DOJ Year End FCA Enforcement Roundup

Litigation Alert

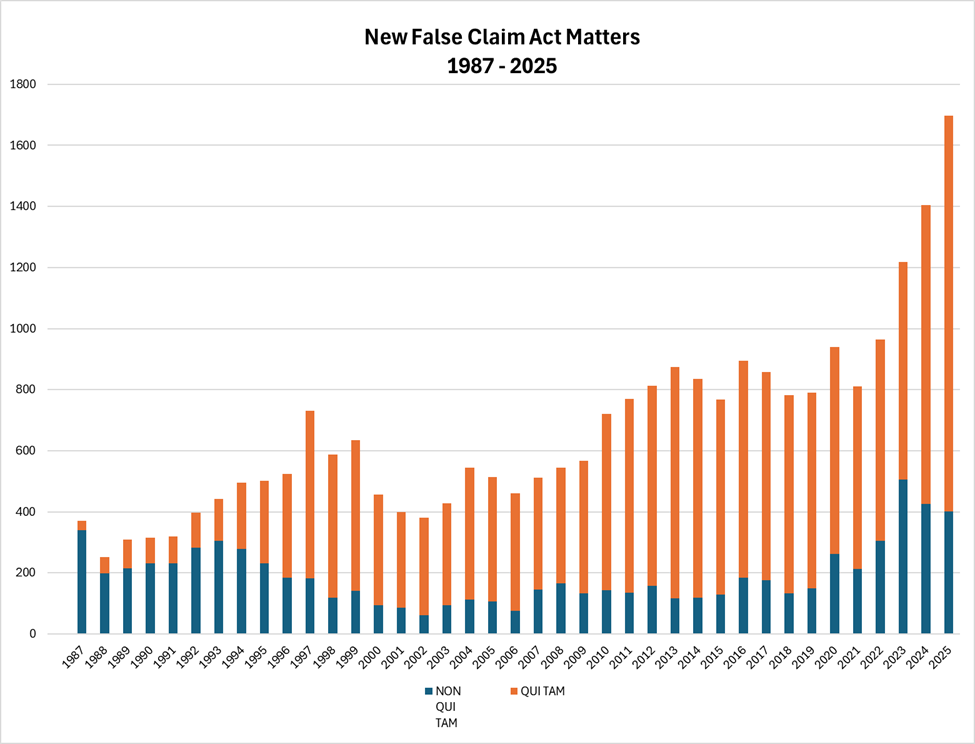

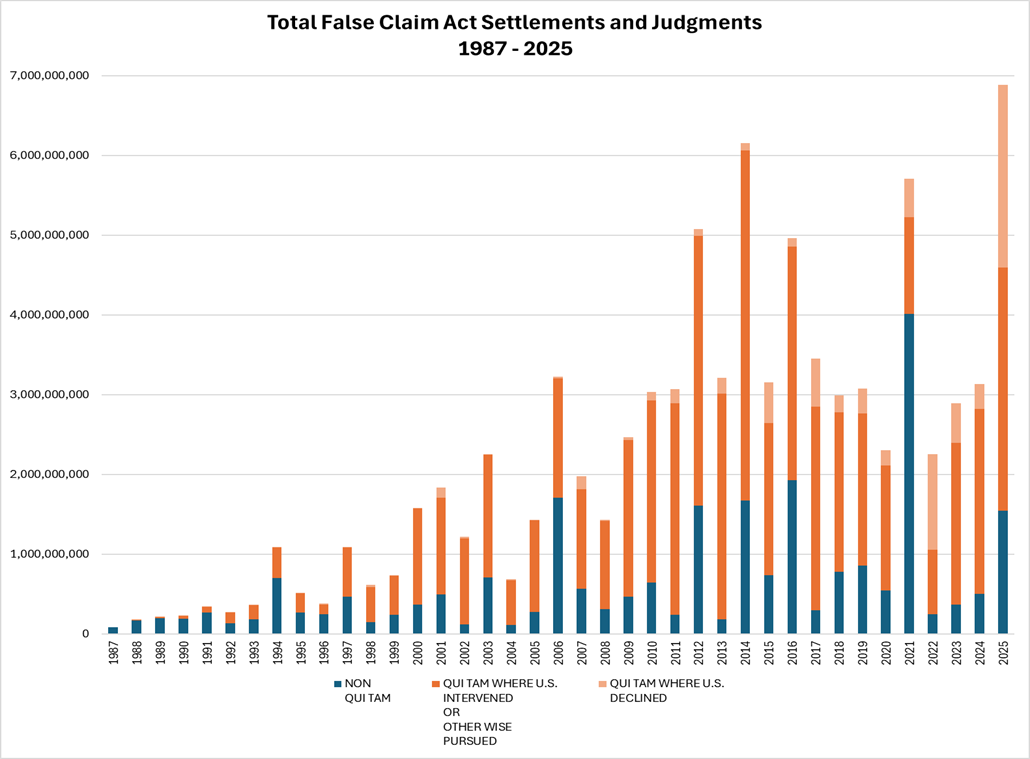

On January 16, 2026, the U.S. Department of Justice (DOJ) provided its annual report of statistics on False Claims Act (FCA) resolutions, announcing a record high of more than $6.8 billion in FCA settlements and judgments in the fiscal year ending on September 30, 2025, more than double what was recovered in each of the previous three years. In addition, the DOJ reported that FY2025 saw an all-time high of qui tam lawsuits initiated, with 1,297 whistleblower filings, as well as 401 non-qui tam FCA lawsuits initiated for the year. All of this reinforces that the FCA remains a critical tool for the administration's efforts to combat "waste, fraud, and abuse." Companies facing possible enforcement actions, especially in heavily scrutinized practice areas discussed below, are advised to evaluate their internal controls to ensure compliance with U.S. law.

The DOJ's report provides insight into the DOJ's enforcement priorities over the first year of the new administration. Those priorities include healthcare fraud, procurement fraud, cybersecurity fraud, and customs and tariff avoidance.

Healthcare fraud remains the "leading source of False Claim Act settlements and judgments," with more than 83 percent of the total dollar amount of FCA resolutions (more than $5.7 billion) coming from settlements and judgments related to alleged healthcare fraud. The judgments in the healthcare fraud space include astronomical settlement and judgment amounts, including a $1.6 billion verdict against Janssen stemming from allegations that the company engaged in off-label promotions of HIV/AIDS drugs Prezista and Intelence, and a $948.8 million jury verdict against Omnicare for allegedly dispensing drugs without valid prescriptions to persons in assisted living and long-term care facilities. The report specifically highlights the DOJ's enforcement actions in three areas:

- "Managed Care," including the Medicare Advantage program (Medicare Part C), which now makes up the largest component of Medicare;

- Prescription Drugs, including claims related to drug pricing, drug dispensing, and alleged kickbacks; and

- Medically Unnecessary Care, i.e. claims of bills submitted to the government for unnecessary healthcare and services.

"Procurement, loan, and grant fraud," which includes military procurement fraud, cybersecurity fraud, and pandemic fraud, was also an area of substantial FCA activity. The report noted particularly high settlements in the area of military procurement fraud, including a $428 million settlement with a company for allegedly providing false cost and pricing data and double billing in defense contracts and at least five other settlements of at least $15 million. Meanwhile, resolutions related to cybersecurity fraud have "more than tripled in each of the past two years." In FY2025, the Department settled nine cybersecurity fraud cases under the FCA, recovering more than $52 million. For example, Health Net Federal Services Inc. and its parent corporation, Centene Corporation, agreed to pay $11.2 million to resolve allegations that it "falsely certified compliance with cybersecurity requirements in a contract with the U.S. Department of Defense."

Finally, as we have previously discussed here, here, and here, it is clear that the Trump administration intends to focus on tariffs and customs avoidance as a priority in FCA enforcement. In a headline settlement, Ceratizit USA agreed to pay $54.4 million to resolve allegations that it failed to pay duties on products imported from China, a record high for a customs-related FCA case that signals the heightened stakes for cases in this area. DOJ also flagged other cases that we have reported on here, including a $12.4 million resolution by Allied Stone and its president to resolve allegations of attempted misrepresentation of goods imported from China and an $8.1 million settlement with Evolution Flooring Inc. and its owners to resolve allegations of avoiding import duties by misrepresenting the country of origin of goods from China.

Separately, the updated year-over-year statistics on qui tam enforcement included in the report show a steady increase in qui tam FCA lawsuits between 1987 and 2025, with qui tam lawsuits significantly outnumbering non qui tam lawsuits over the last two decades. Though non-qui tam suits have increased slightly over the past five years when compared to the previous 10, the number of qui tam suits increased from 679 in 2020 to 1,297 in 2025. This increase is notable as courts decide whether the qui tam provisions of the FCA are constitutional, as we previously discussed here.

DOJ's statistics also indicate that qui tam cases continue to account for the majority of damages recovered, with damages closely split between intervened and non-intervened qui tams. This distinction, which is heavily driven by the major Janssen judgment noted above, marks a change from past years, where intervened qui tams made up a much more significant portion of total recoveries.

The DOJ's statistics confirm the importance of the FCA as an enforcement tool for the government and the importance of qui tam suits in driving those cases. As we head into 2026, we expect the government to use the FCA to bring more fraud-related enforcement cases, particular those related to healthcare, government contracts, cybersecurity, and customs. Companies operating in these areas should shore up internal safeguards, including reporting mechanisms to allow potential whistleblowers to raise concerns internally.

For more information, please contact:

Ian A. Herbert, iherbert@milchev.com, 202-626-1496

Bradley E. Markano, bmarkano@milchev.com, 202-626-6061

Mena Sawyer, msawyer@milchev.com, 202-626-6078

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.