FCPA Spring Review 2012

International Alert

Introduction

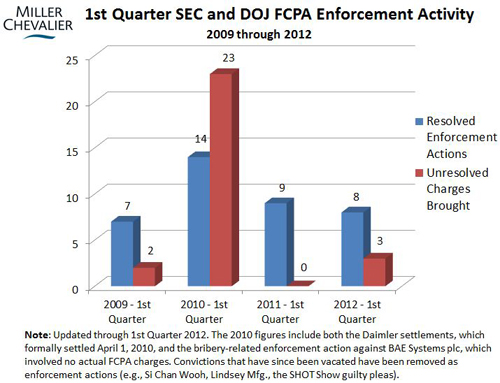

Enforcement in 2012: Foreign Corrupt Practices Act ("FCPA") enforcement activity through the first quarter of 2012 is roughly on par with enforcement activity over the same time period last year, and remains significantly down from the record heights reached in 2010. The U.S. Department of Justice (“DOJ”) and the U.S. Securities and Exchange Commission ("SEC") announced eight resolved enforcement actions during the first three months of 2012, which is one fewer than the nine resolved actions announced during the first quarter of 2011 (excluding the now-vacated SHOT Show guilty pleas) and significantly fewer than the 14 resolved actions during the first quarter of 2010. The agencies also brought still unresolved charges against three additional individuals during the first three months of the year, compared with no charges during the first quarter in 2011 and an unmatched 23 charges in 2010.

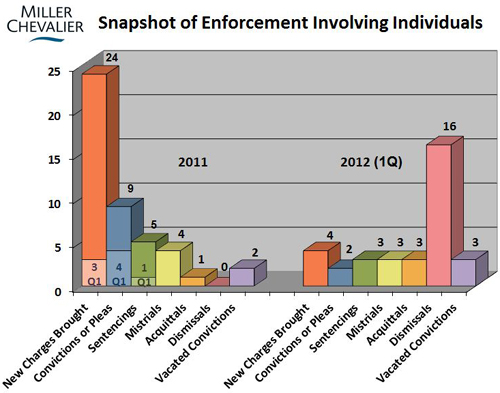

Individual Defendants: As noted in our FCPA Winter Review, one possible reason for the decline in enforcement dispositions since 2010 is the increase in the number of individuals standing trial on FCPA-related counts, which may be diverting government resources from settling corporate actions. It comes as no surprise, then, that the most significant anti-corruption developments this quarter relate to the U.S. government’s continuing efforts to prosecute individual defendants. Although we are just a few months into 2012, we have already seen:

- The collapse of a case against a former executive of a multi-national company on twelve corruption-related counts (John O’Shea);

- A second mistrial in the troubled SHOT Show cases (alongside two more acquittals), and the U.S. government’s subsequent decision to abandon the prosecution of the remaining SHOT Show defendants altogether;

- Comparatively light sentences handed down to key players (Jack Stanley, Jeffrey Tesler and Wojciech Chodan) convicted in connection with one of the largest bribery schemes ever prosecuted under the FCPA; and

- New civil charges brought against several former executives caught up in a long-running industry-wide investigation into the oil and gas industry (Noble Drilling executives).

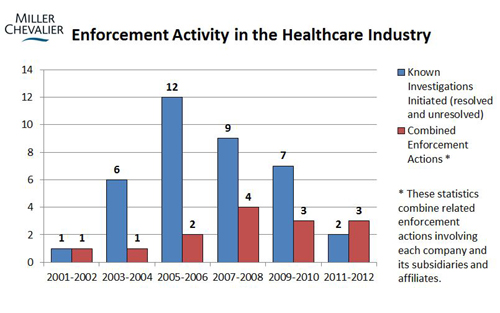

Focus on Health Care Industry: Two medical device manufacturers have resolved enforcement actions so far this year. Along with last year’s Johnson & Johnson settlement, these dispositions represent what is expected to be just the first wave of settlements to come out of industry-wide investigations into the medical-device and pharmaceutical industries initiated by the DOJ and SEC in 2007 and 2010, respectively. Even with the recent resolutions, there is still a backlog of ongoing investigations against more than 20 companies in the health care industry that stretch back to 2007 and earlier. As previously reported in our FCPA Autumn Review 2010, Assistant Attorney General Lanny Breuer noted in 2009 that the application of the FCPA to the pharmaceutical industry would be one area of focus for the agency in the "months and years ahead" because the depth of government involvement in health care systems abroad created an environment ripe for corrupt payments in connection with the sale of pharmaceuticals. Since many doctors and hospital personnel are employed by state-owned facilities, they are considered by enforcement authorities to be "foreign officials" under the FCPA. As a result, pharmaceutical (and other health care) companies covered by the FCPA can interact with officials in connection with any aspect of their business, from imports to clinical trials to marketing to sales to doctors and hospitals. As detailed in the chart below, since 2002, at least 37 companies in the health care industries have announced investigations of potential corrupt payments outside the United States. At least 15 of these companies have resolved the allegations against them, while the rest of the investigations are ongoing.

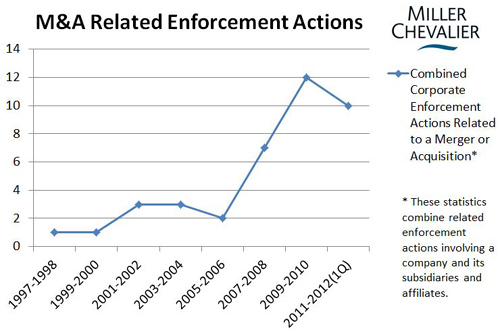

M&A: On the compliance front, after repeatedly faulting companies for failing to conduct FCPA due diligence in connection with mergers and acquisitions, the DOJ has now included new, more detailed terms related to M&A activities in its list of standard compliance program elements that companies subject to Deferred Prosecution Agreements ("DPA") and a Non-Prosecution Agreements ("NPA") must adopt. In a recent DPA for BizJet International Sales and Support, Inc. and in a related NPA for Lufthansa Technik AG, the DOJ included terms that required the companies to, among other things, conduct appropriate FCPA due diligence on prospective acquisitions, report to the DOJ any corrupt payments or inadequate internal controls in newly acquired or merged businesses discovered through such due diligence, and train new employees on company anti-corruption compliance requirements and related internal controls.

FCPA Reform: The prospect of FCPA reform continues to attract attention, particularly since Assistant Attorney General Breuer acknowledged the debate over the need for reforms this past November and announced that the DOJ had plans to release "detailed new guidance" on the FCPA’s "criminal and civil enforcement provisions" in 2012 (more recent comments from the DOJ have suggested a late spring/early summer release date). In anticipation of the forthcoming guidance, Senators Amy Klobuchar (D-MN) and Chris Coons (D- DE), as well as a coalition of business organizations led by the U.S. Chamber Institute for Legal Reform ("ILR"), issued separate letters calling for the guidance to cover a number of areas of concern to businesses seeking to comply with the FCPA. Last week, the ILR and other stakeholder groups met with the DOJ and SEC for a roundtable discussion to address the scope and substance of the forthcoming guidance. While participants described the meeting as “constructive and positive,” there is reportedly a sense among some reform proponents that certain concerns can realistically only be addressed by legislative action.

Monitorships: In 2010 and 2011, many FCPA-related dispositions dispensed with a requirement for independent monitors or consultants in favor of requiring companies to self-report to the agencies on the implementation of their compliance program requirements. (See Is There A Trend Away from FCPA Compliance Monitors?) This quarter, however, the U.S. government has required monitors in a majority of its dispositions, including Smith & Nephew, Biomet, and Marubeni. Whether this represents a general reverse to the earlier trend, or instead is tied to specific case circumstances (for example, two of the settlements are part of the health care industry investigations and the third is related to the Bonny Island cases, in which all but one of the defendants has had a monitor imposed) remains to be seen. The Biomet and Smith & Nephew dispositions also employed a new model for monitorships, combining the imposition of an external monitor for an initial period of 18 months with follow-up self-reporting obligations for the remainder of the companies’ probationary periods.

Actions Against Corporations

Biomet Settles FCPA Charges for Payments to Health Care Providers in Latin America and China

On March 26, 2012, the U.S.-based medical device manufacturer Biomet Inc. ("Biomet") settled FCPA charges brought by the DOJ and SEC over allegations that Biomet and its U.S., Argentine, Swedish, and Chinese subsidiaries bribed publicly-employed health care providers ("HCPs") and hospital administrators in Argentina, Brazil, and China for nearly a decade to win business.

According to the criminal information, from 2000 to 2008, Biomet authorized more than $1.5 million in illicit payments (both direct and indirect), some or all of which were provided to publicly-employed HCPs in the form of money or other “things of value” to induce the purchase of Biomet products. Employees at various levels within Biomet and its subsidiaries, including senior-level executives and at least six U.S. citizens, were allegedly complicit in this bribery, as were certain distributors in Brazil and China.

Under the scheme, Biomet Argentina agreed to pay HCPs in Argentina illicit commissions between 15-20%; Biomet International (U.S.) agreed to pay HCPs in Brazil illicit commissions between 10-20% through a Brazilian distributor; and Scandimed (Biomet Sweden) and Biomet China agreed to pay HCPs in China illicit commissions between 5 to 25% through a Chinese distributor. In addition, the Biomet affiliates in China made improper payments in connection with clinical trials, hosted banquets, sponsored attendance at meetings, and provided inappropriate leisure travel. To facilitate these illicit payments, according to the criminal information, Biomet executives, employees, and distributors falsely recorded certain payments to publicly-employed HCPs as "commissions," "royalties," "consulting fees," "other sales and marketing," and "scientific incentives" to conceal the true nature of the payments in the company’s books and records.

In 2007, the SEC and DOJ sent letters to Biomet inquiring into payments the company had allegedly made to certain publicly-employed doctors. These letters triggered an internal investigation by Biomet that resulted in the eventual cessation of the improper payments. To resolve the associated conspiracy, anti-bribery, books and records and internal controls charges against it, Biomet entered into a DPA with the DOJ and consented to the settlement of a complaint by the SEC. As part of these dispositions, Biomet agreed to pay a $17.28 million criminal penalty, disgorge $5.57 million in illicit profits and pre-judgment interest (for a total of $22.85 million), and implement rigorous internal controls. Biomet also agreed to a hybrid monitorship—agreeing to retain an independent compliance monitor for 18 months, after which it would provide periodic reports to the DOJ for the remainder of the DPA—and to continue cooperating with the investigations of other companies and individuals.

Noteworthy Aspects

- Industry-Wide Investigations – Biomet’s settlement comes just weeks after fellow medical device manufacturer Smith & Nephew resolved its own corruption charges with the DOJ and SEC by agreeing to pay more than $22 million in fines and penalties. Along with last year’s Johnson & Johnson disposition (see our FCPA Spring Review 2011), these enforcement actions represent the first wave of settlements from a backlog of ongoing investigations that the DOJ and SEC are conducting against more than 20 companies in the health care industry (spanning industry-wide investigations in both the medical device and pharmaceutical industries).

- Knowledge by Senior Personnel – Similar to the enforcement actions brought against Smith & Nephew in February, senior personnel within Biomet, including a U.S.-based Senior Vice-President and members of Internal Audit, were aware of and failed to stop the company’s improper payments to publicly-employed HCPs. According to the case documents, from 2000 through 2008, numerous executives, managers, and auditors at Biomet (both in the U.S. and elsewhere) had direct knowledge of the illicit payments made by Biomet and/or its distributors in Argentina, Brazil and China. The DOJ and SEC pleadings cite numerous internal e-mails and memoranda discussing these payments as well as admissions from certain key players. Despite this knowledge, executives, managers and auditors at Biomet did not take actions to stop these illicit payments until late 2008. For instance, the U.S.-based Director of Internal Audit reported to the Senior Vice President and others in the United States that royalties were paid to surgeons in Argentina upon request and were disclosed in the accounting records as “commissions.” In 2005, this same Director of Internal Audit instructed an auditor to classify improper payments being made to doctors in connection with certain clinical trials as "entertainment." In the SEC’s press release announcing the settlement, Kara Brockmeyer, the Chief of the SEC’s FCPA Unit, observed that a “company’s compliance and internal audit should be the first line of defense against corruption, not part of the problem.”

- Inappropriate Gifts and Hospitality in China – Biomet is the latest in a long line of cases spanning various industries to involve the provision of inappropriate gifts, hospitality, and entertainment in exchange for business in China (see, e.g., IBM, Inc.; RAE Systems, Inc.; Veraz Networks, Inc.; Daimler AG; UTStarcom, Inc., Control Components, Inc.; Avery Dennison Corp.; Lucent Technologies, Inc., etc.). The information references the provision of meals, gifts, banquets, sponsorships to attend meetings, and personal and leisure travel, with numerous internal emails and memoranda suggesting that this is how business in China is conducted. In one instance, Biomet China allegedly sponsored the travel of 20 surgeons to Spain for purported training where a substantial portion of the trip was instead "devoted to sightseeing and other entertainment at Biomet’s expense." U.S. enforcement authorities have an expectation that companies operating in China will implement sufficiently robust internal controls, with a particular focus on gifts, travel and entertainment, to account for the high potential corruption risks involved in conducting business there.

- Benefits of Biomet’s Cooperation and Remediation – The DOJ agreed to enter into a DPA with a three-year term on the basis of, among other things: the company’s internal investigation; continued cooperation with the agencies (including the provision of "substantial assistance" in the DOJ’s investigations of other companies and individuals); disclosure of misconduct ("a portion of which was voluntarily disclosed"); and "extraordinary" remediation (including implementation of an enhanced compliance program). In addition to helping Biomet avoid a possible FCPA conviction (which the DPA states would have potentially subjected the company to “exclusion from participation in federal health care programs, the DPA also imposed a reduced monetary penalty which was 20% off the bottom range fine in the Federal Sentencing Guidelines ($17.28 million from $21.6 million). These benefits notwithstanding, as noted above, Biomet’s settlement also included the imposition of a hybrid monitorship first seen in Smith & Nephew earlier this year (see below), which requires a period of self-reporting following an abbreviated 18-month program assessment by an independent compliance monitor.

BizJet Resolves FCPA Charge and Lufthansa Technik Enters NPA with DOJ

On March 14, 2012, the DOJ announced that BizJet International Sales and Support, Inc. ("BizJet"), a provider of aircraft maintenance, repair, and overhaul ("MRO") services based in Tulsa, Oklahoma, paid a criminal penalty of $11.8 million and entered into a three year DPA to resolve an FCPA related charge. In addition, the DOJ entered into an NPA with Lufthansa Technik AG ("Lufthansa Technik"), BizJet’s indirect German parent company and a subsidiary of Deutsche Lufthansa AG, the German airline.

The DOJ’s criminal information, filed in the U.S. District Court for the Northern District of Oklahoma, charged BizJet with one count of conspiring to violate the FCPA’s anti-bribery provisions. According to the criminal information and the DPA, three BizJet executives and a BizJet sales manager paid bribes to foreign officials of the Mexican and Panamanian governments either directly or indirectly through a shell company owned and operated by the BizJet sales manager in order to obtain or retain contracts to perform MRO services. The officials who allegedly received the bribes were: a Captain in the Mexican Federal Police; a Colonel, a Captain, and an employee in the Mexican President’s Fleet; the Director of Air Services for the Mexican state of Sinaloa; and the chief mechanic at the Panama Aviation Authority. According to the information, all of these officials had decision-making authority and influence over the award of MRO contracts.

The court documents indicate that BizJet employees frequently communicated about the payments to employees of potential government clients. For example, on November 16, 2005, two of the three BizJet executives involved in the scheme discussed with BizJet’s Board of Directors the company’s decision to pay commissions in the amount of $30,000 to $40,000 demanded by employees of potential clients. In June 2006, the BizJet sales manager told a customer relations employee that BizJet would purchase a cellular telephone and pay a $10,000 bribe to the Panama Aviation Authority’s chief mechanic.

According to the DPA, BizJet discovered the FCPA violations during the course of an internal audit at which point it initiated an internal investigation and voluntarily disclosed the violations to the DOJ. In calculating the penalty, the DOJ recognized BizJet’s cooperation and remediation efforts, which included conducting an internal investigation, making employees available for interviews, collecting, analyzing, and organizing voluminous evidence for the DOJ, terminating the employees responsible for the corrupt payments, and enhancing its compliance program. For these reasons, the DOJ issued a criminal penalty of $11.8 million, which, according to the DOJ, was approximately 30% below the bottom of the fine range provided by the U.S. Sentencing Guidelines ($17.1 million to $34.2 million in this case).

In addition to paying the fine, BizJet agreed in the DPA to continue to cooperate with the DOJ, other domestic or foreign law enforcement authorities, and with Multilateral Development Banks in any investigation into matters related to corrupt payments. BizJet also agreed to report to the DOJ on its compliance efforts on at least an annual basis for a period of three years, and to continue to enhance its compliance program to ensure the program contains all of the elements specified by the DOJ in the DPA’s Appendix.

The DOJ’s three year NPA with Lufthansa Technik indicates that Lufthansa Technik "admits, accepts, and acknowledges responsibility for the conduct of its subsidiary," BizJet. Recognizing the company’s cooperation and remedial efforts, the NPA requires Lufthansa Technik to cooperate in investigations, to notify the DOJ of criminal conduct by its employees and of other enforcement actions related to fraud or corruption, to adopt a compliance program meeting the DOJ’s requirements as set out in the NPA’s Appendix, and to provide the DOJ with annual corporate compliance reports.

Noteworthy Aspects

- Non-U.S. Parent Liability Without Evident Parent Involvement – Neither the DPA nor the NPA indicates that Lufthansa Technik or its employees had any involvement in the activities resulting in the charge against BizJet. Nevertheless, the NPA states that Lufthansa Technik admitted, accepted, and acknowledged responsibility for the conduct of its subsidiary. The DOJ has held U.S. parents liable for the actions of foreign subsidiaries in other settlements using assertive theories of jurisdiction, and this practice is one of the focuses of the reform efforts being led by the U.S. Chamber of Commerce and others. See FCPA Reform section below. This case presents another twist to this practice, in that a foreign parent is being held accountable for the actions of a U.S. subsidiary, with no discussion of the parent’s role in the offense, any failures in the parent’s compliance program, or the basis for jurisdiction over the direct parent.

- New Compliance Program Elements Required by the DOJ – Both BizJet’s DPA and Lufthansa Technik’s NPA include new additions to the DOJ’s standard compliance program elements that apply in the context of mergers and acquisitions ("M&A"). Specifically, the new DOJ terms specifically require that the companies conduct appropriate FCPA due diligence on prospective acquisitions, report to the DOJ any corrupt payments or inadequate internal controls in newly acquired or merged businesses discovered through such due diligence, ensure their compliance policies apply to new businesses, train new employees, and conduct FCPA specific audits of new businesses. Companies that follow best practices in their compliance programs should undertake these types of M&A due diligence and remediation activities, though the mandatory requirement to report issues to the DOJ is likely here as part of the overall enhanced monitoring program required by the settlement agreements.

- International Cooperation – The DOJ press release indicates that the DOJ worked closely with law-enforcement officials in Mexico and Panama, which highlights the continuing trend of international cooperation in such investigations. This may also result in enforcement actions in those countries against BizJet, Lufthansa Technik, or the individuals who gave or received the bribes.

Smith & Nephew Settles FCPA Charges for Payments to Doctors in Greece

On February 6, 2012, the U.K.-based medical device manufacturer Smith & Nephew ("S&N") and its U.S. subsidiary settled FCPA charges brought by the DOJ and SEC in connection with allegations that S&N’s U.S. and German subsidiaries bribed doctors in Greece for more than a decade to win business.

According to the criminal information, certain S&N employees, subsidiaries, and affiliates agreed to sell S&N products at full price to a Greek distributor while paying discounts and commissions (equal to a percentage of such sales) to offshore shell companies controlled by the distributor for "marketing" or "distribution" services that were never in fact performed.

Specifically, in one arrangement, S&N employees sent 25-40% of the full list price paid by the Greek distributor for S&N products to two offshore companies controlled by the Greek distributor. In another arrangement, S&N entered into a "distribution" agreement with a third offshore company controlled by the Greek distributor. Under the agreement, the offshore company purchased goods from S&N at a 35% discount and then re-sold them to the distributor at a full price. In each case, the difference was accumulated off-shore and used to fund improper payments to publicly-employed HCPs. S&N was faulted by the agencies for failing to question why it was making payments to these offshore companies in connection with local sales by a local distributor.

In all, approximately $9.4 million was paid to three offshore companies under this scheme from 1998 to 2008. The information states that the Greek distributor used some or all of these funds to provide cash incentives and other things of value to publicly-employed HCPs in Greece to induce the purchase of S&N products.

In settling, S&N entered into a DPA with the DOJ to resolve criminal anti-bribery, books and records and conspiracy charges, and consented to the entry of judgment against it on civil anti-bribery, books and records and internal controls charges brought by the SEC. As part of these dispositions, S&N agreed to pay a $16.8 million criminal penalty, disgorge $5.4 million in ill-gotten gains and pre-judgment interest (for a total of $22.2 million), implement an enhanced compliance program with rigorous internal controls (as outlined in Attachment C of the DPA), retain a compliance monitor for at least 18 months, and provide periodic reports to the agencies regarding the remediation and implementation of the enhanced compliance program.

Noteworthy Aspects

- Direct Knowledge and Failure to Respond to Red Flags and Potential Misconduct – The pleadings include direct evidence of employee knowledge of improper payments and also fault S&N for failing to act on numerous corruption-related red flags, including:

- Failure to Respond to Issues Raised – S&N failed to promptly stop the misconduct even though issues related to the improper payments were flagged and/or elevated on numerous occasions. Issues regarding the payments were brought to the legal department’s attention as early as 1999 by S&N’s CFO and internal auditors. Over the decade that followed, issues related to the improper payments and the distributor scheme were discussed and/or elevated repeatedly, both within and outside of the United States, by various employees and even the Greek distributor itself. In one instance, after an employee proposed a reduction in the distributor’s commission, the distributor replied over email: "In case it is not clear to you, please understand that I am paying cash incentives right after each surgery…" Following this exchange, S&N decided not to reduce the distributor’s commission. S&N also did not terminate the relationships with the distributor and its affiliates until June 2008.

- Complicated Off-shore Payment Structures – S&N failed to scrutinize suspicious payment structures that directed funds to offshore entities for services provided by in-country vendors – a situation long noted by the DOJ as a potentially serious red flag for both corruption and tax liability issues. These structures were the means through which the Greek distributor acquired the illicit funds it used to bribe publicly-employed HCPs.

- No "Proof of Services Rendered" – Despite the risks present in the Greek market, S&N did not require offshore companies to prove they performed the purported "marketing" or "distribution" services. In fact, the offshore companies did not render any true services.

- Inadequate Due Diligence, Including Post-Acquisition Diligence and Remediation – The SEC faulted S&N for failing to conduct due diligence on the offshore companies it purportedly hired to provide "marketing services." In addition, whatever due diligence S&N may have conducted on the Greek distributor and a company S&N acquired in 2007 to replace the distributor in the Greek market also appears to have been inadequate. S&N later discovered that its newly acquired subsidiary had itself engaged in improper sales practices both prior to and after the acquisition.

- Transactions to Audit – The SEC faulted S&N for failing to conduct any audits of the company’s transactions with the Greek distributor or the offshore companies. Given the numerous red flags surrounding the business dealings with these entities — including specific concerns brought to the attention of the company’s legal department and the Greek tax inquiries noted above — the targeted auditing of certain transactions was clearly warranted.

- Failure to Respond to Issues Raised – S&N failed to promptly stop the misconduct even though issues related to the improper payments were flagged and/or elevated on numerous occasions. Issues regarding the payments were brought to the legal department’s attention as early as 1999 by S&N’s CFO and internal auditors. Over the decade that followed, issues related to the improper payments and the distributor scheme were discussed and/or elevated repeatedly, both within and outside of the United States, by various employees and even the Greek distributor itself. In one instance, after an employee proposed a reduction in the distributor’s commission, the distributor replied over email: "In case it is not clear to you, please understand that I am paying cash incentives right after each surgery…" Following this exchange, S&N decided not to reduce the distributor’s commission. S&N also did not terminate the relationships with the distributor and its affiliates until June 2008.

- Inquiries Conducted by Local Authorities – In 2004, Greek tax authorities questioned S&N’s offshore payment structure, which, according to the pleadings, resulted in offshore funds not subject to Greek taxes. This local inquiry led to questions from S&N’s internal auditors, but it did not bring an end to the bribery scheme. Rather than continuing to divert a percentage of the Greek distributor’s local purchases to certain offshore companies, S&N employees re-tooled the scheme and began to sell products at a discount to one of the offshore companies, which then re-sold the products at full price to the Greek distributor.

- Hybrid Monitorship/Self-Monitoring – S&N’s settlement disposition appears to have introduced a new model of monitorship, requiring the company to retain an independent compliance monitor for 18 months, after which the company must self-monitor for the remaining 18 months of the DPA, providing periodic reports to the agencies regarding its remediation and the implementation of its enhanced compliance program. Biomet’s subsequent disposition continues a similar model of monitorship (see above).

Marubeni Corporation Settles FCPA Charges with DOJ

On January 17, 2012, the DOJ announced settled charges against a Japanese trading company, Marubeni Corporation ("Marubeni"), related to its alleged role in the Bonny Island bribery scheme in Nigeria. According to the settlement documents, Marubeni acted as an agent for the TSKJ joint venture, which included Technip S.A. ("Technip"), Snamprogetti Netherlands B.V. ("Snamprogetti," a former subsidiary of ENI, S.p.A.), Kellogg Brown & Root, Inc. ("KBR," former subsidiary of Halliburton), and JGC Corporation ("JGC"). As detailed in our Summer 2010 FCPA Review and prior FCPA Reviews, the TSKJ joint venture and its agents allegedly agreed to pay approximately $180 million in bribes to Nigerian officials in order to obtain engineering, procurement, and construction ("EPC") contracts to build liquefied natural gas facilities on Bonny Island.

The DOJ’s two-count criminal information, filed in the Southern District of Texas, charged Marubeni with one count of conspiracy and one count of aiding and abetting violations of the anti-bribery provisions of the FCPA. According to the information, the TSKJ joint venture hired Marubeni to help obtain and retain business in Nigeria, including through paying bribes to Nigerian government officials. Marubeni allegedly conspired with TSKJ for the venture to hire U.K. attorney Jeffrey Tesler to pay bribes to high-level Nigerian government officials and to hire Marubeni to pay bribes to lower-level government officials. The information alleges that TSKJ paid the bribes through consulting contracts with Tesler and Marubeni for "vaguely described marketing and advisory services." TSKJ paid Marubeni a total of $51 million, part of which was allegedly used to bribe employees of Nigeria LNG Limited ("NLNG"), whose largest shareholder was the government-owned Nigeria National Petroleum Company ("NNPC"). NNPC owned 49% of NLNG, and the DOJ characterized NLNG as an entity and instrumentality of the Nigerian government.

To resolve the charges, Marubeni entered a two-year DPA with the DOJ. Under the terms of the agreement, Marubeni must pay a $54.6 criminal penalty, retain an independent compliance consultant, enhance its compliance program, and cooperate with the DOJ in ongoing investigations.

Noteworthy Aspects

- Jurisdictional Basis – While the DOJ does not explicitly identify the basis for jurisdiction over Marubeni, the court documents provide a few insights. The information alleges that Marubeni acted as an agent of a domestic concern (KBR) and as an agent of an issuer (Technip) within the meaning of the FCPA. Marubeni employees allegedly met with KBR’s former CEO Jack Stanley and others in Houston, Texas to discuss the scheme, sent a fax discussing its fees to Stanley in Houston, and aided and abetted KBR in making corrupt payments. In addition, the information notes that Marubeni’s co-conspirators caused wire payments to be made to bank accounts in New York in furtherance of the scheme.

- Last Corporate Resolution Involving Bonny Island – In the DOJ press release announcing the settlement, Mythili Raman, Principal Deputy Assistant Attorney General of the Criminal Division, noted that with the Marubeni resolution, the DOJ has "held accountable all five of the corporations that participated in" the Bonny Island bribery scheme. As reported in our FCPA Winter Review 2009, Halliburton and KBR agreed to a total of $579 million in penalties to settle FCPA charges with the DOJ and SEC in February 2009. The following year, Snamprogetti and Technip settled charges related to their roles in the scheme (see our FCPA Summer Review 2010). Finally, JGC settled charges with the DOJ in April 2011 (see our FCPA Spring Review 2011). To date, the total penalties assessed by the U.S. government against corporate participants in the Bonny Island corruption scheme add up to more than $1.7 billion. See below for more information on DOJ’s prosecution of several individuals for conduct related to the Bonny Island LNG project.

- Requirement for Independent Compliance Consultant – As part of the DPA in this action, Marubeni agreed to retain an independent compliance consultant who was tasked with evaluating Marubeni’s corporate compliance program through annual reviews and providing recommendations in written reports to the board of directors. Marubeni and JGC (two Japanese entities) were required to retain consultants for two years while KBR and Technip were required to retain monitors for three.

- Prior Corruption Incident – This incident is not Marubeni’s first time facing allegations of corruption. In the 1970s, before the FCPA passed into law, Marubeni was implicated in a scandal involving the sale of a Lockheed Martin ("Lockheed") plane. In that incident, Lockheed contracted Marubeni to act as its representative in the multi-million dollar negotiations and Marubeni officials allegedly helped Lockheed make payments to Japanese government officials to secure a contract. That matter was one of a number of transactions that the SEC catalogued and that provided part of the motivation for Congress to enact the FCPA.

Actions Against Individuals

Fourth Circuit Rejects Former Rep. William Jefferson’s Appeal

On March 26, 2012, a three-judge panel of the U.S. Court of Appeals for the Fourth Circuit rejected former U.S. Congressman William Jefferson’s appeal of his conviction on public corruption charges. In 2009, a jury found Jefferson guilty on eleven counts of public corruption, including conspiracy to violate the FCPA, wire fraud, bribery, money laundering and racketeering, and not guilty of five other counts. He was sentenced to thirteen years imprisonment but has remained free on bond pending his appeal. The Fourth Circuit affirmed Jefferson’s conviction, with the exception of one wire fraud count for which the court agreed venue was inappropriate (the Virginia trial court had no jurisdiction over a call from Kentucky to Ghana).

As reported in our Spring 2009 FCPA Review, the U.S. government charged Jefferson with soliciting and receiving bribes from various persons and businesses in exchange for promoting their products and services to African officials and participating in the bribery of a Nigerian government official. As noted in press reports and statements from the DOJ, the infamous discovery of $90,000 in Jefferson’s freezer was the single most powerful piece of evidence presented by the government, along with a video of Jefferson accepting a briefcase full of cash from Lori Mody, a cooperating witness.

In appealing his conviction, Jefferson focused on the elements of the bribery charges under the U.S. domestic bribery statute (i.e. non-FCPA charges), which is part of 18 U.S.C. § 201 scheme titled "Bribery of public officials and witnesses." First, he argued that federal bribery law was not applicable to his business activities, which he claimed did not constitute "official acts" because they were unrelated to his duties as a member of Congress. Jefferson attempted to define "official acts" narrowly – in terms of voting for legislation and committee work – but the Fourth Circuit disagreed. The court found that an "official act" "need not be prescribed by statute, but rather may include acts that a congressman customarily performs, even if the act falls outside the formal legislative process." United States v. Jefferson, No. 09-5130 at 42 (4th Cir. Mar. 26, 2012). The court concluded that "[t]he jury was then entitled to conclude that Jefferson’s actions in connection with both constituent requests and the promotion of trade in Africa fall under the umbrella of his 'official acts.'" Id. at 43.

Second, Jefferson argued that the jury had been improperly instructed on the quid pro quo element of the domestic bribery charges. Jefferson claimed that the bribery statute required the government to demonstrate that Jefferson had done a particular official act in exchange for monetary payments. The Fourth Circuit disagreed, noting that "the quid pro quo requirement is satisfied so long as the evidence shows a course of conduct of favors and gifts flowing to a public official in exchange for a pattern of official actions favorable to the donor." Id. at 45 (internal quotation marks omitted). The court noted that there was ample evidence that this element had been satisfied -- "There was . . . an ongoing course of illicit and repugnant conduct by Jefferson – conduct for which he was compensated considerably by those on whose behalf he was acting." Id. at 46.

Finally, the court rejected Jefferson’s argument that the Supreme Court’s decision in Skilling v. United States, 130 S. Ct. 2896 (2010), had rendered the jury instruction on honest services wire fraud erroneous in his own case. The court noted that the Skilling decision limited the application of the honest services wire fraud statute to instances involving bribes and kickbacks and that Jefferson had indeed been found guilty of bribery charges. The court found that any error in the jury instruction was therefore harmless.

Jefferson has appealed the three-judge panel’s ruling to the full Fourth Circuit, which has discretion to hear such an appeal but rarely does so if the panel’s ruling is unanimous, as it was here. It is unclear whether Jefferson will remain free pending appeal. The government may request that he begin to serve his term immediately.

Another Conviction and Other Developments in Haiti Teleco Case

On March 13, 2012, Jean Rene Duperval, former director of international relations for Telecommunications D’Haiti S.A.M. ("Haiti Teleco"), was convicted by a federal jury in Miami of two counts of conspiracy to commit money laundering and 19 counts of money laundering. See our FCPA Winter Review 2012 and FCPA Autumn Review 2011 newsletters for background on the Haiti Teleco prosecutions.

According to the DOJ press release, Duperval laundered $500,000 paid to him "to obtain various business advantages" including "the issuance of preferred telecommunications rates, a continued telecommunications connection with Haiti and the continuation of a particularly favorable contract with Haiti Teleco." Duperval funneled the money to two shell companies under his control. He created false documents that claimed the money was paid for consulting services and international minutes from USA to Haiti when no actual services were performed. The funds were subsequently disbursed from the shell companies for the benefit of Duperval and his family.

Duperval is currently in U.S. government custody. His sentencing is scheduled for May 21, 2012. The conspiracy to commit money laundering counts and individual money laundering counts each carry a maximum penalty of 20 years in prison and a fine of the greater of $500,000 or twice the value of the property involved in the transaction. The indictment also seeks forfeiture, which the court will determine at a later date.

To date, Antonio Perez, Juan Diaz, Jean Fourcand, Robert Antoine, Joel Esquenazi, Carlos Rodriguez and Patrick Joseph have either plead guilty or been convicted by a federal jury for FCPA violations and/or money laundering related to Haiti Teleco. Many of the sentences handed down in this matter have been lengthy, including the 15-year sentence given to Esquenazi, the longest sentence ever imposed in a case involving the FCPA. In April 2012, prosecutors motioned to reduce the four-year sentence given to Antoine by two years after the “substantial assistance” he provided the government in the prosecution of the other defendants in the case.

Of note, on February 24, 2012, U.S. District Court Judge Jose E. Martinez dismissed the FCPA charges against Cinergy Telecommunications, Inc. ("Cinergy"), which was originally indicted alongside Washington Vasconez Cruz, Amadeus Richers, and others in July 2011 (see FCPA Summer Review). Judge Martinez's Order came at the government’s request. According to the Order, prosecutors "recently learned" that Cinergy is "a non-operational entity that effectively exists only on paper for the benefit" of co-defendants Cruz and Cecilia Zurita, with no employees or assets of any real value. In light of the fact that Cinergy "no longer exists in any real sense" and the government’s belief that it was being used "at least in part" to further the defendants’ litigation strategy, prosecutors opted to drop their case against the company. Cinergy has appealed to the U.S. Court of Appeals for the 11th Circuit challenging the factual predicate for the dismissed but not the dismissed itself.

The FCPA and money laundering charges against Cinergy’s former co-defendants are unaffected by this dismissal, including the charges against fugitives Cruz, Richers, and Zurita (who was just indicted in the case on January 20, 2012). Zurita, Cruz’s wife and Cinergy’s former vice-president, allegedly wrote checks for funds later used to bribe Haitian officials and helped to cover up the illicit payments with false documentation.

Sentences Against Stanley, Chodan and Tesler Close the Last Chapter in Bonny Island Bribery Case

On February 23, 2012, former KBR Chairman and CEO, Albert "Jack" Stanley was sentenced to 30 months in prison for his role in the Bonny Island bribery scheme. On the same day and the day prior, two of Stanley’s co-conspirators, Jeffrey Tesler and Wojciech J. Chodan were separately sentenced to 21 months in prison and one year of probation, respectively.

These sentences represent the last chapter in the DOJ’s prosecution of KBR, and its three partner companies in the TSKJ joint venture, for allegedly bribing Nigerian government officials to obtain engineering and construction contracts. As noted above and in our FCPA Summer Review 2010 and FCPA Winter Review 2009, between 1995 and 2004, the TSKJ joint venture members and their agents allegedly agreed to pay approximately $180 million in bribes to Nigerian officials in exchange for contracts valued at over $6 billion to build liquefied natural gas facilities on Bonny Island, Nigeria. Since the case began in 2008, U.S. enforcement agencies have reached settlements with all other defendants, including the joint venture partners and a corporate agent (Marubeni, as reported above).

All three defendants had pled guilty and agreed to "fully cooperate" with U.S. authorities. Stanley pled guilty on September 3, 2008 to one count of conspiracy to violate the FCPA and one count of conspiracy to commit wire fraud. According to his plea agreement, Stanley participated in major decisions affecting the joint venture, including hiring two U.K. and Japanese agents who made the illicit payments. He also met with high-ranking Nigerian officials on several occasions to arrange the payments. Tesler, a U.K. citizen, pled guilty on March 11, 2011, to one count of conspiracy to violate the FCPA’s anti-bribery provisions and one count of in fact violating the FCPA’s anti-bribery provisions. According to his plea agreement, Tesler, a lawyer, acted as TSKJ’s agent and helped TSKJ to negotiate and pay bribes to Nigerian officials. Chodan, also a U.K. citizen, pled guilty on December 6, 2010 to one count of conspiracy to violate the anti-bribery provision of the FCPA. According to his plea agreement, Chodan, acting as a consultant to KBR, nominated and agreed to hire Jeffrey Tessler and Marubeni to negotiate and pay bribes on behalf of the TSKJ.

Considering the $1.7 billion corporate penalties assessed, the sentences against the three individuals are relatively modest. In comparison, in the "Haiti Teleco" cases, corporate penalties in the single-digit million dollar range contrast with individual sentences as long as 15 years (see our Winter 2012 and prior FCPA Reviews). In the Latin Node case, a corporate penalty of $2 million contrasted with individual sentences as long as 46 months (see our Autumn 2011 FCPA Review). According to DOJ’s press release in this case, the Bonny Island defendants’ sentences "reflect" the defendants’ "substantial cooperation with the government." This is despite the fact that both Tesler and Chodan fought their extradition from the United Kingdom prior to ultimately being charged.

Aside from his prison sentence, Stanley must serve 3 years of supervised release after his prison term and pay $10.8 million in restitution to KBR. Tesler must serve two years of supervised release after his prison term and pay a $25,000 fine. These are in addition to Tesler’s prior agreement to forfeit close to $149 million as a part of his plea deal (see our Spring 2011 FCPA Review). Chodan must pay a $20,000 fine in addition to his one year unsupervised probation.

On February 21, 2012, the DOJ ended what U.S. District Court Judge Richard J. Leon called "a long and sad chapter of white-collar criminal enforcement," by filing a motion to dismiss the charges against the remaining defendants in the African sting investigation, also known as the "SHOT Show" trials. As reported in our FCPA Winter Review 2012 and other past Reviews, 22 individuals were arrested in January 2010 -- 21 while attending the SHOT Show convention in Las Vegas -- and charged with allegedly engaging in schemes to bribe an undercover FBI agent they believed was acting on behalf of the government of Gabon in order to win a $15 million contract to provide law enforcement and defense equipment to the Gabonese presidential guard.

The government’s motion follows on the heels of two consecutive mistrials. Initially, three defendants pled guilty, but the others decided to test the government’s case in front of a jury. Four of the defendants successfully avoided conviction during the first of a series of trials in September 2011 when Judge Leon was forced to declare a mistrial in the face of a hung jury. During the second trial, Judge Leon dismissed conspiracy charges against six other defendants, which led to the acquittal of one; two other defendants in that trial were cleared by the jury; and Judge Leon declared a second mistrial for the remaining three defendants when the jury became deadlocked.

Faced with these results, the government chose to abandon its case, citing in its motion to dismiss, "the outcomes of the first two trials"” "the impact of certain evidentiary and other legal rulings . . . including with respect to Rule 404(b) and other knowledge and intent evidence the government proposed to introduce," and "the substantial governmental resources . . . that would be necessary to proceed with another four or more trials." In prepared remarks, Judge Leon granted the motion and "applaud[ed] the Department for having the wisdom and courage of its convictions to face up to the limitations of its case as revealed in the past 26 weeks of trial. . . ."

With respect to the three defendants who had previously pled guilty to a charge of conspiracy to violate the FCPA – charges Judge Leon dismissed in the second SHOT Show trial – on March 29, 2012, the government moved to dismiss those charges and Judge Leon indicated that he will grant the motion and vacate the prior guilty pleas.

The SHOT Show investigation was the first of its kind to pursue violations of the FCPA using traditional undercover tactics, such as informants, wiretaps, and hidden cameras. However, the government’s primary informant, Richard Bistrong, was repeatedly attacked by defense counsel as a cocaine addict, tax cheat, and admitted thief of millions of dollars from his prior employer. In addition, defense counsel highlighted examples of what they called "vulgar" and "unprofessional" text messages between FBI agents and Bistrong, which, according to Judge Leon, raised "concerns about the way this case had been investigated and was conducted especially vis-à-vis the handling of Mr. Bistrong." Bistrong himself will be sentenced in the coming months by Judge Leon under a plea agreement in which Bistrong pled guilty to one count of conspiracy to violate the FCPA, the International Emergency Economic Powers Act, and the Export Administration Regulations, as reported in our FCPA Autumn Review 2010. According to his plea agreement, Bistrong faces up to five years in prison, a fine of not more than $250,000 or twice the pecuniary gain or loss derived from the offense, and up to three years’ supervised release for paying bribes to procurement agents at the United Nations (for body armor sales), the Dutch National Police Services agency (for pepper spray sales), and the Nigerian Independent National Elections Commission (for fingerprint ink pads sales).

It is unclear whether the failure of the SHOT Show trials and the O’Shea dismissal noted below will have broader implications in the FCPA context. The government may face greater pushback from individual defendants in future cases, but it is too soon to tell whether corporations, who have usually found the specter of criminal charges too unpalatable to risk a government enforcement action in court, will become more willing to challenge aggressive jurisdictional and substantive assertions by the enforcement agencies.

Executives of Noble Drilling Charged with FCPA Violations

In February 2012, the SEC brought charges for alleged FCPA violations against one current and two former executives of Noble Corporation, an offshore drilling contractor ("Noble Drilling"). The first complaint was brought against Mark A. Jackson, who occupied positions of CFO, COO, President, Director, CEO and Chairman of the Board of Noble Drilling at varying times during the period of alleged violations (from 2004 through 2007), and James Ruehlen, the current Director and Division Manager of Noble’s Nigerian subsidiary. The second, separate complaint was brought against the former Controller and head of internal audit at Noble Drilling, Thomas F. O’Rourke.

The charges stem from a November 2010 settlement of an FCPA enforcement action against Noble Drilling. This settlement was announced at the same time as settlements against several other oil and oil field services companies, as well as the Swiss freight forwarder, Panalpina, related to improper payments to customs officials (these are discussed in detail in our FCPA Autumn Review 2010). Noble Drilling and its Nigerian subsidiary allegedly authorized payments to Nigerian customs officials through its customs agent. The goal of the payments was to allow Noble Drilling to continue using oil rigs and other equipment inside Nigerian territorial boundaries past the expiration of Temporary Importation permits ("TI permits") issued by Nigerian Customs, thus avoiding the required but costly re-export and re-import of the rigs. Noble Drilling agreed to pay $8.1 million to SEC and DOJ to settle the charges.

The charges against Jackson and Ruehlen, brought more than a year after the company settlement, charged the two executives with aiding and abetting Noble’s violations of the FCPA accounting provisions, and with direct violations of the FCPA anti-bribery and accounting provisions. According to the complaint, Ruehlen helped Noble Drilling's customs agent to prepare the false documents, processed the customs agent’s invoices for the alleged bribes, and signed checks reimbursing these payments. In addition to similar actions, Jackson failed to implement internal accounting controls to prevent the bribery and false recording of bribes. Although the agent used monikers such as "special handling" or "procurement" charges for the problematic payments, according to the SEC complaint, both Jackson and Ruehlen understood that they referred to unreceipted payments to customs agents. Jackson and Ruehlen also allegedly misled auditors conducting a West Africa Division audit, and falsely signed Sarbanes-Oxley certifications, stating there were no control weaknesses, fraud, or FCPA violations.

In light of his positions at the head of the company, Jackson was also charged as a "control person" under Section 20(a) of the Exchange Act for violations of Noble Drilling, Ruehlen and others. This provision was first used in an FCPA settlement with the CEO and the former CFO of Nature’s Sunshine Products Inc. (see our FCPA Autumn Review 2009). Under that provision, "[e]very person who, directly or indirectly, controls any person liable under [the securities laws] shall also be liable jointly and severally with and to the same extent as such controlled person … unless the controlling person acted in good faith and did not directly or indirectly induce the act or acts constituting the violation or cause of action." The SEC alleges that Jackson exercised supervisory authority over Noble Drilling, Ruehlen, and others, and, as control person, is liable for their violations.

O’Rourke, allegedly, also helped in approvals, and allowed improper booking of the bribes as legitimate operating expenses, despite knowing that the payments would be conveyed to Nigerian government officials. He was charged with aiding and abetting Noble Drilling's violations, and with a substantive count of personally violating the FCPA book keeping and internal controls procedures.

While O’Rourke agreed to settle the SEC’s charges and pay a penalty of $35,000, Jackson and Ruehlen, through statements made by their attorneys, assert that they intend to contest the FCPA charges brought against them.

Charges Against John O’Shea Dropped Following Acquittal

On February 9, 2012, the DOJ moved to dismiss the remaining counts of an indictment against John O’Shea, the former manager of ABB Inc., a Texas-based subsidiary of ABB Ltd., ("ABB") a Swiss engineering company. The motion to dismiss filed by the prosecutors asked that the four counts of money laundering and a count of falsifying records he faced be dismissed. This motion came three weeks after U.S. District Court Judge Lynn Hughes of the Southern District of Texas granted the defendant’s motion for acquittal and threw out twelve substantive FCPA counts and one conspiracy count against him on January 17, 2012.

As reported in our FCPA Autumn 2010 Review, O’Shea was accused of bribing officials at Mexico’s state-owned electric utility company, the Comisión Federal de Electricidad ("CFE") and covering up the payments. The indictment against O’Shea alleged that O’Shea conspired with a Mexican intermediary company and various CFE officials to win, on behalf of ABB, several lucrative contracts with CFE related to Mexico’s electrical network system in exchange for kickbacks to the CFE officials. According to the indictment, the contracts secured by the conspiracy generated more than $81 million, and O’Shea authorized more than $900,000 in corrupt payments to CFE officials. In sum, O’Shea faced one count of conspiracy to violate the FCPA, twelve substantive FCPA counts, four counts of international money laundering, and one count of falsifying records in a federal investigation. If convicted on all counts, he could have been sentenced to more than twenty years in prison.

According to press reports and those who were in the courtroom, in his oral order in favor of the motion to dismiss the FCPA counts against O’Shea, Judge Hughes said that he based his reasoning on the government’s lack of production of sufficient records - financial, accounting or cell phone - and people, as well as the government’s inability to tie O’Shea to the alleged crimes. The principal witness at trial was Fernando Maya Basurto, Jr., who along with his father, Fernando Maya Basurto Sr., allegedly helped O’Shea bribe CFE officials in their roles at the Mexican intermediary company noted above. Reports indicate that the Judge stated that he was unmoved by Basurto Jr.’s testimony, which he said was vague and abstract. According to the reports, the Judge noted that Basurto Jr. knew "almost nothing" and lamented that Basurto Sr., who did not testify, had not been required to provide financial records to earn the immunity the DOJ granted him. The Judge also reportedly noted that the Basurtos had other customers from whom they were collecting money, and that the government had been unable to tie O’Shea specifically to the payments made to the CFE officials.

ABB and its subsidiaries plead guilty to FCPA violations in a settlement in 2010 and paid more than $58 million in civil and criminal penalties. Basurto Jr. was initially charged with conspiracy and structuring transactions to evade currency-reporting requirements, and he ultimately plead guilty in November 2009 to one count of conspiracy to violate the FCPA. On April 2, 2012, Judge Hughes dismissed the original charges against Basurto Jr. and granted prosecutors’ request that Basurto Jr.’s sentence not extend beyond the time he already spent in jail. Basurto Jr. is also required to forfeit roughly $2 million in illegal profits, according to the terms of his plea agreement.

The O’Shea case involved the same Mexican utility, CFE, that was at issue in the Lindsey Manufacturing case. As detailed in our FCPA Winter Review 2012 newsletter, in December 2012, U.S. District Court Judge Howard Matz vacated the convictions of the Lindsey executives.

U.S. Agency and Legislative Developments

As reported in our Preview of International Issues for 2012 and prior FCPA Reviews, recent years have seen several efforts to modify the FCPA, including the U.S. Chamber Institute for Legal Reform’s ("ILR") October 2010 white paper, and the testimony of witnesses during Congressional hearings in late 2010 and 2011. In November 2011, the DOJ acknowledged the debate over whether reforms are needed and stated that in 2012 it will issue new, "detailed guidance" on its enforcement positions under the Act. In anticipation of the forthcoming guidance, Senators Amy Klobuchar (D-MN) and Chris Coons (D- DE), and a coalition of business organizations led by the ILR, issued separate letters to Attorney General Eric Holder calling for the guidance to cover a number of areas of concern to businesses seeking to comply with the FCPA.

Senators Klobuchar’s and Coons’s February 15, 2012 letter stated that “too many companies are devoting a disproportionate amount of resources to FCPA compliance and internal investigations,” and that “[c]lear guidance will further strengthen the FCPA by encouraging compliance, self-reporting, and cooperation with enforcement actions.” In particular, Senators Kloubuchar and Coons asked for "clear and concrete" guidance on:

- The definition of "foreign official"

- The benefits companies may receive for self-reporting violations, cooperating in investigations, and maintaining an adequate FCPA compliance program

- How companies can qualify for credit for cooperation (e.g., requirements for internal investigations)

- Requirements for an adequate compliance program

- Enforcement agencies’ methodology for calculating fines and disgorgements

- The extent to which companies may be held liable for the actions of subsidiaries

- The requisite level of intent for a company to incur liability

- Determining whether a payment would qualify as a legitimate promotional expenditure

- The applicability of the FCPA to “de minimus” value transactions

In the February 21, 2012 letter from the ILR and several dozen business organizations (the "ILR Letter"), the coalition asked for the DOJ and SEC to issue guidance on many of the same issues covered in Senators Klobuchar’s and Coons’s letter. In addition, the ILR Letter called for guidance on:

- Successor liability (where a company can be held liable for the actions of a company it acquires or with which it merges)

- Declination decisions (where agencies have decided to close FCPA-related investigations with no enforcement action) (for an analysis of recent declination decisions and trends, see James G. Tillen’s and Marc A. Bohn’s article in Bloomberg Law Reports)

- Business relationships with relatives of government officials

- Corporate donations to charities that have connections with non-U.S. governments

- Apprentice programs or secondment arrangements in which employees are assigned to work for a customer in which a foreign government holds an interest

Miller & Chevalier Member Mark Rochon recently represented the National Association of Criminal Defense Lawyers ("NACDL") on these issues at a roundtable discussion on the scope and substance of the forthcoming guidance hosted by the ILR and attended by numerous high-ranking officials from the DOJ, SEC, and U.S. Department of Commerce and representatives from various stakeholder groups. Rochon stated that the meeting was a "constructive and positive discussion," while noting that "[i]t may well be that as to some issues, only legislative action would sufficiently protect the interests of individuals and entities charged under this statute."

The SEC Revises its Settlement Policy with Defendants Also Settling Parallel Criminal Charges

Since the early 1970’s, defendants settling with the SEC routinely have recited in their consent judgments that they "neither admit nor deny" the Commission’s allegations. This phrase prevented private plaintiffs from using the SEC’s allegations as admissions in collateral proceedings against the defendants. The SEC revised this policy on January 6, 2012, announcing that it will no longer allow a defendant to "neither admit nor deny" the Commission’s allegations, if that defendant has been convicted of, or has admitted to, criminal violations in a parallel criminal prosecution based on the same alleged facts. Defendants who have not been convicted of and have not admitted to any parallel criminal violation can continue to take advantage of the language when settling.

The SEC applied the revised rule for the first time in an FCPA case in its settlement with Biomet Inc., announced on March 26, 2012 (discussed in detail above). In place of the traditional "neither admit nor deny" language, the Biomet consent recites: “Biomet has entered into a deferred-prosecution agreement ("DPA") with the [DOJ] in which it admits . . . responsibility for criminal conduct relating to certain matters alleged in the complaint in this action.” (Biomet Consent at ¶ 2). The SEC’s Complaint largely mirrored the DPA, with several minor additional factual allegations. (E.g., compare SEC Complaint at ¶27 with Biomet DPA, Attachment A, Statement of Facts at ¶ 21.) Given the revised settlement language, Biomet did not explicitly "not admit" to these additional factual allegations. The "admissions" in the Biomet case appear not to add significantly to the pattern of behavior described in the DPA; however, in cases where the SEC asserts significant allegations not addressed in DOJ settlement documents, defendants will need to consider negotiating additional protective language.

In announcing the policy change, the SEC specifically denied that the change was related to "the recent ruling in the Citigroup case." The Commission was referring to an appeal it had pending against a ruling by Judge Jed S. Rakoff of the Southern District of New York. In that ruling, Judge Rakoff rejected a proposed "neither admit nor deny" settlement between the SEC and Citigroup, in part because "the SEC’s long standing policy – hallowed by history but not by reason – of allowing defendants to enter into Consent Judgments without admitting or denying the underlying allegations, deprives the Court of even the most minimal assurance that the substantial injunctive relief it is being asked to impose has any basis in fact." However,on March 15, 2012, a Second Circuit panel stayed Judge Rakoff’s ruling. The panel stressed the "obligatory deference" the court must give to the SEC’s policy decisions and held that the SEC and Citigroup "have a strong likelihood of success on the merits in their effort to overturn the court’s ruling." (See Order Granting Motion to Stay at 6, 10.) A panel hearing on the merits of the ruling will be scheduled after September 2012.

International Developments

Siemens to Pay $336 Million Settlement with Greece

Siemens will reportedly pay €270 million ($336 million) to the Greek Ministry of Finance to resolve a bribery scandal from the 1990s. The settlement includes a €90 million payment to the Greek government to assist in fighting corruption, an €80 million payment to help Greece pay off its debts, and a €100 million investment to help promote international investment in Greece. According to the Company Press Release, the Greek cabinet approved the settlement in March, which was later ratified by the Greek Parliament in April 2012.

According to Greek authorities, Siemens Hellas paid bribes from 1997 to 2002 to win contracts with the state-owned Hellenic Telecom.

In 2008, Siemens paid $800 million to settle FCPA charges with the DOJ and SEC, the largest penalty ever paid for violating U.S. foreign bribery law. It has also paid approximately $800 million to German authorities.

OECD Reports Assess Effectiveness of U.K. and Hungarian Anti-Bribery Laws

On March 30, 2012, the Working Group on Bribery of the Organization for Economic Co-operation and Development ("OECD") issued follow-up reports on the implementation and application of the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions ("OECD Anti-Bribery Convention") by two member countries. The reports relied upon responses by the United Kingdom and Hungary (the two subject countries) to a "Phase 3" questionnaire, information gathered and discussed during a Working Group site visit to each country and, in the case of the U.K. report, independent public-source research by the Working Group.

The Working Group commended both the United Kingdom and Hungary for their cooperation and credited the countries for the "Phase 2" recommendations they successfully implemented. In addition, the Working Group made note of recommendations that have not been fully implemented and addressed further areas in need of improvement.

According to an OECD press release on the U.K. report, the United Kingdom "has significantly boosted its foreign bribery enforcement efforts but needs to be more transparent" when resolving both criminal and civil cases. As detailed in the report, publicly available information on criminal settlements is limited and inconsistent. For instance, the Crown Court’s sentencing remarks are publicly available in only two of six foreign bribery-related convictions, the plea agreement is available in only one case, and press releases issued by the Serious Fraud Office ("SFO") do not always specify the value of bribes paid or detail the contracts obtained. Regarding civil settlements, the SFO’s press releases contain "skeletal information" regarding the facts and in some cases, confidentiality agreements with a defendant prevent full disclosure. In addition, the Working Group asserted that SFO press releases "only vaguely outline the considerations in reaching the settlement terms without explaining precisely how these considerations affected the order’s amount." With respect to criminal and civil settlements, the Working Group concluded that the lack of information about the settlement process prevents "a proper assessment of whether the sanctions imposed are effective, proportionate, and dissuasive," and consistent with the OECD Anti-Bribery Convention.

The Working Group made various recommendations to the United Kingdom to improve its implementation of the OECD Anti-Bribery Convention, among them that the United Kingdom "avoid confidentiality agreements that prevent disclosure of key information about settled cases." In addition, with respect to other concerns, the Working Group recommended that the United Kingdom clarify the meaning of "reasonable and proportionate" hospitality and business promotional expenditures, provide evidence to foreign counterparts after settling cases, as appropriate, and "ensure that companies effectively move towards ‘zero tolerance’ of facilitation payments."

According to an OECD press release on the Hungary report, the country’s law prohibiting bribery of foreign public officials is "relatively good on paper" but has not been effectively implemented. According to the Working Group, since bribery of foreign public officials became a criminal offense in Hungary in March 1999, the country has had just one successful foreign bribery prosecution. That case involved 26 individual defendants who were convicted of paying small bribes to Slovakian customs officials in connection with obtaining licenses to transport goods across the international border. To date, no company has been charged, prosecuted, or sanctioned for foreign bribery.

The Working Group identified important weaknesses in Hungary’s written law prohibiting bribery of foreign public officials. Chief among them is the requirement that an individual be convicted of bribing a foreign public official before a company can be held criminally liable. The Working Group recommended amending the law to increase the ability of prosecutors to enforce the foreign bribery offense against legal entities. In addition, the Working Group noted that the law could also be strengthened to ensure companies cannot use an intermediary to avoid liability for foreign public bribery. The Working Group also recommended that Hungary “proactively investigate and enforce the foreign bribery offence” and increase awareness of the offense within the public and private sectors.

A New Code of Practice for the Pharmaceutical Industry

On March 1, 2012, the International Federation of Pharmaceutical Manufacturers and Associations (“IFPMA”) released an updated Code of Practice, which applies to interactions of its members (pharmaceutical companies and national associations), with HCPs, patient associations, and medical organizations.

The Code contains several changes from the previous iteration, released in 2006, further restricting the members’ interactions with other health care professionals. Updates to the Code coincide with expansion of the pharmaceutical industry to emerging markets with nascent regulatory oversight, and with the U.S. government’s industry-wide enforcement initiative against pharmaceutical companies. The industry wide review has spawned a recent spate of enforcement actions brought against pharmaceutical and medical device companies for violations of anti-corruption laws (including enforcement actions against Biomet and Smith & Nephew, described above in this newsletter, and the settlement with Johnson & Johnson, noted in our FCPA Spring Review 2011).

While the previous Code only covered interactions with HCPs, the new Code extends to interactions with medical institutions and patient organizations, and also covers promotion of pharmaceutical products.

The new Code includes a set of guiding principles "on ethical conduct and promotion," that were not present in the previous version of the Code. One of the principles states that "pharmaceutical companies’ interactions with stakeholders must at all times be ethical, appropriate and professional. Nothing should be offered or provided by a company in a manner or on conditions that would have an inappropriate influence." Other principles include that pharmaceutical companies will "respect the privacy and personal information of patients," conform to the high standards of quality, safety and efficacy as determined by regulatory authorities, and that "[a]ll clinical trials and scientific research sponsored or supported by companies will be conducted with the intent to develop knowledge that will benefit patients and advance science and medicine."

The Code also poses additional restrictions on providing things of value to HCPs. For example, the Code does not allow member companies to provide for any entertainment, leisure or social activities to HCPs (previously, the Code allowed those that were incidental to meals or refreshments at scientific or professional events). As another example, the Code formerly allowed provision of modest gifts on significant national, cultural, or religious events on an "infrequent" basis. The 2012 Code, in the Q&A section, states that such gifts may only be provided on an “exceptional” basis, and only if the gifts could not be perceived to interfere "with the independence of a healthcare professional’s decision to prescribe, recommend or purchase medicines."

The new Code also requires member companies to train all employees as appropriate, according to their role. It also provides detailed guidance on the process of making and processing complaints in case of violations of any of the procedures. The Code notes that when the IFPMA receives indication of an alleged breach of the Code, the breach will first be validated and then if it is determined valid, it will be sent to the senior management of the company asking for a response, followed by an adjudication, appeals and sanctions process. Where a breach is determined, a summary of the case, including the identity of the company, will be published on the IFPMA website.

However, the IFPMA’s sanctions for any proven breach of the Code are limited: the violating company has 10 working days to provide written details of the action taken to comply with the ruling. At a minimum, such a company will be asked to terminate the activity in use and take all possible steps to avoid a similar breach in the future.

Members of IFPMA must accept the conditions of the IFPMA Code, and must adopt internal policies that comply with local laws and regulations and are consistent with, and are as comprehensive as, the IFPMA Code. The Code takes effect as of September 1, 2012, giving IFPMA members six months to incorporate the Code’s requirements into existing national company and association codes. The IFPMA does, however, acknowledge that some countries already have "an established framework of stringent regulatory and/or legal controls which are effectively as comprehensive in their provisions and application as the IFPMA Code." For countries subject to such laws, the IPFMA does not require establishment of new provisions and procedures.

World Bank Debars Alstom Subsidiaries

On February 22, 2012, the World Bank ("Bank") announced the debarment of Alstom Hydro France ("AHF") and Alstom Network Schweiz AG ("ANS") for alleged bribery related to a hydropower project in Zambia. According to a Bank press release, in 2002 the two subsidiaries of French engineering company Alstom S.A. allegedly made an improper payment of €110,000 (approximately USD $145,000) to an entity controlled by a former senior government official that they characterized as for "consultancy services" related to the Bank-financed Zambia Power Rehabilitation Project.

As part of the Negotiated Resolution Agreement with the Bank, AHF and ANS agreed to pay $9.5 million in restitution. According to the press release and a Bank Debarment List, the two companies and their affiliates in Peru, Morocco, and China are ineligible to be awarded a Bank-financed contract for a period of three years. Moreover, the debarment qualifies for cross-debarment by other multilateral development banks, including the African Development Bank, the Asian Development Bank, and the Inter-American Development Bank Group. However, after 21 months of debarment, AHF and ANS may convert the remaining 15 months of debarment to conditional non-debarment (essentially a period of enhanced oversight of their corporate compliance programs) if they comply with all elements of the resolution. In addition, parent company Alstom S.A. is subject to conditional non-debarment, meaning that its eligibility to participate in Bank-financed activities hinges on its implementation of a compliance program acceptable to the Bank within the next three years.

As noted in our FCPA Winter Review 2012, in 2011 Swiss authorities fined ANS a total of 38.9 million Swiss francs (approximately $41.3 million) for alleged bribery of foreign public officials in Latvia, Tunisia, and Malaysia.

Russia Joins OECD Anti-Bribery Convention

On February 17, 2012, Russia submitted its instrument of accession to OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions at a ceremony in Paris. As reported in our FCPA Summer Review 2011, last year, Russia prepared for accession to the Convention by passing new anti-bribery laws. According to an OECD press release, Russia will become the 39th Party to the Convention on April 17, 2012, and will undergo systematic reviews of its implementation of its anti-bribery laws. As part of the review process, the OECD Working Group on Bribery released its Phase 1 Report for Russia on March 19, 2012. While commending the Russian government for enacting key legislative elements, the report also noted several concerns regarding provisions of the law (e.g., related to the defense of "effective regret," coverage of non-cash transactions, the liability of legal persons, and immunities) that will need to be monitored in Phase 2.

Mabey & Johnson: SFO Recovers Dividends from Major Shareholder

On January 13, 2012, the SFO announced that it secured a civil order from the High Court to recover £130,000 plus costs of £2,440 (approximately $208,000) from Mabey Engineering (Holdings) Ltd. ("Mabey") under Part 5 of the Proceeds of Crime Act 2002 ("POCA"). Unlike proceedings under the U.K. Bribery Act, which are criminal and personal in nature (against individuals and corporations), proceedings under POCA are always civil and against property, not against the individual or company holding the property. POCA allows for the recovery of property that has been acquired through criminal conduct, even where the holder of the property does not have knowledge that the property was acquired unlawfully, as was the case for Mabey. The amount recovered reflects dividends Mabey unknowingly received from contracts won through the unlawful conduct of its subsidiary, the modular bridge manufacturer Mabey & Johnson Ltd. ("M&J"). Mabey is a major shareholder of M&J.

As reported in our FCPA Autumn Review 2009, following a voluntary disclosure in 2008, M&J was convicted in September 2009 for improper payments made in Ghana, Jamaica, and Iraq. M&J paid penalties and reparations totaling £6.6 million (approximately $10.5 million). Additionally, as reported in our FCPA Spring Review 2011, two former company officers, Charles Forsyth and David Mabey, as well as employee Richard Gledhill, were convicted for their roles in breaching UN sanctions in Iraq.