FCPA Winter Review 2010

International Alert

Introduction

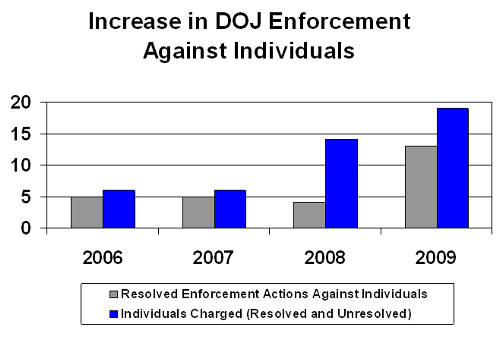

Our first review of 2010 allows us the opportunity to look back at 2009, one of the most exciting years in the history of the Foreign Corrupt Practices Act ("FCPA"). Although corporate enforcement actions were down slightly from 2008, the second year of decline, and penalty levels were lower than the extraordinary high-water mark of the Siemens case, there was a marked increase in enforcement actions involving individuals. Assistant Attorney General Lanny A. Breuer, in November 2009, confirmed the U.S. Department of Justice's ("DOJ's") increased focus on individuals, announcing that "prosecution of individuals is a cornerstone of our enforcement strategy" for FCPA matters. The year 2009 featured DOJ and U.S. Securities and Exchange Commission ("SEC") actions involving 32 individuals, including unresolved indictments against 14 individuals, nine guilty pleas, four individuals settling with the SEC, one unresolved SEC complaint, and four convictions in an unprecedented three jury trials. The last quarter of 2009 alone featured three guilty pleas, while the DOJ brought indictments against five individuals.

The increased focus of FCPA prosecution of individuals is demonstrated in the chart below.

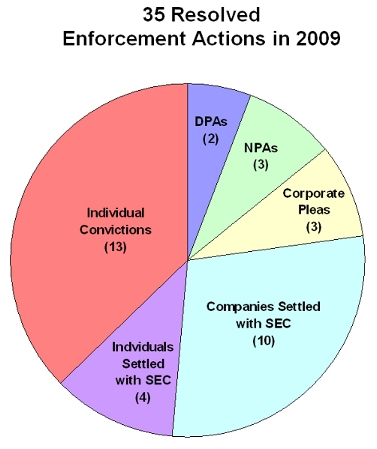

In comparison, resolved enforcement actions brought by the DOJ and SEC remained approximately the same in 2009 as the previous year, totaling 35, in comparison to 34 such actions in 2008. As shown in the chart below, of these 35 resolved enforcement actions, 17 related to individuals and 18 related to corporations. While the total number of resolved enforcement actions against corporations in 2009 decreased slightly from 22 in 2008, the drop in corporate enforcement actions brought solely by the DOJ in 2009 was starker, decreasing from 14 in 2008 to only eight in 2009.

Note: In tallying these statistics we have counted dispositions by the DOJ and SEC separately. We have also counted resolutions involving multiple distinct companies and/or individuals in a single settlement as separate enforcement actions.

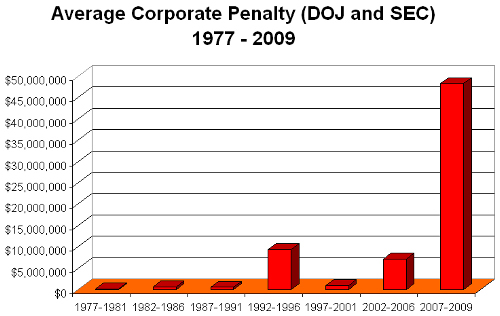

While the average corporate penalty for FCPA related cases decreased to $58.6 million in 2009, from a high of $89 million in 2008, the 2009 average remained extremely high, dwarfing average penalties from previous years. This was in large part due to Halliburton/Kellogg, Brown & Root LLC, and KBR Inc.'s combined $579 million penalty in the settlement reached with the SEC and DOJ in February 2009.

In addition to the above, several developments over the past quarter illustrate trends from throughout 2009, and could shed light on what is likely to come in FCPA enforcement in 2010. These developments include:

FCPA-Related Trials

The evident focus on increased prosecution of individuals under the FCPA resulted in three FCPA-related trials in 2009, the most to occur in a year since passage of the FCPA in 1977. The defendants were Frederic Bourke, William Jefferson, and Gerald and Patricia Green. As described below, Bourke and Jefferson were both sentenced in the last quarter of 2009, while the Greens await sentencing in 2010.

The trials and other litigation involving individuals have illuminated key issues under the FCPA and provided important case law precedent for those charged with FCPA violations in the future. In particular, the Bourke case provided judicial guidance on the degree of knowledge of improper payments required to be vicariously liable for an anti-bribery charge. As described below, recent judicial decisions related to the prosecution of former Control Components, Inc. ("CCI") executives provide additional precedent regarding the FCPA.

Broad Jurisdictional Reach of the FCPA

Several actions in 2009, and during the past quarter, demonstrated the long-arm of the FCPA and related U.S. criminal statutes in reaching foreign entities, including agents of U.S. issuers. As explained in further detail below, in November 2009, Fernando Maya Basurto, a Mexican citizen and sales agent for a U.S. company acquired by ABB, pled guilty to one count of conspiracy to violate the FCPA.

The DOJ's prosecution of agents was highlighted in a November 2009 statement by Assistant Attorney General Lanny Breuer: "The use of intermediaries to pay bribes will not escape prosecution under the FCPA. The Department will continue to hold accountable all the players in an FCPA scheme – from the companies and their executives who hatch the scheme, to the consultant they retain to carry it out."

DOJ Moving Beyond FCPA to Reach Corruption with other Legal Tools

Although the FCPA does not prohibit foreign officials from receiving bribes, in the past quarter, the DOJ demonstrated its willingness to prosecute such officials under a different legal theory. In December 2009, the DOJ indicted two former Haitian government officials in connection with a Florida telecommunication company's scheme to bribe them. As described below, neither official was charged with FCPA violations, but instead with charges related to money laundering. Similarly, the DOJ has gone beyond the FCPA to reach corruption by using the Travel Act to prosecute commercial bribery. See, for example, the Bourke case in our FCPA Autumn Review 2009 and the CCI case in our FCPA Spring Review 2009.

Industry-Wide Investigations

Throughout 2009, U.S. enforcement agencies continued their trend of carrying out industry-wide investigations, a trend that will continue into 2010 according to DOJ comments from last quarter. The oil and gas industry remains under focus, with many companies in the industry still under investigation for alleged corruption related to the U.N. Oil for Food Program in Iraq and the use of global freight forwarder Panalpina. In his November 2009 comments at the American Conference Institute's ("ACI's") 22nd National Conference on the FCPA, and in separate comments at the Pharmaceutical Regulatory and Compliance Congress and Best Practices Forum, Assistant Attorney General Breuer stated that an area of focus in 2010 for the DOJ will be overseas sales in the pharmaceutical industry. See below for more detail on Assistant Attorney General Breuer's comments at the ACI conference, chaired by Miller & Chevalier's Homer Moyer.

International Enforcement

International enforcement of anti-corruption laws continued in 2009. As reported in our FCPA Autumn Review 2009, the United Kingdom has brought several high-profile enforcement actions and indicated a move towards using U.S. prosecutorial techniques. The UK's Serious Fraud Office ("SFO") is proceeding with a case against BAE, as described below. The SFO has also issued guidance on its approach to handling overseas corruption cases, which includes a detailed discussion of the benefits of voluntary disclosure. Several countries, including India, China, Germany, Dubai, and Sweden have all pursued anti-corruption actions in 2009.

International Cooperation

U.S. enforcement authorities continued to collaborate with international officials on global anti-corruption matters. For example, as described below, in December 2009, the U.K.'s SFO charged a former executive of a Johnson & Johnson subsidiary, after the DOJ referred the case to the SFO.

Private Lawsuits

The year 2008 marked a significant spike in private lawsuits, a trend which continued in 2009. Since there is no private right of action under the FCPA, these cases usually allege FCPA violations as part of a larger Racketeer Influenced and Corrupt Organizations Act ("RICO") claim. RICO offers a private right of action for certain criminal activities, which can include violations of the FCPA. For example, as described below, in December 2009, the state-owned company Aluminum Bahrain BSC ("Alba") claimed violations of RICO by the Japanese trading company Sojitz Corporation, and its U.S. subsidiary, (collectively "Sojitz") alleging that Sojitz paid bribes to Alba employees.

U.S. Enforcement Agency Developments

The SEC increased its focus on FCPA enforcement in 2009. As reported in our FCPA Autumn Review 2009, the SEC announced extensive internal administrative changes directed at increasing the efficiency and speed of FCPA enforcement actions, as well as plans to use new enforcement tools. As described below, in October 2009, SEC Enforcement Director Robert Khuzami and Assistant Attorney General Lanny Breuer commented on these changes, indicating that the SEC's new incentives to encourage cooperation in enforcement actions will not interfere with DOJ prosecutions.

The DOJ is also seeing changes in the FCPA arena, with recent press reports that Mark Mendelsohn, Deputy Chief of the DOJ's Fraud Section, has been discussing leaving his post.

Many of these trends will be further developed in 2010, as U.S. enforcement agencies continue to pursue FCPA issues. As Assistant Attorney General Breuer said in his comments at the ACI Conference, the DOJ's FCPA program "certainly has the wind at its back."

Actions Against Corporations

On December 31, 2009, the DOJ and SEC announced that they had collectively settled charges with UTStarcom Inc. ("UTSI" or the "Company"), a California-based telecommunications company, for violations of the FCPA. In total, UTSI agreed to pay $3 million in fines ($1.5 million to each agency) for its actions. The charges related to more than $12 million in transactions involving Chinese, Thai and Mongolian government officials by UTSI and its wholly-owned subsidiary UTStarcom China Co. ("UTS-China").

Settlement with the SEC

According to the SEC's complaint ("complaint"), the Company violated the anti-bribery and accounting provisions of the FCPA by making improper payments that fell into four categories: (1) travel payments for sightseeing and training programs, (2) false consulting fee payments, (3) salary and benefit payments for existent and non-existent employees, and (4) lavish gift and entertainment payments.

Travel Payments for Sightseeing and Training Programs

According to the complaint, UTS-China spent approximately $7 million on 225 ostensibly work-related training trips for its government customers. The complaint states that, in reality, the trips were almost entirely for sightseeing and entertainment purposes. The trips were conducted pursuant to UTS-China's "System Contracts," the name given to sales contracts between the Company and local Chinese governments for wireless network equipment. By 2002, it was common practice for the Systems Contracts to include a provision requiring UTS-China to pay for its government customers to travel overseas. The trips typically lasted for two weeks, cost approximately $5,000 per person, and were often held at popular tourist destinations in the United States, such as Hawaii, Las Vegas and New York City. According to the complaint, little or no business training occurred on the trips.

In addition to the sightseeing trips, UTSI spent approximately $4 million for certain government customers to attend executive training programs at American universities. The programs covered general management topics but otherwise did not relate to UTSI's business. UTSI paid all expenses associated with the programs, including travel, tuition, room and board, field trips to local tourist destinations and substantial cash stipends. The Company accounted for these costs as "marketing expenses." According to the complaint, UTSI's senior management "believed that the executive training programs helped UTSI obtain or retain business."

False Consulting Fee Payments

UTSI allegedly participated in two consulting agreements "under circumstances that showed a high probability that [certain] payments would be used to bribe foreign government officials." The first payment occurred in 2005, when UTSI's Executive Vice-President (who also served as CEO of UTS-China) authorized a $1.5 million fee for a Mongolian company with significant government connections. According to the complaint, the sum was ostensibly paid as part of a consulting agreement, although neither UTS-China nor UTSI recorded what, if any, services were provided by the agreement. While UTSI accounted for the $1.5 million as a licensing fee in its books and records, the actual licensing fee was only $50,000. The complaint alleged that the executive knew that the remaining amount was not a licensing fee, and that a portion would be used to pay at least one government official to resolve a license dispute.

The second consulting payment occurred in 2007, when the same executive authorized payment of a $200,000 fee to a Chinese company. According to the SEC, the consulting agreement was a "sham" and the payment was used to secure a contract with the Chinese government.

Salary and Benefit Payments for Existent and Non-Existent Employees

Between 2001 and 2005, UTSI provided or offered full time salary and employment benefits within the United States on at least ten occasions to Chinese and Thai government customers or their family members. Three of these individuals received such salaries and benefits without ever working for UTSI. The exact amount of the salaries and benefits is unclear. According to the complaint, the Company drafted false performance reviews for these three individuals, and even sponsored permanent residency applications, stating that they were full-time employees of UTSI New Jersey.

Lavish Gift and Entertainment Payments for Thai Government Officials

Finally, UTSI was charged with spending approximately $23,000 in gifts and entertainment expenses for several Thai government officials and agents of Thai officials. The gifts were given while UTSI's bid was under consideration by the Thai government, and included such lavish gifts as rare bottles of French wine costing more than $600 each.

Non-Prosecution Agreement ("NPA") With the DOJ

The DOJ's settlement with UTSI is significantly more limited in scope than the SEC's. Unlike the SEC, the DOJ's NPA is limited to the so-called "training trips" offered to Chinese government officials within the United States. The NPA does not reference the other activities alleged in the SEC's complaint. Moreover, the NPA only identifies $670,000 of the $7 million spent on the training trips as improperly documented as training expenses. The SEC's complaint does not limit its calculations in this manner. Instead, the complaint suggests that the entire $7 million sum was improper.

Noteworthy Aspects of the UTSI Settlements

- Limited Scope of the NPA: The reason for the DOJ's decision to restrict its charges to the training trips is not immediately discernable given the apparent lack of jurisdictional impediments. The SEC complaint describes UTSI's direct involvement in the allegedly improper activity, including the fact that the approver of several payments was an employee of both UTS-China (the foreign subsidiary corporation) and UTSI (the U.S. parent corporation), which could have provided a basis for the DOJ to prosecute both UTSI and UTS-China for activities in addition to the training trips. Also, it is probable that at least some of the payments or other benefits provided to the officials occurred within the United States, given that the trips involved U.S. destinations.

- Risk Factors Identified in the complaint: The complaint serves as a reminder of common FCPA risk factors that have appeared in past FCPA actions, such as the provision of training/sightseeing trips, gift-giving, and the offering of employment opportunities to foreign government officials.

- The Company's "training trips" bear a striking resemblance to the activity in question in the Lucent Technologies Inc. ("Lucent") FCPA enforcement action from 2008, which involved the funding of sightseeing tours for Chinese government officials to popular tourist destinations in the United States. (For a description of the Lucent matter, see our FCPA Winter Review 2008). Notably, however, the SEC alleged that UTSI violated both the FCPA's accounting provisions and the anti-bribery provisions in connection with the behavior. In contrast, the SEC and DOJ alleged that Lucent violated only the FCPA's accounting provisions. It is possible that UTSI's expenditures demonstrated clearer evidence of the quid pro quo nature of the payments as required for an anti-bribery violation. Or, the charges against UTSI may be evidence of the SEC's and DOJ's evolving and increasingly aggressive interpretation of the FCPA's anti-bribery provisions.

- The UTSI matter is also similar to the Avery Dennison Corporation ("Avery Dennison") enforcement action from earlier in 2009, which involved the improper use of gifts and employment opportunities. (For a description of the Avery Dennison matter, see our FCPA Autumn Review 2009). Avery Dennison was fined, in part, for buying shoes for government officials and for offering employment to a Chinese National whose wife was a government official. Both in the Avery Dennison settlement and in the UTSI complaint, the gifts and employment opportunities were found to be improper items of "value" as envisioned by the FCPA.

- The Company's "training trips" bear a striking resemblance to the activity in question in the Lucent Technologies Inc. ("Lucent") FCPA enforcement action from 2008, which involved the funding of sightseeing tours for Chinese government officials to popular tourist destinations in the United States. (For a description of the Lucent matter, see our FCPA Winter Review 2008). Notably, however, the SEC alleged that UTSI violated both the FCPA's accounting provisions and the anti-bribery provisions in connection with the behavior. In contrast, the SEC and DOJ alleged that Lucent violated only the FCPA's accounting provisions. It is possible that UTSI's expenditures demonstrated clearer evidence of the quid pro quo nature of the payments as required for an anti-bribery violation. Or, the charges against UTSI may be evidence of the SEC's and DOJ's evolving and increasingly aggressive interpretation of the FCPA's anti-bribery provisions.

- Self-Monitoring Allowed by the NPA: One of the most noteworthy aspects of the UTSI settlements is the DOJ's monitoring requirement. Unlike a multitude of corporations that have entered into similar FCPA resolutions with the DOJ, UTSI will be permitted to monitor and report its own remediation efforts to the DOJ without an external compliance monitor. UTSI's NPA represents only the second instance in which the DOJ has permitted such "self-monitoring," the first being the July 2009 settlement with Helmerich & Payne Inc. (See our FCPA Winter Review 2009). In both instances, the DOJ drafted NPAs that set forth substantive remedial and reporting guidelines.

- Given the DOJ's tough public stance on FCPA compliance and prosecution, it is unclear why the Department has begun permitting corporations to self-monitor their compliance programs. Such arrangements seem somewhat inconsistent with the principles set forth in the DOJ guidance memorandum entitled the "Selection and Use of Monitors in Deferred Prosecution Agreements and Non-Prosecution Agreements with Corporations" (commonly known as the "Morford Memo"). In that guidance note, the DOJ states that corporations that have violated the FCPA "benefit[] from expertise in the area of corporate compliance from an independent third party." However, in addition to the self-monitoring requirement, some recent dispositions have not required any type of monitoring. For example, as described in our FCPA Spring Review 2009, both the Latin Node, Inc. plea agreement and the Novo Nordisk A/S settlement did not require a monitor. The lack of discussion in public disposition documents as to why a particular monitoring solution was chosen makes it difficult to predict when a monitor will be required and how a monitorship will be structured.

Actions Against Individuals

Charles Jumet Pleads Guilty, John W. Warwick Indicted

Prosecutors have targeted two former executives of Ports Engineering Consultants Corporation ("PECC"), a company organized under the laws of the Republic of Panama with an office in Richmond, Virginia, in connection with a conspiracy to make improper payments to officials in Panama's National Maritime Ports Authority ("APN"). On November 13, 2009, Charles Paul Edward Jumet, the former Vice President and, later, President of PECC, pleaded guilty to conspiracy to violate the FCPA, and on December 15, 2009, John W. Warwick, former President of PECC, was indicted for his role in the conspiracy. According to details contained in both the Statement of Facts to the Jumet plea agreement and the Warwick indictment, the conspiracy charge stemmed from unlawful payments of over $200,000 to APN officials and to shell corporations owned by the officials or associated with their relatives. As described in the Statement of Facts, the alleged bribes were paid between December 1997 and July 2003 as part of a scheme to obtain maritime contracts corruptly from the Panamanian government. Also involved in the scheme were two related companies, Overman Associates, an engineering firm based in Virginia Beach, Virginia, and Overman de Panama, a Panamanian subsidiary that held a management interest in PECC.

According to the criminal information (Jumet) and the indictment (Warwick), the conspiracy involved creating companies organized under the laws of Panama to corruptly receive contracts from APN and designating other companies owned by APN officials or their relatives as shareholders of PECC to funnel "dividends" to the officials. The scheme also allegedly planned for Overman de Panama to sue PECC in the Circuit Court for the City of Virginia Beach to obtain payments from the Panamanian government for money owed under the contracts. As a result of bribes made to APN officials through dividend payments and stock certificates, PECC obtained 20-year contracts to maintain lighthouses and buoys along Panama's waterways outside the Panama Canal, collect lighthouse and buoy tariffs and conduct engineering studies.

In addition to the FCPA conspiracy count, Jumet pleaded guilty to knowingly making a false statement to Special Agents of the Department of Homeland Security Immigration and Customs Enforcement during the criminal investigation. According to the Statement of Facts for the Jumet plea agreement, Jumet falsely informed the Special Agents that an $18,000 dividend check endorsed by a high-ranking Panamanian government official was a donation to the official's reelection campaign despite Jumet's knowledge that the official was not seeking reelection and the check was given as a corrupt payment.

Jumet is scheduled to be sentenced on February 12, 2010. According to the plea agreement, Jumet faces a maximum sentence of five years' imprisonment and a fine of $250,000 or twice the pecuniary gain for the conspiracy charge and a maximum sentence of five years' imprisonment and a fine of $250,000 for the false statement charge. According to press accounts, if convicted, Warwick faces a maximum of five years in prison and a fine of the greater of $250,000 or twice the gain or loss. The Warwick indictment also seeks forfeiture of the proceeds Warwick and Overman Associates received from PECC's Panama contracts.

A noteworthy aspect of this case was the use of investment vehicles and transactions, involving shell companies and dividends, to funnel payments to officials. For example, the set of transactions that funneled payments to officials related to the first contract were allegedly structured as follows: (1) APN awarded PECC a provisional contract, (2) PECC opened a bank account for use in distributing dividends, (3) APN awarded PECC a 20-year concession contract, (4) PECC's Board authorized issuance of 1,000 non-registered common shares, (5) companies owned/affiliated with APN officials became shareholders of PECC to conceal their receipt of corrupt payments in exchange for awarding the contract. While the disposition documents state that this scheme was structured with corrupt intent at senior levels in the company, the pattern of investment transactions as payment conduits shows why any corporate transactions with officials and their relatives raise potential FCPA risks that should be identified and addressed.

Bobby Benton, Former Official at Pride International, Charged

On December 11, 2009, the SEC charged Bobby Benton, Pride International's former Vice-President of Western Hemisphere Operations, with violating the antibribery, internal controls and books and records provisions of the FCPA, aiding and abetting violations of those provisions, as well as making false representations to accountants.

According to the complaint, the SEC brought these charges in connection with bribes made to foreign officials in Mexico and Venezuela, alleging that Benton approved of some of these illicit payments and was aware of and complicit in others. Specifically, the SEC claimed that in December 2004, Benton authorized a third party to make a $10,000 payment to a Mexican Customs official in exchange for overlooking deficiencies identified during the inspection of a supply boat. The payment was recorded in Pride's books and records as an "electricity maintenance expense." Benton allegedly knew of another $15,000 bribe paid to a different Mexican Customs official during that same month to ensure that the export of the rig would not be delayed because of apparent violations related to non-conforming equipment onboard the rig. The SEC also alleged that Benton was aware of roughly $384,000 in payments that a manager of a Pride subsidiary in Venezuela channeled through third party companies to bribe an official from Petróleos de Venezuela, S.A., Venezuela's state-owned oil company, in an effort to secure the extension of three drilling contracts from 2003 to 2005. In the complaint, the SEC accused Benton of concealing these bribes by "redacting references to bribery in an action plan responding to an internal audit report and signing two false certifications in connection with audits and reviews of Pride's financial statements denying any knowledge of bribery." These false certifications formed, among other things, the basis for the SEC's false representations to accountants charge.

According to the complaint, Benton left Pride in 2006, around the time the Houston-based offshore drilling company initiated an internal investigation into improper payments made to government officials. Pride voluntarily disclosed these and other possible violations involving illicit payments totaling upwards of $2.5 million in connection with Pride's global operations in as many as ten countries, including Angola, Brazil, India, Kazakhstan, Libya, Nigeria, the Republic of Congo, and Saudi Arabia, in addition to Mexico and Venezuela. In the wake of the investigation, the Company noted that "[o]ther personnel, including officers, have been terminated or placed on administrative leave or have resigned in connection with this investigation." The complaint states that the SEC and DOJ's investigation of Pride is ongoing and the Company continues to cooperate.

The complaint against Benton seeks to permanently enjoin him from future violations, impose a civil penalty, and disgorge the ill-gotten gains along with prejudgment interest. The complaint states that when subpoenaed by the SEC to testify with regard to this investigation, Benton asserted his Fifth Amendment privilege against self-incrimination.

A noteworthy aspect of this case is that, according to the SEC complaint, Benton's responsibilities included "ensuring that Pride conducted its Western Hemisphere operations in compliance with the FCPA, that adequate controls were in place to prevent illegal payments, and that the company's books and records were accurate."

District Court Rulings in the Prosecution of Former CCI Executives

On December 8, 2009, the district court judge presiding over the prosecution of six former executives of Control Components, Inc. ("CCI") for conspiracy to violate the FCPA and violations of the Travel Act issued an order partially denying the motion of four of the six defendants to compel evidence produced from CCI to DOJ. On the same date, the court also issued an order denying a motion by the same four defendants to dismiss three counts from the indictment. The defendants wanted the three counts dismissed on the basis that the conduct was time-barred under the statue of limitations.

As reported in our FCPA Winter Review 2009, two other former CCI executives pleaded guilty to conspiracy to violate the FCPA in early 2009. CCI is a California-based company that designs and manufactures service control valves for use in the nuclear, oil and gas, and power generation industries. As noted in our FCPA Autumn Review 2009, CCI pleaded guilty on July 31, 2009, to charges of conspiracy to violate FCPA anti-bribery provisions and the Travel Act, and two substantive FCPA anti-bribery violations. As part of its plea agreement, CCI agreed to pay an $18.2 million fine, implement and maintain a comprehensive anti-bribery compliance program, retain an independent compliance monitor for three years, serve a three year term of probation and continue to cooperate with the DOJ during its investigation.

As reported in our FCPA Spring Review 2009, the six former CCI executives were indicted by a Santa Ana, California grand jury on April 8, 2009, on charges of conspiracy to violate the FCPA. The six former executives included four U.S. nationals and two foreign nationals.

Both motions were filed by the four U.S. citizen defendants. Under the first motion, the defendants sought production of various categories of documents. Most significant was defendants' request for 75 million pages from CCI's internal investigation of possible FCPA violations. In their motion, defendants asserted that those documents were discoverable under Federal Rule of Criminal Procedure 16(a)(1)(E) because they were technically in the Government's possession, custody, or control, and were material to their preparation of a defense. According to the court's December 8, 2009, criminal minutes, the defendants alleged that the documents were within the Government's possession, custody, or control because CCI gave the Government a fraction of the 75 million pages at issue as part of CCI's July 2009 plea agreement. The court ruled, however, that the CCI plea agreement was not an agreement to allow the government to request blanket production of anything in CCI's possession. Moreover, the Government had produced all materials in its possession from CCI except for materials that CCI deemed privileged. As a result, the court denied the motion with respect to the blanket production of 75 million pages of CCI's documents.

Pursuant to the second motion, defendants moved to dismiss counts 9 through 11 of the indictment as barred by the five year statute of limitations. The three counts at issue concerned wire transfers that were sent more than five years before the indictment was issued. However, the court denied the motion to dismiss on the grounds that the Government made an official request to the Swiss Confederation for assistance in obtaining certain documents within the five year period for each wire transfer, which tolled the limitations period for all acts within the general subject of the grand jury investigation. We note that often such requests are made by the DOJ without notice to the affected parties. Therefore, when analyzing whether the statute of limitations has run, defendants need to be aware of this process.

Five More Individuals Charged in Miami Telecommunications Case

On December 7, 2009, the DOJ announced that it had charged five people in connection with an unnamed Florida telecommunication company's scheme to bribe Haitian government officials. The scheme first drew attention in May 2009, when two individuals, Antonio Perez and Juan Diaz, pleaded guilty for conspiracy to pay and conceal more than $1 million in bribes to former Haitian government officials. (See our FCPA Spring Review 2009). Diaz was the president of an unnamed intermediary company, while Perez was the controller of the company.

According to the charging documents, the additional five individuals allegedly participated in the scheme to bribe foreign officials and launder money from November 2001 to March 2005. During this time, the U.S. telecommunications company allegedly paid more than $800,000 in bribes to employees of Haiti's state-owned telecommunications company, Telecommunications D'Haiti. According to court documents and news reports, the payments, allegedly authorized by the unnamed company's president and vice-president, were made for the purpose of obtaining various business advantages in Haiti, such as preferred telecommunications rates, reducing the number of minutes for which payment was owed, and giving credits toward money owed.

The new indictments are particularly significant because they involve former government officials and signify the DOJ's willingness to prosecute foreign officials for corrupt activity under a different legal theory than the FCPA, which had previously been held not to cover foreign officials directly. Among those charged were two former Haitian government officials, Robert Antoine and Jean Rene Duperval. Both are former directors of Telecommunications D'Haiti. As the FCPA does not prohibit foreign officials from receiving bribes, the former directors were instead charged with conspiracy to commit money laundering. Duperval was also charged with twelve counts of money laundering. The remaining three individuals, Joel Esquenazi, Carlos Rodriguez, Marguerite Grandison (who is Duperval's sister), were charged with conspiracy to violate the FCPA and to commit wire fraud, in addition to numerous counts of violating the FCPA and money laundering.

John Joseph O'Shea Arrested, Fernando Maya Basurto Pleads Guilty

On November 23, 2009, the DOJ announced the arrest of John Joseph O'Shea, the former general manager of an unnamed Sugarland, Texas-based company acquired by ABB ("Sugarland Company"), which supplies electrical network system products and services, on charges of conspiracy to violate the FCPA, twelve counts of substantive FCPA anti-bribery violations, one count of falsifying documents and four counts of money laundering. On the same day, the DOJ announced that Fernando Maya Basurto, a Mexican national who headed a company that served as Sugarland Company's Mexican sales representative, had pleaded guilty on November 16, 2009, to one count of conspiracy to violate the FCPA.

According to the indictment against O'Shea, Sugarland Company was a business unit of an unnamed Swiss issuer. ABB reportedly confirmed to media sources that its Texas business unit employed O'Shea. To assist it in securing contracts with the Comisión Federal de Electricidad ("CFE"), Mexico's state owned electrical utilities company, Sugarland Company allegedly engaged the Mexican company owned in part by Basurto to act as its sales representative in Mexico on a "percentage of revenue" basis. Basurto had primary responsibility at the Mexican sales representative for performing work related to Sugarland Company's contracts in Mexico, making him an agent of a domestic concern (in this case, Sugarland Company) under the FCPA.

The indictment alleges that O'Shea, Basurto, an unnamed other principal of the Mexican sales representative, and various CFE officials conspired to award Sugarland Company several lucrative contracts with CFE related to Mexico's electrical network system in exchange for kickbacks to the CFE officials. The indictment alleges that the contracts secured by the conspiracy generated more than $81 million, and that O'Shea authorized more than $900,000 in corrupt payments to CFE officials. Sugarland Company allegedly made the improper payments by having the Mexican sales representative pass on a portion of its commission to CFE officials, and by making direct payments in cash to the officials. O'Shea and his co-conspirators allegedly disguised these payments as legitimate expense to two foreign companies ("intermediary companies") for maintenance support, administration, and technical support on the relevant CFE contracts. According to the indictment, the intermediary companies provided no services, and merely served as conduits for the bribe payments. The conspirators also allegedly concealed payments to the CFE officials by routing funds through family members of Basurto and one of the CFE officials. Additionally, the scheme allegedly involved kickbacks paid to O'Shea by Basurto and the unnamed other principal of the Mexican sales representative.

The corrupt payments allegedly ceased, and O'Shea was terminated, after the Swiss issuer parent company (presumably, ABB) uncovered the scheme in the course of an internal investigation. The DOJ announcement stated that the Swiss issuer later voluntarily disclosed the improper payments to the DOJ and SEC; the announcement also noted that the issuer was fully cooperating with their investigations.

O'Shea faces up to five years' imprisonment for each of the twelve substantive FCPA counts, the conspiracy count, and the falsification of records count, plus monetary penalties up to twice the value gained or lost through the relevant transactions. For each of the four money laundering counts, O'Shea faces up to twenty years in prison plus monetary penalties up to twice the value of the property involved in the transactions. The indictment also seeks forfeiture of over $2 million from O'Shea, representing the alleged proceeds from the transactions. Basurto faces up to five years' imprisonment and monetary penalties up to twice the gain or loss from the transactions.

One interesting aspect of the case is that the DOJ arrested the foreign sales agent, Basurto, in April 2009, and arranged a plea agreement with him, prior to arresting O'Shea. The DOJ Information stated that jurisdiction existed over Basurto, a Mexican citizen, as "an agent of a domestic concern" as defined in the FCPA. As part of his plea agreement, Basurto agreed to testify relating to any known criminal activity.

Another noteworthy aspect of this case is the conspirators' alleged cover-up attempt, which prompted the falsification of documents charges. According to the indictment, after O'Shea was terminated, he and other co-conspirators (including CFE officials) agreed to fabricate various backdated documents purporting to show a legitimate business purpose for certain payments to intermediaries. For example, the indictment states that to falsely demonstrate that the payments to intermediaries represented compensation for actual services, the conspirators allegedly plagiarized work product primarily done for CFE and altered it to appear as if it was done by one of the intermediary companies. Also, allegedly aware that emails may contain metadata (e.g., true dates of creation) that could have exposed their scheme, the conspirators allegedly took affirmative steps to avoid electronic detection of the cover-up by attempting to limit email distribution of falsified documents. According to the indictment, as part of the cover-up attempt, O'Shea allegedly sent Basurto an email stating "It seems my lawyer thinks it is OK to use private email such as Yahoo, as it would be much more difficult for anyone to get the exchanges - if it is a company email it belongs to them."

Former Congressman William Jefferson Sentenced

On November 13, 2009, William Jefferson, the former U.S. congressman, was sentenced to 13 years in prison for soliciting bribes, wire fraud, money laundering, racketeering and conspiracy. He is free pending appeal of his conviction, in part because the issue as to whether certain of his actions constituted official acts has not been adjudicated by the appellate courts.

As reported in our FCPA Autumn Review 2009, the U.S. government charged Jefferson with soliciting and receiving bribes from various persons and businesses in exchange for promoting their products and services to African officials, and participating in the bribery of a Nigerian government official. Jefferson was found guilty on 11 of 16 counts, including solicitation of bribes, wire fraud, money laundering, racketeering, and conspiracy to commit bribery, deprive citizens of honest services, and violate the FCPA. Jefferson was acquitted on three wire fraud counts, an obstruction of justice charge and a substantive charge of violating the FCPA.

On November 12, 2009, Paul G. Novak, a former consultant for Willbros International ("WII"), pleaded guilty to two FCPA-related counts, specifically conspiracy to violate the FCPA and violating the FCPA's antibribery provisions, in connection with a scheme to pay more than $6 million in corrupt payments to Nigerian officials related to a major gas pipeline project. Novak was originally indicted in 2008, along with former WII executive James K. Tillery, and charged with one count of conspiring to violate the FCPA anti-bribery provisions, two counts of violating the FCPA antibribery provisions, and one count of conspiring to commit money laundering (see our FCPA Winter Review 2009).

In pleading guilty to the two FCPA-related counts, Novak admitted that from 2003 to 2005, he conspired with others (including WII employees, two consulting firms, and employees of a major German company) to make millions in illicit payments to various Nigerian government and party officials. The purpose of these payments was to obtain and retain a major gas pipeline engineering, procurement, and construction project in the Nigeria Delta called the Eastern Gas Gathering System ("EGGS") Project, a venture valued at around $387 million.

According to the pleadings, Novak and Tillery, aided by co-conspirators that included former WII employees Jason Steph and Jim Bob Brown, concocted a scheme to make these payments to government officials from the Nigerian National Petroleum Corporation ("NNPC") and the National Petroleum Investment Management Services ("NAPIMS"), a senior official in the executive branch of the federal government of Nigeria, members of a Nigerian political party, and officials from the Shell Petroleum Development Company of Nigeria Ltd. ("SPDC").

According to a DOJ press release and information contained in plea documents, to secure the funds for the scheme, Steph and other conspirators had a Willbros subsidiary enter into "consultancy agreements" with two consulting companies represented by Novak. These consulting companies would invoice the subsidiary for consulting services that were never performed. Novak would then re-direct the payments received from this subsidiary to make bribes to the Nigerian officials.

In 2005, Willbros Group, Inc. ("Willbros"), WII's parent company, conducted an internal investigation into possible FCPA violations by Tillery and self-disclosed its findings to the DOJ and SEC. This kicked off a string of FCPA enforcement actions connected to the activities of WII and Willbros. In 2006 and 2007, WII executives Jason Steph and Jim Bob Brown pleaded guilty to criminal charges for bribing Nigerian Government officials. On May 15, 2008, Willbros and WII settled FCPA charges with the DOJ and SEC, agreeing to pay over $32 million in fines, disgorgement and pre-judgment interest in connection with the corrupt activities in Nigeria and Ecuador. Several former Willbros employees, including Steph, Gerald Jansen, Lloyd Biggers and Carlos Galvez, joined with the Company in settling with the SEC. Tillery, indicted along with Novak, continues to remain a fugitive at large. (See our FCPA Autumn Review 2007, FCPA Winter Review 2008, and FCPA Spring Review 2008).

As part of his plea, Novak agreed to pay a criminal fine of $1 million. He is currently scheduled to be sentenced on February 19, 2010, and faces up to ten years of imprisonment.

Frederic Bourke, the co-founder of handbag maker Dooney & Bourke, was sentenced on November 10, 2009, to a year and a day in prison and a $1 million fine for his alleged role in conspiring to pay bribes to Azerbaijan officials. He is free pending appeal of his conviction.

According to press accounts, Judge Shira Scheindlin, the sentencing judge and the judge who denied Bourke's post-verdict motions, said at the sentencing hearing, "After years of supervising this case, it's still not entirely clear to me whether Mr. Bourke is a victim or a crook or a little bit of both."

As reported in our FCPA Autumn Review 2009, the charges against Bourke arose from his involvement in a privatization scheme for the State Oil Company of the Azerbaijan Republic ("SOCAR"). Bourke and several other co-defendants were accused of participating in an investment consortium that made payments to Azeri officials to promote the privatization program and to permit the consortium an ownership interest in the newly privatized entity. Bourke was tried as a result of his role as an investor affiliated with Viktor Kozeny, the president and chairman of Oily Rock Group Ltd., which served as the investment vehicle for the consortium.

The sentencing of Gerald and Patricia Green, two L.A. film producers who were convicted of numerous counts of conspiracy, violating the FCPA and money laundering in mid-September (see our FCPA Autumn Review 2009), has been delayed until January 21, 2010.

The Greens were initially scheduled to be sentenced December 17, 2010, but both the prosecution and the defendants agreed to postpone sentencing because the pre-sentence report had been delivered late. On December 14, 2009, the DOJ, in its response and objections to the pre-sentencing report, opposed any downward departure under the Federal Sentencing Guidelines for Mr. Green. Instead it asserted that, based on Mr. Green's status as the "organizer or leader" of the extensive criminal activity and the fact that he "repeatedly and blatantly perjured himself," he deserved life in prison.

The Greens each face a sentence of up to 185 years' imprisonment (five years for conspiracy and each of the eight FCPA violations, and 20 years for each of the seven money laundering violations), while Ms. Green faces an additional three year term of imprisonment related to the false subscription of tax returns charge.

Civil Litigation

In December 2009, Aluminum Bahrain BSC ("Alba") filed a civil law suit against the Japanese trading company Sojitz Corporation, and its U.S. subsidiary Sojitz Corporation of America (collectively "Sojitz"), alleging that Sojitz paid almost $15 million in bribes to Alba employees in order to obtain an unfair competitive advantage in the U.S. aluminum market. The government of Bahrain maintains a majority share in Alba, thus making its employees "government officials" for purposes of the FCPA. Since there is no private right of action under the FCPA, Alba's claims against Sojitz are based on the Racketeer Influenced and Corrupt Organizations Act ("RICO"), conspiracy to violate RICO, fraud, and conspiracy to defraud. RICO offers a private right of action for certain criminal activities.

This is the second such suit that Alba has filed in recent years. In early 2008, Alba levied similar charges against Alcoa Inc. (See our FCPA Spring Review 2008). After the commencement of Alba's suit, the DOJ intervened in the case and was granted a request to stay the civil action pending a criminal investigation. As of January 5, 2010, available public information suggests that the DOJ had not yet intervened in the Sojitz matter.

Enforcement Agency Public Statements

SEC's Enforcement Director's and Assistant Attorney General's Remarks

According to press accounts, at an American Bar Association ("ABA") panel discussion in Washington DC on October 15, SEC Enforcement Director Robert Khuzami and Assistant Attorney General Lanny Breuer indicated that the SEC's new incentives to encourage cooperation in enforcement actions will not interfere with DOJ prosecutions. As reported in our FCPA Autumn Review 2009, the SEC announced in August that it would develop a standard to evaluate cooperation of individuals similar to the "Seaboard" standards for evaluating corporate cooperation. At the ABA panel discussion, SEC Enforcement Director Khuzami reportedly stated that the agency plans soon to issue a policy statement of general considerations in enabling cooperation, which will be published in the Federal Register. SEC Enforcement Director Khuzami and Assistant Attorney General Breuer reportedly indicated that the SEC's new tool in encouraging individual enforcement will not hinder the agencies' abilities to work together in parallel investigations, and that the agencies would consider each other's interests when seeking agreements with those who cooperate.

During the ABA discussion, SEC Enforcement Director Khuzami also reportedly indicated that the SEC has been considering whether to seek criminal enforcement authority. SEC Enforcement Director Khuzami reportedly stated that the SEC's current focus is on certain draft legislation that would, among other things, give the SEC expanded access to jury material.

Assistant Attorney General Breuer's Recent Comments at the ACI Conference and Pharmaceutical Forum

On November 17, 2009, Assistant Attorney General Lanny Breuer addressed the American Conference Institute's ("ACI's") 22nd National Conference on the FCPA, chaired by Miller & Chevalier's Homer Moyer, and described several FCPA developments during 2009. Assistant Attorney General Breuer stated, "One can say without exaggeration that this past year was probably the most dynamic single year in more than 30 years since the FCPA was enacted. We saw a record number of trials, a record number of individuals charged with FCPA violations, and record corporate fines."

Assistant Attorney General Breuer emphasized the prosecution of individuals for FCPA violations during 2009, stating, "Put simply, the prospect of significant prison sentences for individuals should make clear to every corporate executive, every board member, and every sales agent that we will seek to hold you personally accountable for FCPA violations."

Assistant Attorney General Breuer also praised the public service of Mark Mendelsohn, Deputy Chief of the DOJ's Fraud Section, who has been discussing leaving his post. "Mark has been an exceptional public servant and a visionary steward of the FCPA program," he said. "Regardless of where Mark chooses to go, we will miss him greatly."

Looking ahead, Assistant Attorney General Breuer said that one area of focus for the DOJ will be the pursuit of asset forfeiture and recovery. "Earlier this year, I directed all our attorneys to speak with their supervisors and determine in every case whether forfeiture is appropriate," he said. "We will seek forfeiture in all appropriate cases going forward."

Assistant Attorney General Breuer also stated that the DOJ will focus on overseas sales in the pharmaceutical industry during 2010, a theme he expanded upon during his comments on November 12, 2009, at the Pharmaceutical Regulatory and Compliance Congress and Best Practices Forum. "The depth of government involvement in foreign health systems, combined with fierce industry competition and the closed nature of many public formularies, creates a significant risk that corrupt payments will infect the process," Assistant Attorney General Breuer said. "The Criminal Division stands ready to ferret out this illegal conduct and we are uniquely situated to do so."

Miller & Chevalier's James Tillen commented in the AmLaw Litigation Daily on Assistant Attorney General Breuer's speech, and Assistant Attorney General Breuer's emphasis on the DOJ's range of resources to combat bribery in the pharmaceutical industry. "One thing I thought was very interesting in Lanny's speech is that he said they would be working with the [Justice Department's] health care fraud group," Mr. Tillen said. "The subtext was, we already have ramped up. There won't be a learning curve here."

GAO Testimony Regarding Monitorships

GAO Testifies on Use of Monitors

In November 2009, the Government Accountability Office ("GAO") testified before the House Judiciary Committee's Subcommittee on Commercial and Administrative Law regarding the DOJ's use of monitors in deferred prosecution and non-prosecution agreements ("DPAs" and "NPAs"). The GAO stated that it has concluded that government prosecutors have generally adhered to guidelines, issued by the DOJ, for selecting monitors for DPAs and NPAs. The GAO studied whether prosecutors followed guidelines issued in the March 2008 "Morford Memo" to address concerns about potential favoritism in the selection of monitors, as well as issues associated with costs, accountability and oversight of monitors. The Morford Memo was issued in response to allegations that prosecutors favored former DOJ officials in selecting individuals for the often-lucrative monitorships. The GAO reported that although measures taken to address potential bias in monitor selection were followed in monitor agreements entered into since March 2008, the DOJ needs to take a more active role in resolving conflicts that arise between companies under DPAs or NPAs and their monitors.

For the study, the GAO interviewed DOJ officials and representatives of 13 companies who were required to hire independent monitors. With more than half of the appointed monitors having previously worked for the DOJ, several companies expressed concern that prior DOJ employment could affect the independence and impartiality of the monitor. Most companies did not share these concerns, and many considered the experience and knowledge associated with previous DOJ employment as desirable for their monitors.

The GAO concluded that most companies had some level of concern about the costs associated with their monitors, the scope of the monitors' mission, and the monitors' performance. The GAO stated that it found little to guide the parties with respect to the appropriate role for the DOJ in resolving conflicts between monitors and companies, both during contract negotiations and during the term of monitorships. Many companies did not know they could raise their concerns with the DOJ or felt that raising their concerns could result in repercussions. There was no consensus within the government as to how the DOJ could assist in company-monitor conflicts. To address these ambiguities, the GAO recommended that each corporate NPA and DPA include an explanation on the DOJ's role in resolving company-monitor disputes.

Transparency International's 2009 Corruption Perceptions Index

Global Anticorruption Movement and Transparency International's 2009 Corruption Perceptions Index

On November 17, 2009, TI released its 2009 Corruption Perceptions Index ("CPI"), a list that tracks perceived levels of governmental corruption in 180 countries. The CPI is used by many companies and the enforcement agencies as one measure of the corruption risks present in specific countries. In 2009, New Zealand topped the scale with a score of 9.4, followed closely by Denmark, Singapore, and Sweden, while Iraq, Sudan, Myanmar, Afghanistan and Somalia ranked at the bottom of the scale, all scoring 1.5 or less, with Somalia in last place. Although the United States slipped one place in the rankings to 19th, its score improved slightly from 7.3 in 2008, to 7.5 in 2009. The U.K. dropped one spot in the index to 17th but maintained its 2008 score of 7.7.

Countries showing the largest improvement or decline in CPI scores included Saudi Arabia (up .8 to 4.3), Liberia (up .7 to 3.1), and Greece (down .9 to 3.8). Scores for three high risk countries most frequently involved in FCPA investigations were mixed: China maintained its score of 3.6, Nigeria's score dropped from 2.7 to 2.5, and Kazakhstan's score improved from 2.2 to 2.7.

International Developments

On December 10, 2009, two divisions of the German industrial services company MAN SE (formerly MAN AG) agreed to pay a combined fine of €150 million ($221 million) to resolve an investigation of bribery allegations. The settlement brought to a close a seven-month investigation by German authorities into corruption at MAN SE's diesel engine unit (MAN Nutzfahrzeuge) and turbine manufacturing unit (MAN Turbo AG). According to press accounts, the investigation uncovered evidence that the two units made suspicious payments totaling €51.6 million to potential customers, at least some of which appeared to have been paid to foreign officials and companies in exchange for business.

In addition to penalties paid by the company, former executives and employees remained under scrutiny for their behavior in connection with the alleged bribery. According to press accounts, the December 10 resolution did not affect German prosecutors' investigations of individuals for their involvement in the bribery scheme. Indeed, on December 11, Heinz Jürgen Maus, the former CEO of MAN Turbo AG, was indicted on eight counts of bribery. German prosecutors accused Mr. Maus of coordinating the payment of a €9 million ($13.3 million) bribe to secure a gas pipeline modernization contract in Kazakhstan. The bribe was reportedly mischaracterized as a "market entry fee." Various executives have resigned and been replaced, including the company's CEO, CFO, and two executive board members of MAN Turbo AG. The company has also fired about 20 individuals and press reports have stated that the company is considering whether to sue the former employees for breach of statutory and company regulations for making suspicious payments to third party advisors and agents.

On International Anti-Corruption Day, December 9, 2009, the OECD celebrated the tenth anniversary of the entry into force of the OECD Anti-Bribery Convention. To mark the anniversary, the OECD launched an Initiative to Raise Global Awareness of Foreign Bribery. According to the OECD website, plans for the three-year initiative include a worldwide media outreach campaign, a foreign bribery impact study, and working with business and law schools to include anti-bribery course materials in their standard curricula.

Siemens Collects Damages from Former Executives

On December 2, 2009, Siemens AG ("Siemens") reached a settlement with six former board members for their failure to curb the company's former practice of bribing government officials. In December 2008, Siemens agreed to a landmark $800 million settlement with the DOJ and SEC for widespread and systemic violations of the FCPA (for a full discussion of the Siemens settlement, see our December 2008 FCPA Alert entitled "Siemens Agrees To Landmark $800 Million Settlement.")

The board members involved in the settlement included, former Chairman of the Managing Board and the Supervisory Board Heinrich von Pierer; former managing board members Klaus Kleinfeld, Johannes Feldmayer, Juergen Radomski, Uriel Sharef; and the former Chairman of the Supervisory Board Karl Hermann Baumann. Together, they paid €18 million ($25.8 million). In August, Siemens settled with three other former board members, Edward G. Krubasik, Rudi Lamprecht and Klaus Wucherer for €500,000 ($715,000) each. According to a Siemens press release, the company has yet to reach a settlement with its former board member, Thomas Ganswindt, or former Chief Financial Officer, Heinz-Joachim Neubuerger, because both are under investigation.

Former Deputy Executive Charged in U.K.

On December 1, 2009, the U.K.'s Serious Fraud Office ("SFO") charged Robert John Dougall with violating the Criminal Law Act 1977 by making corrupt payments to Greek healthcare professionals to facilitate sales of orthopedic products. Dougall is a former executive of the Johnson & Johnson medical device subsidiary, DePuy International Limited of Leeds, U.K.

The charges followed a September 2007 U.S. case in which DePuy and four other medical device companies (Biomet, Zimmer, Smith & Nephew and Stryker) paid $310 million to the DOJ to resolve charges that they made improper payments to encourage U.S. doctors to purchase their devices. The case is significant not only because it demonstrates the U.K.'s increased focus on foreign corruption, but also because the investigation was referred by the DOJ. In a public statement on its website, the SFO announced that it accepted the DOJ referral in March 2008.

Delegates from over 100 countries met in Doha, Qatar from November 9 - 13, 2009, to review implementation of the United Nations Convention against Corruption, which came into force in December 2005. Under the new implementation mechanism adopted at Doha, states will be monitored every five years for compliance under the Convention. Findings, based on self-assessments and peer reviews, will be compiled in country review reports. Transparency International criticized the mechanism, stating in a press release, "The adopted mechanism has only made non-mandatory provisions for governments to receive input from civil society, instead of ensuring that these inputs are given to independent reviewers."

According to press reports at the end of December, the U.K.'s Serious Fraud Office ("SFO") was preparing to re-interview BAE Systems ("BAE") executives, in connection with allegations of bribery to win defense contracts. According to press reports, BAE's settlement discussions with the SFO collapsed in September due, in part, to BAE's concern over how a guilty plea would affect its European business. European Union bribery laws prohibit a company convicted of bribery from receiving work from European governments. Despite the SFO's decision to reinterview BAE executives and proceed with the case, however, there is still a possibility of a settlement. According to the press, BAE and SFO may reach a compromise, similar to a DOJ FCPA settlement, which will allow BAE to avoid prosecution for the antibribery offenses and to continue to do business in Europe.

Other Developments

According to press reports, Panalpina is in discussions with the DOJ to settle allegations of bribery in connection with its Nigerian operations. The press reports stated that Panalpina began the talks in mid-December and the process may take several months. Since 2007, according to its own press statements, the company has conducted its own investigation, coordinated with the DOJ, into allegations that it had bribed Nigerian officials in violation of the Foreign Corrupt Practices Act. As reported in our FCPA Autumn Review 2007, Panalpina conducted an internal investigation of its business in Nigeria following reports that the DOJ was investigating at least a dozen Panalpina customers.

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.