Executives at Risk: Navigating Individual Exposure in Government Investigations - Volume IV

White Collar Alert

Welcome to Volume IV of Executives at Risk: Navigating Individual Exposure in Government Investigations. In this edition, we highlight the most significant cases and government investigations that affect corporate executives in the second quarter of 2016. The most noteworthy developments affecting executives include:

- A Second Circuit ruling barring the use of search warrants to access electronic data stored abroad

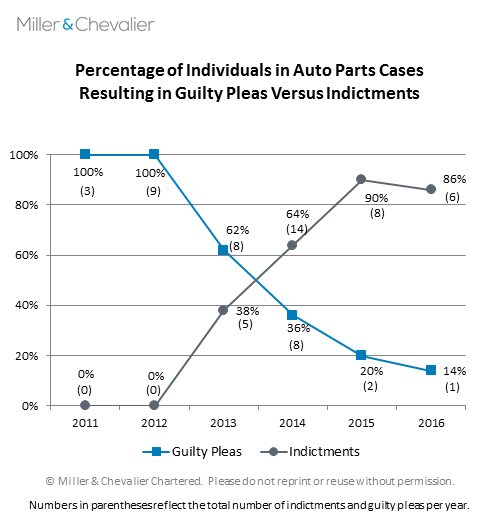

- Seven indictments of foreign executives in international cartel investigations in the auto parts and cargo shipping industries, continuing the trend away from guilty pleas

- Mixed results against individuals in the London Interbank Offered Rate (LIBOR) investigation, including dropped charges in the U.S. and a hung jury in the U.K.

- A Supreme Court ruling in former Virginia Governor Robert McDonnell's case raising the bar for the government to prove bribery of a public official

- A Fifth Circuit ruling adopting a pro-defense interpretation of the "loss" amount in small business fraud cases

- A Second Circuit decision that employees who do not cooperate in internal company investigations can be fired

Extradition and Extraterritoriality

Second Circuit Ruling Bars Government From Accessing Consumer Data Stored Abroad: In a victory for privacy rights, the Second Circuit ruled in July that the U.S. government cannot use search warrants to access consumer data stored on servers abroad. In a unanimous, three-judge decision, the court held that the Stored Communications Act's warrant provisions do not apply extraterritorially. The Second Circuit overturned a Southern District of New York decision upholding a search warrant issued under the statute that compelled Microsoft Corporation to hand over email data stored on a server in Ireland. The court found that the government's broad interpretation of the Stored Communications Act was inconsistent with the presumption against extraterritoriality adopted by the Supreme Court in Morrison v. National Australian Bank Ltd. (2010) and RJR Nabisco, Inc. v. European Community (2016). The court's ruling is significant for executives of multinational companies whose emails and other data may be housed outside the United States. However, the significance may be short-lived. In April, the Supreme Court approved an amendment to Federal Rule of Criminal Procedure 41, which would allow judges to issue search warrants for data stored anywhere in the world in two situations: if the computer is using technology to shield its location, or if it may be part of a botnet, which is a network of computers infected by malware unbeknownst to its users. The amendment will take effect December 1, 2016 unless Congress objects.

Israel Agrees to Extradite to the U.S. Two Citizens Accused of Bank Hacking: In May, the Israeli government agreed to extradite two of its citizens to the United States to face trial for their alleged involvement in a securities fraud scam to hack into the computer systems of nine banks. The individuals were arrested by Israel at the U.S. government's request. An Israeli court authorized extradition after finding the evidence the U.S. government submitted in support of its request sufficient to try the individuals in Israel. The two individuals subsequently consented to their extradition and arrived in New York in June.

Executive Sentenced to More Than Six Years in Prison for Embezzlement After He Pled and Fled: In June, a former Samsung America Inc. executive was sentenced to 75 months in prison for embezzling $1.6 million from his employer. John Y. Lee pled guilty to wire and tax fraud charges in 2008, stemming from a scheme to use a fake business to steer payments from Samsung to his account for services that were never rendered. However, Lee fled to South Korea before he could be sentenced and remained there for eight years, allegedly to help raise his son. The court did not find Lee's argument -- that he deserved credit for returning to the United States voluntarily -- to be availing.

Criminal Actions Against Executives

DOJ Indicts Six Japanese Auto Parts Execs, but Doubts Persist Concerning the U.S. Government's Ability to Secure Convictions: In the second quarter of 2016, six Japanese auto parts executives were indicted for their alleged roles in conspiracies to fix prices and allocate markets in the auto parts industry. Japanese-based Tokai Kogyo Co. Ltd., its wholly-owned United States subsidiary and one of the company's Japanese executives were indicted in June for allegedly participating in a scheme to fix prices, rig bids and allocate sales for automotive body sealing products sold to Honda. In a separate indictment returned the same day, Japanese-based Maruyasu Industries Co., Ltd., its wholly-owned United States subsidiary and four of its Japanese executives were charged for their role in a similar conspiracy involving automotive steel tubes. In May, a Japanese executive who previously worked for Japan-based Corning International KK was indicted for rigging bids and fixing prices for ceramic substrates sold to General Motors, Ford, Chrysler and Honda. The executives are Japanese nationals who reside abroad. Tokai Kogyo and Maruyasu Industries are the first companies to be indicted in the years-long probe, rather than to enter a guilty plea.

The U.S. Department of Justice (DOJ) has secured only one guilty plea of an auto parts executive this year. In April, the former president of Nishikawa Rubber agreed to return to the United States to accept a guilty plea for participating in a price-fixing and bid-rigging scheme over automotive body sealing products sold to Honda and Toyota between 2003 and 2011. The Japanese national had been indicted the year before. He was sentenced to serve 18 months in prison pursuant to a Rule 11(C)(1)(c) plea agreement.

As we previously reported, DOJ has struggled to prosecute individuals located abroad for cartel conduct. To date, DOJ has charged 64 executives, but has been able to secure guilty pleas from only 31 -- about 48%. That percentage has declined annually since DOJ launched its investigation into the auto parts industry -- from 100% in 2011 to 14% in the first half of 2016. A chart depicting this trend is below. The other individuals appear to be beyond the reach of the U.S. government. Indeed, DOJ has obtained only one extradition exclusively on antitrust charges (as opposed to also on non-antitrust charges) in its history. It is, therefore, unlikely that the DOJ will succeed in extraditing many -- let alone all -- of the foreign executives indicted in the auto parts investigation. (See comments in article published by Law360.)

Foreign Ocean Freight Executive Indicted in Shipping Cargo Price-Fixing Scheme: In June, a Chilean national and former vice president of Compania Sudamericana de Vapores S.A. (CSV), an ocean freight company, was indicted for his role in an alleged scheme to fix shipping prices for cargo transported to and from the United States from 2000 to 2012. Four other executives have pled guilty and have been sentenced to prison. Three employees have been indicted but remain fugitives. CSV and two Japanese companies, Nippon Yusen Kabushiki Kaisha and Kawasaki Kisen Kaisha have pled guilty for their involvement in the conspiracy. The three companies agreed to pay fines of $8.9 million, $67.7 million and $59.4 million, respectively.

LIBOR

Mixed Results for the U.K.'s SFO in Third LIBOR Manipulation Trial: After 11 days of deliberations, a London jury failed to reach a verdict as to two defendants in the ongoing prosecution by the U.K.'s Serious Fraud Office (SFO) of individuals for allegedly manipulating LIBOR, a benchmark rate that leading banks charge each other for short-term loans. The SFO announced that it will retry them. The same jury convicted three other defendants, who were sentenced to prison terms of six and one-half years, four years and two years and nine months. The sentences are significantly lower than the 11 years former UBS AG and Citigroup Inc. trader Tom Hayes received after being convicted in the first LIBOR trial in 2015.

The 11-week trial was the SFO's third trial related to the LIBOR manipulation scandal and follows on the heels of an embarrassing blow. In January, a London jury acquitted six brokers allegedly involved in a LIBOR manipulation scheme.

U.K. SFO's Trial Losses Impact DOJ's LIBOR Prosecutions: In June, DOJ prosecutors dropped federal charges against three former traders for allegedly conspiring to rig LIBOR after the U.K.'s SFO failed to secure their conviction at trial in January. In their filing, prosecutors said that they agreed to drop the charges because of the final adjudication of the individuals' cases for the same underlying conduct in the U.K.

However, the United States has seen some success in its ongoing LIBOR investigation in recent months. In July, a former Rabobank derivatives trader pleaded guilty to engaging in a scheme to manipulate LIBOR to his company's advantage. He is the fourth Rabobank trader to plead guilty in the scheme. Rabobank entered into a deferred prosecution agreement with DOJ and agreed to pay a $325 million fine in October 2013. In May, a federal grand jury indicted two former Deutsche Bank senior traders -- the New York Pool Trading Desk supervisor and a derivatives trader in London -- for their role in allegedly manipulating LIBOR. Both individuals are located in the United States. Deutsche Bank entered into a deferred prosecution agreement with DOJ and agreed to pay a $775 million fine in April 2015.

Kickbacks and Fraud

Supreme Court Reins in Government's Prosecution of Former Virginia Governor Who Accepted Loans and Gifts from Corporate CEO: In a highly anticipated decision, on June 27, 2016 the U.S. Supreme Court reversed the bribery conviction of former Virginia Governor Robert McDonnell. The government had alleged that McDonnell and his wife accepted $175,000 in loans and gifts from Jonnie Williams, the CEO of Star Scientific, a Virginia-based nutritional supplement company. The parties agreed that the government was required to show that McDonnell committed (or agreed to commit) an "official act" in exchange for the loans and gifts, but they strongly disagreed about what constitutes such an act under the relevant statutory provisions. The prosecution proceeded on the theory that McDonnell committed at least five official acts, including arranging meetings for Williams to discuss Star Scientific's product, hosting events for Star Scientific at the Governor's Mansion and contacting other government officials concerning Star Scientific's product. The high court rejected the government's theory, holding that even in McDonnell's "distasteful" and "tawdry" case, "setting up a meeting, calling another public official, or hosting an event does not, standing alone, qualify as an 'official act.'" In vacating and remanding the case to the Fourth Circuit for further proceedings, the Supreme Court expressed its concern about "the Government's boundless interpretation of the federal bribery statute," but left intact "[a] more limited interpretation of the term 'official act,'" which the court believes will provide "ample room for prosecuting corruption, while comporting with the text of the [bribery] statute and [Supreme Court] precedent." The parties have asked the Fourth Circuit to hold the case in abeyance while they assess their options.

CEO and CFO of Mortgage Lender Beat SEC's Fraud Charges: In July, a federal jury found the CEO and CFO of mortgage lender TMST Inc. not liable on some charges and failed to reach a verdict on others in a fraud suit brought against them by the Securities and Exchange Commission (SEC). The jury refused to buy into a single count of the SEC's theory that the two executives, Larry Goldstone and Clarence Simmons, fraudulently hid $428 million in losses in a 2007 annual report. In a case in which the two executives were accused of, among other things, books-and-records violations, filing false materials with the SEC, making false certifications and securities fraud, the jury not only found the executives not liable on half the counts, but for the books-and-records violation count, the jury found that the defendants had affirmatively proven by a preponderance of the evidence that the defendants had acted in good faith. Prior to the three-week trial, the company's Chief Accounting Officer, Jane Starrett, who originally had been sued along with Goldstone and Simmons, settled with the SEC. Starrett agreed to pay a $25,000 penalty and accept a three-year suspension of her ability to practice as an accountant before the SEC.

DOJ Drops Civil Fraud Investigation Against Countrywide Co-Founder: More than five years after Angelo Mozilo, the co-founder of failed mortgage originator Countrywide Financial Corp., settled fraud claims with the SEC that he misled investors about the subprime mortgage crisis for $67.5 million, the DOJ has closed its file on Mozilo without filing civil fraud charges against him. Mozilo had at one time also been under criminal investigation for his management of the now-disgraced mortgage lender, but after the SEC settlement in 2010, the DOJ pursued only civil claims.

Former President of Pharma Company Acquitted in Kickbacks Case: In June, in a case that was initially touted by the DOJ as an example of the Yates Memo's principles in action, W. Carl Reichel, the former president of drug maker Warner Chilcott, was acquitted of conspiring to pay kickbacks to doctors after a 15-day trial. The primary evidence against Reichel came in the form of speeches he had given to large groups of sales representatives about using medical education credits and speaker programs -- which prosecutors characterized as social boondoggles -- to sell Warner Chilcott drugs. The verdict comes less than a year after Warner Chilcott pled guilty to a criminal charge of health-care fraud and paid $125 million to resolve a DOJ investigation into its payments to physicians.

Government Contracts Fraud

Fifth Circuit Becomes Third Federal Court of Appeals to Adopt Pro-Defense View of Loss in Small Business Administration (SBA) Fraud Cases: In April, the Fifth Circuit vacated the sentence of an executive convicted for his role in obtaining government contracts set aside for minority-owned small businesses. In a published decision, the court upheld Thomas Harris's conviction but overturned his sentence after concluding that the district court had improperly inflated the loss amount of the fraud when calculating Harris's sentence. The Fifth Circuit ruled that the general loss rule, not the government benefits rule, applies to calculation of loss in small and disadvantaged business fraud cases because procurement contracts do not constitute government benefits. Accordingly, the district court improperly applied the government benefits rule and calculated loss as the total face value of the contracts awarded. Under the general rule, the loss amount is offset by the fair market value of the services rendered.

The Fifth Circuit becomes the third federal appellate court to adopt a pro-defense view of loss calculation in small business set-aside fraud cases. As we reported in Volume II of this newsletter, in 2015, both the Third Circuit and the Ninth Circuit held that courts must offset any loss amount by the value of the services rendered to the government in cases involving disadvantaged business set-aside contracts. In Harris's case, the Fifth Circuit distinguished its unpublished ruling in United States v. Lopez, which held that the government benefits rule applied to a case involving a program that directs federal procurement contracts to non-profits that employ blind or severely disabled people. The court found that Lopez did not apply to government procurement fraud under the small business set-aside program because such government contracts are not a "government benefit" akin to a grant or entitlement program payment.

Construction Company Executive Convicted for $100 Million Veteran Business Fraud Scam: In June, a Massachusetts federal jury convicted construction company owner David Gorski of conspiracy and wire fraud for his role in a scheme to defraud the federal government of nearly $100 million in government contracts intended for businesses owned by service-disabled veterans. The jury deliberated for only two hours before finding him guilty. Gorski recruited a Korean War veteran to act as the front for his construction company, Legion Construction, in order to obtain the set-aside contracts. The executive unsuccessfully argued at trial that he hired accountants and attorney in an effort to stay within the Service-Disabled, Veteran-Owned Small Business Regulations. Gorski faces up to 25 years in prison.

Disadvantaged Business Owner Cops to Taking Kickbacks to Act as Straw Company: In July, the owner of a designated disadvantaged business enterprise (DBE) pled guilty to accepting kickbacks and misrepresenting to the government that her company was performing certain government subcontracts when they were in fact being performed by a non-DBE. Carol Sanzo, owner of a construction materials broker and supply company, admitted that her company acted as a pass-through between the prime contractor and subcontractor on a New York State Department of Transportation construction project over a three year period. She faces up to 20 years in prison.

Three More Birdsall Executives Sentenced For Improperly Securing Millions in Public Contracts: Three more former Birdsall Services Group executives have been sentenced to jail time for their role in a scheme to circumvent New Jersey's pay-to-play law barring companies that make political contributions from securing government contracts. Birdsall shareholders and employees allegedly made small, unreported political contributions rather than having the company make political contributions that would disqualify the now-defunct engineering services company from certain government contracts. The former executives were sentenced as follows: William Birdsall, the company's former senior vice president, was sentenced to 270 days in prison in July; Thomas Rospos, the former executive vice president and second largest shareholder, was sentenced to three years in June; and the former CEO, Howard Birdsall, was sentenced to four years in prison in April. The company pled guilty in 2013 to money laundering and making false representations for government contracts. It was ordered to pay $2.6 million in civil forfeiture and $500,000 in criminal penalties.

Foreign Corrupt Practices Act (FCPA)

Two Former VPs Receive Lenient Sentences in Criminal Bribery Case but Are Sued by Ex-Employer: The Louis Berger Group, a construction management company, recently filed separate complaints against two former company VPs, Richard Hirsch and James McClung, alleging that they breached their duties of good faith and loyalty and violated the company's Code of Business Conduct. As reported in our Autumn 2015 FCPA Review, the two men pled guilty to making and concealing corrupt payments to government officials in India, Indonesia and Vietnam. The company itself, through a subsidiary, entered into a DPA with the DOJ in July 2015 in which it admitted to conspiring to violate the FCPA's anti-bribery provisions and agreed to pay a $17.1 million criminal penalty. Separately, Hirsch and McClung's cooperation won them lenient sentences of two years' probation (Hirsch) and a year and a day in prison (McClung). The prosecution commended Hirsch's cooperation at his sentencing hearing and noted that Hirsch was forthcoming at a time when the company itself had been unwilling to concede that bribery had occurred. In its civil suit against the former executives, the company seeks, among other things, both compensatory damages and the clawback of advanced legal fees.

Consulting Company Owner Pleads Guilty to FCPA Charges for Bribing Employee of European Bank for Reconstruction and Development: In April, Dmitrij Harder, the former owner and president of the Pennsylvania-based Chestnut Consulting Group, Co. and Chestnut Consulting Group, Inc., pled guilty to two counts of violating the anti-bribery provisions of the FCPA for his alleged role in bribing an official of the European Bank for Reconstruction and Development (EBRD). We initially reported on his indictment in our Spring 2015 FCPA Review. The EBRD is an international development bank, sponsored by more than 60 nations, whose mission is to provide financing for development projects in emerging economies. Harder admitted to participating in a scheme to pay more than $3.5 million in bribes to an EBRD official between 2007 and 2009. In exchange for the payments, the EBRD subsequently approved two applications for financing for two Chestnut Consulting Group clients, resulting in an $85 million investment and a €90 million loan for one, and a $40 million investment and a $60 million loan for the other. Harder admitted that the Chestnut Consulting Group earned approximately $8 million dollars in success fees as a result of the EBRD's approval of these two applications. Harder's sentencing is scheduled for November.

Energy Executive Pleads Guilty to Conspiring to Violate the FCPA in Connection with Venezuelan Energy Contracts: In June, a sixth defendant pled guilty in the DOJ's ongoing investigation into energy contracts with Venezuelan state-owned energy company Petroleos de Venezuela S.A. (PDVSA). Roberto Enrique Rincon Fernandez, a Venezuelan national and resident of Texas, pled guilty to violating the anti-bribery provisions of the FCPA, a related conspiracy count, and making a false statement on his income tax return. As described in our Spring 2016 FCPA Review, Rincon and his co-conspirators owned multiple U.S.-based energy companies that sought to obtain contracts from PDVSA for the provision of equipment and services to the state-owned company. Rincon allegedly made wire transfers totaling more than $1.3 million to bank accounts in Texas and other jurisdictions belonging to PDVSA officials and their associates, in addition to covering some of their hotel stays, meals and entertainment. The alleged purpose of the payments was to ensure the inclusion of his companies on PDVSA bidding panels and approved vendor lists and to receive payment priority ahead of other PDVSA vendors.

Export Control

CEO of Metallurgy Company Pleads Guilty to Illegally Exporting Goods to Iran: In June, Global Metallurgy CEO Erdal Kuyumcu pled guilty to a single count of conspiracy to violate the International Emergency Economic Powers Act, which provides the statutory criminal predicate for the United States' regime of sanctions against Iran. The government alleged that Kuyumcu illegally exported a specialized metallic powder made of cobalt and nickel to Iran without a license from U.S. Treasury Department's Office of Foreign Assets Control (OFAC). The parties agree that the powder can be used to coat gas turbine components, but the government further contends that it can be used for missile production and nuclear applications -- something the defense "vehemently dispute[s]." According to DOJ, Kuyumcu and a co-conspirator hid the final destination of their powder by arranging for it to be shipped through Turkey before being sent on to Iran. Kuyumcu faces up to 20 years in prison and a $1 million fine when he is sentenced in October.

Tax

DOJ Employment Tax Enforcement Initiative: The DOJ Tax Division continues its push on civil and criminal employment tax enforcement. U.S. employers are required to collect, account for and pay over to the Treasury payroll taxes withheld from employee wages, i.e., federal income taxes and FICA (Social Security and Medicare) taxes, including the new Additional Medicare tax on high earners. Employers also have a separate responsibility to pay their matching share of FICA taxes. According to the DOJ, as of September 2015, more than $59 billion in taxes actually reported on quarterly employment tax returns (i.e., Forms 941) remains unpaid. Moreover, employers "who view amounts withheld from employee wages as a personal slush fund, treat withheld employment taxes as a loan from the government that can be repaid if and when they see fit, or whose business model is based on a continued failure to pay employment tax, are engaging in criminal conduct and face prosecution, imprisonment, monetary fines and restitution." In 2015, individuals convicted of employment tax crimes were sentenced to an average of 24 months in prison.

DOJ Drops IRS Summons Enforcement Efforts After UBS Voluntarily Turns Over Records from Singapore Office: The IRS served an administrative summons on UBS for records pertaining to accounts held by Ching-Ye "Henry" Hsiaw, a U.S. citizen who now lives in China. The IRS had issued a Bank of Nova Scotia summons, which is a summons served on a U.S. branch of a foreign financial institution to seek documents held at one of the bank's foreign locations. See In re Grand Jury Proceedings (Bank of Nova Scotia), 691 F.2d 1384 (11th Cir. 1982). After failing to turn over the records, the DOJ commenced a summons enforcement proceeding, asserting that the IRS needed the records in order to determine Hsiaw's federal income tax liabilities for 2006 through 2011. The government further asserted that Hsiaw transferred funds from a Swiss UBS account to the Singapore branch in 2002, after UBS had indicated to account holders that it would have to identify account holders with U.S.-sourced investments. UBS originally argued that Singapore's bank secrecy laws prevented it from turning over the documents, but UBS turned over the documents after Hsiaw consented to the release. Subsequently, in June, DOJ voluntarily dismissed the action.

Former Qwest CEO Loses Bid to Deduct Criminal Forfeiture: In June, the Federal Circuit held that Joseph P. Nacchio, former CEO of Qwest Communications International, Inc., could not take a deduction for a $44 million forfeiture resulting from his insider trading conviction. In 2010, Nacchio was sentenced to 70 months for selling Qwest stock and failing to publicly disclose that Qwest would not hit its earnings predictions. The appellate court found that Nacchio was not entitled to deduct the forfeiture as a business expense and that Nacchio failed to establish that the forfeiture was not a fine or similar penalty.

Obstruction

Former Bank Chairman and CEO Sentenced to 18 Months in Prison for Obstruction of Federal Reserve Board (Fed) Investigation: In July, the former Chairman and CEO of Voyager Bank, Timothy Paul Owens, was sentenced to 18 months in prison for obstructing a Fed investigation. In 2009, the Fed sent the holding company's board a letter of inquiry regarding $5 million in loans the bank allegedly provided to Owens. Owens allegedly intercepted the letter, failed to show it to the bank holding company's board and then prepared a false and misleading response that had not been vetted by the board. Owens was fired from his position in 2011, indicted in December 2014 and pled guilty to the charge of obstruction of an examination of a financial institution. His sentence was at the lower end of the recommended sentence range of 18 to 24 months.

FIFA Corruption Scandal

Last of Extradited FIFA Officials Pleads Not Guilty: In May, former Nicaraguan Football Federation president and Fédération Internationale de Football Association (FIFA) executive Julio Rocha pled not guilty to charges stemming from the FIFA corruption scandal. As we previously reported, Rocha was one of seven FIFA officials arrested in Switzerland and extradited abroad to face charges. Rocha is one of more than 40 individuals and entities who have been charged in the FIFA investigation. The indictment against him alleges that Rocha accepted bribes from a sports marketing firm executive in order to obtain worldwide commercial rights related to the 2018 World Cup qualifier matches.

Responsible Corporate Officer Doctrine

In Divided Ruling, Eighth Circuit Upholds Prison Sentences for Failure to Prevent Salmonella Outbreak: In July, a divided Eighth Circuit panel upheld the sentences of a father-and-son owner and chief operating officer of a United States egg producer that sold eggs containing salmonella enteritidis. As we previously reported, the two were convicted under the responsible corporate officer doctrine, which imposes liability on corporate officers based on their status as persons responsible for the company involved in the crime, not their involvement or awareness of the misconduct. Although the egg company executives were not directly responsible for selling and shipping the contaminated eggs, their failure to effectively oversee their company's operations and prevent lower-level workers from shipping eggs containing salmonella enteritidis ultimately resulted in three-month prison sentences for each. On appeal, the majority opinion conceded that imposing a prison term for a vicarious liability crime would violate due process. However, the majority concluded that the responsible corporate officer doctrine as set forth in the Food Drug & Cosmetic Act (FDCA) does not constitute vicarious liability. Rather, the FDCA holds corporate officers liable for their own failure to prevent or remedy the problem, not the acts or omissions of others. The dissent, on the other hand, found no precedent for imposing a prison sentence in the absence of mens rea. Given the divided ruling, the two executives may seek an en banc review of the decision.

Civil Litigation

Eleventh Circuit Restricts SEC's Ability to Impose Disgorgement by Applying Five-Year Statute of Limitations: As described in our Alert, on May 26, 2016, the Eleventh Circuit held in S.E.C. v. Graham that the five-year statute of limitations in 28 U.S.C. § 2462 -- the U.S. Code's general statute of limitations -- applies to the SEC's claims for disgorgement or declaratory relief. Graham represents a significant challenge to the SEC's stated position that disgorgement is not subject to § 2462 because it is an equitable remedy and is a blow to the SEC's current view of its enforcement powers. As a result of Graham, individuals currently involved in SEC enforcement proceedings are quite likely to vigorously challenge any continued efforts by the Commission to pursue disgorgement if the statute of limitations has run. Graham may also discourage defendants from signing tolling agreements to extend or entirely waive the statute of limitations and give them increased leverage to do so.

Second Circuit Says Employees Who Refuse to Cooperate in Internal Company Probes Can Be Fired: In June, the Second Circuit rejected efforts by William Gilman and Edward McNenney Jr., two former executives of insurance broker Marsh & McLennan, to recover employment benefits after they were terminated for failing to sit for interviews during the course of their employer's internal investigation into concerns about the executives' involvement in a bid-rigging scheme. Gilman and McNenney argued, among other things, that their employer unreasonably forced them to choose between termination and providing potentially incriminating statements while the company was cooperating with the New York Attorney General's Office. The Second Circuit rejected this argument, finding that although the two executives had been placed "in the tough position of choosing between employment and incrimination," the law was on the company's side. Otherwise, "[t]here would be a complete breakdown in the regulation of many areas of business if employers did not carry most of the load of keeping their employees in line and have the sanction of discharge for refusal to answer what is essential to that end." The Second Circuit notably distinguished this case from its decision in United States v. Stein, 541 F.3d 130 (2d Cir. 2008), in which it had found that federal prosecutors had so coerced KPMG into refusing to pay the legal defense bills of its employees, that KPMG had essentially become a state actor, which implicated the employees' Fifth Amendment rights. Here, despite the employer's cooperation with the government, the Second Circuit found that the facts did not show that the cooperation rose to the Stein-level of coercion.

Company Sues Former President Who Pled Guilty to Violating Trade Sanctions Regime: In May, Delfin Group USA LLC, a Russian-owned producer of synthetic motor oil, sued its former president after he pled guilty to deliberately routing Delfin's shipments through the United Arab Emirates to avoid U.S. trade embargos on Iran. Former Delfin president, Markos Baghdasarian, originally was sentenced to three years in prison for his involvement in the scheme but had his sentence reduced by a year in April 2014. Delfin's lawsuit seeks to recover legal costs and the cost of seized goods in the amount of $4.25 million.

Former Bank CEO Loses Bid for Golden Parachute Payments: In April, the Eighth Circuit upheld a decision of the Federal Deposit Insurance Corporation (FDIC),which had refused to grant permission to Reliance Bank to make a golden parachute disbursement to its former CEO, Jerry Von Rohr. The bank terminated Von Rohr in September 2011 and provided him a letter the next month that his termination was based on the board's opinion that his leadership was significantly responsible for the bank's troubled financial condition. Von Rohr felt that he had one year left on the contract and sued for compensation. The FDIC, which was monitoring the bank due to its "troubled condition," refused to grant permission to the bank to make the disbursement, labeling it a golden parachute payment. The Eighth Circuit rejected Von Rohr's lawsuit against the bank, finding that Von Rohr was attempting to create a "giant loophole" in the FDIC's golden parachute regulations and that Von Rohr had submitted no evidence to rebut the board's opinion of his leadership failings.

Policy Issues -- The Yates Memo and Its Aftermath

U.S. Chamber Institute for Legal Reform Jumps into the Fray on the Yates Memo, Warns of Unintended Consequences: Following the release of the Yates Memorandum -- which directs DOJ's line prosecutors to prioritize the prosecution of corporate executives for individual corporate wrongdoing -- numerous commentators have issued predictions about the policy's future impact on individual prosecutions.

The U.S. Chamber Institute for Legal Reform, an affiliate of the U.S. Chamber of Commerce, recently joined the debate by publishing "DOJ's New Threshold for 'Cooperation,'" a paper on certain potential "unintended consequences" of the Yates Memo. The paper warns of "collateral risks relating to costs, attorney-client privilege, and data privacy," and, in light of the "all-or-nothing" approach to corporate cooperation, questions the benefits of "boiling the ocean in search of facts and turning employees against one another if there is no guarantee the end result will be some form of favorable credit."

Editors: Kirby D. Behre, Lauren E. Briggerman,* Dawn E. Murphy-Johnson*

Contributors: Homer E. Moyer, Jr., Marc Alain Bohn,* Sarah A. Dowd,* Jonathan D. Kossak,* Saskia Zandieh,* Andrew C. Strelka,* Austen Walsh,* Theresa A. Androff,* and Quinnie Lin**

*Former Miller & Chevalier attorney

**Former Miller & Chevalier law clerk

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.