FCPA Spring Review 2010

International Alert

Introduction

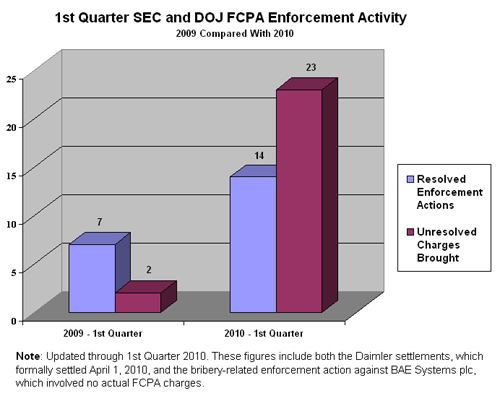

Numerous high profile anti-bribery related actions unfolded in the past quarter, one of the most active anti-bribery enforcement seasons on record. Among the more significant were the arrest and indictment of over 20 individuals on Foreign Corrupt Practices Act ("FCPA") related charges during a sting operation at the Las Vegas SHOT Show and an anti-corruption related fine of over $445 million levied on BAE Systems plc ("BAE"). As compared to the same period last year, bribery-related enforcement actions were up significantly, with a total of 14 resolved enforcement actions: four actions involving individuals and ten actions involving corporations. In each category, these numbers were at least double what they were during the same period in 2009.

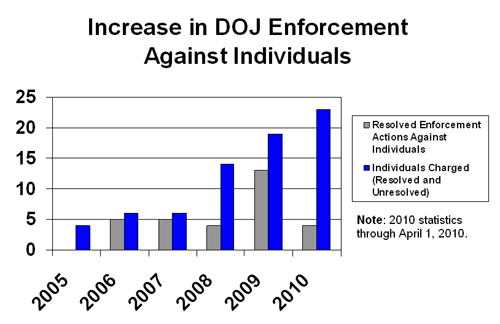

The SHOT Show arrests, described below and in our January 20, 2010 FCPA Alert, illustrated the U.S. government’s continued focus on FCPA enforcement actions against individuals. In the first quarter of 2010, the Department of Justice ("DOJ") issued 16 indictments against 22 individuals, filed a criminal information against another, and entered into plea agreements with four individuals charged over the past two years. The chart below illustrates the growth in FCPA-related individual enforcement actions over the past five years, including the significant spike in individuals charged during the first quarter of this year.

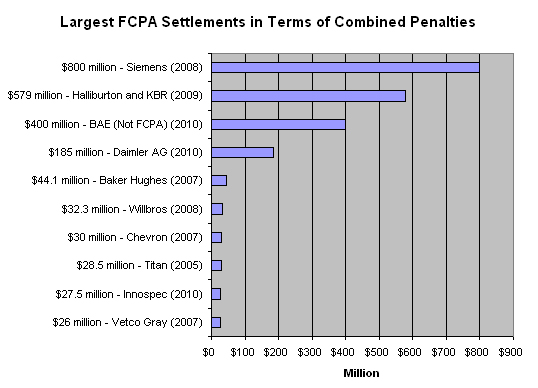

Among the ten FCPA-related enforcement actions involving corporations is the resolution of a non-FCPA but bribery-related disposition against BAE, which constituted the third largest foreign bribery-related case to date in terms of penalties. The United States and United Kingdom imposed a combined penalty on BAE of over $445 million -- most of which ($400 million) was charged by the DOJ. Additionally, the DOJ and the U.S. Securities and Exchange Commission ("SEC") imposed a combined FCPA-related monetary penalty of $185 million on carmaker Daimler AG ("Daimler"), the fourth largest such penalty since the FCPA’s enactment in 1977. With companies such as Technip (245 Million Euros ($326.8 million)), ENI (250 Million Euros ($333.5 million)), Pride ($56.2 million) and Alcatel-Lucent ($137.4 million) announcing or reserving funds for anticipated settlements with the DOJ and the SEC, significant penalties may become the norm, rather than the exception. The chart below details the ten highest FCPA-related combined penalties imposed on corporations since enactment of the FCPA.

Other significant anti-corruption developments in the first quarter of 2010 included:

International Enforcement and Cooperation

As described in greater detail below, several countries lent assistance to U.S. FCPA enforcement actions in the past three months and announced their own anti-corruption initiatives. For example, Hong Kong assisted the DOJ in its FCPA investigation of Nexus Technologies, Inc. ("Nexus") and the United Kingdom participated in joint proceedings with the United States against Innospec, Inc. ("Innospec") and BAE. As described below, in Innospec’s case, the United Kingdom and United States agreed, for the first time, to the appointment of a joint monitor. However, limitations on international enforcement and cooperation still exist. The Bahamian Court of Appeals upheld the decision of a lower court to deny extradition of Victor Kozeny, the alleged mastermind of a scheme to bribe Azeri officials. The Bahamas has not enacted laws criminalizing international bribery, despite its obligations under the Organization for Economic Cooperation and Development ("OECD") Anti-Bribery Convention. Additionally, despite its renewed focus on anti-bribery measures, the United Kingdom was criticized for its final determination in the BAE case, especially for choosing not to pursue potentially culpable individuals. A recent speech by the head of the U.K.’s Serious Fraud Office ("SFO"), Richard Alderman, also raised questions regarding the strength of U.K. enforcement.

Targeting of Foreign Officials

During the past quarter, the DOJ continued to demonstrate its willingness to prosecute foreign officials, bringing charges against both Haitian and Thai officials in separate cases. As described below, the officials were not charged with FCPA violations, but with charges related to money laundering.

U.S. Enforcement Agency Developments

The SEC provided additional guidance on its approach to FCPA enforcement during the past quarter and appointed Cheryl Scarboro, current SEC Associate Director, to head the SEC’s new FCPA unit. As described below, Ms. Scarboro has emphasized that investigators within the unit will focus exclusively on FCPA matters. The SEC also announced a new "analytical framework" that it will use to evaluate an individual’s cooperation in determining penalties. Meanwhile, several internal DOJ movements may presage action on Deputy Fraud Chief Mark Mendelsohn’s announced departure to private practice.

Legislative Developments

As described below, several new U.S. legislative and regulatory initiatives were discussed this quarter, which could have a bearing on FCPA enforcement. The U.S. Sentencing Commission announced proposed reforms to the Federal Sentencing Guidelines, including new incentives for organizations to implement compliance measures to receive a sentence reduction. Additionally, a new U.S. Senate bill was released that would reward whistleblowers who assist the SEC in an investigation. Under the proposal, the SEC would pay an award of not less than ten percent and not more than 30 percent of collected monetary sanctions. This could be a potentially powerful incentive for employees to make FCPA-related reports to the SEC, given the record-breaking fines associated with recent FCPA actions.

Actions Against Corporations

On April 1, 2010, carmaker Daimler AG ("Daimler" or the "company") settled charges with the DOJ and SEC to resolve a long-standing bribery investigation of the company’s international operations, agreeing to payment of fines and disgorgement totaling $185 million, the fourth largest FCPA-related penalty to date.

Under the company’s Deferred Prosecution Agreement ("DPA") with the DOJ, Daimler agreed to charges of two counts, including one count of conspiracy to violate the books and records provisions of the FCPA and one count of violating the FCPA’s books and records provisions. The DOJ assessed a total fine of $93.6 million on Daimler. As part of the agreement, Daimler agreed to retain Louis Freeh, the former head of the Federal Bureau of Investigation ("FBI"), as an independent compliance monitor for a three-year term, and to continue to implement an FCPA compliance program.

Daimler’s wholly-owned subsidiary, DaimlerChrysler China Ltd. ("DCCL"), also agreed to a separate DPA, and two Daimler wholly-owned subsidiaries, DaimlerChrysler Automotive Russia SAO ("DCAR") (now known as "Mercedes-Benz Russia SAO") and Daimler Export and Trade Finance GmbH ("ETF"), pled guilty. The charges related to the three Daimler subsidiaries (DCCL, DCAR, and ETF) each contain two counts, including conspiracy to violate the anti-bribery provisions of the FCPA and violating the anti-bribery provisions of the FCPA. The DOJ determined that the applicable fine against DCCL would be $5.0 million; however, the parties agreed that DCCL would not pay any separate monetary penalty outside of Daimler’s $93.6 million fine. The DOJ assessed a $27.4 million against DCAR, and $29.1 million against ETF, but these amounts were offset against Daimler’s $93.6 million DOJ penalty. Each of the three subsidiaries acknowledged and accepted that they would be monitored by a corporate compliance monitor pursuant to the terms of Daimler’s DPA, and thus will be covered by the scope of Mr. Freeh’s engagement.

The SEC complaint contained three claims against Daimler, a U.S. issuer since 1993, including violating the anti-bribery, books and records, and internal controls provisions of the FCPA. Without admitting or denying the allegations in the SEC’s complaint, Daimler agreed in a Final Judgment to disgorge $91.4 million of ill-gotten gains to the SEC and to retain an independent compliance monitor.

Daimler AG ("Daimler")

The DOJ’s criminal information and the SEC complaint describe a long-running bribery scheme by Daimler. According to the charging documents, the company made hundreds of improper payments, worth tens of millions of dollars, to foreign officials in at least 22 countries, including individuals employed by Daimler’s government customers, to secure contracts for the purchase of Daimler vehicles. In the scope of its definition of "foreign official" in the information, the DOJ included Daimler’s customers at government ministries and state-owned or state-controlled companies, such as Sinopec Corp. ("Sinopec"), a Chinese state-owned energy company, and Dorinvest, a Russian government-owned and controlled purchasing agent for the city of Moscow.

According to the DOJ, payments with a territorial connection to the United States resulted in over $50 million in pre-tax profits for Daimler. The SEC alleged that, through "tainted sales transactions" involving at least 6,300 commercial vehicles and 500 passenger cars, Daimler earned $1.9 billion in revenue and at least $91.4 million in illegal profits.

Countries involved in the scheme included China, Croatia, Egypt, Greece, Hungary, Indonesia, Iraq, Ivory Coast, Latvia, Nigeria, Russia, Serbia and Montenegro, Thailand, Turkey, Turkmenistan, Uzbekistan, Vietnam, and others. According to the Sentencing Memorandum, bribe payments were identified and recorded within Daimler as "commissions," "special discounts," and "nützliche Aufwendungen" or "N.A." payments (i.e., "useful" or "necessary" payments).

The DPA and SEC complaint detail alleged systematic efforts by Daimler to hide bribe payments through the use of corporate ledger accounts known internally as "third party accounts" or "TPAs." At the time of Daimler’s merger with Chrysler Corporation in 1998, Daimler maintained over 200 internal TPAs used to facilitate improper payments and the provision of gifts to foreign officials.

According to the disposition documents, these accounts were maintained as receivable ledger accounts on Daimler’s books and were controlled by third parties outside the company or Daimler’s subsidiaries. Funds were credited to the accounts through price inclusions, discounts, rebates, and other mechanisms. The accounts were improperly recorded in Daimler’s books and records and were not subject to normal auditing or financial controls. Additionally, certain accounts remained "off the books" of certain Daimler affiliates for which Daimler maintained the accounts.

According to the Sentencing Memorandum, Daimler’s policies provided that TPAs were managed internally by the company at the request of TPA account holders, including foreign officials, Daimler’s foreign subsidiaries, outside distributors, dealers, and consultants used as intermediaries to make payments to foreign officials. For example, according to the SEC complaint, Daimler maintained a TPA called "Consulting Egypt" for the benefit of a senior official of a government-owned factory that purchased Daimler parts and assembled and sold personnel carriers to the Egyptian Army. Daimler allegedly paid the official through credits to the TPA to secure the factory’s purchases of vehicle chassis and fire trucks.

Before 2002, Daimler’s TPA policies allowed Daimler employees to make cash disbursements from a corporate "cash desk" located at a facility in Stuttgart, Germany. Employees allegedly would take cash and bring it to foreign countries to bribe officials. For example, Daimler employees allegedly withdrew DM 400,000 (about $27,330) and $150,000 from the cash desk and transported the funds to Nigeria to pay bribes to foreign officials in return for the government purchase of Daimler vehicles.

The DPA describes failed efforts by Daimler’s internal audit division in Germany to rein in the use of TPAs following Germany’s ratification of the OECD Anti-Bribery Convention in 1998 and adoption of implementing legislation in 1999. Daimler allegedly did not eliminate the use of TPAs and impose needed controls to prevent such practices until 2005, following the inception of the SEC and DOJ investigations into the company.

In addition to the direct and indirect payment of bribes to various foreign officials located throughout the globe, Daimler also paid bribes to the Iraqi government under the U.N. Oil for Food ("OFF") program. According to the DPA and SEC complaint, Daimler, or its intermediaries, allegedly agreed to pay a ten percent commission to the Government of Iraq in return for contracts for the sales of its vehicles under the OFF program.

DaimlerChrysler Automotive Russia SAO ("DCAR")

According to the Statement of Offense attached to DCAR’s plea agreement with the DOJ, Daimler and its wholly-owned subsidiary in Russia, DCAR, made over 3 million Euros (about $4.1 million) in improper payments to Russian foreign officials in order to secure business for Daimler. DCAR and Daimler’s Russian customers included the Russian Ministry of Internal Affairs, the Russian military, and the city of Moscow.

Daimler and DCAR allegedly made improper payments directly to Russian foreign officials employed at Daimler’s Russian customers through direct cash payments and by over-invoicing customers and paying the excess amount back to the foreign officials. Daimler and DCAR also allegedly made payments to designated third parties with the understanding that the funds would be passed on to Russian foreign officials.

Daimler Export and Trade Finance GmbH ("ETF")

According to the Statement of Offense attached to ETF’s plea agreement with the DOJ, Daimler’s wholly-owned German-based subsidiary, ETF, allegedly made approximately 4.7 million Euros (about $6.3 million) in improper payments directly to Croatian foreign officials and through third parties to assist in securing the sale of fire trucks to the Croatian government. Some of these improper payments went to employees of IM Metal ("IMM"), a Croatian government-controlled and partially-owned former weapons manufacturer that ETF included, at the request of the Croatian government, as part of the consortium of companies bidding on the fire truck contract. The DOJ considered IMM to be an "instrumentality" of the Croatian government, and executives employed by IMM, or their designees, as "foreign officials" under the FCPA.

DaimlerChrysler China Ltd. ("DCCL")

According to DCCL’s DPA, between 2000 and 2005, employees of DCCL, Daimler’s wholly-owned subsidiary in China, allegedly made at least 4.2 million Euros (about $5.6 million) in improper payments in the form of commissions, travel, and gifts to employees of Chinese "government" customers in connection with over 112.4 million Euros (about $150.2 million) in sales of commercial and all-terrain vehicles. According to the DOJ, these "government" customers included the Bureau of Geophysical Prospecting ("BGP"), Sinopec, and Changqing Petroleum Exploration Bureau (a state-owned oil and natural gas extracting company).

Daimler and DCCL allegedly inflated the sales price of vehicles sold to Chinese customers and then transferred the excess profit to the officials via special bank accounts maintained by Daimler, including one called the "special commissions" account. Additionally, DCCL and Daimler, at the direction of Chinese officials, made improper payments into U.S. bank accounts belonging to third parties to obtain contracts for the sale of vehicles to Chinese customers.

Daimler and DCCL employed agents to assist in securing contracts from the Chinese customers, and did not perform due diligence on these agents or ensure adequate controls over the agents. Additionally, agency agreements were not in writing.

Noteworthy Aspects:

- Whistleblower Complaint: In March 2004, a former Daimler employee filed a whistleblower complaint with the U.S. government, alleging that he was terminated for voicing concerns that Daimler maintained secret accounts to bribe foreign officials. Following receipt of the complaint, the SEC launched an FCPA investigation. Thereafter, the DOJ began its own investigation. The DOJ noted in its sentencing calculation that Daimler received only a partial reduction in its culpability score because the company did not voluntarily disclose its conduct prior to the filing of the whistleblower lawsuit.

- Role of Internal Audit: The DPA and SEC criticized Daimler for its continued use of TPAs despite its awareness of the legal risks associated with this practice. As detailed in the SEC’s complaint, a 1986 internal audit report acknowledged that the TPAs might violate the laws of other countries. As a result, the accounts were maintained with "absolute confidentiality" and only "in the knowledge of few [Daimler] employees." After Germany criminalized transnational bribery in 1999, internal audit notified senior Daimler executives of the risks associated with a lack of internal controls over the accounts. In a May 2000 memo and an August 2000 audit report, Daimler’s internal audit department recommended ending the use of illegitimate TPAs and warned of risks posed by these accounts; however, the company did not improve internal controls over the accounts, or end their practice. Despite these warnings, the Board of Management did not direct internal audit to review the TPAs for compliance, and, according to the disposition documents, internal audit faced pressure from senior overseas sales executives to keep TPAs open. In 2002, Daimler decided to reduce the number of TPAs to 50 accounts and to shut down its central cash desk; however, cash payments allegedly continued to be made through cash desks and bank accounts controlled by Daimler’s subsidiaries.

- Reduced Criminal Fine: The DOJ recognized Daimler’s remedial actions and cooperation by recommending a fine significantly below the minimum recommended penalty set forth in the Federal Sentencing Guidelines. Per the violations committed by Daimler, the fine range was calculated at between $116 million to $232 million; however, Daimler was only fined $93.6 million by the DOJ. In support of the DOJ’s recommended fine (an approximate 20% reduction from the Sentencing Guidelines range) the DOJ noted several mitigating actions taken by Daimler.

- Daimler’s Extensive Internal Investigation: The DOJ was laudatory of Daimler for its "excellent" cooperation in the investigation. The DOJ noted the scope of Daimler’s internal investigation, involving "dozens of countries and every major market in which the company does business." The DOJ also credited Daimler for regularly presenting its findings to the DOJ, making certain witnesses available to the DOJ, and voluntarily complying with requests for document production from overseas.

- Disciplinary Actions: The DOJ noted that Daimler had taken disciplinary actions against culpable employees. Daimler sanctioned over 60 employees, including terminating about 45 employees.

- Anti-Bribery Compliance Program: The DOJ commended Daimler’s implementation of numerous compliance reforms, including the centralization of compliance operations and audit; the inclusion of a compliance component in board-level compensation; the establishment of a whistleblower hotline; the creation of a sales practices hotline to counsel employees in bribery prevention; and the requirement of anti-bribery contract terms and audit rights for company intermediaries. The DOJ praised Daimler for making these reforms while its investigation was ongoing, and regularly reporting on the reforms to the DOJ.

- Daimler’s Extensive Internal Investigation: The DOJ was laudatory of Daimler for its "excellent" cooperation in the investigation. The DOJ noted the scope of Daimler’s internal investigation, involving "dozens of countries and every major market in which the company does business." The DOJ also credited Daimler for regularly presenting its findings to the DOJ, making certain witnesses available to the DOJ, and voluntarily complying with requests for document production from overseas.

- No Anti-Bribery Violations: While Daimler’s foreign subsidiaries agreed to anti-bribery charges, Daimler itself avoided a criminal charge of violating the anti-bribery provisions of the FCPA. Such charges could have prevented the company from bidding on public-sector projects in the United States (pursuant to the Federal Acquisition Regulations) and the European Union. According to the DOJ’s Sentencing Memorandum, the DOJ’s "analysis of collateral consequences included the consideration of the risk of debarment and exclusion from government contracts, and in particular included European Union Directive 2004/18/EC, which provides that companies convicted of corruption offenses shall be mandatorily excluded from government contracts in all EU countries." In addition, the DPA did not allege that Daimler violated the FCPA’s internal controls provisions, despite numerous accounts of the Company’s "inadequate compliance structure." The SEC alleged anti-bribery, books and records, and internal controls violations in its complaint. However, in the SEC Final Judgment, Daimler did not admit or deny the allegations. Therefore, the SEC’s allegations of civil violations do not threaten Daimler’s status as a government contractor.

- DPA Terms: Daimler’s DPA is effective for the relatively unusual period of two years and seven days following the entry of guilty pleas by DCAR and ETF. The DPA can be extended for up to one year due to non-compliance, or terminated early for good behavior if the DOJ finds "that there exists a change in circumstances sufficient to eliminate the need for the corporate compliance monitor . . . and that the other provisions of this Agreement have been satisfied . . . ."

- Court Involvement in Monitorships: According to the news organization Main Justice, in his closing remarks during Daimler’s hearing on April 1, 2010, Judge Richard Leon stated that he would like to be involved in the monitorship, stating, "The court might want to hear periodically from the monitor and the counsel." The prosecution and defense reportedly agreed to Judge Leon’s request. Similarly, as detailed below in the Innospec case, Judge Ellen Segal Huvelle reportedly indicated that she would closely review Innopsec’s monitor selection and the monitor’s work plan. The comments of Judge Leon and Judge Huvelle suggest that courts may be more active in monitor selection and oversight in the future. Proposed amendments to the Sentencing Guidelines, described below, would include monitors as an option for corporate probation, which could also lead to increased court involvement in the use of monitors.

- Potential International Repercussions: According to press reports, Sinopec acknowledged that Daimler paid bribes to one of its employees, and called on the Chinese government to curb bribery by foreign companies. According to the reports, Sinopec stopped doing business with Daimler after Chinese courts convicted the employee in 2006 for crimes related to corruption. As described below in the discussion of the four Rio Tinto executives, the Chinese government appears to have stepped up its anti-corruption efforts, including those against international companies operating in China.

On March 18, 2010, Innospec Inc. ("Innospec"), a U.S. chemical producer, and its U.K. subsidiary, Innospec Ltd., settled enforcement actions brought by U.S. and U.K. authorities relating to improper payments in Iraq and Indonesia, and sales to Cuban customers in violation of U.S. embargo laws. Specifically, to settle the DOJ enforcement action, Innospec pleaded guilty to a 12-count criminal information charging the company with conspiracy to violate the FCPA and substantive FCPA anti-bribery and accounting violations in connection with improper payments in Iraq, and wire fraud in connection with the company’s payment of kickbacks to the former Iraqi government under the OFF Program. In Innospec’s plea agreement with the DOJ, it also admitted violating the U.S. embargo against Cuba by selling chemicals to Cuban power plants. In the SEC’s related case, Innospec consented to the entry of a court order, settling civil charges of FCPA anti-bribery and accounting violations. To settle charges brought by the United Kingdom’s SFO, Innospec Ltd. pleaded guilty in U.K. court to a charge of conspiracy to corrupt in connection with bribery in Indonesia. In reaching the global settlement with the DOJ, SEC, the Office of Foreign Assets Control ("OFAC") of the U.S. Department of the Treasury, and the SFO, Innospec agreed to pay $40.2 million in total monetary penalties and disgorgement, retain an independent compliance monitor, and continue to cooperate in ongoing related investigations.

According to the criminal information, the OFF Program-related charges focus on Iraqi contracts obtained by Innospec’s Swiss subsidiary, Alcor. Specifically, the DOJ claimed that from 2000 to 2003, Alcor obtained five contracts to sell tetraethyl lead ("TEL") to Iraqi refineries by paying or promising to pay kickbacks to the Hussein regime. As in other OFF cases, Alcor inflated the price of the contracts by approximately ten percent to cover the cost of the kickbacks before submitting them to the United Nations ("U.N.") for approval, and falsely characterized the payments on its books as "commissions" paid to Ousama Naaman, its agent in Iraq. The DOJ claimed that Innospec made the commission payments to Naaman "through" Alcor, without specifying Innospec’s level of knowledge of the kickbacks.

The DOJ also claimed that after the fall of the Hussein regime, Innospec paid and promised to pay more than $1.5 million in numerous bribes in the form of cash and travel to officials in the Iraqi Ministry of Oil ("MoO") to secure sales of TEL, and paid $150,000 to MoO officials to ensure that a competing product was not approved for use in Iraq. According to the criminal information, Innospec channeled these bribes through Naaman, and recorded them as "commissions." Unlike in the DOJ’s OFF Program-related allegations, the criminal information specifically claims that Innospec employees were directly involved in the post-U.S. invasion bribery. For example, regarding an order under a long-term purchase agreement with the MoO in 2004, Naaman allegedly emailed an Alcor manager and a division managing director for Innospec stating that a letter of credit for payment on the order would be opened immediately, "provided we share [with Iraqi officials] half the currency fluctuation rate (4.5%) which makes it a minimum of 2% to their favor…We are sharing most of our profits with Iraqi officials."

In another example cited in the disposition documents, Naaman allegedly emailed the Alcor manager and the division managing director for Innospec regarding "pocket money" to be given to Iraqi officials during a trip provided by Innospec to the United Kingdom: "Kindly arrange for 8 envelopes with the name of each delegate [i.e., Iraqi official]. In each envelope, put GBP 1,000/- except for the envelope for [a certain unnamed official], put GBP 2,000/- since he is the delegation head." As reported in our FCPA Autumn Review 2009, Naaman was indicted in August 2008 and arrested in Germany in July 2009 for his alleged participation in the kickback scheme and post-U.S. invasion bribery in Iraq. The United States is currently seeking his extradition from Germany.

The SEC’s complaint primarily covers the conduct described in the DOJ pleadings regarding improper payments in Iraq. However, on several points, the SEC provides additional detail. For example, among the charges of bribes paid as travel and related expenses for Iraqi officials, the SEC claimed that Innospec paid for a honeymoon trip to Jordan and Thailand for a MoO official and his wife, including hotel accommodations, food, and transportation costs.

The SEC complaint also alleged that Innospec paid numerous bribes to Indonesian officials from at least 2000 through 2005 to win contracts for the sale of TEL to state-owned oil and gas companies. Similar to the payments in Iraq, Innospec allegedly made the bribe payments in Indonesia through an agent. Innospec allegedly paid the bribes through several schemes, including annual bribe payments to officials based on TEL sales, the payment of "special commissions" to a Swiss account, and a "one-off" payment. Innospec allegedly recorded bribe payments as "commissions" and "legal fees," among other false descriptions.

The SFO’s Opening Statement (the "SFO’s Statement") in the U.K. case provides a detailed account of Innospec Ltd.’s alleged bribery in Indonesia. Quoting at length from emails between Innospec Ltd. and its Indonesian agent (which the SFO’s Statement identifies as PT Soegih Interjaya, headed by Willy Sebastian), the SFO alleged that Innospec Ltd. paid bribes through regular commission payments to the agent, as well as through various "ad hoc funds." Innospec allegedly referred to the ad hoc funds as the "Lead Defense" fund, "compensation fund," "exceptional promotional work," "special bonus," and "cranes," among other designations. As described in the SFO’s Statement, these ad hoc funds were used not only to secure particular sales, but also to increase good will among Indonesian officials.

Unrelated to the various charges of improper payments in Iraq and Indonesia, Innospec also admitted in its plea agreement with the DOJ that between 2001 and 2004, it had sold chemicals to two state-owned Cuban power plants in violation of the U.S. embargo of Cuba. The plea agreement states that a Cuban agent of Innospec concealed the transactions by using several Mexican Innospec subsidiaries. Innospec also admitted financing the travel of Cuban nationals on seven occasions. Innospec settled these charges in a separate agreement with OFAC.

To settle the various charges with U.S. and U.K authorities, Innospec agreed to a $14.1 million criminal fine to the DOJ, $11.2 million in disgorgement to the SEC, $12.7 million criminal penalty to U.K. authorities, and $2.2 million to resolve the embargo violations with OFAC. In addition, under the DOJ, SEC, and SFO agreements, the company must retain an independent compliance monitor for a period of three years.

Noteworthy Aspects:

- Partial Waiver of Criminal Fine and Disgorgement: The DOJ plea agreement notes that under the Federal Sentencing Guidelines, the minimum criminal fine for Innospec’s offenses would be $101.5 million. The plea agreement states that the DOJ and Innospec agreed that the company would be unable to pay such a fine without threatening the ongoing viability of the company, and that Innospec represents that its total ability to pay all enforcement agencies is $40.2 million. Similarly, the SEC noted that it would waive all but $11.2 million of a court order to pay over $60 million in disgorgement. The SFO press release provides some insight into the process by which the various enforcement agencies and the company arrived at the ultimate monetary penalties, stating that the SFO’s investigation into Innospec’s ability to pay involved SFO investigators working with SEC staff in coming to a "fair and true assessment of the Company’s means to pay financial penalties." It is also noteworthy that under the DOJ plea agreement, a portion of Innospec’s criminal fine (up to $6.4 million) is to be paid on a contingent basis, tied to Innospec’s continuing sales of chemicals to the Republic of Iraq.

- Significant Legal Fees: The SFO’s Statement sheds light on Innospec’s legal costs in conducting its internal investigation into misconduct in Iraq, Indonesia and Cuba. Specifically, it states that the company incurred legal costs of over $32 million, approximately one-third of which was attributable to the U.K. investigation.

- Criminal Accounting Charges: Usually, the SEC, rather than the DOJ, deals with FCPA accounting violations through civil enforcement actions. This stems from the higher statutory requirements under the FCPA to bring criminal accounting charges. Specifically, Section 78m(b)(4)-(5) provides that no criminal accounting liability shall be imposed unless the defendant "knowingly" circumvents or fails to implement internal accounting controls or "knowingly" falsifies records. Civil accounting violations, on the other hand, do not require any particular state of mind. Here, while the DOJ does not specifically allege that Innospec acted "knowingly" when it incorporated Alcor’s falsified records into its SEC filings, it nevertheless brought criminal accounting charges against the company.

- Further Evidence of the U.K.’s Adoption of U.S. Enforcement Tools: In the SFO’s Statement, it notes that it "sought to follow the model for corporate regulation adopted by the DOJ in the United States under the FCPA [which] recognizes that corporate remediation is an important factor in considering the propriety and proportionality of lengthy investigations into companies that are willing to come forward, engage co-operatively with the Prosecuting authorities and admit their guilt." Additionally, Lord Justice Thomas’s sentencing judgment in the U.K. case (discussed further below) indicates significant levels of coordination between U.S. and U.K. authorities in reaching the settlement agreements and the SFO’s use of U.S.-style plea bargaining.

- First U.S. - U.K. Joint Monitor: As pointed out in the SFO’s press release, "In a first for both the SFO and DOJ, these prosecuting authorities have agreed to the appointment of a joint monitor, to be acceptable in both the U.K. and U.S." The DOJ plea agreement provides that while the DOJ "retains the right, in its sole discretion, to accept or reject any Monitor candidate . . . the [DOJ] will consult with the [SFO] throughout the process to ensure the Monitor selected is also acceptable to [the SFO]. This process shall continue until a Monitor acceptable to [the DOJ, the SFO, and Innospec] is chosen." The plea agreement does not contain any requirements related to the nationality of the Monitor, as have been included in other recent DOJ plea agreements, such as those of Siemens and Alcatel-Lucent (described below). According to press accounts, U.S. District Court Judge Ellen Segal Huvelle, who presided over Innospec’s case in the U.S. District Court for the District of Columbia, issued a critique of compliance monitor requirements during the plea hearing. Specifically, she reportedly expressed strong discomfort with the lack of transparency in the process of monitor selection, the difficulties of monitor oversight by the court, and potential windfalls for compliance monitors. She also reportedly indicated that she would closely review the monitor selection and the monitor’s work plan in this case. The U.K. court, on the other hand, indicated in its sentencing judgment that it would approve the terms of any "monitoring which embodies what may be agreed in the US," and considered whether the "US should take the lead" role in overseeing monitoring and "liaising as necessary" with U.K. authorities.

- Possible Future Individual Enforcement Actions: Given the extensive evidence of bribery from email discussions between the company and its agents, and the indictment and arrest of Alcor’s Iraqi agent, Naaman, U.S. and U.K. enforcement agencies may in the future bring charges against other individuals involved in Innospec’s bribery in Iraq and Indonesia. Indeed, the DOJ press release states that Innospec agreed to fully cooperate with the DOJ and foreign authorities in "ongoing investigations of corrupt payments by Innospec employees and agents." Furthermore, the DOJ’s prior assertion of jurisdiction over Naaman as an agent of a U.S. "issuer" (despite his being a foreign national who acted entirely outside of the United States) suggests that the DOJ would likely assert jurisdiction not only over any employees of Innospec or its foreign subsidiaries, but also over agents of such companies.

- Regina v. Innospec Ltd.: On March 28, 2010, Lord Justice Thomas of the Crown Court at Southwark in the United Kingdom issued a sentencing judgment with respect to the Innospec plea. In his decision, Lord Justice Thomas indicated that he would approve the plea, financial penalties, and the compliance and monitoring terms agreed to by Innospec and the SFO. However, he indicated that he would do so for reasons particular to this case, and that this case "should be no precedent for the future." After summarizing the facts, investigation and plea agreements, his decision noted that the proposed disposition raised questions regarding the extent of a U.K. prosecutor’s "powers and duties in light of the constitutional position of a prosecutor, the role of the courts in the UK and the rules relating to plea agreements in the UK." The court emphasized that "the imposition of a sentence is a matter for the judiciary," that the court considered the agreed U.K. fine of $12.7 million to be "wholly inadequate" in reflecting "the criminality displayed," and that "the Director of the SFO had no power to enter into the arrangements made and that no such arrangements should be made again," noting that "it is for the court to decide on the sentence and to explain that to the public." The decision raises obvious questions about the plea bargaining approach taken by the SFO and potential problem areas for future coordination between U.S. and U.K. enforcement authorities, although the decision can perhaps be read as holding that such proposed dispositions are subject to approval, rejection, or modification by U.K. courts.

On March 16, 2010, the DOJ announced that privately-owned Nexus Technologies, Inc. ("Nexus"), a Philadelphia-based export company, had pleaded guilty to violations of the FCPA, conspiracy, violations of the Travel Act, and money laundering. Nexus agreed to cease operations as a condition of the guilty plea.

According to the superseding indictment, the plea was in connection with a conspiracy to bribe individuals employed at various entities related to the Vietnamese government, including Southern Services Flight Company, an airline owned and operated by the Vietnam People’s Army based at Vung Tau Airport; Southern Flight Management Center, which engaged in activities related to the Vietnamese government’s management of civil aviation at Vung Tau Airport; Vietsovpetrol Joint Venture, a joint venture wholly-owned and controlled by the Vietnamese and Russian governments; PetroVietnam Gas Company, a subdivision of PetroVietnam; and T&T Co. Ltd., which was engaged in activities related to border security and was the procurement arm of Vietnam’s Ministry of Public Security. The DOJ alleged that employees of these entities were "foreign officials" under the FCPA.

According to the DOJ press release, Nexus was a privately-owned export company that identified U.S. vendors for contracts opened for bid by the Vietnamese government and other companies operating in Vietnam. The contracts allowed for the purchase of a wide variety of equipment and technology, including underwater mapping equipment, bomb containment equipment, helicopter parts, chemical detectors, satellite communication parts and air tracking systems.

The president and owner of the company, Nam Nguyen, and his siblings and fellow Nexus employees, Kim Nguyen and An Nguyen, all U.S. citizens, also pleaded guilty on March 16, 2010, in connection with the conspiracy. Aside from the indictments, all documents are under seal in the case; however, the DOJ did issue a summary press release.

According to the DOJ press release, Nexus and the Nguyens admitted that from 1999 to 2008 they knowingly paid bribes in excess of $250,000 to individuals employed at the Vietnamese entities, described above, in exchange for contracts. The bribes were falsely described as "commissions" in company records.

Nexus pleaded guilty to one count of conspiracy, nine counts of violating the FCPA, nine counts of violating the Travel Act in connection with violations of bribery under Pennsylvania state law, and nine counts of money laundering. Nam and An Nguyen each pleaded guilty to conspiracy, a substantive FCPA violation, a violation of the Travel Act and money laundering. Kim Nguyen pleaded guilty to conspiracy, a substantive FCPA violation and money laundering.

Sentencing is scheduled for July 13, 2010. According to the DOJ press release, Nexus faces a maximum fine of $27 million. Nam and An Nguyen each face a maximum sentence of 35 years in prison, and Kim Nguyen faces a maximum sentence of 30 years in prison. As reported in our FCPA Autumn Review 2009, on June 29, 2009, former Nexus partner Joseph T. Lukas, pleaded guilty to conspiracy and to violating the FCPA. Lukas faces a maximum sentence of ten years in prison and is also scheduled for sentencing on July 13, 2010.

Noteworthy Aspects:

- International Cooperation: Similar to other recent FCPA investigations, the DOJ collaborated with foreign enforcement agencies, receiving assistance from the Independent Commission Against Corruption of the Hong Kong Special Administrative Region.

- Travel Act and Foreign Officials: As noted, the FCPA charges related to payments to employees of entities owned or controlled by the Vietnamese government. While the initial indictment against Nexus, the Nguyens and Lukas only contained FCPA charges, the later superseding indictment against only Nexus and the Nguyens also included the non-FCPA charge of violation of the Travel Act, which permits the federal government to bring charges when interstate or foreign commerce is used in violation of a law. In this case, Pennsylvania state commercial bribery laws served as the predicate action for the DOJ’s application of the Travel Act. Press reports suggest that prior to pleading guilty, Nexus was mounting a challenge to the DOJ’s application of the FCPA’s "foreign official" definition to the recipients of the alleged bribes. The DOJ’s inclusion of Travel Act charges might have been intended to supplement the FCPA charges in case the court favorably viewed Nexus’ challenge.

On February 5, 2010, BAE Systems plc ("BAE") resolved protracted, controversial bribery investigations by U.K. and U.S. authorities by agreeing to pay combined penalties totaling over $445 million. As analyzed in depth in our February 11, 2010 International Alert, the case concerned BAE’s activities in Tanzania, the Czech Republic, Hungary, and Saudi Arabia, and raised a host of significant legal and policy questions that are only partly explained in the public documents.

In the wake of the settlements, the U.S. State Department imposed a freeze on export licenses for products made by, or products with components made by, BAE and its U.S. subsidiary, despite prominent language in the DOJ plea agreement stating that the subsidiary was not involved in any of the misconduct cited. On March 9, 2010, the State Department modified the freeze by allowing new licenses for two types of BAE products: (1) those that support U.S. and allied war efforts in Iraq and Afghanistan, and (2) those that are related to existing programs for allied countries. Nevertheless, the freeze on BAE-related export licenses illustrates the potential collateral consequences a company may suffer as a result of an anti-bribery investigation, even if the ultimate DOJ plea agreement does not contain substantive FCPA violations; other U.S. agencies are not precluded from taking action even in the aftermath of a DOJ settlement. For example, the Titan Corporation, following its 2005 settlements of FCPA charges with the DOJ and SEC, entered into a separate administrative settlement agreement with the U.S. Department of the Navy to avoid suspension and debarment from defense contracts.

On January 12, 2010, the SEC announced that it had settled charges with NATCO Group Inc. ("NATCO"), for violations of the FCPA’s accounting provisions. The charges related to activities by NATCO’s wholly-owned subsidiary, TEST Automation & Controls, Inc. ("TEST"), in the United States and Kazakhstan. Without admitting or denying the charges that it violated the FCPA, NATCO agreed to pay a civil fine of $65,000.

NATCO and TEST, both based in the United States, sell a variety of oil and gas production equipment and support services. The companies were acquired in November 2009 by Cameron International Corporation ("Cameron"), an oil and gas products and services provider. During the relevant period, TEST operated a branch office in Kazakhstan.

Payment of "Cash Fines" for Failure to Obtain Work Visas

In June 2005, TEST Kazakhstan won a contract to provide instrumentation and electrical services in Kazakhstan. According to the SEC’s complaint (the "complaint"), TEST Kazakhstan staffed the project with both local Kazakh and expatriate workers. In February and September 2007, Kazakh immigration authorities audited TEST Kazakhstan’s facilities to ensure compliance with relevant immigration laws and regulations. Following both audits, the authorities determined that TEST Kazakhstan’s expatriate employees were operating without the necessary immigration documentation and threatened to "fine, jail or deport the workers" if TEST Kazakhstan did not pay "cash fines." Believing the "threats to be genuine," TEST Kazakhstan’s employees sought guidance from TEST’s senior management in Louisiana. TEST’s senior management responded by authorizing the payments.

According to the complaint, TEST structured the "fine" payments as follows. TEST Kazakhstan employees used personal funds to make two payments to Kazakh authorities: an initial payment of $25,000 for the February violation, followed by a $20,000 payment for the September violation. TEST reimbursed the employees for the first payment via wire transfer, improperly describing the reimbursement in an e-mail as an "advance against [the paying employee’s] bonus." The e-mail further described the bonus as "substantial" in order to render the transaction less suspicious. TEST informed its U.S. bank that the payment was a "Payroll Advance" and "inaccurately recorded the payment in its books and records as a salary advance." TEST then transferred an additional $20,000, which it described in its books and records as "visa fines."

The SEC determined that the payments were mischaracterized in NATCO’s books and records, and that NATCO’s internal controls failed to ensure that TEST recorded the true purpose of the "fine" payments. Based on these conclusions, the SEC charged NATCO with violating the books and records and internal controls provisions of the FCPA.

Cash Payments to Outside Consultants

The complaint also alleges that TEST Kazakhstan made improper payments to outside consultants who assisted the company in obtaining necessary immigration documentation. According to the complaint, one of these consultants was hired, notwithstanding the fact that it did not have a license to perform visa services, because it had close ties to the Kazakh Ministry of Labor. The consultant allegedly requested nearly $80,000 in cash from TEST Kazakhstan "to help him obtain the visas." To support these requests, the consultant allegedly drafted "bogus" invoices. The invoices were apparently necessary to satisfy a Kazakh law that requires companies to submit invoices prior to withdrawing cash from a bank.

The complaint states that TEST Kazakhstan "knew" these invoices were false, but nonetheless submitted them to Kazakh banks and later to TEST in the United States. The complaint further alleges that TEST reimbursed TEST Kazakhstan for the payments despite "knowing" that the invoices "mischaracterized the true purpose of the services rendered."

The SEC determined that the $80,000 payment was mischaracterized in NATCO’s books and records, and that NATCO’s internal accounting controls failed to ensure that TEST recorded the true purpose of the payment.

Noteworthy Aspects of the NATCO Settlement:

- Risk Factors Identified in the Complaint: The complaint serves as a reminder of common FCPA risk factors that have appeared in past FCPA actions, such as transacting business with third-party consultants and foreign immigration officials, and the use of cash to make payments.

- Third-Party Consultants: As with most FCPA enforcement actions over the past year, liability for NATCO was in part premised on its use of a third party to interact with government officials on behalf of the company. The SEC identified several red flags associated with the retention of NATCO’s consultant, including the fact that the consultant was hired because of its close ties to the Kazakh Ministry of Labor, notwithstanding the fact that it did not have a license to perform visa services, and the fact that the consultant requested payments in cash supported by bogus invoices.

- Immigration Risks: Similar to the warnings raised by the Panalpina investigations regarding customs transactions, this and other recent matters highlight the potential FCPA risks inherent in immigration-related transactions, especially those using third party providers. For example, the Halliburton Company announced in its July 2008 10-Q filing that it had been subpoenaed over its consortium’s use of an immigration services provider, "apparently managed by a Nigerian immigration official, to which approximately $1.8 million in payments in excess of costs of visas were allegedly made." Similarly, DynCorp International announced in its November 2009 10-Q filing that it had "identified certain payments made to expedite the issuance of a limited number of visas and licenses from foreign government agencies that may raise compliance issues under the" FCPA. Additionally, Pride International anticipates a settlement with the DOJ and SEC over possible FCPA violations, including alleged illegal payments for assistance on immigration matters.

- Cash Payments: According to the complaint, the Kazakh Immigration prosecutor levied "fines" against TEST Kazakhstan based on two un-announced audits. During both audits, the prosecutor discovered that certain TEST Kazakhstan employees were working in Kazakhstan without valid immigration documents. Based on these facts alone, the fines would seem an appropriate use of the prosecutor’s authority. The fact that the payments were requested in cash and were given to a government official, not a government entity, however, should have raised significant compliance red flags within the company.

- Third-Party Consultants: As with most FCPA enforcement actions over the past year, liability for NATCO was in part premised on its use of a third party to interact with government officials on behalf of the company. The SEC identified several red flags associated with the retention of NATCO’s consultant, including the fact that the consultant was hired because of its close ties to the Kazakh Ministry of Labor, notwithstanding the fact that it did not have a license to perform visa services, and the fact that the consultant requested payments in cash supported by bogus invoices.

- Charges Limited to Accounting Provisions: The SEC limited its charges against NATCO to the FCPA’s accounting provisions despite allegations of payments to Kazakh officials.

- When discussing TEST Kazakhstan’s payments to the Kazakh immigration prosecutor, the complaint refers to the payments as "extorted." The complaint also notes that the Kazakh officials threatened to fine, jail or deport the employees if they did not pay the cash fines. However, the SEC also suggests that TEST Kazakhstan violated Kazakh immigration law by failing to obtain the necessary paperwork, suggesting that the fines may have been warranted. The pleadings do not make clear whether the "extortion" involved created a situation in which the SEC viewed the available evidence surrounding the "fine" payments as insufficient to satisfy the corrupt intent and quid pro quo elements of the FCPA’s anti-bribery provision. It is also possible that evidence for other anti-bribery provision elements was not present, or that the result was part of a negotiated outcome.

- Also of note is the SEC’s statement, when discussing the company’s payments to the outside consultant, that "it is not known how the consultant used these funds or to whom they were paid." This signals that the available evidence was insufficient to determine definitively whether the payments were used by the consultant to pay officials. Again, a lack of evidence may explain the SEC’s decision not to include an anti-bribery charge.

- When discussing TEST Kazakhstan’s payments to the Kazakh immigration prosecutor, the complaint refers to the payments as "extorted." The complaint also notes that the Kazakh officials threatened to fine, jail or deport the employees if they did not pay the cash fines. However, the SEC also suggests that TEST Kazakhstan violated Kazakh immigration law by failing to obtain the necessary paperwork, suggesting that the fines may have been warranted. The pleadings do not make clear whether the "extortion" involved created a situation in which the SEC viewed the available evidence surrounding the "fine" payments as insufficient to satisfy the corrupt intent and quid pro quo elements of the FCPA’s anti-bribery provision. It is also possible that evidence for other anti-bribery provision elements was not present, or that the result was part of a negotiated outcome.

- Local Law: The NATCO settlement also serves as a reminder to corporations doing business abroad to familiarize themselves with local law prior to engaging in business ventures. TEST Kazakhstan potentially could have avoided requests for improper payments by the Kazakh immigration authorities had it obtained the necessary immigration paperwork prior to commencing its project.

Actions Against Individuals

Two More Individuals Plead Guilty in Miami Telecommunications Case

On March 12, 2010, and February 19, 2010, two more individuals, including a former Haitian government official, pleaded guilty in connection with their roles in a conspiracy to pay and conceal more than $1 million in bribes to former Haitian government officials. The first individual, Jean Fourcand, was the president and director of Fourcand Enterprises, Inc., a Miami-based company. The second individual, Robert Antoine, was the Director of International Relations for Telecommunications D’Haiti ("Haiti Teleco"), Haiti’s state-owned national telecommunications company. For further information on the case, see our FCPA Winter Review 2010 and our FCPA Spring Review 2009. Fourcand pled guilty to one-count of engaging in monetary transactions in property derived from specified unlawful activity. Antoine pled guilty to one count of conspiracy to commit money laundering.

According to Fourcand’s information, Fourcand received funds from U.S. international telecommunications companies that he funneled to Antoine in exchange for business advantages for the U.S. companies, conferred in the form of preferred telecommunication rates, reduced rates per minute, and credits toward debts owed Haiti Teleco. According to his plea agreement, Antoine admitted to receiving $800,000 in bribes from one unnamed U.S. telecommunications company and to laundering the bribes through intermediary companies such as J.D. Locator Services to disguise their origin.

At sentencing, Fourcand faces a maximum of ten years imprisonment and a fine of the greater of $250,000 or twice the value of the property involved in the transaction. Fourcand also agreed to forfeit $18,500 as part of his guilty plea. Fourcand’s sentencing is scheduled for May 3, 2010. Antoine faces a maximum penalty of 20 years in prison and a fine of the greater of $250,000 or twice the value of the property involved in the transaction. Antoine also agreed to forfeit $1,580,771. Antoine’s sentencing is scheduled for May 27, 2010.

In addition to Fourcand and Antoine, five other individuals have been implicated in the Haiti Teleco scheme, including one additional former Haitian government official. Juan Diaz, the president of an intermediary company, J.D. Locator, pleaded guilty on May 15, 2009, to conspiracy to commit violations of the FCPA and money laundering. A second former director of Haiti Teleco, Jean Rene Duperval, was charged with conspiracy to commit money laundering and twelve counts of money laundering. The remaining three individuals, Joel Esquenazi, Carlos Rodriguez, and Marguerite Grandison (who is Duperval’s sister), were charged with conspiracy to violate the FCPA and to commit wire fraud, in addition to numerous counts of violating the FCPA and money laundering.

As discussed in our FCPA Winter Review 2010, the DOJ’s targeting of the former Haitian official is particularly significant as an indication that the DOJ is willing to prosecute foreign officials for corrupt activity under a different legal theory than the FCPA, which had previously been held not to cover foreign officials directly.

The Haiti Teleco case is another example of the increase in international cooperation in FCPA investigations. The Haitian government played a part in the prosecution of Fourcand and Antoine, providing assistance in gathering evidence during the investigation.

As a postscript to his December 15, 2009 indictment (see our FCPA Winter Review 2010), on February 10, 2010, John W. Warwick pleaded guilty to conspiracy to violate the FCPA in connection with improper payments made to officials in the National Maritime Ports Authority ("APN") of the Republic of Panama ("Panama"). Mr. Warwick also agreed to forfeit the $331,000 in proceeds received from contracts with APN. Mr. Warwick was President of Ports Engineering Consultants Corporation ("PECC"), a company organized in Panama with an office in Richmond, Virginia, and President of Overman de Panama, a Panamanian subsidiary that held a management interest in PECC. Mr. Warwick’s guilty plea follows closely on the heels of the November 13, 2009 guilty plea of his co-conspirator Charles Paul Edward Jumet, the former Vice President and, later, President of PECC. (See our FCPA Winter Review 2010).

According to details contained in the Statement of Facts, Mr. Warwick, Mr. Jumet and other unnamed persons conspired to make unlawful payments of over $200,000 to APN officials and to shell corporations owned by the officials or associated with their relatives. As described in the Statement of Facts, the alleged bribes were paid between December 1997 and July 2003 as part of a scheme to obtain maritime contracts corruptly from the Panamanian government. Also involved in the scheme were two related companies, Overman Associates, an engineering firm based in Virginia Beach, Virginia, and Overman de Panama.

According to the indictment and the Statement of Facts, the conspiracy involved creating companies organized under the laws of Panama to corruptly receive contracts from APN and designating other companies owned by APN officials or their relatives as shareholders of PECC to funnel "dividends" to the officials. The scheme also allegedly planned for Overman de Panama to sue PECC in the Circuit Court for the City of Virginia Beach to obtain payments from the Panamanian government for money owed under the contracts. As a result of bribes made to APN officials through dividend payments and stock certificates, PECC obtained no-bid 20-year contracts to maintain lighthouses and buoys along Panama’s waterways outside the Panama Canal, collect lighthouse and buoy tariffs, and conduct engineering studies.

Mr. Warwick is scheduled to be sentenced on May 14, 2010. According to the plea agreement, Mr. Warwick faces a maximum sentence of five years’ imprisonment and a fine of $250,000 or twice the pecuniary gain or loss. According to a recent DOJ press release, the sentencing of co-conspirator Mr. Jumet has been rescheduled from February 12, 2010 to April 19, 2010.

On January 19, 2010, the DOJ announced the arrest and indictment of 22 executives and employees of the defense and law enforcement products industry for violations of the FCPA and related conspiracy and money laundering statutes. Law enforcement officials arrested 21 of the defendants on January 18, 2010, in Las Vegas, where they were scheduled to attend the SHOT Show, an annual industry trade show for the shooting, hunting and firearms industry. Law enforcement officials simultaneously arrested the remaining defendant in Miami. For further information on the arrests see our January 20, 2010 FCPA Alert: FCPA Sting Operation Nets 22 Individuals.

According to the indictments (16 in all), the individuals, representing a collective 19 companies, engaged in a scheme to bribe the minister of defense of an unnamed African country -- reportedly Gabon -- in connection with a portion of a $15 million contract to outfit the country’s presidential guard. The scheme actually was part of an undercover operation conducted by the FBI, with undercover FBI agents posing as intermediaries for the fictitious defense minister.

On January 23, 2010, just days after the SHOT Show raid, the DOJ filed a criminal information against Richard Bistrong, the former Vice President of International Sales for military equipment manufacturer Armor Holdings, Inc. ("Armor Holdings"). While the criminal information did not explicitly identify Bistrong as the lynchpin of the Shot Show sting operation, press reports quickly identified Mr. Bistrong as "individual 1" from the indictments, who allegedly introduced each of the defendants to an undercover FBI agent posing as a sales agent for the African defense minister. Bistrong himself, however, is not charged in connection with these SHOT Show indictments.

Bistrong’s criminal information alleges that, between 2001 and 2006, he and several co-conspirators concealed roughly $4.4 million in payments to various third party intermediaries to secure contracts to supply military and law enforcement equipment to U.N. peacekeeping forces and to government entities in Nigeria and the Netherlands. The information also accuses Bistrong and a co-conspirator of causing vests and helmets to be shipped to the U.A.E. for reexport to the Kurdistan Regional Government in Northern Iraq without a proper license. In connection with these activities, the information charges Bistrong with conspiring to violate the anti-bribery and books and records provisions of the FCPA, as well as some U.S. export license regulations. After Bistrong was caught, it appears he decided to cooperate with the authorities, using his extensive connections within the defense and law enforcement products industry to help set up the sting operation that led to the SHOT Show arrests.

At a February 3, 2010 arraignment hearing, prosecutors asserted that the 22 SHOT Show-related defendants were all part of one large conspiracy, but for practical reasons had been indicted separately. According to a report by the news organization Main Justice, Judge Richard Leon was skeptical of this claim because the initial indictments failed to establish any such broad conspiracy among the defendants. Judge Leon pressed prosecutors to provide the basis for the conspiracy, which they claimed would become evident through the course of discovery. Leon also pushed for prosecutors to identify the name of the cooperating witness. As noted earlier, although Bistrong had been identified in media reports, he had not been named in the original indictments. Prosecutors promised they would soon begin turning over large amounts of evidence collected during the investigation to the defense attorneys. During the course of this arraignment and one held later in the day, 19 of the SHOT Show defendants entered pleas of not guilty.

In subsequent February 2010 status hearings, Judge Leon ordered prosecutors to divulge all evidence concerning the cooperating witness by March 10, 2010. Judge Leon also informed prosecutors, according to a report by Main Justice, that he was "simply unwilling" to try the 22 defendants in one trial and told them to decide by March 22, 2010, if they were going to try to consolidate the case into one conspiracy.

In the weeks that followed, prosecutors reportedly transferred a considerable amount of evidence to the defense attorneys, including hard drive copies of several thousand phone call recordings, numerous CDs with audio recordings of all meetings with undercover agents, and a CD with relevant emails and invoices. Prosecutors also released a superseding criminal information on March 5, 2010, against one of the initial 22 SHOT Show-related defendants, Daniel Alvirez, which laid a stronger foundation for the broad conspiracy claim and formally identified Bistrong as the cooperating witness. With this, prosecutors claimed they had complied with Judge Leon’s February production orders.

After the filing of the superseding criminal information against Alvirez, the former president of the law enforcement and equipment company ALS Technologies, Inc., Alvirez’s attorney indicated that Alvirez intends to plead guilty and will cooperate with authorities, assisting government prosecutors in their cases against the other defendants. The new indictment introduces previously undisclosed allegations and, as noted, adds details to some existing claims that bolster the government assertion that all of the defendants were part of a broader conspiracy. Specifically, the indictment alleges that Alvirez and defendant Lee Allen Tolleson worked with the government’s cooperating witness, Richard Bistrong, to identify individuals and companies to approach regarding participation in the deal with the African minister of defense. The indictment also asserts that Alvirez conspired with other defendants to make improper payments to help facilitate the sale of ammunition and MREs to the Government of Georgia.

On April 1, 2010, Prosecutors filed a notice in the case that detailed the discovery produced to date and the discovery the government expects to continue to receive and produce as it becomes available. Of note, the notice lists documents regarding the defendant’s participation in the publicized SHOT Show sting as well as historic deals, which, according to Main Justice, indicates that prosecutors have evidence of other potential violations beyond what has been charged to date.

On January 28, 2010, Jim Bob Brown and Jason Steph were sentenced for their roles in a conspiracy to bribe Nigerian government officials to obtain and retain pipeline construction business for Willbros International ("WII"), a subsidiary of the Houston-based oil, gas, and power company Willbros Group, Inc. The two former WII executives pleaded guilty to the conspiracy in 2006 and 2007. Under the FCPA, Mr. Brown and Mr. Steph faced maximum sentences of five years in prison and a $250,000 fine. However, the sentencing judge recognized their assistance in the DOJ’s investigation of Willbros’ and WII’s bribery schemes in Nigeria, Ecuador, and Bolivia and issued much lighter sentences. Mr. Brown received a sentence of 12 months and one day in prison, two years of supervised release, and a fine of $1,000 per month during the supervised release period. Mr. Steph received a sentence of 15 months in prison, two years of supervised release, and a $2,000 fine.

As reported in our FCPA Spring Review 2008, Willbros and WII settled FCPA charges with the DOJ and SEC on May 14, 2008, agreeing to pay a $22 million criminal penalty in connection with corrupt payments to Nigerian and Ecuadorian government officials for construction projects. Both the SEC and the DOJ acknowledged cooperation on behalf of Willbros, which voluntarily disclosed the violations after discovering the payments in the course of an internal audit and conducted an internal investigation. In addition to Brown and Steph, five other individuals have been charged in connection with the schemes. On May 14, 2008, former employees Gerald Jansen, Lloyd Biggers, and Carlos Galvez settled SEC charges. On November 12, 2009, Paul G. Novak, a former consultant for WII, pleaded guilty to two FCPA-related counts, specifically conspiracy to violate the FCPA and violating the FCPA’s anti-bribery provisions, in connection with the Nigerian bribery scheme. (See our FCPA Winter Review 2010). Mr. Novak is currently scheduled to be sentenced on July 9, 2010, and faces up to ten years of imprisonment. Finally, on December 19, 2008, an indictment was unsealed against former Willbros executive Kenneth Tillery, charging him with conspiring to make more than $6.3 million in bribe payments to Nigerian and Ecuadoran officials; two individual counts of violating the FCPA in connection with the authorization of specific corrupt payments to officials in those countries; and one count of conspiring to launder the bribe payments through purported consulting companies. (See our FCPA Winter Review 2010). Mr. Tillery remains a fugitive at large. (See our FCPA Autumn Review 2007, FCPA Winter Review 2008, and FCPA Spring Review 2008).

Prosecution of Thai Government Officials

On January 19, 2010, the U.S. District Court for the Central District of California unsealed an indictment against Juthamas Siriwan, the former governor of the Tourism Authority of Thailand, and her daughter, Jittisopa Siriwan, an employee of the Thailand Privileges Card Co., Ltd., a wholly-owned subsidiary of the Tourism Authority of Thailand. The indictment charges the Siriwans with one count of conspiracy, seven counts of money laundering, and one count of aiding and abetting.

The charges relate to the prosecution of California film producers, Gerald and Patricia Green, who were convicted of numerous counts of conspiracy, violating the FCPA and money laundering in mid-September 2009. The jury found the Greens guilty, among other things, of violating the FCPA by bribing Siriwan to secure access to the Bangkok International Film Festival. The Greens’ sentencing was delayed until April 29, 2010. (For more information on the Greens see our FCPA Autumn Review 2009 and FCPA Winter Review 2010.)

Juthamas Siriwan allegedly accepted roughly $1.8 million in illicit payments over a five year period from the Greens. Jittisopa Siriwan allegedly conspired in this scheme and assisted her mother in processing the bribes, which were often cloaked as sales commissions.

The prosecution of the Siriwans, along with the bribery-related prosecutions of former Haitian officials Robert Antoine and Jean Rene Duperval (see above), represents an aggressive new FCPA enforcement posture by the DOJ that seeks to crack down not only on those who pay foreign bribes, but the foreign officials who take them as well. The Siriwans are not charged with a violation of the FCPA here, as the law does not target the recipients of bribery. The DOJ instead has asserted jurisdiction over the Siriwans, who are both Thai citizens, by claiming that they violated U.S. money laundering laws by "combin[ing], conspir[ing] and agree[ing]" to "transport, transmit and transfer" monetary instruments from the United States to various locations abroad, including banks in Singapore and the United Kingdom as well as some cash payments that Juthamas is accused of personally retrieving during visits to the United States. Juthamas and Jittisopa each face up to 20 years in prison if they are convicted on the counts against them.

Reports of Upcoming Settlements

Bonny Island, Nigeria Corruption Scheme Prosecutions

Potential Halliburton/KBR-related U.S. and U.K. Settlements

In Halliburton Company’s ("Halliburton") February 17, 2010 annual report, it announced that a joint venture of its former subsidiary, KBR, Inc., was expecting to enter into a plea negotiation process in the United Kingdom to settle an ongoing SFO investigation into corruption involved in the construction and expansion of a multibillion dollar natural gas liquefaction project in Bonny Island, Nigeria. According to the annual report, the joint venture, M.W. Kellogg Limited ("MWKL"), is 55% owned by KBR and was involved in the Bonny Island, Nigeria project, which was the subject of Halliburton’s and KBR’s settlements with U.S. enforcement authorities in February 2009. As reported in our FCPA Winter Review 2009, in the 2009 settlements, KBR agreed to a $402 million criminal fine, and KBR and Halliburton jointly agreed to pay $177 million in disgorgement. Halliburton agreed to indemnify KBR for all but $20 million of these monetary penalties. According to the annual report, Halliburton’s continuing indemnification responsibilities under its separation agreement with KBR may require Halliburton to cover up to 55% of any monetary penalties imposed on MWKL (reflecting KBR’s ownership interest).

Other Potential Settlements with European Companies

According to press accounts, other European companies involved in the Bonny Island project have set aside funds in anticipation of possible settlements with U.S. authorities. Specifically, the French company Technip has reserved approximately $326.8 million, and the Italian company ENI S.p.A. has reserved approximately $333.5 million.

Individual Prosecutions

On March 25, 2010, a British court ruled that Jeffrey Tesler can be extradited to the United States to face FCPA charges in U.S. District Court for the Southern District of Texas. As reported in our FCPA Spring Review 2009, Tesler was indicted in February 2009 along with another U.K. citizen, Wojciech Chodan, on one count of conspiracy to violate the FCPA and ten substantive FCPA violations in relation to their alleged participation in the Bonny Island corruption scheme. According to the indictment, Tesler served as an agent of a joint venture set up by KBR and other companies for the purpose of funneling bribes to Nigerian government officials to secure contracts for the Bonny Island project. The indictment alleged that Tesler and Chodan are subject to U.S. jurisdiction based on their agency relationship with KBR and because some of the money for the bribes passed through U.S. bank accounts.

The London Metropolitan Police arrested Tesler in March 2009 at the request of the United States, and he has since fought extradition to the United States. Tesler’s attorney had challenged his extradition on grounds that the U.S. connection to Tesler’s alleged misconduct was merely "tangential," arguing that he never visited the United States in relation to the acts concerned in the indictment. At a hearing on March 25, 2010, at the City of Westminster Magistrates’ Court, District Judge Caroline Tubbs disagreed, stating that Tesler’s alleged crimes had a "substantial connection" with the United States. Tesler is expected to appeal the decision.

According to press accounts, at Chodan’s hearing on February 22, 2010, his lawyer argued that extraditing Chodan to the United States, where the 72-year-old defendant could face a lengthy potential prison sentence, would be "unjust and oppressive." Chodan’s lawyer also reportedly argued that Chodan’s alleged misconduct lacked sufficient nexus to the United States, as it mostly took place in the United Kingdom and Nigeria.

If the defendants are extradited and convicted in the United States, Tesler and Chodan face penalties of up to 55 years in prison and forfeiture of approximately $132 million representing the proceeds traceable to the alleged violations. District Judge Tubbs is expected to announce her decision on Chodan’s extradition on April 20, 2010.

Pride International Signals Anticipated Settlement

On February 16, 2010, Pride International ("Pride"), a Houston-based offshore drilling company, announced that it set aside $56.2 million in the fourth quarter of 2009 in anticipation of a potential settlement with the DOJ and SEC over possible FCPA violations.

In 2006, Pride voluntarily disclosed information about initial allegations its audit committee uncovered regarding possible improper payments to foreign officials. In its February 29, 2008 public filing, the company provided details into its subsequent internal investigation. Among other things, the ongoing investigation identified nearly $1 million in suspect payments to government officials in Venezuela and Mexico over a five-year period. These payments were made in exchange for extending drilling contracts, facilitating customs clearance, and assisting on immigration issues. The filing stated that the investigation also extended to Pride’s other international operations, with the DOJ requesting information relating to Pride’s relationship with the freight forwarder and customs agent Panalpina and its importation of rigs into Nigeria. Pride’s review uncovered evidence of nearly $2 million in suspect payments made directly or indirectly to "government officials in Saudi Arabia, Kazakhstan, Brazil, Nigeria, Libya, Angola, and the Republic of the Congo in connection with clearing rigs or equipment through customs or resolving outstanding issues with customs, immigration, tax, licensing or merchant marine authorities in those countries."

In approaching this expected settlement, Pride’s filing stated that the company has continued to cooperate with the DOJ’s and the SEC’s investigations. The filing asserts that the $56.2 million set aside "represents the company’s best estimate of potential fines, penalties and disgorgement related to settlement of the matter with the DOJ and SEC."

Noteworthy Aspects:

- Remedial Action: In its February 29, 2008 public filing, Pride stated that it believed that members of its senior operations management were aware, or should have been aware of the improper payments. It noted that personnel, including officers such as its former Chief Operating Officer, "have been terminated or placed on administrative leave or have resigned in connection with the investigation." The company stressed that it had taken and would continue to take disciplinary actions "where appropriate" as well as other "corrective action" in order to reinforce its commitment to ethics and compliance.

- Bobby Benton: As reported in our FCPA Winter Review 2010, the SEC charged Bobby Benton, Pride’s former Vice President of Western Hemisphere Operations, with violating the anti-bribery, internal controls and books and records provisions of the FCPA, aiding and abetting violations of those provisions, as well as making false representations to accountants. These charges centered on alleged bribes made to foreign officials in Mexico and Venezuela; Benton is accused of being aware of, approving, or complicit in the alleged bribes. According to the SEC complaint, Benton left Pride in 2006, around the time the company initiated its internal investigation.