Monthly Tax Roundup (Volume 2, Issue 4)

Tax Alert

Introduction

This month's roundup features important recent guidance from the Internal Revenue Service (IRS) as well as coverage of three important court decisions. The IRS and Department of the Treasury released eagerly anticipated proposed regulations implementing the new semiconductor investment tax credit under section 48D. In addition, the IRS released taxpayer-favorable informal guidance for mid-year repatriation of previously taxed earnings and profits. The courts were active as well: the Seventh Circuit ruled in the research and experimentation (R&E) credit case for Little Sandy Coal, the Ninth Circuit provided a cautionary tale to complying with the return filing requirements in order to start the running of the statute of limitations, and the Supreme Court weighed in on the long-running dispute regarding the application of Report of Foreign Bank and Financial Accounts (FBAR) penalties with some interesting comments on deference to the IRS.

"I can't talk right now, unless you can help me with my taxes. What is 'gross necklaces?'" – Evelyn Wang (Michelle Yeoh) in Everything Everywhere All at Once

Tax Fact: According to the IRS, it receives nearly four billion information returns per year and projects that by 2028, it will receive over five billion information returns each year.

Treasury Issues Proposed Regulations on CHIPS Tax Credit

George Hani, Loren Ponds,* Layla Asali, and Samuel Lapin

On March 23, 2023, Treasury and the IRS issued proposed regulations to implement the section 48D advanced manufacturing investment credit established by the CHIPS Act of 2022 to incentivize semiconductor manufacturing in the U.S. The proposed regulations provide guidance on critical definitions in the statute – including key definitions such as "qualified property" and "semiconductor manufacturing" – and the requirement that qualified property be "integral to the operation of the advanced manufacturing facility." Notably, the preamble requested comments on the scope of the proposed definition of "semiconductor" and whether certain items should be incorporated into the definition. The proposed regulations also provide safe harbors for determining the "beginning of construction" for purposes of the statutory rule providing for the termination of the credit for property the construction of which begins after December 31, 2026.

The proposed regulations elaborate significantly on the credit recapture provisions under section 50(a) whereby a taxpayer that benefits from the section 48D credit must recapture the credits if it engages in an "applicable transaction" during the 10-year period after it places in service property that is eligible for the section 48D credit. The credit recapture provisions relate to certain expansions of semiconductor manufacturing capacity in a "foreign country of concern," e.g., China, and include exceptions for certain transactions involving legacy semiconductor manufacturing. The preamble to the proposed regulations states that they were intended to "align and harmonize" the credit recapture provisions with standards set forth in proposed rules issued by the Department of Commerce on the same day.

Comments on the proposed regulations are due May 22, 2023.

IRS Releases Additional Guidance on Mid-Year Distributions of Previously Tax Earnings

On March 10, 2023, the IRS Office of Associate Chief Counsel (International) released an Advice Memorandum (AM 2023-002) addressing the basis consequences of a mid-year repatriation of previously taxed earnings and profits (PTEP). The memorandum articulates the legal basis for a taxpayer-favorable ruling released earlier this year (PLR 202304008).

In the earlier ruling, the IRS concluded that when a foreign corporation distributed earnings before the end of the taxable year, its U.S. shareholder accounted for its upward adjustment to basis under section 961(a) (for current year global intangible low-taxed income (GILTI) and subpart F inclusions) when determining the basis reduction required under section 961(b) (for the mid-year distribution of PTEP). This sequence is critical to preventing recognition of non-economic gain. For additional background, please see our prior discussion.

Existing regulations from 1965 provide that the upward basis adjustment occurs at the end of the year, whereas the basis decrease occurs when the U.S. shareholder "receives such excluded amount" – the amount excluded from gross income under section 959, because it was previously included under section 951(a). See generally Treas. Reg. §§ 1.961-1, -2. Treasury and the IRS have had a longstanding guidance project to update these regulations. The Advice Memorandum observes that the current regulations are ambiguous and should be interpreted in light of the fact that the "final amount of PTEP for the taxable year" cannot be determined until the end of the year, when subpart F and GILTI can be calculated. This statement implies that the U.S. shareholder does not receive an "excluded amount" until the end of the year, notwithstanding receipt of cash earlier in the year. The memorandum's approach to timing prevents recognition of non-economic gain, furthering what it describes as "section 959 and section 961's common purpose of preventing double taxation."

The transaction in the memorandum is stylized and will not answer all the questions adjacent to mid-year distributions. For example, the memorandum assumes that the foreign corporation maintains a U.S. dollar functional currency and therefore sidesteps any question about a potential mismatch between the U.S. dollar value of the upward and downward basis adjustments.

Although the memorandum may not be relied upon as precedent, the memorandum represents the current position of the IRS Office of Associate Chief Counsel (International), which will be available to examining agents reviewing PTEP distributions. When evaluating the basis consequences of mid-year distributions, taxpayers may consider the strength of the reasoning articulated in the guidance, as applied to their specific transaction.

Seventh Circuit Issues Mixed Decision on Process of Experimentation for R&E Credit

George Hani, Robert Kovacev, and Samuel Lapin

The U.S. Court of Appeals for the Seventh Circuit ruled that Little Sandy Coal Co, Inc. is not entitled to R&E credits for its subsidiary's expenditures to design and build 11 ships. The Seventh Circuit affirmed a U.S. Tax Court decision that found that the subsidiary, Corn Island Shipyard, Inc. (CIS), failed to properly demonstrate that it performed qualified research — specifically that substantially all of its activities with respect to the 11 ships at issue were elements of a process of experimentation, as required under section 41(c)(1)(C). But in doing so, the Seventh Circuit gave future taxpayers a partial win by rejecting the Tax Court's treatment of the production of pilot models.

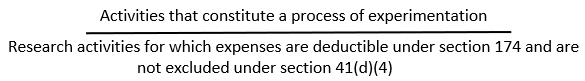

Taxpayers must perform qualified research to be eligible for the R&E credit. Under section 41(d)(1), a taxpayer performs qualified research when it can show that it satisfied four tests: the section 174 test, the technological information test, the business component test, and the substantially all test. The question before the court was whether CIS satisfied the substantially all test, under which substantially all — i.e., 80 percent — of a taxpayer's research activities with respect to a business component must constitute elements of a process of experimentation. A "process of experimentation" is a process that is based on the scientific method in which the taxpayer evaluates "one or more alternatives to achieve a result where the capability or the method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer's research activities." Whether a taxpayer satisfies the substantially all test is determined based on the following fraction:

The Tax Court ruled in favor of the government. Little Sandy Coal Co, Inc. v. Comm'r, T.C. Memo. 2021-15. It held that the taxpayer did not satisfy the substantially all test for two reasons. First, it rejected the taxpayer's argument that it met the substantially all test because most of the ships were new or novel designs. Next, the Tax Court held that the production of a pilot model, while included in the denominator of the "substantially all" fraction, cannot constitute an element of a process of experimentation. A pilot model is defined in Treas. Reg. § 1.147-2(a)(4) as "any representation or model of a product that is produced to evaluate and resolve uncertainty concerning the product during the development or improvement of the product." The Tax Court held that production of a pilot model is direct support for research under section 41(b)(2)(B), not research itself, and therefore can never be an element of a process of experimentation. The Tax Court also found that the taxpayer failed to provide specific enough records demonstrating the time that relevant employees spent on activities that were elements of a process of experimentation.

The Seventh Circuit affirmed the Tax Court decision on appeal. But despite its agreement with the Tax Court's conclusion, the Seventh Circuit disagreed with its treatment of pilot models with respect to the substantially all test. The Seventh Circuit, like the Tax Court, concluded that pilot model production is included in the denominator because expenses incurred for production of pilot models prior to the elimination of uncertainty were deductible under section 174. The Seventh Circuit then held that production of pilot models can be an element of a process of experimentation provided that the pilot model is used in a methodical process of evaluating alternatives driven by the scientific method. The Seventh Circuit cited support from the examples in the regulations elaborating on the substantially all test. The court specifically noted Example 3 in Treas. Reg. § 1.41-4(a)(8), which shows that the use of models in a methodical evaluation of alternatives can be part of a process of experimentation, and that it does not distinguish production activities from testing activities. This was a rejection of the Tax Court's conclusion on production of pilot models, which the Seventh Circuit attributed to Tax Court's erroneous importation of the distinction between qualified research and direct supervision of qualified research into the substantially all test from section 41(b).

Ultimately, the Seventh Circuit agreed with the Tax Court that the taxpayer had not demonstrated its entitlement to R&E credits and held that the Tax Court correctly rejected that the taxpayer's argument emphasizing the novelty of the ships because the substantially all test focuses on activities, not on business components or elements thereof. The court also agreed with the Tax Court's construction of the fraction for the substantially all test. Most importantly, the Seventh Circuit found that the taxpayer had not sufficiently substantiated its eligibility for the R&E credits. Having held that the production of the pilot models could be included in the numerator of the substantially all fraction, the Seventh Circuit concluded that the taxpayer had not sufficiently demonstrated that CIS produced the ships as part of process of experimentation because "[n]o hypothesis was postulated, and no alternatives were evaluated."

Despite the result for the taxpayer in this case, Little Sandy Coal should be reason for some optimism among taxpayers. The Seventh Circuit widened the scope of activities that may be included in the numerator of the substantially all fraction to include activities direct support and direct supervision of research. Rather than categorically excluding direct support and direct supervision activities from the numerator, Little Sandy Coal holds that they should be evaluated like any other research activity — to determine whether they were performed as part of a process of experimentation.

Full Ninth Circuit Holds that "Meticulous Compliance" Necessary to Start Statute of Limitations

The full Ninth Circuit Court of Appeals recently held that a return faxed to a revenue agent during an audit was not "filed" such that it triggered the statute of limitations for the IRS to assess tax attributable to a partnership's return. Seaview Trading, LLC v. Comm'r, No. 20-72416, slip op (9th Cir. March 10, 2023). The Ninth Circuit held that taxpayers must meticulously comply with filing requirements to begin the period of limitations on assessment. The court's holding, while addressing the now-defunct Tax Equity and Fiscal Responsibility Act (TEFRA) partnership audit rules, could have has broad implications for what constitutes filing a return for purposes of triggering the statute of limitations.

The taxpayer, a partnership subject to the TEFRA audit rules, claimed a $35.5 million loss in 2001 in connection with a tax shelter transaction. In 2005, at the beginning of an IRS audit, the taxpayer faxed a copy of its 2001 return to the revenue agent. Later, in 2007, the taxpayer also mailed a copy of its 2001 return to IRS attorneys. The IRS determined an adjustment and issued a notice of final partnership administrative adjustment (FPAA) to the taxpayer in 2010, more than three years from when the taxpayer faxed and subsequently mailed its 2001 return to the revenue agent and IRS attorney, respectively.

Generally, the IRS had three years to assess income attributable to a partnership item under the TEFRA rules. The period of limitations began upon either (1) the date on which the partnership filed its Form 1065 for the tax year at issue or (2) the last day for filing a Form 1065 for that taxable year to assess tax. Section 6229(a). But the statute of limitation never starts if a TEFRA partnership never files a return for taxable year. Section 6229(c)(3).

Before the U.S. Tax Court, the taxpayer argued that the IRS issued the FPAA after the statute of limitations expired and therefore could not disallow its claimed deduction. Citing Lucas v. Pilliod Lumber Co, 281 U.S. 245 (1930), the Tax Court held that a taxpayer must show "meticulous compliance . . . with all named conditions" to claim the benefit of the statute of limitations. It then held the faxed copy did not constitute a "filing" for purposes of the statute of limitations because the taxpayer did not meticulously comply with the filing procedures for TEFRA partnerships set out in former section 6230(i), regulations thereunder, and the instructions to the Form 1065. Because the taxpayer had not filed its 2001 return for purposes of the statute, the statute of limitations never began for that tax year. The Tax Court also held that the Form 1065 the taxpayer faxed to the agent did not constitute a "return."

On appeal to the Ninth Circuit, a split panel reversed the Tax Court decision. Based on the ordinary meaning of "filed" and informal IRS guidance, the panel held that a partnership return is filed when a partnership delivers its return to an IRS official authorized to receive it. The panel also held that the copy of the return faxed to the revenue agent in 2005 constitutes a "return" such that it starts the statute of limitations. On November 10, 2022, the Ninth Circuit vacated the panel's opinion and announced that the case would be reheard en banc.

On March 10, 2023, the full Ninth Circuit changed course and affirmed the Tax Court opinion, holding that the taxpayer had not filed a return for purposes of triggering the statute of limitations. The court cited Pilliod Lumber in holding that a taxpayer must meticulously comply with all filing requirements to have the benefit of the statute of limitations. While the court walked through the relevant statute and regulations, it ultimately focused on the instructions to the Form 1065, which provide that partnerships with a principle place of business in California (such as the taxpayer) must file the form to the service center in Ogden, Utah. Because the taxpayer did not file its Form 1065 to the Ogden service center, the court held that it did not meticulously comply with filing requirements and, therefore, the statute of limitations had not begun to run. The court also rejected the taxpayer's argument that Treas. Reg. § 1.6031(a)-1(e) applies to only timely returns, not to delinquent returns. It found no distinction between timely and delinquent returns in the statute or regulations and held that the informal IRS guidance to which the taxpayer cited was either not applicable or not binding on the court. Because the taxpayer had not filed its return in accordance with the requirements, the FPAA was timely.

A dissenting opinion notes that the IRS in this case took a position contrary to public statements in which it advised taxpayers that revenue agents will be able to accept delinquent returns. The dissent argues that the IRS's position in this case is an about-face that "throws our tax system into disarray," and therefore "taxpayers can no longer trust what the IRS has told them about how to file delinquent returns."

Seaview Trading is a cautionary tale that taxpayers must diligently follow the applicable filing procedures to start the running of the statute of limitations, even when they have also provided a delinquent return to a revenue agent or other IRS official. While a return not filed in "meticulous compliance" with filing requirements may be accepted for some purposes — in this case it was used as a basis for an audit of the taxpayer — that does not guarantee that it will be treated as filed. While Seaview Trading addressed a Form 1065, there is nothing in the court's reasoning that is specific to TEFRA partnerships. Therefore, we expect to see similar disputes in the context of other returns and in the context of amended returns.

Bittner Resolves a Circuit Split on FBAR Penalties and Raises Interesting Questions About the Application of Skidmore Deference

Andy Howlett and Joseph Rillotta*

On February 28, 2023, the Supreme Court issued its much-anticipated (at least in the tax community) decision in Bittner v. United States (hereafter, Slip Op.). Bittner concerned the application of non-willful penalties to a U.S. taxpayer's failure to file the FBAR. 31 U.S.C. § 5321 imposes a maximum penalty of $10,000 for each "violation" of 31 U.S.C. § 5314. Section 5314 requires every taxpayer to "file reports" when they "mak[es] a transaction or maintai[n] a relation" with a "foreign financial agency."

It is not illegal for a U.S. citizen or permanent resident to own a foreign bank account. Many law-abiding citizens have several, which can make life a lot easier when they travel abroad, conduct business with foreign parties, or invest in non-U.S. real property and equities. Of course, we all know that foreign bank accounts can be used as an instrument of tax evasion as well, as it has historically been much more difficult for the IRS to track information about income received (e.g., interest, dividends, rents, etc.) in foreign bank accounts than in domestic ones. Hence, the requirement of 31 U.S.C. § 5314 that FBARs be filed reporting information regarding foreign bank accounts.

What happens when a citizen has multiple reportable accounts (let's say 61), and is unaware of the requirement to file (and, thus, non-willfully fails to file) an FBAR? Meet Mr. Alexandru Bittner, a dual citizen of the U.S. and Romania, who initially failed to file an FBAR for years 2007 through 2011 (but subsequently corrected that failure). Should the maximum penalty be limited to $10,000 for each year, or should it be $10,000 for each account (up to 61) for each year?1

Justice Gorsuch, writing for the Court's majority, held that the former, more taxpayer-friendly approach was the correct one, overturning the decision of the Fifth Circuit. United States v. Bittner, 19 F.4th 734, 739-740 (5th Cir. 2021). The thrust of the majority opinion was that because the language of section 5314 "did not speak of accounts or their number," the obligation to file a correct and complete FBAR for a given year was "binary": either the taxpayer met it or he did not. And therefore, because the penalty provision 31 U.S.C. § 5321 refers not to "accounts" but to "violations," and because a violation occurs when a form is not filed (or is incomplete and/or incorrect), there can be only a single $10,000 non-willful penalty for a given tax year.

Significantly, other parts of section 5321 do authorize per-account penalties. Specifically, in the case of willful violations, a penalty of the greater of $100,000 or 50 percent of the "balance in the account at the time the of the violation" (emphasis added) may issue. 31 U.S.C. § 5321(a)(5)(C) and (D)(ii). Under a straightforward application of expressio unius est exclusio alterius – the expression of one thing is the exclusion of the other – the Court found that the non-willful penalty provision must not apply on a per-account basis. Slip Op. at 7.

Other Contextual Clues

In reaching its conclusion, the Court examined "other contextual clues pressing against the government's theory" that section 5321 imposed non-willful penalties on a "per-account" basis." It examined the preamble to proposed regulations that stated the civil penalty was "not to exceed" $10,000. Slip Op. at 9 (quoting 75 Fed. Reg. 8854). It also quoted an IRS form letter (Letter 3709) and the FBAR instructions that stated that the non-willful penalty cannot “exceed $10,000." The Court acknowledged that the government's "guidance documents" did not control the outcome but were relevant because "courts may consider the consistency of an agency's views when we weigh the persuasiveness of any interpretation it professes in court." For this proposition, the majority opinion cited Skidmore v. Swift & Co. Slip. Op. at 10 (quoting 323 U.S. 134, 140).

But Skidmore is generally understood to refer to the level of deference that an agency's interpretation of the law may receive in court. The so-called "Skidmore deference" means that a court must defer to an agency's interpretation (i.e., in administration guidance) to the extent it is persuasive. It is somewhat surprising to see the Supreme Court cite Skidmore to reject the government's litigating position on the basis that the IRS said something different in taxpayer-facing administrative guidance.

Far From Unanimous

The Bittner decision was far from unanimous. Justice Gorsuch wrote the majority opinion and was joined in an ideologically diverse alliance by Justices Jackson, Alito, and Kavanaugh, as well as Chief Justice Roberts. Interestingly, the Chief Justice and Justices Alito and Kavanaugh removed themselves from section II-C of Justice Gorsuch's opinion, meaning that this was not part of the ruling of the Court. Section II-C addressed the taxpayer's contention that his narrow interpretation of section 5314 was mandated by the rule of lenity. Justice Gorsuch and Justice Jackson agreed with this, deeming the question to fall within the precedent of Commissioner v. Acker that statutes imposing penalties ought to be construed strictly against the government. 361 U.S. 87, 91 (1959). Justice Gorsuch noted that the Court's decision would have criminal implications as well as civil ones, because the statute providing for criminal sanctions for failing to file an FBAR – 31 U.S.C. § 5322 – also ties punishment to "willful[] violat[ions]" of the Bank Secrecy Act (BSA). If criminal violations arose on a per-account basis, each willfully misstated or late-reported account could be a separate offense entailing the possibility of a $250,000 fine and five years in prison. Justice Gorsuch wryly observed that this would mean had Mr. Bittner's violations been willful, he could face a $68 million fine and 1,360 years in prison. In such a case, "the rule of lenity, not to mention a dose of common sense, favors a strict construction." Slip. Op. at 16, citing Leocal v. Ashcroft, 543 U.S. 1, 12, n.8 (2004).

Justice Barrett wrote the dissent, in which Justices Thomas, Sotomayor, and Kagan joined. The thrust of Justice Barrett's dissent was that "the most natural reading" of the statue supports a per-account interpretation. The basis for this position is that § 5314 requires taxpayers to "file reports" when they "maintain[] a relation…with a foreign financial agency." Thus, the subject matter of the FBAR is the "relation" with the foreign bank. Justice Barrett argues that this most naturally refers to the account with a bank and bolsters this argument by noting that the reporting that § 5314 actually requires relates to foreign bank accounts.

Further, Justice Barrett notes that 31 U.S.C. § 5321(a)(5)(B)(ii) provides an exception to the non-willful penalty, stating that no penalty applies if the violation was due to reasonable cause and "the balance in the account at the time of the transaction was properly reported" (emphasis added). Thus, per Justice Barrett, "this language suggests that the underlying violation of § 5314 is similarly tied to a specific account." Slip. Op. (Barrett, J. Dissenting) at 4.

Finally, Justice Barrett parses the FBAR regulations (31 U.S.C. §§ 1010.306 and 350) and observes that these regulations distinguish between "reports" required by the statute and "forms" (i.e., the FBAR form), noting that multiple reports may be required to be made on a single form. This strongly implies, according to Justice Barrett, that a violation of the required "report" occurs with respect to each unreported account. She goes on to criticize the Court's embrace of administrative guidance to help its cause, noting that such materials "add little, if anything, to the interpretive enterprise when traditional tools of construction supply an answer." Slip. Op. (Barrett, J. Dissenting) at 8.

* * *

These diverging views on administrative guidance (including, potentially, forms and publications and stock letters to taxpayers) is arguably the most interesting part of Bittner. While it is true that the Court did not exclusively rely on administrative guidance materials, the majority opinion did find them helpful. It will be interesting to watch and see if taxpayers and the government cite Bittner for the proposition that a preamble to proposed regulations or an IRS form letter can be persuasive authority in deciding a case. Certainly, it will add a new dimension to considerations that Treasury, the IRS, and taxpayer advocates will grapple with in future rule-making processes.

-----------

1As the Supreme Court noted, a similar case arose in the Ninth Circuit. See United States v. Boyd, 991 F.3d 1077, 1079 (9th Cir. 2021). The Ninth Circuit came to the same conclusion ultimately arrived at by the Supreme Court, holding that 31 U.S.C. § 5314 only authorizes a single annual maximum penalty for a non-willful violation "no matter the number of accounts." 991 F.3d at 1078.

*Former Miller & Chevalier attorney

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.