FCPA Autumn Review 2009

International Alert

Introduction

Administrative and enforcement innovations by the U.S. Securities and Exchange Commission (“SEC”) and important trial successes by the U.S. Department of Justice (“DOJ”) have characterized recent months in the area of U.S. Foreign Corrupt Practices Act (“FCPA”) enforcement. The SEC announced extensive internal administrative changes directed at increasing the efficiency and speed of FCPA enforcement actions, as well as plans to use new enforcement tools, such as Deferred Prosecution Agreements and guidelines to evaluate the cooperation of individuals. Additionally, in the Nature’s Sunshine Products, Inc. case, the SEC unveiled a new enforcement tool in the FCPA context, “control person” liability, to bring an enforcement action against two senior executives who were not alleged to have had any direct knowledge of improper payments by a foreign subsidiary.

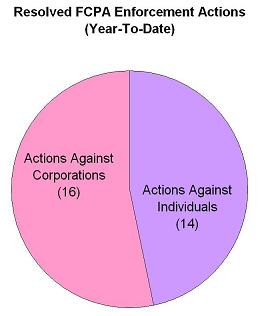

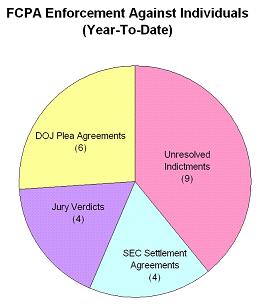

The DOJ has continued its focus on FCPA enforcement actions against individuals this year, issuing nine indictments, reaching five plea agreements, and securing important wins at trial. While historically, few FCPA cases have gone to trial, since July, Federal juries have reached verdicts regarding FCPA-related charges against four individuals -- Frederic Bourke, William Jefferson, and Gerald and Patricia Green. These cases have generated judicial opinions and jury instructions that provide useful guidance on ambiguous aspects of the FCPA. Of particular significance is the Bourke case, which has shed light on the degree of knowledge of improper payments required to be vicariously liable for an anti-bribery charge.

Other significant anti-corruption developments in recent months include:

Potential monetary benefits of voluntary disclosure and cooperation with enforcement agencies - Pleadings in the Control Components Inc. case demonstrate that voluntary disclosure and cooperation can result in significant discounts from the criminal fine range recommended by the Federal Sentencing Guidelines.

Companies must ensure that ultimate recipients of gratuitous items do not create FCPA risks - In the first DOJ Opinion Procedure Release of 2009, the DOJ gave guidance on the provision of valuable commercial items to local governments, and suggested that a company must take extensive precautions to ensure that ultimate recipients of such items are not government officials in a position to bestow an improper advantage on the company.

Broad jurisdictional reach of the FCPA - The indictment of Ousama Naaman shows how the FCPA can reach agents of U.S. issuers, even where the agent is a non-U.S. national acting outside of the United States.

Increased international enforcement - China has stepped up its anti-corruption efforts by instituting several new programs aimed at encouraging whistleblowers, and by arresting several employees of a multinational mining company who are under suspicion of bribery. The United Kingdom has brought several high-profile enforcement actions and indicated a move towards using U.S. prosecutorial techniques. Most notably, the Serious Fraud Office recently issued guidance on its approach to handling overseas corruption cases, which includes a detailed discussion of the benefits of voluntary disclosure.

Actions Against Corporations & Officers

A. Nature’s Sunshine Products, Inc., and its CEO, Douglas Faggioli, and Former CFO, Craig D. Huff

On July 31, 2009, Nature’s Sunshine Products, Inc. (“NSP”), its President, Chief Executive Officer, and board member, Douglas Faggioli, and its former Chief Financial Officer, Craig D. Huff, settled charges with the U.S. Securities and Exchange Commission (“SEC”) relating to alleged improper payments made by NSP’s Brazilian subsidiary to customs officials to import certain unregistered products into Brazil. Specifically, the SEC charged NSP with violating the anti-bribery provisions of the FCPA and various securities laws and rules, and charged Faggioli and Huff with violating the books and records and internal controls provisions of the securities laws as “Control Persons” under Section 20(a) of the Exchange Act. Without admitting or denying the SEC’s allegations, NSP, Faggioli and Huff consented to the entry of final judgment enjoining each of the defendants from future FCPA and securities laws violations and ordering NSP to pay a civil penalty of $600,000, and Faggioli and Huff to each pay a civil penalty of $25,000.

According to the SEC Complaint, NSP is a Utah-based manufacturer of nutritional and personal care products, which markets its products in numerous countries through subsidiaries and distributors. In the mid-1990s, NSP established a wholly-owned subsidiary in Brazil (“NSP Brazil”) and Brazil became NSP’s largest foreign market. However, in 1999 and 2000, the Brazilian government reclassified certain products as medicines, including products being sold by NSP Brazil. This change in classification required NSP Brazil to register certain of its products as medicines. Because the company was unable to obtain such registrations, NSP Brazil’s sales dramatically declined from approximately $22 million in 2000 to $2.6 million in 2003. To circumvent the new registration requirements (i.e., to import unregistered products), NSP Brazil allegedly made over $1 million in undocumented cash payments to Brazilian customs brokers, some of which were later paid to Brazilian customs officials. In the process of making such payments, NSP Brazil allegedly falsified its books, records, and accounts to hide the payments (e.g., booking the payments as “importation advances” and characterizing the payments as legitimate importation expenses). Moreover, NSP failed to disclose the payments in its public filings.

According to the Complaint, NSP Brazil’s operations manager voiced detailed concerns about the company’s importation of unregistered products into Brazil, including the high customs brokerage fees charged to import such products, to two former NSP controllers (one of whom was NSP’s corporate controller) who visited NSP Brazil’s office. The operations manager also reported to the controllers that, on sharing his concerns with the general manager of NSP Brazil, the general manager informed him that NSP was “fully aware of the problems in Brazil.” One of the former controllers claimed to have informed a senior manager at NSP of these statements by the operations manager. Additionally, after an NSP Brazil controller later identified numerous undocumented cash payments, NSP Brazil purchased fictitious supporting documentation to create the appearance that the cash payments were legitimate importation expenses. Notably, the Complaint by the SEC does not allege that that Faggioli or Huff had direct knowledge of these statements or had been briefed by the controllers after their December 2000 visit to NSP Brazil.

As president, CEO, and member of the board of directors, Faggioli had broad supervisory responsibilities covering NSP’s operations, including the worldwide export and sale of NSP products, including those into Brazil. As CFO, Huff had supervisory responsibilities over NSP senior management and was also responsible for company policies regarding books and records and internal controls relating to the registration of products sold in Brazil. Faggioli’s and Huff’s direct reports included the senior management allegedly responsible for making and keeping NSP’s books and records regarding registration of products sold in Brazil and devising and maintaining sufficient internal controls. The SEC alleged that Faggioli and Huff failed to adequately supervise such personnel during 2000 and 2001.

Noteworthy Aspect:

- First use of “Control Person” liability in an FCPA enforcement action - Section 20(a) of the Exchange Act (“§ 20(a)”) provides; “Every person who, directly or indirectly, controls any person liable under [the securities laws] shall also be liable jointly and severally with and to the same extent as such controlled person…unless the controlling person acted in good faith and did not directly or indirectly induce the act or acts constituting the violation or cause of action.” While this is the first time the SEC has used § 20(a) in an FCPA enforcement action, this provision has been used extensively in other contexts (e.g., securities class actions), and has generated a significant amount of case law, and conflicting precedents, on issues such as the meaning of “control” and the degree of culpability necessary to sustain liability. Here, the SEC did not allege that Faggioli or Huff had direct knowledge of, or participated in, the underlying improper payments or accounting failures. The facts outlined in the Complaint, however, suggest that the agency believes the executives bear some level of culpability for failing to identify a series of red flags (e.g., increased payments to customs brokers following the reclassification of products and sharp decline in sales, and the concerns voiced to NSP’s controllers) that should have made the bribery apparent to them had they performed their corporate duties adequately and in good faith. It is difficult to predict whether the SEC’s novel use of § 20(a) in this case represents an anomaly or the beginning of a new trend. This case may come to be viewed as an outlier if the SEC reserves § 20(a) charges for executives of companies that, like NSP, engage in egregious misconduct and fail to recognize significant red flags. However, the possibility does exist that the SEC could use § 20(a) as a standard tool to aggressively punish individual executives who may have no direct role in, or knowledge of, FCPA violations committed by subsidiaries or lower level employees.

Actions Against Corporations

On July 28, 2009, the SEC filed two settled enforcement proceedings against Avery Dennison Corp. (“Avery”), a California-based producer of a wide range of products with operations in over sixty countries, to settle charges related to improper payments or promises of improper payments in China and several other countries. Specifically, the SEC filed a civil action in the U.S. District Court for the Central District of California and issued an administrative order in which it charged Avery with violations of the FCPA’s books and records and internal control provisions in connection with the activities of Avery’s indirect Chinese subsidiary and two companies recently acquired by Avery.

The SEC complaint and order allege that Avery’s third-tier wholly-owned Chinese subsidiary, Avery (China) Co. Ltd. (“Avery China”) made or authorized kickbacks, sightseeing trips, and gifts for Chinese government officials to obtain contracts with several government entities.

In particular, the SEC alleged that between 2002 and 2005, Avery China and its employees engaged in various illicit schemes to obtain Chinese government contracts:

- An Avery China sales manager bought shoes for several officials of a government institute that certified Avery’s reflective material products (“Wuxi Institute”).

- Avery China hired a person who was both a former government official and the spouse of a current government official who oversaw two projects that Avery China wanted to pursue.

- An Avery China Reflectives Division manager won contracts for Avery China to install graphics on over 15,000 police cars by promising kickbacks to the Wuxi Institute and its officers and recorded the kickbacks as “consulting fees.”

- A Reflectives Division salesman proposed and the Reflective Division manager approved hosting a sightseeing trip for five government officials, and concealed the expenses for the trip in reimbursement requests.

- The Reflectives Division manager approved a kickback payment to an official of a state-owned enterprise to secure a sales contract.

- A Reflectives Division sales manager instructed Avery China’s distributor to pay a kickback to a government project manager, and book the transaction as a sale to the distributor, rather than to the government end-user.

- A different Reflectives Division manager paid for sightseeing trips for at least four government officials, and “buried” the sightseeing expenses in expenses for rooms, meals, and transportation.

Overall, the amount of illicit payments actually paid totaled approximately $30,000.

The SEC pleadings note that Avery discovered several of these schemes during an internal review of Avery China’s Reflectives Division, prevented several of the kickbacks from being paid, and voluntarily approached the SEC regarding possible improper payments.

According to the pleadings, after Avery’s initial disclosure to the SEC, Avery discovered possible improper payments made by two companies respectively acquired by Avery in 2005 and 2007. Specifically, Avery allegedly discovered that an Indonesian contractor it had acquired had continued its practice of paying $300 per month from a petty cash account to customs officials who regularly visited its warehouse to inspect goods. Avery also allegedly discovered through a whistleblower that employees of Paxar, a NYSE listed company that Avery acquired, made illicit petty cash payments to officials in Indonesia, Pakistan and China.

The Indonesian contractor and Paxar allegedly made the illicit payments both before and after their acquisition by Avery. Overall, the amount of illicit payments made by the acquired companies totaled approximately $51,000.

The SEC found that Avery’s books and records did not properly reflect the kickbacks, sightseeing trips, and gifts that Avery China made or promised to Chinese officials, and the illicit payments made by the acquired companies. The SEC also found that Avery failed to design or maintain adequate internal controls to assure that Avery China and the acquired companies complied with the FCPA and accurately recorded transactions.

Without admitting or denying the SEC’s findings Avery agreed to cease and desist from violating the FCPA, and to disgorge $273,213 and $45,257 in prejudgment interest. In the Federal civil action, Avery agreed to the entry of final judgment requiring it to pay a civil penalty of $200,000.

Noteworthy Aspects of Avery’s Settlement:

Relatively small gifts and entertainment can, when aggregated, result in FCPA liability - This case shows how FCPA liability can attach to gifts and entertainment of arguably small value when such items are part of a pattern of payments to secure improper business advantages with government clients abroad. Here, among various improper payments, the SEC cites Avery’s provision of several pairs of shoes and a few sightseeing trips.

The importance of pre-acquisition due diligence – The types of payments allegedly made by the companies Avery acquired in 2005 and 2007 may have been discoverable through pre-acquisition due diligence. As seen in the April 2009 enforcement action against Latin Node Inc. (“Latin Node”) reported in our Spring 2009 FCPA Review, the discovery of such potential FCPA violations can dramatically affect the value of acquisitions. As with eLandia International Inc., the acquirer of Latin Node, if Avery had discovered the companies’ potential FCPA violations in pre-acquisition due diligence, the activity could have been stopped and the potential costs of such violations could have been factored into the sales price, and Avery could have made a more informed decision regarding whether to purchase the companies.

On July 29 and 30, 2009, Helmerich & Payne, Inc. (“H&P”), a Delaware corporation providing oil drilling rigs, equipment, and personnel on a contract basis in the United States and South America settled charges of FCPA books and records and internal controls violations with the SEC and entered into a non-prosecution agreement with the DOJ related to improper payments to Argentine and Venezuelan government officials and representatives. H&P acknowledged that two wholly owned subsidiaries Helmerich & Payne (Argentina) Drilling Company (“H&P Argentina”) and Helmerich & Payne de Venezuela, C.A. (“H&P Venezuela”), made improper payments directly and indirectly, through third party customs brokers, to foreign customs authorities to avoid delays associated with the international transport of drilling parts.

According to the SEC Order and DOJ NPA, from 2003 to 2008, H&P Argentina made payments totaling $166,000 through customs brokers to Argentine customs officials. As a result of the payments, H&P avoided $186,000 in expenses. The payments were to permit and expedite the importation and exportation of equipment and materials without required certifications and to allow the importation of materials that could not be imported under Argentine law. H&P Argentina falsely or misleadingly described the payments as “additional assessments,” “extra costs,” or “extraordinary expenses.” During the same time period, H&P Venezuela allegedly paid customs officials, through customs brokers, $19,637 to import and export equipment and materials not in compliance with Venezuelan regulations or to secure a partial inspection, rather than a full inspection of imported goods. H&P Venezuela falsely or misleadingly described the payments as “Urgent processing,” “urgent dispatch,” or “customs processing.” As a result of the payments, H&P avoided more than $134,000 in expenses. While the NPA does not explicitly state the basis of the DOJ’s jurisdiction in this case, the NPA does note that H&P Argentina and H&P Venezuela employees created false records of payments, which were consolidated into H&P’s financial statements issued to the SEC.

To settle with the SEC, H&P consented to an order requiring it to cease and desist from future FCPA violations and requiring H&P to pay $375,681.22 in disgorgement and prejudgment interest. To settle with the DOJ, H&P agreed to pay a fine of $1 million, to refrain from committing any crimes for two years, to truthfully and completely disclose non-privileged information with respect to the activities of H&P, its officers and employees, and inform the DOJ of all criminal conduct or criminal investigations involving H&P senior managerial employees or any administrative proceedings or civil actions brought by any governmental authority alleging fraud by or against H&P.

Noteworthy Aspects of the Helmerich & Payne Agreements:

- The value of effective FCPA training, reporting, and internal investigations - The investigations of H&P arose out of the company’s voluntary disclosure. Specifically, H&P instituted a new set of FCPA policies and procedures in early 2008. During a training session an employee voluntarily disclosed the violations and H&P instituted an internal investigation. In response to the investigation, H&P agreed to conduct reviews of its internal controls, policies and procedures. According the NPA, H&P’s cooperation was “timely, voluntary, and complete,” occurred in “real-time,” and supplemented extensive remedial measures taken by the company.

- Customs is a common FCPA risk area - As demonstrated in numerous recent enforcement actions, such as the Nature’s Sunshine Products case (described above), and the international investigations related to the freight forwarder Panalpina, as reported in our Autumn 2007 FCPA Review, the DOJ continues to focus on transactions with customs officials. This case also demonstrates that the opportunity for corruption can arise with both imports and exports.

On July 31, 2009, Control Components Inc. (“CCI”), a California based company designing and manufacturing service control valves for use in the nuclear, oil and gas, and power generations industries, pleaded guilty to charges of conspiracy to violate FCPA anti-bribery provisions and the Travel Act, and two substantive FCPA anti-bribery violations. As part of its plea agreement, CCI agreed to pay an $18.2 million fine, implement and maintain a comprehensive anti-bribery compliance program, retain an independent compliance monitor for three years, serve a three year term of probation and continue to cooperate with the DOJ during its investigation.

According to the information and plea agreement, from 1998 through 2007, CCI made a series of corrupt payments to officers and employees of state-owned and privately-owned customers around the world to obtain or retain business. Specifically, CCI made approximately 236 payments in over thirty countries, including China, Korea, Malaysia, and the United Arab Emirates, totaling approximately $6.85 million. As a result of the corrupt payments, CCI allegedly made approximately $46.5 million in profit.

The DOJ’s investigation of CCI arose out of a voluntary disclosure by the company in August 2007. CCI learned of the corrupt payments in mid-2007 and instituted an internal investigation. The investigation revealed that several former executives had engaged in corrupt activities and that CCI’s former president had created the sales model that involved the corrupt payments. As noted in the Spring 2009 FCPA Newsletter, charges have been filed against eight former CCI executives, including the former president Stuart Carson and two other former executives, Mario Covino and Richard Morlok, who pleaded guilty in January 2009 to conspiracy to violate the FCPA.

In response to the investigation and its findings, CCI cooperated fully with the DOJ investigation, terminated all personnel primarily responsible for engaging in improper payments, and completed comprehensive revisions to its compliance policies and training procedures. CCI also disclosed the improper business practices to its customers.

Noteworthy Aspect of the CCI Plea Agreement:

- Voluntary disclosure and cooperation secures significant discount in monetary fine - The DOJ appears to have rewarded CCI’s voluntary disclosure, forceful remedial actions and cooperation by assessing a fine significantly below the fine range set forth in the Federal Sentencing Guidelines. Per the violations committed by CCI, the fine range was calculated at between $27.9 and $55.8 million, however, CCI was only fined $18.2 million. In support of the DOJ’s recommended fine (an approximately 35% discount from the Sentencing Guidelines range), CCI’s Memorandum in Support of Plea and Agreed Upon Settlement (“CCI Memorandum”) highlights remedial steps CCI took upon discovering the corrupt payments and its level of cooperation with the DOJ. Asserting that the 35% downward departure was in keeping with past enforcement actions, the Memorandum referenced several cases in which cooperating defendants had received 42% to 69% discounts (e.g., SSI International Far East Ltd, Baker Hughes, Siemens).

Indeed, the statistics cited in CCI’s Memorandum are consistent with our review of the fourteen joint settlements with the DOJ and SEC since 2007, which shows that the average monetary penalty for violations that were not voluntarily self-disclosed was approximately two and a half times the average profit from the improper payments, whereas the average monetary penalty for violations that were voluntarily self-disclosed was approximately two times the average profit from the improper payments. Thus, when compared to the average profit from the bribes, the average penalty for voluntarily self disclosed violations was 20% lower than the penalty for violations that were not voluntarily disclosed.

- Travel Act used to punish commercial bribery - Similar to the 2006 enforcement action against SSI International Far East Ltd., the DOJ used non-FCPA charges to reach commercial (i.e., non-governmental) bribery. In this case, the DOJ used the Travel Act, which punishes whoever travels in interstate or foreign commerce with intent to promote, manage, establish, carry on, or facilitate any unlawful activity (here, commercial bribery in violation of Californian law), and thereafter performs or attempts to perform such an act.

D. AGCO Corp.

On September 30, 2009, AGCO Corp. (“AGCO”), a U.S.-based international producer of machinery and equipment, agreed to pay monetary penalties and disgorgement totaling approximately $20 million to settle wire fraud and FCPA charges with the DOJ and SEC stemming from improper kickbacks paid by its subsidiary to the government of Iraq under the U.N. Oil for Food program.

The DOJ charged AGCO’s U.K. subsidiary with conspiracy to commit wire fraud and to violate the books and records provisions of the FCPA. AGCO acknowledged responsibility for the improper payments and agreed to pay a $1.6 million criminal penalty as part of a three-year DPA.

The SEC charged AGCO with violating the books and records and internal controls provisions of the FCPA. AGCO, without admitting or denying the charges, consented to the entry of a final judgment on these charges, enjoining it from future FCPA violations and ordering the company to pay approximately $13.9 million in disgorgement, $2 million in pre-judgment interest, and a $2.4 million civil penalty.

AGCO is the latest company to be prosecuted by the DOJ and SEC in their ongoing investigations into the U.N. Oil for Food program. According to the DOJ criminal information and DPA, between 2000 and 2003, AGCO’s U.K. subsidiary, with the assistance of its subsidiaries in France and Denmark, made approximately $553,000 in payments to the former government of Iraq to secure over €17.7 million in contracts to sell agricultural equipment and parts. AGCO’s subsidiaries made the illicit payments through a Jordanian agent that owned a company that served as AGCO’s agent and distributor in Iraq. AGCO concealed the kickback payments by inflating the Jordanian agent’s commission, subject to an understanding that the agent would pass along the additional commission payments to a state-owned company. AGCO concealed the payments among legitimate commission payments in the inflated contracts it submitted to the U.N. for approval by recording them as “Ministry Accruals” for infrastructure repair. The SEC complaint outlines additional kickbacks, alleging that AGCO paid, in total, approximately $5,912,393 in illicit “after sales services fees” on sixteen contracts. AGCO marketing and finance employees in the United Kingdom, Denmark and France were complicit in the scheme, and efforts to conceal the payments from the company’s internal auditors, its legal department, and the United Nations.

Noteworthy Aspects of AGCO’s Settlement:

- Parallel international enforcement - The DOJ and SEC worked in conjunction with the Danish Prosecutor’s Office for Serious Economic Crime in bringing this enforcement action. In a related proceeding, AGCO entered into a criminal disposition with Danish prosecutors to resolve an on-going Danish investigation into two Oil for Food contracts entered into by AGCO’s Danish subsidiary, AGCO Danmark A/S. In settling this matter, AGCO agreed to disgorge approximately $630,000 in profits to Danish authorities.

- Eleventh Oil for Food settlement - As reported in our past FCPA Reviews, U.S. authorities have now brought FCPA enforcement actions against eleven companies, and to date, the SEC alone has recovered over $148 million.

- No anti-bribery violations - As with most other Oil for Food cases, the criminal charges brought in the AGCO case involved only a conspiracy. AGCO was charged with conspiracy to both commit wire fraud and violate the FCPA accounting provisions, but not the anti-bribery provisions. One benefit to avoiding any substantive or anti-bribery charges is that it significantly reduces the risk of any debarment by either the U.S. government or international governmental organizations such as the World Bank and United Nations.

Actions Against Individuals

A. Former Nexus Technologies Inc. Executive Pleads Guilty

On June 29, 2009 the DOJ announced that Joseph T. Lukas, a former executive of Philadelphia-based Nexus technologies Inc. (“Nexus”), pleaded guilty to FCPA charges of conspiracy to bribe Vietnamese officials in exchange for contracts to supply equipment and technology to Vietnamese government agencies. Lukas’s indictment by a federal grand jury in Philadelphia included one count of conspiracy to bribe Vietnamese public officials in violation of the anti-bribery provisions of the FCPA and one substantive count of violating the anti-bribery provisions of the FCPA. According to the indictment, Nexus was a privately owned export company that identified U.S. vendors for contracts opened for bid by the Vietnamese government to purchase a wide variety of equipment and technology, including underwater mapping equipment, bomb containment equipment, helicopter parts, chemical detectors, satellite communication parts and air tracking systems.

As reported in our Autumn 2008 FCPA Review, Lukas and his alleged co-conspirators, three other former Nexus employees, were arrested in September 2008 for allegedly making improper payments to Vietnamese government officials in violation of the FCPA. According to court documents, Lukas, a 60 year-old resident of New Jersey, was a partner in Nexus Technologies until 2005 and was responsible for overseeing the negotiation of contracts with suppliers in the United States. Lukas’s guilty plea included an admission that from 1999 to 2005 he and other employees agreed to pay, and knowingly paid, bribes totaling at least $150,000 to Vietnamese government officials in exchange for contracts with the agencies for which the officials worked. The charges alleged that the bribes were falsely described as “commissions” in the company’s records. Lukas faces a maximum sentence of 10 years in prison and is scheduled for sentencing on April 6, 2010. Cases are still pending against the other former Nexus employees and the company.

B. Frederic Bourke Jury Verdict

The trial of Frederic Bourke Jr. in connection with the Azeri oil scandal came to a close on July 6, 2009, when a federal jury in the Southern District of New York convicted Bourke on charges of conspiracy to violate the FCPA and making false statements to the Federal Bureau of Investigation (“FBI”). The case revealed important new insights into FCPA interpretation and highlighted the increased efforts of the Government to prosecute individuals for FCPA violations.

As reported in the Spring 2009 FCPA Review and Winter 2009 FCPA Review, the charges against Bourke arose from his involvement in a privatization scheme for the State Oil Company of the Azerbaijan Republic (“SOCAR”). Bourke and several other co-defendants were accused of participating in an investment consortium that made payments to Azeri officials to promote the privatization program and to permit the consortium an ownership interest in the newly privatized entity. Bourke was tried as a result of his role as an investor affiliated with Viktor Kozeny, the president and chairman of Oily Rock Group Ltd (“Oily Rock”), which served as the investment vehicle for the consortium.

The government originally charged Bourke with numerous violations of the FCPA and Travel Act, as well as conspiracy, money laundering and making false statements to the FBI. As reported in our Autumn 2008 FCPA Review, on August 29, 2008, the U.S. Court of Appeals for the Second Circuit upheld the dismissal of most of the charges pending against Bourke on grounds that the applicable statute of limitations had expired before his indictment. Bourke thus succeeded in having all but three of the charges pending against him dropped.

As explained in more detail in an article by Miller & Chevalier Member James Tillen, “Bourke Conviction Provides Clarity on FCPA Interpretation,” the Bourke trial broke new ground in FCPA enforcement actions, and shed light on a number of important areas of FCPA interpretation. In addition to developing further understanding of the application of the FCPA’s local law affirmative defense and application of the statute of limitations, Judge Sheila Scheindlin’s pretrial decisions provided rare instruction on the types of evidence necessary to prove the knowledge element of a conspiracy violation and provided useful insight into judicial interpretation of the conscious avoidance doctrine of the FCPA.

The Government sought to prove Bourke’s knowledge of the conspiracy’s “unlawful purpose” (i.e., unlawful payments to Azeri officials to encourage privatization) through application of the FCPA’s conscious avoidance doctrine, which is part of the Act’s knowledge standard. Judge Scheindlin ruled that an instruction on conscious avoidance was proper to prove that Bourke was “aware of a high probability of [the unlawful payments] existence and consciously and intentionally avoided confirming that fact.” She went on to explain that “[k]nowledge may be proven in this manner if, but only if, the person suspects the fact, realized its high probability, but refrained from obtaining the final confirmation because he wanted to be able to deny knowledge.”

Judge Scheindlin allowed the Government to introduce two types of evidence at trial to prove that Bourke “consciously avoided” knowledge of the consortium’s bribes to Azeri officials: (1) background evidence relating to the corruption environment in Azerbaijan at the time of Bourke’s investment in SOCAR, and (2) evidence regarding the knowledge of the consortium’s unlawful activities by individuals other than Bourke to impute that knowledge to Bourke. The admission of this evidence was critical to proving that Bourke was aware of the high probability that Azeri officials were being bribed and that he consciously and intentionally avoided confirming that fact.

With few reported cases on application of the conscious avoidance doctrine, Judge Scheindlin’s decisions and the types of evidence allowed in to prove conscious avoidance has significant implications for companies, executives and investors operating in corrupt countries, and stands as a strong example of the U.S. Government’s focus on individuals in seeking to deter FCPA violations. As recently noted by Miller & Chevalier Member John Davis in his comments on the recent Bourke FCPA conviction, the case gives company compliance officials a “much clearer example” than was available up to now to illustrate to senior managers that they can go to jail for failure to perform due diligence. In addition, Davis commented, the Bourke verdict could even cause some investors to shy away from investments they would have otherwise made, but the case does not mean an investor “can’t invest in areas with high corruption.” “FCPA Verdict Sets Up Compliance Example For Global Investors” Inside U.S. Trade, July 24, 2009.

C. William Jefferson Jury Verdict

On August 5, 2009, former Congressman William Jefferson’s trial came to close after five days of deliberation and one month of hearing evidence. The DOJ announced that the federal jury found Jefferson guilty on eleven of sixteen counts, including solicitation of bribes, wire fraud, money laundering, racketeering and conspiracy. Jefferson was acquitted on three wire fraud counts, an obstruction of justice charge and a substantive charge of violating the FCPA.

As reported in our Spring 2009 FCPA Review, the U.S. government charged Jefferson with soliciting and receiving bribes from various persons and businesses in exchange for promoting their products and services to African officials and participating in the bribery of a Nigerian government official. As noted in press reports and statements from the DOJ, the infamous discovery of $90,000 in Jefferson’s freezer was the single most powerful piece of evidence presented by the government, along with video of Jefferson accepting a briefcase full of cash from Lori Mody, a cooperating witness.

It is unclear, however, whether this evidence ultimately convinced the jury that Jefferson conspired to violate the FCPA. Press reports note that prosecutors told jurors that the money in his freezer was intended to bribe the then vice president of Nigeria to secure his help with a telecommunications venture and that the money was never delivered only because Jefferson could not deliver it before the FBI found it. The FCPA conspiracy charge against Jefferson was part of Count 1, which read “conspiracy to solicit bribes, deprive citizens of honest services by wire fraud and violate the FCPA.” Thus, the verdict regarding conspiracy may or may not have included conspiracy to violate the FCPA. It is also not clear whether the jury acquitted on the substantive FCPA count merely because the money had not in fact been paid to a foreign official (and thus ignored “offer or promise” as sufficient basis to convict) or whether the verdict suggests the jury found Jefferson never intended to pass on the funds (and thus formed no “agreement”) and defrauded Mody for his own gain.

Following the trial, the DOJ announced that U.S. District Judge T.S. Ellis III accepted the verdict and scheduled sentencing for October 30, 2009. The day after Jefferson’s conviction, the same jury voted unanimously that he should forfeit $470,653 of assets that the jury determined were linked with the crimes. Jefferson faces a maximum penalty of 150 years in prison and, according to press reports, his attorneys plan to appeal the decision.

The convictions of Gerald and Patricia Green mark the third and fourth FCPA-related jury verdicts within approximately three months. On September 11, 2009, in the U.S. District Court for the Central District of California, a jury found Gerald and Patricia Green guilty of conspiracy to violate the FCPA and U.S. money laundering laws, eight counts of violating the FCPA’s anti-bribery provisions, and seven counts of money laundering. Additionally, Patricia Green was found guilty of falsely subscribing U.S. income tax returns in connection with the bribery scheme. According to the DOJ press release, the government dismissed a substantive money laundering count prior to the case going to the jury, and the jury was unable to reach a verdict on an obstruction of justice count against Gerald Green.

According to the DOJ press release, evidence in the trial showed that beginning in 2002 and continuing through 2007, the Los Angeles couple, a film producer and his wife, conspired to bribe Ms. Siriwan, the former governor of the Tourism Authority of Thailand (“TAT”), to secure lucrative contracts to run the Bangkok Film Festival and other TAT contracts. The payments allegedly amounted to $1.8 million, and the contracts were worth at least $14 million. The DOJ stated that trial evidence also showed that the Greens used multiple business entities, some with dummy contact information, in their dealings with the TAT to conceal the large amount of money the Greens were paid under the contracts. Additionally, the DOJ said that the trial evidence showed that the Greens disguised the bribes as “sales commission” payments and made the payments for the benefit of Ms. Siriwan through the foreign bank accounts of intermediaries, including accounts in the name of Ms. Siriwan’s daughter and friend.

According to press accounts, during the defense’s opening statements, the Greens’ attorney reportedly claimed that the Greens’ payments to the daughter of Ms. Siriwan were legitimate fees paid under a consulting agreement. The Greens’ attorney also reportedly claimed that the couple did not reap large profits from the contracts.

At the Greens’ upcoming sentencing scheduled for December 17, 2009, the Greens each face a sentence of up to 185 years imprisonment (five years for conspiracy and each of the eight FCPA violations, and twenty years for each of the seven money laundering violations), and Patricia Green faces an additional three year term of imprisonment related to the false subscription of tax returns charge.

This case may signal future FCPA enforcement actions focused on the entertainment industry. Specifically, this case is the first FCPA enforcement action brought against film producers, and, as noted by M&C Member James Tillen in the Los Angeles Times, “once the DOJ learns the ins and outs of a particular industry and knows where the FCPA risks are, they’re more likely to keep their eyes peeled and go after others in the future.”

According to press accounts, the Greens are planning to appeal the verdict.

E. Lebanese/Canadian National Charged in Connection with U.N. Oil for Food Scandal and Post-U.S. Invasion Bribery

On July 31, 2009, the DOJ announced that it had charged Ousama Naaman, of Abu Dhabi, United Arab Emirates, a Lebanese/Canadian dual national, with one count of conspiracy to commit wire fraud and to violate the anti-bribery and books and records provisions of the FCPA, and two counts of violating the anti-bribery provisions of the FCPA. Specifically, the substantive anti-bribery charges were brought under Section 78dd-1 of the FCPA, which prohibit agents of U.S. issuers from bribing foreign officials.

According to the indictment, from 2001 to 2003, Naaman offered and paid ten percent kickbacks to the Saddam Hussein regime on behalf of an unnamed publicly traded U.S. chemical company (a Delaware producer of gasoline additives with executive offices in the United Kingdom) (“parent”) and its subsidiary in exchange for five contracts with the Iraqi Ministry of Oil (“MoO”) under the U.N. Oil for Food Program. Specifically, Naaman, allegedly acting as an agent for both the parent and the subsidiary, negotiated the contracts, which included price increases to cover the cost of the kickbacks. Naaman allegedly received a fee of two percent of the value of the contracts for handling the kickbacks in addition to the two percent he received for securing the contracts. The indictment cites correspondence between an unnamed employee of the subsidiary and Naaman in which the kickbacks are referred to as “commission payments and “additional money for third party reimbursement.” Naaman allegedly concealed the kickbacks as “remuneration for after sales service” in invoices to the subsidiary; and the subsidiary booked the payments as “agent’s commissions.” The subsidiary allegedly inflated prices in contracts that it submitted to the UN for approval to cover the cost of the kickbacks. The parent allegedly incorporated the subsidiary’s books and records into its financial statements filed with the SEC. Thus, the charge against Naaman of conspiracy to violate the books and records provisions of the FCPA relates to the conspiracy’s impact on the parent’s books and records.

Additionally, in 2006, after the fall of the Hussein regime, Naaman allegedly paid $150,000 in bribes on behalf of the parent to officials in the MoO to ensure that a competing product made by a competitor failed a field test and would therefore not be used by the MoO in place of the parent’s product. The parent allegedly authorized the subsidiary to reimburse Naaman for a portion of the bribe payments, and paid a portion to Naaman directly.

Naaman was indicted on August 7, 2008, in the U.S. District Court for the District of Columbia, but the indictment was sealed until after his arrest on July 30, 2009 in Frankfurt, Germany. The DOJ is currently seeking his extradition to the United States. If convicted on all charges, Naaman faces a maximum prison sentence of 15 years.

This case represents a rare example of an individual FCPA prosecution in connection with the Oil for Food scandal. While a handful of individuals have been prosecuted for their participation in the Oil for Food investigations, to date, FCPA charges have not been brought against any individuals. One possibility of why FCPA charges have not been brought against individuals in this context is that the then Iraqi government was the recipient of the kickbacks, rather than any particular official (as required under the FCPA anti-bribery provisions). What distinguishes this case from other Oil for Food actions, however, is that Naaman’s alleged activities involved payments to officials of the MoO that were unrelated to the Oil for Food Program. Thus, Naaman’s payments to officials, rather than to the Iraqi government, likely account for the anti-bribery charges in this case.

This case also illustrates the broad jurisdictional reach of the FCPA. In this case, while Naaman was a non-U.S. national acting outside of the United States, he was nevertheless charged with FCPA violations because of his agency relationship with a U.S. issuer and its subsidiary.

In our Spring 2008 Review, we reported that Faro Technologies Inc. (“Faro”), a software development and manufacturing company based in Lake Mary, Florida, had reached an agreement with the DOJ and SEC to settle allegations of bribery and books and records violations associated with its Chinese subsidiary, Faro China. Now, the individual at Faro who allegedly authorized the illicit payments and directed the falsification of its books has also reached a settlement. On August 28, 2009, the SEC filed a settled enforcement action in the United States District Court for the District of Columbia against Oscar Meza, the former Vice President of Asia Pacific sales for Faro and head of Faro China’s sales efforts. The settlement addressed charges that Mr. Meza violated the anti-bribery, books and records and internal controls provisions of the FCPA, and aided and abetted such violations by Faro. As part of the settlement agreement, Mr. Meza will pay a $30,000 civil penalty and $26,707 in disgorgement and prejudgment interest.

As detailed in the SEC’s complaint, prior to 2003 Faro had operated in China through a Chinese distributor. In 2003, Faro began operating directly in China through a subsidiary -- Faro China -- whose sales operations were overseen by Mr. Meza. Mr. Meza recommended that an employee of Faro’s former Chinese distributor be hired as Faro China’s sales manager. Once hired, the sales manager requested permission of Mr. Meza and other Faro employees to do business the “Chinese way” -- i.e., paying kickbacks to secure contracts. Despite the opinion of Faro’s Chinese counsel that such payments would violate Chinese law, and despite the instructions of Faro officers not to approve any such payments, Mr. Meza nevertheless authorized Faro China’s sales manager to offer and pay kickbacks. The sales manager proceeded to make a number of illicit payments to various officials at Chinese state-owned enterprises that generated approximately $4.5 million in sales for Faro.

In addition to continuing to authorize the payment of kickbacks, Mr. Meza also directed that Faro China’s books be altered to disguise any illicit payments. For example, Mr. Meza instructed Faro China staff to delete the names of the recipients of any recorded payments. Mr. Meza also instructed that the payments be recorded not as “customer referral fees,” but instead as just “referral fees.”

It is unclear why the DOJ has not brought a parallel enforcement action. Meza is a U.S. citizen, and would thus be subject to the FCPA, and the detailed allegations in the SEC complaint suggest that a cooperating witness was available.

G. Leo Winston Smith Pleads Guilty

On September 3, 2009, Leo Winston Smith, the former director of sales and marketing for Pacific Consolidated Industries (“PCI”), a manufacturer of aircraft support equipment, pleaded guilty to conspiracy to violate the FCPA stemming from the payment of nearly $70,000 in bribes to an official at the UK’s Ministry of Defense (“UK-MOD”). In addition to the FCPA count, Smith also pleaded guilty to a tax evasion charge for underreporting income on his 2003 tax return and for failing to file a tax return for a separate company he owned. Smith’s guilty plea comes on the heels of the guilty plea entered in May of 2008 by Martin Eric Self, PCI’s owner and former president, which we reported on in our Spring 2008 FCPA Review. Self received two years probation.

According to the plea agreement, Smith and Self hired the relative of a UK-MOD official -- who they deemed a marketing “consultant” -- to provide cover for the illicit payments. In return, PCI obtained contracts from UK-MOD valued at over $11 million. Smith is scheduled to be sentenced on December 18, 2009. He faces a maximum penalty of eight years in prison.

The use of an official’s relative as a conduit is a common tactic to disguise illicit bribe payments to state officials, and underscores the need for companies to ensure that the consultants and employees they retain to conduct business overseas are not related to any state officials with whom the company seeks to do business. The PCI case also highlights how an FCPA investigation can spawn tax charges, and how FCPA violations can occur even in “low-risk” countries like the United Kingdom.

SEC Enforcement Director's Remarks

On August 5, 2009, the SEC’s Director of Enforcement, Robert Khuzami, announced numerous significant changes related to the SEC’s handling of FCPA investigations and enforcement actions, including:

- Delegation of authority to issue formal orders of investigation, and accompanying subpoena power, to senior officials throughout the enforcement division, which eliminates the former requirement of advance SEC approval.

- Reorganization of the enforcement division into five specialized units, including one devoted exclusively to FCPA matters.

- Reduction in the number of tolling agreements, which are now subject to the Director’s approval.

- Acceleration of the pace of enforcement actions once initiated.

- Creation of an “Office of Market Intelligence” responsible for analyzing and processing the hundreds of thousands of tips and complaints received each year.

- Encouragement of cooperation by individuals in enforcement actions by creating a standard to evaluate such cooperation that will resemble the “Seaboard” standards for evaluating corporate cooperation.

- Institution of an expedited process for authority to submit immunity requests to the DOJ.

- Exploration of ways to provide cooperating witnesses with oral assurance that the SEC does not intend to bring enforcement actions against them.

- Use of Deferred Prosecution Agreements (“DPA”s) requiring cooperation, waiver of statutes of limitations defenses, and compliance undertakings.

Cumulatively, the SEC’s new organizational efficiencies (e.g., a unit devoted to FCPA matters, delegation of authority to issue formal orders, Office of Market Intelligence) could result in increased and more effective FCPA enforcement activity by the SEC. The organizational efficiencies could enable the SEC to move more quickly than the DOJ in its FCPA investigations and enforcement actions, which could create problems for companies seeking coordinated settlements with both agencies. Indeed, with the planned reduction in the number of tolling agreements, the agency’s staff will be under significant timing pressures to bring enforcement actions in a timely manner.

Additionally, the SEC’s new enforcement tools (e.g., standards for evaluating the cooperation of individuals, DPAs), combined with the agency’s potential use of “control person” liability to reach executives who supervise employees engaged in bribery (as discussed in the Nature’s Sunshine Products case, above) could lead to increasingly aggressive SEC FCPA enforcement actions against individuals. Also, by establishing standards for evaluating the cooperation of individuals that resemble the “Seaboard” standards already in place for companies, the SEC may succeed in pitting executives against their employers, with both competing to demonstrate superior cooperation.

Opinion Procedure Release

On August 3, 2009, the DOJ responded to a request from a U.S. company (“Requestor”) for an opinion regarding the provision of samples of a specific type of medical device to a foreign government at no cost for the purpose of gaining the government’s endorsement of the device.

The Requestor, a company that designs and manufactures a specific type of medical device, met with a senior government official of the foreign country who explained that the government planned to provide a specific medical device to patients in need. The official explained that while all major manufacturers of such devices were allowed to participate in tenders for government purchases of the devices, the government would only endorse products that it has technically evaluated with favorable results. To gain such an endorsement, the official advised the Requestor to provide sample devices to government health centers for evaluation of the technology. The Requestor planned to provide such sample devices, relevant accessories and follow-on support free of charge, with the value of the items totaling approximately $1.9 million.

The Requestor noted that it would supply the sample devices according to various guidelines designed to ensure objective technical evaluation of the devices, and fair and transparent selection of patients who will receive the sample devices. For example, the names of the recipients will be published on a government agency web site, and close family members of the government agency’s personnel who are participating in the selection process or in testing and evaluating the devices will be ineligible to be recipients unless certain additional criteria are met (e.g., the government-employed relative of the recipient must hold a low-level position and not wield influence the selection or testing process). The Requestor will disclose any such relatives of officials who receive the devices to the DOJ. Additionally, all recipients of the sample devices who are immediate family members of any other government officials will receive additional review, and will be reported to the Requestor’s legal counsel. The Requestor also noted that its relevant country manager had received several FCPA training sessions in 2009.

In response, the DOJ indicated that it did not intend to take any enforcement action with respect to the Requestor’s proposal.

Noteworthy Aspects:

- The DOJ stated that the Requestor’s proposed provision of sample medical devices and related items falls outside the scope of the FCPA in that the items will be provided to the foreign government, as opposed to individual government officials, for ultimate use by patient recipients selected in accordance with the guidelines described by the Requestor. By specifically noting the importance of the Requestor’s guidelines in its determination, the DOJ’s opinion suggests that companies must ensure not only that direct recipients of gratuitous items (here, government entities), but also ultimate recipients of such items (here, patients) are not government officials in a position to convey an improper advantage.

- In keeping with the speedy response times in recent Opinion Procedure Releases, the DOJ issued this opinion only three days after the Requestor had submitted all supplemental materials to its request. As reported in our Autumn 2008 FCPA Review, per its regulations, the DOJ has 30 days to issue opinions after receiving requests. While in prior years, the DOJ has taken months to issue opinions, the past two opinions (involving Halliburton Company and TRACE International Inc.) were issued within days of being requested.

Congressional Hearing Regarding DPA, NPA & Corporate Monitor Oversight Bill and GAO Report

On June 25, 2009, the House of Representatives Judiciary Committee, Subcommittee on Commercial and Administrative Law held a hearing on deferred prosecution agreements (“DPAs”), non-prosecution agreements (“NPAs”), and corporate monitors. The hearing was an opportunity for five witnesses, including representatives from the Department of Justice (“DOJ”) and the U.S. Government Accountability Office (“GAO”) to present their positions on the recently introduced “Accountability in Deferred Prosecution Act of 2009,” H.R. 1947. A vocal witness was former New Jersey U.S. Attorney Christopher Christie, who spoke to issues regarding transparency and conflicts of interest in connection with his involvement in hiring his former boss and Attorney General John Ashcroft for a lucrative corporate monitor position. The hearing also included a second panel comprised of New Jersey Representatives Frank Pallone (D) and Bill Pascrell (D), co-sponsors of H.R. 1947. The bill, as mentioned in the FCPA Spring 2009 Review, is an attempt to increase transparency and establish uniformity, particularly with respect to the compensation of corporate monitors. Opposition to the bill came from the DOJ, Mr. Christie, and a few Subcommittee members, who felt the bill would prevent prosecutors from exercising their expertise and discretion and that transparency already exists, since complaints and agreements are publicly posted.

Supporters of the bill highlighted testimony by Eileen R. Larence, Director of Homeland Security and Justice for the GAO, who discussed the GAO’s report of preliminary findings regarding the DOJ’s use and oversight of DPAs and NPAs. The GAO found that despite DOJ-issued guidelines for prosecuting business organizations, prosecutors differed in their willingness to use DPAs and NPAs. Indeed, the DOJ guidelines are inconsistently followed, partly because they are not viewed as mandatory. Moreover, because the DOJ does not require documentation of the monitor selection process, it is difficult for the DOJ to assert that its guidelines are uniformly adhered to. The GAO report concludes by noting companies’ concerns that they had little leverage to address the scope of monitor involvement, fees, and perceived favoritism in monitor selection; similar concerns were also vocalized by some Subcommittee members. The report states that the DOJ agreed with the GAO recommendation that “internal procedures [be adopted] to document both the process used and reasons for monitor selection decisions,” so that the public is assured that monitors are chosen “based on their merits and through a collaborative process.” At the hearing, Ms. Larence emphasized that the DOJ should provide prosecutors with a list of monitors to choose from and require documentation of the selection process to establish consistency.

International Developments

1. Defense Contract Bribery Scandal

In June 2009, Defence Minister A.K. Antony blacklisted seven companies connected to a defense contract bribery scandal, Israel Aerospace Industries (Israel), Singapore Technologies (Singapore), Media Architects (Singapore), BVT (Poland), HYT Engineering (India), T S Kishan and Company (India), and R K Machine Tools (India). The companies are alleged to have made unlawful payments to obtain contracts worth $2 billion to supply the Defence Ministry with artillery, ammunition, and weapons control systems. The Minister’s order freezes all ongoing acquisition from the companies, which are under investigation by the Central Bureau of Investigation (“CBI”).

2. SNC-Lavalin

In June 2009, the CBI filed a charge sheet against the former Power Minister of Kerala and others involved in the SNC-Lavalin corruption case. The CBI alleged that Canadian engineering company SNC-Lavalin made unlawful payments to obtain contracts to renovate three Indian power plants in the mid-1990s, when the Communist Party of India-Marxist’s Kerala secretary Pinaraya Vijayan was the Power Minister of the State. The CBI began investigating corruption within the Power Ministry in January 2007. Nine individuals have been accused of criminal conspiracy and corruption, including former ministry officials.

After the charge sheet was filed, SNC-Lavalin issued a statement denying allegations of unlawful payments in connection with acquisition of the power plant contracts.

1. Rio Tinto

On August 11, 2009, the Chinese Government formally arrested four employees of the Anglo-Australian mining company Rio Tinto PLC (“Rio Tinto”). The arrests of Stern Hu, a Chinese born Australian who managed Rio Tinto’s iron-ore division, and three other Chinese employees, marks the latest development in the highly publicized case.

The four men were originally detained on July 10, 2009, on charges of espionage, stealing state secrets and harming the Nation’s economic interests and security. Following the arrests, China Daily, China’s largest English Language newspaper, alleged that the Rio Tinto employees bribed executives from all of China’s State-run steel mills to gain access to industry information; it is these actions that were described as “stealing state secrets.” The case has been the focus of intense media scrutiny because of the government’s use of its opaque state secrets laws. The detentions have also shocked many multinational companies that operate in China due to the country’s invocation of its espionage laws for actions that appear to be fall within the realm of commercial bribery.

The August 11, 2009 arrests marked a major turning point in the case. Ostensibly due to diplomatic pressure by the Australian Government, China dropped the more serious charges of espionage and violation of the state secrets law. The Rio Tinto employees are now charged with the lesser crimes of commercial bribery and infringement of trade secrets

The arrests suggest that the Chinese Government is attempting to crack down on the Chinese iron-ore industry, which, according to press accounts, is widely perceived as plagued by rampant corruption. In addition to the Rio Tinto arrests, China is also said to be actively investigating executives from several large steel companies in connection with the scandal.

2. New Anti-Corruption Efforts

According to press accounts, China has instituted several new programs aimed at fighting official corruption, including the establishment of an anti-corruption hotline and significant awards for reporting corruption. The hotline, which was opened on June 22, 2009, reportedly allows whistleblowers to anonymously contact Chinese law enforcement regarding alleged corruption via phone, fax, and internet. According to press accounts, in the hours after the hotline was opened, the phone hotline was overwhelmed with calls and the related internet site froze, presumably because of a flood of traffic.

Additionally, according to press accounts, Chinese authorities are encouraging people to report official corruption by rewarding them with up to 10% of the funds recovered by law enforcement. Such rewards will reportedly be capped at the equivalent of approximately $14,000, though higher rewards may be possible with certain government approval.

Since April, Dubai authorities’ investigation of corruption has touched on companies including Deyaar Development, Dubai Islamic Bank, Tamweel, Nakheel, and Sama Dubai. According to press accounts, the recent crack-down is a sign that Sheikh Mohammed bin Rashid Al Maktoum is serious about maintaining the flow of foreign investment dollars into the emirate despite the global economic crisis.

Australian businessmen Marcus Lee and Matt Joyce were charged with fraud on July 21, nearly six months after their arrest in connection with a complicated property deal in Dubai. Lee and Joyce worked on a property management project for the UAE government-owned Nakheel property group, which is also involved as a developer on the massive Palm Islands project. Both men remain behind bars and likely face a trial in Dubai.

Two individuals associated with Nakheel are also being questioned by authorities: former sales executive and Egyptian national Karim Masaad and current general manager for sales, Walid Al Jaziri.

Abdulsalam Almarri, chief executive of the Lagoons project, and three other employees of the UAE government-owned real estate developer, Sama Dubai, were arrested in August and held for questioning on allegations of bribery and mistrust.

The offices of German industrial services company MAN Ferrostaal AG (MAN) were searched in July and three arrests were made for suspected corruption. The corruption charges relate to manufacturing contracts for seagoing tugs. The offices of unidentified companies in Hamburg and Cuxhaven and private apartments were also searched. According to a MAN spokesman, the company and its employees are witnesses, not suspects, in the ongoing investigation.

In 2008, MAN weathered bribery allegations lodged in the Sunday Times, a Johannesburg, South Africa newspaper. The Sunday Times alleged that MAN paid bribed South African President Thabo Mbeki a $3.9 million bribe to secure a multi-billion contract to supply the South African Navy with three submarines.

In May, German prosecutors initiated a corruption and bribery investigation of MAN's parent company, MAN AG. MAN AG is suspected of paying millions of dollars in bribes in Germany and abroad in exchange for deals to sell and lease its trucks and buses. According to an anonymous source, authorities have obtained evidence that payments were made to foreign officials and companies in exchange for business.

Three Chinese companies are under investigation for alleged bribery in Namibia. Namibian prosecutors are investigating Nuctech, a supplier of airport security scanners, for alleged bribery in connection with a $56 million government contract. Nuctech is a Chinese state-owned company that, until 2008, was headed by Hu Haifeng, the son of Chinese President Hu Jinatao. Thus far, three individuals have been arrested in connection with the bribery investigation: Nuctech’s African representative, Yang Fan, and the two Namibian owners of a consultancy called Teko Trading, Teckla Lameck and Kongo Mokoxwa. Charges were allegedly filed after Nuctech was awarded an uncontested contract to supply the scanners to Namibian airports and ports.

Days after the Nuctech deal went public, Lieutenant General Martin Shalli, chief of the Namibia Defence Force, was suspended for allegedly taking a $250,000 kickback on a Chinese arms deal.

Also under investigation for alleged corruption is a third Chinese company, China National Machinery & Equipment Import and Export Company (CMEC). CMEC allegedly paid a 10 percent kickback to secure a deal to build a $61 million, 38-mile long, rail link. Teko Trading is also involved in the CMEC scandal.

According to press accounts, Nigeria’s Attorney General said that the long-awaited report of the panel tasked to probe the Nigerian officials involved in the Halliburton/KBR scandal has been delayed because of a change of the chairman of the panel. As reported in our Spring 2009 FCPA Review, Nigeria commenced what was supposed to be an eight-week inter-agency panel to investigate the Halliburton/KBR scandal on April 21, 2009. The panel has questioned numerous current and former high-ranking Nigerian officials, and reportedly continues to complain about deficiencies in international cooperation, particularly regarding the United States.

1. World Bank Settlement

According to press accounts, on July 2, 2009, Siemens AG (“Siemens”) reached an agreement with the World Bank to settle allegations of bribery in connection with World Bank projects. The agreement reportedly requires Siemens to make payments totaling approximately $109 million over a fifteen year period to support anti-corruption campaigns, and to refrain from bidding on Bank-financed projects until 2011. Additionally, Siemens’s Russian unit could face a four-year ban from Bank-funded contracts pending a future determination by the World Bank. Specifically, the World Bank alleged that Siemens Russia paid approximately $3 million in bribes between 2005 and 2006 in connection with Bank-funded transportation projects in Russia. In exchange for Siemens’s commitments, the World Bank agreed to refrain from instituting sanctions proceedings regarding Siemens’s subsidiaries in other countries.

2. Greece Investigations

According to press accounts, on September 7, 2009, a Munich court confirmed its ruling in favor of sending Michalis Christoforakos, the former managing director of Siemens Hellas, back to Greece to face bribery charges related to contracts with the government-owned telephone company OTE. As reported in our Spring 2009 FCPA Review, Christoforakos fled to Germany earlier this year to elude Greek authorities, which issued an international arrest warrant accusing Christoforakos of participating in bribery involving OTE prior to 2003. Christofarokos’s lawyers reportedly said they will appeal the ruling to prevent his extradition.

1. BAE/Saab Probe Dropped

According to press accounts, on June 16, 2009, Swedish authorities closed their investigations into Saab AB (“Saab”) and its Gripen International unit in connection with alleged bribery in the Czech Republic, Hungary and South Africa. Despite evidence that Saab’s partner, British weapons manufacturer BAE, paid bribes to secure the sale and leasing of Gripen fighter jets in those countries, a prosecutor reportedly said that Swedish authorities could not verify that Saab participated in the bribery after July 1, 2004. Any bribery occurring before that date is barred by a statute of limitations. According to press accounts, Mark Pieth, chairman of the Organization for Economic Co-Operation and Development (“OECD”) Working Group on Bribery in International Business Transactions, is concerned that this decision may signal a lack of commitment on the part of Sweden to the OECD convention. As reported in our Winter 2009 FCPA Review and Autumn 2008 FCPA Review, the OECD working group on bribery recently leveled harsh criticism at the United Kingdom for terminating its inquiry into BAE’s alleged bribery in the sale of jet fighters to Saudi Arabia.

2. Novo

According to press accounts, Novo Nordisk A/S (“Novo”), a Danish pharmaceutical company and a leading supplier of insulin, is facing possible charges of bribery in Sweden in connection with its partial sponsorship of trips to South Africa for Swedish medical personnel. Novo, which, as reported in our Spring 2009 FCPA Review, settled wire fraud and FCPA charges related to the U.N. Oil for Food scandal with U.S. authorities earlier this year, reportedly sent 150 hospital employees on a conference trip that was deemed tourist in nature by a Swedish watchdog organization. Additionally, some conference participants were accompanied by their partners, though Novo denies paying the partners’ expenses. Novo reportedly admitted that its actions breached Sweden’s recently tightened regulations regarding conferences funded by pharmaceutical companies, and its Swedish subsidiary has reportedly been fined approximately $11,000 by Swedish authorities.

I. Transparency International Reports

1. Enforcement of the OECD Convention

On June 23, 2009, Transparency International (“TI”) released its 2009 progress report on the enforcement of the Organization for Economic Co-operation and Development (“OECD”) Convention on Combating Bribery of Foreign Public Officials in International Business Transactions (“Convention”), in which it found that only four of the Convention’s 38 parties were actively enforcing the Convention: Germany, Norway, Switzerland, and the United States. The progress report found that eleven countries have moderate enforcement, while twenty-one countries have little or no enforcement. The progress report points out that enforcement in the eleven countries with moderate enforcement does not provide effective deterrence against foreign bribery. Overall, the progress report attributes the deficient current levels of enforcement to a lack of political will, and warns that “the present situation is dangerously unstable. Unless enforcement is sharply increased, existing support will erode and the Convention will fail.” The progress report makes numerous recommendations directed at the OECD and parties to the Convention. According to press accounts, TI recently presented its report at a meeting of the OECD, and its Managing Director, Cobus de Swart, reportedly told reporters that “the failure of the OECD Convention would arguably be the single most serious setback to the fight against international corruption.”

2. Global Corruption Report 2009

On September 23, 2009, TI released its Global Corruption Report 2009: Corruption and the Private Sector (“GCR”), which provides an in-depth analysis of corruption and remedies for the private sector. Specifically, drawing on input from over eighty experts, the GCR describes persisting problems related to corruption, such as its destructive social and economic costs. According to the GCR, businesses supply approximately $40 billion in bribes annually, and bribery has resulted in consumers being overcharged approximately $300 billion between 1990 and 2005. The GCR also provides recommendations directed at businesses, governments, civil society, and stakeholders, which propose means of tackling corruption in the private sector.

1. Mabey & Johnson

On September 25, 2009, the U.K. based bridge company Mabey & Johnson (“Mabey”) was sentenced in the Southwark Crown Court in London to pay penalties and reparations totaling £6.6 million (approximately $10.5 million) and required to submit its compliance program to review by a Serious Fraud Office (“SFO”) approved independent monitor. Mabey had formally pleaded guilty on August 7, 2009, on corruption charges related to improper payments in Ghana, Jamaica and Iraq. Mabey, which is based in Reading, England, is one of the world’s largest bridge manufacturers.

The case arose after an internal investigation and a 2008 voluntary disclosure to the Serious Fraud Office (“SFO”) that the Company potentially bribed Government Officials in Ghana, Jamaica and Iraq. Following the disclosure, the firm was charged with improperly attempting to influence government decision makers to obtain bridge building contracts in both Jamaica and Ghana from 1993 to 2001. The firm was also charged to paying more than €422,000 ($603,206) to the Sadam Hussein Regime in violation of the Oil-For-Food program from 2001 to 2002. A subsequent internal investigation revealed additional corrupt payments made by Mabey in Madagascar, Angola, Mozambique and Bangladesh. Five of Mabey & Johnson’s directors have resigned since the original disclosure was made.

2. British Solicitor Charged with Corruption in the Congo - First UK National Prosecuted by City of London Police Anti-Corruption Unit

On June 17, 2009, the City of London’s Anti-Corruption Unit announced that it had charged Patrick Orr, a solicitor, with conspiracy to corrupt, conspiracy to launder money and conducting fraudulent trades in connection with a United Nations program to provide life-saving HIV and anti-malarial drugs to the Democratic Republic of Congo. Orr allegedly conducted the £21m ($34 million) scheme along with two Dutch consultants, Guido Bakker and Art Scheffer between 2005 and 2007.

This is the Anti-Corruption Unit’s second case since it was established in 2006. The Unit was established in response to international criticism of the U.K.’s poor record on prosecuting corruption violations abroad.

3. SFO Plans for New Negotiation Model

On July 21, 2009, the SFO issued formal guidance on its new approach to dealing with corruption by British nationals overseas. The guidance confirmed that the SFO is moving towards a US-Style negotiation system such as deferred prosecution agreements. The new system will allow companies to voluntarily disclose corruption violations and then enter formal settlement negotiations. In return for receiving voluntary self disclosures, the SFO has pledged to use civil fines instead of criminal penalties wherever possible. Notably, the SFO also indicated that it would rely on the independent monitoring system which the DOJ has used for years.

As reported in our Autumn 2008 FCPA Review, the SFO first used the US-Style plea agreement in its settlement of the Balfour Beatty case in 2008.

4. Financial Services Authority Plans to Increase Fines in February 2010

In July, 2009, the Financial Services Authority (“FSA”) announced that it will increase fines imposed on parties that violate FSA regulations. The new fine structure, scheduled to take effect in February 2010, could potentially treble the size of fines.

5. Joint Committee on the Draft Bribery Bill Recommends Tougher Treatment of Companies

Currently, as reported in our Spring 2009 FCPA Review, the U.K.’s Draft Bribery Bill contains a new offence that would impose corporate liability for a company’s negligent failure to prevent bribery by its employees and agents. According to press accounts, the Joint Committee on the Draft Bribery Bill recently recommended removal of the need to prove negligence to sustain corporate liability, effectively providing strict liability for bribery, subject to an affirmative defense of having “adequate procedures.” The Committee also called for government guidance on the meaning of “adequate procedures”

6. SFO to Prosecute BAE

On October 1, 2009, Britain’s Serious Fraud Office (“SFO”) announced plans to prosecute BAE Systems (“BAE”) for foreign corruption in connection with arms contracts in countries including the Czech Republic, Romania, Tanzania, and South Africa. The SFO announced that it must obtain the approval of the attorney general, Baroness Patricia Scotland, to prosecute. Based on the SFO’s published statement, the required paperwork is not yet ready for seeking the attorney general’s approval. However, the statement indicates that settlement talks have failed, at least for the time-being. According to press accounts, BAE failed to meet a September 30, 2009 deadline to plead guilty and agree to a substantial fine or face prosecution. Specifically, BAE reportedly rejected an offer by the SFO to settle bribery charges for £300 million. If convicted, BAE could face a penalty as high as £500 million ($790.8 million).

As reported in our past FCPA Reviews, the SFO began investigating the arms giant in July 2004 for corruption involving members of the Saudi royal family. BAE is alleged to have paid billions of dollars to the Saudi government over the years to secure massive contracts for the sale of arms. Specifically, BAE allegedly deposited £1 billion ($1.97 billion) into the Washington bank account of Saudi Prince Bandar bin Sultan in exchange for his help in brokering the sale of Typhoon jet fighters to the Saudi government. Former Prime Minister Tony Blair shut the probe down in 2006 on national security grounds and his decision was upheld on appeal to the House of Lords.

As reported in our Winter 2009 FCPA Review, the SFO continued to investigate BAE in connection with the alleged bribery of officials in Austria and the Czech Republic to secure contracts for the sale of military aircraft (see [BAE-Austria section of this newsletter] for an account of the parallel Austrian investigation). In December 2008, a Swiss court reportedly held that Swiss authorities could supply the SFO with confidential Swiss bank records related to the alleged bribery of Czech politicians.

According to press accounts, allegations of BAE’s foreign corruption in the Czech Republic, Romania, Tanzania, and South Africa involved contracts worth well over £2 billion and payments to third party facilitators totaling over £120 million.