Proposed Regulations Extend Section 163(j) to CFCs

Tax Alert

On November 26, 2018, the Department of Treasury (Treasury) and the Internal Revenue Service (IRS) issued proposed regulations (Proposed Regulations) under section 163(j).1 The 2017 Tax Cuts and Jobs Act significantly broadened the scope of section 163(j), extending its application to individuals and partnerships and applying the limitation to interest paid to both related and unrelated parties. As amended, section 163(j) limits a taxpayer's business interest expense deduction to the sum of (1) its business interest income; (2) 30 percent of its adjusted taxable income (ATI), which shall not be less than zero; and (3) floor plan financing interest.2 For taxable years beginning before January 1, 2022, ATI is taxable income computed without regard to interest, taxes, depreciation, and amortization (EBITDA).3 A taxpayer may carry forward any business interest disallowed under section 163(j) indefinitely.4 This limitation generally applies to all taxpayers with average annual gross receipts of more than $25 million, as determined under section 448(c).5 However, certain trades or businesses are excepted from the limitation, such as electing real property businesses.6

Overview of Proposed Regulations

The Proposed Regulations are divided into 11 sections. These 11 sections address many issues, including general rules on how to compute the section 163(j) limitation, as well as rules applicable to tax-exempt corporations, partnerships, S corporations, REITS, excepted trades or businesses (such as regulated utilities), and foreign corporations with effectively connected income (ECI). As signaled in Notice 2018-28,7 the Proposed Regulations adopt rules to apply section 163(j) to consolidated groups on a single entity basis.

The Proposed Regulations provide an expansive definition of "interest" for purposes of section 163(j). Interest includes not only amounts treated as interest under general federal tax principles (i.e., amounts paid or accrued for the use or forbearance of money under the terms of a debt instrument), but also amounts such as substitute interest payments, gains and losses on derivatives used to hedge an interest-bearing asset, commitment fees paid to lenders, debt issuance costs, and amounts treated as interest under an anti-avoidance rule that applies if the expense is predominantly incurred in consideration of the time value of money.8

In contrast, the Proposed Regulations provide a definition of ATI that hews to the items specifically referenced in section 163(j)(8), notwithstanding the grant of authority in section 163(j)(8) to Treasury to provide additional adjustments. Adjustments are provided to "prevent double counting," including the adjustments for U.S. shareholders of CFCs described below and adjustments that apply in the event that a taxpayer sells or otherwise disposes of depreciable property and recognizes gain associated with depreciation deductions that were previously added back to ATI. Treasury chose not to adopt additional adjustments that would have resulted in an ATI that approximated cash flow, as the term had been interpreted in prior proposed regulations under prior law section 163(j).9 Notably, the Proposed Regulations do not provide for an adjustment (in the pre-2022 period) for depreciation, depletion, or amortization that is capitalized in inventory under section 263A and included in cost of goods sold.10 Unless this approach is changed, capital-intensive taxpayers with inventories will be severely disadvantaged by the rules.

Application of Section 163(j) to CFCs

The Proposed Regulations extends the section 163(j) limitation to controlled foreign corporations (CFCs).11 Under a general rule, the section 163(j) limitation applies on a separate entity basis to determine the deductibility of a CFC's business interest expense in the same manner as the limitation applies to a domestic corporation.12 As such, a CFC with business interest expense would apply section 163(j) to determine the deduction limitation for purposes of computing subpart F income (under section 952), Global Intangible Low-taxed Income (GILTI)-tested income (under section 951A(c)(2)(A)), and income effectively connected with a U.S. trade or business (for purposes of section 882). If a CFC is a partner in a partnership, the Proposed Regulations provide that section 163(j) and the related regulations apply to the partnership as if the CFC were a domestic C corporation.13

Election to Apply Section 163(j) on a CFC Group Basis

The Preamble to the Proposed Regulations observes that the general rule described above, which applies section 163(j) to related CFCs on an entity-by-entity basis, may be inappropriate in certain circumstances. For example, where CFC1 lends funds to a related CFC2, CFC2 would have an interest deduction that could be limited by section 163(j), whereas CFC1 would have interest income that may be taxable to the U.S. shareholder of both CFCs as GILTI.14

To address this potential mismatch and align the treatment of highly related CFCs with the treatment of U.S. affiliates, the Proposed Regulations provide for an irrevocable election that allows the members of a "CFC Group" to apply section 163(j) on a group basis (the Alternative Method). The election may be made by reporting results consistent with the Alternative Method on tax returns, and once made is irrevocable.15 A CFC Group is two or more applicable CFCs if at least 80 percent of the stock by value of each applicable CFC is owned, within the meaning of section 958(a), by a single U.S. shareholder or, in aggregate, by related U.S. shareholders if each U.S. shareholder owns the stock of each applicable CFC in the same proportion.16 An "applicable CFC" is defined as a foreign corporation in which at least one U.S. shareholder directly or indirectly owns stock.17 Members of a consolidated group and individuals filing jointly are treated as a single person for purposes of determining a CFC group, and stock of a CFC owned through certain passthrough entities is treated as owned by a U.S. person that owns 80 percent or more of the passthrough entity.18 If any CFC Group members conduct a financial services business, those entities are treated as comprising a separate subgroup and are subject to special rules.19 The Proposed Regulations generally treat a controlled partnership (in general, a partnership in which CFC Group members own, in aggregate, at least 80 percent of the interests) as a CFC Group member, and the interest in the controlled partnership as stock.20

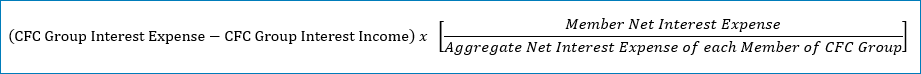

The Alternative Method limits the amount of business interest expense of each member of the CFC Group to the amount of that member's "allocable share" of the CFC Group's "applicable net business interest expense."21 The applicable net business interest expense of the CFC Group is the excess of (1) the sum of the amounts of business interest expense of each CFC group member, less (2) the sum of the amounts of business interest income of each CFC group member.22 A member's allocable share is determined based on a contribution of that member's net business interest expense (computed on a separate company basis) to the sum of the net business interest expense of each member of the CFC Group (computed on a separate company basis).23 The amount of interest expense subject to section 163(j) limitation for each member of the CFC Group under the Alternative Method can be represented as follows:

This amount may be more or less than a CFC Group member's actual interest expense for the year. If a CFC Group has only intragroup debt, then none of the business interest expense is subject to the section 163(j) limitation, because the CFC Group's applicable net business interest expense would be zero. Thus, the Alternative Method generally alleviates the income-deduction mismatch concern that the Treasury and IRS identified in the preamble. Note that a mismatch could still exist under the proposed rules, for example, with respect to interest paid by a CFC to its U.S. shareholder.

The CFC Group election is limited to situations in which a payor CFC and payee CFC have substantially identical ownership by U.S. shareholders.24 However, the Preamble to the Proposed Regulations requests comments on whether it would be appropriate to provide additional modifications to the application of section 163(j) to CFCs and whether there are particular circumstances in which it may be appropriate to exempt a CFC from the application of section 163(j).25

Rules for Computing CFC ATI

The Proposed Regulations also provide rules for calculating the ATI of an applicable CFC. The principles of Treas. Reg. § 1.952-2 (or section 882, as applicable) apply for determining the applicable CFC's income and deductions. The Preamble to the Proposed Regulations requests comments on the application of the rules under Treas. Reg. § 1.952-2 for purposes of determining a CFC's taxable income for purposes of section 163(j), particularly regarding whether the section 163(j) rules should allow a CFC a deduction or require a CFC to take into account income with respect to an item that is expressly limited to domestic corporations under the Code.26

The ATI of an applicable CFC excludes any dividends received from a related person. The Preamble explains that this rule is intended to avoid double counting, because the dividend amount will be part of the paying corporation's ATI.27

Under the Alternative Method, "excess" ATI, referred to as CFC Excess Taxable Income, of lower-tier members of the CFC Group "rolls up" to upper-tier CFCs and can be used to increase the section 163(j) limitation of upper-tier CFCs.28 CFC Excess Taxable Income means the excess of (1) 30 percent of the ATI of a member of the CFC Group, less (2) the CFC Group member's allocable share of the applicable net business interest expense.29 If the lowest-tier CFC member has CFC excess taxable income, then that excess is proportionately taken into account by its direct owners.30 This "rolling up" continues until the highest tier member is allocated the balance.31

Thus, the Alternative Method election affects both the amount of a CFC's interest expense that is subject to the section 163(j) limitation, and, through the rolling up of ATI to upper tier members of the CFC Group, the amount of that limitation.

Rules for Computing ATI of a U.S. Shareholder

The Proposed Regulations provide a general rule that the ATI of a U.S. shareholder is computed without regard to any amounts included in gross income under sections 78, 951(a), and 951A(a) (such as subpart F income, investments in U.S. property, and GILTI) that are properly allocable to a non-excepted trade or business of the U.S. shareholder, and any deduction allowable under section 250(a)(1)(B) (the GILTI deduction) (determined without regard to the taxable income limitation in section 250(a)(2)).32 Although the Preamble states that this rule is necessary to avoid double counting of the taxable income of a CFC already taken into account to determine the CFC's section 163(j) limitation, the rule overshoots the mark to the extent 30 percent of the CFC's ATI exceeds the CFC's net business interest expense.

If an Alternative Method election is made, however, and a U.S. shareholder has a subpart F or GILTI inclusion from a member of its CFC Group, then the U.S. shareholder may include in its ATI its proportionate share of any Eligible CFC Group Excess Taxable Income (Eligible CFC Group ETI) (but not in excess of inclusions under subpart F or GILTI).33 Eligible CFC Group ETI is determined by multiplying the amount of CFC Excess Taxable Income that has tiered up to a highest tier member of the CFC Group and the percentage of the CFC Group's income that constitutes GILTI or subpart F income.34

If a U.S. shareholder of a CFC Group member for which an Alternative Method election has been made is a domestic partnership, the addback rule does not apply to determine the ATI of the domestic partnership.35 However, if the domestic partnership shareholder has a domestic C corporation partner, the addback rule is applied, with certain modifications, to the U.S. corporate partner for purposes of computing the U.S. corporate partner's ATI.36 In addition, the addback rule is modified to provide that for purposes of determining a U.S. corporate partner's pro rata share of Eligible CFC Group ETI of a specified highest-tier member, the domestic partnership is treated as if it were a foreign partnership.37

Effect on Earnings and Profits

The limitation on deductions and subsequent disallowance and carryforward of a deduction of a foreign corporation's business interest expense does not affect whether and when such business interest expense reduces the corporation's earnings and profits.38 Further, the limitation on deductions and subsequent disallowance and carryforward of a deduction of an applicable CFC's business interest expense will not affect the limitation of subpart F income to earnings and profits under section 952(c).39

Effective Date

The rules applicable to CFCs in the Proposed Regulations (including the election to apply the Alternative Method) generally apply to any foreign corporation's taxable year that ends after the date that the regulations are finalized.40 However, a foreign corporation, its shareholders, and their related parties may apply the rules discussed above to a taxable year of a foreign corporation beginning after December 31, 2017, and to the taxable year of a shareholder of a foreign corporation ending with or within the taxable year of the foreign corporation, if the foreign corporation, its shareholders, and their related parties consistently apply the Proposed Regulations and any related rules.41

Observations

The Proposed Regulations implementing the extension of the section 163(j) rules to CFCs, provide a default regime that applies the section 163(j) limitation on an CFC-by-CFC basis. Importantly, the Proposed Regulations provide an election to apply an Alternative Method, which applies the 163(j) rules on the basis of the CFC Group and permits the U.S. shareholder to add income inclusions from CFCs to its ATI under certain circumstances. While issues and questions are bound to arise, the Proposed Regulations will allow multinationals with CFCs to begin to model the effects of section 163(j) with precision. It appears that the Alternative Method was intended to be beneficial in most circumstances, and therefore it should be studied closely. The regulations permit an election to use the Alternative Method to be made for the 2018 tax year. However, once made, the election is irrevocable and presents considerable complexity, so it will be important for taxpayers to consider how the election will affect both current and future borrowings, and to consider alternatives. Moreover, the Proposed Regulations provide that a taxpayer making the election in reliance on the Proposed Regulations must consistently apply the Proposed Regulations.

For more information, please contact:

Layla J. Asali, lasali@milchev.com, 202-626-5866

Rocco V. Femia, rfemia@milchev.com, 202-626-5823

Andrew L. Howlett, ahowlett@milchev.com, 202-626-5821

David W. Zimmerman, dzimmerman@milchev.com, 202-626-5876

Jennifer E. Maul*

Loren C. Ponds*

*Former Miller & Chevalier attorney

-----------

1REG-106089-18 (Nov. 26, 2018). All "section" references are to the Internal Revenue Code of 1986 (the Code), as amended and currently in effect.

2Section 163(j)(1).

3Section 163(j)(8). For taxable years beginning after January 1, 2022, ATI is taxable income computed without regard to EBIT.

4Section 163(j)(2).

5Section 163(j)(3).

6See section 163(j)(7).

72018-16 I.R.B. 492 (April 2, 2018).

8Prop. Treas. Reg. § 1.163(j)-1(b)(20).

9See 56 Fed. Reg. 27907, 27908-09 (June 18, 1991). (Stating in the preamble that former Prop. Treas. Reg. § 1.163(j)-2(f) "defines adjusted taxable income as taxable income computed without regard to carryforwards and disallowances under section 163(j) and with certain adjustments.... In general, the purpose of these adjustments is to modify taxable income to more closely reflect the cash flow of the corporation.")

10Prop. Treas. Reg. § 1.163(j)-1(b)(1)(iii).

11Prop. Treas. Reg. §§ 1.163(j)-7, -8.

12Prop. Treas. Reg. § 1.163(j)-7(b)(2).

13Id.

14REG-106089-18 at 93.

15Prop. Treas. Reg. § 1.163(j)-7(b)(5).

16Prop. Treas. Reg. § 1.163(j)-7(f)(6). A CFC with any ECI (including ECI derived through a partnership) is excluded from the definition of a CFC Group.

17Prop. Treas. Reg. § 1.163(j)-7(f)(2). This definition appears directed at excluding foreign corporations that are treated as CFCs as a result of the repeal of section 958(b)(4) but have no section 958(a) U.S. shareholders.

18Prop. Treas. Reg. § 1.163(j)-7(f)(6)(ii).

19Prop. Treas. Reg. 1.163(j)-7(f)(1)(ii).

20Prop. Treas. Reg. 1.163(j)-7(d)(3).

21Prop. Treas. Reg. § 1.163(j)-7(b)(3).

22Prop. Treas. Reg. § 1.163(j)-7(f)(3).

23Prop. Treas. Reg. § 1.163(j)-7(f)(1).

24Prop. Treas. Reg. § 1.163(j)-7(f)(6).

25REG-106089-18 at 92-93.

26REG-106089-18 at 99.

27Prop. Treas. Reg. § 1.163(j)-7(c)(2).

28Prop. Treas. Reg. § 1.163(j)-7(c)(3).

29Prop. Treas. Reg. § 1.163(j)-7(f)(5).

30Prop. Treas. Reg. § 1.163(j)-7(c)(3)(ii).

31Id.

32Prop. Treas. Reg. § 1.163(j)-7(d)(1)(i).

33Prop. Treas. Reg. §1.163(j)-7(d)(2).

34Prop. Treas. Reg. § 1.163(j)-7(f)(14). In order for income of a member of a CFC Group to be included in this calculation, the member must be the highest-tier member or a lower-tier member with respect to such highest-tier member, and it must have CFC excess taxable income (without regard to the rolling up rules).

35Prop. Treas. Reg. § 1.163(j)-7(d)(3).

36Id.

37Id.

38Prop. Treas. Reg. § 1.163(j)-7(e). This is consistent with the rule generally applicable to domestic C corporations. Prop. Treas. Reg. § 1.163(j)-4(c).

39Prop. Treas. Reg. § 1.163(j)-7(e).

40Prop. Treas. Reg. § 1.163(j)-7(h).

41Id.

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.