Monthly Tax Roundup (Volume 3, Issue 3)

Tax Alert

Introduction

In this month's roundup, we analyze recent judicial decisions involving the economic substance doctrine, the informal claim doctrine, and microcaptive insurance, provide key takeaways on an OECD report addressing Amount B for Pillar One, and highlight trends in audits of high-income taxpayers and developments in the employee retention credit.

Tax Fact: According to the Congressional Research Service (CRS), transferred energy tax credits in 2023 were sold at 89 cents to 95 cents on the dollar. These valuations shift according to purchase amounts. Credits bought for less than $10 million traded at 89 cents on the dollar. Purchases exceeding $100 million traded at an average of 95 cents on the dollar.

"Let me tell you what I'm scared of. I'm scared of spiders, snakes, and the IRS." – Former NFL Coach Bill Parcells

Another Microcaptive Program Does Not Qualify as Insurance

Maria Jones and Andrew Beaghley*

The U.S. Tax Court recently reviewed another section 831(b) microcaptive insurance program organized by Celia Clark (who is known for her involvement in the Avrahami program) and concluded once again that the taxpayer's program does not qualify as insurance.

In Swift v. Commissioner, T.C. Memo. 2024-13 (Feb. 1, 2024), the Tax Court applied its established template for analysis from previous cases and focused on whether there was risk distribution and whether the microcaptive program satisfied commonly accepted notions of insurance. In Swift, the court held that the taxpayer failed to demonstrate risk distribution based on its related company risks under direct policies because there was an insufficient number of risk exposures, and alternatively, because they did not have independent risks. In addition, the court held that the participation in reinsurance pools did not provide risk distribution because the products provided under the pools did not qualify as insurance. The court also found that the Swifts' captive arrangement did not constitute insurance in the commonly accepted sense, noting that while the "captives displayed some attributes of insurance companies, they failed to operate as insurance companies" and that the premiums were "engineered to suit the tax needs of the moment" and "were nonsense." The court held against the taxpayers in every way possible, finding that the premiums were income to the captives, the premiums were not deductible as ordinary and necessary business expenses by the taxpayer's business, the legal and professional fees paid to Ms. Clark were not deductible because they were not sufficiently related to the taxpayer's business, and the Swifts were liable for the 20 percent accuracy-related penalties under section 6662(a).

Swift follows several other Tax Court decisions against taxpayers in this space: Avrahami v. Commissioner, Reserve Mechanical Corp. v. Commissioner (which the Tenth Circuit affirmed), Syzygy Insurance Co. v. Commissioner, Caylor Land & Development, Inc. v. Commissioner, and just last month, Keating v. Commissioner. At the end of 2021, the IRS conceded the amounts at issue in Puglisi (a microcaptive case that was docketed in the Tax Court and in line for trial), which signaled a willingness on the IRS's part to recognize that at least some microcaptive arrangements can qualify as insurance for federal tax purposes. See Puglisi v. Commissioner, Docket Nos. 4796-20, 4799-20, 4826-20, 13487-20, 13488-20, 13489-20 (T.C. Nov. 5, 2021). We know that there are many other cases in the Tax Court pipeline, including some that have been tried and are awaiting decision. These cases are extraordinarily fact-intensive and many of them have facts that are more favorable than those in the decided cases. The big remaining question is whether the court will get an opportunity to decide any cases with favorable facts, or whether the IRS can continue its winning streak by settling the favorable cases before they get to court. We will continue to watch this space for developments.

Tax Court Looks to Case Law to Disregard Sham Stock Purchase Agreements

Kevin Kenworthy, Samuel Lapin, and Caroline Reaves*

On February 13, 2024, the U.S. Tax Court sustained IRS adjustments based on the sham transaction doctrine in Acqis Inc. v. Commissioner, T.C. Memo. 2024-21. Although the court acknowledged that the related economic substance doctrine has been codified under section 7701(o), it deferred to the IRS decision not to invoke section 7701(o) and instead disregarded the transactions as "economic shams" based on pre-codification case law.

The taxpayer in Acqis, a patent licensing entity, sought to enforce patents that it owned for computer hardware technology via licensing transactions or litigation. In 2009, the taxpayer filed a lawsuit alleging patent infringement against 11 technology companies. In connection with settlement negotiations, the taxpayer issued a new class of common stock (Class B Stock) that provided neither voting rights nor entitlement to dividends and had a secondary liquidation preference. The taxpayer offered to reduce the damages it sought from certain of the defendants in the patent litigation if those defendants purchased shares of its Class B Stock at an agreed upon price. Three of the defendants accepted this arrangement and entered into share purchase agreements (SPAs) and reduced their liability for damages. The taxpayer did not report any of the amounts received from the three defendants who agreed to purchase Class B shares as gross receipts, instead relying on sections 118 and 1032 to exclude the amounts as contributions to capital. The IRS determined a deficiency, asserting that those amounts were taxable gross receipts.

The court held that the SPAs were economic shams and should be disregarded. While acknowledging that the codified economic substance doctrine under section 7701(o) was effective for the years at issue, the court instead looked to the "sham transaction doctrine" as applied historically in the Ninth Circuit, to which the case would be appealable. The court examined the SPAs using the two familiar prongs of economic substance doctrine — the objective economic substance of the SPAs and the taxpayer's subjective motivation for entering into the transactions — but it ostensibly undertook this analysis under a "holistic approach" rather than strictly requiring the transaction to satisfy both prongs of the conjunctive test established in section 7701(o).

Ultimately, the distinction between the tests proved irrelevant, as the court determined the SPAs lacked both business purpose and objective economic effect. First, the court determined that the taxpayer had no business purpose beyond obtaining tax benefits for proposing and entering into the SPAs. Next, the court determined that the SPAs lacked objective economic effect, holding that the Class B shares were worthless given that there was no arm's-length negotiation as to the value of the shares, a departure from the taxpayer's traditional approach to potential investors, and that the defendants did not receive the benefits and burdens of equity in the taxpayer. Rather than non-taxable equity investments, the court held that the amounts paid to the taxpayer for Class B shares were settlements of the patent infringement litigation and characterized as taxable royalty payments.

The court's approach in Acqis effectively treats the codified economic substance doctrine and the common law sham transaction doctrine as alternatives that the IRS and courts may apply. While these alternatives would yield the same result for this transaction, the decision to apply the common law sham transaction doctrine substantially affected the penalty analysis.

Section 6662(b)(6) imposes a 20 percent penalty on an understatement of income tax attributable to any tax benefit disallowed under section 7701(o) or "any similar rule of law." The penalty under section 6662(b)(6) is a strict liability penalty for which no exceptions are available. Under section 6662(i), the 20 percent penalty is enhanced to 40 percent for any "nondisclosed noneconomic substance transaction." The IRS announced in Notice 2014-58, 2014-44 I.R.B. 746, that it would not apply the penalty to transactions for which the "underlying adjustments" were based on "other judicial doctrines."

Consistent with that policy statement, the IRS did not assert the strict-liability penalty, and the court specifically evaluated (and rejected) the taxpayer's position that it had "substantial authority" and "reasonable cause" for its treatment of the transaction – defenses the taxpayer could not have raised for a transaction disregarded under section 7701(o). Moreover, the IRS did not attempt to enhance the penalty to 40 percent as a "nondisclosed economic substance transaction." We are interested to see to what extent the Tax Court and other courts follow this approach to the economic substance doctrine and, if so, how they apply the penalty in section 6662(b)(6).

District Court Denies Taxpayer Refund Claim Based on a Variant of the Informal Claim Doctrine in American Guardian Holdings

Robert Kovacev and Omar Hussein*

On February 7, 2024, the District Court for the Northern District of Illinois denied a taxpayer's refund claim in American Guardian Holdings, Inc. v. United States, 2024 WL 474165 (N.D. Ill. 2024). The informal claim doctrine provides that an insufficient refund claim may be treated as adequate if formal defects and lack of specificity in an original return are remedied in an amended filing after the statutory period closes, so long as the initial claim was timely. The purpose of the doctrine is to allow taxpayers to seek relief for good faith attempts to amend harmless errors even if the statutory period is closed. This case demonstrates the limitations of the informal claim doctrine and highlights the dangers of changing the grounds for a refund in successive amended returns.

American Guardian Holdings (AGH) prepared, but apparently did not file with the IRS, a timely amended return for the 2015 tax year claiming a refund based on an alleged error on its original return. After changing accountants, AGH prepared a second amended return, incorporating the first (unfiled) amended return and reflecting additional claims. AGH successfully filed this second amended return within the statute of limitations. AGH subsequently filed a third amended return, asserting a completely different theory from the first and second amended returns, along with a request that the IRS "discard" the second amended return. This third amended return was filed after the statute of limitations expired for the 2015 tax year. The IRS rejected the third amended return as untimely and AGH filed a refund suit in district court.

The Department of Justice (DOJ) moved to dismiss for lack of subject matter jurisdiction because the third amended return was untimely. AGH argued that the informal clam doctrine allowed it to file subsequent amended returns after the expiration of the statute of limitations. The court granted DOJ’s motion and dismissed the case. The court agreed that the informal claim doctrine permitted subsequent amendments to refund claims after the expiration of the statute of limitations, so long as the first refund claim was timely. In this case, however, the court noted that the third amended return was based on a wholly different ground for refund than the previous amended returns. While the district court did not explicitly invoke the variance doctrine, which precludes a taxpayer from pursuing a refund suit on grounds substantially different than those of the refund claim, it held that the third amended return (and the complaint based on it) did not present the same claim as the previous two claims because it sought a refund on a different basis. Accordingly, the third amended return was untimely and the court lacked jurisdiction. The court left open the possibility that AGH could still pursue a refund under the second amended claim, provided that it exhausted administrative remedies with the IRS before filing suit. This decision is appealable to the Seventh Circuit.

OECD Releases Report on Amount B of Pillar One

Loren Ponds,* Rocco Femia, and Jaclyn Roeing

The OECD/Group of 20 (G20) Inclusive Framework on Base Erosion and Profit Shifting (IF) released a report on Pillar One's Amount B on February 19, 2024. Amount B provides an optional simplified and streamlined approach to applying the arm's length principle to baseline distribution activities of multinational enterprises (MNEs). Jurisdictions may authorize or require in scope taxpayers to apply this approach beginning in 2025. The report has been incorporated into the OECD Transfer Pricing Guidelines (TPG) as an Annex.

Background

The report follows the public consultation on Amount B in July 2023, during which the IF indicated that future work on Amount B would focus on (1) establishing quantitative scoping metrics and (2) harmonizing key aspects of Amount A (a portion of excess profits of large and profitable multinationals to be allocated to market jurisdictions) and Amount B. This release delivers on half of the mandate from last July and sets forth quantitative scoping metrics based on relevant factor asset intensity classifications specific to three industry groupings. Additional guidance is forthcoming in which issues related to the interdependence between Amounts A and B will be examined.

Amount B is meant to relieve not only compliance burdens for MNEs with routine distributors but also the burden on low-capacity jurisdictions of administering the transfer pricing rules. If these twin goals are achieved, it is envisioned that transfer pricing disputes involving distribution activities will be greatly reduced and taxpayers will enjoy increased tax certainty. The impact of a streamlined approach is significant, as reports estimate that between 30 percent and 70 percent of all transfer pricing disputes in low-capacity jurisdictions relate to distribution activities. Eliminating the bulk of these transactions from the agendas of low-capacity jurisdictions will enable them to devote resources to more material and complex transactions.

Scope

The simplified and streamlined approach applies to in-scope distributors that undertake qualifying transactions, such as buy-sell arrangements (where the distributor purchases goods from associated parties and then sells those goods on a wholesale basis to unrelated customers), and sales agent and commissionaire arrangements that support another group entity's wholesale distribution of goods to third parties. Out-of-scope transactions include sales of digital goods, commodities, and services.

In limited circumstances, a distributor may be in scope even if it performs non-distribution activities that can be independently priced, like manufacturing. Distributors are out of scope if they assume certain economically significant risks or own unique and valuable intangibles. Distributors are also out of scope if they incur operating expenses outside of certain thresholds in relation to their annual net revenues.

Pricing Method

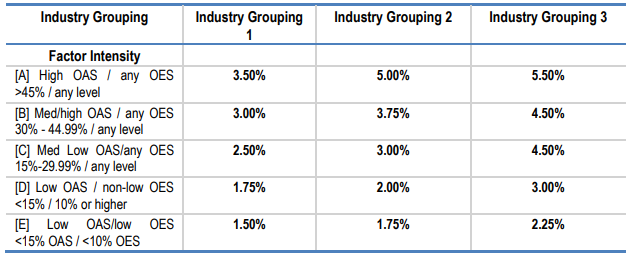

The IF has applied the Transactional Net Margin Method (TNMM) to a global set of distributors to derive a "pricing matrix" (see Table 1 below) that sets forth the arm's-length ranges of return on sales (ROS) based on industry groupings and various permutations of factor intensity classifications. Specifically, the pricing matrix sets forth (1) three potential industry groupings that distributors may fall into and (2) five iterations of net operating asset intensity (OAS) and operating expense intensity (OES) depending upon whether these values are high, medium, or low. Using these values, taxpayers will be able to determine the arm's-length range of ROS by reference to the matrix value, plus or minus 0.5 percent.

Table 1 Pricing Matrix (return on sales percent) derived from the global dataset (Report at 29)

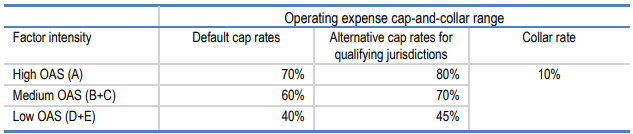

An operating expense cross-check is applied as a guardrail to the results under the ROS (see Table 2 below). The cross-check effectively provides for a cap and a floor on profits expressed as a return on operating expenses, with different caps and floors depending on OAS. The cap is higher for distributors in certain jurisdictions.

Table 2 Operating expense cap-and-collar range (Report at 31)

Next Steps

The OECD TPG have been revised to reflect these developments on Amount B. The OECD Council must approve any conforming changes to the commentary on Article 25 (Mutual Agreement Procedure) of the OECD Model Tax Convention, according to an OECD release. As noted above, further assessment of the interdependence of Amount B and Amount A under Pillar One is expected prior to the signing and entry into force of the Multilateral Convention.

Countries may choose to apply the simplified and streamlined approach to in-scope distributors for fiscal years (FY) commencing on or after January 1, 2025. Such countries will be faced with two options for implementation: (1) allow in-scope domestic distributors to elect to apply the approach as a safe harbor; or (2) require distributors and tax administrations to apply the approach. Because adoption is elective, it's to be expected that there will be differences in outcomes as between jurisdictions that have permitted or mandated implementation of Amount B and those who have not. The report notes, however, that IF members have committed to respect outcomes determined under the simplified and streamlined approach by other countries. Members have also committed to "take all reasonable steps" to relieve potential double taxation that could occur when a low-capacity jurisdiction applies the approach and bilateral tax treaties are in place. The IF aims to agree on a list of low-capacity jurisdictions by March 31, 2024, and to develop other elements necessary to implement this commitment during 2024.

The IF is working on optional qualitative scoping criteria that countries may adopt in addition to the quantitative scoping criteria summarized above, and this additional guidance is expected to be announced by March 31, 2024. This effort responds to a key point of disagreement that arose during negotiations between IF members regarding how to identify non-baseline distribution arrangements. For example, India expressed reservations about relying exclusively on quantitative scoping criteria, noting that qualitative scoping criteria were necessary to ensure that the simplified and streamlined approach applied only to baseline distributors and not those who provided extraordinary value. In such circumstances, an application of the purely quantitative analysis may not adequately price transactions, resulting in an under-allocation of revenue (and thus, tax) to the country where the distributor is located. On the other hand, the introduction of qualitative (i.e., subjective) scoping criteria may erode the utility of the simplified and streamlined approach.

Takeaways

MNEs with in-scope distributors should review the report and consider the possible application of the simplified and streamlined approach to arrangements with affiliated distributors. The promise of reduced compliance burdens may be of interest. MNEs should assess the extent to which the results under the approach would align with their existing transfer pricing policies. The current simplified and streamlined approach is based solely on quantitative metrics and therefore may not be sufficiently nuanced to reflect the relevant facts and circumstances of the distribution transactions at issue. Furthermore, distributors that opt into the simplified and streamlined approach will be required to provide additional documentation to tax authorities, such as reconciliations that show how the simplified and streamlined approach ties to annual financial statements, suggesting that the reduced compliance burden may not be as significant as taxpayers might have hoped. MNEs should continue to monitor developments, particularly implementation by countries of interest.

Past is Prologue: GAO Report Analyzes a Decade of IRS Audits of High-Income Taxpayers as IRS Turns Its Attention to Corporate Jets

Jim Gadwood, Andy Howlett, and Caroline Reaves*

A recent Government Accountability Office (GAO) report analyzes and critiques IRS audits of high-income individuals over the last decade. The report is particularly interesting given the IRS's ongoing efforts to use additional funding from the Inflation Reduction Act (IRA) to increase scrutiny of high-income and high-wealth individuals. To paraphrase Mark Twain, while history doesn't repeat itself, it often rhymes. The report's discussion of IRS audit activity over the last decade may provide a window into what high-income and high-wealth individuals should expect from the IRS in the decade to come.

The GAO analyzed audits of individual returns with $500,000 or more of "total positive income" — all positive amounts shown on the tax return — that the IRS closed in FY 2012 through 2022. Perhaps unsurprisingly, the GAO found that the IRS on average recommended larger adjustments in absolute terms in audits of individual tax returns with $10 million of more of total positive income than in audits of individual tax returns with $500,000 to $10 million of total positive income. More interesting is the GAO's finding that these highest income audits — $10 million or more of total positive income — generally resulted in at least double the recommended additional tax per IRS audit hour compared to audits in other high-income categories. These per-hour statistics could suggest that the IRS will increasingly focus its auditing resources on individual tax returns with $10 million or more of total positive income relative to individual tax returns with $500,000 to $10 million of total positive income.

The report also discloses that in 2020, the U.S. Department of the Treasury directed the IRS to audit at least eight percent of returns filed each year by individuals with $10 million or more of adjusted gross income (that is, gross income less certain deductions). The GAO found that the IRS is on track to meet this audit rate goal for tax years 2018 through 2020. Directionally speaking, this means one out of every 12 or 13 taxpayers at this income level should expect to face an IRS examination.

Consistent with recent press releases, the GAO observed that the IRS has been developing plans to improve its auditing of high-income and high-wealth tax returns. But the GAO found that, in certain respects, the IRS's plans "are unclear and not yet finalized." That said, taxpayers should expect the IRS to sharpen its plans in the near term as the IRS works to deploy its additional IRA funding.

For instance, a recent IRS news release announced plans to begin dozens of audits on personal use of business aircraft, an area that has long been fertile ground for disputes between taxpayers and the IRS. When executives use a business aircraft for personal purposes, there is potential tax avoidance by both the business (which claims a deduction for the relevant expense) and the individual (which does not take into his or her income the use of the plane). Given that private jets are generally used by the same high-income and high-wealth individuals the IRS is already targeting for audit, it is easy to see why the IRS has publicly identified this area as a priority.

According to the IRS release, these audits will focus on whether taxpayers are properly allocating jet usage between business and personal flights for tax purposes. The IRS intends to use "advanced analytics and resources from the Inflation Reduction Act to more closely examine this area, which has not been scrutinized during the past decade as agency resources fell sharply." Related news coverage stated that Commissioner Werfel "was vague about how exactly the IRS was using data analytics to aid its audit efforts, but he did let on that it has access to data on corporate jet activity." Taxpayers should expect to see a mix of audits of both businesses and individuals as the IRS tries to root out perceived tax abuse with respect to the approximately 15,000 corporate jets operating in the U.S.

The IRS also recently heralded new efforts focusing on high-income taxpayers who have failed to file one or more a tax returns between tax years 2017 and 2021. Based on third-party reporting such as Forms W-2 and 1099, the IRS identified 125,000 cases where an individual has an estimated $400,000 to $1 million of income but failed to file a federal income tax return. According to Commissioner Werfel, the IRS finally has the funding to identify non-filers and address this "core tax administration work." The IRS began mailing compliance letters last week.

Family offices and other advisors to high-income and high-wealth individuals should be cognizant of increased IRS audit risk, particularly for individuals with at least $10 million of adjusted gross income. Contemporaneous documentation of private jet usage — not to mention charitable contributions and material participation — is perhaps now more important than ever.

The Employee Retention Credit Remains a Concern for Just About Everyone

Andy Howlett and Jorge Castro*

For a credit that expired in 2021, the Employee Retention Credit (ERC) has a way of staying in the news.

The blockbuster news of course is that the House of Representative passed the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) on January 31. The legislation is currently awaiting action in the Senate. As we've chronicled, the legislation contains a hodgepodge of business tax priorities, including the extension of bonus depreciation, the reinstatement of expensing for research and experimentation (R&E) expenses, and taxpayer favorable adjustments to section 163(j). There's also a provision that has the effect of a creating a tax treaty with Taiwan, along with provisions for the expansion of the child tax credit (CTC) and relating to disaster losses and affordable housing. All the aforementioned items (except for the Taiwan legislation) are revenue losers according to the Joint Committee on the Taxation (JCT).

Provisions relating to the ERC make the bill more or less revenue neutral, however. These provisions – which JCT says will raise $78.6 billion over 10 years – include an absolute cutoff on ERC payouts unless refund claims were submitted on or before January 31, 2024, enhanced penalties for so-called COVID-ERC promoters under section 6701 (relating to "penalties for aiding and abetting understatement of tax liability"), and an extension of the statute of limitations on assessment of ERC-related underpayments.

Congress isn't the only part of government where the ERC remains a concern. The IRS remains deluged with already-submitted ERC claims which it has neither denied nor paid out. On February 20, 2024, it reminded taxpayers that both the ERC voluntary disclosure program (for taxpayers that filed a claim "in error" and received a payment) and the withdrawal program (for pending claims) were available. The voluntary disclosure program, which is scheduled to expire after March 22, allows qualifying taxpayers repay 80 percent of the ERC payment received, with no requirement to adjust income tax returns to reduce wage expense or to pay penalties and interest. The withdrawal program, by contrast, is open to taxpayers for whom the IRS has not paid their claim or for those taxpayers who have not cashed the IRS's check with respect to that claim. Even taxpayers under audit may participate.

In the meantime, the IRS continues to audit and investigate criminal ERC claims. According to a January 25 news release, the IRS has "thousands of [taxpayer] audits in the pipeline," 123 active reviews of ERC promoters, and 352 criminal investigations involving $2.9 billion in an investigations.

While the IRS charges ahead with ERC audits, its Chief Counsel's Office released a generic legal advice memorandum (GLAM) on February 16 relating to the liability of so-called third party payors for ERCs claimed by their clients. Last summer, we covered regulations that allow the IRS to assess and collect erroneously paid out ERC claims in the same manner as underpaid taxes, even though the paid-out ERCs typically exceed employment tax liability because the credit is refundable. In the February 16 GLAM, the IRS set forth its view on which parties are liable for these "underpaid taxes." The GLAM concludes that all third-party payors may be liable for underpayments of employment tax for the ERC for all quarters. The conclusion articulated in the GLAM would provide the IRS significant flexibility in deciding whether to assess third party payors, clients, or both for erroneously paid ERCs.

Given the substantial use of Professional Employer Organizations (PEOs) and the large number of ERC audits, it's conceivable that one or more targeted parties could challenge the IRS's interpretation. For example, a third-party payor could argue that certain amendments in the Consolidated Appropriations Act prohibit the IRS from targeting third party payors for 2021 quarters. It's also conceivable that a party – either a third-party payor or a client – could challenge the regulations' position that the IRS can assess an erroneously paid ERC in the same manner as underpaid taxes on the grounds that an ERC in excess of applicable employment tax liability isn't really an underpaid tax.

*Former Miller & Chevalier attorney

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.