FCPA Summer Review 2014

International Alert

Introduction

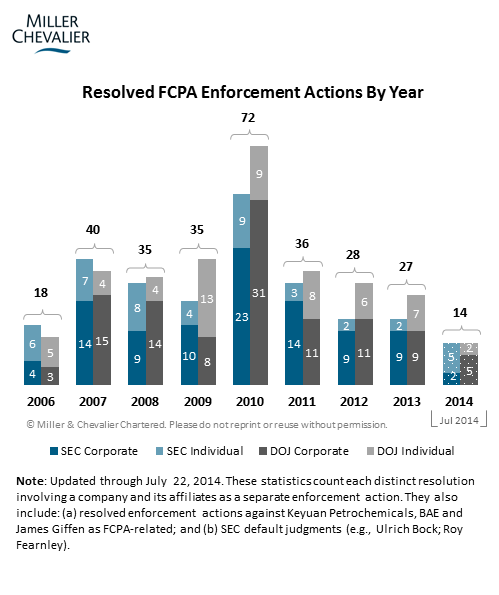

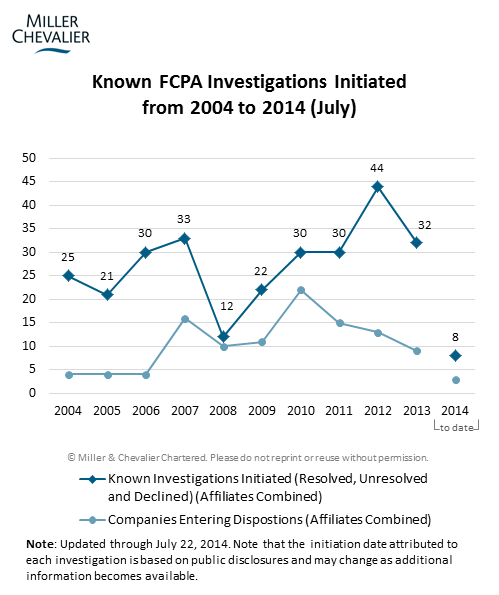

During the second quarter of 2014, U.S. enforcement agencies entered into four corporate Foreign Corrupt Practices Act ("FCPA") actions against Hewlett-Packard Company and three of its subsidiaries (discussed further below). This level of activity represents a continued decline in resolved FCPA enforcement dispositions after a slow first quarter that included only three corporate dispositions involving two companies. While investigation activity levels appear robust (as indicated by the "Known FCPA Investigations Initiated" below), the overall pace of enforcement in 2014, in terms of resolved dispositions, remains at very low levels.

According to Miller & Chevalier’s tracking, there have been fourteen resolved enforcement actions (corporations and individuals) so far this year. After the peak in resolved enforcement in 2010, 2014 levels to date are consistent with activity levels of 2012 (when there were fifteen resolved actions at midyear) and slightly ahead of 2013 levels (when there were eleven resolved actions at midyear).

We anticipate at least one additional settlement in the near future -- that of Avon Products, Inc., which disclosed a tentative settlement with U.S. enforcement agencies in its March 31, 2014, 10-Q filing. Avon stated in its disclosure that the company expects to pay $135 million in aggregate fines, disgorgement, and prejudgment interest to U.S. agencies: $68 million to the U.S. Department of Justice ("DOJ") to resolve a criminal probe and $67 million to the Securities and Exchange Commission ("SEC") to resolve a civil probe. On the DOJ side, the company is expected to enter into a Deferred Prosecution Agreement ("DPA"), while its Chinese unit will plead guilty to books-and-records violations of the FCPA. As part of its DPA, Avon will have a compliance monitor for at least 18 months, to be followed by a period of self-monitoring. On the SEC side, Avon will consent to the entry of final judgment against it on civil charges filed by the Commission. The U.S. agency probe has lasted five years and has cost Avon around $400 million in investigative costs, not including the anticipated settlement payments. The investigation began after Avon identified and self-disclosed allegations of potential misconduct in China.

We have learned of additional FCPA investigations initiated in 2013 from recent disclosures, and with 32 known investigations, 2013 is now the third-highest year on record in terms of investigations initiated, falling just short of 2007 (33 investigations) and 2012 (44 investigations). While we have identified only eight investigations thus far in 2014, this does not necessarily indicate a decline in enforcement activity, as there can be a lag in identifying new investigations because public companies may wait months (or even years) to disclose the existence of an investigation in their public filings, while private companies often never disclose investigations unless they come to light through independent reporting or the announcement of dispositions with enforcement authorities.

In contrast to the slow pace of corporate actions, there have been a number of actions against individuals in 2014, including both U.S. and non-U.S. nationals. These dispositions comport with a trend we noted in the FCPA Spring Review 2014 -- an apparent increase in enforcement actions against individuals aimed at deterring corrupt activities by corporate employees.

As discussed in greater detail below, in this quarter, the government charged two additional executives from Direct Access Partners, sentenced the former President of American Bank Note Holographics, and indicted a former Co-Chief Executive Officer of PetroTiger. In addition, the 11th Circuit provided additional guidance for the FCPA term "instrumentality," while upholding the conviction of two defendants in United States v. Esquenazi.

In our next Review, we will cover in detail the resolution of at least three more dispositions against individuals. The first two dispositions are the SEC's settlement with two Noble Corporation ("Noble Corp.") executives, days before their scheduled trial on FCPA books-and-records charges. Mark Jackson, Noble Corp.'s former CEO, and James Ruehlen, the current head of Noble Corp.'s Nigeria unit, had been scheduled to go on trial July 9, 2014. As discussed in prior Reviews, the two were accused of bribing Nigerian officials in order to acquire illegal import permits for drilling rigs. See FCPA Spring Review 2014, FCPA Spring Review 2013, FCPA Winter Review 2013, and FCPA Spring Review 2012. According to a settlement stipulation and accompanying documents filed in the United States District Court for the Southern District of Texas on July 2, Jackson and Ruehlen will not pay any penalties as part of their settlement with the government. (See Ruehlen consent, Ruehlen judgment, Jackson consent, and Jackson judgment).

The third disposition is the July 17, 2014, guilty plea of William Pomponi, a former vice president at Alstom Power Inc., the Connecticut-based subsidiary of Alstom SA, to conspiracy to violate the anti-bribery provisions of the FCPA. Pomponi was charged on July 30, 2013, and is the fourth defendant to plead guilty to charges related to the investigation of the Taharan power project in Indonesia. (See FCPA Autumn Review 2013 and FCPA Summer Review 2013) As covered in our Spring FCPA Review 2014, Marubeni Corporation, a Japanese corporation that was Alstom's partner in the project, pled guilty to related charges in March 2014.

As discussed below, there were also developments outside the United States this quarter, including the sentencing of the first individual for violating Canada's equivalent of the FCPA, China's continued ramp-up of its investigation of JPMorgan and GlaxoSmithKline, the United Kingdom's disbarment of a lawyer convicted of FCPA violations, and the European Union's adoption of more extensive compliance program reporting requirements. Additionally, the World Bank's Office of Suspension and Debarment issued a Sanctions Report covering the first six fiscal years of the Office's operations from 2007-2013, which sheds light on the Office's practices and their effectiveness.

Actions Against Corporations

Hewlett-Packard Settles with U.S. Agencies for $108 Million

On April 9, 2014, the Hewlett-Packard Company ("HP") and three of its subsidiaries, in Russia, Poland, and Mexico, collectively agreed to pay more than $108 million in criminal and regulatory fines and penalties to the U.S. government to resolve FCPA violations.

HP Russia

HP's wholly owned Russian subsidiary, CJSC Hewlett-Packard A.O. ("HP Russia"), pled guilty to conspiracy to violate the FCPA, as well as one count each of violation of FCPA's anti-bribery, internal-controls, and books-and-records provisions. Under the plea agreement, HP Russia agreed to pay a criminal fine of $58,772,250, and both HP Russia and HP agreed to enhance their compliance programs. In addition, during the three-year term of the plea agreement, HP agreed to file annual reports with the DOJ regarding its remediation efforts and to promptly report any newly discovered credible evidence of potential FCPA violations.

According to the Information, between 2000 and 2004, in connection with an attempt to win a €35 million ($47.5 million) contract to sell computer equipment to the Office of the Prosecutor General of the Russian Federation ("the GPO"), several HP Russia executives created a secret slush fund of several million dollars, partly for the purpose of bribing Russian officials. To create the fund, the HP Russia executives caused a HP German subsidiary to sell the equipment intended for the GPO to a German intermediary and then bought the equipment back at a nearly €8 million ($10.8 million) markup, plus an additional €4.232 million ($5.75 million) payment for purported services. After the GPO paid for the equipment, the intermediary distributed almost all of the excess profits to various shell companies. Some of these companies were associated with "Russian Official A," the director of the Russian government agency overseeing the awarding of the GPO contract, and Official A's associates. In addition to the slush fund, HP Russia also directly entered into a 2003 off-book contract with a shell company associated with Russian Official A to pay that shell company €2.836 million ($3.85 million) in a "commission fee" for the GPO contract.

With respect to the internal-controls and book-and-records charges, the DOJ stated that HP had internal-controls in place to review all HP group companies' service-related projects valued above $500,000. But, the HP Russia executives circumvented that review process: when HP questioned the justification for the €8 million markup, the HP Russia executives offered a falsified a list of services and never disclosed the intended recipients of the markup. In addition, HP Russia never disclosed the off-book €2.836 million commission contract to HP management outside of HP Russia or to internal and external auditors.

To track and hide the slush fund payments, the involved HP Russia executives kept two versions of the GPO-project financing records: a sanitized version for sharing with HP credit, finance, and legal officers outside of HP Russia, and an off-the-book version known only to the conspirators. The off-the-books records were kept as encrypted, password-protected spreadsheets, and those spreadsheets tracked payments to Russian officials and, in one version, explained how the slush fund payments should be hidden.

HP Russia was a wholly owned subsidiary of HP, and as such, a privately held Russian company not ordinarily subject to the FCPA. The DOJ brought its anti-bribery charges against HP Russia under 15 U.S.C. § 78dd-3, which allows the U.S. government to prosecute any who, "while in the territory of the United States, corruptly . . . do any . . . act in furtherance of" a corrupt payment. The DOJ's allegations contain two potential predicate acts. First, the DOJ alleged that in 2001, the HP Russia executives held a meeting regarding the GPO project in Rockville, Maryland, with HP managers and the principals of a proposed intermediary for the GPO project that had "close ties to the Russian government." Second, the DOJ alleged that, concurrent with the bribery scheme, one of the HP Russia executives falsely certified under Sarbanes-Oxley ("SOX") to the accuracy of HP Russia financials and the adequacy of HP Russia internal-controls, and the content of that certification was transmitted to HP's office in Palo Alto, California.

The DOJ relied on 15 U.S.C. § 78m(b)(5) for the internal-controls and books-and-records charges, which allows the U.S. government to prosecute any person who "knowingly circumvent[s] or knowingly fail[s] to implement a system of internal accounting controls" or "knowingly falsif[ies] any book, record, or account" of an issuer.

HP Poland

HP's wholly owned Polish subsidiary, Hewlett-Packard Polska, SP. Z O.O ("HP Poland"), entered into a DPA with the DOJ on two FCPA counts: an internal-controls violation and a books-and-records violation. Under the Agreement, HP Poland admitted to the DOJ's allegations and agreed to pay $15,450,224, in penalties. As with the HP Russia plea agreement, both HP Poland and HP committed to enhance their compliance program, and HP undertook filing annual reports with the DOJ regarding remediation efforts and to promptly report any newly discovered credible evidence of potential FCPA violations.

According to the Information, between 2006 and 2010, HP Poland made corrupt payments to the Director of Information and Communications Technology ("ICT") of the Komenda Glowna Policji ("KGP"), the Polish National Police agency, to win supply contracts with the KGP. The Information recounts seven occasions on which HP Poland's then District Manager of Public Sector Sales delivered cash, generally in paper bags, to the ICT Director. The bags were sometimes delivered in parking lots or at the ICT Director's personal residence. The value of all cash given to the Director totaled approximately $600,000. In addition to the cash, HP Poland also gave the Director personal computers, mobile devices, iPods, flat screen televisions, a home theater system, as well as leisure travel in and around Las Vegas and San Francisco. During the same period, the Polish government awarded HP Poland at least seven contracts in connection with KGP, with a total value of approximate $60 million.

To evade HP's internal-controls, the involved HP Poland executives and the ICT Director communicated using anonymous email accounts and prepaid mobile phones. They met in remote locations and communicated by typing messages in a text file on a computer and passing the computer between them.

Like HP Russia, HP Poland is a wholly owned subsidiary of HP, and as such, a private Polish company not ordinarily subject to the FCPA. The DOJ charged HP Poland with violating the FCPA's internal-controls and books-and-records provisions, under the same section the DOJ used to charge HP Russia, 15 U.S.C. § 78m(b)(5). It is not immediately clear, other than the negotiated nature of such settlements, why the DOJ chose not to charge HP Poland with anti-bribery violations given that HP Poland employees accompanied and funded the ICT Director's leisure travel in and around Las Vegas and San Francisco, which suggests an apparent jurisdictional hook.

HP Mexico

HP's wholly owned subsidiary based in Mexico, Hewlett-Packard Mexico, S. de R.L. de C.V. ("HP Mexico"), entered into a three-year non-prosecution agreement ("NPA") with the DOJ under which it admitted to facts as alleged by the government and agreed to forfeit illicit proceeds in the amount of $2,527,750.

According to the Statement of Facts attached to the NPA, in 2008 and 2009, in the course of trying to win a contract to sell business technology optimization ("BTO") products to Petroleos Mexicanos ("Pemex"), Mexico's state-owned petroleum company, HP Mexico indirectly paid $1.41 million to a "Consultant" linked to Pemex's then Chief Operating Officer and Chief Information Officer. According to the Statement of Facts, HP Mexico had understood early in the sales process, that to win the sale, it had to make payments to the Consultant. While the Consultant "had technical experience with Pemex's IT systems," HP Mexico ultimately retained the Consultant "primarily because of Consultant's connection" to Pemex's senior officials. After contracting with the Consultant, HP Mexico did win the BTO contract, valued at approximately $6 million. HP Mexico then paid the Consultant its commission through an intermediary. A few weeks after receiving the commission, the Consultant made a number of cash payments, totaling at least $125,000, to an entity controlled by Pemex's then Chief Information Officer.

To pay the Consultant, who was not an approved HP Mexico channel partner, HP Mexico paid the deal-partner fee through another company that was an approved partner (even though that intermediary played no role in negotiating the BTO deal). HP Mexico employees misrepresented to HP managers the services the Consultant provided in order to circumvent HP's internal-controls.

In explaining its decision to not prosecute HP Mexico, the DOJ cited HP Mexico's cooperation, "extensive remediation," and the company's commitment to future cooperation and further compliance enhancements. As is generally the case, the NPA does not state the specific FCPA charges the DOJ had declined to prosecute, or their jurisdictional basis. Like HP Russia and Poland, HP Mexico is a wholly owned subsidiary of HP, and as such, a private Mexican company not ordinarily subject to the FCPA.

HP

The DOJ did not charge HP directly. As a party to the DOJ's settlements with HP Russia and HP Poland, HP guaranteed the payments of those subsidiaries' penalties, committed to implement an adequate compliance program "throughout its operations," and, as described above, agreed to file annual reports with the DOJ regarding its remedial efforts.

In contrast, the SEC brought an administrative action against HP, but not any of the three HP subsidiaries, alleging violations of the FCPA's internal-controls and books-and-records provisions. The SEC's allegations are largely identical to the DOJ's allegations against the three HP subsidiaries, except that the SEC also alleged that the subsidiaries' false accounting entries were consolidated into HP's reported financials, and that HP had failed to devise and maintain sufficient accounting controls to detect and prevent the subsidiaries' improper payments.

To settle the SEC charges, HP consented to a Cease and Desist Order and agreed to pay $29 million in disgorgement and $5 million in prejudgment interest. HP also agreed to, during the three-year term of the Order, report any newly discovered credible evidence of potential FCPA violations to the Commission and submit annual reports to the Commission regarding its remedial efforts.

Noteworthy Aspects

- Different Resolution Approach for Each HP Entity: One interesting aspect of this settlement is the variety of mechanisms deployed to resolve the matter. The public papers suggest, but do not clearly state, the basis for taking different approaches with each of the four entities involved in the matter. The DOJ did not charge HP, but charged its foreign subsidiaries, against which the FCPA ordinarily would not directly apply. As discussed above, for the accounting charges, which were brought against HP Russia and HP Poland, the DOJ relied on 15 U.S.C. § 78m(b)(5). For the anti-bribery charges against HP Russia, the DOJ notes two potential predicate acts for establishing territorial jurisdiction under 15 U.S.C. § 78dd-3. For one of the potential predicate acts -- the false SOX certification -- the DOJ only alleged that the certification was transmitted to, but not that it was made while "in the territory of" the United States. As reported in our coverage of the SHOT Show trials in FCPA Summer Review 2011, at least one court has held that mailing a document to the United States from a foreign country cannot satisfy the acting "while in the territory of the United States" requirement. For HP Poland, the DOJ did not charge the company with anti-bribery violations, even though it appears that the agency could have done so given activities by HP Poland employees in the United States. Similarly, for HP Mexico, while the DOJ did not identify what charges it would have filed against the company, it appears that the DOJ could have charged HP Mexico with accounting violations under 15 U.S.C. § 78m(b)(5). Allegations stated in HP Mexico's NPA do not appear to support a jurisdictional basis for charging HP Mexico with anti-bribery violations -- the only United States related allegation is that HP Mexico made the payments that ultimately went to the Consultant "via wire transfer in U.S. dollars through a correspondent bank account in the United States." In the end, these variations probably are most instructive as illustrations of how much negotiation goes into the structure and content of FCPA settlements.

- Good, but Not Good Enough: FCPA resolutions often involve U.S. agencies giving defendants credit for cooperation, and the HP prosecution is no exception. But less common is credit given for a company's pre-existing compliance program, with a notable exception being that of Morgan Stanley, which we covered in our FCPA Summer Review 2012. In prosecuting the three HP subsidiaries, the DOJ alleged in each case that executives at the subsidiary took actions to "circumvent" HP's internal-controls. Indeed, the DOJ charged HP Russia and HP Poland with "knowingly" circumventing HP's compliance procedures under 15 U.S.C. § 78m(b)(5). The DOJ did not charge HP for internal-controls or books-and-records failings; rather, in its charging documents, the DOJ described various HP internal-controls and explained how subsidiary employees evaded those controls. While the SEC did charge HP with accounting violations, the agency imposed a comparatively modest penalty in comparison to the penalties imposed on HP Russia. These facts suggest that the U.S. agencies gave HP credit for its compliance program, even if the program was not good enough to win full immunity for HP, as was in the case of Morgan Stanley.

Many factors could explain the difference in outcome between HP and Morgan Stanley, but the most important is perhaps highlighted in SEC's Press Release, in a quote from Kara Brockmeyer, Chief of the SEC Enforcement Division's FCPA Unit, that "Hewlett-Packard lacked the internal-controls to stop a pattern of illegal payments to win business in Mexico and Eastern Europe" (emphasis added). In contrast to Morgan Stanley, where a single individual was accused of evading the company's internal-controls in a single transaction structured to enrich himself and a foreign official, HP's internal-controls failed in multiple high-risk countries, in multiple transactions that involved more than a few inadequately vetted third parties and contracts. At a more granular level, comparing the DOJ's descriptions of HP's and Morgan Stanley's internal-controls suggests that HP's controls were not as robust and lacked certain elements present in Morgan Stanley's program, such as frequent anti-corruption training, random audits of high-risk transactions, and extensive and stringent due diligence requirements on all new third parties.

- FIFA World Cup Entertainment: The SEC's Order alleged that, in 2006, HP Russia, in violation of HP policy, arranged for a number of government customers to attend an HP marketing event in connection with the FIFA World Cup tournament in Germany and provided those government customers with high-value travel and entertainment. World Cup-related allegations also came up in the November 2013 prosecution of Weatherford International Ltd., which we discussed in our FCPA Winter Review 2014. The inclusion of World Cup hospitality in these resolutions is a reminder that companies hosting customers at major entertainment events -- such as the upcoming 2016 Olympics in Brazil -- should ensure that they have proportionate and adequate procedures in place to detect and prevent potential violations.

- Pemex, Again: Pemex, Mexico's state-owned petroleum company, features in the HP Mexico resolution. By our rough count, Pemex is one of the instrumentalities implicated most frequently in FCPA resolutions. Indeed, it was featured in one of the first FCPA prosecutions, the 1982 prosecution of International Harvester Company.

- Follow-on Prosecution by U.S. Agencies: The HP prosecution presents the mirror image of the common scenario of U.S. prosecutions spurring follow-on prosecutions in other countries. According to press reports, the investigation against HP Russia began in Germany, in 2007, when German tax authorities flagged a €22 million payment to a small computer hardware company in Leipzig that did not seem to have the capacity to perform work of such high value. The Leipzig company is likely the German intermediary identified by the DOJ and the SEC that HP Russia used in the GPO transaction. The investigation became public when, in April 2010, Russian authorities raided HP Russia's Moscow office at the request of the German investigators. U.S. agencies joined the investigation thereafter. In September 2012, German authorities charged three former HP Russia executives for making improper payments to win the GPO contract. Reportedly, one of the charged executives is an American.

Actions Involving Individuals

Two More from Direct Access Partners Charged for Giving Kickbacks to Venezuelan Bank Official

In April 2014, the DOJ, SEC, and the U.S. Attorney's Office for the Southern District of New York indicted and filed amended complaints against two Wall Street executives, Benito Chinea and Joseph DeMeneses, for conspiring to conceal multi-million dollar kickback payments to María de los Angeles González de Hernandez, an official in Venezuela's state-owned economic development bank, Banco de Desarrollo Económico y Social de Venezuela ("BANDES"). Chinea and DeMeneses were the Chief Executive Officer and a managing partner, respectively, of the New York- and Miami-based brokerage firm Direct Access Partners ("DAP").

These most recent charges, which include money laundering, obstruction of justice, and conspiracy to violate the FCPA's anti-bribery provisions and the Travel Act, arose just one year after the arrest of three other high-level DAP employees, Ernesto Lujan, Tomas Alberto Clarke Bethancourt, and Jose Alejandro Hurtado, all of whom pled guilty to six counts of conspiring to violate the FCPA, the Travel Act, and money laundering in August of 2013. (See our FCPA Summer Review 2013).

According to the indictment, Chinea and DeMeneses bribed Gonzalez to direct BANDES' bond-trading business to DAP's Global Markets Group. The indictment alleges that between 2008 and 2012, Chinea and DeMeneses (along with Lujan, Bethancourt, and Hurtado) engaged in this scheme with Gonzalez, through which DAP ultimately received over $60 million in commissions from BANDES, of which $5 million went to Gonzalez.

The indictment states that Chinea and DeMeneses also allegedly attempted to launder the money through third parties posing as "foreign finders," shell companies, and Swiss bank accounts. The indictment further alleges that, although BANDES' profits surged, Gonzalez became increasingly dissatisfied with the lateness of her payments, at one point threatening to withdraw BANDES' business, prompting Chinea and DeMeneses to transfer $1.5 million to her from their personal bank accounts. The two men then allegedly used DAP's funds to reimburse themselves and hid the payments in DAP's financial books as fake loans to associated corporate entities.

The scheme emerged in 2010 when the SEC was performing a periodic audit of DAP. The complaint states that, in 2011, DeMeneses and others allegedly agreed to conceal their payments to Gonzalez from the SEC through actions such as deleting emails.

The SEC filed an amended complaint which sought disgorgement and financial penalties against Chinea, DeMeneses, and five other defendants at DAP. As part of its complaint, the SEC also alleged that the two men engaged in a similar kickback scheme with executives at another Venezuelan state-owned bank, Banfoandes.

In April, Chinea and DeMeneses pled not guilty in the U.S. District Court for the Southern District of New York. Their trial is scheduled to begin on February 9, 2015.

Former President of American Bank Note Holographics Sentenced Nearly 13 Years After Guilty Plea

On May 8, 2014, Chief Judge Loretta A. Preska of the Southern District of New York sentenced Joshua Cantor, the former president and director of American Bank Note Holographics, Inc. ("ABNH"), to time served and ordered him to pay a $400 fine. The sentencing came nearly thirteen years after Cantor entered a guilty plea, in 2001, to a four-count indictment. The first three counts of the indictment charged Cantor with conspiracy and falsifying books-and-records in connection with a financial-statement fraud scheme, which took place in the late 1990s -- alleged violations of the Securities Act of 1933 and the Securities Exchange Act of 1934. The fourth count separately alleged that Cantor violated the anti-bribery provisions of the FCPA by authorizing an improper payment through a Swiss bank account for the benefit of one or more Saudi Arabian officials to secure business for ABNH to produce holograms for the government of Saudi Arabia.

As reported in our FCPA Spring Review 2013, the lengthy delay in Cantor's sentencing was tied to delay in the sentencing of Morris Weissman, the former Chairman and CEO of American Banknote Corp. and, later, ABNH. Cantor had cooperated with prosecutors in the case against Weissman and testified at Weissman's trial. A federal jury convicted Weissman in 2003, but he was not sentenced until January 3, 2013, due primarily to his ongoing health problems.

Former Co-Chief Executive Officer of PetroTiger Indicted

On May 9, 2014, the DOJ indicted the former Co-Chief Executive Officer of PetroTiger Ltd, Joseph Sigelman, for his role in a scheme to bribe Colombian officials in exchange for a $39.6 million oil services contract from state-controlled oil company Ecopetrol SA. See our FCPA Spring Review 2014. The DOJ charged Sigelman with conspiracy to violate the anti-bribery provisions of the FCPA, conspiracy to commit wire fraud, conspiracy to launder money, and substantive FCPA anti-bribery and money laundering violations. According to court records, U.S. District Court Judge Joseph Irinas has set an accelerated trial date for July 28, 2014.

According to public sources, PetroTiger voluntarily brought the case to the DOJ's attention and has been cooperating with the investigation. Three former PetroTiger executives have been indicted in relation to the Colombian bribery scheme, including PetroTiger's other former Co-CEO, Knut Hammarskjod, and former general counsel, Gregory Weisman, who have both pled guilty to conspiracy to violate the FCPA and commit wire fraud.

Six Foreign Nationals, Including Foreign Officials, Indicted in Connection with Mining in India

On April 2, 2014, federal prosecutors unsealed an indictment alleging six foreign nationals, including a Ukrainian oligarch, paid bribes to India's then-Chief Minister of Andhra Pradesh and other Indian state and central government officials for mining licenses. Prosecutors indicted the defendants -- Dmitry Firtash and Suren Gevorgyan of Ukraine; Andras Knopp, a Hungarian businessman; Gajendra Lal, an Indian national and former longtime resident of the United States, currently residing in Russia; and Periyasamy Sunderalingam of Sri Lanka -- on June 20, 2013, for conspiracy to violate the anti-bribery FCPA provisions, interstate travel in aid of racketeering, and racketeering and money laundering conspiracy. Prosecutors also indicted Ramachandra Rao, a sitting Member of Parliament in India and former advisor to the late Chief Minister of Andhra Pradesh, on the non-FCPA charges. By indicting Rao on these charges, the DOJ once again sought to prosecute foreign corruption via alternative legislation to the FCPA, a trend highlighted in the FCPA Spring Review 2014.

The pleadings state that Firtash, a Ukrainian billionaire alleged to have ties to Russian President Vladimir Putin, conspired to pay at least $18.5 million in bribes from Group DF, his "international conglomerate" of companies, to the late Chief Minister of Andhra Pradesh. The DOJ also alleges that Knopp and Gevorgyan met with Indian officials and "Company A," an unnamed company headquartered in Chicago that would benefit from the licensing. According to the pleadings, Lal and Sunderalingam coordinated the amount and payment of bribes to Rao who allegedly abused his position of power in acceptance of the payments. The indictment identifies $10.59 million in transfers between various entities, many controlled by Group DF, from April 2006 through July 2010, and seeks the forfeiture of that amount from all defendants in addition to Firtash's property and contractual rights in 159 companies and funds in 41 bank accounts. According to the indictment, the defendants paid the bribes to facilitate mining licenses for minerals including ilmenite, which is used in titanium-based products commonly in the aerospace industry. Sales of titanium products manufactured from these minerals to an unnamed company headquartered in Chicago were expected to produce $500 million annually.

None of the defendants are currently in U.S. custody. Austrian authorities arrested Firtash in Vienna, Austria on March 12, 2014, and he is currently free on bail, having posted a record bond equivalent to about $174 million. He awaits extradition to the United States. The DOJ has requested India arrest Rao. Other defendants remain free. According to U.S. Attorney Zachary T. Fardon, "Criminal conspiracies that extend beyond our borders are not beyond our reach. We will use all of the tools and resources available to us to ensure the integrity of global business transactions that involve U.S. commerce."

Firtash's arrest by Austrian authorities at the request of the Federal Bureau of Investigation (FBI) coincided with an escalation of tensions between Russia and the United States. According to media reports, Firtash insists on his absolute innocence and his supporters claim that his arrest is a politically motivated attempt to preclude him from influencing Ukrainian politics and a demonstration of the U.S. resolve to counter President Putin's foreign policy towards Ukraine.

Civil Litigation

Developments in Wal-Mart Shareholder Litigation

This quarter featured developments in two separate lawsuits against Wal-Mart stemming from their FCPA investigation.

Wal-Mart Class Action Suit over FCPA-Related Misrepresentations Survives Motion to Dismiss

On May 8, 2014, a magistrate judge in the District Court of the Western District of Arkansas denied Wal-Mart's motion to dismiss related to a putative class action case brought by a pension fund (See Judge's report). The case alleges various securities fraud violations by Wal-Mart and its current CEO, Michael Duke, related to allegations of bribes in Mexico that are currently the subject of an ongoing FCPA investigation by U.S. agencies.

We have reported on the Wal-Mart investigation in our prior FCPA Reviews (See FCPA Autumn Review 2012 and FCPA Spring Review 2014). The plaintiffs in this shareholder suit, citing extensively from the April 2012 New York Times article that first raised the issue in public, allege that Wal-Mart knew that the newspaper was investigating the corruption issues in Mexico and an alleged cover-up of those issues within the company in Fall 2011. Despite this knowledge, the plaintiffs assert that Wal-Mart did not sufficiently disclose these issues in a Form 10-Q filed in December 2011.

Specifically, the plaintiffs allege that Wal-Mart's disclosure misled investors by suggesting that the company had only learned of the issues in 2011, that it had hired outside counsel to investigate, and that the company had undertaken remedial measures and disclosed the case to the DOJ. The plaintiffs then allege that each of these disclosures was inaccurate and misleading, as shown by the New York Times article and as effectively admitted by the company in its changed description of the matter filed in its June 2012 10-Q. Citing share price fluctuations after the publication of the newspaper article, the plaintiffs state that "billions of dollars of shareholder value was erased immediately" and never regained, despite later increases in the share price due to other factors.

In response, Wal-Mart filed a motion under Rule 12(b)(6) of the Federal Rules of Civil Procedure for failure to state a claim. The magistrate judge analyzed this under standards for surviving such motions enacted under the 1995 Private Securities Litigation Reform Act. These standards effectively require plaintiffs to plead in detail the falsity of each allegation and to plead facts that raise a "strong inference" that the company had the required state of mind, or scienter, to support a securities fraud violation. Focusing on the facts and circumstances pleaded by both sides regarding the December 2011 10-Q, the magistrate judge determined that the exclusion of facts related to Wal-Mart's 2005-2006 investigation (which were described by the newspaper article) was an omission that a reasonable investor would have viewed as "significantly altering" the information available. The magistrate judge also determined that this omission, together with other allegations revealed in the article and Wal-Mart's own changes in the June 2012 10-Q, met the standard for pleading scienter.

Surviving a motion to dismiss is an important step for any securities fraud case, but this ruling does not mean that the plaintiffs will ultimately prevail. The ruling does open the road to discovery and other legal wrangling that will likely add significantly to the costs to Wal-Mart being generated by these issues.

Delaware Supreme Court Affirms Ruling Ordering Wal-Mart to Produce Internal Investigation Files

On July 23, 2014, the Delaware Supreme Court unanimously affirmed a lower court ruling that allowed shareholder plaintiffs extensive discovery into Wal-Mart's confidential and privileged documents relating to its internal investigation of a 2005 whistleblower's allegations of corrupt payments by Wal-Mart Mexico.

The case on appeal, Indiana Electrical Workers Pension Trust Fund IBEW v. Wal-Mart Stores Inc., was filed in August 2012, a few months after the New York Times published articles alleging that in 2005, Wal-Mart received a whistleblower complaint that alleged widespread bribery by Wal-Mart's Mexican subsidiary ("Wal-Mart Mexico"), and that Wal-Mart senior executives cut short and "hushed up" the internal investigation into the whistleblower's allegations after a preliminary investigation found evidence of potential illegal corrupt payments. The plaintiffs ultimately seek to hold Wal-Mart board members personally liable for the allegedly "hushed up" investigation. As a part of that effort, the plaintiffs demanded that Wal-Mart turnover documents related to the internal investigation, arguing in part that those documents could show that Wal-Mart directors knew about the whistleblower complaint or related red flags but failed to diligently investigate those red flags, thereby failing at their fiduciary duty as directors to prevent corporate wrong doing.

In its appellate brief and during the oral arguments, Wal-Mart claimed that the lower court's ruling ordering Wal-Mart to produce documents demanded by the plaintiffs was unprecedentedly broad. The lower court's Final Order required the company to produce: (1) officer (and lower) level documents regardless of whether they were ever provided to Wal-Mart's Board of Directors or any committee thereof; (2) documents spanning a seven-year period and extending well after the alleged bribes and investigation at issue; (3) documents from disaster recovery tapes; and (4) any additional responsive documents "known to exist" by the undefined "Office of the General Counsel." In addition, the order required the production of "contents of Responsive Documents that are protected by attorney-client privilege … and the contents that are protected by the attorney work-product doctrine."

Wal-Mart argued that the lower court abused its discretion by requiring production of documents that "far exceed[ed]" the proper scope of such proceedings and that the court improperly ordered Wal-Mart to hand over information protected by attorney-client privilege and attorney work-product doctrine.

The Delaware Supreme Court, however, affirmed the lower court's production requirements in whole. It ruled that the lower court did not overstep its boundaries and that the required document production was essential and necessary to IBEW's purpose of investigating the underlying bribery and subsequent handling of the investigation. In regards to Wal-Mart's objections based on attorney-client privilege and attorney work-product doctrine, the Court explicitly held that privilege exceptions can be made in derivative actions alleging fiduciary duty violations, including actions for corporate books and records that may proceed such derivative actions, if the plaintiff can demonstrate "good cause" under factors initially stated in Garner v. Wolfinbarger, a Fifth Circuit case from 1970. The Delaware Supreme Court held that the plaintiffs have shown "good cause" in this case under Garner, highlighting in particular that: (1) the plaintiffs have a colorable claim, (2) the requested information is essential to plaintiffs' case and not available otherwise, and (3) the requested information was narrowly focused on the alleged fiduciary duty violations at issue, and did not implicate the current litigation.

Other U.S. Developments

Appeals Court Finds Telecom Company a Government "Instrumentality" under the FCPA

In May, in a much-anticipated ruling, the U.S. Court of Appeals for the Eleventh Circuit held that a Haitian telecommunications company was an "instrumentality" of the government of Haiti. United States v. Esquenazi, 11-15331 (11th Cir. May 16, 2014). Providing the DOJ with a significant win, the Eleventh Circuit became the first federal appellate court to define "instrumentality" as used in the FCPA.

In a decision that largely accepted the DOJ definition of the term, the court found "instrumentality" to mean any "entity controlled by the government of a foreign country that performs a function the controlling government treats as its own" and provided a non-exhaustive list of factors to assist the analysis.

Classifying an entity as an "instrumentality" is important because the definition of "instrumentality" drives the scope of statutory term "foreign official." The FCPA prohibits bribes to "foreign officials," defined as "any officer or employee of a foreign government or any department, agency, or instrumentality thereof" (emphasis added). The meaning of the term "instrumentality," which the statute does not separately define, has been previously addressed by several U.S. district courts that have defined the term by reference to a list of overlapping factors. Consistent with those district court decisions, A Resource Guide to the U.S. Foreign Corrupt Practices Act (FCPA Guide) states that companies "should consider these factors when evaluating the risk of FCPA violations and designing compliance programs." Before Esquenazi, no U.S. Court of Appeals had ruled on the issue. For a more extensive discussion about the arguments from both sides, please refer to our FCPA Winter Review 2014.

The main question in Esquenazi was whether Telecommunications D'Haiti, S.A.M. ("Teleco"), a Haitian-government-owned telecommunications company is an "instrumentality." The defendants, co-owners of Miami-based Terra Telecommunications Corp., were convicted of bribing Teleco directors in violation of the FCPA. On appeal, they argued that Teleco was not an instrumentality and therefore its directors were not "foreign officials" for purposes of the FCPA. The Eleventh Circuit rejected this argument.

Noting the company's 97% ownership by the government, appointment of directors by the Haitian President, and monopoly over telecommunications services, the court determined that "Teleco would qualify as a Haitian instrumentality under almost any definition we could craft." The court went on to define the term, implicitly acknowledging the likely precedential effect of its decision and citing the needs of both corporations and the government to know whether they are working with "foreign officials" to avoid potential problems.

The court in Esquenazi set forth a two-part test for determining whether a company is an "instrumentality." An entity is an "instrumentality" if (a) it is controlled by the government of a foreign country and (b) performs a function that the controlling government treats as its own. Acknowledging that each prong of the test raises "fact-bound questions," the court then outlined for each a list of non-exhaustive factors that "may be relevant to deciding the issue."

In analyzing if the government controls an entity, courts and juries should look to:

- The government's formal designation of the entity;

- Whether the government has a majority interest;

- The government's ability to hire and fire the entity's principals;

- The extent to which the government profits or subsidizes the entity; and

- The length of time these indicia have existed.

For the second prong of the test -- whether the entity performs a function the government treats as its own -- the court cites the following considerations:

- Whether the entity has a monopoly over the function;

- Whether the government subsidizes costs associated with the entity providing services;

- Whether the entity provides services to the public; and

- Whether the public and the government perceive the entity to be performing a governmental function.

The court's step-by-step analysis in reaching its decision in this case is worth noting. As Esquenazi presented a question of statutory interpretation, the court began with the plain meaning of the statute and dictionary definitions of the term. The court then reviewed the statutory context of the term. It first looked at the language of the facilitating payments exception provision in the FCPA, which defines such payments in light of their purpose "to expedite or to secure the performance of a routine governmental action by a foreign official" (emphasis in the original). The court noted that "routine governmental action" is defined in the statute as action commonly performed by a foreign official in, "among other things, ‘providing phone service'" and concluded that if an entity providing such a service could never be included in the definition of a "foreign official," it would not have been necessary to provide an express exception for such an entity. This logic, the court reasoned, nullified the defendants' argument to categorically exclude government-controlled entities providing telephone services from inclusion under "instrumentality."

Next, the court undertook an analysis that is logical here, but uncommon in statutory construction, namely, looking to after-the-fact congressional action to determine the intended meaning of a statutory provision enacted years before. For guidance, the court looked to the 1998 amendments to the FCPA that Congress adopted to implement the Organization for Economic Cooperation Development's Convention on Combating Bribery of Foreign Public Officials in International Business Transactions ("OECD Convention"). Specifically, the court found that Congress's failure to amend the term "foreign official," which was defined when the FCPA was adopted in 1977, reflected a congressional determination that the meaning of the phrase was at least as broad as the meaning of the corresponding term in the OECD Convention.

To determine that meaning of the OECD Convention term "foreign public official," the court turned to both the Convention itself and the "commentaries" to the Convention, which further explicate the Convention's terms. The Convention defines a "foreign public official" to include any person exercising a public function for a "public enterprise." The commentaries further state that a "public enterprise" is any enterprise over which a government may directly or indirectly "exercise a dominant influence."

Based on each of its analyses, the court found that the definition argued by the individual defendants in Esquenazi was inconsistent with the language of the FCPA and would likely conflict with the international treaty obligations the United States accepted in ratifying the OECD Convention.

The test set forth by the court in Esquenazi is not a simple binary test for which some have argued, and it does not eliminate the opportunity for either the government or defendants to base arguments on various factors that the court listed, or on others. As has been the case to-date, judgments on whether individuals are "foreign officials" will have to be made on a case-by-case basis.

The decision does, however, give considerably greater shape to the definition of this key statutory term. While the applicability of the term remains a factual issue, in many situations the status of an entity as an "instrumentality," and thus the status of its employees as "foreign officials," may be clear without having to resort to the court's subsidiary factors that could become the focus of disagreement in closer cases.

Although the decision of the Court of Appeals may be appealed, and similar issues may come before other appellate courts, the Esquenazi decision largely confirms the government's interpretation and implementation of two terms that the statute defines broadly. A lesser consequence is that it leaves the agencies' FCPA Guide in need of a limited update.

International Developments

European Union (EU) Adopts Broad Compliance Disclosure Rule

On April 15, 2014, the European Council and Parliament adopted a new Directive requiring large companies to disclose non-financial information about internal policies regarding anti-corruption and bribery issues, environmental compliance, social and employee-related matters, respect for human rights, and diversity on boards of directors.

The new measure will apply to large public-interest entities with more than 500 employees whose balance sheets exceed €20 million or with a net turnover of €40 million. These entities include publicly listed companies, unlisted companies (such as banks and insurance companies), and other companies designated by EU Member States because of their business activities, size, and number of employees. The new requirements will affect approximately 6,000 large companies and groups across the EU.

The Directive requires concise, useful information necessary to understand a company's internal policies regarding the environmental and social matters that the Directive covers, the performance and impact of the company's initiatives, and the risks and risk management in these different sectors. Companies should provide the following non-financial information regarding anti-corruption issues:

- A brief description of the company's business model and commercial strategy;

- A description of the company's internal policies to fight corruption and bribery, including due diligence processes for monitoring the company's supply chain (or, if the company does not have such policies in place, it should explain why);

- The result and impact of existing policies;

- Significant corruption or bribery incidents that occur during the reporting period;

- The principal risks the company faces with regards to corruption and bribery; and

- The way the company manages the risks it has identified.

Affected companies will retain significant flexibility as to how to disclose relevant information. They may choose to report at the group level, instead of having each affiliate provide a separate report. Additionally, although the European Commission (the "Commission") is expected to develop more detailed, non-binding guidelines at a later date, companies currently may choose to report following international, European, or national guidelines, such as the UN Global Compact, ISO 26000, or the German Sustainability Code. Finally, where disclosing information relating to ongoing negotiations would seriously prejudice the company, Member States may allow a company to omit confidential information as long as doing so would not prevent a fair and balanced understanding of the company and the impact of its activity.

According to the Commission, the new reporting requirements will result in direct costs to large companies of up to €5,000 per year, and up to €30 million to the EU as a whole. The Commission also suggests that increased transparency will benefit companies in the long term by attracting more investors and talented employees, as well as reducing companies' financing costs and making them more successful.

The new Directive also represents a first step towards implementing the European Council Conclusions of May 22, 2013, which called for long-term measures to fight tax evasion and fraud through country-by-country reporting by large companies and groups. By July 2018, the Commission is expected to report on the possibility of introducing an obligation requiring annual country-by-country reports on profits made, taxes paid, and public subsidies received.

World Bank Office of Suspension and Debarment Releases Sanctions Report

On June 25, 2014, the World Bank's Office of Suspension and Debarment ("OSD") released a "Report on Functions, Data and Lessons Learned 2007-2013," providing new insights into the World Bank sanctions system. The report follows the publication of other important information that sheds light on World Bank sanctions, such as the Sanctions Board Law Digest and case decision overviews for cases that have gone to appeal since 2012.

OSD performs the first level of adjudication in the sanctions process. It reviews evidence of sanctionable practices collected by the Integrity Vice Presidency ("INT"), finds if the evidence is sufficient to support a determination that a Respondent engaged in a sanctionable practice, issues a Notice of Sanctions Proceeding to formally commence the sanctions proceeding, and recommends a specific sanction. Respondents can accept the sanction recommended by OSD or appeal it to the Sanctions Board. This system of adjudication is designed to help ensure an impartial review of the sufficiency of evidence.

OSD's new report covers the first six fiscal years of its operation. It has several key findings:

- In 95% of sanctions cases, OSD determined that there was sufficient evidence to support at least one of the claims made by INT. It rejected 5% of cases in their entirety.

- OSD referred 38% of cases back to INT based on a determination that there was insufficient evidence to support one or more of the accusations made.

- OSD found insufficient evidence on all claims related to 13% of Respondents included in cases (some cases involve multiple Respondents).

- On average, OSD takes 60 days to make an evidentiary determination in a case.

- OSD renders a new determination, on average, once every ten days.

- In 40% of cases, Respondents appeal the case to the Sanctions Board.

- Settlements account for a considerable percentage of cases -- almost 30% in FY 2011, 22% in FY 2012, and 23% in FY 2013.

- While INT investigations take significant time to complete, they have steadily grown shorter. In FY 2008 and 2009, they commonly lasted up to three years, or longer. In FY 2011 and 2012, it was more common to see investigations completed in less than two years.

- 86% of cases and settlements received by OSD are based on fraud, 14% on corruption, and 9% on collusion (some cases include more than one type of sanctionable practice).

- When considering the types of fraud at issue in sanctions cases, there are about the same amount of cases involving forged third-party documents, like bank guarantees, manufacturer's certificates, and performance or experience documentation (105 cases), as there are of other forms of fraud, like false invoices or payment certifications, misrepresentation or omission regarding conflict or agent, or misrepresentation regarding past performance (99 cases).

In its report, OSD provides "lessons learned" for setting up suspension and debarment systems. This section might be intended to provide guidance to other multilateral development banks that have less mature sanctions programs. National governments could also use these recommendations in managing their administrative proceedings. Lessons include securing sufficient budgets, setting up administrative and case management systems, keeping a detailed chronological file of every case down to each phone call and meeting, and creating mechanisms for obtaining interpretations on legal and procedural matters.

Canada Sentences First Individual to Prison under Anti-Corruption Act

On May 23, 2014, Canada sentenced Nazir Karigar to three years in prison for allegedly offering to bribe Air India officials and then-Indian Minister of Civil Aviation to secure an airline security contract in June 2006. Karigar is the first individual sentenced to jail under Canada's Corruption of Foreign Public Officials Act ("CFPOA"), which Canada enacted in 1998.

The pleadings state that Karigar, an Ottawa businessman, organized a bribery conspiracy between Cryptometrics, a Canadian company that designs facial recognition technology, and Air India. In 2005, Air India sought bids for facial recognition technology to enhance airline security. The pleadings allege that despite transfers of $450,000, to Karigar's Mumbai bank account for the purpose of bribing Indian officials, Cryptometrics did not win the bid because the arrangements fell through. A former Cryptometrics Vice President, who was closely involved in the conspiracy and received immunity for his testimony, was the primary witness for the prosecution.

In his sentencing opinion, the judge signaled that the three-year sentence would not be unusual: "[A]ny person who proposes to enter into a sophisticated scheme to bribe foreign public officials to promote the commercial or other interests of a Canadian business abroad must appreciate that they will face a significant sentence of incarceration in a federal penitentiary." Under the CFPOA, the maximum prison sentence for an individual is fourteen years. The CFPOA does not prescribe a maximum monetary fine for individuals or organizations. For organizations, a court may also set conditions of probation including restitution, requiring compliance measures, and requiring public disclosure of conviction.

Arrest and Accusation of JPMorgan and GSK Executives in China

Several news outlets reported in May that Hong Kong's Independent Commission Against Corruption (the "ICAC") arrested Fang Fang, the former head of JPMorgan in China. Authorities questioned and released Fang, but prohibited him from leaving Hong Kong. The SEC and DOJ are investigating whether JPMorgan hired the children of government officials to win business in China, as indicated by the bank in a quarterly securities filing in 2013. Fang's arrest is related to a similar inquiry by Chinese authorities. Two days after Fang's arrest, the ICAC searched JPMorgan's local headquarters and confiscated documents from Fang's office. Fang was not formally accused, but Hong Kong's special prosecutor still may bring charges after reviewing the evidence. Notably, according to news sources, the United States' investigation focuses on the bribery of government officials in particular, but the Chinese investigation extends to all forms of corruption, not only those involving government officials. This expanded scope may have far-reaching implications for JPMorgan in China and throughout Asia.

In addition, in May, the Chinese government formally charged Mark Reilly, the former head of GlaxoSmithKline in China, with corruption. The Chinese authorities allege that Reilly ordered his subordinates to form a "massive bribery network" that resulted in higher drug prices and illegal revenue of more than $150 million. As reported in our FCPA 2013 Autumn Review, Chinese authorities previously alleged that GSK China used up to $500 million to bribe government officials, drug associations, medical foundations, hospitals, and doctors to secure business. The Chinese government arrested several other GSK employees at the time, but did not formally charge them. Meanwhile, GSK has insisted that the alleged wrongdoing was outside its system of controls, and was limited to only a few Chinese-born employees. While charges against foreign nationals remain rare in China (the last being Rio Tinto in 2009), Reilly's indictment shows that foreign executives are not immune. The charge carries a maximum sentence of life in prison, and was more severe than industry insiders expected. Given that the U.S. enforcement agencies also have expanded their investigation into GSK's operations in China, Reilly's indictment is likely to be of particular interest to the SEC and the DOJ.

With both of these developments, the Chinese government appears to be working to demonstrate commitment to its pledge to eradicate corruption in China. Miller & Chevalier will continue to follow both of these cases.

British Lawyer Disbarred for Violating FCPA

In May, the U.K. Disciplinary Tribunal of the Solicitors Regulation Authority ("SRA") disbarred Jeffrey Tesler, a British lawyer convicted of FCPA violations for helping KBR and three other companies bribe Nigerian officials. The Southern District of Texas convicted Tesler in February 2012 of conspiracy to violate the FCPA and of violating the anti-bribery provisions of the FCPA. The disbarment comes on the heels of Tesler's forfeiture of more than $148 million and a 21-month jail sentence.

As reported in our FCPA Winter Review 2009, KBR and three other companies formed a joint venture to build natural-gas facilities in Nigeria. KBR allegedly hired Tesler and a Japanese trading company to help bribe Nigerian government officials in order to obtain the construction contracts. During the decade-long scheme, Tesler routed millions of dollars in payments on behalf of the joint venture, and in return the Nigerian government awarded the consortium more than $6 billion in contracts.

Following his extradition and conviction, the SRA, which regulates English and Welsh solicitors (a class of attorneys that generally perform preparatory legal work), initiated disciplinary proceedings against Tesler. The Tribunal reviewed the following allegations against Tesler:

- Conviction of conspiracy and violation of FCPA, in breach of integrity and public confidence rules of the Solicitor's Code of Conduct;

- Entering into a plea agreement with the DOJ that confirmed his guilt, in breach of integrity and public confidence rules of the Solicitor's Code of Conduct; and

- Making a statement to the district court that he was guilty of the offenses, in breach of integrity and public confidence rules of the Solicitor's Code of Conduct.

The Tribunal found all of the allegations proved beyond a reasonable doubt and that the acts of bribery with intent to corrupt public officials were so serious that they prejudiced Tesler's integrity and diminished the public's confidence in him and in the profession. As a result of these findings, the Tribunal ordered the 65 year-old lawyer disbarred.

Although solicitors may be disbarred for numerous reasons, such as dishonest misappropriation of clients' money, grossly misleading clients, and criminal convictions, the solicitor disbarment rate is fairly low. Out of over 120,000 practicing solicitors in England and Wales, only 75 were disbarred in 2013 (Solicitors Disciplinary Tribunal Annual Report 2012-2013). The United States had about a 30% higher disbarment rate in 2011 (based on data from the American Bar Association). The SRA commented that it believes this is its first disbarment for a solicitor's overseas conviction.

Editors: Kathryn Cameron Atkinson, John Davis, James Tillen, Marc Alain Bohn,* and Ann Sultan*

Contributors: Matteson Ellis, Ben Gao,* Amelia Hairston-Porter,* Kuang Chiang,* Katherine Pappas, Irina Anta,* Sarah Dowd,* Maryna Kavaleuskaya,* Quinnie Lin,** and Manuela Londono***

*Former Miller & Chevalier attorney

**Former Miller & Chevalier law clerk

***Summer associate

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.