TAX TAKE: Time Keeps On Slippin', Slippin', Slippin' Into The Future

Tax Alert

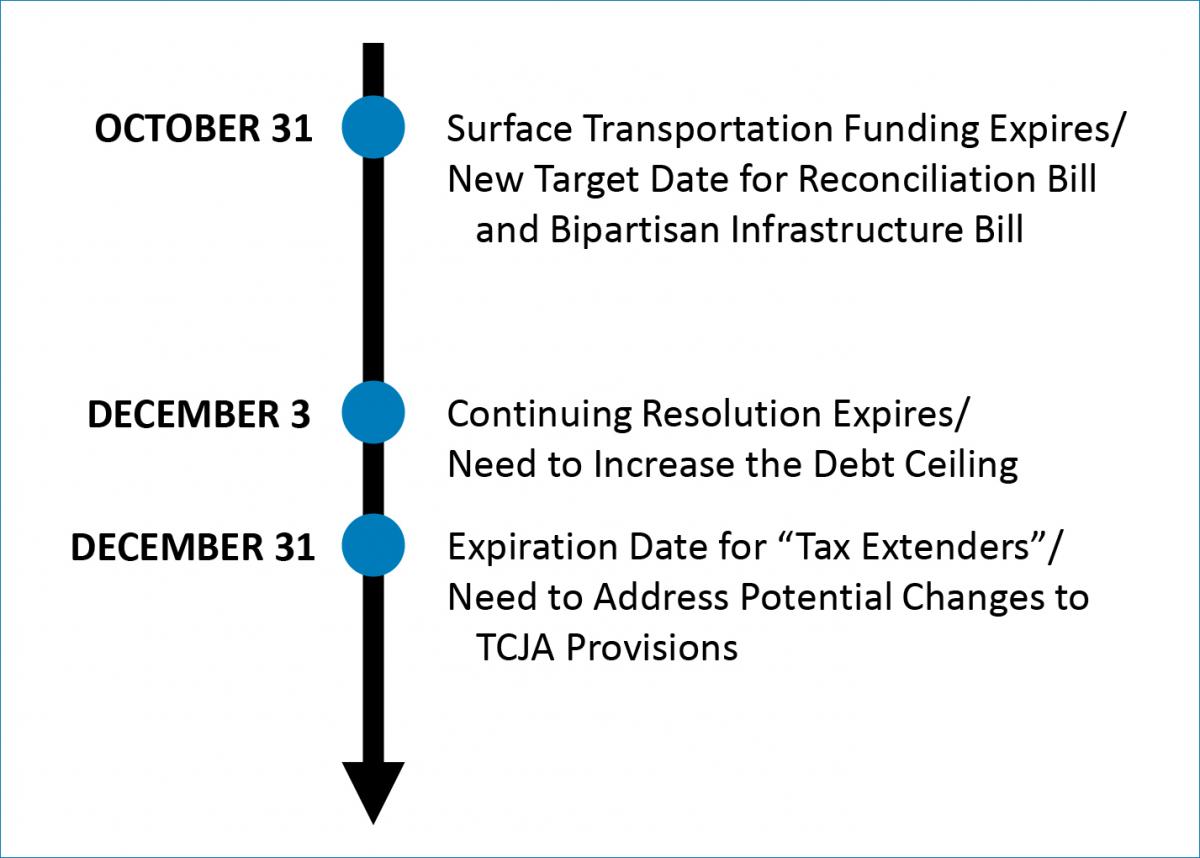

The legislative timeline for consideration and potential enactment of the Build Back Better Act reconciliation bill continues to slip, as Congressional Democrats and the Biden Administration carry on with negotiations to develop a spending and tax package that can secure the support of both the progressive and moderate wings of the party. Simultaneously, Congress must also address a number of other significant fiscal issues that are impacting the timing of the reconciliation bill. Surface transportation funding will run out on October 31 and Speaker Pelosi has set that date as the new target date for consideration of both the reconciliation bill and the pending bipartisan infrastructure bill, although that date seems ambitious given the status of the current reconciliation bill negotiations.

Assuming the October 31 date does slip, the next legislative deadline would not be until December 3, when the current continuing resolution to fund the federal government expires and Congress will need to lift the debt ceiling (assuming the House passes the pending Senate bill to provide a short-term extension). And, of course, December 31 heralds the expiration of a host of "tax extenders," as well as implementation of a number of important TCJA provisions, including the amortization of research and development expenses and the reduced interest expense deduction limitation, both of which are set to become effective in 2022. Thus, there is the potential that December 3 or December 31 becomes the backstop for Congress to address the reconciliation bill and the bipartisan infrastructure bill. Needless to say, things remain quite fluid, but it is important to monitor these pending legislative deadlines as they provide an opportunity for potential action. #TaxTake

Upcoming Speaking Engagements and Events

- On October 14, Jorge will present at The Philanthropy Roundtable 2021 Annual Meeting where he will discuss tax policy issues impacting the charitable sector.

- Marc will discuss the upcoming tax legislative agenda at the Savannah Estate Planning Council's 2021 Fall Meeting on October 21.

- Marc will speak at the 56th Annual Southern Federal Virtual Tax Institute on a panel titled, "The 2021 Legislative Landscape: Evaluating Actual and Potential Changes," on October 25.

- On November 8, Loren will speak on the tax policy panel at the 32nd Annual Philadelphia Tax Conference.

- Loren will present, "Pending Regulatory Challenges to Select International Provisions of the Tax Cuts and Jobs Act," at the 67th Annual William & Mary Tax Conference on November 12.

- On November 30, Loren will speak on the North America panel at IFA's 2021 virtual event, "The Global Tax Agreement: The Two-Pillar Solution."

In the News

Jorge discussed the spending bills currently under consideration by Congress in InvestmentNews. He said the uncertainty regarding U.S. tax rate changes could run well into December. "I don't think Congress will be willing to move ahead until the CBO weighs in on how much the bills will cost and their effect on the deficit," Jorge said

The information contained in this communication is not intended as legal advice or as an opinion on specific facts. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. For more information, please contact one of the senders or your existing Miller & Chevalier lawyer contact. The invitation to contact the firm and its lawyers is not to be construed as a solicitation for legal work. Any new lawyer-client relationship will be confirmed in writing.

This, and related communications, are protected by copyright laws and treaties. You may make a single copy for personal use. You may make copies for others, but not for commercial purposes. If you give a copy to anyone else, it must be in its original, unmodified form, and must include all attributions of authorship, copyright notices, and republication notices. Except as described above, it is unlawful to copy, republish, redistribute, and/or alter this presentation without prior written consent of the copyright holder.