FCPA Summer Review 2013

International Alert

Introduction

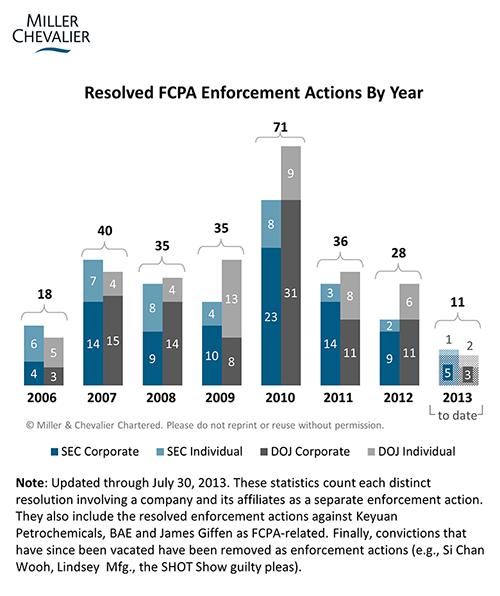

The second quarter of 2013 saw an increase in resolved Foreign Corrupt Practice Act ("FCPA") enforcement dispositions after a slow first quarter, which arguably only included one corporate disposition. While investigation activity levels appear robust, the overall pace of enforcement in 2013, in terms of resolved dispositions, remains at its lowest level since 2006 (see chart below).

The second quarter began with the announcement on April 8, 2013, of a settlement between the Securities & Exchange Commission ("SEC") and the Dutch electronics giant Koninklijke Philips Electronics NV ("Philips") regarding improper payments Philips' Polish subsidiary allegedly made in connection with the sale of medical equipment to Polish hospitals (see FCPA Spring Review 2013). On April 16, 2013, the Houston-based drilling services company Parker Drilling Co. settled FCPA charges with the Department of Justice ("DOJ") and SEC over improper payments the company allegedly made through an agent to resolve a customs dispute with the Nigerian government. On April 22, 2013, U.S. clothing manufacturer Ralph Lauren entered into parallel non-prosecution agreements ("NPAs") with the DOJ and SEC (the latter a first) to settle FCPA allegations over bribes allegedly paid to government officials in Argentina. Finally, on May 29, 2013, French oil and gas company Total, S.A. settled FCPA charges with the DOJ and SEC in connection with payments to a government official in Iran to obtain valuable oil and gas concessions.

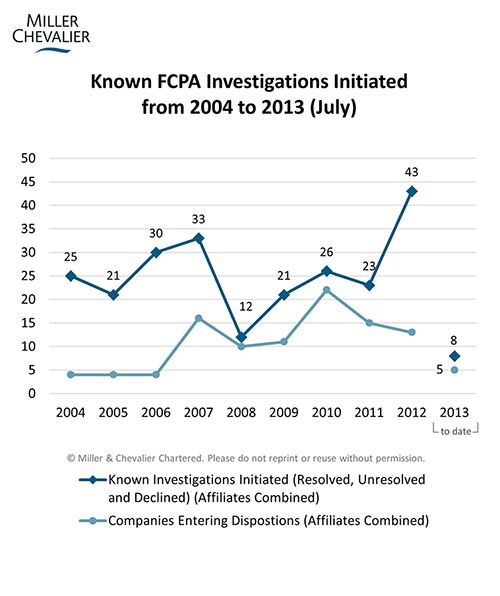

There has been much commentary regarding the fact that nine of the ten largest FCPA dispositions to date, including the $398 million action against the French company Total, have been brought against non-U.S. companies. However, as the chart below indicates, U.S. companies are nevertheless the overwhelming focus of the agencies' enforcement efforts, comprising over 65% of the companies known to have been under investigation since 2004 (resolved and unresolved).

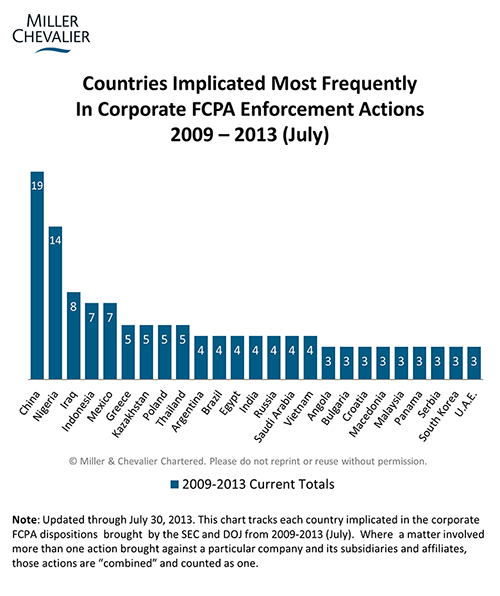

Parker Drilling's disposition is just the latest in a long-line of enforcement actions involving allegations of misconduct in Nigeria. The accompanying chart breaks down countries most frequently implicated in FCPA resolutions since 2009, led by China and Nigeria. Of the remaining countries implicated in enforcement actions this quarter, Poland (Philips) ranks 9th and Argentina (Ralph Lauren) ranks 11th. The enforcement action against Total relating to its conduct in Iran is somewhat unusual, largely because many companies are no longer willing to engage in business with Iran as a result of stringent sanctions imposed by the United States and European Union.

As we noted in our last newsletter, despite the relative decrease in resolved enforcement actions this past year, reported data suggest that FCPA investigations continue apace. In 2013 thus far, we have identified new corporate investigations by the DOJ and/or SEC into eight companies (see Known Investigations Initiated Chart below).

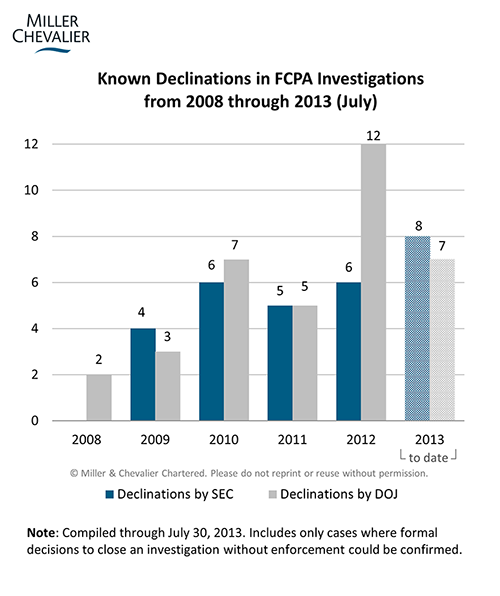

Finally, the pace of disclosed "declinations" -- instances in which an agency decided to close an FCPA investigation without pursuing enforcement -- is continuing set a record pace in 2013, with 15 reported through July 30, 2013. As noted in our Spring Review, the agencies' current focus on closing out their existing backlog of cases with declinations, where appropriate, may be one reason why enforcement levels in 2012 and 2013 (thus far) have dipped.

Corporate Cases

Total SA Settles Iranian Bribery Allegations in the United States While Investigations Continue in France

On May 29, 2013, French oil and gas company Total SA ("Total") agreed to pay a combined amount of over $398 million to settle SEC and DOJ allegations that it paid $60 million in bribes between 1995 and 2004 to an Iranian official to help it obtain concessions related to the development of oil and gas fields in Iran. The payment includes $153 million in civil disgorgement and prejudgment interest under an administrative Cease-and-Desist Order ("CDO") from the SEC and a monetary penalty of $245.2 million under a Deferred Prosecution Agreement ("DPA") with the DOJ filed in the U.S. District Court for the Eastern District of Virginia. Under the CDO and DPA, Total also agreed to retain an independent compliance monitor/consultant for three years. As reported in our FCPA Spring Review 2013 and FCPA Autumn Review 2011, the SEC and DOJ had been investigating Total since 2003, and had been in settlement negotiations with the company since 2010. This disposition represents the third-largest settlement involving a foreign company in FCPA history, and the fourth-largest settlement overall.

According to the DOJ press release, French enforcement authorities have requested that Total, its chairman and chief executive officer, Christophe de Margerie, and two other individuals be referred to the Criminal Court for potential violations of French law, including France's foreign bribery law. The decision regarding whether to send Total and these individuals to trial currently rests with the magistrate in charge of the investigation. On July 8, 2013, French courts acquitted Total, Mr. de Margerie, and 17 other defendants in an unrelated corruption trial involving the U.N. Oil-for-Food Program in Iraq, as discussed in our FCPA Spring Review 2013 and FCPA Autumn Review 2011.

Under the DOJ's Criminal Information, Total was charged with one count of conspiracy to violate the anti-bribery provisions of the FCPA, one count of violating the internal controls provisions of the FCPA, and one count of violating the books and records provisions of the FCPA. The SEC based its charges under the CDO on the same underlying facts and alleged that Total violated the FCPA's anti-bribery, books and records, and internal controls provisions. The SEC and DOJ identified Total as an "issuer" under the FCPA because it had American Depository Shares registered with the SEC and traded American Depository Receipts on the New York Stock Exchange.

The conduct at issue involved the negotiation of two contracts between Total and the National Iranian Oil Company ("NIOC") in 1995 and 1997. The Information describes NIOC as a "government-owned corporation under the direction and control of the Ministry of Petroleum of Iran."

With respect to count one, the Information alleges that the purpose of the conspiracy was to violate the FCPA's anti-bribery provisions by obtaining and retaining oil and gas contracts through "the promise and payment of tens of millions of dollars in unlawful payments to an Iranian official and others." The pleadings describe the Iranian official as the head of two entities that were owned by the government of Iran, as well as a government advisor to a high-ranking Iranian official, thereby qualifying him as a "foreign official" under the FCPA. The Information does not specify anyone other than the Iranian official who was allegedly promised and received payments.

The Information alleges that Total caused its wholly-owned Bermuda-registered subsidiary Total International Ltd. ("Total International") to execute consulting agreements with two different intermediaries as a mechanism for Total to make payments to the Iranian official. The DOJ described the intermediaries as an employee of a Swiss private bank and a British Virgin Islands company. The Information identifies 20 overt acts spanning from 1995 to 2004 in furtherance of the conspiracy, resulting in approximately $60 million of payments to the Iranian official from Total through the intermediaries for the purpose of inducing the official to use his influence in connection with the company's efforts to obtain and retain the oil and gas projects.

With regard to count two, the Information alleges that Total knowingly falsified and caused books, records, and accounts to be falsified by mischaracterizing unlawful payments under the various consulting agreements as "business development expenses," and improperly characterizing the unlawful consulting agreements as legitimate consulting agreements. Under count three, the Information alleges that Total knowingly circumvented and failed to implement a system of internal accounting controls sufficient to provide reasonable assurances that transactions and dispositions of Total's assets complied with applicable law, detailing specific internal control failures such as not performing due diligence on the parties to the consulting agreements.

In resolving the criminal charges alleged in the DPA, Total admitted, accepted, and acknowledged that it was responsible under U.S. law for the acts of its officers, employees, agents, and subsidiaries. Total agreed to engage a corporate compliance monitor, a French national, to evaluate "the effectiveness of Total's internal controls, record-keeping, and financial reporting policies and procedures as they relate to Total's current and ongoing compliance with the books and records, internal accounting controls, and anti-bribery provisions of the FCPA, the anti-corruption provisions of French law, and other applicable anti-corruption laws." The monitor will be expected to conduct and report on yearly reviews, but the DPA notes that the monitor may rely on "results of studies, reviews, audits, and analyses conducted by or on behalf of Total, and on sampling and testing methodologies." The DPA also notes that the monitor "is not expected to conduct its own inquiry into historical events...a comprehensive review of all business lines, all business activities, or all markets." Reports from the monitor will first be submitted to Total's Board of Directors and contemporaneously to French authorities so that the information can be forwarded to U.S. authorities in accordance with French law. In line with recent standard practice, the DPA allows for early termination if the need for the monitor has been eliminated and the other terms of the DPA have been satisfied.

Similarly, in resolving the SEC's administrative action, Total agreed to engage a French independent compliance consultant to review and report on the company's compliance with the FCPA. As with the corporate compliance monitor under the DPA, the consultant's task will be to focus on assessing and improving the effectiveness of Total's anti-corruption compliance program.

Noteworthy Aspects:

- Cooperation with French Authorities: Both the DOJ press release and the SEC press release acknowledge and applaud the cooperation and assistance of French law enforcement authorities, with the DOJ noting that this case represents "the first coordinated action by French and U.S. law enforcement in a major foreign bribery case." Close coordination between the two countries is highlighted by the DPA and CDO which structure the compliance monitorship/consultancy to account for French data protection and labor laws by requiring the monitor/consultant to be a French national and for all reporting regarding findings to be routed through French authorities so that they may relay information to U.S. authorities in accordance with French law.

- Evidentiary Challenges: In settling this enforcement action, the DOJ made an unusual statement in the DPA noting that "evidentiary challenges" were a relevant consideration in reaching the resolution, since "most of the underlying conduct occurred in the 1990s and early 2000s." Evidentiary challenges associated with prosecuting a case involving substantially dated communications and activities can include identifying relevant actors and confirming key facts. Additionally, evidentiary challenges can make it difficult to prove that an offense occurred within the applicable statute of limitations; indeed, such "challenges" are the reasons for the application of limitations periods in matters involving potentially criminal behavior. The public documents do not provide further details here, though it is often the practice of the agencies. Because the DPA is a negotiated settlement, unless there is an issue with the DPA's administration down the road, neither party will be able to test the sufficiency of the evidence in court.

- Limited U.S. Nexus for Anti-Bribery Charge: Out of the 20 overt acts identified in the Information to establish the conspiracy charge, only one act alleges a U.S. territorial nexus. Specifically, the Information cites a 1995 wire transfer of $500,000 from a New York bank account belonging to Total's Bermuda-registered subsidiary Total International to a bank account in Switzerland. The DOJ presumably relied on this one wire to satisfy the interstate commerce requirement of the FCPA, which may have served as the jurisdictional hook for the conspiracy charge, as the remaining payments did not involve a U.S. nexus. The SEC in bringing the anti-bribery charge in its CDO did not set forth its basis for establishing jurisdiction. Notably, the $500,000 transfer represents less than 1% of the total amount of bribery alleged ($60 million).

Ralph Lauren Enters into NPAs with SEC and DOJ

On April 22, 2013, Ralph Lauren Corp. ("RLC") entered into simultaneous NPAs with the SEC and DOJ, representing the first time that the SEC and DOJ had entered into NPAs with a single defendant and the first time the SEC had entered into an NPA in connection with an FCPA violation.

The NPAs relate to actions taken by RLC's indirectly wholly-owned subsidiary in Argentina, P.R.L. - S.R.L. ("RLC Argentina") between 2005 and 2009. RLC Argentina's General Manager and other employees allegedly approved bribe payments through a customs broker to Argentine customs officials. According to the agreements, the bribes helped the company evade certain inspections, obtain customs clearance for certain items without the necessary paperwork, and obtain clearance for certain prohibited goods. The customs broker allegedly masked the payments, which totaled approximately $568,000, as "Loading and Delivery Expenses" and "Stamp Tax/Label Tax" on invoices. The DOJ and SEC asserted that RLC Argentina also authorized several high value gifts to Argentinian government officials.

The SEC alleged that RLC violated the internal controls and books and records provisions of the FCPA by failing to conduct adequate due diligence with regard to the customs broker, by maintaining inadequate policies, procedures and training related to anti-corruption, and by inaccurately recording bribes in RCL Argentina's books, records and accounts. The DOJ, in turn, alleged that RLC violated the anti-bribery provisions of the FCPA based on the improper payments approved by the General Manager of RLC Argentina.

In connection with the NPAs, RLC paid $593,000 in disgorgement and $141,846 in prejudgment interest to the SEC as well as a criminal fine of $882,000 to the DOJ.

Noteworthy Aspects:

- Prompt Disclosure: Both the SEC and DOJ cited RLC's timely reporting and cooperation as mitigating factors. RLC conducted an internal investigation into the alleged bribery and came forward to the SEC and DOJ within two weeks of learning of the illegal payments.

- Expansive Assertion of Parent-Company Liability: The DOJ deemed RLC liable under the FCPA's anti-bribery provisions for the actions of RLC Argentina based on the characterization of the General Manager of RLC Argentina as an "agent" of RLC. Notably, neither NPA included allegations of authorization, control, or knowledge of the General Manager's or RLC Argentina's actions by RLC, although they did note that RLC hired the General Manager in 2003. The DOJ's theory of liability may signal a more expansive approach to parent corporate liability on the part of the DOJ, going beyond even the guidelines published by the SEC and DOJ in A Resource Guide to U.S. Foreign Corrupt Practices Act, which states: "... DOJ and SEC evaluate the parent's control -- including the parent's knowledge and direction of the subsidiary's actions, both generally and in the context of the specific transaction -- when evaluating whether a subsidiary is an agent of the parent." As with other cases, this theory will not be tested in litigation, as RLC accepted the relevant language as part of the settlement.

- Argentinian Response: The Wall Street Journal reported that Argentina had requested information from the U.S. government related to the alleged bribes to Argentinian government officials paid by RLC Argentina, which has ceased operations in the country. This inquiry may result in follow-on prosecution in Argentina. However, prosecution for bribery-related offenses in Argentina is not always assured; as the Miller and Chevalier 2012 Latin America Corruption Survey noted, only 54% of respondents in Argentina believe an offender is likely to be prosecuted in their country.

Parker Drilling Settles Allegations of Improper Payments to Nigerian Officials

On April 16, 2013, Houston, Texas-based Parker Drilling Company ("Parker Drilling") settled FCPA charges with the DOJ and SEC for allegedly making improper payments to Nigerian officials to reduce fines related to the importation of its rigs. The company entered into a DPA with the DOJ and agreed to pay an $11.76 million penalty to settle charges under the FCPA's anti-bribery provisions. To resolve SEC charges under the FCPA's anti-bribery, books and records, and internal controls provisions, the company consented to an SEC judgment barring it from further FCPA violations. In addition, Parker Drilling agreed to pay disgorgement of $3,050,000 and pre-judgment interest of $1,040,818 but no civil fine in connection with the SEC judgment. Parker Drilling is subject to the FCPA as an issuer registered on the New York Stock Exchange.

According to the pleadings, Parker Drilling's customs agent, Panalpina World Transport (Nigeria) Limited ("Panalpina"), filed false paperwork on behalf of Parker Drilling suggesting that the company had physically exported and re-imported the oil rigs from Nigerian waters, when it in fact had not. The DPA's stipulated facts state that the Nigerian government subsequently determined Parker Drilling had improperly avoided Nigerian customs duties in connection with the importation of the rigs and assessed a $3.8 million fine against the company.

According to the DPA, after the fine was imposed in April 2004, Parker Drilling directed a U.S. law firm to retain a third party agent who had been recommended by one of the law firm's clients. The DOJ and SEC documents fault Parker Drilling for directing the U.S. law firm to hire the agent, without conducting sufficient due diligence on the agent's qualifications. The pleadings also assert that Parker Drilling authorized a series of payments through the U.S. law firm to the agent, even though the agent had told the company that he intended to use the money to "entertain" Nigerian government officials and had requested funds using invoices that vaguely described the funds requested as "professional fees" and "expenses."

According to the pleadings, Parker Drilling authorized approximately $1.25 million in payments to the agent in connection with the efforts to reduce the customs fine. These payments were allegedly approved by two Parker Drilling executives. The DOJ and SEC asserted that the agent's actions succeeded in reducing Parker Drilling's Nigerian fines from $3.8 million to $750,000.

According to the DPA, Parker Drilling accepted responsibility for the violations committed by its officers, cooperated fully at all stages of the U.S. government's investigation, and implemented an extensive remediation program. As a result, the DOJ deferred criminal charges against the company and imposed a penalty that is 20 percent below the bottom of the standard fine range. While the government did not impose a monitor to supervise Parker Drilling's implementation of the compliance program, the company agreed to cooperate fully with the DOJ in any future matters relating to corrupt payments and provide periodic reports to the DOJ over the next three years regarding the implementation of its compliance program and internal controls policies and procedures.

Noteworthy Aspects:

- Cooperation Credit: As explained above, Parker Drilling avoided criminal prosecution and harsher penalties by cooperating with the agencies and voluntarily implementing a comprehensive compliance protocol. The DPA notes that Parker Drilling has transformed itself into a positive example of FCPA compliance by retaining a full-time compliance team, including a Chief Compliance Officer reporting directly to the CEO, and implementing a compliance-awareness initiative for its employees that includes the issuance of periodic anti-bribery compliance alerts.

- Relationship to the Panalpina Investigations: The background allegation -- that Panalpina filed false paperwork on behalf of Parker Drilling to avoid Nigerian customs duties on oil rigs -- closely tracks some of the allegations made by U.S. authorities in their late 2010 FCPA settlements with Panalpina and six of its oil and gas industry customers, extensively discussed in our FCPA Winter Review 2011. However, in contrast to the 2010 settlements with Panalpina's customers, the agencies did not explicitly allege that Panalpina bribed Nigerian officials to process Parker Drilling's false paperwork, and charged Parker Drilling only for improper payments it allegedly made to avoid the subsequent fines assessed by the Nigerian government.

- Importance of Due Diligence: Although Parker Drilling worked through U.S. counsel when it retained and paid the Nigerian agent, the DOJ and SEC asserted that the company missed a number of red flags, including the agent's apparent lack of relevant credentials to properly address the customs issues, the agent's stated intent to entertain Nigerian government officials, and the agent's failure to produce detailed invoices. The resolution is a reminder that companies should ensure that third parties' interacting with officials have appropriate qualifications, should communicate expectations regarding business practices and documentation, and should scrutinize invoices submitted by third parties.

- Involvement of U.S. Law Firm No Guarantee of Protection: According to the DPA, many of the communications between the Nigerian agent and the two Parker Drilling executives were conducted through Parker Drilling's U.S. outside counsel, a law firm with multiple offices in the United States. The agreement with the agent specified that the agent would serve "as a consultant to [U.S. outside counsel] to provide professional assistance" to Parker Drilling. The U.S. law firm read and forwarded the agent's requests for "entertainment" expenses, often in amounts of more than $100,000 at a time without receiving invoices from the agent. This situation demonstrates that relying on law firms to assist with issues in high-risk jurisdictions does not eliminate FCPA risk. Even when engaging a U.S. law firm, it is important for companies to take steps to mitigate FCPA risk and not delegate responsibility for FCPA compliance without verifying that the firm is experienced and sensitive to such issues.

Tyco and IBM Finalize FCPA Settlements with SEC

As reported in our FCPA Autumn Review 2012, Tyco International Ltd. ("Tyco") entered into a proposed Final Judgment with the SEC on September 24, 2012, in which it agreed to pay approximately $13.1 million in penalties as a result of various bribery schemes operated by its subsidiaries in Asia and the Middle East from 2006 to 2009. The SEC had alleged that the Tyco subsidiaries knowingly falsified books and records to disguise illicit payments to officials. Those inaccurate records were then incorporated into Tyco's financial statements, which resulted in violations of the FCPA's books and records and internal controls provisions.

On June 17, 2013, nine months after the proposed Final Judgment, Tyco and the SEC officially finalized the $13.1 million settlement, which was signed by U.S District Judge Richard J. Leon in the District of Columbia. The Final Judgment requires Tyco to pay $10.5 million in disgorgement and $2.6 million in prejudgment interest, and also permanently enjoins the company from any future violations of the FCPA's anti-bribery, books and records, and internal controls provisions.

The delay in approval of the settlement was most likely due to Judge Leon's insistence upon several additional reporting requirements not included in the original proposed Final Judgment. Tyco must now submit an annual report for two consecutive years to both the SEC and the court describing its efforts to comply with the FCPA and also report "immediately upon learning it is reasonably likely" that an FCPA violation may have occurred. Likewise, the company must report to both the court and the SEC within 60 days of learning it is subject to any major federal investigation or enforcement proceeding, major federal administrative proceeding, major civil litigation, or criminal investigation by the Department of Justice.

As discussed in our FCPA Winter Review 2013, Judge Leon also had previously refused to approve IBM's March 2011 proposed settlement with the SEC until additional reporting requirements were included. Although IBM initially opposed adopting the additional reporting requirements on grounds that they were unduly burdensome, on July 25, 2013, Judge Leon finally approved the settlement after IBM acquiesced. Like Tyco, IBM agreed to a two-year reporting requirement as to both potential FCPA violations and federal investigations. The company also agreed to pay a $10 million fine and be permanently enjoined from future violations.

Despite both the Tyco and IBM agreement, this sort of judicial scrutiny of FCPA corporate settlements continues to be rare. However, the increased accountability imposed on companies by these additional requirements may become a more common feature of future settlement negotiations with the agencies.

Individual Cases

Former Willbros Consultant Novak Sentenced

On May 3, 2013, Paul Novak, a former consultant for Willbros International Inc. ("WII"), a subsidiary of Houston-based Willbros Group Inc. ("Willbros"), was sentenced to prison for his role in a conspiracy to pay more than $6 million in bribes to Nigerian government officials.

Novak pled guilty, in November 2009, to one count of conspiracy to violate the FCPA and one substantive count of violating the FCPA. He admitted that, while acting as WII's consultant, he conspired with others (including WII employees, two consulting firms, and employees of a major German company) to make around $6 million in illicit payments to various Nigerian government and party officials in order to obtain and retain a major gas pipeline engineering, procurement, and construction project in the Niger Delta called the Eastern Gas Gathering System Project, a venture valued at around $387 million. We discussed the details of the Willbros settlement in our FCPA Spring Review 2008 and Novak's guilty plea in our FCPA Winter Review 2010.

Novak was sentenced to 15 months in prison, followed by two years of supervised release, and ordered to pay a $1 million fine. According to the DOJ, the sentence "was consistent with the government's recommendation" and "took into consideration Novak's cooperation."

Novak's sentencing caps a prosecution that began in 2008 and saw SEC and DOJ settlements with Willbros and WII, three individual civil settlements (Jason Steph, Gerald Jansen, and Lloyd Biggers) and two other criminal sentences (Jim Bob Brown and Jason Steph). Brown and Steph were sentenced, respectively, to: 12 months in prison, two years of supervised release, and a $17,500 fine; and 15 months in prison, two years of supervised release, and a $2,000 fine. The only person who still has charges pending stemming from the bribery scheme is Kenneth Tillery, the former president of WII, who remains a fugitive.

SOCAR Privatization Scheme Prosecutions Conclude, With One Exception

On May 10, 2013, Fredric Bourke Jr. reported to prison, 15 years after he began investing in a scheme to obtain control of shares in the State Oil Company of the Azerbaijan Republic ("SOCAR"). As reported in our FCPA Autumn Review 2009, Bourke was indicted in 2005 and convicted on July 6, 2009 of conspiracy to violate the FCPA. The conviction arose from Bourke's involvement in a privatization scheme for SOCAR in which Bourke and several other co-defendants were accused of participating in a consortium, led by Victor Kozeny, which made payments to Azeri officials to promote the privatization program and to permit the consortium an ownership interest in the newly privatized entity.

Bourke appealed his conviction all the way to the Supreme Court, which denied his petition for certiorari on April 15, 2013 (see FCPA Spring Review 2013). He maintained at trial and through his appeals that he did not know of Kozeny's plan to bribe Azeri officials when he invested in the scheme, and this insistence led to several notable legal rulings on the "conscious avoidance" doctrine, including rulings by the trial judge, Judge Scheindlin of the Southern District of New York, on a jury instruction on conscious avoidance (upheld by the Second Circuit) and on the types of evidence admissible to prove conscious avoidance (see FCPA Winter Review 2012).

Judge Scheindlin sentenced Bourke, after his conviction, to a year and a day in prison and levied a million dollar fine. According to press reports, the 67-year old Bourke will be serving his one-year sentence at a minimum-security facility in Englewood Colorado.

Another defendant implicated in the same scheme, Thomas Farrell, was sentenced on April 26, 2013 to time served. Farrell pled guilty in 2003 to one count each of conspiracy to violate and substantive violation of the FCPA and cooperated with the government, including testifying against Bourke as to Bourke's knowledge of the bribery scheme. Farrell was accused of helping Kozeny to carry out the bribery scheme, including purchasing privatization vouchers and delivering bribe payments.

With Farrell's sentencing, prosecutions against all defendants implicated in the scheme have been completed, except Kozeny, who, according to press reports, currently resides in the Bahamas and has so far successfully avoided extradition to the U.S.

Case Law/Developments

On April 30, 2013, the DOJ charged William Pomponi and Frederic Pierucci, two former executives at French multinational conglomerate Alstom, with FCPA-related violations. Pomponi is a former vice president of regional sales at Alstom's Connecticut subsidiary, and is a U.S. citizen. Pierucci held executive level positions at Alstom and its subsidiaries, including Vice President of Global Sales. While working at the Alstom subsidiary in Connecticut, Pierucci, a French national, was a resident of the United States. The DOJ charged Pomponi and Pierucci each with two counts of conspiracy to violate the FCPA, four counts of violating the anti-bribery provisions of the FCPA, one count of conspiracy to commit money laundering and three counts of substantive money laundering violations. A third executive - David Rothschild - a former vice president of sales for Alstom USA, pled guilty in November, 2012, to a one year FCPA conspiracy (violation of the anti-bribery provisions) count.

Alstom provides equipment and services for power generation and high-speed rail transport. Shares of Alstom's stock were listed on the New York Stock Exchange until August 2004. Accordingly, until August 2004, Alstom was an "issuer." The DOJ's superseding indictment notes that the Alstom subsidiary at which the defendants worked was headquartered in Windsor, Connecticut, incorporated in Delaware, and "thus a 'domestic concern,' as that term is used in the FCPA." The indictment notes that Pierucci and Pomponi were domestic concerns as a U.S. resident and a U.S. citizen respectively, and employees and agents of a domestic concern.

In its indictment, the DOJ stated that the defendants and others worked with consultants to bribe a member of the Indonesian Parliament and officials at the Indonesian state-owned electricity company. The DOJ alleged that the bribes helped Alstom and a consortium partner win a $118 million contract. Specifically, the DOJ's documents state that the defendants retained two consultants to pay bribes to Indonesian officials. Allegedly, Alstom first retained Consultant A, who was to receive a commission based on the overall value of the contract, from which he was expected to pay bribes to Indonesian officials. According to the DOJ, the consultant received hundreds of thousands of dollars into his Maryland bank account, which he then transferred to a bank account in Indonesia for the benefit of the official. However, Pierucci, Pomponi and others at Alstom and its subsidiaries came to the conclusion that Consultant A was not effectively bribing key Indonesian officials, and they informed the consultant that going forward he would be responsible only for paying bribes to a member of parliament and that another consultant would pay bribes to the electricity company officials. The charges allege that Alstom deviated from its usual practice of paying consultants on a pro-rata basis in order to make a much larger up-front payment to the second consultant so that the consultant could "get the right influence." The DOJ's indictment includes extensive and detailed history of electronic communication among the defendants about the alleged acts in question.

Outside the United States, Alstom has also been under investigation for bribery for several years. On March 24, 2010, the SFO arrested three directors on the board of Alstom SA ("Alstom") in the United Kingdom on charges of bribery and corruption, conspiracy to pay bribes, money laundering and false accounting. Individuals arrested included the President of Alstom's U.K. division, its finance director, and its legal director and corporate secretary. These individuals were reportedly questioned at police stations and released without charge (see FCPA Spring Review 2010).

Then, in November, 2011, the Swiss Office of the Attorney General announced a summary punishment order against Alstom Network Schweiz AG, a unit of Alstom SA, assessing a total penalty of 38.9 million Swiss francs (approximately $41.3 million). After a two year investigation encompassing fifteen countries, the Swiss authorities charged Alstom with corporate negligence, stating that the company "did not take all necessary and reasonable organizational precautions to prevent bribery of foreign public officials in Latvia, Tunisia, and Malaysia" (see FCPA Winter Review 2012).

Most recently, in February, 2012, the World Bank announced the debarment of Alstom Hydro France ("AHF") and Alstom Network Schweiz AG ("ANS") for alleged bribery related to a hydropower project in Zambia. According to a Bank press release, in 2002, the two subsidiaries of French engineering company Alstom S.A. allegedly made an improper payment of €110,000 (approximately USD $145,000) to an entity controlled by a former senior government official that they characterized as for "consultancy services" related to the Bank-financed Zambia Power Rehabilitation Project. ANS agreed to pay $9.5 million in restitution.

Investigation and Arrest over Activities Related to Guinean Mine Concessions

As noted in the FCPA Spring Review 2013, on April 13, 2013, the DOJ announced the arrest of a French citizen, Frederic Cilins, in Florida on charges related to an ongoing federal grand jury investigation concerning potential FCPA and money laundering violations committed by BSG Resources, Ltd. ("BSGR"), a foreign company engaged in the mining of iron ore in the African Republic of Guinea. On April 15, 2013, a criminal complaint ("Complaint") was filed against Cilins charging three separate counts of (1) tampering with a witness; (2) obstruction of a criminal investigation; and (3) destruction, alteration, and falsification of records in a federal investigation, all of which stemmed from Cilins's alleged attempts between March and mid-April 2013 to bribe a cooperating witness in the investigation in exchange for the witness's promise to destroy documents responsive to a grand jury subpoena.

The charges against Cilins exposed the existence of a federal grand jury investigation into BSGR's procurement of a concession to extract iron ore from Guinea's Simandou Mountains ("Simandou Concession"), described as the site of one of the world's largest known deposits of untapped iron ore. According to the Complaint filed against Cilins, BSGR's activities in Guinea have been under investigation since January 2013. A corresponding investigation is also ongoing in Guinea itself. At issue is whether BSGR obtained the Simandou Concession through the payment of bribes to officials of the former government of Guinea.

The U.S. government's cooperating witness has been identified as Mamadie Touré, one of several former wives of General Lansana Conté, the former dictator of Guinea who died in 2008, after nearly 20 years of rule. According to the Complaint, while General Conté was still in power, Cilins offered Touré $12 million (to be distributed among Touré and other Guinean officials) to help BSGR secure the Simandou Concession through General Conté. Federal investigators obtained copies of contracts allegedly executed between a wholly-owned subsidiary of BSGR and Touré (and/or entities controlled by Touré) that set forth the terms by which BSGR would pay Touré to assist in securing the Simandou Concession. The Complaint cites five such contracts -- an Engagement Letter; two "Protocols" which discuss transferring 5% of the shares of the BSGR subsidiary to Touré's business; a Commission Contract allocating $2 million for Touré's business to distribute to helpful officials; and a contract dated August 3, 2010, in which an additional $5 million, payable in two installments spread two years apart over four years, was promised. The August 3, 2010 contract allegedly required Touré to conceal the source of the payments. According to the Complaint, Touré was paid in part through wire transfers to a bank account she controlled in Florida (Touré settled in Jacksonville, Florida after General Conté died).

The Complaint alleges that Touré began cooperating with federal investigators in March 2013. During the month of March, Touré and Cilins spoke several times on the phone and eventually arranged an in-person meeting on March 25, 2013, at an airport in Jacksonville. This meeting, like the earlier March phone calls between Touré and Cilins, was recorded and monitored by federal investigators. The Complaint alleges that Cilins told Touré that she would receive $300,000 immediately, and that another payment would be made after Touré and Cilins destroyed documentation which, according to the Complaint, included the five contracts previously referenced. Cilins also allegedly told her that he had been questioned about BSGR's procurement of the Simandou Concession and that if Touré were questioned, she should deny that she had any involvement and deny that she received any money. When Touré asked how to respond if the U.S. government approached her, Cilins allegedly stated that this possibility was a primary reason why it was imperative that the documents he had referred to previously should be destroyed immediately.

Cilins allegedly met with Touré a second time, on April 11, 2013, at the same Jacksonville airport. This meeting was also monitored and recorded by federal investigators. According to the Complaint, Touré was instructed by the government to tell Cilins that she had been approached by FBI agents inquiring about bribe payments made to Guinean officials in exchange for mining contracts. Cilins allegedly replied that they urgently needed to destroy all documentation that the U.S. government was seeking. He noted that he had had obtained a report summarizing an investigation completed by a law firm that described Touré's participation in the Simandou Concession deal, and that the report referenced signed, sealed documentation on BSGR letterhead evidencing Touré's relationship with BSGR.

Cilins also allegedly told Touré that she needed to disclaim any involvement in the matter, to deny being married to General Conté, and to avoid saying anything over the phone. Cilins apparently also demanded to be present when Touré destroyed the documents; he allegedly stated that he had been instructed to see it happen in person. Cilins also allegedly told Touré that she would receive an extra $1 million and a payment of $5 million if BSGR successfully maneuvered through the investigations and retained the Simandou Concession. Finally, Cilins allegedly presented Touré with an attestation for her to sign that stated that she had never signed a contract with BSGR, never received money from BSGR, and never intervened in Guinea on the company's behalf.

Touré allegedly had brought only copies of various documents to the April 11, 2013 meeting and Cilins required another meeting to witness the destruction of the originals. According to the Complaint, Touré expressed concern about lying to the FBI and Cilins promised to try to secure an extra $50,000 from a senior BSGR employee to provide to her. On April 14, 2013, Cilins and Touré allegedly met for a third time at the Jacksonville airport. After the meeting, Cilins was arrested by FBI agents who found $20,000 in a Wells Fargo Bank envelope in Cilins's possession.

Bail was initially set in May at $15 million, but the government argued that Cilins was a flight risk and the court revoked his bail on July 3, 2013. Israeli-born billionaire Beny Steinmetz, effectively the owner of BSGR, has been identified in the press as the person referred to as "co-conspirator 1" in the Complaint, and Asher Avidan, a former member of Israel's internal security service, Shin Bet, has been identified as the head of BSGR's Guinea operations who signed many of the contracts with Touré (see New Yorker article). Although Steinmetz has denied asking Cilins to personally oversee the destruction of documents in Touré's control, federal investigators have referenced in court documents a statement made by Cilins in a secretly recorded conversation with Touré that Steinmetz instructed Cilins to do so.

The Cilins investigation appears to be the tip of the iceberg of a multi-national investigation into BGSR's activities in Guinea. News reports indicate that the FBI has sent two teams of investigators to Guinea and that the U.K.'s Serious Fraud Office has also opened up an investigation into BGSR's activities -- not to mention Guinea's own investigation into the procurement of the Simandou Concession.

Four Charged in Alleged Direct Access Partners Bribery Scheme

Since May 2013, the DOJ has filed criminal charges against three Direct Access Partners ("DAP") executives and one Venezuelan government official for their involvement in an alleged bribery scheme to direct Venezuelan bond trading business to DAP. On May 7, the DOJ charged Tomas Alberto Clarke Bethancourt ("Clarke") and Jose Alejandro Hurtado ("Hurtado"), two DAP employees, with conspiracy to violate the FCPA's anti-bribery provisions, violation of the FCPA anti-bribery provisions, conspiracy to commit money laundering, money laundering, conspiracy to violate the Travel Act, and violation of the Travel Act.

In addition, on June 12, the DOJ arrested and charged Ernesto Lujan ("Lujan"), the managing partner of DAP's Global Markets Group ("DAP Global") and head of DAP's Miami office. In its May 7 Criminal Complaint, the DOJ also charged Maria de los Angeles Gonzalez de Hernandez ("Gonzalez"), a former Vice President of Finance at Banco de Desarrollo Economico y Social de Venezuela ("BANDES"), Venezuela's state-run development bank, with money laundering and violation of the Travel Act. The Travel Act charges against the defendants are premised on violations of the anti-bribery provisions of the FCPA, as well as New York State Penal Law Sections 180.00 and 180.05, which prohibit commercial bribery.

In a separate action, the SEC entered civil charges against Clarke, Hurtado, Lujan, and two others, alleging a number of related securities fraud charges. While DAP was not an "issuer" as defined under the FCPA, the company was a registered broker-dealer with the Commission. The company and its employees therefore were subject to SEC regulations and authority. The SEC's securities fraud charges allege that the individual defendants developed a system of sham trades and then fraudulently hid the profits in shell corporations and hidden bank accounts. According to the DOJ complaint, the alleged bribery scheme was uncovered during a periodic SEC examination of DAP as part of the agency's oversight over the broker-dealer's activities.

According to the DOJ Criminal Complaint, Clarke, Hurtado, and Lujan (domestic concerns under the FCPA) bribed Gonzalez to direct BANDES's bond trading business to DAP Global, which served institutional clients by providing fixed price trading services buying and selling sovereign debt. From December 2008 through October 2010, the four defendants allegedly participated in an arrangement in which Gonzalez directed investment business she controlled at BANDES to DAP Global in exchange for a share of the commissions generated by these trades. The DOJ Complaint notes that the majority of DAP's revenue during 2009 and 2010, over $60 million, resulted from this arrangement.

The DOJ and SEC also allege that many of the transactions orchestrated by the defendants were fraudulent in nature, having "no legitimate business purpose." For example, in January 2010, DAP Global executed at least two "round-trip" trades with BANDES in which DAP bought bonds from BANDES and immediately sold those same bonds back to BANDES at a steep markup.

In order to conceal their payments to Gonzalez, the defendants allegedly funneled money through a network of offshore bank accounts and shell corporations owned by the defendants in Switzerland and Panama. As explained in the SEC Complaint, Clarke and Hurtado transferred commissions generated from BANDES trades to Gonzalez by disguising them as "various forms of sham compensation to Hurtado . . . with the understanding that a portion of those payments would then be remitted to Gonzalez." All told, Gonzalez allegedly received at least $9 million in bribes and kickbacks between 2009 and 2010. Interestingly, Clarke, Hurtado, and Lujan often falsified the size of DAP's markups to BANDES in order to underpay Gonzalez, according to the pleadings.

In addition to the SEC and DOJ charges, the government has filed a civil forfeiture action seeking the forfeit of assets, property, and bank accounts associated with this bribery scheme.

Noteworthy Aspects:

- FCPA Enforcement Heightens a Focus on the Financial Sector: The charges in this case demonstrate the government's continuing emphasis on investigating and prosecuting FCPA violations in the financial sector. A DOJ press release quotes Acting Assistant Attorney General Mythili Raman as stating that the Clarke prosecution "is a wake-up call to anyone in the financial services industry who thinks bribery is the way to get ahead." Other investigations in the financial sector include the 2007 NPA between the DOJ and Omega Advisors over alleged bribery in Azerbaijan, which was summarized in the FCPA Autumn Review 2007, the action involving a former executive of Morgan Stanley, discussed in the FCPA Summer Review 2012, and the ongoing FCPA-related investigation of Barclays. As noted, the charges in this matter were first uncovered by a periodic SEC examination of DAP. Such periodic examinations of financial sector businesses have increased as a result of the Dodd-Frank financial reform and may be an effective tool for the government to detect FCPA violations.

- Prosecution of a Foreign Official: This case is also notable for the concurrent prosecution of Ms. Gonzalez, a foreign official. According to the DOJ press release, Ms. Gonzalez was arrested in Miami, Florida on May 3, 2013, and charged with violating the Travel Act and Money Laundering Control Act. As a foreign government official and alleged recipient of bribes, Gonzalez is not directly covered by the FCPA. The prosecution of Ms. Gonzalez, however, is in keeping with prior efforts to prosecute foreign officials for their involvement in bribery schemes, such as in the 2010 Haiti Teleco prosecution as reported in our FCPA Summer Review 2010.

- DAP Goes Out of Business: Following the initial DOJ complaint against Clarke, Hurtado, and Gonzalez, Goldman Sachs, DAP's clearing agent, ceased clearing the company's trades. Other financial institutions soon stopped doing business with DAP as well. As a result, DAP was forced to stop handling orders and has since shut down entirely. The dramatic demise of DAP demonstrates that FCPA issues can have devastating consequences on a company's image and bottom line.

Wynn/Okada Squabbles Continue with U.S. as Third Party

In early July 2013, federal investigators with the SEC announced that they had concluded their investigation into allegations that Wynn Resorts, a casino industry conglomerate, donated $135 million to the University of Macau Development Foundation ("UMDF") in an effort to curry favor with Macau public officials as Wynn Resorts pursued land rights in order to build a third casino there. The allegations of misconduct and potential violations of the FCPA were leveled against the company by Kazuo Okada, the former single largest shareholder of Wynn Resorts, and former friend and business partner of Wynn Resorts' CEO Steve Wynn. According to press reports, the company received a letter from the SEC in which the agency declared that, as a result of its investigation, it would not pursue an enforcement action against Wynn Resorts. Nevada gaming officials, after conducting an investigation of their own, also found no evidence of any misconduct in connection with Wynn Resorts' donation to the UMDF. However, Okada himself, is now under federal investigation for allegations that he bribed public officials in the Philippines.

The boardroom drama between Okada and Wynn has been ongoing at least since 2011, when Wynn Resorts decided against backing an Okada-led casino project in the Philippines. In the aftermath of that decision, Okada, the former vice chairman and member of the board of directors of Wynn Resorts, opposed the company's donation pledge to the UMDF. Okada even brought suit in a Nevada state court seeking documents related to the pledge.

In November 2011, Wynn Resorts hired former FBI director Louis Freeh's firm to conduct an internal investigation into Okada's efforts to establish a casino in the Philippines. According to press accounts, the Freeh report was released in February 2012, and accused Okada of making improper payments to Philippine gaming officials. Largely on the basis of the Freeh report, Wynn Resorts forcibly redeemed Okada's approximately 20% share of the company at a 30% discount to its market price, and removed Okada as a director of the company.

Wynn Resorts also filed suit against Okada for breach of fiduciary duty in Nevada state court. In the suit, Wynn Resorts alleged that Okada gave more than $110,000 in improper payments and gifts to Philippine officials, including the country's chief gambling regulator. Wynn Resorts claimed that Okada's conduct in the Philippines threatened Wynn Resorts' gaming licenses in Nevada and elsewhere due to Okada's status as a controlling shareholder. Okada then counter-sued in March 2012, and challenged the discounted redemption of his stake in Wynn Resorts -- a discount worth $800 million.

In August 2012, Okada filed a $143 million defamation lawsuit in Japan against Wynn Resorts and Steve Wynn himself, claiming that not only had his image been tarnished, but that his company, Universal Entertainment Corp., had lost business and its stock value had dropped as a result of the Wynn allegations against Okada.

In April 2013, the U.S. government filed a motion to intervene in the lawsuit that Wynn Resorts had brought against Okada in February 2012. The U.S. government sought a temporary halt to the collection of evidence in the suit. The government claimed that there was a substantial overlap between the facts at issue in the civil litigation and the government's criminal investigation, and the United States was concerned that proceeding with civil discovery could compromise the criminal investigation.

The SEC's announcement that it will not pursue a civil enforcement action does not mean that the U.S. government's involvement in the Wynn/Okada dispute is at an end. The April 2013 motion to intervene strongly suggests that a criminal investigation by the DOJ is ongoing. The internecine corporate battle between the two former friends and business partners has opened up a Pandora's box for both men and the companies with whom they are associated. While most companies agonize over whether to disclose potential FCPA violations to federal investigators, Wynn and Okada have essentially invited the U.S. government to explore their activities, both foreign and domestic. It remains to be seen whether Okada will be able to navigate the investigations into his activities as well as Wynn Resorts did with the SEC's investigation into the company's donation to UMDF.

International Cases/Developments

U.K. Prosecutors Authorized to Enter into Deferred Prosecution Agreements with Corporations

Beginning in February 2014, the Serious Fraud Office ("SFO") and the Crown Prosecution Service ("CPS") will be permitted to enter into DPAs with cooperating corporate defendants to settle prosecutions for fraud, bribery, and economic crimes. As discussed in our FCPA Winter Review 2013, the use of DPAs against corporations was introduced in the Crime and Courts Act 2013, which was enacted in April. Although U.K. law already permits DPAs in prosecutions of individuals, the adoption of corporate DPAs mirrors the U.S. government's preferred approach for prosecuting corporate misconduct in the anti-corruption area.

On June 27, 2013, the SFO released a draft Deferred Prosecution Agreement Code of Practice, which outlined its proposed approach to using DPAs. The draft Code of Practice is not final, however, and comments from interested parties will be accepted until September 20. According to the draft Code of Practice, DPAs will be used as "an alternative to prosecution" and are described as "a discretionary tool ... to provide a way of responding to alleged criminal conduct." DPAs will not be offered in every prosecution. Instead, the draft Code of Practice outlines when the SFO and CPS will offer to negotiate a DPA and how such negotiations will proceed.

According to the Code of Practice, the SFO and CPS are "first and foremost prosecutors" and will only offer to negotiate DPAs in circumstances deemed appropriate by the agency directors. When determining whether to enter into a DPA, prosecutors will engage in a two stage test. First, prosecutors will assess the strength of the evidence against the defendant, determining whether the "the evidential stage of the Full Code Test in the Code for Crown Prosecutors is satisfied" or that "there is at least a reasonable suspicion that the commercial organization has committed the offence...." Second, prosecutors will assess whether the public interest "would be properly served by the prosecutor not prosecuting but instead entering into a DPA." If an alleged offense is serious in nature, the draft Code notes that it is more likely that the SFO and CPS will choose to prosecute rather than negotiate a DPA. Additional public interest factors include: the defendant's history of similar conduct; whether the "alleged conduct is part of the established business practices of the company"; the effectiveness of the company's compliance programs; whether the company has received prior warnings; failure to report the wrongdoing in a reasonable amount of time; failure to properly report the true extent of the alleged violations; economic impact on England and Wales; and the "economic harm to victims" of the alleged violations.

If the prosecutor decides to initiate a DPA negotiation, it will do so "by way of a formal letter of invitation" describing the parameters of the proposed discussion. According to an SFO press release, the DPA negotiation phase will offer the parties a chance seek agreement on a number of issues, "which may include the payment of a financial penalty, payment of compensation, and cooperation with future prosecutions of individuals." The parties must also agree upon a statement of facts giving "full particulars relating to each alleged offense." Once DPA negotiations are initiated, however, there is no guarantee that a DPA will be offered at the conclusion of discussions.

Developments in Canada's Enforcement of Anti-Corruption Laws

In recent years, the Canadian government has increased its efforts to investigate and prosecute violations of its Corruption of Foreign Public Officials Act ("CFPOA"), its equivalent of the FCPA. As discussed in prior editions of the FCPA Review, recent prosecutions by the Canadian government include Griffiths Energy International, Inc. (FCPA Spring Review 2013) and Niko Resources, Ltd. (FCPA Summer Review 2011), Canada's first multimillion dollar fine in an anti-bribery action. Furthermore, on June 19, 2013, Canada enacted Bill S-14, which was first explained in our FCPA Review Spring 2013. This bill amends the CFPOA to include an enhanced jurisdictional scope over and stiffer penalties for foreign bribery. On June 3, 2013, the Royal Canadian Mounted Police ("RCMP") announced the creation of the RCMP National Division, which will have centralized authority over investigating the corruption of Canadian and foreign officials.

One example of the Canadian government's increased CFPOA enforcement is the ongoing investigation of SNC-Lavalin, a Montreal-based engineering firm that is traded on the Toronto Stock Exchange. The company, which is under investigation but to date has not been formally charged, faces accusations of foreign corruption in over ten African and Asian countries. On June 26, 2012, Ramesh Shah ("Shah"), a former SNC-Lavalin vice-president, and Mohammad Ismail ("Ismail"), a former engineer, were charged under the CFPOA for alleged bribery of government officials in Bangladesh (see our FCPA Summer Review 2012). In April 2013, the World Bank Group debarred SNC-Lavalin and 100 of its affiliates from working on World Bank-funded projects for ten years due to alleged misconduct in Bangladesh, Cambodia and elsewhere. The debarment may be reduced to eight years if SNC-Lavalin complies with all conditions of the debarment agreement.

Due to a publication ban in the Canadian government's case against Shah and Ismail, the exact contours of SNC-Lavalin's bribery scheme are unknown. However, a Canadian Broadcasting Corporation ("CBC") article recently reported that SNC-Lavalin International Inc. ("SLII"), a division of the company that focuses on designing and supervising large-scale international construction projects, allegedly paid millions of dollars in bribes to obtain contracts funded by international financial institutions such as the World Bank and African Development Bank. According to a World Bank letter to Bangladesh's Anti-Corruption Commission, SLII managers and employees used the terms "CC" or "PCC" to describe hidden "project consultancy costs" or "project commercial costs," which were "a euphemism used ... to indicate the costs of the bribes to be paid."

According to one ex-SLII employee in Nigeria interviewed by the CBC, Shah often directed the employee to deliver cash to Nigerian government officials in charge of a World Bank-funded sewage project in Nigeria's Bauchi state. The CBC reported that the employee paid the Nigerian officials out of his own pocket and was then reimbursed by SLII. The article further alleged that the Bauchi project included a "PCC" line item in company accounting records.

As the CBC reports, the RCMP's probe of SNC-Lavalin continues to expand. In addition to the above charges, the RCMP is investigating allegations that former SNC-Lavalin executive vice president of construction Riadh Ben Aissa paid approximately $160 million Cdn in bribes to the son of Moammar Gadhafi to obtain business in Libya. Furthermore, SNC-Lavalin's CEO Pierre Duhaime resigned last year after being charged with overseeing corruption to secure a contract to build a new hospital in Montreal. The RCMP was alerted to these alleged violations by Swiss authorities investigating SNC-Lavalin's activities in Libya and Tunisia.

In response to the corruption allegations, SNC-Lavalin recently announced a 90-day amnesty program in which it promised not to fire or make claims for damages against employees who voluntarily report violations of the company's code of ethics. The program excludes high-level executives and employees who personally profited from misconduct.

Brazil Bolsters Anti-Bribery Law

On July 4, 2013, the Brazilian Senate approved a bill known as the "Clean Company Act" (the Bill of Law 6.826/2010) that would significantly expand the country's anti-bribery legal framework. The nation's Chamber of Deputies had previously approved the bill on April 24, 2013. President Dilma Rousseff is expected to sign the bill into law before September 2013. The Clean Company Act would thereafter take effect in early 2014.

The Clean Company Act would represent a significant step forward for Brazil in meeting its obligations under the OECD Convention on Combating Bribery of Foreign Public Officials in International Business. The Act would make it unlawful "to promise, offer or give, directly or indirectly, an undue advantage to a public agent or to a third person related to the public agent." The Act would cover other misconduct as well, such as fraud and bid rigging in public procurements.

Significantly, the Clean Company Act would establish civil and administrative liability for legal entities, like companies of any corporate model, foundations, and associations. Previously, liability for corrupt acts in Brazil had been limited to individuals. When the Act is adopted, companies will be liable for the corrupt acts committed on their behalf by directors, officers, employees and agents.

The Act would cover bribery of Brazilian officials and also provide for extraterritoriality, extending to Brazilian entities that engage in corrupt acts outside of Brazil. It would also apply to non-Brazilian entities that have offices, branches, or representation within Brazil.

The Act would also strengthen penalties for bribery offenses. Companies would be subject to administrative fines of between 0.1% and 20% of the gross revenue of the legal entity in the previous year. If gross revenue cannot be determined, a fine of between R$6,000 (approximately US$3,000) and R$60,000,000 (approximately US$30,000,000) would be applied. Total fines would be limited to the total amount of goods or services contracted or sought. For judicial actions, possible sanctions include the seizure of assets gained from the misconduct, dissolution of the legal entity, confiscation, and debarment from receiving public incentives or financing for one to five years.

For administrative penalties, the law would apply a strict liability standard. Thus, companies would be held liable without a showing of intent or fault, including liability for the acts of third parties without a showing that a company individual knew or approved those acts. Judicial actions would require the showing of intent or fault, except for purposes of the sanction of seizure of assets.

The Clean Company Act would also establish for successor liability for companies that acquire targets that committed violations. The fines and damages that can result from successor liability would be limited to the value of the assets transferred.

The Act would also establish a leniency program for companies wishing to cooperate with government investigations, allowing fines to be reduced by up to two thirds. In applying penalties, credit could be given to companies that have strong compliance programs in place, described as "internal integrity mechanisms and procedures, audit procedures, and reporting channels for denouncing irregularities in applying codes of conduct and ethics within the company." The federal government would be tasked with drafting specific guidelines for assessing compliance.

Recent Miller & Chevalier Developments

Getting the Deal Through: Anti-Money Laundering 2013

Miller & Chevalier recently authored the "Avoiding the Domino Effect: Keeping Abreast of the Global AML/CFT Legal and Regulatory Landscape" and "United States" chapters in the annually published Getting the Deal Through -- Anti-Money Laundering 2013, which covers 19 jurisdictions worldwide. James Tillen and Laura Billings served as contributing editors for the volume, and co-authored the chapter addressing U.S. anti-money laundering laws and enforcement with Jonathan Kossak.

Editors: John Davis, James Tillen, and Marc Alain Bohn*

Contributors: Leila Babaeva,* Matteson Ellis, Jacqueline Ferrand,* Ben Gao,* Amelia Hairston-Porter,* Jonathan Kossak,* Annie Wartanian Reisinger,* Ann Sultan,* and Austen Walsh*

*Former Miller & Chevalier attorney

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.