court order settling charges of FCPA books and records and internal controls violations and agreed to pay the SEC $14,545,020 in disgorgement and prejudgment interest.

According to the SEC complaint, the accounting and internal controls violations were related to two general categories of alleged improper payments: (1) training, travel, and entertainment provided to employees of foreign-government owned clients and third parties; and (2) payments to third-party facilitators. With respect to improper recording of the first category of alleged improper payments, the pleadings describe several training and education funds administered by Aon Limited, Aon's United Kingdom subsidiary, to furnish training and education trips for officials employed by Instituto Nacional de Seguros ("INS"), the Costa Rican state-owned insurance company. As stated in the pleadings, between 1997 and 2005, Aon Limited used the funds to finance airfare, hotel accommodations, conference fees, meals, and other related expenses for INS officials and their relatives, some of which were unrelated to a legitimate business purpose. For instance, according to the NPA, a significant number of the INS officials' trips were in connection with conferences and seminars in tourist destinations such as London, Paris, Monte Carlo, Zurich, and Cairo, and the records did not demonstrate that the expenses were related to legitimate business purposes.

In addition, the DOJ found that the substance of some of the conferences and trainings was unrelated to the insurance industry, such as a literary conference and a Mexican information technology conference, as well as some holiday expenses and pure entertainment. Both the DOJ and SEC also alleged that Aon Limited arranged for many of the trips using a tourism company in Costa Rica whose board included the director of the INS reinsurance department. The INS reinsurance department director was involved in setting up the training funds and allegedly benefitted from numerous trips between 1996 and 2001, accompanied by his wife on multiple occasions. According to both enforcement agencies, Aon Limited's records of the disbursements from the two funds, which were consolidated into Aon's books and records, did not accurately and fairly reflect, in reasonable detail, the purpose for which the expenses were incurred and did not consistently disclose or itemize the disproportionate amount of leisure and non-business related activities that were also included in the costs.

The SEC complaint also alleged books and records violations with respect to travel and travel-related expenses for employees of the Egyptian government-owned Egyptian Armament Authority ("EAA") and its U.S. arm, the Egyptian Procurement Office ("EPO"). Between 1998 and 2007, the Baltimore office of Aon Risk Services ("ARS") allegedly paid $100,000 to sponsor annual trips for EAA and EPO officials to the United States, which were provided in the contract between ARS and EAA. The trips included a business component but, according to the SEC complaint, also included a disproportionate amount of leisure activities and lasted longer than necessary to conduct the business activities. According to the SEC, ARS's and Aon's books and records did not accurately and fairly reflect the purpose for which the delegation trip expenses were incurred.

With respect to improper recording of payments to third-party facilitators, the SEC complaint alleged that Aon's subsidiaries in Vietnam, Indonesia, the United Arab Emirates, Myanmar, and Bangladesh made payments to third parties, some of which appeared to perform no legitimate services, thus suggesting they were conduits for improper payments to foreign officials. In Vietnam, the SEC alleged that Aon Limited made payments to a third-party facilitator in exchange for "information and services" to assist Aon Limited in securing the government-owned Vietnam Airlines account in the 2003 policy year and retain a share of that account in subsequent years. According to the SEC, Aon's records indicate that the third-party facilitator did not provide legitimate services, but instead transferred some of the consultant payments from Aon Limited to unidentified individuals referred to as "related people." In Indonesia, the SEC alleged that between 1998 and 2007, Aon Limited authorized improper payments to government officials to secure the Pertamina and BP Migas brokerage accounts for Aon Limited. The complaint states that Aon Limited channeled those payments through an individual consultant and a consulting company and further promised to pay the consultant, a company for which the consultant was a principal, and "other interested parties," a percentage of Aon Limited's premiums if the consultant secured the Pertamina account for Aon Limited. Moreover, the SEC complaint alleged that two Aon brokers made $100,000 in payments to a "third-party introducer" in 2004 and 2005 for its assistance in obtaining the BP Migas account for Aon Limited.

In the United Arab Emirates, the SEC alleged that Aon Limited made payments to the general manager of a privately-held insurance company between 1997 and 2007 as inducements to secure and retain the account for Aon Limited. The SEC complaint also noted that a predecessor in interest to Aon Limited made the payments from 1983 until 1997. In Myanmar, the SEC alleged that between 1999 and 2005, Aon Limited retained an "introducer" to assist the company with its accounts with two government-owned entities, Myanmar Airways and Myanmar Insurance. Pursuant to the SEC complaint, company records suggest that the third party made payments to a senior manager at Myanmar Insurance in exchange for his promise to "protect [Aon Limited's] interests." In Bangladesh, the SEC alleged that between 2002 and 2007, Aon Limited made payments to an individual and a consulting company to secure brokerage accounts with the government-owned entities Biman Bangladesh Airways and Sudharan Bima Corporation. According to the SEC complaint, company email records demonstrated that Aon Limited employees were aware that the third party was using a percentage of his fee from Aon Limited to make payments to an individual believed to be the politically-connected son of a former high-ranking Bangladeshi government official.

In the NPA the DOJ acknowledged Aon's "extraordinary cooperation" with both agencies, which the DOJ credited as substantially reducing the corporation's monetary penalty. Moreover, the DOJ noted Aon's "timely and complete disclosure" of facts concerning conduct in Costa Rica described in the NPA as well as facts relating to improper payments in the other countries that were discovered during an internal investigation of Aon's global operations; the early and extensive remedial efforts undertaken by Aon, including substantial improvements to its anti-corruption compliance procedures; the prior financial penalty of £5.25 million paid by Aon Limited to the United Kingdom's Financial Services Authority ("FSA") in 2009, covering the conduct in, Bangladesh, Bulgaria, Indonesia, Myanmar, the United Arab Emirates, and Vietnam; and lastly, the FSA's close and continuous supervisory oversight over Aon Limited.

Noteworthy Aspects

- Multi-Jurisdictional Enforcement - As noted in previous FCPA Reviews, multi-jurisdictional enforcement actions are increasingly common. In recent years, some companies have been successful in coordinating dispositions with enforcement officials in multiple countries. For example, Siemens settled anti-bribery prosecutions with U.S. and German authorities in 2008 and Innospec reached a global settlement with the DOJ, SEC, Serious Fraud Office ("SFO"), and Office of Foreign Assets Control for more than a dozen criminal charges in the United States and the United Kingdom, including violations of the FCPA, in 2010. Here, although Aon's resolution with U.S. enforcement authorities followed the FSA resolution, the DOJ gave Aon credit for the FSA penalty. The prior resolution was also a factor in the DOJ decision to enter into an NPA with Aon rather than a DPA or plea agreement.

- Contractual Travel Provisions and Recordkeeping Requirements - In this matter, the DOJ and SEC focused largely on travel and travel-related offenses as they have in numerous FCPA enforcement cases before. Notable here, however, is the fact that the travel provisions in Aon Limited's contract with the Egyptian government-owned EAA did not inoculate Aon from FCPA-related accounting and internal controls violations where the agencies determined that Aon Limited provided non-business related travel viewed as beyond the terms of the contract. More generally, the agencies noted instances in which travel-related records lacked detail allowing for a breakdown between what could have been legitimate business travel (which can be subject to the FCPA's affirmative defense) and non-business travel and other purely personal/entertainment activities that were deemed by the agencies as exceeding the allowed scope under the Act. This reflects an increasing level of enforcement guidance from the agencies regarding how to parse these types of expenses.

- Extended Statute of Limitation - Although the FCPA's statute of limitations normally expires after five years, some of the conduct mentioned in the pleadings occurred nearly thirty years ago, in 1983. In its most recent quarterly filing, Aon stated that it had agreed with the DOJ and SEC to toll any applicable statute of limitations pending completion of their investigations of conduct that gave rise to the FSA bribery charges and settlement.

On October 13, 2011, the SEC filed a cease-and-desist order against Watts Water Technologies, Inc. ("Watts") and Leesen Chang, a former employee of Watts Valve Changsha Co. Ltd. ("CWV"), a wholly-owned Chinese subsidiary of Watts prior to its sale in 2010. The order alleges violations of the FCPA's books and records and internal controls provisions related to payments by CWV to employees of state-owned instrumentalities in China. As part of the settlement, the SEC ordered Watts to pay a $200,000 civil penalty, $2,755,815 in disgorgement and $820,791 in prejudgment interest. In addition, Chang, a U.S. citizen, was ordered to pay a civil penalty of $25,000.

Watts is a New York Stock Exchange-listed U.S. corporation that designs, manufactures, and sells water valves. In 2005, Watts established CWV to purchase Changsha Valve Works ("Changsha Valve"), a Chinese entity involved in the manufacturing and sale of valves. The SEC order notes that although Watts maintained substantial operations in China prior to the acquisition, this was Watts' first experience with a Chinese subsidiary that conducted business predominantly with state-owned entities.

According to the order, CWV sales personnel made improper payments to employees of Chinese state-owned "Design Institutes," which the SEC defined in a May 2011 enforcement action against Rockwell Automation as "state-owned enterprises that provided design engineering and technical integration services that can influence contract awards by end-user state-owned customers." CWV sales personnel allegedly made the payments in order to influence the Design Institutes to (1) recommend CWV products to other state-owned entities in China for infrastructure projects, and (2) create specifications in their design proposals that increased the probability that the state-owned customers would choose CWV products. These payments allegedly were authorized by a sales incentive policy created by Changsha Valve and adopted by CWV after acquiring Changsha Valve in 2006. Under the sales incentive policy, CWV employees earned commissions of up to 7.5% of the contract price that could cover sales-related expenses such as travel, meals, entertainment, and "consulting fees" paid to the Design Institutes. The policy also provided that CWV employees could use their commissions to make payments to Design Institutes of up to 3% of the contract amount. The payments were recorded as commissions in Watts' books and records.

Chang's role in the scheme arose from his position as Vice President of Sales at Watts China and interim General Manager at CWV. According to the order, Chang approved commission payment requests that contained itemized payments of 3% to design institutes. He allegedly resisted an effort by colleagues to translate the sales incentive policy into English and submit it to Watts' management in the United States. The order characterizes Chang's actions in this respect as a cause of Watts' internal controls violations because they prevented Watts from uncovering the payments.

Without admitting or denying any of the allegations in the SEC's order, Watts and Chang consented to entry of the order.

Noteworthy Aspects:

- Failure to Address Risks Posed by Small, Newly-Acquired Subsidiary - The SEC press release announcing the action notes that Watts failed to implement a system of FCPA compliance and internal controls commensurate with the risks posed by CWV when it acquired Changsha Valve. CWV's revenues accounted for only approximately 1% of Watts' gross revenues. However, the risks posed by CWV greatly outstripped its share of Watts' revenues given that CWV conducted business primarily with state-owned entities. In a lesson for other companies' FCPA compliance programs, the failure to implement FCPA training or adequate internal controls in this subsidiary and its newly acquired operations, despite their minor roles within the overall company, led to an enforcement action and its attendant costs.

- Enforcement Trend Involving Chinese Research and Design Institutes - Alleged payments to Chinese Research and Design Institute employees have appeared in several recent enforcement actions. In February 2009, the SEC settled charges with ITT Corp. (see FCPA Spring Review 2009) related to alleged payments to employees of Design Institutes that assisted with large infrastructure projects in China. Similarly, the SEC filed an order against Avery Dennison Corp. in July 2009 (see FCPA Autumn Review 2009) based partly on alleged payments to employees of the Traffic Management Research Institute in Wuxi, Jiangsu Province. Most recently, the SEC filed a cease-and-desist order against Rockwell Automation (see FCPA Summer Review 2011) alleging that its Chinese subsidiary made payments and funded travel for employees of Design Institutes.

- General Counsel's Knowledge of Recent Enforcement Prompted Discovery of the Alleged Violations - According to the SEC Order, in March 2009 Watts' General Counsel learned of an SEC enforcement action against another company (presumably ITT Corp.) that involved payments to employees of Chinese Design Institutes. Thereafter, Watts implemented anti-corruption and FCPA training for its Chinese subsidiaries. In-house counsel at Watts China learned of the potential violations during discussions with CWV sales personnel who were participating in the training. The method of discovery highlights the importance of staying abreast of FCPA enforcement actions and compliance risk trends. Enforcement actions provide insight into the agencies' interpretation of the FCPA and risk areas (both in terms of issues and geographic trends) that have received government attention.

Actions Against Individuals

Court Dismisses Conspiracy Charges Against Six Defendants in SHOT Show Litigation

On December 22, 2011, U.S. District Judge Richard J. Leon dismissed conspiracy charges against six defendants -- Stephen Giordanella, Patrick Caldwell, John and Jeana Mushriqui, John Godsey and Mark Morales -- after twelve weeks of trial in what is the second of four SHOT Show trials scheduled to take place. As reported in our FCPA Autumn Review 2011 and other past Reviews, these six defendants were among the 22 individuals arrested in January 2010 -- 21 while attending the SHOT Show convention in Las Vegas -- and charged with allegedly engaging in schemes to bribe an undercover FBI agent they believed was acting on behalf of the government of Gabon in order to win a $15 million contract to provide law enforcement and defense equipment to the Gabonese presidential guard. Prior to this latest trial, three defendants had already pled guilty, and four others had been tried in the summer of 2011 before Judge Leon, who was forced to declare a mistrial in the case in September when the jury could not agree on a verdict. On January 4th, 2012, Judge Leon scheduled the retrial of these four defendants for May 29, 2012.

After the prosecution rested its case in the current trial, and before the defendants presented any defense, the defendants moved the court to dismiss the conspiracy charges against them. Judge Leon agreed with the defendants, ruling that the prosecution had failed to set forth sufficient evidence of an "overarching conspiracy," and therefore he would not allow the conspiracy charges to be put before the jury. One of the defendants, Giordanella, had been charged only with conspiracy to violate the FCPA, so Judge Leon's ruling exonerated him. Judge Leon's ruling on the conspiracy charges came just days after he admonished the prosecution for withholding evidence and using "sharp tactics" to gain an edge in the case. Judge Leon also dismissed two substantive FCPA charges against John and Jeana Mushriqui, ruling that they did not have the requisite knowledge of the corrupt nature of the Gabon deal to substantiate two of the charges against them.

On January 2, 2012, the remaining five defendants asked Judge Leon to declare a mistrial or sever their cases. In light of the court's dismissal of the conspiracy charges, the defendants' position is that they were improperly joined together for trial and their defenses were prejudiced as a result -- for example, prosecutors were allowed to introduce hearsay statements of alleged co-conspirators and related evidence that would have been inadmissible at individual trials. If Judge Leon denies the remaining defendants' request for mistrial or severance, the trial will proceed against them jointly on the remaining charges, which include substantive FCPA violations, conspiracy to commit money laundering, and aiding and abetting. If the court grants a mistrial, it would be the second consecutive mistrial in the largest prosecution of individuals under the FCPA in the history of the statute and would significantly undermine the viability of the government's case as a whole.

U.S. Court Sentences Canadian Agent to Thirty-Month Term

On December 22, 2011, Canadian national Ousama Naaman was sentenced to a 30-month prison term and fined $250,000 by Judge Ellen Segal Huvelle in U.S. District Court for the District of Columbia. As reported in our FCPA Summer Review 2010 and our FCPA Autumn Review 2009, after being indicted in July 2009, arrested in Germany and then extradited to the United States, Naaman pled guilty to charges relating to his role in making various improper payments to Iraqi officials under the U.N. Oil for Food program on behalf of U.S. chemical producer, Innospec Inc. ("Innospec") and its foreign subsidiaries. Specifically, Naaman pled guilty to two counts: 1) conspiracy to violate the laws of the United States, namely the FCPA and wire fraud; and 2) violating the FCPA.

Naaman faced a potential sentence of up to ten years imprisonment and fines up to $350,000 or twice the gain from the offenses. While the DOJ showed some flexibility in their request during sentencing, the government nonetheless asked for a term of more than seven years. Press reports indicate that DOJ fraud prosecutor Nathanial Edmonds appealed to Judge Huvelle by arguing that judges in subsequent cases will look to this case for guidance on how to handle foreign national agents involved in bribery schemes. Edmonds reportedly expressed the position that no leniency should be provided to non-U.S. residents who are charged in FCPA cases and that a shorter prison sentence may not have an effective deterrent effect. After considering the length of sentences imposed in past FCPA enforcement actions, Judge Huvelle rejected the DOJ's request and imposed a much shorter sentence of 30 months on Naaman.

Judge Huvelle has not determined when Naaman must surrender and start serving his prison term. Naaman is now free on a personal recognizance bond and his attorneys have announced that he is hopeful that he can serve his prison term in Canada.

Separately, Naaman settled with the SEC in August 2010 over his alleged role as an intermediary in providing improper payments to Iraqi officials. He agreed to disgorge $810,076 plus prejudgment interest of $67,030 to the SEC, as well as to pay a civil penalty of $438,038. The civil penalty will be reduced by $250,000 which represents the amount of an additional criminal fine which has been imposed (see FCPA Autumn Review 2010).

To date, Naaman is the only individual who has been prosecuted in the United States for involvement in the Innospec bribery scheme (see FCPA Spring Review 2010). Three former Innospec executives, Dennis Kerrison, Paul Jennings, and David Turner have been charged by the U.K. SFO with overseas bribery and are scheduled to appear in court in London on January 6, 2012.

Bourke's Appeal and Motion for New Trial Denied

On December 14, 2011, the Second Circuit Court of Appeals denied Frederic Bourke's appeal of his jury conviction of conspiracy to violate the FCPA and the Travel Act, and of making false statements. Bourke's conviction and "a year and a day" sentence (combined with a $1 million fine) stem from his investment in a failed bid to privatize the Azerbaijani state oil company, SOCAR. The bid was alleged to involve a multimillion dollar bribery scheme orchestrated by Victor Kozeny, to whom both the trial and the appeal decisions referred to as "the Pirate of Prague." (For more information on Bourke's trial and appeal see our FCPA Summer Review 2010, FCPA Winter Review 2010, and other past issues.)

Although FCPA commentators eagerly awaited the decision by the influential Second Circuit, the ruling did not significantly alter the FCPA landscape. Among other issues, on appeal Bourke argued that the court should not have issued its instruction on "conscious avoidance" of knowledge of the bribery scheme because evidence presented at trial was not sufficient to show "conscious avoidance." Bourke claimed that the relevant evidence at most showed that Bourke was negligent in not inquiring further into potential corrupt activities of the investment fund. In the view of many commentators, this was Bourke's strongest argument, supported by several post-trial statements. For example, the jury foreman's statement in a post-verdict interview -- "We thought he knew and he definitely should have known. He is an investor. It is his job to know" -- fell close to articulating a negligence standard. At sentencing, Judge Sheindlin said that she was not certain whether Bourke was "a victim or a crook or a little bit of both."

Nonetheless, the Second Circuit Court disagreed with Bourke, finding that evidence established a sufficient factual predicate to support the instruction on conscious avoidance. As Miller & Chevalier's Matthew T. Reinhard described in his post on The FCPA Blog the evidence that the Court cited as sufficient can be called "Evidence of the Four Bads" - or, bad place, bad person, bad actions and bad thoughts. Specifically, according to the ruling, the evidence showed:

i) That Bourke was aware Azerbaijan was a corrupt place generally (bad place);

ii) That Bourke knew Kozeny had a corrupt reputation (bad person);

iii) That Bourke took affirmative steps to attempt to shield himself from FCPA liability by creating US advisory companies to hold his place (and investment) on the Oily Rock board (bad actions); and

iv) Most damning, Bourke recorded phone conversations with another investor and their attorneys where he mused about whether Kozeny was paying bribes and what one had to do if he became aware that Kozeny and his crew were paying bribes (bad thoughts).

The Court also stated that the same evidence could be used to support actual knowledge and conscious avoidance; therefore, the lower court did not make an error in giving a conscious avoidance jury instruction.

A day after the Second Circuit Court rejected Bourke's appeal, the District Court also denied Bourke's motion for a new trial. Bourke's request for a new trial was based on the grounds that Kozeny's attorney Hans Bodmer committed perjury by falsely testifying about a meeting with Bourke. He also stated that the prosecutors knew or should have known that Bodmer would make false testimony under oath. Judge Scheindlin disagreed. She found that while Bodmer may have been mistaken about the date of the meeting, evidence was not sufficient to show that he had "fabricated the entire event." Judge Scheindlin also stated: "It is conceivable that the Government did not cross-check the details of Bodmer's anticipated testimony against [the] difficult to decipher flight records." Judge Scheindlin ordered Bourke to begin serving his sentence on January 3, 2012.

DOJ and SEC Bring Charges Against Former Siemens AG Executives

On December 13, 2011, the DOJ charged eight former employees and contractors of Siemens Actiengesellschaft ("Siemens AG") and its Argentinean subsidiary, Siemens S.A. ("Siemens Argentina") for their roles in an alleged scheme to secure, implement, and recoup the profits of a $1 billion contract for Siemens AG from the Argentinean government. The defendants include a former member of the Siemens Management Board and of the central executive committee of Siemens AG; five former executives of Siemens Argentina and Siemens Business Services ("SBS"); and two facilitators allegedly used by the executives to pass payments to government officials. The alleged scheme lasted from approximately 1996 through 2007. Siemens AG became subject to U.S. securities laws after March 12, 2001.

On the same day, the SEC charged seven former executives of Siemens AG and Siemens Argentina, in connection with the same alleged scheme. The SEC did not charge the two intermediaries included among DOJ's defendants. The SEC complaint also lists the former SBS CFO as a defendant; he is not included in the DOJ action.

DOJ charges included conspiracy to commit FCPA anti-bribery violations and money laundering, and a substantive wire fraud charge. SEC charged the defendants with violations of the FCPA anti-bribery and accounting provisions, and with aiding and abetting violations of the same provisions by Siemens AG. The former SBS CFO is also charged with violating Rule 13b2-2 of the Securities Exchange Act of 1934 by signing an internal certification containing false or misleading statements. The cases were filed in the U.S. District Court for the Southern District of New York.

The charges come three years after Siemens AG and Siemens Argentina paid $1.6 billion in record fines to the SEC, DOJ, and the Office of General Prosecutor in Munich. (See Miller & Chevalier Winter 2008 FCPA Alert, "Siemens Agrees to Landmark $800 Million Settlement). The settlement documents in those cases described multiple schemes of corrupt payments throughout Siemens AG's global operations, including in Argentina. Notwithstanding the record penalties, Siemens AG received high praise (and a penalty reduction) from U.S. enforcement authorities for cooperating with the investigation, which likely included providing evidence against individual actors involved in the violations. In a press release announcing the individual indictments, the DOJ also praised Siemens AG and its audit committee for disclosing potential violations to it after the Munich Public Prosecutor's Office commenced an investigation.

In the years following the settlement, the DOJ and SEC were criticized by commentators and the U.S. Senate for failing to prosecute individual perpetrators of bribery offences. In response, enforcement officials stated that the cases were not yet over. The DOJ's and SEC's efforts in amassing evidence likely scattered among several countries came to fruition in the charges filed on December 13.

The DOJ indictment alleges that the defendants conspired to pay more than $100 million in bribes to Argentinean government officials. The initial aim was to secure a contract for Siemens AG in a tender to replace Argentinean national identity cards ("DNI Project"). After a government change in 1999, the project was terminated, and the defendants allegedly conspired to make additional payments in an effort to get the DNI Project reinstated. Having failed to do that, despite the alleged payments, Siemens AG brought an arbitration action against Argentina in World Bank's International Centre for Settlement of Investment Disputes ("ICSID") in Washington DC to recoup revenues that would have been due under the contract. The defendants allegedly conspired to make additional payments to keep the evidence that the contract was obtained through bribery out of the proceeding (Argentina could have used such evidence as a defense). Co-conspirators also allegedly arranged for one of the intermediaries to bring a sham arbitration case in Argentina, and caused Siemens AG to settle the case for $8.8 million. The money was allegedly used to fund additional payments. The settlement agreement imposed strict confidentiality requirements on the participants, which allowed them to keep evidence of the alleged bribery out of the ICSID arbitration. In 2007, ICSID awarded $217 million plus interest to Siemens AG (in 2009, Siemens waived the award).

According to the agencies' documents, the co-conspirators allegedly used different mechanisms to generate funds and conceal payments, namely: withdrawing cash from Siemens AG's general purpose accounts; moving funds through off-shore intermediary companies belonging to purported consultants and to government officials; approving "sham" invoices and contracts with the intermediary companies and consultants for services never performed; and using off-books accounts. The agencies asserted that some of the payments were channeled through U.S. bank accounts, and that some of the meetings relevant to the alleged conspiracy took place in the United States.

One of the defendants named in the SEC compliant - Bernd Regendantz, a CFO of SBS from February 2002 through 2004 - has already settled SEC civil charges. He agreed to pay a $40,000 fee, but the penalty was "deemed satisfied" by his payment of €30,000 to the General Prosecutor's Office in Munich. Regendantz was not named as a defendant in the DOJ's indictment (which included other co-conspirators not named as defendants). According to the SEC's complaint, Regendantz started working at SBS after the scheme was already underway, and was urged to approve transactions aimed to generate money for improper payments. Regendantz claimed that he objected to the payments, but received clear instructions from his superiors to approve the transactions. According to the complaint, he was also told that the Siemens Argentina executives were being threatened with physical harm because the promised bribes remained unpaid.

According to SEC and DOJ officials, these are landmark actions for a number of reasons. For example, as a former member of the Siemens Management Board, the defendant Uriel Sharef is the first board member of a Fortune Global 50 company charged with FCPA violations. Also, SEC officials stated that this is the SEC's biggest enforcement action against individuals for bribery of foreign officials.

All defendants are non-U.S. citizens, some of whom may require extradition to be prosecuted. The DOJ's good, working relationship with the General Prosecutor's Office in Munich, with whom DOJ cooperated closely in the Siemens investigation, may be of assistance to the agencies in this complicated process, as will mechanisms in the OECD anti-corruption convention, of which both the United States and Germany are members.

Convictions Against Lindsey Manufacturing, Two Executives Dismissed

On December 1, 2011, U.S. District Judge Howard Matz of the Central District of California vacated the convictions and dismissed the indictments against Lindsey Manufacturing Company ("Lindsey"), Keith Lindsey (Lindsey's President and CEO) and Steve Lee (Lindsey's Vice-President and Chief Financial Officer). Lindsey and the executives were convicted in May, 2011 of conspiracy to violate the FCPA along with five substantive FCPA violations.

The Lindsey case has previously been reported on in our FCPA Summer Review 2011 and FCPA Winter Review 2011. In the Order, the Court expressed its "deep regret" that it was "compelled to find that the Government team allowed a key FBI agent to testify untruthfully before the grand jury, inserted material falsehoods into affidavits submitted to magistrate judges in support of applications for search warrants and seizure warrants, improperly reviewed e-mail communications between one Defendant and her lawyer, recklessly failed to comply with its discovery obligations, posed questions to certain witnesses in violation of the Court's rulings, engaged in questionable behavior during closing argument and even made misrepresentations to the Court." The Court made several factual findings of the Government's flagrant misconduct, both pre- and post-indictment, which were "clearly wrongful" and stated that, "at best … the Government was reckless in disregarding and failing to comply with its duties." The Court also acknowledged the ordeal that the defendants were put through, "a result of a sloppy, incomplete and notably over-zealous investigation, an investigation that was so flawed that the Government's lawyers tried to prevent inquiry into it." In denying the U.S. government a "do over," the Court expressed its hope that its ruling "will have a valuable prophylactic effect."

Following the dismissal, the government also agreed to vacate Angela Aguilar's conviction pending its appeal of Judge Matz's order. Aguilar was convicted alongside Lindsey and its executives of conspiracy to launder money and faced up to twenty years in prison. Aguilar had not appealed her conviction, agreeing instead to a sentencing deal that required a forfeiture of $3 million, but which released her from federal detention and permitted her return to Mexico. Aguilar's husband, Enrique Faustino Aguilar Noriega, was also charged, but did not appear at trial and is currently a fugitive in Mexico.

Fifteen Year Sentence Imposed in Haiti Teleco Case

On October 25, 2011, Joel Esquenazi, the former president of Terra Telecommunications Corporation ("Terra") was sentenced to 15 years in prison as part of his role in a conspiracy to pay and conceal bribes to employees of Haiti's state-owned telecommunication company, Telecommunications D'Haiti ("Haiti Teleco"). Former Terra executive vice president, Carlos Rodriguez, was also sentenced to seven years in prison for his role in the scheme. According to the indictment, Esquenazi and Rodriguez authorized bribes to Haiti Teleco officials to secure business advantages for Terra, which included preferred telecommunications rates, a reduced number of minutes for which payment was owed (effectively reducing the per minute rate), and a variety of credits toward sums owed. Thereafter, Esquenazi and Rodriguez allegedly caused Terra to falsely record the bribes as "commissions" or "consulting fees" on financial, banking, and accounting documents.

In addition to their prison terms, Esquenazi and Rodriguez were also ordered to pay a total assessment of $2,100 and restitution of $2.2 million, the latter jointly and severally among Esquenazi, Rodriguez, and another Haiti Teleco defendant, Juan Diaz. The former president of the intermediary company J.D. Locator, Diaz was sentenced to 57 months in prison after pleading guilty to conspiring to violate the FCPA and commit money laundering by using his company to receive and funnel bribes from Terra and other Florida-based telecommunications companies to Haiti Teleco officials. (See our FCPA Autumn Review 2011, FCPA Spring Review 2011, and FCPA Autumn Review 2010). As discussed in our FCPA Autumn Review 2011, Esquenazi and Rodriguez were convicted in August 2011 of conspiring to violate the FCPA and commit wire fraud and committing substantive FCPA and money laundering violations.

The 180-month prison term imposed on Esquenazi is the most severe sentence ever imposed in an FCPA prosecution, followed by the 87-month sentence imposed on Charles Edward Jumet (see our FCPA Summer Review 2010) and the 84-month sentence imposed on Rodriguez. In a DOJ press release, Assistant Attorney General Lanny A. Breuer called Esquenazi's sentence "a stark reminder to executives that bribing government officials to secure business advantages is a serious crime with serious consequences." In addition, Breuer cited the sentence as a warning that the DOJ "will continue to hold accountable individuals and companies who engage in such corruption."

Rodriquez filed a motion on December 29, 2011, indicating that he plans to appeal the court's decision regarding the definition of a key statutory term in the FCPA – what is an ‘instrumentality' of a foreign government. Rodriguez's challenge could be the first time the issue is presented to a higher court, though other lower courts have ruled on the issue, generally in terms that favor the agencies' broader interpretation.

Private Litigation

SciClone Pharmaceuticals Resolves Shareholder Derivative Suit

On December 15, 2011, a California state court approved a settlement agreement that resolved a consolidated shareholder derivative suit against former directors and officers of SciClone Pharmaceuticals, Inc, a NASDAQ-listed pharmaceutical company headquartered in Hong Kong. The litigation stemmed from an August 9, 2010 announcement SciClone made in its Form 10-Q, in which the company disclosed that the SEC and DOJ had initiated FCPA investigations into the company's sales practices in foreign countries, such as China.

SciClone shares declined 41% the day after the disclosure. Within two weeks of the announcement, seven shareholder derivative class actions were filed against SciClone's officers and directors on behalf of the company. See FCPA Autumn Review 2010. Several of those actions were later consolidated as In re SciClone Pharmaceuticals, Inc., Shareholder Derivative Litigation, No. CIV 499030, in California state court. The plaintiffs' primary claim asserted that the company's former officers and directors "by reason of their failure to implement and maintain internal controls and systems at the Company to assure compliance with the FCPA, breached their fiduciary duties."

Although the individual defendants denied all charges of wrongdoing or liability against them and denied that the plaintiffs, the Company, or its shareholders were harmed by their alleged omissions, the parties agreed to settle the matter under the following conditions:

-

SciClone must implement and maintain for at least a three year period certain Corporate Governance Measures. These include:

-

A requirement that the Company pursue personnel actions against any director, officer, employee, or independent contractor found to have participated in an "Established Violation," defined as a "guilty plea or other admission of guilt under penalty of perjury, or a criminal or civil judgment or sanction." The Company is also tasked with considering whether to take action to recoup "all incentive based compensation paid to the director, officer, employee, or independent contractor that would not have been earned but for the Established Violation."

-

A requirement that the Company establish a "Compliance Coordinator," who must be "fluent in Mandarin and English" and "a senior professional with FCPA compliance experience who would be a member of the executive team and oversee implementation of the Company's compliance programs." The proposed settlement details the Compliance Coordinator's responsibilities, which essentially would be those of a Chief Compliance Officer.

-

A requirement that the Company establish a "Global Anti-Bribery & Anti-Corruption Policy," including an "overall statement expressing clear corporate policy prohibiting the provision of any financial benefit or benefit-in-kind to any non-U.S. Government Official ("Government Official") or Health Care Professional ("HCP") . . . in exchange for prescribing, recommending, purchasing, supplying or administering SciClone products or for a commitment to continue to do so, or that may have an inappropriate influence on a Government Official or HCP, or HCP's prescribing practices, or that would create the appearance of doing so."

-

A requirement that the "Company conduct due diligence pertaining to the hiring of all foreign agents and distributors utilized by the Company," and that "[b]efore entering into any contract with any third-party to act as a foreign agent or distributor . . . the Company must first conduct a reasonable investigation into its background, reputation and business capabilities."

-

A requirement that the Company maintain its internal audit and compliance functions, mandate annual employee FCPA compliance training, and establish a more robust and detailed whistleblower program.

-

-

The Company's director and officer liability insurers pay $2,500,000 in attorneys' fees and expenses to the plaintiffs' counsel.

This suit was part of an increasing trend of parallel civil litigation following FCPA disclosures. Announcements of shareholder civil suits have closely followed the disclosure of FCPA investigations in several other cases, including Weatherford International, Avon Products, and Johnson & Johnson. See FCPA Summer & Winter Reviews 2011. There is still no indication from SciClone, the DOJ or the SEC about the status of the government's investigations; however, it is unclear whether the government will impose more onerous compliance mechanisms on SciClone than the proposed settlement does -- few DPAs or NPAs are as detailed as the proposed settlement.

Domestic Legislation

FCPA Debarment Legislation Reintroduced

On December 7, 2011, Representatives Peter Welch (D-VT) and Jason Chaffetz (R-UT) introduced a bill, the Overseas Contractor Reform Act, to debar from federal contracting any individual or company that violates the FCPA. This bill for the most part restates language from a previous bill introduced by Representative Welch in 2010. As discussed in our FCPA Autumn Review 2010, the language of the earlier bill suggested that certain common types of FCPA settlements (e.g., DPAs, NPAs) would not meet the threshold for debarment (because they would not constitute a "finding" of a violation), which could increase incentives for companies to settle. The new bill does not provide further guidance in this area. Similar to the 2010 bill, the new bill gives the heads of Federal agencies broad discretion to waive the debarment requirements. However, the new bill also gives the heads of Federal agencies the ability to grant exemptions for individuals and companies who voluntarily disclose violations. Thus, this bill, if passed, could also increase incentives for companies to voluntarily disclose violations.

Legislation Creating Private Right of Action Against "Foreign Concerns" Reintroduced

On November 30, 2011, Representative Ed Perlmutter (D-CO) introduced a bill, the Foreign Business Bribery Prohibition Act of 2011, which would give domestic companies and individuals the right to sue "foreign concerns" (i.e., non-U.S. corporations and individuals) for anti-bribery violations. The bill restates proposed amendments to the FCPA that Representatives Perlmutter and Shelly Berkley (D-NV) introduced in 2009, which did not reach a vote in the U.S. House of Representatives or the Senate. As reported in our FCPA Spring Review 2009, under the proposed amendments, non-U.S. companies could face private suits for significant amounts, including treble damages (i.e., three times the amount of a "contract or agreement" obtained through bribery).

U.S. Agency Developments

DOJ to Provide Guidance on the FCPA

On November 8, 2011, Assistant Attorney General Lanny A. Breuer, in a keynote speech to attendees at the American Conference Institute's annual National Conference on the FCPA in Washington, DC ("ACI Conference"), addressed recent efforts to amend the FCPA and made a full-throated defense of the Act.

Breuer called the passage of the FCPA "a milestone" and said that the DOJ has "no intention whatsoever of supporting reforms whose aim is to weaken the FCPA and make it a less effective tool for fighting foreign bribery." In the face of a worldwide trend toward the criminalization of foreign bribery, Breuer said that "watering down the Act – by eliminating successor liability in the FCPA context, for example – would send exactly the wrong message," underscoring that it is "precisely the wrong moment in history to weaken the FCPA."

As to the criticisms leveled by proponents of the effort to amend the FCPA, Breuer said that "whether or not certain clarifications to the Act are appropriate, now is the time to ensure that the FCPA remains a strong tool for fighting the ill effects of transnational bribery." To this end, he announced the DOJ's intent to issue "detailed new guidance" in 2012 on the FCPA's "criminal and civil enforcement provisions," something he said he hoped would be a "useful and transparent aid" for those subject to the Act.

Breuer's announcement has been welcomed by, among others, the U.S. Chamber of Commerce, which has strongly advocated for FCPA reform, and Sen. Charles Grassley, the ranking member of the Senate Judiciary Committee, which has held hearings on FCPA reform. Sen. Grassley, in a series of questions he recently submitted to Attorney General Eric Holder, said he hoped the forthcoming guidance would help "businesses that want to do the right thing, know what the right thing is in the eyes of the [DOJ]." He also sought more information on the guidance, including, among other things: when it is expected to be published; what form it will take and how it will be implemented; who will be primarily responsible for drafting it; whether the SEC will participate in the drafting of and/or be bound by the guidance; whether it will include an enforcement safe harbor for gifts and hospitality of de minimis value; and whether it will provide clarity on such hot button issues as the definition of "foreign official" and "government instrumentality" and when one company may be held liable for the pre-acquisition or pre-merger conduct of another.

In an interview with the Wall Street Journal, Homer Moyer, a Miller & Chevalier member who co-chaired the ACI Conference, called the promised guidance "a big step" considering that the DOJ declined to issue interpretive guidelines after the 1988 amendments to the FCPA called for the agency to determine whether compliance with the FCPA "would be enhanced and the business community would be assisted by further clarification" of the Act in the form of written guidelines and cautionary procedures. (15 U.S.C. § 78dd–1 (d)). Moyer cautioned, however, that not much is known about the DOJ's plans for the guidance at this point, with Breuer's announcement consisting of two sentences from his keystone speech.

While the guidance is certain to provide some clarity on the DOJ's interpretation of the FCPA's various provisions and give companies more direction in their efforts to comply, most commentators are skeptical that the guidance will deviate significantly from the DOJ's current approach to enforcement. The DOJ is expected to issue the guidance within the next six to twelve months.

SEC Issues First Annual Report on Dodd-Frank Whistleblower Program and House Panel Issues Bill Mandating Whistleblower Internal Reporting

In November 2011, the SEC issued its first Annual Report on the Dodd-Frank Whistleblower Program. As reported in our FCPA Summer Review 2011, on May 25, 2011, the SEC adopted final rules implementing the whistleblower program provided for in Section 922 of the Dodd Frank Act. The rules, which came into effect on August 12, 2011, authorize the SEC to pay rewards of 10% to 30% of penalties to individuals who provide the Commission with original information that leads to a successful enforcement action resulting in sanctions of at least $1 million.

The Dodd-Frank Act also requires the SEC to report its activities under the whistleblower program to Congress on an annual basis. In its first report, the SEC explained that, in 2011, it created the Office of the Whistleblower headed by Sean X. McKessy. In addition, it worked to implement the program by providing training and guidance to Commission staff, developing policies, establishing a whistleblower hotline, creating a website, and meeting with the public and with other Government agencies, and identifying and tracking cases with whistleblower involvement.

In the seven-week period from when the rules went into effect to the end of the Commission's 2011 fiscal year on September 30, 2011, the SEC received 334 whistleblower tips. Of those, just under 4% were related to potential FCPA violations, following well behind complaints related to market manipulation (16.2%), corporate disclosure (15.3%), and offering fraud (15.6%). The Commission received complaints from 37 states, the majority of which were from California (34 complaints), New York (24 complaints), and Florida (19 complaints). In addition, the SEC received 32 complaints from foreign countries, over half of which were from China (10 complaints) and the United Kingdom (9 complaints).

In other developments, on December 14, 2011, the House Financial Services Subcommittee on Capital Markets and Government Sponsored Enterprises approved the Whistleblower Improvement Act of 2011 (H.R. 2483), which was introduced on July 15, 2011, by Rep. Michael Grimm (R-N.Y.). If passed into law, the bill would significantly alter the whistleblower provisions of the Dodd Frank Act.

Among other things, the bill would require employees to report an alleged violation to their employer before providing the information to the SEC in order to be eligible for a whistleblower reward. The requirement would not apply if the whistleblower claims, and the SEC determines, that the employer lacks a policy prohibiting retaliation for reporting potential misconduct, lacks an internal reporting system allowing for anonymous reporting, or that internal reporting was not a viable option for the whistleblower because the misconduct was committed by those at the highest level of management or the employer had acted in bad faith.

In addition, the bill would eliminate mandatory awards in the range of 10% to 30%, and, instead, allow the SEC to determine if an award should be granted at all and, if so, the amount of the award. It would also prohibit a whistleblower from receiving an award if the whistleblower is found by the SEC to have participated in the misconduct that constitutes the violation or if the whistleblower is found civilly liable in an action related to the misconduct. Currently, the Dodd Frank Act only prohibits whistleblowers who are convicted of a related criminal violation from receiving an award.

International Developments

Ferrostaal Settles Bribery Cases with Germany

On December 20, 2011, after a three day hearing, a regional court in Munich imposed a €140 million fine (approximately $181 million) against Ferrostaal AG ("Ferrostaal"), a German industrial services company, and additional penalties against two former company managers. According to press reports, the two former company managers, Johann- Friedrich Ha and Hans-Dieter Mue, were convicted of bribery and received suspended prison terms of two years (conditioned on the making of a large charitable contribution). Ha was fined €36,000 and required to pay an additional €30,000 to charities. Mue was fined €18,000 and required to pay an additional €22,000 to charities.

The charges stemmed from suspected bribery in the sale of submarines to Greece and Portugal, and in the construction of a compressor station in Turkmenistan. The company's press release indicates that the court deemed the company to have insufficient internal controls such that it was unable to prevent the corrupt activities by its former managers.

These prosecutions highlight Germany's continued aggressive enforcement of its anti-corruption laws. Please see our prior FCPA Reviews and Alerts for analysis of recent German enforcement actions against Ferrostaal's former parent, MAN SE ("MAN"), and Siemens.

The Ferrostaal matter also demonstrates how corruption scandals can derail acquisitions and contribute to dramatic losses. According to press accounts, MAN had completed the first stage of its sale of Ferrostaal to Abu Dhabi-based International Petroleum Investment Company ("IPIC") before the bribery scandal surfaced. At that time, IPIC reportedly paid $700 million for a 70% stake in Ferrostaal. According to media sources, the bribery scandal sparked a dispute between IPIC and MAN regarding completion of the sale, and IPIC ultimately sold its shares back to MAN for approximately $450 million. MAN then reportedly agreed to sell Ferrostaal to another party for approximately $200 million. In sum, the bribery scandal contributed to a drop of over $500 million in Ferrostaal's sale value.

A leaked investigation report prepared by outside counsel, which was posted on an online media site, provides significant detail on activities that may have given rise to the enforcement actions. The possibility that the report's publication could be viewed by enforcement authorities as a waiver of attorney-client privilege (the report was marked as privileged), and the potential use of the report by third parties in ancillary litigation, illustrates the tensions companies face in fully documenting findings from internal investigations.

Swiss Authorities Fine Alstom $41 Million

On November 22, 2011, the Swiss Office of the Attorney General announced a summary punishment order against Alstom Network Schweiz AG, a unit of Alstom SA, assessing a total penalty of 38.9 million Swiss francs (approximately $41.3 million). After a two year investigation encompassing fifteen countries, the Swiss authorities charged Alstom with corporate negligence, stating that the company "did not take all necessary and reasonable organizational precautions to prevent bribery of foreign public officials in Latvia, Tunisia, and Malaysia." Consultants engaged by Alstom allegedly forwarded a significant portion of their success fees to foreign officials to influence the award of state contracts to Alstom. As reported in our FCPA Spring Review 2010 and FCPA Spring Review 2008, U.S., French, and Brazilian authorities are reportedly investigating bribery allegations involving Alstom.

Transparency International Corruption Perceptions Index

On December 1, 2011, Transparency International released its 2011 Corruption Perceptions Index ("CPI"), a list that tracks perceived levels of governmental corruption in 183 countries using a 1 - 10 scoring system with 1 representing the highest level of perceived corruption and 10 representing the lowest. In addition to individual corruption scores, each country receives a ranking, with lower rank representing lower levels of corruption. The CPI is used by many companies and enforcement agencies as one measure of the corruption risks present in specific countries.

New Zealand was ranked as the least corrupt country, followed by Denmark and Finland which were tied for second place, with Sweden and Singapore rounding out the top five. Sudan, Turkmenistan, Uzbekistan, Afghanistan, Myanmar, North Korea, and Somalia all ranked at the bottom of the scale, scoring 1.6 or less.

The United States slipped again in its ranking, from 22nd in 2010 to 24th, while its score remained constant at 7.1. Perhaps reflecting the implementation of the U.K. Bribery Act, the United Kingdom improved in its ranking, moving up from 20th to 16th, and in its score, moving up from 7.6 to 7.8. Haiti and Guatemala experienced the biggest drops in rankings this year, moving down from 146th to 175th and from 91st to 120th respectively, with the scores dropping 0.4 for Haiti from 2.2 to 1.8 and dropping 0.5 for Guatemala from 3.2 to 2.7.

Transparency International Bribe Payers Index

On November 2, 2011, Transparency International released its 2011 Bribe Payers Index, a list that ranks 28 of the world's largest economies according to perceived likelihood of companies from those countries to pay bribes abroad. The list is based on the results of surveys of more than 3000 business executives. Each country was given a score between zero and ten, with ten indicating that companies from that country never use bribery. Russia ranked at the bottom of the scale, scoring 6.1. China posted a score of 6.5. Transparency International praised China's efforts in combating bribery, such as a recently passed law making it a crime for Chinese citizens and companies to bribe foreign officials (see FCPA Spring Review 2011). However, the group said that, in addition to the legislative changes, the effort "also requires sufficient enforcement processes and resources, international cooperation and moreover, the continued willingness of the authorities to treat this issue as an important priority." India was ranked the "most improved" country, earning a score of 7.5, compared to 6.8 in the 2008 study.

Identification and Quantification of the Proceeds of Bribery

On November 28, 2011, the OECD and the World Bank/UNODC Stolen Asset Recovery Initiative released a joint corruption law study in an effort to make it easier for governments to quantify and recover the proceeds of corruption. The study, titled, "Identification and Quantification of the Proceeds of Bribery," discusses the international legal framework for the treatment of proceeds of active bribery, catalogues the legal remedies available in various jurisdictions such as confiscation, disgorgement of profits, and contractual restitution, and notes how these remedies may interact. The study also discusses methods for determining unlawful proceeds specific to each type of legal remedy, and provides a compilation of illustrative case studies from jurisdictions such as Germany, Indonesia, South Africa, Switzerland, the United Kingdom, and the United States, as well as the International Court of Arbitration. In addition to helping governments recover the proceeds of corruption, this study could also serve as a resource for companies to identify and target weaknesses in their anti-corruption compliance programs and for inclusion in training materials.

SFO Launches a Confidential Reporting Service for Whistleblowers

In line with its approach of private sector engagement, on November 1, 2011, the U.K. SFO launched "SFO Confidential," a confidential whistleblower resource aimed at encouraging reports of suspected fraud or corruption. According to the website, the service is run by trained staff focused on protecting the identity of whistleblowers; the SFO states that it will not trace or record calls, and while it prefers that whistleblowers share their identities, reports can be made anonymously. If a whistleblower shares his or her identify, the SFO asserts that it will only disclose that information to others on a need-to-know basis or if ordered to do so by a judge and has promised to consult with the whistleblower before doing so. Reports can be filed by phone, email or in writing.

In recent public statements, SFO Director Richard Alderman encouraged company executives, staff, professional advisors, business associates, potential acquiring parties and competitors to come forward with reports of suspicious activities, no matter how small. He expressed that the SFO's ultimate goal is to encourage companies to self-police so that they will already be investigating and reporting suspicious activities to the SFO before whistleblowers disclose such information to the agency. Alderman also noted that the SFO will take a pragmatic approach to prosecuting Bribery Act violations and intends to grant goodwill credit to companies who initially disclose their suspicions, in effect, before whistleblowers do. Press reports indicate that Alderman will be leaving the SFO in four months time but that he will be replaced by David Green, a leading barrister and former head of Revenue and Customs prosecution office.

It is too early to tell how exactly the SFO plans to "pragmatically" address issues raised by whistleblowers, and how many reports will be filed. Notably, unlike the SEC's Whistleblower Program in the United States, the SFO's whistleblower program does not offer cash incentives for disclosing suspected fraud or corruption.

First Conviction Under the U.K. Bribery Act

As discussed in the FCPA Autumn Review 2011, the first conviction under the U.K. Bribery Act was handed down on October 14, 2011, and the culprit was not a multinational conglomerate. Instead, it was a London court clerk who admitted to asking for £500 to help clear a suspect of a speeding ticket.

Munir Patel worked as an administrative clerk at Redbridge Magistrate's Court in London and allegedly aided 53 traffic offenders over the course of a year in exchange for a total of at least £20,000 (approximately $31,000). The bulk of activity was prosecuted under the offense of misconduct in a public office. However, the Crown Prosecution Service also charged one violation of the U.K. Bribery Act, which prohibits the receipt of bribes by a police officer, for Patel's acceptance of a payment following the Act entering into enforcement in July 2011. Patel was sentenced to three years for bribery and six years for the misconduct offense, with the sentences to run concurrently.

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.