FCPA Summer Review 2012

International Alert

Introduction

"Expectant" describes the mood of FCPA practitioners during the first half of 2012. With a slow first half of the year for enforcement releases, and expected developments such as the issuance of the new FCPA Guidance around the corner, the second half of 2012 should be eventful, if not historic, for the 35-year old statute.

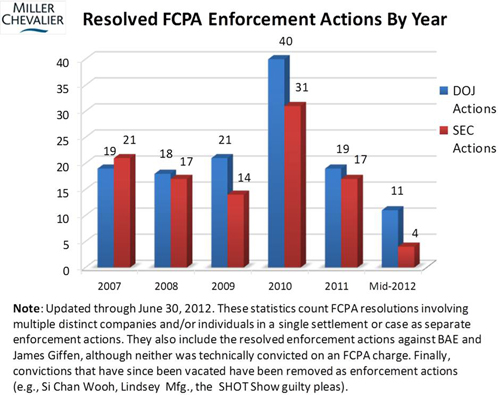

With 15 resolved enforcement actions through June 30, 2012, the first half of 2012 has been the slowest in terms of FCPA enforcement releases since 2009. Thus far, the U.S. Department of Justice ("DOJ") and the U.S. Securities and Exchange Commission ("SEC") have resolved eight actions involving corporations and seven involving individuals, compared with 13 and 12, respectively, during the same period last year1. If the current pace of enforcement continues through the year's end, 2012 will be the slowest year for resolved FCPA enforcement actions since 2006. On July 10, 2012, as this Review was going to press, the SEC and DOJ announced resolved enforcement actions with Orthofix International N.V., a Texas-based medical device company, regarding alleged illicit payments by its Mexican subsidiary to Mexican officials and agreed to pay more than $7.4 million in penalties. Miller & Chevalier will provide an analysis of this action in its next quarterly Review.

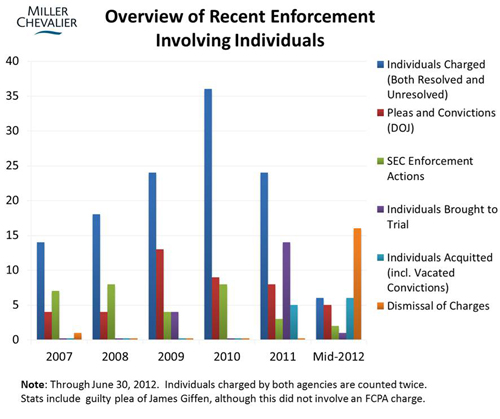

This period of relative quiet follows two of the most active and eventful years of FCPA enforcement on record. In 2010, the number of resolved FCPA enforcement actions exceeded the combined total number of such actions brought from 1977 through 2005. In 2011, the DOJ tried 15 individuals in four different trials involving FCPA related charges, a number that far outstripped any prior years. Moreover, at the end of 2011, the DOJ was preparing for scheduled trials of 19 more defendants charged with FCPA related violations. In contrast, the DOJ has conducted no such trials thus far this year and has none scheduled.

The past two years were eventful beyond mere enforcement numbers. The dramatic rise and decline in individual prosecutions is largely connected with DOJ's SHOT Show prosecution, in which it arrested and charged 22 defendants with FCPA charges in January 2010, only to dismiss all charges against all defendants in February this year, after two consecutive mistrials and multiple acquittals and dismissals. The DOJ also suffered other setbacks in late 2011 and early 2012, including the overturning of jury convictions against Lindsey Manufacturing and its executives in December 2012, and the acquittal and dismissal of charges against John O'Shea of ABB Inc. in February 2012.

The flurry of activity of the past two years is expected to produce some changes that could shape FCPA enforcement in the future. Many FCPA practitioners, including the FCPA and Anti-Corruption Practice Group at Miller & Chevalier, have been waiting for and tracking these changes, the most important of which include:

- New FCPA Guidance: Most immediately, the FCPA bar is eagerly awaiting promised "detailed guidance" from the DOJ and the SEC, which many hope will provide more clarity and certainty with regard to the agencies' positions on various issues arising in FCPA compliance and enforcement. The agencies had targeted the Guidance's release for late spring. With summer here, the Guidance could be issued any day.

- FCPA Reform: The promised "detailed guidance" emerges out of the larger context of FCPA reform. Congressional interest in FCPA reform has been high over the past two years, with Congress holding multiple hearings on FCPA enforcement and reform proposals. With organizations like the Chamber of Commerce continuing to focus on such reforms, the debate will certainly continue and may yet produce results more significant than the Guidance.

- FCPA Team Turnover at the DOJ: In the first half of this year, the DOJ's FCPA unit lost one of its two assistant chiefs, William Stuckwisch, as well as one long-serving FCPA trial attorney, Kathleen Hamann. In addition, the Fraud Section, which encompasses the FCPA unit, lost Hank Walther, who was an FCPA assistant chief until mid-2010. In their place, the DOJ hired four experienced prosecutors, one of whom, Jason Jones, was designated as the third assistant chief of the FCPA unit, a newly created position. Despite the loss of institutional knowledge, the addition of new prosecutorial experience, combined with lessons learned from DOJ's first major wave of FCPA trials in the past two years, will likely lead to more refined prosecutorial strategies going forward.

- Court Challenges to Enforcement Agencies' FCPA Definitions: The agencies' increased focus on individual prosecution, and the resulting trials and appeals, has allowed courts opportunities to weigh in on the debate over the scope of the FCPA generally and, in particular, the definition of "foreign official." At the district level, courts have generally refrained from significantly narrowing the enforcement agencies' interpretation of the term "foreign official." The first circuit court level challenge was lodged this past quarter, promising a more authoritative determination of the scope of the FCPA.

While the FCPA compliance community waits for these developments to take shape, the following are some events from the past quarter that provide insights into the future shape of FCPA enforcement:

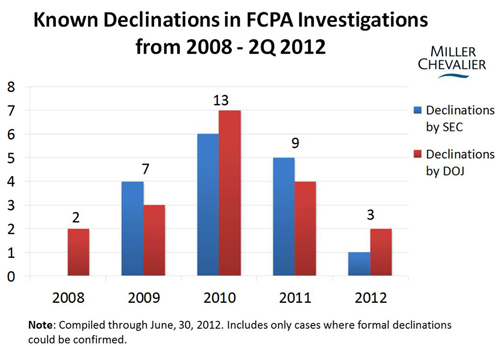

- Declination and Compliance Defense: In what may be a first, the DOJ and the SEC publicly announced their declination decisions in one case, and as a part of that announcement, clearly acknowledged that companies can avoid FCPA prosecution by instituting an effective compliance program. In disclosing the plea agreement with the China-based Morgan Stanley real estate executive Garth R. Peterson, the agencies publicly discussed their decisions to not prosecute Morgan Stanley in light of the company's effective system of internal controls, its voluntary disclosure of the conduct at issue, and its cooperation with the DOJ and SEC throughout its investigation (see below). This decision to conclude an investigation into potential violations of the FCPA without bringing an enforcement action is the most recent example of a trend of declinations discussed by James G. Tillen and Marc Alain Bohn in August 2011 (see Declinations During the FCPA Boom). In contrast to previously identified declinations, however, which were publicized either by the company itself or in the press, the DOJ described the basis for its decision to not prosecute Morgan Stanley publicly and in detail. This real life example of a company avoiding an enforcement disposition with the DOJ through maintaining an effective compliance program may foreshadow elements of the agencies' impending FCPA Guidance.

- International Developments: The steady trickle of international enforcement and legislative news in prior reviews makes clear that more countries around the world are strengthening their anti-corruption laws, and more of them are taking steps to enforce those laws. This past quarter saw Thailand ratifying the UN Convention Against Corruption and strengthening its anti-corruption laws, Algeria and Canada using their anticorruption laws against violators both foreign and domestic, and the United Kingdom considering adding deferred prosecution agreements ("DPA") to its prosecutorial arsenal. The World Bank, while only capable of imposing administrative sanctions, sought to magnify the deterrent effect of its debarment sanctions by beginning to publish its debarment decisions online. As may be expected, the United States is still far ahead of other countries in terms of enforcement. The OECD Working Group on Bribery, which monitors member countries' compliance with the OECD Anti-Bribery Convention, released its annual report for 2011 in June and reported that out of its 38 members, only 14 have imposed any sanctions for foreign bribery since 1999, with prosecution by the United States constituting a significant percentage of the total number of enforcement actions.

Perhaps the more significant news is the apparent evolution in attitudes toward corruption in business transactions that the enforcement of anti-corruption laws, especially the FCPA, have produced among business people around the world. One recent indication of that change is the 2012 Latin America Corruption Survey conducted by Miller & Chevalier, Matteson Ellis Law, and 12 other law firms throughout Latin America. The surveyed reached more than 400 executives in the region, and the results show that 75% of the respondents were aware of someone being prosecuted for making or receiving illicit payments, while 64% reported being somewhat or very familiar with the FCPA. This increased awareness of illegality of corruption is arguably one of the most important effects of the rigorous enforcement of the FCPA, as well as long-running efforts under the auspices of the Inter-American Convention Against Corruption.

- Expanded M&A Compliance Program Elements: The DOJ has continued to include new elements in the compliance program that is a part of its standard settlement agreements: mergers and acquisitions due diligence, compliance integration, and reporting obligations. The details of these expanded terms are discussed below and in our FCPA Spring Review 2012. These terms were first seen in their current form in the non-prosecution agreements ("NPA") entered into by BizJet and Lufthansa in March this year. The terms were again included in the latest DPA entered into by the DOJ, with Data Systems & Solutions LLC.

- Kleptocracy Asset Recovery: This quarter also saw the first seizure executed as part of the DOJ's Kleptocracy Asset Recovery Initiative announced in May 2011. The Initiative aims to identify and seize assets believed to be proceeds of high-level foreign corruption hidden in the United States, and return those assets to the originating country. This first seizure, of $401,931, was against a former governor of the oil-producing Nigerian state of Bayelsa. The DOJ has announced its intention to use this new anti-corruption tactic extensively in the future.

Actions Against Corporations

On June 18, 2012, the DOJ announced that Data Systems & Solutions LLC ("DS&S"), a Reston, Virginia-based power plant service provider, paid a criminal penalty of $8.82 million and entered into a two-year DPA to resolve two FCPA-related charges.

The DOJ's criminal information, filed in the U.S. District Court for the Eastern District of Virginia, charged DS&S with one count of conspiring to violate the FCPA's anti-bribery provisions and one count of violating the FCPA's anti-bribery provisions by making improper payments to officials employed by the Inglina Nuclear Power Plant ("INPP"), a state-owned nuclear power plant in Lithuania.

According to the criminal information and the DPA, from 1999 to 2004, DS&S authorized more than $1 million in illicit payments to induce the award and retention of multi-million dollar contracts for DS&S to design, install, and maintain INPP's instrumentation and controls systems. The illicit payments were made both directly and indirectly, by giving "things of value" to INPP officials, including a Cartier watch and trips to Hawaii and Florida, and by funneling cash payments to INPP officials through several subcontractor companies. Employees at various levels within DS&S were allegedly complicit in the bribery, including a vice president of marketing and business development, several senior vice presidents, and a project manager.

As stated in the DPA, DS&S made and concealed illicit payments to INPP officials through its subcontractors in several ways. First, DS&S made payments for fictitious subcontract modifications to a simulation technology subcontractor employed on the INPP projects. No legitimate services were performed in association with the subcontract modifications and the subcontractor used the additional funds to pay bribes directly to INPP officials or indirectly through two other subcontractors (a power generation company beneficially owned by a senior INPP official and a shell company incorporated in the United States that did not perform any legitimate services for DS&S). Second, DS&S made payments to the power generation subcontractor owned by the senior INPP official noted above, which employed INPP personnel to perform work for DS&S on INPP projects and received payment at above-market rates. At least five INPP officials, including the Director General of the organization and the lead software engineer, benefitted from the bribery scheme. The officials had the ability to influence the award of contracts at INPP in several respects: (1) by recommending which bidder should be awarded the contract; (2) providing information about the project and competing bidders to DS&S and the simulation technology subcontractor, which allowed them to tailor their bids to win the contracts; and (3) designing project specifications that favored DS&S.

Although the Company did not make a voluntarily disclosure, the DOJ did credit Data System's "extraordinary" cooperation, which resulted in substantially reduced company penalties. Moreover, the DOJ's press release highlighted DS&S's "extensive, thorough and swift internal investigation" and remedial efforts, which included "terminating the officers and employees responsible for the illicit payments; instituting a more rigorous compliance program; enhancing its due diligence protocol for third-party agents and subcontractors; strengthening its ethics policies; providing FCPA training for all agents and subcontractors; and establishing heightened review of most foreign transactions." Notably, the resolution did not mention that DS&S is a wholly-owned indirect subsidiary of the British company Rolls Royce Holdings plc.

In addition to paying the fine, DS&S agreed to report to the DOJ on its compliance efforts on at least an annual basis for a period of two years, and to continue to enhance its compliance program to ensure the program contains all of the elements specified by the DOJ in the DPA's "Corporate Compliance Program" attachment.

Noteworthy Aspects

- Expanded Standard Compliance Program Elements – The DPA includes the same enhanced compliance program elements that apply in the context of mergers and acquisitions ("M&A") previously seen in the BizJet DPA and the Lufthansa Technik NPA. The DOJ terms require that DS&S conduct appropriate FCPA due diligence on prospective acquisitions, report to the DOJ any findings of corrupt payments or inadequate internal controls, and ensure that its anti-corruption compliance policies and procedures are promptly applied to new acquisitions or newly merged entities. Further, DS&S is obligated to ensure that its "policies and procedures regarding the anti-corruption laws apply as quickly as is practicable to newly acquired businesses or entities merged with DS&S." To that end, DS&S must promptly provide anti-corruption training to all directors, officers, employees, and agents and business partners "who present a corruption risk to DS&S", and "[c]onduct an FCPA-specific audit of all newly acquired or merged businesses as quickly as practicable." The inclusion of this language in the BizJet DPA, Lufthansa NPA, and DS&S DPA suggests that it is now a standard compliance term in DOJ settlement agreements; companies wishing to keep pace with evolving standards of compliance "best practices" should consider processes and procedures addressing M&A due diligence and post-acquisition integration in their compliance programs.

- Reports Required Under DPA Designated "Non-Public" – Likely in response to a recent ruling by U.S. District Court Judge Gladys Kessler allowing a reporter to access a court appointed monitor’s reports (see Access to Monitor Reports below), the DPA includes a provision explicitly designating as "non-public" the reports DS&S will submit to the DOJ as part of its settlement. Specifically, the provision states: "The reports will likely include proprietary, financial, confidential, and competitive business information. Moreover, public disclosure of the reports could discourage cooperation with the review and thus undermine the objectives of the reports. For these reasons, among others, the reports and the contents thereof are intended to remain and shall remain non-public, except as otherwise agreed to by the parties in writing, or except to the extent that the Department determines in its sole discretion that disclosure would be in furtherance of the Department's discharge of its duties and responsibilities or is otherwise required by law."

- Extended Statute of Limitations – Although the conduct described in the pleadings reached as far back as 13 years ago and some of the specific acts would be beyond the scope of the FCPA's five-year statute of limitations if charged as separate offenses, the DOJ referenced that conduct by alleging that the payments were part of a continuing conspiracy which extended from 1999 into April 2004. For conspiracies, as a general matter, the statute of limitations does not begin to run until the last act in the conspiracy. Presumably, some form of tolling agreement brought that 2004 conduct within the statute of limitations, and hence allowed the charging of the lengthy conspiracy back until 1999. Similarly, the second count of the information, charging a wire offense, was alleged to have occurred in March 2004, also presumably within a tolled statute of limitations.

- Follow-up Investigation by Foreign Prosecutors – According to a Lithuanian press account, following the DOJ's announcement of its settlement with DS&S, the regional Prosecutor General's Office launched an investigation into alleged corruption and misuse of power at INPP. However, the office informed reporters that the circumstances mentioned in the DOJ pleadings are not the subject of its investigation. The former CEO of INPP, Viktor Shevaldin, confirmed in an interview that he accepted a watch from DS&S but said it was a birthday present given to him in public after a deal with DS&S closed. He denied accepting any payments from DS&S.

Lindsey Manufacturing's FCPA Prosecution Ends

In October 2010, federal prosecutors indicted Lindsey Manufacturing, along with two of its executives, alleging conspiracy and actual violations of the FCPA's anti-bribery provisions. See FCPA Review Winter 2011. The case attracted close attention from the FCPA bar when the Lindsey Manufacturing defendants fought their charges by challenging the government's "foreign official" definition, first in their motion to dismiss, and then by taking the same challenge to the jury. See FCPA Review Spring and Summer 2011. When the defendants were convicted on the FCPA charges in May 2011, Lindsey Manufacturing became the first company to have ever been tried and convicted for FCPA violations. See FCPA Review Summer 2011. That rare and unenviable status did not last long. Seven months later, Lindsey Manufacturing's conviction was thrown out by the trial court for prosecutorial misconduct, and the charges were dismissed with prejudice. See FCPA Review Winter 2012. On May 25, 2012, the case officially ended when the government voluntarily dismissed its appeal. As covered elsewhere in this Review, the "foreign official" definition debate is now being carried on in other courts, and in the FCPA reform debate.

Actions Against Individuals

Four Former CCI Executives Plead Guilty to FCPA-Related Charges

In the latest development in the Control Components Inc. ("CCI") case, four former CCI executives pleaded guilty to FCPA-related charges this quarter. CCI is a California-based company that supplied valves to the nuclear, oil and gas, and power-generation industries. As reported in our FCPA Autumn Review 2009, CCI pleaded guilty to conspiracy to violate the FCPA and the Travel Act and to two substantive violations of the FCPA in July 2009. Earlier that year, two former CCI employees, Mario Covino and Richard Morlok, also pleaded guilty to FCPA related charges (see our FCPA Winter Review 2009). Flavio Ricotti, another former CCI executive, also pleaded guilty to FCPA-related charges in April 2011 (see our FCPA Summer Review 2011).

Four of the remaining five individuals charged in the CCI case have been involved in litigation, which garnered significant attention because the defense challenged the U.S. Government's interpretation of the term "foreign official" (see our FCPA Spring Review 2011). This quarter, all four of the defendants involved in that litigation pleaded guilty to FCPA-related charges. FCPA charges are pending against the final defendant in this case, Han Yong Kim, who has not appeared in the United States to face trial.

Stuart and Rose Carson's Pleas

On April 16, 2012, Stuart and Hong (a.k.a. "Rose") Carson pleaded guilty to one count each of violating the FCPA's anti-bribery provisions. Stuart Carson was the president of CCI and his wife, Rose Carson, was CCI's Manager of Sales for China and Taiwan and later CCI's Director of Sales for China and Taiwan. According to the superseding information and the DOJ press release, Stuart Carson pleaded guilty to "corruptly [causing] an e-mail to be sent authorizing the payment of approximately $16,000 to officials of [the Turow Power Plant in Poland] for the purpose of securing Turow's business." For her part, Rose Carson pleaded guilty to "corruptly [causing] an email to be sent authorizing the payment of $40,000 to officials of Kuosheng [Nuclear Power Plant in Taiwan] for the purpose of securing Kuosheng's business."

The Carsons' sentencing is scheduled for October 15, 2012. According to Stuart Carson's plea agreement, Stuart Carson faces up to ten months in prison, three years supervised release, a fine of up to $20,000, and a special assessment of $100. According to her plea agreement, Rose Carson faces no prison time, but could be sentenced to up to three years of probation, which may include up to six months of home confinement, a fine of up to $20,000, and a special assessment of $100.

Paul Cosgrove's Plea

On May 29, 2012, Paul Cosgrove, CCI's former Head of Worldwide Sales, pleaded guilty to one count of making a payment to a foreign government official in China in violation of the FCPA. According to the indictment, these charges were based upon his alleged involvement in making "corrupt payments of approximately $1.9 million to officers and employees of state-owned companies, and corrupt payments totaling approximately $300,000 to officers and employees of private companies." Cosgrove's sentencing is scheduled for August 27, 2012, and, according to his plea agreement, he faces up to 15 months in prison, three years supervised release, a fine of up to $20,000, and a special assessment of $100.

David Edmonds' Plea

On June 15, 2012, David Edmonds, CCI's former Vice President of Worldwide Customer Service pleaded guilty to one count of violating the FCPA. According to the superseding information and to the plea agreement, Edmonds approved the payment of $45,000 to officials of Public Power Corporation of Greece, a Greek state-owned entity, in order to secure its business. Edmonds' sentencing is set for November 12, 2012, and he faces up to 15 months in prison, three years supervised release, a fine of up to $20,000, and a $100 special assessment.

Notably, all four plea agreements include language mirroring a jury instruction issued by Judge James Selna in the litigation against the four CCI defendants. Specifically, the plea agreements indicate that, among other things, in order for the defendant to violate the FCPA, the relevant payment had to be made to "(a) a person the defendant knew or believed to be a foreign official or (b) any person and the defendant knew all or a portion of such money or thing of value would be offered, given, or promised (directly or indirectly) to a person the defendant knew or believed to be a foreign official." That language, which requires a defendant to know or believe the bribe recipient was a foreign officials, is directly related to the defendants' challenge to the Government's inclusion of employees of state-owned companies in the definition of "foreign official" (see our FCPA Spring Review 2011 for details on the defendants' challenge).

While these guilty pleas mean that the defendants' challenge to the Government's definition of "foreign official" will not be litigated in this case, the inclusion of that language in the plea agreements may complicate the U.S. Government's future efforts to charge individuals with violations of the FCPA where payments are made to an employee of a state-owned company and the person making the payment did not know or believe the employee was a foreign official.

DOJ Seizes Over $400,000 in Bribes and Corruption Proceeds from Former Nigerian Governor

On June 13, 2012, the U.S. District Court for the District of Massachusetts granted a motion for default judgment and forfeiture filed by the DOJ Criminal Division's Asset Forfeiture and Money Laundering section against Diepreye Solomon Peter Alamieyeseigha, former governor of the oil-rich Nigerian state of Bayelsa. The order was executed on June 28, 2012, and allowed the United States to seize $401,931 worth of assets illegally hidden by Mr. Alameiyeseigha in a Massachusetts brokerage account. In a separate civil forfeiture matter, the DOJ is seeking to forfeit a home belonging to Mr. Alamieyeseigha in Rockville, Maryland worth more than $600,000 and allegedly linked to money laundering activities.

This action is the first asset forfeiture judgment obtained under the DOJ's new Kleptocracy Asset Recovery Initiative, whose mission is to identify and seize assets linked to corruption and bribery of foreign officials that have been hidden in the United States. Civil forfeiture allows the DOJ to file complaints in federal court against an individual's property, rather than the individual himself, when there is a link to foreign corruption. According to the DOJ, the seizure of Mr. Alameiyeseigha's assets is the first in what it hopes is a long line of forfeitures of foreign corruption proceeds.

Mr. Alamieyeseigha was the governor of Bayelsa state in Nigeria from 1999-2005. He was impeached by Nigeria's Bayelsa State House of Assembly in 2005 amid charges of financial improprieties and, in 2007, was sentenced by a Nigerian federal court to two years in prison for corruption, money laundering, and failure to disclose assets (which totaled up to $15 million). According to press reports, Mr. Alameieyeseigha is currently in Nigeria and remains one of the wealthiest men in the country.

Former Latin Node Executives Sentenced

During the second quarter of 2012, three former executives of Latin Node Inc. ("LatiNode") were sentenced in connection with their roles in a conspiracy to violate the anti-bribery provisions of the FCPA by making improper payments to Honduran government officials.

- On April 24, 2012, former Vice President for Business Development Manuel Caceres was sentenced to 23 months in prison, followed by one year of supervised release. Caceres was also ordered to pay a special assessment of $100.

- On April 25, 2012, former CCO Juan Pablo Vasquez was sentenced to three years of probation, 500 hours of community service, and six months of electronic monitoring. Vasquez was also ordered to pay a special assessment of $100 and a criminal penalty of $7,500.

- On June 6, 2012, former CFO Manuel Salvoch was sentenced to ten months in prison followed by three years of supervised release, with six months of electronic monitoring during which time he must perform 35 hours of community service a week. Thereafter, and depending on his employment status, Salvoch must complete between 400 and 1,200 hours of community service per year of the supervised release.

As discussed in our FCPA Autumn Review 2011, former LatiNode CEO Jorge Granados was sentenced last September to 46 months in prison, followed by two years of supervised release. All four individuals pleaded guilty to a single count of conspiring to violate the FCPA. The harsher sentences imposed on Granados and Caceres (46 and 23 months in prison, respectively) as compared to the sentences imposed on Salvoch and Vasquez (ten months in prison and three years of probation, respectively) are consistent with their apparent greater responsibilities as members of senior management. Granados had the authority to set company policy and establish sales practices, including in foreign countries, while Caceres was responsible for developing LatiNode's business in Honduras.

In 2009, as discussed in our FCPA Spring Review 2009, LatiNode pleaded guilty to one count of violating the anti-bribery provisions of the FCPA and agreed to pay a $2 million fine.

Developments in the Haiti Teleco Case

Duperval Sentenced to Nine Years

As reported in our FCPA Spring Review 2012, on March 13, 2012, Jean Rene Duperval, former director of international relations for Haiti's state-owned telecommunications company, Telecommunications D'Haiti S.A.M. ("Haiti Teleco"), was convicted by a federal jury in Miami of two counts of conspiracy to commit money laundering and 19 counts of money laundering (see our FCPA Winter Review 2012 and FCPA Autumn Review 2011 for background on the Haiti Teleco prosecutions).

According to a DOJ press release, Duperval laundered $500,000 paid to him "to obtain various business advantages" including "the issuance of preferred telecommunications rates, a continued telecommunications connection with Haiti and the continuation of a particularly favorable contract with Haiti Teleco." Duperval funneled the money to two shell companies under his control. He created false documents that claimed the money was paid for consulting services and international minutes from the United States to Haiti when no actual services were performed. The funds were subsequently disbursed from the shell companies for the benefit of Duperval and his family.

On May 21, 2012, Duperval, who had been in federal custody awaiting sentencing since his conviction, was sentenced to nine years in prison and ordered to forfeit $497,331. The two conspiracy to commit money laundering counts and the 19 individual money laundering counts he was facing each carried a maximum penalty of 20 years in prison and a fine of the greater of $500,000 or twice the value of the property involved in the transaction.

To date, aside from Duperval, Antonio Perez, Juan Diaz, Jean Fourcand, Robert Antoine, Joel Esquenazi, Carlos Rodriguez and Patrick Joseph all have either pleaded guilty or have been convicted by a federal jury for FCPA violations and/or money laundering related to Haiti Teleco. Many of the sentences handed down in this matter – all by U.S. District Court Judge Jose Martinez of the Southern District of Florida – have been lengthy, including the 15-year sentence given to Esquenazi, which is the longest sentence ever imposed in a case involving the FCPA. Duperval's nine year sentence is the second-longest of any of the defendants in the Haiti Teleco matter, which – aside from the DOJ's aborted SHOT Show matter – is the largest FCPA prosecution in the statute's history in terms of the number of defendants charged (13). Three defendants indicted in the Haiti Teleco case are still fugitives – Washington Vasconez Cruz and his wife, Cecilia Zurita, and Amadeus Richers.

Duperval filed an appeal to his sentence on June 5, 2012.

Former Terra Executives Challenge DOJ's Interpretation of "Instrumentality" Before Eleventh Circuit

In the past quarter, two individuals involved in the Haiti Teleco matter appealed their convictions for FCPA and related violations. As a result, there will be an appellate review of the DOJ's interpretation of the "foreign official" element of the FCPA for the first time.

Joel Esquenazi and Carlos Rodriguez, former executives of Terra Telecommunications Corporation ("Terra"), were convicted on several counts, including substantive violations of the FCPA, conspiracy, wire fraud, money laundering, and others. Esquenazi and Rodriguez were found guilty of having approved improper payments to employees of Haiti Teleco in order to receive rebates, tariff reductions, and other benefits for Terra. Before trial, the DOJ asserted that because of government ownership and control of Haiti Teleco, it was an "instrumentality" under the FCPA, and its employees were "foreign officials." Defendants challenged the DOJ's interpretation in a motion to dismiss. The district court agreed with the DOJ's interpretation, and gave jury instructions accordingly. Based on that instruction, the jury convicted both Esquenazi and Rodriguez, thereby finding that the evidence met the DOJ standard. Both Esquenazi and Rodriguez appealed their convictions to the Eleventh Circuit. Among other things, their appeals challenge the district court's jury instructions on the "instrumentality" element.

The FCPA statutory definition of a "foreign official" includes "any officer or employee of a foreign government or any department, agency, or instrumentality thereof." However, the FCPA does not separately define "instrumentality." The district court instructed the jury that an instrumentality is "a means or agency through which a function of the foreign government is accomplished. State-owned or state-controlled enterprises that provide services to the public may meet this definition." The court also provided several non-exhaustive factors for the jury to consider in deciding whether or not Haiti Teleco qualifies as an instrumentality:

- Whether Haiti Teleco provides services to the citizens or inhabitants of Haiti;

- Whether the company's key officers and directors are government officials or are appointed by government officials;

- The extent of Haiti's ownership of Haiti Teleco, including whether the Haitian government owns the majority of the company's shares or provides financial support such as subsidies, special tax treatment, loans, or revenue from government-mandated fees;

- The company's obligations and privileges under Haitian law, including whether the company exercises exclusive or controlling power to administer its designated functions; and

- Whether Haiti Teleco is widely perceived and understood to be performing official or governmental functions.

Esquenazi's appellate brief challenges the district court's instruction and argues that the term "instrumentality" should only apply to "foreign entities performing governmental functions similar to departments or agencies." While acknowledging that "governmental function" was included in the court's list of factors, Esquenazi asserts that because the list was "non-exhaustive and disjunctive," the jury could have found that Haiti Teleco was an instrumentality even if they did not find that Haiti Teleco was performing governmental functions. Moreover, according to Esquenazi, the court did not even define "governmental function," and the court's broad and unqualified statements preceding the list of factors only compounded the error. Therefore, the district court erred in not specifically instructing the jury to determine that Haiti Teleco exercised a "governmental function." Esquenazi also argues that, in any case, the government's evidence could not have met the "governmental function" test. Therefore, Esquenazi maintains that employees of Haiti Teleco could not have been government officials.

According to Rodriguez's appellate brief, the Eleventh Circuit had already ruled on a definition of instrumentality in Edison v. Douberly, 604 F.3d 1307 (11th Cir. 2010). In that non-FCPA case, involving the status of a private prison management corporation under the Americans with Disabilities Act, the Eleventh Circuit agreed to define "instrumentality of a state" as "governmental units or units created by them," and declined to define instrumentality as an entity performing "the functional equivalent of government entities." Rodriguez claims that the language of the two statutes is similar in their use of the term "instrumentality," and should therefore be interpreted alike. According to Rodriguez's brief, the instruction Rodriguez proposed at trial (defining instrumentality as "part of the foreign government itself") is consistent with the Edison interpretation, and the district court was bound by precedent to accept it.

Rodriguez also argues that the court abused its discretion because it did not require the government to prove that the FCPA knowledge standard applied to the "government official" element – in other words, the jury did not have to find that Rodriguez had the requisite knowledge that Haiti Teleco employees were government officials. Rodriguez says that evidence presented by the government would have been insufficient to prove the requisite knowledge.

Both Esquenazi and Rodriguez also contend that the district court erred in rejecting their request for an evidentiary hearing about conflicting declarations made by Jean Max Bellerive, then-Prime Minister of Haiti on the subject of Haiti Teleco. According to their briefs, on July 26, 2011, Bellerive signed a declaration asserting that, "Haiti Teleco has never been and is not a State enterprise." On August 25, 2011, however, Bellerive made a second declaration, ostensibly "clarifying" parts of the first declaration, but in fact contradicting several key points of that document. In the August 25 declaration, Bellerive also stated that the initial declaration was not made for use in a criminal proceeding, but for internal purposes. The DOJ, which used the second declaration in a response to the defendants' request for an evidentiary hearing, admitted that it helped Bellerive to prepare the August 25 declaration.

Although these appeals are the first instance in which the definition of "instrumentality" has been raised before a federal appeals court, this element of the statute has been interpreted in several other recent cases at the district court level, including United States v. Carson, No. 8:09-cr-00077 (C.D. Cal.), United States v. Lindsey Manuf. Co., No. 2:10-cr-01031 (C.D. Cal.), and United States v. O'Shea, No. 4:09-cr-00629 (S.D. Tex.). In each of these cases, the district court agreed with the government's definition of "instrumentality" and rejected the defendants' narrower interpretations. However, none of the three cases reached appellate review: the Carson defendants pleaded guilty, the Lindsey executives' jury convictions were vacated for prosecutorial misconduct, and O'Shea's case was dismissed by the court for insufficient evidence.

Whether the circuit court accepts Esquenazi's statutory interpretation, or chooses to rule more narrowly and apply the Eleventh Circuit precedent in Edison, interpretation of the "foreign official" element generally and "instrumentality" in particular is likely to get additional attention; according to statements by DOJ officials, the DOJ will address both definitions in the FCPA Guidance it is expected to issue later this year.

Former Morgan Stanley Executive Pleads Guilty to Evading FCPA Internal Controls; DOJ and SEC Decline to Prosecute the Company

Actions Against Executive

On April 25, 2012, the former Managing Director of Morgan Stanley's real estate business's Shanghai office, Garth Peterson, pleaded guilty to a criminal information, brought by the DOJ, charging him with conspiracy to circumvent FCPA internal controls provisions. In a related civil case, the SEC charged Peterson with violations of the anti-bribery, books and records and internal controls provisions of the FCPA, as well as with aiding and abetting violations of the anti-fraud provisions of the Investment Advisors Act of 1940.

The alleged misconduct at issue took place between 2004 and 2007. During that time Peterson was said to have secretly acquired millions of dollars' worth of real estate investments for both himself and others, including the then-Chairman of Yongye Enterprise (Group) Co. ("Yongye"), a Chinese state-owned entity. In one key instance, Peterson allegedly convinced Morgan Stanley to sell a portion of an investment to what he claimed was a subsidiary of Yongye called Asiasphere. In reality, Asiasphere was a shell company ultimately owned by Peterson, the Chinese official and another beneficiary. Peterson allegedly misled Morgan Stanley on a continuing basis regarding the nature of Asiasphere, including in the course of extensive corporate due diligence interviews. Peterson also allegedly arranged to have at least $1.8 million paid to himself and the Chinese official, which he misrepresented as "finders' fees," in breach of both his and Morgan Stanley's fiduciary duties to their fund clients.

Peterson is scheduled for sentencing on his criminal conspiracy charge on July 17, 2012, in the Eastern District of New York, where he faces a maximum penalty of five years in prison and a maximum criminal fine of $250,000 or twice his gross gain from the offense. In the related civil case, Peterson consented to a SEC settlement requiring him to disgorge over $250,000 as well as a portion of his ill-gotten real estate interests, currently valued at approximately $3.4 million. Peterson also agreed to permanent debarment from the securities industry. The proposed settlement was approved by Judge Jack B. Weinstein on May 9, 2012.

Declination for Company

While bringing charges against Peterson, both the DOJ and the SEC declined to file any actions against Morgan Stanley. Unlike previous declination decisions, the DOJ and SEC publicly announced their decision and their rationale (the agencies have come under criticism in the reform debate regarding non-transparency of declination decisions). In a SEC press release, the Chief of the SEC Enforcement Division's FCPA Unit, Kara Novaco Brockmeyer, called Peterson "a rogue employee who took advantage of his firm." Similarly, Assistant Attorney General Lanny A. Breuer noted in a DOJ press release that Peterson used a "web of deceit to thwart Morgan Stanley's efforts to maintain adequate controls designed to prevent corruption."

As emphasized in the pleadings, the declination with regard to Morgan Stanley may be based, at least in part, on the effectiveness of the company's internal controls as well as Peterson's deliberate efforts to circumvent them. For example, in the criminal information, the DOJ noted that Morgan Stanley employed over 500 dedicated compliance officers as well as dedicated anti-corruption specialists who conducted regular training, held random audits of financial transactions, performed extensive due diligence on all new business partners, and imposed stringent controls on payments to business partners, among other things. Furthermore, during the course of Peterson's employment, Morgan Stanley held at least 54 anti-corruption training sessions for Asia-based employees. Peterson, in particular, allegedly received FCPA compliance training on at least seven occasions and was specifically informed that employees of Chinese state-owned entities could be government officials under the FCPA. Peterson also allegedly received at least 35 FCPA compliance reminders.

With regard to intentional efforts to circumvent internal controls, the DOJ highlighted that Peterson misled Morgan Stanley by using its past, extensive due diligence conducted on Asiasphere to benefit his own interests and to act contrary to Morgan Stanley's interests. Peterson was terminated by Morgan Stanley in 2008.

The outcome of this case demonstrates how a company's efforts to maintain an effective compliance program and internal controls can create real benefits through protection against FCPA liability in the face of potential rogue employees.

Ongoing Developments

Daimler AG's DPA Extended by Nine Months

On April 4, 2012, the DOJ filed an amendment with the U.S. District Court for the District of Columbia to extend the two-year probationary term of German car manufacturer Daimler AG's DPA by nine months. The DPA, which was originally scheduled to end on April 8, 2012, now expires on December 31, 2012.

Daimler and its Chinese subsidiary DaimlerChrysler China Ltd. (now "Daimler North East Asia, Ltd." or "DNEA") each entered into DPAs on April 1, 2010, to resolve charges brought in connection with a long-standing bribery investigation of Daimler's international operations (see our FCPA Spring Review 2010). According to original charging documents, Daimler and its subsidiaries (including DNEA as well as two others which entered into separate guilty pleas) made hundreds of improper payments, worth tens of millions of dollars, to foreign officials in at least 22 countries, including officials employed by Daimler's government customers, to secure procurement contracts for the purchase of Daimler vehicles. The SEC's Complaint against Daimler alleged that these "tainted sales transactions" resulted in $1.9 billion in illicit revenue for Daimler, including at least $91.4 million in illegal profits. In settling these allegations with the DOJ and SEC, Daimler agreed to pay a total of $185 million in fines and disgorgement and consented to the appointment of an independent monitor for a term of three years.

Of note, the DPAs entered into by Daimler and DNEA were the first to explicitly include the now standard DPA provision granting the DOJ the right to unilaterally extend the term of an agreement — in this case up to a year — if the DOJ determined, in its sole discretion, that the company involved had "knowingly violated" its DPA. Daimler first revealed in its 2011 Annual Report that it was in discussions with the DOJ about a possible extension of its DPA to enable the company to align the DPA's provisions "more closely with the monitor's review period and to provide Daimler with additional time to improve the sustainability of its compliance systems." In its Quarterly Report for Q1 2012, released shortly after the DOJ filed its amendment extending the DPA, Daimler stated that "[b]ased on these discussions and to complete the ongoing and vigorous remediation of certain challenges that have arisen, the DOJ, Daimler AG and [DNEA] mutually agreed on March 30, 2012 to extend the terms of their respective deferred prosecution agreement until December 31, 2012."

While the terms of the original DPAs expressly allowed for the extension of the agreements based on a DOJ determination of non-compliance, the DOJ's amendment, which appears to only extend the term of Daimler AG's DPA, includes no explanation for what the DOJ, Daimler and DNEA characterize as a mutual decision. While Daimler admits that "certain challenges arose," it is unclear whether the DOJ had grounds for a unilateral extension (i.e., a determination of non-compliance by the DOJ). This development is an interesting contrast to the November 2008 prosecution of U.K. corporation Aibel Group Ltd. ("Aibel"), during which Aibel simply admitted that it was out of compliance with its February 2007 DPA and pleaded guilty to the underlying violations. Aibel's DPA did not include provisions expressly allowing for the possibility of extending the agreement, so it is unclear whether doing so was even an option, but one benefit to pleading guilty was that it allowed Aibel to immediately terminate its probationary period with the DOJ.

Under the amended terms of Daimler's DPA, the DOJ is again granted the authority to unilaterally re-extend Daimler's agreement, in this instance for up to three months and a week. As with prior extension provisions, the amended terms permit the DOJ to terminate the DPA early if good behavior justifies.

Under the extension amendment, Daimler's monitor, former FBI Director Louis J. Freeh, must certify by October 31, 2012, whether Daimler's compliance program, including its policies and procedures, is "reasonably designed and implemented to prevent and detect violations within Daimler of the FCPA and other applicable anti-corruption laws." The term of Freeh's 3-year monitorship is otherwise unaffected by the amendment and remains on schedule to expire on April 8, 2013.

Civil Litigation

Watts Water Sues Law Firm over FCPA

On June 6, 2012, Watts Water Technologies, Inc. ("Watts") filed a complaint in the Superior Court for the District of Columbia against Sidley Austin LLP ("Sidley") alleging professional negligence, breach of contract, and negligent misrepresentation with regards to due diligence activities conducted in the course of an acquisition. Watts is a publicly-traded company that designs and manufactures water valves and related products.

The complaint alleges that Watts hired Sidley in 2002 to conduct due diligence with respect to the potential acquisition of a Chinese company. According to Watts, during the due diligence, Sidley uncovered a document demonstrating that the target company had a written "kickback" policy ("KBP"), by which the company paid Chinese government officials or officials of state-owned entities (such as Chinese "design institutes") to secure government contracts for the company. Watts claims that Sidley should have disclosed the KBP to Watts as it was "part and parcel" to the sales agent contracts that Sidley reviewed. Nevertheless, Watts claims that Sidley never disclosed the KBP in any form during the course of the due diligence and, as a result, Watts was unaware of the KBP when it ultimately acquired the target company in 2006 as well as for several subsequent years. The complaint also alleges that the Sidley partner responsible for the due diligence subsequently admitted that the KBP was a "red flag."

Watts alleges to only have discovered the KBP and resulting alleged FCPA violations in 2009 when an employee from the Chinese subsidiary reported the policy following FCPA training. Subsequently, Watts self-reported to the SEC and DOJ and, as previously reported in our FCPA Winter Review 2012, on October 13, 2011, entered into a cease-and-desist order with the SEC and agreed to pay over $3.6 million in disgorged profits, pre-judgment interest, and civil penalties. The cease-and-desist order did not cite inadequate due diligence as a specific basis for the enforcement action. Instead, the SEC noted that Watts failed to implement a system of FCPA compliance and internal controls commensurate with the risks posed by the Chinese subsidiary (which sold almost exclusively to Chinese state-owned enterprises) when it was acquired. The cease-and-desist order also stated that Watts "failed to conduct adequate FCPA training for its employees in China" until three years after the completion of the acquisition.

According to the complaint, Watts demands judgment against Sidley on all counts in an amount to be determined at trail, but believed to be in excess of $100,000 in damages plus attorneys' fees. Sidley has yet to file its response to the complaint. An initial scheduling conference is currently set for September 7, 2012.

Regardless of the outcome of the dispute between Watts and Sidley, this case illustrates the importance of clear standards and close collaboration in the acquisition context between in-house deal teams, in-house compliance personnel, and outside counsel in understanding what constitutes effective due diligence in the FCPA context. Due diligence activities and outcomes should be reviewed and clarified among the parties throughout the process.

U.S. Agency Developments

On April 16, 2012, Judge Gladys Kessler of the United States District Court for the District of Columbia granted a reporter's motion to gain access to monitor reports from American International Group, Inc.'s ("AIG") settlement with the SEC. Though AIG's settlement did not stem from FCPA charges, the Court's analysis is not dependent on the underlying allegations, and may thus have implications for FCPA enforcement actions involving monitors. In particular, it shows that the public may be able to gain access to monitor reports in some circumstances, but also suggests that companies may be able to take steps to safeguard the confidentiality of monitor reports.

The monitorship in this case stemmed from a 2004 settlement between the SEC and AIG related to violations of federal securities laws. AIG's Consent Order required, among other things, that the company retain an independent consultant ("IC") to review certain policies, procedures, and transactions. In 2011 and 2012, the reporter made multiple unsuccessful requests to enforcement agencies to gain access to the reports, before filing the motion giving rise to the current decision.

In granting the reporter's motion, Judge Kessler ruled that the monitor's reports were "judicial records" to which the reporter had a common law right of access. In her opinion, Judge Kessler considered (1) whether the monitor reports were relevant to the adjudicatory process, and thus qualified as "judicial records," and (2) whether the public interest in disclosure outweighed AIG's and the SEC's interest in confidentiality. Judge Kessler reasoned that, because the reports may provide information leading the SEC to return to the Court to secure further relief, and because the reports may prove critical to the Court's assessment of AIG's compliance with the Consent Order, the reports were "judicial records." Judge Kessler also determined that the public's interest in access to the reports outweighed AIG's and the SEC's interest in keeping the reports secret, for a number of reasons, including indications that AIG and the SEC did not consider confidentiality a priority at the time of settlement, and the public's interest in knowing AIG's potential role in the financial downturn of 2008. To protect AIG's proprietary information from competitors, the Court permitted AIG to redact that information in the reports.

The Court's rationale indicates that the public may have access to monitor reports where the settlement agreement giving rise to the monitorship was court-approved and allowed for potential judicial enforcement of its terms, and where there is sufficient public interest in access to the reports. However, the factors considered in the Court's balancing of interests suggest that such access may be limited to circumstances where a company has not sought to protect confidentiality at the time of settlement, and where an especially strong public interest exists.

In particular, Judge Kessler noted that AIG and the SEC did not request modification of the Consent Order to prevent disclosure of the reports until over a year and a half after entry of the Final Judgment and Consent Order. Judge Kessler also stated "it is hard to believe that confidentiality was very significant to the parties at the time the Consent Order was signed, if such an important provision was forgotten or overlooked by all the high powered and highly paid attorneys on both sides." This suggests that companies that negotiate confidentiality provisions in settlement agreements may be able to protect monitor reports from disclosure.

Regarding the public's interest, Judge Kessler suggested that the country as a whole had a strong interest in access to the reports. As the opinion states, "most important of all, given the financial meltdown of 2008, the recession it spawned, and the suffering the country has endured because of it, and given the role that AIG played in that financial meltdown," the public needed to know whether AIG and the SEC complied with their obligations and responsibilities under the Consent Order. It is unclear whether such a strong public interest would be found in FCPA cases, which may have broad social implications, but arguably less extensive than those in the case against AIG.

In what is likely a reaction to Kessler's ruling, the DOJ's recent DPA with DS&S (see Data Systems Enters DPA above) includes an explicit provision stating that the self-monitoring reports required of DS&S and their contents are "intended to remain and shall remain non-public" unless: (1) otherwise agreed by the parties in writing; (2) the DOJ determines disclosure necessary to further the discharge of its "duties and responsibilities"; or (3) disclosure is otherwise required by law. The DPA states that this "non-public" designation is necessary because, among other reasons, "the reports will likely include proprietary, financial, confidential, and competitive business information" and "public disclosure… could discourage cooperation with the review and thus undermine the objectives of the reports." It remains to be seen whether this explicit indication that DS&S and the DOJ considered the confidentiality of future reports to be an integral component of the settlement, something that did not occur in the AIG settlement, will be enough to tip the balance of interests in favor of confidentiality.

The DOJ has reshuffled the ranks of its foreign bribery team in recent months, bringing in new blood as mainstays on the team have departed. Since January, the unit responsible for enforcing the FCPA has seen an influx of four new hires, while two long-time members have left and another is on detail. The changes include:

Going

Hank Walther, who joined the DOJ in 2006, as a trial attorney, resigned from the Justice Department in January to enter private practice. While at the DOJ, he rose to assistant chief of the criminal fraud section's FCPA unit before taking over the Health Care Fraud Unit in March 2010.

Bill Stuckwisch resigned from the DOJ in April to enter private practice. Stuckwisch joined the fraud section in 2004 and most recently served as assistant chief in the FCPA unit. In February, he concluded a long-running series of Nigerian bribery prosecutions that yielded more than $1.7 billion in fines and penalties.

Kathleen Hamann, a trial attorney in the DOJ's FCPA unit, is currently on detail to the New Jersey U.S. Attorney's office. Hamann helped to oversee the FCPA team's targeted sweep of the pharmaceutical industry and also served on the DOJ's delegation to the Organization for Economic Co-operation and Development.

Coming

Jason Jones joined the FCPA unit in February as the third assistant chief, a newly created position. Jones formerly served as the head of the Violent Crime and Terrorism unit in the U.S. Attorney's office for the Eastern District of New York. His experience includes the prosecution of a wide range of federal crimes, including FCPA, money laundering, tax fraud, narcotics and firearms trafficking, child pornography, immigration violations and counterfeiting.

Three assistant U.S. attorneys – John Borchert, Tarek Helou and Jason Linder – have also come on as trial attorneys in the DOJ's fraud section since the start of the year. The new hires are all experienced prosecutors. Borchert worked in the fraud and public corruption sections and the appellate division at the U.S. Attorney's Office for the District of Columbia. Helou was previously in the major crimes section in the Northern District of California, while Linder worked on the special prosecutions and major crimes unit of the Miami U.S. Attorney's office. They will all answer to Deputy Chief Chuck Duross.

James Koukios was promoted to the position of assistant chief in the DOJ's FCPA unit in April. Koukios was formerly a senior trial attorney in the unit since June 2011, and before that an Assistant U.S. Attorney in the Southern District of Florida.

U.S. Legislative Developments

As reported in our Preview of International Issues for 2012, FCPA Spring Review 2012, and prior FCPA Reviews, recent years have seen a number of calls to reform the statute, and the DOJ stated that in 2012 it will issue new, "detailed guidance" on its enforcement positions under the Act. In anticipation of forthcoming guidance on the FCPA, non-governmental and business organizations continued to advocate their respective positions to the DOJ and SEC on topics that the guidance should address.

The U.S. Chamber of Commerce Institute for Legal Reform ("ILR") remained active in calling for the guidance to cover a number of areas of concern to businesses seeking to comply with the FCPA. However, the ILR recently drew criticism from Congressmen Elijah Cummings (D-MD) and Henry Waxman (D-CA) about the involvement of corporations represented on its board that have violated or been under investigation for violating the FCPA, which may inhibit the ILR's calls for legislative change.

In a May 22, 2012, letter to the ILR, the two members of Congress noted that they had originally been concerned about the participation of Walmart executives on ILR's board, but their concern had expanded. They stated their belief that there were a number of corporations represented on ILR's board that have violated or been under investigation for violating the FCPA. The letter expresses the authors’ concerns that the ILR has "advocated changes that would weaken" the FCPA, but had not disclosed the significant number of board members associated with these companies. They requested additional information about all board members’ involvement in the development of this policy and questioned whether their participation created an unresolved conflict of interest.

The Congressmen's criticism mirrors the arguments of opponents to legislative reform who contend that trade associations and companies that have sought legislative changes to the FCPA are actually aiming to undermine its effectiveness. Proponents of legislative change argue that the need for change is prompted by an overly broad statute coupled with ambiguous guidelines from the government that make it extremely difficult to comply with the law, which has resulted in increased enforcement actions and record-breaking financial penalties.

This being an election year, any legislative changes ultimately may be deferred to 2013 or later amid other priorities. However, as noted earlier, the DOJ and SEC's guidance is expected to be issued in the summer of 2012.

International Developments

Algerian Court Convicts Employees of Chinese Telecom Companies ZTE and Huawei of Bribery

On June 6, 2012, an Algerian court convicted three Chinese nationals of international bribery offenses and sentenced them in absentia to ten years in prison and imposed a fine of approximately $65,000. The men were employees of the Algerian subsidiaries of Chinese telecommunications companies ZTE and Huawei. The companies were also fined and barred from bidding on public contracts in Algeria for two years.

Two Algerian men, a former senior official with Algeria Telecom, the state-owned telecom company, and a businessman with dual Luxembourg and Algerian citizenship, were also convicted in relation to the bribery scheme. They were found guilty of money laundering and sentenced to 18 years in prison, fined $111,660 and ordered to forfeit all assets accumulated during the scheme.

The scheme reportedly involved transferring money through two shell companies in the British Virgin Islands to bank accounts located in Luxembourg. Allegedly, $10 million had been transferred between 2003 and 2006. The former Algeria Telecom official testified that he was paid to conduct market studies, he had no authority to award contracts and that nothing he did was illegal. According to press reports, international arrest warrants have been issued for the arrest of the three Chinese men. Huawei has stated that it takes the matter "very seriously" and is reviewing the Algerian court decision. ZTE has not made an official comment.

World Bank: Greater Transparency in Debarment Decisions

In May 30, 2012, in a move to increase the transparency and accountability of its sanctions process, the World Bank began publishing the full text of sanction decisions issued by the international body's Sanctions Board.

There are five types of World Bank sanctions: public letter of reprimand, conditional non-debarment, debarment with conditional release, indefinite or fixed-term debarment, and restitution. The default sanction, under the current system, is debarment for a term of years with conditional release (for example, conditioned on implementation of compliance improvements).

The World Bank Group can impose debarment, as an administrative sanction, on companies or individuals found to have committed "sanctionable misconduct" in connection with a World Bank Group-financed project. The five categories of "sanctionable misconduct" include: fraud, corruption, collusion, coercion, and obstructive practices. Debarred companies and individuals may be excluded from bidding on future projects.

The Sanctions Board is the upper tier of the World Bank's two-tier debarment review process. In broad terms, the review process works as follows: upon receiving an allegation of sanctionable misconduct, the Integrity Vice-Presidency ("INT") investigates and presents both its exculpatory and inculpatory findings to the first tier of the sanctions review process, the Evaluation & Suspension Officer ("ESO"). On the basis of INT's findings, the ESO makes a sanctions recommendation. The investigated party may contest the findings or the sanction, and present its own evidence. Based on the investigated party's arguments, the ESO may amend or revoke the sanction. If this second decision by ESO is contested, the case moves to the Sanctions Board.

The seven-member Sanctions Review Board includes three World Bank employees and four external members. The Board reviews all the presented evidence and arguments de novo. It may also hold a hearing, if either of the parties requests one. If the Board's review leads it to conclude that it is "more likely than not" that the third party committed sanctionable misconduct, it imposes a sanction. The decisions of the Sanctions Board may not be appealed. The current process has been in existence since 2007.

Under an agreement among development banks, an entity blacklisted by the World Bank Group is also debarred by the European Bank for Reconstruction and Development, the World Bank, the Asian Development Bank and the African Development Bank. Thus, an entity debarred by the Sanctions Board will also be unable to bid on projects by other development banks, even if the sanctionable conduct was unrelated to those institutions. Furthermore, the World Bank may refer the results of its investigation to enforcement authorities of the country relevant to the alleged misconduct or to its perpetrator.

The full-text publication will cover decisions issued in January 2011 or later, including both Sanctions Board decision in contested cases, and uncontested ESO determinations. Earlier decisions of the Sanctions Board are included in a digest, also available on the World Bank website. The digest summarizes the Board's past decisions and highlights the important points of law made in those decisions. The Bank also publishes a list of debarred companies on its website (including names, nature of sanctioned conduct, and nature of sanction imposed), as well as redacted reports of some of the INT investigations.

According to a World Bank managing director Sri Mulyani Indrawati, the full-text publication of debarment decisions is a move towards greater accountability and transparency and "deepen[s] the deterrent effect of debarments."

U.K. Ministry of Justice Requests Consultation on Implementation of Deferred Prosecution Agreements

On May 17, 2012, the U.K. Ministry of Justice ("MOJ") released a formal request for comments regarding its proposal to introduce DPAs as a new tool in its arsenal for combating serious economic crimes (bribery, fraud, corruption, and money laundering).

In its supplemental consultation paper detailing its DPA-related proposals, issued in conjunction with its request for comments, the MOJ acknowledged that U.K. law enforcement officials (primarily in the Serious Fraud Office ("SFO")) face significant obstacles in prosecuting economic crimes. The current regime offers two options: criminal prosecution or civil recovery. According to the MOJ, however, both methods are expensive and time consuming, which limits the number of investigations that can be pursued during a given year.

According to the MOJ, without DPAs, current U.K. law offers little incentive for commercial organizations to self-report and/or cooperate with government enforcement actions for fear of inviting criminal prosecution. Because U.K. law bars the prosecution of an entity that has already been convicted of the same offense, many companies who could be prosecuted in the United Kingdom may choose instead to engage with a more lenient jurisdiction in order to avoid future actions in England. This is particularly true with respect to the United States, which makes widespread use of DPAs that allow companies to disclose wrongdoing and pay a penalty without a criminal conviction. Accordingly, the MOJ hopes that the introduction of DPAs as a voluntary, transparent, and non-criminal option will encourage covered commercial organizations to self-report at home on a more consistent basis, thereby increasing the overall efficiency of economic crime enforcement actions.

Under the MOJ's proposal, in contrast to the U.S. system, the terms and conditions of a U.K. DPA must receive judicial approval both at the preliminary stage and the final negotiation. Once final judicial approval is given, details of the agreement would then be published and made freely available to the public. The MOJ believes that making the agreements public will increase confidence in the judicial system and encourage commercial entities to self-police and self-report offending behavior. The proposal also requires that each DPA follow a consistent framework: (1) statement of facts; (2) time period for the duration of the agreement; (3) required financial penalties; (4) reparation to victims; (5) disgorgement of profits; and (6) implementation of measures to prevent future wrongdoing (anti-fraud policies, procedures, training, etc.). The prosecutor would then set out, but would not be required to proceed with, criminal charges pending the commercial entity's successful completion of the agreement's specified terms and conditions.

Under the proposal, negotiation of the DPA would be a collaborative process between prosecutors and the company, from which the company could withdraw at any time before the DPA is formally approved by a judge. Once a judge approved a DPA, a company would be expected to abide by its terms. Non-compliance or breach of a DPA could result in the reinstitution of formal enforcement proceedings, depending on the severity of the breach. The MOJ has stated that it hopes that this increased transparency, consistency in proceedings, and knowledge that criminal charges are not the default response will encourage companies to voluntarily disclose acts of wrongdoing and proactively implement policies and procedures necessary to prevent economic crimes. At the same time, traditional civil and criminal enforcement actions would still be available if a DPA is not the best course of action for a particular company's situation.

The consultation period runs from May 17, 2012 – August 9, 2012, and is open to submissions from all members of the public, including the judiciary, legal practitioners, commercial organizations, services providers, and any other interested parties in England and Wales.

Executives Arrested and Charged in Canada for Attempted Payments to Bangladeshi Officials

Two executives from the SNC-Lavalin Group Inc. ("SNC") were charged in Canadian court in April with corruption for offering payment to government officials in Bangladesh. The company is one of the world's largest engineering firms, and the largest in Canada. The charges follow on the heels of last year's prosecution against oil and gas company Niko Resources, Ltd., which ultimately agreed to pay CDN$ 9.5 million in Canada's first multi-million dollar anti-corruption settlement, as reported in our FCPA Summer Review 2011. The only other conviction in Canada for foreign bribery occurred in 2001, a CDN$25,000 ($24,680), fine against Hydro Kleen Systems Inc.

The two executives, Ramesh Shah and Mohammad Ismail, were arrested in February on allegations that SNC attempted to make improper payments to government officials to secure a government contract. SNC submitted a bid to act as the supervisor on construction of a bridge across the Padma River (known as the Ganges River in India), a project worth approximately $1.2 billion. SNC ultimately did not win the contract, but Canadian authorities were alerted to the alleged corruption by the World Bank, which had agreed to finance the project. Based on information provided by the World Bank, the Royal Canadian Mounted Police launched an investigation, raided SNC's Montreal headquarters in late 2011, and arrested the two executives in February of this year.

The men were charged under Canada's Corruption of Foreign Public Officials Act ("CFPOA"), Canada's equivalent of the FCPA. According to news reports, no money changed hands, but the accused are alleged to have violated the CFPOA by offering benefits to six influential Bangladeshis, including government officials. The maximum penalty under the CFPOA is five years in prison, and unlimited fines. The executives' preliminary hearing is set for April 2013.

The arrests came just as SNC was completing its own internal investigation into unaccounted payments of about $56 million. According to various press reports, the company's investigation found that the $56 million is now missing and appears to have been made to "agents" that the company could not identify, and on contracts that did not exist. The company also found chief executive Pierre Duhaime to have breached company policy in approving the missing payments, and forced him to resign. Specifically, according to press reports, the company found that Duhaime approved, over the objections of SNC's chief financial officer, payments arranged by then-executive vice president Riadh Ben Aissa, who oversaw SNC's construction operations worldwide. Ben Aissa also was forced to resign from the company, and is currently in custody in Switzerland in connection with an investigation into corruption, fraud, and money laundering in North Africa. The company has since turned its documentation over to Canadian police for further investigation.

The World Bank has since suspended funding of the bridge, which would have linked underdeveloped southern Bangladesh to the capital city Dhaka and the port of Chittigong. The World Bank also has suspended an SNC subsidiary from bidding on any new projects financed by the Bank.

Thailand Strengthens its Anti-Corruption Measures

On March 31, 2011, Thailand became the 149th country to ratify the United Nations Convention Against Corruption ("UNCAC"). The UNCAC was originally adopted by the UN General Assembly on October 31, 2003, and entered into force on December 14, 2005. Among other measures, the UNCAC requires each country to amend its laws to comply with UNCAC's principles. The Thai government has been moving toward this goal by making its first amendments to the Organic Act on Counter-Corruption, Thailand's core anti-corruption legislation. One significant amendment was to increase the transparency of procurement contracts by requiring contractors of large public projects to provide detailed accounting to the National Anti-Corruption Commission. This is an important step toward improving the procurement process in Thailand, which historically has been opaque.

1 Once the recent dismissals and acquittals involving cases brought by the DOJ are factored in, however, those 2011 numbers drop to 12 corporate and seven individual actions.

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.