FCPA Spring Review 2016

International Alert

Introduction

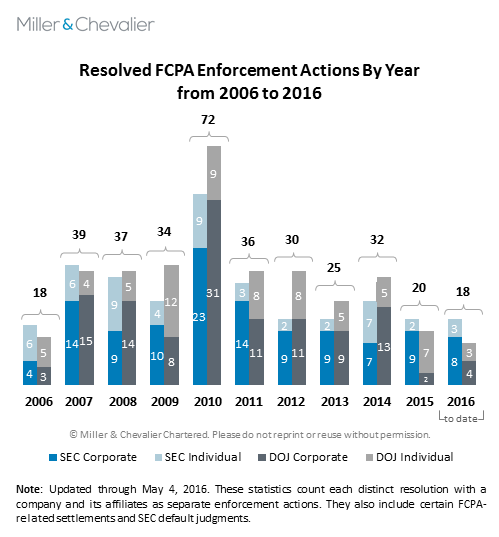

After a relative slowdown in 2015, the pace of enforcement activity under the U.S. Foreign Corrupt Practices Act ("FCPA") has increased sharply in 2016, resulting in the highest number of first-quarter enforcement actions on record -- 16 in the first quarter and 18 year-to-date. This pick-up in enforcement dispositions announced by both the U.S. Securities and Exchange Commission ("SEC" or "Commission") and the U.S. Department of Justice ("DOJ" or "Department") appears to be a natural rebound following the drop in resolved enforcement actions during the second half of 2015.

As we observed in our FCPA Winter Review 2016, the reduced pace of resolved enforcement actions, particularly by the DOJ, was not necessarily indicative of any emerging trend, but was likely the product of a confluence of factors, such as the complexity of certain FCPA cases currently under investigation, shifts in the DOJ's and SEC's priorities and turnover at the agencies. The FCPA dispositions entered into by the DOJ and the SEC this quarter reflect many of these factors, as discussed below. Indeed, this quarter may represent a microcosm of enforcement trends we are likely to see in the near term on the FCPA front: a DOJ focus on high-value corporate settlements; a significant number of "lower impact" corporate enforcement dispositions by the SEC that the DOJ frequently chooses not to pursue; a rise in criminal and civil enforcement actions against individuals; renewed scrutiny of the healthcare sector; a continued emphasis on China, along with a focus on other high-risk regions such as Latin America and the former Soviet Union; and an acceleration of efforts to cooperate with other enforcement agencies, foreign and domestic.

A recent policy development that could contribute to the upward trend in enforcement is the FCPA enforcement pilot program, announced by the DOJ on April 5, 2016, and discussed further in the following section.

Enforcement Trends

The heightened enforcement activity we saw during the first quarter of 2016 brings to mind an observation Andrew Weissmann, Chief of the DOJ Criminal Division's Fraud Section, made in January, when he suggested that waiting just three more months might result in a "very different picture" in terms of FCPA enforcement. The chart below illustrates this "different picture," which involves 18 resolved FCPA enforcement actions to date this year, including 16 through March 31 -- the largest number ever brought during a year's first quarter. In terms of corporate enforcement, the DOJ's four corporate dispositions in this year to date already exceed the two it brought during all of 2015, while the SEC's eight dispositions thus far fall just one short of its total for 2f015.

The DOJ's corporate dispositions this quarter include a deferred prosecution agreement ("DPA") with Dutch telecommunications company VimpelCom Ltd. ("VimpelCom") and a guilty plea by its wholly owned Uzbek subsidiary Unitel LLC, both stemming from misconduct in Uzbekistan. VimpelCom agreed to a combined resolution of more than $795 million, including its settlements of related proceedings with the SEC and the Dutch Public Prosecution Service ("DPPS"). The VimpelCom disposition came two days after the DOJ entered into a non-prosecution agreement ("NPA") with two Chinese subsidiaries of Boston-based software company PTC, Inc. ("PTC"), a settlement involving the provision of excessive gifts, travel and entertainment to Chinese officials. Less than two weeks later, medical equipment manufacturer Olympus Latin America agreed to pay $22.8 million as part of a DPA to settle DOJ charges related to the provision of improper gifts, travel and medical equipment to healthcare professionals ("HCPs") in Central and South America.

In addition to its settlement with VimpelCom, the SEC's enforcement activity in the first quarter of 2016 includes settlements with three technology companies – SAP SE ("SAP"), Qualcomm Inc. ("Qualcomm") and PTC (the latter in parallel with its subsidiaries' DOJ settlement) – and with three pharmaceutical companies – SciClone Pharmaceuticals, Inc. ("SciClone"), Nordion (Canada) Inc. ("Nordion") and Novartis AG ("Novartis"). The SEC's eighth corporate action of the year, and its first of the second quarter, is an April 7, 2016, settlement with Las Vegas Sands Corp. ("Sands") related to questionable consultant payments in China and Macau. We will cover the Sands resolution in detail in our forthcoming FCPA Summer Review 2016.

Of note, all but one of the SEC's corporate enforcement actions thus far this year have been settled via administrative proceeding, with VimpelCom being the only settlement involving a court-filed complaint. The SEC's strong preference for pursuing cases in its own administrative forum rather than in federal court continues a shift that began in 2014 (see our Summer and Autumn 2015 FCPA Reviews for further analysis of this trend and discussion of the SEC's recently issued internal guidance regarding forum selection and proposed Rules of Practice changes). To date, neither the forum selection guidance nor the proposed rule changes have had any apparent effect on the SEC's forum-selection practices: since January 2014, 19 of the SEC's 24 corporate FCPA settlements were handled via administrative proceedings, including 12 administrative proceedings and two court-filed settlements since the SEC issued its internal forum-selection guidance on May 8, 2015.

In terms of individual enforcement, each agency successfully prosecuted two individuals during the first quarter. On the DOJ side, Abraham Jose Shiera Bastidas ("Shiera"), an owner of several U.S. energy companies, and Moises Abraham Millan Escobar ("Millan"), a former employee of Shiera's, each pled guilty to their roles in bribery-related activities to secure contracts with Petróleos de Venezuela S.A. ("PDVSA"), Venezuela's state-owned oil and natural gas company. In addition, on April 20, 2016, Dmitrij Harder, former owner and President of the Chestnut Consulting Group, pled guilty to two counts of violating the FCPA following his January 2015 indictment (discussed here and here). (Note that we will cover Harder's plea in detail in our forthcoming FCPA Summer Review 2016.)

On the SEC side, the Commission entered into an administrative settlement with Ignacio Cueto Plaza, the CEO of LAN Airlines, and Mikhail Gourevitch, a former Nordion employee, which dealt with improperly recorded payments to an Argentine official and third-party consulting contracts allegedly used to channel bribes, respectively. In addition, as part of its settlement with PTC on February 16, 2016, the SEC disclosed a previously unannounced DPA from November 2015 with Yu Kai Yuan, a former employee of PTC's Chinese subsidiaries. (For statistical purposes, we have counted Yuan as a 2016 resolution).

Although the DOJ has been vocal about its goal of increasing individual prosecutions under the FCPA, none of the DOJ's corporate resolutions this year has, to date, resulted in the announced criminal prosecution of any individuals. The individual prosecutions that were brought do not appear to be the product of the Yates Memo, which the DOJ issued in September 2015 to establish a policy requiring that corporations under investigation that wished to receive cooperation credit provide detailed evidence about all employees involved in the alleged wrongdoing (discussed previously here, here and here). Realistically, it is probably too early to expect any enforcement actions against individuals specifically triggered by the Yates Memo, since building individual prosecutions can be time-consuming even where an individual defendant chooses to plead guilty, let alone when the individual chooses to contest the charges. For example, the DOJ indicted Harder more than a year and a half before issuing the Yates Memo, and almost certainly initiated the prosecutions of Shiera and Millan prior to then, as well. Going forward, however, it is still unclear whether the Yates Memo will incentivize enough corporations to share relevant evidence about wrongdoing by their executives to produce a sustained uptick in individual enforcement.

For its part, the SEC appears to have stepped up its focus on individual accountability for corporate wrongdoing: of the SEC's seven corporate FCPA enforcement actions this quarter, two -- PTC and Nordion -- were accompanied by enforcement actions against employees, and another one -- SAP -- follows on the heels of a settlement with and guilty plea by the SAP employee at the center of the alleged misconduct (discussed in our FCPA Autumn Review 2015). The link between individual and corporate accountability is also apparent in the SEC's settlement with Cueto, the LAN Airlines CEO, although the role of that company in the SEC's enforcement action against Cueto is not clear from public documents.

The Yates Memo plays a prominent role in another recent DOJ initiative -- the recently launched one-year FCPA pilot program, which provides certain incentives to companies that self-report FCPA violations and cooperate with the DOJ. As noted in Miller & Chevalier's April 2016 Executives at Risk Newsletter, one purpose of the pilot program, which underscores that compliance with the Yates Memo directives is required to receive full cooperation credit, is to increase the government's ability to "prosecute individual wrongdoers whose conduct might otherwise have gone undiscovered or been impossible to prove."

Announced on April 5, 2016, the pilot program is noteworthy because of the effect it might have on the enforcement landscape and what it means for companies to "cooperate" going forward, particularly given the DOJ's sustained effort to promote the benefits available under the program for companies that choose to participate by self-disclosing potential misconduct. In brief, the four main requirements of the pilot program are: voluntary self-disclosure of FCPA violations; full cooperation with the DOJ; appropriate remediation measures; and disgorgement of all profits resulting from the FCPA violation. If a company takes all these steps, the Fraud Section "may accord up to a 50 percent reduction off the bottom end of the Sentencing Guidelines fine range" and "generally should not require appointment of a monitor." In addition, where a company fulfills those same conditions, "the Fraud Section's FCPA Unit will consider a declination of prosecution."

Although most aspects of the pilot program have represented informal DOJ policy for some time, the program itself, including the expectations it could establish, will likely influence the outcome of any investigations in the DOJ's enforcement pipeline this coming year, regardless of whether a company is formally participating. In our upcoming FCPA Reviews, we will track the DOJ's implementation of the pilot program and analyze its apparent impact.

Focus on Healthcare Industry

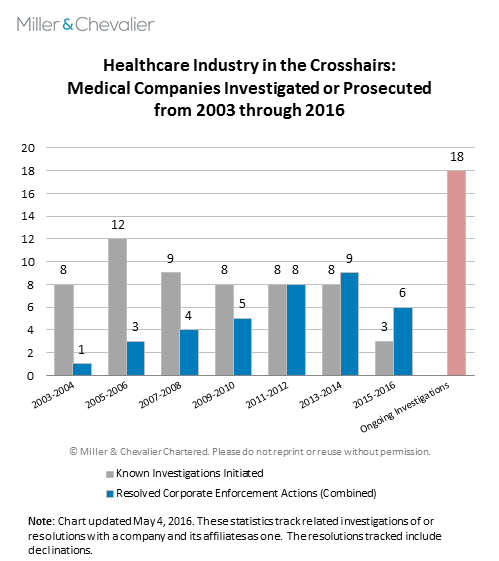

As noted above, three of the SEC's enforcement actions this quarter are against healthcare companies -- SciClone, Nordion and Novartis -- and they come as the SEC's FCPA Unit Chief, Kara Brockmeyer, has suggested that the Commission will be turning its attention back to the pharmaceutical industry "after a break for a period of years." It is worth noting, however, that although the number of publicly reported FCPA investigations into companies in the healthcare industry has fallen in recent years, enforcement has remained relatively steady. For instance, in the last 10 months, the SEC and DOJ have entered into settlements with three additional healthcare-related companies: Mead Johnson Nutrition Company Co. ("Mead Johnson") in July 2015, Bristol-Myers Squibb ("Bristol-Myers") in October 2015 and Olympus Latin America in March 2016. Moreover, these dispositions reflect only a portion of the known investigations the SEC and DOJ are currently conducting in the healthcare space, with at least 18 open investigations we are tracking that do not appear to have been resolved or declined.

Many of the healthcare-related enforcement actions detailed in the chart above are related to the highly publicized investigations of medical device and pharmaceutical companies initiated by the DOJ and SEC in 2007 and 2010, respectively. (See, e.g., our FCPA Autumn Review 2010.) In fact, the misconduct alleged in each of the enforcement actions settled in the last six months dates back to the period of time when these industry-wide investigations were in full swing: according to the corresponding administrative orders, the alleged improper activities took place between 2004-2011 (Nordion), 2007-2012 (SciClone), 2008-2013 (Mead Johnson), 2009-2013 (Novartis), 2009-2014 (Bristol Myers) and 2006-2011 (Olympus Latin America). These statistics suggest that not only is the enforcement pendulum swinging back toward the healthcare industry, but that at least the SEC never fully turned away from it.

Investigation Duration Trends

These recently concluded healthcare investigations illustrate an interesting data point -- six investigations that began years apart were all resolved within a few months of each other. This section explores the broader theme of what factors may influence the length of an investigation, as well as several relevant trends.

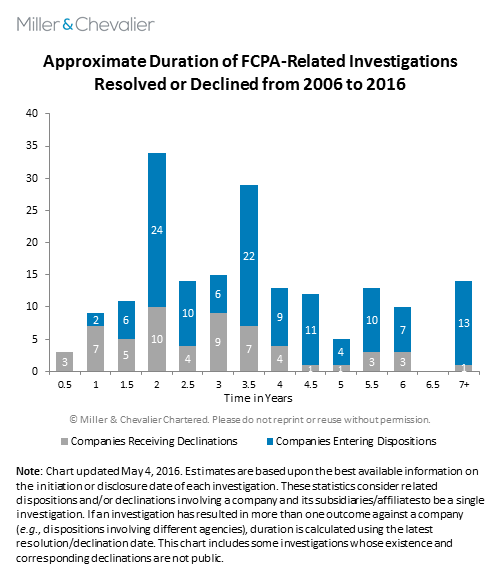

FCPA investigations by the SEC and DOJ are often time-consuming affairs. Based on an analysis of publicly available data, corporate FCPA investigations rarely last less than two years and a notable number have lasted six years or more. More than three quarters of the corporate FCPA investigations the agencies concluded between 2006 and 2016 lasted less than five years. Without taking any other factor into account, investigations tend to last between two and four years; however, many factors determine when an investigation will ultimately end.

One important trend not captured by the chart is the significant increase in the average length of a corporate FCPA investigation by the SEC or DOJ over the last decade. The average duration of all corporate FCPA investigations since 2006 is approximately 3.6 years. The investigations resolved in 2015, however, lasted on average 4.8 years. This increase in the average time to resolution is likely attributable to the increasing complexity of the investigations themselves and the underlying subject matter over the years, as well as a more common (and sometimes unnecessary) tendency to expand the scope of an investigation based on the allegations or interim findings -- whether by the company itself or by the government. As we have noted in previous reviews, it may also reflect the increased focus on cooperation with enforcement agencies in other countries -- a process that can sometimes be ponderous depending on the relevant treaty or cooperation arrangements, but that also has enabled the U.S. agencies to obtain better access to evidence abroad.

Regardless, there is a general correlation between the value of a settlement and the duration of an investigation. At one end of the penalty spectrum are declinations. Overall, investigations that have resulted in declinations lasted approximately 2.8 years, with some appearing to last less than one year (it can be difficult to gauge this accurately based on available data). Investigations that have resulted in enforcement actions lasted, on average, almost a year longer. Analyzed by penalty size, settlements over $50 million average approximately 5.7 years; settlements over $100 million average approximately 6.1 years; and settlements over $200 million average approximately 6.4 years.

Rather than a direct causal relationship between an investigation's duration and its value, both are likely the consequence of additional factors that can vary from case to case, including, among others, the complexity and breadth of the corruption scheme, the number of foreign jurisdictions involved, pre-investigation efforts to expose or obscure potential wrongdoing, the clarity and accuracy of a company's books and records, corporate cooperation in the investigation and agency decisions on whether to pursue actions against culpable individuals. The lack of direct causation is also highlighted by some notable exceptions, including Siemens AG (discussed here) and VimpelCom (discussed below). Each of these investigations lasted only two years, even though they concluded with resolutions that imposed substantial penalties and, according to public documents, involved significant allegations of misconduct, enforcement by multiple jurisdictions and complex dynamics that affected both timing and penalty amounts.

Thus, while the data shows some correlation between the length of an investigation and penalty amount, a longer investigation does not always equate to a larger penalty (or vice versa). The factors noted above can change enough in any specific case to diverge from the overall trends noted.

Declinations

As we discussed in our last two FCPA Reviews (see here and here), the slowdown in resolved enforcement actions in the second half of 2015 was accompanied and somewhat counterbalanced by a steady pace of declinations by both agencies. The first quarter of 2016, on the other hand, saw only one publicly disclosed declination: in announcing its settlement with the SEC, SciClone stated that "[t]he Department of Justice (DOJ) has also completed its related investigation and has declined to pursue any action." To begin the second quarter, Key Energy Services Inc. ("Key Energy") disclosed the year's second known declination in an April SEC filing. While reporting on an agreement in principle with the SEC to end the Commission's ongoing FCPA investigation into the company, Key Energy announced that it has been informed by the DOJ that "the Department has closed its investigation and that it has decided to decline prosecution of the Company."

The number of declinations provided during this quarter is likely to rise, however, as companies generally wait to announce the closure of investigations in their quarterly securities filings or annual reports, if they choose to disclose them at all, which generally results in a delay in identifying new declinations. This lag can be several months or more and, as such, our declination totals are always subject to revision. Note that we continue to track "declinations" based on a broad interpretation of the term, counting any instance in which the DOJ or SEC chose to close an FCPA investigation without pursuing enforcement, regardless of the agency's reason for doing so. (See Discussion of Declinations by Miller & Chevalier Counsel Marc Alain Bohn.)

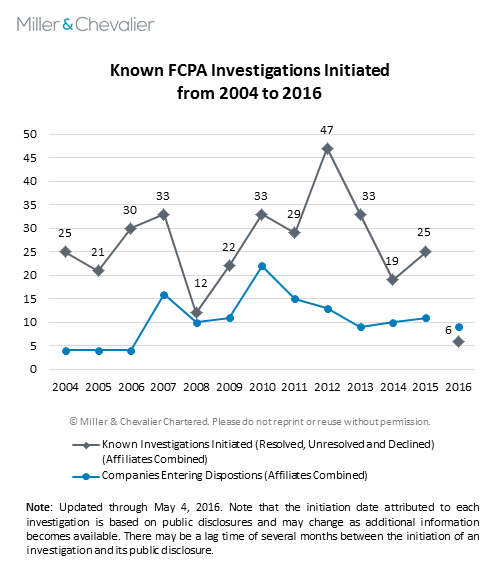

Known Investigations Initiated This Year

To date, we have identified six new FCPA investigations initiated by the enforcement agencies in 2016. In addition, since the publication of our FCPA Winter Review 2016 on February 8, 2016, we have identified another FCPA investigation initiated in 2015 and two more initiated in 2014. As usual, these numbers are likely to rise, since the circumstances under which companies disclose new investigations are similar to those surrounding the disclosure of declinations, as discussed above. Public companies may choose to wait months, or even years, to disclose the existence of an investigation in their public filings (with some choosing never to do so), while private companies often never disclose the existence of an investigation.

International Developments

On the international front, this quarter saw the Petróleo Brasileiro S.A. ("Petrobras") investigation uncover additional corruption schemes and continue to ensnare more public officials in and outside of Brazil. Brazilian construction conglomerate Grupo Odebrecht S.A. ("Odebrecht S.A.") is central to many of the new developments, as further reflected by the sentencing of its former CEO to more than 19 years in prison on corruption-related charges. Odebrecht S.A. is a subject of an investigation into corruption in at least two multi-billion projects related to the upcoming Summer Olympic Games in Rio de Janeiro, as well as allegations of corrupt payments to the President of Peru and a former Transportation Secretary in Argentina. It is also connected to a reported U.S. investigation into petrochemical producer Braskem S.A., a company in which Odebrecht S.A. holds a majority stake. In addition, the fallout from the Petrobras investigation contributed to the impeachment of Brazilian President Dilma Rousseff by Brazil's lower house of Congress, with an impeachment trial in the upper house -- the Federal Senate -- appearing imminent.

Among other international developments, we also provide an update related to the Organisation for Economic Co-operation and Development ("OECD") Working Group on Bribery, including an open letter to the Working Group by several global non-governmental organizations ("NGOs"), calling into question the deterrence value of corporate settlements and requesting that the Working Group develop global standards for them. The creation of such standards could have significant implications for anti-corruption enforcement by signatories to the OECD Anti-Bribery Convention, including the United States.

Actions Against Corporations

SAP Reaches Settlement with the SEC Over Alleged Misconduct in Obtaining Government Contracts in Panama

On February 1, 2016, the SEC announced a settlement with SAP SE, a Germany-based business software company and issuer of securities on the New York Stock Exchange. Under the settlement, SAP agreed to pay approximately $3.9 million to settle the SEC's allegations that the company violated the books-and-records and internal-accounting-controls provisions of the FCPA. The SEC's Cease-and-Desist Order ("the Order") imposed $3.7 million in disgorgement, representing the approximate ill-gotten gains from the alleged underlying conduct, and $188,896 in prejudgment interest. The SEC did not impose a civil penalty in acknowledgement of SAP's cooperation.

The settlement rests on many of the same facts alleged by the DOJ and SEC in parallel enforcement actions against former SAP executive Vicente Garcia, announced last August, which we discussed in our FCPA Autumn Review 2015.

SAP, an international software manufacturer headquartered in Waldorf, Germany, conducts business in Panama through SAP Mexico S.A. de C.V. ("SAP Mexico") and SAP International, Inc. ("SAPI"). At all relevant times, Garcia served as SAP's Vice President of Global and Strategic Accounts and appeared on SAPI's payroll.

According to the Order, Garcia conspired with a Panamanian lobbyist to bribe Panamanian government officials between 2009 and 2013 in order to obtain software contracts with the Panamanian government. In particular, Garcia allegedly paid one official $145,000 and offered to bribe two additional officials, discussing the scheme via personal email. As a result, the Panamanian government awarded four contracts to SAP that generated revenues of approximately $3.7 million.

Garcia reportedly caused SAP to sell software to a Panamanian partner company at discounts as high as 82 percent. Garcia then allegedly created a slush fund from the discounts, which his partner used to pay bribes and kickbacks. Although SAP exercised approval over these discounts, the Order states that Garcia concealed the scheme from others within SAP and circumvented SAP's internal controls by misstating the business justification on SAP's approval forms. In one instance, Garcia reported that the discounts were necessary for SAP to compete with other software companies and to establish a rapport with the Panamanian government.

According to the SEC, SAP lacked sufficient internal controls to prevent and detect Garcia's scheme. In particular, the SEC faulted SAP for giving employees wide latitude in seeking approval for discounts to local partners and failing to conduct verification of business justifications provided by employees. The Commission also found fault with SAP's failure to require heightened due diligence for large discounts, such as the 82 percent discount requested by Garcia. Finally, the SEC asserted that the company's indirect reporting structure, with Garcia reporting to and directing employees in several regional subsidiaries across multiple countries, created gaps in supervision that allowed Garcia to implement the bribery scheme. The SEC noted, for example, that Garcia was employed by SAPI in Miami but reported to supervisors in other regional subsidiaries while using employees from SAP Mexico to further his scheme.

The large discounts that Garcia used to funnel bribes were improperly recorded as legitimate discounts on the books of SAP Mexico, which were then consolidated into SAP's financial statements.

Noteworthy Aspects

- SAP's Compliance Program: The SAP case demonstrates the critical importance of following up on red flags and monitoring high-risk employees and third parties. Though the SEC faulted SAP for insufficient internal controls related to its failure to prevent Garcia's bribery, the Order also identified instances in which SAP's compliance program functioned effectively. The SEC noted that, in 2009, SAP changed its Code of Business Conduct to prohibit employees from inviting government officials to hospitality events after Garcia invited a Pemex official to a marketing event at the Monaco Grand Prix (the Order states that an SAP review found Garcia did not attempt to influence the Pemex official in that instance). The Order also notes that SAP prevented Garcia's first bribery attempt when it rejected Garcia's request to replace an existing partner with a local Panamanian partner. However, Garcia persisted, and SAP failed to inquire further when he proposed unusually large distributor discounts to procure a government contract.

- Distributor Pricing/Discounts as Source of Compliance Risk: As noted, the Order highlights the central role that loose controls over review and approval of discounts to local partners/distributors had in allowing Garcia to fund the scheme of improper payments. Controls over the justification and timing of such discounts and related pricing structures are critical to prevent employees' ability to fund such schemes "off the books" and to deter other conduct that can create significant risks for companies, such as channel stuffing and other revenue recognition and reporting issues.

- No Parallel DOJ Enforcement: Neither the DOJ nor SAP have made any public statements regarding any action by the DOJ, although Garcia did plead guilty to individual criminal charges in August 2015. The absence of parallel DOJ enforcement against SAP likely is not for lack of jurisdiction: the Order makes clear that Garcia is a U.S. citizen and resided in Miami during his employment with the company. For its part, the SEC commended SAP for its thorough internal investigation and extensive cooperation, which included voluntarily producing over 500,000 pages of documents, translating significant documents, sharing timelines and facilitating an interview of Garcia without disclosing the investigation into his conduct. The DOJ may have accounted for this level of cooperation in assessing its own potential case. While the lack of an announced investigation would be consistent with the DOJ's decisions not to prosecute in other matters, no definitive conclusion is possible without further public information.

- Bribery Risk in Panama and Central America: This is the third corporate enforcement action involving Panama, and the second action this year involving conduct in Central America (see Olympus below). As discussed by Miller & Chevalier Member Matteson Ellis, Garcia's conspiracy leveraged his extensive local relationships and "highlights the uniquely close-knit relationships that are common between the business and government sectors in Central American countries, where political and economic power is highly concentrated." The recent "Panama Papers" leak, involving the disclosure of millions of documents relating to a Panamanian law firm's work creating offshore bank accounts and shell companies for hundreds of global clients, underscores the country's connection to activities that may be related to money laundering and related crimes, such as official corruption.

SciClone Pharmaceuticals Settles with the SEC Over Gifts, Travel and Entertainment Allegedly Provided to Officials in China

On February 4, 2016, the SEC announced a disposition with SciClone Pharmaceuticals, Inc. related to the California-based company's pharmaceutical operations in China. The allegations set out in the SEC's Cease-and-Desist Order ("the Order") include violations of the anti-bribery, books-and-records and internal-accounting-controls provisions of the FCPA. SciClone agreed to pay approximately $12.8 million in disgorgement, prejudgment interest and a monetary penalty to settle the allegations, although it neither admitted nor denied wrongdoing.

The SEC alleged that between 2007 and 2012, employees of SciClone subsidiaries "gave money, gifts, and other things of value to foreign officials, including health care professionals who were employed by state-owned hospitals in China, in order to obtain sales of SciClone pharmaceutical products." The Order states that at least some SciClone managers in China were aware of and condoned these activities, the activities were falsely recorded in the company's books and records, and the company failed to have sufficient internal accounting controls or an effective anti-corruption compliance program during the time at issue.

According to the Order, sales representatives in China provided reports of their sales efforts to the senior management of one of SciClone's wholly owned subsidiaries, operating out of Hong Kong. The Order stated that some SciClone officers served as officers or directors of this affiliate and were involved in various affiliate management activities, including contract negotiations with Chinese distributors. The reports provided by the sales representatives to the affiliate allegedly contained explicit references to trips, vacations, meals, classes and entertainment provided to Chinese HCPs to obtain sales. The SEC alleged that sales representatives identified some of the HCPs as "VIP clients" and provided them with additional benefits, including, in one instance, paying for the HCP's family vacations and regular family dinners.

The Order also refers to a regulatory affairs specialist ("Specialist") whom SciClone hired to assist in licensing a new medical device product and renewing the license for another product. According to the Order, the "well-connected" Specialist arranged for two foreign officials with oversight of government approvals and renewals to attend a conference in Greece that was solely related to the new device. When they could not obtain visas to travel, the Specialist provided them with "lavish gifts" worth at least $8,600. When SciClone learned of the gifts, the company terminated the relationship with the Specialist and launched an internal investigation into the Specialist's conduct in China. However, the Order notes that the company did not perform a broader investigation of its sales and marketing practices in China, and the investigation of the Specialist's conduct did not lead to further remedial measures.

The SEC also alleged that local Chinese travel companies were hired to provide services in connection with conferences, seminars and other events, but the company did not perform adequate due diligence for these third-party vendors. According to the SEC, "Many events did not include a legitimate educational purpose or the educational activities were minimal in comparison to the sightseeing or recreational activities."

The Order notes that "as part of its remedial efforts, SciClone conducted a detailed, comprehensive internal review of promotional expenses of employees from 2011 to early 2013." The review "found high exception rates indicating violations of corporate policy that ranged from fake fapiao (a concept explained in some detail here), inconsistent amounts or dates with fapiao, excessive gifts or meal amounts, unverified events, doctored honoraria agreements, and duplicative meetings."

In addition, prior to the SEC settlement, SciClone took a number of steps to improve its internal accounting controls, including hiring a compliance officer for its China operations and reviewing and improving various internal training, policies and procedures. As part of the settlement, SciClone agreed to report to the SEC at least every nine months over three years regarding its remediation efforts and its implementation of compliance measures. SciClone also agreed to pay $9,426,000 in disgorgement, $900,000 in prejudgment interest and a civil penalty of $2,500,000.

Noteworthy Aspects

- FCPA Enforcement Actions in the Healthcare Sector: SciClone came under scrutiny during the course of the SEC and DOJ's industry-wide investigation of the pharmaceutical industry. While not one of the initial group of companies contacted in April 2010, SciClone received a subpoena in August 2010, reportedly triggered by information the SEC received during the industry-wide investigation. Previous FCPA Reviews have discussed other dispositions that have arisen from this industry-wide investigation.

- Misconduct Continued After Investigation Initiated: The SEC alleged anti-bribery and accounting violations on the basis of misconduct from 2007 to 2012, which indicates that the improper activities continued for roughly a year and a half after the investigation was initiated. The public documents do not contain enough information to determine whether this fact might have affected the disposition.

- SEC's Criticism of Scope of Previous Internal Investigation: In the Order, the SEC criticized SciClone's 2008 internal investigation regarding the Specialist because the company failed to more broadly investigate its sales and marketing practices in China. Aside from terminating the relationship with the Specialist, SciClone apparently did not take any further action or remedial measures, notwithstanding the fact that a senior vice-president had approved at least one of the reimbursement requests relating to these lavish gifts.

- DOJ Declination: SciClone indicated in a press release regarding the settlement that the DOJ had completed its investigation and declined to pursue enforcement in connection with this misconduct, making it the latest in a string of companies that the SEC has sanctioned but that the DOJ declined to prosecute.

PTC Settles with the SEC and DOJ Related to Its Subsidiaries' Interactions with Officials at Chinese State-Owned Entities

On February 16, 2016, the SEC and DOJ announced that Boston-based software company PTC, Inc., an issuer, and its two Chinese subsidiaries agreed to pay more than $28 million to settle parallel civil and criminal actions with the SEC and DOJ. The agencies alleged that recreational travel and gifts and entertainment provided directly and indirectly by PTC to officials at Chinese state-owned entities violated the anti-bribery, internal-controls and books-and-records provisions of the FCPA.

According to the SEC Order and the NPA entered with the DOJ, PTC paid for the employees of its Chinese state-owned customers to travel to the United States for training at PTC's headquarters in Massachusetts; however, the trips typically included one day of business activities, followed by several days and up to two weeks of recreational travel to other parts of the United States, such as New York City, Los Angeles, Las Vegas and Hawaii. According to the settlement documents, PTC's subsidiaries paid for the travel through their "business partners" in China.

According to the SEC Order, PTC's Chinese subsidiaries regularly hired business partners to both find deals, for which PTC would pay a commission, and to provide technology and other services, which PTC would subcontract to the business partner. The SEC Order further notes that business partners were typically Chinese companies with specific knowledge of, and relationships with, customers, many of which were state-owned entities. According to the SEC, "[o]ften the Chinese government officials chose the business partner with whom they wished to collaborate." Officials selecting or recommending third parties has long been considered a "red flag" related to possible improper payments.

According to the SEC Order, senior PTC China's sales staff had wide discretion in setting the fee arrangements for business partners and generally agreed to commissions ranging from 15 percent to 30 percent of the contract price. The parties allegedly formalized the commission amounts at or around the time a deal closed, and PTC China's sales staff tracked the payments to business partners on spreadsheets kept on their computers, separate from the company's electronic accounting records. During contract negotiations with the state-owned entities, employees of customers, in conjunction with the respective business partner, would often request that PTC provide them with overseas "training," the purpose of which the parties understood to be leisure travel. According to the SEC Order, the customers would typically agree to "gross up" the contract price by the amount of the anticipated travel costs, and PTC's Chinese subsidiaries would record the inflated prices as subcontracting payments or commission payments for the business partners. Because PTC China's employees negotiated commission fees on a deal-by-deal basis, they were able to include the costs of the overseas travel in the commission fees without raising suspicion.

PTC's Chinese subsidiaries allegedly paid over $1 million, through two different business partners, to fund 24 trips for 100 employees of their Chinese state-owned clients, according to the DOJ. The DOJ's NPA states that during the same time period, PTC's Chinese subsidiaries entered into more than $13 million in contracts with the same entities. The disposition documents also note that in addition to the travel costs paid indirectly through the business partners, PTC's subsidiaries provided gifts and entertainment directly to Chinese state-owned entity officials, including small electronics, gifts cards, wine and clothing, ranging from $50 to $600 per occurrence and totaling approximately $250,000.

According to the DOJ's NPA, PTC's policies in place at the time of the activities noted above prohibited the improper provision of travel, gifts and entertainment to government officials. The SEC, however, claimed that PTC's Code of Ethics and Anti-Bribery policies were "vague." Among other issues, the SEC alleged that PTC failed to conduct a sufficient review of its business partners despite the risk of corruption inherent in paying for "influence services," such as arranging seminars and meetings with officials of the state-owned entities.

PTC agreed to pay approximately $11.9 million in disgorgement and $1.8 million in prejudgment interest to settle the SEC's charges. The SEC's Order stated that the disposition took into account PTC's self-reporting of its misconduct and the significant remedial acts the company has since undertaken.

With regard to the parallel DOJ investigation, PTC's two Chinese subsidiaries entered into an NPA and agreed to pay over $14.5 million in penalties, which did not include disgorgement. Under the NPA, the subsidiaries agreed to a three-year self-reporting period, which requires them to report annually to the DOJ regarding the operation of and improvements to their compliance and internal-controls programs.

On April 20, 2016, PTC disclosed in its SEC Form 8-K that the Chinese regulator, the China Administration for Industry and Commerce, opened an investigation into the company's Chinese subsidiaries in early March, after the company's FCPA settlements with the DOJ and SEC.

Noteworthy Aspects

- First DPA Entered with Individual by SEC: In PTC, the SEC entered into its first DPA with an individual in an FCPA case. The SEC's deferred prosecution agreement ("DPA") with Yu Kai Yuan, a former sales executive of PTC's Shanghai based subsidiary, alleged that Yuan caused the company to fail to maintain accurate books and records and sufficient internal accounting controls. The SEC's DPA with Yuan is discussed in further detail below.

- SEC Noted Specific Issues Causing Internal Accounting Failures: The SEC cited the following issues, among others, to support its claim that PTC's Chinese subsidiaries failed to devise and maintain an adequate system of internal accounting controls:

- PTC investigated compliance issues at its Chinese subsidiaries in 2006, 2008 and 2010, including possible corruption involving its business partners. However, PTC failed to identify and stop the ongoing and systematic illicit payments to Chinese government officials by the subsidiaries.

- Despite the findings from the previous investigations, PTC failed to undertake periodic comprehensive risk assessments for its Chinese subsidiaries to ensure that the company's internal-accounting-controls procedures were suited to conducting business with Chinese officials.

- PTC's Code of Ethics and Anti-Bribery policies for the provision of business entertainment were "vague." Notably, they stated that employees should use "good taste" and consider the "customary business standards in the community," which was not risk-tailored to the Chinese market.

- PTC did not have independent compliance staff or an internal audit function that had the authority to review and test its internal-accounting-controls processes or to intervene in management decisions and, if appropriate, take remedial action.

- PTC failed to properly vet the potential business partners of its Chinese subsidiaries.

- PTC failed to monitor for corrupt payments and ensure that its sales staff followed its anti-corruption policies and maintained accurate records.

- PTC investigated compliance issues at its Chinese subsidiaries in 2006, 2008 and 2010, including possible corruption involving its business partners. However, PTC failed to identify and stop the ongoing and systematic illicit payments to Chinese government officials by the subsidiaries.

- Failure to Fully Disclose Results in No Credit for Voluntary Disclosure from DOJ: While the SEC praised PTC for its cooperation, the DOJ did not provide voluntary disclosure credit or full cooperation credit to PTC's Chinese subsidiaries.

In the NPA, the DOJ stated that "although the Companies, through their parent corporation PTC Inc., reported to the Office in 2011 certain misconduct identified through a then-ongoing internal investigation, they did not voluntarily disclose relevant facts known to PTC Inc. at the time of the initial disclosure until the Office uncovered salient facts regarding the Companies' responsibility for the improper travel and entertainment expenditures at issue independently and brought them to the Companies' attention, after which the Companies disclosed information that they had learned as part of an earlier internal investigation . . . ."

As a result, PTC's subsidiary companies received only a partial cooperation credit of fifteen percent off the lower range of the U.S. Sentencing Guidelines. The DOJ's language suggests that the parent company, PTC Inc., which appears to have handled the disclosure and the investigation, might have known relevant facts that it failed to disclose. However, it is also possible that the subsidiaries withheld information from the parent company or, if the investigation was not managed centrally, that the subsidiaries did not disclose information that was disclosed by the parent company. The DOJ's treatment of PTC's failure to disclose all relevant facts may be an indication of how the DOJ's new disclosure pilot program requirements will be applied.

VimpelCom Enters into Resolution with U.S. and Dutch Authorities in Connection with Alleged Misconduct in Uzbekistan

On February 18, 2016, Netherlands-based telecommunications company VimpelCom Ltd. (an "issuer" on the NASDAQ and previously on the New York Stock Exchange) and two of its non-U.S. subsidiaries (collectively, "VimpelCom") agreed to a resolution with the DOJ, SEC and Dutch authorities ("DPPS") in connection with an investigation of VimpelCom's business in Uzbekistan. As part of the resolution, VimpelCom agreed to pay a total of $795 million to the government agencies, putting this resolution within the "top 10" resolutions in terms of total amount paid by a company.

The government actions against VimpelCom stemmed from VimpelCom's operation of its business in Uzbekistan, through its subsidiary Unitel LLC, from 2006 to at least 2012. During that time, the disposition documents state that VimpelCom entities made more than $114 million in improper payments to a foreign official in Uzbekistan in exchange for that official's understood influence over the telecommunications regulator in Uzbekistan. VimpelCom entered into multiple transactions with the foreign official's Gibraltar-based shell company, including a partnership agreement and "fake" consulting contracts to directly and indirectly pay money to the foreign official. Certain of the payments were in conjunction with the award of 3G and 4G/LTE telecommunications licenses and related frequencies desired by the company. According to the disposition documents, VimpelCom Ltd. also falsely recorded relevant entries in its books and records, by recording payments as for "consulting services" or "professional services" and by treating the 3G and 4G/LTE license acquisition payments as the acquisitions of intangible assets and as consulting expenses. The SEC also alleged violations related to the payments "made under the guise of legitimate charitable contributions or sponsorships."

As part of its resolution with the DOJ, VimpelCom Ltd. entered into a DPA for one count of conspiracy to violate the anti-bribery and books-and-records provisions of the FCPA and one count of violating the internal-accounting-controls provisions of the FCPA. VimpelCom's Uzbekistan subsidiary, Unitel LLC, pled guilty to conspiracy to violate the anti-bribery provisions of the FCPA. VimpelCom agreed to pay a criminal fine of $460,326,398, of which $40 million would be classified as forfeiture of proceeds of transactions in violation of the anti-bribery provisions of the FCPA, and up to $230,163,199.20 of which would be offset by payments made by the company to the DPPS in connection with resolution of the company's potential prosecution in The Netherlands. The DPA and guilty plea, together with related documents, were approved by the U.S. District Court for the Southern District of New York.

For its part, the SEC filed a civil complaint against VimpelCom, also in the Southern District of New York. The agreement to settle charges of violating the payments, books-and-records and internal-accounting-controls provisions of the FCPA was approved and the court issued a permanent injunction covering VimpelCom Ltd. As part of the resolution, VimpelCom agreed to pay the SEC $375 million, $167.5 million of which would be offset by the company's disgorgement payment to the DPPS and $40 million of which would be offset by the company's disgorgement payment to the DOJ.

To resolve the investigation in The Netherlands, the DPPS entered into an agreement with VimpelCom Ltd. and Silkway Holding BV, the Netherlands-based VimpelCom subsidiary that is a majority owner of Unitel LLC. VimpelCom agreed to pay to the DPPS a criminal penalty of $230 million and a disgorgement amount of $167.5 million. (See DPPS press release.)

The U.S. resolutions also required VimpelCom to retain an independent compliance monitor for three years. The compliance monitor will report to the company's Board and to the SEC and DOJ.

Noteworthy Aspects

- Global Resolution and Intergovernmental Cooperation: This is a simultaneous resolution for prosecutions in multiple countries. In particular, the resolution documents specifically take into account payments to other agencies and in other jurisdictions. By contrast, Siemens AG faced prosecutions in multiple countries (Germany, Norway, the U.S., Greece and Italy) at various times. (See our FCPA Alert.) VimpelCom's resolution may signal not only increasing international coordination with respect to resolutions, but also with respect to fact-gathering and case-building. In its press release, the SEC thanked agencies of 14 other countries for assisting in its investigation. The DOJ noted that it was "one of the most significant coordinated international and multi-agency resolutions in the history of the FCPA."

- DOJ Sentencing Guidelines Reduction: The DOJ noted that it had reduced VimpelCom's criminal penalty 45 percent below the bottom of the applicable Sentencing Guidelines fine range for the offense. This reflected a reduction by 25 percent for VimpelCom's full cooperation, as permitted by relevant foreign data privacy and national security laws, as well as an additional 20 percent reduction for VimpelCom's prompt acknowledgement of wrongdoing and willingness to resolve its criminal liability on an expedited basis.

- Related Forfeiture Action: The DOJ has filed two related civil complaints in courts in New York -- one for $300 million and another for $550 million -- seeking the forfeiture of the alleged proceeds of bribes and property paid by VimpelCom and two other telecommunications companies held by entities linked to officials in bank accounts located in Switzerland, Belgium, Luxembourg and Ireland. This effort is being spearheaded under the DOJ's Kleptocracy Asset Recovery Initiative by the Criminal Division's Asset Forfeiture and Money Laundering Section, which was unveiled in 2010. VimpelCom's resolution is the first instance of a related civil forfeiture action publicly announced alongside a large FCPA criminal resolution. Assistant Attorney General Lesley Caldwell described DOJ's FCPA enforcement program and Kleptocracy Initiative as "two sides of the same anti-corruption coin." We may be seeing more coordination between these two efforts.

Miller & Chevalier was lead U.S. counsel for VimpelCom in this matter.

Olympus Settles Bribery and Kickback Charges in Latin America and the United States

On February 29, 2016, the DOJ announced an FCPA settlement with Olympus Corporation of the Americas ("OCA") and its subsidiary Olympus Latin America ("OLA"). The DOJ charged OLA with violating the FCPA's anti-bribery provisions by illegally providing money, travel and free equipment to doctors and hospitals across Central and South America to induce them to purchase Olympus products. OLA admitted the charges, entered into a DPA, and agreed to pay $22.8 million in penalties. In a parallel action, OCA entered into a settlement with the U.S. Attorney's Office for the District of New Jersey to resolve charges under the U.S. Anti-Kickback Statute and the U.S. and various state False Claims Acts for similar conduct in the United States and agreed to pay $623.2 million in penalties. The settlement agreements require both OLA and OCA to retain an independent compliance monitor for a period of three years.

Background

Olympus Corporation is a global manufacturer and distributor of commercial photographic equipment, as well as specialized medical imaging and surgical equipment. It is based in Tokyo, Japan. OCA, wholly owned by Olympus Corporation and headquartered in Pennsylvania, distributes Olympus equipment and uses its majority-owned subsidiary, OLA, to sell Olympus products in the Caribbean, Central America and South America. Headquartered in Miami, Florida, OLA works with distributors to directly market and sell medical equipment to government and private customers.

According to the DPA, between 2006 and 2011, OLA carried out a plan to increase Olympus sales in Central and South America by "providing personal benefits, including cash, money transfers, personal or non-Olympus medical education travel, free or heavily discounted equipment, and other things of value to certain HCPs employed at government-owned and private healthcare facilities." OLA specifically targeted HCPs who could authorize or influence purchasing decisions, such as members of public tender boards, and referred to them as "Key Opinion Leaders" or "KOLs" (a term commonly used in the industry). To encourage KOLs to favor Olympus products, OLA opened "training centers," nominally set up to train and educate doctors. Although the centers did provide some of these services, the DPA states that OLA mainly created them to serve as vehicles through which the company funneled improper benefits. Many of these training centers were connected to state-owned hospitals. OLA provided the KOLs who managed the centers with annual salaries of $65,000, 50 percent discounts on Olympus products and management budgets of $130,000.

Aside from the training centers scheme, the DPA also identifies a "Miles Program" that OLA established to provide KOLs with free travel. Under this program, OLA paid KOLs between $5,000 and $30,000 in travel expenses not related to any legitimate business purpose. According to the DPA, "OLA did not require any pre-approval of the travel and did not establish or use any review process for submitted expenses that were to be redeemed under the Miles Program." The DPA also states that OLA supplied free or heavily discounted equipment to KOLs. Olympus did not record any of these improper benefits, and the DPA notes that certain OLA senior management and sales employees specifically took steps to hide references to gifts, donations and payments from the HCP contract language.

According to the DPA, over the course of six years, OLA authorized hundreds of unlawful payments of the type discussed above, amounting to approximately $3 million, to HCPs in order to promote Olympus products, influence public tenders and prevent public institutions from purchasing its competitors' technology. OLA pursued this strategy in Brazil, Bolivia, Colombia, Argentina, Mexico and Costa Rica -- all countries with healthcare systems that are either partially or entirely public -- and saw at least $7.5 million in profit as a result.

Charges and Agreement

The DOJ charged OLA with one count of conspiracy to violate the FCPA anti-bribery provisions and one count of violating the FCPA anti-bribery provisions. In entering into the DPA, the Department considered several factors, including OLA's failure to timely disclose the FCPA violations and the company's cooperation and remediation efforts. The DPA notes that OLA terminated its involvement with numerous responsible parties (such as employees and third-party distributor relationships), committed to continue to enhance its compliance program and internal controls and agreed to cooperate with the DOJ in any ongoing investigation. For its cooperation with the DOJ's investigation, which included "conducting an extensive internal investigation, translating documents as necessary, and collecting, analyzing, and organizing voluminous evidence," the company received a cooperation credit of 20 percent. OLA and OCA agreed to pay $22.8 million in penalty and enter into a three-year monitorship in exchange for not facing criminal prosecution or any civil action relating to the underlying conduct. The DOJ announced that Larry Mackey, a former federal prosecutor best known for trying the Oklahoma City bombing cases, will serve as the independent monitor.

Parallel Enforcement Action for U.S.-based Conduct

The OLA settlement was part of a much larger enforcement action. OCA, the parent company, entered into a separate DPA with the U.S. Attorney's Office for the District of New Jersey to resolve parallel civil and criminal investigations relating to charges of violating the U.S. Anti-Kickback Statute and the federal and various state False Claims Acts. To resolve these charges, OCA agreed to pay a $623.2 million in penalty -- $312.4 million for Anti-Kickback Statute violations and $310.8 million for False Claims Acts violations.

According to the DPA, OCA's conduct in the United States largely mirrored that of its subsidiary in Latin America. From 2006 until 2011, OCA induced "doctors, hospitals, and other healthcare providers to buy Olympus products by giving them various types of remuneration, including grants, payments for travel and recreational activities, consulting payments, and gifts or no-charge loans of Olympus equipment, some of which sold for $20,000 or more." Olympus received over $600 million in sales and grossed more than $230 million in profits from these schemes.

The DPA also notes that during this time, OCA did not have appropriate training and compliance programs. The company did not have a Compliance Officer position until 2009 and did not hire an experienced compliance professional until 2010. In fact, according to the media, it was the company's first Chief Compliance Officer, John Slowik, who was fired and then filed a lawsuit against Olympus in 2010 alleging breaches of the FCPA, Anti-Kickback Statute and the relevant New Jersey state equivalents. The DOJ announcement states that Mr. Slowik will receive a total of $52 million from OCA's settlement for his contributions to the investigation and prosecution.

In addition to its resolutions with the DOJ and the U.S. Attorney's Office, OCA has entered into a Corporate Integrity Agreement with the Department of Health and Human Services, Office of Inspector General. The agreement requires OCA to notify healthcare providers about the settlement and imposes compliance enhancement, disclosure, risk assessment and training requirements on the company for five years.

Noteworthy Aspects

- Continued Focus on Healthcare Companies: Olympus is the latest case in a string of FCPA actions against healthcare corporations. (See, for example, our discussions of the Bristol-Myers and Mead Johnson settlements). The DOJ's press release signaled that more such actions may be forthcoming, stating that the FCPA resolution with OLA "demonstrates the department's commitment to ensuring the integrity of the health-care equipment market, regardless whether the illegal bribes occur in the U.S. or abroad." This sentiment, particularly against the backdrop of the enforcement trend, highlights the importance for healthcare companies to have strong compliance programs and to pay particular attention to their activities involving HCPs who may be considered "foreign officials" under the FCPA. Olympus is the twentieth company to face an FCPA enforcement action for violations related to improper payments to HCPs and, counting the Anti-Kickback Statute/False Claims Acts penalties, it will pay the largest total amount in settlement of any medical device company.

- Parallel Enforcement Actions: It is unclear whether the SEC is investigating OCA, an issuer under the FCPA. As mentioned above, OCA not only faced FCPA repercussions for the conduct of its Latin American subsidiary but was also charged with violating the Anti-Kickback Statute and the federal and state False Claims Acts for similar actions in the United States. The Anti-Kickback Statute prohibits payments to induce purchases paid for by federal healthcare programs, and the False Claims Act allows private parties, such as OCA's former compliance officer John Slowik, to sue those who commit fraud against government entities. This case highlights the common risks that conduct improper under one statute may trigger the U.S. government's scrutiny under another statute or regulation, followed by enforcement by a different agency. Therefore, companies should be mindful about their potential exposure and may need to expand their internal investigations to ensure that they cover related areas of law as well.

- Expectation of Self-Reporting: The OLA DPA emphasizes again that while the DOJ gave the company a 20 percent credit for cooperation (including conducting an internal investigation), the lack of timely, voluntary disclosure was a key factor considered when entering into the agreement and calculating the penalty. While there is no legal requirement for a company to report potential FCPA issues to the government, not doing so can result in a loss of significant mitigating credit in any penalty calculation.

Qualcomm Reaches Settlement with the SEC Related to Hiring Relatives of Chinese Government Officials

On March 1, 2016, the SEC announced that Qualcomm Inc. agreed to pay $7.5 million to settle charges that it violated the FCPA by hiring relatives of Chinese government officials who had decision-making authority over whether to adopt Qualcomm's mobile communications technology for Chinese operators and to purchase Qualcomm products, and by providing illegitimate gifts, travel and entertainment to Chinese officials. Qualcomm agreed to the administrative settlement without admitting or denying the SEC's allegations. In addition to the $7.5 million civil penalty, Qualcomm also agreed to make periodic reports to the SEC for two years on its remediation and compliance efforts, and to report any "credible evidence" of possible questionable or corrupt conduct.

Alleged Anti-Bribery Violations

Qualcomm is a wireless communications technology company and issuer headquartered in San Diego. In its Administrative Order, the SEC alleged that, during the relevant period from 2002 to 2012, Qualcomm pursued a strategy focused on urging the adoption of Qualcomm technologies in key international markets, with China being a particularly crucial market. In pursuit of its strategic goal in China, Qualcomm allegedly "provided or offered full-time employment and paid internships to family members and other referrals" of foreign officials at two Chinese state-owned telecommunications companies and a Chinese government agency. According to the SEC, such hires were "often" at the request of foreign officials. Moreover, some of the individuals hired allegedly "did not satisfy Qualcomm's hiring standards," some individuals "had previously failed to obtain employment with Qualcomm through the standard hiring process," and in some cases, "new positions were created for these hires."

In one example, the Order states that Qualcomm provided the son of a Chinese telecom company executive with the following benefits:

- A $75,000 research grant to an American university where he was studying, allowing him to retain his position in a PhD program and renew his student visa;

- a Qualcomm internship;

- subsequent permanent employment despite interviewers' conclusions that he did not meet the "minimum" hiring requirement, and that he would "be a drain on teams he would join";

- a business trip to China followed by leave to visit his parents over the Chinese New Year, despite other employees expressing concern regarding his qualifications for the assignment; and

- a Qualcomm executive personally provided the son with a $70,000 loan to buy a home.

The SEC concluded that the employment and benefits for relatives of foreign officials were improperly given to assist Qualcomm retain and obtain business in violation of the FCPA's anti-bribery prohibitions under 15 U.S.C. §78dd-1.

The Order also alleged that Qualcomm provided meals, gifts and entertainment to foreign officials and their family members in order to influence these officials to adopt and purchase Qualcomm technology. The Order alleges that the company's provision of meals, gifts and entertainment, along with Qualcomm's failure to adequately control and record such expenditures, violated the FCPA's internal-accounting-controls and books-and-records provisions.

The specific internal-accounting-controls and books-and-records violations alleged against Qualcomm include the lack of a full-time compliance officer in China, the lack of "processes for vetting hospitality event invitations" (and Qualcomm employees' failure to comply with vetting procedures Qualcomm did have), failure to provide regular anti-corruption training to gate keepers, and failure to record the meals, gifts and entertainment spending accurately and in sufficient detail. In connection with the alleged corrupt hiring practices, the SEC also faulted Qualcomm for failing to consider FCPA risks in the hiring process and failing to provide FCPA training to human resources personnel.

Noteworthy Aspects

- Second Prosecution Involving Hiring Practices: This is the second FCPA disposition announced so far that focuses on alleged corrupt hiring practices. The first prosecution was against BNY Mellon, which we covered in our FCPA Autumn Review 2015. A slew of other financial institutions are reportedly under investigation for alleged corrupt hiring practices in Asia, including, at the last count: HSBC, Deutsche Bank, J.P. Morgan Chase, Credit Suisse, Goldman Sachs, Morgan Stanley, Citigroup and UBS.

- Investigation and Settlement History: The Qualcomm settlement came after a long and somewhat unusual investigation history. SEC first notified Qualcomm of its investigation in September 2010, after a whistleblower made reports in December 2009 to both Qualcomm's audit committee and the SEC. According to Qualcomm, its audit committee completed an internal review of the whistleblower's allegations in 2010 and did not identify any errors in the company's financial statements. But, in January 2012, Qualcomm learned that the DOJ had also begun an FCPA investigation of the company. On March 13, 2014, Qualcomm received a Wells Notice from the SEC, and Qualcomm responded by making two Wells submissions, in April and May 2014, respectively. Finally, on January 27, 2016, a few days before the SEC settlement, Qualcomm announced that the DOJ had terminated its investigation and would not pursue charges against the company. This investigation and settlement history is notable in several respects:

- The DOJ's declination is notable as some facts recited in the SEC Order suggest that the DOJ had jurisdiction to prosecute Qualcomm, if the evidence was sufficient. In particular, the Order identified the "executive vice president and president of Qualcomm's Global Business" as authorizing or directing some of the alleged improper conduct, and some of the benefits were allegedly provided in the United States.

- The SEC's use of a Wells Notice is interesting because they are less common in FCPA prosecutions than in some other SEC enforcement actions. The SEC's decision to issue a Wells Notice suggests that there may have been concerns about Qualcomm's level of cooperation or that, before the issuance of the Notice, Qualcomm and the SEC had negotiated but failed to reach a settlement. Notably, the SEC in its Order, made no mention of Qualcomm's cooperation, nor did the Order discuss remediation steps the company has taken.

- Finally, the SEC did not explain how it arrived at the $7.5 million penalty. For its part, Qualcomm has repeatedly stated in its public filings that its own investigation had found that "the aggregate monetary value of the benefits in question to be less than $250,000, excluding employment compensation."

- The DOJ's declination is notable as some facts recited in the SEC Order suggest that the DOJ had jurisdiction to prosecute Qualcomm, if the evidence was sufficient. In particular, the Order identified the "executive vice president and president of Qualcomm's Global Business" as authorizing or directing some of the alleged improper conduct, and some of the benefits were allegedly provided in the United States.

Nordion Reaches FCPA Settlement with the SEC Related to Payments to a Third-Party Agent in Russia

The SEC announced on March 3, 2016, the conclusion of its four-year investigation into Nordion (Canada) Inc., and that the Canadian-based health science company agreed to pay $375,000 to settle charges that it lacked sufficient internal accounting controls to detect and prevent a bribery scheme. A former employee also agreed to settle related charges with the SEC through a $100,000 disgorgement payment, $113,950 in prejudgment interest, and a $66,000 penalty. Nordion and the former employee consented to the SEC's cease-and-desist orders without admitting or denying their findings.

The SEC's Cease-and-Desist Order ("the Order") against the Company noted that the company's significant cooperation, self-reporting and remedial acts were all considered in reaching the settlement amount.

Nordion is a global health-science company that provides medical isotopes and sterilization technologies. Throughout the time period covered by the Order, Nordion was headquartered in Ottawa, Canada and its common stock was traded on the New York Stock Exchange and Toronto Stock Exchange. The Company first disclosed the investigation after learning of the potential misconduct in a "statement on voluntary disclosure" released August 8, 2012. Following an acquisition by Sterigenics International Inc. on August 6, 2011, Nordion became a privately held company.

The Order states that from at least 2004 through 2011, Nordion committed books-and-records and internal-accounting-controls violations related to payments made to a third-party agent in order to obtain the Russian government's approval to distribute TheraSphere, Nordion's liver cancer treatment, in Russia. An employee of the company, Mikhail Gourevitch, recommended a personal friend to assist with Nordion's expansion into Russia in early 2000 because, at the time, Nordion was inexperienced with the Russian market. The company signed its first agency contract with the employee's friend in early 2002 to obtain medical isotopes from a Russian governmental entity. The Order notes that there was no due diligence conducted prior to entering this contract, despite the fact that the agent had no experience in the nuclear power industry, nuclear medicine or medical isotopes.

After the initial contract, Nordion expanded its relationship with the agent and signed a contract in 2004 regarding services related to obtaining government approval for TheraSphere. The Company ultimately paid the agent approximately $235,043 for consulting work during 2005-2011 and failed to properly account for these payments. The Order faults Nordion for failure to implement effective internal accounting controls to ensure that the funds were used as authorized, to properly vet the third-party agent, or to provide sufficient anti-corruption training for employees.

In its voluntary disclosure, Nordion reported that it discovered the potentially improper payments and other financial irregularities during a routine internal interview. The company immediately hired outside counsel to launch an internal investigation and voluntarily disclosed the conduct to the U.S. agencies. Nordion terminated all contracts with the agent and dismissed Gourevitch. In addition, the company implemented significant corrective measures, such as hiring a compliance personnel team, incorporating compliance into annual performance reviews and providing extensive anti-corruption, internal accounting controls and finance training to its Board of Directors, management teams and employees. Further, Nordion implemented standard procedures for the retention and compensation of third-party agents and required FCPA and anti-corruption contractual language.

Noteworthy Aspects

- Importance of Employee Training Programs: The SEC Order against Nordion focuses on the lack of a sufficient compliance program, specifically faulting the company for failing to provide employee training in high risk markets. Prior to its entry into Russia, Nordion did not have experience operating experience in countries with high-corruption risk. The SEC indicated that in light of such inexperience, Nordion should have provided anti-corruption compliance training to its employees. This point reinforces the importance of robust compliance and employee training programs, particularly in the case of a company expanding to a high-risk jurisdiction in which it lacks prior experience.

- Canada Aids U.S. Investigation, but Declines to Prosecute: The Royal Canadian Mounted Police ("RCMP") decided not to prosecute the Company due to a lack of evidence, according to statements by the company's Canadian lawyer, but the reasons for declining to prosecute the Canada-based company have not been publicly released by the RCMP. Canadian authorities have in the past prosecuted companies that self-reported alleged foreign bribery misconduct. However, Canada's Corruption of Foreign Public Officials Act ("CFPOA") did not contain accounting offense provisions until mid-2013. Further, the CFPOA does not include civil enforcement mechanisms regarding improper books and records or the failure to have internal accounting controls; indeed, it only contains a criminal offense. Because the conduct at issue for Nordion occurred before 2012, and may not have risen to the level of criminal misconduct, it is possible that the CFPOA would not have reached the conduct at issue.

Despite the decision not to separately charge Nordion, the SEC Press Release indicates that RCMP provided significant support and assistance to the SEC's investigation.

The RCMP has not yet declared whether it will pursue enforcement actions against Gourevitch, who at the time of the conduct at issue, was a dual Canadian-Israeli national, but currently resides in Israel.

- Relatively Low Fine Amount: The $375,000 fine Nordion must pay is a relatively low FCPA settlement. However, despite the fact that the company made payments to obtain approval to distribute its products in Russia, Nordion was ultimately unable to distribute its products in Russia, and thus, did not earn profits on the sale of the products in Russia. The lack of profits earned by Nordion may have influenced the relatively low settlement amount. While the settlement amount was low, the investigation lasted more than four years and Nordion incurred substantial legal fees throughout the process. Therefore, although the fine appears low, the Company did not earn profits on the scheme and endured an extensive and expensive investigation that may have impacted their restructuring.

Novartis Settles SEC Charges Related to the Provision of Travel and Hospitality to Chinese Officials

On March 23, 2016, the SEC announced a settlement with Novartis AG, a Swiss pharmaceutical company and issuer with shares traded on the New York Stock Exchange. Under the settlement, Novartis will pay approximately $25 million to settle the SEC's finding that two Novartis subsidiaries in China violated the FCPA's books-and-records and internal controls provisions. The payment includes $21.5 million in disgorgement, representing the profits gained as a result of the alleged improper conduct, $1.5 million in interest, and a $2 million civil penalty. In addition, the settlement requires Novartis to submit to a two-year self-monitorship.

Novartis is an international biopharmaceutical company headquartered in Switzerland. Novartis conducts its business in China through subsidiaries, two of which were the focus of the investigation: Shanghai Novartis Trading Ltd ("Sandoz China") and Beijing Novartis Pharma Co., Ltd. ("Novartis China").

According to the SEC's Cease-and-Desist Order ("the Order"), between 2009 and 2011, certain employees of Sandoz China provided cash and other things of value to HCPs at state-owned and -controlled hospitals in China in exchange for increased prescription sales. The things of value included gifts, travel, improper sightseeing or vacations, and entertainment for the HCPs and their families. Between 2011 and 2013, employees of Novartis China allegedly made cash payments to HCPs through event planning and travel companies. The SEC alleges that Novartis failed to maintain both a sufficient system of internal accounting controls and an effective anti-corruption compliance program to detect the improper activities.

The Order gives further details showing that a number of Sandoz China sales representatives provided cash and gifts to HCPs by submitting false expense reports, and that certain members of management, including the country sales supervisor, allegedly knew about this practice. The Order points to one instance in which an employee submitted a receipt for $1,154, purportedly for the purchase of holiday gifts, but then used the proceeds to provide spa and sauna sessions for 25 HCPs instead. In addition, Sandoz China hired local travel companies to arrange transportation, accommodations and meals for HCPs in connection with educational events, where those arrangements also included purely recreational activities. For example, in 2009, Sandoz China sponsored 20 HCPs to attend a surgical congress in Chicago. While the congress served legitimate educational purposes, Sandoz China provided the HCPs an excursion to Niagara Falls, $150 in "pocket" money and cover charges at a strip club. Sandoz China also paid for the HCPs' spouses to travel to the United States. Finally, Sandoz China paid HCPs to collect and analyze patient medical data ostensibly to understand better the use of and reaction to a particular Novartis drug. The Order states, however, that the studies provided no legitimate data and were instead a cover for payments to HCPs. Novartis' Global Clinical Quality Assurance function did not approve the study, as required under corporate policy; senior sales and marketing personnel designed them instead. The payments made in connection with these studies totaled approximately $522,000.

The Order also states that between 2011 and 2013, employees of Novartis China also leveraged third-party travel and event-planning vendors to funnel cash to HCPs. While the SEC does not point to any particular examples, it alleges that the cash payments were recorded improperly as legitimate selling and marketing costs in the subsidiary's books. The Order adds that while Novartis China had hosted thousands of marketing events in China and used numerous third-party event-planning vendors, it did not have sufficient internal accounting controls or anti-corruption measures to safeguard against improper third-party payments.