FCPA Winter Review 2026

International Alert

Introduction

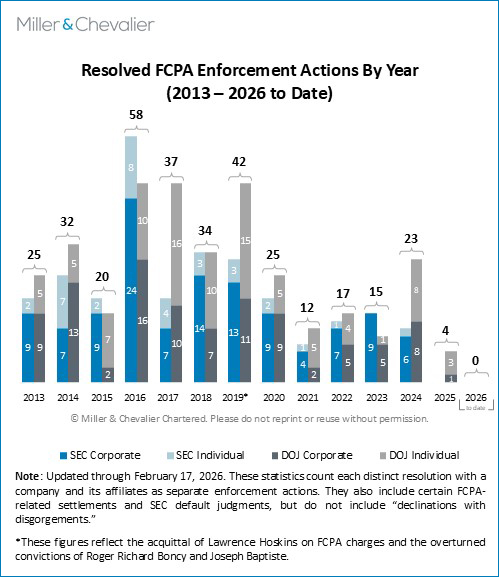

The last quarter of 2025 saw a spark of new activity under the administration's June 2025 FCPA guidelines, though it remains to be seen how active enforcement levels will be going forward. The Department of Justice (DOJ) and Securities and Exchange Commission (SEC) remain focused on other priorities, and key enforcers continue to issue sometimes contradictory public statements regarding the Foreign Corrupt Practices Act (FCPA).

The administration's more general changes to corporate criminal enforcement policy, which will continue in 2026, make it likely that companies in many cases will find that the agencies are more willing to agree to favorable dispositions as long as, for example, the revised DOJ Corporate Enforcement Policy's (CEP) requirements are met. As we continue to advise clients, the fundamental CEP requirements are generally the same as past administrations: to receive favorable treatment, companies must self-disclose issues, cooperate with government investigations, and remediate identified problems appropriately.

2025 FCPA Cases

The DOJ formally resolved two corporate cases in 2025 – entering a deferred prosecution agreement (DPA) with telecommunications company Millicom and its Guatemalan subsidiary in November and a declination with disgorgement with insurance company Liberty Mutual in August. While unsurprising given the administration's review and reset of FCPA enforcement, this represents the fewest corporate FCPA dispositions in many years (traditionally, we have not counted declinations with disgorgement in our statistics, so for comparison's sake, the total for the year in our count is one).

The DOJ closed investigations or ended non-trial dispositions (e.g., DPAs or non-prosecution agreements (NPAs)) for various companies early, including Glencore's monitorship and DPAs for Albemarle, Stericycle, ABB, and Honeywell. In an unusual move, in October 2025, the DOJ added Smartmatic to its existing cases against former executives of the company, which will continue in 2026.

With regard to cases against individuals, the DOJ successfully prosecuted several FCPA cases, including wins at trial in two cases – those involving Carl Zaglin and Ramón Rovirosa.

The SEC also froze or closed several previously announced investigations without action. The agency brought no new cases during 2025.

2025 International Developments

2025 saw continued pockets of enforcement activity in some countries – mostly from those with prior track records. The full effect of the slowdown in U.S. activity – and any issues with international mutual legal assistance driven both by that slowdown and more general foreign policy issues between the U.S. and some of its traditional allies – remains to be seen, though the signals thus far are mixed. Traditionally active enforcers face new challenges in 2026, such as the unexpected retirement of the director of the U.K. Serious Fraud Office (SFO) and the continuing judicial reversal of significant Lava Jato cases in Brazil. But other countries, such as Indonesia and Singapore, have recently brought successful actions against companies resulting in substantial penalties.

Thus, while companies should consider how best to address some of the newer risks created by the U.S. administration's priorities and greater instability in the international system generally, they should continue to focus on anti-corruption compliance in their operations.

DOJ Developments and Corporate Dispositions

In the last quarter of 2025 and early 2026, the leadership team for the main DOJ units responsible for FCPA prosecutions and related cases formally assumed their roles. The DOJ also announced its first corporate enforcement action since FCPA cases were restarted in June 2025.

Key FCPA Leadership Formalized

On December 18, 2025, Florida prosecutor Andrew Tysen Duva was confirmed by the U.S. Senate as the new Assistant Attorney General (AAG) for the Criminal Division. During his confirmation hearing on October 22, 2025, and in his written responses, Duva stated that he "would dedicate Fraud Section resources to investigating and prosecuting violations of the FCPA firmly but fairly and consistent with Department policies and priorities." At the hearing, he discussed related prosecution priorities such as fraud and market manipulation and a continued focus on the activities of transnational criminal organizations (TCOs), including through the anti-corruption lens.

In other Fraud Section developments, the DOJ named Lorinda Laryea as Chief of the Fraud Section in January 2026. She had been serving in that role in an acting status since March 2025. David Fuhr remains as Chief of the FCPA Unit.

Millicom Subsidiary Settles with DOJ Related to Activities in Guatemala

On November 10, 2025, the DOJ unsealed the first corporate FCPA-related DPA since the February 2025 FCPA enforcement "pause" by the Trump administration. This is also the first DPA issued under the revamped FCPA enforcement guidance issued by the DOJ in June 2025.

Comunicaciones Celulares S.A. (d.b.a. TIGO Guatemala), a subsidiary of Millicom International Cellular, S.A. (Millicom), a Luxembourg-based telecommunications provider that operates in Latin America, agreed to the DPA to resolve a criminal information charging the company with one count of conspiracy to violate the FCPA's anti-bribery provisions related to alleged widespread bribery in Guatemala. TIGO Guatemala agreed to pay $118 million, comprising a $60 million fine and $58.2 million in forfeiture. Although TIGO Guatemala is the defendant in the prosecution, Millicom, as TIGO Guatemala's parent, agreed to several terms in the DPA, including the requirement to maintain an anti-corruption compliance program (Attachment C). Consistent with the DOJ's revised May 2025 Memorandum on Selection of Monitors in Criminal Division Matters, the DPA does not require TIGO Guatemala and Millicom to hire an Independent Compliance Monitor. Instead, the DPA requires the companies to self-report on the status of remediation and implementation of the anti-corruption compliance program for the two-year term of the DPA.

According to the DPA, from 2012 through 2018, TIGO Guatemala made monthly cash payments to members of the Congress of Guatemala in exchange for their support in passing legislation that benefited the company. In 2012, the bribes helped secure passage of an amendment to Guatemala's telecommunications law that enabled TIGO Guatemala to win a favorable 20-year contract to use the country's radio frequency spectrum, superseding the company's prior 15-year contract. The DPA states that in 2014, the bribes helped secure passage of another law (colloquially referred to as Ley TIGO) that required telecommunications companies to block cell phone reception around detention facilities. Ley TIGO's technical specifications were drafted such that only TIGO Guatemala could initially meet its procurement requirements, giving the company an unfair advantage over its competitors.

The DOJ alleged that the scheme was led by two unnamed TIGO Guatemala executives ("Shareholder 1" and "Guatemala Executive 1") and the company's former Head of Legal and Chief Corporate Affairs Officer, Acisclo Valladares Urruela (Valladares), with assistance from a Guatemalan banker, Alvaro Estuardo Cobar Bustamante (Cobar), and other unnamed individuals. According to the DPA, the individuals used four different schemes to generate cash for the bribes.

In the first scheme, an employee of one of Shareholder 1's other companies delivered cash to Valladares. The employee transported the money in duffel bags by helicopter directly to TIGO Guatemala's helipad. Valladares then delivered the money to government officials or their political parties. The helicopter payments eventually ended in 2013 when one cash courier had to make an emergency landing at a military base, which prompted an investigation into the incident.

The second scheme originated from Shareholder 1's "Put-Call" agreement with Millicom. The DPA asserts that in early 2014, Shareholder 1 agreed to grant Millicom an option to buy its 45 percent interest in Millicom in return for a $15 million "execution fee." According to the DOJ, in late 2013, Shareholder 1 told a Millicom executive and a TIGO board member (an unnamed U.S. citizen, who was also a Millicom executive) that he would use a portion of this fee to pay bribes to Guatemalan officials.

The third scheme involved Guatemala Executive 1, who executed an inflated contract on behalf of TIGO Guatemala with another company associated with Shareholder 1, generating a $12 million fund allegedly to be used for bribes. The DPA states that the money was then funneled through shell companies to Valladares, including to his U.S. personal bank account, and used to fund the corrupt payments.

In the final scheme, Shareholder 1, Guatemala Executive 1, and Valladares engaged Cobar to "identify a new source of cash to be used for bribes." Cobar used laundered money from a narcotics trafficker to meet the demand. The DOJ alleged that Valladares and Cobar backdated contracts and falsified invoices to legitimatize the transfers.

According to Millicom's press release, Millicom first self-reported improper payments to the DOJ in 2015. At that time, however, it did not have operational control over TIGO Guatemala (despite owning 55 percent of the company) to assess the misconduct. Before 2021, TIGO Guatemala operated as a joint venture (JV) between Millicom and "Panama Company," controlled by Shareholder 1, who owned the other 45 percent and allegedly used its influence to block Millicom's legal compliance efforts. As we noted in our FCPA Summer Review 2018, the DOJ closed its initial investigation of that self-report in April 2018. According to the DPA, in 2020, the DOJ reopened the investigation after obtaining new evidence from other sources, including evidence that cash used by TIGO Guatemala for the bribes derived from narcotrafficking. In 2021, Millicom purchased Shareholder 1's interest for approximately $2.2 billion and became the sole owner of TIGO Guatemala. In 2022, the DOJ served Millicom with a subpoena.

Key Takeaways

- JV and M&A Risk: TIGO Guatemala's investigation highlights the heightened risks arising from JVs and acquisitions. Millicom's efforts to root out corruption at TIGO Guatemala were routinely blocked by Shareholder 1, who appears to have used his operational control to prevent investigation of the misconduct. Of note, the monthly cash payments apparently continued for almost three years after Millicom had raised corruption concerns to the DOJ. Companies entering a JV should weigh the compliance risks of ceding operational control over any venture operations, and, in all cases, conduct careful due diligence prior to closing the deal, take actions to attempt to ensure the JV adopts an anti-corruption compliance program and internal accounting controls, and exercise appropriate monitoring mechanisms (such as audit rights) to understand and influence the activities of the joint venture and the actions of the other partner on behalf of the venture. Millicom's subsequent acquisition of the Panama Company’s share in TIGO Guatemala also highlights the risk of successor liability in M&A transactions.

- Link to Cartel Activities: The June 2025 FCPA Guidance issued by the DOJ directs prosecutors to prioritize misconduct that "utilizes money launderers or shell companies that engage in money laundering for Cartels or TCOs." Here, the DPA emphasizes that some of the money laundered to generate funds to pay the cash bribes came from narcotrafficking, and the DOJ noted that fact was relevant to their reopening of the investigation in 2020.

- Benefits of Disclosure and Cooperation: In line with the revised CEP, the DOJ credited Millicom’s self-disclosure and cooperation, recommending a 50 percent reduction in the statutory fine, and a reduced reporting term of two years. As we noted in a previous publication, the CEP was revised in May to "clarify that additional benefits are available to companies that self-disclose and cooperate, including potential shorter terms." Although Millicom's cooperation extends back to 2015, when it disclosed alleged improper payments, Millicom and TIGO Guatemala were not eligible for a declination or an NPA. The DOJ noted that a DPA was appropriate because there were aggravating circumstances, such as the fact that "the criminal conduct continued during and after the [DOJ's] closure of the first phase of the investigation and involved narcotrafficking proceeds that were used to generate cash for some of the bribe payments." Still, the DOJ asserted that the self-disclosure was given "significant weight" in determining the appropriate disposition.

- DOJ Preserves Attachment C: Although the DOJ's approach to FCPA enforcement has changed significantly over the past year, TIGO Guatemala’s Attachment C is substantially similar to the Attachment C used by the DOJ in 2024, with only two substantive differences. The first difference is the omission of the following previously included sentence from the section on confidential reporting: "To ensure effectiveness, the Company commits to following applicable anti-retaliation and whistleblower protection laws, and to appropriately training employees on such laws." There is no explanation given for this omission, and the company would still be obliged to following any such applicable laws and regulations. The second change is the addition of "subject to local labor laws" to the following sentence in the Compensation Structures section: "These incentives shall include, but shall not be limited to, the implementation of criteria related to compliance in the Companies' compensation and bonus system subject to local labor laws." This addition should be helpful for the company in navigating the sometimes different labor law requirements in the various jurisdictions in which it will be operating.

Cases Involving Individuals

The last quarter of 2025 featured more FCPA-related activity as to cases against individuals than on the corporate side. This result is consistent with the June 2025 FCPA guidelines' directive that prosecutors "focus on cases in which individuals have engaged in criminal misconduct and not attribute nonspecific malfeasance to corporate structures." The DOJ's handling of these cases also gives some indications of other priorities, such as a focus on Latin America and activities that harm U.S. economic interests.

However, many of these cases are legacies from the prior administration. While their survival after the DOJ's review of FCPA enforcement in the first half of 2025 can be parsed in line with current priorities, other factors, such as the strength of evidence or the status of the case at the time of the review, likely played a significant role. Thus, in our view they do not yet present a clear direction on how the current administration will proceed on FCPA enforcement in 2026 and beyond.

On January 12, 2026, the U.S. Supreme Court vacated lower court rulings against two defendants in the long-running FIFA corruption scandal, effectively overturning the convictions of Full Play Group and former media executive Hernán López. Full Play Group had filed a petition for a writ of certiorari on September 30, 2025. In a reversal of its long-standing position, the DOJ (via the Solicitor General) filed a brief on December 9, 2025, that stated, "[t]he government has determined in its prosecutorial discretion that dismissal of this criminal case is in the interests of justice." The DOJ noted that it had filed a motion in district court to dismiss the convictions with prejudice and asked the Supreme Court to remand the case to the district court so that the court could take action on the dismissal.

The DOJ gave no further public reasoning for its reversal in the case. Various media reports have discussed potential theories, including the timing of the World Cup, FIFA actions related to the president, and concerns that the Supreme Court could use the case to further reduce the scope of so-called "honest services" fraud in line with a series of such decisions that date back to its holding in McDonnell v. U.S. in 2016. We will discuss these developments and how the dismissal might affect other FIFA scandal cases in our next Review.

Texas-Based Businessman Convicted at Trial of FCPA and Related Counts Tied to Petróleos Mexicanos (Pemex) Bribery

On December 5, 2025, a jury in a federal district court in Houston, Texas, convicted Texas-based businessman (and Mexican national) Ramón Alexandro Rovirosa Martínez (Rovirosa) on two counts of violating the FCPA and one related conspiracy count. This is the second successful prosecution of an individual by the DOJ for FCPA-related offenses since the issuance of the June 2025 guidelines. The first was the conviction of Carl Zaglin in September 2025.

According to the DOJ press release, Rovirosa and his co-conspirators "paid more than $150,000 in bribes to officials at [Pemex subsidiary] PEP to retain contracts and payments from PEMEX and PEP [worth "at least $2.5 million] and obtain other improper advantages in business with PEMEX and PEP, for the benefit of companies associated with Rovirosa." The bribes were "in the form of cash payments, luxury goods and other valuable items." The DOJ noted that "Rovirosa's co-conspirator, Mario Avila, is a fugitive."

The case went to trial only four months after indictments against Rovirosa and others were unsealed on August 11, 2025. As discussed in our last review, an initial (and later changed) DOJ press release alleged that Rovirosa had links to Mexican cartels. After several filings before the court in the autumn run-up to the trial, the cartel issue was dropped with the judge ruling that "such language and inferences will not be tolerated in this trial from either party."

Customs Broker Pleads Guilty to FCPA Conspiracy Charge

On October 23, 2025, Carlos Leopoldo Alvelais Alarcón pleaded guilty to one count of conspiracy to violate the FCPA. Information on the case is limited as the files are under seal. According to media reports, Alarcón was the head of a customs broker company based on Chihuahua, Mexico and a freight forwarding business in Texas. The docket in the case shows that Alarcón is scheduled to be sentenced on March 9, 2026.

Former Goldman Sachs Banker Asante Berko to Face Trial in 2026 on FCPA and Related Charges

After a series of court actions, on January 14, 2026, a federal judge ordered that former Goldman Sachs banker Asante Berko's trial will commence on July 27, 2026. Berko was extradited from the U.K. on July 15, 2024 (after being arrested based on a 2020 indictment), and arraigned the next day in the Eastern District of New York (EDNY) on charges of "violations of the [FCPA] and money laundering for bribing Ghanaian government officials to secure a power plant deal and laundering the payments through the U.S. financial system." Berko pleaded not guilty and his counsel began preparing for trial.

In July 2025, Berko filed a motion to dismiss the case, citing violations of his Sixth Amendment right to a speedy trial and statute of limitations arguments. In November 2025, the federal judge overseeing the case conducted an evidentiary hearing on these issues and in December 2025 denied Berko's motion. The limitations argument stemmed from Berko's assertion that the sealing of the indictment by the DOJ was "improper" and delayed the case until past the applicable limitations period. The court determined that the seal was properly justified and maintained in light of the facts and circumstances. The December hearing transcript notes that Berko had been interviewed under a "safe passage" arrangement at some point, but that any such contact did not give him a right to "self-surrender" pursuant to the indictment. The transcript also references the DOJ's concerns regarding potential flight risk and Berko's connections to high-level officials in Ghana that could have impeded the case. The judge found that the DOJ's efforts to find and arrest Berko – including the issuance of an Interpol diffusion notice and tracking Berko's movements to the U.K. – constituted sufficient diligence in attempting to locate and track Berko during the time the indictment was under seal.

As to the speedy trial issue, the court weighed the governing factors under applicable case law and held that no Sixth Amendment violation had occurred, despite the length of time that had passed. The court noted that significant delay occurred in the context of the extradition process, but that Berko's contesting of extradition in the U.K. courts was a significant cause of that delay. The court also noted that the delay in the unsealing of the indictment did not support an argument for a speedy trial violation.

Berko's case is separate from the Goldman Sachs corporate resolutions related to the 1MDB scandal in Malaysia.

Key Participants in Honduran Bribery Case Sentenced

On December 2, 2025, Carl Zaglin, the former chief executive officer (CEO) of a Georgia-based "tactical gear" company, was sentenced to eight years in prison. Zaglin, one of several individuals charged in a scheme to bribe Honduran public officials to obtain government contracts with the national police force, was convicted at trial on multiple FCPA and money laundering charges in September 2025. The judge also ordered Zaglin to forfeit over $2 million related to the money laundering charge. Prior to sentencing, the judge denied Zaglin's motion for a new trial.

Earlier, on October 28, 2025, a court sentenced Florida businessman Aldo Nestor Marchena to seven years in prison following his June 2025 plea agreement related to conspiracy to commit money laundering. Marchena allegedly had been a middleman in the Honduran bribery scheme, funneling money from Zaglin's company to one or more Honduran procurement officials using sham invoices. Marchena testified against Zaglin at Zaglin's trial, per the terms of the plea agreement.

Pras Michel Ordered to Forfeit Almost $65 Million Related to 1MDB Case

On October 30, 2025, a federal judge ordered rapper/singer Prakazrel (Pras) Michel to forfeit close to $65 million, an amount determined to be the "illegal proceeds" of his participation in the vast 1MDB scandal involving Malaysia's sovereign wealth fund. Michel was convicted at trial in August 2023 in part for "conspiring with "Low Taek Jho, aka Jho Low, of Malaysia… and others to engage in undisclosed lobbying campaigns at the direction of Low and [a Chinese government minister]… to have the 1MDB embezzlement investigation and forfeiture proceedings involving Low and others dropped and to have a Chinese national sent back to China." Michel subsequently lost a "Rule 29" motion for acquittal in April 2024 and a motion for a new trial in August 2024.

According to the judge's October 30 order, the DOJ filed a forfeiture motion in December 2024, which Michel challenged, resulting in a delay in sentencing and proceedings related to the DOJ's motion. The judge's order assesses various legal and factual arguments raised by Michel objecting to the forfeiture request but ultimately concludes that the over $100 million Michel received from Jho Low and deposited into various accounts "constitutes the proceeds of a conspiracy under [relevant statutes] on which Mr. Michel was convicted at trial," thus supporting a "personal money judgment" in the amount ordered.

Court Reconsiders Restitution Payments by Tuna Bonds Case Defendants

On December 12, 2025, an EDNY federal judge issued an order that revisited an earlier order requiring that three ex-Credit Suisse bankers – all of whom had pleaded guilty in connection with the so-called "Tuna Bonds" corruption scandal – pay restitution to a financial institution that alleged it had been defrauded and injured by their actions. The most notable defendant in the Tuna Bonds cases was the former Finance Minister of Mozambique, Manuel Chang, who was convicted at a jury trial in August 2024 for his role in obtaining $7 million in bribe payments in exchange for signing guarantees to secure $2 billion in funding for projects to be carried out by Mozambican state-owned companies, hundreds of millions of dollars of which Chang, along with co-conspirators, diverted for other purposes. In October 2021, Credit Suisse entered dispositions with U.S. and U.K. authorities related to the activities of several of the bank's affiliates in support of the Tuna Bond scheme, agreeing to pay approximately $475 million in penalties.

In May 2025, a federal judge ordered Chang and the three former bankers to pay a combined total of $352.2 million in restitution to "investor-victim" VTB Capital (VTBC), which had lent money to state-owned Mozambican companies based on allegedly fraudulent representations by Chang and the other defendants. The court ordered Chang to pay over $42.2 million. Banker Andrew Pearse, who cooperated with the DOJ's investigation and testified at Chang's trial, but who received by far the largest kickbacks in the scheme – $45 million by his own admission – was ordered to pay over $264 million to VTBC. Former banker Surjan Singh was ordered to pay over $32.2 million based on his receipt of almost $5.7 million in bribes, while the third former banker, Detelina Subeva, was required to pay over $10.5 million.

In August 2025, Singh and Subeva each requested reconsideration of that order; Pearse also raised arguments regarding his restitution requirement. Singh argued that he had not been involved in the loans to VTBC and thus should not be subject to a restitution claim from the bank. Subeva noted that her 2022 sentence related to her plea did not require a restitution payment. The DOJ, in response, agreed with the arguments raised by both Singh and Subeva. In the December order, the judge agreed and vacated the parts of his May 2025 order that required Singh and Subeva to pay restitution.

The DOJ opposed Pearce's request for reconsideration, noting (according to the December 2025 court order) that "Pearse pleaded guilty to conspiring 'to defraud one or more investors and potential investors… and that VTBC's losses 'flowed from the reasonably foreseeable actions' of Pearse and his co-conspirators." The DOJ also argued that "Pearse was aware that material misrepresentations in the loan agreements and related business plans (which he helped prepare) 'induced' VTBC to go forward with the transactions." The court agreed with these arguments and maintained that Pearse was required to pay restitution to VTBC consistent with its May 2025 order. However, the court noted that Pearse also raised arguments related to his financial status and limited ability to pay. In light of this, the court modified its earlier order to require Pearse to pay "5% of [his] post-tax income with an initial grace period of three years."

Separately, on November 6, 2025, the judge ordered Singh to forfeit $5.7 million.

Former Oil Trader Glenn Oztemel Sentenced to 15 Months in Prison Related to Brazilian Bribery

On December 9, 2025, Glenn Oztemel, a former oil trader who worked for two companies, including Freepoint Commodities, was sentenced by a federal court to 15 months in prison "for his role in a nearly eight-year-long scheme to bribe Brazilian government officials [at state-owned oil company Petrobras] and to launder money to secure business for… two companies where he worked." The court also imposed a fine of $300,000. In its sentencing memorandum, the DOJ argued for a much longer sentence, as well as forfeiture. On January 6, 2026, a DOJ filing stated that Oztemel agreed to forfeit just over $1.7 million.

Oztemel was convicted by a jury at trial on September 26, 2024, of conspiracy to violate the FCPA, conspiracy to commit money laundering, three counts of violating the FCPA, and two counts of money laundering. In August 2025, a federal judge denied his motion for a new trial.

Oztemel's brother Gary Oztemel pleaded guilty in June 2024 to money laundering and was sentenced in October 2024 to two years of probation and forfeiture. Another defendant, Eduardo Innecco, was arrested in France but fled to Brazil to avoid extradition to the U.S. In a December 8, 2025 pleading, the DOJ noted that Innecco died in late October 2025 and requested that the court dismiss the case against him. Oztemel's former employer, Freepoint Commodities, entered a three-year DPA with the DOJ (and an agreement with the Commodity Futures Trading Commission (CFTC)) in December 2023 under which the company paid a criminal penalty of $68 million and an administrative forfeiture of $30.5 million related to FCPA charges arising in part from Oztemel's activities.

Litigation

Sixth Circuit Upholds Privilege of Internal Investigation in FirstEnergy Shareholder Suit

On October 3, 2025, the U.S. Court of Appeals for the Sixth Circuit reversed a district court decision and held that material from two internal investigations of FirstEnergy Corporation (FirstEnergy) conducted by outside counsel was protected from disclosure under both attorney-client privilege and the work-product doctrine.

In 2020, FirstEnergy and its board initiated two internal investigations after the DOJ brought criminal charges against former Ohio House Speaker Larry Householder, alleging he was involved in a bribery scheme implicating FirstEnergy that resulted in the passage of legislation favorable to FirstEnergy. In connection with the charges, the DOJ issued subpoenas to FirstEnergy. Shortly after, shareholders sued FirstEnergy in a securities class action demanding access to materials from outside counsel's internal investigation of FirstEnergy. At the district court proceedings related to discovery, a special master recommended, and the district judge agreed, that the internal investigation materials were not subject to attorney-client privilege or work-product protections. FirstEnergy appealed that ruling and requested a writ of mandamus to prevent production of the investigation materials.

The Sixth Circuit reversed the district court's holding, finding that FirstEnergy "clearly sought legal advice" when it retained outside counsel to advise on how to navigate potential civil and criminal liability in response to the DOJ subpoenas and investigation. The court noted that FirstEnergy frequently met with outside counsel to discuss findings, updates, and legal assessment of liability. Because the investigations were conducted for the purpose of providing legal advice, the court determined that they were protected by the attorney-client privilege doctrine in line with the Supreme Court's decision in Upjohn Co. v. United States, 449 U.S. 383 (1981), which remains the leading authority regarding whether and when attorney-client privilege applies when a corporation seeks legal advice to assess risks of criminal and civil liability.

In reaching this conclusion, the Sixth Circuit rejected the district court's characterization that the internal investigations were initiated for "business advice," a finding based on the district court's conclusion that FirstEnergy later used the information obtained from the investigation to make business decisions. The Sixth Circuit clarified that attorney-client privilege turns on whether a company seeks legal advice, not what it chooses to do with that advice. Companies regularly consult their attorneys about a variety of legal questions connected to ordinary business problems, like the legal implications of adjusting compensation plans, filing for bankruptcy, or terminating employees. The court thus found that any business purpose for seeking legal advice does not "transform the communication[] and legal work into something other than legal advice."

The court also held that the FirstEnergy internal investigations were protected by the work-product doctrine, which applies to documents prepared by lawyers in anticipation of litigation. The court found that the company conducted the investigation in "reasonable" anticipation of litigation for a variety of potential government investigations, civil suits, securities law claims, and regulatory proceedings, some of which commenced upon the company being subpoenaed by the DOJ. The court noted that FirstEnergy would not have initiated the investigation "but for" the legal action against it, drawing the connection between the commencement of the internal investigation and the anticipation of litigation.

The Sixth Circuit's decision adopted arguments advanced by, among others, Miller & Chevalier in an amicus brief, signed by 39 law firms, submitted to the court in August 2024. The decision also reaffirms Upjohn's applicability to internal corporate investigations, which are an important component of effective corporate compliance programs.

SEC Developments

The SEC remains focused on areas outside the FCPA context. On January 12, 2026, the agency announced the appointment of two deputy directors for enforcement to oversee regional office activities. The fourth quarter of 2025 continued a trend of announcements that detailed the end of SEC FCPA-related investigations without action.

Charles River Laboratories Announces End of SEC Investigation

In a disclosure dated November 14, 2025, medical research company Charles River Laboratories announced that the SEC "notified the Company that it concluded its investigation [disclosed in 2023 related to "the sourcing of non-human primates"] and… it does not intend to recommend an enforcement action by the SEC against the Company." The disclosure also stated that "the Company's independent investigation into these matters has also concluded, with no material findings."

As noted, Charles River Laboratories disclosed in May 2023 that the SEC was investigating the company's "shipments of non-human primates from Cambodia" for medical testing. The disclosure occurred shortly before another company, Inotiv, revealed in August 2023 that it was cooperating in a new FCPA-related investigation by the SEC regarding the importation of non-human primates from Asia, including information relating to whether corporate importation practices complied with the FCPA. Charles River Laboratories did not note an FCPA connection. Inotiv announced the end of its SEC investigation in June 2025.

Calavo Growers Announces End of SEC Investigation

On December 22, 2025, Calavo Growers, Inc., a food distributor, announced that it received a letter from the SEC notifying the company that it had concluded its investigation of potential FCPA violations in Mexico and "does not intend to recommend an enforcement action by the Commission against the Company." Calavo Growers announced the launch of an internal investigation and subsequent voluntary disclosure to the DOJ and SEC in its 10-K dated January 31, 2024. As noted in our FCPA 2025 Autumn Review, the DOJ previously closed its investigation of the company on September 2, 2025.

Supreme Court to Decide Disgorgement Dispute

In an early 2026 development that could significantly impact SEC enforcement of the FCPA in the future, the Supreme Court granted certiorari on January 9, 2026, to hear an appeal in the case Sripetch v. SEC. At issue is whether a federal court can award disgorgement in an SEC enforcement action "without a finding of pecuniary harm to investors" (in the words of the U.S. government's brief). The petitioner challenged this authority but lost at both the district court and in an appeal to the Ninth Circuit. However, as the U.S. government brief notes, the Ninth Circuit decision does not align with decisions on similar arguments in the Second Circuit. The U.S. government, while agreeing with the Ninth Circuit decision that allowed disgorgement in such matters, supported the Supreme Court's taking the case. The issue centers, in part, on the interpretation of the 2020 Supreme Court decision in Liu v. SEC and subsequent congressional amendments to the Exchange Act enacted as part of the FY 2021 National Defense Authorization Act (NDAA).

MDB Developments

World Bank Debars Indian Company Transformers and Rectifiers

On November 4, 2025, the World Bank issued a three-year-and-seven-month debarment with conditional release for Indian company Transformers and Rectifiers (India) Ltd. (T&R) for engaging in fraudulent and corrupt practices in relation to an electricity project in Nigeria. The World Bank Integrity Vice Presidency (INT) alleged fraud over T&R's failure to disclose commission payments to two agents during the bidding and execution stages of a power equipment supply contract and for making improper payments to public officials. The Bank applied aggravating and mitigating factors to reach the duration and conditions of its enforcement action. It found that the multiple incidents of misconduct and the involvement of high-level management in the misconduct constituted aggravating factors, while the cooperation T&R provided to the Bank's investigation was a notable mitigating factor. Debarment was conditional upon T&R's implementation of remedial measures to address the specific sanctionable misconduct and integrity compliance measures to prevent future misconduct.

World Bank Integrity Guidelines Updated to Focus on Risk Assessment, Obstruction, and Technology Issues

On November 24, 2025, the World Bank issued revised Integrity Compliance Guidelines to "provide practical guidance to [sanctioned] entities… whose release from [Bank] sanctions (e.g., debarment with conditional release, conditional non-debarment) is conditioned on the sanctioned entity developing, adopting, and implementing integrity compliance measures."

World Bank Anti-Corruption Chief Steps Down

Mouhamadou Diagne stepped down as the vice president of the World Bank Group (WBG) INT in December 2025. After joining the WBG in 2020, Diagne oversaw the unit responsible for conducting investigations and pursuing sanctions in connection with fraud, corruption, collusion, coercion, and obstruction in projects financed by the WBG. Before joining INT, Diagne served as the Inspector General of the Global Fund to Fight Aids, Tuberculosis, and Malaria, where he managed and led investigations into fraud and corruption in programs financed by the Fund.

Lisa Rosen, the WBG’s Head of Ethics, has been appointed interim chief of INT.

International Developments

Spanish Court Orders Extradition of U.N. Official to the U.S. for Alleged Bribery

On October 20, 2025, the Audiencia Nacional, Spain's High Court for criminal matters, ordered the extradition of Vitaly Vanshelboim, a Ukrainian national and former high-ranking official with the United Nations (U.N.) Office for Project Services, to the U.S. in connection with allegations of bribery and money laundering. The arrest warrant, issued by a U.S. federal grand jury in the Southern District of New York (SDNY), alleges that Vanshelboim accepted $3 million in bribes from a British businessman, David Kendrick, in exchange for directing more than $60 million in U.N. contracts to Kendrick's business in areas such as sustainability, housing, and ocean protection. Last year, a U.N. Tribunal ordered Vanshelboim to repay $58.8 million to the Office for Project Services. The U.N. fired Vanshelboim in January 2023 following an internal investigation. According to media reports, the decision to extradite ultimately rests with the Spanish Prime Minister.

Brazilian Lower Court Nullifies J&F Investimentos' Lava Jato-related R$10 Billion Fine

On November 4, 2025, a Brazilian lower court nullified part of the 2017 Leniency Agreement signed by J&F Investimentos (J&F) to resolve allegations of bribery in Brazil related to Lava Jato. The court ruled that the 10 billion reals penalty (approximately $1.9 billion) was the result of "administrative arm-twisting" and that the company therefore had no choice but to accept the settlement. According to the court, the penalty was imposed under duress, such that it is completely null. J&F has not been making payments on the penalty since the Brazilian Supreme Court granted an injunction staying the requirement over a year ago.

The lower court ordered the fine to be recalculated based on three "guiding principles": full deduction of amounts already paid to the DOJ; exclusion of the company's global revenue as basis for the penalty; and "rigorous limitation" to those domestic activities directly related to the criminal activity. According to media reports, Brazil's Federal Prosecution Office (MPF) has appealed the decision.

SFO Publishes New Corporate Compliance Guidance

On November 26, 2025, the U.K's Serious Fraud Office (SFO) published an update to its "Guidance on Evaluating a Corporate Compliance Programme," which sets out six scenarios for when the SFO may need to evaluate an organization's compliance program. Originally, the Guidance included only five such scenarios. The SFO would assess an organization's compliance program to determine: (1) whether prosecution of an organization is in the public interest; (2) whether the SFO should enter into a DPA with the organization; (3) whether the SFO should require that organization's DPA to include certain compliance terms or a monitorship; (4) whether an organization has a defense of "adequate procedures" to a charge of Failure to Prevent Bribery; and (5) in accordance with the Sentencing Council Guidelines, in some sentencing decisions related to corporate offenses for fraud, bribery, and money laundering (i.e., a robust compliance program indicates lesser culpability and thus might result in a lighter sentence).

The key change was the inclusion of a sixth scenario: to determine whether a company has "reasonable procedures" in place to prevent fraud, a defense available under the new offense of "Failure to Prevent Fraud," established by the Economic Crime and Corporate Transparency Act 2023 (ECCTA). The organization has a defense if, "at the time of the [offense], [it] had reasonable procedures in place to prevent fraud or if [it] can demonstrate that it was not reasonable in the circumstances to expect the organization to have any procedures in place." As with the other factors, a robust and effective compliance program indicates the existence of reasonable procedures. As we noted in 2024, the SFO will consider six guiding principles in deciding whether the company has sufficient procedures in place to prevent fraud: top level commitment, risk assessment, proportionate procedures, due diligence, training, and monitoring and review.

Wilmar International's Subsidiaries in Indonesia and China Found Guilty of Corrupt Practices

On September 25, 2025, Singapore-based Wilmar International (Wilmar), a food processing and investment holding company, announced in a public filing that the Supreme Court of Indonesia overturned the acquittal of five of its Indonesian subsidiaries. According to the public announcement and information from the Indonesian Attorney General's Office, the subsidiaries have been charged with alleged misconduct in relation to securing palm oil export permits in 2021 during a national shortage.

The next day, September 26, 2025, Wilmar issued another disclosure stating that "the Supreme Court has posted its verdict on its website stating that each of the five Wilmar subsidiaries charged in relation to this matter… is sentenced to a fine of IDR 1 billion (approximately USD 59,666) and that [collectively] the Wilmar [subsidiaries will] be required to pay compensation for State losses totalling IDR 11,880,351,801,176" (over $708 million). Wilmar had already been required to make a "security deposit" of IDR 11,880,351,802,619 with the Indonesian Attorney General's Office, and the disclosure notes that those funds would therefore be transferred to the "State Treasury." Wilmar's statement asserted that "the actions taken by the Wilmar Respondents… were done in compliance with prevailing regulations and in good faith" and that "Wilmar may apply for judicial review of the Supreme Court's decision."

On a related note, the judges who originally acquitted the subsidiaries were later arrested for allegedly accepting bribes to render a favorable decision.

Separately, on November 19, 2025, Wilmar disclosed that its local subsidiary in China, Yihai Guangzhou Oils & Grains Industries (Guangzhou Yihai) was found guilty of contractual fraud for allegedly participating in a scheme to defraud a Chinese state-owned palm oil importer, Anhui Huawen. According to media reports, the public prosecutor's office charged Guangzhou Yihai with being an "accomplice" to the fraud, alongside privately owned Yunnan Huijia Import and Export Co., Ltd. Wilmar denied the accusations and stated that it intends to appeal the lower court's judgment. Wilmar's statement asserts that "Guangzhou Yihai's position has always been that Yunnan Huijia, having bribed executives and employees of Anhui Huawen, fabricated transactions which resulted in losses to Anhui Huawen, and is now attempting to implicate Guangzhou Yihai and shift responsibility for such losses to Guangzhou Yihai."

SFO Formally Arraigns Six Ex-Glencore Employees with Conspiracy to Make Corrupt Payments in West Africa

On November 10, 2025, the SFO formally arraigned six former Glencore executives and traders, including the former head of the company's oil trading division, with "various[] charge[s] in connection with the awarding of oil contracts spanning Cameroon, Nigeria and the Ivory Coast from 2007 to 2014." Some of the defendants were also charged with "falsifying documents for an accounting purpose to Glencore's London office, marked as service fees to a Nigerian oil consultancy." The SFO originally brought the charges in August and September 2024.

All six defendants pleaded not guilty. The trial is currently scheduled for October 4, 2027.

OECD Working Group on Bribery Presses U.S. on FCPA Enforcement

After not attending the March 2025 plenary meeting of the Organisation for Economic Cooperation and Development's (OECD) Working Group on Bribery, the U.S. sent representatives to the June plenary session. The public summary record of that session was released during Q4 2025. Among other agenda items, the record states that the Working Group "[h]eard the United States provide an update on developments following Executive Order 14209, including the issuance of new FCPA Guidelines in June 2025…." The summary further notes that "Member countries asked questions about the Guidelines' interpretation, prioritisation, corporate liability, enforcement resources, and mutual legal assistance." The U.S. representatives reportedly "confirmed that [the U.S.] remains committed to prosecuting foreign bribery and that it is continuing to investigate and prosecute FCPA matters."

In conclusion, the report states that "[t]he Working Group decided to invite the United States to provide a written update in December 2025 on the review of pending and new FCPA matters, enforcement resources, and any changes to SEC policies." The summary record of that plenary session (which occurred on December 9-12) is not yet available as of the date of publication. The published agenda shows that the session included a half hour timeslot for discussion of a "United States Phase 4 ad hoc written report."

EU Parliament and Council Reach "Provisional Agreement" on New EU Anti-Corruption Directive

On December 2, 2025, the EU Parliament and EU Council announced that the two bodies had reached a "provisional agreement on the EU's first ever directive harmonising criminal laws to fight corruption, strengthening efforts to prevent, prosecute and punish offences across the EU." According to the announcement, the new directive would "set[] harmonised definitions for offences such as bribery, misappropriation of funds, and obstruction of justice" to be used by all EU Member States and "establish a common level for maximum prison sentences across the EU, while allowing each country to legislate for stricter penalties." The announcement further noted that "[t]he negotiators also agreed on rules on liability of legal persons and better alignment with legislation protecting EU financial interests." The directive would enhance "cooperation among national authorities and EU bodies including the European Anti-Fraud Office (OLAF), the European Public Prosecutor's Office, Europol and Eurojust."

The EU Commission first proposed the draft directive in May 2023 as part of a broader set of anti-corruption initiatives. The proposal went to the EU Parliament, which issued a report in February 2024 on its own positions relating to an EU-wide anti-corruption directive. The report included a side-by-side analysis of the Parliament's proposals compared to the 2023 draft Commission directive, and showed that the Parliament was proposing, among other things, additional provisions that address "demand"-side bribery, especially when high-level officials are involved. Negotiations on reconciling and finalizing the proposed directive among the Commission, Parliament, and European Council occurred in late 2024 and through the first half of 2025. By mid-year 2025, negotiations had reached an impasse over several issues, including the inclusion of "abuse of functions" as a criminal offence, obligations to create and fund new national authorities, and issues of subsidiary and proportionality related to the intersection of the directive with national laws and policies.

The negotiations in the fall of 2025 appear to have addressed these issues, though it remains to be seen if some of the compromises will survive to the final, approved text. The EU Parliament's summary states, for example, that "[r]egarding the contentious issue of abuse of functions, the term is not used in the final agreement" – rather, "the agreed wording establishes an obligation for Member States to 'ensure that at least certain serious violations of law in the performance of or failure to perform an act by a public official in the exercise of his functions are punishable as a criminal offence, when committed intentionally'."

Of note for compliance personnel, the draft directive will "mandate[] the annual publication of EU-wide corruption data" and each EU Member State will be "required to adopt and publish national anti-corruption strategies, developed in consultation with civil society and a range of stakeholders."

Both the Parliament and Council must go through the process of final approval for the provisional agreement; that process has begun as of early 2026.

France's Highest Court Narrows Attorney-Client Privilege

On September 30, 2025, the Criminal Chamber of France's highest court, the Court of Cassation, narrowed the scope of attorney-client privilege by holding that legal privilege covers only those communications connected to a lawyer's advisory work when the client either "expects to be prosecuted in the near future" or "knowing that he has committed a criminal offence, prepares his defence."

The case involves the National Financial Prosecutor (PNF), the agency tasked with prosecuting complex financial crimes. The agency seized documents, including timesheets and legal records, from a law firm in connection with a proceeding against an individual accused of favoritism, embezzlement of public funds, and receiving stolen goods. The defendants argued that the seized documents were covered by legal privilege, but the Court of Cassation disagreed, upholding a lower court decision that the documents were not closely related to a legitimate defense ("since they were not documents relating to judicial proceedings or proceedings aimed at imposing a sanction") to warrant protection by legal privilege. The court also upheld the lower court's decisions that cited EU laws were not applicable to the case and that "all the seized documents, covered by attorney-client privilege, were necessary to establish the truth, as the offenses being prosecuted were related to the proper use of public funds, which is at issue in the proceedings."

This ruling restricts the ability of corporations to seek privileged legal advice regarding compliance matters where such advice is "not related to the exercise of the rights of the defense." Under this ruling written communications, fee records, timesheets, and other potentially sensitive information may not be protected by legal privilege in France if prepared outside the posture of potentially impending litigation. Faced with the risk of disclosure, any company with legal operations in France may be discouraged from obtaining legal advice on compliance issues until prosecution appears likely and defense preparation becomes imminent. Such a shift could undermine the preventative purpose of compliance programs and could weaken the overall adherence to global corporate norms.

Indian Supreme Court Affirms Advocate-Client Privilege for Advocates But Leaves In-House Counsel in the Lurch

On October 31, 2025, the Indian Supreme Court reaffirmed the importance of advocate-client privilege for independent advocates, while casting uncertainty over its application for in-house counsel.

The case arose from a challenge to a police summons issued to the advocate who had filed a bail application for a client in a loan dispute. The summons sought to "know the true details of the facts and circumstances" of the case. The Gujarat High Court upheld the summons, disregarding the protections afforded under advocate-client confidentiality.

The Indian Supreme Court took up this case on their own initiative without being prompted by a petition or motion. The Court examined recent evidence legislation, known as the Bhartiya Sakshya Adhiniyam (BSA), specifically analyzing section 132, which forbids advocates from disclosing communication made by a client during the course of a professional engagement. The Court held that this section imposes "absolute confidentiality" on the advocate because the privilege is held by the client, a protection which can only be waived through express client consent, where communications further an illegal purpose, or where the advocate observes a crime or fraud after representation begins. While the privilege is held by the client, it confers immunity to the advocate, shielding them from compelled disclosure of otherwise privileged information, even during the course of an investigation. The Court concluded section 132 prevents police and other investigative authorities from overriding advocate-client privilege outside of the noted limited exceptions.

However, the judgment sharply diverged when addressing whether legal privilege protections apply to communications involving in-house counsel. The Court held that a salaried in-house lawyer does not fall within the definition of an "advocate" and therefore cannot claim privilege for communications with their employer under section 132. In reaching this conclusion, the Court took "notice" of the European Court of Justice's (ECJ) Akzo Noble Limited v. European Commission, which limits legal professional privilege to legal advice provided "in full independence," excluding in-house counsel due to their "economic dependence" and "close ties" to their employer. The Indian Supreme Court similarly reasoned that in-house counsel lack the requisite professional independence, rendering them "beholden" to their employer and ineligible for the statutory privilege conferred on independent advocates under section 132 of the BSA.

The ruling introduces significant risk for companies operating in India that rely on in-house legal teams. Internal reports, interview summaries, whistleblower complaints, and legal advice prepared by in-house lawyers may now be vulnerable to compelled disclosure during investigations by Indian authorities, which could also have consequences beyond India for multinational companies in cross-border investigations that involve Indian operations.

While there are important differences in scope, both the French and Indian court rulings mean that internal reports, emails, messages, interview notes, and compliance assessments prepared by in-house counsel outside a litigation posture may be vulnerable to compelled disclosure or exposure in those jurisdictions. These rulings thus threaten to undercut the preventative function of in-house legal and compliance personnel, potentially undermining the operation of corporate compliance programs.

Five International Law Enforcement Agencies, Including the U.S. FBI, Publish Indicators of Foreign Bribery

On December 22, 2025, the International Foreign Bribery Task Force (IFBTF) published Indicators of Foreign Bribery, a list of key indicators intended to help individuals working in high-risk industries recognize and report instances of foreign bribery. The IFBTF task force (part of the "Five Eyes" intelligence-sharing group of anglophone countries) is comprised of anti-bribery specialists from the Australian Federal Police, Royal Canadian Mounted Police, New Zealand Police and Serious Fraud Office, U.K. SFO and National Crime Agency, and the U.S. Federal Bureau of Investigation (FBI).

The publication of Indicators of Foreign Bribery marks the first time these five law enforcement agencies have issued a public joint report on foreign bribery. Indicators identifies examples of conduct related to third party transactions, government affiliation, country links, ownership, corporate registration, and associations to help individuals identify and assess foreign bribery risk. The report emphasizes that "[t]aken in isolation the indicators do not automatically equate to criminal activity [but] [i]nstead, they highlight factors which, when considered in combination and within context, raise the risk profile suggesting further evaluation or assessment is warranted." The report also notes that "[s]ome of the indicators are common to other financial crimes, including money laundering."

Indicators is more comprehensive than the list of third party red flags included in the latest version of the DOJ/SEC FCPA Resource Guide issued in 2020, though they reflect factors cited in guidance issued by some of the other agency authors and guidance by international organizations.

Miller & Chevalier Recent Publications and Podcasts

Podcasts

EMBARGOED! is intelligent talk about sanctions, export controls, and all things international trade for trade nerds and normal human beings alike, hosted by Miller & Chevalier. Each episode will feature deep thoughts and hot takes about the latest headline-grabbing developments in this area of the law, as well as some below-the-radar items to keep an eye on. Subscribe for new bi-monthly episodes so you don't miss out: Apple Podcasts | Spotify | Amazon Music | YouTube

Recent Publications

| 02.18.2026 | Trade Compliance Flash: Trump's America First Arms Transfer Strategy Prioritizes the Domestic Industrial Base (Timothy P. O'Toole, Alex L. Sarria, Jason N. Workmaster, Melissa Burgess, Collmann Griffin, Ashley Powers, Caroline J. Watson, Connor W. Farrell, Elissa B. Harwood, Peter Kentz) |

| 02.11.2026 | Cartels, Sanctions, and Terrorism Designations: A Practical Glossary (Matteson Ellis, Laura G. Ferguson, Ian A. Herbert, James G. Tillen, Collmann Griffin, Franco Jofré) |

| 02.11.2026 | Lexology Panoramic Next: Anti-Bribery & Corruption 2026 - Global & USA Chapters (Ian A. Herbert, Leah Moushey, James G. Tillen, Katie Cantone-Hardy, Jesse Schwab) |

| 02.05.2026 | Trade Compliance Flash: Criteria for Using Venezuela General License No. 46 (Leah Moushey, Timothy P. O'Toole, Melissa Burgess, Collmann Griffin, Caroline J. Watson, Arooshe P. Giroti, Peter Kentz) |

| 01.14.2026 | How U.S. Companies May Return to Venezuela and Be Compliant (Matteson Ellis) |

| 01.08.2026 | End-of-Year DOJ Announcements Signal Increased Risk to Importers from Criminal and Civil Trade Fraud Enforcement (William P. Barry, Joshua Drew, Richard A. Mojica, Bradley E. Markano, Brittany Huamani) |

| 12.03.2025 | Trade Compliance Flash: IEEPA Tariff Litigation & Refunds: What Should Importers Be Doing Now? (Adam P. Feinberg, Richard A. Mojica, Julia M. Herring) |

Editors: John E. Davis, James G. Tillen

Contributors: Alexandra Beaulieu, Arooshe P. Giroti, Igor Sampley dos Santos

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.