FCPA Summer Review 2011

International Alert

Introduction

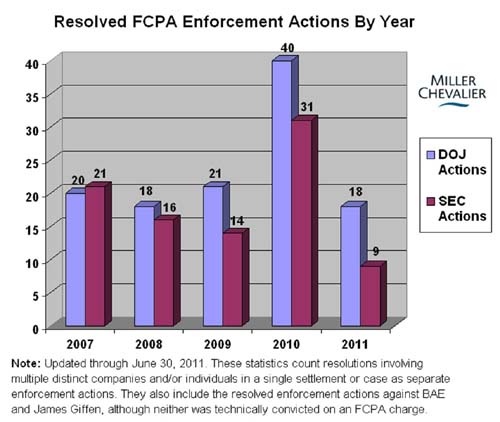

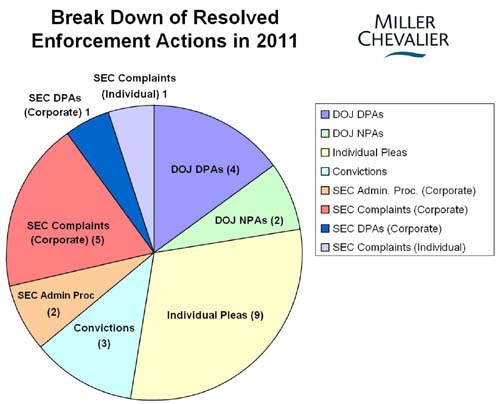

With twenty-seven resolved enforcement actions to date this year, the pace of Foreign Corrupt Practices Act ("FCPA") enforcement by the Department of Justice ("DOJ") and the Securities and Exchange Commission ("SEC") falls slightly behind the pace of the seventy-one resolved actions in 2010. Since our Spring Review, Lindsey Manufacturing, two of its executives, and its Mexican intermediary were convicted by a federal jury, Rockwell Automation settled with the SEC, and Tenaris settled with both the DOJ and SEC. Additionally, four individuals pled guilty to FCPA-related charges, including executives from Latin Node and Control Components Inc., as well as one of the SHOT Show defendants, Haim Geri.

At the time this Review went to press, several additional enforcement actions were announced by the DOJ and SEC. The DOJ announced that it had charged Cinergy Telecommunications Inc., Cinergy’s president and director, the president of Florida-based Telecom Consulting Services Corp., and two former Haitian government officials in a superseding indictment for their alleged roles in the Haiti Teleco matter covered in our FCPA Spring Review 2010, FCPA Summer Review 2010, FCPA Autumn Review 2010, and FCPA Spring Review 2011. In addition, the DOJ announced a non-prosecution agreement with Armor Holdings under which the company agreed to pay $10.29 million to resolve alleged FCPA violations in connection with sales to the United Nations. In a related civil matter, the SEC announced settled charges against Armor Holdings and the assessment of $5.7 million in disgorgement, prejudgment interest, and penalties. Our next Review will cover these enforcement actions.

In federal court, both the government and defendants have been turning up the heat. In the Lindsey case, the convictions are currently at risk of being thrown out due to claims by defendants of prosecutorial misconduct. U.S. District Judge Richard J. Leon declared a mistrial in the high-profile prosecutions of four SHOT Show defendants after jurors failed to agree on a verdict. Moreover, in the case against SHOT Show defendant Pankesh Patel, the court dismissed one of the substantive FCPA charges that the DOJ had based on a broad interpretation of Section 78dd-3. Other important developments in federal court include multiple challenges to the government's treatment of state-owned entity ("SOE") employees as "foreign officials" subject to the FCPA. Those challenges were raised by defendants separately in the Lindsey, Carson, and O'Shea cases. They were thrown out in the cases of Lindsey and Carson, but the challenge still remains pending in the case of O'Shea. The recent trend of shareholder derivative suits filed in the aftermath of FCPA investigations continued with a class action brought against eleven board members of Johnson & Johnson.

There have also been numerous significant developments at the SEC, including the departure of FCPA unit head Cheryl Scarboro; the SEC's entry into its first Deferred Prosecution Agreement ("DPA") with Tenaris; temporary suspension of trading for a China-based issuer under investigation for possible FCPA violations; and issuance of the final rules for its program incentivizing whistleblowers to report suspected FCPA and other securities violations directly to the agency. Developments at the DOJ include issuance of its first Opinion Procedure Release of the year and the first civil forfeiture action from the newly created Kleptocracy Asset Recovery Initiative Team. Legislatively, the House Judiciary Committee held an FCPA hearing in June where witnesses discussed the need for statutory amendments to the FCPA.

The second quarter of 2011 has also witnessed several international developments. Most significantly, the U.K. Bribery Act came into effect on July 1, 2011. As described in a separate analysis by Miller & Chevalier's Homer E. Moyer, Jr., the Act differs from the FCPA with regard to several key aspects, including treatment of corporate hospitality, facilitating payments, and commercial bribery. Also in this quarter, Canada settled its second foreign bribery matter, India ratified the U.N. Convention against Corruption, and Russia was invited to join the Organization for Economic Cooperation and Development's ("OECD") anti-bribery convention. Additionally, a Costa Rican court sentenced the former Costa Rican President to five years in prison for accepting bribes from Alcatel and the German prosecutors charged a former Siemens board member for alleged bribery in Argentina.

Actions Against Corporations

Tenaris S.A. Settles with DOJ and SEC; First Use of DPA by the SEC

On May 17, 2011, the DOJ and SEC settled enforcement actions against Tenaris S.A. ("Tenaris"), a Luxembourg-based manufacturer of steel pipe products for the oil and gas industry that lists ADRs on the New York Stock Exchange and therefore qualifies as an issuer. As part of its disposition with the DOJ, Tenaris entered into a two-year non-prosecution agreement ("NPA") in which it agreed to pay a $3.5 million criminal penalty for violations of the FCPA's anti-bribery and books and records provisions. In the related SEC matter, Tenaris entered into a two-year DPA under which it agreed to pay $5.4 million in disgorgement and prejudgment interest. The resolution with the SEC represents the first-ever use of a DPA by the SEC, an approach which the SEC touted in its press release as a means to facilitate and reward cooperation in SEC investigations.

According to the pleadings, in 2006 and 2007 Tenaris bid on a series of contracts with O'ztashqineftgaz ("OAO"), a subsidiary of Uzbekistan's state-owned Uzbekneftegaz, to supply pipelines for the transport of oil and natural gas. In connection with those bids, Tenaris hired an agent whose services included obtaining from OAO tender officials confidential information about bids placed by the company's competitors. Tenaris then submitted revised bids through OAO officials who were cooperating with the agent. The pleadings state that the company's sales personnel understood that a portion of the commissions paid to the agent would be used to pay OAO officials for providing the competitors' bid information. In email correspondence quoted in the DOJ's NPA, Tenaris employees used code language to refer to the agent's services, which were characterized as "left-handed" and a "dirty game."

As set out in the pleadings, around November 2007, the agent informed Tenaris sales personnel that a competitor had complained to an Uzbek government agency, Uzbekexpertiza JSC ("Uzbekexpertiza"), that the company had obtained access to their bid information. According to the pleadings, the agent suggested that Tenaris pay a bribe to Uzbekexpertiza officials to persuade them not to recommend an investigation of Tenaris or to reopen the bidding process. The agent told Tenaris that Uzbekexpertiza officials had agreed to "close their eyes" in return for the proposed payment. Certain emails referenced in the DPA suggested that Tenaris employees agreed to the agent's proposed bribe, but the DPA notes that it was unknown whether Tenaris eventually made such a payment. According to the DPA, Tenaris failed to keep books and records that accurately and fairly reflected the transactions with the agent and the payments to OAO officials. In addition, the DPA stated that the company failed to maintain adequate internal controls to ensure due diligence on the agent the detection or prevention of improper payments to OAO officials.

Tenaris discovered the aforementioned conduct in the context of an internal investigation into separate allegations related to business in another country. Those allegations surfaced in or around March 2009, when a third party disclosed to Tenaris its awareness that certain sales agency payments by Tenaris may have improperly benefited employees of the third party. In response, Tenaris's Audit Committee initiated an internal investigation and informed the SEC and DOJ of the third party's allegations and of the later preliminary findings of the investigation. According to the pleadings, Tenaris informed the government in or around July 2009 that it would undertake a thorough, world-wide investigation of the company's business operations and internal controls. In the context of that investigation, the company discovered the transactions in Uzbekistan that form the basis of the allegations in the enforcement actions.

Noteworthy Aspects:

- First DPA by the SEC - The SEC announced an initiative in January 2010 to employ more of the tools traditionally used by the DOJ to encourage corporations and individuals to make voluntary disclosures and cooperate with SEC investigations. Robert Khuzami, Director of the SEC's Division of Enforcement, highlighted this focus on cooperation in a statement released with the announcement of the Tenaris settlement: "The company's immediate self-reporting, thorough internal investigation, full cooperation with SEC staff, enhanced anti-corruption procedures, and enhanced training made it an appropriate candidate for the Enforcement Division's first Deferred Prosecution Agreement. Effective enforcement of the securities laws includes acknowledging and providing credit to those who fully and completely support our investigations and who display an exemplary commitment to compliance, cooperation, and remediation." Neither that release nor the DPA give additional details regarding the benefits of Tenaris' acknowledged cooperation, beyond the use of the DPA itself. Indeed, beyond changes in fine levels that were not described, the benefits of a DPA over the SEC's usual disposition involving a cease-and-desist order are unclear.

- Agent Commissions - The commission paid to the agent, 3.5% of the value of the relevant contracts, does not necessarily on its face represent a level of payments that would automatically raise red flags about possible pass-through payments. The facts of this case highlight the danger of relying merely on percentage commission rates to assess the risks associated with agents; those rates should be assessed within the specific factual context, which can include industry-specific benchmarks, an assessment of the value of the services being provided by the agent, and other potential red flags.

Lindsey Manufacturing, Executives and Intermediary Convicted on All Counts; Prosecutorial Misconduct Charges to be Argued in September 2011

On May 10, 2011, Lindsey Manufacturing Company ("Lindsey"), two of its executives, and a Mexican intermediary were convicted by a federal jury in Los Angeles for their roles in bribing employees of the Comisión Federal Electricidad ("CFE"), a Mexican state-owned utility company, between February 2002 and March 2009, to win $19 million in contracts. Lindsey is a privately-held company based in Azusa, California that produces emergency restoration systems and other equipment used by electrical utility companies. As detailed in our FCPA Winter Review 2011, Keith E. Lindsey, President, and Steve K. Lee, Vice President and CFO of Lindsey, as well as Enrique Faustino Aguilar Noriega and Angela Maria Gomez Aguilar of Grupo Internacional de Asesores S.A. ("Grupo"), were each charged in a superseding indictment on October 21, 2010, with conspiracy to violate the FCPA's anti-bribery provisions and violations of the FCPA's anti-bribery provisions. The Aguilars were initially indicted September 15, 2010, as reported in our FCPA Autumn Review 2010.

Following the trial, Lindsey, Mr. Lindsey, and Mr. Lee were each convicted on one count of conspiracy to violate the FCPA and five counts of FCPA violations. Ms. Aguilar was convicted of one count of conspiracy to commit money laundering. The court also entered a judgment of acquittal prior to the jury's verdict on one substantive count of money laundering against Ms. Aguilar. Mr. Aguilar remains a fugitive. Mr. Lindsey and Mr. Lee face a maximum penalty of five years in prison and a fine of the greater of $250,000 or twice the value gained or lost on the FCPA conspiracy charge. Additionally, each of the FCPA counts carries a maximum penalty of five years in prison and a fine of the greater of $100,000 or twice the value of the property involved in the transaction. The money laundering conspiracy charge of which Ms. Aguilar was convicted carries a maximum penalty of 20 years in prison and a fine of the greater of $500,000 or twice the value of the property involved in the transaction. However, after a post-trial agreement between prosecutors and Ms. Aguilar, Ms. Aguilar was sentenced to less than ten months served. The U.S. government is seeking forfeiture against all defendants.

The core dispute at issue for Lindsey was whether the CFE employees, who were provided money and luxury items, including a Ferrari Spyder and a $1.8 million yacht, qualified as "foreign officials" under the FCPA. The issue was first raised in a motion to dismiss filed by Mr. Lindsey and Mr. Lee, and joined by Ms. Aguilar. In the motion, the defendants argued that state-owned enterprises ("SOEs"), such as CFE, were not "instrumentalities" of the government and therefore its employees could not be "foreign officials." (See our FCPA Spring Review 2011). The defendants argued that the term "instrumentality" should be interpreted in light of the two words preceding it in the statute, "department" and "agency," and that the term "must be understood to capture only entities that share qualities that both agencies and departments share."

On April 20, 2011, U.S. District Judge A. Howard Matz rejected the defendants' challenge in a written ruling, concluding that the question of whether the bribe recipients were "foreign officials" was a question of fact and that, in this case, the government had provided sufficient evidence that CFE was in fact an "instrumentality" of the state. In his decision, Judge Matz rejected the defendants' "all-or-nothing" approach, in which they argued that an SOE can never be an "instrumentality" because SOEs do not always share the characteristics of "departments" and "agencies." Indeed, Judge Matz found it "not difficult to point to various characteristics of government agencies and departments" that fall within the description of "instrumentality," and provided a non-exclusive, fact-based list of those characteristics, including (quoted from his order):

- The entity provides a service to the citizens — indeed, in many cases to all the inhabitants — of the jurisdiction;

- The key officers and directors of the entity are, or are appointed by, government officials;

- The entity is financed, at least in large measure, through governmental appropriations or through revenues obtained as a result of government-mandated taxes, licenses, fees or royalties, such as entrance fees to a national park;

- The entity is vested with and exercises exclusive or controlling power to administer its designated functions; and

- The entity is widely perceived and understood to be performing official (i.e., governmental) functions.

Judge Matz found that CFE has all of these characteristics ("[i]t was created by statute as a ‘decentralized public entity;' its governing Board is comprised of various high-ranking governmental officials; it describes itself as a government agency; and it performs a function the Mexican nation has described as a quintessential government function — the supply of electricity"), and denied the defendants' motion.

On May 9, prior to the jury rendering its verdicts, attorneys for Mr. Lindsey and Mr. Lee filed a motion to dismiss the indictment claiming prosecutorial misconduct, including alleged repeated false statements by FBI Agent Susan Guernsey during grand jury testimony in September and October 2010. Judge Matz had ordered prosecutors to give defense attorneys complete transcripts of Ms. Guernsey's testimony, but prosecutors told the judge on June 27, 2011, following the verdict, that they had inadvertently failed to turn over all the transcripts. Judge Matz, noting the government's "sloppy investigation and prosecution" practices, including the warrantless searches of buildings and improperly obtained emails, invited the parties to file briefs on whether he should throw out the convictions. Judge Matz set a date of September 8, 2011, to hear arguments on the motion to dismiss and vacated the sentencing date previously set for September 16, 2011.

Noteworthy Aspects:

- First Company to be Tried and Convicted for FCPA Violations - As detailed in our FCPA Winter Review 2011, criminal indictments against corporations are rare because most companies settle such charges with the government. Lindsey was one of the few companies to ever have been indicted and became the first company to be tried and convicted under the FCPA. Following the conviction, Assistant Attorney General Lanny Breuer released a statement emphasizing that while Lindsey may be the first company to face a criminal conviction for FCPA violations, it will not be the last.

- Additional Clarity on What Constitutes an "Instrumentality" of a Foreign Government, Department, or Agency - As reported in our FCPA Spring Review 2011, the Lindsey and Carson (see below) cases have brought increased clarity to what constitutes an "instrumentality" of a foreign government.

Rockwell Automation, Inc. Settles with the SEC

On May 3, 2011, the SEC settled an enforcement action with Rockwell Automation, Inc. ("Rockwell"), a Wisconsin-based issuer engaged in the design and manufacture of industrial automation products and services.

From 2003 to 2006, employees of Rockwell's wholly-owned Chinese subsidiary, RAPS-China, made $615,000 in payments to various Design Institutes, which were typically state-owned enterprises, through third-party intermediaries. The Design Institutes provided some bona fide services to RAPS-China. According to the pleading, because the Design Institutes had influence on the Chinese government-owned mining companies to which RAPS-China aimed to sell its product, RAPS-China's Marketing and Sales Director also intended the payments to influence the award of sales contracts. The SEC alleged that RAPS-China earned $1.7 million in net profits on sales contracts that were associated with the payments to the Design Institutes.

In addition, RAPS-China funded international travel for employees of the Design Institutes and other Chinese government-owned companies. The trips typically were a combination of business and leisure travel. In addition, RAPS-China funded approximately $450,000 in trips that had no direct business component, "other than the development of good will."

The SEC Cease and Desist Order states that RAPS-China's payments violated the books and records provision of the FCPA because RAPS China recorded the payments to Design Institutes as "costs of sales" despite the fact that the payments were intended to influence sales contracts with Chinese government-owned companies (in addition to securing bona fide services). In addition, the Order noted that the travel payments were recorded in Rockwell's books and records as business expenses, without indicating that the trips were not directly connected to the negotiation or execution of contracts or to the promotion of RAPS-China products. The pleading also notes that, by making the various payments, Rockwell violated the internal controls provisions of the FCPA.

The SEC, noting Rockwell's cooperation with the agency and the remedial measures it took after discovering and voluntarily disclosing the payments, ordered Rockwell to pay disgorgement of $1,771,000, prejudgment interest of $590,091, and a civil monetary penalty of $400,000. In addition, the SEC ordered Rockwell to cease and desist from violating the books and records and internal controls provisions of the FCPA.

Noteworthy Aspects:

- Narrow Reading on Hospitality Payments - Although the Cease and Desist Order only alleged violations of the FCPA's accounting provisions, the enforcement action sheds light on how the SEC appears to interpret the affirmative defense to the FCPA's anti-bribery provisions for promotional expenditures. As noted, the SEC determined that RAPS-China's books were inaccurate because they did not note that the trips for the officials were not directly related to the "negotiation or execution of contracts or to the promotion" of the company's products. The quoted language tracks the language of the affirmative defense to the FCPA's anti-bribery provisions. Thus, the SEC in this case has taken a very narrow view under which travel that had no direct business component "other than the development of good will" did not satisfy the FCPA's affirmative defense and could not be characterized as business expenses.

- Double FCPA Risk When State-Owned Enterprises Serve as Third Parties - In this case, Rockwell made payments to Design Institutes that are Chinese government-owned companies, which in turn exerted influence on Chinese government-owned mining companies. Although enforcement agencies frequently find FCPA violations where a company has used an agent to make a payment to a foreign official, it is rare that the intermediary is, itself, a government entity.

Actions Against Individuals

Mistrial Declared in Initial SHOT Show Litigation

On July 7, 2011, U.S. District Judge Richard J. Leon declared a mistrial in the case against Pankesh Patel, John Benson Wier III, Andrew Bigelow, and Lee Allen Tolleson, after jurors failed to agree on verdicts on the various charges. As reported in our FCPA Spring Review 2010 and other past Reviews, these four defendants were among the 22 SHOT Show defendants arrested in January 2010 and charged with allegedly engaging in schemes to bribe an undercover FBI agent they believed was acting on behalf of the government of Gabon in order to win a $15 million contract to provide law enforcement and defense equipment to the Gabonese presidential guard. Three of the other defendants previously pled guilty (including Haim Geri, discussed below), and the remaining defendants are awaiting trial. The case against Patel, Wier, Bigelow and Tolleson was the first to go to trial.

According to media sources, the attorneys for the Defendants emphasized the past crimes of the U.S. government's main cooperating witness, Richard Bistrong (discussed in our FCPA Fall Review 2010), and claimed that the government, assisted by Bistrong, improperly carried out the sting operation by concealing the criminal nature of the transaction, among other arguments. While the government has reportedly stated its intention to retry the case, it is expected to reevaluate its trial strategy for any future proceedings against Patel, Wier, Bigelow and Tolleson, as well as for the anticipated proceedings against the remaining defendants. More significantly, the potentially problematic use of undercover tactics and reliance on Bistrong in this case may inform, or possibly discourage, the DOJ's use of similar tactics in future cases.

Court Rejects DOJ's Interpretation of FCPA's Jurisdictional Reach

In another significant development from the trial of Patel, Wier, Bigelow and Tolleson, the court dismissed one of Patel's substantive FCPA anti-bribery charges, rejecting the U.S. government's expansive interpretation of Section 78dd-3 of the FCPA, which extends jurisdiction to non-U.S. nationals and companies under certain circumstances.

In the indictment against the 22 SHOT Show defendants, the DOJ claimed that Patel committed a substantive anti-bribery violation by sending a package via DHL from the United Kingdom to Washington DC containing an original copy of a purchase agreement for the corrupt deal, among other charges. Because Patel is a U.K. national (and does not otherwise qualify as an "issuer" or "domestic concern" under the FCPA), the DOJ charged Patel under Section 78dd-3, which prohibits non-U.S. nationals from doing any act in furtherance of a corrupt payment "while in the territory of the United States."

At trial, the DOJ argued that Patel's mailing a package into the United States satisfied Section 78dd-3 because he had previously taken other acts within the United States (e.g., attending a meeting at Clyde's restaurant in Washington, DC, which was the basis of another FCPA count against Patel). According to the government's position, as summarized by U.S. District Judge Richard J. Leon during a hearing, "[Because Patel has] already taken one act within the United States, the subsequent act of mailing doesn't have to be within the United States."

The attorney for Patel argued that the government's position conflicts with the plain meaning of the statute. According to Patel's counsel, "[the DOJ] charged [Patel] with being in London and dropping a DHL package in the mail as a substantive FCPA violation, while the statute very clearly requires that he can only be liable for something while in the territory of the United States."

Judge Leon indicated that he did not understand the basis of the government's interpretation of the statute, and concluded: "I would think the more cautious, conservative interpretation would be that each act has to be while in the territory of the United States." The court then granted Patel's motion to dismiss the relevant charge, though it did not issue a formal statement of Judge Leon's reasoning for the dismissal.

The court's dismissal of the charge against Patel suggests that jurisdiction is only appropriate under Section 78dd-3 when a non-U.S. citizen or company takes an act in furtherance of an improper payment while physically in the territory of the United States. This position directly conflicts with the DOJ's broad interpretation of 78dd-3 articulated in its "Lay-Person's Guide to the FCPA Statute," which can be viewed as a statement of the DOJ's enforcement position. The Guide states that "a foreign company or person is now subject to the FCPA if it causes, directly or through agents, an act in furtherance of the corrupt payment to take place within the territory of the United States" [emphasis added]. Thus, according to the DOJ's interpretation, Section 78dd-3 does not require a physical presence by the non-US national or company, it only requires that the individual or company cause an act in the United States (i.e., a defendant can be subject to jurisdiction under a "cause/effect" theory).

Pleadings from past enforcement actions indicate that the DOJ has used this cause/effects theory in prior cases. For example, in the Daimler case, described in our FCPA Spring Review 2010, Daimler's foreign subsidiaries settled 78dd-3 charges based upon improper payments to U.S. bank accounts and U.S. shell companies, and contracts with U.S. shell companies. The pleadings do not include any specific allegations of acts taken by the companies while physically within the United States.

Haim Geri Pleads Guilty

On April 28, 2011, one of the 22 SHOT Show defendants, Haim Geri, pled guilty to the charge of conspiracy to violate the FCPA. This was the third guilty plea in connection with the SHOT Show prosecutions, following the September 2010 pleas of Daniel Alvirez and Jonathan Spiller.

According to the Statement of the Offense attached to the plea agreement, Geri, a U.S. citizen, was president of a North Miami Beach company that served as a sales agent for companies in the law enforcement and military products industries. Similar to the facts set forth in prior pleadings in related cases, the Statement of the Offense claims that Geri agreed to proceed with the sale of products for the presidential guard of Gabon after being told that the Minister of Defense would personally receive a 10% commission in connection with the deal. The pleading also states that Geri sent price quotations reflecting an inflated sales price that included the "commission," arranged for a wire payment of the "commission," attended a reception in connection with the deal at Clyde's restaurant in Washington DC, and traveled to Las Vegas expecting to receive partial payment for the transaction, among other acts in furtherance of the conspiracy.

Under the plea agreement, Geri faces up to five years imprisonment, monetary penalties, and up to three years supervised release. However, the DOJ agreed to recommend adjustments under the U.S. Sentencing Guidelines based upon Geri's acceptance of responsibility and assistance to authorities, which could result in a term of imprisonment of 18 to 24 months.

Fourth Former Latin Node Executive Pleads Guilty to Conspiracy to Violate the FCPA

On May 18, 2011, Manuel Caceres, the former Vice President of Business Development for Miami-based telecommunications company Latin Node Inc. ("Latin Node"), pled guilty to a single count of conspiring to violate the FCPA. The following day, on May 19, 2011, former Latin Node CEO Jorge Granados also pled guilty to a single count of conspiring to violate the FCPA. As reported in our FCPA Winter Review 2011, Caceres and Granados initially pled not guilty to nineteen counts of conspiracy, violations of the anti-bribery provisions of the FCPA, and international money laundering.

Caceres and Granados are the third and fourth former Latin Node executives in the last six months to plead guilty to conspiracy to violate the FCPA by bribing employees of the Honduran-government owned Empresa Hondureña de Telecomunicaciones ("Hondutel"). As reported in our FCPA Spring Review 2011, Manuel Salvoch (former CFO) pled guilty on January 12, 2011, and Juan Pablo Vasquez (former VP Sales, among other senior executive positions) pled guilty on January 21, 2011. According to Granados' plea agreement, he was an organizer or leader of criminal activity involving five or more participants. A fifth as yet unnamed co-conspirator was identified in the Granados and Caceres indictment as a senior executive of Latin Node, holding such titles as VP Network Operations and Quality Assurance and managing LN Comunicaciones in Guatemala.

Latin Node pled guilty in April 2009 to one count of violating the FCPA's anti-bribery provisions related to activities in Honduras and Yemen (see our FCPA Spring Review 2009). Under Latin Node's plea agreement with the DOJ, the company agreed to cooperate with U.S. authorities and pay a $2 million fine. According to the criminal information filed against Latin Node, alleged improper payments of approximately $1,100,000 were made to Hondutel officials to secure an interconnection agreement and preferential interconnection rates by means of sham "consulting" agreements and cash payments to Hondutel employees. (See our FCPA Winter Review 2011).

Former CCI Executive Pleads Guilty to FCPA-Related Charges

On April 28, 2011, Flavio Ricotti, former vice president for sales of Control Components Inc. ("CCI"), pled guilty to one count of conspiracy to violate the FCPA and the Travel Act. Ricotti was charged alongside five other former CCI executives, whose trial is scheduled to begin October 4 of this year. According to the FBI's press release, Ricotti has admitted to conspiring to bribe an official of Saudi Aramco, the Saudi Arabian state-owned oil company, as well as an employee of a private company in Qatar. The purpose of the bribes was to win contracts for CCI. In related cases, two other former CCI employees, Mario Covino and Richard Morlok, pled guilty in 2009 to FCPA-related charges. Ricotti faces up to five years in prison.

Ongoing Developments

United States v. Carson Developments

On May 18, 2011, Judge James Selna of U.S. District Court for the Central District of California denied a motion by the defendants in United States v. Carson to dismiss the FCPA counts against them. As reported in our FCPA Spring Review 2011, various individual defendants moved to dismiss the indictments against them in United States v. Carson, No. 8:09-cr-00077 (C.D. Cal.), United States v. Lindsey Manuf. Co., No. 2:10-cr-01031 (C.D. Cal.), and United States v. O'Shea, No. 4:09-cr-00629 (S.D. Tex.). The question presented to the courts was whether a government-owned or -backed enterprise falls within the "instrumentality thereof" clause of the antibribery prohibitions. The respective defendants argued that, if not, any bribes paid to officers and employees of such an enterprise could not violate the FCPA. Those challenges have now failed in both Lindsey (see above) and Carson, and a decision in O'Shea remains pending.

In Carson, the defendants are accused of bribing employees of state-owned companies in China, Korea, Malaysia, and the United Arab Emirates. Judge Selna, referring to the Lindsey and Haiti Teleco cases noted that his court reached the same conclusion as those district courts: "state-owned companies may be considered ‘instrumentalities' under the FCPA, but whether such companies qualify as ‘instrumentalities' is a question of fact." After conducting his own fact-based inquiry, Judge Selna denied the defendants' motion to dismiss. In Judge Selna's written order, he concluded that "several factors bear on the question of whether a business entity constitutes a government instrumentality," and he provided his own non-exclusive list:

- The foreign state's characterization of the entity and its employees;

- The foreign state's degree of control over the entity;

- The purpose of the entity's activities;

- The entity's obligations and privileges under the foreign state's law; including whether the entity exercises exclusive or controlling power to administer its designated functions;

- The circumstances surrounding the entity's creation; and

- The foreign state's extent of ownership of the entity, including the level of financial support by the state (e.g., subsidies, special tax treatment, and loans).

In sum, Judge Selna concluded that the "chief utility" of these factors "is simply to point out that several types of evidence are relevant when determining whether a state-owned company constitutes an ‘instrumentality' under the FCPA — with state ownership being only one of several considerations." For example, a mere monetary investment might not be enough to qualify an entity as an "instrumentality," but when combined with "additional factors that objectively indicate the entity is being used as an instrument to carry out governmental objectives, that business would qualify as a governmental instrumentality."

Thus, the decisions issued in both Lindsey and Carson make clear that whether a state-owned company qualifies as an "instrumentality" is a question of fact, to be resolved after consideration of a variety of factors relating to issues of control by the foreign government, the purpose and activities of the entity, and ownership interests. In Carson, this has led to the prosecution and defense submitting proposed jury instructions on the meaning of "instrumentality," and additional wrangling over this important issue is certain to arise in future litigation and on appeal.

The trial in Carson is scheduled to commence on June 5, 2012.

Since our last Review, there have been several domestic and international developments related to the Alcatel-Lucent FCPA matter. As reported in our FCPA Winter Review 2011, on December 27, 2010, French telecommunications company Alcatel-Lucent, S.A. ("Alcatel-Lucent") and three subsidiaries agreed to pay over $137 million in penalties and disgorgement of profits to settle charges brought by U.S. enforcement agencies that the company violated the FCPA. According to the pleadings, Alcatel CIT, S.A. (now known as Alcatel Lucent France S.A.), one of the subsidiaries, bribed employees of the Costa Rican government-owned Instituto Costarricense de Electridad ("ICE") from December 2001 to October 2004. On behalf of Alcatel CIT, Alcatel Standard, A.G. (now known as Alcatel Lucent Trade International A.G.) hired numerous consultants as conduits who performed little to no actual work, including one who was a relative of Edgar Valverde, then President and Country Senior Officer of Alcatel de Costa Rica. The pleadings state that the consultants paid at least $7 million in bribes to ICE employees and to a high-ranking executive branch official (presumably a reference to former Costa Rican President Miguel Angel Rodriguez Echeverria, as described below) and that Alcatel CIT reimbursed $25,000 in expenses incurred by ICE officials on a vacation-oriented trip to France in October 2003. As a result of the payments, Alcatel CIT obtained telecommunications contracts valued at approximately $303 million.

ICE's Petition for Relief as a Victim of Alcatel-Lucent's Conduct

In an unusual twist to an FCPA resolution, ICE filed a petition in U.S. federal court on May 2, 2011, seeking invalidation of Alcatel-Lucent's settlement agreements with the DOJ in order to obtain restitution for harm suffered as a victim of Alcatel-Lucent's unlawful conduct. In its petition filed under the Crime Victims' Rights Act (18 U.S.C. § 3771), ICE positioned itself as distinct from and innocent of the actions of its former directors and senior managers who accepted bribes from Alcatel and whom ICE terminated once the scandal leaked to the press. ICE also characterized itself as an autonomous legal entity and therefore independent of the Costa Rican government.

The DOJ and Alcatel-Lucent each filed oppositions to the petition on May 23, 2011. Both characterized ICE as complicit in the underlying offense and therefore not a victim. In particular, the DOJ described ICE as a place where corruption was pervasive for years and reached the highest levels of the organization. Both parties also argued that the settlement documents were fairly negotiated and that the settlement should not be prolonged in order to determine ICE's merely speculative damages. Moreover, the DOJ contended that ICE was making improper use of U.S. criminal proceedings to seek a remedy for civil contract claims recently rejected by a Costa Rican court. ICE had sought $73 million in damages against Alcatel-Lucent in Costa Rica.

On June 1, 2011, the federal court denied ICE's petition. The court determined that ICE was the defendants' co-conspirator, not a victim, in light of "the pervasive, constant, and consistent illegal conduct" of its Board of Directors and management.

ICE's petition marked the first filed by a purported victim under the FCPA. Ironically, if the federal court had adopted ICE's description of itself as a non-governmental entity, no crime would have been committed under the FCPA because there would not have been a "foreign official" to accept Alcatel-Lucent's bribes, thus obviating ICE's chances for restitution. Had the court granted ICE victim status and restitution rights, it would likely complicate FCPA enforcement actions, with other entities claiming to be victims claiming their share of the large penalties that up to now have gone to the U.S. Treasury.

Sentencing of Former Costa Rican President

On April 27, 2011, former Costa Rican President Miguel Angel Rodriguez Echeverria was sentenced by a Costa Rican court to five years in prison for accepting bribes from Alcatel. The Costa Rican court also banned Rodriguez from seeking public office for twelve years. Rodriguez was President of Costa Rica from 1998 to 2002. In 2004, he served briefly as the Secretary General of the Organization of American States ("OAS") before resigning in light of the Alcatel scandal. According to press accounts, the Costa Rican court convicted him of accepting $500,000 of a total $14 million paid by Alcatel to Rodriguez and ICE officials. The court also sentenced three former ICE officials to prison terms of two to fifteen years.

On May 25, 2011, Rodriguez appealed his conviction before a Costa Rican court and plans to submit a complementary appeal to the Third Chamber (Sala III) of the Costa Rican Supreme Court. Rodriguez's lawyer has indicated that if Rodriguez loses his appeal within the Costa Rican legal system, he may appeal to the OAS's Inter-American Court of Human Rights.

Sentencing of Former Alcatel Costa Rica President Valverde

On April 27, 2011, the Costa Rican court also sentenced Edgar Valverde, former President and Country Senior Officer of Alcatel de Costa Rica, to a lengthy prison term that, depending upon the source, is either fifteen or twenty years. The DOJ accused Valverde in June 2007 of violating the FCPA and since then, he has been a fugitive from U.S. authorities. Valverde's former colleague and former Alcatel executive Christian Sapsizian was sentenced to 30 months in prison after he pled guilty to two substantive FCPA violations. (See our FCPA Autumn Review 2007 and FCPA Autumn Review 2008). Sapsizian implicated Valverde as his co-conspirator. (See our FCPA Autumn Review 2007).

SEC Temporarily Suspends Trading in RINO; China-Based Issuer Under Investigation for Possible FCPA Violations

On April 11, 2011, the SEC temporarily suspended trading in the Chinese firm RINO International Corp. ("RINO"), a manufacturer of environmental protection equipment that currently trades on the OTC Markets Group Inc. (or "Pink Sheets") and is the subject of an ongoing FCPA investigation. While trading in RINO was reinstated on April 25, 2011, the SEC explained at the time that it was imposing the suspension due to "a lack of current and accurate information" concerning the company's securities. According to the suspension order, RINO had failed to disclose that the law firm and forensic accountants hired by the company to investigate allegations of financial fraud and corruption had resigned at the end of March 2010 after reporting the results of their investigation to the company's management and board. RINO also reportedly failed to disclose the resignations of the chairman of its audit committee and its remaining independent directors, which occurred around the same time. The SEC suspension order further noted that questions have arisen regarding, among other things, "the size of the company's operations and number of employees," "the existence of certain material customer contracts," and "the existence of two separate and materially different sets of corporate books and accounts."

The temporary suspension came fewer than six months after RINO disclosed that it was the subject of a formal SEC investigation into the company's financial reporting and FCPA compliance from January 1, 2008, through the present. RINO simultaneously announced that the NASDAQ had suspended trading of the company's common stock on November 17, 2010, and was delisting the company's securities effective December 8, 2010, based upon several considerations, including: (a) the company's announcement that its financial reports since 2008 could no longer be relied upon; (b) the company's admission that it had not entered into certain previously disclosed contracts; and (c) the company's failure to respond to requests for additional information from the NASDAQ.

RINO has provided few details about its ongoing SEC investigation, but a China-focused hedge fund, Muddy Waters LLC, issued a research report in November 2010 claiming that RINO had significantly exaggerated its revenues, that its flawed accounting suggested "cooked books," and that company management was misappropriating funds for personal use. Some commentators have speculated that the Muddy Waters report may have served as the trigger for the SEC investigation and led to the subsequent delisting of RINO's securities by the NASDAQ.

Noteworthy Aspects:

- Emerging Market Firms Listed on U.S. Exchanges - The China-based RINO is one of a growing number of foreign firms from emerging markets that have sought to list securities on U.S. exchanges in recent years. In listing themselves on U.S. exchanges, these emerging market firms take upon themselves substantial compliance obligations and open themselves up to increased liability as "issuers" under the FCPA. Many of these new issuers may not be sufficiently familiar with the increased risks and responsibilities associated with being listed on U.S. markets. The potential risks can be further amplified by lax regulation or enforcement in some emerging markets and resistance to cooperation with U.S. enforcement authorities.

- Increasing Regulatory Focus on China - Based upon concerns about the risks posed by certain foreign-based issuers, particularly those based in China, SEC Chairman Mary Shapiro recently declared that the Commission was moving "aggressively" to protect investors in this area, including suspending trading in more than a dozen China-based entities such as RINO, whose financial disclosures were found to be problematic. She also noted that in mid-2009, the SEC launched a "proactive risk-based inquiry" into U.S. audit firms that represent these types of entities. On April 4, 2011, Luis Aguilar of the SEC publicly confirmed that the SEC has assembled an "internal task force" to investigate fraud and corruption at U.S.-listed Chinese companies, especially those listed through "backdoor" methods such as reverse mergers. While the SEC's FCPA investigation of RINO represents the first known instance of a wholly China-based company being targeted under the FCPA, in light of the growing number of China-based firms listed on U.S. exchanges through reverse mergers (159 since 2007 according to one PCAOB analysis) and the increased attention the SEC is devoting to these entities, it is not likely to be the last.

- Financial Toll of Investigations - While trading in RINO was reinstated, the suspensions and ongoing investigation have taken a financial toll, with the company's stock price dropping from approximately $19 a share shortly before the release of the Muddy Waters report on November 10, 2010, to approximately $0.52 in July 2011.

Domestic Litigation

Johnson & Johnson Shareholders File Derivative Suit

On May 2, 2011, a class action lawsuit was brought against eleven members of the Board of Directors of Johnson & Johnson ("J&J") by J&J shareholders on behalf of the company in federal district court in New Jersey. The shareholders' derivative suit against the directors seeks at least $70 million in damages and includes claims for breach of fiduciary duty, mismanagement, abuse of control, corporate waste, unjust enrichment and violations of the federal securities laws.

The lawsuit follows on the heels of settlements between J&J and the SEC, DOJ, and the U.K.'s Serious Fraud Office ("SFO") in connection with allegations that J&J's subsidiaries, employees and agents engaged in the aforementioned bribery and kickback schemes. As described in our FCPA Spring Review 2011, on April 8, 2011, J&J agreed to pay more than $48.6 million in disgorgement and prejudgment interest to settle the SEC's charges; entered into a three-year deferred prosecution agreement with the DOJ under which it agreed to pay a $21.4 million criminal penalty; and agreed to pay a civil penalty of approximately $7.85 million to settle charges with the U.K. SFO related to the activities of a J&J subsidiary, DePuy Inc.

The crux of the Complaint is that "when faced with a known duty to act, i.e., ensuring J&J's compliance with the FCPA, defendants breached their duty of loyalty by failing to cause J&J to implement an internal controls system for detecting and preventing bribes to public doctors and administrators in Greece, Poland, and Romania and kickbacks to Iraq to win business there." (See Complaint at ¶ 3). The Complaint alleges that the defendants compounded this duty of loyalty breach by failing to detail, in full candor, the nature and extent of J&J's FCPA violations in the company's annual 10-K Reports and Proxy Statements for the years 2006-2010. Specifically, while the Complaint acknowledges that the 2006-2010 Annual Reports contained references to the company's February 2007 voluntary disclosure to the DOJ and SEC of potential FCPA violations, the plaintiffs allege that the defendants failed to disclose that the bribery and kickback scheme extended to Greece, Poland, Romania, and Iraq, and neglected to explain the culpability of J&J's directors for failing to implement adequate internal controls to prevent the company from being able to detect or prevent the conduct.

The lawsuit claims that the defendants' efforts to conceal the full extent of the company's FCPA violations not only violated their duty of loyalty/candor, but also violated Section 14(a) of the Securities and Exchange Act and Rule 14a-9, which prohibits the omission of material facts in proxy statements. Furthermore, the Complaint claims that due to the defendants' alleged violation of Section 14(a), their incentive compensation and fees should be rescinded under Section 29 of the Act. Similarly, defendants face claims of unjust enrichment under the theory that many of them received valuable stock-based compensation as J&J's stock price rose during the same period of time that J&J's subsidiaries were allegedly engaged in bribery and kickback schemes. Plaintiffs claim that defendants should not be able to retain the financial benefits they obtained from 2000-2006, given that the Company's fortunes were allegedly buoyed by illicit conduct that the defendants had a duty to prevent through the institution of an adequate internal controls system.

This shareholder derivative lawsuit against J&J continues a recent trend described in our FCPA Autumn Review 2010 wherein civil suits are filed against a company in the aftermath of FCPA investigations; other recent examples include suits against SciClone Pharmaceuticals, Weatherford International, Avon Products, and Pride International. What distinguishes this action is that it comes four years after the Company first disclosed in its 2006 annual 10-K Report that it had self-reported potential FCPA violations to the DOJ and SEC. In contrast, a shareholders derivative lawsuit was filed against SciClone Pharmaceuticals only four days after the company reported the mere existence of an FCPA investigation in its August 2010 10-Q filing.

U.S. Agency Developments

DOJ Issues First Opinion Procedure Release of 2011

On June 30, 2011, the DOJ issued its first Opinion Procedure Release of the year. A U.S. adoption service provider (the "Requestor") requested the DOJ's input into its proposal to pay the expenditures of two foreign officials visiting the United States to learn about the services provided by the Requestor. The officials would be selected by their agencies without involvement of the Requestor. The Requestor has "no non-routine business (e.g., licensing or accreditation) under consideration by the relevant foreign government agencies." No spouses or family members would attend the two-day trip and the Requestor would pay all costs (economy class airfare, lodging, local transport and meals) directly to the providers (e.g., airline, hotel, restaurants). The Requestor would not "fund, organize, or host any other entertainment, side trips, or leisure activities for the officials, or provide the officials with any stipend or spending money."

Noting that the proposed travel was consistent with two past favorable Opinion Releases (07-01 and 07-02), the DOJ opined that the proposed travel was reasonable and directly related to the "promotion, demonstration, or explanation of [the Requestor's] products or services" under the FCPA's affirmative defense for promotional expenses. As a result, the DOJ indicated that it did not intend to take any enforcement action with respect to the proposed hosting of the officials.

Noteworthy Aspects:

- Proposed Hospitality Consistent with Past Opinion Releases - The most noteworthy aspect of this Opinion Release is the fact that it is not noteworthy within the context of past DOJ practice. As noted by the DOJ in the Release, the proposed hospitality is entirely consistent with past favorable Releases and the Requestor will employ multiple safeguards previously endorsed by the DOJ. The Release therefore does little to define the parameters of the affirmative defense for promotional expenditures and provides no guidance on when, or if, side trips, business class tickets, entertainment, or other common aspects of business travel are acceptable. It is in sharp contrast to the U.K. Ministry of Justice's Guidance for the U.K. Bribery Act, which confirms that entertainment not directly tied to "promotion, demonstration, or explanation of products or services" can be acceptable under the Act.

- DOJ Focus on Lack of Non-Routine Business - The DOJ's emphasis in Opinion Release 11-01 (and in previous Releases) on the fact that the Requestor has "no non-routine business" pending before the foreign officials appears inconsistent with the affirmative defense for promotional expenditures. The promotion, demonstration, and explanation of products and services are more likely to occur when there is non-routine business pending (e.g., at the inception of a business relationship, when seeking regulatory approvals, when a contract award is pending, when a contract is up for renewal), as is suggested by the second prong of the affirmative defense, which permits bona fide and reasonable expenditures when related to contract execution or performance of a contract.

DOJ Kleptocracy Unit Targets Former Nigerian Governor

On May 25, 2011, in a speech before the World Bank, Assistant Attorney General Lanny Breuer, head of the Department of Justice's Criminal Division, announced that the Division's newly created Kleptocracy Asset Recovery Initiative Team had filed its first civil forfeiture actions against property in the United States that is believed to be the proceeds of high-level foreign corruption.

Mr. Breuer highlighted the forfeiture actions brought against property purchased as part of a money laundering scheme involving Diepreye Solomon Peter Alamieyeseigha (known as "DSP"), the former governor of the oil-producing Nigerian state of Bayelsa. According to affidavits provided in support of the forfeiture actions in federal district court in Massachusetts (see United States v. The Contents of Account Number Z44-343021 Held at Fidelity Brokerage Services LLC., Boston, Massachusetts, No. 1:11-cv-10606-RWZ (D. Mass. 2011)) and Maryland (see United States v. Solomon & Peters, Ltd., No. 8:11-cv-662-RWT (D. Md. 2011)), DSP, as the elected governor of Bayelsa State, was required under Nigerian law to report his assets and sources of income to Nigerian officials and was prohibited from owning or controlling bank accounts outside of Nigeria.

DSP allegedly filed only three financial statements during his period as governor, from 1999-2005. His entire salary during those six years was less than $81,000 and his total declared income was less than $248,000. According to the affidavits, he never disclosed owning any bank accounts outside of Nigeria during that time.

However, during DSP's tenure as governor, Bayelsa State entered into contracts worth tens of millions of dollars, and DSP, through two shell companies, Solomon & Peters, Ltd. ("S&P") and Santolina Investment Corporation ("Santolina"), allegedly acquired four real properties in the United Kingdom worth approximately $8.8 million and received funds worth approximately $3.3 million in various bank accounts outside of Nigeria.

In 2005, DSP was arrested at London's Heathrow Airport on suspicion of money laundering; a subsequent search of his London residence turned up approximately $1.5 million in cash. DSP was released on bail and fled back to Nigeria, where he was impeached and indicted on charges of issuing false declarations and money laundering. In addition, his shell companies were also indicted on money laundering charges. Eventually, DSP entered guilty pleas on behalf of himself and his shell companies. In 2007, he was sentenced to two years imprisonment and forfeiture of related property; his shell companies were ordered to be wound up and their property and cash holdings forfeited.

The two properties that are the subject of forfeiture actions in the United States are a private residence in Maryland worth approximately $600,000 and assets in a Fidelity Brokerage Services Account worth approximately $400,000. According to the affidavits, DSP attained these assets with the assistance of his associate, Ehigie Uzamere, who, in addition to having a history of conducting financial transactions on behalf of DSP and his family, also owned companies that held multi-million dollar contracts with the Bayelsa State Government during DSP's tenure as governor. Mr. Uzamere allegedly facilitated the purchase of the Maryland property by illegally diverting Bayelsa State Government funds to S&P and then obtaining the Maryland property in the name of S&P with the help of another DSP associate, Domingo A. Obende, who is a Nigerian businessman with interests in oil and gas. According to the affidavits, Uzamere also assisted DSP in laundering funds amounting to approximately $400,000 through various accounts with JP Morgan Chase Bank, Bank of America, and eventually Fidelity.

If the United States pursues these forfeiture actions successfully, the assets it recovers will be returned to Nigeria.

Mr. Breuer stated that he expected the Kleptocracy Asset Recovery Initiative Team to file more forfeiture complaints in the near term.

SEC Adopts Final Rules Implementing Whistleblower Program

On May 25, 2011, the SEC adopted final rules implementing the highly-anticipated whistleblower program for securities law violations. The new program, enacted pursuant to Section 922 of the Dodd-Frank Act, authorizes the SEC to pay rewards to individuals who provide the Commission with original information that leads to a successful enforcement action garnering sanctions of at least $1 million. As discussed in our FCPA Winter Review 2011, the SEC released proposed rules on November 3, 2010, generating significant public comment. The SEC received hundreds of letters and held more than fifty face-to-face meetings on various aspects of the proposal, with perhaps the most-discussed issue being the interplay with corporate compliance programs.

While many companies had argued for a requirement that a whistleblower report violations internally before going to the SEC, the commissioners rejected that approach in the final rules. Instead, the SEC maintained the incentive approach included in the proposed rules, whereby the agency may increase the amount of an award for a whistleblower who reports internally before reporting to the SEC. Conversely, the SEC may decrease the amount of an award for a whistleblower who interferes with the internal compliance program.

The final rules also extend the time period for a whistleblower to report to the SEC after first reporting internally. This "lookback period" was increased from 90 to 120 days, allowing a whistleblower to hold his or her place in line and receive credit for providing original information as of the day that he or she reported internally. In addition, an employee who reports internally may receive an award if the company then voluntarily discloses information based on the employee's complaint. The SEC will attribute to the employee all of the information disclosed by the company, thereby giving credit to the employee for information discovered by the company in its internal investigation.

In another change from the proposed rules, the SEC will allow aggregation of sanctions imposed in numerous enforcement actions to meet the $1 million threshold for whistleblower reward eligibility. Thus, the SEC will combine the sanctions from multiple Commission proceedings to meet the threshold so long as the proceedings arise from a single nucleus of operative facts. In a webinar hosted by Main Justice and Miller & Chevalier on June 15, Sean McKessy, the Chief of the Office of the Whistleblower, clarified that the SEC will aggregate only actions brought by the Commission in determining whether the threshold for award eligibility has been met. The determination of the amount of the whistleblower's reward is a separate consideration. In calculating the 10 to 30% reward, the SEC will include sanctions imposed in related actions based upon the same original information that led to the successful enforcement of the Commission action.

The Commissioners voted 3-2 to adopt the final rules, which will become effective on August 12, 2011.

Noteworthy Aspects:

- Wide Scope of Eligible Whistleblowers - The rules exclude certain parties from claiming a whistleblower reward, such as employees of regulatory or governmental agencies (such as the SEC, DOJ, and PCAOB), foreign government officials, and persons convicted of criminal violations in connection with the relevant SEC action or a related action. However, there is no bar on awards to persons found civilly liable in connection with the violations that formed the basis for the award. The rules also generally exclude compliance and audit personnel, directors and officers who learn of the violations from another person, and individuals who come to learn of information through an audit or investigation of the company, but there are crucial exceptions to these exclusions. If such individuals have a reasonable basis to believe that disclosure to the SEC is necessary to prevent substantial financial harm to the company or investors, or that the company is engaging in conduct that will impede an investigation, they become eligible for an award. Likewise, if the company does not act on the information within 120 days, such individuals become eligible for an award. Notably, the rules do not exclude customers, shareholders, or competitors from receiving credit as whistleblowers.

- Importance of Appropriate Detection and Response - The structure of the whistleblower program heightens the need for early detection of potential violations and a rapid and robust response to allegations. Companies should be proactive in designing effective internal reporting procedures and encouraging their use. Documentation of internal compliance measures and the company's response to employee concerns will be increasingly important in this regard. In addition, companies should train managers how to respond appropriately to employee concerns in light of the anti-retaliation provisions contained in the Dodd-Frank Act and clarified in the final rules.

U.S. Legislative Developments

House Judiciary Committee Holds Hearing on the FCPA

On June 14, 2011, the U.S. House Judiciary Subcommittee on Crime, Terrorism and Homeland Security, chaired by Rep. Jim Sensenbrenner (R-WI), held a hearing on the FCPA. Greg Andres, Deputy Assistant Attorney General of the DOJ's Criminal Division, testified along with three other speakers: former Attorney General Michael Mukasey of Debevoise & Plimpton LLP, testifying on behalf of the U.S. Chamber Institute for Legal Reform, George Terwilliger of White & Case LLP, and Shana-Tara Regon, Director, White Collar Crime Policy of the National Association of Criminal Defense Lawyers.

At the hearing, Mr. Andres was the sole speaker advocating that the FCPA needed no statutory changes. He reiterated previous comments (made, for example, at a November 30, 2010 Senate Judiciary Committee hearing covered in our FCPA Winter Review 2011) indicating that the DOJ has "made great strides prosecuting foreign corruption in all corners of the globe." He discussed the nine factors in the DOJ's "Principles of Federal Prosecution of Business Organizations" from the U.S. Attorney's Manual and how they guide whether the DOJ pursues charges under the FCPA. Although other speakers discussed the lack of clarity in the statute that leads companies to forego business opportunities abroad for fear of prosecution of minor infractions, Mr. Andres spoke of providing guidance to companies in the form of DOJ officials speaking publicly about its enforcement efforts and the Opinion Release Procedure, which allows companies to obtain an opinion in advance whether proposed conduct would violate the FCPA. He emphasized that the DOJ prosecutes pervasive company corruption, not isolated minor incidents, but said the DOJ opposes establishing a de minimis threshold for bribery.

Both Messrs. Mukasey and Terwilliger suggested that the FCPA be amended to include a compliance defense, whereby companies could rebut criminal liability that might occur if a rogue individual violated the FCPA despite the company's robust compliance program. Both witnesses also advocated restricting successor liability so that acquiring companies would not be liable for criminal or other actions taken by their new subsidiaries before the acquisition occurred. Mr. Mukasey described four additional suggested changes to the FCPA: clarifying the scope of the term "foreign official," improving procedures for guidance and advisory opinions from the DOJ; adding a "willfulness requirement for corporate criminal liability; and limiting a parent company's liability for acts of a subsidiary not known to the parent. Ms. Regon focused her remarks on the FCPA's harmful effects on companies by criminalizing legitimate business behavior.

Several Subcommittee members questioned the witnesses as to whether the law provides too much discretion to the DOJ, and the lack of clear definitions of key terms ("foreign official," "instrumentality"), and they elicited situations showing how companies were disadvantaged due to the DOJ's and the SEC's interpretations of the FCPA. Other members probed for specific incidents or prosecutions where the DOJ and/or the SEC prosecuted minor offenses, which witnesses could not generally provide. At the end of the hearing, Rep. Sensenbrenner, not appeased by Mr. Andres' statements, emphatically directed him to tell the Attorney General that the Subcommittee intends to draft legislation amending and clarifying the FCPA.

International Developments

Canada Assesses First Multimillion Dollar Fine in Anti-Bribery Enforcement Action

On June 24, 2011, Niko Resources Ltd. ("Niko") agreed to pay CDN$9.5 million (approximately $9.8 million) and undergo a three-year probation period to resolve charges that it bribed a Bangladeshi official in contravention of Canada's equivalent to the FCPA -- the Corruption of Foreign Public Officials Act ("CFPOA"). Prior to this resolution, the only other Canadian conviction for foreign bribery had resulted in a CDN$25,000 (approximately $25,940) fine.

The alleged bribery took place in 2005, when Niko's Bangladeshi subsidiary gave the then- Minister of Energy in Bangladesh a vehicle worth CDN$191,000 (approximately $198,000). In addition, Niko itself paid travel and accommodation expenses for the Minister to attend an energy conference in Canada and then to travel on to New York and Chicago to visit family members. The Royal Canadian Mounted Police ("RCMP") found that paying for the additional travel to New York and Chicago, valued at CDN$5,000 (approximately $5,200), constituted a bribe. According to the settement agreement, however, the RCMP was unable to prove that Niko received any benefit from the payments. (See Agreed Statement of Facts at ¶ 58).

During the probation period, Niko has agreed to continue to cooperate with Canadian law enforcement agencies on additional ongoing investigations related to the alleged bribery. Niko also agreed to adopt an anti-corruption compliance program and submit three annual independent auditor's reports to the Alberta Queen's Court and the RCMP regarding Niko's compliance program, internal controls and its efforts to prevent further violations of Canada's anti-bribery laws.

The Court stated that the following facts played a role in the RCMP's calculation of the fine: (1) the clear-cut nature of the alleged bribery; (2) the knowledge by high-level company officials of the payments (the parent company, Niko Canada, had visibility into Niko Bangladesh and its operations, and Niko Canada's CEO served on the board of Niko Bangladesh); (3) the "potentially very large amount of money" that Niko Canada stood to gain or lose in Bangladesh; and (4) the amount of the fine would not affect Niko's viability as an ongoing company. Additional facts that mitigated the fine and probation time included: (1) Niko's status as a first-time offender; (2) Niko's cooperation with the investigation after its initiation; (3) Niko's guilty plea, which obviated the need for a trial; (4) Niko agreement to the Court's supervision for the next three years; and (5) Niko's substantial steps to prevent future offenses.

From a practitioner's perspective, this case provides valuable information on how the RCMP and Canadian courts are now implementing the CFPOA. First, in this case the Government of Canada calculated a much more expensive fine of CDN$9.5 million--perhaps with an eye toward deterring bribery--than before, where the first violator paid only CDN$25,000 for bribing a U.S. Customs official in 2005. The fine is particularly significant given both the relatively small value of the bribes and the fact that no proof existed that Niko benefited from its payments. Second, companies that work in both Canada and the United States will recognize similarities between U.S. and Canadian resolutions, such as requiring the implementation of a compliance program and self-monitoring. Third, companies operating in Canada need to recognize that the RCMP and courts consider that the CFPOA extends to conduct abroad by a foreign subsidiary and is not limited to direct bribery in Canada (which was in question before this settlement).

Companies can expect to see further clarifications of the CFPOA in coming months and years. The RCMP has over twenty-five ongoing investigations, the results of which should further elucidate Canadian methodology.

OECD Invites Russia to Join Anti-Bribery Convention

On May 25, 2011, Russia was invited to join the Organization for Economic Cooperation and Development ("OECD") Convention on Combating Bribery of Foreign Public Officials in International Business Transactions at a ceremony in Paris. The invitation followed the passage of a law this past spring prohibiting Russian companies from bribing foreign officials. According to press reports, the ceremony marked the beginning of Russia's application process to join the OECD Convention and was also a step toward full OECD membership. Russia asked to join the OECD in 2007.

Siemens Discloses Potential Bribery in Kuwait; German Prosecutors Charge Former Siemens Board Member

On May 24, 2011, Siemens, which settled anti-bribery prosecutions with U.S. and German authorities in 2008 by agreeing to pay $1.6 billion in fines, penalties, and disgorgement of profits (See our December 15, 2008 Alert), disclosed potential bribery violations in Kuwait to U.S. and German officials. According to media sources, earlier in 2011, an agent in Kuwait approached three Siemens employees and promised them an energy contract if they were willing to pay bribes to Kuwaiti officials. Although the employees accepted the offer, Siemens compliance officials received a tip on the company hotline before the deal was completed. The company promptly investigated and fired the employees involved. Siemens has indicated that its ability to prevent the deal from going through is evidence that it now has mechanisms in place to detect and prevent bribery.

Shortly after Siemens' disclosure, German prosecutors announced they had charged an unnamed former board member of Siemens AG with breach of trust for alleged bribery to win a project in Argentina. According to press reports, the individual served on Siemens' board from 2000 through 2007, and was responsible for the Americas business. German prosecutors explained that in the 1990s, Siemens bribed local officials in Argentina in order to secure a contract to provide identity cards. Siemens employees then covered up the deal by preparing false contracts. The deal was cancelled in 2001, but government officials demanded at least $27 million, and the former manager in question ordered that at least some of the money be paid out of a slush fund. Then, in November 2003, the former manager met with a middleman for Argentine government officials and agreed to pay a further $4.7 million.

India Ratifies United Nations Convention Against Corruption

On May 12, 2011, India became the 152nd country to ratify the United Nations Convention against Corruption ("UNCAC"). The UNCAC which was originally adopted by the UN General Assembly on October 31, 2003, and entered into force on December 14, 2005.

India is the fourth country to ratify the UNCAC this year, following ratification by Iceland, Thailand, and Nepal in March. According to press reports, India's Prime Minister characterized the ratification as a reaffirmation of India's commitment "to fight corruption and to undertake vigorously administrative legal reforms to enable our law enforcement agencies to recover the illicit assets stolen by corrupt practices."

The UNCAC contains mandatory and non-mandatory provisions related to five principal topics: (1) prevention of corruption; (2) criminalization and law enforcement measures; (3) international cooperation; (4) asset recovery; and (5) technical assistance and information exchange.

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.