Treasury Releases New Regulations Providing Guidance Under GILTI and Participation Exemption

Tax Alert

On June 14, 2019, the Department of Treasury (Treasury) and the Internal Revenue Service (IRS) simultaneously issued proposed regulations (GILTI Proposed Regulations)1 and final regulations (GILTI Final Regulations)2 regarding global intangible low-taxed income (GILTI) under section 951A and related rules.3 On the same date, Treasury and the IRS also released temporary regulations (Section 245A Temporary Regulations) and proposed regulations under the dividends received deduction (DRD) of section 245A. The final and temporary regulations represent the last set of binding international tax guidance under newly enacted provisions of the 2017 Tax Cuts and Jobs Act (TCJA) effective back to the date of enactment pursuant to section 7805(b)(2).

Section 951A requires that U.S. shareholders of any controlled foreign corporation (CFC) include in gross income in the current taxable year their share of the CFC's GILTI.4 The amount of a U.S. shareholder's GILTI inclusion generally reflects the sum, across all of its CFCs, of certain CFC income, offset by the sum of certain CFC losses, in excess of a 10 percent return on tangible asset investment (with the return reduced by certain interest expense). CFC income that is not currently included in income as GILTI or as subpart F income is generally eligible for a "participation exemption" under section 245A. Section 245A provides for a 100 percent deduction for the foreign-source portion of dividends received by a domestic corporation from a "specified 10%-owned foreign corporation" (SFC).

A key aspect of the GILTI Proposed Regulations is a new election pursuant to which taxpayers can exclude certain high-taxed income from GILTI. The GILTI Proposed Regulations also address the treatment of domestic partnerships for purposes of determining amounts included in the gross income of their partners under section 951A with respect to CFCs owned by the partnership. Taxpayers who are affected by the GILTI Proposed Regulations should consider engaging in the notice-and-comment process. Written comments to the GILTI Proposed Regulations and requests for a public hearing are due September 19, 2019.5

The GILTI Final Regulations retain the basic approach of the October 2018 proposed regulations (the Prior GILTI Proposed Regulations) in determining the amount of GILTI to be included in the gross income of U.S. shareholders of CFCs, including U.S. shareholders who are members of a consolidated group. The GILTI Final Regulations provide guidance relating to the determination of a U.S. shareholder's pro rata share of a CFC's subpart F income and GILTI to be included in the shareholder's gross income, as well as certain reporting requirements relating to inclusions of subpart F income and GILTI. The GILTI Final Regulations retain and revise anti-abuse provisions that were included in the Prior GILTI Proposed Regulations. The GILTI Final Regulations also revise the provisions from the Prior GILTI Proposed Regulations relating to domestic partnerships and adopt an aggregate approach for purposes of determining the amount of GILTI to be included in the gross income of the partners of a domestic partnership with respect to CFCs owned by the partnership.

In the same release, Treasury finalized particular aspects of the proposed foreign tax credit (FTC) regulations. Specifically, they finalize the provision that denies a section 245A DRD to section 78 dividends received by a fiscal year CFC after December 31, 2017. Treas. Reg. § 1.78-1(c) provides that the TCJA's amendment to Section 78 (which provides that a section 78 dividend is not considered a dividend for purposes of section 245A) applies to "section 78 dividends that are received after December 31, 2017, by reason of taxes deemed paid under section 960(a) with respect to a taxable year of a foreign corporation beginning before January 1, 2018." The Preamble supports this "special applicability date," which departs from the literal language of the statute, on the basis that

"[a]llowing a dividends-received deduction for a section 78 dividend would undermine the purpose of the section 78 dividend because taxpayers would effectively be allowed both a credit and deduction for the same foreign tax" and that the rule is necessary "in order to prevent arbitrary disparate treatment of similarly situated taxpayers."6

The Section 245A Temporary Regulations provide for new limitations on the availability of the section 245A dividends received deduction for certain dividends received from current or former CFCs in transactions that Treasury and the IRS consider abusive. The Section 245A Temporary Regulations apply retroactively to transactions occurring after December 31, 2017.7 Identical proposed regulations were released by cross-reference to the Section 245A Temporary Regulations. Taxpayers may provide written or electronic comments and requests for a public hearing to these proposed regulations by September 16, 2019.8

I. GILTI

A. Statutory Overview

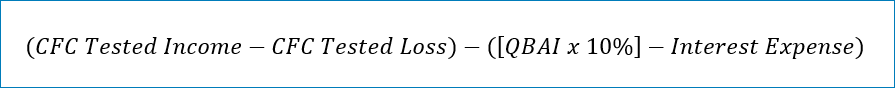

A U.S. shareholder's GILTI inclusion amount is its net CFC tested income for the taxable year, less the shareholder's net deemed tangible income return (DTIR) for the taxable year.9 Net DTIR is 10 percent of the aggregate of the U.S. shareholder's pro rata share of qualified business asset investment (QBAI) for each of its CFCs, reduced by certain interest expense.10

Net CFC tested income is the aggregate of the U.S. shareholder's pro rata share of tested income of each of its CFCs less the aggregate of the U.S. shareholder's pro rata share of the tested loss of each of its CFCs.11 Tested income is the gross income of any CFC excluding (1) any income effectively connected to a U.S. trade or business; (2) any gross income taken into account in determining the CFC's subpart F income; (3) any gross income excluded from foreign base company income or insurance income because it is taxed at a foreign effective tax rate greater than 90 percent of the U.S. corporate tax rate; (4) any dividend received from a related person; and (5) foreign oil and gas extraction income, and reduced by any deductions (including taxes) properly allocable thereto.12 A CFC's tested loss is the excess (if any) of deductions (including taxes) properly allocable to the CFC's gross tested income less the amount of such gross income.13

Finally, QBAI, which is the average of the aggregate of adjusted bases (measured at the end of each quarter in the taxable year) in specified tangible property for which a depreciation deduction is allowed.14 The complete GILTI formula is represented as follows:

B. GILTI High-Tax Exclusion

Section 951A(c)(2)(A)(i)(III) provides that gross tested income of a CFC does not include any gross income excluded from foreign base company income or insurance income by reason of the exception under section 954(b)(4) (the "GILTI high-tax exclusion"). The Proposed GILTI Regulations broaden the application of the GILTI high-tax exclusion as compared to the Prior GILTI Regulations, but do so on a prospective basis only. Comments are requested regarding the operation of the GILTI high-tax exclusion.

The Prior GILTI Proposed Regulations provided that the GILTI high-tax exclusion applies only to income excluded from foreign base company income or insurance income "solely" by reason of an election made under section

954(b)(4) and Treas. Reg. § 1.954-1(d)(5). The preamble to the GILTI Proposed Regulations notes that "[n]umerous comments requested that the scope of the GILTI high-tax exclusion be expanded in the final regulations."15 The Treasury and the IRS rejected these comments in the GILTI Final Regulations and retained the narrow GILTI high-tax exclusion in the GILTI Proposed Regulations without modifications. Thus, under the GILTI Final Regulations taxpayers may not exclude any item of income from gross tested income unless such income would otherwise be foreign base company income (as defined in section 954) or insurance income.16

However, the GILTI Proposed Regulations provide for a broader election to exclude high-taxed income from gross tested income, and they state that this election will be available prospectively only to taxable years beginning after the GILTI Proposed Regulations are finalized.17 The preamble to the GILTI Proposed Regulations cites textual and legislative history support for the decision to provide an election to exclude high-taxed income from GILTI, providing that "any item of gross income…could be excluded from FBCI or insurance income ‘by reason of' section 954(b)(4) if the provision is one of the reasons for such exclusion, even if the exception under section 954(b)(4) is not the sole reason."18 This is because the "legislative history evidences an intent to exclude high-taxed income from gross tested income."19 This high-tax exclusion allows a U.S. shareholder "to ensure that its high-taxed non-subpart F income is eligible for the same treatment as its high-taxed FBCI and insurance income, and thus eliminates an incentive for taxpayers to restructure their CFC operations in order to convert gross tested income into FBCI for the sole purpose of availing themselves of section 954(b)(4) and, thus, the GILTI high tax exclusion."20

High-taxed income is gross income subject to foreign income tax at an effective rate that is greater than 90 percent of the U.S. corporate rate, i.e., 18.9 percent based on the current U.S. corporate rate of 21 percent.21 In testing the effective rate, the relevant items of income are all items of gross tested income attributable to a qualified business unit (QBU), which is determined by reference to the items of income reflected on the books and records of the QBU, as adjusted for certain disregarded payments.22 The aggregate of these items for a single QBU is referred to as the "tentative gross tested income item."23 The effective rate of foreign income tax is tested at the CFC level by allocating and apportioning deductions to a tentative gross tested income item to determine the "tentative net tested income item,"24 and then by determining the CFC's current year taxes that would be allocated and apportioned to the tentative net tested income item under the principles of the proposed FTC regulations (i.e., Proposed Regulation § 1.960-1(d)(3)(ii)).25 The GILTI Proposed Regulations provide that gross income attributable to a QBU is determined under federal income tax principles, except that income attributable to a QBU is adjusted to account for disregarded payments.26 This rule for disregarded payments is consistent with the approach taken in the proposed FTC regulations with regard to determining foreign branch income.27 Taxes allocable to items of income excluded under the high-tax exclusion are not creditable under section 960, and tangible property used to produce that income does not qualify as specified tangible property and therefore is not included in the U.S. shareholder's QBAI.28

The election to exclude high-tax income from gross tested income is made by the CFC's controlling domestic shareholders by attaching a statement on an original or amended return.29 The election applies to all CFCs within a "controlling domestic shareholder group." Therefore, if the election is made, it applies with respect to each high-tax item of income of each CFC in a group of commonly controlled CFCs.30 The election applies with respect to each tentative gross tested income item of the CFC and is binding on all U.S. shareholders of the CFC.31 The election may be revoked,32 but if it is revoked, a new election cannot be made for 60 months, and a subsequent election cannot be revoked for another 60 months, unless there is a change in control.33 Treasury and the IRS request comments on the manner and terms of the election, specifically as to whether the limitations with respect to revocations and the consistency requirements should be modified.34 The election is much less flexible than the high-tax exclusion as applied in the subpart F context, which generally permits taxpayers to exclude high-taxed items of income on the basis of separate categories of income within certain income groups. Taxpayers should model the application of these proposed rules to their operations to determine whether the election would be advisable, or whether to advocate for increased flexibility with respect to the election to increase its utility.

The GILTI high-tax election is available for CFC taxable years beginning on or after the date the final regulations are published in the Federal Register.35 The preamble to the GILTI Final Regulations also addresses the effective date, providing that until the GILTI Proposed Regulations are finalized, taxpayers may only rely on the more narrow subpart F high-tax election provided for in the GILTI Final Regulations.36 Given the policy concerns animating the broader high-tax election provided in the GILTI Proposed Regulations, it is concerning that the broader election will not be available for tax years beginning before the regulations are finalized.

C. Partnerships

The GILTI Final Regulations do not adopt the hybrid approach to partnerships that was previously proposed.37 Instead, the GILTI Final Regulations apply an aggregate approach for purposes of determining a partner's GILTI inclusion amount resulting from CFC stock owned by a domestic partnership. In other words, partners are treated as proportionately owning CFC stock owned by the domestic partnership, just as they would be for a foreign partnership.38 The aggregate treatment provided in the GILTI Final Regulations is limited, however; the rule does not apply for purposes of determining U.S. shareholder or CFC status, nor does it apply for purposes of determining whether a U.S. shareholder is the controlling domestic shareholder.39

To ensure consistent treatment across the GILTI and subpart F regimes, the GILTI Proposed Regulations extend the aggregate approach to section 951, noting in the preamble that "Congress intended for the subpart F and GILTI regimes to work in tandem."40 Specifically, the rule is intended to provide parity "particularly with respect to foreign tax credits, previously taxed earnings and profits ('PTEP') and related basis rules."41 Accordingly, for purposes of determining the subpart F inclusions of partners of a domestic partnership which is the U.S. shareholder of a CFC, an aggregate approach will also apply such that the partners will be treated as proportionately owning the CFC stock that is held by the domestic partnership.42 As in the GILTI context, this rule does not apply for purposes of determining U.S. shareholder or CFC status, or whether the U.S. shareholder is a controlling domestic shareholder.43

These rules are effective for tax years of foreign corporations beginning on or after the finalization date.44 However, taxpayers may apply and rely on the GILTI Proposed Regulations for tax years beginning after December 31, 2017, provided they do so consistently.45

D. Pro Rata Share

The Prior GILTI Proposed Regulations included a pro rata share anti-abuse rule that was broadly worded to disregard any transaction with a principal purpose of reducing a U.S. shareholder's pro rata share of subpart F income with respect to a CFC.46 Commenters expressed concern that the rule could be broadly interpreted to disregard any disposition of CFC stock.47 Accordingly, the GILTI Final Regulations clarify the language and narrow the scope of the pro rata share anti-abuse rule to target transactions where the allocation of CFC earnings and profits (E&P) is distorted, and now require "appropriate adjustments to the allocation of allocable earnings and profits that would be distributed in a hypothetical distribution" from a CFC.48

Section 951(a)(2)(B) reduces a U.S. shareholder's pro rata share of subpart F income with respect to CFC stock by the amount of distributions received by any other person during the year as a dividend with respect to the stock. Section 951A(e)(1) provides that a U.S. shareholder's pro rata share of tested income is determined in the same manner as subpart F income. As such, the Prior GILTI Proposed Regulations provided that a U.S. shareholder's pro rata share of tested income is determined under section 951(a)(2) and Treas. Reg. §§ 1.951-1(b) and (e).49 Treasury and the IRS determined that the Prior GILTI Proposed Regulations could be interpreted as permitting a dollar-for-dollar reduction under section 951(a)(2)(B) in both a U.S. shareholder's pro rata share of subpart F income and its pro rata share of tested income, which would be "an inappropriate double benefit that is not contemplated under section 951(a)(2)(B) and section 951A(e)(1)."50 The GILTI Final Regulations were revised to prevent this double benefit, providing that a dividend received during the taxable year by a person other than the U.S. shareholder reduces the U.S. shareholder's pro rata share of subpart F income and its pro rata share of tested income in the same proportion as its pro rata share of each amount bears to its aggregate pro rata share of both amounts.51

The preamble to the GILTI Final Regulations adds that Treasury and the IRS are studying aspects of section 951(a)(2)(B), including in the case of "dividends paid to foreign persons, dividends that give rise to a deduction under section 245A(a), and dividends paid on stock after the disposition of such stock by a U.S. shareholder."52 The preamble requests comments in this regard.53

E. Gross Income and Allowable Deductions

The GILTI Final Regulations continue to determine gross income and allowable deductions by reference to Treas. Reg. § 1.952-2, which treats a CFC as a domestic corporation.54 The preamble to the GILTI Final Regulations notes that several comments requested "modifications to, or clarifications regarding, the application of 1.952-2," including regarding net operating loss (NOL) carryovers, disallowances under section 162(m) or section 280G, section 163(j) carryforwards, and section 245A.55 The preamble states that Treasury and the IRS intend to address these issues in a future guidance project, providing that the guidance is "expected to clarify that, in general, any provision that is expressly limited in its application to domestic corporations, such as section 250, does not apply to CFCs by reason of § 1.952-2."56

F. Coordination with Section 952(c)

The GILTI Final Regulations retain the coordination rule from the Prior GILTI Proposed Regulations which provides that gross tested income and allowable deductions are determined without regard to section 952(c), i.e., without regard to the earnings and profits limitation of section 952(c)(1)(A) or subpart F recapture of section 952(c)(2).57

G. Section 961(c) Basis Adjustments

The GILTI Final Regulations do not address whether basis adjustments under section 961(c) should be taken into account for purposes of determining gross tested income of a CFC upon the CFC's disposition of stock of another CFC. The interaction between sections 961(c) and 951A will be considered in connection with a guidance project addressing PTEP under sections 959 and 961.58 Treasury and the IRS request comments on this issue.59

H. Disqualified Basis

The Prior GILTI Proposed Regulations provided rules that treated certain CFC asset basis as "disqualified basis" that could not be taken into account in determining QBAI or in determining depreciation or amortization deductions that reduce CFC tested income.60 The GILTI Final Regulations retain and clarify these rules. The GILTI Final Regulations retain the rule from the Prior GILTI Proposed Regulations disallowing deductions attributable to disqualified basis in depreciable or amortizable property resulting from a disqualified transaction (i.e., a related party transaction occurring during the gap period between the transition tax and GILTI effective date), with some revisions "to better reflect the source of its authority" to impose such a rule.61 The preamble to the GILTI Final Regulations explains Treasury has authority to provide for such a rule because such deductions are not "properly allocable" to gross tested income.62 Instead, the GILTI Final Regulations note that such deductions are properly allocable to "residual CFC gross income" and not to tested income, subpart F income, or effectively connected income of the CFC.63

The GILTI Final Regulations provide for an election to reduce basis in CFC property with disqualified basis by the amount of the disqualified basis, thereby eliminating the disqualified basis for all purposes.64 This election avoids concurrent application of section 901(m) and the GILTI disqualified basis rules.65

I. Sec 367(d) Deemed Payments

Section 367(d) provides that if a U.S. person transfers intangible property to a foreign corporation in a section 351 or 361 exchange, the transferor is treated as having sold the property in exchange for contingent payments. The 367(d) regulations provide that a deemed payment may be treated as an expense of the foreign corporation transferee allocated to subpart F income. The GILTI Final Regulations clarify that a deemed payment under section 367(d) is also treated as an allowable deduction for purposes of determining tested income and tested loss.66 This treatment avoids double inclusion of such item for the U.S. shareholder.

J. Tested Loss CFCs and QBAI

The GILTI Final Regulations retain the previously proposed rule that a tested loss CFC's tangible property is not "specified tangible property" and therefore its QBAI is zero.67

K. Temporarily Held Property and QBAI

The Prior GILTI Proposed Regulations provided that if a tested income CFC ("acquiring CFC") acquires specified tangible property with a principal purpose of reducing the GILTI inclusion amount of a U.S. shareholder for any U.S. shareholder inclusion year, and the acquiring CFC holds the property temporarily, the specified tangible property is disregarded in determining the acquiring CFC's average adjusted basis in specified tangible property for purposes of determining the acquiring CFC's QBAI for any CFC inclusion year during which the tested income CFC held the property.68 Further, the Prior GILTI Proposed Regulations created a per-se rule that property held less than 12 months is disregarded for purposes of determining QBAI.69 Comments asserted that the rule was overbroad,70 and in response, the GILTI Final Regulations narrow the scope of this rule by making it apply based on a principal purpose of increasing the DTIR of a U.S. shareholder and create a rebuttable presumption – rather than a per-se rule – for property held less than 12 months.71 The GILTI Final Regulations also create a safe harbor for transfers (1) between CFCs with the same U.S. shareholder in the same taxable year, and (2) between all tested income CFCs.72

L. Stock Basis Adjustments for Tested Loss CFCs

The GILTI Final Regulations do not adopt the rules in the Prior GILTI Proposed Regulations that provided for downward basis adjustments to the stock of a tested loss CFC. These downward basis adjustments were made at the time of a subsequent sale of CFC stock and were intended to prevent a tested loss from resulting in an uneconomic or duplicated loss. Commenters raised many significant issues with respect to these rules, and the GILTI Final Regulations reserve on the rules related to basis adjustments for tested loss CFCs. The preamble to the GILTI Final Regulations notes that these rules will be considered in a separate project and will apply prospectively only with respect to tested losses incurred in years after the publication of such guidance.73

M. Consolidated Groups

1. Calculation of GILTI Inclusion Amount

The GILTI Final Regulations generally retain the approach of the Prior GILTI Proposed Regulations in applying GILTI on a consolidated group basis. The preamble to the GILTI Final Regulations notes that the application of GILTI to consolidated groups is challenging because "clear reflection of the GILTI inclusion amounts of both individual members and the consolidated group as a whole is not feasible."74 Specifically, section 951A requires a U.S. shareholder-level calculation where there are multiple CFCs with offsetting incomes, creating variability at the level of the consolidated group. The Prior GILTI Proposed Regulations provided that the members' inclusion amounts should be "determined in a manner that clearly reflects the income tax liability of the consolidated group and that creates consistent results regardless of which member of a consolidated group owns the stock of the CFCs."75 To do so, the Prior Proposed Regulations adopted a multi-step process to determine the GILTI inclusion amount for each member of a consolidated group. The GILTI Final Regulations retain the multi-step process used in the Prior Proposed GILTI Regulations.76

2. Basis Adjustments to Member Stock Relating to Tested Loss CFCs

Consistent with the decision to reserve on the rules for adjusting stock basis for tested loss CFCs, the GILTI Final Regulations do not address the corresponding basis adjustments to member stock. This issue will instead be considered in a separate project.77

3. F Adjustment

The Prior GILTI Proposed Regulations contained a so-called "F adjustment," which treated a consolidated group member as receiving tax-exempt income immediately before another member recognizes income, gain, deduction, or loss with respect to a share of the first member's stock.78 However, Treasury and the IRS note that they are "aware of serious flaws with the F adjustment," such as unintended and duplicative tax benefits.79 As such, the F adjustment provision in the Prior GILTI Proposed Regulations were not finalized and taxpayers may not rely on it.80

N. Effective Date

The rules in the GILTI Final Regulations generally apply to any domestic corporation's taxable year that ends after December 31, 2017.81 The high-tax exclusion in the GILTI Proposed Regulations applies to taxable years of foreign corporations beginning after the date that those regulations are finalized. The provisions in the GILTI Proposed Regulations relating to domestic partnerships apply to taxable years of foreign corporations beginning after the date that those regulations are finalized, but taxpayers may apply those rules to taxable years ending after December 31, 2017.

II. Dividends Received Deduction

A. Statutory Overview

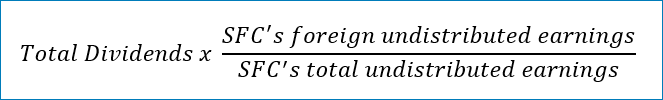

Section 245A provides a 100 percent deduction for the foreign-source portion of dividends received by a domestic corporation from an SFC.82 An SFC is defined as a foreign corporation in which a domestic corporation is a U.S. shareholder (as defined in Section 951(b)), not including a passive foreign investment company that is not a CFC.83 The foreign-source portion of an SFC's dividend is reflected below:84

An SFC's foreign undistributed earnings equal total E&P (under sections 964 and 986) less the sum of: (1) income that is effectively connected with the conduct of a U.S. trade or business, and (2) dividends from U.S. C-corporations in which the foreign corporation owns 80 percent of the stock by vote and value.85

B. Section 245A Temporary Regulations

The Section 245A Temporary Regulations provide for limitations on the applicability of the 100 percent DRD of section 245A in the case of certain "extraordinary transactions" targeted by Treasury and the IRS. The Section 245A Temporary Regulations include rules addressing two types of extraordinary transactions: (1) "extraordinary dispositions" and (2) "extraordinary reductions."

The rule for extraordinary dispositions applies to certain related-party, non-ordinary course transactions undertaken by fiscal-year CFCs during the period after the section 965 transition tax measurement date and before the effective date of GILTI with respect to such CFCs.

Unlike the rule for extraordinary dispositions, the rule for extraordinary reductions is not limited to transition year transactions or related-party transactions. Instead, the rule addresses the interaction of sections 245A and 951(a) in situations where a controlling shareholder of a CFC disposes of CFC stock or its interest in the CFC is diluted, but the CFC's tax year does not end. In such cases, the U.S. transferor would not include its pro rata share of subpart F income or tested income because it is not a U.S. shareholder as of the last day of the CFC's tax year, and it may claim a 100 percent DRD with respect to dividends, including any section 1248 dividends, from the CFC. At the same time, the transferee may reduce its pro rata share of subpart F income or tested income of the CFC by dividends paid to the U.S. transferor, or there may be no U.S. person with an inclusion under subpart F or GILTI. The latter scenario may occur because the CFC may remain a CFC even though it has no direct or indirect U.S. shareholder, due to the repeal of section 958(b)(4) in the TCJA.

Treasury and the IRS states that the Section 245A Temporary Regulations were necessary because "[b]ased on the structure and history of the international provisions of the Code, including changes made by the Act, the Treasury Department and the IRS have concluded that section 245A was not intended to eliminate taxation with respect to the foreign earnings of a CFC that are attributable to income of a type that is subject to taxation under the subpart F or GILTI regimes."86 The preamble indicates that the Section 245A Temporary Regulations are intended to be narrowly targeted, and that the Section 245A Temporary Regulations "limit the section 245A deduction only with respect to certain dividends received by a domestic corporation in connection with specific transactions that facilitate the avoidance of taxation of subpart F income or tested income and that, in many cases, may have been entered into with a purpose of avoiding the consequences of the new international tax regime as adopted by Congress in the Act."87 The language in the preamble appears to be drafted in anticipation of challenges to the regulations, which depart in certain respects from the literal language of the statute.

C. Extraordinary Dispositions

If the extraordinary disposition rule applies, the section 245A deduction is limited to 50 percent of the "extraordinary disposition amount."88 The 50 percent limitation is intended to "reflect the fact that taxpayers generally would have been eligible for a deduction under either" section 250 (if the amount had been included as GILTI) or section 965(c) (if the amount had been subject to transition tax).89

Extraordinary dispositions are certain non-ordinary course transfers of property by an SFC to a related person during the "disqualified period."90 The disqualified period is, with respect to an SFC that is a CFC, the period beginning on January 1, 2018 and ending as of the close of the taxable year of the SFC that begins before January 1, 2018.91 Transfers of intangible property are considered to be non-ordinary course transactions on a per se basis.92 The rule requires the U.S. shareholder to maintain a "extraordinary disposition account" to track affected amounts.93 These rules also include successor rules for section 245A shareholders that acquire stock of a SFC from another section 245A shareholder with respect to which there is an extraordinary disposition account.94

D. Extraordinary Reductions

The rule for extraordinary reductions applies when a controlling section 245A shareholder disposes of more than 10 percent of its stock of the CFC or there is a greater than 10 percent change in the controlling section 245A shareholder's ownership of the CFC.95 However, a transaction does not give rise to an extraordinary reduction if the taxable year of the CFC ends immediately after the transfer, provided the controlling section 245A shareholder owns the stock on the last day of the year. If the CFC's tax year does not end, section 951(a)(2)(B) generally provides that a U.S. shareholder that acquires stock of the CFC reduces its subpart F income or tested income by dividends received by another person. Accordingly, the sale by the controlling section 245A shareholder may give rise to a dividend by reason of section 1248. The preamble notes that if section 245A applied to the dividend, the amount of the dividend "might both (i) be excluded from the transferor's income by reason of the section 245A deduction and (ii) reduce the transferee's pro rata share of subpart F income or tested income of the CFC by reason of section 951(a)(2)(B)."96

In the event of an extraordinary reduction transaction, the "extraordinary reduction amount" is the earnings and profits representing the amount of dividends paid by the CFC that are attributable to subpart F income or tested income, to the extent such earnings and profits (1) would have been taken into account by the controlling section 245A shareholder under section 951 or section 951A had the extraordinary reduction not occurred, and (2) is not taken into account by a domestic corporation or a U.S. individual.97 The effect of the rule is to deny the section 245A DRD to the transferor, while continuing to reduce the transferee's pro rata share of subpart F income or tested income under section 951(a)(2)(B).

The Section 245A Temporary Regulations also provide for an election under which the controlling section 245A shareholder is not required to reduce its DRD, but instead may elect to close the CFC's taxable year for all purposes of the Code on the date of the extraordinary reduction.98 If this election were made, all U.S. shareholders would include their pro rata share of subpart F income and tested income as of that date. The election generally must be made on an original return, but during a transition period before the Section 245A Temporary Regulations are made final, the election may be made on an original or amended return.

E. Section 954(c)(6) Look-Through Rule

The Section 245A Temporary Regulations also provide for limitations on the section 954(c)(6) exception from subpart F in the case of transactions involving lower-tier CFCs that produce similar effects as extraordinary dispositions and extraordinary reductions.99 In these cases, the section 954(c)(6) exception applies only to the extent that the amount of the dividend exceeds the sum of each section 245A shareholder's extraordinary disposition account with respect to the lower-tier CFC, divided by the aggregate ownership of all U.S. tax residents of the upper-tier CFC that have section 951(a) inclusions and multiplied by 50 percent.100

F. Effective Date

The Section 245A Temporary Regulations apply retroactively to distributions occurring after December 31, 2017.101 The preamble to the Section 245A Temporary Regulations defends this retroactive effective date and issuance without prior notice and opportunity for public comment with a statement of "good cause," consistent with Treasury's recent policy statement on the tax regulatory process (Tax Alert: Treasury and the IRS Issue Joint Policy Statement on Deference and the Tax Regulatory Process). But notwithstanding the claims in the preamble that the rules for extraordinary dispositions and extraordinary reductions are narrowly targeted, the rules do not require a transaction to have a tax avoidance purpose. Moreover, the extraordinary reduction rule applies to ordinary course transactions with unrelated parties. The retroactive effective date may present challenges for taxpayers.

For more information, please contact:

Layla J. Asali, lasali@milchev.com, 202-626-5866

Rocco V. Femia, rfemia@milchev.com, 202-626-5823

David W. Zimmerman, dzimmerman@milchev.com, 202-626-5876

Jennifer E. Maul*

Loren C. Ponds*

*Former Miller & Chevalier attorney

-----------

1REG-101828-19 (June 14, 2019). The Proposed Regulations were published in the Federal Register on June 21, 2019. 84 F.R. 29114 (June 21, 2019).

2T.D. 9866 (June 14, 2019). The GILTI Final Regulations were published in the Federal Register on June 21, 2019. 84 F.R. 29288 (June 21, 2019).

3All "section" references are to the Internal Revenue Code of 1986, as amended and currently in effect.

4Section 951A(a).

584 F.R. at 29115.

684 F.R. at 29319.

784 F.R. at 28398.

884 F.R. 28426 (June 14, 2019).

9Section 951A(b)(1).

10Section 951A(b)(2).

11Section 951A(c)(1).

12Section 951A(c)(2)(A).

13Section 951A(c)(2)(B).

14Section 951A(d).

1584 F.R. at 29117.

16See Treas. Reg. § 1.951A-2(c)(1)(iii).

17See Prop. Reg. § 1.951A-2(c)(6).

1884 F.R. at 29120.

19Id. (citing S. Comm. on the Budget, Reconciliation Recommendations Pursuant to H. Con. Res. 71, S. Print No. 115-20, at 371).

20Id.

21See Prop. Reg. § 1.951A-2(c)(6)(i).

22See Prop. Reg. § 1.951A-2(c)(6)(ii)(A)(1).

23See Prop. Reg. § 1.951A-2(c)(6)(ii)(A).

24See Prop. Reg. § 1.951A-2(c)(6)(ii)(B).

25See Prop. Reg. § 1.951A-2(c)(6)(iii).

26See Prop. Reg. § 1.951A-2(c)(6)(ii)(A)(2).

27See Prop. Reg. § 1.904-4(f)(2)(vi).

28See Treas. Reg. §§ 1.951A-3(b), (c)(1).

29See Prop. Reg. § 1.951A-2(c)(6)(v)(A). As noted earlier, the aggregation rule in the GILTI Final Regulations does not apply for purposes of determining whether a U.S. shareholder is a controlling domestic shareholder. Thus, the election to exclude high-tax income will be made at the domestic partnership level. See 84 F.R. at 29316.

30See Prop. Reg. § 1.951A-2(c)(6)(v)(E)(1).

31See Prop. Reg. § 1.951A-2(c)(6)(v)(B).

32See Prop. Reg. § 1.951A-2(c)(6)(v)(C).

33See Prop. Reg. § 1.951A-2(c)(6)(v)(D).

34See 84 F.R. at 29120-21.

35See Prop. Reg. § 1.951A-7(b).

3684 F.R. at 29294.

3783 F.R. 51072 at 51078 (Oct. 10, 2018).

38See Treas. Reg. § 951A-1(e)(1).

3984 F.R. at 29297.

4084 F.R. at 29118.

41Id.

42See Prop. Reg. § 1.958-1(d)(1).

43See Prop. Reg. § 1.958-1(d)(2).

44See Prop. Reg. § 1.958-1(d)(4).

45See id.

4684 F.R. at 29289.

47Id.

48Treas. Reg. § 1.951-1(e)(6).

4984 F.R. at 29290.

50Id.

51Treas. Reg. § 1.951-(b)(1)(ii).

5284 F.R. at 29290.

53Id.

54Treas. Reg. § 1.951A-2(c)(2).

5584 F.R. at 29293.

56Id.

57Id. at 29295.

58Id. at 29298.

59Id.

60Id. at 29308.

61Id. at 29298-99.

62Id. at 29299.

63Treas. Reg. § 1.951A-2(c)(5)(i).

64Treas. Reg. § 1.951A-3(h)(2)(ii)(B)(3).

6584 F.R. at 29301.

66Treas. Reg. § 1.951A-2(c)(2)(ii).

67See 84 F.R. at 29302.

68Id. at 29307.

69Id.

70See id.

71Treas. Reg. § 1.951A-3(h)(1)(iv)(A).

72Treas. Reg. § 1.951A-3(h)(1)(iii).

7384 F.R. at 29318.

74Id.

75Id.

76Id.

77Id. at 29319.

78See id.

79Id.

80Id.

81Treas. Reg. § 1.951A-7.

82Section 245A(a).

83Section 245A(b).

84Section 245A(c)(1).

85Section 245A(c)(2).

8684 F.R. at 28400.

87Id.

88Treas. Reg. § 1.245A-5T(b).

8984 F.R. at 28401.

90Treas. Reg. § 1.245A-5T(c)(3)(ii).

91Treas. Reg. § 1.245A-5T(c)(3)(iii).

92Treas. Reg. § 1.245A-5T(c)(3)(ii)(E).

93Treas. Reg. § 1.245A-5T(c)(3)(i).

94Treas. Reg. § 1.245A-5T(c)(4).

95Treas. Reg. § 1.245A-5T(e)(2)(i)(A).

9684 F.R. at 28402.

97Treas. Reg. § 1.245A-5T(e)(1) and (2).

98Treas. Reg. § 1.245A-5T(e)(3)(i).

99See Treas. Reg. § 1.245A-5T(d).

100Id.

101Treas. Reg. § 1.245A-5T(k).

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.