FCPA Summer Review 2016

International Alert

Introduction

After a record number of resolved enforcement actions under the U.S. Foreign Corrupt Practices Act ("FCPA") during the first three months of the year, the second quarter saw U.S. enforcement agencies bring a slower -- though steady -- stream of dispositions, including five corporate settlements and three individual actions. In the absence of any "blockbuster" settlements, the resolutions announced this past quarter are notable for the insight they provide into the current enforcement priorities of the U.S. Securities and Exchange Commission ("SEC" or "Commission") and the U.S. Department of Justice ("DOJ" or "Department"), as well as for the light they shed on how the DOJ's recently unveiled FCPA "pilot program" works in practice. In large part consistent with the agencies' recent patterns of enforcement:

- the SEC continues to focus on relatively small corporate actions, most of them self-reported, while the DOJ appears to have generally closed its parallel investigations without enforcement, except in cases where the alleged misconduct was relatively egregious;

- a significant number of the agencies' resolved enforcement actions involve alleged misconduct in China; and

- both agencies, and in particular the DOJ, are continuing to engage in a concerted effort to target misconduct by individuals.

The new FCPA pilot program has provided the DOJ with a new avenue to highlight the benefits of self-disclosure and cooperation. Breaking with prior practice, the DOJ has begun to publicly disclose certain instances in which it claims to be declining enforcement following an investigation in light of the company's participation in the program.

Enforcement Trends

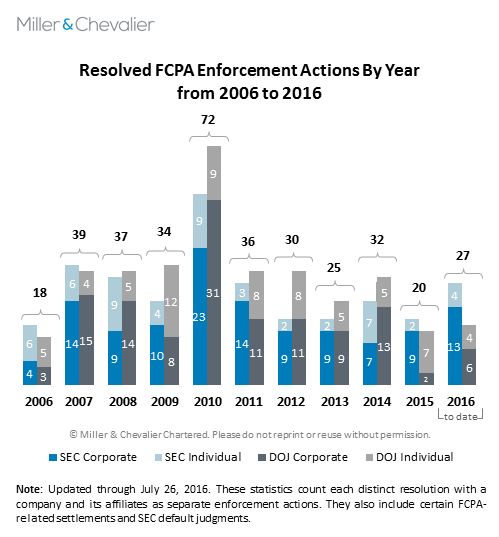

The chart below depicts the 27 resolved enforcement actions brought by the SEC and DOJ to date this year -- a number that already exceeds the total number of actions brought by the agencies in all of 2015, which, as we have previously noted, represented the slowest year on record since 2006. Although down from first quarter, the eight FCPA resolutions this past quarter, along with the three resolved actions in July thus far (which we will cover in our FCPA Autumn Review 2016), keep the agencies on track to match or exceed the total number of enforcement actions brought in any year since 2011.

The agencies' eight second quarter resolutions include SEC civil settlements with four corporations and one individual, a DOJ criminal settlement with one corporation and guilty pleas to DOJ criminal charges by two individual defendants.

Of the SEC's four corporate settlements, three involved alleged violations of the FCPA's accounting provisions related to alleged misconduct in China, including the Commission's resolutions with global entertainment company Las Vegas Sands Corp. ("Sands"), internet-services company Akamai Technologies ("Akamai") and manufacturing company Nortek Inc. ("Nortek"). The focus on China has been a longstanding theme in FCPA enforcement, a matter we elaborate on in our discussion of the agencies' geographic enforcement footprint below.

According to public documents, the Sands administrative action revolved around bookkeeping irregularities and the company's failure to follow its internal accounting policies in connection with more than $62 million in questionable payments to a third-party intermediary facilitating business activities in China and Macau. As part of its settlement, Sands agreed to pay a $9 million penalty. The SEC's non-prosecution agreements ("NPAs") with Akamai and Nortek centered on alleged violations of the FCPA's accounting provisions based on payments and gifts made by the companies' Chinese subsidiaries to employees of state-owned entities or government officials. To resolve these unrelated allegations, Akamai and Nortek agreed to pay approximately $670,000 and $320,000, respectively. Notably, these are the first NPAs the SEC has entered into since the Commission entered into its NPA with Ralph Lauren Corp. in April 2013.

The SEC also reached a joint settlement with medical device manufacturer Analogic Corp. ("Analogic") and Lars Frost, the former CFO of Analogic's Danish subsidiary, over allegations that hundreds of payments made by the subsidiary -- BK Medical ApS ("BK Medical") -- to unknown third parties resulted in violations of the FCPA's books-and-records and accounting-controls provisions. In settling, Analogic agreed to pay $11.47 million in disgorgement and prejudgment interest, while Frost consented to a $20,000 civil fine.

The DOJ's lone corporate settlement this past quarter was a parallel settlement with BK Medical, which agreed to a $3.4 million criminal fine as part of an NPA with the Department, admitting that it had caused the falsification of Analogic's books, records and accounts. The DOJ also announced, in a June court filing, that medical device manufacturer Biomet Inc. breached its Deferred Prosecution Agreement ("DPA") with the Department due to misconduct in Mexico and Brazil. Nonetheless, the DOJ stated that it continues to cooperate with the company instead of seeking to prosecute the deferred charges based on the breach. As highlighted below, the DOJ also completed criminal investigations into the allegations of misconduct by Akamai and Nortek, publicly announcing in conjunction with the SEC's civil settlements that it was declining to prosecute the companies. By contrast, the lack of any corresponding DOJ announcement regarding Sands -- which previously acknowledged being the subject of a criminal FCPA investigation -- provides only limited insight into whether the DOJ investigation into the gaming giant is ongoing or the Department has declined enforcement (see our discussion of Sands below.)

The DOJ is also forging ahead with the prosecution of corporate executives for FCPA-related misconduct. In the second quarter of 2016, Dmitrij Harder, the former owner and President of two Pennsylvania-based consulting companies, and Roberto Enrique Rincon Fernandez ("Rincon"), the owner of several U.S. energy companies, each entered into plea agreements with the DOJ to resolve FCPA and related charges. As detailed below, both men initially pled not guilty to the counts against them before eventually conceding their participation in the alleged corruption schemes: Harder to bribing an official of the European Bank for Reconstruction and Development ("EBRD"), and Rincon to conspiring to with others to bribe officials from Venezuela's state-owned energy company Petroleos de Venezuela S.A. ("PDVSA").

In the third quarter thus far, the agencies have resolved three enforcement actions, including SEC administrative proceedings against Johnson Controls, Inc. and LAN Airlines S.A. ("LAN"), and a DOJ DPA with LATAM Airlines Group S.A. (LAN's successor-in-interest following its merger with TAM Airlines). We will cover these resolutions in more detail in our forthcoming FCPA Autumn Review 2016.

In another noteworthy development, Berger Group Holdings Inc. ("BGH") initiated civil suits against two former executives implicated in the bribery of foreign officials. BGH argued that former Senior Vice Presidents Richard Hirsch and James McClung -- who pled guilty to FCPA violations in 2015 -- should be held responsible for the related $17.1 million criminal penalty imposed on BGH subsidiary Louis Berger International Inc. in July 2015, as well as the company's debarment by the World Bank. In addition to civil damages, BGH is seeking to recoup the legal fees it advanced to help the executives fight the DOJ's claims. It is likely that the DOJ's heightened focus on individual liability will result in more companies following BGH's lead in seeking to recover losses from culpable employees, which could have the collateral effect of shifting public and investor attention away from the company itself to the individual "rotten apples."

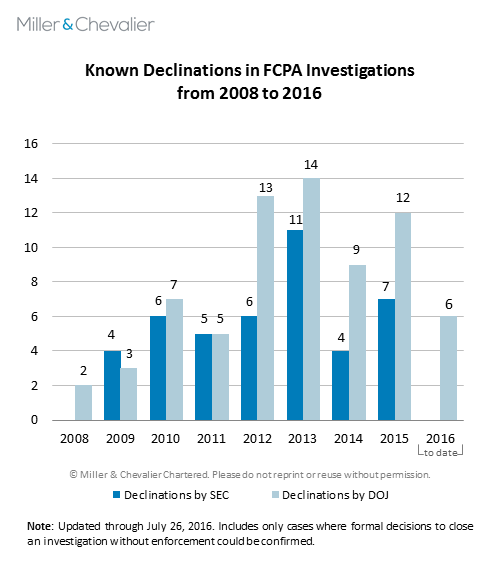

Declinations

In addition to its single corporate settlement, the DOJ issued four known declinations -- or decisions to not bring an enforcement action -- during the second quarter of 2016, bringing the total for the year to six (including the declination the DOJ provided to Johnson Controls Inc. earlier this month, a development we will cover in our forthcoming FCPA Autumn Review 2016.) Note that since the reasoning underlying an agency decision to close an FCPA investigation without enforcement is often difficult to discern, we track "declinations" based upon a broad interpretation of the term.

The declinations we identified during the second quarter include:

- Key Energy Services, Inc.: In a Form 8-K filed on April 28, 2016, Key Energy stated that it "has been informed by the Department of Justice that the Department has closed its [FCPA] investigation and that it has decided to decline prosecution of the Company." Key Energy had previously disclosed its cooperation with the SEC and DOJ into possible FCPA violations in Russia, Mexico and Colombia, and its 8-K filing further announced that the company "has reached an agreement in principle with the [SEC] on the terms of a proposed offer of settlement," which it hoped to conclude in the second quarter of 2016. The company also stated that it "has accrued a liability in the amount of $5 million" in connection with the tentative settlement.

- Harris Corp.: In a Form 10-Q filed on May 4, 2016, Harris noted that after a 2011 acquisition of Carefx Corp., it learned that some employees of Carefx's Chinese subsidiary "had provided pre-paid gift cards and other gifts and payments to certain customers, potential customers, consultants, and government regulators." According to the 10-Q filing, Harris took remedial action and disclosed its investigation results to the DOJ and SEC, and "[d]uring the second quarter of fiscal 2016, the DOJ advised [the company] that they have determined not to take any action against us related to this matter." Harris further announced its continued cooperation with the SEC's investigation. Of note, Harris enjoys the distinction of being the first and only public company to have successfully contested criminal FCPA charges at trial, securing an acquittal in 1991.

- Nortek: The DOJ's June 3, 2016 letter to Nortek's counsel, issued in connection with the SEC's NPA with the company, states: "Based upon the information known to the Department at this time, we have closed our inquiry into this matter . . . despite the bribery by employees of the Company's subsidiary in China . . . ." As discussed in detail below, the DOJ's letter frames the declination as the product of a number of factors under the DOJ's FCPA pilot program.

- Akamai: The DOJ's June 6, 2016 letter to Akamai's counsel, issued in connection with the SEC's NPA with the company, is largely identical to the DOJ's letter to Nortek. The letter states, in relevant part: "Based upon the information known to the Department at this time, we have closed our inquiry into this matter . . . despite the bribery by an employee of the Company's subsidiary in China and one of that subsidiary's channel partners . . . ." As with the Nortek declination, the DOJ refers its FCPA pilot program as a driver behind its decision to not prosecute, a topic we explore in more depth below.

The DOJ's release of the Nortek and Akamai declination letters is particularly significant because, until now, the Department has traditionally resisted calls to publicly identify the companies receiving such declinations. The DOJ's change in course here is connected to the introduction of the new FCPA pilot program (previously discussed in our FCPA Spring Review 2016), with each letter highlighting factors under the program that the DOJ considered in declining enforcement (see our discussion of the Nortek and Akamai settlements below). The DOJ's release of the letters appears to be an effort by the Department to emphasize the benefits of the program and encourage other companies to voluntarily self-report under similar circumstances -- one of the pilot program's explicit aims. The publication of the letters also reflects a stated goal of Andrew Weissmann, Chief of the Criminal Division's Fraud Section, who in November 2015 suggested that the DOJ wanted to introduce greater transparency into the declination process, including publicizing declination recipients by name, where possible.

Geographic Focus of Recent DOJ and SECs Enforcement

In analyzing DOJ and SEC enforcement patterns over time, one interesting trend we have identified is a geographical shift in the agencies' enforcement focus over the years.

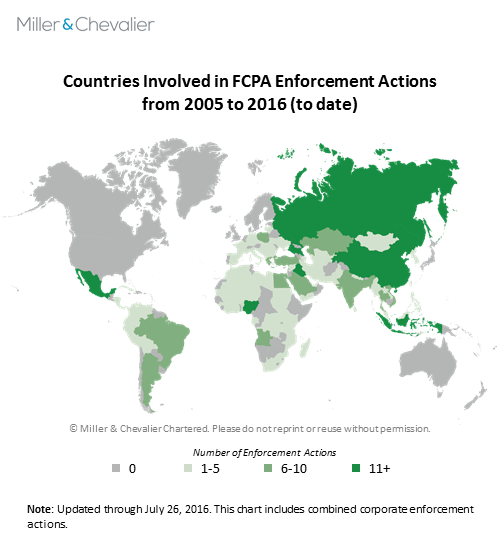

The map below charts the countries involved in FCPA-related enforcement actions since 2005 and serves as a useful visual aid for identifying countries and regions with elevated FCPA risk. The map also demonstrates the broad reach of the FCPA, highlighting how U.S. enforcement authorities have pursued misconduct in virtually every region of the world over the last 12 years.

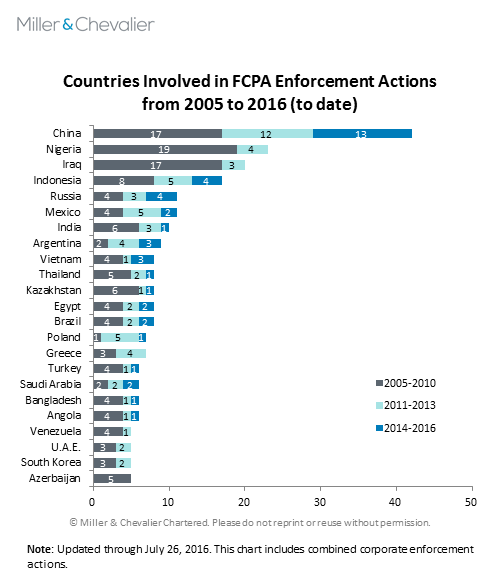

To analyze how the geographic focus of FCPA actions has shifted in recent years, we have separated the country-by-country enforcement statistics into three different time periods. The first of these, from 2005 to 2010, serves as a historical reference, while the next two periods -- 2011 to 2013, and 2014 to present day -- cover approximately three years each and provide a basis for analyzing recent trends.

Historically, Nigeria, Iraq and China were the countries implicated most frequently in FCPA dispositions. In recent years, however, China has eclipsed Nigeria and Iraq, neither of which has been involved in an FCPA enforcement action since 2013. Nigeria's and Iraq's continued placement near the top of the chart is due primarily to a few prominent FCPA investigations during the 2005-2010 time period that centered on misconduct in these countries, including the Panalpina and Bonny Island scandals in Nigeria, and the U.N. Oil-for-Food Program in Iraq. Although fewer enforcement actions could in some cases suggest that the FCPA risk in a given country has subsided, such a trend could also be a sign of political instability, a volatile business climate, or other factors that might reduce the business community's interest in international trade and investment opportunities in the country, as is likely the case with both Iraq and Nigeria.

As FCPA enforcement related to Nigeria and Iraq has slowed, focus has turned to countries in other regions of the world. Following China, the countries most frequently involved in FCPA enforcement actions over the last six years are Indonesia, Russia, Mexico and Argentina, each of which has served as the setting for at least seven or more resolved enforcement actions since 2010. In addition, our internal tracking indicates that the agencies have a slew of investigations involving these same countries in the pipeline.

While the country-level statistics we maintain in many instances are not significant enough to generate localized trends, they nevertheless provide useful data on regional trends. For instance, our analysis makes clear that Latin America continues to be a high-risk area, with Brazil joining Mexico and Argentina near the top of both our resolved enforcement action and ongoing investigation lists since 2014. (Miller & Chevalier's soon-to-be released report on the results of its Latin America Corruption Survey will provide a detailed examination of corruption risks in the region based on a survey of business executives.) Similarly, Southeast Asia (in particular Vietnam and Thailand) and the Middle East / North Africa (primarily Egypt and Saudi Arabia) are regions presenting higher-than-average FCPA risk.

As noted, however, activities in China have continued to draw FCPA scrutiny. To date this year, the agencies have already brought China-related enforcement actions against eight companies, and the 25 companies the agencies have entered into China-related dispositions with since 2010 constitute nearly a quarter of the combined corporate FCPA actions during that time period. Furthermore, this focus on China shows no signs of letting up. To begin the year's third quarter, the SEC announced an FCPA settlement this month with HVAC manufacturer Johnson Controls, Inc. involving alleged misconduct in China, and we are currently tracking approximately 40 China-related FCPA investigations reportedly underway by the SEC and/or DOJ. China's prominence in FCPA actions is likely attributable to a combination of factors, including the increasing importance that China plays in the global economy, the enormous opportunity the country offers to Western multinationals, and the challenges associated with operating in a state-run economy that struggles with systemic corruption issues.

FCPA enforcement actions involving China have targeted a broad range of industries, such as the technology, pharmaceutical, medical device, mining, finance, engineering, automobile, tobacco, retail, manufacturing and gaming sectors. Among these, however, the life sciences industry has been disproportionately affected, with at least eight companies operating in the pharmaceutical, medical device or healthcare space in China entering into dispositions with the DOJ and/or SEC over the last four years. And given that U.S. enforcement officials recently signaled a renewed focus on the pharmaceutical industry, the prospect of additional China-related enforcement actions in this area seems likely.

Inaccurate books and records and inadequate internal accounting controls are the most common FCPA charges brought by the SEC in connection with misconduct in China, which often centers around the misuse of gifts, travel and entertainment or the engagement of questionable third parties. For example, the SEC's administrative action against Sands flagged a range of accounting violations, including improperly recorded payments, payments made without the requisite internal approvals and the improper use of cash and reimbursements. The SEC's recent settlements with Bristol-Myers Squibb and SciClone Pharmaceuticals, Inc. similarly involved a range of accounting irregularities, such as altered invoices and receipts, fake purchase orders and purported backup documentation from meetings that never occurred. Corruption schemes involving fapiao -- official receipts recognized by Chinese tax authorities -- constitute a particular challenge for companies struggling with compliance in China. For instance, employees may seek reimbursement for fapiao that have been fabricated, altered, inflated or illicitly-obtained as a means of generating funds for improper purposes. Companies operating in China need to be familiar with such schemes to ensure that their internal accounting controls are sufficiently comprehensive to prevent and detect such misconduct. Such controls, backed by effective training and periodic compliance-focused audits and assessments, will help reduce the likelihood of such issues.

Beyond the approximately 40 China-related FCPA investigations mentioned above, we are currently tracking more than 20 FCPA-related investigations involving Brazil and 10 involving Russia. Depending on how many of these open investigations result in enforcement actions, Russia and Brazil may soon displace Nigeria and Iraq behind China on our list of countries most frequently involved in FCPA-related enforcement actions.

International Developments

The past quarter saw a number of relevant international developments, including several enforcement actions resolved by foreign authorities, an important decision from the Supreme Court of Canada that deals with World Bank anti-corruption investigations, and continuing fallout from Operation Car Wash in Brazil.

Two of the foreign enforcement resolutions involve the application of U.K. law: both the U.K. Bribery Act of 2010 ("UKBA"), and the Prevention of Corruption Act of 1906, which applies, in part, to acts of foreign official bribery that predate the UKBA's enactment. The first is a civil settlement between the Scottish Crown Office and Braid Group (Holdings) Limited, following the company's self-disclosure of potential unlawful payments to customers in order to win business. This resolution is the third UKBA settlement achieved by the Scottish authorities, who have jurisdiction over UKBA violations relating to Scotland. In the second matter, a jury in London voted to convict Peter Chapman, a former manager of Australian company Securency International Pty Ltd., for bribing a Nigerian official in an effort to secure orders for his employer. Another notable foreign enforcement action, this one outside the United Kingdom, is a settlement between Siemens AG ("Siemens") and Israeli authorities, in which Siemens agreed to pay $43 million to settle allegations that it bribed executives of an Israeli state-owned utility company in exchange for gas turbine orders.

In a development from Canada, the Canadian Supreme Court considered whether defendants in a criminal proceeding could subpoena certain records generated in an investigation by the World Bank Group Integrity Vice Presidency ("INT"), as well as testimony by two of its investigators. The court ruled that INT archives and personnel enjoy certain immunities and privileges under Canadian law that shield them from compelled production and other legal processes in domestic legal proceedings.

In Brazil, the corruption investigation of Petróleo Brasileiro S.A. ("Petrobras") continues to result in charges against, and cooperation by, a number of political and business leaders. In addition, the Brazilian Senate voted in May to impeach President Dilma Rousseff, with the impeachment trial likely to come in the coming months. By law, Rousseff could not continue in office, resulting in Vice President Michel Temer taking over as acting President. At the same time, one of Rousseff's main political foes, the President of the Brazilian Chamber of Deputies Eduardo Cunha, has resigned his post, in large part due to allegations of corruption and money laundering related to the Petrobras investigation.

In more recent developments, on July 18, 2016, the Mexican government adopted significant new anti-corruption legislation, which includes new offenses, new disclosure requirements and broadened sanctions and penalties. We will discuss the new laws and their impact in a separate upcoming Alert.

Actions Against Corporations

Las Vegas Sands Reaches Settlement with the SEC for Accounting Provisions Violations in China and Macau

On April 7, 2016, the SEC announced a settlement with Las Vegas Sands Corp. ("Sands"), a Nevada-based casino and resort operator, following an investigation into the company's operations in China and Macau from 2006 to at least 2011. Pursuant to the Cease-and-Desist Order ("the Order") instituted against Sands, the company agreed to pay a $9 million penalty to the SEC for alleged violations of the books-and-records and internal-accounting-controls provisions of the FCPA. The settlement provides that the company neither admits nor denies the SEC's findings.

The settlement focused on Sands' alleged failure to properly record or authorize payments to a consultant in China in connection with the transfer of more than $62 million for the purchase of a basketball team and a building to be used as a business center, as well as on failures of oversight related to Sands' business ventures in Macau. Sands established three wholly-foreign-owned entities between 2007 and 2008 to explore business opportunities in China. Two of these subsidiaries were involved in activities mentioned in the Order. In Macau, Sands conducts its business through two other subsidiaries. Sands is an issuer of securities on the New York Stock Exchange.

The Consultant

According to the Order, in 2006, Sands engaged a consultant ("Consultant") who claimed to be a former government official to assist Sands with its operations in China, including interfacing with government entities. Because casino gambling is illegal in China and the country restricts what assets gaming companies may own and where they can advertise, Sands allegedly used the Consultant as an intermediary, in part, to conceal its involvement in certain projects. The Order indicates that although the Consultant established at least ten business entities that he used in his dealings with Sands, Sands conducted due diligence only on the consultant himself and three of the entities. Moreover, the Order states that Sands made payments to the Consultant through its two Chinese subsidiaries, which allegedly lacked their own internal accounting policies and procedures. The Order notes that these Chinese subsidiaries merely implemented, on an ad hoc basis, some of the corresponding procedures designed for Sands' Macau subsidiaries.

The Order alleges that, to circumvent a Chinese law prohibiting gaming companies from owning Chinese Basketball Association ("CBA") teams, Sands transferred approximately $6 million to the Consultant in March 2007 for the purchase and sponsorship of a CBA team. The Order notes a series of concerns identified within Sands relating to payments to the Consultant in connection with the basketball team: in late 2007, a Sands Senior Director of Finance who served as a director of finance at one of the company's Chinese subsidiaries notified Sands' CFO that additional payments to the Consultant lacked documentation justifying their need; in response to the CFO's attempt to conduct financial due diligence on the team, the Consultant allegedly refused a request for an on-site review; and as part of the due diligence process, the Consultant presented a handwritten list of the basketball team's expenses, which the Senior Director of Finance deemed "facially unreliable." The Order quotes the Sands CFO as stating that, with respect to transactions with the Consultant relating to the basketball team, "the manner in which this has transpired is not indicative of a sound control environment" from a Sarbanes-Oxley perspective, and an accounting firm engaged by Sands to investigate issues surrounding the matter notified Sands' senior management that the company could not account for more than $700,000 paid to the Consultant. However, according to the SEC, the President of Sands continued to approve transfers of funds to the Consultant during this time, and Sands proceeded to send an additional $5 million to the Consultant despite the issues that had been identified.

In addition, according to the Order, starting in 2006 Sands also used the Consultant in an effort to purchase a building in Beijing from a Chinese state-owned-entity to establish a business center. The Order states that after initially envisioning a joint venture with the state-owned-entity that owned the building, Sands ultimately transferred $43 million to one of the Consultant's business entities to acquire the building, despite lacking analysis as to whether "a need existed for such a business center, the amount of any profit or loss it was likely to generate, or whether it would do anything to improve [the company's] image in China." The Order further notes that Sands spent an additional $14 million for expenses related to the building, despite the absence of required internal approvals for most of that amount.

According to the Order, Sands employees learned that the basement of the building was not included in the purchase. The Order details that the CFO approved a payment to the Consultant of approximately $3.6 million -- an amount in excess of the CFO's approval authority -- as pre-payment for a lease of the basement from the Consultant, all without documentation that the Consultant had obtained the title to the basement or could lawfully lease it. Sands also allegedly paid approximately $1.4 million to another entity associated with the consultant and recorded the expense as "arts and crafts," even though those funds were not used to purchase any artwork and despite indications that the purpose of the payment was a different development project. The Order states that Sands also transferred approximately $900,000 in "property management fees" for the building to one of the Consultant's businesses, even though an independent property management company managed the building and the Consultant's business did not provide any management services. Ultimately, Sands abandoned the development of the business center less than three years later, with the Order suggesting that Sands lost approximately $17 million on this project.

Macau Operations

In addition to Sands' operations in China, the Order highlights several issues with the company's operations in Macau, which, as a special administrative region within China, allows gambling, unlike the rest of the country. To transport customers to its casinos in Macau from China and Hong Kong, Sands contracted with a ferry service partially owned by a Chinese state-owned ferry company. The SEC identified several issues with Sands' Macau operations. First, the Order states that Sands failed to follow its own policies and performed due diligence on neither the shipping company that partially owned the ferry service nor the shipping company's principals. Second, according to the Order, the internal audit department of a Sands subsidiary in Macau determined that the ferry company spent most of its "Business Entertainment" budget on government officials, including meals and cash gifts. Despite allegedly being informed by the ferry company's employees that these expenditures were "necessary" to "secure routes for the ferries," the Order states that the subsidiary's audit department did not escalate this issue.

The Order also identified multiple instances of the Macau subsidiaries' employees circumventing the financial policies and procedures in place by using cash advances and reimbursements to make purchases in the tens of thousands of dollars. The SEC noted one instance of a Sands executive receiving a reimbursement of more than $85,000 from a Sands Macau subsidiary for a personal expense report from an event in Beijing. In another instance noted in the Order, an outside counsel submitted and was reimbursed for a $25,000 bill for "Expenses in Beijing" without any supporting documentation. In addition, casino and hotel employees of the Macau subsidiary also allegedly failed to record the recipients of complimentary items and services, including government officials and politically exposed persons ("PEPs").

Charges, Cooperation and Remediation

The Order states that the Company failed to "devise and maintain a reasonable system of internal accounting controls over operations in Macao and China to ensure that access to assets was permitted and that transactions were executed in accordance with management's authorization." Further, Sands did not ensure "that transactions were recorded as necessary to maintain accountability for assets, particularly with regard to the accounts payable process, the purchasing process, due diligence, and controls surrounding contracts." The SEC concluded that Sands' repeated failure to properly document the purpose of its payments in China and Macau, detailed above, violated the books-and-records provisions of the FCPA. The SEC further determined that the lapses in Sands' approval, purchasing, and oversight procedures for its activities in China and Macau violated the internal-accounting-controls provisions of the FCPA.

The SEC noted that upon initiation of the Commission's investigation, Sands conducted its own internal investigation with the assistance of outside counsel and cooperated with the SEC's inquiry. Sands also made personnel changes, formed a Board of Directors Compliance Committee, and reformed various internal policies and codes of conduct. In a press release, Sands noted that compliance was now a separate, "free standing" function. In addition to the $9 million penalty, the Order requires Sands to retain an independent consultant to review and evaluate the company's FCPA controls for a period of two years. Sands' press release refers to the company's earlier statements that the investigation stemmed from claims included in the wrongful termination suit filed by Sands' former interim President of Macau Operations Steven Jacobs in late 2010. Sands has reportedly agreed to pay Jacobs more than $75 million under a settlement reached in June 2016.

Noteworthy Aspects

Based on publicly available documents, the following aspects merit note.

- Allegations of Bribery and Possibility of DOJ Action. Although the Order contains numerous references to possible instances of bribery, the SEC included no any anti-bribery charges against the company, and the Commission's press release makes no mention of bribery. The Company's press release highlights this fact, stating that "[t]he SEC made no finding of corrupt intent or bribery by Las Vegas Sands." The Order does, however, refer to concerns among Sands employees that the Consultant had paid a CBA official from funds intended for the team's purchase and may make "improper payments to government officials" related to the purchase of the Beijing building's basement. The Order also refers to transactions involving state-owned entities that Sands entered into in part because such transactions would be "politically advantageous" for the company or would improve its chances of receiving required government approvals.

In its 10-K filing announcing the SEC investigation in March 2011, Sands stated that the DOJ had also commenced an investigation. To date, neither the DOJ nor Sands has issued an official statement about the status of the DOJ investigation, although Sands noted in its 10-Q filing at the end of May 2016 that it "continues to respond to all remaining government inquiries." As with many FCPA cases, challenges in establishing jurisdiction could be factoring into any DOJ decision on whether to bring criminal bribery charges against the company.

- Actions by Other Enforcement Agencies. On May 19, 2016, the Nevada Gaming Control Board filed a $2 million settlement order against Sands in connection with its alleged "failure to exercise discretion and sound judgment to prevent incidents which might reflect on the repute of the State of Nevada and act as a detriment to the development of the industry." Under Nevada Gaming Commission Regulations, the Board may discipline any licensee that it determines has engaged in activity "that is inimical to the public health, safety, morals, good order and general welfare of the people of the State of Nevada, or that would reflect or tend to reflect discredit upon the State of Nevada or the gaming industry." The charges related to the SEC settlement described above and a prior 2013 NPA between the DOJ and Sands, in which Sands paid more than $47 million for failing to report suspicious financial activity by a gambler in its Las Vegas casino.

- No Disgorgement. Although the SEC has in prior settlements required disgorgement even though the only charges settled were alleged violations of the FCPA's accounting provisions, no disgorgement was ordered here. Because of the cause-and-effect requirement for disgorgement, there is a question whether disgorgement can lawfully be required in the case of an accounting violation which, unlike a bribe, typically does not cause the company to realize illicit profits. In this case, the SEC did not even allege that bribes had, in fact, been paid to officials. Alternatively, disgorgement may not have been sought because the transactions related to the accounting violations were not profitable. Indeed, various statements in the Order suggest that Sands suffered significant losses from its questionable transactions in China and Macau.

- Emphasis on Senior Leadership. Throughout the Order, the SEC highlighted the role of Sands' then-President and Chief Operating Officer in spearheading many of the business initiatives, and his personal approval of several of the transactions involving the Consultant despite concerns raised by others within the company. The Order alleges that the President authorized the use of the Consultant to purchase the business center building, a transaction the SEC suggested was intended to facilitate the development of a non-gaming resort on Hengqin Island sought by the President. The SEC also indicated that the President had put "pressure" on Sands employees to purchase the partially state-owned ferry company apparently to gain political favor. Additionally, the Order notes that the President played a part in the termination of the company's Senior Director of Finance, who had raised concerns about the Consultant's expense documentation, and that the President approved subsequent payments to the Consultant despite other concerns raised both internally and by an external auditor. Despite these statements, the SEC did not allege FCPA violations by the President, and the DOJ has yet to bring any charges. The SEC did note that the President is no longer employed by Sands.

Akamai and Nortek Enter into NPAs with the SEC and Receive Declinations from DOJ in Connection with Improper Payments by Chinese Subsidiaries

On June 7, 2016, the SEC announced that it had entered into NPAs with two unrelated U.S. companies, Akamai Technologies ("Akamai") and Nortek Inc. ("Nortek"), in connection with alleged violations of the FCPA's accounting provisions involving each company's Chinese subsidiaries. At the same time, the DOJ informed both companies of the Department's decision to close its investigations into possible FCPA violations by the companies' Chinese subsidiaries without prosecution.

Akamai is an international internet-services provider based in Cambridge, Massachusetts, and Nortek is a Rhode-Island-based company that manufactures and sells various residential and commercial business products. Both companies' shares trade on NASDAQ, making the companies "issuers" for the purposes of the FCPA. Under the NPAs, both Akamai and Nortek will disgorge all profits derived from alleged misconduct by their foreign subsidiaries in China, and, in exchange, the SEC will not bring any FCPA enforcement actions or proceedings against the companies or impose additional penalties.

Before its NPAs with Akamai and Nortek, the SEC had entered into only one FCPA-related NPA -- an April 2013 settlement with Ralph Lauren Corp. ("Ralph Lauren"). The significance of the agencies' parallel NPAs and declinations here is undercut, however, by the aggressive conditions imposed by the SEC in the NPAs and the absence of facts in either the DOJ's declination letters or SEC documents that would suggest that there was DOJ jurisdiction or a criminal violation of the FCPA.

Akamai's Alleged Violations of FCPA Accounting Provisions

Akamai conducts business in China through its wholly-owned subsidiary, Akamai Technologies, Co. Ltd. ("Akamai-China"), which is located in Beijing and was the focus of the SEC investigation. Pursuant to Chinese regulations, Akamai-China operates through third parties by contracting with local Chinese channel partners to deliver its services to end users. According to the NPA, between 2013 and 2015, the Regional Sales Manager of Akamai-China "schemed with an Akamai-China channel partner . . . to bribe employees of three end customers, two of which were Chinese state owned entities, to obtain and retain business." The NPA states that the Regional Sales Manager paid these customers' employees to induce them to "purchase up to 100 times more network capacity from the Channel Partner than each company actually needed." The Regional Sales Manager allegedly paid $155,500 in total, including $38,500 directly to employees who were Chinese government officials. The NPA notes that Akamai-China employees also routinely violated the company's written policies by providing their end customer employees, including government officials, with gifts and entertainment cumulatively worth about $32,000.

The NPA highlights Akamai's inadequate internal accounting controls and inaccurate books and records relating to the improper payments. According to the NPA, the company did not conduct formal due diligence of its China-based channel partners, failed to translate anti-bribery and anti-corruption policies into Mandarin, and did not conduct adequate FCPA training for employees, among other deficiencies, allowing the alleged bribery scheme to go undetected. The NPA also notes that Akamai-China improperly recorded the improper gifts and payments as legitimate business expenses in its books and records, which were subsequently consolidated into Akamai's books and records.

Nortek's Alleged Accounting Provisions Violations

Like Akamai, Nortek conducts its business in China through an indirect wholly-owned subsidiary, Linear Electronics Co. Ltd. ("Linear-China"), located in Shenzhen. According to the NPA, Linear-China's managing director and other employees "made or approved improper payments and gifts to local Chinese officials in order to receive preferential treatment, relaxed regulatory oversight, and/or reduced customs, duties, taxes, and fees" from 2009 to 2014. The NPA states that Chinese officials from various government agencies, including customs, tax, police and telecommunications, received bribes in forms of cash, gift cards, travel, entertainment and accommodations. In total, Linear-China allegedly made more than 400 payments totaling $290,000. As with the case of Akamai-China, Linear-China's bribes were inaccurately recorded and consolidated into Nortek's books and records. Similarly to the Akamai NPA, the Nortek NPA notes that Nortek also possibly violated the FCPA's accounting provisions by failing to devise and maintain a system of internal accounting controls that would ensure that transactions were executed properly and by failing to notice obvious red flags in Linear-China's financial records.

Remedial Measures, Self-Reporting and Disgorgement

According to the NPAs, upon learning of the bribes, both companies "took immediate action to end illicit payments and implemented significant remedial measures." Among the cited measures were termination of the employees involved in the illicit conduct, strengthening of the companies' anti-corruption policies and mandatory FCPA training for employees with a focus on bolstering internal audit procedures. In addition, Nortek and Akamai cooperated with the SEC by providing timely updates with new information to Commission staff, identifying and presenting relevant documents, voluntarily making witnesses available for interviews and voluntarily translating documents into English. The NPAs also state that both companies conducted internal investigations and promptly self-reported the misconduct upon confirming the improper payments.

Under the NPAs, Akamai will pay a disgorgement of $652,452 plus $19,433 in interest, while Nortek will pay a disgorgement of $291,403 plus interest of $30,655. Neither Akamai nor Nortek will be charged with FCPA violations, and neither company will face prosecution by, or additional monetary penalties from, the SEC.

Noteworthy Aspects

- DOJ Declinations: Almost simultaneously with the SEC's announcement, the DOJ circulated letters informing Akamai and Nortek of the Department's decision to close its respective inquiries into possible FCPA violations involving the companies' Chinese subsidiaries. The letters explain that the Department decided to close its inquiries -- despite identifying acts of bribery by Chinese subsidiaries -- because of each company's involvement in the Department's FCPA pilot program (previously discussed in our FCPA Spring Review 2016). Consistent with the pilot program's terms, the DOJ declined enforcement based on a number of factors, including the companies' prompt voluntary self-disclosure, cooperation and remedial measures. The DOJ's release of the declination letters is significant because the Department has ordinarily rejected calls to publicly identify companies it has declined to prosecute under the FCPA. The decision to release the letters may be an attempt by the Department to bolster the pilot program and motivate companies to voluntarily self-disclose potential FCPA violations by highlighting the benefits of participating in the new initiative.

- DOJ Declinations, But Possibly No DOJ Jurisdiction or Criminal Violations? In order to be criminally liable for violating the FCPA's anti-bribery provisions, an issuer must engage in improper conduct -- the issuer is not automatically liable simply because its subsidiary acted unlawfully. Similarly, issuers are criminally liable for violating FCPA books-and-records or internal-controls provisions if they knowingly fail to comply with these accounting provisions. In both cases here, neither the NPAs nor the DOJ declination letters present facts suggesting that anyone within Nortek or Akamai authorized, knew of or participated in unlawful conduct of their subsidiaries. Without parent company involvement or some action by the foreign subsidiary that would create jurisdiction under FCPA section 78dd-3 (i.e., an act in furtherance of a bribe in U.S. territory), DOJ would have no anti-bribery jurisdiction. On the accounting-provisions side, the NPAs' statements of facts specifically note that the subsidiaries concealed the illicit payments from the parent companies by improperly recording them as legitimate expenditures. Thus, it is not clear what, if any, FCPA violations the DOJ declined to prosecute and whether, based on the facts, the DOJ had grounds to bring criminal charges against Akamai and Nortek in the first place.

- SEC's Aggressive "Internal Controls" Jurisdiction: A parent company that is an issuer under the FCPA must ensure that its majority-owned subsidiaries maintain a system of internal accounting controls. If the subsidiary fails in this regard, the parent company is strictly liable, meaning that the SEC may prosecute the company for the wrongdoing. With respect to Akamai and Nortek, it is not clear that most of the violations listed by the SEC in the NPAs were internal-accounting-controls violations. The NPAs do note some accounting controls weaknesses, such as failure to review or test the subsidiaries' accounts and failure to proactively exercise audit rights. But the NPAs also allege that Akamai and Nortek did not provide adequate employee training, lacked formalized due diligence, and did not translate anti-bribery and anti-corruption policies into Mandarin, among other shortcomings. These deficiencies are failings of a compliance program, rather than inadequate internal accounting controls. In recent years, the SEC has expanded its definition of "internal controls" and has asserted broader jurisdiction for itself by labeling inadequate compliance programs as accounting violations. This aggressive interpretation demonstrates the continuing risk that the SEC will allege violations of "internal accounting controls" on the basis of perceived compliance program deficiencies, even though the FCPA imposes no compliance requirements.

- Non-Prosecution Agreements: Prior to its settlements with Nortek and Akamai, the SEC had only entered into one FCPA-related NPA -- with Ralph Lauren, as covered in our FCPA Summer Review 2013. NPAs are a relatively new tool for the SEC. In 2010, the SEC adopted its Cooperation Initiative, an effort to encourage greater cooperation from companies and individuals. As part of this initiative, the SEC stated that it would begin to use the pre-trial resolutions (previously employed only by the DOJ) of cooperation agreements, DPAs and NPAs, along with standard administrative orders and consent judgments, to resolve enforcement matters. The Director of the SEC Enforcement Division, Andrew Ceresney, explained that these new tools might be used "where an entity or person has engaged in misconduct and where the cooperation is extraordinary, but the circumstances call for a measure of accountability."

In the case of Ralph Lauren, one of the company's subsidiaries allegedly paid bribes to local customs officials through a customs broker to evade inspections and obtain clearance for certain items. The SEC entered into an NPA with the company, requiring Ralph Lauren to pay $735,000 in disgorgement and interest, but did not charge a penalty. In the NPA, the SEC praised Ralph Lauren's immediate self-reporting (the company reported within two weeks of discovering misconduct), internal investigation, extensive cooperation, enhanced due diligence procedures and enhanced training. The Chief of the SEC's FCPA Unit noted that the company's "level of self-policing along with its self-reporting and cooperation led to" the NPA.

In the cases of Akamai and Nortek, the SEC similarly praised the companies' prompt self-reporting, "significant" remedial measures and "comprehensive, organized, and real-time cooperation." It is evident that the Commission saw the extensive remedial measures undertaken by each company as outweighing the fairly egregious violations in both cases (e.g., Linear-China's "systemic" improper payments, resulting in more than 400 bribes). Perhaps, like the DOJ and its pilot program, the SEC intended for these cases to help spur greater cooperation under its own Cooperation Initiative. It remains to be seen whether NPAs will represent a new trend for SEC resolutions to come.

- Expansive "Cooperation" Requirements: In exchange for not bringing any charges or mandating a penalty, the SEC imposed far-reaching obligations on Akamai and Nortek. Both companies agreed to cooperate fully in the SEC's investigations and any other related enforcement proceedings to which the SEC is a party. Of course, Akamai and Nortek also agreed to disgorge all ill-gained profits with interest. In addition, however, the companies "agree[d] to cooperate fully and truthfully, when directed by the Division's staff, in an official investigation or proceeding by any federal, state, or self-regulatory organization," including entering into tolling agreements during the period of cooperation, thereby extending the statutes of limitations. Under the sweeping language of the NPAs, the companies essentially must cooperate with any investigation at any time, if directed so by the SEC. Companies entering into settlements with the SEC should be mindful of such provisions and consider whether the benefits outweigh the costs.

- Risk Posed by China: Both Akamai and Nortek actions involved misconduct by their respective subsidiaries in China, bringing this year's count of companies settling China-related FCPA enforcement actions with the DOJ and SEC to eight -- more than half of the thirteen companies entering into dispositions so far this year. China has long been the country most-frequently implicated in FCPA enforcement actions -- a trend, as discussed above, showing no signs of letting up. These Akamai and Nortek settlements highlight the importance of an effective compliance program for companies operating in China, including formalized thorough due diligence of third parties, translating anti-corruption policies into the employees' language and ensuring employees receive FCPA training.

- Improper Gifts, Travel and Entertainment, Again: Both of these cases involve gifts, travel and entertainment ("GTE") provided to Chinese officials, making Akamai and Nortek the latest in a long line of China-related actions involving GTE and showcasing the significant risk such expenses in China can pose. The FCPA does not contain a minimum threshold for what amount would violate the statute, while the FCPA Resource Guide notes that "a small gift or token of esteem or gratitude is often an appropriate way for business people to display respect for each other," with the operative question being whether the expenditure is "reasonable." A company may not, however, provide GTE in an effort to improperly influence a government official, and the larger the value of the GTE, the more likely the enforcement agencies would consider it a bribe. Because FCPA liability stemming from improper GTE is often tied to internal accounting failures, companies should ensure that they have an effective GTE policy that imposes monetary limits and requires the pre-approval of payments, expense tracking and a periodic examination of the company's books and records. Notably, the risks associated with this area are driving some companies, particularly those in the healthcare space, to abandon GTE for officials altogether.

- Internet Services and Technology Enterprises: Akamai, an internet service provider, is the latest of several computer and technology companies involved in recent FCPA actions. (See, for example, our coverage of the SAP SE, PTC, Inc. and Hewlett-Packard settlements). Internet service providers and technology companies face broader FCPA risks because state-owned entities are frequently some of the largest users of these products and services and may thus pose very lucrative client opportunities. In addition, the laws of some countries, such as China, require technology companies to work through local third parties, presenting additional risks. The misconduct outlined in the Akamai NPA, as well as the facts of other recent FCPA settlements with technology companies, highlight the particular importance for such companies of being careful with their sub-contractor and consultant relationships and adequately vetting third parties.

BK Medical ApS, Its CFO Lars Frost and U.S. Parent Company Analogic Corp. Settle with SEC and DOJ over Distributor-Related Scheme

On June 21, 2016, the SEC and DOJ announced that Massachusetts-based medical device manufacturer Analogic Corp. ("Analogic"), its wholly-owned Danish subsidiary BK Medical ApS ("BK Medical"), and former BK Medical CFO Lars Frost agreed to parallel settlements in connection with violations of the books-and-records and accounting-controls provisions of the FCPA. Under the SEC's Cease-and-Desist Order (the "Order"), Analogic agreed to pay disgorgement of $7,672,651 and $3,810,311 in prejudgment interest, and Frost agreed to pay a monetary penalty of $20,000. In a parallel action, the DOJ entered into a three-year NPA with BK Medical, with the company admitting to the knowing and willful falsification of Analogic's books, records and accounts. BK Medical agreed to pay a penalty of $3,402,000.

According to the Order and the NPA, from at least 2001 until 2011, BK Medical made more than 250 payments to third parties through illicit arrangements with its distributors. At least 180 of these payments involved BK Medical acting as a "conduit" for the transfer of funds to third parties at the direction of its principal Russian distributor. Under the scheme, BK Medical and its Russian distributor would reach an agreement on the purchase of products. The distributor would then request that BK Medical provide it a second, fake, invoice with an inflated price, and would send BK Medical a template for such an invoice. BK Medical personnel would paste BK Medical's logo onto the invoice template and send it to the distributor with the equipment. On some occasions, the distributor also sent BK Medical a contract corresponding to the inflated invoice. The distributor would then pay BK Medical the inflated price, but BK Medical would record only the actual price in its accounts and transfer the excess payment to its account for the distributor. The disposition papers also state that the distributor later directed BK Medical to transfer certain amounts to third parties, otherwise unknown to BK Medical, which BK Medical did. These payments required two approvals and were not made through BK's accounts payable system, in contravention of BK Medical's internal accounting controls. Twice during the 10-year period, BK Medical made payments to unknown third parties before receiving funds from the distributor. The third parties to whom BK Medical made transfers included individuals in Russia and shell companies in Belize, the British Virgin Islands, Cyprus and the Seychelles.

According to the Order and the NPA, during the same time period, BK Medical participated in similar, though smaller value, arrangements with distributors in Ghana, Israel, Kazakhstan, Ukraine and Vietnam. In total, BK Medical channeled almost $20 million in improper payments to unknown third parties at the direction of various distributors.

Lars Frost, a Danish citizen and resident, who worked in BK Medical's finance department and was the company's CFO between 2008 and 2011, approved about 150 of the 180 payments, including 10 as CFO.

Upon discovering the improper distributor-payment scheme in 2011, Analogic halted the transactions, conducted an internal investigation and self-reported its findings, including an accounting of all of the suspicious payments. Analogic and BK Medical also engaged in extensive remediation, including terminating several distributor relationships, terminating and disciplining a number of officers and employees, implementing a new program for distributor due diligence, hiring a corporate compliance officer, improving internal accounting controls and enhancing both companies' FCPA training programs.

Noteworthy Aspects

- First Corporate Enforcement Agreement under the DOJ's FCPA Pilot Program: BK Medical's NPA is the DOJ's first corporate enforcement agreement since the Department unveiled its pilot program focused on promoting voluntary self-disclosures. This settlement follows declinations that the DOJ provided to Akamai and Nortek on June 7, 2016, described in detail above.

- "Cooperation" Under FCPA Pilot Program: Under the new FCPA pilot program, the DOJ can offer a company a reduction of up to 50 percent of the Sentencing Guidelines for the fine amount. Here, the DOJ granted Analogic a "discount" of 30 percent. Although Analogic self-disclosed its violations, provided all known facts to the DOJ by the conclusion of the investigation, and engaged in extensive remedial measures, the DOJ determined that Analogic did not initially disclose all relevant information known to the company regarding the end-users of its products and certain statements given by employees during the course of its internal investigation. The pilot program guidelines and BK Medical's NPA do not disclose how much credit the DOJ provided for the company's self-disclosure and remediation versus its cooperation, but it is possible that receiving only partial credit for cooperation might have cost Analogic an additional 20 percent reduction of the Guidelines penalty amount.

- Cooperation with Foreign Governments: In what may be an extra emphasis on individual prosecutions in the wake of the Yates Memorandum (for more details, see our coverage here and here), BK Medical's NPA included a specific commitment by the company to "cooperate with foreign authorities that are prosecuting individuals involved in this matter." It remains to be seen whether additional prosecutions will result.

- High-Level Accounting Failures: As noted, BK Medical's former CFO personally authorized approximately 150 conduit payments to unknown third parties despite knowing that the payments violated BK Medical's internal accounting controls. In addition, despite his responsibility to complete quarterly checklists designed to identify unusual transactions, Frost submitted numerous false quarterly sub-certifications to Analogic and knew of and failed to disclose the fake contracts requested by BK medical's distributors. Other unnamed employees were also involved in parts of the scheme, including the authorization of wire transfers and the creation of fake invoices. The seniority the CFO in the company and the evident participation of multiple employees appears to have led the DOJ to characterize the books-and-records violations here as criminal.

- Payments to Unknown Third Parties as Internal-Accounting-Controls Violations: The settlement papers describe the third parties to whom BK Medical transferred funds as "unknown." According to the SEC and DOJ, BK Medical did not know or have business relationships with the third parties to whom it was making payments, though the NPA suggests that some of the money went to employees at state-run hospitals. According to the SEC, regardless of whether or not some monies went to officials, Analogic's lack of knowledge regarding the payments' recipients constituted a violation of the FCPA's accounting provisions.

Actions Against Individuals

Consulting Company Owner Pleads Guilty to FCPA Charges for Bribing Employee of European Bank for Reconstruction and Development

On April 20, 2016, Dmitrij Harder, the former owner and President of the Pennsylvania-based Chestnut Consulting Group, Co. and Chestnut Consulting Group, Inc., pled guilty in the U.S. District Court for the Eastern District of Pennsylvania to two counts of violating the anti-bribery provisions of the FCPA. This plea is the latest in a series of developments following Harder's indictment by a federal grand jury on January 6, 2015, for his alleged role in bribing an official of the European Bank for Reconstruction and Development ("EBRD"). The EBRD is an international development bank, sponsored by more than 60 nations, whose mission is to provide financing for development projects in emerging economies.

As set forth in the indictment and described in our FCPA Spring Review 2015, the charges against Harder included five counts of violating the anti-bribery provisions of the FCPA, five counts of violating the Travel Act, two counts of money laundering and related conspiracy charges. Commercial bribery in violation of a Pennsylvania statute served as the predicate crime for the Travel Act violations, with the conduct premised on the same facts as the FCPA charges. Harder initially pled not guilty and was released on bail. During the proceedings, the court ordered four continuances of the trial date in view of the complexity of the case and the significant volume of evidence involved. After Harder's change of plea, the court revoked his bail, adjudging Harder a potential flight risk. According to the indictment, Harder, while a permanent resident alien of the United States, is a Russian national and a naturalized German citizen.

Harder's plea documents were filed under seal. The DOJ's announcement of the plea states that Harder admitted to participating in a scheme to pay more than $3.5 million in bribes to Andrey Ryjenko, an EBRD official, between 2007 and 2009. According to the DOJ, Harder bribed Ryjenko in exchange for Ryjenko's approval of EBRD financing for Chestnut Group clients and for directing business to the Chestnut Group. The indictment discloses that Harder paid Ryjenko via payments made to Ryjenko's sister, Tatjana Sanderson, for "consulting" and "other services" to the Chestnut Group, even though that she provided no such services. The EBRD subsequently approved two applications for financing for two Chestnut Group clients, resulting in an $85 million investment and a €90 million loan for one, and a $40 million investment and a $60 million loan for the other. According to the DOJ, Harder admitted that the Chestnut Group earned approximately $8 million dollars in success fees as a result of the EBRD's approval of these two applications.

As noted in our FCPA Spring Review 2015, the government asserted that Ryjenko was a "foreign official" under the FCPA because he worked for a "public international organization." Recognizing that the vast majority of FCPA actions involve "foreign officials" who are employees or officers of a foreign government or state-owned or -controlled entities, Harder filed a motion to dismiss, challenging the government's position that the FCPA's jurisdiction reaches public international organizations such as the EBRD. The court denied Harder's motion. Referring to the language of the statute, the court stated: "Plainly, the FCPA thus proscribes unlawful conduct in connection with a public international organization -- itself an association of foreign governments." Moreover, as noted in our FCPA Spring Review 2015, an executive order designated the EBRD a "public international organization" under 22 U.S.C. § 288 in 1991, the year of the bank's formation. The court thus held that Ryjenko -- at the time a senior banker in the EBRD's Natural Resources Group and an operations leader responsible for reviewing project-financing applications to the EBRD -- qualifies as a "foreign official" as an employee of a "public international organization."

Harder's sentencing is scheduled for November 3, 2016. According to the DOJ, the U.K. Crown Prosecution Service has charged Ryjenko and Sanderson with accepting bribes and money laundering, and the prosecution against them is ongoing.

Energy Executive Pleads Guilty to Conspiracy to Violate the FCPA in Connection with Venezuelan Energy Contracts

Another defendant has pled guilty in the DOJ's ongoing investigation into energy contracts with Venezuelan state-owned energy company Petroleos de Venezuela S.A. ("PDVSA"), which we previously covered in our FCPA Spring Review 2016. On June 16, 2016, the DOJ and U.S. Immigration and Customs Enforcement ("ICE") both announced that Roberto Enrique Rincon Fernandez ("Rincon"), a Venezuelan national and resident of Texas, pled guilty to violating the anti-bribery provisions of the FCPA, a related conspiracy count, and making a false statement on his income tax return. Rincon had initially pled not guilty after being arrested in December 2015.

As described in our FCPA Spring Review 2016, Rincon and his co-conspirators owned multiple U.S.-based energy companies that sought to obtain contracts from PDVSA for the provision of equipment and services to the state-owned company. The information charging Rincon alleges that he and his co-conspirators orchestrated a scheme to secure these contracts by providing payments and other things of value to PDVSA officials. To this end, between 2010 and 2013, Rincon's companies allegedly made wire transfers totaling more than $1.3 million to bank accounts in Panama, Texas and other jurisdictions belonging to the officials and their associates, in addition to covering some of their hotel stays, meals and entertainment. According to the DOJ and ICE announcements, Rincon admitted that the purpose of the payments was to ensure the inclusion of his companies on PDVSA bidding panels and approved vendor lists, and to receive payment priority ahead of other PDVSA vendors.

Rincon is the sixth person to plead guilty in this investigation. Like his co-defendants, Rincon agreed to forfeit the proceeds from his criminal activity. His sentencing is scheduled for September 30, 2016, before U.S. District Judge Gray H. Miller in the Southern District of Texas.

Ongoing Developments

DOJ Asserts that Biomet Breached DPA Based on Conduct in Latin America and Compliance Program Flaws

In a status report filed in the U.S. District Court for the District of Columbia on June 6, 2016, the DOJ disclosed that Indiana-based Biomet Inc. ("Biomet") had breached its March 26, 2012 DPA. As described in our FCPA Spring Review 2012, Biomet entered into the three-year DPA with the DOJ as part of the company's parallel settlements with the SEC and DOJ to resolve allegations that it had bribed healthcare professionals in several countries. The DPA required Biomet, in part, to implement a rigorous FCPA compliance and ethics program and to retain an independent compliance monitor. In March 2015, the DOJ extended the DPA and the independent monitor's term for one year, as the government continued to investigate potential FCPA violations in Brazil and Mexico that the company self-disclosed in April 2014. In a Form 8K, filed with the SEC on March 25, 2016, Biomet stated that although the DPA was "set to expire" the following day, the "DOJ, the SEC and Biomet have agreed to continue to evaluate and discuss these matters during the second quarter of 2016 and, therefore, the matter is ongoing and will not conclude in its entirety on March 26, 2016." Biomet further noted that the "DOJ has informed Biomet that it retains its rights under the DPA to bring further action against Biomet relating to the conduct in Brazil and Mexico disclosed [by the company] in 2014 or the violations set forth in the DPA."

According to the DOJ's recent filing, the Department determined that Biomet breached the DPA based on the "conduct in Brazil and Mexico" and the company's "failure to implement and maintain a compliance program as required by the DPA." The DOJ's status report provides no additional detail regarding how the company's conduct in Brazil and Mexico or its compliance practices may have breached the DPA. Particularly notable, under the circumstances, is the DOJ's decision to refrain from immediately reopening the deferred charges against Biomet, which would have exposed the company to additional liability, and instead engage in continued discussions with Biomet to resolve this matter in a matter that "would obviate the need for a trial."

With the DPA's March expiration date having passed, the agreement's current status is unclear. The DOJ's June 6 filing acknowledges the DPA's four-year term (including the one-year extension), but does not address its status or its possible expiration. Biomet's statements in its SEC disclosure and the DOJ's apparent position are, nevertheless, consistent with the current status of the deferred criminal action against Biomet in the DC District Court, which remains open, with the Information yet to be dismissed and with the court ordering the DOJ to file an updated status report by September 9, 2016. Notably, the terms of the DPA allow the present scenario, with prosecution in case of a breach of the DPA permissible even after "the expiration of the [original three-year] Term plus one year."

Civil Litigation

Eleventh Circuit Restricts SEC's Ability to Impose Disgorgement by Applying Five-Year Statute of Limitations

As described in our Alert, on May 26, 2016, the U.S. Court of Appeals for the Eleventh Circuit held in S.E.C. v. Graham that the five-year statute of limitations in 28 U.S.C. § 2462 -- the U.S. Code's general statute of limitations -- applies to the SEC's claims for disgorgement or declaratory relief. Although Graham is not binding outside of the Eleventh Circuit, it represents a significant challenge to the SEC's stated position that disgorgement is not subject to § 2462 because it is an equitable remedy. Graham is a body blow to the SEC's current view of its enforcement powers, particularly if its reasoning is adopted by other circuit courts or if the U.S. Supreme Court affirms the decision.

Graham is particularly notable because of the importance the SEC places on disgorgement in enforcement proceedings. Disgorgement, which is provided for under the Securities and Exchange Act of 1934 ("Exchange Act"), is a tool the SEC frequently relies on in civil dispositions, including those involving alleged violations of the FCPA, to oblige alleged wrongdoers to disgorge their ill-gotten gains. The SEC first ordered disgorgement as part of an FCPA resolution in 2004, and it has since become the primary driver of the SEC's record-setting monetary impositions under the FCPA over the last 10 years. In the last three years alone, the SEC has extracted more than $940 million from companies as part of FCPA-related civil enforcement actions, of which approximately $829 million has been disgorgement, $59 million has been civil fines and $53 million has been prejudgment interest. This imbalance is attributable, at least in part, to the SEC's current view, rejected in Graham, that no statute of limitations prevents the Commission from seeking injunctions, declaratory judgments or the disgorgement of ill-gotten gains, regardless of when the conduct occurred, because these remedies are equitable in nature and therefore not subject to § 2462.

In the short term, Graham will likely put pressure on the SEC to take measures to resolve enforcement actions more quickly. Such an effort by the Commission could mirror recent attempts by the DOJ to accelerate the pace of its own FCPA enforcement. This push by the DOJ has included working with the FBI to create three squads devoted to the prosecution of FCPA and money laundering violations, increasing the number of DOJ attorneys devoted to FCPA cases by 50 percent and enacting the FCPA pilot program to encourage companies to voluntarily self-disclose FCPA issues (discussed in our FCPA Spring Review 2016).

Additionally, individuals and entities currently involved in SEC enforcement proceedings, particularly administrative proceedings or in judicial circuits that have not considered this issue, are quite likely to vigorously challenge any continued efforts by the Commission to pursue disgorgement if the statute of limitations has run.

Graham may also discourage defendants from signing tolling agreements to extend or entirely waive the statute of limitations. Given the importance the SEC places on cooperation as a factor in settlement negotiations, however, it is likely that companies and some individuals will continue to sign such agreements, but this decision should increase the leverage of these entities and individuals, who may now be more aggressive in pushing the SEC to narrowly define the scope of their tolling agreements.

Because of the decision's potentially significant impact on SEC enforcement strategies, the Commission is likely to seek review by the Supreme Court. Though it is always difficult to predict which cases the Supreme Court will agree to hear, the Court may be willing to hear this case.

Louis Berger Parent Company Sues Two Former Executives in Connection with their Guilty Pleas to FCPA Violations; Both are Sentenced within Weeks of the Civil Complaints

On June 10, 2016, and July 1, 2016, New Jersey-based construction company Berger Group Holdings Inc. ("BGH") and its subsidiaries (collectively, the "Company") sued two former Company executives in connection with their guilty pleas for FCPA-related violations and the Company's settlement with the DOJ. Both suits allege breaches of fiduciary duty, in addition to other claims.

As reported in our FCPA Autumn Review 2015, on July 17, 2015, BGH subsidiary Louis Berger International, Inc. ("LBI") entered into a DPA with the DOJ and agreed to pay $17.1 million criminal penalty to resolve alleged violations of the FCPA's anti-bribery provisions between 1998 and 2010. On the same day, Richard Hirsch and James McClung, both former Senior Vice Presidents with the Company, each pled guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA and one substantive count of violating the FCPA. Both admitted to playing a part in making and concealing corrupt payments to foreign government officials, with Hirsch pleading guilty to charges related to the bribery of officials in Indonesia and Vietnam, and McClung to similar charges related to officials in Vietnam and India. (See our earlier coverage for extensive details of the alleged bribery schemes.) Following its self-disclosure and an investigation, the Company entered into a DPA with the DOJ, admitting that it and its employees conspired to violate anti-bribery provisions of the FCPA by paying bribes to secure government construction contracts. The Company's conduct also led to sanctions by the World Bank, including a one-year debarment of BGH subsidiary Louis Berger Group ("LBG").

According to the Company's civil suits, Hirsch did not cooperate in the Company's internal investigation and was separated from the Company when it learned of his breaches of fiduciary duties, and the Company terminated McClung for cause in 2012 after learning of his concealed conflicts of interest and self-dealing.

Hirsch Suit

The complaint against Hirsch, filed by BGH and LBG in New Jersey state court on June 10, 2016, claims that Hirsch breached his fiduciary duty to the Company by making bribe payments to foreign government officials that led to the subsequent penalties imposed on the Company by the DOJ. The suit alleges that Hirsch, as the Company's senior in-country official in Indonesia and Vietnam, directed, facilitated and approved payments from the Company to foreign government officials in violation of the FCPA and the Company's policies, procedures and shareholders agreement (Hirsch owned 250 shares in the Company). More specifically, the complaint alleges that Hirsch breached his duties of good faith and loyalty and violated the Company's Code of Business Conduct provisions governing "Ethical Business Activities," "Bribes and Kickbacks," "Gifts and Courtesies," "Procurement Integrity," and "Avoidance of Corrupt Practices."

The civil suit incorporates the allegations in the Information related to Hirsch filed by the DOJ, including that he authorized and approved 27 payments totaling $692,670 from the Company to a Vietnamese entity, which used the money to make improper payments to government officials in connection with the Company's government contracts. The suit further claims that Hirsch directed wire payments totaling $375,250 to Indonesian shell entities, which made improper payments to officials in Indonesia.

The complaint seeks unspecified compensatory and punitive damages that resulted from Hirsch's admitted misconduct. The complaint states that the Company's damages include "the financial penalty imposed by the DOJ" and "the millions of dollars spent in professional fees to investigate the improper payments relating to Hirsch's conduct and resolve them with the DOJ." The complaint also alludes to "damage to [the Company's] reputation and its business with ongoing and prospective government customers."

In addition, the Company seeks repayment for more than $49,000 that the Company advanced to Hirsh's for his legal defense costs relating to the government's investigation of his activities. The complaint claims that Hirsch requested an advance of these expenses and agreed that if he was not entitled to indemnification by the Company, he would repay the advanced amount. The Company alleges that Hirsch should be accountable for the full amount of legal fees advanced to him because of his guilty plea and related admissions.

McClung Suit

On July 1, 2016, BGH and LBI filed a similar suit against McClung. The complaint includes claims of breach of fiduciary duty and seeks the recovery of the legal fees advanced to McClung. In addition, the complaint alleged that McClung engaged in a pattern of self-dealing and unjustly enriched himself by authorizing unwarranted payments to third-party entities and individuals under his ultimate control. The Company claims that McClung's conduct violated the same provisions of the Company's Code of Business Conduct as Hirsch's conduct, and also alleges violations of the section on "Conflicts of Interest."