FCPA Spring Review 2013

International Alert

Introduction

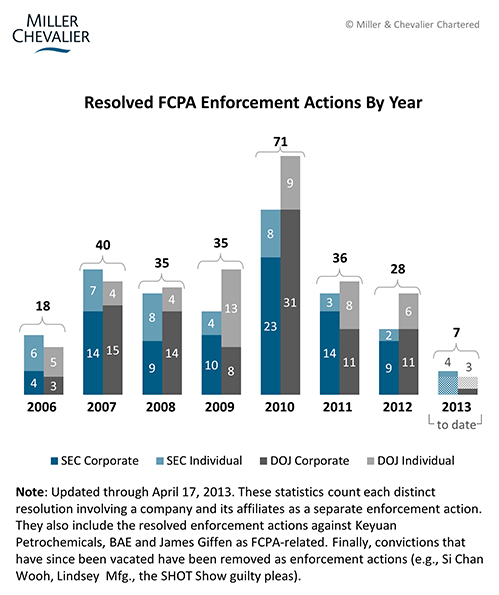

The first quarter of 2013 involved either one or no resolved corporate Foreign Corrupt Practice Act (FCPA) enforcement dispositions, depending on one's characterization of the Keyuan Petrochemicals resolution discussed below. The last time the Department of Justice (DOJ) and the Securities Exchanges Commission (SEC) did not resolve a single FCPA-related corporate action in a quarterly period was the third quarter of 2006. The chart below tracks the rise in the total number of resolved FCPA enforcement actions per year to its peak in 2010, and the subsequent fall to enforcement levels not seen in seven years.

The first two weeks of the second quarter of the year, however, brought three corporate dispositions against two companies. On April 8, 2013, the Dutch electronics giant Koninklijke Philips Electronics NV settled FCPA allegations with the SEC over improper payments its Polish subsidiary allegedly made in connection with the sale of medical equipment to Polish hospitals. And on April 16, 2013, the Houston-based drilling services company Parker Drilling Co. settled FCPA charges with the DOJ and SEC over improper payments the company allegedly made through an agent to resolve a customs dispute with the Nigerian government in 2004 (the Parker disposition will be covered in our next quarterly review).

Perhaps weary of speculation surrounding a perceived lull in prosecutions in the last quarter, Chuck Duross (Deputy Chief of the DOJ Criminal Division's Fraud Section), Kara Brockmeyer (Chief of the SEC's FCPA Unit), and Elisse Walter (former Chair of the SEC), each publicly proclaimed the agencies' continuing focus on FCPA enforcement, with Duross stating that the DOJ is "as busy today as [it has] ever been," Brockmeyer warning that "blockbuster corruption cases are still on the horizon," and Walter attesting that she sees "an increasing commitment to fighting [foreign] corruption" by the U.S. enforcement authorities.

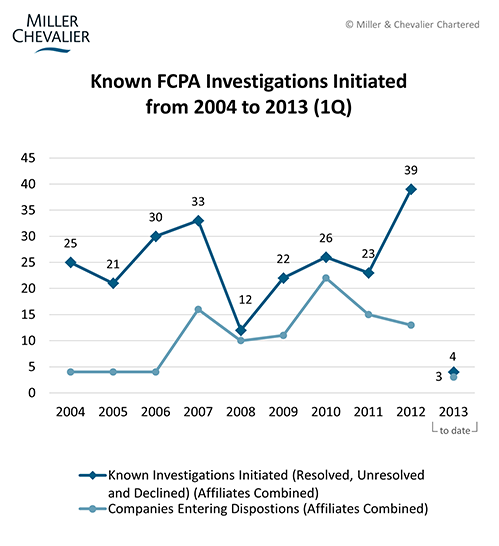

Reported data also suggest that FCPA investigations continue apace. Miller & Chevalier, as reflected in the Known Investigations Initiated Chart below, is currently tracking at least 39 corporate FCPA investigations that were initiated in 2012 — more than we have seen initiated in any prior year. This new wave of investigations represents more than one-third of the approximately 110 pending FCPA investigations that our firm is currently tracking. By contrast, the last time the number of known investigations initiated per year spiked above 30 was in 2006 and 2007, which helped to drive the record enforcement levels we saw from 2007 to 2011. While it is difficult to predict what will come of the large number of investigations recently initiated—particularly in light of the increasing number of declinations discussed below—any spike in enforcement they would trigger likely would be delayed.

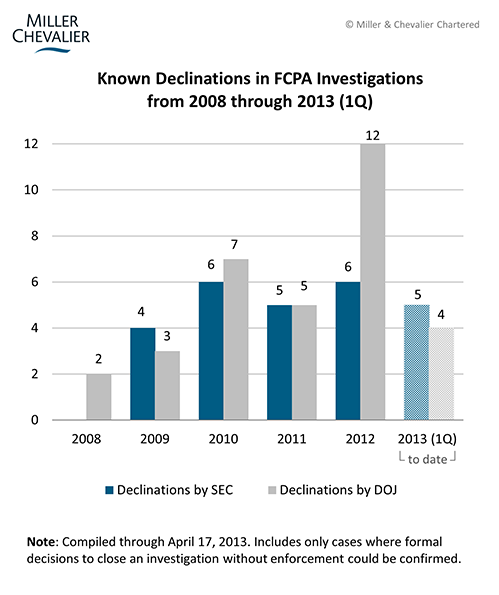

In contrast to the number of prosecutions, the number of disclosed declinations — instances in which an agency decided to close an FCPA investigation without pursuing enforcement — set a record pace this past quarter with nine reported. As the Declinations Chart below shows, the agencies are currently on track to double the number of declinations announced last year, itself a record. A focus on closing out the agencies' existing backlog of cases with declinations, where appropriate, may be one reason why enforcement levels in 2012 and 2013 (thus far) have dipped.

One theory offered to explain the recent drop in resolved enforcement actions has been the agencies' involvement in resource-consuming litigation in connection with the prosecutions of individuals (discussed in our FCPA Winter Review 2013). Regardless of that theory's basis in reality, this past quarter saw a number of enforcement developments related to individuals. As discussed below, the DOJ resolved enforcement actions with two executives of BizJet International Sales and Support Inc. ("BizJet"), while indicting two additional BizJet executives. In addition, on April 12, 2013, a federal court approved a long tentative SEC settlement with former Siemens executive Uriel Sharef. On April 13, 2013, the DOJ announced the arrest of a French citizen in Florida on charges of obstruction of justice and witness tampering in relation to the FCPA investigation of a mining company in the Republic of Guinea. And finally, on April 16, 2013, the DOJ unsealed charges against one current and one former executive of the U.S. subsidiary of the French power and transportation company Alstom for their alleged participation in a scheme to bribe foreign officials. These latter two developments will be analyzed in our next quarterly review.

FCPA jurisprudence has been advanced by these individual prosecutions. In the last quarter, the Southern District of New York issued two opinions addressing several legal issues important to FCPA enforcement, some of which have not been previously considered in the FCPA context. We discuss the two rulings below, one issued in the prosecution of three Magyar Telekom executives, the other in the prosecution of a Siemens executive. Another interesting ongoing legal battle we follow below is the prosecution of two Noble Drilling executives in Texas.

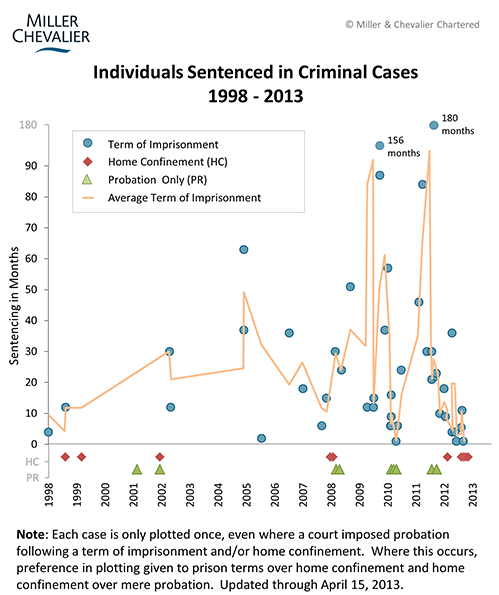

The rising number of FCPA individual prosecutions has also led to an increasing number of individuals sentenced for FCPA violations. Since January 1, 2013, courts have sentenced eight defendants in four cases—American Banknote, Control Components, Kozeny, and BizJet—none of whom received prison terms beyond time already served. As reflected in the sentencing chart below, these sentences highlight a disparity in sentencing that has arisen in recent years: in contrast to the more than 30% of FCPA defendants not sentenced to imprisonment, 10.5% of those convicted since 1998 were sentenced to prison terms exceeding four years. A review of the facts involved in each case — including the level of personal involvement, the size of the alleged bribes and the purported benefit received — reveals no consistent pattern on sentencing.

Finally, as in past reviews, we continue to document the slow but steady rise in non-U.S. prosecutions against international corruption. The number of such prosecutions has grown to such an extent that we are only able to report on matters and emerging themes of likely significance to our clients. One theme from this past quarter is the emergence of Canada as another active prosecutor of international corruption: last quarter, Canada announced the prosecution of Griffiths Energy International, Inc., as well as a proposed set of stronger anti-international-corruption laws (in addition, the Canadian and international press also focused on an ongoing investigation of SNC-Lavalin Group for fraud and corruption in Canada, Libya, Algeria, and other countries). Another continuing trend is the growing number of non-U.S. prosecutions against companies or individuals implicated in earlier U.S. FCPA settlements—including Greece's prosecution of Johnson & Johnson subsidiary DePuy and Greek doctors who allegedly took bribes from DePuy, and Latvia's prosecution of Latvian officials who allegedly took bribes from a Daimler AG subsidiary—a development that has significantly increased the complexity of international corruption prosecutions. We also discuss the international-corruption related prosecutions Total S.A. and former executives in France and Finmeccanica, its subsidiary AgustaWestland, and executives in Italy and India.

Actions Against Corporations

Keyuan Petrochemicals, Arguably the Year's First FCPA Disposition

In what is thought to be the first FCPA-related enforcement action ever taken against a China-based company, on February 28, 2013, the SEC entered into a joint settlement with Keyuan Petrochemicals Inc. and its former CFO, Aichun Li, over alleged violations of the books and records and internal controls provisions of the FCPA, and the anti-fraud and reporting provisions of other federal securities laws.

We categorize the Keyuan settlement, which includes allegations of a large off-books account in China and improper payments to Chinese officials, as the first FCPA enforcement action of 2013, though it is not universally recognized as such. For instance, the SEC does not formally classify Keyuan as an FCPA matter and does not include the settlement on its FCPA enforcement page. One possible reason for this omission is that the thrust of the allegations in the joint settlement (including all of those against Li) relate to insider trading, not the Company's accounting violations related to improper payments to Chinese officials. The SEC complaint also does not specify a corrupt intent in connection with the improper payments. Failure to allege all of the elements of an anti-bribery violation, however, has not stopped the SEC from characterizing enforcement actions as "FCPA" matters in the past, including a large number of the "oil-for-food" enforcement actions.

The non-FCPA related allegations include Keyuan's "systematic" failure to disclose numerous "related party" transactions involving the company's three controlling shareholders, entities controlled by or affiliated with them, and entities controlled by Keyuan's management or their family members. However, the complaint also states that from 2008 until 2011, Keyuan maintained an off-books account into which it channeled approximately $1 million that was used, in part, to fund gifts to Chinese government officials, including officials from the local environmental, port, police, and fire departments. The gifts, which were typically given around the Chinese New Year, ranged from household goods (such as beddings and linens) to "red envelope" gifts, in which cash was directly given to the officials.

Keyuan initiated an internal investigation into these issues in March 2011, after the company's former auditor elevated certain irregularities to the company's Audit Committee. Keyuan was delisted from the NASDAQ in October 2011 after it amended its prior SEC filings to disclose the existence of potential violations of both Chinese and U.S. securities laws, including the FCPA. The company currently trades shares on the OTCQB marketplace.

As part of their joint settlement, Keyuan and Ms. Li agreed to an injunction against future violations of the relevant U.S. securities laws, including the FCPA's books and records and internal controls provisions (15 U.S.C. § 78m(b)(2)(A), § 78m(b)(2)(B), and § 78m(b)(5)), and consented to civil penalties of $1 million and $25,000, respectively. Ms. Li also agreed to a two-year suspension of her right to appear or practice as an accountant before the SEC. The proposed settlement is still subject to court approval.

Noteworthy Aspects:

- Source of Illicit Funds: According to the SEC complaint, Keyuan's off-books account, which was created and overseen by the company's former vice-president of accounting, was funded through a variety of means, including the sale of promissory notes, scrap metal and construction materials, as well as the use of fictitious or false reimbursement claims submitted by Keyuan employees. The diverse array of funding for Keyuan's off-books account underscores the need for companies to periodically test their internal controls over less visible assets such as scrap and support equipment.

- Risks Posed by Reverse Mergers: Keyuan, which is headquartered in Ningbo, China, was formed in April 2010, when its predecessor, Ningbo Keyuan Plastics Ltd., consummated a reverse merger with a Nevada shell corporation that traded on U.S. exchanges. In 2010 and 2011, reverse mergers were a popular "backdoor" method for firms from emerging markets to secure a listing on U.S. exchanges without having to go through the rigor of a formal IPO. In doing so, these firms took on substantial compliance obligations and opened themselves up to increased liability as "issuers," in some instances without a full appreciation of the risks involved. As a result, these types of foreign-based issuers, particularly those based in China, have drawn increased attention from the SEC. For instance, as noted in our FCPA Summer Review 2011, the SEC temporarily suspended trading in the China-based environmental protection equipment manufacturer RINO International Corp., which had recently disclosed that it was the subject of an SEC investigation for, among other things, potentially violating the FCPA. Though the reverse merger trend appears to have slowed significantly in 2012, the risks for companies formed as a result of such transactions remain the same.

Philips Resolves FCPA Allegations with the SEC

On April 5, 2013, Dutch medical equipment manufacturer Koninklijke Philips Electronics N.V. ("Philips") resolved with the SEC FCPA-related books and records and internal controls allegations involving its Polish subsidiary, Philips Polska sp. z o.o. ("Philips Poland"). As part of its settlement, Philips, a U.S. issuer under the FCPA, agreed to pay more than $4.5 million in disgorgement and pre-judgment interest.

According to the SEC Order, Philips Poland employees made improper payments to publicly-employed healthcare officials in Poland in connection with at least 30 transactions from 1999 through 2007, in an effort to secure public tenders with Polish healthcare facilities for the purchase of medical equipment. In exchange for these payments — which were generally between 3% to 8% of a contract's net value — officials who were in a position to do so would award contracts directly to Philips Poland; other officials would incorporate the specifications of Philips' equipment into the tender requirements, thereby greatly increasing the likelihood that Philips Poland would be awarded the relevant contracts. The disposition documents state that Philips Poland employees, who generally utilized a third party agent to assist in making the improper payments, would falsely characterize the expenses as legitimate in the company's books and records, and would sometimes create false documentation to support the false entries. Philips Poland's books and records were then consolidated into Philips' financial statements.

The SEC documents note that Philips first became aware of potential issues in Poland in August 2007, after Polish authorities raided three Philips Poland offices and arrested two employees. In response, Philips conducted an internal audit, but failed to discover the improper payments to healthcare officials. It nevertheless terminated and disciplined several Philips Poland employees, made substantial changes to the subsidiary's management, and significantly revised the company's internal controls. In December 2009, Polish authorities indicted three former Philips Poland employees as part of a broader crackdown on corruption in the local healthcare industry. This triggered an internal investigation by Philips, which uncovered the long-running bribery scheme perpetrated by the former Philips Poland employees. In early 2010, Philips voluntarily disclosed its ongoing internal investigation to the DOJ and SEC. Although the agency did not allege that Philips was aware of the conduct of its subsidiary, the SEC, based on the above findings, determined that Philips violated the books and records and internal controls provisions of the FCPA.

In settling with the SEC, Philips, while neither admitting nor denying the allegations, agreed to disgorge $3,120,597 in illicit profits stemming from the improper payments and $1,394,581 in prejudgment interest. The SEC also issued an injunction, ordering the company to cease-and-desist from future violations of the FCPA's books and records and internal controls provisions. The SEC Order explicitly states, however, that the Commission did not impose a civil penalty in recognition of Philips' extensive cooperation.

Noteworthy Aspects:

- Declination from the DOJ: In press coverage following its settlement with the SEC, Philips indicated that the DOJ informed the company in late 2011 that it was closing its investigation without pursuing enforcement. Although Philips did not elaborate on the reasoning behind the DOJ's decision, there may have been jurisdictional hurdles, as the SEC Order does not cite any evidence suggesting knowledge on the part of Philips the parent nor does it allege any U.S. nexus (i.e., no use of the means or instrumentality of U.S. interstate commerce).

- Continued Focus on Healthcare Industry: Philips is the ninth healthcare-related company to enter into an FCPA disposition in the last two years, and the DOJ and SEC are showing no signs of letting up. M&C is currently tracking nearly 20 ongoing investigations against companies in the medical industry.

- Poland in the Crosshairs: The Philips case is just the latest in a string of corporate FCPA dispositions involving corruption in Poland in recent years, including Tyco International Ltd., Eli Lilly and Co., Johnson & Johnson Co., Daimler AG, and Control Components, Inc.

- Compliance and Training Programs as "Internal Accounting Controls": In finding that Philips' internal controls were inadequate for the purposes of the FCPA, the SEC faulted Philips for failing "to implement an FCPA compliance and training program commensurate with the extent of its international operations."

- Philips' Significant Investigation and Remediation: In response to the bribery allegations, Philips retained three law firms and two auditing firms to conduct its internal investigation and design remedial measures to address weaknesses in the company's internal controls. The enhanced controls included: (i) strict due diligence procedures for the engagement of third parties; (ii) additional contractual safeguards (e.g., a centralized contract administration system; an enhanced contract review process; and a broad-based payment verification process); (iii) significant revisions to Philips' Global Business Principles; and (iv) an enhanced anti-corruption training program with a certification process and a variety of training applications. In response to the internal audit and investigation, Philips also terminated and disciplined several local employees and installed new management at Philips Poland.

Actions Against Individuals

Four Former BizJet Executives Charged with Foreign Bribery; Two Sentenced

On April 5, 2013, charges were unsealed against four former executives of a Tulsa, Oklahoma-based subsidiary of Lufthansa Technik AG ("Lufthansa"), BizJet International Sales and Support Inc. ("BizJet"), which provides aircraft maintenance, repair and overhaul (MRO) services. These charges are connected to a March 2012 BizJet and Lufthansa settlement with the DOJ of alleged FCPA violations. As reported in our FCPA Spring Review 2012, the DOJ alleged that three BizJet executives and a BizJet sales manager paid bribes to officials of the Mexican and Panamanian governments either directly or indirectly through a shell company owned and operated by the BizJet sales manager in order to obtain or retain contracts to perform MRO services. To resolve the FCPA charge against it, BizJet entered into a three year Deferred Prosecution Agreement ("DPA") with the DOJ and paid a criminal penalty of $11.8 million. Even though not alleged to have played any role in the illegal conduct, BizJet's parent, Lufthansa, also agreed to a three-year Non-Prosecution Agreement ("NPA") with the DOJ.

The four executives charged are Bernd Kowalewski, the former president and CEO; Jald Jensen, the former sales manager; Peter DuBois, the former vice president of sales and marketing; and Neal Uhl, the former vice president of finance. According to the DOJ's press release, two of the four, DuBois and Uhl, pleaded guilty on January 5, 2012, and were sentenced on April 5, 2013, the same day the charges against them were unsealed; the other two, Kowalewski and Jensen, were indicted on January 5, 2012, but are "believed to remain abroad." Both DuBois and Uhl were sentenced to 5 years probation, including eight months home detention, reduced from the higher sentencing guidelines range based on their cooperation with the government's investigation. The court also directed Dubois to forfeit $98,950, and imposed a $10,000 criminal fine on Uhl. The charging documents against the four largely recount the DOJ's earlier allegations against BizJet and make clear the role each defendant played, including that Jensen was the sales manager who allegedly owned and operated the shell company that "funneled bribes" to foreign officials.

In the DOJ's press release, Acting Assistant Attorney General Mythili Raman stressed that, "[t]hese charges reflect our continued commitment to holding individuals accountable for violations of the FCPA, including, as in this instance, after entering into a deferred prosecution agreement with their employer."

Former Siemens Board Member Uriel Sharef Settles with the SEC

On April 15, 2013, a former Managing Board member of Siemens Actiengesellschaft ("Siemens"), Uriel Sharef, agreed to pay a $275,000 civil penalty to settle FCPA charges with the SEC. Sharef had served on Siemens' Managing Board from 2000 to 2007.

As reported in our FCPA Winter Review 2012, the SEC and the DOJ initially charged Sharef in December 2011, along with a number of other former employees of Siemens and its Argentinean subsidiary, Siemens S.A., for his role in an alleged scheme to secure, implement and recoup the profits of a $1 billion contract for Siemens AG from the Argentinean government. DOJ and SEC officials have characterized the prosecution of Sharef and the other former Siemens executives as a landmark, in part because Sharef is the first board member of a Fortune Global 50 company to be charged with FCPA violations. Sharef, as former member of the Siemens Managing Board, is the most senior of all the Siemens defendants.

According to press reports, Sharef actually reached a settlement in principle with the SEC in October 2012, but this settlement agreement was not formalized until now. In addition to the monetary penalty, Sharef also consented to an injunction against future violations of the FCPA.

No developments have been reported to date on the status of the DOJ's pending criminal charges against Sharef.

Nearly 10 Years After Conviction, Former Chairman and CEO of American Banknote Sentenced

On January 3, 2013, Morris Weissman, the former Chairman and CEO of American Banknote Corp. ("ABN") and, later, American Bank Note Holographics, Inc. ("ABNH"), was ordered to pay $64,390,632 in restitution and sentenced to time served (1 day), along with five years of supervised release (including 18-months home confinement).

Weissman was convicted by a federal jury in 2003 on several counts, including conspiracy and falsifying books and records, in connection with accounting fraud related to the 1998 IPO of ABNH. This conviction followed the 2001 guilty plea of ABNH's former president, Joshua Cantor, for his role in the aforementioned accounting fraud and for conspiring to violate the FCPA by authorizing improper payments to secure a state contract in Saudi Arabia.

The lengthy delay in Weissman's sentencing was primarily due to his ongoing health problems. This delay, in turn, postponed Cantor's sentencing, as Cantor had cooperated with prosecutors in their case against Weissman. Cantor is now scheduled to be sentenced on May 14, 2013.

Last Three Control Components Executives Sentenced

In mid-March 2013, Judge Selna of the Central District of California sentenced the last three defendants involved in the Control Components Inc. ("CCI") bribery case, officially ending a series of investigations and prosecutions that began in 2007.

As reported in our FCPA Autumn Review 2009, on July 31, 2009, CCI, a California-based company that designed and manufactured industrial service control valves, pleaded guilty to two substantive FCPA anti-bribery violations, as well as conspiracy to violate the FCPA and the Travel Act. According to court documents, from 1998 through 2007, CCI made 236 corrupt payments to officers and employees of both state- and privately-owned customers in over thirty countries, including China, Korea, Malaysia, and the United Arab Emirates, totaling approximately $6.85 million. These corrupt payments allegedly returned approximately $46.5 million in profits. CCI voluntarily disclosed the violations in August 2007, and subsequently, pursuant to its plea agreement, the company paid $18.2 million in fines, implemented a comprehensive anti-bribery compliance program, retained an independent compliance monitor for three years, and served three years of probation.

As reported in our last issue, FCPA Winter Review 2013, during the fall of 2012, Judge Selna sentenced four former CCI senior executives: Stuart Carson (CEO), Hong Rose Carson (sales director), Paul Cosgrove (head of worldwide sales), and David Edmonds (vice president). Judge Selna sentenced three other former CCI executives in March: Flavio Ricotti, Mario Covino, and Richard Morlok.

Ricotti was CCI's Director of Power Business and VP for Sales. He had pleaded guilty to a single transaction involving Saudi Aramco, the state-owned oil company. Citing the 11 months he had already served, which was "twice the time the Court would impose if it adopted" the sentence recommended under the Sentencing Guidelines, the Judge sentenced him to time served and did not impose a fine.

Covino was CCI's Director of Worldwide Factory Sales, and according to the Sentencing Memorandum, was "instrumental in causing over $1,000,000 in ‘commission' payments used as subterfuges for bribes which returned over $5 million in profits for CCI." Citing his cooperation (he was the first person to plead), his "exceptional" acceptance of responsibility, and the relatively short sentences the more senior and less cooperative CCI executives had received, the Judge sentenced Covino to three years probation with three months home detention, and ordered him to pay a $7,500 fine.

Morlok was CCI's Director of Finance, and according to the Sentencing Memorandum, was "instrumental in approving over $600,000 in ‘commission' payments used as subterfuges for bribes which returned over $3.5 million in profits for CCI." The Judge cited Morlok's cooperation, his "exceptional" acceptance of responsibility, and the relatively short sentences of the more senior CCI executives, and sentenced Morlok to three years probation with 3 months home detention, as well as ordered the payment of a $5,000 fine.

Two Co-Conspirators in Viktor Kozeny's Bribery Scheme Sentenced

Hans Bodmer, Viktor Kozeny's Swiss Attorney, Sentenced

On March 6, 2013, Judge Scheindlin of the Southern District of New York sentenced Swiss lawyer Hans Bodmer to time served (165 days), and ordered him to forfeit $131,906 in criminal proceeds and pay a $500,000 fine. Bodmer was the former attorney for Viktor Kozeny, who allegedly orchestrated a failed bid to privatize the Azerbaijani state oil company, SOCAR. The bid reportedly involved a multimillion dollar scheme to bribe senior Azeri government officials. Bodmer helped Kozney to set up the complex corporate structures and Swiss bank accounts used for transferring bribe payments to Azeri officials.

After his extradition to the United States, Bodmer pleaded guilty in 2004 to one count of conspiracy to commit money laundering and cooperated with U.S. prosecutors. He provided damning testimony at the trial of Frederic Bourke, Jr., an investor in the scheme and the co-founder of handbag maker Dooney & Bourke, about Bourke's knowledge of the alleged scheme. He also assisted U.S. prosecutors in their failed attempt to extradite Kozeny. Bourke was convicted by the jury, and took his appeal to the Supreme Court, which denied Bourke's petition for certiorari on April 15, 2013, as discussed below. (For more information on Bourke's conviction and appeal, and the failed attempt to extradite Kozeny, see our FCPA Spring Review 2010, FCPA Winter Review 2012, among other past issues.)

According to Bloomberg, at the sentencing hearing, Bodmer said that "I made a bad decision 15 years ago . . . I have not run away. I have accepted the consequences." Scheindlin reportedly acknowledged that "it may be difficult to compel Bodmer, a Swiss citizen, to pay his fine" and "appealed to his 'conscience' to make the payment."

Clayton Lewis, Former Investment Manager at Omega Advisors, Inc., Sentenced

On April 4, 2013, Judge Buchwald of the Southern District of New York sentenced U.S. investor Clayton Lewis to time served (6 days) for his role in the failed bribery scheme in Azerbaijan. According to the disposition papers, Lewis, the former investment manager for Omega Advisors, Inc. and the sole principal at Pharos Capital Management LP, used these investment funds to purchase more than $150 million in vouchers related to SOCAR's planned privatization while knowing that bribes would be paid to numerous Azeri officials to ensure the investment's success.

Lewis, who was arrested in 2003, pleaded guilty to one count of conspiracy to violate the FCPA in 2004 and agreed to cooperate with U.S. enforcement authorities, including helping prosecutors build cases against Kozeny and former American International Group Inc. director David Pinkerton. For its part, Lewis's former firm, Omega Advisors, entered into an NPA with the DOJ in 2007 to resolve the allegations against it (see our FCPA Autumn Review 2007).

According to Bloomberg, Lewis accepted responsibility for his misconduct at his sentencing, stating that "I made a terrible decision 15 years ago . . . This case has been a dark cloud for 10 years now."

Another Kozeny associate, Thomas Farrell, is expected to be sentenced shortly. We will cover this development in our next review.

Ongoing Developments

Contrasting Motions to Dismiss Opinions in Magyar Telekom and Siemens Executives' Prosecution

A pair of contrasting rulings from the Southern District of New York, both issued in February 2013, provide judicial guidance on several legal issues important to FCPA enforcement. Both opinions responded to individual defendants' motions to dismiss the SEC's complaints against them for alleged FCPA violations. The two opinions both considered the application, in the civil FCPA enforcement context, of well-established law on personal jurisdiction under the due process clause to foreign defendants accused of violating the FCPA while outside of the United States. However, the courts reached different conclusions under the applicable facts. In addition, in one of the rulings, the court made decisions on three other FCPA-related legal issues, at least one of which the court noted appeared to be a matter of first impression: (1) whether the FCPA's statute of limitations is tolled if a defendant is outside of the United States, (2) the required intent associated with the FCPA's instrumentality of interstate commerce element, and (3) the pleading standard applicable to FCPA's foreign official element.

The first decision, issued on February 8, 2013, was in the SEC's civil prosecution of several former Magyar Telekom executives – Elek Straub, Andras Balogh, and Tamás Morvai (the "Magyar defendants") – all of whom are Hungarian nationals, for alleged bribery of Macedonian officials. For a more detailed factual background, please see our FCPA Winter Review 2012. The second decision, issued on February 19, 2013, was in the SEC's civil prosecution of a former Siemens AG executive – Herbert Steffen – a German national, for alleged bribery of Argentinian officials. For factual background on this case, please see our FCPA Winter Review 2008. We have recounted in detail the parties' arguments in our last issue, FCPA Winter Review 2013; hence, below, we focus on the courts' rulings.

Personal Jurisdiction

On personal jurisdiction, the issue in the two cases is the same: whether the relevant court has jurisdiction over FCPA defendants under the due process clause of the Constitution where they are foreign nationals and all their alleged misconduct took place wholly outside of the United States. The relevant background factual allegations in the two cases are similar: both Magyar and Siemens publically sold securities in the United States during the relevant period; both filed quarterly and annual disclosures with the SEC; both allegedly orchestrated schemes to bribe non-U.S. government officials; and both concealed alleged bribes behind devices such sham consulting contracts, which ultimately resulted in false certifications under the Sarbanes-Oxley rules and violations of the FCPA accounting provisions. The defendants in both cases are foreign nationals and all conduct forming the basis for the allegations against them occurred wholly outside of the United States (except for an allegation that Steffen, while in Argentina, discussed the bribery scheme in a phone call initiated from the United States).

Both opinions acknowledged that the relevant legal principles are well-established generally, by such law school perennials as International Shoe v. Washington, World-Wide Volkswagon v. Woodson, and their progeny. As the court in the case against Steffan noted, under the so-called effects doctrine, "a court may exercise personal jurisdiction over a foreign defendant who causes an effect in the forum by an act committed elsewhere." United States SEC v. Sharef, 2013 U.S. Dist. LEXIS 22392, at *13 (S.D.N.Y. Feb. 19, 2013) (internal citations and punctuations omitted). However, "foreseeability [of the effect] alone has never been . . . sufficient" for jurisdiction under the effects doctrine to establish the required minimum contacts; rather "defendants must have followed a course of conduct directed at . . . the jurisdiction of a given sovereign, so that the sovereign has the power to subject the defendant to judgment concerning that conduct." Id. at *13-14. Moreover, the "effects in the United States must occur as a direct and foreseeable result of the conduct outside the territory and defendant must know, or have good reason to know, that his conduct will have effects in the [forum] seeking to assert jurisdiction over him." Id. at *14.

Applying these established legal principles, the two district court judges reached divergent, though compatible, conclusions based on the relevant facts. For the Magyar defendants, Judge Sullivan decided that the court had jurisdiction over the defendants because, as senior executives of an issuer at the time of the alleged conduct, the defendants allegedly authorized the bribe payments, structured the sham contracts, and played significant roles in falsifying filings with the SEC by signing management representation and sub-representation letters to Magyar's auditors. Judge Sullivan stressed that the defendants' conduct satisfied the minimum contact standards because they "engaged in a cover-up through their statements to Magyar's auditors knowing that the company traded ADRs on an American exchange, and that perspective purchasers would likely be influenced by any false financial statements and filings." SEC v. Straub, 2013 U.S. Dist. LEXIS 22447, at *24-25 (S.D.N.Y. Feb. 8, 2013) (internal citations and punctuations omitted).

In contrast, for Steffen of Siemens, Judge Scheindlin decided that the court did not have jurisdiction over Steffen because he "neither authorized the bribe, nor directed the cover up, much less played any role in the falsified filings" made by Siemens under relevant SEC rules. Sharef, 2013 U.S. Dist. LEXIS 22392, at *20. Instead, the Judge noted that Steffen's role was limited to negotiating the bribes and urging company executives to pay bribes promised to or demanded by Argentine officials (actions which occurred outside of the United States). Although the SEC's allegations suggested that Steffen facilitated the payment of bribes to Argentine officials through sham contracts that hid the true nature of the payments, Judge Scheindlin specifically noted that the SEC had not alleged that Steffen "had any involvement in the falsification of SEC filings in furtherance of [Siemens'] cover ups," nor had the SEC alleged that "his position [at Siemens] would have made him aware of, let alone involved in, falsification of these filings." Id. at *17.

The two rulings provide important guidance on how courts are likely to apply the effects doctrine in deciding whether foreign nationals could be prosecuted in U.S. courts for alleged FCPA violations carried out wholly outside of the United States – a not- uncommon scenario. The rulings are consistent in their focus on whether the defendant's alleged actions directly caused the alleged bribe payments and the misstatements in SEC filings. In Steffan's case, the judge stated that the defendant's "actions [were] too attenuated from the resulting harm to establish minimum contacts." Id. at *17. In contrast, the relevant court noted that the Magyar executives directly authorized the illicit payments and each played a direct role in Magyar's SEC reporting process, during which they signed false certifications.

Statute of Limitations

In response to the Magyar defendants' motion to dismiss, Judge Sullivan also ruled on the question of whether the general federal statute of limitations under 28 U.S.C. 2462, which applies to FCPA civil penalty actions, is suspended as long as a defendant is not "physically present in the United States." Straub, 2013 U.S. Dist. LEXIS 22447, at *38. The relevant statutory language states that the statute of limitations of a civil penalty action is five years "if, within the same period, the offender . . . is found within the United States in order that proper service may be made thereon." The Court acknowledged that the relevant language, "if found within the United States" was added to the statute in 1839 and was understood then to toll the time limitation "while defendants were outside of the United States and, therefore, not amenable to service." Id. at *40. Relying on textual arguments and the fact that Congress has had several opportunities to amend the statute, but has not done so (even after the U.S. accession to the Hague Service Convention, which established a procedure for service in other signatory countries), the Court held that the statute of limitations for the SEC's FCPA civil penalty actions is effectively tolled indefinitely for defendants not physically present in the United States.

Instrumentality of Interstate Commerce

On what the court stated was an issue of first impression, Judge Sullivan also ruled on the question of whether, to violate the FCPA's anti-bribery provisions, a foreign defendant must knowingly or intentionally "make use of [an] instrumentality of interstate commerce corruptly in furtherance of" the alleged bribery scheme. 15 U.S.C. § 78dd-1(a). The defendants argued that the anti-bribery provision's use of the word "corruptly" modified not only the acts in furtherance of a prohibited payment, but also the "interstate commerce" element itself, which the SEC has typically alleged as a jurisdictional provision.

In this case, the SEC had alleged that the Magyar defendants, while outside of the United States, used email and the internet to communicate about their bribery scheme, and that some of those communications were "routed through and/or stored" on servers located in the United States. However, the SEC did not specifically allege that the defendants knew or intended for this to occur. Straub, 2013 U.S. Dist. LEXIS 22447, at *43-44. After finding that the statutory language itself was ambiguous, Judge Sullivan, largely relying on legislative history and comparisons with comparable language in other federal statutes (including mail and wire fraud and money laundering), sided with the SEC, holding that "defendants need not have formed the particularized mens rea with respect to the instrumentalities of commerce." Id. at *48.

Identity of Foreign Official Bribe Recipient

The last issue on which Judge Sullivan ruled was whether the SEC must specifically identify the intended foreign official bribe recipients in its complaint. The Southern District of Texas had sided with the SEC regarding this question in a December 2012 ruling in the case against former Noble Corporation ("Noble Drilling") executives for FCPA violations. The Texas court stated that it "seriously doubts that Congress intended to hold an individual liable under 15 U.S.C. § 78dd-1(a)(3)(A) only if he took great care to know exactly whom his agent would be bribing and what precise steps that official would be taking." SEC v. Jackson, 2012 U.S. Dist. LEXIS 174946, at *37 (S.D. Tex. Dec. 11, 2012). Judge Sullivan, citing and agreeing with the Noble Drilling opinion, held that the SEC did not need to specifically name the foreign official to satisfy its pleading burden under FRCP 8(a). The prosecution of former executives of Noble Drilling is discussed below, as well as in our FCPA Winter Review 2013.

SEC Claims Against Two Former Noble Drilling Executives Partially Time-Barred in the Wake of SEC v. Gabelli Decision

On March 25, 2013, in the wake of an important decision by the U.S. Supreme Court in SEC v. Gabelli, the SEC filed a second amended complaint in the civil action for bribery and accounting violations against one current and one former executive of Noble Drilling. The unanimous Gabelli Court held that when the SEC seeks a penalty or fine in connection with a civil enforcement action, the Commission must file the action within five years of the completion of the alleged fraud or wrongful conduct. (For a more in-depth discussion of Gabelli, please see this article by Miller & Chevalier associate Leila Babaeva).

Initially, the SEC had charged Mark A. Jackson, former CFO, CEO, and Chairman of the Board of Noble Drilling, and James Ruehlen, currently Vice President and General Manager of Noble Drilling's Mexico Division, with aiding and abetting Noble Drilling's violations of the FCPA accounting provisions, and with direct violations of the FCPA anti-bribery and accounting provisions, in connection with alleged payments to Nigerian customs officials between 2004 and 2007 (for more information, see our FCPA Winter Review 2011 and our FCPA Spring Review 2012).

Jackson and Ruehlen challenged the complaint, arguing in part that the SEC's charges were time-barred. As detailed in our FCPA Winter Review 2013, the district court agreed in part with Jackson and Ruehlen's statute of limitations arguments while also granting the SEC leave to amend to plead the effects of tolling agreements signed by Jackson and Ruehlen. The SEC did so, filing an amended complaint on January 25, 2013, in which the Commission argued in part that the complaint was not time-barred because it was filed within five years of Noble Drilling's disclosure of potential FCPA violations. Further, the SEC argued that Jackson and Ruehlen had each signed three tolling agreements, which tolled the running of the limitations period for 290 days.

Jackson and Ruehlen challenged the amended complaint, arguing that the SEC's claims for monetary penalties based on alleged conduct that occurred before May 10, 2006, were time-barred because the SEC had not established the applicability of the doctrines of fraudulent concealment or continuing violations. In the meantime, the U.S. Supreme Court issued the Gabelli ruling, which forced the SEC to scale back its claim for monetary penalties to conduct that occurred within five years of filing its complaint, as adjusted by the tolling agreements. As a result, the parties agreed that, in view of the three tolling agreements, the SEC's demand for civil penalties was timely only as to any violations that accrued on or after May 12, 2006.

Bourke's Petition to Supreme Court Denied

On April 15, 2013, the Supreme Court denied the petition for certiorari filed by Frederick Bourke to appeal his July 2009 jury conviction of conspiracy to violate the FCPA and the Travel Act, and of making false statements. For more information on the verdict, see our FCPA Autumn Review 2009.

Bourke had raised three questions for Supreme Court review, including the critical question raised in his other appeals regarding the proper jury instruction and related standards related to "conscious avoidance" or "willful blindness" under the FCPA's standard of "knowledge" regarding a third party's activities. His attorneys had argued that different circuits had taken different approaches to this issue in the wake of a 2011 Supreme Court ruling (in the case Global-Tech Appliances, Inc. v. SEB, S.A.) regarding "willful blindness" in a different context, and thus clarification of the appropriate standard by the Court in criminal cases was needed. Miller & Chevalier filed an amicus brief in the case on behalf of the National Association of Criminal Defense Lawyers.

This decision represents the end of Bourke's various avenues of appeal, clearing the way for the implementation of his November 2009 sentence of one year and one day in prison and a $1 million fine (Bourke had been free on bail pending the conclusion of his appeals). Previously, Bourke had appealed his conviction to the Second Circuit Court of Appeals, and had also petitioned the district court for a new trial. Both petitions were denied in December 2011 (see our FCPA Winter Review 2012).

Civil Litigation

Dismissal of Iraq's Civil Suit for Oil-for-Food Program Corruption

On February 6, 2013, the Southern District of New York dismissed a 2008 civil suit brought by the Government of Iraq against approximately 90 companies claiming damages – for improper payments made by the defendants in connection with the United Nations' Oil-for-Food Program – under the FCPA, the Racketeer Influenced and Corrupt Organizations Act (RICO), and common law tort theories. According to the plaintiff, the defendant companies, including ABB A.G., Daimler-Chrysler AG, Novo Nordisk and Siemens A.A., made improper payments to Saddam Hussein's regime in exchange for opportunities to do business in the country, and harmed the Iraqi people by depriving them of approximately $7 billion in humanitarian goods (Opinion at 12).

As reported in our FCPA Autumn Review 2008, the United Nations established the Oil-for-Food Program in 1996 to allow the Iraqi government to export oil, despite international sanctions, to fund purchases of humanitarian goods and services for the Iraqi people. Under the program, the United Nations was designated to collect the proceeds of oil sales into an escrow account and to distribute the proceeds only for verified humanitarian purposes. In its suit, the Government of Iraq claimed that the defendant companies circumvented the UN's escrow account by making payments directly to Hussein's regime. Specifically, the Iraqi government explained in its complaint that the Hussein regime required, and the defendant companies made, improper payments disguised as "transportation fees" on all shipments of humanitarian goods into Iraq (Opinion at 11).

Judge Stein dismissed the RICO claim because the alleged wrongful conduct occurred outside of the United States and lacked the domestic link required under RICO (Opinion at 35). The Judge dismissed the FCPA claims on the ground that, under long-standing judicial precedent, the FCPA does not create a private right of action (Opinion at 47). The remaining tort claims were dismissed on jurisdictional grounds. Judge Stein also noted that the Government of Iraq should not be able to recover from wrongdoing that it itself had engineered (Opinion at 27). According to the Judge, the current Government of Iraq bore legal responsibility for the Hussein regime's improper actions, even though that regime was no longer in power.

The dismissal of the Iraqi government's case represents a different result from the October 2012 Alcoa Inc.'s settlement of a RICO suit brought by Aluminum Bahrain BCS ("Alba"), a Bahraini government owned company. As reported in our FCPA Winter Review 2013, Alba's RICO suit alleged that Alcoa made $9.5 million in improper payments to Alba executives and other Bahraini officials in exchange for unreasonably favorable contract terms with Alba. Alcoa settled Alba's claims for $85 million without admitting any wrongdoing.

Though the Alcoa/Alba case was not tested in court in the same way as the Iraq case, one relevant distinction may be the fact that the Iraqi government had admitted that it had required the illicit payments from the defendant companies (Opinion at 18), while the Bahraini government had not made any such statement against interest. In fact, Alba's claims appeared to have characterized both Alcoa and the bribe recipients as having defrauded and harmed Alba and the Bahraini government (see e.g., Complaint at ¶¶ 29, 61, 66, 71-74, 82). At the time of the Alba settlement, the chief executive of Alba declared that the "landmark" settlement would encourage other foreign entities to bring similar claims in the future. The dismissal of the Iraqi government's case marks another interesting turn in this developing story of civil litigation brought by government entities allegedly harmed in part by the corruption of its own officials.

DC Circuit Decision on Access to AIG Monitor's Records

On February 1, 2013, the DC Circuit overturned a lower court's ruling that had granted a journalist access to the corporate monitor records related to American International Group's (AIG) 2004 settlement with the SEC for violation of federal securities laws. The 2004 settlement ended the SEC's investigation into AIG's alleged improper accounting practices, but it also provided a mechanism, in the form of a corporate monitor, to ensure AIG's compliance with the terms of the settlement. Although such monitors are paid by the company, they become the eyes and ears of the government pursuant to the terms of the settlement and are required to report any company activity in violation of the settlement's terms.

In a twist on the usual role of a monitor, AIG's corporate monitor also was tasked with reviewing four years of AIG's accounting practices prior to 2004 to develop an understanding of those practices that were at the heart of the SEC's complaint against AIG. The question posed to the courts by an intervening journalist, Sue Reisinger, of Corporate Counsel and the American Lawyer, was whether a monitor's records should be made public due to their connection to a court-approved settlement.

As reported in our FCPA Summer Review 2012, on April 16, 2012, DC District Court Judge Gladys Kessler issued a decision in which she concluded that Reisinger had a right to the records under the Freedom of Information Act (FOIA), through which Reisinger had requested the release of the records in 2011. Securities & Exchange Comm'n v. Am. Int'l Group, Inc., 854 F. Supp. 2d 75 (D.DC 2012). Even though Judge Kessler, at the urging of the parties, had previously modified the Consent Order approving the settlement to restrict access to the monitor's records, Reisinger argued that she had a right to the records under the First Amendment and the common law notion of the public's right to access judicial records.

Judge Kessler rejected Reisinger's First Amendment argument, noting that the First Amendment permits public access to court documents in criminal cases, whereas the AIG monitorship was imposed as part of a civil settlement. Id. at 79. But Judge Kessler agreed that the monitor reports were judicial records, principally because they could prove "useful to th[e] court's evaluation of compliance with the consent decree," and therefore were "relevant to the adjudicatory process." Id. at 81. Judge Kessler also noted that the documents "were necessary to ensure public accountability," in the absence of "a full adjudication on the merits in this case." Id. Finally, Judge Kessler concluded that the public's interest in the records "far outweigh[ed]" the parties' interest in keeping them confidential. Id. at 83.

The DC Circuit, reviewing the case de novo, flatly disagreed that the monitor's records were judicial records, because "the district court made no decisions about them or that otherwise relied on them." Securities & Exchange Comm'n v. Am. Int'l Group, Inc., No. 12-5141, 2013 U.S. App. LEXIS 2247 at *4 (DC Cir. Feb. 1, 2013). The DC Circuit noted that the monitor did not even exist prior to the court's approval of the settlement – while the monitor requirement was important to the court's approval of the settlement, the results of the monitor's investigation had no obvious impact on the lower court and therefore could not be considered judicial records. Id. at *4-5. Thus, the DC Circuit concluded that "[d]isclosure of the reports would do nothing to further judicial accountability." Id. at *5. For similar reasons, the court concluded that Reisinger had no First Amendment right to the records. Id. at *9. Finally, the court concluded that the monitor's reports were not public records because they had been created by an independent consultant and their submission to the government did not transform them into government documents. Id. at *8-9.

It is worth noting that the DC Circuit's opinion does not foreclose the possibility that corporate monitor reports could be released to the public. The SEC claimed that Judge Kessler's modification of the Consent Order permitted it to reject Reisinger's FOIA request, and the DC Circuit specifically noted that it was not taking a position on the correctness of the SEC's action. This leaves open the possibility that future FOIA requests in the absence of access-restricting court orders may succeed in shedding light on corporate monitor reports. However, as noted in our previous review of this case, there is little likelihood that future corporate monitor reports will be left vulnerable to public access, as the DOJ's best practice going forward appears to provide for the confidentiality of corporate monitor reports within the terms of the settlement itself.

International Developments

Oil-for-Food Trial Against Total SA Commences in French Court

On January 21, 2013, a corruption trial against Total S.A. ("Total"), its Chief Executive Officer, Christophe de Margerie ("de Margerie"), and 17 other defendants related to Total's involvement in the United Nations' Oil-for-Food Program in Iraq commenced in France's lower criminal court, the 11e Chambre du Tribunal Correctionnel de Paris. The trial ended on February 20, 2013, and in its most recent Form 20-F Annual Disclosure filed with the SEC on March 28, 2013, Total reported that it expects a judgment in the case on July 8, 2013.

As discussed above, the U.N. Oil for Food Program (1996-2003) was established to enable Iraq to sell its oil at a fixed price in order to pay for humanitarian aid in food, medicine, and services, with the intent of mitigating the effect of the blanket trade embargo imposed on Iraq after the first Gulf War. However, in 2000, the Iraqi government began requiring companies to pay an improper kickback of 10% of the relevant contract price (characterized as an "after sales services fee") in order to win a sale.

As reported in our FCPA Autumn Review 2011, the French investigation into the Iraq allegations began in 2002. Total was formally charged by the French Prosecutor's office in early 2010 and accused of paying kickbacks to the Hussein regime in violation of the U.N. embargo. Similarly, de Margerie was placed under formal investigation in October 2006 and added as a defendant on July 28, 2011. If found guilty, de Margerie and the other individual defendants could be jailed for up to 10 years and fined €150,000 ($199,770), and Total could be fined as much as €1.875 million ($2.44 million). The Company has said repeatedly in its SEC disclosures that it believes its activities with regard to the Oil-for-Food Program were in compliance with U.N. regulations.

In the United States, the DOJ and SEC have been investigating Total since 2003 for alleged kickbacks to Iranian officials. As we have reported previously, the investigation has focused on payments in exchange for rights to gas fields, and whether the payments benefitted Iranian officials. Total has been in settlement negotiations with both the DOJ and SEC in relation to these allegations since 2010, and its recent Form 20-F disclosed that, although discussions are not yet final, the company has set aside $398 million in estimation of a potential agreement.

Canada Prosecutes Griffiths Energy International for Chadian Bribes

On January 25, 2013, a Canadian court approved a $10.35 million penalty against Griffiths Energy International, Inc. (GEI), a privately held corporation based in Calgary that engages in oil and gas exploration and production. GEI pled guilty to violating the Corruption of Foreign Public Officials Act (CFPOA), the FCPA's Canadian cousin, in connection with GEI's conduct in Chad, Africa. The company admitted that between August 2009 and February 2011, it developed a relationship with Chad's ambassador to Canada in order to secure his assistance in obtaining contracts that would provide GEI with the exclusive right to explore and develop oil and gas reserves and resources in southern Chad. GEI also admitted that in the course of its relationship with the ambassador, the company violated paragraph 3(1)(b) of the CFPOA by providing direct or indirect benefits to a foreign public official – in the form of payments to the ambassador's wife's consulting company and other parties – in an attempt to induce the ambassador to use his position to influence decisions of Chad regarding the desired contracts.

According to the released statement of facts, a year prior to GEI's incorporation in August 2009, its three founding shareholders began working to establish a relationship with the Chadian ambassador, who resides in Washington, DC, and is also the ambassador to the United States, Brazil, Argentina, and Cuba. The shareholders engaged outside counsel to draft a consulting agreement under which GEI agreed to pay $2 million to a Maryland-based entity wholly-owned by the ambassador if GEI was awarded certain oil and gas reserve blocks prior to 2010. The agreement was finalized on August 30, 2009, after GEI's incorporation, but was terminated shortly thereafter (and the $2 million never paid) when GEI's outside counsel advised against the arrangement due to the ambassador's status as a government official.

However, soon after the termination of the first consulting agreement, GEI entered into a second, nearly identical agreement with another consulting company, Chad Oil Consulting LLC, which was wholly-owned by the ambassador's wife and incorporated in Nevada on September 10, 2009 (i.e., five days before the second consulting agreement was signed). The statement of facts noted that GEI also permitted the ambassador's wife and the wife of the Deputy Chief of the Chadian Embassy in Washington, DC to purchase "founders shares" of GEI during the relevant time. A third person was also permitted to purchase "founders shares" at the ambassador's wife's behest; those shares were eventually transferred to the Nevada consulting company and then to the ambassador's wife herself.

The statement of facts noted that the ambassador's wife then set up a meeting in Washington, DC, between GEI executives and high-level officials from the Government of Chad to sign a memorandum of understanding (MOU) in relation to certain oil and gas reserve blocks. The MOU was signed in October 2009, and GEI then spent months acquiring and analyzing data on the reserve blocks. Further progress was impeded by the appointment of a new Minister of Petroleum and Energy and a change in Chad's oil concessions regime that limited the influence of Chad's ambassador to Canada.

Nevertheless, GEI succeeded in obtaining a new MOU with the Government of Chad on December 23, 2010, in exchange for a $40 million signature bonus, a common and legal form of up-front payment, to Chad's Ministry of Petroleum and Energy. By this time, GEI's consulting agreement with the ambassador's wife's company had expired, so in January 2011, GEI engaged new outside counsel to draft a new agreement with the ambassador's wife's consulting company. This new agreement was substantially the same as the prior agreement and included the $2 million fee, which had not been paid under the expired agreement.

On January 19, 2011, GEI's subsidiary in Chad signed a contract with the Ministry of Petroleum and Energy and on February 8, 2011, the ambassador's wife's consulting company received the $2 million payment from GEI through its outside counsel. The funds were deposited into the consulting company's bank account at the bank's Washington, DC branch.

In the summer of 2011, GEI hired a new management team and six new independent Directors were appointed to the GEI Board of Directors. In anticipation of the company's IPO, GEI engaged in a due diligence process that uncovered the consulting agreements and led to an independent internal investigation of the company's activities. The company disclosed the subject of its internal investigation to Canadian and U.S. authorities in November 2011 and withdrew its planned IPO.

The ensuing probe by Canadian authorities resulted in GEI's guilty plea (the U.S. DOJ has yet to disclose the existence of any U.S. investigation). GEI agreed to pay a $9 million penalty plus a 15% "victim fine surcharge" that increased the total to $10.35 million. Canadian authorities chose not to contest GEI's position that the bribes had no effect on the outcome of the contract, and therefore did not seek disgorgement penalties. The company also agreed to cooperate with and assist Canadian authorities in other legal proceedings relevant to this matter. No other conditions were imposed on GEI, thanks in large part to the extraordinary amount of cooperation shown by the company, including the fact that it brought the issue to the attention of Canadian authorities, disclosed the detailed findings of its internal investigation, and shared attorney-client privileged materials with authorities. The disposition order also acknowledged the company's active role in the investigation, the fact that it had already implemented robust anti-corruption compliance programs and internal controls, and the fact that the company had spent $5 million on its internal investigation and foregone nearly $2 million by withdrawing from its anticipated IPO.

Noteworthy Aspects:

- Follow-On Investigations: Canadian prosecutors are still trying to recoup the proceeds of the crime, particularly from the ambassador's wife. This is because GEI has regrouped and is preparing to go through with its IPO, and under certain valuations of the company, unless her shares are abrogated, the Chadian Ambassador's wife could stand to gain over $30 million through her possession of GEI founders shares, which she was allowed to purchase in 2009 as part of her engagement with GEI. According to media reports, at the end of February, Canadian prosecutors executed a search warrant on GEI's former outside counsel's offices, where authorities seized the founders shares purchased by the ambassador's wife in 2009.

- Rare CFPOA Conviction: GEI's conviction is only the second major conviction under the CFPOA, which has been in force since 1999. As reported in our FCPA Summer Review 2011, two years ago, Niko Resources Inc., a publicly traded company, agreed to pay $9.5 million in Canada's first multi-million dollar anti-corruption settlement.

- Self-Disclosure Had Significant Benefits: While GEI voluntarily self- disclosed its conduct to Canadian authorities, Niko did not. In addition, GEI shared with the Canadian authorities all the details of its internal investigation, including legally privileged documents between GEI and its former counsel. While both companies evidenced cooperation after investigations began and undertook remedial measures, in press coverage of the case, the Canadian authorities and the court reportedly noted the importance of self-disclosure and GEI's decision to share its investigation results in determining a reasonable penalty. Supporting these official statements were the facts that the bribery payments in the GEI matter ($2 million) were ten times those made in the Niko matter, yet the financial penalties against GEI were only 8 percent higher. Moreover, the Niko sentencing Order included compliance enhancement requirements traditionally found in FCPA settlement agreements, while the GEI Order did not.

Canada's Proposed New Anti-Corruption Law Updates

On February 5, 2013, Canada's Foreign Affairs Minister John Baird announced the introduction of a Senate bill to strengthen the CFPOA. As explained above in our coverage of the Canadian prosecution against GEI, the CFPOA criminalizes the bribing of non-Canadian public officials for the purpose of obtaining or retaining business by persons or companies possessing a "real and substantial link" to Canada. In contrast to the FCPA, the CFPOA does not include books and records or internal controls offenses. The maximum penalty for individuals is five years imprisonment; the statute does not define a upper limit for corporate penalties.

In announcing the Senate bill, Minister Baird proclaimed that Canada is "redoubling [its] fight against bribery and corruption," and aims, through the reforms, to "further deter and prevent Canadian companies from bribing foreign public officials." The proposed amendment to the CFPOA vests exclusive prosecutorial authority in the Royal Canadian Mounted Police and strengthens the existing law in several respects:

- New books and records offense. The amendment adds a new books and records offense.

- Longer prison sentences. Individuals convicted of bribery or books and records offenses would face a maximum imprisonment of fourteen years.

- Nationality jurisdiction. The amendment will expand the Government of Canada's jurisdiction to all persons or companies that have Canadian nationality, regardless of where the alleged bribery occurred.

- Elimination of facilitation payments. The CFPOA currently does not criminalize "a payment made to expedite or secure the performance by a foreign public official of any act of a routine nature" and provides several examples of what might constitute such routine acts (e.g., issuing a permit or license; processing a visa or work permit; or providing power, water, or telecommunications services). The amendment will eliminate this exception for facilitation payments.

- Application to not-for-profit entities. The amendment removes the words "for profit" from the definition of business, thus ensuring that the CFPOA applies to for-profit and not-for-profit entities alike.

OECD Final Follow-Up to Phase III Report on the United States

On January 28, 2013, the Organization for Economic Cooperation and Development (OECD) released its final Phase III report on U.S. implementation of the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions ("Convention"). The Convention, signed in 1997, commits signatories to establishing and enforcing laws that criminalize and deter bribery of public officials. As reported in our Winter 2011 FCPA Review, the OECD last evaluated the United States in its Phase III Report issued in October 2010, in which it made several recommendations to improve the United States' implementation of the Convention, including the need to consolidate publicly available information on the FCPA for the private sector, and to ensure that the applicable statute of limitations is adequate for enforcement agencies to complete investigations and prosecute bribery offenses.

The current Final Follow-Up to Phase III Report and Recommendations ("Report") includes an overview of the U.S. efforts to address the Phase III recommendations, and the assessment of that effort by the OECD's Working Group on Bribery ("Working Group"). In the Report, the Working Group praised the United States for continuing to "robustly enforce" the FCPA, citing data on enforcement actions and penalties imposed since the Working Group's last review, and concluded that the United States had completed most of the Working Group's recommendations.

Regarding the statute of limitations in FCPA cases, the Working Group explained that it considered its recommendation to be fully met because of the "large volume of cases completed by U.S. prosecutors." The Working Group nevertheless encouraged the United States to consider increasing the statute's length because U.S. prosecutors had declined to bring criminal charges in some cases in part due to a lack of admissible evidence obtained prior to the statute's running. In the United States' submission, which is incorporated in the Report, the United States pointed out that in most FCPA cases the effective statute of limitations in practice is more than five years, and that the running of the statute does not prevent the SEC from obtaining disgorgement and pre-judgment interest of illicit gains from bribery (we note that this second point was not before the Supreme Court in Gabelli, discussed above).

The Working Group noted that the United States had undertaken a "major initiative" to consolidate and summarize information in the Resource Guide to the FCPA, though the Guide had not been issued at the time of the Working Group's assessment. The Working Group also praised the United States for making significant efforts to raise awareness among small and medium enterprises (SMEs). In the Report, the Working Group required the United States to report back in March 2013 on the Guide's publication, at which time the Working Group will assess whether the United States has effectively implemented remaining recommendations.

Latvia Prosecuting Officials in Daimler Bribery Case

In February 2013, the Latvian Prosecutor General's Office announced charges against a former Riga city councilman for accepting "repeated bribe[s] . . . in large amounts," including in connection with the purchase of Mercedes-Benz buses from EvoBus GmbH, a subsidiary of Daimler AG, the German automobile manufacturer.

As reported in our FCPA Spring Review 2010, Daimler settled FCPA allegations against it with the DOJ and SEC in April 2010, and agreed to pay $185 million in fines and disgorgement of profits. SEC alleged in its complaint that Daimler, in association with a tender to sell 117 buses to "a city in Latvia," had paid "under the table money" to city council members and members of a political party who controlled the city council, "including the son of a high-ranking government official whose father had influence over the tender." (SEC Complaint at ¶¶ 100-101.) A local news report suggests that "information received from investigators in the United States" prompted investigation of the Riga city councilman by Latvia's Corruption Prevention Bureau (the "KNAB"). The report noted that, to date, KNAB has recommended prosecution against seven individuals in connection with the "Daimler bribery case," and the Riga city councilman was the first charged by the Prosecutor General's office, who had explained that the case was "voluminous."

According the Wall Street Journal, a Daimler spokesperson said that neither Daimler nor EvoBus have been contacted as part of the investigation, but believe that the "probe was connected to Daimler's April 2010 settlement."

This case is a part of an increasingly common trend in the anti-corruption arena, in which local authorities initiate prosecutions of alleged corruption after an FCPA prosecution by U.S. agencies has unearthed illicit payments to local government officials. Indeed, Russia reportedly launched its own Daimler-related investigation in 2010. Many past follow-on prosecutions have focused solely on the bribe payor (for example, in the cases of Greece's prosecutions of Siemens (see FCPA Autumn Review 2012) and Nigeria's settlement with Halliburton/KBR (see FCPA Winter Review 2011). In contrast, Latvia's prosecution to date only addresses the alleged bribe recipients, while Greece's prosecution against DePuy, discussed below, is directed against both alleged payors and recipients. Even cases that focus solely on the recipients, however, can raise potential legal and reputational risks for alleged payors.

Finmeccanica Head Arrested on Charges of Foreign Bribery

On February 12, 2013, Italian police arrested Giuseppe Orsi, then Chief Executive and Chairman of defense group Finmeccanica SpA, in Milan for his alleged role in paying bribes to intermediaries, for purposes of securing a contract with the Indian Air Force in February 2010, while he was in charge of the company's U.K. subsidiary AgustaWestland. The contract for the sale of 12 military helicopters, valued at €560 million (approx. $750 million), has been suspended. In addition to arresting Orsi, Italian prosecutors have also placed three other individuals, including AgustaWestland's then Chief Executive Bruno Spagnolini, under house arrest. The Italian government is the largest individual shareholder of Finmeccania, holding more than 30 percent of the company. Finmeccanica is also the world's eighth largest defense and aerospace contractor and Italy's second-largest corporate employer.

According to media reports, the 64-paged arrest warrant alleges that Orsi and others paid middlemen, including Indian nationals and a dual U.S. and Italian national, Guido Ralph Haschke, at least €100,000 ($1.3 million) to bribe former Indian Air Force Chief S.P. Tyagi into changing the terms of the tender to allow AgustaWestland to win the contract.

Soon after Orsi's arrest in Italy, the Indian government ordered the Central Bureau of Investigation (CBI) (India's federal investigative agency) to launch an investigation into the deal between AgustaWestland and the Indian Air Force. On March 13, the CBI registered a case against Tyagi, Finmeccanica, Orsi, AugustaWestland, Spagnolini, as well as two Indian companies, a Mauritian company, a Tunisian company, three middlemen, and other individuals. India's defense minister announced that, following the conclusion of CBI's investigation, the government will move to take the "strongest action" available, which could include canceling the contract in accordance with its "integrity clause" (which prohibits bribery and use of undue influence), barring the company from future defense contracts, and criminal action. Being blacklisted from future Indian defense contracts poses a significant business risk for any large defense company, as India is currently the world's largest weapons importer. Additionally, since a 1980s scandal involving allegations of kickbacks paid to Indian officials by Swedish gun manufacturer Bofors, Indian law prohibits the use of middlemen in defense deals.

Media reports indicate that U.K. Prime Minister David Cameron has pledged to provide assistance to Indian investigators and will respond to any requests for information. The Italian and Indian investigations are ongoing.

Greece Brings Follow-on Prosecution Against Johnson & Johnson Subsidiary DePuy

On February 12, 2013, Greek prosecutors announced criminal charges against five employees of DePuy, a Johnson & Johnson subsidiary specializing in making orthopedic devices, for allegedly paying €16 million ($21.5 million) in bribes to doctors at Greek government owned hospitals. According to the Associated Press, the alleged bribes were paid between 1998 and 2006, in order to promote the company's products. In addition to charging the DePuy executives, the bribe payors, Greece has also "formally accused" eight Greek state hospital doctors – mostly orthopedic specialists – of "taking bribes and money laundering in the same case."

The DePuy prosecution in Greece is almost certainly an off-shoot of the earlier Johnson & Johnson prosecution in the United States. As reported in our FCPA Spring Review 2011, in April 2011, Johnson & Johnson resolved FCPA charges with the DOJ and SEC for payments allegedly made by the company's subsidiaries to doctors at publicly-owned hospitals in Greece, Poland and Romania, as well as kickbacks the company allegedly paid to the former government of Iraq. The illicit conduct in Greece alleged by the U.S. prosecutors occurred between 1998 and 2006. As a part of its settlement, J&J entered into a three-year DPA with the DOJ, and agreed to pay, in total, more than $70 million in monetary assessments to the two U.S. enforcement agencies. In a parallel action, the United Kingdom's Serious Fraud Office obtained a Civil Recovery Order against DePuy International Ltd. ("DIL"), a Johnson & Johnson subsidiary (it's unclear whether DIL is the same subsidiary whose executives were charged by Greece in February), for the same underlying conduct, and ordered DIL to pay £4.8 million ($7.85 million).

Similar to Latvia's prosecution of local officials discussed above, this is another example of a local prosecution arising out of information unearthed by an earlier FCPA prosecution in the United States – a trend that has further complicated the defense of international corruption prosecutions.

Recent Miller & Chevalier Developments

Getting the Deal Through: Anti-Corruption 2013

Miller & Chevalier recently authored the "Global Overview" and "United States" chapters for the 2013 volume of Getting the Deal Through: Anti-Corruption Regulation, which provides a detailed discussion of the anti-corruption legal framework and enforcement developments in 50 countries around the world. Homer Moyer served as contributing editor for the annual volume, and co-authored the chapter addressing U.S. anti-corruption laws and enforcement with James Tillen, Marc Alain Bohn and Erik Nielsen.

Editors: John Davis, James Tillen, Marc Alain Bohn,* and Ben Gao*

Contributors: Leila Babaeva,* Kuang Chiang,* Jonathan Kossak,* Amelia Hairston-Porter,* Nathan Lankford, and Annie Wartanian Reisinger*

*Former Miller & Chevalier attorney

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.