FCPA Autumn Review 2014

International Alert

Introduction

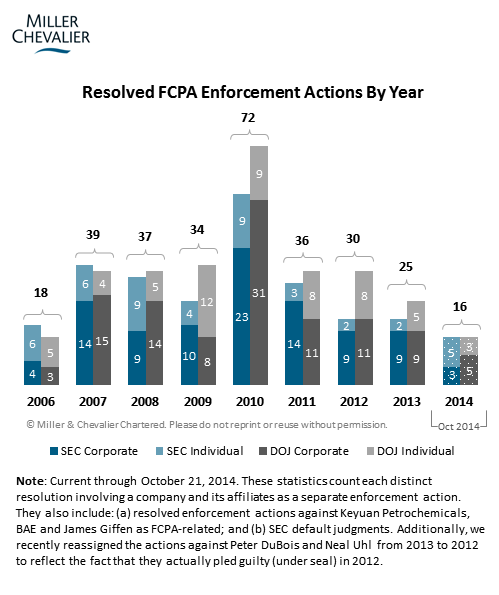

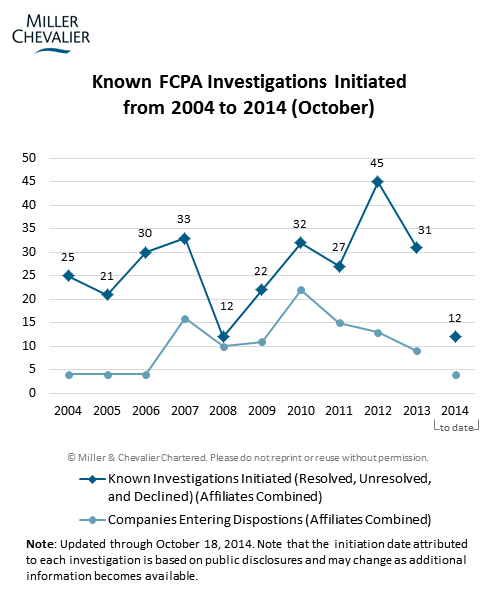

In line with a trend in 2014 of declining Foreign Corrupt Practice Act ("FCPA") corporate enforcement dispositions, U.S. enforcement authorities entered into one new corporate settlement during the third quarter. The administrative settlement between the Securities and Exchange Commission ("SEC") and Smith and Wesson Holding Corporation follows slow enforcement in the first and second quarters that included only seven corporate dispositions involving three companies. While investigation activity levels remain strong (as indicated in the "Known FCPA Investigations Initiated" chart and discussion below), the overall pace of enforcement in 2014, in terms of resolved dispositions, remains at low levels when compared to recent years.

Overall, there have been 16 enforcement actions (involving corporations and individuals) resolved through the end of the third quarter of 2014. This level of public enforcement activity is on par with last year, during which there were 14 resolved enforcement actions at the end of the third quarter. 2013 ended with an uptick of 11 resolved enforcement actions in its last quarter, however, and the same trend could be replicated in Q4 2014 if the enforcement agencies make an effort to resolve certain cases before year's end.

As reported in the FCPA Summer Review 2014, we anticipate at least one additional corporate settlement in the near future -- that of Avon Products, Inc. ("Avon"). In March 2014 Avon disclosed a tentative settlement with U.S. enforcement agencies that is projected to cost the company upwards of $135 million in aggregate fines, disgorgement, and prejudgment interest. Furthermore, aggressive remarks from enforcement officials indicate a potential increase in investigations and enforcement actions may be on the horizon. According to the Wall Street Journal, James Koukios, Senior Deputy Chief of the Department of Justice ("DOJ") Criminal Division's Fraud Section, recently told a New York audience that there are "a bunch" of FCPA actions forthcoming. "It's fair to assume that the penalty amounts are not going to go down," Koukios added.

Overall, the DOJ and SEC concluded a number of FCPA-related prosecutions against individual defendants this quarter, including two Noble Corporation executives, former BizJet CEO Bernd Kowalewski, and former Alstom executive William Pomponi. Frederic Cilins also pled guilty to one count of obstructing a federal criminal investigation relating to the DOJ's ongoing FCPA investigation of BSG Resources, Ltd. These prosecutions are discussed in greater detail below.

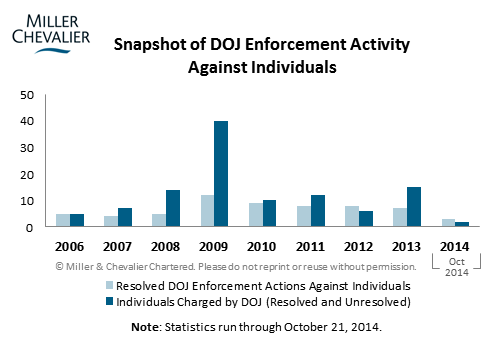

In contrast to the slow pace of corporate enforcement actions, FCPA enforcement activity against individuals, at least on the DOJ side, has been on the uptick (although there is clearly some overlap, with many cases mixing individual and corporate actions). The DOJ has announced FCPA-related charges against 11 individuals thus far in 2014, most of whom were actually charged last year under seal so as not to compromise the confidentiality of ongoing investigations. These newly revealed FCPA cases make 2013 one of the busiest on record in terms of the DOJ's prosecution of individuals for FCPA-related misconduct, second only to 2009 when the agency brought charges against, among others, 22 executives in connection with a sting operation in the defense and law enforcement product industries (see our January 2010 FCPA Alert).

On September 17, 2014, Marshall Miller, Acting Principal Deputy Assistant Attorney General for the DOJ Criminal Division, emphasized the DOJ's aggressive approach in prosecuting individual violators when he stated that companies seeking to cooperate with DOJ investigations must identify individual suspects. Speaking to a group of industry professionals and defense counsel at Global Investigations Review Live New York, Miller stated: "If you [corporations] want full cooperation credit, make your extensive efforts to secure evidence of individual culpability the first thing you talk about when you walk in the door to make your presentation." In addition to merely identifying suspects, however, corporations must provide specific evidence of alleged individual wrongdoing: "Most importantly," Miller added, "make securing evidence of individual culpability the focus of your investigative efforts so that you have a strong record on which to rely." Finally, Miller emphasized that the DOJ's efforts to encourage corporations to report individual wrongdoing will be augmented by the DOJ's own efforts "that may not been used frequently enough in white collar cases in past years," such as "wiretaps, body wires, physical surveillance, and border searches."

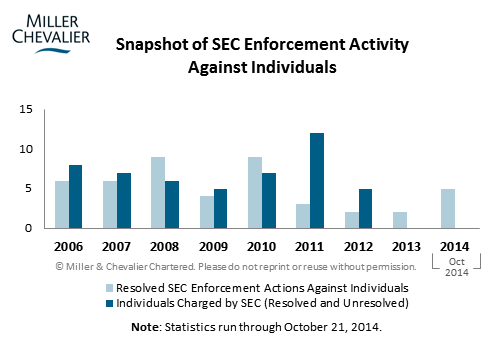

For its part, however, the SEC has not charged an individual with FCPA-related misconduct in more than two years. One reason for the absence of new actions against individuals by the SEC may be that the Commission's resources have been focused in recent years on resolving several contested actions, including the civil charges against current and former executives from Siemens AG, Magyar Telekom Plc., Noble Corporation, and Digi International, Inc.

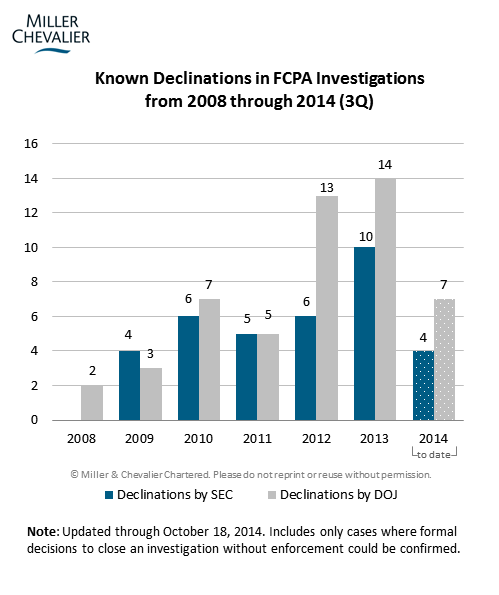

The FCPA compliance community continues to remain interested in information on declinations and other resolutions of investigations that do not involve formal charges or penalties. Overall, we have identified 11 known declinations in 2014 thus far, more than half of which have come in the past three months. While this total represents a decrease in the pace of publicly discussed declinations compared to 2013 (when we identified 23 declinations through three quarters), it still matches 2012's pace through the same time frame, which is the second highest on record.

Since it is generally not possible to determine in what instances the agencies believed they had grounds to bring an enforcement action, for tracking purposes we define "declinations" broadly to refer to instances in which the DOJ or SEC opted to close an FCPA investigation without pursuing enforcement. In the absence of the agencies publicly acknowledging such decisions, one trend we have noticed in recent public filings is an increase in the number of announcements in which companies quote the DOJ and/or SEC as crediting their cooperation, voluntary disclosure, and/or remediation. Since June, four of five companies receiving declinations cited such language:

Smith & Wesson Holding Corp.: On June 19, 2014, Smith & Wesson disclosed that following "an extensive investigation and evaluation," the DOJ had closed its investigation of the company. In declining to pursue any FCPA charges, Smith & Wesson said that the DOJ highlighted the company's "thorough cooperation."

Dialogic Inc.: In August, the SEC ended an informal investigation of California-based Dialogic Inc. without bringing an enforcement action against the company. According to company releases, the SEC investigated Dialogic for potential books and records violations after the company acquired Veraz Networks, Inc., which had paid $300,000 in 2010 to settle SEC charges that it violated the books and records and accounting provisions. Dialogic stated that it had taken remedial efforts after acquiring Veraz and "updated and improved compliance procedures."

Layne Christensen Co.: On August 14, 2014, Layne Christensen disclosed that it had been notified by the DOJ that the agency did not intend to file any charges against the company following an investigation into potential violations of the FCPA. Based on its conversations with the DOJ, Layne Christensen said in its disclosure that it understood that the company's "voluntary disclosure, cooperation and remediation efforts have been recognized and appreciated by the staff of the DOJ and that the resolution of the investigation reflects these matters." The SEC's parallel investigation into these potential violations remains open, and Layne Christensen has set aside $5.3 million for an anticipated settlement.

Image Sensing Systems Inc.: On September 8, 2014, Imaging Sensing Systems announced that the DOJ and SEC had recently notified the company that they were closing their respective inquiries into potential FCPA violations by the company's Polish subsidiary. In declining to bring an enforcement action, the company declared that the DOJ cited the Image Sensing Systems' "voluntary disclosure, thorough investigation, cooperation and voluntary enhancements to its compliance program." The company said that it understood that its efforts to cooperate had "been recognized and that the resolution of the investigation reflects this cooperation."

Agilent Technology: In mid-September 2014, Agilent Technology stated that the company had received letters from the DOJ and SEC informing it that the agencies had decided to close their respective investigations into potential FCPA violations in China without enforcement. The DOJ's letter reportedly cited the company's "voluntary disclosure and thorough investigation."

We have identified 12 investigations initiated thus far in 2014. This pace, though down slightly, is roughly on par with the number of new investigations we had identified at this same point last year. The numbers do not necessarily indicate a decline in investigative activity on the part of the agencies, however, as there is often a delay in identifying new investigations since public companies may wait months (or even years) to disclose the existence of an investigation in their public filings (with some choosing never to do so), while private companies often never disclose the existence of an investigation. Public remarks from enforcement officials, discussed above, suggest that investigative activity has not slowed and warn of an increase in enforcement activity on the horizon.

In other developments, this quarter featured divergent developments in the shareholder lawsuits against Avon and Wal-Mart stemming from their FCPA investigations. In the Avon suit, a federal judge dismissed the shareholder's argument that the company hid potential violations from them, whereas the court in the Wal-Mart action allowed an action based on a similar argument to advance. Additionally, the Second Circuit clarified that the anti-retaliation provision of the Dodd-Frank act does not apply extraterritorially. This ruling is likely to cause uncertainty for multinational compliance departments, because foreign whistleblowers may now be incentivized to report internal violations directly to the SEC.

As discussed below, there were significant international developments this quarter, including the conclusion of China's investigation of GlaxoSmithKline (see FCPA Summer Review 2014), which resulted in a record $492 million penalty against the company, and the UK Serious Fraud Office's (SFO's) announcement of the sentencing of four former executives and employees of Innospec Inc. (previously reported in our FCPA Spring Review 2010). Additionally, Transparency International-USA provided some useful guidelines for corporations evaluating their anti-corruption programs.

Actions Against Corporations

SEC Administrative Settlement with Smith & Wesson

On July 28, 2014, Smith & Wesson Holding Corporation entered into an administrative settlement with the SEC to resolve FCPA violations relating to the company's international sales operations. As stated in the SEC's Cease and Desist Order, the SEC charged the Massachusetts-based issuer with violating the anti-bribery, books and records, and internal controls provisions of the FCPA. Smith & Wesson agreed to pay over $2 million in penalties, consisting of $107,852 in disgorgement, $21,040 in prejudgment interest, and a $1.906 million fine. The company also agreed to report its FCPA compliance efforts to the SEC at six- to 12-month intervals over a period of two years.

The SEC charged Smith & Wesson with violating the anti-bribery provisions of the FCPA in connection with efforts to increase sales of firearms products to military and police departments in Pakistan, Indonesia, Turkey, Nepal, and Bangladesh. According to the settlement papers, between 2007 and early 2010, Smith & Wesson "employees and representatives engaged in a pervasive practice of making payments" and provided gifts to foreign officials in numerous attempts to secure the sales contracts. At the time, Smith & Wesson's "international business was in its developing stages and accounted for approximately 10% of the company's revenues." In 2008, the company's Vice President of International Sales and its Regional Director of International Sales authorized the sale of guns to a Pakistani agent for use as gifts to Pakistani police. The settlement documents state that the two high-level employees also authorized commission payments to the agent "while knowing or consciously disregarding the fact that the agent would be providing the guns" and cash as gifts to Pakistani police officials "as an inducement for them to award the [gun supply] tender to the company." Ultimately, Smith & Wesson secured a contract to supply 548 pistols to the Pakistani police, for which the company earned profits of $107,852. Although the Cease and Desist Order does not specify where the Vice President of International Sales and Regional Director of International Sales were based, it is likely that they were in the United States because Smith & Wesson does not have any international subsidiaries.

In Indonesia, Turkey, Nepal, and Bangladesh, the SEC alleged that Smith & Wesson used third-party agents to pass through portions of commission payments to foreign officials as contract inducements. In Indonesia, the settlement papers assert, the company's agent "indicated that the Indonesian police expected Smith & Wesson to pay them an additional amount in above the actual cost of testing the guns." According to the settlement papers, the company's Vice President of International Sales and its Regional Director of International Sales authorized and made these inflated payments, doing so even after the agent notified them that the price of "testing" the guns had increased. The company also authorized payments through non-U.S. agents while attempting to secure contracts to supply handcuffs to Turkish police, firearms to the Turkish military, and unspecified contracts in Nepal and Bangladesh. No products shipped in connection with these deals -- indeed, the inducement payments did not always result in an award of a particular contract to Smith & Wesson. However, the disposition papers state that the company "attempted to obtain [these contracts] by using third party agents as a conduit for improper payments…."

Smith & Wesson accepted the SEC's allegations that the company failed to properly account for the improper payments in its books and records and had insufficient internal controls with respect to its international sales operations. The company recorded the payments to its Pakistani agent as legitimate commissions, and the inflated lab testing payments to its Indonesian agent and improper payments to Turkish agents as legitimate business expenses. The company also "failed to devise and implement adequate policies and procedures with regard to commission payments, the use of samples for test and evaluation, gifts, and commission advances." Finally, the settlement documents note that the company's "FCPA policies and procedures, and its FCPA-related training and supervision were inadequate."

The SEC acknowledged Smith & Wesson's cooperation with the investigation without specifying the particulars of that cooperation, and recognized remedial acts taken after the conduct came to light. Smith & Wesson terminated the pending international sales transactions, implemented significant measures to improve its internal controls and compliance process, and terminated its entire international sales staff.

Noteworthy aspects

- DOJ Declination and SHOT Show Connection: Smith & Wesson reported in its recent 10-Q filing that the DOJ declined to prosecute the company for FCPA violations, closing out a four-year investigation initiated after the 2010 "SHOT Show" indictments (see our FCPA Spring Review 2010 and other past reviews). In the same filing, the company announced that it received a subpoena from the SEC in 2011 concerning violations of federal securities laws and stated that the SEC's inquiry arose in part out of the DOJ investigation. Smith & Wesson is not alone in receiving a DOJ declination following a lengthy FCPA investigation spurred by an individual's SHOT Show indictment (see our coverage of the Allied Defense Group declination in our FCPA Autumn Review 2013 and FCPA Spring Review 2012). However, Smith & Wesson is the only company to date to reach a settlement with the SEC for investigations initiated in connection with the SHOT Show indictments.

- Enforcement Scrutiny of Small- and Medium-Sized Enterprises: On multiple occasions, the SEC's FCPA Unit Chief Kara Brockmeyer has referred to the Smith & Wesson settlement as an example of how small- and medium-sized enterprises ("SMEs") should not conduct business. In the SEC announcement, Brockmeyer said the settlement is "a wake-up call for small and medium-size businesses that want to enter into high-risk markets and expand their international sales" to "ensure that the right internal controls are in place and operating." Additionally, during a recent panel discussion in which Miller & Chevalier Member Homer Moyer participated, Brockmeyer noted that smaller companies should not think that because of their smaller size they do not need to deploy effective FCPA safeguards. As discussed in Matt Ellis's recent FCPAmericas Blog entry, DOJ and SEC officials expect SMEs to adhere to the same standards of ethical conduct and compliance with law as multinational corporations with respect to company culture, management involvement, and reasonableness of compliance actions, while recognizing that SMEs can meet these requirements with less formal compliance programs and fewer resources.

- Low International Revenues Do Not Excuse Inadequate FCPA Compliance: The Smith & Wesson settlement demonstrates that enforcement officials expect companies to commit to FCPA compliance even when international business accounts for a small portion of their revenue. This is especially important when a company relies on third-party representatives, a known area of increased risk, to conduct business overseas. The SEC alleged that while prioritizing growth in new and high-risk international markets, Smith & Wesson did not perform any anti-corruption risk assessments and conducted very little third-party due diligence. The company lacked appropriate procedures governing paying commissions, providing samples, and giving gifts to officials, and failed to train relevant employees on FCPA compliance. Finally, the Vice President of International Sales could conduct much of the company's international business without checks on his authority, such that he had the ability unilaterally to approve most commissions. As with some other recent cases, the SEC appears to have considered these compliance program and training inadequacies to be failures of the company's internal accounting controls (see, e.g., our discussion of the ADM settlement in our FCPA Winter Review 2014).

Actions Against Individuals

On July 25, 2014, U.S. District Court Judge William H. Pauley III sentenced Frederic Cilins, a French citizen, to two years imprisonment on charges related to an ongoing federal grand jury investigation. As initially outlined in the FCPA Summer Review 2013 (and updated in the FCPA Winter Review 2014 and FCPA Spring Review 2014), on April 13, 2013, the DOJ announced Cilins's arrest in Florida on charges related to an ongoing federal grand jury investigation concerning potential FCPA and money laundering violations committed by BSG Resources, Ltd. ("BSGR"), a foreign company engaged in the mining of iron ore in the Republic of Guinea. Nearly 15 months later, and four months after Cilins pled guilty to one count of obstructing a federal criminal investigation, the two-year sentence was imposed.

Cilins was originally charged by criminal complaint on April 15, 2013, with three separate counts: (1) tampering with a witness; (2) obstruction of a criminal investigation; and (3) destruction, alteration, and falsification of records in a federal investigation (two additional counts of tampering with a witness were added in a criminal indictment issued on April 25, 2013). All of these charges stemmed from Cilins' alleged attempts between March and mid-April 2013 to bribe a cooperating witness in the investigation of BSGR with money in exchange for the witness's promise to destroy documents responsive to a grand jury subpoena related to BSGR. The initial charges against Cilins exposed the existence of a federal grand jury investigation into BSGR's procurement of a concession to extract iron ore from Guinea's Simandou Mountains, one of the world's largest known deposits of untapped iron ore.

On February 18, 2014, the DOJ increased the pressure on Cilins by filing a superseding indictment that alleged six counts of criminal behavior (adding a conspiracy count and a fourth witness-tampering count, and dropping the obstruction count, to the April 25, 2013, indictment). Less than a month later, Cilins made a deal with the prosecutors to plead guilty to one count of obstruction of a federal criminal investigation. During his plea hearing, Cilins told the court that he had tried to bribe a government witness with money ($20,000 initially and then more later) to persuade her to leave the country to avoid questioning by the FBI. Cilins admitted he knew his actions were wrong, but claimed he did not know that the witness was cooperating with the government.

This sentence imposed by Judge Pauley was less than the 37-46 months the prosecution had requested, but more than the 15 months (i.e., time served) that Cilins's attorneys had urged. Cilins was also ordered to pay a $75,000 fine and to forfeit the $20,000 he was carrying when he was arrested. There is no indication in the public documentation that Cilins's plea deal requires him to cooperate with the U.S. government's ongoing investigation into BSGR.

Former BizJet CEO Pleads Guilty to FCPA Charges

On July 24, 2014, former BizJet International Sales and Support, Inc. ("BizJet") President and Chief Executive Officer Bernd Kowalewski pled guilty to conspiracy to violate the FCPA and to a substantive violation of the FCPA's anti-bribery provisions in connection with a scheme to secure contracts with foreign government customers in Mexico and Panama (see our FCPA Spring Review 2012 for background on the BizJet case). Kowalewski was indicted on January 5, 2012, along with former BizJet Sales Manager Jald Jensen, former Vice President of Sales and Marketing Peter DuBois, and former Vice President of Finance Neal Uhl.

Between 2004 and 2010, Kowalewski and his colleagues allegedly conspired to pay "incentives" or "commissions" to employees of foreign government customers, including the Mexican Federal Police, the Panama Aviation Authority, and the Mexican President's Fleet, to obtain and retain maintenance, repair, and overhaul contracts. U.S. Attorney Danny C. Williams Sr. lauded Kowalewski's arrest in Amsterdam as evidence of vigorous cross-border FCPA enforcement, and called his guilty plea "an example of our continued determination to hold corporate executives responsible for criminal wrongdoing whenever the evidence allows."

For each FCPA charge, Kowalewski faces a maximum term of imprisonment of five years and a fine of not more than $250,000 or the greater of two times the loss to the victims or the gross pecuniary gain. The court has yet to set a sentencing date.

As reported in the FCPA Spring Review 2013, of the individuals indicted with Kowalewski, DuBois pled guilty to one count of conspiracy to violate the FCPA and one count of violating the FCPA, and Uhl pled guilty to one count of conspiracy to violate the FCPA on January 5, 2012. DuBois and Uhl were sentenced on April 5, 2013, each receiving five years probation, including eight months of home detention. The court also imposed a $10,000 criminal fine on Uhl and directed Dubois to forfeit $98,950. Jensen remains at large.

Former Alstom Executive William Pomponi Pleads Guilty to Conspiracy to Violate the FCPA

On July 17, 2014, former Alstom executive William Pomponi pled guilty to conspiring to violate the FCPA. As reported in our FCPA Summer Review 2013, the DOJ had previously charged Mr. Pomponi with two counts of conspiracy to violate the anti-bribery provisions of the FCPA, four counts of violating the anti-bribery provisions of the FCPA, one count of conspiracy to commit money laundering, and three counts of substantive money laundering violations.

According to his plea agreement, Mr. Pomponi stipulated that beginning in 2002, when he was an Alstom Vice President of Regional Sales, he was assigned to work on the Tarahan project in Indonesia to build a power plant. Mr. Pomponi admitted to joining in a conspiracy among Alstom employees, Alstom subsidiary employees, employees of Marubeni (a Japanese company that was Alstom's consortium partner on the Tarahan project), and third-party consultants, to pay bribes to foreign officials to secure the project. (We have previously covered FCPA actions involving Marubeni in our FCPA Spring Review 2014 and FCPA Spring Review 2012).

As a consequence of his pleading, Mr. Pomponi faces five years imprisonment, a $250,000 fine, a supervised release period of not more than three years, and a fine equal to the greatest of: (1) twice the gross gain resulting from the offense; (2) twice the gross loss resulting from the offense; or (3) $250,000. The government agreed to recommend that the court reduce by two levels Mr. Pomponi's adjusted offense level based on his "prompt recognition and affirmative acceptance of personal responsibility for the offense."

Mr. Pomponi is the fourth defendant to plead guilty to charges related to the investigation of the Taharan power project in Indonesia. (See FCPA Autumn Review 2013, FCPA Summer Review 2013, and FCPA Spring Review 2014).

Noble Corporation Executives Settle FCPA Charges

On July 3, 2014, just days before they were scheduled to go to trial, the Southern District of Texas (Hon. Keith B. Ellison) entered final consent judgments in the cases against former Noble Corporation ("Noble Drilling") executive Mark A. Jackson and the current director of Noble Drilling's Nigerian subsidiary, James A. Ruehlen. This resolution was the result of a settlement agreement with the SEC over a pending enforcement action for alleged books and records and anti-bribery violations of the FCPA.

Under the terms of the settlement, neither Jackson nor Ruehlen were fined or admitted liability. Instead, they consented to an order restraining and enjoining Ruehlen from aiding and abetting in violations of, and Jackson from violating, the books and records provisions of the FCPA.

As reported in our FCPA Summer Review 2014 and FCPA Spring Review 2012, in February 2012, the SEC brought charges against Jackson and Ruehlen. The SEC filed these charges just over one year after Noble Drilling settled a related FCPA enforcement action. The complaint against Jackson and Ruehlen alleged, inter alia, that they had authorized Noble Drilling's customs agent to pay bribes to Nigerian government officials to influence the temporary import permit process and that they circumvented internal controls at Noble Drilling in order to record the bribes as legitimate operating expenses. The complaint further alleged that Ruehlen assisted in the preparation of false documents, processed invoices for bribes, and signed checks reimbursing the customs agent for bribes paid and that Jackson failed to implement internal accounting controls and misled auditors. Because of Jackson's former positions as Chief Financial Officer, Chief Operating Officer, and President, Chief Executive Officer, and Chairman of the Board of directors, the complaint named him as a "control person" who was liable for the violations of Noble Drilling, Ruehlen, and others.

Jackson and Ruehlen moved to dismiss the complaint in May 2012, and, as detailed in our FCPA Winter Review 2013, the court eventually granted in part and denied in part their motions on December 11, 2012. However, the court also permitted the SEC to amend its complaint, which the SEC filed on January 25, 2013. As reported in our FCPA Spring Review 2013, Jackson and Ruehlen then challenged the amended complaint on statute of limitations grounds. Following the Supreme Court's decision in Gabelli v. SEC, which held that the five-year statute of limitations for civil penalty actions brought by the SEC begins to run when the fraud is complete, the SEC was forced to limit its claim for monetary penalties to conduct that occurred within five years of the filing of the complaint (adjusted by tolling agreements). (For a more in-depth discussion of Gabelli, please see our FCPA Spring 2013 Review). Thus, the SEC filed a second amended complaint demanding civil penalties only as to violations accruing on or after May 12, 2006. On May 30, 2014, the court denied Jackson and Ruehlen's motions for summary judgment.

At the same time that the agency filed its initial charges against Jackson and Ruehlen, the SEC filed a separate complaint against Thomas F. O'Rourke, the former Controller and head of Internal Audit at Noble Drilling. O'Rourke settled the SEC's charges and paid a $35,000 penalty, with a final judgment entered in his case on March 28, 2012.

Civil Litigation

Developments in Wal-Mart and Avon Shareholder Litigation

This quarter featured two divergent developments relating to shareholder lawsuits against Avon and Wal-Mart stemming from their FCPA investigations.

U.S. District Court Dismisses Class Action Suit Against Avon

On September 29, 2014, U.S. District Judge Paul G. Gardephe of the Southern District of New York dismissed a class action suit against Avon Products, Inc. and two former executives. The shareholders had sued the defendants for allegedly issuing materially false and misleading statements concerning Avon's compliance with the FCPA in violation of Section 10(b) and 20(a) of the Securities Exchange Act of 1934 and Securities and Exchange Commission Rule 10b-5.

According to their Amended Complaint, the shareholders claimed that Avon and its executives made materially misleading statements in three ways. First, the shareholders alleged that although Avon's Ethics Codes and Corporate Responsibility Reports declared a commitment to high ethical and legal standards, its compliance programs were inadequate. Second, the shareholders contended that Avon's financial disclosures failed to disclose its bribery of foreign officials and misleadingly attributed Avon's success to its market strategy and legitimate business practices. Third, the complaint alleged that even though Avon announced it was conducting an internal investigation, its actual compliance efforts were "virtually nonexistent."

Avon filed a motion to dismiss on October 12, 2012. Nearly two years later, on September 29, 2014, Judge Gardephe granted the motion to dismiss. Judge Gardephe held that certain statements in Avon's Ethics Codes and Corporate Responsibility Reports regarding Avon's commitment to legal compliance and integrity were "puffery" and, thus, non-material. The court found certain other corporate statements regarding Avon's internal controls and economic success in China to be material, but nevertheless dismissed claims relating to those statements, stating that the shareholders had failed to plead sufficient facts demonstrating that Avon made those statements with "intent to deceive, manipulate or defraud."

Next, Judge Gardephe noted that the shareholders failed to plead sufficient facts showing that Avon's officers intended to deceive Avon shareholders by deliberately omitting evidence of bribery when making financial disclosures in 2008, 2009, 2010, and 2011. The Court concluded that shareholders' allegations were "generalized" and failed to specify how management became aware that Avon employees were paying bribes to Chinese officials or that management knew Avon's financial successes were the result of FCPA violations.

Finally, Judge Gardephe rejected plaintiffs' contention that Avon knew its compliance program was inadequate before learning of the potential violations. The Court found that the plaintiffs failed to demonstrate that Avon's management would have known that its compliance program was inadequate to detect FCPA violations. Indeed, the Court noted that Avon's disclosure of potential FCPA violations and subsequent internal investigation supported the inference that Avon was unaware of the inadequacies in its compliance programs. Although Judge Gardephe dismissed the complaint, all is not lost for the Avon plaintiffs, because he granted permission to refile an amended complaint.

Wal-Mart Litigation Survives Attempted Dismissal

On September 26, 2014, a judge in the District Court of the Western District of Arkansas adopted a magistrate judge's report and recommendation denying Wal-Mart and CEO Michael Duke's motion to dismiss securities fraud class action claims. The plaintiffs have alleged violations of Section 10(b) and 20(a) of the Securities Exchange Act of 1934 and violations of the Securities and Exchange Commission Rule 10b-5.

We have reported on the Wal-Mart investigation in our prior FCPA Reviews (see FCPA Autumn Review 2012 and FCPA Spring Review 2014). The plaintiffs in this shareholder suit, citing extensively from the April 2012 New York Times article that first raised the issue publicly, have alleged that in Fall 2011, Wal-Mart knew that the newspaper was investigating corruption issues (dating back to 2005 and 2006) in Wal-Mart de Mexico and an alleged cover-up of those issues within the company. The plaintiffs have asserted that, despite this knowledge, Wal-Mart did not sufficiently disclose these issues in a Form 10-Q filed in December 2011.

In an order issued on September 26, 2014, Judge Hickey opined that Wal-Mart's omission of the 2005 and 2006 corruption issues in the Form 10-Q likely misled investors into believing that Wal-Mart first learned of the bribery scandal in fiscal year 2012. The court further surmised that the disclosure of this omitted fact would have "significantly altered the total mix of information available" for an investor. The court also concluded that plaintiffs sufficiently had alleged facts showing scienter because they contended that Wal-Mart executives knew of the corruption in 2005 through an email from a top Wal-Mart lawyer and, instead of instituting an independent investigation, Wal-Mart assigned the investigation to Wal-Mart de Mexico, the very office engaging in the corrupt activities.

Synthesizing Wal-Mart and Avon

The difference between the Wal-Mart and Avon decisions is in the details. The plaintiffs in Wal-Mart not only presented facts apparently demonstrating the misleading statements in a Form 10-Q, but also described how Wal-Mart and its executives learned of the corruption. The Avon plaintiffs, in contrast, failed to assert facts showing how Avon executives became aware of the corruption; instead they relied on generalities and suspicion. The Wal-Mart case demonstrates that asserting fraud under the Private Securities Litigation Reform Act particularity standard is not impossible to meet.

Second Circuit Finds No Extraterritorial Application of the Anti-Retaliation Provision of Dodd-Frank Act

On August 14, 2014, the Second Circuit ruled that the anti-retaliation provision of the Dodd-Frank Act, 15 U.S.C. § 78u-6(h)(1)(A), does not apply extraterritorially. Liu v. Siemens AG, 763 F.3d 175 (2d Cir. 2013). As discussed previously (see the FCPA Autumn Review 2013) with respect to the trial court's decision, the dispute in Liu v. Siemens AG centered on the claims of a former regional compliance officer for a Chinese subsidiary of Siemens in which the officer accused the company of illegally retaliating against him. The former compliance officer claimed he was fired after raising concerns internally that employees of the Chinese subsidiary had violated anti-bribery internal controls that Siemens had installed as part of its 2008 plea agreement with the DOJ. After he was terminated, the plaintiff also filed a whistleblower disclosure with the SEC.

At the district court level, Siemens argued that the anti-retaliation provision does not apply to foreign citizens complaining of overseas activities. The district court agreed, noting in its opinion granting Siemens's motion to dismiss that nothing in the Dodd-Frank Act's anti-retaliation provision indicated that it applied extraterritorially. See Liu v. Siemens AG, 978 F. Supp. 2d 325, 329 (S.D.N.Y. 2013). The district court based its conclusion on the principles established in the Supreme Court's decision in Morrison v. Nat'l Austl. Bank Ltd., 561 U.S. 247 (2010), in which the Court stated that Congress must express an affirmative intention to give a statute extraterritorial effect in order for courts to find that a statute applies beyond U.S. borders.

The Second Circuit affirmed the district court's ruling for three main reasons. First, the appellate court concluded that the appellant had failed to plead that any of the events related to his firing occurred within the United States. The appellant had argued that U.S. jurisdiction over Siemens existed because Siemens listed some of its securities on an American stock exchange. The Second Circuit rejected this argument, concluding that in a case in which the alleged wrongdoing or protected activity occurred outside the U.S., "the listing of securities alone is the sort of ‘fleeting' connection that 'cannot overcome the presumption against extraterritoriality.'" Liu, 763 F.3d at 180 (quoting Morrison, 561 U.S. at 263).

Next, the Second Circuit rejected the former compliance officer's legal argument that the Dodd-Frank anti-retaliation provision is intended to be applied extraterritorially. The appellate court, like the trial court before it, relied on the principles articulated in Morrison and concluded that "there is absolutely nothing in the text of the provision . . . or in the legislative history of the Dodd-Frank Act, that suggests that Congress intended the anti-retaliation provision to regulate the relationships between foreign employers and their foreign employees working outside the United States." Id. Moreover, the Second Circuit explained, the appellant himself pointed out that there are other provisions in the Dodd-Frank Act that do explicitly apply extraterritorially. The appellant had argued that this proved that the Act as a whole should be applied extraterritorially, but the appellate court disagreed, noting that this argument "inverts the ordinary canons of statutory interpretation," id. at 181, whereby, "the logical inference is that the antiretaliation provision, enjoying no such explicit grant of extraterritorial application, has none." Id.

Finally, the Second Circuit rejected the appellant's argument that the SEC's regulations applicable to the SEC's whistleblower bounty program contain indications that the bounty program is meant to have an extraterritorial reach, and therefore that the anti-retaliation provision should also be considered to have extraterritorial application. The court explained that the statutory presumption against extraterritoriality trumped any deference the court might afford to the SEC's interpretation of either the Dodd-Frank Act's whistleblower bounty provision or the anti-retaliation provision, particularly when that interpretation appeared "unmoored from any plausible statutory basis." Id. at 182. The court also noted that even if it were to defer to the SEC, the SEC's own regulations "suggest that the requirements of the anti-retaliation and bounty provisions are to be considered separately," so that the regulations "addressing the bounty provision cannot be taken to support the proposition that the antiretaliation provision should apply extraterritorially." Id. Furthermore, the court differentiated between the whistleblower and anti-retaliation provision by suggesting that the whistleblower provisions are "far less intrusive into other countries' sovereignty than [the anti-retaliation provisions, which] seek to regulate the employment practices of foreign companies with respect to the foreign nationals they employ in foreign countries." Id. at 183. For all of these reasons, the court concluded, "none of the arguments that the bounty provisions is meant to have extraterritorial reach provide any support for [the plaintiff's] claim that the anti-retaliation provision is meant to have extraterritorial reach." Id.

The Second Circuit did not reach any of the other issues raised on appeal, such as whether the Dodd-Frank Act's whistleblower protection provisions protect those who report their concerns internally, but not to the SEC. Thus far, only the Fifth Circuit, in Asadi v. G.E. Energy (USA) LLC, 720 F.3d 620 (5th Cir. 2013), has addressed that question. As discussed in the FCPA Autumn Review 2013, the Asadi court determined that the whistleblower protections do not apply to individuals who fail to report directly to the SEC, a position contrary to the SEC's own views. The SEC had filed an amicus brief in Liu v. Siemens AG laying out its position, but the Second Circuit declined to comment on it.

International Developments

Chinese Authorities Impose Record Fine Against GlaxoSmithKline

On September 19, 2014, the BBC reported that Chinese authorities levied a record $492 million penalty against GlaxoSmithKline ("GSK") for bribery. As reported in our 2013 Autumn Review, and updated in our 2014 Summer Review, China's Ministry of Public Security had accused GSK executives of making approximately $500 million in improper payments to government officials, drug associations, medical foundations, hospitals, and doctors to induce them to use GSK products. This September, as GSK posted on its website, the Changsha Intermediate People's Court in Hunan Province found GSK's Chinese subsidiary, GSK China Investment Co. Ltd., guilty of bribery. The court imposed the fine after a one-day, secret trial.

According to The New York Times, the Chinese Ministry of Public Security accused GSK executives of masterminding a massive bribery network that lasted several years and netted GSK approximately $150 million in illegal profits. As with some past FCPA enforcement actions related to China, notably the 2011 IBM disposition, the Chinese authorities in this case were interested in the relationships between companies and travel agencies. The Times reported that the Chinese government claimed that local travel agencies funneled cash from GSK executives to doctors and hospitals. With the travel agencies' cooperation, executives allegedly organized fictitious conferences, overbilled for training sessions, and filed other sham expenses to develop bogus travel receipts. The executives then submitted the bogus receipts for reimbursement and used the money for bribes. The travel agencies, in turn, skimmed off a portion of the money for themselves.

The court also returned a guilty verdict for British national Mark Reilly, the former head of GSK's China operations. When Reilly was charged with bribery earlier this year, Reuters reported, his indictment marked the first time since 2009 that Chinese authorities had charged a foreign national with violating Chinese bribery laws. Reilly received a three-year suspended sentence and will be deported (BBC Sept. 2014). The severity of the fine and the conviction of a foreign national both highlight the Chinese government's intense and increasing scrutiny of multinational companies for potential bribery.

United Kingdom Update -- Serious Fraud Office Activity

Successful Prosecutions by the SFO

Though the U.K. SFO has still not brought a successful corporate prosecution under the U.K. Bribery Act ("UKBA"), the SFO had several wins this summer under the United Kingdom's prior anti-bribery laws (which apply to conduct committed before the UKBA went into force on July 1, 2011). On August 4, 2014, the SFO announced that four former executives and employees of the chemical producer Innospec (which previously had settled U.S. and U.K. corruption charges, as reported in our FCPA Spring Review 2010) received sentences for their roles in bribing officials in Indonesia and Iraq. One of the former Innospec employees received a suspended sentence with 300 hours unpaid work, and the others received prison sentences ranging from 18 months to four years. In another enforcement action, on July 22, 2014, the SFO announced that Bruce Hall, an Australian national, received a prison sentence of 16 months for accepting bribes while he was an employee of Aluminum Bahrain B.S.C. ("Alba"). The SFO's successful prosecution of Hall follows a high-profile setback in the SFO's Alba-related prosecutions, reported in our FCPA Winter Review 2014, in which the SFO dropped its case against Victor Dahdaleh, an alleged bribe payer in the scheme, because the SFO no longer believed there was a reasonable prospect of conviction.

New and Ongoing SFO Investigations

Thus far in 2014, the SFO has announced investigations into the commercial practices of GSK and its subsidiaries (which media sources have linked to corruption investigations into the company's activities in China which are discussed above, and other countries), and an investigation into a surveyor company, Sweett Group (which reportedly asked an architecture firm to bribe UAE officials in connection with a hospital construction contract in Morocco). The SFO's investigation into Rolls-Royce's activities in China and Indonesia, reported in our FCPA Winter Review 2014, is also ongoing. In addition, the SFO announced on July 24, 2014, that it has charged a subsidiary of the French multinational conglomerate Alstom with violations of the U.K.'s prior anti-bribery laws for activities related to large transport projects in India, Poland, and Tunisia. An SFO press release did not link the charges against Alstom to prior FCPA actions against company executives for bribery in Indonesia, but did state the charges stemmed from "information provided to the SFO" by the Swiss government. Finally, in early July, the SFO reportedly arrested six people in connection with an investigation into bribery by a subsidiary of Airbus Group NV in Saudi Arabia.

The SFO's ongoing investigations and prosecutions continue to fuel expectations of high-profile corporate prosecutions. Despite these public successes and ambitious open cases, questions about the SFO's future persist. According to media sources, the U.K. government is currently reviewing the SFO's effectiveness, and is considering plans to abolish the SFO and merge its personnel and functions into other U.K. agencies. Media sources have also reported that the SFO has requested a significant budget increase, which may determine whether it has the resources to effectively carry out large investigations.

Other Developments

Transparency International-USA Report Provides Guidelines to Use in Evaluating Anti-Corruption Programs

On July 24, 2014, Transparency International-USA ("TI-USA") released a report, Verification of Anti-Corruption Compliance Programs ("Report"), providing what it purports to be concrete, implementable lessons for companies evaluating their anti-corruption programs.

The TI-USA Report defines verification to include "all efforts, both internal and external, to assess that a company has a risk-appropriate and effective program for preventing and detecting corruption in its business operations." The Report makes four principal findings and five recommendations. In addition, the Report aggregates and distills several official compliance guides, listing common elements of effective anti-corruption programs and discussing best practices for companies to include in their verification processes.

The Report's four principal findings are:

- Public reporting is a "valuable tool" that permits a company to communicate its commitment to anti-corruption practices to business partners and external stakeholders.

- Companies benefit from using outside experts, such as law firms, accounting firms, and consulting firms, to conduct verification reviews. Outside experts can spot gaps in existing compliance programs and design improved programs.

- Third party certifications for compliance are still evolving and have not yet gained acceptance from regulators and others. The lack of acceptance is largely because the underlying review methodologies can vary substantially.

- External stakeholders, such as regulators, consumers, investors, and others, rely on existing social and environmental certifications because they are based on internationally accepted standards and are seen as indicators of good practice. The same approaches used in these certifications cannot easily be transferred to anti-corruption efforts, however, because "the metrics for anti-corruption verification are more subjective."

The Report makes the following main recommendations:

- Internal reviews are necessary to ensure a company's compliance program is adequate. Companies must weigh reliance on in-house and external resources.

- Companies should supplement internal reviews with independent, external reviews. The frequency and breadth of external reviews should be based on a company's risk profile. The report suggests companies with high-risk operations conduct an external review every three years.

- Companies should take a risk-based approach when determining the scope of a compliance program and of verification. Risk factors include: countries of operation, the extent of interactions with government officials, business sectors involved, and relationship with business partners.

- Companies should publicly disclose their anti-corruption program, including information about verification of the program. Such reporting promotes "transparency and public trust."

- Companies, investors, and non-governmental organizations should cooperate to develop agreed-upon standards for certification of a company's anti-corruption program.

The Report cites the Global Reporting Initiative and the UN Global Compact, which TI helped prepare, as frameworks companies can use to ascertain if they meet international standards. The Report singles out Baker Hughes, General Electric, and Statoil as examples of companies with good practices in corporate reporting.

Elsewhere at Miller & Chevalier

Richard Mojica Joins Miller & Chevalier as Customs Counsel

We are pleased to announce that Richard Mojica has joined the firm's International Practice, as Counsel. Richard will be at the center of our Customs & Import Practice. He has significant experience advising multinational companies on a wide range of global supply chain issues -- from developing import compliance policies and procedures and auditing existing controls, to strategic planning on how to optimize the supply chain through the use of duty savings programs.

Miller & Chevalier's Customs & Import Practice includes several former U.S. government officials, including a former Chief Counsel of U.S. Customs and Border Protection. The Customs team works closely with the firm's FCPA and Anti-Corruption Practice on matters including compliance assessment reviews and trade-related due diligence in the context of mergers and acquisitions.

Prior to joining Miller & Chevalier, Richard spent four years at U.S. Customs and Border Protection (in the Office of Regulations & Rulings), followed by another three years at Baker & McKenzie in Washington, DC.

For additional information about Miller & Chevalier's Customs & Import Practice, please contact Richard Mojica at rmojica@milchev.com or (202) 626-1571.

Editors: John Davis, James Tillen, Marc Bohn,* Ann Sultan,* and Austen Walsh*

Contributors: Kuang Chiang,* Abigail Cotterill,* Jacqueline Ferrand*, Aiysha Hussain,* Jonathan Kossak,* Nate Lankford, Richard Mojica, Claire Palmer,** Katherine Pappas, and Saskia Zandieh*

*Former Miller & Chevalier attorney

**Former Miller & Chevalier consultant

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.