FCPA Spring Review 2011

International Alert

Introduction

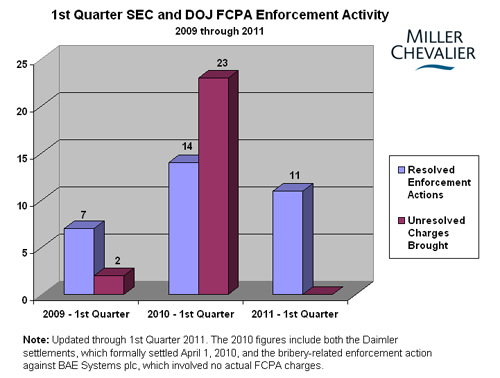

The record pace of Foreign Corrupt Practices Act ("FCPA") enforcement actions witnessed in 2010 waned in the first quarter of 2011 (though the pace appears to have increased early in the second quarter with the announcement of several dispositions during the first week of April). As compared to the same period last year, bribery related enforcement activity was down considerably, with only eleven resolved enforcement actions brought -- six against corporations and five against individuals -- and no additional unresolved charges filed against any corporations or individuals, meaning 2011 started with less than a quarter of the enforcement activity of 2010.

Continuing a trend we identified in connection with the Panalpina-related resolutions last year, none of the six corporate resolutions in the first quarter of 2011 involved the appointment of an independent corporate monitor - the two Department of Justice ("DOJ") resolutions require the companies to self-monitor and report to the DOJ. Has the controversy surrounding the appointment of monitors led to the curtailment of this practice? The recently announced JGC settlement may suggest that independent monitors will be employed for larger companies or in situations of serious or systemic violations. It is also possible that, given the length of time that the JGC settlement has been in negotiations and its link to the other Bonny Island cases, the imposition of JGC's "independent compliance consultant" is an artifact of earlier enforcement practice. The recent Johnson & Johnson disposition, which did not result in an outside monitor or advisor despite apparent significant compliance program issues, supports that the latter is more likely the case. Miller & Chevalier will continue to "monitor" resolutions to assess present and future trends in this area.

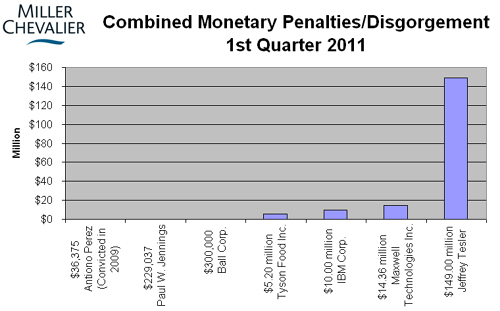

While the number of FCPA-related enforcement actions against individuals has not thus far come close to rivaling those of 2010, several individual actions from 2010 were resolved this quarter. Two of the SHOT Show defendants pled guilty, and two Latin Node defendants were sentenced to prison. Also of note among the resolved individual actions is the plea agreement involving Jeffrey Tesler, the U.K. lawyer involved in the Bonny Island bribery scheme, which has already led to FCPA enforcement actions against KBR, Technip, Eni, and JGC. As part of the deal, Tesler agreed to forfeit almost $149 million, an amount rivaling corporate penalties meted out over the years and significantly dwarfing all previous FCPA-related forfeiture orders against individuals.

Defendants in at least three FCPA cases have sought dismissal of bribery charges in criminal matters by arguing that officers and employees of state-owned companies are not "foreign officials" because the term "instrumentality" as used in the FCPA does not encompass state owned entities. The parameters of the term "instrumentality" have not previously been addressed by the federal courts. The U.S. Government has opposed the motions to dismiss and, while conceding that its interpretation of "instrumentality" is broad, argued that such an interpretation is necessary to ensure the United States' compliance with international anti-corruption conventions to which it is a signatory. One motion has already been ruled upon from the bench, with the court rejecting the defendants' position and allowing the trail to continue. As discussed below, the rulings of the courts on this issue is expected to directly impact how the DOJ and Securities Exchange Commission ("SEC") handle such cases in the future.

The most significant international development thus far in 2011 was the announcement by the U.K. Ministry of Justice ("MOJ") that the U.K. Bribery Act will go into effect on July 1, 2011, and the issuance of formal published guidance by the MOJ and Serious Fraud Office ("SFO"). As described in a separate analysis by Miller & Chevalier's Homer E. Moyer, Jr., the Act and the MOJ/SFO guidance, which asserts that it takes a "common sense" approach to combating bribery without relying on overly burdensome procedures, differ in several key ways from the FCPA. Most significantly, the U.K. Bribery Act does not address accounting violations, but prohibits facilitating payments and commercial bribery.

Actions Against Corporations

On April 8, 2011, Johnson & Johnson ("J&J"), a U.S.-based pharmaceutical, medical device and consumer products manufacturer listed on the NYSE, resolved FCPA charges with the DOJ and SEC relating to a long-running FCPA investigation into payments allegedly made by the company's subsidiaries to doctors at publicly-owned hospitals in Greece, Poland and Romania, as well as kickbacks the company allegedly paid to the former government of Iraq. As part of its disposition with the DOJ, J&J entered a three-year deferred prosecution agreement ("DPA"), under which it agreed to pay a $21.4 million criminal penalty. J&J likewise consented to the entry of judgment against it on charges brought by the SEC, agreeing to disgorge more than $48.6 million in profits and pre-judgment interest. In total, J&J will pay a monetary assessment imposed by U.S. enforcement authorities of more than $70 million. In a parallel proceeding also announced on April 8, 2011, the U.K.'s SFO obtained a Civil Recovery Order in the U.K.'s High Court against J&J's wholly-owned Leeds-based subsidiary DePuy International Ltd. ("DPI") stemming from the same underlying conduct; DPI was ordered to pay £4.8 million ($7.85 million).

Allegations Involving Greece

According to the pleadings, from 1998 to early 2006, several J&J subsidiaries made improper payments, primarily through agents, to doctors at publicly-owned hospitals in Greece to persuade them to use DePuy surgical orthopedic implants, allegedly earning J&J approximately $24.25 million in profit on resulting sales. In total, the companies allegedly paid approximately $16.4 million to Greek agents, knowing that a significant portion would be passed along to doctors to induce the purchase of DePuy products. J&J's internal auditors reportedly discovered this long-running scheme in early 2006 based on a whistleblower complaint. An anonymous letter had previously flagged the issue, among others, for another internal audit team in 2003, but according to the disposition documents the team had failed to fully investigate the issue.

These improper payments were allegedly authorized initially by DPI, a subsidiary J&J acquired in November 1998 as part of its acquisition of DPI's parent, DePuy, Inc. ("DePuy"), a U.S.-based medical device company. The SEC Complaint states that prior to the acquisition, DPI had retained a "well-known" Greek agent who enjoyed "long-standing relationships" with area surgeons and entered into two "sham" agreements with companies owned by the agent: the first, a Greek company hired as DPI's exclusive distributor in Greece ("Greek Distributor"); and the second, a private company on the Isle of Man ("Private Company") that would purportedly provide DPI with "marketing support." Under the agreements, the DPA states that the Greek Distributor received a 35% discount on DePuy products and the Private Company received a 25% "commission" on all net sales to the distributor. The Greek agent allegedly used this commission, which was increased to 35% in 1998, to pay doctors to use DePuy products. The SEC Complaint states that after the merger, a top J&J executive (who had previously been with DePuy) ("Executive A") and certain DPI executives, all of whom were allegedly aware of the improper payments, knowingly continued the scheme with the Greek agent.

In January 2000, several DPI executives recommended terminating the relationship with the Greek agent, allegedly because of bribery concerns. The SEC Complaint states that Executive A instead proposed buying the Greek Distributor and retaining the Greek agent as a consultant, arguing that terminating the Greek Distributor (and its owner, the Greek agent) would mean losing half the company's business in Greece. The disposition documents state that despite numerous red flags surrounding the proposed acquisition of the distributor, including explicit concerns raised by a J&J executive, DPI issued a draft due diligence report in November 2000 finding no evidence of any bribery connected with the Greek Distributor. J&J finalized the purchase in January 2001 and eventually renamed the distributor DePuy Helles.

After the acquisition, the pleadings state, DePuy Helles continued to use the Greek agent to facilitate improper payments, entering into a consultant agreement that paid him 27% of all sales in Greece. When DPI's outside accountants questioned this commission amount, DPI executives allegedly split the payments between two new agreements, some paid by DPI and others by DePuy Halles, to conceal their true purpose and amount. According to the pleadings, the improper payments continued in the years following the acquisition. When the Greek agent was eventually fired in October 2003 over a sales-related dispute, the payments allegedly did not stop; DPI simply hired another agent to fill the same role in the bribery scheme. From 2002-2006, DePuy Helles employees also allegedly withdrew petty cash booked as "miscellaneous" and paid doctors directly whenever the Greek agent and his replacement were late in making payments.

Allegations Involving Poland

According to the pleadings, from 2000-2006, executives at J&J's wholly-owned Polish subsidiary, Johnson & Johnson Poland Sp. Z.o.o. (J&J Poland), were responsible for entering into fictitious contracts, providing questionable travel sponsorships, and creating "slush funds" of cash and equipment, all as a means to channel improper payments to healthcare professionals in Poland to induce the purchase of J&J products. J&J allegedly earned approximately $4.3 million in profit on resulting sales.

J&J Poland allegedly entered into these fictitious contracts with key doctors and administrators at publicly-owned hospitals for purported services, such as lecturing or conducting clinical trials, which were never actually provided. Instead, the contracts simply served as a vehicle for making, by SEC estimates, approximately $775,000 in improper payments to doctors in exchange for using J&J medical devices or to influence hospital administrators to steer tenders to J&J Poland. Although J&J Poland required approval for contracts in excess of approximately $5,000, the SEC Complaint states the company had no internal controls in place requiring proof that any services were actually performed prior to payment.

The pleadings state J&J Poland sponsored attendance at medical conventions in Poland and abroad to induce healthcare professionals to use J&J medical products or steer public tenders to J&J Poland. Employees at J&J Poland would also allegedly falsify travel expenses with the help of a local travel agency to generate cash for improper payments to doctors. From 2000-2006, J&J Poland spent approximately $7.6 million on travel sponsorships, of which an indeterminate amount constituted bribes due to insufficient recordkeeping.

Allegations Involving Romania

According to the pleadings, from 2000-2008, employees at J&J's wholly-owned Romanian subsidiary, Johnson & Johnson d.o.o. (J&J Romania), provided improper payments, gifts and sponsorships to publicly-employed doctors and pharmacists in Romania to induce them to prescribe certain J&J pharmaceutical products. From July 2005 to mid-2008, the DPA states, J&J Romania authorized the payment of approximately $140,000 in incentives to healthcare professionals. By SEC estimates, J&J Romania earned $3,515,500 in profit on the resulting sales from 2000-2007.

To generate the cash for the payments and gifts, employees allegedly provided the company's distributors with discounted or free goods, which could be sold for an additional profit to obtain excess funds. Employees or distributors would then deliver the cash to certain doctors, who, according to the SEC Complaint, received 3-5% of the cost of the drugs they prescribed. These distributors also allegedly worked with doctors and patients to ensure the prescriptions received approval and reimbursement from the Ministry of Health's public health insurance funds. In exchange for their help, the DPA states that distributors received a 10-12% discount off of sales invoices and an additional 10% in the form of free goods.

The SEC Complaint alleges that in late 2007, after J&J's internal audit began investigating allegations of cash payments to healthcare professionals, J&J Romania group employees "apparently" responded by initiating a scheme to sponsor trips for doctors and pharmacists to attend medical congresses in exchange for prescribing (or promising to prescribe) J&J pharmaceuticals. In some cases, employees allegedly directed local travel agents to overcharge J&J Romania for the trips, with the excess funds used to cover additional expenses such as family travel or "pocket money."

Allegations Involving the U.N. Oil-for-Food Program

According to the pleadings, from 2000-2004, two wholly-owned J&J subsidiaries, Janssen Pharmaceutica NV ("Janssen") and Cilag AG International ("Cilag"), based in Belgium and Switzerland, respectively, engaged in a scheme to pay over $857,387 in kickbacks through a Lebanese agent to the Iraqi government in conjunction with United Nations Oil-for-Food Program. In exchange, Janssen and Cilag allegedly received 18 contracts worth, by DOJ estimates, approximately $9.9 million to provide pharmaceuticals to the Iraqi Ministry of Health, which generated approximately $6.1 million in profits. In order to win the contracts, Janssen and Cilag signed "side letters" with their Lebanese agent inflating his commissions by 10%. The companies then submitted the proposed Iraqi contracts, including the inflated "commissions," to the United Nations for approval. Once approved, Janssen and Cilag initiated payment from a New York bank account, thereby generating the funds for their agent to pay kickbacks. These kickbacks were allegedly mischaracterized by Janssen, Cilag and J&J on their books and records. In June 2004, after the invasion of Iraq obviated the need for kickbacks, the DPA states Janssen and Cilag amended their agent contracts by revoking the inflated 10% surcharge.

Settlement Details

In settling with the DOJ, J&J itself was not charged with any criminal violations of the FCPA. Under its DPA, however, J&J acknowledged responsibility for the actions of its subsidiary, DePuy, which had a criminal information filed against it on charges of conspiracy to violate the FCPA's anti-bribery provisions and violating the FCPA's anti-bribery provisions. In addition to its monetary penalty, J&J also agreed to implement enhanced compliance program requirements and report periodically on its compliance efforts to the DOJ during the term of the agreement.

In settling with the SEC, J&J, without admitting or denying the allegations, consented to the entry of judgment against it on charges that it violated the FCPA's anti-bribery, books and records and internal controls provisions. In addition to disgorging ill-gotten gains, J&J also agreed to comply with certain undertakings regarding its FCPA compliance program.

Noteworthy Aspects

- Voluntary Disclosure of the "Majority" of the Misconduct - Although the initial investigation against J&J was not triggered by a voluntary disclosure, J&J appears to have received partial credit for one, at least rhetorically. J&J originally received a subpoena from the SEC in February 2006 requesting documents related to participation by several J&J subsidiaries in the Oil-for-Food program. The following year, and while that investigation was still underway, the Company voluntarily disclosed to the DOJ and SEC potentially improper payments made by its subsidiaries in connection with the sale of medical devices in two small-market countries. The SEC press release acknowledges that J&J "voluntarily disclosed some of the violations by its employees," while the DPA credits the company for "voluntarily and timely disclos[ing] the majority of the misconduct."

- Remediation and Self-Monitoring - The DOJ press release states that J&J was not required to retain a corporate monitor because of the company's "pre-existing compliance and ethics programs, extensive remediation, and improvement of its compliance systems and internal controls, as well as the enhanced compliance undertakings included in the agreement." Instead, J&J must self-monitor, reporting to the DOJ "on the implementation of its remediation and enhanced compliance efforts every six months for the duration of the agreement." J&J must also disclose to the DOJ any "credible evidence" of questionable payments or "transfers of property" and any problematic related accounting issues, during this time. The imposition of such self-reporting requirements is a fairly recent enforcement phenomenon, but, as noted above, it appears it is becoming the DOJ's preferred approach in FCPA dispositions, with the DOJ now requiring it in the clear majority of recent corporate settlements. The enhanced compliance obligations imposed on J&J, set out in Attachment D to the DPA, appear to be a new addition to the DOJ's standard settlement agreement that adds detail to the standard "corporate compliance program" attachment. The enhanced obligations require J&J to create a more robust compliance department, with both regional and business segment compliance personnel, that reports directly to the Audit Committee through a seasoned Chief Compliance Officer. The obligations also call for J&J to, among other things, maintain effective mechanisms for tracking compliance issues, institute well-tailored gifts, hospitality and travel policies and procedures, conduct periodic risk assessments and audits, complete thorough pre-acquisition due diligence on acquisition targets, vet all third party sales intermediaries, and provide sufficient anti-corruption training.

- Industry-Wide Investigation - The DOJ press release characterizes J&J as having "played an important role in identifying improper practices in the life sciences industry" and highlights the company's "significant assistance in the industry-wide investigation." Given J&J's unique make-up as both a medical device and pharmaceutical company, this statement likely refers to both the pharmaceutical and medical device investigations under the larger umbrella of the "life sciences industry"(see our FCPA Winter Review 2008 and FCPA Autumn Review 2010, respectively). Some press outlets have questioned whether the J&J investigation was the impetus for these industry-wide investigations. The DOJ press release provides some support for this idea in stating that "as a result of its cooperation in the ongoing investigation of other companies and individuals" J&J received a reduction in its criminal fine, as outlined in the U.S. Sentencing Guidelines. According to J&J's DPA, the DOJ imposed a 25% downward departure from the bottom of the Sentencing Guidelines fine range (which was $28.5 million).

- Reduced Penalties in Recognition of U.K. Enforcement - The DOJ and SEC each stipulated that they reduced the financial assessments imposed on J&J in light of civil penalties the United Kingdom was going to impose on DPI (see Parallel Enforcement below).

- Parallel Enforcement - In a parallel proceeding based on the same underlying facts, the SFO obtained a Civil Recovery Order in the U.K.'s High Court on April 8, 2011, against DPI in recognition of "unlawful conduct relating to the sale of orthopedic products in Greece between 1998 and 2006" and DPI was ordered to pay £4.8 million ($7.85 million). The SFO launched its investigation into DPI in October 2007 after a referral from the DOJ. The SFO release characterized the J&J/DPI enforcement as a "global resolution" and concluded that criminal prosecution of DPI was prohibited in the United Kingdom by "principles of double jeopardy" in light of the DOJ's criminal prosecution of DePuy's parent, J&J, which had "the legal character" of a formally concluded prosecution and punished the same conduct. The SFO also noted that Greece has frozen €5.785 million ($8.35 million) worth of DePuy Hellas' assets while an investigation by Greek authorities into the matter continues. In January 2011, a Greek prosecutor reportedly brought felony charges against six state hospital doctors in connection with the bribery scheme. Not mentioned in either the U.S. or U.K. settlements, however, are bribery allegations that surfaced against J&J's Shanghai subsidiary in China in June 2010. According to press reports, J&J Medical (Shanghai) is being investigated by Chinese authorities for allegedly bribing Zhang Jingli, a former director of China's State Food and Drug Administration removed from his post in May 2010, to assist the company with drug applications and medical product registration. Zhang was reportedly expelled from the ruling Communist Party in January 2011 in connection with the investigation, which press accounts say prepares the way for his prosecution.

- Prosecution of "Executive A" - On April 14, 2010, Robert John Dougall, a former Director of Marketing for DePuy and J&J, pleaded guilty in the United Kingdom to making £4.5 million in corrupt payments to Greek healthcare professionals and was eventually sentenced to 12-month suspended sentence (see our FCPA Summer Review 2010). Dougall is almost certainly "Executive A" from the DOJ and SEC pleadings, and it was widely reported that Dougall was the first "cooperating defendant" in a major SFO anti-corruption investigation.

- Continued Oil-for-Food Prosecutions - J&J is the nineteenth company to be charged with an FCPA violation in the ongoing Oil-for-Food scandal.

- Due Diligence and Remediation - The J&J disposition is a reminder of the integral roles that due diligence and remediation of resulting issues play in a well-functioning compliance program. Here, J&J failed to conduct adequate due diligence on its initial target, DePuy, and its subsequent target, the Greek Distributor. As a result, J&J was never able to adequately assess the risks involved in these acquisitions at the outset or effectively integrate DePuy, its subsidiaries, and the Greek Distributor into the company's compliance program after the deal had been consummated. According to the pleadings, J&J also consistently failed to conduct adequate due diligence on agents and distributors and overlooked or ignored frequent red flags. Failure to place adequate emphasis on due diligence or have sufficient systems in place to identify and respond to red flags is a consistent theme of most FCPA enforcement actions.

On April 6, 2011, the DOJ and SEC settled enforcement actions against Comverse Technology, Inc. ("CTI"), a New York-based issuer formerly listed on the NASDAQ National Market system. CTI is a global provider of software and software systems for communication and billing services. According to the SEC's litigation release, the SEC alleged that CTI violated the FCPA's books and records and internal controls provisions and, as part of the settlement, CTI agreed to pay $1,249,614 in disgorgement and $358,887 in prejudgment interest. In the related DOJ matter, CTI entered into a two-year Non-Prosecution Agreement ("NPA") in which it agreed to pay a $1.2 million criminal fine, to continue to cooperate with ongoing related investigations, and to strengthen its compliance program. The DOJ's NPA only alleges FCPA books and records violations.

According to the disposition documents, from 2003 to 2006, Comverse Limited, an Israeli operating subsidiary of CTI, made improper payments totaling $536,000 to employees of a Greek telecommunications provider, Hellenic Telecommunications Organisation S.A. ("OTE"), whose largest single shareholder at the time was the Greek government. The payments were made in order to obtain or retain business contracts worth approximately $10 million in revenues. Comverse Limited allegedly reaped profits of approximately $1.2 million from the contracts.

The disposition documents state that, to facilitate and conceal the payments, Comverse Limited entered into a consulting agreement as early as 2000 with a third-party agent (the "Agent"), an Israeli citizen, purportedly to assist with sales for Comverse Limited in Greece and other countries, such as Italy. In 2003, at the direction of Comverse Limited's senior executives, the Agent incorporated an offshore entity in Cyprus called Fintron Enterprises Ltd. ("Fintron"). Comverse Limited entered into a contract with Fintron that specified that Fintron was to be paid a monthly retainer fee and agent commissions associated with each Comverse Limited customer.

According to the disposition documents, the agent commissions were a way to funnel improper payments to OTE and other customers. Fintron's only role was to be a conduit for the cash bribes; it had no offices or employees. Comverse Limited's employees directed the Agent's activities, determined his itinerary, and paid for his travel arrangements. They instructed him on the amount of his invoices to Comverse Limited, prepared and submitted the paperwork for the invoices' approval through an automated system at Comverse Limited, and deposited the funds in Fintron's Cyprus bank account. The Agent, after taking 15% from the total for himself, then allegedly paid or facilitated the payment of the remaining amount to Comverse Limited's customers in the form of cash bribes. These money exchanges occurred in Greece, Italy, and Israel directly between the Agent and Comverse Limited's customers, or between the Agent and Comverse Limited employees, who would then deliver the cash to Comverse Limited customers.

According to the disposition documents, Comverse Limited falsified its books and records by characterizing and recording the bribes as legitimate sales commissions. These improper records were then consolidated into CTI's financial statements and formed the basis of the books and records violations.

In addition, the disposition documents allege that in December 2005, Comverse Limited's head of security was alerted by airline officials that the Agent was engaged in suspicious activity in the form of frequent same-day round-trip flights between Israel and Italy. The Agent apparently falsely identified himself as an employee of CTI. Comverse Limited's head of security investigated the Agent and recommended, via a memorandum, that Comverse Limited gradually end its relationship with the Agent, and, in the interim, take steps to obscure Comverse Limited's connections with the Agent's activities (including hiring an outside travel agent, having the Agent stay at different hotels where he was not known as a Comverse Limited employee, and directing the Agent not to return on the same outbound flight he had taken to leave the country).

The SEC alleged that neither CTI nor Comverse Limited had policies or internal controls that required Comverse Limited's head of security to notify senior executives of the Agent's conduct. The SEC also alleged that CTI and its subsidiaries did not have a process for conducting due diligence of sales agents or for the independent review of agent contracts outside of the sales department. These issues formed the basis of the internal controls violations charged by the SEC but not the DOJ.

Noteworthy Aspects

- No Antibribery Charges Despite Partial Government Ownership of Customer - The DOJ's NPA alleges that the improper payment scheme involved Comverse Limited's customers in both Italy and Greece. Significantly, neither the SEC nor the DOJ alleged FCPA anti-bribery violations by CTI or Comverse Limited. With the exception of OTE, other Comverse Limited customers who received bribes are not identified in the disposition documents; presumably they were non-governmental actors and therefore not within the scope of the FCPA's anti-bribery prohibitions. Neither the SEC nor the DOJ identifies OTE as a government instrumentality, although the language used (identifying the Greek government as the largest single shareholder but not majority owner) suggests that they would have brought anti-bribery charges if there was evidence that CTI had knowledge of the payments or that Comverse Limited engaged in improper activity in the United States. This matter demonstrates that improper payments can serve as the predicate for FCPA accounting violations regardless of the status of the recipients.

- Follow-on Investigation - In the aftermath of the DOJ and SEC's announcements, news reports have indicated that OTE has initiated its own internal investigation to address allegations that individuals connected to the company accepted bribes from Comverse Limited during a three-year period from 2003 to 2006.

On April 6, 2011, JGC Corporation ("JGC"), a Japanese provider of global engineering, procurement, and construction ("EPC") services, settled charges with the DOJ relating to its alleged role in a scheme to obtain contracts by bribing various Nigerian government officials. JGC was a member of the TSKJ joint venture, whose other participants included Kellogg Brown & Root, Inc. ("KBR," former subsidiary of Halliburton), Snamprogetti Netherlands B.V. ("Snamprogetti," a former subsidiary of ENI, S.p.A. ("ENI")), and Technip S.A. ("Technip"). As detailed in our Summer 2010 FCPA Review and prior FCPA Reviews, the TSKJ joint venture and its agents allegedly agreed to pay approximately $180 million in bribes to Nigerian officials in exchange for contracts valued at over $6 billion to build liquefied natural gas facilities on Bonny Island, Nigeria. Since 2008, U.S. enforcement agencies have reached settlements with each of the other participants in the TSKJ joint venture, two of its U.K. agents (Wojciech Chodan and Jeffrey Tesler, as discussed below), two parent companies (Halliburton and ENI), and KBR's former CEO (Albert "Jack" Stanley). Additionally, non-U.S. enforcement actions related to the Bonny Island scheme include the Nigerian government's settlements with Halliburton and Snamprogetti, and the U.K. government's recent settlement with a former U.K. affiliate of KBR and JGC (M.W. Kellogg Limited ("MWKL"), as discussed below).

In its DPA with the DOJ, JGC agreed to pay a $218.8 million criminal fine. The company also agreed to review and enhance its compliance program, and to retain an independent compliance consultant to evaluate the program over the two year term of the DPA.

Noteworthy Aspects

- Ambiguous Basis for Jurisdiction - While the DPA and criminal Information indicate the basis for jurisdiction over other participants in the scheme (e.g., as "domestic concerns" or "issuers"), the DOJ does not specifically identify the basis of jurisdiction over JGC. Given JGC's status as a Japanese company that is not listed on any U.S. stock exchange, jurisdiction would appear to be possible only under Section 78dd-3 of the FCPA, which covers companies that are neither "issuers" (i.e., companies with securities registered with the SEC) nor "domestic concerns" (i.e., U.S. companies). In the pleadings, however, the DOJ does not reference 78dd-3. Rather, the criminal Information alleges that JGC conspired to violate, and aided and abetted violations of, Sections 78dd-1 and 78dd-2, which would apply to other participants in the scheme that qualify as "issuers" or "domestic concerns." It therefore appears that the DOJ used non-substantive charges (i.e., aiding and abetting, conspiracy) to reach conduct that was arguably beyond the jurisdiction of the underlying substantive crimes (78dd-1 and 78dd-2).

- Credit for Cooperation - Under the heading "Relevant Considerations," the DPA states that "after initially declining to cooperate with the Department based on jurisdictional arguments, JGC began to cooperate." This suggests that JGC received some credit for cooperation despite its initial refusal. However, the DPA's fine calculation does not mention JGC's cooperation (in contrast to the fine calculations for the other TSKJ participants). This suggests that JGC's initial refusal based on jurisdiction prevented it from receiving at least full credit for cooperation. Thus, the extent to which cooperation was a factor in the settlement remains unclear.

- Requirement of Independent Compliance "Consultant" - Under the DPA, JGC agreed to retain an independent compliance "consultant," which appears to serve the same function as the independent compliance "monitors" imposed under Technip's and KBR's settlement agreements. The requirement of an independent compliance consultant in this case contrasts with recent enforcement actions (which have tended not to include requirements for monitors). The difference could be attributed to various possibilities. The imposition of a consultant could be in response to the serious and systemic violations involved in JGC's case (and for which KBR and Technip were subjected to the requirement of an outside monitor). However, the requirement also could reflect that JGC began negotiating the terms of its settlement prior to the DOJ's apparent shift away from imposing independent monitors and consultants.

- Total U.S. Monetary Penalties Related to Bonny Island Scheme Dwarf Landmark Siemens Settlement - To date, the total penalties assessed by the U.S. Government against corporate participants in the Bonny Island corruption scheme are $1.5 billion. This amount far exceeds the landmark 2008 U.S. settlement with Siemens ($800 million).

On March 24, 2011, the SEC ordered Ball Corporation ("Ball Corp.") to cease and desist from committing or causing any violations of the FCPA's books and records and internal controls provisions and assessed a civil monetary penalty in the amount of $300,000, resolving the Commission's investigation of allegations that a Ball Corp. subsidiary, Formametal, paid bribes to Argentine officials to ease import and export restrictions.

Ball Corp. is an Indiana corporation based in Colorado and listed on the NYSE with 14,000 employees and worldwide operations that manufacture metal packaging for beverages, foods, and household products. In March 2006, Ball Corp. acquired Formametal, an Argentine company that manufactures aerosol cans. As a wholly-owned subsidiary of Ball Corp., Formametal's financial results are consolidated with Ball Corp's financial statements.

The Commission found that three months after the acquisition of Formametal, a Ball Corp. accountant discovered that the subsidiary's employees may have made questionable payments to Argentine customs officials, and reported this to his superiors. The SEC alleges that several senior Ball executives saw the "Formametal Report" but did not take action sufficient to prevent future infractions by Formametal employees.

As a result, the Commission found that between July 2006 and October 2007, Formametal's senior officers, including its former President and Vice President of Institutional Affairs, authorized at least ten unlawful payments totaling approximately $106,749 to Argentine officials. The majority of the alleged bribes were paid to Argentine customs officials to evade Argentine laws prohibiting the importation of used equipment and parts. The payments were disguised to appear as legitimate business expenses in Formametal's books and records.

The SEC specifically highlighted two cases of alleged improper payments. First, according to the Order, Formametal's former President authorized five payments of $4,821 each to a customs official in an attempt to avoid high government duties on copper scrap exports. The President estimated that obtaining waivers for such duties could create $1.5 million in annual profits for the company. The payments were disguised by funneling them through a third party customs agent. The SEC found that despite the President's efforts, the plan was unsuccessful.

The second incident described in the SEC's order involved the payment of a bribe by Formametal's former Vice President of Institutional Affairs to a customs official in connection with the importation of certain machinery. The SEC alleged that the Vice President paid the bribe out of his personal funds and was reimbursed by Formametal in the form of a company car. Ball Corp.'s accountants discovered this incident in February 2007.

The SEC alleged that both Ball Corp. and Formametal had weak internal control systems that made it difficult to detect the improper behavior. The Commission found, for example, that Formametal imported equipment into Argentina in 2006 and 2007 without appropriate invoices and documentation. The agency also noted that Ball Corp. retained "key personnel [of the subsidiary] responsible for dealing with customs officials . . . even though external due diligence performed on [the subsidiary] suggested that [the subsidiary's] officials may have previously authorized questionable payments."

Ball Corp. voluntarily disclosed these issues to the SEC and the DOJ, cooperated with the SEC's investigation, and promptly engaged in remedial acts, all of which was recognized by the SEC when it crafted its cease-and-desist order and civil monetary penalty. The company noted in its annual report that DOJ also investigated the matter and chose not to bring charges.

Noteworthy Aspects

- Post-Acquisition Risks and Liabilities - As noted above, the SEC rebuked Ball Corp. for retaining employees found to have engaged in potentially risky past behavior. The facts available also suggest that, while Ball Corp. undertook post-acquisition due diligence, it did not act sufficiently quickly on the results of that effort to remediate the chance of similar behaviors for which it was then held liable. Thus, this case provides an additional example as to the importance of engaging in, and taking expeditious action on the results of, post-acquisition diligence.

- No Anti-Bribery Violations - Although the SEC's order specifically discusses bribes made by the subsidiary's executives after the parent's executives were put on notice of potentially improper payments, the SEC did not charge Ball Corp. with violating the FCPA's anti-bribery provision.

- Customs a Common FCPA Risk Area - This case follows a number of other matters (notably the Panalpina cases FCPA Winter Review 2011) that centered on payments involving customs officials. This case is a reminder that compliance efforts should concentrate on this area of risk, among others.

- Potential Benefits of Voluntary Disclosure and Cooperation - The SEC's order states that "the Commission is not imposing a civil penalty in excess of $300,000 based upon [the company's] cooperation in a Commission investigation and related enforcement action." This penalty is far lower than that assessed in recent FCPA matters.

On March 18, 2011, IBM Corporation ("IBM") settled charges with the SEC regarding IBM's alleged violation of the FCPA's books and records and internal controls provisions from 1998 to 2009. According to the Commission, IBM failed to prevent or detect the flow of improper cash payments, gifts, and travel and entertainment benefits from the company's affiliates in South Korea and China to "foreign officials" in those countries (the Complaint does not specify whether the officials were employees of state-owned entities or government agencies; it merely states generically that the South Korean officials were employees of "South Korean government entities" and that the Chinese officials were employees of "government-owned or controlled [IBM] customers in China.").

From 1998 to 2003, employees of IBM Korea, Inc. ("IBM-Korea"), an IBM subsidiary, and LG IBM PC Co., Ltd. ("LG-IBM"), a joint venture in which IBM held a majority (51%) interest, allegedly supplied South Korean officials with improper cash payments in exchange for assistance in securing the sale of IBM products. According to the SEC, IBM-Korea spent approximately $135,558 in cash bribes and LG-IBM spent $71,599; the Commission also alleged that LG-IBM provided free personal computers to, and paid for the entertainment expenses of, South Korean officials. The SEC's Complaint states that payments typically were either supplied directly from IBM-Korea employees to South Korean officials in cash envelopes, or were supplied indirectly through LG-IBM business partners, who were paid large "installation fees" to reimburse them for bribes that LG-IBM directed be paid to certain South Korean officials. According to the SEC, these improper payments were recorded as legitimate business expenses and formed the basis of the Korea-related books and records and internal controls charges stated in the SEC's Complaint.

From 2004 to 2009, employees of IBM (China) Investment Co., Ltd., and IBM Global Services (China) Co., Ltd. (collectively "IBM-China"), both wholly-owned IBM subsidiaries, allegedly created slush funds at local travel agencies in China that were then used to pay for overseas and other travel expenses incurred by Chinese officials. According to the SEC, IBM-China employees created similar slush funds with their business partners in order to provide cash payments and improper gifts, such as cameras and laptop computers, to Chinese officials. The primary improper behavior in China centered on travel junkets for which IBM-China allegedly furnished funds for side-trips, per diems, and gifts to Chinese officials, or paid for trips unrelated to any business purpose. The SEC's Complaint states that these payment schemes were concealed by the submission of fraudulent purchase requests and fake invoices and notes that IBM's internal controls failed to detect at least 114 instances of improper activity involving two key IBM-China managers and more than 100 IBM-China employees.

To settle the allegations, IBM agreed to pay disgorgement of $5.3 million, $2.7 million in prejudgment interest, and a $2 million civil penalty, for a total of $10 million. IBM also consented to the entry of a final judgment that permanently enjoins the company from violating the FCPA's books and records and internal controls provisions.

Noteworthy Aspects

- Multi-Jurisdictional Prosecutions - The settlement of the SEC's investigation comes after a flurry of prosecutions by South Korean authorities regarding the same activity in South Korea. According to IBM's September 2010 10-Q filing, in January 2004, South Korean prosecutors brought criminal bid-rigging charges against IBM-Korea, LG-IBM, and certain employees of those companies. Later that same year, a number of the targeted employees were found guilty and sentenced, while IBM-Korea and LG-IBM were forced to pay fines and abide by temporary debarment orders. This is a further example of a recent trend in which companies alleged to have engaged in illicit conduct face prosecution in multiple countries regarding the same activity.

- Joint Venture Liability - In this matter, like the RAE case settled earlier this year, IBM was held responsible for the conduct of employees of a joint venture, LG-IBM, in which IBM had a controlling 51% interest. Issuers need to be aware that with regard to the FCPA's books and records and internal controls provisions, they are strictly liable for the violations of majority-owned joint ventures.

- Travel Expenses - This case highlights the fact that the provision of travel benefits and expenses for foreign officials poses a significant area of risk for companies operating in China. Several prior FCPA cases have involved similar activity, (see, e.g., Lucent Technologies and UTStarcom), in which a company's Chinese subsidiary funds lavish travel experiences for Chinese officials and hides the illicit conduct from the parent company by submitting fraudulent requests for approval of purportedly legitimate business travel. These matters and the use of a travel agent for improper payments by Johnson & Johnson's subsidiary in Poland noted above, suggest that travel agents should be treated as high risk third parties and subject to enhanced due diligence and monitoring in certain countries.

- No Anti-Bribery Violations - Although the SEC's Complaint refers to the improper cash payments made by IBM-Korea and LG-IBM as "bribes," the SEC did not charge IBM with violating the FCPA's anti-bribery provision. This is likely due to the SEC's lack of jurisdiction over IBM's Korean affiliates and is reflected by the absence of any mention in the Complaint of improper activity in the United States or involvement of the parent company.

- Repeat Offender - This is the second FCPA resolution involving IBM, although the SEC's Complaint makes no mention of that fact despite the Commission's highlighting of other companies' repeat offender status (see Vetco FCPA Winter Review 2009, FCPA Autumn Review 2007, and in our July 9, 2004 Alert). In December 2000, IBM entered into a settlement with the SEC regarding charges that IBM violated the FCPA's books and records provision due to the actions of its Argentine subsidiary, which allegedly made improper payments to Argentine officials in an attempt to win a $250 million computer systems contract for a government-owned commercial bank.

On February 10, 2011, Tyson Foods Inc. ("Tyson") settled charges with the SEC related to improper payments made by its subsidiary, Tyson de Mexico ("TdM"), to two government veterinarians performing certifications of Tyson products being exported from Mexico. In its Complaint filed in the District Court for the District of Columbia, the SEC accused Tyson of violating the FCPA's anti-bribery and accounting provisions. Tyson consented to the entry of a final judgment ordering disgorgement plus pre-judgment interest of more that $1.2 million.

Also on February 10, 2011, the DOJ filed a criminal information against Tyson, charging the company with one count of conspiracy to violate the FCPA's anti-bribery and accounting provisions and one count of violating the FCPA's anti-bribery provision. Tyson entered into a two-year DPA with the DOJ, agreeing to pay a $4 million penalty.

The SEC and DOJ charges relate to payments made by TdM to two government veterinarians and their wives over a twelve year period. From 1994 through 2004, the veterinarians were classified by the Mexican government as "approved" veterinarians, which allowed them to bill Tyson for the inspection services they provided to TdM. During the same time period, Tyson also allegedly paid salaries and benefits to the wives of both veterinarians, which improperly supplemented payments to the veterinarians. In 1994, shortly after Tyson acquired a controlling interest in TdM, Tyson executives attempted to stop making payments directly to the veterinarians, but later approved resuming them when one of the veterinarians "threatened to interfere" with the shipment of products from a TdM facility.

By 2004, both veterinarians had been reclassified as "official" veterinarians and were paid directly by the Mexican government; under Mexican law they were no longer permitted to receive fees for their services from Tyson. Tyson did not, however, cease paying the veterinarians their consulting fees. Also in 2004, according to the disposition documents, several Tyson executives, including the former General Manager of TdM and subsequent President of Tyson International, the VP for Internal Audit, and the VP for International, met to discuss shifting the salary payments from the wives to the veterinarians. The disposition documents state that, while the executives conceded that the payments to the ghost employees should stop, they determined that payments to the veterinarians needed to continue to prevent them from causing problems at the plants. In August 2004, TdM allegedly stopped making payments to the wives, but increased the fee payments to the veterinarians by the exact amount the wives had received. The payments were discovered by counsel for TdM in 2006, after which Tyson conducted an internal investigation and voluntarily disclosed its findings to the SEC and DOJ in April 2007.

Noteworthy Aspects

- Violations - Despite noting that TdM had made improper payments to the veterinarians and their wives since 1994, and had books and records violations for those years, the SEC and DOJ only charged Tyson with anti-bribery violations, and disgorged profits, for 2004, 2005, and 2006.

- Culpability Score - In calculating the culpability score, the DOJ gave Tyson credit for responding promptly to the improper payments once they were discovered through the 2006 internal investigation, even though the former General Manager of TdM and President of Tyson International, the VP for Internal Audit and the VP for International knew of the payments in 2004 and approved them through 2006. According to press reports, these executives are either no longer with the company or have been disciplined following the investigation.

On January 31, 2011, Maxwell Technologies Inc. ("Maxwell"), a U.S. manufacturer of energy storage and power delivery products, agreed to pay over $14 million in penalties and disgorgement of profits to settle charges that the company violated the FCPA's anti-bribery and accounting provisions, and SEC disclosure regulations. The DOJ and SEC alleged that Maxwell used a Chinese agent to pay bribes to secure contracts with Chinese state-owned companies, and that Maxwell mischaracterized the illicit payments to the agent as sales-commission expenses.

Maxwell's DPA with the DOJ states that from at least July 2002 through May 2009, Maxwell and its Swiss subsidiary paid approximately $2.7 million to its Chinese sales agent to be distributed to "foreign officials," specifically employees of Chinese state-owned entities, in exchange for securing contracts. The DPA states that Maxwell's subsidiary generated the funds for the improper payments by adding 20% to its sales quotes to the state-owned entities at the agent's instruction. The agent's invoices characterized the additional 20% as an "extra amount" or "special arrangement" fees.

The DPA states that Maxwell's U.S. management had knowledge of the bribery scheme, tacitly approved it, and concealed it. In particular, the DPA states that Maxwell's Controller for Europe, upon learning of a payment to a Chinese bank account related to the sale of equipment, sent an email to the company's most senior officers in which he concluded "[i]t would appear that this payment is a kick-back, pay-off, bribe, whatever you want to call it." Maxwell's Chief Operating Officer allegedly replied that "this is a well know[n] issue," and that there should be "[n]o more emails please." Following this exchange, the DPA states that the payments to the agent only increased.

In the DPA, Maxwell agreed to pay an $8 million criminal penalty and to implement an enhanced compliance program and internal controls to settle charges of anti-bribery and books and records violations. It also agreed to report periodically to the DOJ concerning its compliance efforts over the three year term of the DPA.

In the related SEC enforcement action, the agency charged Maxwell with disclosure violations in addition to anti-bribery and accounting violations under the FCPA. Specifically, the complaint alleges that Maxwell violated Section 13(a) of the Exchange Act and related Rules by failing to disclose in its annual and periodic filings that the material proceeds from the bribery scheme enabled Maxwell to better financially position itself until it could develop and sell new products.

The SEC's complaint also provides more detailed allegations than the DPA in certain areas, including deficiencies in the company's oversight of the Chinese agent, and response to concerns about the agent. In particular, the complaint alleges that Maxwell failed to question the purpose of the 20% added to contract prices, did not request supporting documentation for the agent's invoices, performed no due diligence on the agent, did not require FCPA training for relevant employees, and failed to take any action after concerns came to the attention of senior managers in 2002. To settle the charges brought by the SEC, Maxwell agreed to pay over $6.3 million in disgorgement and pre-judgment interest.

Noteworthy Aspects

- Disclosure Violations Stemming from Material Bribery - The inclusion of charges of disclosure violations is rare in FCPA enforcement actions. Here, the SEC brought such charges because it considered the proceeds from the scheme to be material. In particular, the SEC claimed that Maxwell greatly depended on revenue from the bribery to help fund its expansion into new product lines that are expected to become Maxwell's future source of revenue. The SEC also alleged that over the course of the scheme, revenues from the bribery increased, to account for over 13% of the company's total revenues in 2009.

- Self-Monitoring - Under the DOJ settlement, Maxwell is required to conduct a review of its anti-corruption compliance program and to submit periodic reports to the DOJ over the three-year term of the DPA. As noted in the introduction considering the DOJ's requirement of self-monitoring in other recent enforcement actions, this case may be additional evidence of a trend away from the use of external monitors.

- Criminal Accounting Charges - Sections 78m(b)(4)-(5) of the FCPA reserve criminal accounting liability for instances where defendants knowingly commit a books and records or internal controls violation. Allegations of criminal accounting violations are rare. The DOJ's allegation that Maxwell's actions met this higher standard suggests that the agency found the company's actions to be unusually egregious.

- Potential Individual Prosecutions - In light of the DOJ's and SEC's allegations that U.S. officers of Maxwell were aware of the bribery scheme, there would appear to be no jurisdictional impediments to bringing enforcement actions against such officers. Additionally, the emails cited in the complaints could be used as evidence in individual prosecutions. However, according to the SEC pleadings, the subsidiary's Senior Vice President who approved the agent's contracts is a Swiss national and left the company in 2009, which could impede the agencies' exercise of jurisdiction over that individual. In the DOJ's and SEC's respective press releases, the agencies noted that their investigations are ongoing.

- Blurring of Knowledge Requirement - In addition to instances where the SEC claimed the company had actual knowledge of the bribery scheme, the agency alleged that certain documents show Maxwell "knew or should have known" of the scheme. This language differs from the standard enumerated in the statute (which requires "knowledge," defined to include awareness of a high probability of bribery) and is similar to the "reason to know" standard that was removed from the FCPA by a 1988 amendment.

Actions Against Individuals

In March 2011, two of the 22 SHOT Show defendants, Daniel Alvirez and Jonathan Spiller, pled guilty to FCPA-related charges. As reported in our FCPA Spring Review 2010, the SHOT Show defendants were arrested in January 2010 and charged with allegedly engaging in schemes to bribe an undercover FBI agent they believed was acting on behalf of the government of Gabon in order to win a $15 million contract to provide law enforcement and defense equipment to the Gabonese presidential guard.

On March 29, 2011, Jonathan Spiller, a U.K. citizen, pled guilty to one count of conspiracy to violate the anti-bribery provisions of the FCPA. According to his plea agreement, Mr. Spiller faces up to five years in prison, a fine of not more than $250,000 or twice the pecuniary gain or loss derived from the offense, and up to three years' supervised release.

Mr. Spiller, the former owner and president of a Florida company providing consulting services related to law enforcement and military equipment and part owner of another Florida company in the business of marketing and selling law enforcement and military equipment, is alleged to have committed one count of conspiracy to violate the FCPA relating to his involvement in sales of equipment to undercover FBI agent he believed was acting on behalf of the Gabonese government.

According to the details contained in the indictment and statement of offense accompanying the plea deal, Mr. Spiller proceeded with an agreement to supply defense articles to the Gabonese presidential guard after being informed that the price would be inflated so that half of the commission payments could be paid to an individual he believed to be the Gabonese Minister of Defense. The statement of offense alleges that Mr. Spiller took steps in furtherance of the conspiracy, including receiving payment from an account understood to be controlled by the Gabonese government and making arrangements to wire funds from his company's bank account to make the payment to the minister of defense.

Based upon the federal sentencing guidelines, the government is recommending a sentence between 37-46 months. As of the date of publication, no sentencing date has been set.

On March 1, 2011, Daniel Alvirez, former president of ALS Technologies Inc., an Arkansas-based company that manufacturers ammunition and other military equipment, pled guilty to two counts of conspiracy to violate the anti-bribery provisions of the FCPA. According to his plea agreement, Mr. Alvirez faces up to five years in prison, and a fine of not more than $250,000 or twice the pecuniary gain or loss derived from the offense, and up to three years' supervised release for each count.

According to the superseding information, filed on March 5, the first conspiracy count related to the Gabonese sting operation described above. The second count of conspiracy to violate the FCPA related to Alvirez's involvement in sales of equipment and rations to the Republic of Georgia. According to the details contained in the statement of offense, Mr. Alvirez and a co-conspirator entered into an agreement to purchase ammunition for the Republic of Georgia believing that the sales representative and sales agent facilitating the sale were "directly or indirectly paying bribes to government officials in Georgia to assist in obtaining and retaining the ammunition contract." The statement of offense further alleges that Mr. Alvirez received a finders' fee from the same sales agent, for introducing the sales agent to a company that manufactured meals ready to eat. The government alleges Mr. Alvirez believed the sales agent was making payments to government officials to obtain the meals ready to eat contract.

The superseding information did not include the money laundering charges or substantive FCPA charges present in the initial indictment. Mr. Alvirez is scheduled to be sentenced on June 22, 2011. Based upon the federal sentencing guidelines, the government is recommending a sentence between 87-108 months.

Jeffrey Tesler, an alleged former middleman for the TSKJ joint venture, pled guilty on March 11, 2011, before U.S. District Judge Keith Ellison of the Southern District of Texas to one count of conspiracy to violate the FCPA's anti-bribery provisions and one count of violating the FCPA's anti-bribery provisions. As detailed in our prior FCPA Reviews and discussed in the section on JGC above, the DOJ indicted Tesler and Wojciech Chodan (a former consultant to a subsidiary of KBR) in February 2009 for their alleged role in helping the TSKJ joint venture partners to obtain EPC contracts to build liquefied natural gas facilities on Bonny Island, Nigeria. Tesler and Chodan, both U.K. citizens, unsuccessfully fought extradition in the U.K. courts. Following Chodan's extradition in December 2010, he pled guilty to FCPA violations and is awaiting sentencing. Tesler was extradited on March 11, the same day that he pled guilty. According to the Department of Justice press release, Tesler agreed to forfeit $148,964,568.67 as part of his plea deal, the largest-ever FCPA-related forfeiture order against an individual. According to the DOJ release, Tesler faces a maximum penalty of five years in prison on each count. Tesler was released on a $50,000 cash bond and is required to live in the Houston area until his June 22 sentencing. Chodan and Tesler are now scheduled to be sentenced on June 21 and 22 respectively.

Former Innospec Executive Settles with SEC

On January 24, 2011, the former CFO and CEO of Innospec, Paul W. Jennings, agreed to settle SEC charges alleging violations of the anti-bribery, books and records, and internal control provisions of the FCPA. As reported in our FCPA Spring Review 2010, in March of last year, Innospec, a chemical and additives manufacturer and distributor, reached a $40.2 million global settlement with the DOJ, SEC, SFO, and OFAC for more than a dozen criminal charges in the United States and the United Kingdom, including violations of the FCPA. Mr. Jennings is the third individual associated with Innospec to face separate enforcement actions related to the widespread bribery that occurred at the company between 2000 and 2008. As part of his settlement, Mr. Jennings has agreed to disgorge $116,092 in ill-gotten gains, pay pre-judgment interest of $12,945, and pay a civil penalty of $100,000. The fines take Mr. Jennings' cooperation into consideration. The SEC has acknowledged help from the DOJ and the SFO. Neither of those agencies has announced separate charges against Mr. Jennings.

The SEC complaint alleged that Mr. Jennings played a key role in Innospec's bribery activities in Iraq and Indonesia. In Iraq, Mr. Jennings was allegedly aware of and, in at least one case, actively approved, payment of kickbacks and the provision of lavish trips to officials at the Iraqi Ministry of Oil ("MoO") in part through Innospec's agent for Iraq, Ousama M. Naaman. The SEC complaint primarily covers the same conduct concerning the MoO alleged against Innospec and Mr. Naaman, who was charged and settled with the SEC and DOJ as detailed in our FCPA Spring Review 2010 and FCPA Summer Review 2010. In addition to those allegations, Mr. Jennings was allegedly aware of a separate bribery scheme which involved paying Iraqi officials to ensure the failure of a competitor's product during a field test and a scheme involving offering bribes of about $850,000 to Iraqi officials as part of a 2008 Long Term Purchase Agreement ("LTPA"). The LTPA bribes were never paid due to government investigations and while Mr. Jennings was alleged to be generally aware of them, the SEC did not allege that he had specific knowledge.

Mr. Jennings is also alleged to have approved improper payments to personnel affiliated with the Indonesian state owned oil and gas concerns BP-MIGAS and Pertamina from 2000 through 2005 in order to secure contracts worth over $48 million. As discussed in the complaint and FCPA Spring Review 2010, Mr. Jennings used various euphemisms to refer to the bribery scheme, including "the Indonesian Way," "the Lead Defense Fund," and "TEL optimization." The bribes were allegedly made through an Indonesian agent and amounted to approximately $2,883,507.

The SEC's complaint also alleged that from 2004 to 2009, Mr. Jennings signed annual certifications that were provided to auditors where he falsely stated that he had complied with the company's Code of Ethics which incorporated Innospec's FCPA policy and that he was unaware of any violations of the Code of Ethics by anyone else. Mr. Jennings also signed quarterly and annual personal certifications pursuant to the Sarbanes-Oxley Act of 2002 ("SOX") in which he made false certifications regarding the company's books and records and internal controls. He also signed false management certifications to Innospec's auditors indicating that the books and records were accurate and that Innospec had appropriate internal controls.

Former Latin Node CFO and Senior Executive Pleaded Guilty to Conspiracy to Violate the FCPA

On January 12 and January 21, 2011, Manuel Salvoch and Juan Pablo Vasquez, two former executives of Miami based telecommunications company Latin Node Inc. ("Latin Node"), pled guilty to conspiracy to violate the FCPA. Mr. Salvoch served as CFO from 2005 to 2007, and Mr. Vasquez held various senior executive positions including Vice President of Sales, Vice President Wholesale Division, and COO between 2000 and 2007. Both defendants' cases were sealed at the outset. To-date, the DOJ has not issued a press release in either case.

According to the Mr. Salvoch's criminal information, he was responsible for approving payments and wire transfers to employees of the Honduran state-owned telecommunications company, Empresa Hondureña de Telecomunicaciones ("Hondutel"). For his part, the Vasquez criminal information indicates that Mr. Vasquez was allegedly involved in the decision to pay bribes to Hondutel officials in exchange for preferential interconnection rates between the United States and Honduras. Sentencing for Mr. Salvoch and Mr. Vasquez is currently scheduled for April 21, 2011, and May 6, 2011, respectively.

As noted in the FCPA Winter Review 2011, former Latin Node executives Jorge Granados and Manuel Caceres pleaded not guilty in January 2011 to nineteen-counts of conspiracy, violations of the anti-bribery provisions of the FCPA, and international money laundering. Their trial is currently scheduled to commence on September 26, 2011.

Telecommunications Company Controller Sentenced to 24 Months

On January 21, 2011, former telecommunications company controller Antonio Perez was sentenced to a 24 month prison term for his role in a conspiracy to pay and conceal bribes to employees of Haiti's state-owned telecommunication company, Telecommunications D'Haiti ("Haiti Teleco"). In addition, the court ordered Perez to pay a $100 special assessment. As noted in our FCPA Spring Review 2009, Perez pled guilty in May 2009 to one count of conspiracy to violate the anti-bribery provisions of the FCPA and the Money Laundering Control Act of 1986 ("MLCA"). At the time of Perez's plea, he faced a maximum sentence of 60 months followed by a supervised release of 36 months. However, the DOJ agreed to recommend a reduction in the offense level by 2 to 3 levels pursuant to Section 3E1.1(a) of the Sentencing Guidelines. According to the DOJ, the sentencing recommendation was based on Perez' timely recognition and acceptance of personal responsibility for his misconduct.

According to the criminal information against Perez, from 2001-2002, he offered to pay and assisted with the processing of "side payments" to a Haiti Teleco official. The funds were funneled from Perez's employer (an unidentified U.S. telecommunications company) through a holding company called J.D. Locator to the now former Haiti Teleco Director of International Relations, Robert Antoine. Perez's company paid over $800,000 in bribes intended for Antoine while Antoine was a Haiti Teleco employee. Perez admitted in his plea to conspiring to issue two "side payment" checks totaling $36,375 to J.D. Locator and falsely recording the payments as "consulting services."

Perez is the fourth of eight individuals charged in the Haiti Teleco scheme to be sentenced. Former Haiti Teleco director Antoine, J.D. Locator president Juan Diaz, and president/director of Miami-based Fourcand Industries Jean Fourcand were sentenced previously, as discussed in our FCPA Summer Review 2010 and FCPA Autumn Review 2010. The three remaining individuals, Joel Esquenazi, Carlos Rodriguez, and Marguerite Grandison, are currently in trial in the Southern District of Florida on charges of conspiracy to violate the FCPA and to commit wire fraud and numerous counts of violating the FCPA and money laundering.

Domestic Litigation

Challenges to the FCPA Definition of "Foreign Official"

In at least three recent criminal cases brought against individuals for alleged violations of the FCPA's anti-bribery provisions, defendants have moved to dismiss either the FCPA counts against them or entire indictments — arguing that officers and employees of state-owned companies are not "foreign officials" for purposes of the FCPA. One motion was denied, and two remain pending. The U.S. Government's position that such personnel fall within the scope of the FCPA has been a condition underlying the disposition of a number of FCPA cases over the years, including some discussed above. As with several other interpretive issues under the Act, companies have chosen not to dispute these issues with the DOJ and SEC. Instead, individual defendants, facing jail time and unencumbered by public relations and other considerations faced by companies, are at the forefront of challenging enforcement positions in court.

Four individual defendants in United States v. Carson, No. 8:09-cr-00077 (C.D. Cal.), filed a motion to dismiss ten counts of the indictment against them, arguing that the FCPA does not apply to officers and employees of state-owned business entities, and thus challenging the U.S. Government's interpretation of "foreign official." The indictment alleges that the defendants violated the anti-bribery provisions of the FCPA by paying bribes to officers and employees of state-owned companies in China, Korea, Malaysia, and the United Arab Emirates. In their motion, the four defendants, who are former executives of Control Components, Inc. ("CCI") (see our FCPA Spring Review 2009, FCPA Autumn Review 2009, FCPA Winter Review 2009, and FCPA Winter Review 2010 for more information on the CCI prosecution), argue that officers and employees of a state-owned company are not "foreign officials" for purposes of the FCPA, because the term "instrumentality" as used in the FCPA does not encompass state-owned businesses.

Under the FCPA, "foreign official" is defined as an "officer or employee of a foreign government or any department, agency, or instrumentality thereof." But the federal courts have never squarely addressed whether a government-owned or -backed enterprise falls within the "instrumentality thereof" clause, and the district courts are now wading into the issue.

In their motion, the moving Carson defendants urged Judge James V. Selna to consider five main points:

- First, as used in the FCPA, the term "instrumentality" refers to a governmental unit or subdivision that is akin to a "department" or "agency," the two terms that precede it in the statute; the definition of "instrumentality" does not, however, extend to entities in which a government merely has a monetary investment, because such a definition would make the term fundamentally different from those that precede it;

- Second, the Government's proposed interpretation would lead to absurd results; for example, it would transform persons no one would consider to be foreign government employees (e.g., U.S. citizens working in the United States for companies that have some component of foreign ownership) into "foreign officials";

- Third, the legislative history of the FCPA makes clear that Congress did not intend the statute to cover payments made to employees of state-owned business companies, but instead intended to target bribery of foreign government officials;

- Fourth, Congress knows how to define the term "instrumentality" in terms of government ownership of a commercial enterprise, and it did not do so in the FCPA; and

- Fifth, adopting the Government's expansive interpretation of "instrumentality" would result in unconstitutional vagueness.

As to the fifth point, the moving defendants noted that the "Government has never explained with any clarity what constitutes a ‘state-owned' business in the context of the FCPA. Is a minority investment by a foreign government enough? Is a majority investment required? Must the state direct the majority of voting rights? Is there a required element of control? Does the purpose or type of commercial enterprise matter? Could a subsidiary of a state-owned business qualify?" The defendants argue that "[w]ithout a clear demarcation, especially in an era of large-scale government investments and bailouts of traditional private enterprises, the FCPA's reach, under the Government's theory, would be whatever the prosecution says it is in any given case."

Judge Selna has scheduled a May 9, 2011, hearing on the Carson defendants' motion, which comes on the back of an April 1, 2011, ruling in United States v. Lindsey Manuf. Co., No. 2:10-cr-01031 (C.D. Cal.), denying defendants' motion to dismiss in that case. The Lindsey defendants sought to dismiss the action on grounds similar to those advanced in Carson. In Lindsey, the entity in question is Comisión Federal de Electricidad ("CFE"), a Mexican electric utility company. The U.S. Department of Justice ("DOJ") opposed the Lindsey defendants' motion, in which it contended that the plain language of the term "instrumentality" includes state-owned entities, and that a contrary interpretation "would leave a portion of the FCPA without any effect and would take the United States out of compliance with its treaty obligations…" The DOJ also urged that an interpretation of "instrumentality" that includes state-owned entities is consistent with the legislative history of the FCPA.

To the DOJ, any entity through which a foreign government achieves an end or purpose is an "instrumentality" of that government. The DOJ's definition is broad, with the DOJ itself noting that the spectrum of government purposes can be "myriad." For example, the DOJ stated that if a government decides to provide electricity through an entity as a government service, then the DOJ considers that entity to be an instrumentality of the government. And in answering the question of when an entity is, in fact, state-owned or state-controlled, it appears that the DOJ will primarily consider the "nature" of the relevant entity, in terms of whether the entity was mandated by constitution, formed by law, owned by the public," and/or intended to serve the public. Otherwise, the DOJ has indicated that other important factors to consider include whether the government may, directly or indirectly, exercise a "dominant influence" over the entity, meaning whether the government:

- Holds the majority of the entity's subscribed capital;

- Controls the majority of votes attaching to shares issued by the entity; and/or

- Can appoint a majority of the members of the entity's administrative or managerial body or supervisory board.

The "dominant influence" standard is set out in the official Commentaries to the 1998 OECD Anti-Bribery Convention, which is one of the key treaties cited by the U.S. Government as imposing the obligations the DOJ is defending in this case.

Ruling from the bench, Judge Howard Matz found that it was unnecessary to turn to the FCPA's legislative history to determine whether employees of state-owned companies are "foreign officials" — because based on the undisputed facts concerning the entity in question and dictionary definitions of "instrumentality," it could be determined as a matter of statutory construction that the officials were "foreign officials." Thus, the Lindsey trial will move forward.

The issue is also being litigated in at least one other case, United States v. O'Shea, No. 4:09-cr-00629 (S.D. Tex.), where the defendants have filed a similar motion to dismiss, which the DOJ has opposed. With three different courts addressing the same question — whether an officer or employee of a state-owned enterprise is a "foreign official" for purposes of the FCPA — the result(s) will likely have a direct impact on how the DOJ approaches, investigates, and prosecutes pending and future cases involving allegations of corrupt payments to such individuals. The decisions likely will ultimately generate at least a circuit level decision, as was the case with the Kay case several years ago, which construed another key provision of the FCPA.

International Developments

Panalpina-Related Cases Lead to Nigerian Settlements

On March 3, 2010, Tidewater Inc. ("Tidewater") became the latest Panalpina case company to reach a settlement with Nigerian authorities. As reported in our Winter 2011 FCPA Review, the freight forwarder Panalpina and six of its customers, including Tidewater, Royal Dutch Shell plc ("Shell"), Transocean Inc., Pride International Inc., Noble Corp. ("Noble"), and GlobalSantaFe Corp, settled charges by the DOJ and SEC that Panalpina made improper payments to officials on the customers' behalf to import items into Nigeria and other countries. According to press accounts, since December 2010, Nigerian authorities have arrested executives of several of the customers (including Noble and Tidewater), and Shell and Noble have agreed to pay $10 million and $2.5 million respectively to settle Panalpina-related charges with Nigerian authorities. Tidewater announced that it will pay $6.3 million to resolve the Nigerian investigation.

China Passes Foreign Bribery Law; Indonesia and India Introduce Foreign Bribery Legislation

Three nations in Asia have made prominent moves in the criminalization of foreign bribery in recent months. On February 25, 2011, the People's Republic of China signaled an intent to prosecute bribery beyond its borders with the passage of an amendment to an existing domestic bribery provision in China's criminal code.

The existing Criminal Law of the People's Republic of China 1979 (amended 1997) ("CLPRC"), criminalizes both active and passive domestic bribery. Article 164 of the CLPRC criminalizes the giving of property by any person to a State functionary, and in economic activities, the giving of kickbacks or service charges to a State functionary or to a State organ, State-owned company, enterprise, institution or people's organization as well as giving property to a State functionary or any employee of a company or enterprise. The amendment passed in February adds a provision to Article 164 stating that whoever gives property to any foreign public official or official of an international public organization for the purpose of seeking illegitimate commercial benefit shall be punished in accordance with the provisions on domestic bribery. Offenses are punishable with fines and imprisonment for up to ten years. Jurisdiction for such offenses covers Chinese citizens regardless of where they are located, foreign citizens within China, and all companies organized under the laws of China, which would include joint ventures and wholly foreign-owned entities. The amendment takes effect on May 1, 2011.