Collateral Issues Dominate in Final Briefing for Varian and Sysco

Tax Alert

Ancillary issues threaten to claw back a major portion of the taxpayer victory last summer in Varian Medical Systems Inc. v. Commissioner. In August 2024, the Tax Court unanimously held that the plain language of the effective date provisions of the Tax Cuts and Jobs Act (TCJA) entitled a fiscal year (FY) taxpayer to a section 245A dividends received deduction (DRD) for section 78 dividends the taxpayer was deemed to receive during a one-time "gap period." The Tax Court set aside a Treasury regulation that purported to modify the effective dates set by statute (Treas. Reg. § 1.78-1). Shortly thereafter, the Tax Court applied the Varian decision to the taxpayer in Sysco Corp. v. Commissioner. In cross-motions for summary judgment in Varian and Sysco, the parties now dispute (1) how to compute an offsetting detriment to each taxpayer's foreign tax credit (FTC) and (2) whether the court's earlier decision extends to section 78 dividends from lower-tier controlled foreign corporations (CFCs).

While the taxpayer in Varian prevailed on its eligibility for the section 245A DRD, the Tax Court agreed with the IRS that section 245A(d) required Varian to reduce its FTCs by the amount that its deemed paid foreign taxes were attributable to the foreign earnings reflected in its section 78 dividend. The Tax Court endorsed a formula offered by the IRS in its brief. That formula had not previously been articulated in regulations or subregulatory guidance, and the opinion itself does not expressly define the terms in the formula. The Tax Court provided an example applying the formula to a subpart F inclusion, while stating in a footnote that "the equation achieves the same result" for amounts included under the section 965 transition tax. In cross-motions for summary judgment in each case, the parties in Varian and Sysco now contest the application of the formula when applied in the unique context of the transition tax. Although briefing has not yet concluded, the positions of the parties are crystallizing.

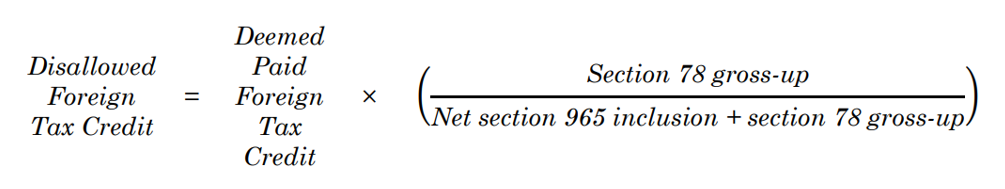

The formula adopted by the Tax Court provided that the amount of the "Disallowed Foreign Tax Credit" equals the taxpayer's "Deemed Paid Foreign Tax Credit" multiplied by the ratio of the "Section 78 gross-up" to the sum of the taxpayer's "Net section 965 inclusion + section 78 gross-up."

In contrast to a typical subpart F inclusion, when Congress enacted section 965, it constructed a complex series of rules to reduce the effective rate of U.S. tax down to a level between eight percent and 15.5 percent. The parties' dispute centers around those statutory mechanics. In the current briefing, the parties appear to agree that the "Deemed Paid Foreign Tax Credit" is the amount of deemed paid foreign taxes, after applying the reduction required by section 965(g)(1). The reduction mandated by section 965(g)(1) disallows a taxpayer's FTC by approximately the same percentage that the taxpayer's inclusion under section 965(a) is reduced by the deduction under section 965(c). The parties further agree that the "Section 78 gross-up" is the amount after applying a similar haircut under section 965(g)(4). However, the taxpayers and the IRS dispute whether the definition of "Net section 965 inclusion" is determined with or without application of the section 965(c) deduction.

The taxpayers contend that the plain language of section 965 and the plain meaning of the court's formula dictate that "Net section 965 inclusion" equals the section 965 inclusion after netting the U.S. shareholder's amounts with respect to deferred foreign income corporations with its share of the deficits from E&P deficit foreign corporations, but before the separate deduction under section 965(c). The taxpayers further assert that the IRS's approach would inappropriately result in the double disallowance of FTCs, yielding a result that departs from the court's example involving a typical subpart F inclusion. The IRS counters that "Net section 965 inclusion" must reflect the section 965(c) deduction to align with the formula's other components. The IRS further emphasizes that section 245A(d) broadly disallows FTCs for any foreign taxes paid "with respect to" the section 78 dividend. The IRS position yields a smaller denominator, which results in a higher percentage of disallowed FTCs. Under the IRS position, it appears that deemed paid FTCs are disallowed at a rate equal to the effective rate of foreign tax.

Separately, the IRS is now challenging the application of the Varian decision to section 78 dividends from lower-tier CFCs. In the August 2024 decision, the Varian court observed that $100 million of the $159 million deduction claimed by the taxpayer arose from its lower-tier CFCs. Based on the briefing and oral argument, a footnote in the decision stated that "[t]here is no dispute in this case that Varian satisfied the relevant holding period." The IRS now contends that no section 245A DRD is permitted for section 78 dividends from lower-tier CFCs, because it is impossible for the U.S. shareholder to satisfy the holding period requirements in section 246(c). Specifically, the IRS contends that the holding period in section 246(c) can only be satisfied with direct ownership, section 78 does not deem the U.S. shareholder to directly own stock of the lower-tier CFCs from which it receives deemed dividends, and even if section 78 provided for this fiction, that ownership would last only a "moment-in-time." The taxpayers have countered that the holding period requirement does not apply to section 78 dividends, and, in any event, the holding period may be satisfied through indirect ownership.

Similarly situated taxpayers should continue to monitor Varian, Sysco, and related cases for resolution of these collateral issues.

For more information, please contact:

Jeffrey M. Tebbs, jtebbs@milchev.com, 202-626-1480

Katherine Lewis, klewis@milchev.com, 202-626-5894

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.